Pablo Picasso Le pigeon aux petits pois (Pigeon with Peas) – stolen May 20 2010 1911

Almost off the news radar, Germany’s problems get serious, and drag Europe down with it.

• German Industrial Production Falls Most Since 2009. New Orders Plummet (WS)

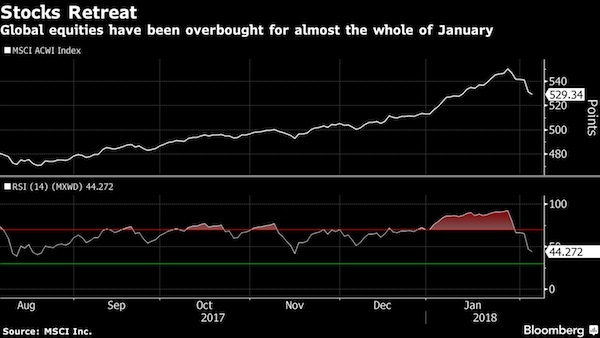

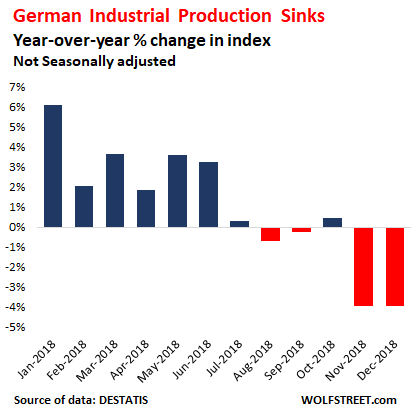

“Unexpectedly,” German industrial production fell 3.9% in December 2018 compared to December 2017, after having fallen by a revised 4.0% in November, according to German statistics agency Destatis Thursday morning. These two drops were steepest year-over-year drops since 2009. Even during the European Debt Crisis in 2011 and 2012 – it hit Germany’s industry hard as many European countries weaved in and out of a recession, with some countries sinking into a depression — German industrial production never fell as fast on a year-over-year basis as in November and December:

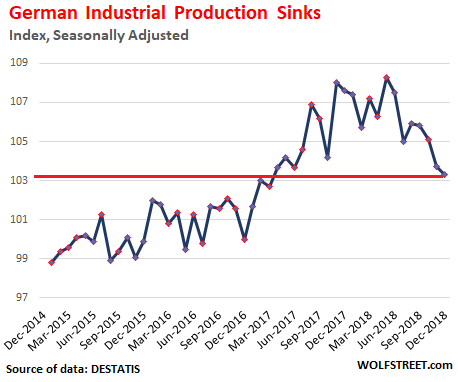

The declines on a year-over-year basis were broad: Without construction, industrial production fell 3.9% year-over-year in December, after having fallen 4.5% in November. And just manufacturing production, which includes mining and quarrying, fell 4.0% year-over-year in December, after having fallen 4.6% in November. On a longer-term scale, the industrial production index peaked in May 2018 and has since fallen 4.6%. It is now back where it had first been in February 2017:

And industrial production is not getting a whole lot better any time soon as new orders for the manufacturing sector have plunged – according to data released by Destatis on Wednesday. New orders dropped 7.0% year-over-year in December (adjusted for calendar differences), after having fallen 3.4% in November and 3.0% in October. In fact, orders have fallen seven months in a row on a year-over year basis in ever larger drops. The chart below shows the decline in each month compared to the same month a year earlier — with a sharp deterioration at the end of the year:

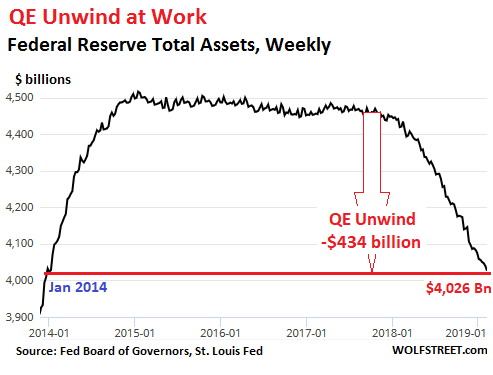

As I’ve said before, tweaking rates is sort of an instant measure, but re-purchasing $434 billion in assets takes much longer. If only because the Fed will cause a panic if they try.

