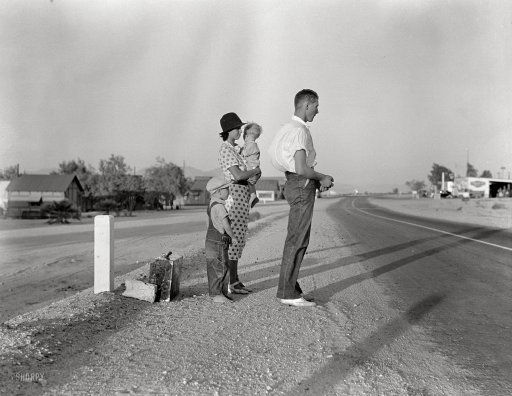

Dorothea Lange Refugees: Drought hit OK farm family on way to CA Aug 1936

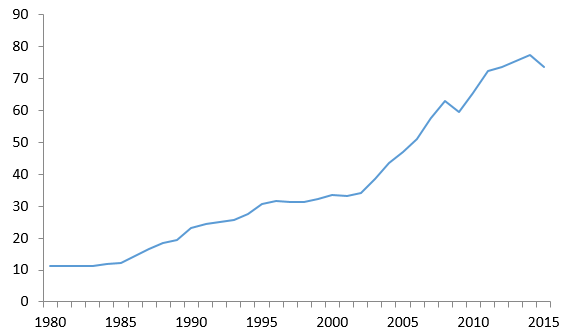

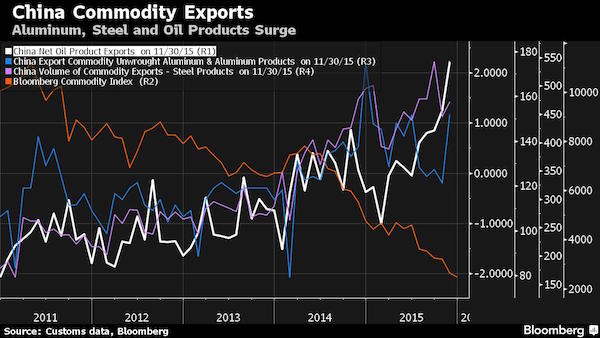

Note: total Chinese exports have fallen for 5 months now. While commodity exports are rising fast. So outside of commodities, the fall in exports is that much bigger.

• When It Rains It Pours as China Unleashes Commodity Torrent (BBG)

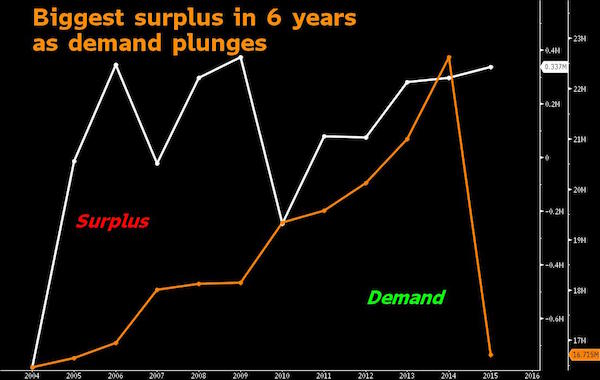

There’s no let-up in the onslaught of commodities from China. While the country’s total exports are slowing in dollar terms, shipments of steel, oil products and aluminum are reaching for new highs, according to trade data from the General Administration of Customs. That’s because mills, smelters and refiners are producing more than they need amid slowing domestic demand, and shipping the excess overseas. The flood is compounding a worldwide surplus of commodities that’s driven returns from raw materials to the lowest since 1999, threatening producers from India to Pennsylvania and aggravating trade disputes. While companies such as India’s JSW Steel decry cheap exports as unfair, China says the overcapacity is a global problem.

“It puts global commodities producers in a bad situation as China struggles with excess supplies of base metals, steel and oil products,” Kang Yoo Jin at NH Investment & Securities said. “The surplus of commodities is becoming a real pain for China and to ease the glut, it’s increasing its shipments overseas.” Net fuel exports surged to an all-time high of 2.22 million metric tons in November, 77% above the previous month, customs data showed. Aluminum shipments jumped 37% to the second-highest level on record while sales of steel products climbed 6.5%, taking annual exports above 100 million tons for the first time. Chinese oil refiners are tapping export markets to reduce swelling fuel stockpiles, particularly diesel. The nation is also encouraging overseas shipments by allowing independent plants to apply for export quotas to sustain refining operation rates and ease an economic slowdown, according to Yuan Jun at oil trader China Zhenhua Oil.

