Russell Lee Saloon, Craigville, Minnesota Aug 1937

Not in labor force is the only number rising strongly.

• US Stocks End Sharply Lower After Jobs Report (MarketWatch)

U.S. stocks ended Friday’s session sharply lower, as a highly anticipated monthly jobs report intensified the debate about the Federal Reserve’s decision to raise interest rates in September. Widely seen as the last notable economic report before the Federal Reserve decides whether to raise interest rates at its two-day meeting on Sept. 16-17, the jobs data showed that the U.S. economy added a weaker-than-estimated 173,000 nonfarm jobs last month, while the unemployment rate dropped to 5.1%—marking its lowest level since April 2008.

The employment report began a downbeat day for the market as investors seemed to read the data as signaling that the Fed may soon decide to end its ultraloose monetary policy in two weeks. “The Fed has been clear about wanting to raise rates this year and at least now they have a green light if they decide to do so,” said Kate Warne, investment strategist at Edward Jones. Friday’s losses capped another brutal week for the main indexes, which suffered their second-largest weekly losses this year.

That sounds clear enough.

• China’s Central Banker Says His Nation’s Bubble ‘Burst’ (Bloomberg)

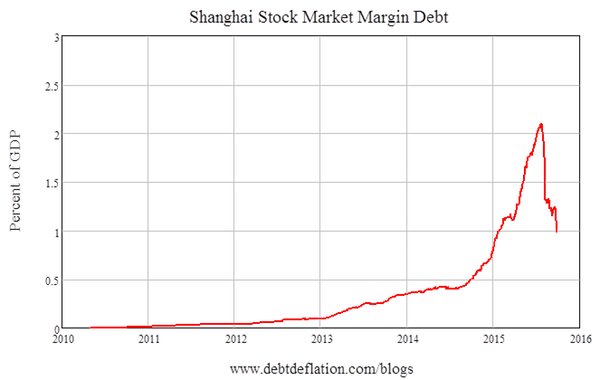

Zhou Xiaochuan, governor of China’s central bank, couldn’t stop repeating to a G-20 gathering that a bubble in his country had “burst.” It came up about three times in his explanation Friday of what is going on with China’s stock market, according to a Japanese finance ministry official. When asked by a reporter if Zhou was talking about a bubble, Japanese Finance Minister Taro Aso was unequivocal: “What else bursts?” A dissection of the slowdown of the world’s second-largest economy and talk about the equity rout which erased $5 trillion of value was a focal point at the meeting of global policy makers in Ankara. That wasn’t enough for Aso, who said that the discussions hadn’t been constructive.

Chinese stocks have plunged almost 40 percent since a June peak, triggering unprecedented intervention from the authorities. The central bank cut rates for the fifth time since November last month and lowered the amount of cash banks must set aside, falling back on its major levers to support equity prices and the slowing economy. It was China, rather than the timing of an interest-rate increase by the Federal Reserve, that dominated the discussion, according to the Japanese official, with many people commenting that China’s sluggish economic performance is a risk to the global economy and especially to emerging-market nations.

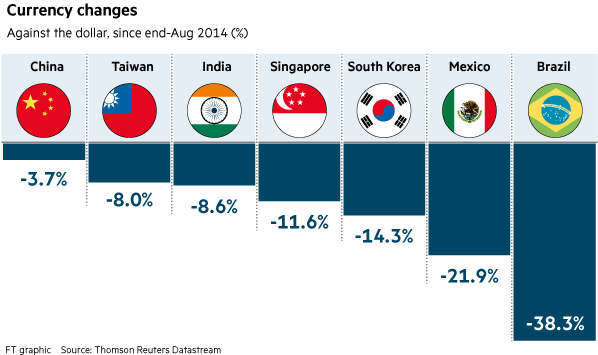

“It’s clear there are problems in the Chinese market, and at today’s G-20 meeting, many people other than myself also expressed that opinion,” Aso said after a meeting of finance chiefs and central bank governors. The PBOC shocked global markets by allowing the biggest yuan depreciation in two decades on Aug. 11, when it changed the exchange-rate mechanism to give markets a bigger role in setting the currency’s level. That historic move would not get a mention in the communique, according to the Japanese official, who asked not to be named, citing ministry policy.

After the election.

• 100% Risk Of A 50% Stock Crash (Paul B. Farrell)

“Who will get the Dreary Recovery Going?” taunts Mort Zuckerman in a Wall Street Journal op-ed. The head of U.S. News & World Report warns America that a recession is coming: “They occur about every eight years and America is ill-prepared to weather the one on the horizon.” Ill-equipped. Yes, the clock is ticking, every 8 years. 2000. 2008. Next 2016, even with a President Trump. Another great newsman, Bill O’Neill, publisher of Investors Business Daily, author of perennial best-seller “How To Make Money in Stocks,” agrees: Markets have peaked and crashed roughly every four years for the last century, with bigger crashes, long recessions, every eight years. And still most investors will be ill-prepared.

