Dorothea Lange Siler City, North Carolina Jul 1939

If you’re a girl and you’re old and you’re grey and you’re the size of a hobbit, who’s going to get angry at you? If your predecessor had all the qualities anyone could look for in a garden gnome, and his predecessor was known mainly as a forward drooling incoherent oracle, how bad could it get? Think maybe they select Fed heads on purpose for how well they would fit into the Shire?

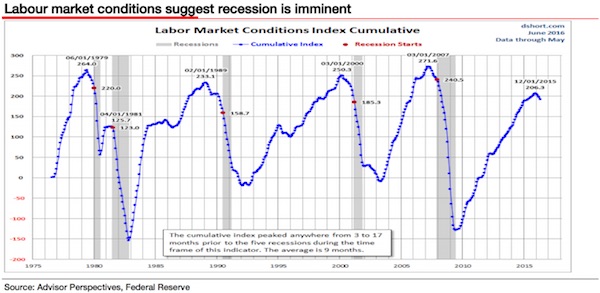

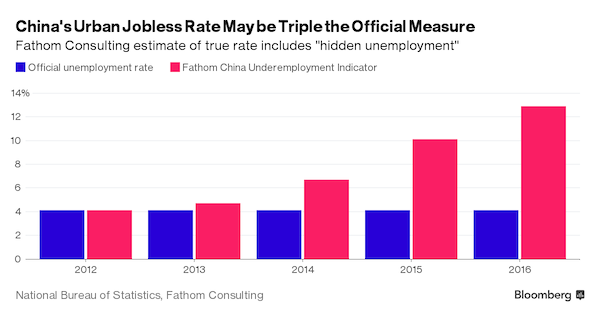

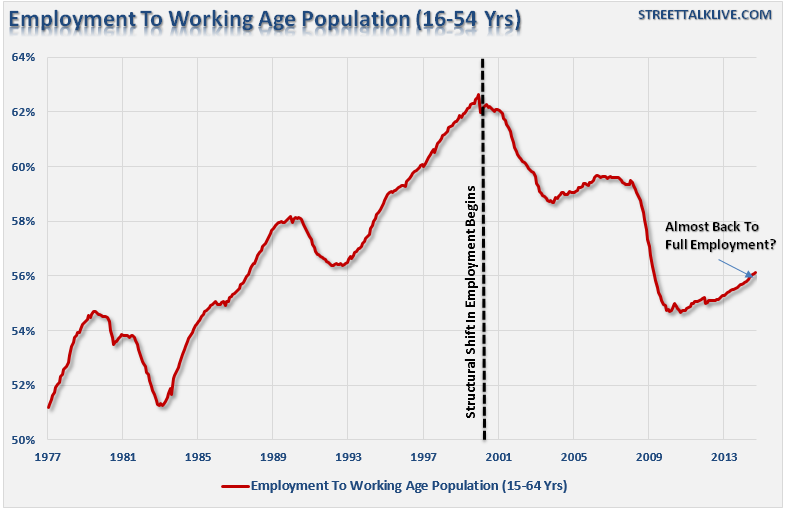

Janet Yellen has a serious problem: the story no longer fits. The Fed under Bernanke said in its forward guidance that it would taper if certain job market conditions were met. And now they have been, at least on paper, but Yellen knows only too well that those are not the real numbers.

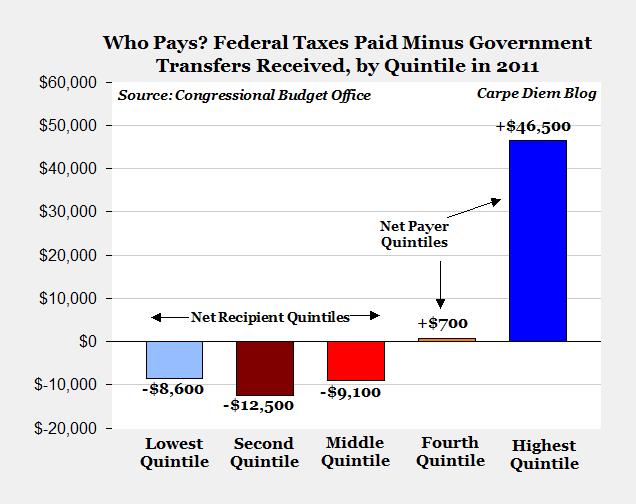

She’s acutely aware of how the BLS calculates US unemployment numbers. She knows about all the millions of people who are not counted as being in the labor force anymore, all the millions who are forced to work part time jobs, all those working more than one job just to make ends meet, and all of the above who simply don’t bring home enough money at the end of the month to pay the bills.

She knows it all, but she has to go by the official numbers, lest the US government looks like a bunch of manipulative inglourious lying basterds. So this afternoon she once again went off into that staple most boring and elaborate speech this side of your least favorite librarian. It’s a routine job for Janet.

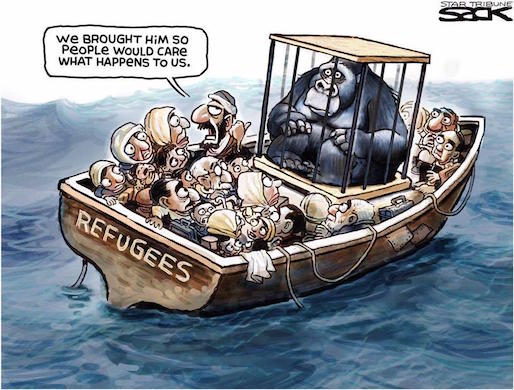

But imagine, or maybe you don’t have to because you actively experience it on a daily basis, that you’re unemployed or you’re working 3 jobs or you’re simply just scraping by and still always falling behind, you got credit card debt, maybe a looming foreclosure. And then Janet Yellen speaks, at Jackson Hole, an event you will certainly never be invited to, but she talks about the policies she and her minions decide on that will greatly influence your life too.

