Vincent van Gogh Weaver 1884

To reiterate from yesterday, Xiang Songzuo, professor at Renmin University in Beijing, former deputy director at the People’s Bank of China and chief economist at the Agricultural Bank of China, said in a speech in December that real GDP growth was 1.67%, and now says: “I think this year, regulators will encourage more shadow banking financing, particularly to the private sector.”

Perhaps the biggest takeaway today is that China is failing to increase domestic demand, long predicted to be the country’s saving grace.

• China Warns Of ‘Tough Struggle’, Cuts Growth Target To Lowest Since 1990 (G.)

China has set its lowest growth target in nearly three decades as premier Li Keqiang warned of “tough” challenges facing the world’s second-largest economy. He set the country’s growth at 6.0 to 6.5%, down from a target of 6.5% last year. In 1990, growth sank to 3.9% because of international sanctions sparked by the Tiananmen square protests. Growth in 2018 was 6.6%, the slowest rate since 1990. Speaking at the opening of the National People’s Congress, China’s legislative body, on Tuesday, Li said: “We will face a graver and more complicated environment as well as risks and challenges … We must be fully prepared for a tough struggle.”

Li’s state-of-the-nation-style address comes as the ruling Chinese Communist Party faces a difficult year amid a slowing economy, a trade war with the US, and diplomatic tensions over Huawei, the Chinese tech giant. Domestically, China has been hit by public health scandals as well as protests by workers, students, and small pockets of activists. Striking a sombre tone, Li stressed the “severe challenges” China is faced last year, including trade frictions, “mounting protectionism and unilateralism” and slowing domestic demand. “Downward pressure on the Chinese economy continues to increase, growth in consumption is slowing, and growth in effective investment lacks momentum. The real economy faces many difficulties,” Li said.

The people who gave you empty cities.

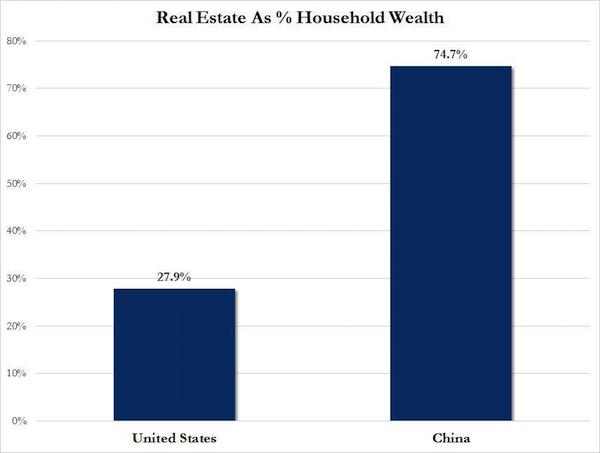

• China’s Largest Property Developer To Sell All Homes At A 10% Discount (ZH)

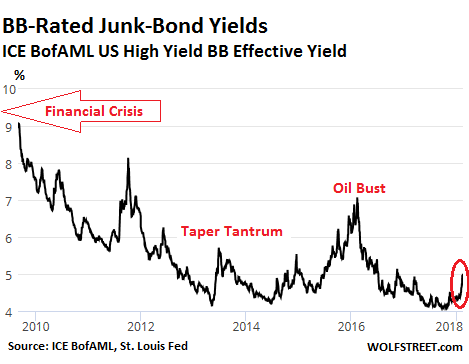

“Property accounts for roughly 70 per cent of urban Chinese families’ total assets – a home is both wealth and status. People don’t want prices to increase too fast, but they don’t want them to fall too quickly either,” said Shao Yu, chief economist at Oriental Securities. “People are so used to rising prices that it never occurred to them that they can fall too. We shouldn’t add to this illusion,” Shao added, echoing Ben Bernanke circa 2005. The bottom line is that just like true price discovery for US capital markets is prohibited (and sees Fed intervention any time there is an even modest, 10-20% drop in asset prices) or else the risk of an all out panic is all too real, in China true price discovery is also not permitted, however when it comes to the country’s all important, and wealth effect boosting, real estate.

Which is a problem, because whereas China suddenly appears to be suffering from all the conventional signs of deflation in the auto retail sector, where as we noted previously, neither lower prices nor easier loans have managed to put a dent the ongoing demand plunge the same ominous price cuts – which are clearly meant to boost flagging demand – are starting to emerge in China’s housing sector. Case in point, according to China’s Paper, Hui Ka Yan, the Chairman of Evergrande, China’s biggest property developer, and China’s second richest person announced it must ramp up home sales and to do that it would sell all its properties at a 10% discount after its home sales tumbled in January amid a cooling market.

