Edouard Vuillard The window 1894

Pope

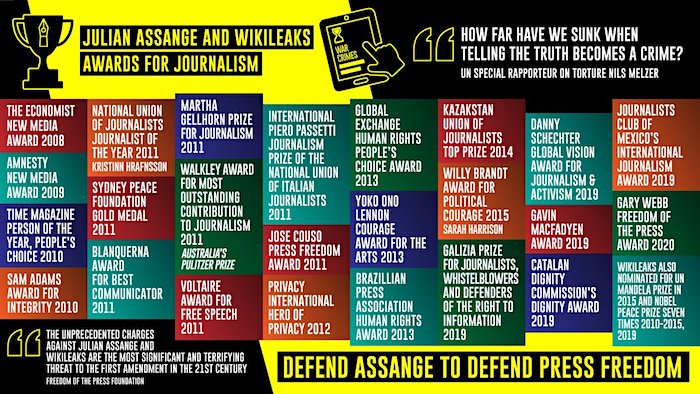

https://twitter.com/bennyjohnson/status/1918683034401812862

These kids are so hard core. No weekends. They know they’re racing against a media and political clock that won’t thank them for their service.

No exaggeration this is the most inspiring effort in government of our lifetime. Long @DOGE 🇺🇸🫡pic.twitter.com/Pwn7LVrXOb

— Katherine Boyle (@KTmBoyle) May 2, 2025

https://twitter.com/SilverlochMedia/status/1918482139072602406

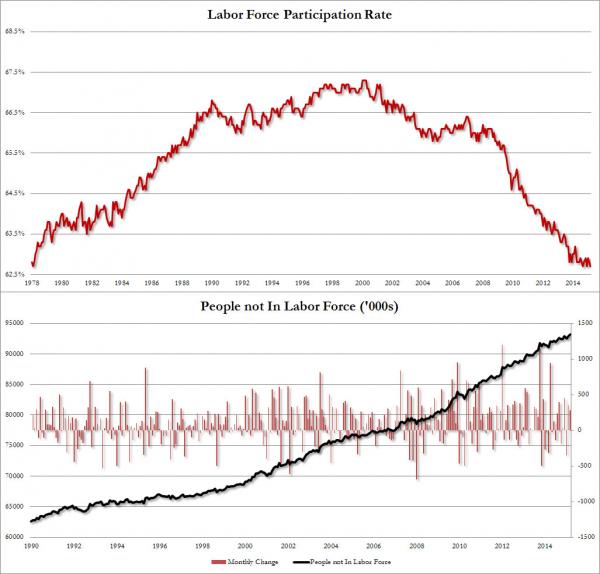

Charles Payne is loving not only the April jobs report but the massive amount of people coming back into the workforce. "500,000 people came back to the labor force. What is the thing we have been hearing the last few weeks? Nobody wants to work in America. Why would we bring… pic.twitter.com/NNhyioFg66

— DeVory Darkins (@devorydarkins) May 2, 2025

Did you see Mike Waltz’s ‘disguise’?

More confirmation of what AIPAC's director said in audio I obtained from a private session: Mike Waltz was groomed by the Israel lobby to serve as an asset in a GOP White House

He'll now serve Israel at the UN pic.twitter.com/SsqGPgMQm7 https://t.co/VtMJOY3iiB

— Max Blumenthal (@MaxBlumenthal) May 3, 2025

Tulsi

They said Biolabs were Russian disinformation.

Tulsi Gabbard says different. pic.twitter.com/kDUslHHUwY

— Chay Bowes (@BowesChay) May 3, 2025

RT Editor-in-Chief

"I warned about US-funded biolabs in Ukraine. Who knows what kind of pathogens are in these labs? When released they could create another Covid-like pandemic."

This is no longer a "Kremlin talking point" from a "maverick" politician, but facts from America's most senior… pic.twitter.com/NhEnMvGT7C

— Margarita Simonyan (@M_Simonyan) May 2, 2025

Orban

⚠️ Brussels wants to fast-track Ukraine’s EU membership, no matter the cost. We cannot let our children pay for Brussels’ globalist fantasies. It’s time to snap out of the dream world and wake up those still asleep. Europe’s citizens, the clock is ticking – demand that your… pic.twitter.com/VOTUkf4baB

— Orbán Viktor (@PM_ViktorOrban) May 2, 2025

Hungary passed "Stop Soros" laws

“A series of laws that criminalize any individual or group who help asylum seekers, including NGOs”

“Hungary outlawed EU attempts to relocate asylum seekers”

Why doesn’t the Republican majority Congress pass “Stop George Soros” laws? pic.twitter.com/sGQlLRIpIO

— Wall Street Apes (@WallStreetApes) May 2, 2025

💸 While Brussels burns €140 billion on a failed war in Ukraine, Hungary chose a different path.

We adopted Europe’s largest tax cut programme:

👩🍼 Mothers with 3+ children: lifelong income tax exemption

👶 From Jan 1: mothers under 40 with 2 children = tax-free

➡️ Step by step,… pic.twitter.com/XRuhIiBxO7— Orbán Viktor (@PM_ViktorOrban) May 3, 2025

Romania has ‘elections’ today, without the leading candidate.

https://twitter.com/ricwe123/status/1918569944905633948

“That I was useful in the furtherance of civilization,.. “That I helped move civilization forward, added to the store of knowledge and capability — that I helped to understand the universe.”

• Elon Musk : DOGE, Support For Trump ‘Essential’ For America (NYP)

Tesla co-founder Elon Musk is beginning his exit from the Department of Government Efficiency (DOGE) as his time as a special government employee comes to a close. His tenure as the public face of DOGE has been marked by historic cuts and widespread outrage, but the tech titan does not regret his time with the Trump administration. Although once praised by the media and championed by the left, Musk’s decision to become a force in the public sphere has not been without backlash. From his purchase of Twitter, now X, to coming out in support of then-candidate Donald Trump, Musk’s year has been anything but “boring.” Fox News host Lara Trump asked Musk if he had any “regret” over his work at DOGE or his support of Trump, to which the SpaceX founder replied, “No.” “I think it was essential for President Trump to win to ensure that America remained great, and that we reach greater heights,” Musk said in an interview that aired Saturday on “My View with Lara Trump.”

Just in: Elon Musk discusses his friendship with Donald Trump

“I do consider the President a friend. I think he considers me a friend. We get along very well.

I think probably, if you asked us both the same set of questions in two different rooms, 80% of the time we'd come up… pic.twitter.com/yOlPAmy5yc

— ELON CLIPS (@ElonClipsX) May 3, 2025

In the run-up to the November 2024 election, Musk became a staunch supporter of Trump despite having been a former Obama donor, citing concerns over former President Joe Biden’s “most radical-left, crazy administration ever.” “Whoever controlled the auto pen and teleprompter during the Biden administration was the real president,” he said. Musk also told Lara Trump that he believed “if President Trump had not won, I think the Democrat campaign to import vast numbers of illegal voters would have succeeded,” adding that America would have risked becoming a “one-party state from which we could never escape.” “Some people out there may be somewhat skeptical. They may think, ‘Well, there isn’t some Democrat plan to subvert democracy and achieve a permanent one-party, deep blue socialist state.’ I assure you, the more you research it, the more that you will see it is true.”

Elon Musk: Electing Trump was essential.

“It was essential for President Trump to win to ensure that America remained great and that we reached greater heights.

Some very basic things need to happen. We need to have, obviously, a secure border. We need to have safe cities… pic.twitter.com/XiMNpPOl66

— ELON CLIPS (@ElonClipsX) May 3, 2025

With Trump winning in November, Musk was put to work on day one of the new administration, but his cost-cutting efforts have sparked nationwide opposition. “It’s not been boring, that’s for sure — an eventful year to say the least. At least I didn’t get shot, you know. Look on the bright side,” Musk said. “But we have had people shoot up Tesla stores and burn down Tesla cars. I wasn’t expecting that level of violence, really,” he continued. Musk even conceded the bad actors targeting him and his companies are “somewhat inevitable.” Part of the backlash has been a “relentless propaganda campaign” from opponents of the Trump administration, attempting to “destroy [his] public perception” and “doing character assassination,” he said.

