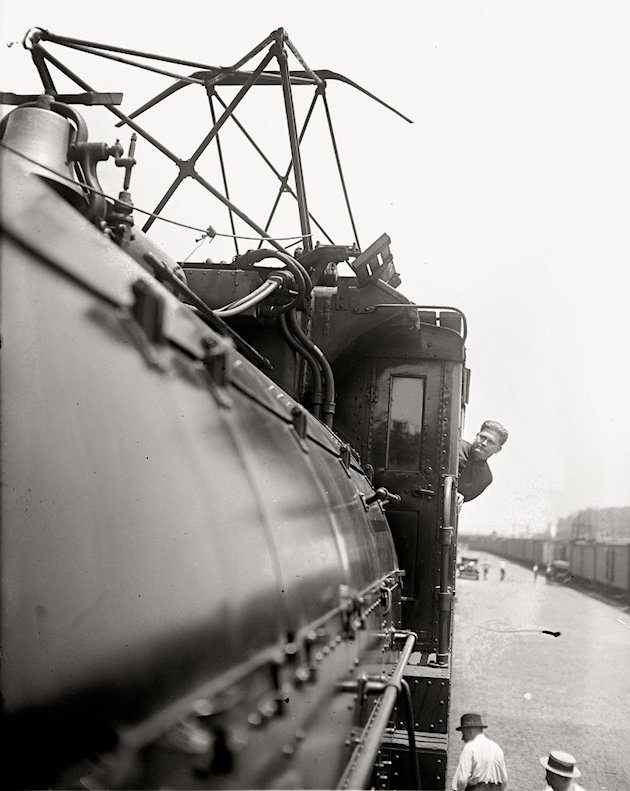

NPC “Largest electric locomotive and Congressman John C. Schafer” 1924 (he’d be in an electric car today)

Happy Juneteenth!

