NPC Robey Motor Co., 1429 L Street, Washington, DC 1926

More accusations fly across the media, like so many flocks of Canada geese, of direct Russian involvement in Ukraine. Much is made of an interview with Donetsk National Republic leader Alexander Zakharchenko, in which he “admits” there are Russian volunteers fighting on his side.

To the west, that’s all the proof they need. There are 1000 Russians in Ukraine, cries NATO. That doesn’t make them the Russian army though. If there are only 1000, that would be disappointing. These are people who are seeing their family just across the border shot to bits.

That Zakharchenko also said there were French and other nationals fighting on the same side is not deemed worth reporting. Just like not much has been made of the many thousands of German, British, French, Belgian, Dutch, Canadian and American nationals fighting in Syria and Iraq, mostly on the side of the IS. Other than the British guy in the beheading video, and the US citizen who got killed.

So the Commerce Department really just raised its Q2 US GDP estimate to 4.2%, one day after the CBO lowered its 2014 estimate to 1.5%? Oh my. What’s next?

I’m still thinking that even if Russia were involved in Ukraine, why would that make Putin a devil? After all, we know where the Ukraine army gets its financing from, and it too has many – foreign – mercenaries on its payroll.

Does anyone still think Putin is going to call uncle on this one? You should have been reading the Automatic Earth over the past year. He won’t, and he can’t.

Can we truly deny Russia, and Russian family members of east Ukrainian Russian-speaking people, the right to help out their people when they’re attacked by bombers and swastikas, while they have exactly zero planes themselevs? On what basis exactly? And what gives Kiev the right to bomb its own citizens?

But let’s not get into that again today. In the slipstream of the talks this weekend in Minsk between Putin and Poroshenko, a precious little detail seems to have escaped the western press entirely. But I think all our fine journalists will soon have to address it.

You may remember that in an earlier phase of the dispute between Ukraine and Russia (not to be confused with the Kiev vs rebels fight), no agreement was reached on the payment of a $4.5 billion gas bill that Russian Gazprom said was overdue from Ukraine’s Naftogaz. And Gazprom demanded pre-payment for any future gas deliveries to Ukraine.

Kiev, instead of paying the bill, claimed Russia had overcharged it for the already delivered gas, by $6 billion, going back to 2010. And brought its argument before the Arbitration Institute of the Stockholm Chamber of Commerce.

Now maybe, just maybe, someone in the Kiev camp should have paused right before that moment, and consulted with their western backers in Brussels and Washington. Perhaps not so much Washington, but Brussels for sure, and Berlin. And Athens. Rome. Prague. Warsaw.

You see, a pending case before the Arbitration Institute of the Stockholm Chamber of Commerce can apparently take 12-15 months to resolve. And perhaps Europe doesn’t have that much time. Which is what Putin hinted at at a press-op he did after the weekend Minsk talks. What it comes down is that even if Russia wanted to accommodate Ukraine, it can’t. On strictly legal terms, nothing political.

What’s more, Gazprom had already paid Naftogaz in advance for the use of Ukraine pipelines, but the payment was returned. And that can have grave consequences not just for Kiev, but for almost all of Europe. Lots of countries get their gas through these pipelines.

It looks like the EU, and especially Germany, has started to smell – potential – trouble:

EU Suggests Russia, Ukraine Sign Interim Gas Agreement

The E.U. has suggested an interim agreement on the gas supplies between Russia and Ukraine without waiting for a Stockholm arbitrary court decision, E.U. Energy Commissioner Gunther Oettinger said in a news conference following his meeting with Ukrainian President Petro Poroshenko late Tuesday Two cases are before the Stockholm court, but the hearings will take 12-15 months, which is too long, while Europe needs an interim solution for this winter, Oettinger said In June, Russian gas giant Gazprom switched Ukraine off gas over the unpaid debt and filed a $4.5 billion suit to the Stockholm arbitration court. Later, Kiev reciprocated by sending a suit to the court against Gazprom for making Ukraine overpay $6 billion for gas since 2010, setting too high prices in its contract.

The Russian Legal Information Agency has this:

Putin: Naftogaz Suit Against Gazprom Axes Discount For Ukraine

The fact that Ukraine’s Naftogaz has invoked arbitration proceedings against Gazprom prevents Russia from giving Ukraine a gas price discount, President Vladimir Putin said in Minsk where he met with Ukrainian President Petro Poroshenko. “We cannot even consider any preference solutions for Ukraine since it pursues arbitration,” Putin said. “Russia’s possible actions in this sphere could be used against it in the court. We couldn’t do it even if we wanted to.” After Gazprom switched to a prepayment system for gas deliveries to Ukraine on June 16, Naftogaz turned to the Arbitration Institute of the Stockholm Chamber of Commerce. Naftogaz wants Gazprom to cut the price for gas and to get back $6 billion that Ukraine has allegedly overpaid since 2010.

Gazprom in turn is seeking to recover Ukraine’s $4.5 billion debt for gas deliveries. Putin said Russia offered a compromise solution during the talks held before Gazprom switched to the prepayment scheme. “We reduced the price by $100,” Russian President said. Gas talks between Russia, Ukraine and the European Union went on from April to mid-June. Kiev said it would not repay its $4.5 billion debt unless Russia agreed to supply gas at a lower price. Russia offered a discount, but Ukraine turned down the offer. Russia then said it would only resume gas supply talks after Ukraine paid off its debt.

More signs of German nerves are here in a piece from the European Council on Foreign Relations – I kid you not, they exist -, along with a nice but curious admission:

Has Germany Sidelined Poland In Ukraine Crisis Negotiations?

