Opening night of the movie ‘Grand Hotel’ on Times Square at Astor Theater, New York 1932

Caitlin Johnstone. Is right.

• Dear America: Please Stop This Shit. Signed, The Rest Of The World. (CJ)

They want you arguing over who should and shouldn’t be called a terrorist based on what ideology you subscribe to and what color the latest killer’s skin was. They do not want you talking about the way the label “terrorist” itself is being used to justify unconstitutional detentions, torture, mass surveillance, and wars. They want you arguing over whether to support the Democrats because the Republicans will take civil rights away from disempowered groups or Republicans because the Democrats will take away your guns and force you to bake gay wedding cakes. They don’t want you talking about the fact that both parties advance Orwellian surveillance, neoliberal exploitation and neoconservative bloodshed in a good cop/bad cop extortion scheme to keep Americans cheerleading for their own enslavement.

They want you arguing about whether Trump did or did not collude with Russia. They do not want you looking at what preexisting agendas the CNN/CIA Russia narratives are advancing and who stands to benefit from them. They want everyone fighting over table scraps while they pour unfathomable riches into expanding and bolstering their empire. They psychologically brutalize you with propaganda day in and day out, and then expect you to look to them for protection from the phantoms they invented. They don’t want you paying attention to the growing number of signs that the current administration is gearing up for a major military bloodbath which may lead our species into a third and final world war. They want you talking about Stormy Daniels instead.

[..] Please stop this shit, America. If the US war machine goes after Iran or Russia it will likely mean a world war against multiple nuclear-armed countries, which could very easily send our species the way of the dinosaurs should a nuke get deployed in the fog of war. We don’t have time to focus on Stormy fucking Daniels.

Cool down.

• Asian Shares Battered As Trade War Fears Sap Sentiment (R.)

Global markets were shaken when U.S. President Donald Trump moved to slap tariffs on Chinese goods, on top of import duties on steel and aluminum, prompting a defiant response from Beijing. But E-Mini futures for the S&P 500 brushed off the gloom on Monday to leap 0.6% on reports the United States and China have quietly started negotiating to improve U.S. access to Chinese markets. The United States also agreed to exempt South Korea from steel tariffs, imposing instead a quota on steel imports as the two countries renegotiate their trade deal. “If we do start to hear more favorable news from the U.S. administration and indeed from the Chinese side over the next few trading sessions, then we may see a sharp reversal of the recent moves in the market,” said Nick Twidale at Rakuten Securities Australia.

The curse of the reserve currency.

• US-China Trade Deficit Is Set To Keep On Rising – Stephen Roach (CNBC)

