Arthur Rothstein Accident on US 40 between Hagerstown and Cumberland, MD 1936

“The wrong people got the capital..”

• “We Are On The Precipice Of A Liquidation In Emerging Markets” (FT)

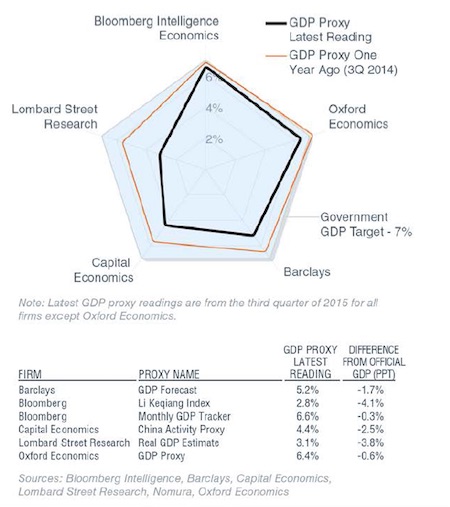

The world economy is locked on a course towards an emerging markets crisis and a renewed slowdown in the US, regardless of the Federal Reserve holding off on a rise in rates last week, according to one of 2015’s most successful hedge fund managers. John Burbank, whose Passport Capital has placed a raft of lucrative bets against commodities and emerging markets this year, forecast that the Fed would eventually be forced into a fourth round of quantitative easing to shore up the economy. In an interview with the Financial Times, Mr Burbank said years of QE had caused a misallocation of capital across the world, while the end of QE last year triggered a dollar rally with consequences that were only now beginning to be realised.

“The wrong people got the capital — emerging markets countries and corporates and a lot of cyclical companies like mining and energy, particularly shale companies — and this is now a major problem for the credit markets,” he said. Passport, based in San Francisco, manages $4.1bn in three main funds. Its $2.1bn Passport Global fund was up 14.6% at the end of August and a smaller, more concentrated “special opportunities” fund was up 30.6%. Both funds are in the top 15 best performers, year to date, according to the industry league table compiled by HSBC. Among Passport’s publicly-declared short positions is Glencore, the commodities trader that has suffered a 55% tumble in its share price this year.

The Fed last week decided against raising US interest rates from their present level of zero. Although one dissident member of its Federal Open Market Committee did vote for a quarter of a point increase, the committee took a cautious stance, warning of “global economic and financial developments” that could restrain US growth.

Read more …

“I don’t think [China] had any idea just how many people there are out there who think their economy is collapsing..”

• Currency Market Braces For Renminbi Weakness (FT)

It is hard to say who was more surprised by China’s devaluation of the renminbi last month — international markets, with no inkling whatsoever it was coming, or Chinese officials, stunned by the resulting reaction overseas. This week, President Xi Jinping’s visit to Washington will at least allow officials from both sides to have it out. The common view outside of the mainland is that China bungled it, rocking asset prices from government bonds to iron ore as well as the currency world with its unexpected promise of a “market-based” regime — a pledge its subsequent heavy intervention implies is dead at least for now. The biggest casualty came last week, however, with the Federal Reserve’s decision to hold, not raise, overnight interest rates following the market turmoil triggered by China’s move to shift exchange rate policy and push the renminbi lower.

For Fed chair Janet Yellen, the move by the People’s Bank of China clearly rankled as she highlighted global concerns, pointedly questioning “the deftness with which [Chinese] policymakers were addressing those concerns”. Hence, what China does next with its currency is critical — to the dollar’s path, market sentiment, the Fed’s rate deliberations and the US economy. Stuart Oakley, managing director, global EM, Nomura, says the renminbi would remain stable for the duration of the state visit. “After that, the chance of another leg of weakness for the [renminbi] rises considerably,” he said. “The PBoC will undoubtedly be very mindful of how its own policy decisions on the [renminbi] will affect the dollar on the broader level. I think they will have no issue with seeing the dollar stronger still from here.”

To China bears, the PBoC’s dramatic 1.9% devaluation of August 11 looked like a desperate attempt to bolster flagging exports by starting a currency war under the figleaf of introducing the sort of market-friendly reform designed to impress the IMF. Another interpretation is that Beijing really was focused on the IMF and winning acceptance for the renminbi as a reserve currency, and misjudged the likely reaction. “I don’t think [China] had any idea just how many people there are out there who think their economy is collapsing,” said Chris Wood at CLSA, the pan-Asia brokerage. He thinks further big moves this year are unlikely as officials continue to focus on moving from an investment-led to a consumer-driven economy. “A big devaluation would be an admission their economic shift had failed,” he added.

Read more …

“The US press is already calling VW the “Lance Armstrong” of the car market..”

• ‘Made In Germany’ Lies In The ‘Gutter’ After Volkswagen Caught Cheating (AEP)

