Lewis Wickes Hine Newsies in St. Louis 1910

Note: Shanghai plunge protection came in in late trading. It ended up 1.23%.

• Asian Shares Plunge To Two-Year Lows As China Stocks Continue To Fall (Guardian)

Asian shares on Wednesday struggled at two-year lows after Chinese stocks extended their fall, stoking fears about the stability of China’s economy. The Shanghai Composite Index retreated 3.9% a day after worries that the central bank could be in no hurry to ease policy further pushed it down 6.1%. The plunge dented hopes of Chinese share markets stabilising after Beijing effectively pulled out all the stops to stem the rout. Japan’s Nikkei fell 0.5% and South Korea’s Kospi lost 1.3%. “Investors care about these two things: China’s economy and the timing of a US rate hike. These two concerns dominate their minds now,” said Masaru Hamasaki, head of market and investment information department at Amundi Japan.

MSCI’s broadest index of Asia-Pacific shares outside Japan slid to a two-year low and was last down 0.1%. Australian stocks bucked the trend and climbed 1.2%. Shares of importers and firms with high US dollar-denominated debt have been under pressure following last week’s yuan devaluation. The spectre of a slowdown in China’s economic growth and a US interest rate hike has hit asset markets in emerging economies hardest. MSCI’s emerging market index fell to its lowest level since October 2011. It has dropped more than 20% from the year’s peak it hit in April. Wall Street shares also retreated overnight, with the S&P 500 sliding 0.26%, pressured by weak earnings from retail giant Wal-Mart.

Must read from Pettis.

• Do Markets Determine The Value Of The Renminbi? (Michael Pettis)

One of the main questions being batted around is whether, under the new system, the value of the RMB is finally going to be determined by the market. If it is, it almost certainly means that the value of the RMB will decline. Why? Because the balance of payments, which is the sum of the current account surplus and the capital account deficit, is in deficit if we exclude PBoC interventions. At current prices there is more RMB selling than there is buying, and the PBoC has to sell reserves and buy RMB in order to keep the currency from depreciating. This, many people argue, proves that the RMB is overvalued. The “market”, they claim, has spoken, and it has told us that the RMB is overvalued. They are wrong. The “market” is not telling us that the RMB is overvalued.

It is telling us only that there is more supply of RMB than there is demand for RMB at the current exchange rate. Because “overvaluation” and “undervaluation” usually refer to the fundamental value of a currency, this excess of supply over demand would only imply an overvaluation of the RMB if supply and demand were driven primarily by economic fundamentals. Excluding central bank intervention, which is mainly a residual contributed automatically by the PBoC to balance supply and demand for foreign currency, all purchases or sales of foreign currency in China can be divided into current account activity, which mostly consists of the trade account, along with other transactions including tourism, royalty payments, interest payments, etc., and capital account activity, which consists of direct investment, portfolio investment, and official flows.

Imbalances in both the current account and the capital account can be driven by economic fundamentals, in which case it might make sense to say that the RMB’s “correct” exchange rate is broadly equal to the clearing price at which supply is equal to demand. In this case if the central bank were to purchase RMB, reserves would decline and it would be reasonable to assume that PBoC intervention would cause the RMB to become overvalued, while PBoC sales of RMB would cause reserves to increase and the RMB to become undervalued. But neither the current account nor the capital account is necessarily driven only by economic fundamentals. As an aside, most people, including unfortunately most economists, typically assume that the current account is independent and the capital account, if they think of it at all, simply adjusts to maintain the balance, but this is an extremely confused way to think about the balance of payments.

“Her credit markets are fragile and they are unwinding what has been the world’s biggest ever credit boom, and capital outflows are meaningful..”

• China’s Devaluation May Be Bad News For FX Industry (Reuters)

China’s currency devaluation should give a shot in the arm to global foreign exchange volumes as traders take advantage of and protect themselves against the surprise surge in volatility, but its longer-term impact on market activity may not be so benign. Investors with longer-term horizons than a day’s trading profit, from pension funds seeking stable returns to companies considering expanding overseas, will be alarmed by the prospect of wild swings in exchange rates triggered by another round of “currency wars”. Former Brazilian finance minister Guido Mantega coined the term “currency wars” in 2010. It refers to countries trying to make their exports more competitive – and ultimately boost their growth – at the expense of rivals, by weakening their exchange rates.