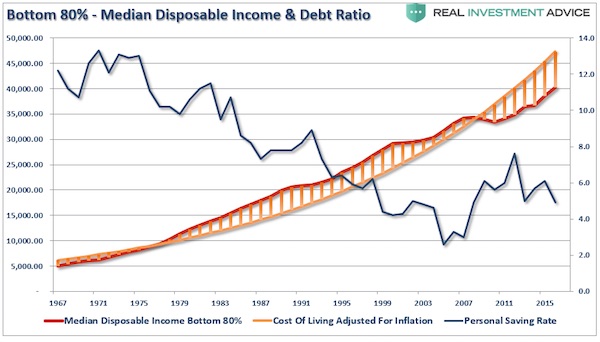

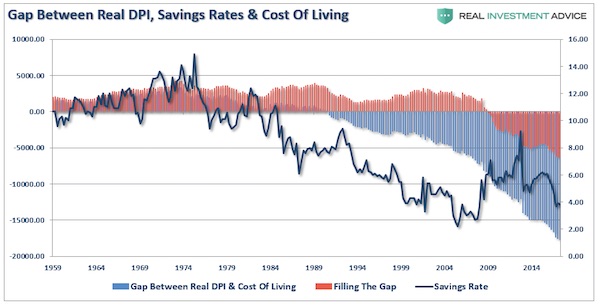

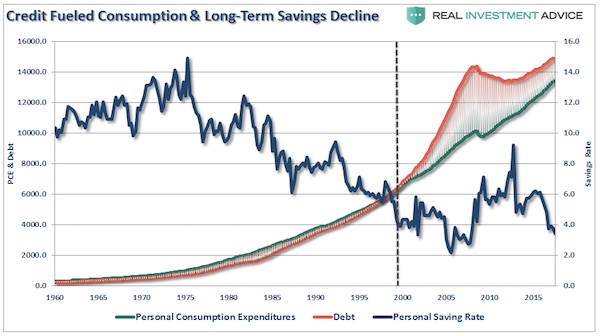

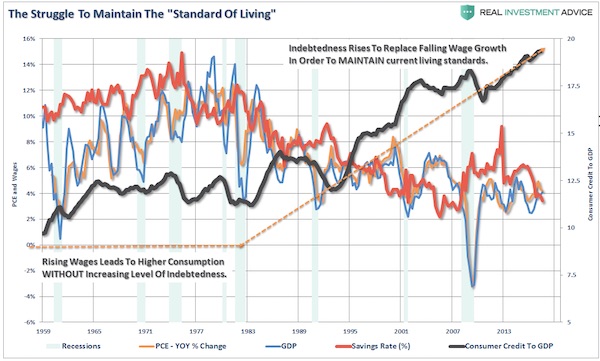

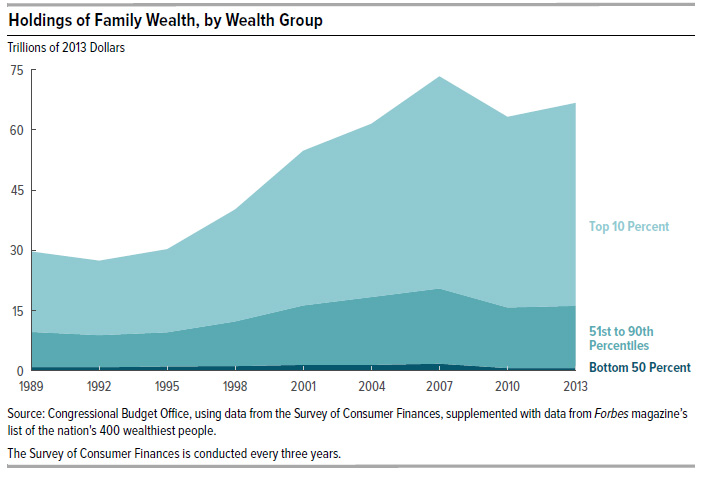

Washington’s trade imbalance with Beijing – the stated motivation behind President Donald Trump’s punitive tariffs — will continue expanding in the years ahead, according to Yale University’s Stephen Roach. America’s trade deficits with China and other countries fundamentally reflect “the fact that we don’t save enough,” said Roach, a former Morgan Stanley Asia chairman. “When you don’t save and you want to spend and grow, you import surplus savings from abroad and you run these massive balance of payments and trade deficits to attract the foreign capital,” he told CNBC Monday at the annual China Development Forum. “That’s the way it’s always worked.”

The Trump administration budget deficits are “going to push our savings rate lower and if anything, our trade deficits are going to get bigger in the years ahead, including the one probably with China.” Reducing the U.S. trade deficit is one of Trump’s top policy goals – he’s argued that it hurts American job creation and weighs on overall growth. But many economists, including Roach, say trade imbalances are not a good metric for economic health since they are influenced by a variety of macroeconomic factors. “The bilateral trade deficit in the U.S. is really pretty meaningless,” Roach said.

And Trump’s $1.5 trillion tax cut, which was signed into law in December, is unlikely to change the status-quo. The fiscal stimulus package “is going to take debt-to-GDP ratios up by 1 to 2 %age points a year, relative to what they otherwise would have been,” Roach said. “For an economy like the United States, where the savings rate is already low, that’s going to push our savings rate even lower. So, we’re going to have to keep importing the surplus savings and running these balance of payments deficits to square the circle.”

“..stop forced technology transfer..”

• US Seeks Deal With China in Bid to Avert Trade War (BBG)

Treasury Secretary Steven Mnuchin said he’s optimistic the U.S. can reach an agreement with China that will avert the need for President Donald Trump to impose tariffs on at least $50 billion of goods from the country. “We’re having very productive conversations with them,” Mnuchin said on “Fox News Sunday,” when discussing talks with China. “I’m cautiously hopeful we reach an agreement.” Trump on Thursday also directed Mnuchin to propose new investment restrictions on Chinese companies within 60 days to safeguard technologies the U.S. views as strategic. He has said he also wants a $100 billion decrease in the U.S. trade deficit with China.