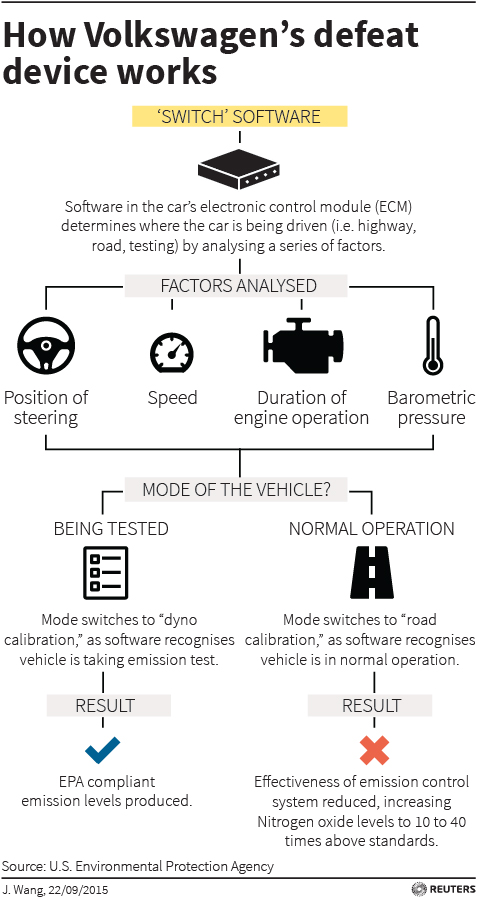

Volkswagen has suffered a shocking loss of credibility after conspiring to violate US pollution laws and dupe customers on a systemic scale. The scandal has once again exposed a culture of corrupt practices at the top of German export industry. “We are facing a blatant abuse of consumer trust and a degradation of the environment,” said Jochen Flasbarth, the German state secretary in charge of pollution enforcement. The scandal is intrinsically worse than the explosion of BP’s Deepwater Horizon drilling rig in the Gulf of Mexico in 2010. While BP and its contractors may have been negligent, VW appears to have engaged in a cynical plan to trick regulators in a wholesale breach of the US Clean Air Act.

“It is profoundly serious. The accusation is that VW deliberately set out to mislead regulators with a cleverly hidden piece of software,” said Max Warburton from AllianceBernstein. It is of an entirely different character from earlier breaches of US law by Hyundai and Ford, which stemmed mostly from errors. The US Justice Department is weighing serious criminal charges. “‘Made in Germany’ in the gutter,” said German newspaper Bundesdeutsche Zeitung. The financial daily Handelsblatt called the deception a “catastrophe for the whole of German industry”, warning that it had completely undermined a joint campaign by Audi, BMW, Mercedes, Bosch and VW to convince Americans that diesel is no longer dirty and is the best way to meet tougher US emission standards.

Germany is the world leader in clean diesel. Its car companies have bet heavily on the technology, hoping to win the strategic prize in the US as new rules come into force imposing fuel efficiency of 54.5 miles per gallon by 2025. “We are worried that the justifiably excellent reputation of the German car industry and in particular that of Volkswagen will suffer,” said Sigmar Gabriel, the country’s vice-chancellor and economy minister. Volkswagen’s own vow to become the “greenest” car producer in the world by 2018 has been exposed as a hollow publicity stunt. Theoretically, the company could face fines of $18bn in the US, based on a standard penalty of $37,500 for each of the 482,000 cars fitted with “defeat devices”, which allowed them to mask exhaust emissions of nitrogen oxide (NOx) in pollution control tests.

The actual release of these toxic particles – blamed for emphysema and respiratory diseases – is in reality 40 times above the acceptable levels imposed by the US Environmental Protection Agency. The cars will be recalled and modified, greatly reducing their fuel efficiency. The US press is already calling VW the “Lance Armstrong” of the car market, an apt allusion to drug cheating in sport, and a deadly epithet in an industry where brand image and goodwill are the lifeblood of sales. VW’s share price crashed 19pc in Frankfurt. The company’s strategic ambition to dominate clean diesel sales in the US lies in ruins. “There is no way to put an optimistic spin on this. The best case for VW is probably still a multi-billion dollar fine, pariah status in the US, and damage to its leading position in diesel,” said Mr Warburton.

Read more …

Don’t hold your breath.

• Volkswagen Said Focus of U.S. Criminal Probe on Emissions (Bloomberg)

The U.S. Justice Department is investigating Volkswagen over its admission that it cheated on federal air pollution tests, according to two U.S. officials familiar with the inquiry. That adds the specter of criminal proceedings to challenges the world’s biggest automaker already faces from regulators, lawmakers and vehicle owners in the three days since it admitted that it had rigged diesel vehicles to pass emissions tests in the lab. The vehicles emitted as much as 40 times the legal limit of pollutants when they were on the road, the Environmental Protection Agency alleges.

The criminal probe, which the officials described on condition of anonymity because it is continuing, will provide an early test of the Justice Department’s newly stated commitment to holding individuals to account for corporate wrongdoing. Earlier this month, the department said companies that want credit for cooperating with investigators must name individuals they allege are responsible for misconduct. The probe is being led by the Justice Department’s Environment and Natural Resources Division, which prosecutes violations of pollution-control laws, according to the officials.

Read more …

Good account.

• It Took More Than a Year of EPA Pressure to Get VW to Admit Fault (NY Times)

Two years ago, the International Council on Clean Transportation, a nonprofit environmental group staffed by a number of former E.P.A. officials, had been testing the real-world performance of so-called clean diesel cars in Europe, and were less than impressed with the emissions results. The group decided it would test diesel-powered cars in the United States, where regulations were much more strict, as a way of almost shaming the European automakers to tighten their compliance. The group fully expected the American cars to do well, and run cleaner than their counterparts across the pond. What they could not have foreseen was that they would stumble onto one of the biggest frauds in recent automotive history.

Further, on the campus of West Virginia University, a group of emissions researchers who mainly dealt with heavy trucks noticed an unusual posting by the transportation council, which was looking for a partner to test diesel-powered cars. “No one had done that before in the U.S.,” said Arvind Thiruvengadam, a professor at the university. “It sounded very interesting, to test light-duty diesel vehicles in real-world conditions. We looked around at each other said, ‘Let’s do it.’ ” The university’s team bid on the project and got the contract. Mr. Thiruvengadam and his colleagues never envisioned where it would lead. “We certainly didn’t have an aim of catching a manufacturer cheating,” he said. “It didn’t even cross our minds.” The study also did not target Volkswagen specifically.

