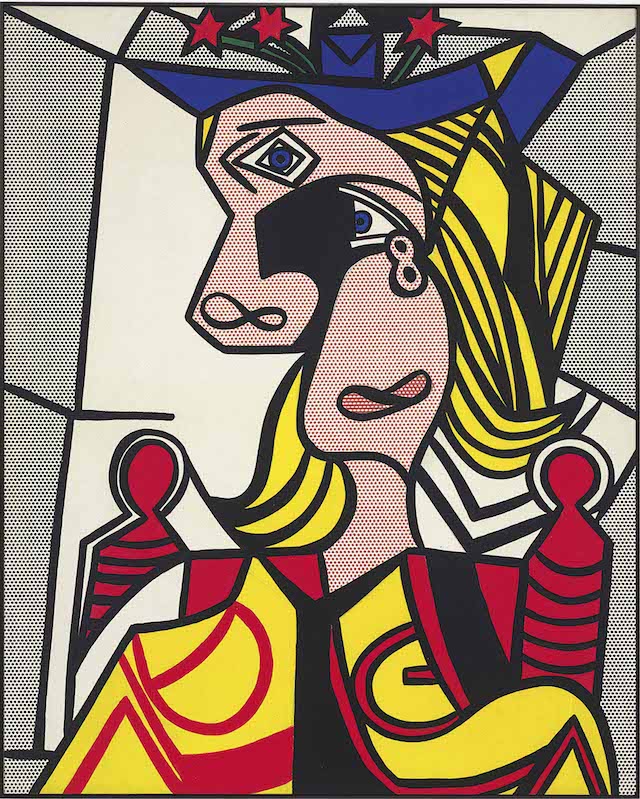

Roy Lichtenstein Woman With Flowered Hat 1963

https://twitter.com/GonzaloLira1968/status/1641143573578907656

Reset

Incredibly well done. pic.twitter.com/hUrPv02yTA

— Liz Churchill (@liz_churchill9) March 29, 2023

Nap/Macgregor

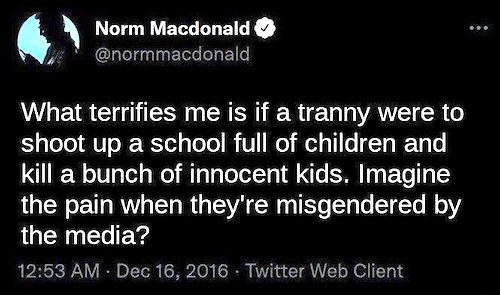

Norm McDonald, 2016

EdDowd

The smoking gun of millennial deaths, according to @DowdEdward (from @patrickbetdavid podcast). https://t.co/2UmWZIeYAP To be discussed tonight pic.twitter.com/kTf0ehwhbG

— Viva Frei (@thevivafrei) March 29, 2023

LNP

This is one of the most disturbing videos I have ever seen.

It confirms that the TGA knew back in Jan 2021 that the lipid nanoparticles (and the mRNA) didn’t stay in the inject site, but spread throughout the entire body including the brain, the liver and female ovaries.

This… pic.twitter.com/nTd88LzHZk

— Craig Kelly (@CKellyUAP) March 27, 2023

Ron Johnson

Today, Democrats defeated my amendment to require Senate ratification for any pandemic agreement with the World Health Organization.

Now we know Democrats are willing to relinquish U.S. sovereignty to a global entity. How sad. pic.twitter.com/NYdPRVoprN

— Senator Ron Johnson (@SenRonJohnson) March 28, 2023

Jim lays it out very well. Maybe because he’s an avid reader of the Automatic Earth.

• Lies, Nuttery & Craziness Everywhere in America – James Howard Kunstler (USAW)

Renowned author and journalist James Howard Kunstler (JHK) has been complaining and pointing out that the American public is told one lie after another by the Lying Legacy Media (LLM), the government and the medical community. This kind of lying, according to JHK, is pure treason by all parties, from the 600 million CV19 bioweapon/vax injections, to the crumbling banking system, to the war in Ukraine. Let’s start with the genocide of the CV19vax. JHK says, “They are pretending that they didn’t cause any damage, and they are ignoring their own assembled statistics, and they don’t want to paint a realistic picture for the American public to see what the consequences were for their vaccination program. . . . I don’t think they can suppress the reality of it that much longer. There are just too many people who know too many people who have been injured or killed by the vaccines.

