�NPC US Naval Research Lab, Bellevue, DC� 1925

And Abe will use his self wrought crisis to grab more power through an election in which he has no real competition.

• Japan Falls Into Recession As Consumers ‘Stop Spending’ (BBC)

Japan’s economy unexpectedly shrank for the second consecutive quarter, marking a technical recession in the world’s third largest economy. GDP fell at annualised 1.6% from July to September, compared with forecasts of a 2.1% rise. That followed a revised 7.3% contraction in the second quarter, which was the biggest fall since the March 2011 earthquake and tsunami. Tokyo Correspondent Rupert Wingfield-Hayes says, “ordinary people in Japan have stopped spending money”. Economists said the weak economic data could delay a sales tax rise. Prime Minister Shinzo Abe is widely expected to call a snap election to seek a mandate to delay an increase in the sales tax to 10%, scheduled for 2015.

The tax increase was legislated by the previous government in 2012 to curb Japan’s huge public debt, which is the highest among developed nations. April saw the first phase of the sales tax increase, from 5% to 8%, which hit growth in the second quarter and still appears to be having an impact on the economy. The economy shrank 0.4% in the third quarter from the quarter previous. The data also showed that growth in private consumption, which accounts for about 60% of the economy, was much weaker than expected. The next tax rise had already been put in question by already weak economic indicators.

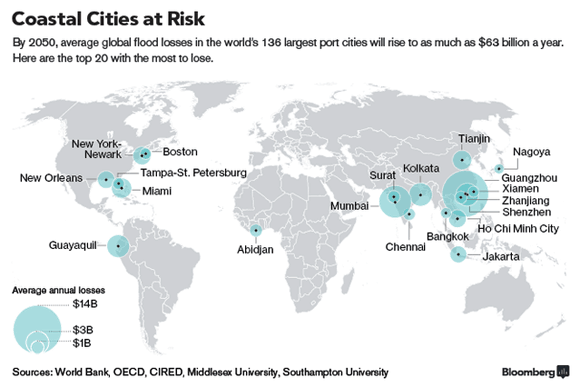

I think these numbers are grossly lowballing the problems.

• China Bad Loans Jump Most Since 2005 (Bloomberg)

China’s bad loans jumped by the most since 2005 in the third quarter, fueling concern that a cooling economy will be further weakened as banks limit lending to avoid credit risks. Nonperforming loans rose by 72.5 billion yuan ($11.8 billion) from the previous quarter to 766.9 billion yuan, the China Banking Regulatory Commission said in a statement on Nov. 15. Soured credit accounted for 1.16% of lending, up from 1.08% three months earlier. As China heads for the weakest economic expansion since 1990, Communist Party leaders have discussed lowering the nation’s growth target for 2015, according to a person with knowledge of their talks. Bankers’ low appetite for risk and their rising concerns about asset quality are leading to a “sluggish” expansion in credit, according to UBS AG.

“We are still suffering from the aftermath of the credit binge and massive stimulus measures put in place in 2008,” said Rainy Yuan, a Shanghai-based analyst at Masterlink Securities Corp. “Banks have accelerated recognition of their bad loans in the last two quarters so that they could start the clean-up process.” Still, the pace of debt souring may have reached its peak, Jim Antos, a Hong Kong-based analyst at Mizuho Securities Asia, said in a note today. He estimated that nonperforming loans at Hong Kong-listed banks will probably increase by 18% in 2015, slowing from an estimated 31% gain in 2014.

The potential fall-out from the demise of shadow banking in China is like that of a nuclear bomb.

• China’s Shadow Banking Grinds To A Halt As Bad Debt Surges (Zero Hedge)

[..] as China finally reveals little by little the true extent of its gargantuan bad debt problem (which is far worse than ever in history, although Beijing is taking its time in making the necessary revelations: and after all Chinese banks are all SOEs – if needed they can all just get a few trillions renminbi in in liquidity injections a la the “developed west”), it is also slamming the breaks on the shadow banking system that for years what the sector where marginal credit creation, and thus growth as well as bad debt formation, was rampant. And as Japan showed so clearly just 48 hours after the end of America’s own QE3, reserves, like credit and money, are infinitely fungible in the global interconnected market. And infinitely, no pun intended, in demand, because if one central bank ends the goosing of risky assets, another has to immediately step in its place.