Policymakers fear Beijing’s move could accelerate this race to the bottom, particularly as most countries, including those in the developed and industrialized world, have few growth-boosting policy tools left open to them. It’s a worry for a troubled foreign exchange industry. After years of rapid growth, which made it the world’s largest financial market and a money-spinner for big banks, trading volumes are slowly shrinking and jobs are being lost. Tighter regulation, increased automation, greater competition, and a global market-rigging scandal all suggest its glory days are over. The depressive impact on investment of a lengthy currency war would do little to restore its fortunes. “Any prolonged uncertainty in the market resulting from this, and real-money players such as pension and mutual funds will be less inclined to invest,” said Neil Mellor at Bank of New York Mellon.

As analysts at Morgan Stanley point out, China accounts for 21% of the trade-weighted dollar index used by the Federal Reserve. It is the biggest single component of the equivalent euro trade-weighted index at around 23%. So what happens to the yuan has a growing influence on dollar and euro flows. Analysts at Cross Border Capital say China’s credit markets have grown 12-fold since 2000 and are now worth around $25 trillion – roughly the same size as U.S. credit markets. “Her credit markets are fragile and they are unwinding what has been the world’s biggest ever credit boom, and capital outflows are meaningful,” they wrote in a report last month. “China remains the key risk and reward for global investors.” In that, the foreign exchange industry is no exception.

The 800 pound blind spot in Beijing’s financial Ponzi politics comes back to haunt it.

• China Shadow Banks Appeal For Government Bailout (FT)

The collapse of a state-owned credit guarantee company in China’s rust belt has shone a new spotlight on risk from bad debt and moral hazard in the country’s shadow banking system. As China’s economy slows, concerns are mounting over rising defaults, especially on loans from non-bank lenders, which provide credit to risky borrowers at high interest rates. Eleven shadow banks have written an open letter to the top Communist party official in northern China’s Hebei province asking for a bailout that would enable the bankrupt credit guarantee company to continue to backstop loans to borrowers. If the guarantor cannot pay, it could spark defaults on at least 24 high-yielding wealth management products (WMPs).

Analysts worry that a series of bailouts in recent years has encouraged irresponsible lending by fuelling the perception the government will not tolerate default. The latest appeal for a bailout will again force officials to choose between ensuring short-term financial stability or imposing market discipline on investors, which should improve lending practices in the long term. Hebei Financing Investment has guaranteed Rmb50bn ($7.8bn) in loans from nearly 50 financial institutions, according to Caixin, a respected financial magazine. More than half of this total is from non-bank lenders, mainly trust companies, who lent to property developers and factories in overcapacity industries. The letter appeals directly to the government’s concern about social stability and the fear of retail investors protesting the loss of “blood and sweat money”.

The 11 companies sold 24 separate WMPs worth Rmb5.5bn. “The domino effect from the successive and intersecting defaults of these trust products involves a multitude of financial institutions, an immense amount of money, and wide-ranging public interests,” 10 trust companies and a fund manager wrote to Zhao Kezhi, Hebei party secretary. “In order to prevent this incident from inciting panic among common people and creating an unnecessary social influence, we represent more than a thousand investors, more than a thousand families, in asking for a resolution.” Most trust products are distributed through state-owned banks, leaving unsophisticated investors with the impression that the bank and ultimately the government stands behind them, even when the fine print says otherwise.

There has been a series of technical defaults on bonds and high-yield trust products in recent years, but bailouts have shielded retail investors from losses in most if not all cases, often following public protests by angry investors at bank branches. Trust lending has exploded since 2010 amid a pullback by traditional banks. Trusts sell WMPs to investors, marketing the products as a higher-yielding alternative to traditional savings deposits. They use the proceeds for loans to property developers, coal miners and manufacturers in overcapacity sectors to which banks are reluctant to lend. Trust loans outstanding rose from Rmb1.7tn in 2011 to Rmb6.9tn at the end of June. Hebei Financing stopped paying out on all loan guarantees in January, when its chairman was replaced and another state-owned group was appointed as custodian.