The basic problem is dishonesty puts you in a place of weakness, and the truth puts you in a position of strength. Eventually, if you are not being honest with yourself and the other people around you, you are going to be found out. . . . They have to keep doubling and tripling down on narratives that are manifestly untrue, and pretty soon I think people are going to be super pissed off about how all this went down.” With the banking crisis, JHK says the lie that everything is under control is going to be exposed too. JHK says, “When you are compelled to liquidate like Silicon Valley Bank, they are liquidating their assets below their supposed value and they become insolvent. I would imagine there is a great deal of damage waiting to express itself out there, and we haven’t seen much action in the derivatives racket so far, and that’s going to be a big deal when that happens because of the completely reckless contracts that are made. . . .

It’s really a bad bet, and the people taking the bet can’t pay off the bet, and the whole thing is really a disaster waiting to happen.” JHK says the so-called reset is going to happen, but not the way Klause Schwab wants it to happen. All will go extremely local, and JHK says, “Social discourse will make it all much worse.” The lies about Ukraine and the losing war started by NATO are summed up by JHK, “In retrospect, we could see why Donald Trump would want to have a phone call with Zelensky over the Biden family activities in Ukraine. . . . The whole Ukraine portfolio is just a big bag of crap. . . . Because of those activities, there is a war against the people, and that includes a war against Donald Trump. They are trying every way possible to shove him off the playing field. . . . I think it is safe to say the U.S. government is not your friend.”

In closing, JHK says, “This is an extremely socially and politically perverse period of history. . . .I grew up in the hippie period. . . .It was quite based compared to the baseless nuttery and lunacy that this country is involved in now. The fact that there has to be any debate about drag queen story hour for children is amazing. . . . That’s okay? Deliberately, demonstrable male imitation of a female. That’s supposed to be good for kids and not scare them? . . . There is a uniform craziness across the culture, and people are being asked to swallow increasingly absurd propositions. That’s where we are now. We are being asked to swallow absurd ideas one after another.”

“Should we let machines flood our information channels with propaganda and untruth?”

My take is: instead of doing the exact same ourselves?

• Musk, Wozniak Call For Pause In Developing ‘More Powerful’ AI Than GPT-4 (ZH)

Elon Musk, Steve Wozniak, AI pioneer Yoshua Bengio and others have signed an open letter calling for a six-month pause in developing new AI tools more powerful than GPT-4, the technology released earlier this month by Microsoft-backed startup OpenAI, the Wall Street Journal reports. “Contemporary AI systems are now becoming human-competitive at general tasks, and we must ask ourselves: Should we let machines flood our information channels with propaganda and untruth? Should we automate away all the jobs, including the fulfilling ones? Should we develop nonhuman minds that might eventually outnumber, outsmart, obsolete and replace us? Should we risk loss of control of our civilization? Such decisions must not be delegated to unelected tech leaders. Powerful AI systems should be developed only once we are confident that their effects will be positive and their risks will be manageable.” -futureoflife.org

“We’ve reached the point where these systems are smart enough that they can be used in ways that are dangerous for society,” said Bengio, director of the University of Montreal’s Montreal Institute for Learning Algorithms, adding “And we don’t yet understand.” Their concerns were laid out in a letter titled “Pause Giant AI Experiments: An Open Letter,” which was spearheaded by the Future of Life Institute – a nonprofit advised by Musk. “The letter doesn’t call for all AI development to halt, but urges companies to temporarily stop training systems more powerful than GPT-4, the technology released this month by Microsoft Corp.-backed startup OpenAI. That includes the next generation of OpenAI’s technology, GPT-5. OpenAI officials say they haven’t started training GPT-5. In an interview, OpenAI CEO Sam Altman said the company has long given priority to safety in development and spent more than six months doing safety tests on GPT-4 before its launch.” -WSJ

“In some sense, this is preaching to the choir,” said Altman. “We have, I think, been talking about these issues the loudest, with the most intensity, for the longest.” Goldman, meanwhile, says that up to 300 million jobs could be replaced with AI, as “two thirds of occupations could be partially automated by AI.” So-called generative AI creates original content based on human prompts – a technology which has already been implemented in Microsoft’s Bing search engine and other tools. Soon after, Google deployed a rival called Bard. Other companies, including Adobe, Salesforce and Zoom have all introduced advanced AI tools.