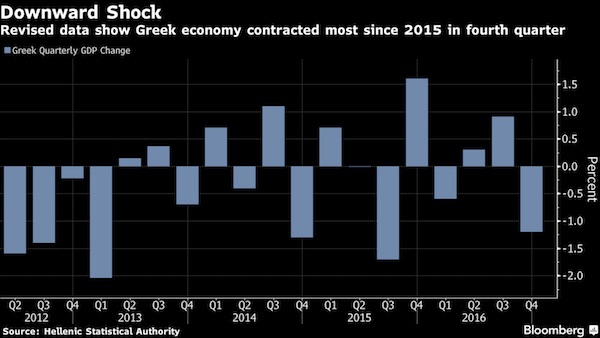

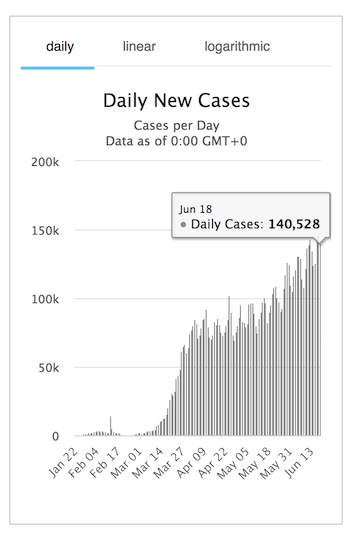

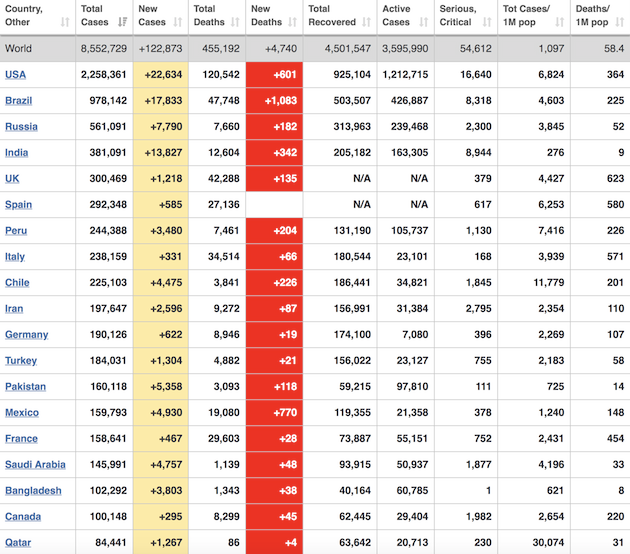

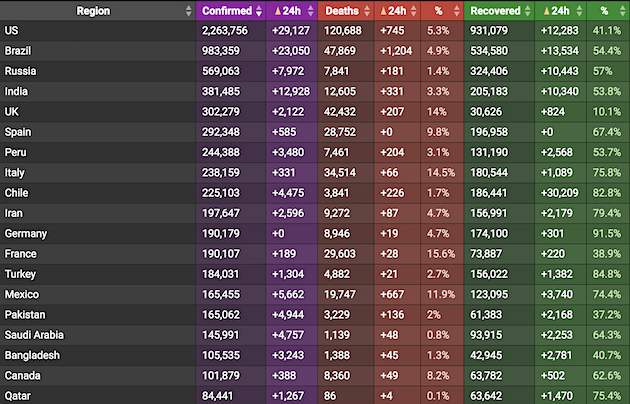

I made sure to check quite a few times, but it is what it is: according to Worldometer data, over the past 24 hours global new cases went from an almost record 141,872 on June 17 to an all-records shattering 177,168 on June 18. Maybe something’s off, but right now I couldn’t say what.

Worldometer reports new cases for June 18 (midnight to midnight GMT+0) at + 140,528. Third consecutive day above 140,000.

My count 6AM EDT to 6AM EDT based on Worldometer numbers is much higher today at 177,168.

New cases past 24 hours in:

• US + 29,180

• Brazil + 23,050

• Russia + 7,790

• India + 13,827

• Mexico + 5,662

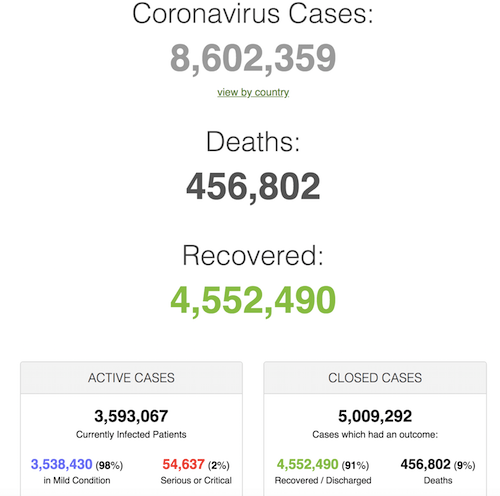

• Cases 8,602,359 (+ 177,168 from yesterday’s 8,425,191)

• Deaths 456,802 (+ 4,994 from yesterday’s 451,808)

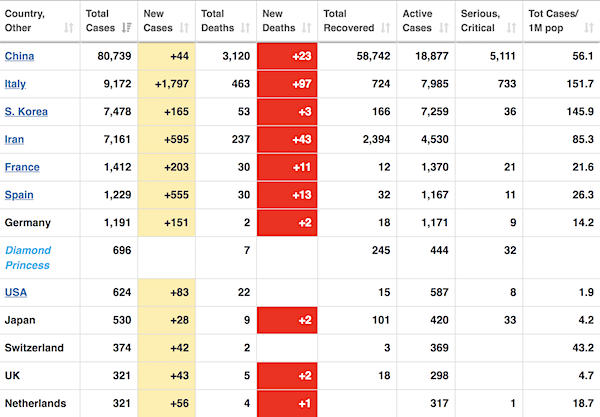

From Worldometer yesterday evening -before their day’s close-:

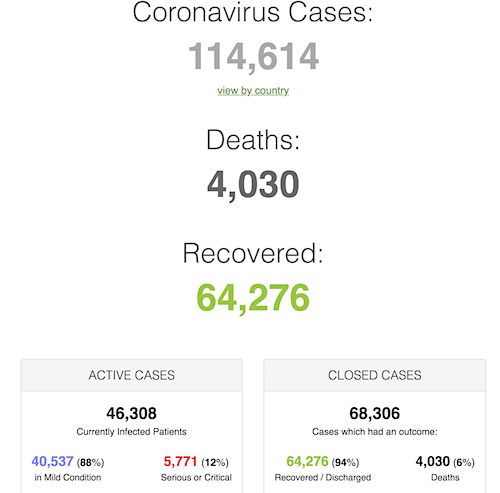

From Worldometer:

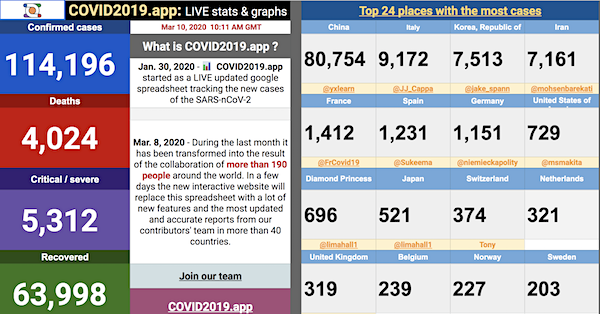

From COVID19Info.live:

Before COVID-19 the dots plot from the Fed was interesting. Not so much anymore. Unanimous opinion that near-zero rates are here for a couple of years https://t.co/Lsul1hOcFP pic.twitter.com/qaxMzdi1SA

— Mark Riepe (@MarkRiepe) June 18, 2020

Hunan we have a problem.

• Mainland China Reports 32 New Coronavirus Cases, 25 Of Them In Beijing (R.)

Mainland China reported 32 new coronavirus cases as of the end of June 18, 25 of which were reported in the capital city Beijing, China’s National Health Commission said on Friday. This compared with 28 confirmed cases a day earlier, 21 of which were in Beijing. Local authorities are restricting movement of people in the capital and stepping up other measures to prevent the virus from spreading further following a series of local infections. Another five asymptomatic COVID-19 patients, those who are infected with the coronavirus but show no symptoms, were also reported as of June 18 compared with eight a day earlier. China does not count these patients as confirmed cases.

Did we close the borders yet?

• Mexico Posts Record Number Of New Coronavirus Infections (R.)

Mexico’s health ministry reported on Thursday a record 5,662 new confirmed cases of coronavirus infections and 667 additional fatalities, bringing the total in the country to 165,455 cases and 19,747 deaths. The government has said the real number of infected people is likely significantly higher than the confirmed cases.

“AMC Theater CEO Adam Aron says their cinemas won’t require masks upon reopening because they didn’t “want to be drawn into a political controversy.”

Is testing also a political viewpoint? How about COVID19 treatment at hospitals? Can we deny that to people who have political issues with facemasks?

• AMC Theaters To Reopen, Say Face Masks A “Political Controversy” (V.)

AMC Theatres, the world’s largest exhibitor, has unveiled plans to re-open after coronavirus forced it to close its more than 600 venues in the U.S. for nearly four months. The company is expected to resume operations in 450 of those locations on July 15 and expects to be almost fully operational by the time that Disney’s “Mulan” debuts on July 24 and Warner Bros.’ “Tenet” bows on July 31. As part of that process, AMC is reducing its seating capacity in order to help people social distance, it is implementing new cleaning procedures, placing hand-sanitizing stations throughout its theaters and encouraging contact-less and cash-free concessions. “We didn’t rush to reopen,” AMC CEO and president Adam Aron said in an interview with Variety.

“There were some jurisdictions in some states, such as Georgia and Texas, that allowed people to reopen theaters in mid-May. We opted to remain closed, so we could give the country time to get a better handle on coronavirus. We wanted to use this time to figure out how best to open and how to do so safely.” AMC’s competitors Regal and Cinemark announced their own plans to resume business earlier this week, targeting a similar mid-July timeframe for when they expect to be fully operational. [..] Prior to coronavirus there was a great deal of consolidation in the exhibition space, much of it made possible by debt financing. AMC’s decision to acquire rivals such as Odeon Cinemas, UCI Cinemas and Carmike Cinemas left it heavily leveraged with more than $5 billion in debt. In recent filings, AMC acknowledged that the coronavirus pandemic could push it into bankruptcy. [..]