It was something of a fluke, he said, that two out of three diesel vehicles bought for the testing were VWs. It did not take long for suspicions to set in. The West Virginia researchers were well-versed in diesel performance on real roads, and had certain expectations for how the test cars should ebb and flow in their emissions. But the two Volkswagens behaved strangely. “If you’re idling in traffic for three hours in L.A. traffic, we know a car is not in its sweet spot for good emissions results,” Mr. Thiruvengadam said. “But when you’re going at highway speed at 70 miles an hour, everything should really work properly. The emissions should come down. But the Volkswagens didn’t come down.”

Even then, however, it is difficult for most researchers to be sure exactly what is going on. There are so many factors involved in real-world driving — speed, temperature, topography, braking habits. It is not unheard-of for cars to perform much differently in on-the-road tests than one expected. But this time there was a key difference: the California Air Resources Board heard about the groups’ tests and signed on to participate. The regulators tested the same vehicles in their specially equipped lab used to judge cars’ compliance with state emissions standards. That gave the project what most studies lacked: a baseline. “That broke loose everything,” Mr. Thiruvengadam said.

Read more …

But in Europe, Merkel reigns. And she won’t want one of Germany’s largest corporations to go down.

• VW’s Worst Nightmare Is For The Scandal To Spread To Europe (Bloomberg)

Just days after General Motors settled with federal prosecutors for its deadly negligence over faulty ignition switches, Volkswagen has admitted that it cheated for years on U.S. Environmental Protection Agency emissions tests. Having built its brand in the U.S. around diesel technology, VW faces severe damage to its reputation here, along with billions in EPA fines and now a federal criminal investigation. Worse for consumers, there’s no guarantee that the fallout of this scandal will be limited to VW alone. Clearly, shareholders are spooked: No amount of damage to VW’s relatively weak U.S. market position could justify the huge declines in VW’s stock price (near 23% on the day, for a market-value hit of $17.6 billion).

The fear, almost certainly, is that this scandal could end up affecting VW’s European market dominance, which is also highly dependent on diesel sales. Having to bring its entire EU fleet into compliance could cost orders of magnitude more than U.S. market repairs, as well as the firm’s widely-respected chief executive officer, Martin Winterkorn, his job. In the U.S., nearly a half-million vehicles equipped with VW’s 2.0 liter TDI engine have been deemed out of compliance with EPA regulations after the International Council on Clean Transportation, a nonprofit watchdog group, discovered they emitted far more nitrogen oxide in normal driving than in testing environments. Faced with an EPA threat to decertify new diesel models, VW admitted that it had installed a “defeat device” to give artificially low emissions results in Audi A3, VW Jetta, Beetle, Golf and Passat models.

The EPA is raining righteous fury down on Volkswagen, but its record of clamping down on automakers’ malfeasance shows it’s on thin ice here. A 2012 scandal in which Hyundai and Kia goosed the numbers on fuel-efficiency tests provided ample evidence that the agency’s protocol – which allows automakers “broad latitude” to test their own vehicles and involves spot-checks on just 10% to 15% of all models – is an invitation to corner-cutting and outright cheating. Until emissions tests are improved, or a consistent complimentary “real world” testing regime is put into place, regulators will lack the leverage to pressure automakers into admitting who is cheating and who is merely gaming the rules. Nor will the agency know if the common discrepancies between test and real-world results reflect shortcomings in the test procedure itself.

Read more …

Seems inevitable. But political pressure will be severe.

• VW Emissions Scandal Could Snare Other Firms, Whistleblower Claims (Guardian)

The emissions-fixing scandal that has engulfed Volkswagen in the US could extend to other companies and countries, one of the officials involved in uncovering the alleged behaviour has told the Guardian. Billions of pounds have been wiped off the value of global carmakers amid growing concerns that emissions tests may have been rigged across the industry. “We need to ask the question, is this happening in other countries and is this happening at other manufacturers? Some part of our reaction is not even understanding what has happened exactly,” said John German, one of the two co-leads on the US team of the International Council for Clean Transportation (ICCT), the European-based NGO that raised the alarm.

Shares in Volkswagen fell by almost a fifth after the world’s second biggest carmaker issued a public apology in response to US allegations that it used a defeat device to falsify emissions data. South Korea said on Tuesday it would investigate emissions of VW Jetta and Gold models and Audi A3 cars produced in 2014 and 2015. If problems are found, South Korea’s environment ministry said its probe could be expanded to all German diesel imports, which have surged in popularity in recent years in a market long dominated by local producers led by Hyundai. US Congress confirmed it is investigating the scandal on Monday. House energy and commerce committee chairman Fred Upton and oversight and investigations subcommittee chairman Tim Murphy announced that the Oversight and Investigations Subcommittee will hold a hearing.

The US Justice Department is conducting a criminal investigation of Volkswagen admission, according to Bloomberg, which cited two officials familiar with the inquiry. The company could face a fine of up to $18bn, criminal charges for its executives, and legal action from customers and shareholders. The US law firm Hagens Berman has already launched a class-action law suit on behalf of customers who bought the affected cars. VW shares fell by 19% in Frankfurt, wiping almost €15bn off its value. Shares in Renault, Volkswagen’s French rival, also dropped by 4%, while Peugeot was down 2.5%, Nissan 2.5% and BMW 1.5% amid concerns they could be caught up in investigations.

The US Environmental Protection Agency (EPA) said on Friday that VW had installed illegal software to cheat emission tests, allowing its diesel cars to produce up to 40 times more pollution than allowed. The US government ordered VW to recall 482,000 VW and Audi cars produced since 2009. In response, Martin Winterkorn, chief executive of VW, said on Sunday he was “deeply sorry” for breaking the trust of the public and ordered an external investigation. German tipped off regulators at the California Air Resources Board (Carb) and the EPA after conducting tests that showed major discrepancies in the amount of toxic emissions some VW cars were pumping out compared with the legal limits. Max Warburton, an analyst at the financial research group Bernstein, said: “There is no way to put an optimistic spin on this – this is really serious.”