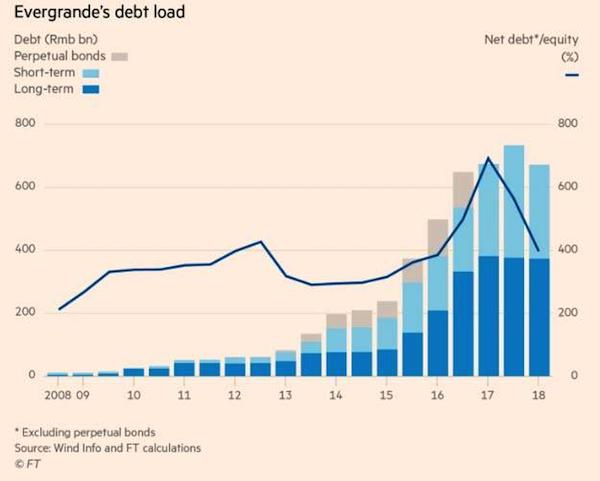

[..] In November, Evergrande, which carries the industry’s largest debt pile of any Chinese housing developer, was caught in a vicious funding squeeze and raised eyebrows with a $1.8BN, 5-year bond deal, which it had to pay a whopping 13.75% coupon, prompting analysts to say the move “carried a whiff of desperation.” The fact that chairman Hui Ka Yan, China’s second-richest person, bought $1bn of it himself, added to a sense that outside investors were shunning the company. In many ways, Evergrande had no choice: after the property market boomed for the past three years, helping to power the economy through Xi Jinping’s crucial political transition year of 2017, in 2018 the market slowed sharply, after local governments shifted focus to controlling frothy prices and China Development Bank, the policy lender, phased out a $1 trillion subsidy program for homebuyers in smaller cities, where Evergrande’s projects are concentrated, the FT reported.

Even the official China News Service, usually a cheerleader for the economy, acknowledged recently that the property market “was a bit chilly”. Nomura chief China economist Ting Lu put it more starkly, forecasting a “frigid winter”. The bigger problem for Evergrande, which had $208 billion in total liabilities at the end of June 2018 — the most of any Chinese developer — including $43bn maturing in 2019, is that should China’s housing market suffer a steep downturn, it will likely be the company to suffer the most, if for no other reason than its massive leverage which stood at a net debt to equity ratio of 400%.

I like and appreciate Satiayit Das, but the Fed doesn’t make grand policy errors, it simply protects its clients with public money. Since it does that by killing off price discovery, let’s stop talking about ‘markets’.

• Relying On Central Banks For Growth Is A Bad Idea (Das)

