Claude Monet Hollowed Cliff near Étretat 1883

Who ordered this autopsy? Where are the reports on all the other autopsies?

• Coroner Confirms 44-Year-old BBC Presenter Died From Vaccine Side Effect (RT)

A coroner’s report has confirmed that late BBC Radio presenter Lisa Shaw died from “complications” related to AstraZeneca’s Covid-19 vaccine. Shaw died on May 21 at the age of 44 roughly three weeks after she received her first dose of AstraZeneca’s vaccine. She did not have any known underlying health problems but developed blood clots after receiving the jab. On Thursday – over three months after her death – a coroner finally confirmed that Shaw died from complications that were suffered as a result of vaccination. Coroner Karen Dilks declared that Shaw “died due to complications of an AstraZeneca Covid vaccination,” or specifically, “vaccine-induced thrombotic thrombocytopenia” which caused the blood clots in her brain.

In the weeks after the vaccine, Shaw had complained about severe headaches. Some 332 similar cases and 58 deaths have been recorded in relation to the AstraZeneca vaccine. Many countries have suspended or completely stopped the use of AstraZeneca’s vaccine, with some limiting its use for those over the age of 60. In the UK, however, the age restriction is significantly lower. On May 7, just over a week after Shaw received her dose, the UK government announced that those under the age of 40 should be offered an alternative to AstraZeneca “if available and if it does not cause delays in having the vaccine.” The government currently warns that AstraZeneca’s side effects can include rare blood clots, capillary leak syndrome and Guillain-Barre Syndrome, and that those who experience “a severe headache that is not relieved with simple painkillers or is getting worse or feels worse” should “seek medical advice urgently.”

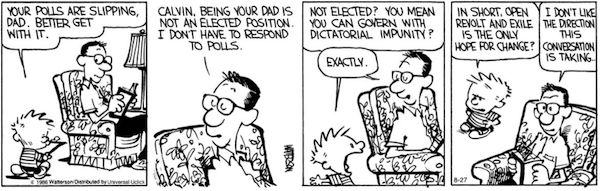

How do you “break up” one person?

• New Zealand Police Break Up One-Person Anti-lockdown Protest In Auckland (G.)

A one-person anti-lockdown protest in central Auckland has been shut down, after the police were alerted to discussions of a potential gathering on social media. New Zealand police said officers were on Queen Street on Friday after hearing a protest was being planned, but only one person arrived with the intention of protesting, Newshub reported. “Police have been in the area and have spoken to one person who arrived intending to attend the protest. Police spoke to the individual who was encouraged to comply with alert level four restrictions and chose to leave,” a spokesman said. They said they are continuing to monitor the situation. An Instagram account had called on people “who see the bigger picture” to get involved in the protest, Newshub reported, despite also saying it wasn’t involved in the demonstration and had no idea who was behind it.

The post criticised prime minister Jacinda Ardern and the government for “destroying the economy” and “destroying jobs”, despite the unemployment rate dropping to 4 percent in the June 2021 quarter and the economy weathering the pandemic better than expected. Last week, around 100 anti-lockdown protesters gathered on Queen Street, and four people were arrested. Four people were also arrested at a protest of about 20 people in the city of Tauranga outside the local police station. Another group gathered outside a police station in the South Island city of Nelson the same day, but dispersed after officers issued 20 verbal warnings.

We’ve known this all along. Where’s the bombshell?

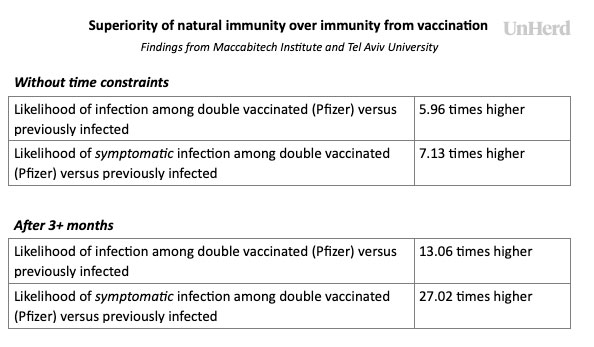

• ‘Bombshell’ Study Finds Natural Immunity Superior To Vaccination (Unherd)

A major study conducted by Israeli researchers into natural immunity has found that immunity acquired via infection from Covid-19 is superior to immunity from the Pfizer vaccine. Researchers at Maccabi Healthcare and Tel Aviv University compared the outcomes of over 76,000 Israelis in three groups: the doubly vaccinated (with the Pfizer vaccine), the previously infected but unvaccinated, and the previously infected with a single dose. They found that fully vaccinated people were significantly more likely to have a “breakthrough” Covid infection than people who had previously been infected and recovered from the disease. “This study demonstrated that natural immunity confers longer lasting and stronger protection against infection, symptomatic disease and hospitalisation caused by the Delta variant,” the authors conclude.