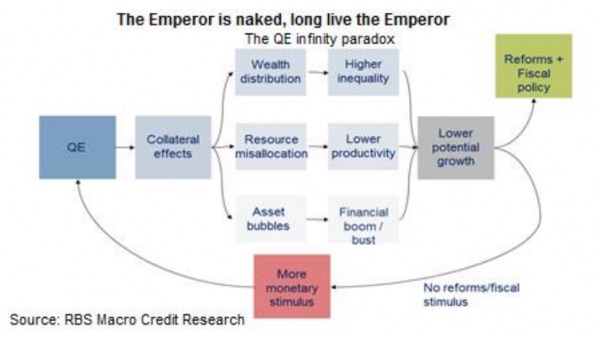

A boon for the economy, you said?

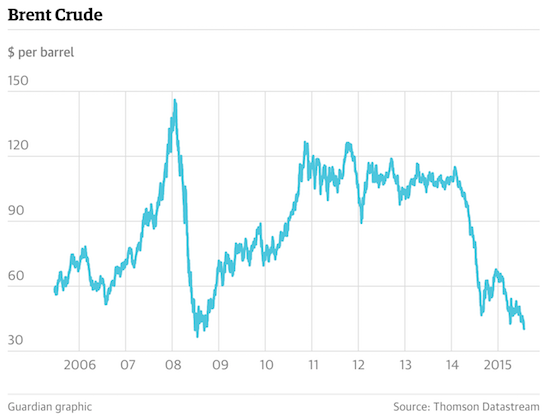

• Oil Producers Prepare For Prices To Halve To $20 A Barrel (Guardian)

The world’s leading oil producers are preparing for the possibility of oil prices halving to $20 a barrel after a second day of financial market turmoil saw a fresh slide in crude, the lowest iron ore prices in a decade, and losses on global stock markets. Benchmark Brent crude briefly dipped below $40 a barrel for the first time since February 2009 before speculators took profits on the 8% drop in the cost of crude since last week’s abortive attempt by the oil cartel Opec to steady the market. But warnings by commodity analysts that the respite could be shortlived were underlined when Russia said it would need to make additional budget cuts if the oil price halved over the coming months.

Alexei Moiseev, Russia’s deputy finance minister, told Reuters: “If oil goes to $20, we will need to do additional [spending] cuts. Clearly we have shown that we are very willing to cut fiscal spending in line with an oil price at $60, for example. In order for us to be long-term sustainable [with the] oil price at $40, we need to do additional cuts, but if the oil price goes to $20 we need to do even more cuts.” Russia and Saudi Arabia – the world’s two biggest oil producers – both increased spending when oil prices rose to well above $100 a barrel. The fall from a recent peak of $115 a barrel in August 2014 has left all Opec members in financial difficulty, but Saudi Arabia has refused to relent on a strategy of using a low crude price to knock out US shale producers.

Hopes that Opec would announce production curbs to push prices up were dashed when the cartel met in Vienna last Friday, triggering the latest downward lurch in the cost of oil. Lord Browne, the former chief executive of BP, refused to rule out the possibility that oil could halve again in price when he was interviewed by Bloomberg TV. Asked if oil could hit $20 a barrel, Browne – who ran BP from 1995 to 2007 during a period when the cost of crude rose from $10 to $100 a barrel, said in the short term nothing was impossible. He added: “In the long run, $20 is probably wrong, but that’s as far as I’d go.”

Some jobs to be transferred to new owners of assets Anglo sells off.

• Anglo American To Slash Workforce By 85,000 Amid Commodity Slump (Guardian)

Anglo American has suspended its dividend and announced plans to cut its workforce by 85,000 and dispose of more than half its mines in response to the plunging price of iron ore and other metals. The UK mining company said it would not pay a dividend for the second half of this year and all of next year. The last time Anglo American cut its dividend was during the worst of the financial crisis in 2009. In a presentation to investors, Anglo American said it would sell or close up to 35 mines, leaving it with about 20 sites and cutting employee and contractor numbers from 135,000 to fewer than 50,000 after 2017. It will halve the number of business units from six to three: the De Beers diamond operation, industrial metals and bulk commodities.

The company, which mines materials such as iron ore, manganese, coal, copper and nickel, said it would cut capital spending by a further $1bn (£670m) to the end of 2016, taking the reduction in capital spending to $2.9bn by the end of 2017. It increased the amount it plans to raise from asset sales to $4bn from $3bn. The plan is the biggest restructuring by a mining company in reaction to the commodities rout. Prices have plunged because of slowing world economic growth and falling demand from China, the world’s biggest consumer of iron ore, copper, nickel and most other commodities. Anglo American’s shares, which have lost almost three-quarters of their value this year, fell more than 12% to a new all-time low of 323p.