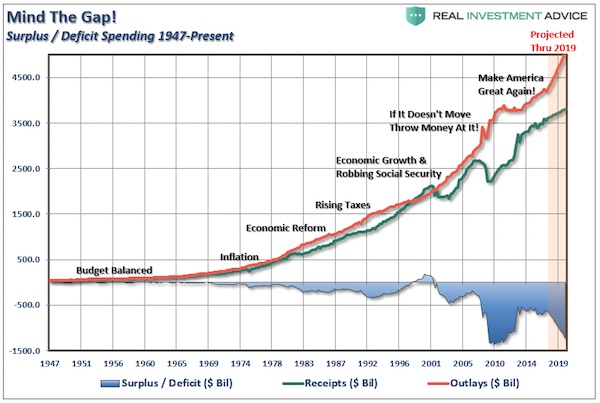

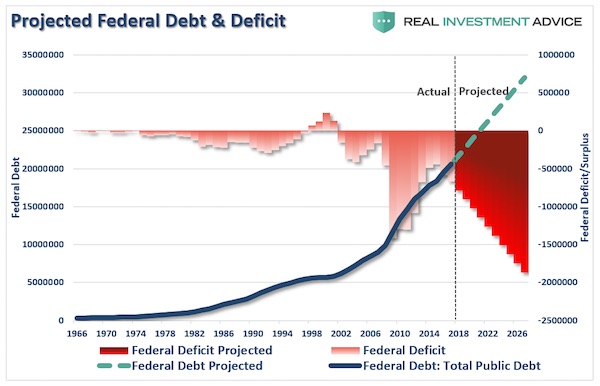

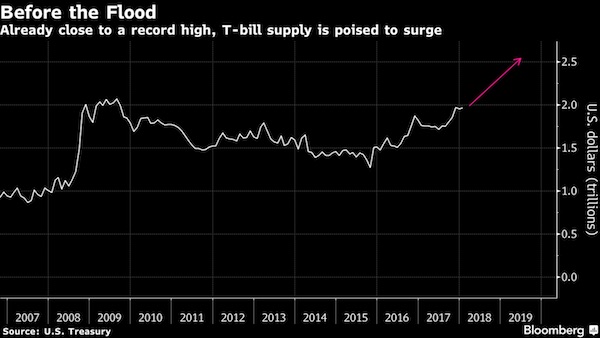

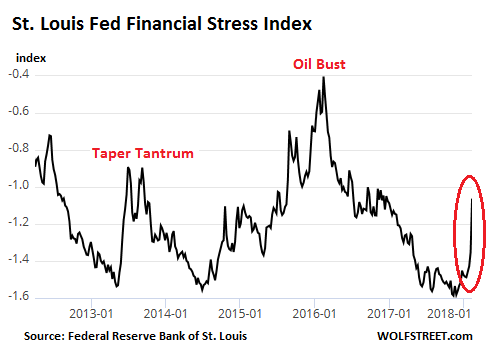

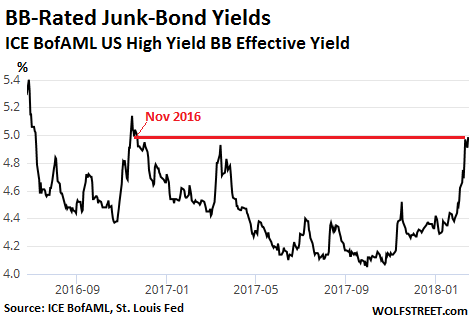

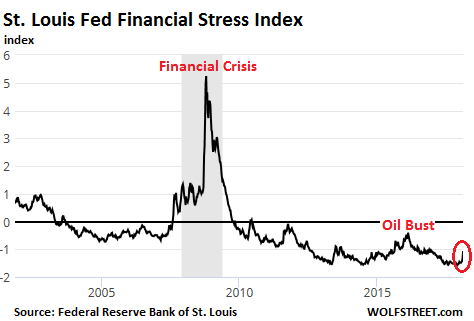

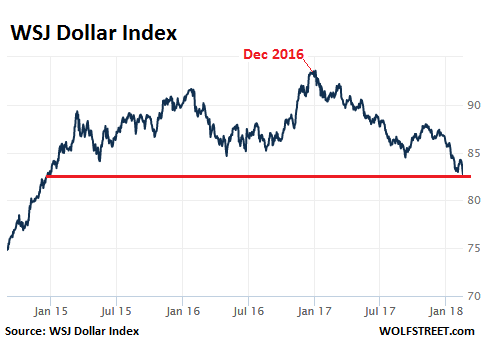

Just since December 2018, central banks have collectively injected as much as $500 billion of liquidity to stabilize economic conditions. The U.S. Federal Reserve has put interest rate increases on hold and is contemplating a halt to its balance-sheet reduction plan. Other central banks have taken similar actions, fueling a new phase of the “everything bubble” as markets careen from December’s indiscriminate selling to January’s indiscriminate buying. The monetary onslaught appears a reaction to financial factors – falling equity markets, rising credit spreads, increased volatility – and a perceived weakening of economic activity, primarily in Europe and China.

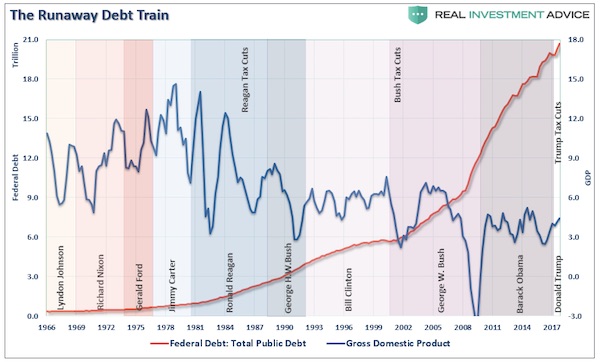

If they heeded Walter Bagehot’s oft-cited rule, central banks would act only as lenders of last resort in times of financial crisis, lending without limit to solvent firms against good collateral at high rates. Instead, they’ve become lenders of first resort, expected to step in at any sign of problems. U.S. central bankers are currently debating whether quantitative-easing programs should be used purely in emergency situations or more routinely. Since 2008, the global economy has grown far too dependent on huge central bank balance sheets and accommodative monetary policy. The U.S. economic boom President Donald Trump loves to tout is largely fake, engineered by artificial policy settings.