The study is only published as a preprint at this stage and has not been peer reviewed. Critics including British immunologist Andrew Croxford have pointed out potential limitations, but it has been described by infectious diseases expert Professor Francois Balloux as a “bombshell” development. If the findings are confirmed, the implications for global Covid policy will be profound. It would not undermine the importance of vaccination for more vulnerable groups in society. However it would weaken the case for vaccinating children, despite the programme being confirmed in the UK today, as they (and the people around them) would get superior future protection from contracting the disease. And it would pose a fundamental challenge to the singular emphasis on vaccine passports for travel and large events, if unvaccinated people who have already had Covid actually pose less of a risk.

“For those who received two doses of the Pfizer Vaccine in January 2021, the vaccine is “only 16% effective against symptomatic infection.”

• The Suspicious FDA “Approval” Of The Pfizer Vaccine (Techno Fog)

The FDA says COMIRNATY is “safe and effective in preventing COVID-19 in individuals 16 years of age and older.” How effective? They state (~6 months after dose 2) that it is “91% effective in preventing COVID-19 disease,” citing to a study where Pfizer observed “77 cases of COVID-19 occurring in the vaccine group.” This leaves us with an important question. The Pfizer study is from a “follow-up through March 13, 2021.” That is over 5 months ago. Is the FDA using outdated data in support of the COMIRNATY approval? In other words, how long does the effectiveness really last? Pfizer has an answer for us. According to its August 23, 2021 fact sheet, “The duration of protection against COVID-19 is currently unknown.”

If you’re looking for data on the waning effectiveness of the Pfizer Vaccine against COVID-19, you have to search for yourself. You won’t find it with the FDA or Pfizer, underscoring an apparent effort to cherry-pick the data for the “approval.” According to one UK study of over 400,000 people (a study that is, by the way, much more rigorous than the one cited in the FDA approval), the “effectiveness fell to 74% five or sixth months after receiving both doses of the Pfizer vaccine.”

The news out of Israel is worse. For those who received two doses of the Pfizer Vaccine in January 2021, the vaccine is “only 16% effective against symptomatic infection.”

As we have observed, the CDC has promoted a misleading message on the risks the vaccines present to pregnant mothers. They used self-reporting studies that were racially skewed studies (~79% white and 1.4% black) and limited to looking at miscarriages from weeks 6-20. (This caused them to omit from the study 35 self-reported pregnancy losses at less than 6 weeks.) The new approval mentions a study on the Pfizer Vaccine exposure during pregnancy to be completed in 2025. Four years from now pregnant women will know whether this vaccine is safe. As for the current data? Here’s what the COMIRNATY package insert says about there being “insufficient” information on the vaccine risks to pregnancy.

Ok Techno, I’m with you so far… but did Pfizer do any studies on whether the vaccine was safe for pregnant women? YES! They did toxicology studies on female rats.

“..if being vaccinated makes the person who gets it more-infectious then being jabbed is not only personally dangerous it is dangerous to public health..”

• ******nit, Stop The FRAUD (Denninger)

in the best case you must repeatedly take the risk of strokes and heart attacks, along with other serious adverse effects, in order to maintain protection. If the risk is 1/10,000 to do it once then the risk is 1/5,000 to do it twice, assuming the risk is linear which we do not know. If its exponential, and there is a strong suggestion that is the case because most of these events occurred after the second jab in the series, then the risk from taking three jabs may be 1/1,000 instead of 1/10,000 which is ridiculously higher and makes the decision to risk infection rather than vaccination simple for most people since only the quite-morbid are at higher risk from infection than 1/1,000 (0.1%) even if we assume the risk of eventual infection, if you do nothing, is 100%.