Its announcement sent all other mining shares down in London with the sector at a 10-year low. The biggest mining companies are slashing spending and cutting costs to protect their financial strength as metal prices plunge. Glencore, the British miner and commodities trader, has suspended its dividend and is selling assets to cut its debt in an effort to rebuild investor confidence. Anglo American has been affected more severely by the commodities crash than some of its rivals because of its reliance on iron ore, whose value has fallen by almost 40% this year as demand from China has fallen.

The commodities dump puts the entire global economy in jeopardy and Bloomberg says it’s all great. “..the world has enjoyed a windfall equivalent to 2% of GDP it would otherwise have spent on crude..” The crude does come from the world, though, right?

• OPEC Provides Economic Stimulus Central Bankers Can’t or Won’t (BBG)

The world’s central bankers just got a helping hand from the world’s oil ministers. As the ECB delivers less monetary stimulus than investors sought and with the Federal Reserve set to tighten next week, the world economy may find support instead from the weakest oil price in more than six years. West Texas Intermediate is trading at about $40 a barrel four days after OPEC chose not to limit output, extending the commodity’s decline from its June 2014 peak of $107.73 and this year’s high of $62.58 in May. While its earlier slide failed to provide the economic pickup some anticipated, economists at UniCredit, Commerzbank and Societe Generale are still banking on cheaper fuel to spur spending by consumers and companies in 2016.

“On net, central bankers should take this as a positive,” said Peter Dixon, an economist at Commerzbank in London. “This does help to stimulate demand by leaving a little bit of money in the pocket and providing a feel-good factor.” At Societe Generale, Michala Marcussen, global head of economics, reckons every $10 drop in the price of oil lifts global growth by 0.1 percentage point. She estimates that since 2014, the world has enjoyed a windfall equivalent to 2% of GDP it would otherwise have spent on crude. “Our biggest relief last week was that OPEC decided no output cut, promising consumers inexpensive oil for longer,” said Marcussen. Even though falling oil may weaken the inflation rates central bankers are struggling to lift, Erik Nielsen at UniCredit said it was important to recognize that it’s “‘good’ disinflation, because it stems from supply rather than demand and so should raise real income, thereby propelling consumption and the recovery.”

“A drop in energy prices is the equivalent of a tax cut, with no implications for debt,” he said, adding that faster expansions as a result should end up bolstering prices too and so investors should be wary of wagering on a deterioration in inflation.

That sounds very similar to what they said about cheaper oil, and we said from the get-go it wouldn’t work out well. Besides, copper producers? There’s no production, it’s mining. There’s some ‘purification’ involved, but no ‘production’. Like a refinery doesn’t ‘produce’ oil. BTW, that’s one mighty ugly graph.

• Copper Meltdown Burning Miners Is Boon to Builders as Costs Sink (BBG)

Copper producers from Glencore to Freeport-McMoRan spent most of this year getting slammed by the metal’s worst slump since the recession. But there are some folks who are cheering. With prices heading for a third straight annual decline, the rout is a welcome reprieve for metal buyers like electricians and builders who put about 400 pounds (181 kilograms) of copper into the average U.S. home. As recently as 2011, copper traded in New York was at all-time-highs, after more than five-fold gains in the previous decade. Now, with demand growth cooling in China, the biggest user, global surpluses have emerged. “Business has been so much better – the best in about 10 years,” said David Chapin, the president Willmar Electric Service, a Minnesota-based company that spends about $1 million a year on copper wire it installs for clients in several Midwest states.

While that’s only 5% of Willmar’s total costs, cheaper metal is boosting profit on projects that a few years ago were close to being money losers, Chapin said. On the Comex, copper futures fell 28% this year to $2.048 a pound and are heading for the biggest annual retreat since 2008. The metal touched $2.002 on Nov. 23, a six-year low. Prices haven’t traded below $2 since 2009. Copper’s role in construction and architecture dates as far back as ancient Egypt, where temple doors were clad with the metal, according to the Copper Development Association. In modern times, the commodity’s conductive properties and it’s resistance to corrosion have made it sought after for pipes and wires. Globally, construction accounts for about 30% of demand, Bloomberg Intelligence data show. The transportation industry makes up about 13%, including for use in cars and trucks.

