DPC Main Street north from Sixth, Little Rock, Arkansas 1911

“The dollar has soared a staggering 96% against the Russian ruble since June 30.”

• How The US Dollar Stacks Up Against Major World Currencies (AP)

The U.S. dollar has been rolling. Since June 30, its value has jumped 16% against a collection of world currencies. Investors are embracing the dollar because the U.S. economy is strong, especially compared with most other nations. U.S. economic growth clocked in at a 5% annual rate from July through September, the fastest quarterly pace in more than a decade. During 2014, American employers added nearly 3 million jobs, the most in any year since 1999. Investors also like the safety of U.S. Treasurys, which pay a higher yield than government bonds in Japan and most big European countries do. Another lure: The Federal Reserve is expected to raise short-term interest rates this summer or fall, making U.S. rates even more attractive for investors. But the dollar’s strength also reflects weakness elsewhere:

• JAPAN: The dollar is up 16% against the Japanese yen since mid-2014. Japan slid into recession last quarter after the government imposed an ill-timed sales tax increase. The Bank of Japan has tried to revive the economy by buying bonds to lower rates, boost inflation and drive down the value of the yen to aid Japanese exporters.

• EURO: The dollar has surged 18% against the euro since June 30. Economic growth among the 19 countries that use the euro has flat-lined. Last year, the European Central Bank slashed rates and sought to stimulate lending by promising to buy bundles of bank loans. Next week, the ECB is expected to announce a program to buy bonds — a version of what the Fed did three times since 2008 — to lower long-term rates and stimulate the eurozone economy.

• BRAZIL: The dollar has gained nearly 20% against the Brazilian real since the middle of last year. The Brazilian economy is beset by a combination of slow growth and high inflation. The Brazilian Central Bank will likely raise rates next week to try to fight inflation and rally the real, economists at Barclays predict.

• RUSSIA: The dollar has soared a staggering 96% against the Russian ruble since June 30. Plummeting oil prices and economic sanctions have devastated the Russian economy, which is likely headed toward recession. Money is fleeing the country. In mid-December, the Russian central bank raised rates to try to salvage the currency. The move has at least slowed the free-fall.

Read more …

“People are underestimating what a strong U.S. dollar can do and oil is just one of those things.”

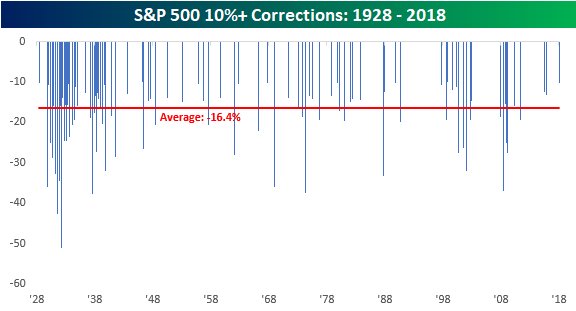

• This Is The Case For A ‘Large, Sharp Correction’ (CNBC)

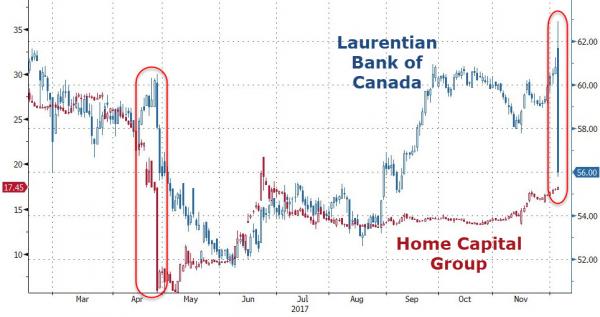

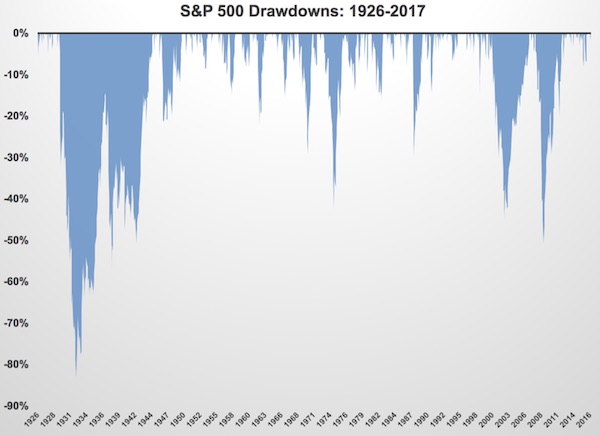

Pain in the market may just be getting started, according to Raoul Pal of the Global Macro Investor. “The chance of a large sharp correction? Absolutely, because volatility is there and people will be forced to reduce risk, ” Pal said on CNBC’s “Fast Money.” “I would put that as a reasonably high probability that the S&P falls possibly from here down to the 1,800 level.” Pal thinks there will be a lot of volatility in the market this year and currency volatility will be the driving force. He expects the sharp currency moves that have happened globally to hit the U.S. equity markets. A violent move in the Swiss franc on Thursday shook investors as the Switzerland National Bank removed its cap on its currency relative to the euro.

The cap was in place to prevent the franc from gaining ground against the euro while Europe remained in recovery mode. Switzerland has been a beacon of financial stability throughout the euro zone’s recession. Brokerage and financial firms reported millions of dollars of losses from the sudden gains in the Swiss franc on Thursday and that may not be the end of it. Currency swings are an issue at home with the U.S. dollar on a tear over the past year. “The biggest risk to U.S. equities is if the long dollar trades unwind. If that happens, then you may see people unwinding their stock positions as well,” said “Fast Money” trader Brian Kelly.

