John Collier Trucks on highway en route to Utica, New York 1941

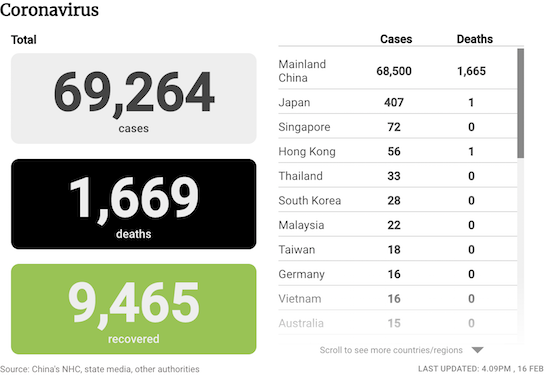

• Cases: 69,264, up 2,162 from yesterday

• Deaths: 1,669, up 143 from yesterday

Cruise ship the Diamond Princess -off Yokohama- has 3,711 people on board. 1,219 have been tested of which 355 have been confirmed positive for the virus. The ship has been in quarantine for 11 days, so capacity for testing is apparently limited to just over 100 per day. Not impressive. And this doesn’t yet tell us how many people have been tested more than once. But that appears to be necessary.

The main development over the past 24 hours concerns the cruise ships and getting infected more than once. The Diamond Princess is turning into one of Dante’s circles of hell -take your pick- just as governments send planes to pick up their citizens aboard the ship. Who will arrive home just in time to start another 14 days of quarantine. Lovely. Hong Kong and Canada have reported this renewed quarantine, the US must follow suit.

The Diamond Princess is also a loud flashing warning sign about the ease with which the virus spreads. Everyone has been isolated in their cabins for 10+ days, yet there are 70 more cases daily. With a 14-day incubation time, less than a third of passengers tested in those 10+ days with a 30% infection rate, and questionable testing quality, what awaits these people? What awaits those who are not at present considered suspect?

Another cruise ship, the Werkendam, finally accepted in Cambodia after being shunned by 4-5 other countries, has let well over 1,000 passengers leave the ship before one was diagnosed positive for COVID19. It arrived on Thursday carrying 1,455 passengers and 802 crew, 236 passengers and 747 crew remain on board.

Potentially even more ominous is Tyler’s piece on re-infection. If people can be infected more than once, that means their immune systems have successfully fought the virus once, only to be weakened by both the fight and the medication applied in that fight. Imagine large scale re-infection. Imagine the hospital accomodation needed. Which country has that kind of spare capacity?

A second infection of a recovered patient will hit a body with compromised immunity. Cytokine storms, ACE2.

• Chinese Doctors Say Wuhan Coronavirus Reinfection Even Deadlier (ZH)

Doctors working on the front lines of the novel coronavirus (COVID-19) outbreak have told the Taiwan Times that it’s possible to become reinfected by the virus, leading to death from sudden heart failure in some cases. “It’s highly possible to get infected a second time. A few people recovered from the first time by their own immune system, but the meds they use are damaging their heart tissue, and when they get it the second time, the antibody doesn’t help but makes it worse, and they die a sudden death from heart failure,” reads a message forwarded to Taiwan News from a relative of one of the doctors living in the United Kingdom.

“The source also said the virus has “outsmarted all of us,” as it can hide symptoms for up to 24 days. This assertion has been made independently elsewhere, with Chinese pulmonologist Zhong Nanshan saying the average incubation period is three days, but it can take as little as one day and up to 24 days to develop symptoms. Also, the source said that false negative tests for the virus are fairly common. “It can fool the test kit – there were cases that they found, the CT scan shows both lungs are fully infected but the test came back negative four times. The fifth test came back positive.” -Taiwan Times