• Fed’s QE Unwind Reaches $434 Billion, Remains on “Autopilot” (WS)

The Fed shed $32 billion in assets in January, according to the Fed’s balance sheet for the week ended February 6, released this afternoon. This reduced the assets on its balance sheet to $4,026 billion, the lowest since January 2014. Since the beginning of this “balance sheet normalization,” the Fed has now shed $434 billion.

[..] the questions going forward are these: One, will the Fed continue to trim its balance sheet on “autopilot,” or will it deviate from plan and slow or stop the balance sheet reductions; Or two, will the Fed reverse course and restart QE all over again at any moment now, as the biggest Wall Street hype-mongers have prophesied; Or three, will the Fed tweak the roll-off – as a slew of Fed governors have suggested – to where it would get rid of its MBS more quickly by outright selling them; and by replacing some of them with short-term Treasury bills to lower the balance sheet’s average maturity, which currently is over eight years.

Over the next few months, the Fed will likely announce some tantalizing tidbits about how it might tweak the balance-sheet reduction. One of those tidbits will likely relate to how it will shed MBS faster and replace those additional reductions of MBS with short-term Treasury bills. The effects of this may not be what the markets had hoped for in their wildest dreams. And the Fed will likely dole out more clues about how much further it wants to cut its balance sheet. But all this will take months, and until those tweaks are nailed down and announced, the balance sheet normalization will proceed on autopilot at its by now customary glacial pace.

Dreams of empire. France does the exact same thing.

• UK Forcing Poor Nations Into Risky Post-Brexit Trade Deals (Ind.)

Some of the world’s poorest countries are being forced to agree potentially damaging trade deals with the UK by government “threats” in the rush to Brexit, campaigners say. Liam Fox, the international trade secretary, is accused of piling pressure on developing nations to “sign up blind” – without knowing the value of the deals – with a warning they will otherwise be lost. Just three of the 40 agreements the UK enjoys through EU membership, covering 71 countries, have been successfully “rolled over” – as the government promised – with Brexit day just seven weeks away. Now the Department for International Trade is under fire for telling the countries concerned they risk punishing tariffs on crucial exports to the UK, unless they re-sign the deals in time.

Among them are Ghana, which relies on banana sales, Mauritius (tuna), Kenya (flowers), Cote d’Ivoire (cocoa), Namibia (grapes and beef), Swaziland (sugar), and scores of other developing countries in Africa, the Caribbean and Central America. And, says the fair trade charity Traidcraft Exchange, they risk a legal challenge at the World Trade Organisation (WTO) under an extraordinary plan to treat EU parts as originating from the UK. “The continuity agreements are being rushed because of the threat of no deal. Countries are being asked to sign up blind,” said Liz May, the charity’s head of policy.

“Without the full picture of how the EU and UK will trade in the future, it is impossible for countries to judge what these deals are really worth, how they will work in practice or even how some elements will be enforced. “Instead of acknowledging this difficulty, the government is relying on developing countries being compelled to sign up at the last minute, rather than risk high tariffs being slapped on their key exports. “This type of bad-faith negotiating – using implicit threats to get countries ‘over the line’ – is not a great way to start the UK’s independent trade policy.”

“I’m thinking about maybe we just set up a popcorn machine in the back because that’s what this is becoming. It’s becoming a show..”

The Senate will vote on Barr next week anyway, so why the showboating carnival?