Note that if there is no end to these jabs then eventually even the most-morbid are stupid to take them since the risk of the jab killing them will rapidly exceed that of the virus doing so and this assumes that vaccine-induced enhancement does not show up and wildly multiply the risk of serious disease and death from the virus itself. There is no way to know whether these risks will converge either naturally or by forced action of a malevolent party but that they exist and are independently present is now known with scientific certainty as all of those mutations have now been found in the gene banks from sampled patients. If that “next mutation” winds up being of benefit to “being first” in an uninfected, non-recovered host and worse, if being vaccinated makes the person who gets it more-infectious then being jabbed is not only personally dangerous it is dangerous to public health and will cause a wave of serious illness and death to tear through the vaccinated population and if that happens there is nothing that can be done to stop it.

The FDA knows all of this as they have the same access to the published scientific work I do. They didn’t hold a hearing or take public comment, as they are supposed to, because then people like myself could submit into the formal, government record papers like the one I cited above. In addition the FDA cut off the data far enough back to deliberately ignore the most-recent few weeks, which show crazy deterioration in the percentage of people who die of Covid-19 and are vaccinated. In some counties (e.g. Clark, NV) the vaccinated are now the majority of the deaths. Does this prove vaccine-induced enhancement is here and raging? No; the data is too thin. But what it does prove is that being jabbed doesn’t stop you from getting sick nor does it stop you from giving the virus to others and that by itself reduces the decision to be vaccinated to one of personal choice at best.

And finally even Pfizer admits that they can’t get ahead of such a mutational event whether it occurs naturally or is forced and released by a malevolent actor. They say they can turn around a new version of the jab within 95 days but then you have to get it into the hundreds of millions of Americans and that can’t happen any faster the second time than the first. Assuming you immediately can ramp up production and distribution expecting that you can get effective coverage within less than another three to six months is fantasy-level bull**** as we didn’t manage that the first time and the virus mutates faster than you can accomplish it, making the attempt a game of whack-a-mole which you will inevitably lose. Never mind the risk that the reformulated version may produce immediate and extremely dangerous adverse events at a wildly-elevated rate: Without trials, which again will add months or years to the time required to deploy, there is no way to know! It is sheer arrogance to presume none of this will happen when we now have hard proof that least some of it did with the first go-around.

“..these measures cannot be fast tracked in the same way in the US because Americans are heavily armed and have the ability to bury the establishment six feet under if we organized to do so..”

• What Can We Learn About COVID Tyranny From Australia And Afghanistan? (Smith)

I have warned consistently that all governments around the world would eventually try to adopt proof of vaccination requirements in order for people to participate in everyday activities such as going to public venues, going to school, shopping in stores or even getting a job. The mainstream media and governments consistently claimed last year that vaccine passports were “not going to happen”, and that the very notion was a conspiracy theory. Now, the vaccines passports are being implemented in numerous countries including some parts of the US and anyone who stands against them is called a “conspiracy theorists”. You see how that works? If you expose the truth of an authoritarian plot the establishment lies and calls you a “conspiracy theorist”.

Once the establishment admits to the plot and you refuse to comply with it those same liars call you a conspiracy theorist AGAIN, as well as a “terrorist.” Yes, this was also predicted by myself and others at the beginning of the pandemic. We said that the people that fight against vaccine passport tyranny would be quickly labeled as traitors and terrorists “putting others at risk” because we are too “selfish” to bow down and take the experimental jab or submit to the lockdowns. This is exactly what has happened, with the DHS recently announcing that one of the warning signs of a potential terrorist includes opposition to covid mandates and vaccines.

I also predicted that the ultimate goal of the covid agenda will be to create domestic travel restrictions and state and city checkpoints, not to mention covid “camps” or prisons for the unvaccinated. In the US the DHS is admitting that they are entertaining the concept of interstate travel limits and a “papers please” system to prevent Americans from moving around freely. The state of New York hinted at covid camps many months ago, but the real plan is being revealed overseas in other Western nations like Australia and New Zealand.

And here is where we find the telegraphed punches… I have specifically examined Australia and New Zealand’s fast track covid tyranny plans a year ago in my article ‘The Totalitarian Future Globalists Want For The Entire World Is Being Revealed’ and I noted that whatever happens in these countries along with certain countries in Europe is going to be tried in the US in the near term. The main difference being that these measures cannot be fast tracked in the same way in the US because Americans are heavily armed and have the ability to bury the establishment six feet under if we organized to do so.

“Once “medicine” and “science” are mixed with social pressure, they are no longer science or medicine. At that point they are instruments of thuggery, and nothing more.”