How about this fine paragraph courtesy of her spin writers:

… wage developments reflect not only cyclical but also secular trends that have likely affected the evolution of labor’s share of income in recent years. As I noted, real wages have been rising less rapidly than productivity, implying that real unit labor costs have been declining, a pattern suggesting that there is scope for nominal wages to accelerate from their recent pace without creating meaningful inflationary pressure. However, research suggests that the decline in real unit labor costs may partly reflect secular factors that predate the recession, including changing patterns of production and international trade, as well as measurement issues. If so, productivity growth could continue to outpace real wage gains even when the economy is again operating at its potential.

If you’re an unemployed American, like millions of your fellow country(wo)men, what are you supposed to think about that, or do with it? If you’re busting your behind just to feed your kids, and perhaps provide a decent education for them, so they don’t end up in the streets in some gang or drug operation, what do those words mean?

Janet Yellen is not talking to you. But she IS talking about you. Just in a language you don’t understand. And that you’re not supposed to understand. Or she would choose to use different words. Yellen and her fellow ” the ring is mine” chasers won’t invite you to their meetings, and they won’t talk in a language that relates to you. They will, however, make decisions that affect your life, and often to a great extent.

What Yellen said in her speech today is that while she’s bound to go by the official numbers, she knows very well those numbers have very little to do with the reality Americans experience in their lives.

Which is why she says things like:

More jobs have now been created in the recovery than were lost in the downturn

And follows up with:

.

.. it speaks to the depth of the damage that, five years after the end of the recession, the labor market has yet to fully recover.

More jobs created than lost, but the job market hasn’t recovered. Go figure. Yellen could tell the BLS to redo their numbers, but instead says “the labor market has yet to fully recover”, which is a polite way of saying it’s a mess out there (always note the choice of words). More Yellen:

I would like to provide some context concerning the role of the labor market in shaping monetary policy over the past several years. During that time, the FOMC has maintained a highly accommodative monetary policy in pursuit of its congressionally mandated goals of maximum employment and stable prices.

This in nonsense, and she knows it very well. The Fed’s ‘highly accommodative monetary policy’ was never aimed at the job market, and even if it were, it failed so badly, once you count part time and poorly paid and not in the labor force, that it should have been abandoned. Instead, the policy was – always – aimed at keeping banks standing up, zombified as they are, at the cost of the people scrambling for their share of the jobs market, and their children too.

As the recovery progresses, assessments of the degree of remaining slack in the labor market need to become more nuanced because of considerable uncertainty about the level of employment consistent with the Federal Reserve’s dual mandate

How empty can a speech be? What does this have to do with Americans who only seek to feed their kids? How is this not mere gobbledy gook designed to put the unemployed to sleep while their few remaining future resources are being looted?

As an accounting matter, the drop in the participation rate since 2008 can be attributed to increases in four factors: retirement, disability, school enrollment, and other reasons, including worker discouragement. Of these, greater worker discouragement is most directly the result of a weak labor market, so we could reasonably expect further increases in labor demand to pull a sizable share of discouraged workers back into the workforce.

Indeed, the flattening out of the labor force participation rate since late last year could partly reflect discouraged workers rejoining the labor force in response to the significant improvements that we have seen in labor market conditions. If so, the cyclical shortfall in labor force participation may have diminished.

I’m going to leave it at this as far as quotes are concerned. I’m bad at never ending empty. And that’s all Yellen has to offer.

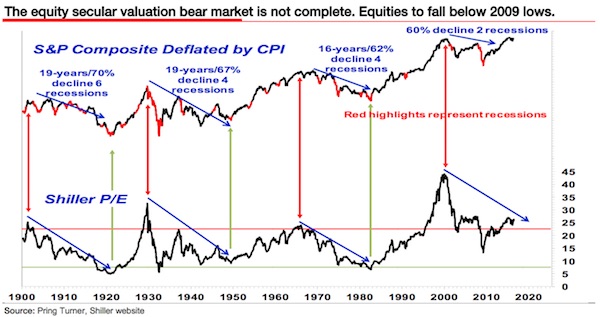

Janet Yellen was brought up with the idea of economic cycles. The short term ones. She doesn’t look like a huge 70 year Kondratieff cycle afficionado.

The scary thing about these people is that they seem to believe in what they say. Which is based on some hodgepodge stew of Keynes and Milton Friedman, not exactly people with proven track records outside of college class rooms.

But wouldn’t you know, while Janet did her show and tell, the international financial press is overflowing with experts and analysts who insist Europe’s state is so bad that trillions of euros in not even yet existent taxpayer money must be thrown at whatever the problem is Europe have got.

The only counter voice is Germany, but Germany landed a negative GDP number. So the pressure on Draghi continues. From all the people who claim that QE has been such a great success in the US and UK. Which sounds cute as long as you don’t count all the debt added to get to what US and UK seem to be at now. Without adding that debt.

London and Washington look good for now, but then so does China, which has launched more debt into the new global stratosphere than anyone else. Will that end well? How about Japan, which has QE’d itself into a trough we will only see the true despair of as we go forward? How good do they make US and UK look? Beyond next week?

All these people who sing the praises of QE, and who say Europe should pour in a trillion or two, they live in their rear-view mirrors. Thay want to go back to what once was, and at all costs. But how realistic is that? And moreover, how wise is it? Do we really want to return, even if it were possible, to, let’s say, the situation of 10 years ago?

It may be tempting when you look at certain sets of numbers, like GDP growth and housing markets, but once you realize all that was achieved only through a huge accumulation of additional debt, is it still all that attractive? And do we really want to risk adding more debt, before the old piles are paid off or restructured, just to return there?