• Acting AG Whitaker Says He Has Not Meddled In Russia Inquiry (AP)

The acting attorney general, Matthew Whitaker, said on Friday that he has “not interfered in any way” in the special counsel’s Russia investigation as he faced a contentious congressional hearing in his waning days on the job. The hearing before the House Judiciary Committee was the first, and likely only, chance for newly empowered Democrats in the majority to grill an attorney general they perceive as a Donald Trump loyalist, and whose appointment they suspect was aimed at suppressing investigations of the Republican president. Democrats confronted Whitaker on his past criticism of the special counsel Robert Mueller’s work and his refusal to recuse himself from overseeing it, attacked him over his prior business dealings, and sneeringly challenged his credentials as the country’s chief law enforcement officer.

“We’re all trying to figure out: who are you, where did you come from and how the heck did you become the head of the Department of Justice,” said congressman Hakeem Jeffries. When Whitaker tried to respond, the New York Democrat interrupted: “Mr Whitaker, that was a statement, not a question. I assume you know the difference.” Yet Democrats yielded no new information about the status of the Mueller invesetigation as Whitaker repeatedly refused to discuss conversations with the president or answer questions that he thought might reveal details. Though clearly exasperated – he drew gasps and chuckles when he told the committee chairman that his five-minute time limit for questions was up – Whitaker nonetheless sought to assuage Democratic concerns by insisting he had never discussed the Mueller probe with Trump or other White House officials, and that there’d been no change in its “overall management”.

“We have followed the special counsel’s regulations to a T,” Whitaker said. “There has been no event, no decision, that has required me to take any action, and I have not interfered in any way with the special counsel’s investigation.” Republicans made clear they viewed the hearing as pointless political grandstanding, especially since Whitaker may have less than a week left in the job, and some respected his wishes by asking questions about topics other than Mueller’s inquiry into potential coordination between Russia and the Trump campaign. The Senate is expected to vote as soon as next week on confirming William Barr, Trump’s pick for attorney general. “I’m thinking about maybe we just set up a popcorn machine in the back because that’s what this is becoming. It’s becoming a show,” said the Republican congressman Doug Collins ,of Georgia, who accused his Democratic colleagues of “character assassination”.

The US food crisis is exclusively caused by Big Ag and Monsanto. Farmers depending on China is not in their interest.

• US Faces A Catastrophic Food Supply Crisis, As Farmers Struggle (SHTF)

American farmers are battling several issues when it comes to producing our food. Regulated low prices, tariffs, and the inability to export have all cut into the salaries of farmers. They are officially in crisis mode, just like the United States’ food supply. “The farm economy’s in pretty tough shape,” said John Newton, chief economist at the American Farm Bureau Federation. “When you look out on the horizon of things to come, you start to see some cracks.” Average farm income has fallen to near 15-year lows under president Donald Trump’s policies, and in some areas of the country, farm bankruptcies are soaring. And with slightly higher interest rates, many don’t see borrowing more money as an option.

“A lot of farmers are going to give the president the benefit of the doubt, and have to date. But the longer the trade war goes on, the more that dynamic changes,” said Brian Kuehl, executive director of Farmers for Free Trade, according to Politico. With no end to the disastrous trade war in sight, many farmers have traveled to Washington to share their plights with the president himself hoping that he’ll end the trade war that’s exacerbating an already precarious food crisis. Farmers make up a fairly large chunk of president Trump’s base, and an unwillingness to put food production in the United States first could be detrimental for Trump reelection chances in 2020. It could also be the beginning of a catastrophic food shortage.

“It’s a tough job, but someone’s got to do it: Propping up the massive US economy.”