Elon Musk on Propaganda and Perseverance: Rising Above the Lies

Elon Musk, a man who grew up in South Africa during the dark days of apartheid, has witnessed firsthand the weight of systemic injustice and division. Those experiences shaped his perspective, grounding him in a… pic.twitter.com/1FX60OPV0z

— Camus (@newstart_2024) May 3, 2025

Musk concluded the outrage shows DOGE’s work is “effective.” As President Donald Trump marked his 100th day in office on Tuesday, DOGE said it has cut at least $160 billion in waste, fraud and abuse in the federal government. With no plans of slowing down, DOGE has made a number of consequential and controversial cuts in recent months, including cuts to hundreds of millions in DEI contracts and efforts to slash federal spending by trimming the federal workforce. While DOGE made historic moves in the Trump administration’s first 100 days, Musk revealed what he most wants his legacy to be. “That I was useful in the furtherance of civilization,” he told Lara Trump. “That I helped move civilization forward, added to the store of knowledge and capability — that I helped to understand the universe.”

ELON MUSK: “If President Trump had not won, I think the Democrat campaign to import vast numbers of illegal voters would've succeeded… They would've naturalized vast numbers of illegals during the sort of common regime… they would've turned America into a one-party state from… pic.twitter.com/OzHqwyPW3U

— America (@america) May 3, 2025

.@DOGE leader @elonmusk explains what he sees as fundamentally wrong with the liberal agenda and details to @LaraLeaTrump the moments leading up to his support for then-candidate @realDonaldTrump on @MyViewFNC. pic.twitter.com/8KdPvqo0GL

— Fox News (@FoxNews) May 4, 2025

• Zelensky Threatens World Leaders Visiting Moscow On Victory Day: Kremlin (ZH)

Ukraine’s President Zelensky has dismissed the Kremlin’s unilateral declaration of a three-day ceasefire for Russia’s World War II commemorations on May 9 as but a “game” and “theatrical performance”. “This is more of a theatrical performance on his part. Because in two or three days, it is impossible to develop a plan for the next steps to end the war,” Zelensky said, offering instead a fuller 30-day ceasefire. We reported earlier that Zelensky days ago went so far as to hint that a Ukrainian attack on Victory Day events could happen. Here’s what Zelensky warned several days ago: “Now they are worried that their parade is in question, and they are rightly worried. But they should be concerned that this war is still going on. They must end the war,” the Ukrainian president said.

Moscow officials certainly took this as a direct threat. Various world leaders, including President Xi Jinping of China, will be present for the V-Day parade through Red Square and other observances. This year’s will be particularly special given it’s the 80th anniversary since the end of WW2. Russian Foreign Ministry spokeswoman Maria Zakharova issued a statement Saturday saying that Zelensky “unambiguously threatened world leaders.” “After every terrorist attack on Russia’s territory, the Kiev regime, its security services, and Zelensky personally boast that this is their doing, that this will continue. Therefore, the phrase that he ‘does not guarantee security on May 9 in Russia’ as it is not his area of responsibility is, of course, a direct threat,” the diplomat stated. She and Peskov further blasted Zelensky’s stance as having exposed “the neo-Nazi nature of the Kiev regime, which has become a terrorist cell,” according to TASS.

Lately there’s been assassination bombings targeting top Russian generals, as well as long-range drone attacks which have reached the outskirts of Moscow. Clearly, Ukrainian intelligence and/or its allied Western intel services have made inroads into Russia. Without doubt, Russian defense and security services will bulk up anti-air systems in an around Moscow for Victory Day events. Defense officials, heads of state, and foreign ministers from various countries and especially Russia-friendly nations are expected to be present. Earlier in the Ukraine war, drones were sent across the Russian border and made it all the way to the Moscow Kremlin complex, lightly damaging the top of a dome, in what was a major first at the time. Since then, Moscow area airports have more frequently halted operations during inbound drone attacks.

You’d almost hope they aim a device at Xi Jinping. Without hitting anyone, of course.

“Zelensky’s remarks “once again prove the neo-Nazi nature of the Kiev regime, which has turned into a terrorist cell..”

• Moscow Responds To Zelensky’s Victory Day Threats (RT)

Vladimir Zelensky’s refusal to join Russia in observing a 72-hour ceasefire to mark the Victory Day celebrations exposes Kiev’s “neo-Nazi essence” and amounts to a threat by an “international-level terrorist,” Russian Foreign Ministry spokeswoman Maria Zakharova said on Saturday. Earlier in the day, Ukrainian leader reiterated his refusal to accept Moscow’s proposal for a three-day ceasefire starting May 8 and continuing through the World War II Victory Day celebrations, dismissing it as a “theatrical production.” Zelensky also appeared to threaten the world leaders expected to take part in the May 9 events in Moscow, stating that Kiev cannot guarantee their safety. Zelensky’s remarks “once again prove the neo-Nazi nature of the Kiev regime, which has turned into a terrorist cell,” Zakharova said in a statement.

“Today [Zelensky] hit a new low: now he is threatening the physical safety of veterans who will come to parades and ceremonial events on that sacred day,” she said. “After every terrorist attack on Russian territory, the Kiev regime, its security services, and Zelensky personally boast that it was their doing and that it will continue to be like this. Therefore, the phrase that he ‘does not guarantee security on May 9 on Russian territory,’ since this is not his area of responsibility, is, of course, a direct threat,” Zakharova stressed. Kremlin spokesman Dmitry Peskov offered a similar take on Zelensky’s remarks, stating the proposed ceasefire is a “test” for Kiev, and the apparent refusal to join it “clearly shows that neo-Nazism is the ideological basis of the contemporary Kiev regime.”

The 72-hour ceasefire was announced unilaterally by Russian President Vladimir Putin on Monday. The president ordered the suspension of all military action against Ukraine’s forces from midnight on May 7 to midnight on May 10 and urged Kiev to join the truce. Zelensky and other top Ukrainian officials, however, dismissed the proposal as a “manipulation attempt,” demanding an immediate 30-day ceasefire instead. In March, Russia and Ukraine both agreed to a US-brokered 30-day partial ceasefire focused on halting strikes on energy infrastructure. Kiev, however, violated the truce on numerous occasions, according to the Russian military. The Victory Day truce follows a similar unilaterally announced pause during Easter weekend in April that ended up being only partially successful. While a certain lull in the hostilities was observed, Kiev violated the truce more than 3,900 times, according to estimates by the Russian Defense Ministry.

Let’s hope they carry some Bandera flags, insignia. That country is lost

• Ukrainian Troops To Take Part In Victory Day Parade In London (RT)

Ukrainian troops will take part in the World War II Victory Day parade in London on May 8 at the invitation of the UK government, the British Ministry of Defense has announced. Moscow has condemned the move as “blasphemous” and “disrespectful” due to Kiev’s open glorification of Nazism. Victory in Europe Day (VE Day) is celebrated in the West on May 8 to commemorate Nazi Germany’s surrender in 1945. In a post on X on Saturday, the UK MOD said Ukrainian troops will take part in a military procession commemorating the event alongside 1,000 British servicemen. The ministry claimed that Kiev’s participation in the event “reminds us that Ukraine is now at freedom’s front line.” UK Defense Secretary John Healey described it as “fitting” that Ukrainian troops will be present at the event.

Moscow has condemned London’s decision. “Inviting followers of neo-Nazi elements to Victory Day celebrations is not just disrespectful to those British veterans who gave their lives during World War II. It is blasphemy,” Kremlin spokesman Dmitry Peskov said on Saturday. Commemorations of WWII-era nationalist figures linked to Nazi Germany have been common in Ukraine. Ukrainian nationalists hold annual torchlight marches in Kiev, Lviv, and other cities in honor of Stepan Bandera, the leader of the Organization of Ukrainian Nationalists (OUN), which collaborated with the Nazis and took part in the massacre of more than 100,000 Poles, Jews, Russians, and Soviet-aligned Ukrainians. Throughout the conflict with Russia, Ukrainian troops have on numerous occasions been filmed displaying Nazi symbols, including patches of SS units and swastikas. Italy’s Rai News 24 apologized last year after a journalist interviewed a Ukrainian fighter wearing a cap with the emblem of the ‘Leibstandarte Adolf Hitler’ SS division.