As Germany takes over leadership of the European Union’s efforts to solve the Ukrainian crisis, Poland is questioning the motivations and strategies behind Berlin’s new diplomatic activism. The initiatives of German Foreign Minister Frank-Walter Steinmeier and Chancellor Angela Merkel are being followed closely in Warsaw – and often with mixed feelings. Is Berlin trying to mastermind a compromise with Russia on Moscow’s terms, ignoring Kyiv’s vital interests? And as Poland is increasingly edged out of the conflict resolution process, has Berlin-Warsaw co-operation on EU Ostpolitik broken down?

Poland was, along with France and Germany, one of the countries that orchestrated the political shift in Ukraine in February. Since then, Warsaw has played a central role in forging a bolder EU response to Russia’s aggression and in providing meaningful assistance to the Ukrainian government. However, as the conflict has worsened, Warsaw has become less visible as an actor in crisis diplomacy. Polish Foreign Minister Radek Sikorski was not invited to join his German, French, Russian, and Ukrainian counterparts in the negotiations on conflict resolution held in Berlin in early July and early August. Before Ukrainian President Petro Poroshenko and Russian President Vladimir Putin agreed to meet at the Customs Union summit in Minsk on 26 August, the idea had been floated of holding another high-level meeting in the “Normandy format” of France, Germany, Russia, and Ukraine.

Kiev is either so high on the EU, US and NATO support it was promised, or so desperate over its latest battlefield losses, that it goes for all on red, probably thinking, and probably rightly so, that the western press will swallow anything whole. Tyler Durden:

Ukraine Accuses Russia Of Imminent Gas Cut-Off, Russia Denies, Germans Anxious

So much for the Russia-Ukraine talks bringing the two sides together as even Germany’s Steinmeier could only say it’s “hard to say if breakthrough made.” Shortly after talks ended, Ukrainian Premier Yatsenyuk stated unequivocally that “we know about the plans of Russia to cut off transit even in European Union member countries,” followed by some notably heavy-on-the-war-rhetoric comments. The Russians were quick to respond, as the energy ministry was “surprised” by his statements on Ukraine gas transits and blasted that comments were an “attempt at EU disinformation.”

Here’s what Putin said at the press op after the talks:

Answers To Journalists’ Questions Following Working Visit To Belarus

Currently, we are in a deadlock on the gas issue. You see, this is very serious matter for us, for Ukraine and for our European partners. It is no big secret that Gazprom has advanced payment for the transit of our gas to Europe. Ukraine’s Naftogaz has returned that advance payment. The transit of our gas to European consumers was just about suspended. What will happen next? This is a question that awaits a painstaking investigation by our European and Ukrainian partners.

We are fulfilling all the terms of the contract in full. Right now, we cannot even accept any suggestions regarding preferential terms, given that Ukraine has appealed to the Arbitration Court. Any of our actions to provide preferential terms can be used in the court. We were deprived of this opportunity, even if we had wanted it, although we already tried to meet them halfway and reduced the price by $100.

The ball is squarely in the western court. Of course many will think and hope that Russia will give in because it needs the revenue, but the problem with that is it could cost the country too much (admittedly, that’s not the only problem). $6 billion to Ukraine for starters, then potentially many more billions on future deliveries to Kiev, and then there’s the rest of its contracts with two dozen or so European nations.

From a legal point of view, this may not be about what Moscow wants to do anymore, but about what it can. The Arbitration Court case may have tied its hands. And unless Europe wants a cold winter, it must seek a solution. Putin, who holds degrees in both judo AND law, understands this. But he didn’t set this up. Western and Kiev hubris did. Certain people got first too pleased with, and then ahead of, themselves.

So what now? There are several options. Ukraine can withdraw the case it has pending in Stockholm. A huge loss of face when you’re waging a war, even if it’s just against your own people. And it would still have to find money it doesn’t have, to pay its past and future gas bills. The fact that Naftogaz returned the Gazprom advance payment doesn’t bode well for that.

The west could end up – having to – withdraw its support for Kiev. But a lot of money has been poured into that support, NATO is erecting new bases on Russia’s borders, there is a war party sentiment, if not exuberance, building up.

There’s a lot of talk of Putin trying to save face, but I’m not so sure that comes from, let’s say, an ‘adequate’ understanding of what’s on the table. A more appropriate question might be: how does the Brussels bureaucracy save face? Angela Merkel may end up having to force them into humility, just so her people don’t freeze.

Or, of course, we could all go to war. Only, we wouldn’t even be able to figure out who’d be fighting whom, or for what reason. It would seriously risk repeating the very past the EU was designed to prevent.

Putin pointed to another rather difficult but highly interesting legal ‘technicality’ as well, which involves Ukraine moving closer to the EU economically:

We once again pointed out to our partners – both European and Ukrainian partners – that implementation of the association agreement between Ukraine and the EU carries significant risks for the Russian economy. We have shown this in the text of the agreement, directly pointing to specific articles in that agreement. Let me remind you that this concerns nullifying Ukraine’s customs tariffs, technical regulations, and phytosanitary standards.

The standards in Russia and Europe currently do not correspond. But, as you recall, the most classic example is the introduction of EU technical regulations in Ukraine. In that case, we would not be able to supply our goods to Ukraine at all. We have different technical standards. And according to the European Union’s standards, we will not be able to supply our machine-building products there, or any industrial goods. If that happens, we cannot accept Ukrainian agricultural production goods in our territory, because we have different approaches to phytosanitary standards. We feel that many problems would occur.

If we do not achieve any agreements and our concerns are not taken into account, then we will be forced to take measures to protect our economy. And we explained what those measures would be. So our partners must weigh everything and make corresponding decisions.

I think Ukraine, through Yatsenyuk and now Poroshenko, has grossly overplayed its hand. Encouraged by Brussels, which is also not nearly big enough for the chair it resides in, and Washington, which is partly simply clueless about the region and partly all too eager to engage in yet another campaign of “smart” bombing and regime change. And which, besides, stuck its neck so deep into the Middle East cesspool once again it has no chance of maintaining focus on an issue that mainly concerns Europe.