• The Weaponization Of Medicine (FMP)

#1: Science is not consensus. Ten, one hundred, or a million people, all draped in lab coats and saying the same thing, does NOT make it so. In fact, it matters not at all. It’s nothing but theater, and it’s anti-science. All science is, really, is a process of testing ideas; it is not an organization, it is not based upon authority (it’s inherently anti-authority), and it is very certainly not allied with power. All that matters in science are verifiable results.

#2: Medicine stands apart from, and above, politics. Medicine is the application of science to the furtherance of human health. Politics is the use of persuasion and power to rule masses of humans. These are fully separate disciplines. To place politics over medicine is to subjugate and degrade medicine: it’s a path backwards into darkness. I’ll leave details on this point to working medical practitioners, who can provide them with far greater specificity than I can… provided they’re not too frightened to do so.

#3: Peer review no longer means much. Again I won’t go into great detail, but peer review has been captured by academic hierarchies and almost fully separated from science proper. It has become a tool of institutional power, wielded by academics who have sold out science for the favors of power and politics. At one time, “peer review” referred to the honest replication of experiments. That time is past.

#4: Medicine and science have nothing to do with social pressure. Once “medicine” and “science” are mixed with social pressure, they are no longer science or medicine. At that point they are instruments of thuggery, and nothing more.

#5: If you don’t read multiple scientific papers, especially from rebels and cast-outs, you simply don’t know. You can pretend you know, of course, and you can be sure that agents of the status quo will provide you with passable reasons to repeat their slogans, but you won’t actually know. What you see on TV is propaganda. What you see on Facebook, Twitter and YouTube is pre-censored. If you want to really know, you’ll have to find the scientific papers that address your question… and you’ll need papers that are rejected by televised authorities. If you don’t, all you’ll have are pre-censored conclusions, the underlying facts of which may or may not be reliable. At this point, if you don’t include “conspiracy theory” research, you’re more or less stuck with Orwell’s Ministry of Truth. Sad but mostly true.

Working their asses off for 20 months and getting a mandate as their reward.

• Health Workers Protest Against Introduction Of Mandatory Covid Jabs (K.)

Hundreds of Greek frontline health workers protested on Thursday against a plan to make Covid-19 vaccinations mandatory for the care sector as infection rates remained high. Healthcare workers observed a four-hour work stoppage against new rules obliging medical staff to vaccinate against the coronavirus, and to call for more resources to public health. The mandatory jab comes into effect for healthcare workers on Sept. 1. Those who do not comply and have not had at least one shot of a vaccine will be suspended from their jobs. According to the POEDIN labor union, about 10 percent of healthcare workers have not had a first vaccine jab. Protesters said that while the call for vaccination was widely acknowledged and complied with by healthcare workers, the view of a dissenting few should to be respected.

“I’m here today because I want to support the constitutional right of every Greek citizen to say ‘yes’ or ‘no’ to vaccination. I personally am vaccinated, but I believe it is my colleagues’ right to not get vaccinated if they don’t want to,” said Evangelia Karatzouli, a nurse at a public hospital. Greece on Thursday reported 3,538 new coronavirus cases in a single day, with 28 deaths. It reported a record daily rate of 4,608 infections on Tuesday. read more The Greek public hospital workers union will support unvaccinated colleagues, said its president, Michalis Yiannakos. “They consist of a tiny number, and have for the last 18-19 months been on the frontlines, caring for patients in the Covid wards, and have not ever gotten infected, and now they are being thrown out on the streets,” he said.

“Whatever a doctor prescribes, that is not in my bailiwick..”

• Arkansas Jail Dosing Inmates With Ivermectin, In Spite Of FDA Warnings (AP)

Inmates at a north-west Arkansas jail have been prescribed a medicine for treating coronavirus that is normally used to deworm livestock, despite federal health warnings to the public in exasperated tones. Washington county’s sheriff confirmed this week that the jail’s health provider had been prescribing the drug. The US Food and Drug Administration (FDA), the federal drugs regulator, issued a warning via Twitter last weekend. “You are not a horse,” it said. “You are not a cow. Seriously, y’all. Stop it.” Sheriff Tim Helder did not say how many inmates at the 710-bed facility had been given ivermectin and defended the health provider that has been prescribing the medication. “Whatever a doctor prescribes, that is not in my bailiwick,” Helder told members of the Washington county quorum court, the county’s governing body.

