Francisco Goya Fire at night 1793-94

As long as Powell hints that hikes will be slower, the ‘markets’ will cheer.

• Fed Expected To Move Forward With Rate Hike, Despite Trump (CNBC)

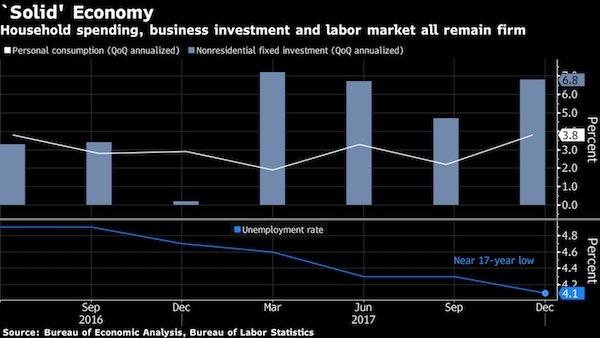

The Federal Reserve is expected to raise interest rates by a quarter point Wednesday and also signal it will not be raising rates as much as it had previously forecast. Strategists say that may soothe volatile financial markets, but the Fed has a tough task in terms of explaining its actions in a way that will not sound too alarmist about the economy or too unconcerned about deteriorating financial conditions. The Fed will be taking the fed funds rate range to 2.25 to 2.50 percent, and Fed watchers expect it to remove language in its post-meeting statement that says it will continue with ‘gradual’ rate increases.

According to its forecast, the Fed was expected to raise interest rates three more times next year, but economists now expect that will change to show two more hikes next year, with another possible in 2020. “The economy is decelerating. They were too optimistic on their outlook, but by the same token, they’re going to have to walk a fine line that they’re not overly concerned. They’re just going to take it down a notch,” said George Goncalves, head of fixed income strategy at Nomura. The Fed’s rate hike is coming against a backdrop of financial market turbulence. Markets have been reacting to concerns about rising interest rates as well as concerns trade wars and weaker global data could lead to a recession.

Fed Chairman Jerome Powell, unlike other Fed chairs, has also faced a stream of criticism from the White House, with President Donald Trump protesting rate hiking policy and in a tweet on Tuesday, the Fed’s balance sheet policy. “I do think the Fed will try and likely succeed in sending a comforting tone to the equity market. I think the market is forcing the Fed to deliver a very dovish hike. We think 2019 dots will come to two. 2020 will show one hike but just above 3 percent. The Fed will make some changes to show they are less on a pre-set course and more data dependent,” aid Mark Cabana, head of U.S. short rate strategy at Bank of America Merrill Lynch.

“..what happens when these algo’s reverse course and rather than “buying the f***ing dip,” they begin to “sell the f***ing rallies” instead..?”

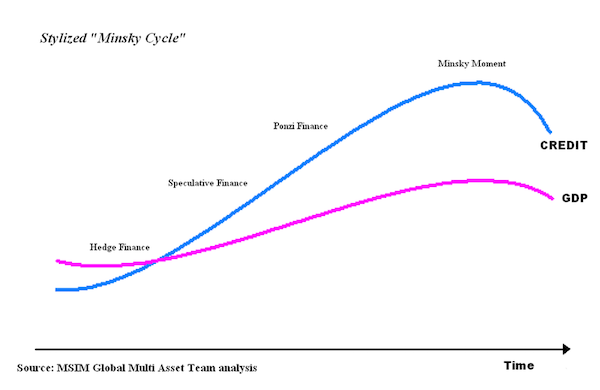

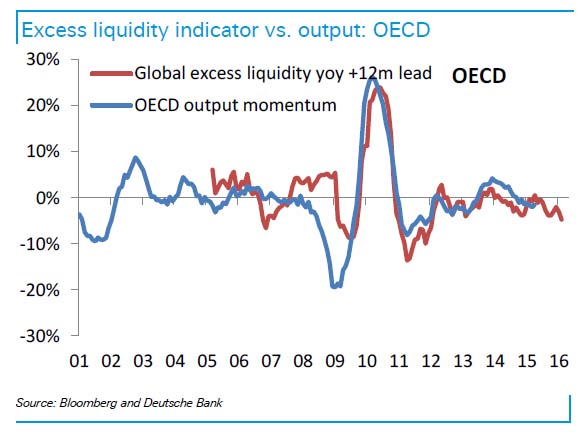

This is where I leave Lance Roberts behind. That graph simply tells me, to the extent that further graphs lose their meaning, that every single thing, the only thing, that happened since 2009 was central banks.