It is time for some cool heads to come to the fore, and for accusations and allegations and innuendo and spin to fade into the background, or this can get way out of hand.

European economies are easily doing bad enough for all efforts to be directed there, not to use this as an added motivation to incite trouble outside of EU borders.

If Kiev announces it’ll stop bombing its own citizens, and follows up on that, there’s no doubt the other side will calm down as well.

Ukraine and the west invited the lawyers in through the case they brought before the Stockholm court. Let’s leave it to the lawyers, and stop killing civilians while we do. Word.

Word.

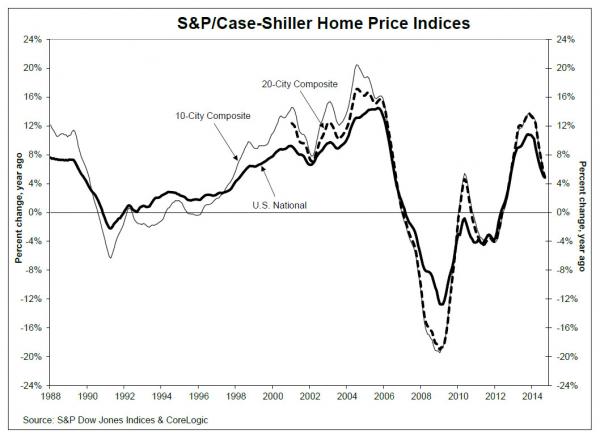

• US Housing Market Is Falling Apart, Recovery Is An Illusion (MarketWatch)

Most real estate experts believe the U.S. housing market is roaring back. Few have anything to negative to say about real estate. But what if they’re wrong? Real estate analyst Keith Jurow, author of the Capital Preservation Real Estate Report, is warning that the real estate market is not as strong as it seems. Says Jurow: “I never bought into the idea that we had a recovery at all.” His research leads him to conclude that home prices will be heading lower. Why? Largely because home listings are going up but sale prices are not. Jurow discovered that as of June 2014, listings in Ft. Lauderdale increased by 89.3% year-over-year. In Miami, listings are up by 65.7% In Charlotte, N.C. they are up 51%, and in Riverside, Calif. they’re up 28.1%. In 10 major metro areas around the country, listings have increased. Jurow gets his data from Redfin.com and Raveis.com.

“Many people waited for prices to rise before putting their house on the market, and they have,” Jurow says. “But now listings are increasing because everyone has the same idea. Unfortunately, May and June are traditionally the strongest months for sales, and these home sellers have missed the peak season.” Jurow points out that Redfin.com’s latest figures show that in 21 out of 29 major metro areas, sales volume is down year-over-year. “If sales are weakening and listings are going up substantially, prices will fall,” he says. The problems in housing are much deeper than many people realize, Jurow contends. Another nagging concern is the large number of homeowners who are delinquent. “Delinquent means you haven’t paid the mortgage,” Jurow says. “The lender or servicer can file an official notice of default, which begins the foreclosure proceeding.” However, to keep prices from falling further, mortgage servicers have sharply reduced the number of homes placed into default.

Millions of homeowners are already seriously delinquent. “The average length of time that houses remain delinquent nationwide is 995 days,” Jurow says. “The worst culprit is New York State. The average delinquency period there is four years.” Many homeowners are aware that banks are not in a rush to file foreclosures, so they stay in their houses mortgage-free. “The banks are not initiating foreclosure proceedings because once the servicer forecloses, the lender takes a hit on earnings,” Jurow says. “They also have to manage the property, and most banks don’t want to do that.”

Read more …

Let’s make sure we all stay stupid.

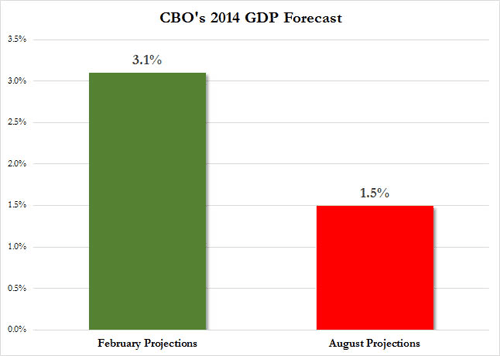

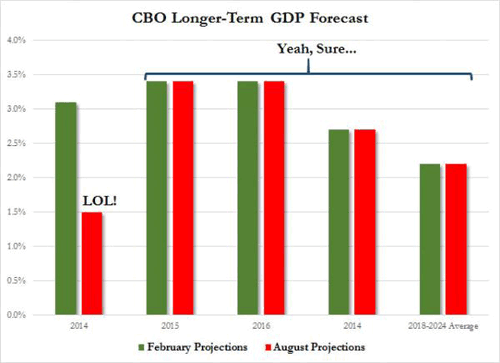

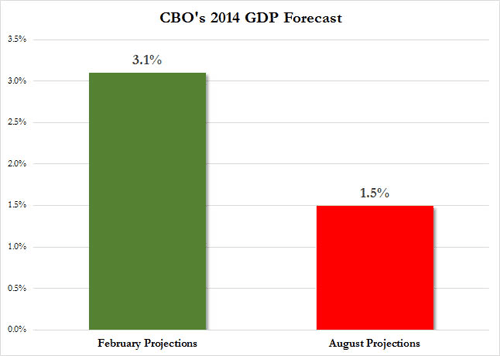

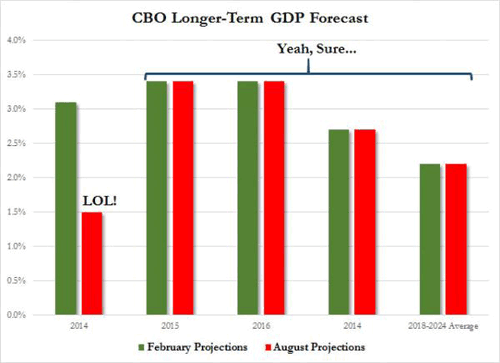

• CBO Revises Its 2014 GDP Forecast, Hilarity Ensues – As Always (Zero Hedge)

The gross, in fact epic, incompetence of the Congressional Budget Office when it comes to doing its only job, forecasting the future state of the US economy, has previously been extensively documented here. This incompetence is in the spotlight once again this morning with the CBO’s release of its latest forecast revision of its original February 2014 projection. And while every aspect of the revised projection has changed, in an adverse direction of course, the punchline is the chart below: the CBO’s revised projection for 2014 GDP. It’s one of those “no comment necessary” visuals.