So while it has been widely documented that Japan is doing all in its power to crush the Japanese economy and in the process to send the Nikkei to all time highs, little has been said about a far greater slowdown in domestic (and indirectly global) credit creation using the “China” channel, where shadow banking has just slammed shut. Finally recall: it was the epic collapse in America’s own shadow banking liabilities in the aftermath of the Fannie and Freddie, and shortly thereafter, Lehman bankruptcy, which wiped out $8 trillion from the US shadow banking peak, that was the main reason for the Fed’s relentless intervention and attempts to reflate systemic funding since then. If the shadow banking collapse virus has finally jumped to China, there is no saying just how far Chinese GDP can drop if it is now constrained on the top side by surge in bad debt. One thing is certain: Japan’s paltry, in the grand scheme of things, expansion in its own QE will barely be felt if the record Chinese credit creation dynamo is indeed slamming shut.

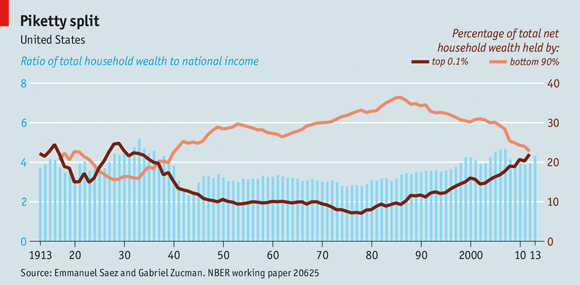

Cameron’s set-up for more policies that enrich the rich.

• UK PM Cameron Warns On Second Global Crash (CNBC)

The global economy is again showing worrying signs of an imminent financial crisis, according to David Cameron, the prime minister of the United Kingdom, who has warned of a dangerous backdrop of instability and uncertainty. Writing in the U.K.’s Guardian newspaper, he said that this weekend’s G-20 summit in Brisbane had further underlined the problems facing the global economy. “Six years on from the financial crash that brought the world to its knees, red warning lights are once again flashing on the dashboard of the global economy,” he said in the article, published late Sunday. Global trade talks have stalled, the eurozone is teetering on the brink of recession and emerging markets are now slowing down, he said.

The spread of Ebola, the conflict in the Middle East and Russia’s “illegal” actions in Ukraine are all adding to the global insecurity, according to Cameron. His words echo those of the Bank of England last week, which said that there were downside risks for the U.K. from weaker euro area activity which could also weigh on exports and be associated with rising market volatility. The U.K. is heavily indebted compared to most of its peers but has been praised by organizations like the IMF for being the fastest growing G-7 economy since the financial crash of 2008. The government – majority-led by the right-of-center Conservative Party – has followed a path of austerity and fiscal restraint since coming to power in 2010, although it has still missed deficit targets during that period.

Criticized at first, the austerity policies have come at the same time as a significant drop in unemployment in the U.K., with the Bank of England now looking to raise interest rates next year. Opposition policymakers argue the country has become unbalanced, with poorer citizens bearing the brunt of the cuts in spending. This thesis gained some backing on Monday with a new report that showed that the poorest groups in U.K. society lost the biggest share of their incomes on average following the benefit and direct tax changes since 2010. The research, by the London School of Economics and the University of Essex, also showed that the changes have not contributed to cutting the deficit and have instead been spent on tax breaks.

No kidding.

• Global Markets ‘Living On Borrowed Time’: Wilbur Ross (CNBC)

Global financial markets are living on borrowed time with geopolitical crises and deflationary risks still a concern, private-equity billionaire Wilbur Ross told CNBC. “I think [markets] are living on borrowed time because investors have no alternatives,” the chairman and chief executive of private equity firm WL Ross & Co told CNBC Europe’s “Squawk Box” on Monday. “Everyone’s scared to death of long-term fixed income because we know rates will be going up, short-term fixed income doesn’t give you any yield, commodities are going no place except down [so] where else can you put money unless you want to buy a $100 million [Alberto] Giacometti sculpture,” he said.

