Pablo Picasso Nude female standing 1922

Brexit will be delayed, quite possibly indefinitely. May’s looking for a way to achieve this while putting the blame on anyone but herself. She survived this votes only becasue of the DUP, whose votes she bought. Welcome to democracy.

• Theresa May Survives Confidence Vote, Britain Remains In Brexit Deadlock (G.)

Theresa May has survived as prime minister after weathering a dramatic no-confidence vote in her government, but was left scrambling to strike a Brexit compromise that could secure the backing of parliament. In a statement in Downing Street on Wednesday night, the prime minister exhorted politicians from all parties to “put aside self-interest”, and promised to consult with MPs with “the widest possible range of views” in the coming days. It followed her announcement that she would invite Jeremy Corbyn and other party leaders for immediate talks on how to secure a Brexit deal, something she had declined to do earlier in the day, although Labour later said Corbyn would decline the invitation unless no-deal was taken off the table.

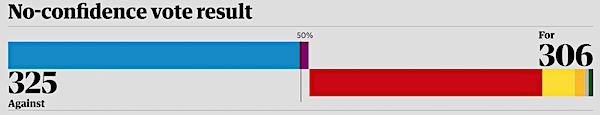

A day after overwhelmingly rejecting her Brexit deal, rebel Conservatives and Democratic Unionist party (DUP) MPs swung behind the prime minister to defeat Labour’s motion of no confidence by 325 votes to 306 – a majority of 19. In her late-night statement, the prime minister said: “I am disappointed that the leader of the Labour party has not so far chosen to take part – but our door remains open … It will not be an easy task, but MPs know they have a duty to act in the national interest, reach a consensus and get this done.”

The Scottish National party’s leader in Westminster, Ian Blackford, met May on Wednesday night, and the Liberal Democrat leader, Vince Cable, also accepted her invitation. Blackford later wrote to May, urging her to make a “gesture of faith” to show that she was serious. He said the SNP would take part in cross-party talks if she was able to confirm “that the extension of article 50, a ruling out of a no-deal Brexit and the option of a second EU referendum would form the basis of those discussions”.

Corbyn is gambling on new elections. That, too, delays any solution.

• Corbyn: No Talks With May Until No-Deal Brexit Is Off The Table (G.)

Jeremy Corbyn has said he will not hold talks with Theresa May until the prime minister agrees to remove the threat of a no-deal Brexit, ruling out any meeting with the prime minister in the immediate aftermath of the no-confidence vote. Responding to May’s offer of swift talks to break the Brexit impasse, the Labour leader told MPs that before he would entertain “positive discussions about the way forward” she had to agree to his precondition. “The government must remove clearly once and for all the catastrophe of a no-deal exit from the European Union and all the chaos that would result from that,” Corbyn said minutes after the opposition party was defeated in the confidence vote.

Minutes after the exchanges in the Commons, with Downing Street refusing to take no deal off the table, Corbyn’s spokesman said that as things stood, the Labour leader would not take up May’s offer of an evening Brexit meeting. The two sides were still in discussions, but in light of such a fundamental difference, appeared unlikely to come to an agreement to speak in the immediate future – even though only 10 weeks remain until the UK’s planned departure date. When asked directly if Corbyn was going to No10, the spokesman added: “As I understand it that is not going to take place.”

Labour is willing to support a Brexit deal if May will accept a customs union, a close relationship with the single market and enhanced protections for workers and consumers rights. However, this would represent a massive shift for the prime minister and risk splits in her own party, making it hard to see how a deal could be agreed. Corbyn’s spokesman acknowledged this, saying, “Any change in the government red lines will cause them internal splits.”

Times headline said 2020.

• Markets Expect Brexit To Be Delayed, Bank Of England Governor Says (G.)

Investors expect a delay to Britain’s exit from the EU following the crushing defeat of the prime minister’s Brexit deal, the Bank of England governor has said. Mark Carney said the reaction of financial markets in the wake of the vote showed a degree of confidence that a no-deal Brexit was unlikely on 29 March. The pound bounced back against the dollar on Tuesday night amid optimism that article 50 would be prolonged and that the prospect of a disorderly severance from Brussels had receded. “Public market commentary, consistent with our market intelligence, is that a rebound appears to reflect some expectation that the process of resolution would be extended and that the prospect of no-deal may have been diminished,” said Carney.

Speaking to MPs on the Treasury select committee on Wednesday, the governor said investors were following developments in parliament closely to detect shifts in the direction of Brexit. The reaction of EU officials and governments across the continent was also being watched closely. Carney said a “sharp rebound in sterling following the vote” was the main indicator that some investors believed Brexit could be delayed beyond the end of March.