NEW – Elon Musk & Tech Leaders Call for a Pause on Advanced AI Systems Citing 'Risks to Society'

"AI systems with human-competitive intelligence can pose profound risks to society and humanity, as shown by extensive research and acknowledged by top AI labs."@elonmusk pic.twitter.com/1R3AxIYDre

— Chief Nerd (@TheChiefNerd) March 29, 2023

24/7. Who needs AI?

• The Government Is Fomenting Mass Hysteria (Whitehead)

We have become guinea pigs in a ruthlessly calculated, carefully orchestrated, chillingly cold-blooded experiment in how to control a population and advance a political agenda without much opposition from the citizenry. This is mind-control in its most sinister form. With alarming regularity, the nation is being subjected to a spate of violence that terrorizes the public, destabilizes the country, and gives the government greater justifications to crack down, lock down, and institute even more authoritarian policies for the so-called sake of national security without many objections from the citizenry. Take this latest shooting in Nashville, Tenn. The 28-year-old shooter (a clearly troubled transgender individual in possession of several military-style weapons) opened fire in a Christian elementary school, killing three children and three adults.

Already, fingers are being pointed and battle lines are being drawn. Those who want safety at all costs are clamoring for more gun control measures (if not at an outright ban on assault weapons for non-military, non-police personnel), widespread mental health screening of the general population, more threat assessments and behavioral sensing warnings, more CCTV cameras with facial recognition capabilities, more “See Something, Say Something” programs aimed at turning Americans into snitches and spies, more metal detectors and whole-body imaging devices at soft targets, more roaming squads of militarized police empowered to do random bag searches, more fusion centers to centralize and disseminate information to law enforcement agencies, and more surveillance of what Americans say and do, where they go, what they buy and how they spend their time.

This is all part of the Deep State’s master plan. Ask yourselves: why are we being bombarded with crises, distractions, fake news and reality TV politics? We’re being conditioned like lab mice to subsist on a steady diet of bread-and-circus politics and an endless spate of crises. Caught up in this “crisis of the now,” the average person has a hard time keeping up with and remembering all of the “events,” manufactured or otherwise, which occur like clockwork in order to keep us distracted, deluded, amused, and insulated from reality. As investigative journalist Mike Adams points out: “This psychological bombardment is waged primarily via the mainstream media which assaults the viewer by the hour with images of violence, war, emotions and conflict. Because the human nervous system is hard wired to focus on immediate threats accompanied by depictions of violence, mainstream media viewers have their attention and mental resources funneled into the never-ending ‘crisis of the NOW’ from which they can never have the mental breathing room to apply logic, reason or historical context.”

“Moscow will simply not tolerate “an openly anti-Russian state, whatever its borders..”

• Moscow Outlines Ukraine Peace Demands (RT)

Russian Deputy Foreign Minister Mikhail Galuzin has offered a ten-point list of things the government in Kiev needs to do in order for hostilities to cease. In an interview on Wednesday, Galuzin said the future of Ukraine itself will depend on how soon Kiev and its Western backers come to grips with reality. For Ukraine to bring about peace, its military forces must stand down and the West must halt all deliveries of weapons to Kiev, Galuzin told the outlet RTVI. Several other conditions he listed have been on the table since the hostilities escalated in February 2022, such as Ukraine’s demilitarization and “denazification,” a pledge to never join the EU or NATO, and the affirmation of Kiev’s non-nuclear status. Another was added in October 2022, and involves the recognition of “new territorial realities” – commonly understood to mean the decision of Kherson, Zaporozhye and the republics of Donetsk and Lugansk to join Russia.

Ensuring the protection of the Russian language and the rights of Russian-speaking citizens, as well as all other ethnic groups in Ukraine also made Galuzin’s list. Moreover, he said Ukraine needs to reopen the border with Russia and restore the legal framework of relations with Moscow and other ex-Soviet republics, which it renounced following the US-backed coup in 2014. For the first time, Moscow has demanded the lifting of all anti-Russian sanctions and the “withdrawal of claims and termination of prosecutions against Russia, its individuals and legal entities,” presumably including the recent International Criminal Court (ICC) warrants for President Vladimir Putin and the children’s rights commissioner, Maria Lvova-Belova. The last demand on Galuzin’s list was for the West to pay for the reconstruction of civilian infrastructure destroyed by Ukraine’s military since 2014.