Surprising? Hardly. After all the CBO is swarming with indoctrinated Keynesian cultists whose only achievement in life is to be wrong about everything (and then to blame the Fed for not “easing enough”). Here is how the CBO “explains” this 50%+ cut in its forecast in just 6 months:

CBO has lowered its projection of real growth of GDP in 2014 from 3.1% to 1.5%, reflecting the surprising economic weakness in the first half of the year.

Which as other Keynesian talking heads have already made quite clear was due to snow. That’s right: over $100 billion in forecast economic growth “evaporated” from the US economy because it… snowed. The good news? The CBO refuses to forecast the “harsh weather” for the foreseeable future, and has kept all of its 2015 and onward GDP estimates as is. So when things go horribly wrong to the CBO’s forecast, which is 100% guaranteed to happen, the CBO can again blame “surprising economic weakness” because, well, everyone else is doing it.

Read more …

I could have written about this today, a crucial line: banks realized the bulk of the benefit of very low interest rates years ago. That’s why rates will rise. So banks can get back to stellar profits. As simple as that.

• Big US Banks Set For Huge Profits When Interest Rates Rise (MarketWatch)

An expected rise in interest rates over the next year will help the largest U.S. banks earn billions of dollars in additional net interest income, setting up their cheap stocks for what could be a stellar run. You might be surprised to be reading anything positive about big banks, in light of Bank of America’s $16.65 billion mortgage settlement with the Department of Justice and several states last week. The epic settlement followed a similar $7 billion settlement by Citigroup in July and a then-record $13 billion settlement by J.P. Morgan last November. While these companies still face continued investigations and litigation over their mortgage lending and securitization activities heading into the housing blowup of 2008, as well as several regulatory investigations of Libor reporting and foreign-exchange trading, it appears that the period of huge settlements is over. Looking ahead, 2015 promises to be a fresh start for the industry, as the interest rate environment improves and the banks move past the settlements.

The Federal Reserve has kept the short-term federal funds rate locked in a range of zero to 0.25% since late 2008, in an effort to increase loan demand and jump-start the economy. This policy and the “QE3” bond purchases that will end this year seem to have worked, with the U.S. economy expanding at a 4% annual rate during the second quarter and continuing to add over 200,000 jobs a month. But the debate at the Federal Reserve has now shifted to the timing of interest rate increases. Most economists expect the federal funds rate to begin climbing in the second half of 2015, but it could well happen sooner than that. For most banks, the extended period of low interest rates has become quite a drag on earnings. Net interest margins — the spread between the average yield on loans and investments and the average cost for deposits and borrowings — are still being squeezed, since banks realized the bulk of the benefit of very low interest rates years ago, while their assets continue to reprice downward.

Read more …

Normal correction coming right up.

• Two Experts Warn Market Correction Could Total 60% (CNBC)

Markets could soon face a fall of up to 60%, two experts told CNBC on Wednesday. A jolt to international confidence in central banks will lead to a 30 to 60% market decline, David Tice, president of Tice Capital and founder of the Prudent Bear Fund, told CNBC’s “Power Lunch.” When this happens, he said, markets will face a “period of extreme turmoil.” This crash will be precipitated, he said, by a disillusionment with the Federal Reserve’s “confidence game,” which will then see inflation rise, and the Fed scramble to raise rates. At that point, Tice added, “the Fed starts to lose control.” Another market watcher also called for an impending fall. The Fed’s low interest rates could bring a “scary” 50-60% market correction, said technical analyst Abigail Doolittle. “Unfortunately, I think it could come on a crash similar to what happened in 2007,” Doolittle, the founder of Peak Theories Research, said on “Squawk Box” a day after the S&P 500 closed above the 2,000 level for the first time ever.

“It’s tough to know what the exact catalyst will be. But that’s the very nature of that kind of selloff. They start slowly and then happen very suddenly.” Doolittle pointed to a 20-year chart of the Dow Jones Industrial Average. “When we take the long-term chart of the Dow … we see that it’s trading in a multiyear trading range, hitting up on resistance. … What makes this so important [is] you can see that the entire bull market trend over the past five years has started to reverse.” “When you see that kind of gyration around the trend, typically it suggests you’re going to see some severe volatility,” she said. “As scary as it is, I think that we could see possibly a 50% or 60% correction—an equal and opposite reaction to all these unusual policy moves.” Doolittle called Tuesday’s S&P 2,000 close a psychological milestone that means very little technically. “As high as these stocks markets go, I’ve become bearish because the underlying technicals from the long-term really support this view.”

Read more …

They can go until they burst. Soon.

• How Low Can They Go? Traders Eyeing Global Bond Rates (CNBC)

Stock traders will be watching a brief flurry of economic reports Thursday, but the main attraction could be the bond market. Reputed to be dull, bonds have been anything but this week. Caught in a tug of war between the opposing policy modes of a tightening U.S. Fed and an easing European Central Bank, bond yields have taken dramatic turns as investors also adjust portfolios ahead of month’s end. While the S&P 500 broke through the 2,000 mark for the first time, bond traders this week have been watching yields creep ever lower in Europe, with yields on shorter duration sovereign debt from Germany and Belgium to the Netherlands and Finland turning negative. The benchmark German 10-year bund fell through 0.90% for the first time Wednesday, while Italian and Spanish 10-year yields traded beneath the U.S. 10-year yield. It was not that long ago that those peripheral euro zone securities were seen as risky high yielders.

