Camille Corot The Burning of Sodom (formerly “The Destruction of Sodom”) 1843 and 1857

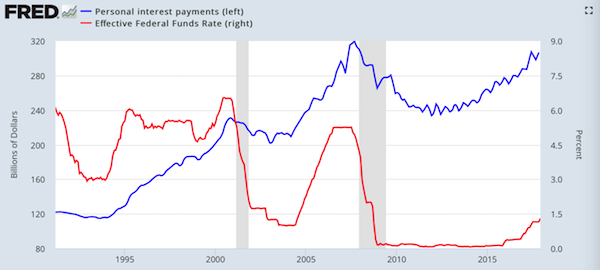

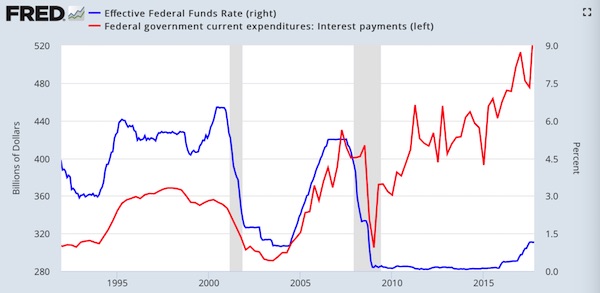

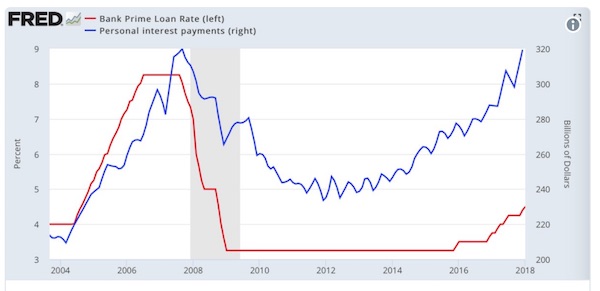

Ultra low rates but ultra high payments.

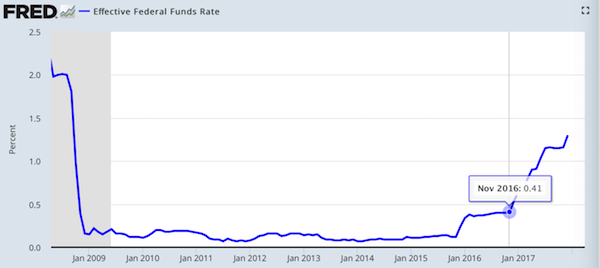

• Rising Debt + Rising Rates (Northman)

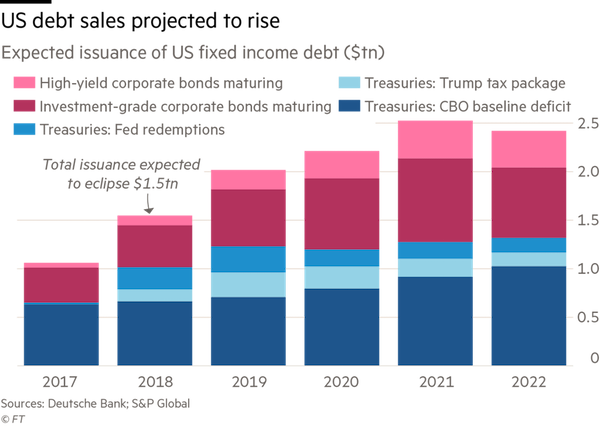

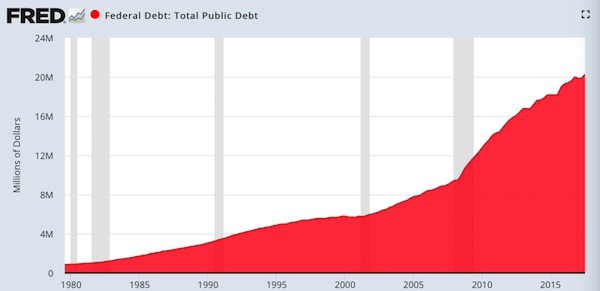

“Interest On The Debt Will Be The Fastest Growing Part Of The Federal Budget…By Far. Forget Medicare, Social Security and the Pentagon: $1 trillion-plus deficits means massive increases in the national debt and that debt will have to be borrowed at higher interest rates. Add the need for the Treasury to roll-over existing debt at higher and higher rates and you get an immediate increase in the amount the U.S. will need to spend on interest each year.” Watch this space:

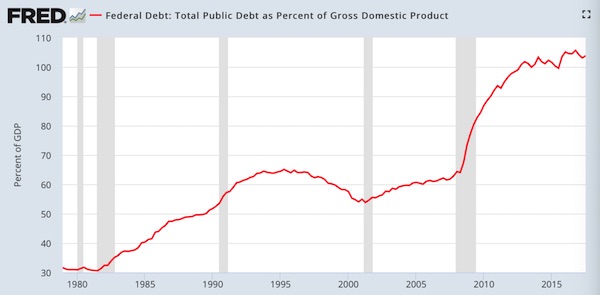

Some people may argue that tax cuts will bring in so much economic growth it will all pay for itself. There is precisely zero evidence for such an assertion:

If you know your tax cut history you know where in the chart above major tax cuts were passed. The debt continued to rise and will continue to rise as spending continues to be expanded. But here’s the kicker: Never in modern times have we seen tax cuts being implemented and spending increased with debt to GDP north of 100%:

Many corporations are drowning in debt, as are consumers, and so are their interest payments:

People invariably argue and say: Yea well, but as a percent of disposable income it’s not so bad. Yes, it’s called artificial low rates, they can mask a lot, but what is currently the situation is not the point, it’s sustainability of debt loads in the very immediate future. As you saw in the above data we are already seeing a vast increase in interest payments despite rates having barely moved off of the historic zero bound line. “As for total debt, the CBO last predicted borrowings of $25.5 trillion by 2027. According to Riedl, the tax cuts, new discretionary outlays and additional interest on the extra spending could add $5 trillion to that number, bringing the total of $30 trillion. That’s 107% of the national income estimate projected by the CBO.

The scariest unknown is what happens to interest expense. At $25.5 trillion, the CBO forecasts outlays for interest of $818 billion in 2027. Going to $30 trillion will raise the load to over $1 trillion. One dollar in seven in spending would be going to interest, versus one in 15 today. And that scenario assumes that the yield on the 10-year Treasury increases to just 3.5% over the next decade, far below its historic average. “If rates go to their average in the 1990s,” warns Riedl, “the deficit will go not to $2 trillion, but to between $2.5 and $3 trillion.”

“..the VIX ETPs are only 5 billion dollars. You have 1.5 trillion of implicit short-volatility strategies..”

• Last Week’s ‘Volocaust’ “Just An Appetizer” – Cole (ZH)

While Cole is happy to accept the back-patting and congratulations for having foretold in near-perfect detail the dynamics that would drive this week’s volatility explosion, those who read our piece summarizing Cole’s (uncannily well-timed) interview two weeks ago will remember that short-vol ETPs like XIV represent only a fraction of the collective $2 trillion short-gamma position that touches nearly every corner of the market. Other components of what calls the ‘implicit’ gamma short – which we’ve touched on this week – include $600 billion invested in risk-parity strategies, $400 billion in volatility-control funds. And $250 billion of risk premium strategies… Rather than buy the dip, Cole ominously warned that it’s more likely this is the beginning of a much larger selloff. Or, as Kevin Spacey’s character put it in the movie “Margin Call”, because of vulnerabilities related to the market’s massively short gamma positioning, “there will be turmoil in the markets for the foreseeable future.”

Everyone talks – congratulations about calling this. Well, I don’t think what I’ve really talked about has come to pass yet. The VIX ETPs are the smallest portion of the global short-vol trade. Talk about this idea of about 1.5 to 2 trillion dollars’ worth of short-vol exposure, both explicit and implicit. Explicit short volatility are VIX exchange-rated products and vol overwriting funds. You know, the VIX ETPs are only 5 billion dollars. You have 1.5 trillion of implicit short-volatility strategies, strategies that may not be directly shorting options, but use financial engineering to mimic the components of a short-option portfolio. About 1.5 trillion dollars’ worth of these, of exposure, this is what we’re seeing come online now.