AMC will not mandate that all guests wear masks, although employees will be required to do so. Nor will AMC perform temperature checks on customers, though it will monitor its employees’ temperatures and have them undergo screenings to check for signs of coronavirus. The situation will be different in states and cities that require residents to wear a mask when they’re in public, but Aron said that AMC was wary of wading into a public health issue that has become politicized. “We did not want to be drawn into a political controversy,” said Aron. “We thought it might be counterproductive if we forced mask wearing on those people who believe strongly that it is not necessary. We think that the vast majority of AMC guests will be wearing masks. When I go to an AMC feature, I will certainly be wearing a mask and leading by example.”

[..] the theater chain said that it is going to lean heavily on technological solutions such as deploying electrostatic sprayers, HEPA vacuums and upgraded MERV 13 ventilation filters, which would eliminate airborne particles and reduce the chance that COVID-19 will spread. Other procedures being implemented include cleaning auditoriums between each showtime and allowing extra time between screenings for disinfection; blocking out every other row of seats to decrease congestion; pushing guests to use online ticketing and kiosks to limit interactions with staff, and designating various points within theaters for one-way foot traffic.

If you think wearing a mask “cuts off your oxygen", just wait until you find out what COVID does.

— Sam Ghali, M.D. (@EM_RESUS) June 18, 2020

“Orange Man Bad” beats Black Lives Matter.

• John Bolton’s Bad Reviews Don’t Stop Him Topping Us Book Charts (G.)

John Bolton’s damning indictment of the Trump presidency is soaring up online charts in the US a week before its release, despite withering reviews describing it as “bloated with self-importance”, as the Trump administration makes a last-ditch attempt to prevent its publication. In the teeth of a series of critical assessments from papers including the New York Times and the Washington Post, Bolton’s The Room Where It Happened is currently No 1 on Amazon’s US charts. Its sales are just ahead of another scathing take on Donald Trump, this time his niece Mary Trump’s forthcoming Too Much and Never Enough, which is subtitled How My Family Created the World’s Most Dangerous Man. Bolton’s book, which is out on 23 June, and Mary Trump’s, scheduled for 28 July, have knocked anti-racism titles by authors including Ibram X Kendi, Ijeoma Oluo and Robin DiAngelo off the top spots.

As the US justice department on Wednesday sought an emergency order to block publication of Bolton’s memoir, copies of the book were leaked to news outlets which revealed a series of explosive claims from the former national security adviser. According to Bolton, Trump pleaded with China to help him with his 2020 re-election campaign, praised China’s president Xi Jinping for his country’s internment camps, and was willing to halt criminal investigations to “give personal favours to dictators he liked”. Trump also weighed in, claiming on Twitter that the book is “made up of lies & fake stories”. Early reviews of the book have not been favourable. The New York Times said the memoir was “bloated with self-importance, even though what it mostly recounts is Bolton not being able to accomplish very much”.

Filled with “minute and often extraneous details”, the review continued, it “toggles between two discordant registers: exceedingly tedious and slightly unhinged”. The Washington Post said that “for a memoir that is startlingly candid about many things, Bolton’s utter lack of self-criticism is one of the book’s significant shortcomings”, while NPR found that Bolton “clearly does not expect to attract the casual reader, or anyone else unable to digest sentences such as this one on the third page: ‘Constant personnel turnover obviously didn’t help, nor did the White House’s Hobbesian bellum omnium contra omnes (war of all against all)’.”

I agree with Twitter that much of CNN’s audience would not recognize this video by @CarpeDonktum as a joke. That’s what makes it a masterpiece. That plus the national press. And the Presidential tweet. https://t.co/sLo24hmSwG

— Scott Adams (@ScottAdamsSays) June 19, 2020

Reminder that CNN is also currently paying Nick Sandmann's college tuition because they smeared him for the crime of smiling while wearing a MAGA hat

— Greg Price (@greg_price11) June 19, 2020

— Donald J. Trump (@realDonaldTrump) June 19, 2020

If you are angry at everything that someone does, their conclusion will not be "I am bad and need to change". It will be "you are are perpetually angry and nothing good comes from interacting with you".