So far, it has been a calm November for global stock markets when compared to the sharp selloff and volatility seen in October on the back of global growth worries. In the last thirty days, for instance, the FTSE100 has gained 7.4% and the S&P 500 and Dow Jones almost 10% – and the Nasdaq over 11% – from the market plunge seen in mid-October. Ross told CNBC earlier in the year that his company had been selling six times as much as it had been buying on the back of attractive stock valuations in the U.S. “We have been a seller on balance, not because we think a terrible crash is coming but we need to sell opportunistically because we tend to have relatively large stakes in relatively thin securities so we have to sell when the markets are very strong.”

” … the IMF and the OECD had calculated the commitments “if fully implemented” would deliver an additional 2.1% to the GDP of G20 economies.” How crazy does that sound to you?

• G20 Final Communique Lists 800 Measures For Economic Growth (Guardian)

G20 leaders have approved a package of 800 measures estimated to increase their economic output by 2.1% by 2018 if fully implemented. At the end of the two-day summit in Brisbane, Australia, leaders representing 85% of the world’s economy also called for “strong and effective action” on climate change, with countries urged to reveal new emissions reduction targets in the first few months of next year. Australia, the host nation, had wanted to keep the summit focused on economic growth rather than climate change, but new commitments by China, the US and Japan helped build momentum for stronger global action to curb greenhouse gases. The host prime minister, Tony Abbott, said the summit had “very substantially delivered” on the goals of Australia’s presidency: boosting growth and employment, enhancing global economic resilience and strengthening global institutions. “We have signed off on a peer-reviewed growth package that, if implemented, will achieve a 2.1% increase in global growth over the next five years, on top of business as usual,” he said.

“This year the G20 has delivered real and practical outcomes. Because of the efforts the G20 has made this year, culminating in the last 48 hours, people right around the world are going to be better off … through the achievement of inclusive growth and jobs.” G20 finance ministers and central bank governors who gathered in Sydney in February agreed to develop policies “to lift our collective GDP [gross domestic product] by more than 2% above the trajectory implied by current policies over the coming five years”. The communique, issued after the leaders’ summit in Brisbane on Sunday said the IMF and the OECD had calculated the commitments “if fully implemented” would deliver an additional 2.1% to the GDP of G20 economies compared with baseline forecasts issued last year. “This will add more than US$2tn to the global economy and create millions of jobs,” the communique said. It said countries would hold one another to account for implementing the commitments spelled out in the Brisbane action plan and comprehensive growth strategies. But the IMF and OECD analysis sounded a note of caution, pointing to “the high degree of uncertainty entailed in quantifying the impact of members’ policies”. G20 members had set out “close to 1,000 individual structural policy commitments, of which more than 800 are new”.

“What’s not clear is whether the long drama that has been the global financial crisis will end happily or with bodies littering the stage.” Excuse me, but that is painfully clear.

• The G20 Small Print: Summits Promise More Than They Deliver (Guardian)

The G20 is going to boost living standards and create better jobs. It has an 800-point action plan that will increase the size of the global economy by more than 2% over the next four years. It is going to step up the fight against climate change, make banks safer, modernise infrastructure, crack down on tax evasion and win the battle against Ebola. Not bad for a weekend in Brisbane. A word of advice: read the small print. Summits invariably promise more than they deliver; commitments made in communiqués are forgotten as soon as leaders have jetted out of the country. A quick look at the document pieced together in Brisbane suggests it is the familiar wishlist of pledges, most of which will not be met. Did the G20 sign up to numerical targets for cutting carbon emissions? No it did not. Did it put extra money on the table for tackling Ebola? No.

Is it expecting the private sector to produce most of the money for infrastructure projects? Yes. Is the action against tax evasion weakened by the failure to make registers of beneficial ownership open to public scrutiny? Most definitely. Is the G20 complacent in thinking that it has fixed the banks? Almost certainly. The G20 is right when it says the global recovery is “slow, uneven and not delivering the jobs needed”. The assessment that the global economy is being held back by a lack of demand is bang also on the money. Few would dispute the conclusion that there are both financial and geopolitical risks out there. It was something of a triumph for Barack Obama to get climate change in the communiqué at all given the opposition of Tony Abbott, the summit’s host. What’s clear is that the world is at a critical juncture. What’s not clear is whether the long drama that has been the global financial crisis will end happily or with bodies littering the stage.