Pal also believes a strengthening dollar will be part of the U.S. market downfall this year, “People are underestimating what a strong U.S. dollar can do and oil is just one of those things.” Oil is down nearly 10% so far this year and that’s after a 45% drop in 2014. Pal isn’t alone in pointing to hard times ahead in the market. On Wednesday, Dennis Gartman told Fast Money he was now net short of stocks. “As of this afternoon, I am slightly, very slightly net short.” As the markets sold off, Gartman did say that he was long the tanker stocks, which had managed to rise on the back of falling oil prices.

Read more …

Chinese data coming this week.

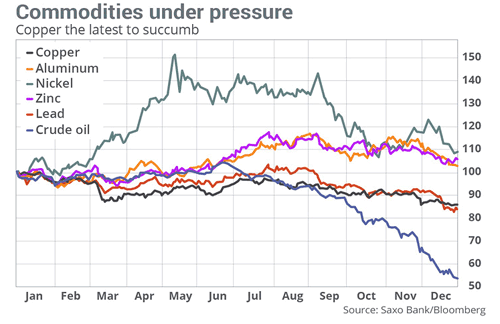

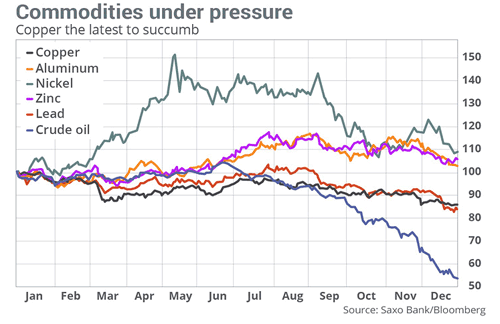

• Copper’s Rout May Be A Red Flag (MarketWatch)

Economists are bullish on growth, but copper’s big plunge on Wednesday appeared to be suggesting that +they’re wrong. For investors, the crucial question is ‘Who is right?’ An ugly 24-hour period drove copper to mid-2009 lows on Wednesday—it fell 5% to $2.1590 a pound. In New York on Tuesday, copper fell 8 cents, but the big crack came later in that day when it crashed through key support at $6,000 a tonne on the London Metal Exchange. That drop was followed by heavy falls in Shanghai on Wednesday, said Ole Hansen, Saxo Bank’s head of commodity strategy.

Known as Dr Copper, the commodity is a chief building and manufacturing material and to some a harbinger of the global economy. So when investors start to bail on it, some say that is a sign of the proverbial canary in the coal mine is starting to keel over. Some blamed copper’s losses on the World Bank, which cut its global-growth outlook, including for China, a country that is a big global buyer of copper. Investors inured to oil serving as the whipping boy for the market’s global-growth worries, were taken aback by yet another commodity caving. Copper falling alone would be less of a worry for Adam Sarhan, chief executive officer of Sarhan Capital. A range of commodities, hard and soft, have joined oil lower: gasoline, corn, sugar, to name a few, Sarhan said.

A combination of this pressure “supports that notion that deflation is getting stronger not weaker and if that is the case then that bodes poorly for both main street and Wall Street,” he said. For its part, oil has lost nearly 60% of its value since peaking in June. Equally concerned was Keith McCullough, CEO of Hedgeye Risk Management, who says he has been telling his clients to short copper for months. “Oil, copper, etc.—they are all legacy carry trades associated with the simple expectation that the Fed could perpetually inflate asset prices,” he said. “Now deflation is dominating expectations, and all of those who underestimated how nasty the deleveraging associated with deflation can be,” said McCullough.

Read more …

“.. a serious threat for tens of thousands of Swiss jobs.”

• Swiss Central Bank’s Shock Therapy Leaves Policy Vacuum (Reuters)

The Swiss National Bank had little choice but to abandon its three-year-old cap on the franc but its execution of the move left a vacuum of policy uncertainty where a pillar of stability stood before. With the euro diving against the dollar as the European Central Bank gears up for fresh stimulus as early as next week, the SNB felt the 1.20-francs-per-euro cap was not sustainable and chose to give it up rather than accumulate further risk. Yet in pulling off the move, the SNB – a conservative institution in a safe-haven state – failed to tip off its peers and shocked investors, who were left wondering whether central banks are now less a source of stability and more one of a risk. “The bottom line: central banks are a lot less predictable than in the past few years,” said Christian Gattiker, chief strategist at Swiss bank Julius Baer. The SNB, whose three board members make their decisions behind closed doors, acted in isolation.

IMF Managing Director Christine Lagarde lamented the lack of a warning from SNB Chairman Thomas Jordan. “I find it a bit surprising that he did not contact me,” she said. For ECB policymaker Ewald Nowotny, the move was “a surprising decision”. In contrast with the ECB, which has 25 policymakers from across the continent who debate major decisions, just three men call the shots at the SNB, albeit in consultation with staff advisers. Details of ECB policy debates often leak because of the large numbers of officials also involved; if President Mario Draghi announces next week that the ECB is to launch quantitative easing, he will surprise no one. Draghi has made no secret of the fact that such a programme is under discussion on the ECB Governing Council.