Notably, one of the ways coronaviruses cripple the immune system is via an HIV-like attachment to white blood cells, which triggers a ‘cytokine storm’ – a term popularized during the avian H5N1 influenza outbreak – in which an uncontrolled release of inflammatory ‘cytokines’ target various organs, often leading to failure and in many cases death. The cytokine storm is best exemplified by severe lung infections, in which local inflammation spills over into the systemic circulation, producing systemic sepsis, as defined by persistent hypotension, hyper- or hypothermia, leukocytosis or leukopenia, and often thrombocytopenia. In addition to lung infections, the cytokine storm is a consequence of severe infections in the gastrointestinal tract, urinary tract, central nervous system, skin, joint spaces, and other sites. (Tisoncik, et. al, Into the Eye of the Cytokine Storm – 2012)

According to the 2012 study, “Cytokine storms are associated with a wide variety of infectious and noninfectious diseases and have even been the unfortunate consequence of attempts at therapeutic intervention.” How do coronaviruses enter the body? With SARS (sudden acute respiratory syndrome), another coronavirus, researchers discovered that one of the ways the disease attaches itself is through an enzyme known as ACE2, a ‘functional receptor’ produced in several organs (oral and nasal mucosa, nasopharynx, lung, stomach, small intestine, colon, skin, lymph nodes, thymus, bone marrow, spleen, liver, kidney, and brain).

ACE2 is also “abundantly present in humans in the epithelia of the lung and small intestine, which might provide possible routes of entry for the SARS-CoV,” while it was also observed “in arterial and venous endothelial cells and arterial smooth muscle cells” – which would include the heart. This has led some to speculate that Asians, who have higher concentrations of ACE2 (per the 1000 genome project) may be affected to a greater degree than those of European ancestry, who produce the least of it – and have largely been the asymptomatic ‘super spreaders’..

The Diamond Princess is a mess. But would it have been better to let potentially infected passengers leave and spread the disease? Perhaps this is one of those situations that we don’t have an solution for.

• 70 More Infections On Diamond Princess Cruise Ship Bring Total To 355 (SCMP)

The number of people who have tested positive for the coronavirus on the Diamond Princess cruise ship, which remains quarantined in a dock in Yokohama, Japan, has risen to 355, up 70 from the last government count, the country’s health minister said on Sunday. “So far, we have conducted tests for 1,219 individuals. Of those, 355 people tested positive. Of those, 73 individuals are not showing symptoms,” Katsunobu Kato told public broadcaster NHK. Canada has chartered a plane to evacuate its citizens from the ship, the Canadian government said in a statement late on Saturday. Canadian passengers who exhibit symptoms of infection will not be allowed to board the flight and will instead be transferred to the Japanese health care system, the government said. Passengers who fly to Canada will enter a 14-day quarantine on arrival.

I lost count, which circle of hell is this again?

• Cruise Passengers Face 14 More Days In Quarantine On Return To Hong Kong (SCMP)

Hong Kong passengers stranded on the Diamond Princess cruise ship in Japan have baulked at the suggestion they spend another 14 days in quarantine when they return home, even as they welcomed the government’s move to arrange chartered flights to bring them back to the city. The evacuation plan came as 70 new cases of the coronavirus were confirmed by Japanese health officials on Sunday morning, taking the total number of infections aboard the vessel to 355, including at least 11 Hongkongers who have been hospitalised. Among the 330 passengers from Hong Kong who have been held on the ship for 11 days, Young Wo-sang, who was stranded with his wife, welcomed the news, but said he did not understand the need for another two weeks in quarantine.

“We have been placed in quarantine in Japan from February 5, and it has been nearly 14 days already. Why is there a need to quarantine us for another 14 days?” The Hong Kong Immigration Department said the move was to protect against the health risks associated with repatriating the residents, 260 of whom are SAR passport holders, with the remaining 70 travelling on other passports. Young said his wife received text messages from the department in the early hours of Sunday, that said the couple would be notified when they could leave, once Japanese authorities had confirmed the detailed plans for disembarkation.

Damned if you do and doomed if you don’t.