• Has “BTFD” Become “STFR”? (Roberts)

Kevin Wilson recently penned a piece for Seeking Alpha that made a great point about where the markets are currently. To wit: “Famous market observer Art Cashin mentioned a metaphor in October 2017 that resonated with me. He said (words to the effect that) at that moment, market players had only the protection provided by pictures of lifeboats, not the lifeboats themselves. This is just like the Titanic, whose measly 16 lifeboats looked nice, but left many hundreds on board with no means of escape when the ship sank. That is the current market situation in a nutshell. Players seem to believe that their positions are diversified enough to protect them in a downturn, and in any case, many appear to expect no major drawdown in spite of many months of extreme volatility. I would argue that the risk is far greater than perceived by many, and the protections most have in place are quite inadequate.”

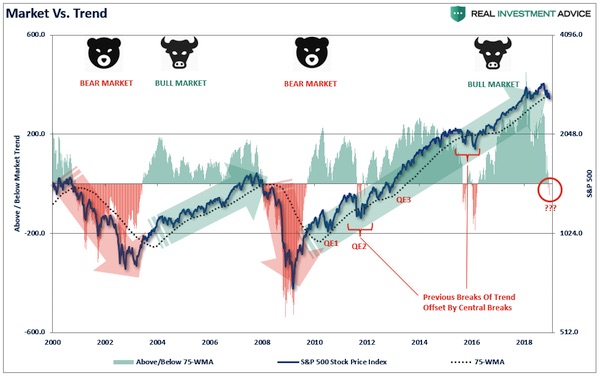

Indeed, that is the case. As I noted in this past weekend’s newsletter, while the S&P 500 has declined only marginally for 2018, the devastation across markets has been dramatically worse. In other words, traditional diversification, which is considered the “defacto” portfolio protection strategy by the mainstream media, has not worked. Over the last several weeks, I have been discussing the transition of the market from “bullish” to “bearish.” “The difference between a ‘bull market’ and a ‘bear market’ is when the deviations begin to occur BELOW the long-term moving average on a consistent basis.”

There goes the Saudi budget: ‘Uncertainty and volatility reign once again. ‘

• Oil Slump Could Get Much Worse Amid Oversupply Concerns (CNBC)

Oil prices are likely to fall even further over the coming weeks, analysts told CNBC Tuesday, as a sharp sell-off in global equities combines with intensifying fears about a market that could soon to be awash with crude. The latest wave of energy market selling comes amid reports of swelling inventories and forecasts of record U.S. and Russian output. Heightened worries of a possible economic slowdown in 2019 have also added downward pressure to the value of a barrel of oil. “The only way is down,” Tamas Varga, senior analyst at PVM Oil Associates, said in a research note published Tuesday.

“There are lots of variables regarding next year’s oil balance but based on available data, information and sentiment, it is fair to say that any price rally will be met by fierce resistance from the sellers’ side,” Varga said. Brent crude fell as much as 4 percent to as low as $57.20 a barrel on Tuesday, on track to register its third consecutive session of declines. The international benchmark has since trimmed some of its losses to trade down 2.7 percent. Meanwhile, U.S. West Texas Intermediate (WTI) dipped further below $50 a barrel on Tuesday, after settling below the psychologically important level for the first time in more than a year in the previous session. U.S. crude stood at $47.94 at around 11:00 a.m. ET, trading 4 percent lower.

Scrooge and the Grinch in one person.

• Alan Greenspan Has A New Warning For Investors: ‘Run For Cover’ (CNBC)

Alan Greenspan, the former Federal Reserve chief who called out the tech-fueled rally of the mid-1990s as “irrational exuberance,” is now giving investors a new warning. In a CNN interview, Greenspan said it was unlikely that the current market would stabilize and then take another big leg higher. “It would be very surprising to see it sort of stabilize here, and then take off again,” Greenspan said. Markets could still go up, but “at the end of that run, run for cover.” Greenspan told CNN the bull market is over, pointing to how stocks have fumbled in recent days.