They’re meeting in 10 days. And no-one is going to volunteer to produce less. At current prices, they need to pump full blast.

• Cracks Widen At OPEC As Oil Prices Tumble (CNBC)

Oil prices firmly below $80 a barrel are rattling nerves within OPEC and calls are mounting for concrete action at the group’s crucial next meeting this month. Over the weekend oil-producing countries Kuwait and Iran raised concerns about oil’s worrying lows and what OPEC should be doing to help protect its members’ economies. Kuwait’s cabinet and the country’s Supreme Petroleum Council held an “extraordinary” joint meeting Sunday to consider measures to stop the slide in prices. According the official KUNA news agency, the meeting “discussed the steps that have to be taken on all levels…including having consultations with fellow OPEC member states for maintaining interests of all parties”.

This comes as a surprise considering the country’s earlier statements of confidence in a rebound of prices and that there was no reason to panic Only last week Kuwait’s oil minister stressed that he did not believe there would be a reduction in output by OPEC when its 12 members gather in November 27 in Vienna. Also Sunday Iran’s oil minister criticized countries of trying to justify keeping oil production at the current level – which were set before countries such as Iran were allowed to return to selling oil in the global marketplace. Iran is already tapping its sovereign wealth fund to mitigate the impact of the oil price slump.

Holland, Luxembourg, Ireland, now France. We add one per day.

• Companies Scouring Europe for Best Tax Deals Are Turning to France (Bloomberg)

Move over, Ireland. Companies from Microsoft to China’s Huawei scouring Europe for fiscally attractive shores are turning to an unlikely country: France. As a base for research and development teams, that is. Tax breaks for R&D, €5.6 billion ($7 billion) this year alone, combined with world-class scientists are making France a honey pot for technology companies. As the French parliament debates how to shrink the country’s budget deficit this month some lawmakers are demanding reining in the R&D credits, saying some companies are abusing them. President Francois Hollande has pledged it’s a budget line he won’t touch. “The research tax breaks are decisive — they make France economically more attractive,” said Olivier Piou, who heads Gemalto, an Amsterdam-based developer of security products for bank cards, mobile phones and passports.

The fiscal breaks offset a significant part of Gemalto’s R&D budget, making it more compelling to keep 30% of its 2,000 researchers worldwide in France, Piou said. Ireland’s corporate tax of 12.5%, less than half France’s 33.3%, ensures companies from Google to Apple keep their European headquarters in the Celtic nation. Still, for R&D, global companies are increasingly beefing up their teams in France, transforming the country into a European technology hub, mirroring the U.K.’s dominance in the financial industry and Germany’s manufacturing prowess. Hollande boasted about the “edge” the measure gives France during his nationally televised interview on Nov. 6. “Often we have our handicaps, but here we have an advantage,” he said.

The jobs being created and the technological ecosystem the tax breaks are spawning is just what Hollande needs as he struggles to rekindle growth and reverse record-high joblessness. The measure, introduced in the 1980s, was expanded by former President Nicolas Sarkozy. It is among the few of his predecessor’s policies retained by Hollande. More than 17,000 companies, ranging from biotechnology and energy to software and gaming, are cashing in on the tax advantages and subsidies for innovation this year in France, with an average break of about €323,500. The R&D tax break is France’s second-biggest behind a payroll credit, a measure to spur competitiveness, according to the Budget Ministry. The move, meant to keep the brightest minds and high-value jobs at home, is also prompting foreign companies to set-up laboratories or hire French algorithm whizzes.

This is what Europe needs: fresh blood in politics, new parties, different visions. And truly sovereign countries.