Such dependence is dangerous and, for various reasons, could well backfire. For one thing, central banks are poor forecasters. GDP growth, inflation and labor markets may prove more resilient than feared, remaining at or above trend. Key risks, such as the trade dispute between the U.S. and China, may recede. Financial markets and asset prices have already recovered substantially. It’s possible that central banks may be forced to make another U-turn to reduce the risk of reflating asset price bubbles and overheating economies. This flip-flop would be destabilizing and affect decisionmakers’ credibility.

Printing money was always going to be easier than withdrawing it later. In effect, central banks are boxed into a situation where they can’t normalize policy and must maintain low rates and abundant liquidity, lest they destabilize fragile asset markets and spur low growth and disinflation. This state of “infinite QE” risks miscalculations and major policy errors. If central banks are, as is now fashionable to state, the only game in town, then the game is lost.

The Tories thought they could get deals done with separate EU countries.

• Theresa May ‘Did Not Understand EU When She Triggered Brexit’ (G.)

Theresa May and her circle of advisers did not understand how the European Union works, and consequently followed a negotiating strategy in 2016 that was doomed to fail, the former UK ambassador to the EU Sir Ivan Rogers has said. Speaking to the Institute for Government on Monday, Rogers said the people around the prime minister at the start of the article 50 process “didn’t know very much about European councils or that much about the EU”. Rogers, who resigned a year ago and has developed a reputation for producing some of the most caustic assessments of the misunderstandings between the UK and the EU, said the UK lived under the illusion that it could circumvent Brussels by making direct deals with the major capitals.

He said: “Capitals obviously matter, but I think having lived through this with a number of prime ministers, a number of different negotiations … that reflex in the British system always to think that we can deal direct with the organ grinders and not the monkeys: it never works like that. “It didn’t work like that in the Cameron renegotiation either. That stuff is not done in the way British politics works, leader to leader. It’s done via the bureaucrats, and the sherpas, and the people at the top of the institutions.” Rogers also warned that the chances of a no-deal Brexit sticking for long were close to zero. “The UK and EU know there is no chance of no-deal Brexit being the long-term end state, as the UK would quickly come back to the negotiating table,” he said. “There is not a world where we are going to end up with no deal.”

A 25% approval rating won’t keep Little Napoleon from designing grande plans. More Europe!

• Dear Europe, Brexit Is A Lesson For All Of Us: It’s Time For Renewal (Macron)

Never since the second world war has Europe been so essential. Yet never has Europe been in such danger. Brexit stands as the symbol of that. It symbolises the crisis of a Europe that has failed to respond to its peoples’ need for protection from the major shocks of the modern world. It also symbolises the European trap. The trap lies not in being part of the European Union; the trap is in the lie and the irresponsibility that can destroy it. Who told the British people the truth about their post-Brexit future? Who spoke to them about losing access to the EU market? Who mentioned the risks to peace in Ireland of restoring the border? Retreating into nationalism offers nothing; it is rejection without an alternative. And this is the trap that threatens the whole of Europe: the anger mongers, backed by fake news, promise anything and everything.

Europe is not a second-tier power. Europe in its entirety is a vanguard: it has always defined the standards of progress. In this, it needs to drive forward a project of convergence rather than competition: Europe, where social security was created, needs to introduce a social shield for all workers, guaranteeing the same pay for the same work, and an EU minimum wage, appropriate to each country, negotiated collectively every year. Getting back on track also means spearheading the environmental cause. Will we be able to look our children in the eye if we do not also clear our climate debt?

The EU needs to set its target – zero carbon by 2050 and pesticides halved by 2025 – and adapt its policies accordingly with such measures as a European Climate Bank to finance the ecological transition, a European food safety force to improve our food controls and, to counter the lobby threat, independent scientific assessment of substances hazardous to the environment and health. This imperative needs to guide all our action: from the Central Bank to the European commission, from the European budget to the Investment Plan for Europe, all our institutions need to have the climate as their mandate.

Not the Onion. The man who has his police maim his own citizens now says “the people will really take back control of their future”.

• EU Must Learn From Brexit And Reform – Macron (G.)

Macron later said: “The Brexit impasse is a lesson for us all”. In a nod to the Brexiters’ campaign slogan “take back control”, he said that in a changed Europe “the people will really take back control of their future”. In a suggestion the UK would deepen its future relationship with the EU, he said that “in this new Europe, the UK, I am sure, will find its true place”. The call for a Europe-wide agency “for the protection of democracies” to shield against electoral interference from outside powers comes as campaigning for May’s European parliament elections gets underway. Security officials are preparing for potential attempts by Russia-linked hackers to sway the vote and potentially deepen divisions in the bloc.