Sounds like a double-teamed confirmation of Jeremy Grantham’s famous BusinessInsider prediction for 2016: “Around the presidential election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse.” Get it? A mega crash is coming, dropping half off its peak, down below Dow 5,000. Not just another 1,000-point correction like last month. But a heart-stopping collapse coinciding with the 2016 elections … then a long systemic recession … probably lasting till the 2020 presidential election, maybe longer … no matter who’s in the White House, Doanld Trump, Jeb Bush or Hillary Clinton.

Yes, recessions hit every eight years. The last was just about 8 years ago, warned Zuckerman with these facts: “The period since the Great Recession ended in 2009 has seen the weakest U.S. recovery since World War II,” Our aging bull is actually warning us … recession dead ahead.

Jesus was a refugee.

• The Bible Is Clear: Let The Refugees In, Every Last One (Guardian)

Thousands more, says David Cameron now, grudgingly conceding to popular pressure. But why not all of them? Surely that’s the biblical answer to the “how many can we take?” question. Every single last one. Let’s dig up the greenbelt, create new cities, turn our Downton Abbeys into flats and church halls into temporary dormitories, and reclaim all those empty penthouses being used as nothing more than investment vehicles. Yes, it may change the character of this country. Or maybe it won’t require anything like such drastic action – who knows? But let’s do whatever it takes to open the door of welcome. “Keep, ancient lands, your storied pomp! Give me your tired, your poor, Your huddled masses yearning to breathe free, The wretched refuse of your teeming shore. Send these, the homeless, tempest-tost to me, I lift my lamp beside the golden door!”

And yes, when Emma Lazarus wrote these words – later inscribed on the Statue of Liberty – by “storied pomp”, she meant us Brits. For years our politicians have piggy-backed upon Christian morality for electoral advantage. We should “feel proud that this is a Christian country”, said Cameron earlier this year (pre-election, of course), in what some might uncharitably see as a call to maintain a Muslim-free view from his Cotswold village. But there is no respectable Christian argument for fortress Europe, surrounded by a new iron curtain of razor wire to keep poor, dark-skinned people out. Indeed, the moral framework that our prime minister so frequently references – and to which he claims some sort of vague allegiance – is crystal clear about the absolute priority of our obligation to refugees.

For the moral imagination of the Hebrew scriptures was determined by a battered refugee people, fleeing political oppression in north Africa, and seeking a new life for themselves safe from violence and poverty. Time and again, the books of the Hebrew scriptures remind its readers not to forget that they too were once in this situation and their ethics must be structured around practical help driven by fellow-feeling. The Passover, first celebrated as a last-minute preparation before leaving Egypt (unleavened bread as there wasn’t time for it to rise) – and the Christian Eucharist that was built on top of it – is nothing less than a call to re-live this basic human solidarity in the face of existential fear and uncertainty. And when the author of Matthew’s gospel describes Jesus as a child refugee, fleeing his country from a despotic ruler intent on taking his life – Herod not Assad – he is deliberately sampling that basic foundational myth of the Exodus.

If not Jesus, would the Holocaust do it?

• UK Must Emulate Kindertransport To Aid Refugee Crisis: Lord Sacks (Guardian)

Britain needs to make a bold gesture similar to Kindertransport to help address the humanitarian crisis engulfing Europe, the former chief rabbi has said. Lord Sacks said it was time for human compassion to triumph in the same way as the scheme that saved thousands of Jewish children before the second world war broke out. He said that a “very clear and conspicuous humanitarian gesture, like Kindertransport” would help to achieve that aim. “Europe is being tested as it has not been tested since the second world war … The European Union was created as a way of saying that we recognise human rights, after the catastrophe of two world wars and the Holocaust, and it’s very chilling to see some of these scenarios being re-enacted,” Sacks told BBC2’s Newsnight on Thursday.

He believes that the UK could accommodate 10,000 displaced people: “It’s a figure to which Britain would respond. The churches, the religious groups, the charities would all join in, and I think we would be better for doing that.” Meanwhile, former home secretary David Blunkett said the UK had a moral obligation to take about 25,000 refugees – which was still a fraction of Germany’s total. “We should concentrate on those coming through Turkey, who have been persecuted and ejected from Syria, and we should concentrate on women and children,” he said. While a global response was needed, Blunkett added: “If we are going to be taken seriously by anybody as a nation in putting that programme together, we are going to have to face the challenge of taking refugees in very large numbers ourselves.”

Sign the petition.

• Grant Visas To Refugees Before They Take The Death Route (ThePressProject)

By now, most of us have seen the gut-wrenching picture of the lifeless three year old Aylan who perished in the Aegean sea while trying to reach Greece. Little Aylan and his family have tried all legal means to reach Canada. But their applications were rejected. They were left with no other option than the perilous journey by sea. They paid for it with their lives. Just a few days earlier, more lifeless bodies of Syrian children were washed ashore after their desperate attempt to find refuge in Europe led to disaster. Dozens more have died a terrible death, suffocating in smuggler’s trucks, crushed by trains, perished of exhaustion, shot by armed coast guards. Some 2,600 people have perished so far in the Mediterranean waters, how many more deaths can we stomach?