Europe’s problem is the entire western world’s problem: people don’t spend nearly enough to keep the economy growing. And it’s not as if nothing has been done to lure them into more spending. The thing is, you won’t get there by making them borrow. People will spend more only when they have more. But rapidly increasing numbers of them have precious little. And if they don’t spend, you’re not going to get more of the so-called inflation (which is defined as rising prices).

It’s a dead end street, the whole thing. There’s only one school left in economics, and it was never a serious field to start with, let alone a science. But the nincompoops who emanate from the various schools and universities end up having an enormous influence on government and central bank policies, all at the cost of you and me. All they have is theories about how things should go, but nothing for when they don’t.

Central banks exist to protect banks, and the banking system as a whole, from danger. They pretend that they protect the larger economy, and the people on Main Street, but that’s just a convenient little story. Enhanced by the idea that what is good for banks is also good for you. Which is absolute baloney, but it works like a charm.

More often than not, banks’ interests are 180º opposites of Main Street, they certainly demonstrably have been since 2007. But then, how would you ever know? The Fed and Wall Street and Washington and all the media that are supposed to inform you but in reality promote only their propaganda, have got an iron grip on how the picture is painted.

So what if the banks themselves are the danger, and not the real economy? Well, then you’re out of luck, because the first thing on the agenda is always to save the banks, no matter what its costs Main Street or the children of Main Street.

And that’s why Janet Yellen holds stupid and insulting speeches like the one today. To tell you that she knows, but she just doesn’t care.

Very nice.

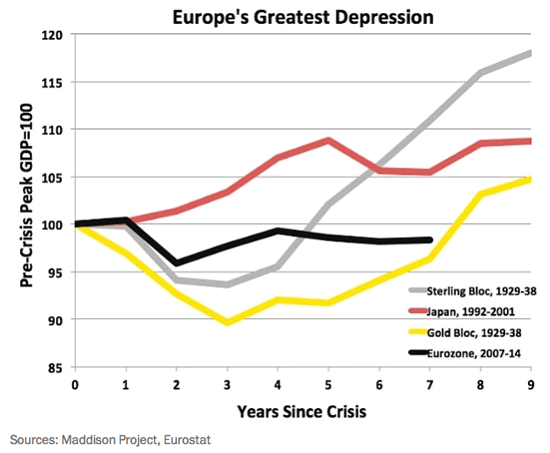

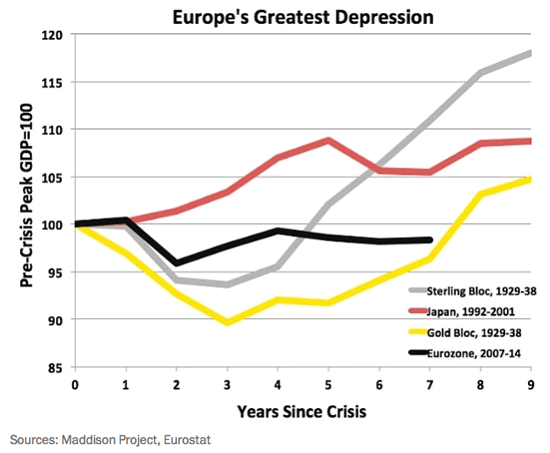

• Worse Than The 1930s: Europe’s Recession Is Really A Depression (WaPo)

As I was arguing last week, it’s time to call the eurozone what it really is: one of the biggest catastrophes in economic history. There have been plenty of those lately. And it’s not just the Great Recession. It’s the way we’ve struggled to make up the ground we lost since. The United States, for one, has had its slowest postwar recovery. Britain has had its slowest one, period. But, six and a half years later, Europe has distinguished itself by not having much of a recovery at all. And, as you can see above, that’s about to make it worse than the worst of the 1930s. I’ve taken the chart above from Nicholas Crafts, and extended it a bit to put Europe’s depression in, well, even more depressing perspective. Eurozone GDP still hasn’t gotten back to its 2007 level, and doesn’t look like it will anytime soon. Indeed, it already wasn’t clear if its last recession was even over before we found out the eurozone had stopped growing again in the second quarter. And not even Germany has been immune: its GDP just fell 0.2% from the previous quarter.

It’s a policy-induced disaster. Too much fiscal austerity and too little monetary stimulus have crippled growth like almost never before. Europe is doing worse than Japan during its “lost decade,” worse than the sterling bloc during the Great Depression, and barely better than the gold bloc then—though even that silver lining isn’t much of one. That’s because, at this rate, it’ll only be another year until the eurozone is well behind the gold bloc, too. So how is Europe making the Great Depression look like the good old days of growth? Easy: by ignoring everything we learned from it. Back then, there were two types of countries: ones that had left the gold standard, and ones that were about to. But that “about to” could take awhile. That’s because governments were sentimentally attached to gold, even though, as Barry Eichengreen has shown, giving it up led to recovery. They simply equated the gold standard with civilization, so they were willing to sacrifice their economies for it. And sacrifice them they did. Although there were limits in extremis.

Britain, for example, refused to raise rates to defend the gold standard in 1931, because unemployment was already 20%. It devalued instead, and the rest of the “sterling bloc”—Sweden, Finland, Norway, Denmark, Portugal, and Canada—followed suit (silver line). The irony, of course, is that this economic weakness made them stronger. Abandoning gold let them do fiscal and monetary stimulus that jumpstarted rather rapid recoveries. Then there were the diehards. Countries that had lots of gold, like France, could actually stay on the gold standard if they wanted to—so they did. They pushed through one austerity budget after another as offerings to almighty gold, and, for that, they paid the economic price. Now, they never crashed like the U.S. did, but they never recovered, either (yellow line). The vicious circle of falling prices, rising unemployment, and bigger budget cuts kept them in a never-ending slump. Until, that is, France and the remaining members of the “gold bloc,” which, at its peak, included Belgium, Poland, Italy, the Netherlands, and Switzerland, finally gave up their Midas delusions in October 1936. Recovery followed.

