Georgia O’Keeffe Autumn leaves, Lake George � 1924

Trump’s discomfort is still understandable.

• Fed Minutes May Unlock Details About Jerome Powell’s Ultimate Plan (Y!)

Wednesday’s minutes of the Federal Reserve’s September meeting, released at 2 p.m. ET, may reveal more details about the pacing of the central bank’s rate hikes, which have rattled investors and President Trump over the past week. Trump has repeatedly criticized the Fed in recent days, calling it “crazy” and “too cute” in various media interviews. Investors seemed to largely agree with this characterization — and sent the Dow Jones Industrial Average down over 1,300 points over a few trading sessions last week, as higher interest rates make stocks less attractive. The Fed has raised interest rates three times this year and has telegraphed a fourth hike as soon as December.

But Danielle DiMartino Booth, a former Federal Reserve advisor and CEO of Quill Intelligence, doesn’t expect Wednesday’s minutes to reflect the market’s recent worry over interest rates. “With Jay Powell, we have seen clean minutes,” she told Yahoo Finance, describing the minutes as a summation of the Fed’s thinking at the time of the September meeting. She said former Fed chairs Ben Bernanke and Janet Yellen used to massage the minutes if they needed to update their outlook in the weeks following the Fed’s last statement. [..] A lot has occurred since the September 25-26 meeting, including a steep rise in bond yields and last week’s aforementioned market turmoil. “[Last week’s market] declines won’t cause Powell to push the panic button,” Booth said. “If you look at the past few trading sessions, much of the declines have reversed.”

The shadows. Not under Xi’s control.

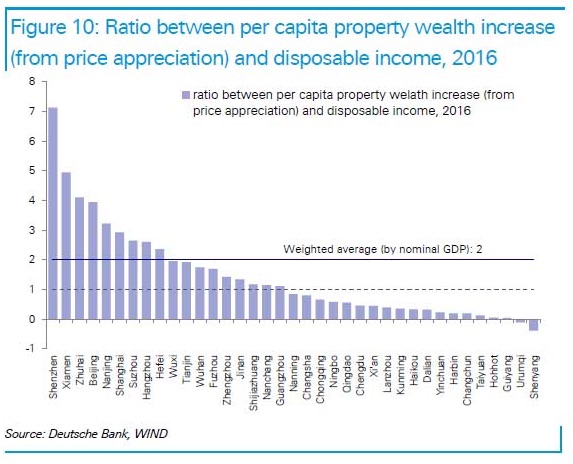

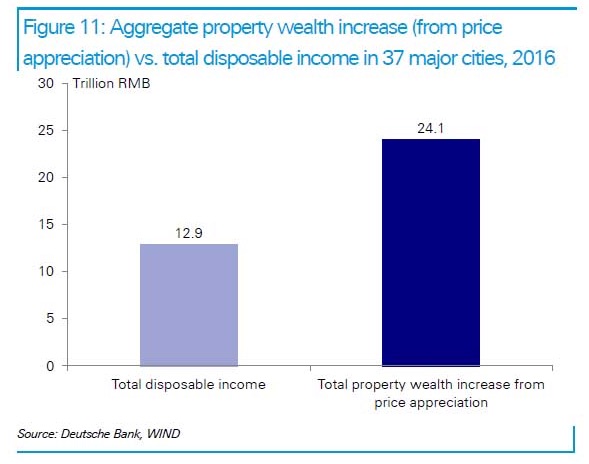

• China May Have $6 Trillion Of Unreported Local Government Debt – S&P (CNBC)

Unreported Chinese local government debt may amount to trillions of U.S. dollars, meaning the country’s debt-to-GDP ratio has hit “alarming” levels, S&P Global Ratings said in a report released Tuesday. The analysts noted a large gap between reported investment in local infrastructure and funding, as permitted by central authorities. As a result, the actual level of off-balance sheet debt could be several times more than what is publicly disclosed and range as high as 30 trillion yuan to 40 trillion yuan, or about $4.34 trillion to $5.78 trillion, credit analysts Gloria Lu, Laura Li and their team said in the report.

“And that’s a debt iceberg with titanic credit risks,” they added, estimating that the ratio of all government debt to GDP was 60 percent last year. To encourage economic growth in the region, local governments in China have invested heavily in infrastructure, often using financing structures known as “local government financing vehicles,” or LGFVs. Details about their size or nature tend to be unclear, and the S&P analysts said much of the hidden debt is in those vehicles. Beijing has been trying to move financing away from off-balance sheet sources, but has had limited success so far. In the future, S&P Global Ratings expects authorities will allow more defaults in local government financing vehicles, the report said.