Ukraine’s peaceful future depends on respecting the rights of its Russian population, restoring friendly relations with all neighbors, and returning to its founding principle of neutral and non-bloc status, enshrined in the 1990 declaration of independence, Galuzin said. “The future of the territories of present-day Ukraine should be determined by the inhabitants of this country themselves,” Galuzin told RTVI, noting that this includes “Ukrainians, Russians, Jews, Hungarians, Moldovans, Bulgarians, Romanians, Poles, and Greeks.” Moscow will simply not tolerate “an openly anti-Russian state, whatever its borders,” as a neighbor, said Galuzin. “Neither Russia, nor any other state, would accept this from the standpoint of security.” The “peace platform” adopted by the government in Kiev includes Russia’s total withdrawal from all territories Ukraine claims as its own, payment of reparations, and war crimes tribunals for the military and political leadership in Moscow.

“These are politico-diplomatic or – if politico-diplomatic are currently impossible, and in the case of Ukraine, they are impossible, to our regret – through military means..”

• Kremlin Only Sees Military Solution To Ukraine Conflict (RT)

There’s no political or diplomatic solution for the ongoing conflict with Ukraine at the moment, with Moscow seeking to resolve it through military means, Kremlin spokesman Dmitry Peskov has said. Speaking to Russian journalists on Wednesday, Peskov reiterated Moscow’s resolve to reach its goals, which were outlined by President Vladimir Putin at the start of the military operation over a year ago. “We have repeatedly said that Russia’s goals … can be achieved in various ways. These are politico-diplomatic or – if politico-diplomatic are currently impossible, and in the case of Ukraine, they are impossible, to our regret – through military means, that is, through the special military operation,” Peskov stated. The spokesman did not provide any estimates on when exactly the ongoing conflict between Moscow and Kiev might end, re-addressing the question to the country’s Defense Ministry.

At the same time, he said the broader conflict – a “hybrid war” between Russia and its adversaries – is likely to drag on for a long time. “This confrontation with hostile states, with the unfriendly countries, this is a hybrid war that they unleashed onto our country, it’ll be there for a long time,” Peskov said. Separately, Russian Deputy Foreign Minister Mikhail Galuzin confirmed that the goals of Moscow in the Ukraine operation are unchanged, and reaching them is the only way to achieve a “comprehensive, just and sustainable peace in Ukraine and Europe.” They include a neutral, non-aligned status of Ukraine, Kiev dropping its plans to join NATO and the EU, confirmation of its non-nuclear status, as well as the demilitarization and denazification of the country, he explained in an interview on RTVI on Wednesday.

Apart from that, Kiev and the international community must recognize the new “territorial reality” on the ground, Galuzin stressed, apparently referring to the incorporation of the four former Ukrainian regions of Kherson and Zaporozhye, as well as of the Donetsk and Lugansk People’s Republics into Russia following referendums held last September. Moscow has repeatedly expressed its readiness for a diplomatic solution to the ongoing hostilities, blaming the lack of any diplomatic efforts on Kiev and its Western backers, who are seeking to inflict a “strategic defeat” on Russia. “Washington, European capitals, but first of all, Washington is filled with the desire not to let, under any pretext, [Kiev] enter into peace negotiations. They simply do not let Kiev even think about it,” Peskov said earlier this month.

“..a hybrid war that they have unleashed against our country – it is bound to last..”

• West’s War Against Russia Is Bound To Last – Peskov (TASS)

Russian Presidential Spokesman Dmitry Peskov has said that Russia’s struggle with the West is a war in the broad sense and warned that it is bound to last. “If you mean, let’s say, war in a broad context – a confrontation with hostile states, with unfriendly countries, a hybrid war that they have unleashed against our country – it is bound to last. We need to stay firm, confident, self-concentrated and united around the president,” he told a news briefing on Wednesday in response to a question about how long the special military operation might take and if there was any chance it might end this year. As for progress in combat operations, Peskov said, only the authorities concerned, such as the Defense Ministry, were in a position to comment.

“The Russian army alone will be left on the chessboard, and all other pieces will be removed..”