A day after Trump’s announcement, which led to a selloff in global markets, China unveiled tariffs on $3 billion of U.S. imports in response to steel and aluminum duties ordered by Trump earlier this month. The White House then declared a temporary exemption for the European Union and other nations on those levies, making the focus on China clear. Though Beijing’s actions so far are seen by analysts as measured, there may be more to come.

China is conducting research on further lists of U.S. imports subject to tariffs, which are likely to cover airplanes, computer chips and the tourism industry, China Daily reported on Saturday, citing Wei Jianguo, a former vice commerce minister. Mnuchin said the two countries agree on reducing the deficit to some degree and are trying to “to see if we can reach an agreement as to what fair trade is for them to open up their markets, reduce their tariffs, stop forced technology transfer.” The U.S. will proceed with tariffs “unless we have an acceptable agreement that the president signs off on,” Mnuchin said Sunday. “We’re not afraid of a trade war, but that’s not our objective,” he said. “In a negotiation you have to be prepared to take action.”

First hurdle out of the way.

• US and South Korea Reach Agreement on Trade, Tariffs (BBG)

The U.S. and South Korea reached an agreement on revising their six-year-old bilateral trade deal, and the U.S. said it wouldn’t impose President Donald Trump’s tariffs on steel imports from its ally in Asia. The two countries reached agreement “in principle” on the trade deal known as Korus, South Korea’s trade ministry said in a statement on Monday. While Korea avoids the steel tariff, shipments of the metal to the U.S. will be limited to a quota of about 2.7 million tons a year, according to the statement. Trump repeatedly criticized the trade deal with South Korea, calling it a “job-killer” that had increased the bilateral trade deficit. While he had pushed for it to be revised and threatened tariffs, there were also concerns that trade tensions would create a wedge between the allies just as the presidents of both nations look to meet with North Korean leader Kim Jong Un.

The announcement came after Treasury Secretary Steven Mnuchin said U.S. Trade Representative Robert Lighthizer reached “a very productive understanding.” “We expect to sign that agreement soon,” Mnuchin said on the “Fox News Sunday” program, calling it “an absolute win-win.” The quota is unlikely to hurt South Korea’s steel exports as sales to the U.S. account for 11% of total steel shipments overseas, the South Korean ministry said. The quota is set at 70% of the average of steel sales to the U.S. during 2015-2017.

Europe makes its decisions behind close backroom doors.

• EU Defends Controversial Juncker Aide Promotion (AFP)

The European Commission on Sunday insisted the controversial promotion of President Jean-Claude Juncker’s top aide and enforcer was “in full compliance” with rules despite a growing cronyism row. The commission, the EU’s powerful executive arm, said there was nothing untoward about the elevation of Juncker’s former chief of staff Martin Selmayr to the post of secretary general, at the head of the EU’s 30,000-strong civil service. The scandal has gained momentum in recent weeks with the European Parliament launching an investigation and warning the affair risks fuelling eurosceptics around the continent. But the commission insisted Selmayr’s appointment was above board and made with the full backing of all EU commissioners.

“The decision was taken by the college of commissioners unanimously, in full compliance with the staff regulations and the rules of procedure of the commission,” the commission said in a written response to a list of 134 questions posed by MEPs. The row centres on what critics say was effectively an instantaneous double promotion for the 47-year-old Selmayr, Juncker’s former chief of staff, on February 21. During a single meeting of commissioners, Selmayr was made first deputy secretary general and then just minutes later secretary general when the incumbent, Alexander Italianer, suddenly announced his retirement. The commission confirmed that Juncker had known of Italianer’s plan to retire as early as 2015 and had told Selmayr about it.

But it rejected claims that Juncker and Selmayr had cooked up a plan in November last year to bounce the German into the secretary general role. It said that technically Selmayr had not been promoted, as he remains on the same civil service grade as before, and that he had taken a pay cut in switching jobs. As well as the parliamentary probe, the EU ombudsman, which investigates allegations of malpractice in European institutions, has also confirmed it has received two complaints about the matter and is analysing them. Sophie in ‘t Veld, a leading liberal member of the European Parliament, said earlier this month the affair “destroys all the credibility of the EU as a champion of integrity and transparency”.

Expand it to Facebook?

• EU Antitrust Chief Keeps Open Threat To Break Up Google (R.)

