Vincent van Gogh View of Saintes-Maries-de-la-Mer 1888

“Now they had a fig leaf – the threat of future tariffs – behind which to hide their long-planned offshoring strategies.”

• Stock Markets See the US Winning the Trade War, Defying Propaganda (WS)

The trade war talk has been going on since the presidential campaign but markets just brushed it off and rallied. In 2018, the trade war verbiage moved to the foreground. But until June 14, the administration vacillated between thinking about tariffs and putting the trade war “on hold,” depending on who was doing the talking or tweeting. This vacillation ended on June 14 (Thursday) evening, when it was reported that Trump had approved to hit an initial list of $50 billion in goods (1,300 products) from China with tariffs of 25%. At the time, the administration was also preparing a second list of products, accounting for another $100 billion in imports from China.

On the evening of June 19 (Monday), Trump threatened to hit another $200 billion of imports from China with tariffs of 10%. And on Tuesday, the Shanghai stock market plunged. Markets were taking it seriously. Since then, Corporate America’s propaganda machine – the same that for the past two decades had extolled the unrivalled virtues of offshoring production to cheap countries – fired up the mainstream media, which launched into incessant, deafening, repetitive, and manipulative coverage of how these tariffs would hurt US jobs more than anything.

Two glorious examples are Harley-Davidson and GM, which had been laying off workers and shutting plants in the US for years as they were offshoring production to cheap countries. For example, in July 2017, Harley-Davidson announced layoffs in the US as it was building a factory in Thailand. GM has been laying off workers in the US since 2016, even as it opted to produce more models in Mexico. Now they had a fig leaf – the threat of future tariffs – behind which to hide their long-planned offshoring strategies.

TBTF banks have no incentive to come clean.

• A Decade On, Pre-Crisis Mortgages Linger For Big Banks, Homeowners (R.)

A decade on big U.S. banks are still running down and selling off crisis-era mortgages, a process executives point to as weighing on loan growth. Eager to see a turning point in loan books, analysts count these portfolios as one factor, along with home equity loan runoff and new mortgage demand, to watch for when deciphering the true loan growth picture as U.S. second-quarter bank earnings start on Friday. Wells Fargo and Bank of America executives have flagged portfolios from prior to the 2008-2009 crisis era where banks are no longer originating similar new products when they are asked to predict a turning point in consumer loans. “These are portfolios of a bygone era that were very, very painful for the banks,” said Gerard Cassidy at RBC Capital Markets.

“They are not plain vanilla portfolios, which means they are more costly to manage. It may just not be worth the headache.” Analysts have said higher loan growth is critical to driving bank’s stock prices, but they anticipate only a modest acceleration year over year, driven primarily by commercial and industrial loans, not residential. “Remember that there’s a portion of that book that, again, is pre-crisis,” Chief Executive Tim Sloan said about Wells Fargo’s mortgage book at a May conference. He added the bank continues to examine the older portfolio’s risk-return tradeoff and sells assets when the opportunity arises, factors “that could have some impact” on growth.

Backpedalling.

• Fed’s Escape From Crisis Holdings Could Hit Dead End (R.)

Not long ago the Federal Reserve expected to quietly shed nearly half of its $4.5-trillion portfolio by around 2022, leaving little trace of the extraordinary steps it took to face down the financial crisis. But an unexpected market kink could force the Fed to scrap the plan two or three years early and permanently leave it holding $1 trillion more than it wanted. The U.S. central bank is making adjustments on the fly and keeping its options open. “I don’t think that’s problematic in any way” to halt the process “somewhat earlier,” William Dudley, the former New York Fed president and key architect of the portfolio strategy, told reporters last month.

Yet if the world’s largest holder of U.S. bonds tossed out its play book and effectively took on a more accommodative stance, the result could be an across-the-board easing of market borrowing costs, the foreign-exchange value of the dollar, and of the growing strains on emerging markets. “The evidence that we have suggests that the ultimate size of the balance sheet will be bigger than what people expected,” said Matthew Luzzetti, senior economist at Deutsche Bank Securities in New York. All of this amounts to the final chapter in the Fed’s unprecedented decision over the last decade to buy some $3.5 trillion in mortgage and Treasury bonds in an effort to boost riskier investments, hiring and economic recovery from recession. In a nod to a stronger U.S. economy, the Fed since 2015 has raised interest rates well above zero and, since October of last year, begun shrinking its balance sheet to a more normal but yet-unspecified size.