• The Explosive Ascent Of The Podemos Party In Spain (Guardian)

Spain is in a mess, with unemployment at almost 25%, and over half its young people without work, a plight that can damage an individual for life. And in comparison with Britain it has been transformed by immigration at lightning speed: in the early 90s fewer than one in every hundred Spaniards were immigrants; in the noughties, the number surged sixfold, from 924,000 immigrants officially registered in 2000 to 5.6 million in 2009. Yet, despite rampant joblessness, poverty and insecurity, parties that have prioritised clampdowns on immigrants have failed to thrive. Instead, disaffection has found a different expression: a party whose premise is that ordinary Spaniards should not have to pay for a crisis they had nothing to do with.

Podemos is founded on the politics of hope: its English translation is “we can”. It was founded only this year but won 1.2m votes and five seats in May’s European elections. And now it has topped opinion polls, eclipsing the governing rightwing People’s party and the ostensibly centre-left PSOE – the Spanish Socialist Workers’ party. There are few precedents for such an explosive political ascent in modern western Europe; in Spain, a discredited political elite appears to be tottering. Not that Podemos simply materialised out of nowhere. In the buildup to Spain’s 2011 general election, hundreds of thousands of indignados took to the streets in protest at the political elite. Yet without political leadership and direction, such movements – although they can mobilise the disengaged – invariably fizzle out.

As Iñigo Errejón, the Podemos election supremo, has written, before May’s European elections, “social mobilisation had been in retreat. Among large sections of the left the most pessimistic assumptions prevailed.” But Podemos was the child of the indignados movement, a party that emphasises bottom-up democratic participation: where the indignados had neighbourhood assemblies, Podemos has “circles” that take similar forms. There are even circles among Britain’s Spanish diaspora in London and Manchester. The funding for its European campaign was largely crowdsourced, and its policies and priorities are decided partly through online voting.

That winter may yet be awfully hard.

• Ukraine Finances In Jeopardy: IMF (CNBC)

A $17 billion loan may not be enough for Ukraine to manage its finances if the conflict with Russia continues, the International Monetary Fund warned over the weekend. All parties involved in the Crimean crisis must work together, “because it’s very hard to imagine how the finances of Ukraine can be kept under control [otherwise],” the group’s deputy managing director David Lipton told CNBC at the G-20 summit in Brisbane. In April, the group agreed to a $17 billion two-year rescue package for Kiev with the aim of restoring macroeconomic stability. Yet that goal remains far off with the country in the midst of a currency crisis and facing an 8% contraction in GDP this year. The hryvnia plunged to record lows against the U.S. dollar in recent days, slumping nearly 90% in value year-to-date. Meanwhile, the World Bank estimates that economic growth may only return in 2016.

“We are working with Ukraine to try and stabilize their economy, which has become destabilized by what’s happened, including this conflict. This program stabilization really is now under threat from the flaring up of conflict,” said Lipton. “We’ve been presuming that Ukraine and the separatists would make some progress after the ceasefire, [and] that Russia would co-operate with that.” However, signs of co-operation remain to be seen. A ceasefire deal between pro-Russian rebels and government forces in September has been repeatedly violated as both groups accuse each other of launching fresh offensives in eastern Ukraine. At the G-20 summit, Russian president Vladimir Putin said “there was a good chance of resolution” in the eight-month old conflict even as Reuters reported fresh rounds of artillery file in Donetsk over the weekend.

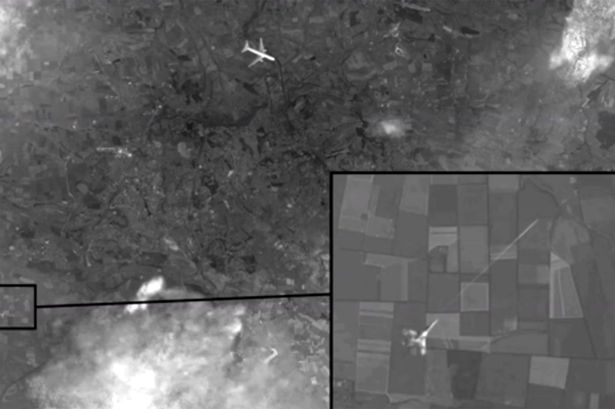

Report immediately ridiculed.