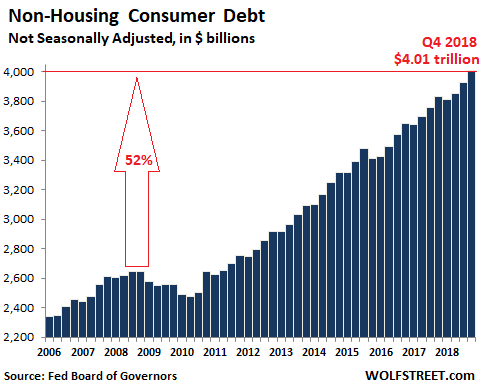

• The State of the American Debt Slaves, Q4 2018 (WS)

It’s a tough job, but someone’s got to do it: Propping up the massive US economy. And consumers are doing it, but in a somewhat lackadaisical manner when it comes to spending money they don’t have. Consumer debt – more enticingly, “consumer credit” similar to “extra credit” – rose 4.7% in the fourth quarter 2018 compared to the fourth quarter last year. In the year 2018, Americans added $179 billion to their balances on their credit cards, auto loans, and student loans. Every dime was spent and added to GDP. It amounted to nearly 1% of GDP. If GDP grew 3.1% in 2018, just under one third of the growth was generated by that additional consumer debt.

Without this additional consumer borrowing, if consumers had just maintained their debt levels, GDP growth might only have been 2.2% in 2018, instead of 3.1%. So, a huge round of applause is due our debt slaves that now owe over $4 trillion for the first time ever, according to the Federal Reserve Thursday afternoon. Consumer debt includes auto loans, student loans, credit-card debt, and personal loans, but it excludes housing related debt, such as mortgages and HELOCs. The $4.01 trillion in consumer debt is up 52% from the peak early in the Financial Crisis in Q3 2008. This is not adjusted for inflation. Over the same period, the Consumer Price Index rose 16% and nominal GDP rose 39%. Thus, Americans are sticking to their time-honored plan of out-borrowing both inflation (by a big margin) and economic growth.

Summary: Trump accused of using the same FBI that spies on him, to spy on Bezos, who’s in bed with the FBI.

I may have temporarily lost the thread, and the logic.

• Bezos, Amazon And Privacy (Greenwald)

On Thursday, Bezos published emails in which the Enquirer’s parent company explicitly threatened to publish intimate photographs of Bezos and his mistress, which were apparently exchanged between the two through their iPhones, unless Bezos agreed to a series of demands involving silence about the company’s conduct. [..] Despite a lack of evidence, MSNBC is already doing what it exists to do – implying with no evidence that Trump is to blame (in this case, by abusing the powers of the NSA or FBI to spy on Bezos). But, under the circumstances, those are legitimate questions to be probing (though responsible news agencies would wait for evidence before airing innuendo of that sort).

If Bezos were the political victim of surveillance state abuses, it would be scandalous and dangerous. It would also be deeply ironic. That’s because Amazon, the company that has made Bezos the planet’s richest human being, is a critical partner for the U.S. Government in building an ever-more invasive, militarized and sprawling surveillance state. Indeed, one of the largest components of Amazon’s business, and thus one of the most important sources of Bezos’ vast wealth and power, is working with the Pentagon and the NSA to empower the U.S. Government with more potent and more sophisticated weapons, including surveillance weapons.

In December, 2017, Amazon boasted that it had perfected new face-recognition software for crowds, which it called Rekognition. It explained that the product is intended, in large part, for use by governments and police forces around the world. The ACLU quickly warned that the product is “dangerous” and that Amazon “is actively helping governments deploy it.” “Powered by artificial intelligence,” wrote the ACLU, “Rekognition can identify, track, and analyze people in real time and recognize up to 100 people in a single image. It can quickly scan information it collects against databases featuring tens of millions of faces.” “Amazon’s Rekognition raises profound civil liberties and civil rights concerns.”

The core of the Venezuela crisis: “Hugo Chávez, broke ties with the IMF and World Bank, which he noted were “dominated by US imperialism.” Instead Venezuela and other left-wing governments in Latin America worked together to co-found the Bank of the South..”