Very graphic. There was no botched kidnapping, and no rogue elements. Find a new line. It doesn’t look like this story can be stopped anymore. Turkey keeps leaking details.

• Jamal Khashoggi’s Killing Took Seven Minutes – Turkish Source (MEE)

It took seven minutes for Jamal Khashoggi to die, a Turkish source who has listened in full to an audio recording of the Saudi journalist’s last moments told Middle East Eye. Khashoggi was dragged from the Consul General’s office at the Saudi consulate in Istanbul and onto the table of his study next door, the Turkish source said. Horrendous screams were then heard by a witness downstairs, the source said. “The consul himself was taken out of the room. There was no attempt to interrogate him. They had come to kill him,” the source told MEE. The screaming stopped when Khashoggi – who was last seen entering the Saudi consulate on 2 October – was injected with an as yet unknown substance.

Salah Muhammad al-Tubaigy, who has been identified as the head of forensic evidence in the Saudi general security department, was one of the 15-member squad who arrived in Ankara earlier that day on a private jet. Tubaigy began to cut Khashoggi’s body up on a table in the study while he was still alive, the Turkish source said. The killing took seven minutes, the source said. As he started to dismember the body, Tubaigy put on earphones and listened to music. He advised other members of the squad to do the same. “When I do this job, I listen to music. You should do [that] too,” Tubaigy was recorded as saying, the source told MEE. A three-minute version of the audio tape has been given to Turkish newspaper Sabah, but they have yet to release it.

Killing companies and cutting 100s of 1000s of jobs is perfectly legal.

• Sears Didn’t ‘Die.’ Vulture Capitalists Killed It. (Kuttner)

If you’ve been following the impending bankruptcy of America’s iconic retailer as covered by print, broadcast and digital media, you’ve probably encountered lots of nostalgia and sad clucking about how dinosaurs like Sears can’t compete in the age of Amazon and specialty retail. But most of the coverage has failed to stress the deeper story. Namely, Sears is a prime example of how hedge funds and private equity companies take over retailers, encumber them with debt in order to pay themselves massive windfall profits, and then leave the retailer without adequate operating capital to compete. Part of the strategy is to sell off valuable real estate, the better to enrich the hedge fund, and stick the retail company with costly rental payments to occupy the space that it once owned.

In the case of Sears, the culprit is a hedge-fund operator named Edward Lampert, once a senior merger guy at Goldman Sachs. In 2005, Lampert merged Sears with Kmart, loaded both up with debt, and used some of the debt on stock buybacks to pump up the share price and enrich shareholders, notably himself and his hedge fund. In a decade, 175,000 people at Sears/Kmart lost their jobs and revenue was cut in half. Various pieces of Sears were sold off. Lampert did just fine. Lampert’s hedge fund also became a prime a lender to Sears, making money off of commissions and interest charges as well as being a prime shareholder. The strategy ensures that the fund and its beneficiaries (including Lampert himself) get rich, even if they run Sears into the ground.

“..at a time of private economic failure, it is vital for government to borrow and spend..”

• On Theresa May, Danny DeVito and ‘Other People’s Money’ (Pettifor)

PEF Council member Ann Pettifor explains how all governments finance their spending (and its not from taxation). She deconstructs Theresa May’s address to the Conservative Party Conference with its deliberate framing of Labour governments as tax raiders. The use of the phrase “other people’s money” was not accidental. It was first used in the title of a famous work (1973) by Donald R. Cressy about the social psychology of embezzlement. The book was later made into a movie about a corrupt corporate raider, and starred Danny de Vito and Gregory Peck. Mrs May’s speech writer wanted to imply that Labour governments are tax raiders.

That is both a calumny, but also a lie – twice over. First because no Labour government has ever run out of money – not even Clement Attlee’s which started life with public debt at 250% of national income, and then spent enormous sums creating the NHS, affordable housing, a public education system etc. As a result of that spending, public debt as a share of GDP fell precipitously, because the Labour government increased the nation’s income, through well-paid employment. Good, well-paid employment in turn generated tax revenues – to pay for the borrowing, and pay down the public debt.

Second, no government – including today’s Conservative government – finances spending from taxation. Instead governments finance spending by borrowing from their own Bank, the Bank of England, or from capital markets. If that borrowing creates employment and increases income, then tax revenues accrue to HMRC, and is used to pay for the borrowing. To keep the public finances balanced at a time of private economic failure, it is vital for government to borrow and spend, to expand the nation’s income and thereby to generate the tax revenues needed to repay the borrowing, and keep the public finances in order.

Most of the world has.