• Quarantined Cruise Ship Passenger Speaks Out Against US Evacuation Plan (Fox)

A passenger aboard the Diamond Princess cruise ship, which is currently quarantined off the coast of Japan amid a coronavirus outbreak, is speaking out against the United States’ plan to evacuate American passengers. Matthew Smith, who has been quarantined with his wife since Feb. 5, told Fox News’ Neil Cavuto that he prefers to stay on the cruise ship. “Our greatest desire at this point is to maintain the quarantine that the Japanese health officials have established,” Smith said, “then get a test for the virus at the end of that quarantine so we can establish with relative certainty that we are not infected and be free to go. “Unfortunately, the State Department has thrown a monkey wrench into that,” he added.

Approximately 400 Americans and their families on the Diamond Princess will be offered seats on two flights that could arrive at Travis Air Force Base near Sacramento, Calif., as early as Sunday, a CDC official told The Wall Street Journal. A CDC team will screen passengers and those exhibiting symptoms won’t be allowed on the flights. Smith, however, said he’s skeptical about the proposed plan. “I understand getting off the ship to be in another space, but under this circumstance, the offer is we’re going to put you on buses with other people who haven’t completed their quarantines and have not been tested for the virus,” Smith said.

“We’re going to then put you on a plane with all these people and take you back to the United States, and because of the risk you still pose due to that situation we’re going to stick you in another quarantine.” Smith said he would rather stay put on the Diamond Princess ship. While the ship is “getting a bad rap” for its living conditions, Smith said he is content where he is. “We have access to the balcony, we are fed well – three times a day along with excess food — they provide all the necessities we need in there,” he said.

Or did she?

• American From Cruise Ship Docked In Cambodia Tests Positive In Malaysia For Coronavirus (R.)

An 83-year-old American woman who had been a passenger on a cruise ship that docked in Cambodia has tested positive for the new coronavirus on landing in Malaysia, health authorities said on Saturday. The American woman flew to Malaysia on Friday from Cambodia along with 144 others from the ship, the Malaysian health ministry said in a statement. The woman’s husband had tested negative, it said. The MS Westerdam, operated by Carnival Corp unit Holland America Inc, docked in the Cambodian port of Sihanoukville on Thursday after being shunned by five countries on fears that passengers could be carrying the virus.

The Westerdam, carrying 1,455 passengers and 802 crew, spent two weeks at sea. The passengers were tested regularly on board and Cambodia also tested 20 once it docked. None was found to have the new coronavirus that has killed more than 1,500 people, the vast majority in China. U.S. President Donald Trump has thanked Cambodia for taking in the ship in a rare message to a country that is one of China’s closest allies and has often been at odds with Washington.

Holland America Line doesn’t think she was ever really positive.

• Cruise Firm Seeks New Virus Test For Passenger From Ship In Cambodia (R.)

More tests are needed to confirm that an American passenger from a cruise ship docked in Cambodia has the new coronavirus after she tested positive in Malaysia, the MS Westerdam’s operator said on Sunday. The 83-year-old woman was the first passenger from the MS Westerdam, operated by Carnival Corp unit Holland America Inc, to test positive for the virus. “While the first results have been reported, they are preliminary at this point and we are awaiting secondary testing for confirmation,” Holland America said in a statement. Cambodian authorities called on Malaysia to review its test results.

Holland America said 236 passengers and 747 crew remained aboard the vessel, which is docked in the Cambodian port of Sihanoukville. It arrived on Thursday carrying 1,455 passengers and 802 crew. It had spent two weeks at sea after being turned away by Japan, Taiwan, Guam, the Philippines and Thailand. The passengers were tested regularly on board and Cambodia also tested 20 once it docked. None was found to have the new coronavirus that has killed more than 1,500 people, the vast majority in China.