This is a message for online Leftists, who will, I am sure, be angry.

— Black Cat (@BlckCatBlckSky) June 19, 2020

• Bolton, Pelosi Agree: Trump Unfit To Be US President (R.)

President Donald Trump came under attack from both sides of the American political spectrum on Thursday as liberal Democratic leader Nancy Pelosi and former White House aide and conservative hawk John Bolton both declared him unfit to lead the country. “President Trump is clearly ethically unfit and intellectually unprepared to be the president of the United States,” Pelosi, the speaker of the U.S. House of Representatives, told a news briefing. In a new book, Bolton, Trump’s former national security adviser, has accused the Republican president of sweeping misdeeds, including explicitly seeking Chinese President Xi Jinping’s aid to win re-election in November. “I don’t think he’s fit for office,” Bolton told ABC News in part of an interview aired on Thursday.

“There really isn’t any guiding principle that I was able to discern other than what’s good for Donald Trump’s re-election.” Pelosi told a weekly news conference she was consulting with her fellow Democrats on whether to subpoena Bolton about the allegations in the book, which has not yet been distributed. If Bolton testifies before Congress, it could revive the issue of Trump’s competence as he faces a stiff challenge on Nov. 3 from Joe Biden, the Democrats’ presumptive presidential nominee, and fends off criticism over his handling of the coronavirus pandemic and protests over racial injustice and police brutality. Bolton refused to testify in the House’s impeachment probe last year and threatened to sue if subpoenaed. He offered to testify in the subsequent trial in the Senate, but the Republican-controlled chamber did not take him up on the offer.

[..] Adam Schiff, the House Intelligence Committee chairman who led the impeachment inquiry, sharply criticized Bolton as unpatriotic for withholding information from the probe. The new allegations are “further proof” that Trump’s actions in Ukraine were part of a pattern of abusing his power and the U.S. government for personal political gain, Schiff said in a statement.

Bolton news is fuzzy. Bolton isn't saying Trump tied Ukraine weapons $ to opening a Burisma/2016 probe. Bolton says Trump wanted Ukraine to "[turn] over all materials they had about the Russia investigation that related Mr. Biden & and supporters of Mrs. Clinton in Ukraine." Huh? pic.twitter.com/RNiBM6ANwT

— Aaron Maté (@aaronjmate) January 26, 2020

Bolton *can't even recall* what he overheard Trump saying he wanted Zelensky to meet Giuliani about. Maybe Hunter Biden OR Hillary Clinton, or "maybe both." In short: Bolton's "bombshell" was such a dud that, per NYT, he did not "fully understand" what was even going on. pic.twitter.com/bNRCF79RpW

— Aaron Maté (@aaronjmate) June 19, 2020

Abenomics will die with Abe’s political career regardless.

• Japan’s Deflation Gathers Momentum As Prices Extend Declines (R.)

Japan’s core consumer prices fell for a second straight month in May, reinforcing deflation expectations and raising the challenge for policymakers battling to revive an economy reeling from the coronavirus pandemic. The data will likely complicate the Bank of Japan’s job of restoring growth and inflation, with a raft of recent indicators suggesting the nation is in the grip of its worst postwar economic slump. Several BOJ board members warned that stronger monetary support and closer policy coordination with the government were needed to prevent Japan from returning to deflation, minutes of the bank’s April meeting showed.

“With the pandemic hurting the economy, there’s a good chance Japan may slide into deflation. Downward pressure on prices will likely persist throughout this year,” said Yoshiki Shinke, chief economist at Dai-ichi Life Research Institute. The nationwide core consumer price index (CPI), which includes oil but excludes volatile fresh food prices, fell 0.2% in May from a year earlier, government data showed on Friday. That compared with market forecasts of a 0.1% fall and followed a 0.2% drop in April, which was the first year-on-year decline since December 2016. The BOJ kept policy steady this week after expanding stimulus in March and April. But governor Haruhiko Kuroda conceded that inflation would remain well short of its 2% target for years to come.