• Ukrainian Army ‘Almost Destroyed’ – Wagner Chief (RT)

The head of the Wagner Group private military company (PMC) Evgeny Prigozhin has described Ukraine’s losses in the battle for the city of Artryomovsk as almost fatal to Kiev’s entire military. The sacrifices made by his force for the sake of Russia were worth it, he added. “As of today, the battle for Bakhmut has almost destroyed the Ukrainian army,” Prigozhin said in a statement on Wednesday, using the name by which Kiev calls the city. The clash also “gave a serious beating to PMC Wagner,” he acknowledged. He called the battle the “general engagement” of the entire conflict and said that in it Wagner troops got pitted against Ukrainian armed forces and “foreign units installed into them.”

A victory by his troops would be “a turning point” and a historic event, securing a Russian victory, Prigozhin predicted. “The Russian army alone will be left on the chessboard, and all other pieces will be removed,” he forecast. “Even if PMC Wagner is destroyed in the Bakhmut meat grinder but takes the Ukrainian army with it … it would mean that we have accomplished our historic mission.” The fight for Artyomovsk has emerged as one of the most intensive and bloody engagements of the armed conflict in Ukraine, with both sides reportedly suffering significant casualties.

Western officials said that the city poses no strategic military value, but Ukrainian President Vladimir Zelensky pledged to defend it as long as possible after proclaiming the city a fortress. The Ukrainian leader explained his refusal to withdraw in an interview with The Associated Press earlier this week. He claimed that if Russia were to capture Artyomovsk, his government would come under international and domestic pressure to seek peace with Moscow. “Our society will feel tired,” he told the news agency of this scenario. “Our society will push me to have compromise with them.”

“Our society will feel tired [if the Russians gain victory in Bakhmut]” “Our society will push me to have compromise with them.”

• Zelensky Explains Why He Won’t Withdraw From Bakhmut (RT)

Ukrainian President Vladimir Zelensky has said that if his troops were to surrender the city of Artyomovsk, known as Bakhmut in Ukraine, his government would come under domestic and international pressure to seek peace with Russia. “Our society will feel tired,” he told the Associated Press (AP) in an interview released on Wednesday. “Our society will push me to have compromise with them.” Western officials have described Artyomovsk, the scene of fierce fighting for several months, as lacking in military importance. Behind closed doors, they – along with Zelensky’s own military leadership – have reportedly urged the president to order a withdrawal, so that his forces can focus on preparing a counteroffensive with heavy weapons provided by the US and its allies.

Speaking to AP mostly in English, during what the agency described as a “morale-building journey” by train across Ukraine, Zelensky suggested that Russia would be emboldened if it were to capture Artyomovsk. Russian President Vladimir Putin would “sell this victory to the West, to his society, to China, to Iran,” he predicted. “If he will feel some blood – smell that we are weak – he will push, push, push.” “We can’t lose the steps because the war is a pie – pieces of victories. Small victories, small steps,” Zelensky added. The battle for Artyomovsk, a key logistics hub, has been one of the fiercest and bloodiest in the Ukraine conflict so far. According to media reports, Kiev has lost some of its most experienced troops while holding the city. It has also allegedly been pouring in newly conscripted, untrained soldiers, to shore up the defensive line, leading to significant casualties.

In the interview, Zelensky also complained about his lack of contact with Chinese President Xi Jinping, who visited Moscow last week. The Ukrainian leader claimed that as president he chose to “unite” the country rather than divide it. Zelensky was elected in 2019 on a promise to end ongoing hostilities in Donbass and reintegrate the then-breakaway Donetsk and Lugansk People’s Republics into a federalized Ukrainian state. However, while in office, he maintained the policy of his predecessor Pyotr Poroshenko by stonewalling the so-called Minsk Agreements. Poroshenko later admitted the accords were used by Kiev to buy time to rebuild its military.

“The loss of Bakhmut would mean a political defeat, could lead to a general defeat in conflict.”

• Zelensky: “If They Stop Helping Us, We Will Not Win” (ZH)

President Volodymyr Zelensky is deeply concerned over ‘Ukraine fatigue’ taking over the West, and especially among the populace of his government’s biggest supporter, funder, and weapons supplier – the United States. “The United States really understands that if they stop helping us, we will not win,” he told the AP in a fresh interview published Wednesday. Waning support has been especially noticeable among Republican voters, according to recent polls, and as we recently reviewed in an article, “The Trump, DeSantis, Tucker Effect: New Polls Show Republicans Increasingly Done With Ukraine.” He issued the words specifically in reference to the still raging battle for the strategic city of Bakhmut in the Donetsk region. Russian forces have it nearly surrounded, even as Kiev has continued to throw additional manpower and weaponry into the city’s defense at a huge cost and amid mounting casualties.