Germany previously expelled seven Ukrainian soldiers undergoing military training in the country because they were wearing Nazi symbols. Ukraine’s notorious Azov unit, a neo-Nazi formation established in 2014 and later integrated into the National Guard, has been accused of war crimes and was designated a terrorist organization by Russia in 2022. Although the original Azov Battalion was defeated in the 2022 Battle of Mariupol, co-founder Andrey Biletsky launched the 3rd Separate Assault Brigade under the Azov banner in 2023, which remains active. Russia has repeatedly warned of a Nazi revival in Ukraine and has accused Kiev of embracing neo-Nazi ideology while whitewashing WWII collaborators. President Vladimir Putin listed “denazification” among the goals of Russia’s military operation against the Kiev regime, along with demilitarization and neutrality.

Farage will win bigly. It’s the same pattern all over Europe. Le Pen, AfD, Georgescu…

• Farage’s Party Making Big Gains In Local British Elections (RT)

The right-wing Reform UK party has won 677 out of more than 1,600 seats in England’s local elections, while the Labour and the Conservative parties suffered heavy defeats across the country. As results began to trickle in on Friday, the party led by firebrand and Brexit proponent Nigel Farage emerged as the strongest performer in contests held in 23 local authorities across England, winning control of ten councils. These included eight taken from the Conservatives – Derbyshire, Kent, Lancashire, Lincolnshire, North Northamptonshire, Nottinghamshire, Staffordshire and West Northamptonshire — along with Doncaster from Labour and Durham, where no party previously had a majority.

Reform also won hard-fought parliamentary by-elections in Runcorn and Helsby, snatching victory from Labour by just six votes after a recount. As a result, the party now controls five seats in the UK Parliament. According to a BBC projection, if a general election were held today, Reform UK would receive 30% of the vote, ahead of Labour at 20% and the Conservatives at 15%. However, the next general election is not due until May 2029. The last one was held last year and saw Labour secure a landslide victory, riding a wave of public dissatisfaction with the economic policies of the Tories. Commenting on his party’s strides, Farage remarked: “In post-war Britain, no one has ever beaten both Labour and the Tories in a local election before. These results are unprecedented… Reform can and will win the next general election.”

UK Prime Minister Keir Starmer said that while he felt a “sharp edge of fury,” he said he understood the voters’ choice while promising to “go further and faster in pursuit of… national renewal.” Meanwhile, Conservative Party leader Kemi Badenoch bluntly acknowledged that the elections were a predictable “bloodbath,” stressing that the Tories must continue work to rebuild trust in the party. Reform UK’s rise has been driven by voter frustration over high levels of immigration, the rising cost of living, and what many see as years of mismanagement by both major parties. The party campaigned heavily on promises to cut migration – including by small boat crossings – lower taxes, and reduce council spending, positioning itself as the only alternative to what it calls “a failed political establishment.”

Ben Shapiro displays a stunning lack of knowledge about the war.

“..cost Ukrainians at least 50,000 dead and the Russians as many as 200,000 dead..”

If Shapiro is right about anything at all, then people like Doug Macgregor and Scott Ritter have been terribly wrong for 3 years running now. They swear there’s not 4x as many Russian casualties, but 7-8x as many Ukrainian. Off by a factor of 30.

• What Does Russia Want? (Ben Shapiro)

Russia’s war to conquer Ukraine has been raging since February 2022. At first, the Russian offensive seemed fated for success: Russian troops came within a few kilometers of Kyiv, and Western powers offered President Volodymyr Zelenskyy exit from the country. Zelenskyy refused; Ukrainian forces proceeded to hold off and reverse the Russian offensive. Within a few weeks, the battle lines solidified, with Russia continuing to hold much of the territory in the East and Crimea they had held since 2014. The only potential solution was the obvious solution: an armistice essentially freezing the lines of conflict and security guarantees to Ukraine sufficient to deter another Russian attack. But no solution could be found. Russia demonstrated little interest, after mid-2022, in any negotiated end to the war.

President Donald Trump came into office pledging to end the war—a war that has cost Ukrainians at least 50,000 dead and the Russians as many as 200,000 dead. To that end, he pressured Zelenskyy to come to the table. Zelenskyy eventually did, offering an unconditional 30-day ceasefire. Russian President Vladimir Putin has thus far refused any such ceasefire—presumably because he hopes that the Trump administration will pull its support from Ukraine, thereby leaving the country vulnerable to a final Russian offensive. And herein lies the problem for Trump. He knows—as everyone knows—that the only off-ramp for the war lies in a Korean War-style armistice. But Russia still refuses to come to the table, no matter the pleading and cajoling of special envoy Steve Witkoff, whose negotiating style seems to be warmly embracing various anti-American dictators, speaking kindly about them in public, and then hoping they will give him what he seeks.

In order to reach an end to the war, therefore, the Trump administration ought to fully consider just what Russia wants at this point. And the answer happens to be surprisingly simple: Russia wants either Ukraine conquered or a puppet government in place or a clear pathway to conquering Ukraine in the future. We know this because Russia repeatedly says it. Alexander Dugin, a philosopher and geopolitics expert known colloquially as “Putin’s brain,” spelled all of this out in his magnum opus, “Foundations of Geopolitics” (1997)—a book that was apparently used as a textbook at the General Staff Academy. For Dugin, the Russian spirit can only be animated by imperial dreams; regional power alone would be “tantamount to suicide for the Russian nation.” The antithesis of the Russian spirit is “‘the West’ as a whole.”

And Ukraine—an independent country that should be suffused with that “Russian spirit” but that wants to orient towards the West—represents a stinging rebuke to the Russian identity as a whole. Thus, Dugin argues, Ukraine must rejoin Russia or forever be condemned to a “puppet existence and geopolitical service” to the West. Ukraine’s continued existence as a sovereign state, Dugin argues, “is tantamount to a monstrous blow to Russia’s geopolitical security, tantamount to an invasion of its territory.” Now, during the war, Dugin writes, “We must win the war in Ukraine, liberate the entire territory of this former country from the Nazi regime. Regardless of Trump’s victory or anything else, this imperative remains unchanged. Just as the ancient Roman consul Cato the Elder used to say, ‘Carthage must be destroyed,’ in our case, ‘Kiev must be taken’”

So, if the true Russian goal is the destruction or subjugation of Ukraine, how could Russia be brought to the table? Only through the “peace through strength” policy Trump pursued during his first term. Only a Russia that believes that the West will refuse to surrender Ukraine will be pressured into an armistice. Trump seems ready to consider that possibility; he’s now acknowledging publicly that Putin seems to be slow-playing him. But the answer won’t be more sanctions. It will be a recognition that Ukraine’s sovereignty can only be guaranteed by force of arms—and that an off-ramp can only be achieved by a guarantee of that sovereignty.

Wonderful history lesson by Timofey Bordachev. It all goes back to the 13th century, the Mongol hordes.

• From The Mongols to NATO: Here’s The Real Russian Doctrine (Bordachev)

“Only crows fly straight,” goes an old saying from the Vladimir-Suzdal region, where the revival of the Russian state began after the devastation of the Mongol invasion in the 13th century. Within 250 years, a powerful state emerged in Eastern Europe, its independence and decision-making unquestioned by others. From its earliest days, Russia’s foreign policy culture has been shaped by a single goal: to preserve the nation’s ability to determine its own future. The methods have varied, but a few constants remain: no fixed strategies, no binding ideologies, and an ability to surprise opponents. Unlike European or Asian powers, Russia never needed rigid doctrines; its vast, unpredictable geography – and its instinct for unorthodox solutions – made that unnecessary. Yet this distinctive foreign policy culture did not develop overnight.