• Britain Fell For A Neoliberal Con Trick – Even The IMF Says So (G.)

I want to address the most stubborn belief of all: that running a small state is the soundest financial arrangement for governments and voters alike. Because 40 years on from the Thatcher revolution, more and more evidence is coming in to the contrary. Let’s start with the IMF itself. Last week it published a report that barely got a mention from the BBC or in Westminster, yet helps reframe the entire debate over austerity. The fund totted up both the public debt and the publicly owned assets of 31 countries, from the US to Australia, Finland to France, and found that the UK had among the weakest public finances of the lot. With less than £3 trillion of assets against £5tn in pensions and other liabilities, the UK is more than £2tn in the red. Of all the other countries examined by researchers, including the Gambia and Kenya, only Portugal’s finances look worse over the long run. So much for fixing the roof.

Almost as startling are the IMF’s reasons for why Britain is in such a state: one way or another they all come back to neoliberalism. Thatcher loosed finance from its shackles and used our North Sea oil money to pay for swingeing tax cuts. The result is an overfinancialised economy and a government that is £1tn worse off since the banking crash. Norway has similar North Sea wealth and a far smaller population, but also a sovereign wealth fund. Its net worth has soared over the past decade. The other big reason for the UK’s financial precarity is its privatisation programme, described by the IMF as no less than a “fiscal illusion”. British governments have flogged nearly everything in the cupboard, from airports to the Royal Mail – often at giveaway prices – to friends in the City. Such privatisations, judge the fund, “increase revenues and lower deficits but also reduce the government’s asset holdings”.

If they are successful others may follow.

• Venezuela Drops US Dollar, Will Use Euro For International Transactions (RT)

Venezuela is abandoning the US dollar, with all future transactions on the Venezuelan exchange market to be made in euro, Tareck El Aissami, the country’s Vice President for Economy, announced. The sanctions, recently introduced by Washington against Caracas, “block the possibility of continuing to trade using the US dollar on the Venezuelan exchange market,” El Aissami said, adding that the American restrictions were “illegal and against international law.” The American “financial blockade” of Venezuela affects both the country’s public and private sectors, including pharmacy and agriculture, and shows “just how far the imperialism can go in its madness,” the vice president said.

Venezuela’s floating exchange rate system, Dicom, “will be operating in euro, yuan or any other convertible currency and will allow the foreign exchange market to use any other convertible currency,” El Aissami said. The vice president added that all private banks in Venezuela are obliged to participate in the Dicom bidding system. The government is going to sell 2 billion euros between November and December to allow the public to purchase the European currency “at a real, non-speculative rate,” he said.

The price of success?!

• The World Will Soon Start Talking Like Trump (FP)

[..] no one doubts that Trump, through his surprise election victory and unprecedented approach to governance, has redefined political communication. For better or worse, every future president and presidential candidate will seek to learn from, and at least partially emulate, Trump’s unique and successful methods in this. Because America often sets trends in political communication, we should also expect to see such Trumpian techniques adopted abroad as well. Of course, there is considerable disagreement about precisely what those techniques are and which aspects of them will endure and transfer into other campaigns. It is early days, but at least three aspects of Trumpian political communication are likely to endure.

The most obvious and most commented upon aspect of Trumpian communication is the president’s use of Twitter. Trump is quite simply addicted to the medium—and he has stuck to it despite warnings from his political advisors that it is unwise for a president to make unfiltered use of social media. [..] Trump [..] clearly values Twitter precisely because it provides him with direct access to voters, unencumbered by the press, advisors, the government bureaucracy, or even personal reflection. He provides breaking news on his feed not available elsewhere and provides insight into his thinking through tweets.

Trump should do this.

• Supreme Court To Hear Case Linked To Who Social Media Can Censor (CNBC)

The Supreme Court has agreed to hear a case that could determine whether users can challenge social media companies on free speech grounds. The case, Manhattan Community Access Corp. v. Halleck, No. 17-702, centers on whether a private operator of a public access television network is considered a state actor, which can be sued for First Amendment violations. The case could have broader implications for social media and other media outlets. In particular, a broad ruling from the high court could open the country’s largest technology companies up to First Amendment lawsuits.

That could shape the ability of companies like Facebook, Twitter and Alphabet’s Google to control the content on their platforms as lawmakers clamor for more regulation and activists on the left and right spar over issues related to censorship and harassment. The Supreme Court accepted the case on Friday. It is the first case taken by a reconstituted high court after Justice Brett Kavanaugh’s confirmation earlier this month. [..] On its face, the case has nothing to do with social media at all. Rather, the facts of the case concern public access television, and two producers who claim they were punished for expressing their political views.