[..] It is not clear what information inmates who were prescribed the drug have been given about it, including warnings that it is not approved to treat Covid. The US FDA has approved ivermectin in both people and animals for some parasitic worms and for head lice and skin conditions. The FDA has not approved its use in treating or preventing Covid-19 in humans. “Using any treatment for Covid-19 that’s not approved or authorized by the FDA, unless part of a clinical trial, can cause serious harm,” the FDA said in a warning about the drug. Prominent rightwingers have been promoting the drug for Covid and public health officials have come under attack from some Republicans for urging Americans to get vaccinated against coronavirus.

Zero.

• The Cost-Benefit Analysis of COVID (Greenwald)

[..] we employ a rational framework of cost-benefit analysis, whereby, when making public policy choices, we do not examine only one side of the ledger (number of people who will die if cars are permitted) but also consider the immense costs generated by policies that would prevent those deaths (massive limits on our ability to travel, vastly increased times to get from one place to another, restrictions on what we can experience in our lives, enormous financial costs from returning to the pre-automobile days). So foundational is the use of this cost-benefit analysis that it is embraced and touted by everyone from right-wing economists to the left-wing European environmental policy group CIVITAS, which defines it this way:

“Social Cost Benefit Analysis [is] a decision support tool that measures and weighs various impacts of a project or policy. It compares project costs (capital and operating expenses) with a broad range of (social) impacts, e.g. travel time savings, travel costs, impacts on other modes, climate, safety, and the environment.” This framework, above all else, precludes an absolutist approach to rational policy-making. We never opt for a society-altering policy on the ground that “any lives saved make it imperative to embrace” precisely because such a primitive mindset ignores all the countervailing costs which this life-saving policy would generate (including, oftentimes, loss of life as well: banning planes, for instance, would save lives by preventing deaths from airplane crashes, but would also create its own new deaths by causing more people to drive cars).

While arguments are common about how this framework should be applied and which specific policies are ideal, the use of cost-benefit analysis as the primary formula we use is uncontroversial — at least it was until the COVID pandemic began. It is now extremely common in Western democracies for large factions of citizens to demand that any measures undertaken to prevent COVID deaths are vital, regardless of the costs imposed by those policies. Thus, this mentality insists, we must keep schools closed to avoid the contracting by children of COVID regardless of the horrific costs which eighteen months or two years of school closures impose on all children.

It is impossible to overstate the costs imposed on children of all ages from the sustained, enduring and severe disruptions to their lives justified in the name of COVID. Entire books could be written, and almost certainly will be, on the multiple levels of damage children are sustaining, some of which — particularly the longer-term ones — are unknowable (long-term harms from virtually every aspect of COVID policies — including COVID itself, the vaccines, and isolation measures, are, by definition, unknown). But what we know for certain is that the harms to children from anti-COVID measures are severe and multi-pronged.

This is far from over.

• Biden Does Surreal Press Conference, Vows To Hunt Down Isis, Blames Trump (ZH)

President Biden on Thursday vowed to “hunt down” the terrorists responsible for a spate of deadly bombings at the Kabul airport which left 12 US servicemembers dead and 15 wounded. “Know this; We will not forgive. We will not forget. We. will hunt you down and make you pay,” he said. In a surreal press conference that included bible quotes, a moment of silence, and blaming President Trump, Biden said he was open to sending US forces back into Afghanistan to assist with the withdrawal. “Whatever they need, if they need additional force, I will grant it,” he said, adding that the US military can target ISIS-K without “large scale military operations.”

Biden said he was in near ‘constant’ communication with military commanders via letter, and that he’d asked them to draw up plans to retaliate against the terrorist group (via carrier pigeon?). Of note, after reading his speech on the teleprompter, Biden said out loud “The first person I was instructed to call upon…” before taking questions. Trump also said he ‘bears responsibility for all that’s happened,’ before turning around and blaming Trump for the deal he ‘inherited.’ He then gave Trump credit for the only reason there was relative peace in Afghanistan until now. Then, towards the end of the presser, Biden said “I have another meeting, for real” – implying other ‘meetings’ haven’t been?

“It’s just appalling and shocking and makes you feel unclean.”

• US Provided Taliban With Names Of Americans, Afghan Allies To Evacuate (Pol.)