Syrians first fled into the neighbouring countries of Jordan, Lebanon, and Turkey. Once there, they found that they had escaped into a prison. They are not allowed to work in Jordan – currently home to 630,000 refugees. They are banned from working in Lebanon – a country of four million people that hosts one million refugees. Turkey, where almost 2 million refugees have sought protection, is trying harder to support them inside their borders, but resources are running low. The US has announced that it will accept 1000 to 2000 refugees. Great Britain has relocated just 216. Syrians that are trying to use formal channels to obtain legitimate visas to Europe or Canada, see their applications rejected. There is no other hope left for them than to jump on a floating coffin to try and reach Europe and claim asylum.

Yet, the poorest of the poor and the unaccompanied Syrian children that beg in the streets of Amman, Istanbul, Beirut, have little hope to raise the money that smugglers are demanding to “sail” them to Europe. They will probably end their lives in the streets. How many floating bodies do we need to see before our governments start re-enforcing asylum processes in the host country? If Syrians could apply for protection while they are still in Turkey, Lebanon or Jordan, through formal channels, less people would opt to travel by sea, less people would become prey to smugglers.

We ask western Governments to create legal channels for the refugees which will grant humanitarian visas, and facilitate family reunions and resettlement, before Syrians are forced to take the “death route” to Europe. We ask the European countries, the United States and Canada to facilitate all mechanisms to allow Syrian refugees that are stranded in Turkey, Lebanon and Jordan, to be able to apply for visas and legal documents that they may travel to their chosen destination.

“..we will not brutalise them, we will not force them to crawl under our fences, we will not write numbers on their skin and we will not ship them off on trains to nowhere.”

• The March of Shame (Irate Greek)

They are people, like us. They are young, they are old, they are men, women and children, they are lawyers or masons or doctors or barbers or plumbers or computer engineers. They are people, and they are coming. Their countries fell apart, their houses were destroyed, their neighbours died. They lost friends and relatives, they lost their loved ones, they lost a limb. They fled. They took trucks or buses or cars or bicycles. They walked. They were smuggled, assaulted, abused, kidnapped on the way. They crossed a border, or two, or three. They were detained, arrested, beaten. They were parked in camps. They were told to live a life without a future, they were told to wait until their country is fixed, they were told to wait with no end in sight.

And then they came. Of course they came. They got on those rickety boats to cross the sea. Some of them were pushed back. Some of them sank and had to return to the coast. Some of them drowned. But they kept coming, and instead of greeting them with open arms, our governments screamed, “we’re being overrun!” Yes, we’re being overrun. It was about time it happened. Because as much as you expect people to stay put and die out of sight, out of mind, they have other plans for their life. As a matter of fact, they want a life worth living. And they are coming to get it. They are coming. Get over it, Europe, they are coming. And if we still want to call ourselves people, if we still want to call ourselves human beings, we will not turn our backs on them, we will not tell them to go away, we will not let them sleep in the streets of our harbours, we will not brutalise them, we will not force them to crawl under our fences, we will not write numbers on their skin and we will not ship them off on trains to nowhere.

There’s a limit to how long you can stay behind the safety of your television screen with pictures of dead children and destroyed cities, and your only reaction is, “how sad”. For them it’s beyond sad. They lost everything. Then they risked what little they had left to come, and they lost even more. ‘Sad’ doesn’t begin to describe that. They are not swarms, they are not invaders, they are not quotas. They are people. They want a life, a life in safety, with a job, a home and a future for their children. They are people, just like us. They are people, and there’s no stopping that. Today they are walking from Budapest to Vienna. Hundreds, maybe thousands of them, decided that they had enough of Viktor Orban’s nonsense, and when he wouldn’t re-establish the trains, they decided to walk.

But these people are only the tip of the iceberg. Europe’s march of shame started thousands of kilometers away. They are coming because of war, destruction, poverty, hopelessness. But this is a march of shame because we the people, we the European people, elected year after year leaders who don’t care about people but only about votes. And for years, despite our aging population, despite our immense wealth, despite all the good reasons for which we could open our borders, our leaders thought that pandering to the xenophobes was more important than helping people who have lost everything and that we could easily accommodate.

But they won’t wait anymore. They are coming, they are marching on Europe, and they are putting us to shame. For the young man in the picture below, the march of shame started when he pushed his grandmother’s wheelchair out of their family home and onto some road in Afghanistan. He has come thus far. Can anything stop him? Can he be made to go back? They are coming. And now it is for us to greet them, to care for them, to give them safe passage, to help them build the home they have lost. Not because we are Europeans, not because we have values, not even because we are filthy rich. But because we must be people. Like them.

Merkel.