2nd referendum is poison. General elections not so much. But the Tories will cling to power no matter what.

• More Than 170 UK Business Leaders Join Call For 2nd Brexit Referendum (G.)

More than 170 business leaders, including Terence Conran and Norman Foster, have thrown their weight behind the campaign for a second referendum on Brexit. In a step designed to indicate growing support for a “people’s vote” after Theresa May suffered the heaviest parliamentary defeat in the modern era over her Brexit plan, the letter due to be published in the Times on Thursday asks both main party leaders in Westminster to support a second referendum. Conran, the renowned designer, who was knighted in 1983, and Lord Foster, the architect behind the Gherkin skyscraper in the City of London, were among 172 signatories from the world of business urging a second referendum on the final Brexit deal.

The architect Sir David Chipperfield and the noble laureate and research scientist Paul Nurse were also among new names on the list of supporters. Several other captains of industry, including Mike Rake, the former chairman of BT, had previously backed the campaign and were also included as signatories. The figures from business, together representing more than £100bn in annual contributions to the UK economy, warned that a bad Brexit deal or Britain leaving without any deal at all could damage the economy. While admitting that many business leaders had initially backed May’s deal, even though they believed it was far from perfect, the group stated that the priority after the prime minister’s defeat in parliament was to stop a “chaotic crash-out from the EU”.

The letter said: “The only viable way to do this is by asking the people whether they still want to leave the EU. With the clock now ticking rapidly before we are due to quit, politicians must not waste any more time on fantasies. We urge the leadership of both the main parties to support a people’s vote.” Both May and the Labour frontbench under Jeremy Corbyn have so far dismissed the idea of a second referendum. The prime minister has said she will speak to senior MPs to find a compromise deal, while Corbyn is pushing for a general election.

German economy is under severe pressure. Still, I don’t see what’s so wrong about fewer cars.

• German Carmakers Warn Hard Brexit Would Be ‘Fatal’ (R.)

German carmakers on Wednesday warned of fatal consequences if Britain left the European Union without a divorce deal, predicting job losses in Britain and Europe and urging lawmakers to redouble efforts to ensure tariff-free trade can continue. Prime Minister Theresa May’s deal to leave the EU suffered an overwhelming defeat in parliament on Tuesday, leaving the country’s future in limbo and manufacturers bracing for their “worst-case scenario”, a no-deal Brexit. Britain would suffer most if it lost free trade with European markets since 80 percent of vehicles assembled in the country are exported, mostly to the European Union. But for Germany the stakes are also high.

In 2016, Britain was the largest single export market for German manufacturers, who sold 800,000 new cars there, or 20 percent of their overall global exports. Fewer cars are exported to China and U.S. because German carmakers have factories there. “The consequences of a ‘no deal’ would be fatal,” German auto industry association VDA said after the vote. “Without an orderly and practical solution for business, jobs in the car industry, particularly on the British side, are on the line.”

Cars is not the big one, agriculture is. But Europe won’t budge on chlorinated chickens.

• Trump ‘Inclined’ To Impose New US Auto Tariffs (R.)

U.S. President Donald Trump is likely to move ahead with tariffs on imported vehicles, a move that could prompt the European Union to agree a new trade deal, said Senate Finance Committee Chairman Charles Grassley on Wednesday. “I think the president’s inclined to do it,” the Republican senator told reporters. “I think Europe (is) very very concerned about those tariffs … It may be the instrument that gets Europe to negotiate.” U.S. Commerce Department recommendations into whether Trump should impose tariffs of up to 25% on imported cars and parts on national security grounds are due by mid-February. Grassley, who has had regular talks with Trump and U.S. Trade Representative Robert Lighthizer on trade issues, said he did not like new tariffs but “they are a fact of life when Trump is in the White House.”

He said they may have been an “effective tool” in getting China, Canada, Mexico and others to negotiate on trade. Iowa senator Grassley also wants the EU to agree to include agricultural issues in trade talks, although EU trade commissioner Cecilia Malmström said last week the 28-country bloc could not negotiate on agriculture. The White House has pledged not to move forward with imposing tariffs on the EU or Japan as long as it is making constructive progress in bilateral trade talks. Trump has urged the EU to drop its 10% tariff on imported vehicles. The U.S. passenger car tariff is 2.5%, while it imposes 25% tariffs on pickup trucks. Trump has repeatedly threatened to impose new auto tariffs. “Cars is the big one,” Trump said last year.