On Tuesday, stocks rallied but they tumbled on Monday and have been in a decline since October, weighed by concerns over global trade conflict and slowing global economies. The S&P was on track, as of Monday’s close, for the worst December since 1931. [..] In the CNN interview, Greenspan said the U.S. could be headed into “stagflation,” an economy characterized by high inflation and high unemployment such as was seen in the 1970s. “How long it lasts or how big it gets, it’s too soon to tell.”

Strangest thing for me yesterday was the judge accusing Flynn of treason, only to apologize for that accusation minutes later.

• Revenge Of The Spies: Flynn Case Shows Extent Of Anti-Trump #Resistance (Malic)

President Donald Trump’s ill-fated first national security adviser Michael Flynn will twist in the wind for another three months or more, before he can face a sentence for getting caught in a FBI ambush while doing his job. Flynn was supposed to be sentenced on Tuesday, ending the year-long legal saga that destroyed his reputation, nearly bankrupted him, and even endangered his family. Then, in a bizarre last-minute twist, his lawyers asked for a delay. The next status hearing will be in March, with the actual sentencing who knows when. At one point in the hearing, Judge Emmett Sullivan urged Flynn to reconsider his guilty plea, telling him that the violation he was admitting to amounted to treason – only to walk back the comments minutes later.

The media, predictably, gave far more coverage to the original statement than the retraction. It’s the perfect example of the collective hysteria that has followed Flynn’s case from the very beginning. Despite the publication of FBI documents showing that agents interviewing Flynn in January 2017 did not think he misled them, intentionally or otherwise, about the content of his conversations with Russian ambassador to the US Sergey Kislyak, Flynn chose to stand by his guilty plea from a year ago. His reasons for this are a mystery. What is not a mystery, however, is how the people involved in railroading Flynn are the same ones implicated in the institutional #Resistance to the Trump administration.

[..] In the orgy of sensationalist reporting that has gripped the US mainstream media for the past two years, Flynn’s actual transgression has been lost to the din of shouting “treason” and “RUSSIA.” What he pleaded guilty to is lying to FBI investigators about his calls with Kislyak. The contacts themselves were right and proper, mind you: it was literally his job to reach out to foreign diplomats on behalf of the president-elect. So, why was the FBI even probing them?

That is where things get interesting. Somebody from the Obama administration – we still don’t know who – “unmasked” Flynn’s name from the classified NSA intercepts of his conversations with the Russian ambassador. This somehow got to Acting Attorney General Sally Yates, who testified that she reached out to the White House with concerns about Flynn being blackmailed. It also somehow got to the Washington Post. There was talk of the Logan Act, an obscure 200-year-old law never used to prosecute anyone.

I have a bunch of questions and doubts, but I like Ellen Brown.

Question 1: Is it a good idea to spend trillions on Green New Deals? How much of it would be geared towards decreased energy use?

Question 2: Is Abenomics really the success Ellen claims it is?

• This Radical Plan to Fund the ‘Green New Deal’ Just Might Work (Ellen Brown)

[..] the “Green New Deal” promoted by Rep.-elect Alexandria Ocasio-Cortez, D-N.Y., appears to be forging a political pathway for solving all of the ills of society and the planet in one fell swoop. Her plan would give a House select committee “a mandate that connects the dots” between energy, transportation, housing, health care, living wages, a jobs guarantee and more. But even to critics on the left, it is merely political theater, because “everyone knows” a program of that scope cannot be funded without a massive redistribution of wealth and slashing of other programs (notably the military), which is not politically feasible.

A network of public banks could fund the Green New Deal in the same way President Franklin Roosevelt funded the original New Deal. At a time when the banks were bankrupt, he used the publicly owned Reconstruction Finance Corp. as a public infrastructure bank. The Federal Reserve could also fund any program Congress wanted, if mandated to do so. Congress wrote the Federal Reserve Act and can amend it. Or the Treasury itself could do it, without the need to even change any laws. The Constitution authorizes Congress to “coin money” and “regulate the value thereof,” and that power has been delegated to the Treasury. It could mint a few trillion-dollar platinum coins, put them in its bank account and start writing checks against them.