Read more …

The biggest challenge may come from investors, car owners and environmental groups.

• VW Faces More Legal Fallout From Cheating – This Time at Home (Bloomberg)

Volkswagen’s legal problems started in the U.S., but the world’s biggest carmaker is finding the fallout over its cheating on U.S. environmental tests and declining share price is extending to its home market. The German company’s shares lost nearly a quarter of their value Monday in Frankfurt, and financial regulator Bafin is looking at possible violations of German rules. VW also faces legal threats from investors and environmental groups. “Like in comparable cases, with strong share movements we look at the VW stock as to insider trading, market manipulation, and ad-hoc disclosure rules,” Bafin spokeswoman Anja Schuchhardt said in an e-mail. “But this is a matter of routine.”

The Wolfsburg, Germany-based company admitted to fitting its U.S. diesel vehicles with software that turns on full pollution controls only when the car is undergoing official emissions testing, the Environmental Protection Agency said Friday. With 482,000 autos part of the case, the U.S. fine could total more than $18 billion. During normal driving, the cars with the software – known as a “defeat device” – would pollute 10 times to 40 times the legal limits, the EPA estimated. The discrepancy emerged after the International Council on Clean Transportation commissioned real-world emissions tests of diesel vehicles including a Jetta and Passat, then compared them to lab results. VW halted sales of the models involved on Sunday and said it’s cooperating with the probe and ordered its own external investigation.

Chief Executive Officer Martin Winterkorn, who has led the company since 2007, said he was “deeply sorry” for breaking the public’s trust and that VW would do “everything necessary in order to reverse the damage this has caused.” Andreas Tilp, a lawyer representing investors in German court, says VW may have to pay damages to stockholders in Germany if the allegations of U.S. authorities are upheld. Investors may seek to recover losses incurred because of the stock’s decline. “We’re convinced that VW failed to properly inform the markets and is liable to investors who can seek billions,” Tilp said. “Concealing for years the immense risks of the pollution manipulation and the U.S. probes is a violation of capital market rules.”

Environmental group Deutsche Umwelthilfe said it will sue carmakers to have diesel vehicles removed from the streets starting 2016. It will also take legal action to have Germany’s Federal Motor Transport Authority revoke licenses for the vehicles. While rules on emissions are similar in the U.S. and Germany, the Federal Motor Transport Authority isn’t properly controlling its implementation, Juergen Resch, DUH’s director, said in an e-mailed statement. The German agency isn’t controlling pollution, and should use recalls in case of violations of environmental rules, Resch said.

Read more …

It’s lonely at the top.

• Volkswagen: The Curse Of The World’s Biggest Carmaker (Forbes)

GM ruled as the No. 1 seller for decades before the problems that led to its 2009 bankruptcy and federal bailout. But those issues caused GM to lose the title in 2008 to Toyota, which spent that decade on a deliberate expansion plan. Once it got to the top, however, Toyota found itself awash in an existential safety crisis that its chief executive, Akio Toyoda, blamed in part on Toyota’s quest to build a global manufacturing empire. Now comes VW, which has been on its own worldwide march over the past five years. It was not aiming to achieve dominance of the car market before 2018, only to find itself taking the top spot this past year, due to its manufacturing growth, especially in China.

Veteran auto industry executives know not to gloat when a car company runs into difficulty. They understand that any carmaker can have “its turn in the barrel,” as the saying goes. The industry has seen what happens when a Japanese company gets in trouble with American regulators, and what transpires when an American company encounters its own scandal. Now, as with Volkswagen’s reign at the top of the industry, the automobile world will see how it handles its emissions case. The one saving grace for VW is that unlike GM or Toyota, the emissions situation did not result in fiery crashes or devastation for the families of accident victims.

It’s primarily a technology issue, on a specific type of vehicle, and in far smaller numbers than affected GM and Toyota. So, it’s possible that recalls can be handled faster, and VW can get the issue behind it more quickly. Nonetheless, it will likely be a huge challengefor Winterkorn,who could face skepticism that he should continue to lead VW, according to at least one analyst. At a time when his company otherwise could have reveled in its industry dominance, VW should expect scrutiny from Congress, legal problems, a potential multibillion-dollar fine and a batch of uncomfortable headlines. GM and Toyota know what that’s like.

Read more …

Greece as a country has been set up. As I wrote on July 19: Was Greece Set Up To Fail?

• Alexis Tsipras Has Been Set Up To Fail (Yanis Varoufakis)

Alexis Tsipras has snatched resounding victory from the jaws of July’s humiliating surrender to the troika of Greece’s lenders. Defying opposition parties, opinion pollsters and critics within his ranks (including this writer), he held on to government with a reduced, albeit workable, majority. The question is whether he can combine remaining in office with being in power. The greatest losers were smaller parties occupying the extremes of the debate following the referendum. Popular Unity failed stunningly to exploit the grief felt by a majority of “No” voters following Tsipras’s U-turn in favour of a deal that curtailed national sovereignty further and boosted already vicious levels of austerity. Potami, a party positioning itself as the troika’s reformist darling, also failed to rally the smaller “Yes” vote.