Before the mid-13th century, Russia’s trajectory looked much like the rest of Eastern Europe’s. Fragmented and inward-looking, its city-states had little reason to unify. Geography and climate kept them largely self-contained. It could have ended up like other Slavic nations, eventually dominated by German or Turkish powers. But then came what Nikolay Gogol called a “wonderful event”: the 1237 Mongol invasion. Russia’s strongest state centers were obliterated. This catastrophe, paradoxically, gave rise to two defining features of Russian statehood: a reason to unify and a deep-seated pragmatism. For 250 years, Russians paid tribute to the Golden Horde but were never its slaves. The relationship with the Horde was a constant struggle – clashes alternating with tactical cooperation. It was during this period that the “sharp sword of Moscow” was forged: a state that functioned as a military organization, always blending conflict and diplomacy. War and peace merged seamlessly, without the moral dilemmas that often paralyze others.

These centuries also forged another trait of Russian thinking: the strength of the adversary is irrelevant to the legitimacy of its demands. Unlike the Western Hobbesian notion that might makes right, Russians have historically viewed force as just one factor – not the determinant of truth. A 16th-century song about a Crimean Khan’s raid sums it up: he is called both a “tsar” for his military power and a “dog” for lacking justice. Similarly, after the Cold War, Russia recognized Western power – but not the righteousness of its actions. Demographics have always been a challenge, driven by climate and geography. Russia’s population did not match that of France until the late 18th century, despite covering an area many times larger than Western Europe. And crucially, Russia has never relied on external allies. Its foreign policy rests on the understanding that no one else will solve its problems – a lesson learned through bitter experience. Yet Russia has always been a reliable ally to others.

A pivotal moment came in the mid-15th century, when Grand Duke Vasily Vasilyevich settled Kazan princes on Russia’s eastern borders. This marked the beginning of Russia’s multi-ethnic statehood, where loyalty – not religion – was the key requirement. Unlike Western Europe, where the church dictated social order, Russia’s statehood grew as a mosaic of ethnic and religious groups, all unified by a shared commitment to defense. This pragmatism – welcoming Christians, Muslims, and others alike – set Russia apart. Spain’s rulers completed the Reconquista by expelling or forcibly converting Jews and Muslims; Russia integrated its minorities, allowing them to serve and prosper without renouncing their identities.

Today, Russia’s foreign policy still draws on these deep traditions. Its core priority remains the same: defending sovereignty and retaining freedom of choice in a volatile world. And true to form, Russia resists doctrinaire strategies. Fixed doctrines require fixed ideologies – something historically alien to Russia. Russia also rejects the idea of “eternal enemies.” The Mongol Horde, once its deadliest foe, was absorbed within decades of its collapse. Its nobles merged with Russian aristocracy, its cities became Russian cities. No other country has fully absorbed such a formidable rival. Even Poland, a centuries-long adversary, was eventually diminished not by decisive battles but by sustained pressure. Victory for Russia has never been about glory – it’s about achieving objectives. Often, this means exhausting adversaries rather than crushing them outright. The Mongols were defeated in 1480 without a single major battle. Similarly, Poland was gradually reduced in stature over centuries of relentless pressure.

This mindset explains Russia’s readiness to negotiate at every stage: politics always outweighs military concerns. Foreign and domestic policy are inseparable, and every foreign venture is also a bid to strengthen internal cohesion, just as the medieval princes of Moscow used external threats to unite the Russian lands. Today’s geopolitical landscape is shifting again. The West – led by the United States – remains powerful, but no longer omnipotent. China is expanding its influence, though cautiously. Western Europe, historically Russia’s main threat, is losing its relevance, unable to define a vision for its own future. Russia, the US and China all possess that vision – and in the coming decades, their triangular relationship will shape global politics. India may join this elite circle in time, but for now, it still lags behind.

Dumb but predictable: the US supports its weapons industry.

• US Approves F-16 Support Package For Ukraine (RT)

The US has approved a $310.5 million deal to sustain Ukrainian-operated F-16 fighter jets provided by Kiev’s European backers. The move comes after the US and Ukraine signed a deal in which Kiev grants Washington access to its natural resources in exchange for future assistance. The F-16 deliveries from European NATO members to Ukraine were approved by former US President Joe Biden in August 2023, but the first jets did not arrive in the country until a year later. While Ukrainian officials hailed the deliveries as a major coup, Western media warned that they would not be a “game changer” in the conflict. In March, the Ukrainian Air Force acknowledged that the F-16s operated by Kiev “cannot compete” with the latest Russian jets.

In a statement on Friday, the Pentagon’s Defense Security Cooperation Agency (DSCA) said the State Department had signed off on a foreign military sale to Ukraine which includes training, spare parts, aircraft modifications, logistics assistance, and software support for F-16s. The agency added that the proposed sale “will support the foreign policy goals… of the United States by improving the security of a partner country that is a force for political stability” in Europe. More than 80 F-16s have been promised to Ukraine, with the bulk expected to come from Belgium and the Netherlands, while the US has never committed to providing the jets on its own. While the exact number of jets delivered is unknown, Moscow confirmed last month it had shot down one F-16. Ukraine’s Vladimir Zelensky said the aircraft’s pilot perished during a “combat mission.”

In 2024, Ukraine reported the loss of another F-16, saying it crashed while repelling a Russian air strike. The DSCA announcement comes after the Pentagon said it is sending “disused and completely non-operational F-16s to Ukraine for parts.” It also follows the signing of a US-Ukraine resource deal that is intended to allow Washington to recover the cost of future military support through shared proceeds from Ukrainian mineral resource licenses. Moscow has condemned the Western arms shipments to Ukraine, warning they will only prolong the conflict without changing the outcome. Russian President Vladimir Putin has said Ukrainian-operated F-16s will “burn” just like other Western-supplied equipment.

India would be big. “Apple announced on April 25 that it would be shifting production of most U.S.-bound iPhones to India from China..”

• Trump’s First Tariff Trade Deal With India Could Be Game-Changing (JTN)

Just a month into his tariff policy, President Donald Trump could unveil his first new trade deals with allies as early as this week as his negotiators press for handshakes and signatures that could further calm markets and empower a brighter future for American workers, officials tell Just the News. Commerce Secretary Howard Lutnick hinted at an approaching announcement last week when he revealed he has a trade deal with an unspecified country, pending approval of its conditions. Administration officials said as many as two or three deals could be unveiled in the coming days.Speculation has swirled surrounding India being the first to forge a partnership after Vice President J.D. Vance last week met with India Prime Minister Narendra Modi in Delhi to discuss a Bilateral Trade Agreement (BTA).

The vice president’s office put out a statement following their meeting, which stated, “The BTA presents an opportunity to negotiate a new and modern trade agreement focused on promoting job creation and citizen well-being in both countries, with the goal of enhancing bilateral trade and supply-chain integration in a balanced and mutually beneficial manner.” Also last week, Treasury Secretary Scott Bessent indicated that many trade partners had reached out to the White House since the tariffs were unveiled and had made ‘very good’ proposals. “I would guess that India would be one of the first trade deals we would sign,” Bessent told CNBC, and that the U.S. also held productive negotiations with Japan and other Asian nations.

Former Deputy National Security Advisor Victoria Coates said an early deal with India could be a game-changer, since it is a partner with the market size of China that could apply pressure on Beijing. “I’d love to have them be first out of the box,” she said, noting Prime Minister Modi’s relationship with Vance has already yielded dividends. Coates said deals with the European Union will take longer, but there are some other big early possibilities. “I would look at Japan. I think that that would be key,” she said. “I think the conversation with the Europeans is going to be a longer one, but again that really has to happen. We might be surprised by the UK.” Mere signs of trade deals on the horizon have already calmed markets after an early free fall prompted by Trump’s “Liberation Day” tariff announcement on April 2.

The S&P 500 on Friday notched its longest streak of closing in the positive column in more than two decades, after it rose 1.47% at the close of business and marked its ninth consecutive day of gains. India has a few notable incentives to make it happen soon: India’s largest trading partner is the United States. The nation was hit with 26% reciprocal tariffs on April 2 before Trump suspended the larger tariffs on most countries for 90 days, but kept a universal 10% tariff in place. India is also placing a large emphasis on an agreement as part of its India-US Comprehensive Global Strategic Partnership, which Modi says “will be a defining partnership of the 21st Century for a better future of our people and the world.”