This is the real risk. So stocks and bonds sell off together. You have disorderly unwind withdrawal of liquidity. And then, all of a sudden, increasing volatility results in a quick deleveraging of these implicit short-volatility strategies. And this will drive the next leg of the crisis. So, people say congratulations, you called the short-vol trade. No, nothing has happened yet. This is an appetizer. This is just the appetizer for the unwind that is about to come. I think this is what people should be really afraid of, and I think this is the next leg of this that we will see. Whether this happens in two weeks or whether this happens over two years, I don’t know. But I strongly believe this will come to pass. And it will be quite disorderly and ugly.

Practice and theory.

• Why People Who Make Money Are Usually Wrong – Taleb (ZH)

Echoing Mark Spitznagel’s insights into how ‘naiveté’ led to the epic losses experienced by many ‘nickel-picker-uppers’ this week in the short-vol game, Nassim Taleb takes to YouTube to provide some more color on the fallacy of forecasting and what destroyed XIV traders. Taleb begins by noting that “many people attempted to profit by forecasting volatility [would drop] and from the fact that the contract [in this case XIV] was poorly constructed… they were right, until they were destroyed.” Academics cannot get the idea that you don’t have to be right about the world to make money.

“Antifragile explains why understanding x is different from f(x) the payoff or exposure from x. Most of the harm/gains come from f(x) being convex or concave, not from understanding x. Forecasting is off an average, and average is for academics and other morons.” As Valuewalk’s Jacob Wolinsky writes, this video illustrates the point with XIV that went bust while being correct about volatility –and why people who make money are usually wrong.

Has Pandora’s box been opened?

• ‘Big Shakeout Coming’: Bridgewater Sounds Warning (G.)

Financial markets are braced for more volatility this week amid predictions from the world’s biggest hedge fund that a “big shakeout” is coming. The Australian stock market was the first to test the water on Monday morning and one point was down 0.7%. But it rallied slightly in afternoon trade to close down 0.3%. Bourses elsewhere in Asia Pacific also found calmer waters. South Korea’s Kospi was up 0.9% while Hong Kong put on 0.8%. The Nikkei in Japan was closed for a holiday. The FTSE100 is London is due to open up 1.25% according to futures trading, while the Dow Jones average on Wall Street is set to rise 0.7%. Last week saw $4tn wiped off the value of shares around the world and the US market entered into an official correction after falling more than 10% from its record level in January.

Wall Street staged a late rally on Friday as the Dow Jones finished 330 points higher and the closely watched Vix index, or “fear index”, has dropped four points to 29 on Monday from 33 on Friday. But Bob Prince, co-chief investment officer at the $160bn US hedge fund Bridgewater, told the Financial Times on Monday (paywall): “There had been a lot of complacency built up in markets over a long time, so we don’t think this shakeout will be over in a matter of days. “We’ll probably have a much bigger shakeout coming.” David Bassanese, the chief economist at BetaShares Capital in Sydney, said in a note on Sunday that despite the big falls last week, the selling could continue. “History suggests the depth of corrections – assuming the underlying bull market persists – don’t usually get beyond 15%, so there’s certainly some scope for market weakness before a bottom is reached,” he said.

Investors would be jittery about US inflation figures on Wednesday, he said. The market was forecasting a “fairly benign” 1.7% annual prices growth, but anything above that was likely to result in more stock losses. Chris Weston at online trader IG said on Monday: “A massive buildup in market leverage has been partially unwound in the blink of an eye and what started as systematic funds selling out of equity and futures positions, as implied volatility headed higher, has morphed into something far more broad-based incorporating many other market participants.”

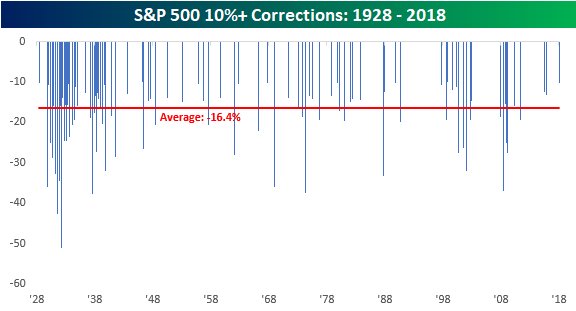

“..the median decline for the S&P in a correction is 16.4%, and the median length of a pullback is 64 days..”