• Leaked Wikileaks Doc Reveals US Military Use of IMF, World Bank (MPN)

In a leaked military manual on “unconventional warfare” recently highlighted by WikiLeaks, the U.S. Army states that major global financial institutions — such as the World Bank, IMF, and the OECD — are used as unconventional, financial “weapons in times of conflict up to and including large-scale general war,” as well as in leveraging “the policies and cooperation of state governments.” The document, officially titled “Field Manual (FM) 3-05.130, Army Special Operations Forces Unconventional Warfare” and originally written in September 2008, was recently highlighted by WikiLeaks on Twitter in light of recent events in Venezuela as well as the years-long, U.S.-led economic siege of that country through sanctions and other means of economic warfare. Though the document has generated new interest in recent days, it had originally been released by WikiLeaks in December 2008 and has been described as the military’s “regime change handbook.”

WikiLeaks’ recent tweets on the subject drew attention to a single section of the 248-page-long document, titled “Financial Instrument of U.S. National Power and Unconventional Warfare.” This section in particular notes that the U.S. government applies “unilateral and indirect financial power through persuasive influence to international and domestic financial institutions regarding availability and terms of loans, grants, or other financial assistance to foreign state and nonstate actors,” and specifically names the World Bank, IMF and the OECD, as well as the Bank for International Settlements (BIS), as “U.S. diplomatic-financial venues to accomplish” such goals.

[..] Given the close relationship between the U.S. government and these international financial institutions, it should come as little surprise that – in Venezuela – the U.S.-backed “interim president” Juan Guaidó – has already requested IMF funds, and thus IMF-controlled debt, to fund his parallel government. This is highly significant because it shows that top among Guaidó’s objectives, in addition to privatizing Venezuela’s massive oil reserves, is to again shackle the country to the U.S.-controlled debt machine. As the Grayzone Project recently noted: Venezuela’s previous elected socialist president, Hugo Chávez, broke ties with the IMF and World Bank, which he noted were “dominated by US imperialism.” Instead Venezuela and other left-wing governments in Latin America worked together to co-found the Bank of the South, as a counterbalance to the IMF and World Bank.”

So many millions of victims nobody tries to count anymore.

• Venezuela: The US’s 68th Regime Change Disaster (AntiWar)

In his masterpiece, Killing Hope: U.S. Military and C.I.A. Interventions Since World War II, William Blum, who died in December 2018, wrote chapter-length accounts of 55 US regime change operations against countries around the world, from China (1945-1960s) to Haiti (1986-1994). Noam Chomsky’s blurb on the back of the latest edition says simply, “Far and away the best book on the topic.” We agree. If you have not read it, please do. It will give you a clearer context for what is happening in Venezuela today, and a better understanding of the world you are living in. Since Killing Hope was published in 1995, the US has conducted at least 13 more regime change operations, several of which are still active: Yugoslavia; Afghanistan; Iraq; the 3rd US invasion of Haiti since WWII; Somalia; Honduras; Libya; Syria; Ukraine; Yemen; Iran; Nicaragua; and now Venezuela.

William Blum noted that the US generally prefers what its planners call “low intensity conflict” over full-scale wars. Only in periods of supreme overconfidence has it launched its most devastating and disastrous wars, from Korea and Vietnam to Afghanistan and Iraq. After its war of mass destruction in Iraq, the US reverted to “low intensity conflict” under Obama’s doctrine of covert and proxy war. Obama conducted even heavier bombing than Bush II, and deployed US special operations forces to 150 countries all over the world, but he made sure that nearly all the bleeding and dying was done by Afghans, Syrians, Iraqis, Somalis, Libyans, Ukrainians, Yemenis and others, not by Americans. What US planners mean by “low intensity conflict” is that it is less intense for Americans.

[..] While Venezuelans face poverty, preventable diseases, malnutrition and open threats of war by US officials, those same US officials and their corporate sponsors are looking at an almost irresistible gold mine if they can bring Venezuela to its knees: a fire sale of its oil industry to foreign oil companies and the privatization of many other sectors of its economy, from hydroelectric power plants to iron, aluminum and, yes, actual gold mines. This is not speculation. It is what the US’s new puppet, Juan Guaido, has reportedly promised his American backers if they can overthrow Venezuela’s elected government and install him in the presidential palace.