The economy grows 6% amid widespread job losses?!

• Chinese Unemployment Worries Grow As Beijing Beefs Up Stimulus (CNBC)

Beijing is working hard to stop a slowing Chinese economy from hitting its workforce. In the last several weeks authorities have made a flurry of announcements, including tax cuts, monetary policy loosening and plans to support public spending. The push comes as economic data points to sagging domestic growth and the U.S. looks set to keep up the pressure on trade. Amid that environment, worries of widespread job losses won’t help the already gloomy sentiment that’s giving consumers a second thought on spending. The overarching worry for China’s leaders is that unemployment could lead to social unrest, and deeper questioning of the Communist Party’s claim to having a handle on the best interests of the country.

Already, the economy is widely expected to slow from around 6.5% growth to just above 6%. “We think the biggest risk in the near term is rising unemployment around the Lunar New Year,” Haibin Zhu, chief China economist and head of China equity strategy, J.P. Morgan, said in a Monday report. [..] Gavekal Dragonomics’ China Consumer Analyst Ernan Cui pointed out in a Jan. 9 report that an official survey covering 374,000 large industrial firms shows total employment declined by about 2.8 million people in the 12 months through November. [..] [A UBS] survey in November found that 23% of 125 Chinese respondents in manufacturing have already laid off employees due to the negative effect of U.S.-China trade tensions. Some 34% planned to lay off employees in the next six months, and 18% had cut wages, the report said.

Job losses in Chinese manufacturing accelerated in mid-2018 after the U.S. imposed tariffs Note: Employment in large industrial enterprises, three-month moving average. December excluded for data anomalies.

“..a panicked “spasm”..”

• China Injects Gargantuan 1.1 Trillion In Liquidity This Week (ZH)

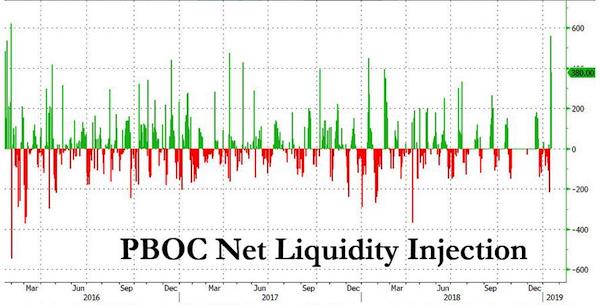

Following what Bloomberg calculated was a record net reverse repo liquidity injection on Wednesday, when the PBOC injected a whopping 560 billion yuan of liquidity into the financial system via open market operations, the Chinese central bank has done it again and in Thursday’s open market operation, it sold 250BN yuan in 7 Day repos (slightly below yesterday’s record 350BN), and 150BN in 28 Day repos, which net of maturities resulted in a whopping net 380BN yuan ($56.2BN) liquidity injection. This brings the net liquidity injection this week to a near record 1.14 Trillion yuan (Monday 20BN, Tuesday 180BN, Wednesday 560BN and Thursday 380BN) and the week is not even over yet – should tomorrow’s reverse repo be of similar magnitude, then this week will go down in history as China’s biggest liquidity injection on record.

As yesterday, today’s massive liquidity injection was aimed at “keeping reasonable and sufficient liquidity in banking system as liquidity falls relatively fast during peak season for tax payments,” according to a statement from the PBOC, although why this year should be such a significant outlier, even when factoring in the liquidity needs ahead of the Lunar new year, to prior periods was not exactly clear. There is, of course, a much simpler explanation: with Chinese economic and trade data turning from bad to worse with every passing day, Beijing’s response is increasingly one of a panicked “spasm”, as Nomura’s Charlie McElligott wrote today when he noted that with regard to the response of Chinese authorities in addressing their economic slowdown and credit crunch, “it had to get worse before it got better”—recently collapsing Chinese data has now clearly forced an escalation of easing-/stimulus-/liquidity- policies.

He ‘won’ by one vote. And now has to win another vote on the name deal itself. Funny to see western media all say Macedonia is set to change its name. Who likes homework, after all? There is no country named Macedonia, that’s the whole point.

• Greek PM Tsipras Wins Confidence Vote After FYROM Name Crisis (R.)

The Greek prime minister, Alexis Tsipras, has won a confidence vote in parliament, clearing a major hurdle for Greece’s approval of an accord to end a dispute over Macedonia’s name and averting the prospect of a snap election. Tsipras called the confidence motion after his rightwing coalition partner Panos Kammenos quit the government on Sunday in protest at the name deal signed between Athens and Skopje last year. Parliament gave Tsipras 151 votes, meeting the threshold he required in the 300-member assembly. His leftist party, Syriza, has 145 seats in parliament. Additional support was given by defectors of Kammenos’s Independent Greeks party (ANEL) and independents.