Much of it is fleeing abroad.

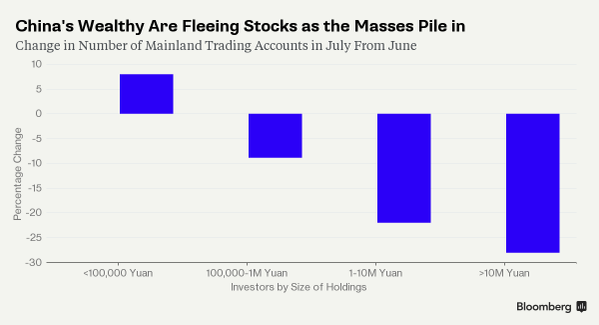

• China’s Richest Traders Are Fleeing Stocks as the Masses Pile In (Bloomberg)

The wealthiest investors in China’s equity market are heading for the exits. The number of traders with more than 10 million yuan ($1.6 million) of shares in their accounts shrank by 28% in July, even as those with less than 100,000 yuan rose by 8%, according to the nation’s clearing agency. While some of the drop is explained by falling market values, CLSA Ltd. says China’s rich have taken advantage of state buying to cash out after the nation’s record-long bull market peaked in June. Investors with the most at stake are finding fewer reasons to own Chinese shares amid weak corporate earnings and some of the world’s highest valuations.

With this month’s devaluation of the yuan adding to outflow pressures, bulls have started to question whether there’s enough buying power to prop up prices once the government pares back its unprecedented rescue effort – a concern that contributed to the Shanghai Composite Index’s 6% plunge on Tuesday. “The high net worth clients are the ones who moved the market,” Francis Cheung, the head of China and Hong Kong strategy at CLSA, wrote in an e-mail. “They tend to be more savvy.” The median stock on mainland bourses traded at 72 times reported earnings on Monday, more expensive than any of the world’s 10 largest markets. The ratio was 68 at the peak of China’s equity bubble in 2007, according to data compiled by Bloomberg.

More than 62% of companies in the Shanghai Composite trailed analysts’ 2014 earnings estimates as the economy expanded at its weakest pace since 1990. Profits at Chinese industrial firms declined by 0.3% in June, versus a 0.6% gain in the previous month. “There is not a lot of fundamental support for the A-share market,” Cheung said. “Earnings are weak.” “This lack of a clear trend in the market causes overreactions by investors” The ranks of investors with at least 10 million yuan in stocks dropped to about 55,000 in July from 76,000 in June. Those with between 1 million yuan and 10 million yuan declined by 22%, according to data compiled by China Securities Depository and Clearing Corp. “Wealthy investors, who have been through bear markets, are better at exiting,” said Hu Xingdou, an economics professor at the Beijing Institute of Technology.

From Fed mounthpiece Hilsenrath.

• US Lacks Ammo for Next Economic Crisis (WSJ)

The U.S. over the past quarter century regularly turned to the Fed to provide stimulus when the economy stumbled. In the most recent recession, short-term interest rates were pushed to near zero, then the central bank embarked on massive—and controversial—bond-buying programs to drive down long-term interest rates. The Fed also promised to keep short-term interest rates low for an extended period. The tactics were meant to make it easier for households to pay off debts, encourage new borrowing and promote risk-taking; officials hoped that would push investment and consumer spending higher.

The next downturn could further expand Fed bondholdings, but with the central bank’s balance sheet already exceeding $4 trillion, there are limits to how much more the Fed can buy. Mr. Bernanke said he was struck by how central banks in Europe recently pushed short-term interest rates into negative territory, essentially charging banks for depositing cash rather than lending it to businesses and households. The Swiss National Bank, for example, charges commercial banks 0.75% interest for money they park, an incentive to lend it elsewhere. Economic theory suggests negative rates prompt businesses and households to hoard cash—essentially, stuff it in a mattress. “It does look like rates can go more negative than conventional wisdom has held,” Mr. Bernanke said.