Meanwhile, yields on shorter duration Treasurys, while slightly lower Wednesday, have been inching higher on expectations that the Fed will ultimately move to raise rates next year. Headlines from Europe Wednesday, including from German Finance Minister Wolfgang Schaeuble, attempted to squash speculation that the ECB would take some further easing action next week, but bond yields still moved lower. Traders said concerns about Ukraine, and reports that Russia was sending troops inside that country, also weighed slightly on the long end of the curve “It’s yield grab and geopolitics at the back end, and policy speculation at the front end,” said Adrian Miller, director of fixed-income strategy at GMP Securities. “Every time the yields tick lower is because someone thinks the ECB is going to drop another pile of cash on the market, and it’s going to spill over to the U.S.”

Read more …

How many ways are there to screw this up?

• What’s the Real US Unemployment Rate? Report Says Nobody Knows (BW)

No U.S. economic statistic is more important than the unemployment rate, which was officially reported as 6.2% in July. But a new academic paper finds that a long-known source of potential error in the unemployment rate “has worsened considerably over time.” The actual rate may be higher than the reported one, though it’s hard to know for sure, the paper says. The unemployment rate is calculated by averaging the results from eight separate samples of the population, known as rotation groups. In theory, the people in all eight rotation groups should have the same likelihood of being unemployed, but they don’t. In the first half of 2014, the newest rotation groups had an unemployment rate of 7.5%. The oldest rotation groups had an unemployment rate of just 6.1%. That disparity of 1.4 percentage points is huge, considering that economists pay close attention to changes in the jobless rate down to the tenth of a percentage point.

The Bureau of Labor Statistics puts a heavier weighting on the older rotation groups, so the official unemployment rate for the first half of 2014 was 6.5%. The new paper is important not just because of its finding but also because one of its authors is Alan Krueger, a Princeton University economist who was chairman of President Obama’s Council of Economic Advisers from 2011 to 2013. His co-authors are Alexandre Mas of Princeton and Xiaotong Niu of the Congressional Budget Office. Gary Steinberg, a spokesman for the Bureau of Labor Statistics, says the agency has done its own research on the topic of what’s known as “rotation group bias” but would have no immediate comment on the paper. The BLS creates a new rotation group each month by drawing a random sample of people from the U.S. population for the Current Population Survey (CPS).

A rotation group is included in the calculation of the unemployment rate for four months, then left out of it for eight months, and then brought back in for four months before being dropped for good. The first researcher to notice discrepancies in the unemployment rates of the various rotation groups, way back in 1975, was a statistician named Barbara Bailar, who later became executive director of the American Statistical Association. At the time, the discrepancy between rotation groups was on the order of half a percentage point. Krueger and his co-authors write that while other economists have delved into the topic, “the magnitude and evolution of rotation group bias in the CPS has not been documented since Bailar’s (1975) study.”

Read more …

A trend that has just started.

• Eurozone Business, Consumer Confidence Decline (WSJ)

Business and consumer confidence across the 18 nations that use the euro deteriorated in August, as managers and households took a gloomier view of their economic prospects. The weakening in confidence was one of several pieces of data Thursday that suggest the euro-zone economy remains fragile, adding further pressure on officials at the European Central Bank to pursue more aggressive policies to help lift the 18-nation economy out of its funk. The European Commission said its European Sentiment Indicator, a broad measure of business and consumer confidence in the euro zone, weakened to 100.6 in August from 102.1 a month earlier, when it posted a surprising increase. The fall was bigger than expected. Economists polled by The Wall Street Journal expected the commission’s gauge of confidence to dip, but only to 101.5. The European Commission said economic confidence weakened significantly in Italy and dipped in Germany, the bloc’s biggest economy. There were milder contractions in France and the Netherlands, while confidence remained flat in Spain.

Business confidence deteriorated because managers gave a more downbeat assessment of their expectations for future production, the commission said. Households, meanwhile, became gloomier about their job prospects and their financial security. The euro-zone economy stagnated in the second quarter, growing by a mere 0.2% in annualized terms. The economy’s prospects have been further undermined by tensions with Russia over unrest in Ukraine and conflict in the Middle East, both of which threaten energy supplies and could hurt trade. Data due Friday are expected to show inflation in the euro zone cooled further in August, heaping pressure on ECB officials to broaden their stimulus efforts. The central bank has already cut interest rates and in September plans to roll out a new program of long-term funding for banks to encourage greater lending. But officials led by ECB President Mario Draghi continue to face calls to embark on a large-scale program of asset purchases, or quantitative easing, to fuel growth and lift inflation back toward its target of just under 2%.

Read more …

France has many more jobless than its numbers indicate. They just call them something else.

• French Unemployment Hits New Record (MarketWatch)

The number of unemployed people in France rose 0.8% in July from June, setting yet another record high at a time when President Francois Hollande is struggling to convince the French, and even his political allies, that he has the right recipe to solve the country’s economic woes. The number of unemployed – defined as registered job seekers who are fully unemployed – reached 3,424,400 in July. “The rise stems from zero economic growth in the euro zone and in France,” labor minister Francois Rebsamen said in a statement. Mr. Rebsamen said state sponsored jobs, particularly for young people, will continue to boost employment. The president’s plan to cut taxes for employers to fuel job creation will also help, Mr. Rebsamen said. Mr. Hollande’s plans have come under fire from within his own camp in recent days. Dissidents criticized painful public spending cuts and said households, as well as employers, should face more tax cuts. The president reacted quickly by dissolving his government and expelling the dissidents.