“As of this year, both programs are in negative cash flow, meaning Congress must provide additional cash to pay the promised benefits.”

• Social Security, Medicare To Add Another $50 Trillion to Our National Debt (JM)

The official, on-the-books federal debt is currently about $21.2 trillion, according to the US National Debt Clock. $21.2T is the face amount of all outstanding Treasury paper, including so-called “internal” debt. This is about 105% of GDP and it’s only the federal government. If you add in state and local debt, that adds another $3.1 trillion to bring total government debt in the US to $24.3 trillion or more than 120% of GDP. Then there’s corporate debt, home mortgages, credit cards, student loans, and more. Add it all together and total debt is about 330% of GDP, according to the IIF data I cited in Debt Clock Ticking. We are in hock up to our ears. In calculating debt, however, we don’t factor in Social Security and Medicare. These aren’t yet debt because they have dedicated revenue streams: payroll taxes.

Most Medicare recipients also pay premiums. To date, these revenue sources have covered current expenditures and more, allowing the programs to build up reserves. But that’s about to change. As of this year, both programs are in negative cash flow, meaning Congress must provide additional cash to pay the promised benefits. It will get worse, too. The so-called “trust funds” are going to run dry sooner or later, and it may be sooner. This month’s annual trustee report estimated Social Security will run out of reserves in 2034, and the hospitalization part of Medicare will go dry in 2026. Just for the record, those “trust funds” don’t exist except as an accounting fiction. It is like you saving $100,000 for your child’s education and then borrowing all the money from your child’s education fund.

You can pretend that you have set aside $100,000 for your child’s future education, but when it comes time to make those payments, you’ll have to pull it out of current income or liquidate other assets. The US government has borrowed (or used or whatever euphemism you want to apply) all the money in those trust funds. So, talking about running out of reserves in 2034 or 2026 is rather meaningless. We’ve already run out of reserves. Any time a politician talks about putting a “lock box” around Social Security or Medicare trust funds, he or she is either staggeringly ignorant or lying.

Stockpiling ahead of the crash?!

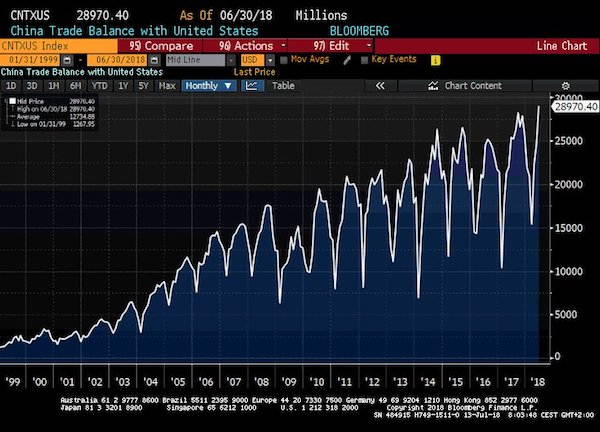

• China’s Record Trade Surplus With US Further Inflames Trade Tensions (R.)

China’s trade surplus with the United States swelled to a record in June as its overall exports remained solid, a result that could further inflame a bitter trade dispute with Washington. The data came after the administration of U.S. President Donald Trump raised the stakes in its trade row with China on Tuesday, saying it would slap 10 percent tariffs on an extra $200 billion worth of Chinese imports, including numerous consumer items. China’s trade surplus with the United States, which is at the center of the tariff tussle, widened to a record monthly high of $28.97 billion, up from $24.58 billion in May, according to Reuters calculations based on official data going back to 2008.

Trump, who has demanded Beijing cut the trade surplus, could use the latest result to further ratchet up pressure on China after both sides last week imposed tit-for-tat tariffs on $34 billion of each other’s goods. Washington has warned it may ultimately impose tariffs on more than $500 billion worth of Chinese goods – nearly the total amount of U.S. imports from China last year. The dispute has jolted global financial markets, raising worries a full-scale trade war could derail the world economy. Chinese stocks fell into bear market territory and the yuan currency has skidded, though there have been signs in recent days its central bank is moving to slow the currency’s declines.

[..] China’s exports to the United States rose 13.6 percent in the first half of 2018 from a year earlier, while its imports from the U.S. rose 11.8 percent in the same period. Separate data showed Chinese shipments to U.S. ports rose more than expected in June, suggesting some retailers moved up orders to insulate themselves from the intensifying trade war that threatens to send up costs on a growing number of consumer products. For January-June China’s trade surplus with the United States rose to $133.76 billion, compared with about $117.51 billion in the same period last year.