• Russia Claims Satellite Image Shows Moment MH17 Shot Down By Fighter Jet (Mirror)

These sensational new pictures allegedly show Malaysia Airlines flight MH17 being shot down by a fighter jet. The photographs were broadcast tonight by Russian state media as evidence the passenger plane was shot down in July by a Ukrainian warplane and not a ground to air missile as previously believed. It was claimed that the images were produced by a British or US satellite. The “leaked” pictures show a missile streaking towards the MH17 flight which was downed, killing all 298 people on board, it was claimed. TV presenter Mikhail Leontiev claimed the mysterious source who provided the images concluded they showed “how a Mig-29 fighter plane destroys the Boeing passenger plane”.

The West has repeatedly suggested the plane was shot down by pro-Moscow rebels using a Russian-made BUK missile system. Russia has argued an unidentified plane was in vicinity at the time of the crash, and that Ukraine and the West have hushed up this fact. The Kremlin-owned channel’s presenter said: “Today we have all grounds to suppose that a State crime was committed by those who deliberately destroyed the plane. And by those who are cynically hiding it, having the full information.” The extraordinary broadcast came ahead of Western leaders including David Cameron confronting Vladimir Putin over the crash at a summit in Australia. Channel One claimed: “We have at our disposal a sensational shot, supposedly made by foreign satellite spy during the final seconds of MH17 above Ukraine.” The reported disputed a BUK missile as the cause of the tragedy. “To cut it short, it looks like there was no BUK and no launch from the ground. There were dozens professional and thousands of amateur witnesses, and no-one registered it,” claimed Leontiev.

They even threw out a human rights treaty.

• Putin Rebukes Ukraine for Cutting Links With East Regions (Bloomberg)

Russian President Vladimir Putin responded to his isolation at a global summit over his role in fomenting fighting in Ukraine by chastising authorities in Kiev. Putin said his counterpart in Ukraine, Petro Poroshenko, made a “big mistake” by moving to sever banking services and pull out state companies from two breakaway regions. He spoke after Group of 20 leaders berated Russia over the conflict at a summit in Brisbane, Australia. “Why are the authorities in Kiev now cutting off these regions with their own hands?” Putin told reporters. “I do not understand this. Or rather, I understand that they want to save money, but this is not the right occasion and the right time to do this.” Putin, who was told by fellow leaders to stop arming pro-Russian rebels, said he was leaving the G-20 gathering early to get some sleep on the flight home before tomorrow’s meetings. Russia has rejected accusations that it’s supplying manpower and weapons to support the insurgents who have carved out separatist republics in eastern Ukraine.

The government in Kiev is moving to revoke the special status and cut off links with rebel-held areas of the regions of Luhansk and Donetsk after they held elections two weeks ago that Ukraine considers illegitimate. Under a presidential decree issued yesterday, state companies and institutions were ordered to suspend work and evacuate employees with their consent. The central bank must stop Ukrainian lenders from servicing accounts used by individuals and companies in the breakaway areas, according to the document on Poroshenko’s website. “This is a big mistake because in this way they are cutting off these regions with their own hands,” Putin said, adding that he wants to discuss the decision with Poroshenko. “I do not think this a fatal blow though. I hope that life and practice in reality will yet make their adjustments to these plans.”

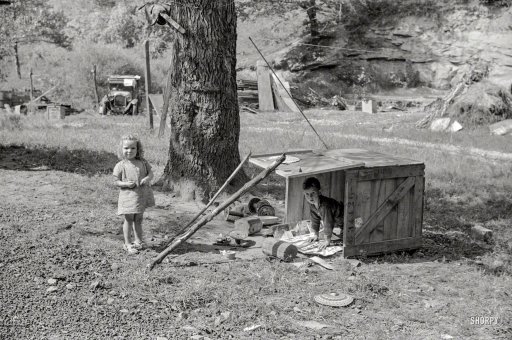

” .. what this place is witnessing is a dust bowl of truly Steinbeckian proportions .. comedians joke that it’s so dry in California these days that the longest lines at Disneyland are for the water fountains – or ponder replacing the bear on the California state flag with a camel.”