• History Suggests The Correction Isn’t Nearly Over (MW)

Perhaps the biggest question on Wall Street right now is whether the recent pain in the U.S. stock market is over. If history is any indication, the answer is no. Both the Dow Jones Industrial Average and the S&P 500 entered correction territory on Thursday, defined as a 10% drop from a recent peak—in this case, record highs that were hit in late January. According to Bespoke Investment Group, which analyzed the 95 corrections the S&P has seen since 1928, investors might want to brace themselves for more pain.

Per Bespoke’s data, the median decline for the S&P in a correction is 16.4%, and the median length of a pullback is 64 days. Were the S&P to hit that median in the current selloff, it would bottom around 2,400, or roughly 7.8% below current levels. “Keep in mind, though, that these are median levels. There have been a number of corrections (13) that saw declines of less than 11%, while several saw deeper declines of more than 20%,” the research group wrote in a blog post. A decline of 20% would put the index into bear-market territory, where nearly one-fifth of S&P components currently trade. “In terms of length, prior corrections have also been all over the map. Some have lasted as little as three days, while others have stretched on for well over a year.”

It will hit millions everywhere.

• Interest Rate Rise Would Hit Millions In UK Who Depend On Cheap Credit (G.)

The Bank of England’s warning that it plans to raise interest rates from as early as May will hit millions of low-income families who have only survived financially for a decade by using cheap credit. The Resolution Foundation said almost half of low-income families were in debt distress before Threadneedle Street said last week that it needed to increase the base rate at an accelerated pace over the next two years. The Bank governor, Mark Carney, said the strength of the economy warranted higher borrowing costs. He cited rising average wages and resilient GDP growth as reasons to begin pushing interest rates from the historically low level of 0.5%.

But a study by the foundation showed the proportion of households in some form of debt distress rose to 45% among the poorest fifth of working age households, with more than a third experiencing difficulty in paying for accommodation and one in six in arrears on either their mortgage or consumer debts. Households headed by someone aged 25-34 spent nearly £1 in every £5 of their pre-tax income on debt repayments in 2017, compared with 20p for households aged 65 and over. Levels of consumer credit have soared in recent years to more than £200bn, prompting debt charities to warn that lenders are repeating the mistakes made in the early part of the century, when households on low incomes were sold loans they could not repay.

Matt Whittaker, the chief economist at the Resolution Foundation, said most of the increase in consumer debt since 2014 was among middle and higher income groups and they could afford to absorb an increase in interest rates. The cost of servicing Britain’s household debt is low by historical standards, he said, with repayments accounting for 7.7% of disposable income, well below the 12.3% recorded just before the financial crisis, and in line with the level seen during the mid-1990s and early 2000s. “However, while the recent growth in debt is less of a concern, it is very worrying that almost half of low-income families are already showing signs of debt distress,” Whittaker said. “While rates have been at historic lows for a decade now, many families have experienced a tight income squeeze over this period and have not been able to get back on the front foot when it comes to servicing their debts.”

Yawn.

• May Starts Drive to End the Conservative Civil War Over Brexit (BBG)

U.K. Prime Minister Theresa May embarks this week on a determined push to bring her divided Cabinet together and come up with a Brexit plan. As European negotiators show increasing signs of impatience, senior U.K. ministers are preparing to deliver a series of speeches in the coming weeks setting out a vision of life outside the European Union. They’ll culminate with an address by May. Dubbed a “Road Map to Brexit,” the schedule begins on Wednesday when Foreign Secretary Boris Johnson issues an appeal to both sides of the Brexit debate. May is expected to offer a new security relationship three days later when she addresses a conference in Munich. Also scheduled to make speeches are Brexit Secretary David Davis, Trade Secretary Liam Fox, and Cabinet Office Minister David Lidington.