The American woman flew to Malaysia on Friday from Cambodia along with 144 others from the ship, the Malaysian health ministry said in a statement, adding that she was in stable condition. The woman’s husband had shown symptoms but tested negative, it said. The couple were the only ones among the 145 to show symptoms, the ministry said. Cambodia’s government said its own tests had been done in collaboration with the World Health Organisation and the U.S. Centers for Disease Control and Prevention. “The Ministry of Health requests the Malaysian authorities to review the results of the test,” Cambodia’s Ministry of Health said in statement.

Everything stands still. Nobody believes China’s official numbers anymore. How about 0% GDP growth?

• New Coronavirus Threatens Meltdown In China’s Economy (SCMP)

Given the rapid advance of medical science and globalisation of recent decades, the scale, spread and economic costs of human epidemics are rocketing up, even if fatality rates are starting to fall. Never before has China paid such an economic price for an epidemic as it has done already with the coronavirus, which originated in the Chinese city of Wuhan and causes the disease now officially known as Covid-19. And the damage is spreading. It is too soon to assess the full impact of the virus as the data changes day after day and not even the brightest expert can say with any certainty when the outbreak might end. Nevertheless, that has not stopped economists from attempting to forecast the likely economic cost based on precedents such as the 2003 outbreak of severe acute respiratory syndrome, or Sars.

Sars sickened about 8,000 people and killed fewer than 800 and in these terms has already been surpassed by the new coronavirus, though its fatality rate of 9.6 per cent is significantly higher than that of Covid-19, which some estimates put at around 2.4 per cent. Sars cut two percentage points from China’s real GDP growth in the second quarter of 2003 and caused US$50 billion of damage to the global economy. Of course, the economic losses from Covid-19 will depend somewhat on how long the outbreak lasts and on what policy support the Chinese government comes up with to offset the impact. But even at this stage, it is obvious that the economic impact of Covid-19 will be far more severe than that of Sars, or any other previous epidemic, for a number of reasons.

Firstly, the Chinese economy is four times as big as it was in 2003, so its losses and the impact on the global economy are likely to be correspondingly larger. China’s gross domestic product accounted for around 16 per cent of the global total last year while it was just four per cent in 2003. A rough estimate is that Covid-19 will cause at least four times as big a loss as Sars. Secondly, the timing is far worse. The outbreak took place just days before the Lunar New Year holiday, when hundreds of millions of Chinese travel domestically and internationally to attend family reunions and festive events. Sars happened in the second quarter of the year, when there was far less activity to disrupt. [..] Thirdly, China’s rapid urbanisation means Chinese are now much more likely to travel domestically and abroad than two decades ago. This also means that when they stop travelling, the disruption is greater.

Not a good time for small business in China.

• Coronavirus Scare Leaves China’s Empty Restaurants Selling Off Stocks (R.)

Wang Chuanchao shuttered his restaurant in central Beijing three weeks ago as the scare over the coronavirus epidemic in country kept customers away and now he’s reduced to selling off vegetables on the street outside to cut losses. Anticipating packed tables at his 125-seater restaurant over the Lunar New Year, Wang says he bought in 300,000 yuan (nearly $43,000) worth of ingredients, ranging from celery to ox tripe. Now, he has to find ways to pay the rent, and his staff, so he can re-open for business once his customers find the courage to come back. “We must help ourselves as we can’t count on anything else,” the 32-year-old Wang, standing in front of a stall laden with vegetables that would perish unless they’re sold quickly. “We must try all efforts to cut our losses.”

Most other restaurants have been forced to do the same, as demand has plummeted following the outbreak in the central city of Wuhan in December, with local authorities across the country curbing travel and closing off public areas to prevent the coronavirus spreading. “We purchased stocks of foodstuffs worth 500,000 yuan before the new year, but now the fresh vegetables have started rotting,” said Liu, a young man working at The Cheng’s restaurant in downtown Beijing. “We threw it all away yesterday.” A report published this week by China Cuisine Association said scare over the epidemic has cost the catering sector 500 billion yuan in lost earnings during the week-long Lunar New Year holiday, with 93% restaurants shutting down operations.