• How Almonds Are Sucking California Dry (BBC)

California’s worst drought for more than a century is causing huge problems for farmers, who need a trillion gallons of water per year for their almond orchards alone. But it also leaves homeowners facing difficult choices about what to do with their lawn I have a neighbour, Deborah, and ever since I’ve lived here, her front lawn has been luxuriant and green. But wandering by the other day I did a double take. Mounds of earth were piled up where the grass had once been, and an army of workmen had set about installing succulent plants and ground cover, and the kind of prickly cactus you normally see in children’s cartoons. By the time Deborah had finished explaining why she was doing it, I could hardly believe I hadn’t done the same thing myself. Aside from the satisfaction of knowing you are planting something that is actually meant to grow in these desert-like conditions – as opposed to grass, which sucks up water with the zeal of an inebriate who has stumbled upon the keys to the drinks cabinet – she also stands to save a fortune on her water bill.

She even avoids having to confront a sorry, burned-out apology-for-a-front-lawn every time she leaves the house. Added to which, the city of Los Angeles actually paid her to do it – generously too, by all accounts. And if paying people to rip up their lawns and replace them with drought-tolerant plants strikes you as an odd use of government resources, then all I can say to you is that desperate times call for desperate measures – and these are desperate times. California is now in its third year of drought. The reservoirs are running dry and so too are the ground water supplies. While comedians joke that it’s so dry in California these days that the longest lines at Disneyland are for the water fountains – or ponder replacing the bear on the California state flag with a camel – what this place is witnessing is a dust bowl of truly Steinbeckian proportions. It’s so dry, in fact, that officials were reportedly thinking of adding a fifth level to the current four-tiered drought scale, which currently rates 99% of the state as “abnormally dry”.

Intriguing piece by brilliant philosopher John Gray.

• Are We Really Interested In Saving Time? (John Gray)

A new food substitute has been advertised as time-saving. But when we say we want to save time, is this a lie we tell ourselves to mask other desires, asks John Gray. It might seem an extreme step to give up eating meals in order to save time, but this is how a new food substitute is being promoted. Soylent is a drink made by adding oil and water to a specially prepared powder that the manufacturers claim contains all the nutrients the human body needs. It’s described as creamy and faintly sweet-tasting, and enthusiasts who have given up regular meals to live on the fluid say it’s quite satisfying. With a month’s supply costing around £40, it’s cheaper than ordinary food and if it becomes widely popular will be even cheaper in future. The suggestion is that you can give your body the nourishment it needs without thought or bother, just by knocking back a drink of the fluid two or three times a day. Invented by a 24-year old American software engineer, Soylent is being promoted as a solution to what many people like to think is the bane of their lives – a perpetual shortage of time.

The name of the new food has a curious history. In Soylent Green, an unsettling film that appeared in 1973, the Soylent in question was a green wafer supposedly made from plankton algae. Taking its theme from a novel Make Room! Make Room!, published by the American science fiction writer Harry Harrison in 1966, the film is set in a heavily overpopulated world in which much of humankind lives by consuming the wafer. The action takes place in New York City, by then an overcrowded megalopolis containing 40 million people. The film’s story line tells how a New York City Police Department detective investigating a suspicious death eventually discovers that the wafer on which the world’s population lives is in fact made from human remains. The film ends with the detective, by now a broken-down figure, exclaiming, “Soylent Green is people!”

Human numbers have greatly increased over the past 40 years – from just under four billion when the film was made to well over seven billion now. At the same time concern about overpopulation, which was widespread when the film was made, has become distinctly unfashionable. Nowadays many would view as heresy the idea that there could be too many human beings on the planet, and I’ve not come across any mention of overpopulation in the publicity surrounding the Soylent that’s being marketed today. The new meal replacement isn’t being presented as a remedy for world hunger or an overcrowded planet. It’s an affliction of the well-fed that the liquid food is meant to cure.

Losing the precautionary principle is never a good idea. But we definitely lost it. And it’s very hard to get it back, that probably requires a disaster to happen.