What stops legislators from exercising those constitutional powers is simply that “everyone knows” Zimbabwe-style hyperinflation will result. But will it? Compelling historical precedent shows that this need not be the case. Michael Hudson, professor of economics at the University of Missouri-Kansas City, has studied the hyperinflation question extensively. He writes that disasters such as Zimbabwe’s fiscal troubles were not due to the government printing money to stimulate the economy. Rather, “Every hyperinflation in history has been caused by foreign debt service collapsing the exchange rate. The problem almost always has resulted from wartime foreign currency strains, not domestic spending.”

As long as workers and materials are available and the money is added in a way that reaches consumers, adding money will create the demand necessary to prompt producers to create more supply. Supply and demand will rise together and prices will remain stable. The reverse is also true. If demand (money) is not increased, supply and GDP will not go up. New demand needs to precede new supply. Infrastructure projects of the sort proposed in the Green New Deal are “self-funding,” generating resources and fees that can repay the loans. For these loans, advancing funds through a network of publicly owned banks would not require taxpayer money and could actually generate a profit for the government. That was how the original New Deal rebuilt the country in the 1930s at a time when the economy was desperately short of money.

The title of my article yesterday very much reflects Brexit: Chaos in 2018, Mayhem in 2019.

• Thousands Of British Troops On Standby For No-Deal Brexit (Ind.)

Thousands of troops have been put on standby to handle any fallout of Britain crashing out of the European Union without having secured a withdrawal deal. The government has said that, with 100 days to go until Brexit day on 29 March, it will implement all of its no-deal planning “in full” – following a clash in cabinet reflected in the wider Tory Party. Senior ministers went head-to-head, with one group demanding “no deal” become Britain’s central planning assumption, while others including the chancellor branded departing without an agreement a “unicorn” idea. Jeremy Hunt, foreign secretary, is said to have told colleagues their party would never be forgiven if it fails to deliver Brexit, but other Conservatives vowed to do everything in their power to stop a no-deal scenario.

In yet another day of Brexit high drama, defence secretary Gavin Williamson revealed he had made 3,500 troops ready to “support any government department on any contingencies they may need”. While he told MPs there had been no request for the troops yet, he said “What we are doing is putting contingency plans in place, and what we will do is have 3,500 service personnel held at readiness, including regulars and reserves, in order to support any government department on any contingencies they may need.” The Ministry of Defence later confirmed the troops would be put on alert in addition to the 5,000 already on standby to deal with potential terror attacks.

[..] Ministers have already announced plans to stockpile food and medicines, chartering ferries to bring in extra supplies and providing extra resources for border agencies. Downing Street said that advice on no-deal preparations would also be going out to households by various channels over the coming weeks. The Treasury will supply an additional £2bn on top of the £2bn already provided, with the Home Office receiving £500m for border security and handling the settlement scheme for EU nationals who want to remain in the country. Another £400m will go to Defra, the environment department, for projects including ensuring clean drinking water, which the UK treats with chemicals and gases imported from the EU.

More British troops, just with different weapons.

“The goal was to establish “key influencers” on social media and determine who is “friendly” to the UK.”

• New ‘Integrity Initiative’ Leaks: Military Ties, Infiltration of European Media (RT)

It’s been over a month since hackers began exposing the Scotland-based ‘Integrity Initiative’ as a UK government-funded propaganda outfit — and gradually new details of the organization’s clandestine activities have come to light. The documents were leaked by a group which claims to be associated with the Anonymous hackers. The first batch of leaks revealed the Integrity Initiative (II) was stealthily operating “clusters” of influencers across Europe working to ensure pro-UK narratives dominate the media. The second batch showed that the organization was also running disinformation campaigns domestically — specifically a smear campaign against Labour leader Jeremy Corbyn; all done under the guise of combatting “Russian propaganda.”

Now, a third batch of leaks has exposed that the project allegedly operated much like a modern-day version of Operation Mockingbird — a secretive 1950s project whereby the CIA worked hand-in-glove with willing journalists in major media outlets to ensure certain narratives were adhered to. Only this time, it’s a UK-funded organization with deep links to the intelligence services and military passing itself off as a non-partisan “charity.”