U.S. officials in Kabul gave the Taliban a list of names of American citizens, green card holders and Afghan allies to grant entry into the militant-controlled outer perimeter of the city’s airport, a choice that’s prompted outrage behind the scenes from lawmakers and military officials. The move, detailed to POLITICO by three U.S. and congressional officials, was designed to expedite the evacuation of tens of thousands of people from Afghanistan as chaos erupted in Afghanistan’s capital city last week after the Taliban seized control of the country. It also came as the Biden administration has been relying on the Taliban for security outside the airport.

Since the fall of Kabul in mid-August, nearly 100,000 people have been evacuated, most of whom had to pass through the Taliban’s many checkpoints. But the decision to provide specific names to the Taliban, which has a history of brutally murdering Afghans who collaborated with the U.S. and other coalition forces during the conflict, has angered lawmakers and military officials. “Basically, they just put all those Afghans on a kill list,” said one defense official, who like others spoke on condition of anonymity to discuss a sensitive topic. “It’s just appalling and shocking and makes you feel unclean.” Asked about POLITICO’s reporting during a Thursday news conference, President Joe Biden said he wasn’t sure there were such lists, but also didn’t deny that sometimes the U.S. hands over names to the Taliban.

“There have been occasions when our military has contacted their military counterparts in the Taliban and said this, for example, this bus is coming through with X number of people on it, made up of the following group of people. We want you to let that bus or that group through,” he said. “So, yes there have been occasions like that. To the best of my knowledge, in those cases, the bulk of that has occurred and they have been let through. “I can’t tell you with any certitude that there’s actually been a list of names,” he added. “There may have been. But I know of no circumstance. It doesn’t mean that it doesn’t exist, that here’s the names of 12 people, they’re coming, let them through. It could very well have happened.”

[..] After the fall of Kabul, in the earliest days of the evacuation, the joint U.S. military and diplomatic coordination team at the airport provided the Taliban with a list of people the U.S. aimed to evacuate. Those names included Afghans who served alongside the U.S. during the 20-year war and sought special immigrant visas to America. U.S. citizens, dual nationals and lawful permanent residents were also listed. “They had to do that because of the security situation the White House created by allowing the Taliban to control everything outside the airport,” one U.S. official said. But after thousands of visa applicants arrived at the airport, overwhelming the capacity of the U.S. to process them, the State Department changed course — asking the applicants not to come to the airport and instead requesting they wait until they were cleared for entry. From then on, the list fed to the Taliban didn’t include those Afghan names. As of Aug. 25, only U.S. passport and green card holders were being accepted as eligible for evacuation, the defense official said.

“The U.S. Government has taken note as new store locations open up for future drone pilot target practice.”

• Taliban Opens Chain Of U.S. Army Surplus Stores (BBee)

Now that Allah has seen fit to bless the Taliban with bountiful weapons and equipment from the U.S. Military, terrorists around Afghanistan have built an already thriving chain of U.S. Army Surplus stores. “We need weapons to kill and subjugate the Afghan people under Sharia Law, but there’s just too much gear here!” said local Taliban leader Bob Muhammed. “There’s, like, billions of dollars and 20 years worth of weaponry around here, and now I can build a thriving business out of selling my wares to other terrorist folk who happen to pass through! Allah be praised!”

Although the merchandise will not be available to the general public (for obvious reasons), Muhammed’s Army Surplus will feature a full selection of deadly weaponry, ammunition, combat boots, MREs, helmets, hashish, and whatever else a soldier of Allah may need. If successful, Bob Muhammed hopes to open more stores in Iraq and Syria. The U.S. Government has taken note as new store locations open up for future drone pilot target practice.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

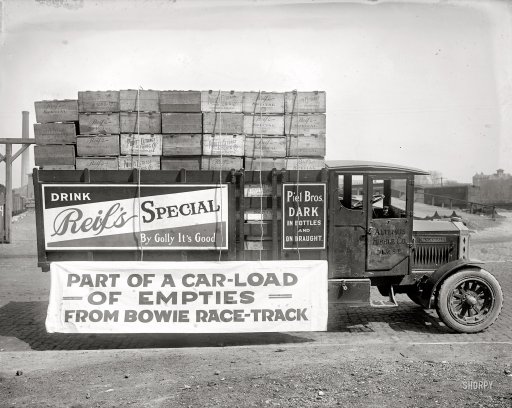

Bagram

This is how we left Bagram Airfield.

July 2nd, in the middle of the night.

We didn’t even tell our Afghan counterparts that we were leaving. pic.twitter.com/llhZ1fV7Se

— Maze (@mazemoore) August 27, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.