The producers, DeeDee Halleck and Jesus Melendez, say that Manhattan Neighborhood Network suspended them for expressing views that were critical of the network. In making the argument to the justices that the case was worthy of review, attorneys for MNN said the court could use the case to resolve a lingering dispute over the power of social media companies to regulate the content on their platforms. [..] While the First Amendment is meant to protect citizens against government attempts to limit speech, there are certain situations in which private companies can be subject to First Amendment liability. Attorneys for MNN have made the case that social media companies are clearly not government actors. But in raising the question, they have provided the Supreme Court an opportunity to weigh in.

Interest-only mortgages.

• Record Number of Older Australians are in Financial Trouble. (ABC.au)

Financial helpline counsellors are at “capacity” with record numbers of older Australians struggling in poverty, but they still urge those experiencing debt distress to not hesitate to call. The National Debt Helpline — a federal government-run financial counselling service — said it’s on track to receive a record number of cases through its call centres this year — many from older Australians who can’t meet their mortgage or rent payments. “The phones just never stop now,” financial counsellor Greg said. “They’re just going day after day, after day. “You put the phone down, you pick the phone up again.”

[..] For the first time, the National Debt Helpline has started fielding calls from Australians struggling to switch from interest, to principal and interest mortgage payments. “We are seeing an increasing number of older Australians calling us,” Ms Cox said. “Very occasionally we’re still seeing people who have just been granted a very large mortgage, even though they’re in their 50s or 60s, and one that’s set to go for a 25 or 30-year term.” Those sorts of lending practices can lead older Australians down a financial rabbit hole. That is when sickness can creep in and marriages break down.

Our economies run on waste.

• UK Restaurants And Cafes Throw Out 320 Million Fresh Meals A Year (G.)

Almost 900,000 perfectly edible, freshly prepared meals end up in the bin in the UK every day, new figures reveal, because they haven’t been sold in time by restaurants and cafes. This means that more than 320m meals are thrown away by British food establishments every year – enough meals for everyone in the UK five times over, according to food waste app Too Good To Go. While consumers are increasingly aware of the food wasted in their homes and by supermarkets, waste by restaurants is still largely overlooked. Figures from the government’s food waste advisory body Wrap state that the problem costs UK businesses over £2.5m every week.

The app – which allows users to “rescue” surplus meals at a discounted price – is calling on more food businesses and consumers to join forces to help cut waste. “No one leaves the lights on when they leave the house,” said Hayley Conick, UK managing director at Too Good To Go. “Yet, whether it’s in restaurants, food shops or our own homes, we don’t think twice about throwing away perfectly good food.” Separately, Britons are being urged to help cut their food waste at home by setting their fridges to a colder temperature to make fresh milk and other chilled foods last longer. The advice from campaign group Love Food Hate Waste comes as a new survey revealed that half the UK population do not realise that their fridge should be set at below 5C to maximise its efficiency.

Not a timeframe we can oversee. So not a call to action.

• Nature Will Need Up To 5 Million Years To Fill The Gaps Caused By Man (Ind.)

Mankind has taken the world to the brink of a mass extinction that could wipe out vast swathes life on Earth for millions of years, scientists have warned in a new study. Humans are killing off animal and plant species so rapidly that evolution is unable to keep up to fill the gaps left behind, the work suggests. Unless conservation efforts are stepped up, nature will require between three and five million years to recover the levels of biodiversity expected to be lost over the next 50 years, predicted researchers. There have been five previous mass extinctions in the past 450 million years, and scientists have warned climate change, poaching, pollution and habitat destruction are bringing about a sixth.

More than 300 mammal species have been eradicated by human activity, according to researchers at Aarhus University in Denmark and the University of Gothenburg. More are likely to follow them into extinction in the next few decades. [..] Instead of simply counting lost or threatened species, the study considered the amount of time each had spent evolving to reflect. The extinction of species with distinct lineages and few close relatives meant the loss of “unique ecological functions and the millions of years of evolutionary history they represented”, researchers said.

“Large mammals, or megafauna, such as giant sloths and sabre-toothed tigers, which became extinct about 10,000 years ago, were highly evolutionarily distinct,” said Aarhus University palaeontologist Matt Davis, who led the study. “Since they had few close relatives, their extinctions meant that entire branches of Earth’s evolutionary tree were chopped off.” Researchers suggested threatened mammals with long evolutionary histories should be prioritised for conversation. They highlighted Asian elephants, one of only two existing species of a once mighty mammalian order that included mammoths and mastodon, and which are said to have just a 33-per-cent chance of surviving the century.