Read more …

Boost the buck!

• The Key To Supercharging The Dollar Rally (CNBC)

After a calm and boring summer of trading, the currency market is getting exciting again with the dollar breaking out to an 11-month high. Things could heat up even further for foreign exchange, as global central bankers convene in Jackson Hole, Wyoming, for the Kansas City Fed Symposium. The dollar index is at the highest level since September. The euro has broken below 1.33 for the first time since that month. The dollar/yen has fought back to levels last seen in April. What’s behind the recent moves to these highs? It’s become apparent to forex traders that the world’s central banks are increasingly diverging in their policy paths. The U.S. economy is outperforming, and the Fed is seen as being the first major actor when it comes to normalizing interest rates from unprecedented crisis lows.

“The essence of a multiyear strong dollar story is U.S. dollar policy divergence, particularly with the ECB and BOJ, but more generally an expectation that the Fed will be hiking rates more than any other G-10 central bank in the next three years,” said Alan Ruskin, chief forex strategist at Deutsche Bank. Here’s what could move exchange rates and supercharge this dollar rally, when policymakers speak in Wyoming. ECB President Mario Draghi speaks Friday, after Fed Chair Janet Yellen. Investors are eager to hear about how he plans to fight a recent economic slump across the 18-member euro zone and the dangerously low inflation rate of 0.4%. Remember, the ECB’s sole mandate is to keep prices rising at just under a 2% rate, so not only is it missing its target, but it’s getting dangerously close to deflation. In June, Draghi lowered the deposit rate below zero and the main interest rate to a record low. He also announced other liquidity-boosters, including a new program designed to spur lending. Importantly, Draghi recently signaled that he’s willing to do more if the outlook gets worse.

Read more …

Been there for a full week.

• Moscow Defies Kiev, Aid Convoy Passes Ukraine Border (Reuters)

Russia ordered a convoy of aid trucks across the border into eastern Ukraine on Friday apparently without Kiev’s permission, raising the danger of direct confrontation with the Ukrainian military which is fighting pro-Russian rebels. A Ukraine government source said 90 white-painted trucks, part of a column of about 260 that had been waiting at the border for over a week, had crossed the border and was heading towards the rebel stronghold of Luhansk accompanied by a small number of separatist fighters. The convoy did not have clearance from the International Committee for the Red Cross (ICRC) or Ukrainian border guards, the source said. An unnamed Ukrainian official told Interfax news agency that the trucks were accompanied by a small number of pro-Russian rebels. The trucks were previously in the no-man’s land between the Russian and Ukrainian border posts, but have now moved past the Ukrainian border post.

The ICRC tweeted that it had not escorted the convoy due to the “volatile” security situation. Timothy Ash, head of emerging markets at Standard Bank said that if true, the move represented a “dangerous development”. “The Ukrainian side have previously argued that they would see such actions (convoy crossing the border without agreement from Ukraine) as an act of aggression by Russia.” Kiev and Western capitals have expressed concern that the convoy, held up by wrangling over the terms of passage, the content of the cargo and the role of the ICRC, could be used as a pretext for some form of direct Russian military intervention. Russia denies the accusation as absurd. Moscow had earlier declared its patience with the delays at the border to be an end. “All excuses to delay sending have been exhausted,” the Russian foreign ministry said in a statement, warning against any attempts to disrupt the convoy’s movement. “The Russian side has taken the decision to act.”

Read more …

Huh? What? Regime change?

• Ukraine’s President Poised To Dissolve Parliament (Reuters)

Ukrainian President Petro Poroshenko said on Thursday he might announce the dissolution of parliament as early as Sunday – a move that will set up a parliamentary election in Ukraine in late October. “The decision will be made when there is a constitutional basis for it and that moment, as everyone knows, is on Independence Day (Aug. 24),” Poroshenko was quoted as saying by Interfax Ukraine news agency. The governing coalition in Ukraine, which ousted its Moscow-backed president in street protests in February precipitating major separatist rebellions in its eastern regions in which more 2,000 people have been killed, collapsed on July 24. Under the constitution, at least a month has to pass before parliament can be dissolved.

Poroshenko, a wealthy confectionery magnate, and his pro-Europe leadership hope to have stabilized the situation enough by October to be able to hold an election under normal conditions which will earn his new administration increased legitimacy. He and his liberal supporters will be seeking an endorsement for the tough line they have taken in the separatist war and the confrontation with Russia, which annexed Crimea in March after ex-president Viktor Yanukovich fled. Poroshenko’s government, headed by the liberal Arseny Yatesniuk, hope an election will clear out many of the “old guard” who supported Yanukovich and produce a parliamentary coalition that will be able to push through vital economic and political reform after years of chaotic misrule and malpractice. “In my discussions with party factions and parliamentary leaders, I will be guided by the desire of the Ukrainian people. They want a ‘reboot’, they want a purging (of the system). The elections will be the best form for a purging,” he said.

Read more …

Scary.

• G20 Edging Towards Deal On ‘Bail-in’ Bond Cushion For Banks (Reuters)

Government leaders are expected to agree in November that the world’s top banks must issue special bonds to increase the amount of capital which can be tapped in a crisis instead of calling on taxpayers to come to the rescue, industry and G20 officials said. The bonds, known as “gone concern loss absorption capacity” or GLAC, are seen by regulators as essential to stopping the world’s 29 biggest lenders from being “too big to fail”. The plans are being drafted by the Financial Stability Board, the regulatory task force of the Group of 20 economies which declined to comment ahead of a G20 summit in November, when G20 leaders will discuss the reform before it is put out to public consultation. The reform would put in place the final major piece of G20 regulation on banking as the global body turns to a “post-crisis” agenda of fostering economic growth and bedding down the rules it has approved.