[..} Some BOJ policymakers were concerned that bolder steps are needed to prevent the country from slipping back to sustained period of damaging price declines, the April minutes showed. “Japan is now facing the risk of deflation, so it’s possible to further enhance coordination between fiscal and monetary policies,” one BOJ board member was quoted as saying.

“The private sector is not involved in creating the money supply, that’s something the central bank does.”

• Fed Chair: Keep Private Entities Out Of Central Bank Digital Currencies (CD)

Private entities aren’t needed to build central bank digital currencies, said the head of the U.S. central bank on Wednesday. Federal Reserve Chairman Jerome Powell, speaking before the House Financial Services Committee, said the idea of a digital dollar – a blockchain-based version of the current world reserve currency – is complex, and one that the Fed takes seriously, but also that the idea needs to be studied further before one can be created and implemented. However, in response to a question from Rep. Tom Emmer (R-Minn.), Powell said he believed private entities did not have a role in designing a digital dollar.

“I do think this is something that the central banks have to design,” he said. “The private sector is not involved in creating the money supply, that’s something the central bank does.” Emmer was asking specifically about a recommendation from the Digital Dollar Project, which was launched earlier this year by former Commodities Futures Trading Commission Chairman J. Christopher Giancarlo, Chief Innovation Officer Daniel Gorfine and Accenture Director David Treat. The project suggested a digital dollar be issued by the Fed but designed in partnership with the private sector and accessible through a two-tiered banking system similar to the one in place in the U.S. today.

Powell said the general public may not be receptive to the idea of private employees being responsible for the money supply because they’re not accountable to “the public good.” Still, the idea is apparently being examined. A group of central banks have gotten together to discuss and better understand the concept as well as evaluate the implications on financial inclusion and concerns around cybersecurity, he said. “If this is something that is going to be good for the United States economy and for the world’s reserve currency, which is the dollar, then we need to be there and we need to understand it first and best,” Powell said. “So we’re working hard on it.”

Jay Powell,

What have we become? Is THIS the American Dream?

Signed,

Parents

20-Year-Old Robinhood Customer Dies By Suicide After Seeing A $730,000 Negative Balance via @forbes https://t.co/Tbhm3fToQj

— Danielle DiMartino Booth (@DiMartinoBooth) June 19, 2020

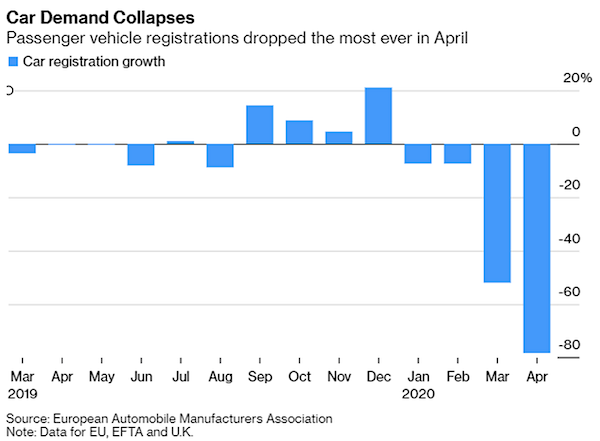

A guy I know said he was driving from Holland to Germany this week to pick up a car he bought, an 8-month old BMW at half the new price.

• EU Car Sales Crash 57% In May As Europe Amid Inventory Glut (ZH)

New car sales in the EU plunged in May, falling 57% to 623,812, as Europe grapples with the same problem that the U.S. has had for weeks: a glut of inventory, despite re-opening some factories and re-starting production in certain areas. All 27 EU member states posted double digit declines in new car sales, with the U.K. falling an astounding 89%, according to MarketWatch. Production coming out of the EU remains “well blow” pre-crisis levels but the lack of demand continues to contribute to a growing inventory problem. This, in turn, has created a slowdown in an industry that’s already moving at a crawl to begin with. Jobs and profits are both threatened from the glut, in addition to the monumental threat they both still continue to face from the ongoing global pandemic.