Others, including Sen. Bob Corker (R.,Tenn.), see only the Fed’s limits. “They have, like, zero juice left,” he said. Many economists believe relief from the next downturn will have to come from fiscal policy makers not the Fed, a daunting prospect given the philosophical divide between the two parties. Republicans doubt federal spending expands the economy, and they seek to shrink rather than grow government. Democrats, meanwhile, say government austerity hobbles the economy, especially in a downturn. At issue is how much the U.S. can afford to borrow and spend to goose the economy out of the next recession. The experience of the past recession has set off sharp disagreement among economists.

Federal debt has grown to 74% of national output, from 39% in 2008. To restrain short-term budget deficits, Congress and the White House agreed earlier this decade on a mix of spending cuts and tax increases. In all, total state, local and federal government spending, adjusted for inflation, shrank 3.3% since the recovery began in 2009, compared with an average increase of 23.5% over comparable periods in past postwar expansions.

Sure, throw some more oil on the fire.

• Abe Aide Says Japan Needs $28 Billion Economic Package (Bloomberg)

Japan needs an economic injection of as much as 3.5 trillion yen ($28 billion) to shore up consumption and stave off a further economic contraction, said Etsuro Honda, an economic adviser to Prime Minister Shinzo Abe. “Households feel their income has been reduced,” Honda, 60, said in an interview Tuesday at the Prime Minister’s Office in Tokyo. “The negative legacy of the previous tax hike is waning, but increases in wages are lower than expected and prices of food and daily commodities are rising.” The world’s third-biggest economy shrank an annualized 1.6% in the three months through June as households and businesses cut spending and exports tumbled.

While the tailwind from the weaker yen and the Bank of Japan’s unprecedented monetary stimulus have helped propel stocks to an eight-year high, consumer confidence has slumped. Honda said a package of 3-3.5 trillion yen is needed to help lower-income households and pensioners. He suggested it should be delivered as subsidies such as child-care support or coupons, rather than spending on public works. Additional spending can be funded from higher-than-expected tax revenues, rather than issuing new government bonds, he said. Economy Minister Akira Amari said Monday he doesn’t expect to add fiscal stimulus, and Bank of Japan Governor Haruhiko Kuroda is counting on growth returning this quarter as he pursues a distant 2% inflation target with unprecedented monetary stimulus.

Honda said fiscal stimulus would be more effective than further central bank easing right now because it kicks in quicker. He said additional central bank easing wasn’t needed now, but didn’t rule it out later should inflationary expectations fall. “We should be on alert. There should be some possibility, of course, for the BOJ to pursue its next round” of easing, he said. Honda, a former Ministry of Finance official, has known Abe since they met at a wedding reception around 30 years ago. They played golf together at the weekend.

Everyone knows what should happen, but that doesn’t mean it will.

• Europe, Listen to the IMF and Restructure the Greek Debt (NY Times Ed.)

The IMF is doing the right thing by not participating in a deeply flawed loan agreement that European leaders have negotiated with Greece. Years of misguided economic policies sought by Germany and other creditors have helped to push Greece into a depression, left more than a quarter of its workers unemployed and saddled it with a debt it cannot repay. The latest European attempt to bail out Greece will make the situation even worse by requiring the country’s government to cut spending and raise taxes while increasing the country’s debt to 200% of its GDP, from about 170% now. The IMF, which joined European countries in their first two loan programs for Greece, says it cannot lend more money because Greece’s debt has become unsustainable.

In a statement on Friday, the fund’s managing director, Christine Lagarde, said Greece’s creditors had to provide “significant debt relief” to the country. Last month, the fund said creditors needed to either reduce the amount of money Greece owes or extend the maturity of that debt by up to 30 years. This is a much tougher position than the IMF has taken before. In 2010, it did not insist that Greek debt be restructured. That was a big mistake because it left Greece with more debt than it had before the crisis and reduced the government’s ability to stimulate the economy. What Ms. Lagarde, a former French finance minister, says matters because European leaders like Chancellor Angela Merkel of Germany want the fund to be a part of the loan program since it has extensive expertise in dealing with financial crises.