Zelensky described that the capture of Bakhmut will mean that Putin will smell weakness. According to the Ukrainian leader’s words: Speaking with The Associated Press, Zelenskyy said that if Bakhmut were to fall, Putin could “sell this victory to the West, to his society, to China, to Iran,” as leverage to push for a ceasefire deal that would see Ukraine agree to give up territory. “If he will feel some blood — smell that we are weak — he will push, push, push,” Zelensky continued.

“Our society will feel tired” if the Russians gain victory in Bakhmut, he said. “Our society will push me to have compromise with them.” Implicit in these words are perhaps a first-time admission that significant sectors of the Ukrainian population are ready for compromise and peaceful negotiations to end the war. And tellingly, CBS commentary on the AP interview included the following observation: “He appeared acutely aware of the risk that his country could see its vital support from the U.S. and Europe start to slip away as the 13-month war grinds on.” Zelensky: “The loss of Bakhmut would mean a political defeat, could lead to a general defeat in conflict.”

“..with about 60% of this money being received by the US side itself..”

• Only 20% Of US Financial Aid For Ukraine Goes To Kiev, Lawmaker Says (TASS)

Washington hands over only about 20% of financial aid allocated for Ukraine directly to Kiev, with about 60% of this money being received by the US side itself, head of the House Committee on Foreign Affairs Michael McCaul said during Committee hearing Wednesday. “Of the $113 billion appropriated across four supplementals, approximately 60% is going to American troops, American workers and modernizing American stockpiles. In fact, only 20% of the funding is going directly to the Ukrainian government in the form of direct budgetary assistance,” the lawmaker said. He pointed out that, when the Republicans gained majority in the House after mid-term elections in November last year, they made it clear that accountability would have key importance for continued aid to Ukraine. The current House Speaker Kevin McCarthy (R-CA) warned last fall that the Republicans would not allow allocation of unlimited and not thoroughly justified aid to Ukraine.

“Only 20% Of US Financial Aid For Ukraine Goes To Kiev”, and they still spend $3.5 billion a month on their military?!

• Kiev Discloses Its Military Spending (RT)

Ukraine spends 130 billion hryvnia ($3.5 billion) a month on its military, Finance Minister Sergey Marchenko has revealed. The minister, who was meeting with the country’s European Business Association (EBA) on Wednesday, also disclosed that Ukraine’s budget receives 80 billion hryvnias in revenue (almost $2.2 billion) monthly. “The key task is to create conditions for financing the military,” Marchenko reportedly said while disclosing the numbers, according to EBA’s press service. He stressed it’s important to collect the anticipated taxes this year, adding that no major tax changes have been planned. Last week, the Ukrainian Parliament, the Verkhovnaya Rada, adopted a law on increasing budget spending on defense by more than $14.6 billion.

Ukraine’s Prime Minister Denis Shmygal had previously specified that the Cabinet of Ministers proposed to allocate additional funds for payments to the military, as well as the purchase of military and special equipment. According to him, the money will be allocated through the support of Western partners. While approving the 2023 draft budget last November, the parliament set aside more than a trillion hryvnias ($31 billion) to the armed forces and national security, which is 43% of all spending, or 18.2% of the country’s GDP. Ukraine’s budget deficit this year is expected to be a record $38 billion. The government plans to cover the deficit using Western foreign aid.

Last month, the US announced $12 billion in additional aid for Kiev, including a $2-billion arms package and $10 billion more to support energy costs and the Ukrainian government’s budget. According to US Treasury Secretary Janet Yellen, Washington has provided nearly $50 billion in support since last year, much of it devoted to weapons. Meanwhile, the European Union in February approved another €545 million ($590 million) in military aid to Ukraine, bringing its total support for Kiev’s forces to €3.6 billion ($3.8 billion). Since the beginning of war, the EU and its member states have reportedly provided €50 billion ($54 billion) in direct support to Ukraine.

“..a potential consequence of China’s strategic partnership with Russia, down the line, could be the weakening of American influence over the EU, which Washington is trying to strengthen by fanning the flames of the Ukraine war..”