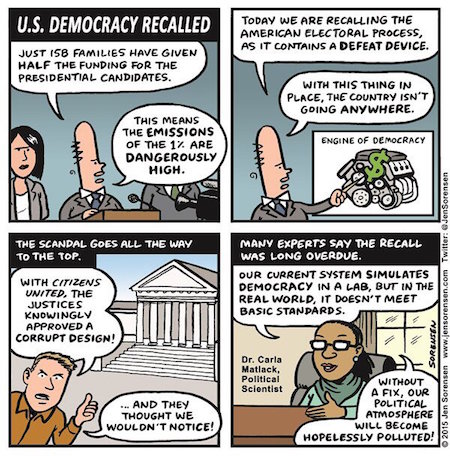

With the all-conquering Tsipras now firmly on board with the troika’s programme, new-fangled, pro-troika parties had nothing to offer. The greatest winner is the troika itself. During the past five years, troika-authored bills made it through parliament on ultra-slim majorities, giving their authors sleepless nights. Now, the bills necessary to prop up the third bailout will pass with comfortable majorities, as Syriza is committed to them. Almost every opposition MP (with the exception of the communists of KKE and the Nazis of Golden Dawn) is also on board. Of course, to get to this point Greek democracy has had to be deeply wounded (1.6 million Greeks who voted in the July referendum did not bother to turn up at the polling stations on Sunday) – no great loss to bureaucrats in Brussels, Frankfurt and Washington DC for whom democracy appears, in any case, to be a nuisance.

Tsipras must now implement a fiscal consolidation and reform programme that was designed to fail. Illiquid small businesses, with no access to capital markets, have to now pre-pay next year’s tax on their projected 2016 profits. Households will need to fork out outrageous property taxes on non-performing apartments and shops, which they can’t even sell. VAT rate hikes will boost VAT evasion. Week in week out, the troika will be demanding more recessionary, antisocial policies: pension cuts, lower child benefits, more foreclosures.

Read more …

“Greece would return to economic growth if it complied with economic reforms, the European Commission said…” Only in fairy tales can economies grow in which people are forced to reduce spending.

• Greece’s New Government ‘Doomed To Fail’ Over Flawed Bail-Out (Telegraph)

Investors cheered the return of Alexis Tsipras as Greece’s new prime minister despite concerns that the new government was doomed to fail in its bid to keep the country in the eurozone. Greece’s 10-year bond yields, a key indicator of default risk, dropped to a yearly low of 8.09pc, as markets bet that political continuity would ease the implementation of the country’s draconian third bail-out programme. Economists, however, warned that the left-wing Syriza party – who lost only four seats in Sunday’s general election – would struggle to jump through the hoops of an €86bn bail-out programme. Athens faces a punishing schedule over the next few months, where it will be required to pass 60 “prior action” laws through parliament by the end of the year. These include hiking taxes on food, hotels and baked goods.

Bail-out monitors will carry out their first review of the government’s progress in October. The reforms are unlikely to be blocked in the majority pro-euro parliament, but Mr Tsipras, who was sworn into office on Monday, still faces a sizeable majority of disgruntled MPs in his own party Failure to make satisfactory progress is set to hinder the prime minister’s battle for much-needed debt relief for the ravaged economy. “Mr Tsipras is unlikely to lie down and accept every new measure forced upon Greece by its creditors and the eurozone’s ‘institutions’,” said Jonathan Loynes, at Capital Economics. “The days of extended negotiations at late-night Brussels summits are not necessarily over,” he added. Despite being plunged into recession, Greece would return to economic growth if it complied with economic reforms, the European Commission said.

GDP is set to contract by more than 2pc this year.] “The underlying growth potential is still there,” said EU vice-president Valdis Dombrovskis. “If the reforms agreed in the new ESM programme are properly implemented, Greece can grow again quite quickly.” But cracks were already beginning to emerge between the new government and Brussels. European parliament president Martin Schulz welcomed Mr Tsipras’s reappointment but questioned the premier’s “bizarre” decision to continue his coalition with the anti-bail-out Independent Greeks (Anel). “I called [Tsipras] a second time to ask him why he was continuing a coalition with this strange, far-right party,” Mr Schulz told French radio on Monday. “He pretty much didn’t answer. He is very clever, especially by telephone. He told me things that seemed convincing, but which ultimately in my eyes are a little bizarre.”

Read more …

He’s had 10 months to do that. Why would it work now?

• Greece’s Tsipras To Demand EU Action On Refugees (Reuters)

As an icon for many on Europe’s left, Greece’s newly elected prime minister, Alexis Tsipras, can be expected to rattle the cages of the continent’s elite whenever he can. After Sunday’s solid re-election, he may start with the migrant crisis, which he believes is emblematic of the European Union’s failure to stick with its founding principles of unity. “When the Mediterranean turns into a watery grave, and the Aegean Sea is washing dead children up on its shores, the very concept of a united Europe is in crisis, as is European culture,” he told a campaign rally last week. European unity, Tsipras reckons, was also sorely lacking when the EU began imposing harsh austerity on his country when it needed to be bailed out over debt.

But not unlike in the debt crisis, Tsipras must balance his outrage at what he sees as the European Union’s failure to respond to the migrants with a need for its help in meeting the cost to frontline Greece. And as over debt, the criticism goes both ways. Most of the refugees who make their way to Europe arrive via Greece, which transports them from its islands to the mainland, from where they trek north via the Balkans. Croatia said on Monday it would demand Greece stop moving the migrants on. Athens received €33 million in EU aid earlier this month to help cope with the migrants. But Nicos Christodoulakis, caretaker economy minister during the election campaign, said a lack of preparation meant Greece was missing out on up to €400 million in EU aid for the crisis.

Tsipras’ first international meeting after re-election will be a Wednesday discussion in Brussels with his EU counterparts about the hundreds of thousands of refugees and migrants pouring into Europe, many via Greek islands that border Turkey. Officials from his leftist Syriza party say he will ally again with other EU countries bordering the Mediterranean such as Italy and demand that the bloc shares the burden of dealing with hundreds of thousands of refugees. “Member states (must) take and share the responsibility, that’s where the rupture is,” a senior Syriza official said.