“There’s a strong likelihood that people will try to manipulate the debates and falsify the European election results,” the EU’s security commissioner, Julian King, told France’s Alsace newspaper last week. The May vote is shaping up as a continental clash between populist and Eurosceptic movements on the one hand, and pro-European internationalists on the other. Macron, who has faced months of gilets jaunes or yellow vest anti-government protests, has sought to style himself as a progressive voice against nationalism. His centrist party La République En Marche is narrowly ahead of Marine Le Pen’s far-right National Rally in French polls – a re-run of his face-off with Le Pen in the 2017 presidential election.

John Pilger gave this speech at a rally in Sydney for Julian Assange recently, organised by the Socialist Equality Party. Unfortunate name.

• The Prisoner Says No To Big Brother (John Pilger)

Whenever I visit Julian Assange, we meet in a room he knows too well. There is a bare table and pictures of Ecuador on the walls. There is a bookcase where the books never change. The curtains are always drawn and there is no natural light. The air is still and fetid. This is Room 101. Before I enter Room 101, I must surrender my passport and phone. My pockets and possessions are examined. The food I bring is inspected. The man who guards Room 101 sits in what looks like an old-fashioned telephone box. He watches a screen, watching Julian. There are others unseen, agents of the state, watching and listening. Cameras are everywhere in Room 101. To avoid them, Julian manoeuvres us both into a corner, side by side, flat up against the wall.

[..] Julian is a distinguished Australian, who has changed the way many people think about duplicitous governments. For this, he is a political refugee subjected to what the United Nations calls “arbitrary detention”. The UN says he has the right of free passage to freedom, but this is denied. He has the right to medical treatment without fear of arrest, but this is denied. He has the right to compensation, but this is denied. As founder and editor of WikiLeaks, his crime has been to make sense of dark times. WikiLeaks has an impeccable record of accuracy and authenticity which no newspaper, no TV channel, no radio station, no BBC, no New York Times, no Washington Post, no Guardian can equal. Indeed, it shames them. That explains why he is being punished.

For example: Last week, the International Court of Justice ruled that the British Government had no legal powers over the Chagos Islanders, who in the 1960s and 70s, were expelled in secret from their homeland on Diego Garcia in the Indian Ocean and sent into exile and poverty. Countless children died, many of them, from sadness. It was an epic crime few knew about. For almost 50 years, the British have denied the islanders’ the right to return to their homeland, which they had given to the Americans for a major military base. In 2009, the British Foreign Office concocted a “marine reserve” around the Chagos archipelago. This touching concern for the environment was exposed as a fraud when WikiLeaks published a secret cable from the British Government reassuring the Americans that “the former inhabitants would find it difficult, if not impossible, to pursue their claim for resettlement on the islands if the entire Chagos Archipelago were a marine reserve.”

The truth of the conspiracy clearly influenced the momentous decision of the International Court of Justice. WikiLeaks has also revealed how the United States spies on its allies; how the CIA can watch you through your iPhone; how Presidential candidate Hillary Clinton took vast sums of money from Wall Street for secret speeches that reassured the bankers that if she was elected, she would be their friend. In 2016, WikiLeaks revealed a direct connection between Clinton and organised jihadism in the Middle East: terrorists, in other words. One email disclosed that when Clinton was US Secretary of State, she knew that Saudi Arabia and Qatar were funding Islamic State, yet she accepted huge donations for her foundation from both governments. She then approved the world’s biggest ever arms sale to her Saudi benefactors: arms that are currently being used against the stricken people of Yemen. That explains why he is being punished.

Nadler et al sent Julian Assange a request for documents. Imagine the brain damage required for that. Other than that, from what I get, there’s nothing new. All 81 requests concern people who’s already sent docs before, to Mueller and elsewhere.

• White House Lambasts Trump Probe (BBC)

House of Representatives Judiciary Committee Chairman Jerry Nadler, a Democrat, said it was the “obligation” of Congress to “provide a check on abuses of power” by the White House. Mr Nadler, whose committee has the power to conduct impeachment hearings, also said it was “very clear” that the president had obstructed justice. But Mr Nadler told ABC News it was too early to discuss removing the president from office. President Trump dismissed Mr Nadler’s probe as a “political hoax”, but added: “I co-operate all the time with everybody.” Democrats, who took control of the House of Representatives in January, have vowed to open investigations into the president and White House.