Unsold cars on dealer lots are “at least 30% above normal” according to industry analysts, while unsold inventory in Germany alone was about $17 billion worth. Antje Woltermann, managing director of the ZDK industry group: “Unsold stocks are climbing, and on the other hand vehicles are not leaving the lots.” While Europe is struggling, many have looked to China, where sales were up 6% in May, for signs of optimism. For example, Stephan Wöllenstein, chief executive of Volkswagen Group China said: “The return of these kinds of figures is encouraging and gives us continued cautious optimism going forward.”

But those numbers don’t account for the recent second wave of lockdowns, including in Beijing, that China now faces. Countries like France and Germany continues to try and spur sales with government incentives, but Germany is focusing primarily on EVs while the glut is in traditional ICE cars. Recall, in May, we were ahead of the curve when we noted that European car registrations had plunged 76% in April. According to the European Automobile Manufacturers Association, the number of new cars sold fell from 1,143,046 to just 270,682 YOY in that month.

Australia is but a lap dog.

The story changed overnight to name China as the main “suspect”. Of course what would be really suspect is if China DID NOT spy on Australia.

• Australia Sees China As Main Suspect In State-based Cyberattacks (R.)

Australia views China as the chief suspect in a spate of cyber-attacks of increasing frequency in recent months, three sources familiar with the government’s thinking told Reuters on Friday. The comments came after Prime Minister Scott Morrison said a “sophisticated state-based actor” had spent months trying to hack all levels of the government, political bodies, essential service providers and operators of critical infrastructure. “We know it is a sophisticated state-based cyber actor because of the scale and nature of the targeting,” Morrison told reporters in the capital, Canberra, but declined to say who Australia believed was responsible.

Three sources briefed on the matter said Australia believed China is responsible, however. “There is a high degree of confidence that China is behind the attacks,” one Australian government source told Reuters, seeking anonymity as he was not authorised to speak to media. Australian intelligence has flagged similarities between the recent attacks and a cyber-attack on parliament and the three largest political parties in March 2019.Last year, Reuters reported that Australia had quietly concluded China was responsible for that cyber-attack. Australia has never publicly identified the source of that attack, however, and China denied it was responsible.

Russiagate revisited.

• Report Reveals CIA Incompetence To Blame For Vault 7 Breach (RT)

According to a just-released internal CIA report, “CCI had prioritized building cyber weapons at the expense of securing their own systems. Day-to-day security practices had become woefully lax.” “Most of our sensitive cyber weapons were not compartmented, users shared systems administrator-level passwords, there were no effective removable media controls, and historical data was available to users indefinitely,” the report goes on to say. The heavily-redacted document actually dates back to October 2017 and was only made public Tuesday by Senator Ron Wyden (D-Oregon), in an effort to pressure the new Director of National Intelligence John Ratcliffe into imposing new security measures. While the CIA ineptitude is the obvious takeaway, no one seems to have noticed the real bombshell: the timing of the breach and its implications.

The report says the CIA “did not realize the loss had occurred until a year later, when WikiLeaks publicly announced it in March 2017.” Now, what all was happening between March 2016 and a year later? You guessed it: Russiagate! Even as his own cyber arsenal was getting swiped from under his very nose, CIA chief John Brennan was obsessing about “Russian hackers” of the Democratic National Committee, or Hillary Clinton’s emails, or something – and pushing the bogus ‘Steele Dossier’ alleging Donald Trump’s collusion with Russia, which eventually made it into the infamous ‘Intelligence Community Assessment’ that accused Moscow of meddling in the 2016 US presidential election. It gets worse. According to the report, “Had the data been stolen for the benefit of a state adversary and not published, we might still be unaware of the loss—as would be true for the vast majority of data on Agency mission systems.”

So if the mythic bogeymen ‘Russian hackers’ had actually wanted to harm the US, they could have just used the CIA’s own, unprotected cyberweapons to stage false flags and wreak havoc across the world? None of which happened, obviously. Yet Brennan and his confederates have been telling everyone for years that the Kremlins wanted to “hack our democracy” by publishing some Democrat emails and posting memes on social media! [..] As for how Vault 7 got to WikiLeaks, the jury is still out on that. Joshua Schulte, the employee charged with leaking the files, is being prosecuted again after a hung jury at his first trial in March. His lawyers have argued the CIA security was so lax, anyone else on the team, or even outsiders, could have done it. The next time the media report some incendiary claim based on US intelligence “assessments,” try to keep all this in mind.

