Francis Tattegrain La ramasseuse d’épaves (The Beachcomber) 1880

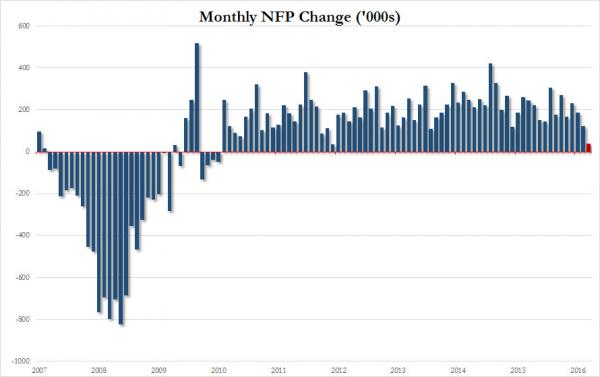

I haven’t really written about finance since April of this year, and given recent fluctuations in what people persist in calling the markets, maybe it’s time. Then again, nothing has changed since that article in April entitled This Is Not A Market. I was right then, and I still am.

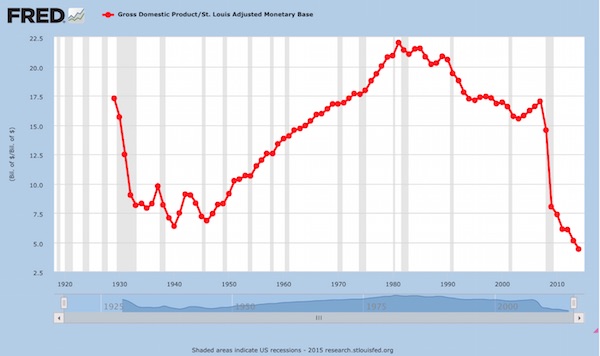

[..] markets need price discovery as much as price discovery needs markets. They are two sides of the same coin. Markets are the mechanism that makes price discovery possible, and vice versa. Functioning markets, that is. Given the interdependence between the two, we must conclude that when there is no price discovery, there are no functioning markets. And a market that doesn’t function is not a market at all.

[..] we must wonder why everyone in the financial world, and the media, is still talking about ‘the markets’ (stocks, bonds et al) as if they still existed. Is it because they think there still is price discovery? Or do they think that even without price discovery, you can still have functioning markets? Or is their idea that a market is still a market even if it doesn’t function?

But perhaps that is confusing, and confusion in and of itself doesn’t lead to better understanding. So maybe I should call what there is out there today ‘zombie markets’. It doesn’t really make much difference. What murdered functioning markets is intervention by central banks, in alleged attempts to save those same markets. Cue your favorite horror movie.

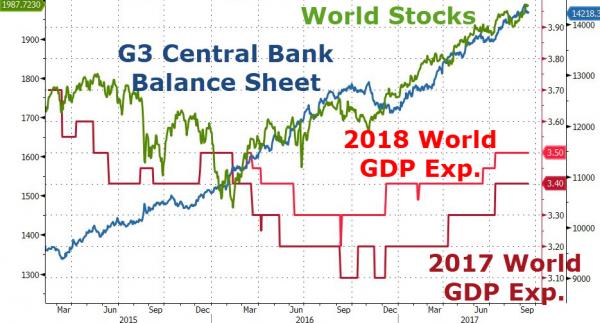

Now Jerome Powell and the Fed he inherited are apparently trying to undo the misery Greenspan, Bernanke and Yellen before him wrought upon the economic system, and people, cue Trump, get into fights about that one. All the while still handing the Fed, the ECB, the BoJ, much more power than they should ever have been granted.

And you won’t get actual markets back until that power is wrestled from their cold dead zombie fingers. Even then, the damage will be hard to oversee, and it will take decades. The bankers and investors their free and easy trillions were bestowed upon will be just fine, thank you, but everyone else will definitely not be.

Central banks don’t serve societies, they serve banks. They fool everyone, politicians first of all, into believing that societies automatically do well if only the demands of banks are met first, and as obviously stupid as that sounds, nary a squeak of protest can be heard. Least of all from ‘market participants’ who have done nothing for the better part of this millennium except feast at the teat of main street largesse.