The European Union holds “grave suspicions” about the dominance of internet giant Google and has not ruled out breaking it up, according to a warning by the EU’s antitrust chief, Britain’s Telegraph reported on Sunday. European Commissioner for Competition Margrethe Vestager reckons the threat to split Google into smaller companies must be kept open, the newspaper said. Google currently faces new EU rules on its commercial practices with smaller businesses that use its services.

Late last year, Vestager said more cases against Google were likely in the future, after the European Commission slapped a record €2.4 billion ($2.97 billion) fine on the world’s most popular internet search engine and told the firm to stop favoring its shopping service. The European Commission is in the process of drafting a new regulation aimed at regulating e-commerce sites, app stores and search engines to be more transparent in how they rank search results and why they delist some services.

They should stop his forays into Syria, Iraq. They won’t. He’s got them by the balls.

• EU Leaders Host Turkish President Erdogan For Uneasy Summit (R.)

The European Union holds an uneasy summit with Turkey on Monday, when it is likely to provide Ankara with fresh cash to extend a deal on Syrian refugees but deflect Turkish demands for deeper trade ties and visa-free travel to Europe. With the bloc critical of what it considers to be Turkish President Recep Tayyip Erdogan’s growing authoritarianism at home and his intervention in Syria’s war, Brussels had hesitated to agree to the summit. But host Bulgaria viewed the meeting at the Black Sea port of Varna as a rare chance for dialogue with the country that remains a candidate for EU membership despite years of stalled talks.

EU leaders also cited Turkey’s importance as a NATO ally on Europe’s southern flank and in curbing immigration to Europe from the Middle East and Africa. “I am looking with mixed feelings towards the Varna summit because the differences in views between the EU and Turkey are many,” said European Commission President Jean-Claude Juncker, who will represent the bloc along with European Council President Donald Tusk. “It will be a frank and open debate, where we will not hide our differences but will seek to improve our cooperation,” Juncker told reporters on Friday after a two-day EU summit that discussed Turkey.

At that meeting in Brussels, leaders condemned what they said were Turkey’s illegal actions in a standoff over eastern Mediterranean gas reserves with bloc members Greece and Cyprus. But in a familiar pattern of public recrimination, Turkey’s minister for EU affairs, Omer Celik, said Ankara viewed the summit as “an important opportunity to move our relations forward” and that he expected “the same positive and constructive approach from the EU.” Erdogan will seek more money for Syrian refugees, a deeper customs union and progress in talks on letting Turks visit Europe without visas, a Turkish foreign ministry spokesman said.

Why there’s a new wave of “Corbyn is an antisemite” going around.

• Labour Moves to Prevent ‘No-Deal’ Brexit as Blair Seeks EU Vote (BBG)

The U.K. Labour Party said it is seeking an amendment to key Brexit legislation to prevent Britain leaving the European Union without a deal, as former premier Tony Blair renewed his own call for a second referendum. “If Parliament rejects the Prime Minister’s deal, that cannot give licence to her, or the extreme Brexiteers in her party, to allow the U.K. to crash out without an agreement,” Labour’s Brexit spokesman, Keir Starmer, will say in a speech on Monday, according to extracts emailed by his party. “That would be the worst of all possible worlds.”

As Starmer plots to bind Theresa May’s Conservative government to negotiating a smooth exit from the European Union, former Labour leader Blair will say that Parliament should get to vote on the planned future relationship with the EU and then the electorate should “make the final judgment” ahead Britain’s scheduled departure from the bloc on March 29 next year. Starmer’s bid to rewrite the EU Withdrawal Bill throws up a new hurdle to the premier’s plans. While she’s repeatedly said she wants to reach an agreement with the bloc, May maintains that exiting without one is better than accepting a bad deal. A majority of lawmakers in both houses of Parliament oppose a hard Brexit.

Talk your way out of this one, Mark.

• Facebook Approached Australian Political Parties To Microtarget Voters (ZH)

In the wake of a massive data harvesting scandal, it has emerged that Facebook approached at least two major Australian political parties during the final weeks of their 2016 election in order to help them “microtarget” voters using a powerful data matching tool, reports the Sydney Morning Herald. Facebook offered “advanced matching” as part of their so-called Custom Audience feature to both the conservative (if not confusingly named) Liberal Party, as well as the “democratic socialist” Labor Party. The tool promised to allow the parties to compare data they had collected about voters – such as names, birth dates, phone numbers, postcodes and email addresses – and match that information to Facebook profiles.