May will have to find something else.

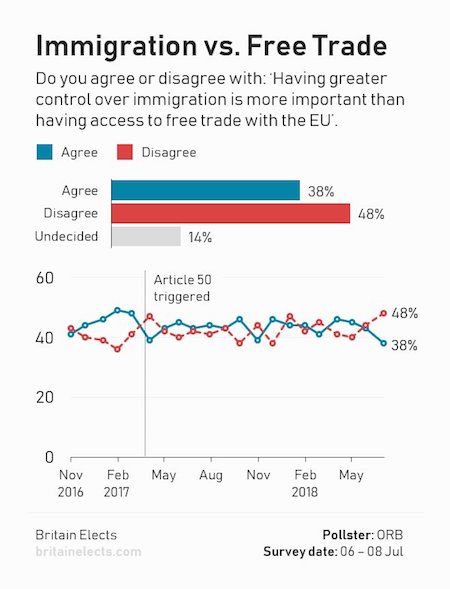

• Approval Of Brexit Negotiations Lowest On Record (Orb)

Approval of the Brexit negotiations has seen a significant fall in July – now the lowest on record. Last month 36% approved of the negotiations and it is now 29%. In June, 32% agreed that Theresa May would get the right deal for Britain in the Brexit negotiations – this has now fallen to 26% – the lowest again on record. These 2,027 interviews were carried out before the resignation of Brexit Secretary David Davis and Foreign Secretary Boris Johnson.

Perhaps the biggest one of a million problems.

• No Brand Of Brexit Can Command A Commons Majority (G.)

Theresa May’s new cabinet has now rallied behind her Chequers plan, set out fully in the government’s white paper on future UK-EU relations. However, far from settling the Brexit debate, recent events have given rise to another nightmare scenario that is only just beginning to take shape: that every conceivable Brexit outcome may now not command a parliamentary majority. The conventional wisdom in Westminster is that since the general election last year, there is no House of Commons majority for a hard Brexit. With a working majority of only 13, including the Democratic Unionists, it would take just seven Tory MPs to oppose it. But there are at least 20-30 pro-European Tories minded to do so.

Yet May’s softer Brexit blueprint has also significantly increased the prospect of Eurosceptic Conservative MPs voting against her EU deal when it is put to parliament later this year. In the febrile atmosphere at Westminster this week, there have been rumours that up to 70 Tories could oppose it – especially if, as seems likely, May makes further concessions in order to win the EU’s backing for a bespoke deal, instead of having to choose between a Canada or Norway-style agreement. Hints in the white paper about a preferential system for EU migrants, despite May’s rhetoric about ending free movement of labour, will fuel the Tory revolt.

May’s embrace for a softer Brexit has therefore changed the Commons arithmetic – and the political calculations that come with it. It is now Labour MPs, rather than Tory ones, who may prove critical. In recognition of this, May has been reaching out to Labour MPs in the hope that soft Brexit supporters vote for her deal, neutralising the impact of the Eurosceptics voting against it. In an unusual move, David Lidington, the Cabinet Office minister and May’s de facto deputy, briefed Labour (as well as Liberal Democrat and SNP) MPs on the Chequers plan. But Labour won’t want to save May. Their leader, Jeremy Corbyn, will almost certainly whip Labour MPs to oppose May’s deal, in the hope that the ensuing chaos will result in an election.

What I said a few days ago.

• Donald Trump Is Right. NATO Is A Costly White Elephant (G.)

Nato was founded in 1949 in response to Stalin’s blockade of Berlin. It was meant to “keep the Soviet Union out, the Americans in, and the Germans down”. Since then, it has welcomed the American nuclear shield, at vast cost to America. Otherwise, its only military achievements have been the breakup of Yugoslavia and the loss of a squalid 17-year war in Afghanistan. Neither has anything to do with the North Atlantic. Nothing better symbolised this than Theresa May’s bizarre gift to Trump this week of 450 British troops for Kabul. Nato was about deterring an attack on Europe from Russia. In 1945, the west agreed the Potsdam settlement, accepting the Soviets’ “sphere of influence” over eastern Europe.

Thus when Russia invaded Hungary in 1956 and Czechoslovakia in 1968, there was no question of Nato, or Europe, retaliating. The iron curtain was iron. Come 1989 and the collapse of Potsdam Europe, Nato did not approach a broken Russia to agree some new settlement. It did the opposite. To protests from Russia’s weakened leader, Boris Yeltsin, it gathered former Warsaw Pact states under its wing and advanced its border east towards Russia. It embraced Poland, Czechoslovakia and Hungary, then the Baltic states, Romania and Bulgaria. It was like Khrushchev stationing missiles in Cuba. Only Germany counselled caution.