Read more …

Will this be the straw that breaks the Union’s back?

• Eastern European Leaders Defy EU Effort To Set Refugee Quotas (Guardian)

Central and eastern European leaders have defied attempts by Brussels and Berlin to impose refugee quotas ahead of two days of high-stakes summits in Brussels to try to decide on what already looks like a vain attempt to limit the flow of refugees and migrants into Europe. After months of being consistently behind the curve in grappling with the EU’s huge migration crisis, interior ministers will meet on Tuesday to focus on the highly divisive issue of mandatory quotas to share refugees across the union. There will then be an emergency summit of leaders on Wednesday. Jean Asselborn, Luxembourg’s foreign minister, who is chairing Tuesday’s meeting, failed to reach a breakthrough in Prague on Monday with his counterparts from the Czech Republic, Poland, Slovakia, Hungary and Latvia.

The Czech government wrote to Brussels arguing that compulsory quotas were illegal and that it could take the issue to the European court of justice in Luxembourg, while the anti-immigration Hungarian government brought in new laws authorising the army to use non-lethal force against refugees massing on its borders. “There are still a few problems to solve,” said Asselborn. “We still have 20 hours.” “The terrain is still very uncertain,” said a senior source from Luxembourg. “We don’t yet have agreement. It’s going to be very, very difficult.” This week’s fresh attempt to agree on a quota system comes amid the deepest divisions between western and eastern Europe since the former Soviet-bloc countries joined the EU a decade ago.

At issue is the paltry figure of 66,000 refugees being shared across the EU after being moved from Italy and Greece. They have already agreed to share 40,000 and were to redistribute a further 120,000. But 54,000 of those were from Hungary, which passed a law on Monday allowing the army to use non-lethal force on migrants and whose hardline government wants no part of the scheme. Given that up to a million people are expected to enter Germany alone this year and that Frontex, the EU’s border agency, says 500,000 are currently preparing to leave Turkey for the EU, the figures being fought over in Brussels are risible.

But the numbers are not the real issue. The row is about power and sovereignty. In the end it seems that all countries will join in sharing refugees, with the exception of Britain, which has opted out of the scheme. The other two countries with opt-outs – Ireland and Denmark – have agreed to take part, leaving the UK isolated.

Read more …

Oh, wait, there’s always backpaddling…

• EU Set To Water Down Refugee Relocation Plan (AFP)

EU ministers are considering a watered down plan to relocate 120,000 refugees throughout the bloc, which drops binding quotas and leaves Hungary out of the scheme, sources said Monday. The softer stance emerged on the eve of a new emergency meeting in Brussels of the 28 EU interior ministers, who last week failed to agree on a European Commission plan for compulsory quotas for refugees fleeing war in Syria, Afghanistan and elsewhere. “Whether voluntary or mandatory, that is an artificial debate,” a source from Luxembourg, which holds the rotating EU presidency, told reporters, despite Commission officials insisting that they still want compulsory quotas. Another Luxembourg source said the word “mandatory” will not appear in the draft document that will go before the ministers when they meet Tuesday afternoon to discuss how many refugees each country will take.

Hopes of a unanimous deal last week collapsed in the face of opposition from Hungary, the Czech Republic, Slovakia and Romania, officials said. With populist parties exploiting anti-immigrant sentiment, many eastern countries argued that a Europe-wide relocation plan made little sense for refugees who preferred to settle in wealthier northern European nations. The original plan envisaged quotas for the relocation to other EU states of 54,000 asylum seekers from Hungary, 50,400 from Greece and 15,600 from Italy. But Hungarian Prime Minister Viktor Orban has insisted that by being included in the plan, his country would be erroneously confirmed as a frontline state for refugee arrivals. He insists that many of the migrants are coming from Greece and should have been registered there first and kept there under EU rules.

“It is established that Hungary will not appear in the draft as a beneficiary country,” a Luxembourg source told AFP. “However, it will have to join the solidarity” by hosting refugees from Greece and Italy, the source added. The figure of 120,000 to be relocated will remain in the draft, but it is not immediately clear which countries will now benefit from the relocation of the 54,000 asylum seekers that were originally earmarked in Hungary, sources said. One proposal is for Italy and Greece to benefit, while a second is for other countries along the Western Balkans route, such as Croatia and Slovenia, to be given relief. Despite failing to reach a deal on the larger figure, the EU ministers last week formally approved a plan first aired in May to relocate 40,000 refugees from Greece and Italy.

Read more …

Obama’s new headache.

• Putin’s Plan: Moscow Handles Syria, US Looks After Iraq (AlArabiya)

At the end of this month, New York will be see several initiatives, talks, understandings, and deals come together under two main themes: terrorism and immigration. Both issues in the minds of world leaders are closely linked to Syria and other crises in the Arab world. U.S. President Barack Obama called for a world summit on terrorism, with ISIS first and foremost in his mind. And Russian President Vladimir Putin tasked his foreign minister Sergei Lavrov to chair a ministerial session of the U.N. Security Council titled “Maintenance of International Peace and Security: Settlement of Conflicts in the Middle East and North Africa and Countering the Terrorist Threat in the Region.” The common denominator between the U.S. and Russian priorities today is reducing the Syrian issue to a terrorism issue.

President Putin has effectively declared to the world that Russia intends to fight a war directly against ISIS and similar groups in Syria, while keeping the Syrian regime as a key ally in this war. Russia wants the United States to be a military partner – including of the Syrian regime – in this bid. Putin wants to meet with Obama on the sidelines of the 70th session of the General Assembly of the United Nations. Obama is now considering whether the meeting will serve one of the key goals behind the Russian leader’s movements in Syria, namely, diverting attention away from Ukraine. The U.S. president is also considering whether he really wants to be drawn into the Syrian crisis, which he has avoided for years. He might therefore bless Russia’s involvement in the Syrian war against ISIS, as long as Putin does not ask the US to officially bless the alliance with the Assad regime.