Richardson, Texas-based Lennox International Inc., which makes and markets heating and cooling equipment, said on an Oct. 19 earnings call that cheaper metals and commodities provided a benefit of $15 million to earnings in 2015. There’s about 50 pounds of copper in the average air-conditioning unit. “The winner here will be anyone who purchases and uses copper,” Dane Davis, a metals analyst at Barclays Plc in New York, said in a telephone interview. “The construction industry stands to benefit from cheaper copper pipes. On a national scale, automobile producers are also going to be winners because it’s an important part of car production.”

As commodities prices sink, so does the market cap of these huge corporations.

• Iron Ore in $30s Seen Near Tipping Point for Largest Miners (BBG)

Iron ore’s tumble into the $30s threatens the world’s biggest miners as prices approach break-even costs, according to Capital Economics. BHP Billiton shares slumped to the lowest in 10 years and Rio Tinto dropped to the lowest since 2009. The most expensive operations at the four largest suppliers are on the verge of making losses at rates below $40 a metric ton, said John Kovacs at Capital Economics in London, who estimates their break-even levels at $28 to $39, taking into account freight and other costs. While these producers will keep output strong, they’ll be constrained by low prices, he said. Iron ore’s plunge below $40 comes as producers including Vale in Brazil and Rio and BHP in Australia press on with expansions to cut costs and defend market share just as demand from the largest consumer China slows.

They’re the world’s biggest suppliers along with Fortescue. Prices of the raw material have lost 45% this year and have plunged 80% from their peak in 2011. “The big four will find it hard to maintain output at below $40,” Kovacs said in response to questions. “If prices remain weak, output from the highest-cost mines of the big four will be under pressure.” Ore with 62% content delivered to Qingdao sank 1.1% to $38.65 a dry ton on Monday, a record low in daily prices compiled by Metal Bulletin Ltd. dating back to May 2009. The raw material peaked at $191.70 in 2011. Kovacs said that while rates will stay low over the next year, he doesn’t believe they’ll remain below $40 for a significant length of time. He expects prices to recover slowly because demand won’t fall much further and the biggest miners will find it difficult to keep up output at these levels.

Oh, you think they couldn’t figure out that one by themselves?

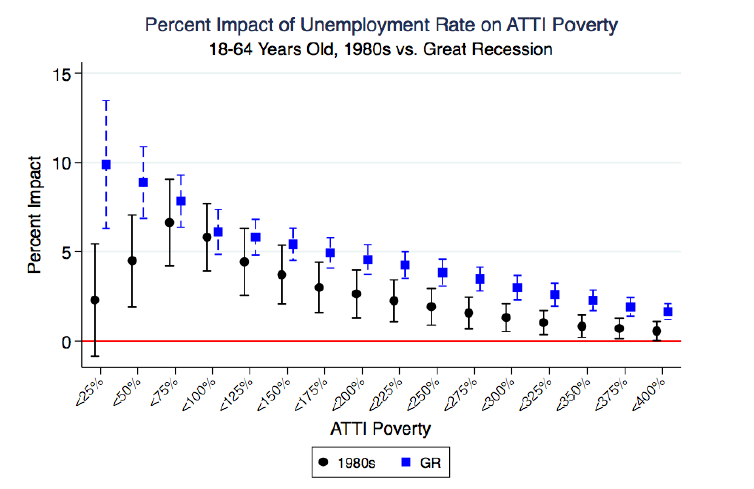

• Emerging Markets Warned of Capital Drought as Fed Nears Liftoff (BBG)

A sudden capital drought in emerging markets could undermine the fragile global expansion, World Bank economists said in a report Tuesday that questions whether the international lender’s main poverty-reduction target is achievable given the bleaker outlook. Now in its sixth year, the slowdown in developing economies is the broadest since the 1980s, World Bank economists said in a research paper released on Tuesday. While emerging nations are better prepared for shocks than they were in the 1980s and 1990s, the recent “rough patch” could signal a new era of slow growth, according to the Washington-based development bank. Even worse, a surge in financial turbulence could cause capital flows into emerging markets to dry up, the World Bank said.

Net capital flows in emerging markets have been declining since last year and stalled to zero in the first half of 2015. The warning comes a little over a week before what investors expect will be the U.S. Federal Reserve’s first increase in its benchmark borrowing rate since 2006. Tightening financial conditions and a slump in commodity prices have hurt resource-rich emerging markets such as Russia and Brazil, a nation which Goldman Sachs has warned may be on the verge of a depression. “Deteriorating external conditions, perhaps resulting from U.S monetary policy tightening or elevated uncertainty about growth prospects in a major emerging market, could potentially combine with domestic factors into a ‘perfect storm’ by sparking a sudden stop in capital inflows to multiple emerging markets,” the World Bank said in the paper.