In the past few days we’ve had both -stock- market rallies and plunges of 5% or so, and people have started to realize that is not normal, and it scares them. So you get Tyler posting DataTrek’s Nicolas Colas saying “Healthy” Markets Don’t Rally 1,086 Points On The Dow. Well, he’s kinda right, but there hasn’t been a healthy market in 10+ years, and he’s missed that last bit. Like most people have who work in those so-called ‘markets’.

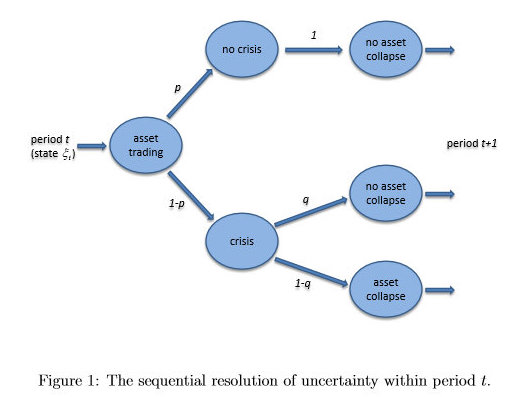

Here’s why Colas is right, but doesn’t understand why. Price discovery is the flipside of the coin that is a functional market, because it allows for people to see why something is valued at the level it is, by a large(r) number of participants. Take that away and it is obvious that violent price swings may start occurring as soon as the comforting money teat stutters, or even just threatens to do so; a rumor is enough.

In physics terms, price discovery, and therefore markets themselves -provided they’re ‘healthy’ and ‘functioning’- delivers negative feedback to the system, i.e. it injects self-correcting measures. Take away price discovery, in other words kill the market, and you get positive feedback, where -simplified- changes tend to lead to ever bigger changes until something breaks.

Also, different markets, like stocks, bonds, housing, will keep a check on each other, so nothing will reach insane valuations. If they tend to, people stop buying and will shift their money somewhere else. But when everything has an insane value, how would people know what’s insane anymore, and where could they shift that is not insane?

It doesn’t matter much for ‘market participants’, or ‘investors’ as they prefer to label themselves, they shift trillions around on a daily basis just to justify their paychecks, but for mom and pop it’s a whole different story. In between the two you have pension funds, whose rapid forced move from AAA assets to risk will strangle mom and pop’s old-age plans no matter what.

People inevitably talk about the chances of a recession happening, but maybe they should first ask what exactly a recession, or a bear market, is or means when it occurs in a zombie (or just plain dead) market.

If asset ‘values’ have increased by 50% because central banks and companies themselves have bought stocks, it would seem logical that a 10% drop doesn’t have the same meaning as it would in a marketplace where no such manipulation has taken place. Maybe a 50% drop would make more sense then.

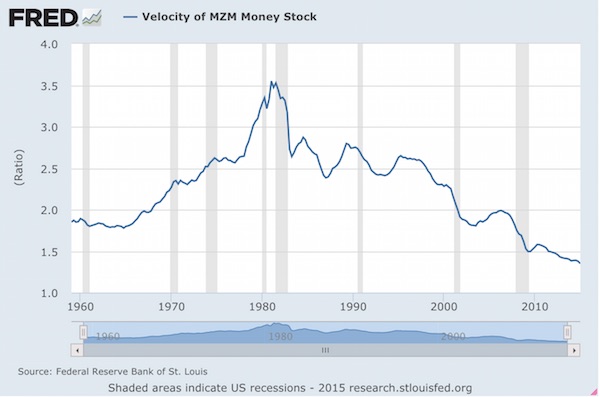

The inevitable future is that people are going to get tired of borrowing as soon as it becomes too expensive, hence unattractive, to do so. Central banks can still do more QE, and keep rates low for longer, but that’s not an infinity and beyond move. It a simple question of the longer it lasts the higher will be the price that has to be paid. One more, one last, simple question: who’s going to pay? We all know, don’t we?