While officials at central banks generally play down the idea that they offer each other advance notice, they almost always prepare financial markets, businesses and each other for important policy shifts by openly discussing their thinking in the run up to any move. But Adam Posen, a former Bank of England official who heads the Peterson Institute for Economics in Washington, said transparency at times needed to be sacrificed. “Central bank communication is overrated,” Posen said at an event in Washington when asked about the SNB’s move. It’s more important to get a policy right than to stick to a “foolish consistency” of communicating everything, he said. For exporters and the tourism industry in Switzerland, the move that has led to a near 18% rise in the franc against the euro is far from understandable. Christian Levrat, president of the left-wing Social Democrat party, called the move “a serious threat for tens of thousands of Swiss jobs”.

Read more …

And many more.

• Swiss Franc Trade Is Said to Wipe Out Everest’s Main Fund (Bloomberg)

Marko Dimitrijevic, the hedge fund manager who survived at least five emerging market debt crises, is closing his largest hedge fund after losing virtually all its money this week when the Swiss National Bank unexpectedly let the franc trade freely against the euro, according to a person familiar with the firm. Everest Capital’s Global Fund had about $830 million in assets as of the end of December, according to a client report. The Miami-based firm, which specializes in emerging markets, still manages seven funds with about $2.2 billion in assets. The global fund, the firm’s oldest, was betting the Swiss franc would decline. The SNB’s decision to end its three-year policy of capping the franc at 1.20 a euro triggered losses at Citigroup, Deutsche Bank and Barclays as well as hedge funds and mutual funds.

The franc surged as much as 41% versus the euro on Jan. 15, the biggest gain on record, and climbed more than 15% against all of the more than 150 currencies tracked by Bloomberg. Everest grew to $2.7 billion by the start of 1998 after navigating crises in Mexico and Southeast Asia. Russia’s default and currency devaluation proved trickier and assets fell by half amid losses. He revived the firm and a decade later Everest managed $3 billion. Then the global financial crisis hit, and assets shrunk by $1 billion. Last year, the main fund rose 14.1%, driven by Chinese equities and bets against currencies, including a wager that the Swiss franc would fall after citizens rejected a referendum that would require the central bank to hold at least 20% of its assets in gold, the investor report said.

Read more …

“The negative effects for the Swiss economy – through the decreased competiveness of its export industries (including tourism and medicine) – may already be showing that abandoning the euro peg was not a good idea.”

• Making Sense Of The Swiss Shock (Project Syndicate)

There is historical precedent for the victory of political pressure, and for the recent Swiss action. In the late 1960s, the Bundesbank had to buy dollar assets in order to stop the Deutsche mark from rising, and to preserve the integrity of its fixed exchange rate. The discussion in Germany focused on the risks to the Bundesbank’s balance sheet, as well as on the inflationary pressures that came from the currency peg. Some German conservatives at the time would have liked to buy gold, but the Bundesbank had promised the Fed that it would not put the dollar under downward pressure by selling its reserves for gold. In 1969, Germany unilaterally revalued the Deutsche mark. But that was not enough to stop inflows of foreign currency, and the Bundesbank was obliged to continue to intervene. It continued to reduce its interest rate, but the inflows persisted. In May 1971, the German government – against the wishes of the Bundesbank – abandoned the dollar peg altogether and floated the currency.

Politics had prevailed over central-bank commitments. Within three months, the fallout destroyed the entire international monetary system, and US President Richard Nixon took the dollar off the gold standard. The credibility of the entire system of central bank commitments had collapsed, and international monetary policy became extremely unstable. The Deutsche mark appreciated, and life became very hard for German exporters. Today, the global ramifications of a major central bank’s actions are much more pronounced than in 1971. When the Bundesbank acted unilaterally, German banks were not very international. But now finance is global, implying large balance-sheet exposures to currency swings. Big Swiss banks fund themselves in Swiss francs, because so many people everywhere want the security of franc assets. They then acquire assets worldwide, in other currencies. When the exchange rate changes abruptly, the banks face large losses – a large-scale version of naive Hungarian homeowners’ strategy of borrowing in Swiss francs to finance their mortgages.

Though the SNB had given many warnings that the euro peg was not permanent, and though it had imposed a higher capital ratio on banks, the uncoupling from the euro came as a huge shock. Swiss bank shares fell faster than the general Swiss index. The risks created by the SNB’s decision – as transmitted through the financial system – have a fat tail. The negative effects for the Swiss economy – through the decreased competiveness of its export industries (including tourism and medicine) – may already be showing that abandoning the euro peg was not a good idea. But the consequences will not be limited to Switzerland. After years of wondering whether the exit of a small, fiscally weak country like Greece could undermine the euro, policymakers will have to deal with an even bigger shock stemming from the exit of a small, fiscally strong country that is not even a member of the European Union.

Read more …

Steve’s first piece for Forbes.

• Beware Of Politicians Bearing Household Analogies (Steve Keen)