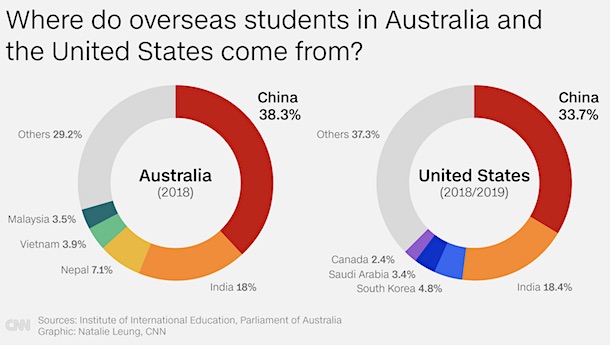

“In 2017, an estimated 900,000 Chinese tertiary students studied abroad.”

• Chinese Students -Used To- Spend Billions Overseas (CNN)

If it weren’t for the novel coronavirus outbreak, Xu Mingxi would have been in class at a prestigious New York university this week. Instead, the 22-year-old has spent the past three weeks confined to his family’s apartment in Wuhan, the Chinese city at the center of the outbreak, which is currently on lockdown to prevent the virus spreading. But even if Xu could leave home, the United States – where he’s studied for the past four-and-a-half years – won’t let him in. Over 1,000 kilometers (620 miles) away in Beijing, Alex – who asked not to use her real name for fear of online retribution – is in a similar situation. She’s spent the past two weeks at home with her mom and grandpa, being delivered groceries by community leaders.

She’s worried she won’t be able to fly to Sydney to study later this month and may have to delay her law degree by a semester. As novel coronavirus spreads, over 60 countries have imposed travel restrictions on Chinese citizens, hoping to limit their exposure to the virus that has killed more than 1,600 people, almost all in mainland China, and infected over 68,000 worldwide. Both Australia and the US have put temporary bans on foreign nationals who visited China in the 14 days prior to their arrival. That has locked Xu and Alex out of their studies — and they are by no means alone. In 2017, an estimated 900,000 Chinese tertiary students studied abroad. Around half of those went to either the United States or Australia, contributing billions of dollars to their economies — money that those countries now stand to lose.

It is not clear how many of the 360,000 Chinese students studying in the US were outside the country when the US travel ban hit on January 31, shortly before many universities were due to resume. But when Australia imposed its restrictions at the start of February, authorities estimated that 56% of Chinese students — about 106,680 people — were still abroad. Term was due to begin in late February or early March. “For Australia, it couldn’t have come at a worse time. It’s exactly the time of the year in which people are coming from China to Australia,” said Andrew Norton, a professor in the practice of higher education policy at the Australian National University. The virus outbreak coincided with the Lunar New Year — the most important holiday in the Chinese calendar, when many students go home to see their family.

First of many?

• Fiat Chrysler Suspends 500L Production Over China Supply Disruption (R.)

Fiat Chrysler Automobiles said it had temporarily halted production at its Serbian plant due to disruptions related to components sourced from China, where companies have been hampered by the outbreak of a new coronavirus. Planned downtime at the Kragujevac plant in Serbia has been rescheduled, an FCA spokesman said on Friday. Production will restart later this month, the spokesman said, adding that the group did not expect the changes would affect total production forecasts for this month. “We are in the process of securing future supply of the affected parts,” the spokesman said. The automaker builds the 500L in Kragujevac.

The spokesman said the supply of audio system parts had been disrupted. Output at the Kragujevac plant was about 40,000 units last year, Serbian media reported, or a quarter of total capacity. FCA had said on Feb. 6 that it might have to temporarily close a European plant within two to four weeks if the impact of the coronavirus in China created supply line issues. The Kragujevac stoppage marks first time an automaker has had to idle a facility in Europe due to the virus. The next few weeks will be critical for automakers. Parts made in China are used in millions of vehicles assembled around the world. China’s Hubei province, epicenter of the coronavirus outbreak, is a major hub for vehicle parts production and shipments.