[..] 3. Skripal ‘monitoring campaign’ The II leapt into action after the poisoning of ex-Russian spy Sergei Skripal in March and supposedly put together a proposal to monitor social media discussion to “evaluate how the incident is being perceived” across Europe. The goal was to establish “key influencers” on social media and determine who is “friendly” to the UK. Lists of tweets on the Skripal affair were put together, along with country reports detailing how journalists in Europe were responding, the leak suggests. One report noted that in Italy, doubts about the UK narrative had been raised by “high-quality newspapers” and suggested that an “effective, discrete and articulated information campaign” must be directed at key figures in Italian politics and media.

Neoliberalism simply failed to rise people’s living standards, so why should they support it any longer?

• Either The EU Ditches Neoliberalism Or Its People Will Ditch The EU (Wight)

De Gaulle took a dim view of the UK in the postwar period, considering London a proxy of Washington. It was a view that gained common currency within French political circles after the debacle known to history as the Suez Crisis, when in 1956 the French and British entered into an ill-fated military pact with Israel to seize control of the Suez Canal from Egypt and effect the overthrow of the country’s Arab nationalist president Gamal Abdul Nasser. President Eisenhower forced the British into a humiliating retreat, threatening a series of punitive measures to leave London in no doubt of its place in the so-called special relationship. The French had been eager to continue with the Suez operation and were disgusted at London’s craven climb down in the face of Eisenhower’s intervention.

In 1958, two years after the Suez debacle, De Gaulle entered the Elysee Palace as French president. Thereafter, the humiliation of Suez still raw, he embarked on an assertion of the country’s independence from Washington that contrasted with Britain’s slavish and unedifying subservience. The French leader withdrew France from NATO’s integrated command and twice blocked Britain’s entry into the European Economic Community (EEC) – the previous incarnation of today’s EU – on the basis that London would be a US Trojan horse if admitted. There is, given this history, delicious irony in the fact that the country responsible for injecting the poison of neoliberalism into the EU – the UK under its fanatical leader Margaret Thatcher – is currently embroiled in a messy divorce from the bloc.

The EU in its current form is a latter-day prison house of nations locked inside a neoliberal straitjacket and single currency. Not only can’t it survive on this basis, but it also does not deserve to. Ultimately, either Europe’s political establishment decouples from Washington and its works – the Trump administration notwithstanding – or its peoples will decouple from them and theirs. As things stand, the latter proposition is far more likely.

Belgian Cabinets are notorious for taking forever to form.

• Belgian PM Charles Michel Resigns After No-Confidence Motion (G.)

Belgium’s government of four years has fallen on the issue of migration after the country’s parliament rejected an appeal from prime minister, Charles Michel, for its support for a minority administration. Michel was forced to offer his resignation to the King of the Belgians, Philippe, after the Socialist party, with support from the Greens, proposed a vote of no confidence in his administration. The country is now braced for a snap election in January. The head of Michel’s party said the opposition had rejected the government’s “fair offer” in order to secure a political scalp. “The Socialist opposition and Greens wanted a trophy and have it”, said David Clarinval, chairman of the liberal Reform Movement party.

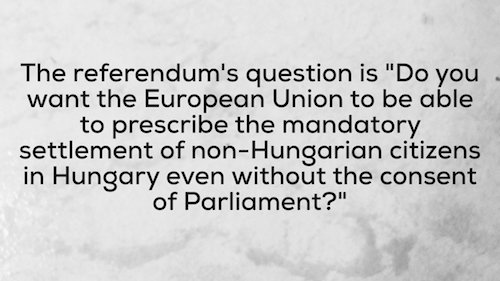

[..] The N-VA, a Flemish nationalist party with hardline views on immigration, walked out of the government earlier this month over Michel’s signature to a UN migration pact providing for a common global approach to migrant flows. The draft UN accord lays down 23 objectives to open up legal migration and better manage a global flow of 250 million people, 3% of the world population. The US dropped out of talks on the pact last year and countries including Italy, Hungary, Austria, Poland, Bulgaria, Slovakia and Australia have rejected it. The deal is expected to be ratified at the UN headquarters in New York on 19 December.