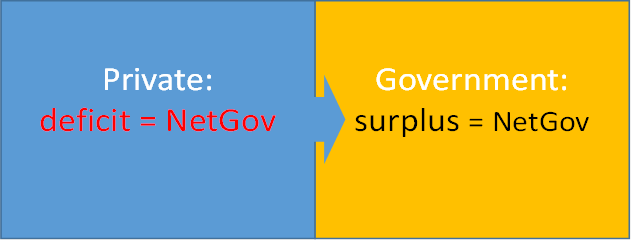

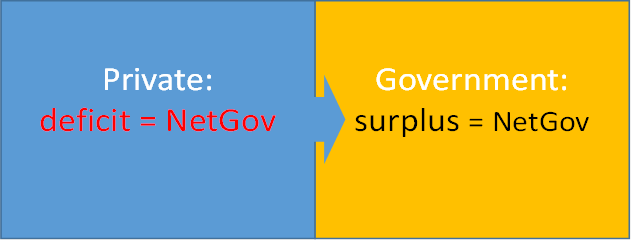

The British election campaign has begun, and Prime Minister David Cameron is running with the slogan that his Conservative Party will deliver “A Britain living within its means” by running a surplus on day-to-day government spending by 2017/18. It is, as the UK Telegraph noted, hardly an inspiring slogan. But it is one that resonates with voters, because it sounds like the way they would like to manage their own households. And a household budget—whether you balance yours or not—is something we can all understand. If a household spends less than it earns, it can save money, or pay down its debt, or both. So it has to be good if a country does the same thing, right? If only it worked that way. In fact, a government surplus has the opposite effect on Joe Public: a government surplus means that the public has to either run down its savings, or increase its debt.

And if the government runs a sustained surplus, then—unless the country in question has a huge export surplus, like Japan or Germany—a financial crisis is inevitable. That’s the opposite of what both politicians and most of the public think that running a government surplus will achieve—and yet it’s easy to prove that that is the outcome a sustained surplus will lead to. Firstly, a government surplus means that, in a given year, the taxes the government imposes on the public exceed the money it spends (and gives) to the public. There is therefore a net flow of money from the public to the government. As a once-off, that doesn’t have to be a problem. But if it’s sustained for many years, then the public has to provide a continuous flow of money to the government. Let’s call this flow NetGov: a sustained surplus requires the situation shown in Figure 1 (where a deficit is shown in red and a surplus in black).

Figure 1: A sustained government surplus requires the private sector to supply the government with a continuous flow of money

One way that the public can do this is to run down its own money stock—to reduce its savings. But that’s the opposite of what the policy is intended to achieve: the expectation of enthusiasts for government surpluses is that it will enable the public to save more, not less. But as a simple matter of accounting, increased public savings—increased balances in the public’s bank accounts—are only compatible with a government surplus if the public can produce more money than it pays to the government to maintain its surplus. This raises the question “how does the public produce money?”. Anyone in the private sector can produce goods and services for sale, but the production of money is a very different thing to production of goods. The public in general can’t “produce money”—but the banks can.

Read more …

Draghi should leave, and Weidmann be appointed head of the ECB.

• Draghi Primes His Rocket, Could End Up Shooting Europe In The Foot (Observer)

Mario Draghi, the urbane boss of the European Central Bank, is about to print hundreds of billions of euros to rescue the faltering continental economy. The City expects him to launch his financial bazooka, otherwise known as quantitative easing (QE), on Thursday after the central bank governing council’s monthly meeting. His hand was forced last week by events in Zurich, where his Swiss counterpart said the policy of pegging the franc to the euro was no longer tenable. The markets were impatient for QE, the Swiss central bank chief said – they have already waited months for a decision. The ECB funds will begin to flow six years after the world’s other major economies adopted QE. The US has spent around $4 trillion, the UK £375bn, and last year the Japanese promised to spend almost $700bn a year, up from $560bn in 2013.

If Draghi goes ahead, the Super-Mario headlines will proliferate across Europe and gigabytes of the web will be devoted to analysing the consequences of the move for the 19-member currency zone – and for its trading partners, such as the UK. The ECB’s aim is to flood the eurozone banking system with money to boost lending after a collapse in the value of consumer and business borrowing. Draghi’s supporters say the very fact of taking action will increase confidence and invigorate a stuttering economic bloc. According to this argument, Brussels has done little apart from impose austerity. Now, with the ECB throwing its weight behind a strategy for growth, confidence and spending will begin to rise.

QE has clearly played a big part in rescuing the global economic system after the crash. But its usefulness as a spur for growth is less clear. As Labour’s Ed Balls has said, governments need to step in with their own funds – albeit borrowed – for investment that ensures growth is sustainable. QE is like an adrenalin shot to revive a stricken patient. It is useless when the patient is in recovery and crying out for something more substantial. But persistently printing vast quantities of a currency has one major effect. It drives down its value against other currencies. Since Christmas, the yen has been trading 50% below where it was in October 2012 against the dollar. That means Japanese exports of cars, TVs and kimonos cost 50% less in the US and, just as importantly, in China, which has pegged the renminbi to the dollar.

Read more …

No, it doesn’t. Well, other than for bringing down the euro. All else has long been priced in.

• Market to European Central Bank: Size of QE Matters! (CNBC)

Earnings and economic reports all take a back seat to the European Central Bank in the holiday-shortened trading week ahead. Investors are looking to the ECB to on Thursday announce a program of government bond purchases, or quantitative easing. “The only thing that is important next week is the ECB meeting,” Mark Luschini, chief investment strategist at Janney Montgomery Scott, said. “The ECB is going to be the biggest driver next week, what they decide to do as far as rates and their QE should have a big impact on global markets,” said Paul Nolte at Kingsview Asset Management.

“The markets are expecting a very impressive QE, a la United States, a la Japan. Some investors may be playing both sides, and by that I mean playing for a big move. If they do come down with a big package, global markets will rally strongly, if they don’t do much of anything, you could see markets fall apart,” Nolte said. “There’s a huge amount of anticipation, and a lot of volatility around this ECB decision on Thursday. It’ll be a combination of what they say they’re going to do, and their intentions after that,” Scott Wren, senior equity strategist at Wells Fargo Investment Institute, said.