There had been unease in Asia and parts of Europe over how big the bond issues need to be to provide this cushion but there is now a new optimism amongst bankers and regulators that the G20 will reach a deal in November. “The industry is definitely in favour of making resolution, supported by an appropriately flexible concept of GLAC, work. That is the key pending aspect on ending too-big-to-fail,” said Andres Portilla, director of regulatory affairs at the Institute of International Finance, a Washington-based banking and insurance lobby.

“What is likely to happen is that there will be a consultative proposal, but without all the detail that a lot of people would like,” Portilla added. However, a G20 source said a deal was not only expected but would also be more detailed than some parties anticipate, which is essential for conducting a thorough impact assessment before finalising the rules.

Read more …

Ambrose’s been busy lately.

• Nobel Guru Fears It May Be Nigh Impossible To Stop Deflation (AEP)

A quick word from Lindau, where half the world’s Nobel economists are gathered on a beautiful island with cobbled streets on Lake Constance, looking out across the Alps. It is a Wittlesbach jewel. Christopher Sims – a monetary expert, who now thinks money indicators have been rendered “essentially obsolete” by modern finance – says it may be impossible to reverse deflation in the Western economies by any normal means, in which case we are in trouble. He argues that the public (including investors) are convinced that there will have to be some sort of payback for all the debts accumulated during the great era of leverage and excess. They have “internalised” the prospect of future tax rises and spending that will make them feel poorer. “Some 60pc of people in the US say they doubt there will be any government benefits for them when they retire, and 60pc of those already retired think their benefits will be reduced,” he said. This has powerful implications. Many of these people are retrenching pre-emptively, en masse, in most of the mature industrial economies.

They are discounting a “future stream of primary surpluses”. By the same token businesses are putting off investment and hoarding cash in anticipation of a hit to come. We may be deluding ourselves in thinking that companies will soon be confident enough to let rip with a fresh burst of spending and investment. They may just sit on their money for year after year. If this is broadly true, it means that any use of fiscal stimulus will be neutralised by the countervailing actions of taxpayers, and may even be a net negative. Deficits become “deflationary”, contrary to standard textbook theory or populist assumptions, and threaten a self-fulfilling effect that becomes almost impossible to stop over time. Prof Sims, who won the Nobel Prize in 2011 for studying “cause and effect in the macroeconomy”, says monetary policy cannot do the trick either once interest rates have dropped to zero. He dismisses the monetary effects of quantitative easing as trivial. At best, he says, QE is a bluff intended to show resolve and change psychology.

Read more …

Good.

• How Central Banks Destroy Corporate Value (Stockman)

Monetary central planning gives rise to economic waste, distortion and deformation because it causes capital to be mis-priced. Nowhere is this more evident than in the massive and destructive level of mergers and acquisitions (M&A) that has become a standard component of bubble finance. Stated simply, ZIRP and financial repression push long-term interest rates to deeply sub-economic levels, causing the value of future cash flows from M&A deals to be grossly and systematically over-estimated. Accordingly, by nearly all accounts upwards of 75-80% of deals fail—that is, they destroy shareholder value rather than enhance it on a long-term basis. Needless to say, such an outcome would not occur on the free market because companies which engaged in serial, loss-making M&A would be severely punished by stock market investors. [..]

M&A speculators could not afford to play the game if they had to pay an honest economic price for their “downside insurance”. That is, takeover speculators typically protect their “long position” in the target company’s stock by means of a short-position or put on the broad market. In that manner, they insulate themselves from a sudden unexpected drop in the stock market that could nix the deal and cause them to experience heavy losses. In today’s central bank dominated capital markets this “speculators insurance” is doubly cheap. First, takeover speculators increasingly opt for thin coverage because they are confident that the Fed has a safety net under the market and that other investors will “buy the dips”. And secondly, for the coverage that they do acquire such as puts on the S&P 500, premiums are at rock-bottom levels owing to the fact that the Fed has crushed volatility and driven short-sellers out of the casino.

As a consequence, the power and scale of of takeover speculation in today’s markets vastly exceeds what would occur in a two-way market of honest money and economically priced finance. In their misguided efforts to stimulate investment and demand via ultra-low interest rates, therefore, the central banks have actually accomplished the opposite. Namely, by subsidizing mindless deal-making—so-called Merger Monday—-they cause an after-the-fact scramble for artificial “synergies” to justify financially-driven deals. In the end, jobs are eliminated, stores and plants are closed, assets are written-off and capital is destroyed as a result of financial engineering, not capitalist enterprise.

Read more …

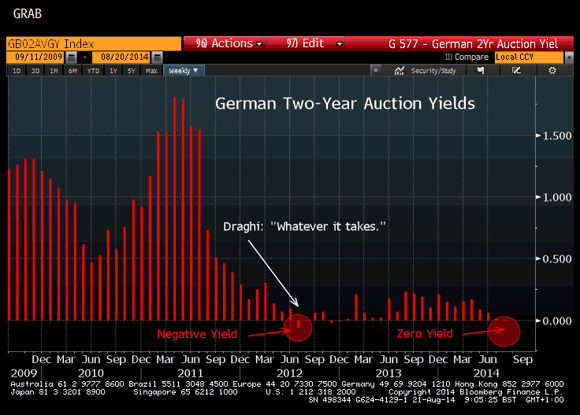

• Free Money for Germany Is Bad News for Euro (Bloomberg)