More than five House committees are now investigating alleged attempts by Russia to meddle in the 2016 election campaign, the president’s tax returns and potential conflicts of interest involving Mr Trump’s family. Those inquiries are in addition to the investigation by Special Counsel Robert Mueller, who is expected to file his report soon. In a statement, White House press secretary Sarah Sanders said: “Today, Chairman Nadler opened up a disgraceful and abusive investigation into tired, false allegations already investigated by the special counsel and committees in both chambers of Congress. “Chairman Nadler and his fellow Democrats have embarked on this fishing expedition because they are terrified that their two-year false narrative of ‘Russia collusion’ is crumbling.

[..] Trump Organization chief financial officer Allen Weisselberg, longtime Trump personal assistant Rhona Graff and ex-White House counsel Don McGahn are also on the list of names released by the House Judiciary Committee. Donald Trump Jr has previously been forced by members of Congress to answer questions about a June 2016 meeting at Trump Tower, in which he sat down with a Kremlin-linked lawyer who had offered dirt on Mr Trump’s opponent Hillary Clinton. Wikileaks, and its founder Julian Assange, have also been sent documents requests by the committee. Wikileaks published emails stolen from the Democratic National Committee and released them during the 2016 campaign, causing political embarrassment to Mrs Clinton and her campaign team.

Yes, Trump has Fox. The other side has just about everything else: CNN, MSNBC, NYT, WaPo, ABC, Politico, etc etc etc. Doesn’t someone who writes pieces like this one see the irony?

• Fox News’s Propaganda Isn’t Just Unethical, It’s Enormously Influential (Vox)

Jane Mayer, the New Yorker’s longtime star investigative reporter, has a fantastic new longform piece out detailing the extent to which the Fox News Channel has become propaganda television for the Trump administration. Many of the basic points — like Fox’s bending of ethical standards to accommodate Sean Hannity, the collaborative relationship between Fox and Trump in shaping the news agenda, and the extent to which Trump at times seems to take his policy cues from Fox & Friends – will be familiar to Vox readers. But Mayer adds critical new insights into the arc of change at the network during a period when CEO Roger Ailes was deposed and then died, vice president Bill Shine left to become White House communications director, and the company’s owner Rupert Murdoch has restructured his media holdings and prepared to pass the baton to his son.

She also adds a couple of key scoops, including: • A Fox reporter named Diana Falzone had pieced together the entire Stormy Daniels story before the election, but network executives killed the story, demoted her, and then, after she sued them, reached a settlement with her that included a nondisclosure agreement. • “Trump ordered Gary Cohn, then the director of the National Economic Council, to pressure the Justice Department to intervene” and sue to block AT&T’s proposed takeover of Time Warner. (The DOJ did sue, though they denied this was due to improper interference from the White House, and ended up losing in court.) • “During the Bush Administration’s disastrous handling of Hurricane Katrina, Fox’s ratings slumped so badly, a former Fox producer told me, that he was told to stop covering it.”

Fox’s propaganda broadcasting matters. It’s a somewhat underexplored topic in political science research, but the information that’s available suggests that right-wing propaganda broadcasting — led by Fox but also including Sinclair Broadcast Group — has a decisive influence on American politics. [..] A study by Emory University political scientist Gregory Martin and Stanford economist Ali Yurukoglu estimates that watching Fox News translates into a significantly greater willingness to vote for Republican candidates. Specifically, by exploiting semi-random variation in Fox viewership driven by changes in the assignment of channel numbers, they find that if Fox News hadn’t existed, the Republican presidential candidate’s share of the two-party vote would have been 3.59 points lower in 2004 and 6.34 points lower in 2008. Without Fox, in other words, the GOP’s only popular vote win since the 1980s would have been reversed and the 2008 election would have been an extinction-level landslide.

Interesting twist. But under wraps.

• Manafort Asks Judge to Revisit Order on Lies to Special Counsel (CN)

Former Trump campaign chairman Paul Manafort asked a federal judge Monday to reconsider her earlier ruling that Manafort violated his plea agreement by lying about his contacts with suspected Russian spy Konstantin Kilimnik. The details of the request remain under seal for now, but a short order from U.S. District Judge Amy Berman Jackson entered into the docket in the case shows it is a request to reconsider her earlier decision based on new evidence. The docket entry specifically references a supplemental filing last month from Special Counsel Robert Mueller’s office that informed Jackson of new information relevant to Manafort’s plea deal that came up in an interview with longtime Manafort associate Rick Gates.