• The Trouble With the Genetically Modified Future (Bloomberg)

Like many people, I’ve long wondered about the safety of genetically modified organisms. They’ve become so ubiquitous that they account for about 80% of the corn grown in the U.S., yet we know almost nothing about what damage might ensue if the transplanted genes spread through global ecosystems. How can so many smart people, including many scientists, be so sure that there’s nothing to worry about? Judging from a new paper by several researchers from New York University, including “The Black Swan” author Nassim Taleb, they can’t and shouldn’t. The researchers focus on the risk of extremely unlikely but potentially devastating events. They argue that there’s no easy way to decide whether such risks are worth taking – it all depends on the nature of the worst-case scenario.

Their approach helps explain why some technologies, such as nuclear energy, should give no cause for alarm, while innovations such as GMOs merit extreme caution. The researchers fully recognize that fear of bad outcomes can lead to paralysis. Any human action, including inaction, entails risk. That said, the downside risks of some actions may be so hard to predict – and so potentially bad – that it is better to be safe than sorry. The benefits, no matter how great, do not merit even a tiny chance of an irreversible, catastrophic outcome. For most actions, there are identifiable limits on what can go wrong. Planning can reduce such risks to acceptable levels. When introducing a new medicine, for example, we can monitor the unintended effects and react if too many people fall ill or die.

Taleb and his colleagues argue that nuclear power is a similar case: Awful as the sudden meltdown of a large reactor might be, physics strongly suggests that it is exceedingly unlikely to have global and catastrophic consequences. Not all risks are so easily defined. In some cases, as Taleb explained in “The Black Swan,” experience and ordinary risk analysis are inadequate to understand the probability or scale of a devastating outcome. GMOs are an excellent example. Despite all precautions, genes from modified organisms inevitably invade natural populations, and from there have the potential to spread uncontrollably through the genetic ecosystem. There is no obvious mechanism to localize the damage.

Overeating is malnutrition too.

• World Is Crossing Malnutrition Red Line (BBC)

Most countries in the world are facing a serious public health problem as a result of malnutrition, a report warns.The Global Nutrition Report said every nation except China had crossed a “malnutrition red line”, suffering from too much or too little nutrition. Globally, malnutrition led to “11% of GDP being squandered as a result of lives lost, less learning, less earning and days lost to illness,” it added. The findings follow on from last year’s Nutrition from Growth summit in London. At the 2013 gathering, 96 signatories made “significant and public commitments to nutrition-related actions” and this report was an assessment of the work that still needed to be done and the progress made. “Malnutrition is an invisible thing, unless it is very extreme,” explained Lawrence Haddad, co-chairman of the independent expert group that compiled the report. “This invisibility stops action happening but it does not stop bad things happening to the children, ” he told BBC News. “It does not stop preventing the children’s brains from developing; it does not stop their immune systems from not developing. “It is a silent crisis and we are trying to raise the awareness of the extent of malnutrition and the damage it does.”

The UN World Food Programme estimates that poor nutrition causes nearly half of deaths in children aged under five – 3.1 million children each year. Dr Haddad, a senior research fellow for the International Food Policy Research Institute, highlighted three areas that the report focused on. “The first thing we did was to say that we were not just going to focus on undernutrition, which is closely related to hunger, but also overnutrition and obesity,” he explained. “Malnutrition just means bad nutrition.” The second thing we did was focus on not just the outcomes, we also focused on the drivers. We looked at underlying factors, such as sanitation, water quality, food security, spending on nutrition and women’s status etc. “The third thing we did was to look at a very specific set of commitments that were made in the 2013 summit that David Cameron hosted in London.”

The expert group’s assessment on global nutrition drew a number of conclusions. “First of all, it is really interesting when you put all the data together you find out that nearly every country in the world has crossed a red line on nutrition in terms of it being a serious public health issue,” Dr Haddad observed. “In fact, the only country that has not is China… [but] they are very close to crossing a red line and that data is four to five years old. He added: “Often you read that it is just a problem that happens in Asia and Africa but, actually, every country in the world is grappling with malnutrition.” “The second big headline is almost half of the countries are grappling with more than one type of malnutrition. About half of the countries in the world are not just grappling with the undernutrition problem but also the overnutrition problem as well. “Countries like the UK dealt with the undernutrition problem, then there was a bit of a respite but then had to start dealing with overnutrition.