Tsipras told parliament: “I call upon you with hand on heart to give a vote of confidence to the government which gave battle, which bled, but managed to haul the country out of memorandums and surveillance,” referring to Greece’s international lenders, who kept the country on a tight leash for years. [..] Greek opponents of the agreement say Macedonia’s new name – the Republic of North Macedonia, reached after decades of dispute between Athens and Skopje – represents an attempt to appropriate Greek identity.

There are far too many questions for this to go away. Bill Barr to the rescue.

• DOJ Official Warned Steele Dossier Biased, Connected To Clinton (Solomon)

When the annals of mistakes and abuses in the FBI’s Russia investigation are finally written, Bruce Ohr almost certainly will be the No. 1 witness, according to my sources. The then-No. 4 Department of Justice (DOJ) official briefed both senior FBI and DOJ officials in summer 2016 about Christopher Steele’s Russia dossier, explicitly cautioning that the British intelligence operative’s work was opposition research connected to Hillary Clinton’s campaign and might be biased. Ohr’s briefings, in July and August 2016, included the deputy director of the FBI, a top lawyer for then-Attorney General Loretta Lynch and a Justice official who later would become the top deputy to special counsel Robert Mueller.

At the time, Ohr was the associate attorney general. Yet his warnings about political bias were pointedly omitted weeks later from the Foreign Intelligence Surveillance Act (FISA) warrant that the FBI obtained from a federal court, granting it permission to spy on whether the Trump campaign was colluding with Russia to hijack the 2016 presidential election. Ohr’s activities, chronicled in handwritten notes and congressional testimony I gleaned from sources, provide the most damning evidence to date that FBI and DOJ officials may have misled federal judges in October 2016 in their zeal to obtain the warrant targeting Trump adviser Carter Page just weeks before Election Day.

They also contradict a key argument that House Democrats have made in their formal intelligence conclusions about the Russia case. Since it was disclosed last year that Steele’s dossier formed a central piece of evidence supporting the FISA warrant, Justice and FBI officials have been vague about exactly when they learned that Steele’s work was paid for by the law firm representing the Clinton campaign and the Democratic National Committee (DNC). A redacted version of the FISA application released last year shows the FBI did not mention any connection to the DNC or Clinton.

David guts the entire narrative. Well done.

• The New York Times Smears the President (Stockman)

The Donald has been on a red hot twitter rampage, and he’s completely justified. Actually, we didn’t think the Russian Collusion Hoax could get any stupider until we saw the New York Times’ Friday evening bushwhack. The trio of authors, apparently self-tortured victims of the Trump Derangement Syndrome, actually had the gall to print a story in the once and former Gray Lady of journalistic rectitude which was nothing more than an ugly smear on the sitting President of the United States—one that would have done Joe McCarthy proud. [..] the trio —one of whom graduated from Harvard in 2015 and the other two not much older—don’t seem to even know that foreign policy is a debatable issue.

Or that the American people actually voted into office a candidate who took the other side of Imperial Washington’s unwarranted demonization of Putin and made no bones about his desire for a rapprochement with Russia. Actually, as to pursuing rapprochement, so did: • JFK, after the near catastrophe of the Cuban Missile Crisis; • Lyndon Johnson, after the Seven Days War during his meeting with Kosygin at Glassboro NJ; • Richard Nixon, with the ABM Treaty, detente and his visit with Brezhnev in Moscow; • Jimmy Carter, when he signed the SALT-II agreement; • Ronald Reagan, when he went to Moscow to virtually end the Cold War; and • Bill Clinton, when he sent a multi-billion IMF aid package to Yeltsin to help him get re-elected in 1996.

The fact is, all of the above presidential policy initiatives were heatedly debated in Washington during a period when the US and Soviet Union each had roughly 9,000 nuclear warheads pointed at the other. But that did not lead to FBI counter-intelligence investigations of politicians—to say nothing of sitting Presidents—who took the “wrong” side of these thoroughly democratic debates.

Wonder who they’re mocking. Is it Bezos?