Jackson said in the short order Monday she will “deem [Manafort’s] filing as a motion for reconsideration” of her earlier decision. The motion is under seal for now, but Manafort and Mueller’s office will discuss whether portions of the filing may become public, according to the order. Manafort is scheduled to be sentenced in Washington, D.C., on March 13. He pleaded guilty to head off a second criminal trial after a federal jury in Virginia found him guilty last year of various financial crimes. In Washington, Manafort pleaded to conspiring to defraud the United States, obstruction of justice and violations of lobbying laws in relation to work he did on behalf of a pro-Russian political party in Ukraine.

Britain would fall apart if it could no longer unite vs Russia.

• Britain Puts New Roof On Skripal House of Horrors (Galloway)

In 12 months of shifting sands, one thing remains as its original foundations: the British state narrative on Salisbury stands as a castle in the air. One year from the dastardly fate of Sergei and Yulia Skripal, no one is a step forward on what happened to them, how, why, or of course where they are. One year ago, a nerve agent was allegedly sprayed onto their front doorknob. One year later, their house needs a new roof as a result. And why the roof? And why only the roof? I don’t know what happened to the stricken pair but then, neither do you, however much you’ve followed the story in Britain’s mass media. In fact, the more you’ve read, the more confused you’re likely now to be. There are some things I do know, however. The first is that the Russian state had as little to gain from attacking this pair in broad daylight on a Salisbury street with a signature Soviet-developed weapon, ‘novichok,’ as I said at the time.

It was exactly 100 days before the World Cup, just days before President Putin’s re-election. If – and it’s a big if – the Russian state wanted to kill the Skripals, many things would’ve been different. Firstly, they would’ve been dead. Yulia would’ve been dead in Russia where she lived. And Sergei would’ve been dispatched at a less sensitive time by rather more reliable, less identifiable means, and by rather less comical killers. The killers would not have flown directly from and back to Moscow. They would not have entrusted their egress to the Sunday service of Wiltshire public transport. They would not have smiled up at every CCTV camera they could find. They would not have stayed at a downscale small hotel in East London, they would not have smoked drugs there, and they would not have noisily entertained a prostitute in their room. They would not have left traces of their nerve agent in their hotel room.

They would not have spent a mere hour scoping Salisbury the day before the alleged poisoning of the Skripals. Nor would they have returned by public transport to London for their sex and drug party, only to retrace their steps by public transport the next day. If they were going to kill a man and his daughter, they would not have trusted nerve agent on a doorknob when there was no conceivable way of knowing who’s hand would touch it. Yulia? Sergei? The milkman? Any Tom, Dick or Harry in the street (or any of their children)? If they were going to smear nerve agent on a doorknob, they would’ve done it in the dark – not at noon the next day, when anyone or any camera could watch them doing so, yet no one did. Quite apart from the salient fact that by noon the victims had already left the house never to return to it.

Very sorry to see what Jacko was up to.

• Sunset Boulevard with Chimp (Kunstler)

If you want some insight into how deep the collective public psychosis of this land runs, check out Dan Reed’s four-hour documentary about the late Michael Jackson streaming on the HBO cable network. The film apparently provoked outrage when it premiered at the Sundance Festival recently, as if it were in bad taste to disclose the icon’s peccadillos in these days of Progressive intersectional triumph. Mr. Jackson methodically assembled a harem of catamites as his show business fame exploded and he struggled with the personal horror of developing into a full-grown man. He solved that problem by restricting his social consort to little boys while surgically metamorphosing into a schematic approximation of a woman — interesting, since he repeatedly referred to women as “evil,” but then his greatest hit was the self-revealing song, Bad.

Everybody and his uncle’s-second-cousin in Hollywood at the time must have known what the deal was with him but they went along with the gag that he was the reincarnation of Peter Pan, just a harmless character out of Show Biz’s own catalog of manufactured mythology, something they could understand, a framing device to spin cotton candy out of the truth that Mr. Jackson was simply a child-molester. [..] perhaps, Leaving Neverland signals an interesting turning point in the madness that has gripped this country for years, and especially the bewitched, bothered, and bewildered thinking class, lost in its labyrinth of sacred monsters. This year 2019 — and especially the coming springtime — promises to be a time of spectacular reversals in politics, manners, and markets.

Most of you will be eating yellyfish in your lifetime, it’s not just your kids anymore.