World Bank President Jim Yong Kim has made it part of the institution’s mission to reduce extreme poverty – living on less than $1.90 a day – to 3% of the world’s population. That milestone will be a challenge to reach “under most plausible scenarios,” the report stated. “In light of the significant global risks going forward, emerging markets urgently need to put in place an appropriate set of policies to address their cyclical and structural challenges and promote growth,” the authors wrote. The report’s authors cite a number of reasons for the slowdown, including weak global trade, the commodities slump as demand from China has weakened, and slowing productivity growth in emerging economies..

Lowballing.

• China’s Illicit Outflows Estimated at $1.4 Trillion Over Decade (BBG)

China’s illicit financial outflows were estimated at almost $1.4 trillion over a decade, the largest amount for any developing nation, as money exited the country through channels including fake documentation on trade deals. The estimate for the 10 years through 2013 was published Wednesday by Global Financial Integrity, a Washington-based group researching cross-border money transfers. The study is based on data reported to the IMF and covers money which GFI believes to be illegally earned, transferred or utilized. Money flowing out of China this year has helped to pump up property markets from Sydney to Vancouver, while prospects for a weaker yuan may drive more cash abroad.

On Wednesday, China cut the currency’s reference rate to the weakest since 2011. The bulk of $7.8 trillion of illicit money that exited developing nations over the 10-year period was disguised as trade through fake invoicing, the report said. That’s a method that was highlighted in China in 2013 when the government cracked down on false documentation that was hiding money flows and distorting the nation’s trade data. While citizens are officially limited to converting $50,000 per person a year, a range of tools exist for getting around that restriction, from pooling quotas to transactions through so-called underground banks.

“..on Tuesday, the IMF joined the New Cold War..”

• The IMF Forgives Ukraine’s Loan To Russia (Michael Hudson)

On December 8, the IMF’s Chief Spokesman Gerry Rice sent a note saying: “The IMF’s Executive Board met today and agreed to change the current policy on non-toleration of arrears to official creditors. We will provide details on the scope and rationale for this policy change in the next day or so.” Since 1947 when it really started operations, the World Bank has acted as a branch of the U.S. Defense Department, from its first major chairman John J. McCloy through Robert McNamara to Robert Zoellick and neocon Paul Wolfowitz. From the outset, it has promoted U.S. exports – especially farm exports – by steering Third World countries to produce plantation crops rather than feeding their own populations. (They are to import U.S. grain.) But it has felt obliged to wrap its U.S. export promotion and support for the dollar area in an ostensibly internationalist rhetoric, as if what’s good for the United States is good for the world.

The IMF has now been drawn into the U.S. Cold War orbit. On Tuesday it made a radical decision to dismantle the condition that had integrated the global financial system for the past half century. In the past, it has been able to take the lead in organizing bailout packages for governments by getting other creditor nations – headed by the United States, Germany and Japan – to participate. The creditor leverage that the IMF has used is that if a nation is in financial arrears to any government, it cannot qualify for an IMF loan – and hence, for packages involving other governments. This has been the system by which the dollarized global financial system has worked for half a century. The beneficiaries have been creditors in US dollars.

But on Tuesday, the IMF joined the New Cold War. It has been lending money to Ukraine despite the Fund’s rules blocking it from lending to countries with no visible chance of paying (the “No More Argentinas” rule from 2001). With IMF head Christine Lagarde made the last IMF loan to Ukraine in the spring, she expressed the hope that there would be peace. But President Porochenko immediately announced that he would use the proceeds to step up his nation’s civil war with the Russian-speaking population in the East – the Donbass. That is the region where most IMF exports have been made – mainly to Russia. This market is now lost for the foreseeable future. It may be a long break, because the country is run by the U.S.-backed junta put in place after the right-wing coup of winter 2014. Ukraine has refused to pay not only private-sector bondholders, but the Russian Government as well.

This should have blocked Ukraine from receiving further IMF aid. Refusal to pay for Ukrainian military belligerence in its New Cold War against Russia would have been a major step forcing peace, and also forcing a clean-up of the country’s endemic corruption. Instead, the IMF is backing Ukrainian policy, its kleptocracy and its Right Sector leading the attacks that recently cut off Crimea’s electricity. The only condition on which the IMF insists is continued austerity. Ukraine’s currency, the hryvnia, has fallen by a third this years, pensions have been slashed (largely as a result of being inflated away), while corruption continues unabated.