Read more …

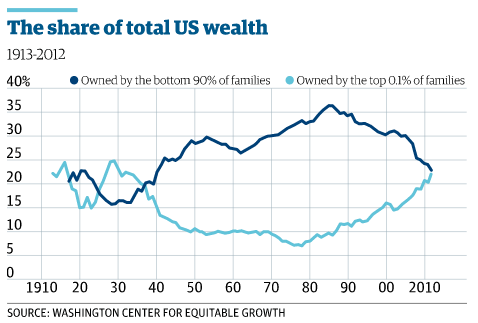

This is how deflation works. Discard all the talk of inflation. Fast growing number of people don’t habe any money. That’s what the pretend recovery is built on.

• Falling Italian Fruit Prices Signal Deflation Woe for Draghi (BW)

Matteo Tosato saw deflation coming months ago as he hauled his traveling fruit and vegetable stand to outdoor markets around the northern Italian city of Padua while his country slid back into recession. “Wherever a factory closed down and people got fired, demand collapsed and I had to lower prices to keep my business running,” said Tosato, 38, who sells peaches, apples, carrots and other farm-fresh goods in as many as four town squares a week. Tosato says his cuts have been as much as 30% to 40% compared with last year. Across Italy, prices are dropping for everything from food to hotels and clothing, leading economists in a Bloomberg survey to predict the country, already in its third economic slump since 2008, is about to join Greece, Spain and Portugal in recording annual consumer-price declines.

Weakening prices across the euro area are ratcheting up pressure on European Central Bank President Mario Draghi to do more to spur inflation and the euro region’s sputtering economy. Draghi said last week that policy makers will use “all the available instruments needed to ensure price stability.” Key inflation figures are due this week. Italian consumer prices probably fell 0.1% in August from a year earlier, according to a survey of 12 economists before a report in Rome tomorrow. That would be the first decline in five years. Euro-area data scheduled to be released at the same time may show inflation in the 18-nation bloc slowed to 0.3% this month from 0.4%, a separate poll showed. That compares with the ECB’s goal of close to 2%. Consumer prices in Spain fell 0.5% in August from a year ago, the sharpest decline since Oct. 2009, even as the economy expanded 0.6% in the second quarter.

Read more …

No QE. Says Germany.

• ECB’s Draghi Has Been “Overinterpreted”, Says Germany’s Schaeuble (Reuters)

Germany’s Finance Minister Wolfgang Schaeuble told a newspaper on Wednesday that European Central Bank chief Mario Draghi had been “overinterpreted” after suggesting that fiscal policy could play a greater role in promoting growth. The comments, made last Friday have been widely seen as a shift of emphasis towards support for greater fiscal stimulus over austerity. “I know Mario Draghi very well, I think he is being overinterpreted,” Schaeuble told the Passauer Neue Presse in an interview, adding he respected the independence of the central banker. Schaeuble also said he wasn’t pleased about comments made by France’s former economy minister Arnaud Montebourg on Germany’s “obsession” with austerity but that this was a domestic debate in France and consequences had been drawn. French President Francois Hollande ejected Montebourg from his cabinet earlier this week.

Read more …

China’s housing is way worse than we, let alone the Chinese, acknowledge. Huge numbers of homes were built as investments, not to live in. If you live in a home and the price goes down, you may still be able to pay the mortgage. If it’s just an investment, the rules change.

• China Property Launches To Add To Inventory, Lower Prices (Reuters)

Property launches in China are set to surge in the latter half of the year with developers sticking to their schedules despite mounting inventories, spelling double trouble for a market hammered by months of falling prices. Prices started to decline in March as the slowing economy hit demand, inventories ballooned and developers began offering discounts. The current slump was confirmed by official data only around the middle of the year, way after developers had already committed themselves to completing projects for 2014. Developers also have little choice but to heap even more supply in a bloated market due to regulations that stop them from sitting on undeveloped land. Those that fail to break ground on new projects a year after purchasing land will face fines, while those that wait more than two years could have their land confiscated. The rush to expedite projects will worsen chronic oversupply that analysts warn may take years to clear.

Unsold properties will also have broader implications – the sector accounts for over 15% of the economy and its fortunes are tied to other industries such as concrete and steel. Earlier this month, Kaisa Group and China Merchants Land confirmed that they planned to launch around 70% of their 2014 projects in the second half. Country Garden said it aimed to meet 60% of its sales target during the period. Price cuts and promotions are the most common methods that developers use to clear inventory. But tight mortgage credit lines from banks and discrepancies in price expectations between developers and home buyers are not helping, analysts say. “Buyers’ attitude has changed. They feel they can wait,” said CIFI Holdings Chief Financial Officer Albert Yau. China’s once white-hot housing market is slowing this year, weighed by the cooling economy and the government’s five-year-long campaign to curb price rises. New home prices fell in July for a third consecutive month, with declines spreading to a record number of big cities including Beijing.

Read more …

• Chinese Developers Offer Hefty Discounts In Strained Housing Market (FT)

In the latest sign of Chinese developers’ desperation to unload inventory into a weak property market, China Vanke Co is offering discounts of up to $325,000 to home buyers who shop on Alibaba’s Taobao, an e-commerce platform. The country’s biggest developer will give discounts that match shoppers’ spending of up to Rmb 2 million ($325,000) on the eBay-like service. Homes in real estate developments in Beijing, Shanghai, Guangzhou and Chongqing, among other cities, will qualify, according to an advertisement on Taobao’s website.

Developers began cutting prices this year but have so far failed to revive flagging volumes. More than 30 cities have also removed purchase restrictions introduced in 2010 to restrain price growth amid public anger over high prices. Residential property sales fell 9.4% in floor space terms in the first seven months of the year compared with the same period in 2013, according to government statistics. Developers are increasingly resorting to creative sales tactics to drum up interest. An office tower in Henan province offered carwashes by bikini-clad models to people who referred a friend to the building’s account on WeChat, the instant messaging service run by Tencent Holdings. A residential developer in Wuhuan offered new iPhone 6s to potential buyers who showed up at the sales office.