• China Is Winning The Diplomatic Struggle Against The US (Fomenko)

The past few weeks have seen a comprehensive show of diplomatic force by China. Shortly after Xi Jinping completed a successful trip to Moscow, where he met with Vladimir Putin, Beijing announced it had brokered a deal to normalize relations between Saudi Arabia and Iran. The breakthrough was widely regarded as a blow to US influence in the Middle East. Then China persuaded Honduras to switch diplomatic recognition from Taiwan to Beijing, and now high-ranking Western politicians and EU officials, including French president Emmanuel Macron, European Commission President Ursula Von der Leyen and the Prime Minister of Spain Pedro Sanchez, are piling in to visit Beijing.

When viewed as a whole, the last several weeks have seen China enjoy massive diplomatic gains at the expense of the US, pouring freezing water on Washington’s attempts to isolate Beijing ‘Cold War-style’ on the global stage and on a relentless propaganda campaign steeped in negativity and fear-mongering. But in spite of it all, the reality continues to shine through that China is simply too big and too globally significant to isolate, illustrating that Biden’s strategy of creating overlapping multilateral alliances in a bid to contain Beijing, isn’t going to work. China has demonstrated that it is a superpower with the ability to steer global affairs in its own direction, a privilege which the US believed was its own exclusive entitlement. Beijing’s peace proposal for Ukraine and the Saudi-Iran normalisation deal caused a shock to the system in Washington.

Xi’s visit to Moscow in particular has brought a new balance to the dynamic around the Ukraine conflict and jeopardized hubris-led US miscalculations that it can escalate the conflict to the point of forcing a zero-sum outcome in favour of its own strategic objectives. As noted above, European leaders have responded to Xi’s visit, not by turning against China as was hoped, but by intensifying their diplomatic engagement with Beijing and scrambling to remain on board. But what is China’s response going to be? It is reasonable to expect an element of “Then stop siding with the United States against us”. Thus, a potential consequence of China’s strategic partnership with Russia, down the line, could be the weakening of American influence over the EU, which Washington is trying to strengthen by fanning the flames of the Ukraine war. Beijing is thus bringing some much-needed balance to the equation.

“..oil purchases by New Delhi surged more than 20-fold last year..”

• Rosneft Announces Major Oil Deal In India (RT)

Moscow and New Delhi have agreed to “substantially increase” the supply of crude oil to India and diversify its grades, Russian energy major Rosneft announced on Wednesday. A deal was reached with the Indian Oil Company during a trip by Rosneft CEO Igor Sechin to the Asian country, the Russian firm said in a press release on its website. Sechin also met with the heads of some of India’s largest oil and gas companies and discussed wider cooperation in the energy sector, the press release states. Possible trade settlements in national currencies were also on the agenda. Russia has for the first time become one of India’s top five trading partners, with turnover reaching $38.4 billion in 2022, according to statistics from India’s Ministry of Commerce and Industry, as cited by Rosneft.

Energy accounts for a major portion of bilateral trade. According to Russian Deputy Prime Minister Aleksandr Novak, oil purchases by New Delhi surged more than 20-fold last year. India, the world’s third-largest crude importer, began to boost purchases of Russian oil shortly after the start of Moscow’s military operation in Ukraine and the ensuing Western sanctions. New Delhi, which has repeatedly stressed that energy security is its top priority, chose not to succumb to Western pressure and continued to stock up on Russian supplies even after the G7 price cap on Russian oil came into force late last year.

Local currencies are the future. Backed by gold?!

• ASEAN Looking To Dump Dollar And Euro, Use Local Currencies (RT)

The Association of Southeast Asian Nations (ASEAN) is set to discuss dropping the US dollar, euro, yen and pound sterling from transactions and moving to settlements in local currencies, according to the news magazine Tempo. An official meeting of ASEAN finance ministers and central bank governors kicked off on Tuesday in Indonesia. A regional grouping that aims to promote economic and security cooperation among its members, ASEAN includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. “Efforts to reduce dependence on major currencies through the Local Currency Transaction (LCT) scheme will be discussed. This is an extension of the previous Local Currency Settlement (LCS) scheme that has already begun to be implemented between ASEAN members,” said the report.