How cann you be lonely when you have a TV set to keep you company?

• Americans Are Unhappiest They’ve Been In Nearly 50 Years (Ind.)

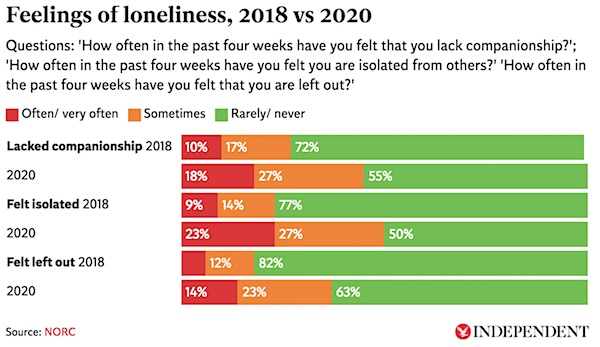

Happiness among Americans has fallen to the lowest level in nearly five decades during the coronavirus pandemic, according to a new poll. The Covid Response Tracking Study, conducted by the National Opinion Research Center (NORC), found that morale was at the lowest point it has ever been since tracking emotional health trends began in 1972. The number of people who described themselves as very happy fell by 17 points to just 14 per cent in 2020. The previous record low – seen shortly after the 2007/8 Financial Crisis – was 29%. For the first time in 48 years, more people said they were unhappy than very happy. More than 60 per cent of Americans reported being “pretty happy”.

Interviews of the 2,279 US adults that took part in the survey took place between 21-29 May, while large parts of the country were under some form of lockdown designed to contain the spread of the Covid-19 virus. Feelings of loneliness have also increased as a result of the coronavirus lockdown, with half of all respondents saying they felt isolated either very often, often or sometimes. When asked the same question two years previously, less than a quarter of respondents said they experienced feelings of isolation.

An alcoholic pet monkey…

• Indian Primate Jailed For Life After Carnivorous Rampage (RT)

An alcoholic pet monkey has been locked up for good in Uttar Pradesh after a terror spree that left 250 people injured and one dead. Efforts to rehabilitate the animal were scrapped and zoo doctors affirm he’s a menace to society. The six-year-old monkey, named Kalua, received a life sentence of solitary confinement at India’s Kanpur Zoo this week after repeated attempts at normalizing his behavior left zookeepers and other monkeys much the worse for wear. Zoo doctor Mohd Nasir told local media the savage simian would harm people wherever he went if set free, explaining “he remains as aggressive as he was” when first brought to the zoo three years ago.

Kalua formerly belonged to an occultist in Mirzapur district, who fed him a diet of meat and copious alcohol. When his owner died, the grieving pet apparently went into withdrawal, becoming vicious and attacking locals. By the time forest and zoo teams succeeded in apprehending the aggressive creature, he had bitten over 250 people, including 30 children. One of his victims died of the injuries, while others – Kalua apparently has a thing for attacking women and girls – were left in need of plastic surgery. While the zookeepers had hoped to calm Kalua down, substituting a vegetarian diet for the human flesh he’d apparently come to rely on, they didn’t have much luck. The carnivorous creature has stayed hostile, especially toward female zookeepers, and plans to release him back into the wild a changed monkey have been shelved.

Kalua’s misbehavior predates the coronavirus outbreak, but he’s not the only monkey in Uttar Pradesh to make the news in recent weeks. A gang of monkeys attacked a lab technician in Meerut last month, stealing several blood samples taken from Covid-19 patients and running off with them in a scene that seemed lifted straight out of a Hollywood pandemic film.

We try to run the Automatic Earth on donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

https://twitter.com/bennyjohnson/status/1273395771912617984

Jason Bounce@MeowedOfficial pic.twitter.com/a9kdQGekPj

— 9GAG (@9GAG) June 18, 2020

Support the Automatic Earth in virustime.