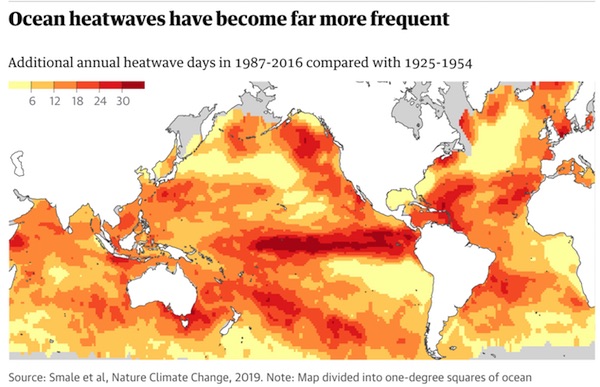

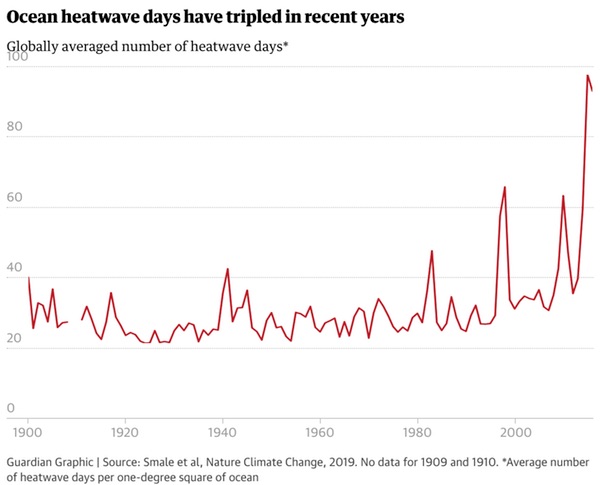

• Heatwaves Sweeping Oceans ‘Like Wildfires’ (G.)

The number of heatwaves affecting the planet’s oceans has increased sharply, scientists have revealed, killing swathes of sea-life like “wildfires that take out huge areas of forest”. The damage caused in these hotspots is also harmful for humanity, which relies on the oceans for oxygen, food, storm protection and the removal of climate-warming carbon dioxide the atmosphere, they say. Global warming is gradually increasing the average temperature of the oceans, but the new research is the first systematic global analysis of ocean heatwaves, when temperatures reach extremes for five days or more. The research found heatwaves are becoming more frequent, prolonged and severe, with the number of heatwave days tripling in the last couple of years studied.

In the longer term, the number of heatwave days jumped by more than 50% in the 30 years to 2016, compared with the period of 1925 to 1954. As heatwaves have increased, kelp forests, seagrass meadows and coral reefs have been lost. These foundation species are critical to life in the ocean. They provide shelter and food to many others, but have been hit on coasts from California to Australia to Spain. “You have heatwave-induced wildfires that take out huge areas of forest, but this is happening underwater as well,” said Dan Smale at the Marine Biological Association in Plymouth, UK, who led the research published in Nature Climate Change. “You see the kelp and seagrasses dying in front of you. Within weeks or months they are just gone, along hundreds of kilometres of coastline.”

The damage global warming is causing to the oceans has also been shown in a series of other scientific papers published in the last week. Ocean warming has cut sustainable fish catches by 15% to 35% in five regions, including the North Sea and the East China Sea, and 4% globally, according to work published by Pinsky and colleagues.

More victims of European fossil fuel replacements. This is so easy to solve: pay them to NOT build that dam. Demand phasing out of palm oil, in fuel and food.

• World’s Rarest Orangutan Under Threat In Indonesia From Dam Project (G.)

Environmentalists in Indonesia have lost a court challenge to a Chinese-backed dam project in Indonesia that will rip through the habitat of the most critically endangered orangutan species. On Monday, the state administrative court in North Sumatra’s capital, Medan, ruled that construction can continue despite critics of the 510-megawatt hydro dam providing evidence that its environmental impact assessment was deeply flawed. Experts said the dam would flood and in other ways alter the habitat of the orangutan species, which numbers only about 800 primates, and was likely to make it impossible to ensure the species survived.

Scientists announced the discovery of the species, Pongo tapanuliensis, in November after DNA analysis and field study revealed unique characteristics. The population, with frizzier hair and distinctively long calls, was previously believed to be Sumatran orangutans, also critically endangered. Without special protection, it is in danger of rapid extinction, according to scientists. The species is found only in the Batang Toru forest, where the dam will be built. Announcing the decision of a three-judge panel, presiding Judge Jimmy C Pardede said the witnesses and facts presented by the Indonesian Forum for the Environment, the country’s largest environmental group, in its case against the North Sumatra provincial government were irrelevant.

A newly-discovered species of orangutan, the Pongo tapanuliensis, is only found in the forest where the dam will be built. Photograph: HANDOUT/Reuters