• Migrants Stream Into Austria, Swept West By Overwhelmed Hungary (Reuters)

Hundreds of exhausted migrants streamed into Austria on Saturday, reaching the border on buses provided by an overwhelmed Hungarian government that gave up trying to hold back crowds that had set out on foot for western Europe. After days of confrontation and chaos, Hungary’s right-wing government deployed dozens of buses to move on migrants from the capital, Budapest, and pick up over 1,000 – many of them refugees from the Syrian war – walking down the main highway to Vienna. Austria said it had agreed with Germany that they would allow the migrants access, unable to enforce the rules of a European asylum system brought to breaking point by the continent’s worst refugee crisis since the Yugoslav wars of the 1990s.

Wrapped in blankets against the rain, hundreds of visibly exhausted migrants, many carrying small children, climbed off buses on the Hungarian side of the border and walked in a long line into Austria, receiving fruit and water from aid workers. “We’re happy. We’ll go to Germany,” said a Syrian man who gave his name as Mohammed. Hungary cited traffic safety for its decision to move the migrants on. But it appeared to mark an admission that the government had lost control in the face of overwhelming numbers determined to reach the richer nations of northern and western Europe at the end of an often perilous journey from war and poverty in the Middle East, Africa and Asia.

On Friday, hundreds broke out of an overcrowded camp on Hungary’s border with Serbia; others escaped from a stranded train, sprinting away from riot police down railway tracks, while still more took to the highway by foot led by a one-legged Syrian refugee and chanting “Germany, Germany!” The scenes were emblematic of a crisis that has left Europe groping for answers, and for unity. By nightfall, the Keleti railway terminus in Budapest, for days a campsite of migrants barred from taking trains west to Austria and Germany, was almost empty, as smiling families boarded a huge queue of buses that then snaked out of the capital.

Utter lying cynicism: “Transportation safety can’t be put at risk..”

• Over 1,000 Exhausted Migrants Reach Austria Border (AP)

More than 1,000 migrants, exhausted after breaking away from police and marching for hours toward Western Europe, have arrived before dawn Saturday on the border with Austria. The breakthrough became possible when Austria announced that it and Germany would take the migrants on humanitarian grounds and to aid their EU neighbor. In jubilant scenes on the border, hundreds of migrants bearing blankets over their shoulders to provide cover from heavy rains walked off from buses and into Austria, where volunteers at a roadside Red Cross shelter offered them hot tea and handshakes of welcome. Many collapsed in exhaustion on the floor, smiles on their faces.

Early Saturday, Austrian Chancellor Werner Faymann announced that it and Germany would take the migrants on humanitarian grounds and to aid their EU neighbor after speaking with German Chancellor Angela Merkel. Hours before, Hungary had announced it would mobilize a bus fleet to scoop the weary travelers overnight from Budapest’s main international train station and from the roadside of Hungary’s main highway and carry them to the Austrian border. In jubilant scenes on the border, hundreds of migrants bearing blankets over their shoulders to provide cover from heavy rains walked off from buses and into Austria, where volunteers at a roadside Red Cross shelter offered them hot tea and handshakes of welcome. Many collapsed in exhaustion on the floor, smiles on their faces.

Janos Lazar, chief of staff to Hungary’s prime minister, said authorities had reversed course and stopped trying to force migrants to go to state-run asylum shelters because the migrants’ movements were imperiling rail services and causing massive traffic jams. “Transportation safety can’t be put at risk,” he said. The asylum seekers chiefly from Syria, Iraq and Afghanistan often have spent months in Turkish refugee camps, taken long journeys by boat, train and foot through Greece and the Balkans, then crawled under barbed wire on Hungary’s southern frontier to a frosty welcome. While Austria, on Hungary’s western border, says it will offer the newcomers asylum opportunities, most say they want to settle in Germany.

Guess who paid?

• Hungary Provides 100 Buses To Take Refugees To Austrian Border (WaPo)

Sending Europe’s refugee crisis hurtling toward another country, Hungary’s leaders on Friday backed down from a confrontation with thousands of asylum-seekers, offering to bus the desperate migrants to the border with Austria. The late-night offer came after days of efforts to repel the thousands of migrants fleeing war and poverty who have streamed into Hungary in a bid to reach Western Europe, where they hope to begin new lives. Hungarian Prime Minister Viktor Orban had painted his hard-line approach against the mostly Muslim asylum-seekers as a stand to preserve Europe as a Christian continent.

But after a column of migrants more than a mile long streamed onto Hungary’s main highway to Austria, it appeared that authorities felt they had no alternative but to pass the challenge to their neighbor, another country that has been ambivalent about the influx. By early Saturday morning, the first asylum seekers began to walk across the border into Austria after having been dropped off by buses on the Hungarian side. The buses had picked people up at Budapest’s main train station. After initial hesitation, the crowds began to climb on board, relieved to be en route out of Hungary.

The Hungarian decision to provide up to 100 buses to take the asylum-seekers to the border did little to resolve the challenge facing Europe, which has failed to come up with a unified response to the mounting numbers on its borders. Instead, the plans simply shifted the crisis to another state, leaving the fundamental problem — a bloc of 503 million people unable to agree whether and how to house several hundred thousand refugees — to burn for another day.