Nato’s provocation was so blatant as to be an open invitation to any new populist leader in Moscow to exploit Russia’s bruised patriotism: hence Vladimir Putin. He and his kleptocratic cronies are virtually a Nato creation. But the fact that America was party to the provocation does not invalidate Trump’s question. What is Nato’s policy beyond needling Russia and feebly relying on the American shield?

But in the end, it’s all about money. That’s why NATO still exists. Nothing to do with security.

• Trump Ready To Help Some NATO States Buy US Arms (R.)

U.S. President Donald Trump said on Thursday he was ready to help smaller NATO countries to buy U.S. weapons as he pushed them to spend more on their own defense. Speaking after a NATO summit, at which he said nations had agreed on new spending pledges, Trump said some less wealthy members had asked during meetings in Brussels if he could help them buy U.S. arms equipment, but did not name the countries. Asked about pressures on countries with weaker finances, he said, “We have many wealthy countries with us today but we have some that aren’t so wealthy and they did ask me if they could buy the military equipment, and could I help them out, and we will help them out a little bit,” he told a news conference.

“We are not going to finance it for them but we will make sure that they are able to get payments and various other things so they can buy – because the United States makes by far the best military equipment in the world: the best jets, the best missiles, the best guns, the best everything.” Trump claimed a personal victory at the summit after telling European allies to increase spending or lose Washington’s support. The White House has been pushing a “Buy American” initiative which aims to help drum up billions of dollars more in arms business. The initiative has raised concerns in Europe, where some see increased weapons sales as a key goal of Trump’s repeated calls for NATO members to increase their military spending.

Americans have no business there. Go home.

• Who Wants To Disrupt Strategic Balance In The Black Sea Region? (SCF)

The US-led series of drills in and around Ukraine’s Black Sea coastline is part of NATO exercise Sea Breeze that kicked off on July 9 to last until July 21. The training event involves an international armada representing 19 countries, including such non-NATO states as Ukraine, India, Georgia, the United Arab Emirates and Moldova. All in all, 29 warships, 1 submarine, and 25 aircraft are involved in the exercise held in Odessa and Mykolayiv and the northwestern Black Sea region. The Black Sea regional security is actually an issue paid little attention to. It’s not addressed by an international forum. NATO official documents adopt an openly provocative language to challenge Russia.

The North Atlantic Alliance always emphasizes the Black Sea’s role as a critical intersection. The US-led NATO activities have been intensifying since 2014 to turn the region into another hotbed along with the South China Sea and the Baltic. Turkey, Bulgaria, and Romania, three of the six Black Sea countries, are NATO members. Ukraine and Georgia are the bloc’s close partners aspiring for membership. The alliance has a significant military presence in Romania, including a US Aegis Ashore BMD system capable of firing long-range cruise missiles at Russia.

American military presence in Romania and Bulgaria is gradually growing. The US plans to deploy up to 2,500 troops at Novo Selo, Bulgaria. The facility is large enough to accommodate as many as 5,000 servicemen. Heavy tanks deployment is envisaged. The 1997 NATO-Russia Founding Act, where NATO pledged not to deploy “substantial forces” near Russia, seems to be forgotten. The US Navy’s policy is aimed at ramping up its presence there. The presence of American warships perilously close to Russia’s borders is undoubtedly provocative. For comparison, the Russian Navy does not stage regular maneuvers in the Caribbean Sea with such allies as Cuba, Nicaragua and Venezuela though nothing prevents it from doing so.

First, Berlin forces Greece to keep the islands loaded with refugees. Then it forces them to load more taxes on the already destroyed economies there.

• Germany Puts Last Bailout Tranche to Greece on Hold (GR)

Germany blocked a final 15 billion-euro ($17.5 billion) bailout payment to Greece after the government in Athens postponed a value-added tax (VAT) hike on a handful of islands that have been hit hard by the influx of migrants. For the tranche to be unblocked by early August, Finance Minister Euclid Tsakalotos pledged at yesterday’s Eurogroup that the measure to retain the 30 percent VAT discount on Lesvos, Chios, Samos, Leros and Kos will end in January 2019, and that the loss of 28 million euros of revenues will be offset from other sources.