“..a source in Washington close to the opposition expressed doubts whether the Trump administration has laid enough groundwork to spur a wider mutiny in the ranks..”

• US In Direct Contact With Venezuelan Military, Urging Defections (R.)

The US is holding direct communications with members of Venezuela’s military urging them to abandon President Nicolas Maduro and is also preparing new sanctions aimed at increasing pressure on him, a senior White House official said. The Trump administration expects further military defections from Maduro’s side, the official told Reuters, despite only a few senior officers having done so since opposition leader Juan Guaido declared himself interim president last month, earning the recognition of the United States and dozens of other countries. “We believe these to be those first couple pebbles before we start really seeing bigger rocks rolling down the hill,” the official said this week, speaking on condition of anonymity. “We’re still having conversations with members of the former Maduro regime, with military members, although those conversations are very, very limited.”

With the Venezuelan military still apparently loyal to Maduro, a source in Washington close to the opposition expressed doubts whether the Trump administration has laid enough groundwork to spur a wider mutiny in the ranks where many officers are suspected of benefiting from corruption and drug trafficking. Members of the South American country’s security forces fear they or their families could be targeted by Maduro if they defect, so the U.S. would need to offer them something that could outweigh those concerns, said Eric Farnsworth, vice president of the Council of the Americas think tank in Washington. “It depends on what they’re offering,” Farnsworth said. “Are there incentives built into these contacts that will at least cause people to question their loyalty to the regime?”

A horse felled Troy.

• Venezuela’s Maduro Spurns US Aid, Rival Warns Military Not To Block It (R.)

Venezuela’s government on Friday said the United States should distribute humanitarian aid in Colombia where it is being stockpiled, while the opposition warned that blocking much-needed food and medicine could constitute crimes against humanity. A day after the aid convoy arrived in the border city of Cucuta, President Nicolas Maduro ridiculed the United States for offering small amounts of assistance while maintaining sanctions that block some $10 billion of offshore assets and revenue. Rival Juan Guaido, who is recognized by dozens of countries as Venezuela’s legitimate leader, warned military officers against blocking the arrival of aid amid spiraling disease and malnutrition brought on by a hyperinflationary collapse.

“Take all that humanitarian aid and give it to the people of Cucuta, where there is a lot of need,” Maduro said in a news conference. “This is a macabre game, you see? They squeeze us by the neck and then make us beg for crumbs.” “They offer us toilet paper, like (U.S. President) Donald Trump threw at the people of Puerto Rico,” he said at the conference, which experienced technical difficulties including a blackout and a microphone failure. He was referring to Trump’s improvised 2018 aid distribution in the U.S. territory following a hurricane, during which he threw rolls of paper towels.

“Societies and economies are fundamentally emergent, non-linear, and self-organizing as they respond to the mandates of reality — which are not necessarily consistent with human wishes.”

America has been blowing green smoke up its own ass for years, promoting oxymorons such as “green skyscrapers” and “clean energy,” but the truth is we’re not going to run WalMart, Suburbia, DisneyWorld, and the interstate highway system on any combination of wind, solar, geothermal, recycled Fry-Max, and dark matter. We’re just running too much stuff at too great a scale for too many people. We’ve blown through the capital already and replaced it with IOUs that will never be honored, and we’re caught in an entropy trap of diminishing returns from all the work-arounds we’re desperately trying. For all that, there are actually some sound proposals in the mostly delusional matrix of the Green New Deal promoted by foxy front-person AOC.

• Revoke corporate personhood by amending our Constitution to make clear that corporations are not persons and money is not speech. Right on, I say, though they have not quite articulated the argument which is that corporations, unlike persons, have no vested allegiance to the public interest, but rather a legal obligation solely to shareholders and their boards-of-directors.

• Replace partisan oversight of elections with non-partisan election commissions. A no-brainer.

• Replace big money control of election campaigns with full public financing and free and equal access to the airwaves. Quite cheap and worth every penny.