Tempo specified that a digital cross-border payments system, allowing ASEAN member states to use local currencies in trade, would be expanded further. An agreement on such cooperation was reached between Indonesia, Malaysia, Singapore, the Philippines, and Thailand in November 2022. Indonesian President Joko Widodo has urged regional authorities to abandon Visa and Mastercard payment systems and start using credit cards issued by local banks. Moving away from Western payment systems is necessary to protect transactions from “possible geopolitical repercussions,” Widodo said. Board member of the Indonesian Credit Cards Association (AKKI), Dodit Proboyakti, told RIA Novosti that Indonesia would apply the experience of Russia and its Mir payment system in promoting its own domestic financial network.

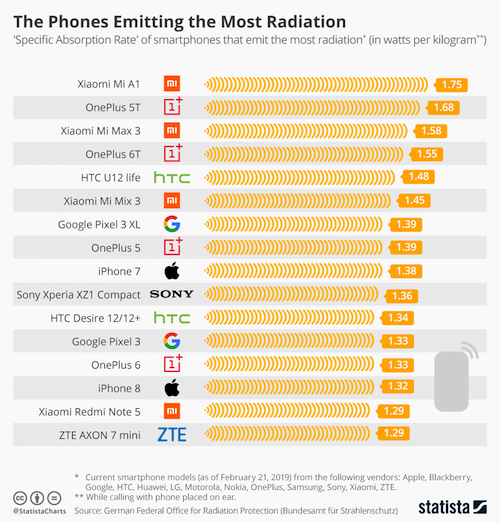

“..within the next few years, smartphones will become the digital wallet through which the Bank of England will have complete control over how much, on what and where we spend its Central Bank Digital Currency.”

• Why You Should Destroy Your Smart Phone Now (OffG)

In the imminent future, smartphones are the instrument onto which, in the guise of the digital verification of our identity — the Government’s ‘consultation’ on which closed this month — the compliant will upload their biometric data (fingerprints, photograph and DNA swab) to a centralised database to which the 32 public authorities presiding over the UK biosecurity state will have access.=

Under the Digital Economy Act 2017, these public authorities include the Cabinet Office; the Home Office; the Department for Defence; HM Treasury; the Ministry of Justice; the Department for Education; the Department for Business, Energy and Industrial Strategy; the Department for Work and Pensions; the Department for Communities and Local Government; the Department for Culture, Media and Sport; the Department for Transport; the Department for Food, Environment and Rural Affairs; Her Majesty’s Revenue and Customs; all county, district and London councils; the Greater London Authority; the Council of the City of London; all fire and rescue authorities; all police authorities; all education authorities; all gas and electricity authorities; HM Land Registry; and, under Section 35, any other public authority, or private agent providing a service for a public authority, designated for a specific purpose justifying access to that data.

Smartphones are the instrument that will monitor whether their owners are up-to-date with what the UK biosecurity state decides is fully ‘vaccinated’ with whatever our Government and its partners in the pharmaceutical industry decide we must inject into our bodies as a condition of access to the rights of citizenship. Smartphones are the instrument that will monitor and record how many times we leave or enter our 15-minute grazing range currently being implemented by our public authorities to restrict and limit our freedom of movement on the justification of ‘saving the planet’.

Smart phones are the instrument that will track our carbon footprint in order to monitor and control the quantity of meat, dairy products, energy, oil, petrol and other products to which the UK biosecurity state — under the terms of the agreements of Agenda 2030 signed by the UK Government in 2015 — will progressively cut off our access between now and 2030. Smartphones are the means by which our compliance with lockdowns, masking mandates and programmes of gene therapy dictated by the World Health Organization’s Pandemic Prevention, Preparedness and Response Treaty and enforced by the UK biosecurity state will be monitored, recorded and enforced by, among other recourses, cutting off our access to the electronic and digital grid. And, within the next few years, smartphones will become the digital wallet through which the Bank of England will have complete control over how much, on what and where we spend its Central Bank Digital Currency.

Help Joe

https://twitter.com/i/status/1640793491633586177

The Universe Sphere has 380,000 laser etched dots, each one representing a galaxy, revealing the largest scale structure of our universe. It contains a 3D map of galaxies in a volume spanning 800 million light years

[read more: https://t.co/O3Q9klRzkJ]pic.twitter.com/T2HBxwSjJ8

— Massimo (@Rainmaker1973) March 29, 2023

Levitation

https://twitter.com/i/status/1640916068955828224

Giants

When Giants walked the Earth…#tartaria pic.twitter.com/5BR2N0H1Du

— SpicySecretHistory (@MakingFranklins) March 29, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.