European officials have said only vaguely that they might be willing to consider debt relief. Many lawmakers and voters in other European nations oppose providing more help because they think the Greek government has failed to carry out the economic and fiscal reforms that would make the country more productive. There is no question that Prime Minister Alexis Tsipras of Greece needs to do more to raise economic growth. But even if he does everything European leaders are asking him to do — a list that includes cutting pensions, simplifying regulations, privatizing state-owned businesses — the country will still not be able to pay back the €300 billion it owes. Rather than go through a messy default in a few years, it is in Europe’s interest to heed the IMF’s advice and restructure Greece’s debt now.

There are still plenty instruments available to hide risks and losses.

• The Hot Thing for Wall Street Banks: Capital-Relief Trades (WSJ)

Faced with new global regulations requiring them to strengthen their capital, big lenders in the U.S. and Europe have turned to a trading tactic that flatters their positions without actually raising extra funds. Banks that have done such “capital-relief trades” include some of the largest in the world: Citigroup, Bank of America, Deutsche Bank and Standard Chartered. But the Office of Financial Research, a U.S. Treasury office created to identify financial-market risks, is suggesting the trades run the risk of “obscuring” whether a bank has adequate capital and pose other “financial stability concerns.” The Securities and Exchange Commission and the Federal Reserve also have also voiced concerns about the trades.

Capital-relief trades are opaque, little-disclosed transactions that make a bank look stronger by reducing its ” risk-weighted” assets. That boosts key ratios that measure the bank’s capital as a%age of those assets, even as capital itself stays at the same level. In a capital-relief trade, a bank can keep a risky asset on the balance sheet, using credit derivatives or securitizations to transfer some of the risk to a hedge fund or other investor. The investor potentially gets extra yield and the credit risk of smaller borrowers in a way it would be hard for them to get otherwise, while the bank gets to remove part of the asset’s value from its closely watched “risk-weighted asset” count. Banks say the trades help them manage their risk, even if they don’t go as far as a bona fide asset sale, and are just one tool among many they are using to meet new capital requirements.

Some say the Office of Financial Research is mischaracterizing the transactions, or that the trades didn’t significantly affect their capital ratios. Bank of America, for example, disclosed $11.6 billion in purchased capital protection in 2014 regulatory filings, but said the impact of the trades on its capital ratios was less than 0.01 %age point. Critics fear the trades can spread risk to unregulated parts of the financial system–just as similar trades did before the financial crisis. “It just seems like another repackaging of risk to mask who’s holding the bag,” said Arthur Wilmarth, a George Washington University law professor and banking expert.

Pretty funny: “KKR and its partners might at least feel cold comfort that some of their cash is going to a good cause.”

• Oil Goes Down, Bankruptcies Go Up – The 5 Frackers Next To Fall (Forbes)

With West Texas Intermediate crude now below $42 a barrel, the edifice of America’s oil and gas boom is finally crumbling. The number of companies in bankruptcy or restructuring has increased, and the clouds will only grow darker in the months ahead. Declining revenues, evaporating earnings and shrinking values of oil and gas reserves will put the crunch on oil companies’ ability to refinance loans, let alone borrow new cash or sell shares. Last week two companies showed that having a heroic name is no defense. Hercules Offshore, a Gulf of Mexico drilling contractor, announced it had reached a prepackaged bankruptcy with creditors to convert $1.2 billion in debt into equity and raise $450 million in new capital.

While Samson Resources on Friday said it is negotiating a restructuring that will see second lien holders inject another $450 million into the company in return for all the equity in the reorganized company. Samson is the biggest bankruptcy of the oil bust so far, and a huge black eye to private equity giant KKR, which in 2011 led a $7.2 billion leveraged buyout of the company. The deal was a classic LBO: about $3 billion in equity backed by more than $4 billion in debt. It seemed like a good idea at the time. Tulsa, Oklahoma-based Samson, founded in the 1970s by Charles Schusterman, had grown to be one of the biggest privately owned oil companies in the nation. It held vast swaths of acreage in North Dakota, Texas and Louisiana seemingly ripe for redevelopment.