• Break up the oversized banks that are “too big to fail.” And while you’re at it, resume enforcement of the anti-trust laws.

• Restore the Glass-Steagall separation of depository commercial banks from speculative investment banks. Duh….There are two kinds of deadly narcissism at work in American culture these days: techno-narcissism — the belief that magical rescue remedies can save the status quo of comforts and conveniences — and organizational narcissism — the belief that any number of committees can lead a march of humanity into a future of rainbows and unicorns. Both of these ideas are artifacts of a fossil fuel turbo-charged economy that is coming to an end. Societies and economies are fundamentally emergent, non-linear, and self-organizing as they respond to the mandates of reality — which are not necessarily consistent with human wishes. Circumstances in the world change and sometimes, when the changes are profound enough, they provoke episodes of flux and disorder. A better index for our journey into the unknown frontier beyond modernity will not be what is “green” and “smart” but perhaps what is “sane” and “insane.”

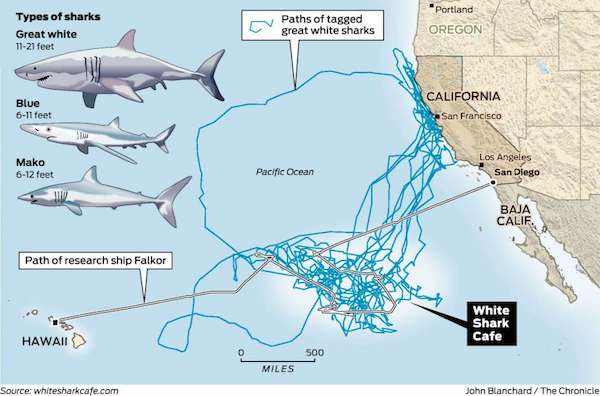

100 million sharks are killed globally each year.

We need to protect, and love, life in all its glory and beauty, because we are life. But we don’t see what connects us to all that we kill, we think we’re some separate entity.

There is no more flagrant failure in our education systems than this: they don’t teach us who we are.

• Wiped Out Before Our Eyes’ Hawaii Proposes Ban On Shark Killings (G.)

Sharks could soon become more numerous in Hawaii waters – and advocates say that’s a good thing. Lawmakers in Honolulu advanced a proposed ban on killing sharks in state waters on Wednesday, after receiving hundreds of calls and letters of support from around the country. The law, which would provide sweeping protection for any shark, rather than select species, could be the first of its kind in the United States. “These amazing animals are getting wiped out before our eyes, and people don’t even realize what they’re missing out on,” said Ocean Ramsey, a Hawaii-based shark conservationist, researcher and tour operator who has been instrumental in lobbying for the bill. Last month, a photo of Ramsey swimming with a 6-metre (20ft) great white shark off the coast of Oahu went viral.

Photograph: OneOceanDiving

Along with killing the animals, capturing or harming them would also incur fines and count as a misdemeanor offense. Sharks, Ramsey said, are deeply misunderstood. Their presence in the ocean is unlike any other animal’s, she noted. “Everything else in the ocean swims away from you, but you can have these incredible interactions with sharks because they’re apex predators and they’re not afraid of you.” The threats to Hawaii’s sharks are numerous, proponents of the bill argue. [..] shark fins can sometimes sell for as much as $500 a pound. Shark fin soup, a delicacy once favored by Chinese emperors, has become widely popular as a status symbol in modern China. As a result, nearly 100 million sharks are killed globally each year, and species are disappearing.

[..] Sharks are crucial to Hawaii’s marine ecosystem, and oceans worldwide. “They’re the ocean’s immune system,” Ramsey said. Multiple studies have linked shark populations to overall ocean health. They serve a critical purpose by picking off sick and injured marine animals and keeping smaller fish populations under control. When the shark population declines, large predatory fish can overproduce and decimate the populations of small plant-eating fish, which are crucial to keeping algae down and supporting reef systems.

Photograph: OneOceanDiving