More like broken leadership.

• This Refugee Crisis Is Too Big For Europe’s Broken Institutions (Paul Mason)

The disorder we have allowed to assemble at the borders of Europe does not easily divide into “economics” and “war”. The conceit that we can segment those coming here into the “deserving and undeserving” is going to shatter as their claims are processed. The immediate challenge for Europe is crisis management: the fiasco in Budapest is just the European leadership problem in microcosm. There is no coherence, no predictability and no urgency. As with Greece, and with the prolonged debt crisis of southern Europe, the institutions move sluggishly until leaders are forced into making flamboyant gestures, and no solution is ever reached. But, as they struggle to achieve coherence and to show compassion, the EU’s leaders are accumulating much bigger risks.

An EU into which half a million people can arrive to claim asylum in six months will struggle to justify the same rules and institutions as the Europe that believed its borders were under control. With Dublin III a dead letter, there will have to be a new asylum system based on reality. People will attempt to claim asylum whether they’re victims of war, drought or poverty. Either they’ll be processed in the place they want to settle, or there will have to be mass deportations back to Greece and Hungary – the two countries with the biggest fascist movements in the EU. And if hundreds of thousands of asylum seekers are given leave to remain in a continent where there is stagnation and mass unemployment, what happens to free movement? The home secretary, Theresa May, has already called for it to be constrained in response to the new situation.

The EU’s leaders can muddle along with broken institutions, flouted laws, flailing border police. Or they can think it through. The OECD’s central projection is that, to stand a chance of avoiding stagnation, the EU’s workforce will have to add 50 million more people through migration by 2060 (a similar number is needed in the US). The Paris-based thinktank says if that doesn’t happen, it is a “significant downside risk” to growth. What this means should be spelled out, because no politician has bothered to do so: to avoid economic stagnation in the long term, Europe needs migrants.

“Finland, one of the wealthiest and least densely populated EU countries, said it would take a mere 800.” Finland’s PM offered to take refugess into his own home. All 800?

• European Union Cracking Under Pressure Of Migrant Crisis (Globe and Mail)

The European Union is cracking, again. This time, it could shatter under the weight of a migrants’ crisis that has virtually every one of its member states madly pulling and pushing in all directions, undermining the founding concept of shared goals, vision, welfare – and shared pain. Every few years, the 28-country EU and the 19 countries within it that use the euro (the euro zone) face severe tests, typically the result of faulty crisis-fighting mechanisms or selfish national behaviour. These crises are inevitable, for the EU and the euro zone are economic and currency unions imposed upon sovereign countries, each of them fully capable of acting in its own interests when the going gets tough.

In 2012, when Europe was in deep recession and Greece in outright depression, the latter seemed on the verge of bolting from the euro zone and making a lie of the notion that the currency was “irreversible.” The European Central Bank (ECB), led by the eminently practical and flexible Mario Draghi, came to the rescue with a barrage of crisis-fighting mechanisms. They more or less worked – outright disaster was avoided – even if they exposed the fragility of the common currency. Three years later, when Greece decided once again to threaten the integrity of the euro zone, the ECB, backed by the financial might of Germany, prevented Greece from leaving. Thanks in good part to the bank, back-to-back existential crises were overcome, if only barely (Greece is an economic wreck and could still hit the road).

The current migrants’ crisis is much bigger than the one unleashed by the Greeks and there is no all-powerful migration version of Mr. Draghi to save the day. Potentially, millions of refugees and economic migrants from conflict areas in the Middle East and Africa are lining up to get in – some nine million Syrians have been displaced as the civil war shreds their country; many of them want to come to Europe. The numbers are already staggering – Europe is seeing the largest influx and internal movement of people since the end of the Second World War. About 350,000 people have entered this year, with Italy, Greece and, now, Hungary, bearing the brunt of the mass arrivals. In August alone, 50,000 migrants reached Hungary.

Almost 3,000 people have died so far this year in the Mediterranean. In April, a shipwreck off the Italian island of Lampedusa claimed 800 lives. On Aug. 28, the bodies of 71 migrants, many of them thought to be Syrian, were found in an abandoned truck in Austria. This week, the world was shocked by images of a three-year-old Syrian boy, whose lifeless body had washed up on a Turkish beach. He drowned when his family tried to reach the Greek island of Kos. But child deaths have been sadly routine among those making the treacherous voyage to southern Europe from Libya and Turkey. In April, several fishermen in Tunisia, near the badlands along the Libyan border, told The Globe and Mail that their nets sometimes snared the bodies of drowned African migrants, a few of them children.

The EU’s reaction to the migrant crisis has, all too predictably, been chaotic, contradictory, near-hysterical and sometimes mean-spirited, heightening the crisis and highlighting an ugly truth –– that the union has no mechanism to fix a disaster that could be managed to minimize the damage and stem outright bigotry. At the EU refugee relocation crisis meeting in July, some countries, such as Austria, refused to take any migrants; others agreed only to take a token number. Finland, one of the wealthiest and least densely populated EU countries, said it would take a mere 800. A few countries, notably Germany, agreed to take way more than their fair share.