Absent, however, is Chancellor of the Exchequer Philip Hammond, who enraged Brexit supporters in January by suggesting Britain would see only “very modest” changes to its relationship with the EU once it leaves the bloc. May has ordered key ministers to attend an “away day” at Chequers, the prime ministerial country retreat outside London, after two meetings to find a joint position on Brexit ended without agreement last week. With just 13 months to go before Britain exits the EU, the ruling Conservatives are mired in a civil war between those who want to retain close ties to the bloc and hard-liners demanding a clean break, including total withdrawal from the EU single market and the customs union. On Friday, Michel Barnier, the EU’s chief Brexit negotiator, expressed his exasperation by warning that the post-Brexit bridging period that once seemed a certainty “is not a given,” prompting investors to sell the pound.

Businesses have said they’ll start to activate contingency plans to move jobs and operations out of the U.K. unless a transition deal is nailed down by the end of March. In her speech to cap off the “Road to Brexit” push — the date of which hasn’t been announced — May will set out the government’s “ambitions for Britain’s partnership with the EU after we have left.” It will be her third major address, following her Lancaster House speech in January last year and her Florence speech in September. “Brexit is a defining moment in the history of our nation,” May’s office said in a statement. “We will be forging an ambitious new partnership with Europe and charting our own way in the world to become a truly global, free-trading nation.”

Afghanistan is like a Bermuda triangle.

• China Enters The Graveyard Of Empires (Escobar)

The latest plot twist in the endless historical saga of Afghanistan as a graveyard of empires has thrown up an intriguing new chapter. For the past two months, Beijing and Kabul have been discussing the possibility of setting up a military base alongside Afghanistan’s border with China. “We are going to build it [the base] and the Chinese government has committed to help financially, provide equipment and train Afghan soldiers,” Mohammad Radmanesh, a spokesman for the Afghan Ministry of Defense, admitted to the AFP. On the record, the Chinese Foreign Ministry only admitted that Beijing was involved in “capacity-building” in Afghanistan, while NATO’s Resolute Support Mission, led by the United States, basically issued a “no comment.”

The military base will eventually be built in the mountainous Wakhan Corridor, a narrow strip of territory in northeastern Afghanistan that extends to China and separates Tajikistan from Pakistan. It is one of the most spectacular, barren and remote stretches of Central Asia and according to local Kyrgyz nomads, joint Afghan-Chinese patrols are already active there. True to Sydney Wignall’s fabled Spy on the Roof of the World ethos, a great deal of shadow play is in effect. Apparently, this is basically about China’s own war on terror. Beijing’s strategic priority is to prevent Uyghur fighters of the East Turkestan Islamic Movement (ETIM), who have been exiled in Afghanistan, crossing the Wakhan Corridor to carry out operations across Xinjiang, an autonomous territory in northwest China.

There is also the fear that ISIS or Daesh jihadis from Syria and Iraq may also use Afghanistan as a springboard to reach the country. Even though the jihad galaxy may be split, Beijing is concerned about ETIM. As early as September 2013, the capo of historic al-Qaeda, Ayman al-Zawahiri, supported jihad against China in Xinjiang. Later, in July 2014, Abu Bakr Al-Baghdadi, the leader of Daesh said: “Muslim rights [should be] forcibly seized in China, India and Palestine.” Then, on March 1, 2017, Daesh released a video announcing its presence in Afghanistan, with the terror group’s Uyghur jihadis vowing, on the record, to “shed blood like rivers” in Xinjiang. At the heart of the matter is China’s Belt and Road Initiative, or the New Silk Road, which will connect China with Asia, Africa, the Middle East and Europe.

Empty politics.

• China Pledges ‘Employment First’ Policies To Create Millions Of Jobs (R.)

China will boost its job creation effort and promote entrepreneurship this year, a spokeswoman for the top state planner said on Sunday, under pressure to find work for millions of unemployed people and new college graduates. Meng Wei of the National Development and Reform Commission (NDRC) said China needs to create jobs for 9.7 million people registered as unemployed and 8.2 million new college graduates, as well as workers affected by industrial capacity cuts. China’s urban-registered unemployment rate fell to 3.9 percent last year and has remained generally stable despite slowing economic growth and the government forging ahead with plans to cut back industrial capacity.

Many analysts say, however, that the official data is an unreliable indicator of employment conditions because it only measures employment in urban areas and does not take into account the millions of migrant workers who form the bedrock of China’s labour force. “We will implement an employment-first strategy and more proactive employment policies…and vigorously promote employment and entrepreneurship,” Meng told a news conference on Sunday, adding that protecting jobs was fundamental to China’s stable growth policy. Authorities are counting on “new growth engines” such as technology and services to support job creation. Meng said China will create a policy environment that supports the digital economy and will promote the big data, artificial intelligence and industrial internet sectors.