The sophisticated KKR team assumed it could squeeze a lot of value out of Samson, which since Schusterman’s death in 2001 had been run by his daughter Stacy. Charles would be proud of her for inking the deal of a lifetime, selling the family jewels at what turned out to be the top of the market for shale-y acreage. It didn’t take long for KKR and its equity partners to realize they had overpaid tremendously. The pain has been spread around. Japan’s Itochu Corp. put up $1 billion in the LBO for a 25% equity stake. Two months ago it sold back its shares to Samson for $1. KKR and its partners might at least feel cold comfort that some of their cash is going to a good cause. The Schusterman family, led by matriarch Lynn, contributed $2.3 billion of their windfall to the Charles & Lynn Schusterman Foundation, which is devoted to Jewish charities and education projects in Tulsa.

Dying breaths?!

• Brace For More Dividend Cuts As Canada’s Oil Patch Runs Out Of Cash (Bloomberg)

Dividend cuts among Canadian energy producers are poised to accelerate as cost reductions fail to boost shrinking cash flow. Companies from Canadian Oil Sands to Baytex Energy are in line for deeper payout decreases, according to analysts, after Crescent Point Energy Corp. slashed its dividend for the first time last week as crude sank to a six-year low. Just 38% of the 63 energy companies in Canada’s Standard & Poor’s/TSX Energy index had positive free cash flow, defined as operating cash flow minus capital expenditures, as of Aug. 17. That’s down from 43% in 2013, data compiled by Bloomberg show. The dwindling cash flow comes even after Canadian companies joined some US$180 billion in global cutbacks this year, the most since the oil crash of 1986, according to Rystad Energy.

“There’s so much cash being spent on dividends,” said Greg Taylor at Aurion Capital Management in Toronto. “You can get increased cash flow by cutting costs but that’s not a sustainable model. The idea dividends are a sacred cow, that’s being put on the backburner.” Companies most likely to cut their dividends include Canadian Oil Sands, Baytex and Pengrowth Energy, said Sam La Bell at Veritas Investment in a telephone interview in Toronto. All three have already cut their dividends, though Baytex and Pengrowth will become more vulnerable if oil prices remain low as their hedges begin to roll off as soon as the second half of this year, La Bell said.

Canadian Oil Sands, which chopped its payout by 86% in January, may be better off canceling the dividend altogether as it struggles to generate cash, he said. “We know the dividend is important to our investors, but even more so is protecting the long-term value of their investment,” said Siren Fisekci, a spokeswoman at Canadian Oil Sands, in an e-mailed response. “We will continue to consider dividends in the context of crude oil prices and Syncrude operating performance.”

Wile E.

• Brazil’s Political Crisis Puts the Entire Economy on Hold (Bloomberg)

In Brazil, General Motors has been halting factories and laying off thousands. Latam Airlines, the region’s biggest, is cutting flights. And the world’s third-largest planemaker, Embraer, is delaying its biggest new aircraft. In the midst of its deepest economic and political crisis in a generation, Brazil is contending with a business climate so punishing that major projects across numerous sectors are being frozen or shrunk, while small businesses slash prices and shift focus. “Political instability is enormous, and it’s paralyzing Brazil,” said Eduardo Fischer, co-CEO at homebuilder MRV Engenharia, in an Aug. 5 interview. In Brasilia, the nation’s capital, “decisions and actions that need to be taken are being delayed, questioned or defeated, and nothing happens.” Even luncheonettes are hurting.

Carambola’s, a juice and sandwich shop in Sao Paulo’s financial district, saw a 30% drop during lunch starting a couple of months ago. The corner store fired two employees, and closes earlier as customers stop coming in after-hours. “People are bringing lunch from home,” Rafael Bruno da Silva, the afternoon manager, said on a recent day as a lone customer sipped coffee. “We’ve lowered the prices of juice, but it doesn’t seem to be making much of a difference.” Opposition lawmakers and many in the public are calling for the resignation of President Dilma Rousseff, whose popularity has sunk to a record low. The senate and lower house presidents are being investigated in an alleged kickback scheme that funneled money from state-run Petrobras, the world’s most indebted oil company, to political parties in the biggest corruption scandal in history.