Adding sweetness to the deal: Apple announced on April 25 that it would be shifting production of most U.S.-bound iPhones to India from China, bringing billions in revenue and jobs to the populous, developing nation. India’s ambition to more than double trade between the U.S. and India, from the current $190 billion to $500 billion, was originally sent by Modi to Trump in February 2025. With headlines alluding to a Trump “misfire,” Democrats and legacy media have wasted no time prognosticating about why the trade deals are taking so long, and may never come. However, sources told Fox Business on Monday that the president is working on broader trade deals encompassing additional nations, not just nations involving tariffs. This, they report, is the reason there has been only speculation and no official announcements of trade deals.

Where will Temu get its sales now?

“If you order a $20 shirt from China effective June 1st, you will pay $220. $20 for the shirt, and $200 minimum tariff. Yep, this is only the beginning.”

• De Minimis Loophole for Beijing Ends, Temu Halts Direct Shipping (CTH)

Think about it. We’ve already heard about the massive stoppages of April factory work in China, causing serious concern for Beijing and Chinese worker protests. American importers front loaded inventory in February and March with a 50% increase in orders. Now, in addition to those factories going quiet, the de minimis rule kicks in. (Via CNBC) – “Chinese bargain retailer Temu changed its business model in the U.S. as the Trump administration’s new rules on low-value shipments took effect Friday. In recent days, Temu has abruptly shifted its website and app to only display listings for products shipped from U.S.-based warehouses. Items shipped directly from China, which previously blanketed the site, are now labeled as out of stock. Temu made a name for itself in the U.S. as a destination for ultra-discounted items shipped direct from China, such as $5 sneakers and $1.50 garlic presses.

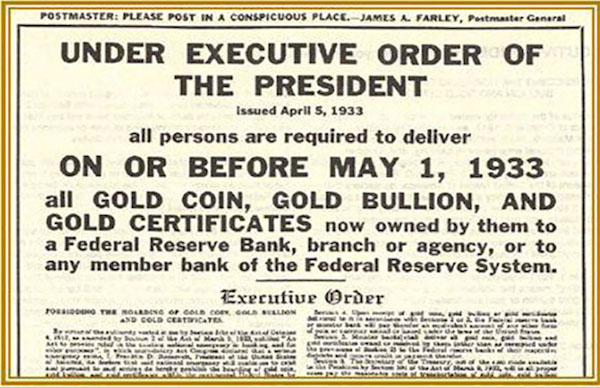

It’s been able to keep prices low because of the so-called de minimis rule, which has allowed items worth $800 or less to enter the country duty-free since 2016. The loophole expired Friday at 12:01 a.m. EDT as a result of an executive order signed by President Donald Trump in April.” The de minimis loophole comes from back in the 1930s. The idea back then was, say you went on a vacation to Paris, you shouldn’t have to file customs paperwork or pay taxes if you decided to ship some little Eiffel Tower statues to your friends back home. Congress in 2015 then raised the de minimis threshold from $200 to $800. However, the e-commerce world exploded, and Chinese companies began using the de minimis loophole to ship cheap goods (ex. Temu and Shein) into the USA direct to consumers without paying any customs duty.

On April 2nd, as part of the global trade reset and tariff structure, President Trump revoked authorization for Chinese goods to transfer to the USA using the de minimis rule. The de minimis exemption was cancelled for all products coming out of China. The rule change only targeted China and Chinese shippers. No one else. As part of the modification to Executive Order #14257, President Trump has increased the baseline tariff for product mailed from China [de minimis tariff] from 30 90 percent to 120%. Mailed products from China now face a 120% tariff. Additionally, minimum tariff amounts increased from $75 to $100 effective May 1st, and from $150 to $200 effective June 1st. Example: If you order a $20 shirt from China effective June 1st, you will pay $220. $20 for the shirt, and $200 minimum tariff. Yep, this is only the beginning.

Ending the “de minimis loophole” is a big deal. This rule allowed foreign companies to avoid paying tariffs on small shipments, giving them an unfair advantage over American small businesses. To small businesses across the country: we have your back. https://t.co/henUfsK0QO

— Howard Lutnick (@howardlutnick) May 3, 2025

“When Trudeau outlines the inability of Canada to agree to trade terms, simply because his country no longer has the capability of adhering to those trade terms, a frustrated President Trump says, “then become a state.”

• An Unavoidable Trade War with Canada is Looming (CTH)

Following the 2024 presidential election, Prime Minister Justin Trudeau traveled to Mar-a-Lago and said if President Trump was to make the Canadian government face reciprocal tariffs, open the USMCA trade agreements to force reciprocity, and/or balance economic relations on non-tariff issues, then Canada would collapse upon itself economically and cease to exist. In essence, in addition to the NATO defense shortfall, Canada cannot survive as a free and independent north American nation, without receiving all the one-way benefits from the U.S. economy. To wit, President Trump then said, if Canada cannot survive in a balanced rules environment, including putting together their own military and defenses and meeting their NATO obligations, then Canada should become the 51st U.S state. It was following this meeting that President Trump started emphasizing this point and shocking everyone in the process.

However, in the emotional reaction to Trump’s statements, no-one looked at the core issues outlined by Trudeau that framed President Trump’s opinion. Representing Canada, Justin Trudeau was not expressing an unwillingness to comply with fairness and reciprocity in trade with the USA, what Trudeau was expressing was an inability to comply. Quite simply, after decades of shifting priorities, Canada no longer has the internal economic capability to comply with a fair-trade agreement (FTA). Trudeau was not lying, and President Trump understood the argument; hence his 51st state remarks.This is where it becomes important to understand the core reason why Trump, Ross and Lighthizer (2017) did not structurally want to replace the NAFTA agreement with another trilateral trade deal. Mexico and Canada are completely different as it pertains to trade with the USA. President Trump would rather have two separate bilateral agreements; one for Mexico and one for Canada.

• Firstly, Canada is a NATO partner, Mexico is not. As President Trump affirmed to Justin Trudeau during the meeting, it would be unfair of President Trump to discuss NATO funding with the European Union, while Canada is one of the worst offenders. Trump is leveraging favorable trade terms and tariff relief with the EU member states, as a carrot to get them into compliance with the 2.0 to 2.5% spending requirement for their military. If the NATO member states contribute more to their own defense, the U.S. can pull back spending and save Americans money. However, Canada is currently 26th in NATO funding, spending only 1.37% of their GDP on defense (link). Canada would have to spend at least another $15 billion/yr on their defense programs in order to reach 2.0%. Justin Trudeau told President Trump that was an impossible goal given the nature of the Canadian political system, and the current size of their economy ($2.25 trillion).

• Secondly, over the last 40 years Canada has deindustrialized their economy, Mexico has not. As the progressive political ideology of their politicians took control of Canada policy, the ‘climate change’ agenda and ‘green’ economy became their focus. The dirty industrialized systems were not compliant with the goals of the Canadian policy makers. The dirty mining sector (coal, coking coal, ore) no longer exists at scale to support self-sufficient manufacturing. The dirty oil refineries do not exist to refine the crude oil they extract. Large industrial heavy industry no longer exists at a scale needed to be self-sufficient. Instead, Canada purchases forged and rolled steel component parts from overseas (mostly China). Making the issue more challenging, Canada doesn’t even have enough people skilled to do the dirty jobs within the heavy manufacturing; they would need a national apprenticeship program. Again, all points raised by Trudeau to explain why bilateral trade compliance was impossible.

• Thirdly, the trade between Canada/U. S and Mexico/U. S is entirely different. The main imports from Canada are energy, lumber and raw materials. The main imports from Mexico are agriculture, cars and finished industrial goods. Mexico refines its own oil; Canada ships their oil to the USA for refining. There are obviously some similar products from Mexico and Canada, but for the most part there is a big difference.

• Forth, USA banks are allowed to operate in Mexico, but USA banks are not allowed to operate in Canada. USA media organizations are allowed to broadcast in Mexico, but USA media organizations are regulated and not permitted to broadcast in Canada. The Canadian government has strong regulations and restrictions on information and Intellectual Property. All of these points of difference highlight why a trilateral trade agreement like NAFTA and the USMCA just don’t work out for the USA. Additionally, if President Trump levies a tariff on Chinese imports, it hits Canada much harder than Mexico because Canada has deindustrialized and now imports from China to assemble into finished goods destined to the USA. In a very direct way Canada is a passthrough for Chinese products. Canada is now more of an assembly economy, not a dirty job manufacturing economy.