“I think the ECB will act next week, and make some type of announcement. But the market is likely to be disappointed by the magnitude that the ECB initially says they’re going to do, as the market would like to see a trillion. Let’s say they come out with €500 billion, and some sort of statement of more”. Switzerland’s central bank upended markets Thursday by removing its cap on the Swiss franc versus the euro, with the action viewed as a preemptive one to shield its currency from pressure should the ECB make a move. “I suspect (ECB President Mario) Draghi gave a wink to the Swiss National Bank and allowed them to get in front of that, the question mark at this juncture is the order of magnitude. The market is vulnerable to an underwhelming response. The key, basically, is trying to restore the balance sheet to 2012 levels, so we’d have to at least have to see €1.3 trillion,” Luschini said.

Read more …

“The country’s overall debt burden has actually increased in the almost five years since it was first “rescued..”

• A New Idea Steals Across Europe – Should Greece Debt Be Forgiven? (Observer)

Forgiveness: it’s a rare enough quality in family life, let alone international policymaking. But if, as the polls suggest, the populist Syriza party wins next weekend’s Greek election, Athens will be asking its European brothers and sisters to forgive and forget some of the €317bn (£240bn) it still owes, so that its economy – and society – can recover from more than six years of austerity and recession. Instead of the defiant tone that once saw Syriza’s leader, Alexis Tsipras, threatening to ditch the euro altogether, the party now hopes to negotiate an agreement with Germany and other creditors that could allow Greece to remain in the single currency – but set it on the path to recovery.

London-based pressure group Jubilee Debt Campaign, which has studied the fate of heavily indebted countries around the world, says Greece is right to demand a more generous approach from its creditors, because although it has received an extraordinary €252bn in bailouts since 2010, just 10% of that has found its way into public spending. Much of the rest poured straight back out of the country: in debt repayments and interest to its creditors, many of them banks and hedge funds in the core eurozone countries, including Germany and France; and in sweeteners to persuade lenders to sign up to the 2012 bond restructuring that helped prevent the country crashing out of the euro. In effect, the “troika” of the European Central Bank, the International Monetary Fund and the European commission has simply replaced the banks and the hedge funds as Greece’s paymasters.

The country’s overall debt burden has actually increased in the almost five years since it was first “rescued”, and of the amount still outstanding, 78% is now owed to public sector institutions, primarily the EU. Stephany Griffith-Jones, an economist who is an expert on debt crises in developing countries, says: “They have got quite a lot of relief already; but a lot of that money that came to the government has gone to servicing the debt, including to the private banks. It wasn’t really money to help the Greeks. This is exactly like when I used to study Latin America in the 1980s: then, it was American and British banks, now it’s German and French banks.”

Read more …

Of coursethere should be such a conference. A fully public one.

• Ireland ‘Not Dismissive’ Of EU Debt Conference SYRIZA Wants (Kathimirini)

SYRIZA leader Alexis Tsipras has seized on comments by Irish Finance Minister Michael Noonan as evidence that not just “progressive economists and the European Left” are coming round to his party’s argument that the European Union needs to hold a meeting to discuss how to reduce the debt of some of its members, including Greece. “In all of Europe, only Mr Samaras called this nonsene,” wrote Tsipras in Sunday’s Kathimerini. The Irish Times reported on Wednesday that Noonan told Irish ambassadors and civil servants he “would not be dismissive” of a European debt conference being held as long as the issue of Irish, Spanish and Portuguese debt could be discussed.

Read more …

“.. nobody believes the party’s over. That’s probably because most employees are older than 40 and have golden handshakes on a Midas scale.”

• Aberdeen: In Scotland’s Oil Capital The Party’s Not Yet Over (Observer)

It has been a strange old week in the self-proclaimed oil capital of Europe. According to some members of Aberdeen’s energy sector, a group with a code of silence that would trump any Trappist throng, the North Sea is a busted flush, a dead zone of drilled-out fields with a long-term future to match. There will certainly be some transient pain in the industry; BP has confirmed 300 job losses and other subsidiaries will view the plummeting price of oil as a wonderful opportunity to trim any perceived excess fat. But if there is any panic in Aberdeen over the end of the gravy train, it is being well concealed. One executive told me on Friday: “Times are tough. And they might get tougher.” But nobody believes the party’s over. That’s probably because most employees are older than 40 and have golden handshakes on a Midas scale.

I walked along Aberdeen’s Union Street last week and one particular image struck me. It’s a once-glorious, now-dowdy thoroughfare with a few refulgent granite buildings surrounded by an excess of eyesores. On one side of the street, the Pound Shop announced that it was closing; on the other, the staff at the recently opened Eclectic Fizz champagne bar were preparing to welcome their steady stream of customers. At another location just outside the city on Thursday evening, a few hours after the BP news had broken, a group of four senior oil officials awaited their trip to the airport in Dyce. After a few minutes, four separate cabs arrived to pick them up: it didn’t matter the quartet were all travelling to the same destination. It may be a recession, Jim. But in Aberdeen, not as we usually know it.

Read more …

‘To make the impossible possible. To rise, and rise”

• Buying A Home In Britain Should Not Be An Impossible Dream (Observer)

‘To make the impossible possible. To rise, and rise”. Uttered in a movie-trailer tone, it sounds like the mission statement for a Mars probe – but, set against the backdrop of the twinkling lights of night-time London, it’s actually the voiceover for a particularly obnoxious Redrow ad for flats in one of the capital’s now-ubiquitous glass and steel skyscrapers, launched and hastily withdrawn earlier this month after a furious outburst on social media. Its sharply suited, go-getting protagonist is whisked through the streets in a cab, reminiscing about all the hours he had to put in (“the mornings … that felt like night”); the calls from mates he was forced to ignore; and the terrible soul-searching he had to endure to succeed (apparently he felt the urge to “be more than individual”).