Wolfie’s back…

• Tension Grows Between Tsipras, Schaeuble Over IMF Role In Greek Program (Kath.)

Tension between Greece and its lenders grew on Tuesday when German Finance Minister Wolfgang Schaeuble seized on comments by Greek Prime Minister Alexis Tsipras regarding the involvement of the International Monetary Fund in the Greek bailout program. During a TV interview on Monday night, Tsipras indicated that he is not keen on the IMF joining the program because of the demands it is likely to make. “The Fund must decide if it wants a compromise, if it will remain a part of the program,” said Tsipras. “If it does not want to, it should come out publicly and say so.” Speaking on the sidelines of yesterday’s Ecofin meeting, Schaeuble slammed Tsipras’s stance. “It is not in Greece’s interests for it to question the IMF’s involvement in the bailout program,” he said.

“I believe we negotiated at length with Mr Tsipras in July and August,” added Schaeuble. “I also believe that he signed the agreement and then held elections to get a mandate from the Greek people so he could implement what he signed.” The German finance minister also indicated that he has the impression Tsipras is having second thoughts about adopting some of the measures demanded by Greece’s lenders. “They should focus their attention on doing what they have to do,” he said. “As always, they are behind schedule. Maybe questioning the agreement is necessary for domestic reasons; he has a slim majority I have noticed. This may be the easy route but it is not in Greece’s interests.”

Schaeuble’s comments prompted an immediate response from Athens. “We remind that the Greek government is responsible for deciding what is in the country’s interests,” said government spokeswoman Olga Gerovasili. “We expect the German Finance Ministry to separate its stance from the unacceptably tough stance of the IMF,” she added. “Europe should and is able to solve its problems on its own.” Greek government sources believe that Schaeuble’s comments indicate there is a split within the German government over Greece.

…and he’s picking fights wherever he can see them…

• Schaeuble Fights EU Deposit Insurance Plan in Clash With ECB (BBG)

German Finance Minister Wolfgang Schaeuble lashed out at plans for joint European deposit insurance, saying the proposal threatens central-bank independence and may be illegal under European Union treaties. Schaeuble’s comments on Tuesday pitted him against officials from the ECB, Italy and Ireland during a public discussion that underscored disputes holding up shared deposit backing, including how to address the risks of government bonds on banks’ balance sheets. The ECB “strongly” supports the European Commission’s plan to introduce common deposit insurance over eight years, ECB Vice President Vitor Constancio said. Schaeuble countered that sovereign risk weighs down banks in too many nations, which shouldn’t benefit from more joint insurance until that’s been addressed.

In addition, the ECB is breaching the barrier between monetary policy and its new bank-oversight goals, he said. “There must be a clear Chinese wall or at least a division by primary law between banking supervision and monetary policy,” said Schaeuble, who called for a treaty change on the ECB’s role and questioned whether current treaties allow deposit insurance as envisaged. As European banks are generally allowed to treat sovereign debt on their balance sheets as free of default risk, any move to add risk weighting or limit such holdings could cause shocks.

In Tuesday’s debate, Constancio called for working globally to address the sovereign-risk question to avoid market disruptions. The European Commission’s proposal would apply to euro-area countries and any others that want to join. Schaeuble’s calls for risk reduction won more allies than his legal questions about the EU proposal. Finnish Finance Minister Alexander Stubb said his view of the legal issues was “a little bit softer” than Schaeuble’s, though risks needed to be addressed before deposit insurance moves ahead. Dutch Finance Minister Jeroen Dijsselbloem called for concrete plans on how to limit banking risks.

Hours after his identity is suggested in the press, his home is raided. But that has nothing to do with each other?

• Australian Police Raid Sydney Home Of Reported Bitcoin Creator (Reuters)

Australian Federal Police raided the Sydney home on Wednesday of a man named by Wired magazine as the probable creator of cryptocurrency bitcoin, a Reuters witness said. The property is registered under the Australian electoral role to Craig Steven Wright, whom Wired outed as the likely real identity of Satoshi Nakamoto, the pseudonymous figure that first released bitcoin’s code in 2009. More than a dozen federal police officers entered the house, on Sydney’s north shore, on Wednesday after locksmiths broke open the door. When asked what they were doing, one officer told a Reuters reporter that they were “clearing the house”.