Read more …

• Did China Just Announce A New Mini-Stimulus Package? (CNBC)

The Chinese government launched a “fresh round of mini-stimulus” to counter growth headwinds, according to a Bank of America Merrill Lynch (BofA-ML) report published Thursday. The measures aim to support the agricultural sector, boost investment in public facilities and improve environmental protection. The People’s Bank of China (PBOC) has given banks a larger re-lending quota at lower rates to support the farm sector. It granted a 20 billion yuan ($3.26 billion) re-lending quota to its local branches to guide rural financial institutions to step up lending support to the sector, it said on its website late Wednesday. Re-lending is a monetary tool used by the central bank to increase financial institutions’ liquidity and guide credit flows.

Other measures include a “push for ramping up investment in clean energy and public facilities such as hospitals, nursing homes and fitness centers, and a promise for delivering the target on social housing and more spending on environmental protection,” Ting Lu and Sylvia Sheng, economists at BofA-ML wrote. These steps will help China deliver the “around 7.5%” growth target, BofA-ML said, noting that it’s comfortable maintaining its gross domestic product (GDP) growth forecast of 7.4% for the second half. A slew of disappointing economic data – from manufacturing to credit growth – over the past month raised concerns that the world’s second-largest economy may be headed into a renewed soft patch.

Read more …

Oh Jeez.

• Portugal’s Espirito Santo Clan In 11th-Hour Borrowing Spree In 2014 (Reuters)

The corporate empire of Portugal’s Espirito Santo family issued €5 billion ($6.6 billion) of new debt in the first six months of 2014, according to people familiar with the matter, just as the clan’s businesses were nearing bankruptcy. The bonds were sold via a complex transatlantic scheme involving companies in Panama and Europe, the people said. Much of the debt ended up with Banco Espirito Santo and its customers, they added, accelerating the financial woes that led to the lender’s state bailout earlier this month. The 11th-hour borrowing gambit uncovered by Reuters is being examined by Portuguese financial regulators who are trying to determine whether it was legally permissible, according to people close to the examination.

It shines new light on the lengths to which Portugal’s biggest corporate dynasty went to save their empire from collapse, mixing family affairs with those of the country’s then largest listed bank, in which until recently they were the single-largest shareholder. The collapse of the 145-year-old Espirito Santo group has caused turmoil in international markets and rocked Portugal’s political and business world. Regulators and prosecutors are examining possible fraudulent behaviour behind the fall. As part of their investigation, regulators are looking into how the bonds issued in the first six months of the year were packaged, marketed and sold to clients, according to the people familiar with the examination.

Read more …

Fun down under.

• Is Kim Dotcom A Threat To The Kiwi Dollar? (CNBC)

What on earth is the connection between Kim Dotcom – one of the world’s biggest internet pirates – and the New Zealand dollar, you ask? Dotcom, who is fighting extradition to the United States on piracy charges, launched a political party earlier this year to contest New Zealand’s general elections on September 30. In late-May, his Internet Party entered an alliance with the Mana Party, a small party that advocates for the nation’s indigenous Maori, to improve his chances of gaining political clout. Their joint party, Internet Mana, is gaining popularity among young voters and is in striking distance of the five% threshold needed to guarantee representation in parliament, according to the One News-Colmar Brunton poll published on August 17. “Fears that the infamous web entrepreneur Kim Dotcom may be starting to influence the New Zealand election is affecting the currency.

Mr. Dotcom’s party has aligned itself with the Maori party and is polling at 5% – a big enough swing in New Zealand politics that could possibly give the ruling majority to the opposition Labour party,” Boris Schlossberg, Managing Director of FX Strategy at BK Asset Management wrote in a note. “Such a move leftward would no doubt shake up the currency markets which have been caught by surprise expecting yet another win by the National party that would maintain the economic status quo,” he said. The National Party-led coalition – headed by Prime Minister John Key and Deputy and Finance Minister Bill English – is lauded for its success in steering the country through the global financial crisis and aftermath of the devastating Christchurch earthquake of 2011. A government led by the main opposition Labor party is viewed as unfavorable by investors.

“A Labor/Green-led government most likely with the support of the more radical small Internet/Mana left element and a populist centrist NZ First would be regarded as unstable and damaging for business confidence,” said Greg Gibbs, head of Asia Pacific markets strategy at RBS. The National Party is currently leading the Labor Party in the polls by a wide margin, at 50% and 26%, respectively. However, the National Party has been losing support. Earlier this month, Key predicted a close general election, saying, “If we could poll 50% on election night that would be great, but the truth is MMP [Multi-Party Proportional voting system] is an environment that’s tough, it’s hard fought and it’s always close.” The complex MMP voting system tends to emphasize the role of minor parties and force the major players into coalition governments. Schlossberg says any significant chance that the left-leaning Labor may wrest control of the government could push the New Zealand dollar-U.S. dollar pair towards $0.80 over the next few weeks.

Read more …

Excellent piece by Butler; good summary of all the things I’ve written about MH17 and the larger Ukraine situation.

• Death & Lies: The Only Truth Of Flight MH17 (Philip Butler)

The day Malaysian Airlines flight MH17 fell to Earth in pieces, everyone in our world was told Russia and Vladimir Putin murdered the 298 people aboard. It is over a month since the biggest ‘shoot-down’ incident in air passenger history, and this is what we know for sure. Whatever happened in the skies above eastern Ukraine on July 17, we’ve been set on a reactionary course charted by either fools or the adjunct henchmen of some unseen game. Was all this conjecture to risk the outbreak of World War III over hearsay and rumor? A mouthy leadership in the West has revealed the only real truth of this matter: credibility and trust was ‘blown out of the sky’ over Ukraine. At 1:15pm in the afternoon on July 17, 2014, the air traffic controllers at Kiev lost radar and voice contact with flight MH17. The Boeing 777-200ER, flying from Schiphol Airport in Amsterdam to Kuala Lumpur, fell in pieces on Ukraine’s eastern frontier. The earliest reports the public received on the catastrophe came from the various mainstream media.