Without encountering another soul, our hero strides into an anonymous lobby and is whisked up to a vast, sparkling eyrie, worthy of a Bond villain’s hideout. An outraged viewer captured the ad for posterity; rival builder Berkeley Homes pulled its own equally nauseating effort (this one involving a private jet) a few days later. Prices for apartments at One Blackfriars, the tower block being marketed by Berkeley, range up to £23m. And judging by the ad, its lucky inhabitants in their hermetically sealed penthouses will never have to rub shoulders with hoi polloi down at ground level. It’s hard to think of a more powerful symbol of Britain’s divisive, winner-takes-all property market. Of course, the rich have always been with us, and to some extent have always cut themselves off. Strolling through the Geffrye Museum in east London recently, I was intrigued by a painting from 1936.

An elegant, bejewelled woman in a shimmering gown peers languorously out on to a crowded London thoroughfare, perhaps Regent Street or Piccadilly, from a plush, warmly lit salon, while a man faces away from the window with studied nonchalance, blowing smoke rings. Only on reading the inscription does it become clear that the lively scene outside the window is not a celebration or a festival, but the arrival of the Jarrow marchers. Britain in the 21st century is a very long way from the Great Depression; yet that well-heeled couple’s cosy imperviousness to their fellow humans’ suffering is all there in the “because I’m worth it” high-rise property porn churned out by Redrow, Berkeley and the rest (“They said nothing comes easy; but if it was easy, then it wouldn’t feel as good,” goes the voiceover).

Read more …

Yada yada.

• Obama Speech To Call For Closing Tax Loopholes (Reuters)

– President Barack Obama’s State of the Union address will propose closing multibillion-dollar tax loopholes used by the wealthiest Americans, imposing a fee on big financial firms and then using the revenue to benefit the middle class, senior administration officials said on Saturday. Obama’s annual address to a joint session of Congress on Tuesday night will continue his theme of income equality, and the administration is optimistic it will find some bipartisan support in the Republican-dominated House of Representatives and Senate. The proposals administration officials listed on Saturday may still generate significant opposition from the Republicans because they would increase taxes.

In a conference call with reporters to preview the taxation aspect of Obama’s address, one official said some of the ideas the president is outlining already have “clear congressional bipartisan support or are ideas that are actually bipartisan in their nature.” Obama’s proposals call for reforming tax rules on trust funds, which the administration called “the single largest capital gains tax loophole” because it allows assets to be passed down untaxed to heirs of the richest Americans. They also would raise the capital gains and dividends rates to 28 percent, the level during the 1980s Republican presidency of Ronald Reagan. As a way of managing financial risk that could threaten the U.S. economy, Obama also wants to impose a fee of seven basis points on the liabilities of U.S. financial firms with assets of more than $50 billion, making it more costly for them to borrow heavily.

The changes on trust funds and capital gains, along with the fee on financial firms, would generate about $320 billion over 10 years, which would more than pay for benefits Obama wants to provide for the middle class, the official said. The benefits mentioned on Saturday would include a $500 credit for families with two working spouses, tripling the tax credit for child care to $3,000 per child, consolidating education tax incentives and making it easier for workers to save automatically for retirement if their employer does not offer a plan. The price tag on those benefits, plus a plan for free tuition at community colleges that Obama announced last week, would be about $235 billion, the official said. Specifics on the figures will be included in the budget Obama will send to Congress on Feb. 2. “We’re proposing more than enough to offset the new incremental costs of our proposals without increasing the deficit,” the administration official said.

Read more …

Greece has historically had close ties to Russia.

• Russia May Lift Food Import Ban From Greece If It Quits EU (TASS)

Russia may lift its ban on food imports from Greece in the event it quits the European Union, Russian Minister of Agriculture Nikolai Fyodorov told a news conference in Berlin on Friday. Fyodorov is leading an official Russian delegation to the International Green Week public exhibition for the food, agriculture, and gardening industry. If Greece has to leave the European Union, we will build our own relations with it, the food ban will not be applicable to it, he said. He said that European Union countries, which felt discomfort from the slump in proceeds from exports of foods to Russia, were asking Russia to cushion the impacts of the Russian food import ban by expanding other types of imports.

We are looking at such possibility, he said, adding that these countries offer new formats of cooperation in those areas that are not covered by the Russian food sanctions. Meanwhile he stressed that Russia did not plan to toughen its sanctions. As concerns possible new sanctions, we are not looking at any such proposals from any structures, he added. Earlier on Friday, Fyodorov met with his German counterpart, Christian Schmidt, to discuss possible expansion of cooperation and mutual trade in agricultural products. The two ministers agreed that Russia and Germany may expand mutual trade in food products in the framework of the current laws.

“We cannot solve pressing political problems, but we can maintain dialogue in the current conditions, the German minister said. We can make trade between our countries more intensive. The Russian minister shared this opinion saying, the Berlin exhibitions was a non-political event working on problems of food security. We discussed possible expansion of cooperation and mutual trade in agricultural products and agreed to work in the new conditions strictly within the frameworks of the current legislation of Russia, the Customs Union, Germany and the European Union, Fyodorov said.

Read more …

This is effectively the US and EU killing women and children.