“The underlying reason is that the creditors wish to get their hands on as many Greek assets as possible at the lowest possible prices.”

• The Poisoned Chalice (James Galbraith And J. Luis Martin)

Luis Martin: Since the outbreak of the Greek crisis in 2010, the European approach has been austerity now and the promise of supply-side policies later; once deficits have been brought under control and structural reforms have been implemented. Five years later, the Greek economy is depressed and debt has skyrocketed. In light of the third bailout Greece is now trying to secure, what is your vision for the Greek economy in the short and medium term?

James Galbraith: First of all, it’s important to distinguish between the public rationale for the policies that have been imposed on Greece, which are as you describe, and the underlying reasons which are quite different. The public rationale is the notion that so-called structural reforms will produce growth. The underlying reason is that the creditors wish to get their hands on as many Greek assets as possible at the lowest possible prices. Once you see that you’ll see that the policies are quite consistent with the reason, though not with the rationale.

What we are going to see now is an intensification of those policies and the liquidation of public and private assets in Greece: public assets which are being auctioned at undoubtedly low prices under the so-called privatization fund, and private assets because the Memorandum provides for accelerated liquidation, basically foreclosures of people’s homes and real estate and of the remaining Greek businesses. Basically that is the direction of policy, and if the Memorandum stays in place that is what we are likely to see.

LM: If you are correct, it would seem that the institutions (the IMF, the EC and the ECB) will have to rescue Greece indefinitely…?

JG: There is no “rescue” going on here. There is no “rescue,” there is no “bailout,” there is no “reform” going on. I really need to insist on this, because these words creep into our discourse. They are placed there by the creditors in order for unwary people to use them, but there is nothing of the kind taking place. What is going on is a seizure of the assets owned by the Greek state, by Greek businesses and by Greek households. There is no sense that this has anything to do with the recovery of the Greek economy or with the welfare of the Greek people. On the contrary, the policy is utterly indifferent to those considerations.

“Greece is going to be the canary in the mine.”

• On CNBC Discussing Greece And Europe – Full Transcript (Varoufakis)

CNBC: The market and a lot of watchers have been wondering what type of man Alexis Tsipras is following the referendum and his success politically, with some saying he’s a masterful politician, others think perhaps he’s just a newcomer who has had a little bit of luck and is now on borrowed time, or perhaps he’s a man that has really great mentors in Brussels. How would you describe him and his political success so far?

Oh there is no doubt he is an excellent politician. I’ve watched him up close; he has what it takes to be a genuine leader. There were very important junctures when he demonstrated his leadership and I witnessed it. But, the political situation in Greece is so toxic, and has been for years now. When you have an economic system which is in free fall and you have this astonishing situation, I don’t think that economic history and political history has ever seen this before, you have lenders, creditors, who are imposing upon you new loans under the conditions that will ensure that they will not get their money back, I think this is a unique historical phenomenon. So no politician, however skilled they might be, can survive the economic implosion which drags down along with it the political system.

CNBC: But Syriza hasn’t helped out here, and we’ve got the spilt from the left platform who have created their own party. Has this been detrimental to Tsipras’ future or has it handed him a golden opportunity to move to the centre of politics?

No, look, this kind of thinking would probably be appropriate under normal circumstances, but this Greece is not experiencing normal circumstances. What happened on the 12th of July was that there was an imposition by the Euro Summit of a programme that everybody in the Euro Summit knew was unviable on an economy which is in a great depression and this debt spiral, debt deflationary spiral, so once you come to this state of irrationality, reflecting Europe’s dithering, Europe’s inability to make up its own mind as to what it wants to do with its monetary union, there is no sense in going into this discussion about left, right, moving, shifting to the centre, median voters and all that.

Think of what happened to the previous governments. The socialist government of the Papandreou period of 2010 and 2011 imploded, the conservative government of Samaras imploded, our government imploded. Why? Because we rest on a foundation of an economy which is imploding and until and unless the economy gets stabilised, and we have some sensible discussion about debt, about investment, about credit, about reforms, which we have not had with the Troika because they were not interested in it, while they are sorting out their own disagreements about what to do with the monetary union, Greece is going to be the canary in the mine.

No one wants a tighter Union, at least not outside of Brussels.

• You Never Want a Serious Crisis to go to Waste (Legrain)

For now, the threat of Grexit has been avoided. Frantic French efforts to keep Greece in the euro succeeded, after Athens submitted to Germany’s punitive terms. But like threatening divorce in a bitter marital dispute, what’s said cannot be unsaid. Indeed, far from backtracking, the German Council of Economic Experts, which advises Chancellor Angela Merkel’s government, has suggested formalising Schäuble’s proposal: any country that breaches the fiscal rules and “continually fails to cooperate” should exit the monetary union. The message to those tempted to defy the German line could scarcely be clearer. Such a Germanic euro is unacceptable to many Europeans, not least in Paris and Rome.