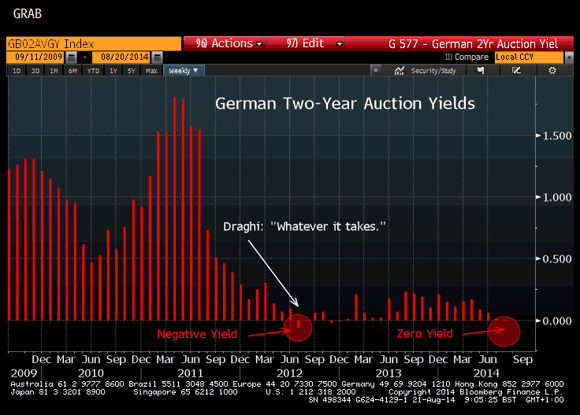

When investors are willing to lend money to Germany for two years for free, at a zero interest rate, you know the euro project is in trouble again. Germany yesterday sold €4.04 billion ($5.3 billion) of notes that pay no interest, repayable in September 2016. Investors, it seems, are willing to forgo income for the safety of stashing their cash in the AAA-rated government debt of Europe’s biggest economy. That’s a huge vote of no-confidence in the region’s growth prospects. Here’s a chart showing how much Germany has paid for two-year money in recent years:

Note that on July 18, 2012, Germany sold two-year notes at a negative yield for the first and only time, meaning investors paid 0.06% for the privilege of lending to the nation. Back then, the euro debt crisis was reaching its climax, with Spanish 10-year borrowing costs spiking to 7.62% at the same time as yields for short-dated Austrian, Finnish and Dutch debt dropped below zero as bond buyers sought safety. A week after that German auction, European Central Bank President Mario Draghi delivered the rescue speech that turned everything around. “The ECB is ready to whatever it takes to preserve the euro,” he said in London. “And, believe me, it will be enough.”

Read more …

Keynes.

• Time To Dust Off Old Euro Crisis Strategies (FT)

The euro area has lived a charmed life in the two years since European Central Bank President Mario Draghi said he would do “whatever it takes” to save the single currency. But the magic seems to be wearing thin. Growth is weakening, lead indicators are rolling over and a persistently weak earnings trend means European equities are making new lows relative to the US without being particularly cheap. A downside shock to European growth or an upside shock to US rates could widen peripheral bond spreads, hurt the banks and see a return of familiar vicious cycle dynamics. Europe urgently needs policies to boost nominal growth. Japan offers a precedent here. It may take a witches’ brew of serious structural reform, unconventional monetary easing and sustained fiscal expansion to raise inflation expectations. Two years ago the euro area was in perpetual crisis. Three words from Mr Draghi and the downward spiral swung powerfully into reverse.

Those who remember the late 1990s euro convergence trade got to see it all over again as the average 10-year sovereign spread for France, Italy and Spain hurtled in from more than 4percentage points over Germany to less than 1percentage point. Funding markets reopened, bank balance sheets improved and economic growth returned. At one point the euro was up 15% against the dollar and unhedged investors saw European equities outperform the US by a full 25%. In recent weeks it seems Mr Draghi’s spell has been wearing off. European lead indicators are weak. France is flat lining, Italy is back in recession and the conflict in Ukraine is hurting business confidence in Germany. There has been some derating of equity markets but it is the persistently weak relative earnings trend that has the Euro Stoxx 50 index making new lows against the S&P 500.

Gradual European underperformance is starting to look normal but a more intense phase could easily return. The euro crisis has been in remission while domestic growth has been strong and the global need for income has provided ready flows into high yielding bond markets. However, the old feedback loop remains largely in place, with banks heavily exposed to their sovereign, legacy debt excluded from discussions on banking union, and a single deposit protection scheme elusive. A downward shock to European growth or a steady rise in US interest rates could put upward pressure on peripheral yields, hurting banks, triggering asset price falls and pushing the more fragile economies back into recession when they are already on the verge of deflation. Worse still, economic weakness would lead to calls for self-defeating austerity when the exact opposite is required.

Read more …

Keynes.

• Spectre Of ‘Lost Decade’ Haunting Europe (FT)

When Nobel Prize-winner Joseph Stiglitz was asked in Germany this week if the country and its neighbours would suffer a lost decade, his response was unequivocal. “Is Europe going the same way as Japan? Yes,” Mr Stiglitz said in Lindau at a meeting for Nobel Laureates and economics students. “The only way to describe what is going on in some European countries is depression.” Dire gross domestic product figures, which showed the eurozone’s recovery had stuttered to a halt in the second quarter, and inflation at a four-and-a-half year low of just 0.4 per cent in July have been a stark reminder of the problems befalling the world’s second-largest economic bloc. Hopes of a meaningful recovery this year have faded, overtaken by concerns that a rise in geopolitical tensions could worsen conditions in the months ahead. Beyond the latest figures, the big picture is bleaker still.

Despite hopes that the worst ravages of the region’s sovereign and banking crises are behind it, the eurozone’s economy remains smaller than it was before the collapse of Lehman Brothers in the autumn of 2008. With debt burdens worryingly high in parts of the currency area, low inflation and little growth risk causing another crisis. That has bolstered calls for the European Central Bank, facing price pressures of less than a quarter of its target, to embark on broad-based asset purchases immediately. The ECB has signalled it will not embark on quantitative easing until at least the end of the year, preferring instead to gauge the impact of the package of measures announced in June, which include up to €1tn in cheap loans for the eurozone banks. The central bank further believes its health check of the bloc’s biggest lenders, whose results will be announced in October, will help to boost investor confidence.