QE bankrolls the house.

• Party On, Dudes (Jim Kunstler)

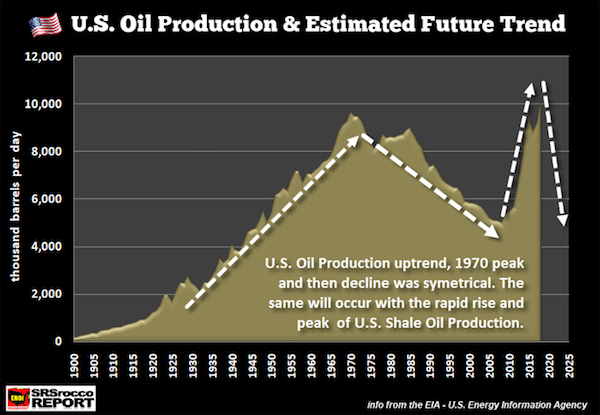

In June of 2008, US crude hit $144-a-barrel, a figure so harsh that it crippled economic activity — since just about everything we do depends on oil for making, enabling, and transporting stuff. The price and supply of oil became so problematic after the year 2000 that the US had to desperately engineer a work-around to keep this hyper-complex society operating. The “solution” was debt. If you can’t afford to run your society, then try borrowing from the future to keep your mojo working. The shale oil industry was a prime beneficiary of this new hyper-debt regime. The orgy of borrowing was primed by Federal Reserve “creation” of trillions of dollars of “capital” out of thin air (QE), along with supernaturally low interest rates on the borrowed money (ZIRP). The oil companies were desperate in 2008. They were, after all, in the business of producing… oil! (Duh….) — even if a giant company like BP pretended for a while that its initials stood for “Beyond Petroleum.”

The discovery of new oil had been heading down remorselessly for decades, to the point that the world was fatally short of replacing the oil it used every year with new supply. The last significant big fields — Alaska, the North Sea, and Siberia — had been discovered in the 1960s and we knew for sure that the first two were well past their peaks in the early 2000s. By 2005, most of the theoretically producible new oil was in places that were difficult and ultra-expensive to drill in: deep water, for instance, where you need a giant platform costing hundreds of millions of dollars, not to mention armies of highly skilled (highly paid) technicians, plus helicopters to service the rigs. The financial risk (for instance, of drilling a “dry hole”) was matched by the environmental risk of a blowout, which is exactly what happened to BP’s 2010 Deepwater Horizon platform in the Gulf of Mexico, with clean-up costs estimated at $61 billion.

[..] The shale oil companies could get plenty of cash-flow going, but it all went to servicing their bonds or other “innovative” financing schemes, and for many of the companies the cash flow wasn’t even covering those costs. It cost at least six million dollars for each shale well, and it was in the nature of shale oil that the wells depleted so quickly that after Year Three they were pretty much done. But it was something to do, at least, if you were an oil company — an alternative to 1) doing no business at all, or 2) getting into some other line-of-work, like making yoga pants or gluten-free cupcakes.

“..87 allegations of sexual abuse by staff in 2016-17..” “..more than 120 workers across a range of leading charities had been accused of sexual abuse in the past year alone..”

• Oxfam Faces Losing Funding As Crisis Grows Over Abuse Claims (G.)

Oxfam was scrambling on Sunday night to contain a growing crisis over claims of sexual misconduct by aid workers before a crunch meeting on Monday that could see the charity stripped of its government funding. Amid anger from the government and the wider aid sector at revelations that Oxfam staff in Haiti paid prostitutes – possibly underage – for sex in 2011, the charity’s chair of trustees, Caroline Thomson, pledged to widen a review of its practices to include the Haiti allegations and admitted “anger and shame that behaviour like that … happened in our organisation”. She set out the steps Oxfam would take to avoid a similar scandal in future after the international development secretary, Penny Mordaunt, issued a damning rebuke to the charity. Mordaunt warned that it would receive no more public money unless it demonstrated “moral leadership” and handed over all information on aid workers’ alleged use of prostitutes on the island.