France’s president, François Hollande, has instead called for a democratically accountable eurozone government. Italy’s finance minister, Pier Carlo Padoan, has echoed the French call for a fiscal and political union. Any proposal with the word “union” in it goes down well in Brussels. But a reality check is needed. There was little support for a federal eurozone government even before the crisis. And now that a financial crisis pitting creditors (the banks) against debtors has become a political conflict between countries, with nationalist insults flying and EU institutions discredited by siding with the creditors, European common feeling is in tatters. With the best will in the world, it is scarcely conceivable that Germans and French people could happily share a government, let alone Germans and Greeks.

There is manifestly little appetite among Europeans for further integration right now. It’s been a decade since the French and the Dutch voted No to the EU constitution and they have become much more sceptical since then. A recent survey by Opinium Research finds that the Dutch are almost as wary of deeper integration as the British, who will be soon voting on whether to leave the EU, while the French are close behind. A mere 17% of Dutch people and 24% of French ones favour further steps towards “ever closer union”, while 42% of Dutch people and 32% of French want to repatriate powers from Brussels. So forget about winning a referendum on steps towards a eurozone government.

Been going on for a long time.

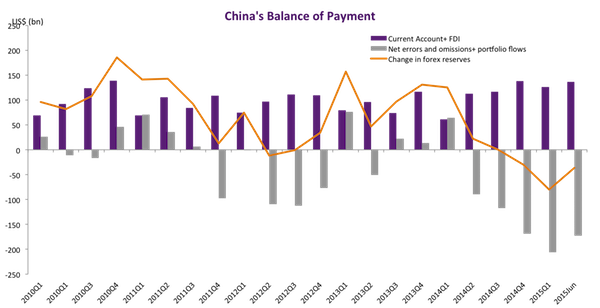

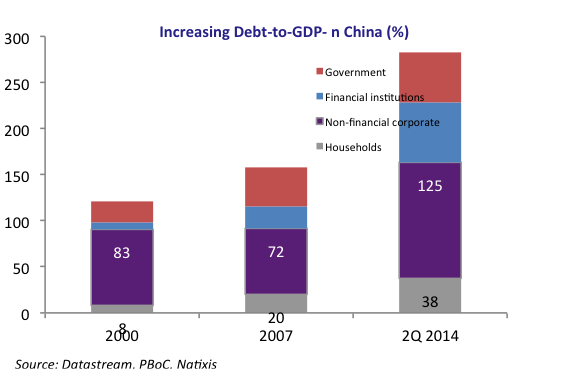

• Capital Outflow From China Adds Another Layer Of Worry (MarketWatch)

In yet another sign of deteriorating confidence in China’s economic prospects, capital outflows from the country are accelerating quickly, adding another layer of worry for investors and policy makers alike. “If all of the capital that went into China since 2010 were to exit, this would mean another $400 billion could leave. If we were to assume that all of the capital inflows that went in since 2008 were to exit, the number rises to another $700 billion,” said David Woo, FX and rates strategist at Bank of America Merrill Lynch. While Woo’s projections are based on the worst-case scenario, analysts at Goldman Sachs in July had noted the alarming pace of funds exiting the country.

“Net capital outflows could be around $224 billion in the [second] quarter, meaningfully up from the first quarter,” they said. “Capital outflows have become very sizeable and now eclipse anything seen in the recent past.” In theory, China’s foreign exchange reserves of $3.6 trillion are sufficient to handle the capital flight, but Woo believes Chinese officials are running out of tools to prop up the economy, forcing them to make a tough choice. “China cannot lower interest rates and defend the Chinese yuan at the same time,” he said. And once the Federal Reserve hikes interest rates, which BAML still expects this month, the interest rate differential between China and the U.S. will further narrow, leading to more capital leaving the country, he said.

But their governments keep denying anything’s wrong.

• Canada, Australia Feel Squeeze In Wake Of Chinese Economic Slowdown (Guardian)

In the mining town of Port Hedland, 1,500km north of Perth, modest prefabricated homes called fibro shacks, which were changing hands for more than A$1m four years ago, are now failing to find a buyer at a third of the price. Apartment blocks hurriedly tacked together by developers at the peak of the country’s boom stand empty, because their promised supply of “fly-in-fly-out” mineworkers has dried up, along with the jobs they were brought in to do. In 2011, the iron ore-rich Pilbara region of north-west Australia was on the frontier of a 21st century gold rush, this time with iron ore as the main prize – driven by China’s formidable appetite for natural resources to build up its infrastructure and modernise its economy.

Pilbara boasted salaries two-thirds higher than the national average and almost 80% of workers were flown into their jobs from Australia’s big cities. Now, mortgaged to the hilt on homes that lost value almost before the paint had dried, the mineworkers that remain are accepting longer hours and lower wages in an effort to keep up with the repayments. Their plight resonates thousands of miles away in Calgary, Canada. Oil, not iron ore, has been the foundation of that city’s prosperity. But fears that China’s appetite for natural resources is waning are sapping confidence; and as oil prices have plunged, another property boom could soon turn to bust.