On top of that, inflation is above the central bank’s target and unemployment is at a five-year high. Moody’s Investors Service said in a report Monday the economy will contract about 2% in 2015. Brazil’s real is the worst-performing major currency in the world this year. The crisis is reminiscent of the 1990s, when clerks were hired to re-sticker prices at grocery stores throughout the day because of hyperinflation. For others, it is a new and frightening experience. “Younger generations haven’t lived through any volatility,” said Fernando Perlatto, a professor of sociology at the federal university of Juiz de Fora. “That contributes to uncertainty. People are cutting costs, not getting married, and such. At the university, we’re not booking any conferences, trips or academic events.”

A view from the right.

• Immigration – Issue of the Century (Patrick J. Buchanan)

“Trump’s immigration proposals are as dangerous as they are stunning,” railed amnesty activist Frank Sharry. “Trump … promises to rescind protections for Dreamers and deport them. He wants to redefine the constitutional definition of U.S. citizenship as codified by the 14th Amendment. He plans to impose a moratorium on legal immigration.” While Sharry is a bit hysterical, he is not entirely wrong. For the six-page policy paper, to secure America’s border and send back aliens here illegally, released by Trump last weekend, is the toughest, most comprehensive, stunning immigration proposal of the election cycle. The Trump folks were aided by people around Sen. Jeff Sessions who says Trump’s plan “reestablishes the principle that America’s immigration laws should serve the interests of its own citizens.”

The issue is joined, the battle lines are drawn, and the GOP will debate and may decide which way America shall go. And the basic issues — how to secure our borders, whether to repatriate the millions here illegally, whether to declare a moratorium on immigration into the USA — are part of a greater question. Will the West endure, or disappear by the century’s end as another lost civilization? Mass immigration, if it continues, will be more decisive in deciding the fate of the West than Islamist terrorism. For the world is invading the West. A wild exaggeration? Consider. Monday’s Washington Post had a front-page story on an “escalating rash of violent attacks against refugees,” in Germany, including arson attacks on refugee centers and physical assaults.

Burled in the story was an astonishing statistic. Germany, which took in 174,000 asylum seekers last year, is on schedule to take in 500,000 this year. Yet Germany is smaller than Montana. How long can a geographically limited and crowded German nation, already experiencing ugly racial conflict, take in half a million Third World people every year without tearing itself apart, and changing the character of the nation forever? Do we think the riots and racial wars will stop if more come? And these refugees, asylum seekers and illegal immigrants are not going to stop coming to Europe. For they are being driven across the Med by wars in Libya, Syria, Iraq, Afghanistan and Yemen, by the horrific conditions in Eritrea, Ethiopia, Somalia and Sudan, by the Islamist terrorism of the Mideast and the abject poverty of the sub-Sahara.

According to the U.N., Africa had 1.1 billion people by 2013, will double that to 2.4 billion by 2050, and double that to 4.2 billion by 2100. How many of these billions dream of coming to Europe? When and why will they stop coming? How many can Europe absorb without going bankrupt and changing the continent forever? Does Europe have the toughness to seal its borders and send back the intruders? Or is Europe so morally paralyzed it has become what Jean Raspail mocked in “The Camp of the Saints”? The blazing issue in Britain and France is the thousands of Arab and African asylum seekers clustered about Calais to traverse the Eurotunnel to Dover. The Brits are on fire. Millions want out of the EU. They want to remain who they are.

The ugly side of the response.

• Hungary Deploys ‘Border Hunters’ to Keep Illegal Immigrants Out (WSJ)

Hungary’s government said Tuesday it will deploy police units of “border hunters” at its frontier with Serbia to keep illegal immigrants out of the country amid a flood of refugees from the Middle East and North Africa. The head of the prime minister’s office said several thousand police will be placed along Hungary’s 175-kilometer border with non-European Union member Serbia, where most of the migrants enter the country. Hungary “is under siege from human traffickers,” Janos Lazar told a press briefing, adding that the police “will defend this stretch of our borders with force.” The government will also tighten punishments for illegal border crossing and human trafficking, steps aimed at “defending the country,” he said.

“[Migrants’] demands to be let in to then take advantage of the EU’s asylum system are on the rise, aggressiveness is increasing. Police have seen that on several occasions,” Mr. Lazar added. The majority of the migrants, whom the government labels as illegal immigrants, are refugees from war-torn Afghanistan, Syria and Iraq, according to human-rights groups. Hungary has registered some 120,000 asylum requests so far this year, an increase of almost 200% from last year. This year’s total could reach 300,000, the country said last week. “Hungary is joining Italy and Greece as the member states most exposed, on the front line” of migration, Dimitris Avramopoulos, EU commissioner in charge of migration, said Friday.