The Australian Federal Police said in a statement that the officers’ “presence at Mr. Wright’s property is not associated with the media reporting overnight about bitcoins”. The AFP referred all inquiries about the raid to the Australian Tax Office, which did not immediately respond to requests for comment. The police raid in Australia came hours after Wired magazine and technology website Gizmodo published articles saying that their investigations showed Wright, who they said was an Australian academic, was probably the secretive bitcoin creator. Their investigations were based on leaked emails, documents and web archives, including what was said to be a transcript of a meeting between Wright and Australian tax officials.

The identity of Satoshi Nakamoto has long been a mystery journalists and bitcoin enthusiasts have tried to unravel. He, she or a group of people is the author of the paper, protocol and software that gave rise to the cryptocurrency. The New York Times, Newsweek and other publications have guessed at Nakamoto’s real identity, but none has proved conclusive. Uncovering the identity would be significant, not just to solving a long-standing riddle, but for the future of the currency. And as an early miner of bitcoins, Nakamoto is also sitting on about 1 million bitcoins, worth more than $400 million at present exchange rates, according to bitcoin expert Sergio Demian Lerner.

Governments should not be allowed to blow these bubbles for short-term popularity. They’re far too disruptive for societies.

• Australian Housing Boom Leaves Swath of Empty Properties (BBG)

Australia’s three-year property boom is leaving Melbourne awash with empty homes. In the country’s second-biggest city, growing numbers of local landlords and absent overseas owners have locked up their properties — forgoing rental income as they focus instead on price gains, a report by Prosper Australia said Wednesday. Some 82,724 properties, or 4.8% of the city’s total housing stock, appear to be unused, said the report, which estimated occupancy rates by gauging water usage. In the worst-hit areas, a quarter of all homes are empty, said Prosper. The research group is lobbying for more affordable housing through tax reform. Driven by a wave of Chinese buyers and record-low interest rates, average home prices have soared to about A$700,000 ($505,000) in Melbourne and around A$1 million in Sydney.

But with prices now cooling, the empty accommodation also masks a hidden glut of supply that could worsen any housing slump. “Those properties need to be utilized,” said Catherine Cashmore, author of the Prosper report, Speculative Vacancies. “Having property sitting vacant has a very high cost on the economy. It’s very destructive to our national prosperity.” The study, now in its eighth year, assessed 1.7 million residential properties in and around Melbourne during 2014. Those using less than 50 liters of water a day – the rough equivalent of one shower and a flush of a toilet – were deemed vacant. Sydney, where high-rise blocks have sprouted in the inner suburbs, is also likely to have a vacancy problem, said Cashmore. Data on water usage at individual apartments isn’t as comprehensive in Sydney as in Melbourne, she said.

Surging home prices triggered a boom in high-rise construction in Melbourne’s inner-city suburbs, squashing rental yields and leaving landlords with little incentive to find a tenant, said Cashmore. Analysts at Credit Suisse estimated this year that Chinese buyers were on course to take out 20% of new homes across Australia in 2020, up from the current 15%. While the Prosper report doesn’t identify overseas-owned properties, it said a “significant proportion” of foreign-owned real estate is empty, inflating prices. “There is a wall of money that is trying to get into Australia,” Cashmore said. “To fight those forces is going to be very difficult.”

But what if next year millions more arrive?

• Germany Takes In More Refugees In 2015 Than US Has In Past 10 Years (Quartz)

Germany is on pace to take in one million asylum-seekers this year. In the last 11 months, the country has taken in 964,574 new migrants, including more than 200,000 just in November. According to Die Welt, more than half of the potential refugees—about 484,000 migrants—came from Syria. Germany has accepted the largest number of asylum-seekers of all European countries, according to the UN High Commissioner for Refugees. “Germany is doing what is morally and legally obliged,” chancellor Angela Merkel said in September. “Not more, and not less.” It’s extraordinary also because it’s larger than the total number of refugees that the US—with a population of 320 million to Germany’s 80 million—has accepted in the last 10 years.

Since 2005, the US has accepted a total of 675,982 refugees from regions all over the world, according to data from the Refugee Processing Center, an arm of the US Department of Justice’s Bureau of Population, Refugees and Migration. President Barack Obama in September announced a plan for the US to resettle 10,000 Syrian refugees over the next year, and has recently called on Americans to welcome Syrian families as modern-day pilgrims. But his campaign to show the US can shoulder more of the weight of Europe’s migrant crisis has faced its own challenges: Obama’s refugees plan has drawn criticism from several, mostly Republican state governors who cite security concerns for US citizens after the Nov. 13 terror attacks in Paris. Just last week, Texas filed a lawsuit against the federal government for moving forward with plans to resettle two Syrian families in the state—although in recent years, the state has taken in more refugees than any other in the US.