The governing council will also hope that signs the Bank of England and the US Federal Reserve are beginning to consider raising rates will weaken the single currency, boosting exports and lifting inflation. But waiting carries risks. John Llewellyn, of Llewellyn Consulting, said: “QE by the ECB looks almost an inevitability. But it would probably have to be massive. And having left it so late, with low-growth expectations now embedded; with deflation an increasing spectre; and with only a limited availability of financial instruments to buy, the ECB may well have missed the boat.” Ken Wattret, economist at BNP Paribas, said: “The longer the inflation rate is allowed to stay so low, and continually approach zero, the smaller the cushion against deflation. Inflation expectations can also suddenly turn into something much more destabilising. The experience in Japan is a warning in both respects.”

Read more …

Buiter?! That still exists?

• Citi Chief Economist Buiter Defends ‘Helicopter Ben’ (CNBC)

Quantitative easing (QE) programs by central banks under the right conditions will always have a positive outcome for household demand, according to Willem Buiter, chief economist at Citi, who predicts that Japan and the euro zone will soon launch “massive” stimulus packages. In a 52-page thesis released on Thursday, the economist analyses Milton Friedman’s principles on “helicopter money”, giving the example of permanent QE – the irreversible open market purchase of sovereign debt by central banks. He concludes that three conditions need to be met for QE to “always” boost aggregate demand. “Deflation, ‘lowflation’ and secular stagnation are therefore unnecessary. They are policy choices,” he said in the paper. “State-issued fiat money is indeed net wealth to the private sector.”

The three conditions that need to be met, according to Buiter, are that there need to be benefits to holding that money other than its rate of return. It also needs to be irredeemable and viewed as an asset, and nominal interest rates need to be positive. He also tries to dispel the idea that households will try to save money in times of easy liquidity in order to pay for future tax increases that may be initiated to pay off the debt. He believes that the issuance of money is effective in boosting household demand regardless of this theory. Buiter name checks former Federal Reserve Chairman Ben Bernanke, who launched a total of three quantitative easing programs in the U.S. following the global financial crash of 2008. “Ben Bernanke spent years living down the moniker ‘Helicopter Ben'”, according to Buiter, whose new thesis is in direct conflict with the idea that QE has had little effect on the real economy and should be swiftly removed.

Read more …

Give it to me.

• Few Homeowners To Benefit From $16.65 Billion Bank of America Settlement (AP)

Bank of America’s record $16.65 billion settlement for its role in selling shoddy mortgage bonds — $7 billion of it geared for consumer relief — offers a glint of hope for desperate homeowners. The settlement requires the nation’s second-largest bank to reduce some homeowners’ loan balances, provide new loans to low-income buyers and address areas of neighborhood blight. But consumer advocates say few people will be helped relative to the devastation triggered by the mortgage bonds, which fueled the worst financial crisis since the 1930s and threw millions of homes into foreclosure.

Only a fraction of homeowners would be eligible for refinancing under the settlement. And the process by which people would qualify and receive aid could drag on for years, with payouts set to be completed as late as 2018. Those who have lost their homes to a foreclosure or a short sale — when a lender accepts less money from a sale than what the borrower owes — likely wouldn’t benefit at all. “It is certainly better than nothing,” said Bruce Marks, chief executive of the nonprofit Neighborhood Assistance Corporation of America. “But for the millions who lost their homes, it reinforces the appearance that the government has not been on their side.”

Read more …

But they spent billions saving GM …

• US Federal Prosecutors Questioning GM Lawyers On Vehicle Recalls (Reuters)

U.S. federal prosecutors have learned that lawyers for General Motors Co were present at key meetings during which information about problems with some of its vehicles were discussed, a source close to the investigation said. The prosecutors from the U.S. Department of Justice have asked how lawyers attending those meetings participated in them and what they did afterward with the information that was shared during the meetings, the source said.

General Motors had issued a report in June which detailed how for 11 years it turned a blind eye to an ignition-switch problem linked to at least 13 deaths but largely pinned the blame on what the report described as incompetent lower-level employees, leaving top brass untouched. Lower-level lawyers are among the 15 people GM has dismissed in the safety debacle that has resulted in millions of recalled vehicles. “We’re cooperating fully,” a representative from the company said. Employees within the No.1 U.S. automaker’s legal department are being scrutinized for concealing evidence from regulators about a faulty ignition switch.

Read more …

Nothing new.

• A Third Of Americans Have Nothing Saved For Retirement (USA Today)

A lot of folks have empty nest eggs. A third of people (36%) in the U.S. have nothing saved for retirement, a new survey shows. In fact, 14% of people ages 65 and older have no retirement savings; 26% of those 50 to 64; 33%, 30 to 49; and 69%,18 to 29, according to the survey of 1,003 adults, conducted for Bankrate.com, a personal finance website. “These numbers are very troubling because the burden for retirement savings is increasingly on us as individuals with each passing day,” says Greg McBride, chief financial analyst for Bankrate.com. “Regardless of your age, there is no better time than the present to start saving for your retirement. The key to a successful retirement is to save early and aggressively.” Other recent research confirms that many people aren’t saving enough for their golden years.

About 36% of workers have less than $1,000 in savings and investments that could be used for retirement, not counting their primary residence or defined-benefits plans such as traditional pensions, and 60% of workers have less than $25,000, according to a survey of 1,000 workers from the non-profit Employee Benefit Research Institute and Greenwald and Associates. Many people realize that they are not on track in saving for retirement, and the two most important reasons they give are cost of living and day-to-day expenses, says Jack VanDerhei, the institute’s research director. He advises people to join the 401(k) plan if their employer offers one and to make sure to contribute at least enough to receive the maximum employer match. “Contributing anything less than that is leaving free money on the table,” he says.

Read more …

I like Chinese.