Last week, Hungary requested €8 million from the European Commission in emergency assistance to expand its capacities to house migrants. Brussels will treat the request without delay, Mr. Avramopoulos said. With an estimated 4,500 migrants housed in its overflowing immigration camps, Hungary is a transit country for the vast majority of the migrants. Once in Hungary—and thus within the EU’s Schengen zone where internal borders aren’t guarded—the migrants typically travel on to countries such as Germany and Sweden. Hungary is now building a double fence on its border with Serbia to reduce the number of migrants crossing the border through woods and meadows.

Europe is in desperate need of leadership on the issue, but there ain’t none.

• Europe Struggles To Respond As Migrants Numbers Rise Threefold (Reuters)

More than three times as many migrants were tracked entering the European Union by irregular means last month than a year ago, official data showed on Tuesday, many of them landing on Greek islands after fleeing conflict in Syria. While the increase recorded by the European Union’s border control agency Frontex may be partly due to better monitoring, it highlighted the scale of a crisis that has led to more than 2,000 deaths this year as desperate migrants take to rickety boats. Italian police said they had arrested eight suspected human traffickers that they said had reportedly forced migrants to stay in the hold of a fishing boat in the Mediterranean as 49 of them suffocated on engine fumes.

Some of those traffickers were accused of kicking the heads of the migrants when they tried to climb out of the hold as the air became unbreathable, prosecutor Michelangelo Patane told a news conference in Catania, Sicily. The dead migrants were discovered last weekend, packed into a fishing boat also carrying 312 others trying to cross the Mediterranean to Italy from North Africa. It was the third mass fatality in the Mediterranean this month: last week, up to 50 migrants were unaccounted for when their rubber dinghy sank, a few days after some 200 were presumed dead when their boat capsized off Libya.

Greece appealed to its European Union partners to come up with a comprehensive strategy to deal with what new data showed were 21,000 refugees landed on Greek shores last week alone. A spokesman for the United Nations refugee agency UNHCR in Geneva said the European Union should help Greece but that Athens, which is struggling with a debt crisis, also needed to show ‘much more leadership’ on the issue. Greek officials said they needed better coordination within the European Union. “This problem cannot be solved by imposing stringent legal processes in Greece, and, certainly, not by overturning the boats,” said government spokeswoman Olga Gerovassili. Nor could it be addressed by building fences, she said.

Merkel’s inaction now leads to her being completely overwhelmed. That’s her fault, her failure.

• Germany May Receive Up To 750,000 Asylum Seekers This Year (Reuters)

Germany expects up to 750,000 people to seek asylum this year, a business daily cited government sources as saying, up from a previous estimate of 450,000, as some cities say they already cannot cope and hostility towards migrants surges in some areas. The influx has driven the issue of asylum seekers high up Germany’s political agenda. Chancellor Angela Merkel has tried to address fears among some voters that migrants will eat up taxpayers’ money and take their jobs. The number of attacks on refugee shelters has soared this year. The interior ministry declined to comment on the figures reported in the Handelsblatt but is set to issue its latest predictions this week. Its previous estimate for asylum applications in 2015 was already double those recorded in 2014.

Germany is the biggest recipient of asylum seekers in the European Union, which has been overwhelmed by refugees fleeing war and poverty in countries such as Syria, Iraq and Eritrea. There is also a flood of asylum seekers from Balkan countries. Almost half of the refugees who came to Germany in the first half of the year came from southeast Europe. Along with a shortage of refugee lodgings in cities including Berlin, Munich and Hamburg, Germany also struggles to process applications, which can take over a year. Merkel has long said this must be accelerated.

On Tuesday, the finance ministry seconded 50 customs officials to the National Office for Migration and Refugees for six months to get through the backlog. After Germany, Sweden is the next most generous recipient of asylum seekers in Europe. In 2014, it recorded 81,200 application and anti-immigration sentiment is on the rise.