Those outlets basically parroted what officials in Kiev and the US State Department released. From the outset, officials in the West started a blame game, and one of massive proportions. Within a few hours of the event, nearly all media reflected assurances that Russia, and the pro-Russian fighters in eastern Ukraine were guilty. We know now that almost all the initial information on the Malaysian Airlines downing was misleading at best. Allegations, ‘cooked up’ evidence from social media, and illogical theories took the place of news reporting for days on end. US intelligence sources said sophisticated BUK surface-to-air missile systems were used to down the plane. Supposedly, these launchers were expertly operated by guerrilla fighters who were surrounded by Ukrainian security forces in contested territory. Meanwhile, the same trillion-dollar security and defense industry that the NSA spies on the world for claimed MH17 was shot down by “Vladimir Putin’s Missile.”

We were expected to believe Russia’s president ordered his military to drive a BUK system across Russia’s border, to deliver it to separatist forces there in order to shoot down a friendly aircraft, and then to drive the launcher back into Mother Russia. Moreover, this was all to be accomplished secretly, and in broad daylight through the most hotly-contested real estate in Europe. Western leadership and once-trusted media asked the world to be complete idiots, hapless peons ready for a Ukrainian ‘shock and awe’ campaign. But today we have a dozen plausible theories of what happened. The most legitimate at the moment, an air-to-air engagement by Ukrainian SU 25 attack aircraft, has been largely ignored even though key experts abide by the theory. The Kiev/US/NATO/GCHQ/EU/White House narrative has quieted down somewhat now, since Russia’s Defense Ministry sent the message that it had all the evidence. But we’re left with crippling counter-sanctions here in Europe. Sanctions levied on Russia based on a heap of lies, for all we know.

Read more …

Sort of good piece, but misses the issues of depletion rates and and ballooning debts.

• US Shale: What Lies Beneath (FT)

In a clearing in a cornfield in the Eagle Ford region of south Texas, the rig drilling the Sisti A3 well for ConocoPhillips looks very similar to the ones that have been working in the state’s shale reserves for more than a decade. But a mile or two below the surface, the way the wells operate has changed radically. Since 2012, Conoco has doubled the volume of ceramic proppant – a sand-like material – it uses for hydraulic fracturing. Mixed with water and pumped into wells at high pressure, the proppant forces open the cracks in the rocks where oil and gas is trapped. Using more proppant has increased the output of each well by 30% – giving a healthy boost to Conoco’s bottom line. Now its engineers are examining ways to double the amount of proppant again. This kind of experimentation has made Eagle Ford and other shale formations, including Bakken in North Dakota and Permian Basin in west Texas, the oil industry’s equivalents of Silicon Valley.

The shale boom is not a one-off event but a permanent revolution, with companies constantly pushing back the frontiers of the technology to cut costs and improve well productivity. “We are a gigantic innovation machine,” says Greg Leveille, Conoco’s general manager for unconventional resources such as shale. “We put a lot of effort into trying to find the optimal combination of fracturing techniques.” Horizontal drilling, which opens up layers of resource-bearing shale, and hydraulic fracturing, or “fracking”, has raised US crude output by more than 65% in the past six years, helped by historically high oil prices that have made the techniques commercially viable. The big question now is how much longer the US shale industry’s growth spurt will last. Few issues are more significant for the future of the world economy. Threats to global crude supplies have risen this year, with turmoil in Iraq, mounting tensions between Russia and the west, and unrest in other oil-producing countries such as Libya.

Yet prices have fallen, with internationally traded Brent crude dropping from about $108 per barrel at the start of the year to about $102 today. In large part, that has been a result of booming US production. Between 2011 and 2013, the US raised its output by 2.2m b/d, more than the entire increase in global demand. While the immediate outlook for global oil supplies is benign, longer-term prospects are more troubling. If emerging economies – above all China – continue to grow, their demand for oil will rise as well. A few countries, including Canada, Brazil and Mexico, have realistic prospects of increasing their production to meet that demand. But there is still a great burden of expectation riding on the US.

Read more …

Lowballing.

• Ebola Cases Could Eventually Reach 20,000 (AP)

The Ebola outbreak in West Africa eventually could exceed 20,000 cases, more than six times as many as doctors know about now, the World Health Organization said Thursday. A new plan to stop Ebola by the U.N. health agency also assumes that in many hard-hit areas, the actual number of cases may be two to four times higher than is currently reported. The agency published new figures saying that 1,552 people have died from the killer virus from among the 3,069 cases reported so far in Liberia, Sierra Leone, Guinea and Nigeria. At least 40% of the cases have been in just the last three weeks, the U.N. health agency said, adding that “the outbreak continues to accelerate.” In Geneva, the agency also released a new plan for handling the Ebola crisis that aims to stop Ebola transmission in affected countries within six to nine months and prevent it from spreading internationally.

Dr. Bruce Aylward, WHO’s assistant director-general, told reporters the plan would cost $489 million over the next nine months and require the assistance of 750 international workers and 12,000 national workers. The 20,000 figure, he added, “is a scale that I think has not ever been anticipated in terms of an Ebola outbreak.” “That’s not saying we expect 20,000,” he added. “But we have got to have a system in place that we can deal with robust numbers.” Aylward said the far-higher caseload is believed to come from cities. “It’s really just some urban areas that have outstripped the reporting capacity,” he said.

Read more …