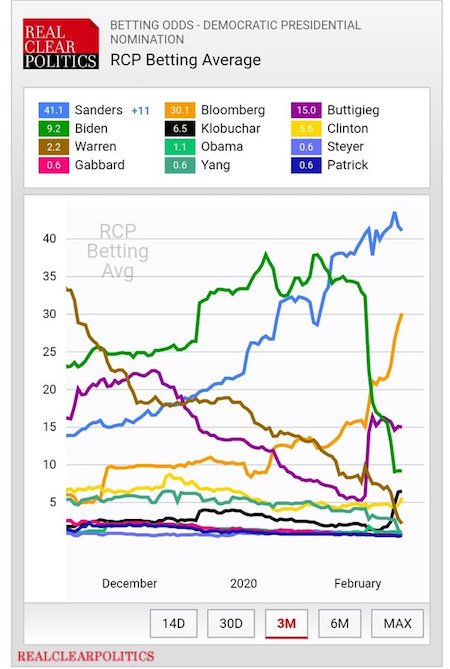

The ultimate fight for control over the party. How can Bernie, Tulsi and AOC be expected to support the Looming Hill-Berg?

• Looming Hill-Berg: Bloomberg Considering Hillary Clinton As Running Mate (NYP)

He’s with her? Mike Bloomberg could team up with Hillary Clinton to try to take down President Trump in November — by making her his running mate. Bloomberg’s internal polling found the combo “would be a formidable force,” sources close to the campaign told the Drudge Report Saturday. Bloomberg’s communications director did not deny the rumored matchmaking effort. “We are focused on the primary and the debate, not VP speculation,” Jason Schechter said in a statement. But minutes after Drudge broke the news, Bloomberg himself posted a coy message about working with female colleagues. “I would not be where I am today without the talented women around me,” he tweeted. “I’ve depended on their leadership, their advice and their contributions.”

A Bloomberg campaign insider told The Post that the two have long been simpatico – going back to the days when she represented New York in the U.S. Senate and he was Gotham’s mayor. “I am sure that they polled it, just because you would be dumb not to wonder,” the insider said. “You want to see what a match-up might look like.” But the pairing is a “net negative” for Bloomberg, a Democratic strategist said. “It doesn’t make any sense to me,” said Brad Bannon, a consultant not affiliated with any presidential campaign. “If he wins the nomination, there’s going to be a lot of unhappiness in the progressive wing of the party,” Bannon explained. “You can’t afford to have them sit on their hands in November.”

[..] Asked about the looming Hill-Berg, Rep. Alexandria Ocasio-Cortez, who has endorsed Sanders, deflected. “I would hope [Bloomberg] would not be in a position to be choosing a running mate at all,” she told The Post during her Queens campaign office opening Saturday. “I think Bloomberg’s past on stop and frisk, on harassment of women— all of these claims are huge red flags.” Clinton and Bloomberg were spotted together in December at Orso in the Theatre District, where they dined with daughter Chelsea, Barry Diller, Diane von Furstenberg, and others, Page Six reported – supposedly to celebrate the birthday of socialite Annette de la Renta. “From what I have seen they have always been friendly,” the campaign insider said.

Trump draws the viewers, Bloomberg pays for them.

• TV Execs Celebrate Unprecedented Flood Of Bloomberg Campaign Spending (IC)

Fox news hosts regularly bash former New York City Mayor Mike Bloomberg as a globalist demagogue intent on seizing Americans’ firearms and big gulp sodas. High-level executives at the company, however, are much more enthusiastic about the billionaire politician and Democratic presidential candidate. Lachlan Murdoch, the chief executive of Fox Corp., the parent company of Fox News, is one of several media executives to welcome Bloomberg’s unprecedented spending spree on television advertisements. In a February 5 briefing for investors, Murdoch noted that he had heard “the Bloomberg campaign has expected to sort of double its advertising spend earlier this week.” The billionaire’s campaign, Murdoch noted, makes purchases on a week-to-week basis, making it difficult to project the ultimate benefit for his company.