• Donetsk Shelled As Kiev ‘Orders Massive Fire’ On East Ukraine (RT)

Violence escalated in eastern Ukraine as Kiev’s troops launched a massive assault on militia-held areas Sunday morning. The army was ordered to start massive shelling of all rebel positions, a presidential aide said. The order to launch the offensive was issued early approximately at 6:00 am, according to Yury Biryukov, an aide to President Petro Poroshenko. “Today we will show HOW good we are at jabbing in the teeth,” he wrote on his Facebook page, a mode of conveying information favored by many Ukrainian officials. In a later post he said: “They are now striking a dot. Uuu…” in a reference to Tochka-U (‘tochka’ means ‘dot’ in Russian), a tactical ballistic missile, one of the most powerful weapons Ukraine so far deployed against rebel forces. “That wasn’t a dot but ellipsis. Strong booms,” he added.

Reports from the ground confirmed a sharp escalation of clashes across the front line, with particularly heavy artillery fire reported at Gorlovka. “Locals in Donetsk said they haven’t heard such intensive shelling since summer,” Valentin Motuzenko, a military official in the self-proclaimed Donetsk People’s Republic, told Interfax news agency. “The Ukrainian military are using all kinds of weapons, Grad multiple rocket launchers, mortars…” Motuzenko said. Several residential buildings, a shop and a bus station have been seriously damaged by artillery fire in the city, RIA Novosti reported. There were also reports of attacks on the town of Makeevka and several nearby villages. The militia added that at least one shell hit a residential area in central Donetsk rather than the outskirts of the city. There were no immediate reports of how many casualties resulted from the offensive.

Read more …

“Canadian media theorist Marshall McLuhan foresaw these developments decades ago. In 1970, he wrote, “World War III is a guerrilla information war with no division between military and civilian participation.”

• New Snowden Docs Reveal Scope Of NSA Preparations For Cyber War (Spiegel)

[..] the intelligence service isn’t just trying to achieve mass surveillance of Internet communication, either. The digital spies of the Five Eyes alliance – comprised of the United States, Britain, Canada, Australia and New Zealand – want more. According to top secret documents from the archive of NSA whistleblower Edward Snowden seen exclusively by SPIEGEL, they are planning for wars of the future in which the Internet will play a critical role, with the aim of being able to use the net to paralyze computer networks and, by doing so, potentially all the infrastructure they control, including power and water supplies, factories, airports or the flow of money. During the 20th century, scientists developed so-called ABC weapons – atomic, biological and chemical. It took decades before their deployment could be regulated and, at least partly, outlawed.

New digital weapons have now been developed for the war on the Internet. But there are almost no international conventions or supervisory authorities for these D weapons, and the only law that applies is the survival of the fittest. Canadian media theorist Marshall McLuhan foresaw these developments decades ago. In 1970, he wrote, “World War III is a guerrilla information war with no division between military and civilian participation.” That’s precisely the reality that spies are preparing for today. The US Army, Navy, Marines and Air Force have already established their own cyber forces, but it is the NSA, also officially a military agency, that is taking the lead. It’s no coincidence that the director of the NSA also serves as the head of the US Cyber Command. The country’s leading data spy, Admiral Michael Rogers, is also its chief cyber warrior and his close to 40,000 employees are responsible for both digital spying and destructive network attacks.

From a military perspective, surveillance of the Internet is merely “Phase 0” in the US digital war strategy. Internal NSA documents indicate that it is the prerequisite for everything that follows. They show that the aim of the surveillance is to detect vulnerabilities in enemy systems. Once “stealthy implants” have been placed to infiltrate enemy systems, thus allowing “permanent accesses,” then Phase Three has been achieved – a phase headed by the word “dominate” in the documents. This enables them to “control/destroy critical systems & networks at will through pre-positioned accesses (laid in Phase 0).” Critical infrastructure is considered by the agency to be anything that is important in keeping a society running: energy, communications and transportation. The internal documents state that the ultimate goal is “real time controlled escalation”.

Read more …

Chilling.

• Guantánamo Diary Exposes Brutality Of US Rendition And Torture (Guardian)

The groundbreaking memoir of a current Guantánamo inmate that lays bare the harrowing details of the US rendition and torture programme from the perspective of one of its victims is to be published next week after a six-year battle for the manuscript to be declassified. Guantánamo Diary, the first book written by a still imprisoned detainee, is being published in 20 countries and has been serialised by the Guardian amid renewed calls by civil liberty campaigners for its author’s release. Mohamedou Ould Slahi describes a world tour of torture and humiliation that began in his native Mauritania more than 13 years ago and progressed through Jordan and Afghanistan before he was consigned to US detention in Guantánamo, Cuba, in August 2002 as prisoner number 760. US military officials told the Guardian this week that despite never being prosecuted and being cleared for release by a judge in 2010, he is unlikely to be released in the next year.

The journal, which Slahi handwrote in English, details how he was subjected to sleep deprivation, death threats, sexual humiliation and intimations that his torturers would go after his mother. After enduring this, he was subjected to “additional interrogation techniques” personally approved by the then US defence secretary, Donald Rumsfeld. He was blindfolded, forced to drink salt water, and then taken out to sea on a high-speed boat where he was beaten for three hours while immersed in ice. The end product of the torture, he writes, was lies. Slahi made a number of false confessions in an attempt to end the torment, telling interrogators he planned to blow up the CN Tower in Toronto. Asked if he was telling the truth, he replied: “I don’t care as long as you are pleased. So if you want to buy, I am selling.”

Read more …

“.. a massive flu outbreak could cost anywhere between $71 billion to $166.5 billion.”