The combination of data sets would then allow political parties to target Australian swing voters with custom tailored ads over Facebook, which advertised a 17% increase in matching rates using a beta version of the service provided to the Liberal Party. Fairfax Media reports that while the conservative Liberal Party turned Facebook down over concerns that sending voter data overseas to Facebook servers would violate the Privacy Act and the Electoral Act, the Labor Party took Facebook up on their offer.

Asked specifically whether Labor used the tool, a Labor spokesman said in a statement: “A range of different campaign techniques and tools are used for campaigning, from doorknocking to phone banking to online. Labor works with different groups to get our message out, including social media platforms like Facebook.” “All of our work is in complete compliance with relevant laws, including the Commonwealth Electoral Act, which makes it a criminal offence to misuse information on the electoral roll.”

“Today’s internet companies suck in free customer data through the front door, and sell it out the back door. The greater the flow, the higher the profits. They’re dominant. They’ll soon be regulated.”

“May Day 1975 marked the start of Wall Street deregulation,” said the historian. “Banks and brokerages flourished thereafter, expanding their power and political influence.” 1998 marked peak deregulation with Clinton’s repeal of Glass-Steagall. “Pump and dump schemes of all sorts propagated; Wolf of Wall Street excesses. Then came the dot com IPO madness which led to Sarbanes Oxley.” The final debauchery was exposed in 2008, and led to sweeping Dodd-Frank financial regulation. “Wall Street’s been in lock-down ever since.” “The 1996 Telecom Act protected America’s nascent internet companies,” continued the historian. AOL started in 1985. Netscape launched in 1993, went public in 1995. Amazon launched in 1994. Yahoo 1995. Facebook 2004. YouTube 2005.

“The Act protected them from liability for anything republished on their sites.” They were too weak to withstand such liability and needed nurturing to foster innovation. “But Facebook has a $460bln market cap. It’s not responsible for what it publishes but the NY Times is. That’s now preposterous.” “When Wall Street lacked regulation, any product, no matter how absurd, was welcomed through the front door and pumped out to clients through the back door,” explained the historian. “The greater the flow, the higher the profits. Those were the glory days.” Then regulations raised costs, stymied product development, crushed the profit model. “Today’s internet companies suck in free customer data through the front door, and sell it out the back door. The greater the flow, the higher the profits. They’re dominant. They’ll soon be regulated.”

Shinzo is addicted to power. But he said he would leave.

• Nearly Half Of Japanese Think Abe Should Quit Over Land Sale Scandal (R.)

Nearly half of Japanese voters believe Prime Minister Shinzo Abe should quit to take responsibility over a cronyism scandal and cover-up that have sent his support sliding, according to an opinion poll released on Monday. Suspicions have arisen about a sale of state-owned land at a huge discount to a nationalist school operator with ties to Abe’s wife, Akie, setting off the biggest political crisis Abe has faced since returning to power in 2012 and prompting protestors to call almost nightly for him to quit.

Abe has denied that either he or his wife intervened in the sale or were involved in altering documents related to the deal, in which mention of his and Akie’s names were removed. According to a public opinion survey covered by the liberal Asahi newspaper at the weekend, 48% of those polled said Abe and his government should quit, compared to 39% who said that wasn’t necessary.

They’re all seeking to ban anything they don’t like.

Wonder who’s going to decide which news is fake. How about the Skripal case? Stormy Daniels? Corbyn is an anti-semite?

• Malaysia: Up To 10 Years’ Jail, Hefty Fines For Publishers Of ‘Fake News’ (R.)

Malaysian Prime Minister Najib Razak’s government tabled a bill in parliament on Monday outlawing “fake news”, with hefty fines and up to 10 years in jail, raising more concerns about media freedom in the wake of a multi-billion dollar graft scandal. The bill was tabled ahead of a national election that is expected to be called within weeks and as Najib faces widespread criticism over the scandal at state fund 1Malaysia Development Berhad (1MDB). Under the Anti-Fake News 2018 bill, anyone who published so-called fake news could face fines of up to 500,000 ringgit ($128,140), up to 10 years in jail, or both.