When Trudeau outlines the inability of Canada to agree to trade terms, simply because his country no longer has the capability of adhering to those trade terms, a frustrated President Trump says, “then become a state.” There is no option to remain taking advantage of the USA on this level, and things are only getting worse. Thus, the point of irreconcilable conflict is identified.

If 80% of those you poll are Democrats, it’s easy going.

• Want To Know The Truth Behind Those Anti-Trump Polls? (Margolis)

You’ve no doubt heard the media narrative about President Trump’s poll numbers according to most pollsters—you know, the ones who got the 2024 election so wrong, Make no mistake about it — the legacy media is at it again with their dishonest polling tactics against President Trump. But this time, their deceptive game has been called out by none other than former House Speaker Newt Gingrich. Appearing on Hannity Thursday night, Gingrich exposed how the media’s recent polling showing Trump’s approval dropping is nothing but smoke and mirrors. The reality? These polls are deliberately skewed to paint a false narrative about Trump’s standing with the American people. Let’s look at the facts. The same media outlets that got it wrong in 2024—ABC News, CBS News, and CNN—are now pushing polls that show Trump’s approval is declining from his February high of 53%.

But are they really? “I got a little preview about poll numbers that are coming out tomorrow, and from both Robert Cahaly and Matt Towery, who I respect a lot,” Hannity said. “And as I suspected, all of the polls that the media has been pushing on the American people about Donald Trump are false, and that’s what the early indications are.” He pointed out the absurdity of the numbers being hyped by the media, especially when far-left figures such as Chuck Schumer were polling in the teens. “All the pollsters that got the election in ‘24 wrong and got every election about Donald Trump wrong—all of those people—the ones saying, ‘Oh, he’s plummeting.’ But meanwhile, they’re ignoring Chuck is at 17% and the Democrats are in the 20s. I’m trying to understand that logic. Can you help me out?” Gingrich didn’t mince words.

“Well, I mean, first of all, they’re just plain lying,” Gingrich replied. “And I think we’ve got to be tougher and clearer about how dishonest these people are.” He cited conversations with veteran GOP pollsters, pointing to the way poll samples are rigged to undercount Republicans. “The fact is, and I talked to John McLaughlin and I talked to Matt Towery about this, they have some polls there that are like 27% Republican when Trump got 50% of the vote. So if you add the 23 points they didn’t test, suddenly he’s in great shape. This is deliberate. It is willful.” Gingrich then laid out what he sees as the last bastions of anti-Trump resistance in the establishment. “Look, there are three great centers of resistance: the propaganda media, which will lie all the time, the fake district judges, and the fake Congressional Budget Office. Those are the last three great centers of resistance, and they’re going to do anything they can to defeat Trump and the Republicans, including lying about virtually everything.”

“None of them, to be honest with you,” Towery said when asked which poll concerned him the most. “I have a group of pollsters I look at who are public pollsters who’ve been right in all three of Trump’s cycles. We happen to be one of those. None of us have had him down by any of these numbers we’ve seen before. The only one that might concern me at all is the Fox News one because Fox did well in the 24 cycle.” Towery also took aim at the methodology behind the polls. “They are absolutely, I don’t like to criticize polling, but how can you have a poll, as John McLaughlin, a good friend of mine pointed out, how could you have a poll that shows Donald Trump at 39%? But yet when you ask people who they voted for and they said they voted for Trump, like 95% said they would vote for him again.”

“The capitulation took effect after midnight in Moscow. May 8 is observed as Victory in Europe Day, with Russia commemorating the occasion on May 9.”

• Trump’s WWII Claim Is ‘Pompous Nonsense’ – Medvedev (RT)

Former Russian President Dmitry Medvedev has dismissed US President Donald Trump’s claim that America played the primary role in winning World War II as “pompous nonsense.”Medvedev made the comment on his VK page on Saturday, in response to Trump’s plan to designate May 8 as ‘American Victory Day’. “Trump recently announced that the US made the main contribution to the victory in World War II and that he would establish a holiday on May 8. A holiday is not bad. But the first conclusion is pompous nonsense,” Medvedev wrote. Earlier this week, Trump wrote on his Truth Social platform that he “will create a new holiday called AMERICAN VICTORY DAY, to be celebrated on May 8.” He went on to say: “This date marks the formal surrender of Nazi Germany to the Allied Forces in World War II, ending the war in Europe. AMERICAN VICTORY DAY will celebrate the heroes who helped vanquish tyranny and secure liberty for generations to come.”

Trump also said he wants to rename Veterans Day, a federal holiday celebrated on November 11, to “Victory Day for World War I,” adding that the US “won both wars.” In response, Medvedev, who currently serves as deputy chairman of Russia’s Security Council, highlighted the Soviet Union’s role in defeating Nazi Germany, stressing that the Red Army bore heavy losses and “liberated ungrateful Europe.” “Our people gave 27 million lives of their sons and daughters for the sake of destroying damned fascism,” he wrote. “Victory Day is ours and it is on May 9. That’s how it was, is, and always will be!” Earlier this week, Kremlin spokesman Dmitry Peskov said Russia is grateful to the US for its support during WWII, but the USSR would have defeated Nazi Germany even without the assistance. “The famous Lend-Lease indeed helped us. We received vehicles, airplanes, ammunition, and tanks. And indeed, without this, it would have been very difficult.”

The Lend-Lease program was a US government initiative that provided allies with military supplies, equipment, food, and strategic raw materials. The Soviet Union received aid valued at around $200 billion in today’s terms, Peskov said. He noted, however, that the assistance was not free. Russia, as the USSR’s successor state, completed its financial obligations related to the Lend-Lease program in 2006. Nazi Germany officially surrendered to the Allied forces on May 8, 1945, following the capture of Berlin by Soviet troops. The capitulation took effect after midnight in Moscow. May 8 is observed as Victory in Europe Day, with Russia commemorating the occasion on May 9.

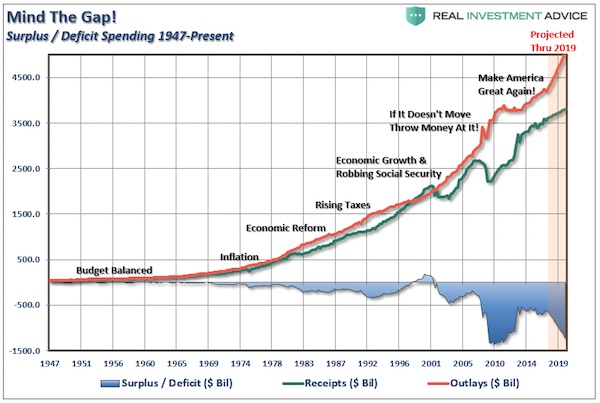

“Starting in 2027, the European Union will expand its emissions trading system (ETS) into new territory with the launch of ETS2..”

“Margaret Thatcher: “Global warming provides a marvelous excuse for global socialism.”

• Freedom in the EU? Only if You Can Afford It (Roos)

Starting in 2027, the European Union will expand its emissions trading system (ETS) into new territory with the launch of ETS2. While the original ETS primarily targeted heavy industry and power plants, ETS2 directly impacts ordinary citizens — their homes, their cars, their daily lives. Under the guise of ’saving the climate,’ the EU will steadily make gasoline, diesel, and gas for heating more expensive. But let’s be honest: ETS2 has very little to do with protecting the environment. It is about economic control, wealth redistribution, and the consolidation of power among banks, large corporations, governments, and the European Commission. Formally, everything remains ‘voluntary.’ You may continue driving a gasoline car. You may continue heating your home with natural gas. But every choice that deviates from the state’s ‘sustainability goals’ will become economically unbearable.

This is not a direct expropriation of property, but it is economic subjugation through price pressure, regulation, and redistribution of the proceeds. Instead of free choices, citizens and companies are financially forced to adopt government-approved behavior. Who benefits? Banks, investment funds, multinational corporations, government treasuries, and the European Commission. Financial giants like Goldman Sachs and Deutsche Bank are already making billions from trading CO2 certificates. Governments are raking in massive revenues from the auctioning of emission permits. Meanwhile, large corporations that receive free allowances or have surplus certificates can sell them for profit—all while greenwashing their public image.