• GMO Production In China Halted (RT)

In a surprise U-turn, China’s Ministry of Agriculture has decided not to continue with a program which developed genetically-modified rice and corn. Some environmentalists say public concerns about GM crops played a key role in the decision. On August 17, when these permits were up for renewal, the Ministry of Agriculture decided not to extend them. In 2009, the ministry’s Biosafety Committee issued approval certificates to develop the two crops, rice and corn. Developed by the Huazhong Agricultural University, near Wuhan, it was hoped that the GMO strains would help to reduce pesticide use by 80% while raising yields by as much as 8%, said Huang Jikun, the chief scientist with the Chinese Academy of Sciences, told Reuters in 2009. It is illegal to sell genetically-modified rice on the open market in China.

However in July, GM rice was found on sale in a large supermarket in Wuhan, which is just across the Yangtze River from the Huazhong Agricultural University, where the product was developed, which caused a public outcry. “We believe that loopholes in assessing and monitoring [GMO] research, as well as the public concern around safety issues are the most important reasons that the certifications have not been renewed,” Wang Jing, a Greenpeace official based in Beijing, wrote in an email to ScienceInsider. According to the South China Morning Post, state television commissioned tests on five packets of rice, which were picked at random, and found three contained genetically-modified rice. It is illegal to sell or commercially grow GM rice in mainland China. The safety certificates issued in 2009 only allowed the rice to be planted for research purposes, but never for sale on the open market.

Read more …

Yikes.

• Tests Under Way For Ebola Following Donegal, Ireland Death (Irish Times)

Tests are being carried out for the Ebola virus and isolation procedures have been put in place after the death of a man in Co Donegal. It is understood the deceased had been working in Sierra Leone and that a number of colleagues had contracted the virus there. He was found dead late last night and taken to Letterkenny General Hospital, it is understood. While the cause of death is unknown the HSE is carrying out tests to see whether it was due to exposure to Ebola. It is believed the suspected victim, named locally as Dessie Quinn, from the Doorin area, outside Mountcharles, Co Donegal, was a father of one aged 43. He is thought to have been living with his partner in Dublin but was visiting his large family in Co Donegal when he was taken ill. In a statement, the HSE said it was currently assessing a suspected case of Ebola virus disease (EVD) in Donegal.

“The public health department was made aware earlier today of the remains of an individual, discovered early this morning, who had recently travelled to the one of the areas in Africa affected by the current Ebola virus disease outbreak,” it said. “The appropriate national guidelines, in line with international best practice, are being followed by the public health team dealing with the situation. This means that the body of the deceased has been isolated to minimise the potential spread of any possible virus.” The statement said blood samples had been sent for laboratory testing to confirm whether or not this individual had contracted Ebola virus disease. “Until a diagnosis is confirmed, and as a precautionary measure, the individual’s remains will stay in the mortuary pending the laboratory results which are expected late tomorrow.”

Read more …

As if it’s not going fast enough.

• Global Warming Slowdown ‘Could Last Another Decade’ (BBC)

The hiatus in the rise in global temperatures could last for another 10 years, according to new research. Scientists have struggled to explain the so-called pause that began in 1999, despite ever increasing levels of CO2 in the atmosphere. The latest theory says that a naturally occurring 30-year cycle in the Atlantic Ocean is behind the slowdown. The researchers says this slow-moving current could continue to divert heat into the deep seas for another decade. However, they caution that global temperatures are likely to increase rapidly when the cycle flips to a warmer phase. According to the Intergovernmental Panel on Climate Change (IPCC), global average temperatures have increased by around 0.05C per decade in the period between 1998 and 2012. This compares with a decadal average of 0.12 between 1951 and 2012. More than a dozen theories have been put forward on the cause of this pause in temperature growth that occurred while emissions of carbon dioxide were at record highs.

These ideas include the impact of pollution such as soot particles that have reflected back some of the Sun’s heat into space. Increased volcanic activity since 2000 has also been blamed, as have variations in solar activity. The most recent perspectives have looked to the oceans as the locations of the missing heat. Last year a study suggested that a periodic upwelling of cooler waters in the Pacific was limiting the rise. However this latest work, published in the journal Science, shifts the focus from the Pacific to the Atlantic and Southern oceans. The team, lead by Prof Ka-Kit Tung from the University of Washington, US, says there is now evidence that a 30-year current alternately warms and cools the world by sinking large amounts of heat beneath these deep waters.

Read more …

Lot of water.

• US West Missing 62 Trillion Gallons Of Water, Surface Rises (Smithsonian)

The record-breaking California drought is so bad that monitoring stations used to study earthquakes can detect the drying ground rising up. Measurements of these subtle movements, made using GPS instruments, suggest that the western United States is missing some 62 trillion gallons of water, enough to cover the entire region six inches deep. Drought has plagued various parts of the western United States for years. California’s dry times started at the beginning of 2013 and have continued to worsen. Nearly 100% of the state is now experiencing drought conditions, according to the U.S. Drought Monitor, and more than half the state falls under the most severe category of “exceptional drought.” Water restrictions are in place. Farmers have been hard hit. And some people are even questioning participation in the viral “ice-bucket challenge” that is raising awareness and funding for amyotrophic lateral sclerosis (ALS).

While it’s not difficult to see parched lawns and drying lakes, and scientists can directly measure changes in rainfall and stream flow, getting a measure of how much water has been lost from the desiccating landscape hasn’t been easy. The new study, appearing today in the journal Science, provides a way to do just that by taking advantage of GPS monitors set up across the country. The Plate Boundary Observatory consists of more than 1,000 permanent GPS stations, with the majority concentrated along the seismically active West Coast. The stations measure millimeter-size movements of the ground, and scientists use that data to study what is happening at the boundary between the Pacific and North American tectonic plates. But Adrian Borsa, a geophysicist at the Scripps Institution of Oceanography in La Jolla, California, noticed an odd trend in the data: Most of the stations have been gradually rising in the last couple of years, just when the region was drying out.

Read more …