“There’s a lot of people here that have been losing their jobs from the energy sector,” says Ann-Marie Lurie, chief economist at local estate agency CREB. Property prices have so far held up, but she says Calgarians are watching the global oil price with alarm. “Into next year the real question becomes, how long are energy prices going to remain this low?” she says, pointing out that, with building starts declining, the knock-on effects are already rippling through the construction industry. She expects house prices in Calgary, which rose by almost 10% in 2014, to go into reverse by the end of this year.

That’s a big number.

• South Korean Exports Fall 14.7%, GDP Forecasts Cut (WSJ)

South Korea’s government has cut its forecast for the nation’s economic growth next year because of the risks from China’s slowdown, Seoul’s finance minister said. Close economic interlinkage between China and South Korea also means a sharp deterioration of the Chinese economy would have an “extremely huge impact” on South Korea, although a so-called hard landing for China is unlikely, South Korean Finance Minister Choi Kyung-hwan said in an interview. Concerns about the Chinese economy are particularly acute in South Korea, an export-dependent nation that sends around a quarter of its overseas shipments to China. South Korean exports fell 14.7% from a year earlier in August—the sharpest drop in six years—as exports to China slid 8.8%.

Wild swings in global financial markets following a currency devaluation in China on Aug. 11 reflect fears that the world’s second-largest economy is entering a major downshift. “China is unlikely to crash-land. It has the capability to manage a soft landing,” Mr. Choi said in an interview with The Wall Street Journal on the sidelines of a conference for finance chiefs from the Group of 20 developed and major developing economies. “But a hard landing could have an extremely huge impact on South Korea.” Due to the increasing risks of a Chinese slowdown, South Korea cut its own growth forecast for 2016 to 3.3% from 3.5% when drawing up a new budget plan for next year, the minister said.

The budget details will be announced on Monday. For this year, there is no change to the forecast of 3.1% growth. Mr. Choi said the government was trying to achieve the target, citing stimulus efforts including the central bank’s policy rate cuts four times since last year and recently announced supplementary budget spending. South Korea’s economy expanded 3.3% last year. In the interview, the minister also called for the U.S. Federal Reserve to make more efforts to reduce uncertainty over pace of its expected interest rate increases through sufficient communications with markets.

Very interesting. Does math describe life?

• Scientists Find Mathematical Secret To How Nature Works (WaPo)

In nature, the relationship between predators and their prey seems like it should be simple: The more prey that’s available to be eaten, the more predators there should be to eat them. If a prey population doubles, for instance, we would logically expect its predators to double too. But a new study, published Thursday in the journal Science, turns this idea on its head with a strange discovery: There aren’t as many predators in the world as we expect there to be. And scientists aren’t sure why. By conducting an analysis of more than a thousand studies worldwide, researchers found a common theme in just about every ecosystem across the globe: Predators don’t increase in numbers at the same rate as their prey. In fact, the faster you add prey to an ecosystem, the slower predators’ numbers grow.

“When you double your prey, you also increase your predators, but not to the same extent,” says Ian Hatton, a biologist and the study’s lead author. “Instead they grow at a much diminished rate in comparison to prey.” This was true for large carnivores on the African savanna all the way down to the tiniest microbe-munching fish in the ocean. Even more intriguing, the researchers noticed that the ratio of predators to prey in all of these ecosystems could be predicted by the same mathematical function — in other words, the way predator and prey numbers relate to each other is the same for different species all over the world. “That’s what was very surprising to us, to see this same pattern come up over and over,” Hatton says. But what’s actually driving the pattern remains something of a mystery.

Hatton and his colleagues suspect that different aspects of different ecosystems may drive the predator-prey ratio: For example, Hatton says, competition for space might be a major factor controlling animal populations, but changes in the nutrients used and produced by plankton might have more of an effect on some marine ecosystems. The thing that’s puzzling is that the same mathematical function can be used to predict all of these ecosystems’ responses. And that’s not all: In a strange twist, the researchers observed that the same function can also be used to predict several other natural processes as well. One of these is the reproduction rates of prey species. If you remove predators from an ecosystem, prey populations start to increase, since there’s nothing eating them.

But there’s a catch: As their populations continue to grow, they reproduce at lower and lower rates – in other words, they continue to increase their numbers, but more and more slowly. And their growth rate can be predicted by the same mathematical function used to predict the way predators increase in response to their prey. Even more fascinating is that the same function applies to certain processes in individual organisms’ bodies. One phenomenon observed consistently in nature is that smaller animals, like mice, tend to be faster, have higher metabolisms, live shorter lives and reproduce at higher rates, while large animals, like elephants, are slower in all aspects. So as size increases, the rate at which bodily functions are performed changes. And the pattern in these changes is governed by – you guessed it – that same mathematical function.