And who bears the cost? Ordinary citizens, small businesses, the transport sector, and independent entrepreneurs. They will face hundreds of euros in additional costs every year just to heat their homes and drive to work. The most vulnerable are promised compensation through a ’Social Climate Fund’—a government handout that makes them ever more dependent on state aid. This brings us to the deeper question: What direction are we heading in? Is this communism, where the state owns the means of production? Or is it fascism, where the state controls production and merges with big business to dominate society? In truth, ETS2 signals a new hybrid system. Private ownership remains in name, but real control is exercised through regulations, price manipulation, and conditional subsidies.

The market is not abolished; it is repurposed around ideological objectives. Economic freedom exists only for those who can afford to comply. The Brussels technocratic pressure is sold as a ‘necessary transition,’ but in reality, it is dismantling the foundation of our economy, destroying the middle class, and eroding prosperity. Instead of fostering genuine innovation, ETS2 punishes those who lack the resources to “comply.” While banks and corporations speculate and profit, the hardworking EU citizen is soon faced with a grim choice: freeze in the winter or take on debt for a heat pump they neither asked for nor needed. The EU claims that prices will rise “gradually” and that safeguards are in place to prevent social unrest. But history teaches us that once new taxes and levies are introduced, they rarely disappear. Temporary exceptions inevitably become permanent rules.

After homes and cars, aviation, agriculture, and consumer goods will follow. Every sector deemed ‘unsustainable’ will face similar price manipulation. Personal freedom will continue to shrink, not through open political force, but through economic coercion masked as environmental stewardship. And for those still believing they will retain the freedom to choose: A choice that becomes financially impossible is no longer a real choice. It is coerced compliance. It is economic submission. Remember the words of Margaret Thatcher: “Global warming provides a marvelous excuse for global socialism.” Climate change must never be used as an excuse for economic servitude. Say no to green tyranny. Say yes to freedom, prosperity, and choice.

Many will follow. It won’t be pretty. The systems are old but volatile.

• Green Energy Fixation Sends Spain Dark (Gonzalez)

VALENCIA, Spain—Two modern ills converged in Europe on Monday, literally one of the darkest days in decades. An ideological obsession with climate fanaticism left countries without power for hours, while censorship of “disinformation,” often information the powerful don’t like, plunged the population in an informational blackout in subsequent days. The electrical blackout brought planes, trains, and automobiles to a screeching halt throughout Spain, Portugal, and small parts of southern France. Electricity simply stopped flowing, and with it control towers, rail lines, and traffic lights. Cellphones became quadrangular black boxes that did nothing and lost their “smartness.” A political conference I was attending in this sunny Mediterranean port city suddenly became eerie when people started coming in and out and whispering to each other. One person in the seat in front finally turned and enlightened a friend and me: “The electricity is down. We’re cut off from the world.”

We then realized that, yes, sirens had been wailing outside, and it had been a while since we’d gotten emails or texts. A generator in the hotel kept our conference going, but nothing else worked; everyone had to take the stairs and use bathrooms in the dark—though water, too, stopped working. It wasn’t quite dystopic, but our modern dependence on electricity and its creature comforts suddenly was brought home to us. Many speculated that it was a cyberattack from Russia or China. Who else had the power to do this? Center-right politicians from across Europe were about to descend on Valencia the next day. Surely, an invitation for bad actors to do their thing. Well, not so fast. Neither Russia’s Vladimir Putin nor China’s Xi Jinping is above carrying out this type of attack, and cybersecurity is a serious matter. But, to quote Vice President JD Vance at a February conference in Munich, Germany, the threat to worry about the most in Europe “is not Russia, it’s not China, it’s not any other external actor.”

“What I worry about,” went on Vance, “is the threat from within, the retreat of Europe from some of its fundamental values.” Vance mentioned Europe’s need “to enjoy affordable energy,” and the fact that, as he put it, “free speech, I fear, is in retreat.” European officials are still fuming about how “rude” that young Vance was, but it looks like he was on the money. It is increasingly clear that what caused the blackout was not a cyberattack. Reuters News agency reported that Spain’s grid operator Red Electrica on Tuesday ruled out external sabotage, and said instead that it had identified two “incidents of power generation loss, probably from solar plants,” in southwestern Spain. That, said the Reuters report, “caused instability in the electric system and led to a breakdown of its connection with France. The electrical system collapsed, affecting both the Spanish and Portuguese systems.”

“There was not enough inertia, or redundancy, in the system to keep it going,” my colleague Diana Furchott-Roth emailed from Washington when I was able to receive communications from the outside world. “The last coal-fired plant was closed on April 12.” Diana has been warning about this type of thing for decades, and Spain’s socialist prime minister Pedro Sanchez is a poster boy for the things she has warned against. His government has not only closed coal-fired plants, but has been busily destroying nuclear plants as well. “Net zero,” or zero CO2 emissions, is the name of this new mad delusion, and Spain’s infantile leftists have been posting on social media gleeful workers destroying nuclear power plants. The goal has been 100% “renewable” generation.

Well, they happened to have gotten very close to their holy grail on Monday at 12:30. The Iberian Peninsula’s power grid was getting a disproportionate amount of energy from the renewables loved by the Left: 80% from solar photovoltaic, solar thermal and wind. Nuclear was at a measly 11%. In a mere five minutes, solar photovoltaic generation plunged by 50%, from 18 gigawatts to eight, according to Reuters. Iberia and adjacent parts of France, including the tiny Pyrenean principality of Andorra, all of which depended on this grid, then descended into darkness at 12:35, from which it was not to recover till late at night. The hapless Sanchez was still arguing late Tuesday that just because Red Electrica was discounting a cyberattack, it did not mean that one hadn’t happened. Governments finding themselves in a corner will lie, or at least equivocate, and it’s the job of the opposition to keep asking for answers.

“An energy policy that prioritizes the fight against climate change above the security of supply has provoked this general blackout,” said an analysis on the site of the think tank Disenso, which is linked to the opposition Vox Party (full disclosure, I sit on Disenso’s foreign advisory board). But it is also the job of the media. Yet Spain’s state television stations, and even private ones, were still keeping the truth about the failure of the Left’s renewable dream from getting any airtime as late as Wednesday morning, when I left for the airport. That was left to radio and to some newspapers on the right. An honest media would be not just informing voters about how a blackout that left at least five dead and stopped a modern economy in its tracks happened. It would also be debating whether such a modern society really does want to stop using comfort creatures and working toilets, all in the name of fighting climate change.

Big Balls can take over. They have a strong team.

• DOGE Cuts Behind Nearly Half of All Layoffs This Year (JTN)

President Donald Trump’s Department of Government Efficiency is responsible for nearly half of all job cuts announced this year, according to a new report. The report from outplacement firm Challenger, Gray and Christmas said DOGE-related actions lead all job cut reasons in 2025 with 283,172, 2,919 of which occurred in April. Another 6,945 cuts were attributed to “DOGE Downstream Impact” through April, primarily at nonprofits and education organizations. These combined (290,117) make up 48% of all job cuts announced so far in 2025, according to the report. “Though the Government cuts are front and center, we saw job cuts across sectors last month,” Andrew Challenger, senior vice president and workplace expert for Challenger, Gray & Christmas. “Generally, companies are citing the economy and new technology. Employers are slow to hire and limiting hiring plans as they wait and see what will happen with trade, supply chain, and consumer spending.”

The vast majority of the DOGE-related cuts were from March, according to the report. After DOGE, market and economic conditions were cited for 95,348 job cuts, as economic uncertainty, consumer spending, and trade challenges hit U.S. companies, according to the report. Tariffs were cited for 1,413 cuts so far this year, with 1,350 occurring in April. Restructuring accounted for 67,627, and 60,551 were due to store, unit or location closing. When Trump created DOGE, he said it would be the government cost-cutting equivalent of the “Manhattan Project.” Both Trump and Tesla CEO Elon Musk promised Americans would get a more efficient government after DOGE addressed government waste, reduced regulations, and reduced the federal workforce. Many of the DOGE-led cuts in government face legal challenges from unions and other groups. Many of those same cuts remain in limbo as pending court cases continue.