Think this is what you call opportunism.

• How Germany’s Right-Wing Tabloid Bild Learned to Love Refugees (BBG)

Bild’s 2015 embrace of refugees was as though Fox News had suddenly endorsed President Obama on climate change. Throughout September, Bild stayed upbeat, dramatizing the journeys of Syrians across the continent, rallying behind Merkel, and shaming European leaders such as David Cameron and Viktor Orbán, who closed their borders. If there were a common thread in Bild’s anti-Greece coverage and its pro-refugee coverage, it was a chest-beating confidence in Germany’s superiority to its European neighbors. Bild was one of the first German newspapers to print a photo of Alan Kurdi, the Syrian boy who drowned on Sept. 2; when some readers criticized the choice, Bild stood its ground, running a subsequent issue without any photos whatsoever.

At the same time, Bild developed “Wir Helfen” into a national campaign. It publicized the volunteer efforts of its readers; teamed with German soccer clubs to promote aid for refugees; and published in Arabic a free welcome guide for refugees in Berlin. “In the past, it was not so often that Germany gave a great example to the world,” Diekmann said. “This is a historic situation, and if we don’t take up this challenge, who else will be able to do so?” Few media critics have accepted Bild’s change of heart at face value. “They are really eager to be positive,” said Mats Schönauer, editor of BildBlog, Germany’s main media criticism outlet, which started in 2004 as a site devoted solely to pointing out Bild’s errors. “The question is first, how long does it last? And second, how honest is it?”

To Schönauer, Bild’s refugee coverage reeks of hypocrisy. “For years, they created this fire, and now they’re playing the role of fireman,” he said. Others attribute the coverage to opportunism. “Bild will never put itself against the mood on the ground of the population,” said Wolfgang Storz, former editor of the Frankfurter Rundschau. “If the mood in Germany swings against refugees, then Bild will undoubtedly campaign against refugees.” Diekmann does not dispute that Bild has largely tracked public opinion rather than shaped it. “No medium is strong enough to create a culture that is not actually there,” he said. “From the beginning, it was clear that this atmosphere would not be there all the time.” In early October, as public support for Merkel dipped, Bild’s tone began to waver.

On Oct. 8, Bild published a poll asking readers whether they supported Merkel or Horst Seehofer, the Bavarian politician who has emerged as the biggest critic of her refugee policy. Ninety% of Bild readers supported Seehofer. A few days later, the tabloid ran a story about a meeting in Sumte, a town of 100 people that was due to house 1,000 refugees in an empty office complex. It quoted one citizen who worried that refugees would rape women on Sumte’s poorly lit streets. “The question that lurks behind every question that is asked this evening: Is one allowed to say that one has fears about the large number of refugees? Or does that make one a Nazi?” the paper asked.

Just another day at the office…

• 6 Afghan Migrant Children Drown Off Turkish Coast On Way To Greece (AP)

Turkey’s state-run news agency says six children have drowned after a rubber dinghy carrying Afghan migrants to Greece sank off Turkey’s Aegean coast. The Anadolu Agency said the coast guard rescued five migrants from the sea on Tuesday and were still looking for two others reported missing. The bodies of the children were recovered. Anadolu didn’t report their ages, but said one of them was a baby. The migrants were apparently hoping to make it to the island of Chios from the resort of Cesme despite bad weather. Turkey has stepped up efforts to stop migrants from leaving to Greece by sea. Last week, authorities rounded up around 3,000 migrants in the town of Ayvacik, north of Cesme, who were believed to be waiting to make the journey to the Greek island of Lesbos.

For letting this happen, Brussels should be dismantled as soon as possible. This is a scar on all Europeans, for the rest of their lives.

• 11 Refugees, Including 5 Children, Drown Near Greek Island, 13 Missing (GR)

Eleven dead, including five children, is the latest toll in the ongoing inflow of refugees on Greek islands near the Turkish coasts. A Frontex boat received a call on Tuesday night about dozens of people in the water northeast of Farmakonisi island. A coast guard rescue boat and a Greek Navy gunboat rushed on the spot and rescued 26 people (17 men, 5 women and 4 children). The rescue team pulled out of the water five children, four men and two women dead, while the survivors said that there are 13 people missing. They said there were 50 passengers on the wooden boat that capsized, despite the fact that the weather conditions were good. A rescue mission is taking place in the area to locate the missing persons.