The SYRIZA-led government postponed the VAT hike in the islands without consulting Greece’s creditors. Germany was eager to send a message to Athens that it will not tolerate any deviation from the program in the future. Commentators say that the Eurogroup decision shows how difficult it will be for the southern country to regain financial sovereignty even as it exits an eight-year bailout regime in August.

Given how Greece gets treated, denial doesn’t sound like the correct term.

• Europe’s Remarkable Ability To Remain In Denial (Varoufakis)

Europe’s establishment is luxuriating in two recent announcements that would have been momentous even if they were only partly accurate: the end of Greece’s debt crisis, and a Franco-German accord to redesign the eurozone. Unfortunately, both reports offer fresh proof of the European Union (EU) establishment’s remarkable talent for never missing an opportunity to miss an opportunity. The two announcements did not come in the same week by accident. The Greek debt implosion, back in 2010, was the ugly symptom of the eurozone’s design flaws, which is why it triggered a domino effect across the continent. Greece’s continuing insolvency reflects the deep disagreements within the Franco-German axis concerning eurozone redesign.

While three French presidents and the same German chancellor were failing to agree on the institutional changes that would render the eurozone sustainable, Greece was asked to bleed quietly. In 2015, the Greeks staged a rebellion, which Europe’s establishment ruthlessly crushed. Neither Brexit nor the EU’s steady delegitimation in the eyes of European voters managed to convince the establishment to change its ways. French President Emmanuel Macron’s election seemed the last hope for the new Berlin-Paris accord needed to prevent a suffocating Italy from triggering the next—this time lethal—domino effect.

Under Macron, new, hopeful ideas were proposed: a common budget for the eurozone; a new safe debt instrument and quasi-federal tax-raising capacities; a common unemployment insurance fund; common bank deposit insurance and a common pot from which to recapitalize failing banks. Moreover, a new investment fund would mobilize idle savings across Europe, without adding to the fiscal stress of member states. A year later, with Italy on a collision course with the EU, the Meseberg Summit between German Chancellor Angela Merkel and Macron delivered an agreement on eurozone reform. A few days later, the Eurogroup of eurozone finance ministers delivered its own “solution” to the Greek debt crisis.

Sensible.

• US Judge Asked To Create Mental Health Fund For Migrant Children (R.)

A civil rights group asked a federal judge on Thursday to order the U.S. government to provide mental health counseling for the around 2,000 immigrant children separated from their parents by officials at the U.S.-Mexican border. The request by the American Civil Liberties Union follows a chaotic week for U.S. immigration officials, who failed to meet a court-ordered deadline on Tuesday for reuniting children under the age of five. The government “must establish a fund to pay for professional mental health counseling, which will be used to treat children who are suffering from severe trauma as a result of their forcible separation from their parents,” said the ACLU in court papers filed late Thursday.

The group said the cost of the fund could be determined at a future date. The rights group brought the lawsuit that prompted U.S. Judge Dana Sabraw in San Diego last month to order the government to reunite families separated at the border. The family separation policy was instituted as part of President Donald Trump’s efforts to curtail illegal immigration. The administration ended the practice last month after widespread protests. The government, in the same court filing on Thursday, acknowledged that it had missed a Tuesday deadline for reuniting the youngest children with their parents, but said it had now complied with the judge’s order.

How does anyone make this, too, about Russia? It’s your own people who use this for spying on you. Targeting ‘Russians’ is just a way to divert your attention from that.

• Facebook Users Marked With “Treason” Label (ZH)

Beleaguered social media giant Facebook has removed “treason” from their database of the keywords assigned to users for advertising purposes, the company stated Wednesday after Danish state broadcaster DR reported its existence. Company spokesman Joe Osborne replied “National treason was an advertising interest because of its historical significance, but as it is an illegal act, we have removed it.” Facebook tags its more than 2 billion users with a wide variety of keywords depending on their interests – from shopping habits to political and religious views in order to sell more efficiently targeted advertising.

This makes Facebook a sublime sales channel for companies. Categorizing users in areas of interest means that companies with ads on Facebook can buy into an almost perfect audience. Eg. garden equipment for people with special interest in gardens, etc. But categorization also allows intelligence services in all countries to look at the population over the shoulder. DR suggests that the a government such as Russia could have used the “treason” tag to locate around 65,000 Facebook users who had been marked with the keyword. The article notes that they do not know “if the Russian authorities have used Facebook’s “treason” keyword” for nefarious purposes – adding “Only the Russian authorities know that.”

Home › Forums › Debt Rattle July 13 2018