It is worth quickly examining what Vitaly Churkin, Russia’s shrewd envoy to the U.N., told the U.S. network CBS about the Russian strategy. He said: “I think this is one thing we share now with the United States, with the U.S. government: They don’t want the Assad government to fall. They don’t want it to fall. They want to fight (ISIS) in a way which is not going to harm the Syrian government.” He added: “On the other hand, they don’t want the Syrian government to take advantage of their campaign against [ISIS]. But they don’t want to harm the Syrian government by their action. This is very complex.” It is not clear whether what Churkin is saying is based on assumptions or whether it is a fact that the U.S. government does not acknowledge publicly. If this is just a Russian interpretation of U.S. policy, then it is part of its strategy to sell its pitch because it assumes that Washington will not demur.

Read more …

Long lost.

• Are Financial Markets Losing Faith In The Fed? (CNBC)

When the U.S. Federal Reserve kept rates on hold on Thursday, the central bank explained it made the decision because of the unstable global outlook. However, some investors have criticized the move, warning that the world could soon lose faith in the Fed. “They (Fed) should not base a rate decision on market volatility, because if you do that, then nobody is going to predict what you’re going to do,” David Kelly, chief global strategist at JPMorgan Funds, told CNBC Monday. “Not only does this now put into doubt when the first rate hike will be, but it means when they begin to raise rates, we don’t know if something could happen in overseas markets and suddenly they stop raising rates.”

In last Thursday’s statement, the central bank pointed to concerns over “global economic and financial developments” as reasons to delay a rate hike, but now investors worry whether this is the right decision and whether this would greatly influence the U.S. economy. St. Louis Fed president, James Bullard, echoed this Monday, telling CNBC it is “inappropriate” for the U.S. central bank to react to financial market turmoil, and focus more on growth and labor markets. Bullard added that to avoid a “1994 scenario”, the Fed should “go early, go gradually”, giving them flexibility to react to future problems that occur. If the U.S. central bank publicizes its concerns over financial markets, markets will in turn become more uncertain over when the Fed will hike, Kelly added.

“Markets hate uncertainty and what the Federal Reserve managed to do is add a huge serving of uncertainty to markets,” Kelly argues, adding that before the Fed had a clear criteria as to what should trigger a first hike and how to maintain, but now talk about China, volatility and commodities adds a whole host of uncertainty for markets. By keeping rates so low, the Federal Reserve is actually helping subdue the U.S. economy, Kelly adds, saying that instead of speeding up economic growth, the central bank is afraid over fears that the economy could be too weak. “If they are going to get derailed by any move in market volatility, then it just makes it more and more cloudy. That is not good for financial markets.”

Read more …

“The Federal Reserve itself is the victim du jour of its own grandiose fatuous fecklessness, in particular the idea that it could play a national economy like a three-button flugelhorn.”

• Fed Cred Dead (Jim Kunstler)

Last week was the watershed for central banking and for the illusion that the current disposition of things has a future. The Federal Reserve blinked on its long-touted Fed funds interest rate hike and chairperson Janet Yellen was left standing naked in the hot glare of her own carbonizing credibility, a pitiful larval creature, still maundering about “the data,” and “the median growth projection,” and other previously-owned figments spun out of the great PhD wonk machine in the Eccles Building. The Federal Reserve itself is the victim du jour of its own grandiose fatuous fecklessness, in particular the idea that it could play a national economy like a three-button flugelhorn.

What seemed like a good idea at the time when Alan Greenspan and then Ben Bernanke stepped into the pilot house now just looks like the fraud of frauds: enabling corporations to borrow ever more money from the future to pretend that their balance sheets are sound. That scam has nowhere left to go, except into the black hole that has been waiting for it. All the Fed really has left is to destroy the value of the dollar (to save it! Just like Vietnam!). This ought to be an interesting week in the financial markets as the players have had a long, anxious weekend to absorb the death of Fed cred. And October, too. Expect dramatic re-pricing. Sometime a few months down the line, financial markets will present a “relief rally.” Don’t get suckered on that one.

Meanwhile, what remains on the other head of this two-headed economy besides driving to-and-from the Walmart? Pornography? The tattoo industry? Meth and narcotics? Prostitution? Professional sports on the flat screen? Kim and Kanye? Grand theft auto? Do you really think Donald Trump can fix this?

Read more …

This may be quite the event this weekend. More Merkel headaches.

• Catalans Threaten Not To Pay Public Debt If Spain Refuses Secession Deal (SP)

The First Minister of Catalonia, Artur Mas, decried the comments made by the Governor of the Bank of Spain, Luis María Linde, earlier in the day as “immoral, irresponsible and indecent” and warned an independent Catalonia might not pay its share of the public debt if Spain refused to do a deal. Mr. Mas, echoing what other Junts Pel Sí candidates had said over the weekend, said the central government was promoting a pre-electoral climate of fear to pressure Catalans before the vote on Sunday: “It won’t work, we won’t swallow it”. “The stakes are high for Spain”, he said, according to a report in El País: “Imagine there is no agreement on Spanish public debt. How would the state face its debt if there is no agreement for Catalonia to assume its part?”