[..] Oxfam’s fight to secure its financial footing came after days of escalating stories about the conduct of its workers after revelations that staff in Haiti had been dismissed for using prostitutes for sex parties. Any hopes the charity’s leadership had that the scandal might quickly subside were dashed when it was reported in the Observer that Oxfam staff in Chad had also used prostitutes and when Oxfam’s own annual report resurfaced, showing it dealt with 87 allegations of sexual abuse by staff in 2016-17. Oxfam’s crisis threatened to spill across the charity sector on Sunday with reports that more than 120 workers across a range of leading charities had been accused of sexual abuse in the past year alone.

Everyone in Haiti knew about this. And it’s not just Oxfam either.

• Oxfam Reels From Prostitution Scandal (G.)

deep disgust at what they were hearing was tinged with a sense of inevitability for some. “We’ve all worked with people who’ve worked in Ethiopia, DRC, Haiti, Malawi, Thailand etc who’ve seen similar things across the entire sector,” said one Oxfam worker in the Middle East. Goldring, admired by staff as “deeply thoughtful”, set out the story – first a chronology of what happened in Haiti in 2011, and then a commentary on the issues it raised, including pointing out the dilemmas that the Oxfam staff handling the case faced. For example, he said, the charity didn’t report it to the Haitian police because it was concerned that could rebound adversely on the women involved.

He struck one attendee as “desperately keen to put across the point that we don’t think there was a cover-up because we didn’t hide that there was a problem in Haiti”. Only Oxfam hadn’t been open about what that problem was. Some staff also felt there was a “single-mindedness about the attack on Oxfam” that was not commensurate with the weight of what had happened in 2011. It was shocking and wrong, but some felt that the problems revealed were probably not unique to Oxfam. “I’m really frustrated at the Oxfam-only lens in this – granted what happened was horrific,” said one Oxfam worker abroad. “I’ve worked for [several other NGOs] and there just isn’t any type of policy or procedure in place for any of this stuff.”

The people responsible for these decisions should be taken to court. Even -make that especially- politicians must be held to their own laws.

• The UK’s Hidden Role In Assange’s Detention (Cook)

It now emerges that the last four years of Julian Assange’s effective imprisonment in the Ecuadorean embassy in London have been entirely unnecessary. In fact, they depended on a legal charade. Behind the scenes, Sweden wanted to drop the extradition case against Assange back in 2013. Why was this not made public? Because Britain persuaded Sweden to pretend that they still wished to pursue the case. In other words, for more than four years Assange has been holed up in a tiny room, policed at great cost to British taxpayers, not because of any allegations in Sweden but because the British authorities wanted him to remain there. On what possible grounds could that be, one has to wonder? Might it have something to do with his work as the head of Wikileaks, publishing information from whistleblowers that has severely embarrassed the United States and the UK.

In fact, Assange should have walked free years ago if this was really about an investigation – a sham one at that – into an alleged sexual assault in Sweden. Instead, as Assange has long warned, there is a very different agenda at work: efforts to extradite him onwards to the US, where he could be locked away for good. That was why UN experts argued two years ago that he was being “arbitrarily detained” – for political crimes – not unlike the situation of dissidents we support in other parts of the world. According to a new release of emails between officials, the Swedish director of public prosecutions, Marianne Ny, wrote to Britain’s Crown Prosecution Service on 18 October 2013, warning that Swedish law would not allow the case to be continued. This was, remember, after Sweden had repeatedly failed to take up an offer from Assange to interview him at the embassy in London, as had happened in 44 other cases between Sweden and Britain.

Ny wrote to the CPS: “We have found us to be obliged to lift the detention order … and to withdraw the European arrest warrant. If so this should be done in a couple of weeks. This would affect not only us but you too in a significant way.” Three days later, suggesting that legal concerns were far from anyone’s mind, she emailed the CPS again: “I am sorry this came as a [bad] surprise… I hope I didn’t ruin your weekend.” In a similar vein, proving that this was about politics, not the law, the chief CPS lawyer handling the case in the UK, had earlier written to the Swedish prosecutors: “Don’t you dare get cold feet!!!”