The Challenger report comes as Musk steps back from government work to focus more on Tesla. Musk initially said DOGE would aim to cut $2 trillion from the federal budget, but he later cut that in half. At a Cabinet meeting in April, Musk said DOGE was on pace to cut $150 billion from the federal budget. The U.S. government employs about 2.4 million federal workers, excluding the military (about 1.3 million active-duty military personnel) and U.S. Postal Service (about 600,000 employees), according to 2024 Pew Research report. That report noted that the federal government employed 1.87% of the entire civilian workforce. That percentage includes postal employees, according to Bureau of Labor Statistics data.

“Musk met with Ratcliffe in late March for a discussion that included government efficiency measures, but no DOGE teams have been working at the agency’s Langley, Virginia, campus.”

• CIA to Cut 1,200 (5%) Jobs -Ratcliffe Shifts Focus to “Human Intelligence” (CTH)

The Washington Post (but of course, CIA outlet) is reporting on a downsizing effort within the CIA to eliminate approximately 1,200 jobs. The number represents approximately 5% of the workforce although the actual number of CIA employees is classified (national security, dontchaknow). Within the report, Director John Ratcliffe is noted as shifting the focus of America’s leading spy agency to use more “human intelligence.” That phrase, “human intelligence,” is IC silo code speak for shifting away from “analysts” (political operatives) and engaging in more factual intelligence information. According to the report, DNI Tulsi Gabbard has also reduced the employment level within the Director of National Intelligence office by approximately 25% (current payroll estimate of 2,000 employees). The general narrative within the WaPo reporting is that “national security” is being compromised by large downsizing of spy agency employment. Additionally, to bolster the positions of the current political operatives within the CIA, the WaPo waxes concerningly about China and other mysterious foreign adversaries recruiting the CIA employees who are now becoming increasingly concerned about their paychecks.

WASHINGTON POST – “The Trump administration is planning significant personnel cuts at the Central Intelligence Agency and other major U.S. spy units, downsizing the government’s most sensitive national security agencies, according to people familiar with the plans. The administration recently informed lawmakers on Capitol Hill that it intends to reduce the CIA’s workforce by about 1,200 personnel over several years and cut thousands more from other parts of the U.S. intelligence community, including at the National Security Agency, a highly secretive service that specializes in cryptology and global electronic espionage, a person familiar with the matter said. The person, like others interviewed, spoke on the condition of anonymity to discuss sensitive matters.

[…] The staff reductions would take place over several years and would be accomplished in part through reduced hiring. No outright firings are envisioned. The goal of a roughly 1,200-person staff reduction includes several hundred individuals who already have opted for early retirement, the person familiar with the matter said. The downsizing is taking place separately from efforts by the U.S. DOGE Service, led by billionaire Elon Musk, to radically restructure the federal government. Musk met with Ratcliffe in late March for a discussion that included government efficiency measures, but no DOGE teams have been working at the agency’s Langley, Virginia, campus.

[Obviously, I can certainly appreciate the “human intelligence” shift noted by Director Ratcliffe for all the factual reasons that necessitate his concern. It is part of the reason why I ended up frustrated with “western reports” and determined the only way to really understand what is going on inside Russia during the sanctions was to travel there myself and review. It was quite an experience to sit in a renamed Starbucks coffee shop at the crowded Galleria Mall in downtown St Petersburg, Russia and read the Wall Street Journal reporting on the devastation to the Russian economy, while looking around at the packed stores and purchases being made on an ordinary weekday. Then to read the New York Times reports of shortages of steel in Russia, while driving past many miles of apartment and condominium construction. Everything cited in western corporate media, “according to sources familiar with the situation”, was/is the complete opposite of everything factually visible.]

Did I see 44,000%?!

• Buffett To Step Down As Berkshire CEO At Year-End (ZH)

It’s the end of an era at America’s largest hedge fund/private equity/insurance float-cum-rollup conglomerate, whatever you want to call it: Warren Buffett just announced during the Berkshire annual pilgrimage to Omaha that he is stepping down as CEO of Berkshire at the end of the year, and that Greg Abel, the vice chairman for non-insurance operations who has been groomed over the past decade for just this moment, will take over the conglomerate. The news was greeted with a standing ovation by the thousands of Berkshire shareholders who were present at Omaha’s Convention Center.

Buffett – whose track record cemented him, along his long-time sidesick Charlie Munger, into a celebrity billionaire renowned for his investing acumen and witticisms – built Berkshire Hathaway into a business valued at more than $1.16 trillion, generating compounded annual returns to shareholders at double the rate of the S&P (19.9% vs 10.4%), since 1965, and a staggering 5,502,482% overall gain on BRK stocks since 1964, vs “only” 39,054% for the S&P. His investing success gave him the power to move stocks and helped him strike lucrative deals with Goldman Sachs and General Electric during times of crisis. The announcement stunned the board and even Abel, who, while long signaled as Buffett’s successor, was unaware that the news was coming as the annual meeting drew to a close. “That’s the news hook for the day,” Buffett said. “Thanks for coming.”

Berkshire grew aggressively over the decades with Buffett as chairman and CEO, as he chose acquisitions and stocks for the company portfolio alongside trusted adviser and vice chairman, Charlie Munger, who died in 2023 at 99. As Bloomberg notes, “the conglomerate acquired a bewildering assortment of businesses, which Buffett often said mirrored the US economy as a whole. A bet on Berkshire, he said, was a bet on America.” Buffett started managing money when he was young, a disciple of Benjamin Graham’s investing style. He moved more into the corporate world when his Buffett Partnership Ltd. bought shares of Berkshire. In 1965, he took control of the rest of the business.

Composed mostly of struggling textile operations that would eventually fade away, Berkshire became the foundation for Buffett’s modern-day giant. Piece by piece, he built and acquired operations into a varied set of industries, including insurance — which gave him cash, or “float” — to help his investing strategy. Now, Berkshire owns businesses ranging from railroad BNSF to auto insurer Geico, sprawling energy operations, and even retailers such as Dairy Queen and See’s Candies. Its collection of companies generated $47.4 billion of annual operating earnings in 2024. Buffett also built up the stock portfolio — populating it with giant bets on the likes of Apple Inc. and American Express — and offering Berkshire another way to participate in the gains of businesses that it didn’t fully own.

FSD

Elon Musk: The Teslas you can buy today will soon drive themselves.

“In a few months, Tesla will release unsupervised full self-driving. The cars will be driving around by themselves with no people in them. We'll start that in Austin in June, and then we'll rapidly expand that… pic.twitter.com/SoEjLe7uGz

— ELON CLIPS (@ElonClipsX) May 3, 2025

AI

The next wave of AI is physical AI. pic.twitter.com/2cwQI5bi14

— The Humanoid Hub (@TheHumanoidHub) May 3, 2025

Fauci

This is amazing, Fauci urges Americans to NOT accept the "normalization of untruths"

There wasn't a thing Fauci DIDN'T lie about during Covid.

He Lied About:

-Masks

-Where The Virus Came From (Cuz It Came From A Lab He Funded)

– Funding The Dangerous Research That Produced The… https://t.co/iUixx4Snjl— Jimmy Dore (@jimmy_dore) May 2, 2025

Ocean

https://twitter.com/dom_lucre/status/1918406723351802248

Moose

Moose cooling down in someone’s garden

pic.twitter.com/o38OqV63Or— Science girl (@gunsnrosesgirl3) May 3, 2025

Birds

Footage captured by a person who left bird food and a camera on her balcony.

by Katie Kreen pic.twitter.com/TVMUT02JTd

— The Figen (@TheFigen_) May 2, 2025

Cows

https://twitter.com/InternetH0F/status/1918410455258718428

Know the difference pic.twitter.com/wDN6mwBzJm

— Massimo (@Rainmaker1973) May 4, 2025

Kookaburra

Kookaburra are so amazing at singing pic.twitter.com/9fuvNFiOJU

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 3, 2025

lion pair

This is really beautiful ♥️♥️ pic.twitter.com/w5efvNth9o

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 3, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.