Employers can ‘ask’ employees to work 400 hrs of overtime per year without compensation.

• France, Hungary, Serbia: Is Half Of Europe Protesting? (DW)

People have taken to the streets to protest against a labor law in Hungary, against tuition costs in Albania and against state violence in Serbia. Germany, meanwhile, has seen its first “yellow vest” style demonstration. Looking at the photos, one could mistake the sea of lights in Budapest for a festive holiday event. The people who gathered in Hungary’s capital Sunday night weren’t holding candles, however, but smartphones. And their message is political, not religious. They are demanding Prime Minister Viktor Orban take back a law that allows companies to ask their employees to work 400 hours overtime per year.

Since the measure was passed in parliament last Wednesday, more and more people have been protesting what has been called a “slave law.” In some cases, the rallies were overshadowed by violence. The protests on Sunday started off peaceful, but police later resorted to teargas again. With around 10,000 or even 15,000 participants, Sunday’s rally was the biggest event so far in a series of protests the likes of which Hungary hasn’t seen during Orban’s eight years in power. France is experiencing similar unrest with the “yellow vest” protests. Is the climate in Europe’s streets growing more heated?

Of course Orban blames it all on Soros. He may come to regret ignoring his people’s anger. Same feelling as with Macron.

• Hungary’s Opposition Plans More Protests After ‘Slave Law’ Passes (G.)

Hungary’s beleaguered political opposition has vowed to keep up the pressure on the country’s far-right prime minister, Viktor Orbán, after a week of protests in which thousands came on to the streets of Budapest, and four MPs were roughed up by security guards after attempting to get their demands across on state television. The protests were triggered by a so-called “slave law”, passed amid chaotic scenes in the Hungarian parliament last Wednesday, which allows employers to force employees to work overtime, and lets them delay payment for up to three years. It was passed together with legislation that provides for greater government control over the court system, the latest move by Orbán’s Fidesz party to capture independent state institutions.

A number of different opposition parties are cooperating on a joint strategy to keep pressure on the government. “We’re closely cooperating on a daily basis, and are planning roadblocks and further demonstrations if the president signs this into law,” said Tímea Szabó, of the opposition LMP party. She also said the opposition would announce civil disobedience action, though she refused to specify what it had in mind.

[..] “Brace yourselves for a new kind of democracy, one born of a carefully managed revolution by remote control,” wrote government spokesman Zoltán Kovács in a blogpost about the protests. “The revolution unfolds with protest leaders from a band of the usual suspects, many of them trained abroad and with close ties to Soros networks.” Kovács also pointed the finger at the international media, claiming they were overselling the protests, and at the “stomach-churning opportunism” of the liberal Belgian politician Guy Verhofstadt, who tweeted his support for the protests and used the hashtag #O1G, which refers to a Hungarian meme insulting Orbán in vulgar language. Kovács described Verhofstadt as “one of Soros’s henchmen in Brussels”.

Living organisms that are 1000s of years old and span 100s a of acres.

• One of Earth’s Largest Living Things Even Bigger Than Previously Thought (Ind.)

A giant honey mushroom considered a contender for the largest organism on the planet is both much larger and much older than previously thought. Scientists first studied the enormous fungus, which lives deep underground in a Michigan forest, in 1992. Then they estimated it was 1,500 years old, and the extensive mass of underground fibres and mushrooms that formed it weighed 100,000kg and stretched 15 hectares. Returning to the site, the same team used more rigorous testing to estimate the fungus was in fact closer to 2,500 years old.

They also discovered that it weighed 400,000kg and stretched over 70 hectares. This makes the enormous honey mushroom, which mostly consists of an underground network of tendrils wrapped around tree roots, heavier than three blue whales. “I view these estimates as the lower bound… The fungus could actually be much older,” said Professor James Anderson, a biologist at the University of Toronto who undertook both studies. [..] While the Michigan fungus is large, it is outclassed by another honey mushroom from Oregon that is even larger. There is also the Pando aspen in Utah, a forest originating from a single underground parent clone that is thought to weigh up to 6 million kg.

Armillaria mellea, Honey Fungus, taken in Whitewebbs Wood, Enfield, UK