• Price Tag Of Saving The World From A Pandemic: $344 Billion (CNBC)

Infectious diseases are incubating everywhere across the world—ranging from the deadly Ebola virus to the more common yet debilitating influenza—to often devastating effect. It raises the question of how large a premium should world governments pay to insulate their economies from global pandemics. Would you believe $343.7 billion? That eye-popping figure is one of several takeaways of a group of scholars calling for a “global strategy” to mitigate the impact of threats to public health. In a recent paper published in the Proceedings of the National Academy of Sciences (PNAS) journal, economists and public health experts said emerging pandemics were increasing in their virulence and frequency.

The grim circumstances, which include the Ebola outbreak ravaging parts of Africa and an increasingly tough flu season in the U.S., calls for “globally coordinated strategies to combat” the hydra-headed threats posed by widespread disease—which the scientists say have their origins in animals. By pooling resources and implementing a host of programs and policies, governments could curtail the spread of infectious viruses by 50% if the measures were implemented within a 27-year span, the paper said. Of course, there’s the matter of the price tag, which is more than South Africa’s nominal GDP and is nearly as large as the U.S. Defense Department’s fiscal year 2015 budget. In response to questions, co-author Peter Daszak said the money would be funneled into “mitigation programs” that isolate the first cluster of cases at their source. The funds would also be spent on hospitals and diagnostic labs in West Africa, and creating a web of information to identify and track diseases. [..]

The study arrives at a time when public health officials are struggling to contain a blitz of mysterious outbreaks. In recent months, isolated cases of Ebola, Legionnnaire’s disease, enterovirus and Chikungunya—all sicknesses most common in developing economies—have all appeared in the U.S. In the larger scheme, the nearly $344 billion call to arms may be a reasonable price to pay to prevent yet another shock to global growth, one that’s already taking a heavy toll on African economies. In a December study, the World Bank said West Africa’s Ebola pandemic had shaved off about two-thirds of Liberia’s and Sierra Leone’s growth. For those who think the flu isn’t that pernicious, think again: A Centers for Disease Control study once estimated that a massive flu outbreak could cost anywhere between $71 billion to $166.5 billion.

Read more …

Absolute madness.

• Is Lancashire Ready For Its Fracking Revolution? (Observer)

The Fylde, the flat, rich pasture land and villages stretching from Preston and the M6 to the Blackpool coast, is set to host the UK’s first full-scale fracking exploration, if Lancashire county council gives planning permission at the end of January. Nationally David Cameron and the government have declared they are “going all out” for fracking, hoping to emulate the shale gas revolution in the US. But on the frontline the mood is more equivocal. Fears of the effects on health and plummeting house prices compete with the promise of jobs and money for communities, accompanied by accusations of misinformation and hysteria from both sides.

The site owned by Sanderson’s uncle and aunt is near Roseacre, and as you wind down the pot-holed lanes towards it, past the huge communication masts of the Royal Navy’s Inskip site, placards of opposition appear: “Don’t frack with Fylde”, “Health not wealth” and “What price fracking? Clean air? Clean water?” At the site, an unspectacular stretch of grassland whose only current features are a black water butt and a dull rumble from the M55, Cuadrilla’s head of well development, Eric Vaughan, explains the company’s plans for up to four wells, each of which would see dozens of fracking blasts to release gas. “I am excited we may finally get going again,” he says. “You have to be optimistic. We have tried to answer every question. Hopefully the planning permission will go through, so we can show people what it really looks like.”

A single frack at Cuadrilla’s Preese Hall site on the Fylde in 2011 produced good flow results, says Vaughan, but it also produced two small earthquakes, a government investigation and a false start for the company. “Because we had the earthquake, we decided to abandon that well,” says Vaughan, who is originally from Kentucky and for the past 30 years has been fracking all over the world, from the US to Thailand to Turkmenistan. Fracking at Roseacre, and at a second proposed site at nearby Preston New Road, will be under way by Christmas, if all goes Cuadrilla’s way. On Friday, the Environment Agency granted the environmental permits Cuadrilla needs for Preston New Road, and has already said it is minded to grant the permits for Roseacre as well.

Read more …

So true.

• Pope Francis: Listen To Women, Men Are Too Machista (RT)

Pope Francis has called on men to listen to women as they have “much to tell us.” Women are able to ask questions that men can’t grasp, the pontiff told an audience in the Philippines, where his comments drew instant applause. “Women have much to tell us in today’s society,” Francis told a mostly male audience at the Catholic University of Santo Tomas in Manila, on the last day of a weeklong visit to Philippines and Sri Lanka. His impromptu comments were welcomed with applause from the audience, which according to organizers’ estimates was 30,000 people. “At times we men are too ‘machista’, the Argentinian pontiff said using word for the term for extreme male chauvinism in his native Spanish. According to the 78-year-old Catholic leader, we “don’t allow room for women but women are capable of seeing things with a different angle from us, with a different eye.”

His comments come after he noted that four out of five people who asked him questions on the stage were male. “There is only a small representation of females here, too little,” he said, to laughter. He added that it was a 12-year-old girl who posed the toughest question to him. Glyzelle Palomar, who was living on the streets before being taken in by a church charity, broke into tears when she was posing her question. “Many children are abandoned by their parents. Many children get involved in drugs and prostitution. Why does God allow these things to happen to us? The children are not guilty of anything,” Palomar said. Francis took her into his arms and hugged her for a few seconds. “She is the only one who has put a question for which there is no answer and she wasn’t even able to express it in words, but in tears,” he said.

Read more …