“The proposed Act seeks to safeguard the public against the proliferation of fake news whilst ensuring the right to freedom of speech and expression under the Federal Constitution is respected,” it said. It defines fake news as “news, information, data or reports which is or are wholly or partly false” and includes features, visuals and audio recordings. The law, which covers digital publications and social media, also applies to offenders outside Malaysia, including foreigners, as long as Malaysia or a Malaysian citizen were affected.

“.. in violation of socialist core values..”

• China Regulator Bans TV Parodies Amid Content Crackdown (R.)

China’s media regulator is cracking down on video spoofs, the official Xinhua new agency reported, amid an intensified crackdown on any content that is deemed to be in violation of socialist core values under President Xi Jinping. The decision comes after Xi cemented his power at a recent meeting of parliament by having presidential term limits scrapped, and the ruling Communist Party tightened its grip on the media by handing control over film, news and publishing to its powerful publicity department. Xinhua said video sites must ban videos that “distort, mock or defame classical literary and art works”, citing a directive from the State Administration of Press, Publication, Radio, Film and Television on Thursday.

Reuters separately reviewed a copy of the directive, which was unusually labeled “extra urgent”. Industry insiders say the sweeping crackdown on media content, which has been gaining force since last year, is having a chilling effect on content makers and distributors. “It means a lot of content makers will have to transition and make their content more serious. For ‘extra urgent’ notice like this, you have to act immediately,” said Wu Jian, a Beijing-based analyst. “Those who don’t comply in time will immediately be closed down,” Wu said.

On Twitter: “Let’s see how ‘speculative’ and ‘premature’ my recent Obama affidavit is after we get access to all the puzzle pieces.”

• Kim Dotcom Wins Human Rights Tribunal Case, Says Extradition Bid ‘Over’ (NH)

The Human Rights Tribunal has ruled that the Attorney-General broke the law by withholding information from Kim Dotcom, which he says means his extradition case is “over”. In July 2015, Mr Dotcom sent an urgent information privacy request to all 28 Ministers of the Crown as well as almost all Government departments, asking for personal information they had on him, including under his previous names. Nearly all the requests were transferred to the Attorney-General Chris Finlayson, who declined the Megaupload founder’s requests on the grounds that they were “vexatious” and trivial. The Solicitor-General also said Mr Dotcom had not provided sufficient reasons for urgency.

On Monday, the Human Rights Tribunal ruled that the Attorney-General unlawfully withheld information from Mr Dotcom, meaning he perverted the course of justice. The Government and Ministers have been ordered to comply with the original requests and supply all relevant documents to Mr Dotcom. Mr Dotcom was awarded damages for loss of benefit and loss of dignity. In a series of celebratory tweets, Mr Dotcom claimed this decision meant his extradition case is “over”. He has threatened former Prime Minister Sir John Key with legal action, and said he will see everyone involved in the so-called “Mega Conspiracy” in court. He has also called for the immediate resignation of the Privacy Commissioner.

If temperature rise is kept below 2ºC “only” 25% of species will be lost.

• Global Warming Puts Nearly Half Of Species In Key Places At Risk (CNN)

About half of all plants and animals in 35 of the world’s most biodiverse places are at risk of extinction due to climate change, a new report claims. “Hotter days, longer periods of drought, and more intense storms are becoming the new normal, and species around the world are already feeling the effects,” said Nikhil Advani, lead specialist for climate, communities and wildlife at the World Wildlife Fund (WWF). The report, a collaboration between the University of East Anglia, the James Cook University, and the WWF, found that nearly 80,000 plants and animals in 35 diverse and wildlife-rich areas – including the Amazon rainforest, the Galapagos islands, southwest Australia and Madagascar – could become extinct if global temperatures rise. The 35 places were chosen based on their “uniqueness and the variety of plants and animals found there,” the WWF said.

“The collected results reveal some striking trends. They add powerful evidence that we urgently need global action to mitigate climate change,” the report said. A corresponding study was also published by the scientific journal Climate Change. If temperatures were to rise by 4.5 degrees Celsius, animals like African elephants would likely lack sufficient water supplies and 96% of all breeding ground for tigers in India’s Sundarbans region could be submerged in water. However, if temperature rise was kept to below 2 degrees Celsius – the global target set by the landmark Paris Climate Accord in 2015 – the number of species lost could be limited to 25%. “This is not simply about the disappearance of certain species from particular places, but about profound changes to ecosystems that provide vital services to hundreds of millions of people,” the WWF said in its report.