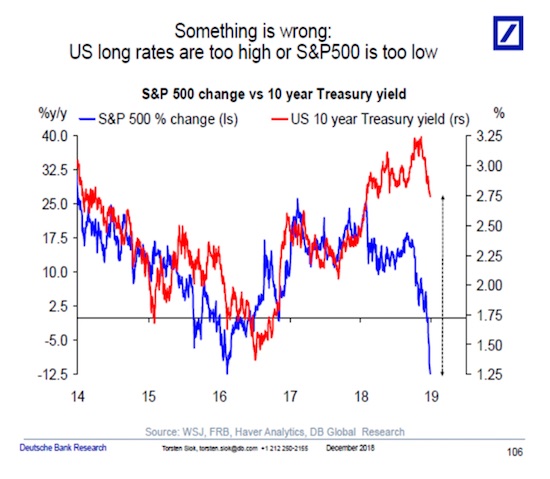

That’s where the Fed is now. You can let interest rates rise, as Powell et al are indicating they want to do, but that will cut off debt growth, and since debt is exclusively what keeps the economy going, it will cut into economic growth as well. Or you can keep interest rates low (and lower), but then people have less and less idea of the actual value of assets, which can, and eventually necessarily will, cause people to flee from these assets.

Powell’s rate hikes schedule looks nice from a normalizing point of view, and g-d knows what normal is anymore, but it would massacre the zombie markets the Fed itself created when it decided to kill the actual markets. You can get back to normal, but only if the Fed retreats into the Eccles Building and stays there until 2050 or so (or is abolished).

They won’t, the banks whose interests they protect will soon be in far too dire straits, and bailouts have become much harder to come by since 2008. It’ll be a long time before markets actually function again, and we won’t get there without a world of pain. Which will be felt by those who never participated in the so-called markets to begin with. Beware of yellow vests.

To top off the perversity of zombie markets, one more thing. Zombie markets build overcapacity. One of the best things price discovery brings to an economy is that it lets zombies die, that bankrupt companies and bankrupt ideas go the way of the dodo.

That, again, is negative feedback. Take that away, as low rates and free money do, and you end up with positive feedback, which makes zombies appear alive, and distorts the valuation of everything.

Most of what the ‘popular’ financial press discusses is about stocks, what the Dow and S&P have done for the day. But the bond markets are much bigger. So what are we to think when the two are completely out of sync -and whack-?

Oh well, those are just ‘the markets’, and we already know that they are living dead. Where that may be less obvious, if only because nobody wants it to be true, is in housing markets. Which, though this is being kept from you with much effort, are what’s keeping the entire US, and most of Europe’s, economies going. And guess what?

The Fed and Draghi have just about hit the max on home prices (check 2019 for the sequel). Prices have gotten too high, Jay Powell wants higher interest rates, Draghi can’t be left too far behind him because EU money would all flow to the US, and it’s all well on its way to inevitability.

And anyway, the only thing that’s being achieved with ever higher home prices is ever more debt for the people who buy them, and who will all be on the hook if those prices are subject to the negative feedback loops healthy markets must be subject too, or else.

The only parties who have profited from rising home prices are the banks who dole out the mortgages and the zombie economy that relies on them creating the money society runs on that way. We have all come to rely on a bunch of zombies to keep ourselves from debt slavery, and no, zombies are not actually alive. Nor are the financial markets, and the economies, that prop them up.

Among the first things in 2019 you will see enormous amounts of junk rated debt getting rated ever -and faster- lower , and the pace at which ever more debt that is not yet junk, downgraded to(wards) junk, accelerating. It looks like the zombies can never totally take over, but that is little comfort to those neck deep in debt even before we start falling.

And as for the ‘players’, the economic model will allow again for them to shove the losses of their braindead ventures onto the destiny of those with ever lower paying jobs, who if they’re lucky enough to be young enough, start their careers in those jobs with ever higher student debts.

You’d think that at some point they should be happy they were never sufficiently credit-worthy to afford one of the grossly overpriced properties that are swung like so many carrots before their eyes, but that’s not how the system works. The system will always find a way to keep pushing them deeper into the financial swamp somehow.

The last remaining growth industry our societies have left is inequality, and that’s what our central banks and governments are all betting on to keep Jack Sparrow’s Flying Dutchman afloat for a while longer. Where the poor get squeezed more so the 1% or 10% get to look good a little longer.

But in the end it’s all zombies all the way down, like the turtles, and some equivalent of the yellow vests will pop up in unexpected places. My prediction for next year.

It doesn’t look to me that a year from now we’ll see 2019 as a particular peaceful year, not at all like 2018. I called it from Chaos to Mayhem earlier, and I’m sticking with that. We’re done borrowing from the future, it’s getting time to pay back those loans from that future.

And that ain’t going to happen when there are no functioning markets; after all, how does anyone know what to pay back when the only thing they do know is everything is way overvalued? How wrong can I be when I say debts will only be paid back at fair value?

2019, guys, big year.