On Monday morning, the governor of the Bank of Spain, Luis María Linde, had said during a breakfast meeting in Madrid that capital controls in a newly independent Catalonia were a possibility, although he said his remarks were made in reference to a “highly unlikely future scenario”, according to a report in Europa Press. He also confirmed what others had said before him—including Angela Merkel, David Cameron and European Commission chief spokesman Margaritis Schinas—about a newly independent Catalonia immediately being left out of the European Union. “There are people who have power and don’t want to lose out”, said Mr. Mas in reference to Mr. Linde: “Today we have another example, the governor of the Bank of Spain. People at the service of the state who don’t want to lose power”.

“It is irresponsible and indecent”, said the First Minister: “to threaten things that no democratic country would dare to insinuate”. On Friday evening, after the close of business, Spain’s leading banks issued a statement via the Spanish Banking Association (AEB) warning of the risks of secession to financial security and the banks’ own continued presence in Catalonia should an attempt at secession be made. The governor of the Bank of Spain said on Monday that the banks’ statement “said very obvious things” and that the secession of Catalonia would create “insecurity, uncertainty and tension”.

Read more …

” If interest rates return to a historical average of 6%, [London] is finished. It will just go boom.”

• Joris Luyendijk: ‘Bankers Are The Best Paid Victims’ (Standard)

When Joris Luyendijk was interviewing bankers, many clearly felt his deepest desire was to be them. “It’s cult-like,” he says of the City. “The macho, master of the universe type has bought into this idea so deeply: ‘I may be working 80 hours a week, I don’t see my family, and my body looks 10 years older than it is, but I am living the life. Everybody wants to be me.’” And as in a cult, insiders were afraid to speak out, fearing expulsion. Whenever he was talking to a financier in a coffee shop and a colleague walked in, they would morph into a “shivering wreck”: “How much of a master of the universe are you if you’re afraid to give your views to a fellow citizen?” Yet many still spoke to him. “I wondered why they would risk their jobs. Some said: ‘I am terrified about what my bank can do to society, and how it is being run’.”

Luyendijk, a 43-year-old investigative journalist, used to cover the Middle East — “interviewing real terrorists not financial terrorists”. But then he started talking to banking employees about the 2008 financial meltdown. The conversations became a Guardian blog and now a book, Swimming With Sharks. It has been so successful in his native Netherlands that he jokingly calls it “Fifty Shades of Joris”. He wants the book to help others see past the obfuscation of the City: “It’s a fundamental misunderstanding that we’re too stupid to understand the problems of finance. A seven-year-old understands perverse incentives. Tell them: ‘Half the class doesn’t do their homework, half does and they all get the same grade; what will happen?’ That’s the bank.”

His view of the future is frightening. “We’ll continue to have ever bigger crashes, until we can no longer save the system. And then we will do what we could do now: rebuild it.” He feels little has changed in banking in the seven years since the crash. “The old mindset is intact: ‘If it’s legal, we’ll do it, and our well-paid lobbyists will ensure it’s legal’. You have these financial empires: too vast, too complex, too toxic to manage. Something happens and they blow up like nuclear reactors.” He has two major predictions. The first is that the next crisis could be caused by terrorists hijacking banking IT systems. “They’re so vulnerable. Because banks were merging and acquiring like crazy, they glued systems together. Imagine if a bank says we can no longer access our data and companies can no longer get their money.”

The second is that the London housing bubble will burst. “It’s a when and not an if. If interest rates return to a historical average of 6%, this city is finished. It will just go boom. Everybody knows this, just as all the [analysts] knew the subprime market in America would explode. It’s just really attractive for George Osborne to reinflate the bubble, so all the home-owning voters are happy.” On the 2008 crisis, Luyendijk argues it wasn’t a failure of capitalism: it showed finance wasn’t really capitalist at all. “I go to the heart of capitalism and I find…” he pauses for effect. “Socialism. Because in most niches, four or five banks control the market, divide it up among themselves and they can’t go bust. Rather than going on about greed, we should make sure there are free market forces in finance again.”

Read more …

Another notch in our belts.

• Sumatran Rhinos Likely To Become Extinct (Guardian)

Earth’s last remaining Sumatran rhinos are edging perilously close to extinction, according to one of the world’s top conservation bodies. There are fewer than 100 of the animals left in the rainforests of the Indonesian island of Sumatra and the Kalimantan province of Borneo. The last Sumatran rhino (Dicerorhinus sumatrensis) in Malaysia was spotted two years ago in the Sabah region of Borneo but experts last month declared the species extinct in that country. That has prompted the International Union for the Conservation of Nature to sound the alarm over the species’ fate, which it said is headed for extinction if urgent action is not taken.

“It takes the rhino down to a single country,” said Simon Stuart, chair of the IUCN’s species survival commission. “With the ongoing poaching crisis, escalating population decline and destruction of suitable habitat, extinction of the Sumatran rhino in the near future is becoming increasingly likely.” The rhino is the smallest of the three Asian rhino species – there are also just 57 Javan rhinos (Rhinoceros sondaicus) and more than 3,000 Indian rhinos (Rhinoceros unicornis). The population of the Sumatran species is believed to have halved in the last decade. The last official assessment in 2008 put their number at about 250 but Stuart said, with hindsight, the true number then had probably been about 200.

Poachers kill the rhinos for their horn, which is even more valuable than that of African rhinos. “For hundreds of years, we’ve been unable to stem the decline of this species. That’s due to poaching. It’s due to the fact they get to such a low density the animals don’t find each other and they don’t breed. It’s due to the fact that if the females don’t breed regularly, they develop these tumours in their reproductive tract that render them infertile,” he said. A large number of females in the wild were likely infertile because they do not breed often enough, he said. The only Sumatran rhino in the western hemisphere, a male called Harapan, is due to be flown from Cincinnati Zoo in the US to a rhino sanctuary in Sumatra this autumn to help the species breed. There are only nine of the animals in captivity worldwide.

Read more …