• Fake Washington Post Copies Announcing Trump Resignation Handed Out In DC (RT)

Taking the art of fake news to new heights, a non-profit has circulated mock Washington Post issues near the White House, telling readers that President Donald Trump fled to Crimea on the back of women-led protests. Activists giving out fake copies of the Washington Post commuters were spotted near the White House on Wednesday morning. Vigilant readers immediately alerted the newspaper, which said that the copies, dated May 1, 2019, were “not Post products” and that it was “looking into this.” The fake copies include an eye-catching headline for the lead story: “UNPRESIDENTED. Ending Crisis, Trump Hastily Departs White House,” complete with a picture of a glum Trump on his way to “slip in a private car in the wee hours of the morning.”

The paper “reports” that Trump abruptly left his office at 3:15am on May 1, leaving a message on a napkin in the Oval Office that blamed “crooked Hillary,” the mysterious “Hfior,” and “the Fake News Media” for his flight. The report, meticulously mimicking the Washington Post’s source-based reporting style, cites “four White House aides” speaking on condition of anonymity, that they found the napkin two days before events took a dramatic turn. Trump’s fictional resignation and the subsequent swearing-in of Vice President Mike Pence, who instantly promises to keep as low a profile as possible, comes amidst “massive protests” staged by a grassroots movement with #MeToo as its backbone.

[..] The news of Trump’s resignation sparks a wave of celebrations across the globe, with European countries refusing to shelter him. The creators of the fake diligently stick to the Washington Post’s style, fanning the Russia collusion narrative just like their prototype by sending Trump to seek safe haven in Russia – namely, Crimea. While there has been speculation that radical liberal political activist group MoveOn or CODEPINK, a women-led grassroots NGO, might be behind the stunt since they promoted the action, later in the day, The Yes Men, a progressive non-profit group, claimed responsibility in a press release.

UK MPs want action. I say don’t depend on politicians if you want to get things done. Britain has a target date of 2042 for phasing out avoidable plastic waste. As its volume is set to treble by 2030. That is so insane, forget about the rest too. Politics won’t solve this.

• Plastic Pollution Of The Oceans Is Set To Treble In The Next Decade (G.)

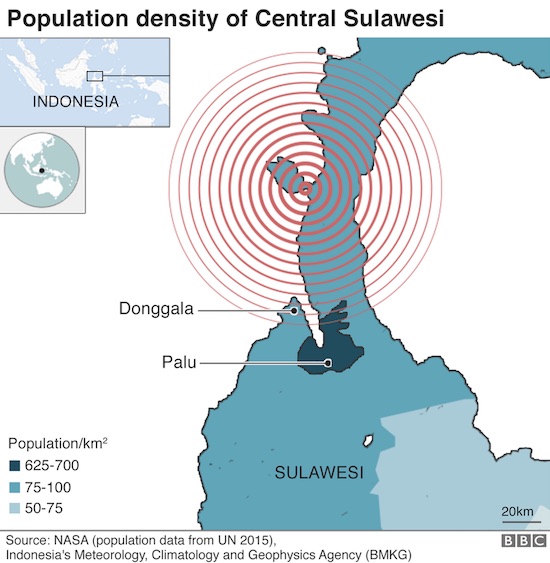

A new global agreement to protect the seas should be a priority for the government to stop our seas becoming a “sewer”, according to a cross-party group of MPs. Plastic pollution is set to treble in the next decade, the environmental audit committee warned, while overfishing is denuding vital marine habitats of fish, and climate change is causing harmful warming of the oceans as well as deoxygenation and acidification. The effects of plastic pollution are particularly poorly understood, the committee found in its report, published on Thursday. It found “a lack of data on the serious long-term harm and health implications of plastic particles entering the food chain” and accused the government of treating the oceans as “out of sight, out of mind”.

One way of tackling the problem would be through a “Paris agreement for the sea”, the MPs recommended. Governments are still working on a possible new ocean protection treaty, under the UN. The MPs also called for the government to bring forward the target date of phasing out avoidable plastic waste from 2042, and urged greater action to reduce greenhouse gas emissions. Labour MP Mary Creagh, chair of the committee, said: “We have to stop treating our seas as a sewer. Plastic, chemicals and sewage are choking our oceans, polluting our water and harming every ocean species from plankton to polar bears. Supporting Indonesia and Malaysia to reduce plastic while simultaneously exporting our contaminated plastics to them shows the lack of a joined-up approach at the heart of the government’s strategy.”

[..] A UK government spokesperson said: “The UK is already a global leader in protecting our seas and oceans. We have recently proposed 41 new marine conservation zones, led calls to protect 30% of the world’s oceans by 2030, and we are going further and faster to tackle the plastic that harms marine life with our ambitious resources and waste strategy. “We know there is more to do, and we will soon publish an international ocean strategy to drive global action to conserve the world’s oceans.”