“But obviously,” he added, “we expect it to be very strong and particularly, as I mentioned, in the markets of our local TV stations.” Bloomberg, the ninth wealthiest person in the world, with a fortune estimated at almost $62 billion, has upended the Democratic presidential primary with an infusion of cash that has smashed through historical records in a matter of weeks. Advertising Analytics, which tracks campaign spending, reported Thursday that Bloomberg has already spent $363 million on cable, broadcast, and radio advertisements alone. The 2020 campaign is shaping up to be an incredible financial opportunity for media companies, with one market research firm recently estimating that nearly $7 billion of paid advertising be spent this year, up over 60 percent since the 2016 presidential race.

Bloomberg alone has enticed media executives to see the race as a golden opportunity. “The political is going to be huge this year,” boasted Christopher Ripley, president and chief executive of Sinclair Broadcast Group, one of the largest owners of television stations in the country, speaking last month at the Citi 2020 Global TMT West conference in Las Vegas. “The amount of fundraising that’s happened through this year has broken all records. And the good news about politicians is they never return the money, they spend it,” Ripley quipped.

Well, it’s going to be an election like never before.

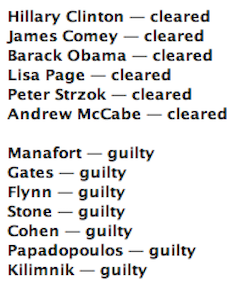

• Why Wasn’t Andrew McCabe Charged? (NR)

The Justice Department announced Friday that it is closing its investigation of Andrew McCabe, the FBI’s former deputy director, over his false statements to investigators probing an unauthorized leak that McCabe had orchestrated. McCabe was fired in March 2018, shortly after a blistering Justice Department inspector general (IG) report concluded that he repeatedly and blatantly lied — or, as the Bureau lexicon puts it, “lacked candor” — when questioned, including under oath. Why not indict McCabe on felony false-statements charges? That is the question being pressed by incensed Trump supporters.

After all, the constitutional guarantee of equal justice under the law is supposed to mean that McCabe gets the same quality of justice afforded to the sad sacks pursued with unseemly zeal by McCabe’s FBI and Robert Mueller’s prosecutors. George Papadopoulos was convicted of making a trivial false statement about the date of a meeting. Roger Stone was convicted of obstruction long after the special counsel knew there was no Trump–Russia conspiracy, even though his meanderings did not impede the investigation in any meaningful way. And in the case of Michael Flynn’s false-statements conviction, as McCabe himself acknowledged to the House Intelligence Committee, even the agents who interviewed him did not believe he intentionally misled them.

I emphasize Flynn’s intent because purported lack of intent is McCabe’s principal defense, too. Even McCabe himself, to say nothing of his lawyers and his apologists in the anti-Trump network of bureaucrats-turned-pundits, cannot deny that he made false statements to FBI agents and the IG. Rather, they argue that the 21-year senior law-enforcement official did not mean to lie, that he was too distracted by his high-level responsibilities to focus on anything as mundane as a leak — even though he seemed pretty damned focused on the leak while he was orchestrating it. The “he did not believe he intentionally misled them” defense is not just implausible; it proved unavailing on McCabe’s watch, at least in General Flynn’s case.

Hence, McCabe has a back-up plan: To argue that it would be extraordinary — and thus unconstitutionally selective and retaliatory — for the Justice Department to prosecute a former official for false statements in a “mere” administrative inquiry (which the leak probe was), as opposed to a criminal investigation. Again, tell that to Flynn, with whom the FBI conducted a brace-style interview — at the White House, without his counsel present, and in blithe disregard of procedures for FBI interviews of the president’s staff — despite the absence of a sound investigative basis for doing so, and whom Mueller’s maulers squeezed into a guilty plea anyway.

Don’t ask.

The Automatic Earth will not survive without your Paypal and Patreon donations. Please support us.