Rembrandt van Rijn The resurrection of Christ 1639

Alex Jones

Alex Jones responds to Elon pic.twitter.com/HgL0G7bxSG

— Luke Rudkowski (@Lukewearechange) November 19, 2022

Meloni

https://twitter.com/i/status/1593793325659815936

“..Kiev, Warsaw, the Baltics and in London, they should remember what the Americans did to Hussein and Bin Laden. They are quite capable of doing the same again, pulling the plug on them all.”

• Towards the Real New World Order (Batiushka)

Now we are talking about a real ‘New World Order’. This is being fought for in the Ukraine and in world political and economic fora at this very moment. And its ideological and military leader is the Russian Federation, the only country with the guts to lead the real New World Order. This will be to its credit for as long as the world lasts. In this context the Saker has written an excellent article, titled with the following hypothetical question: “What would a Russian Defeat Mean for the People of the West?” Although the Saker has given an excellent answer, I would give my own, which is a summary of his. This is: A Russian defeat at the hands of the ‘Combined West’ would mean the end of the world and therefore no New World Order.

Fear not, since Russia is not about to be defeated, the world is not going to end just yet and there is going to be, and there already is, a New World Order. Let us be frank, the Combined West has attacked Russia again and again in history. Many do not know that the Teutonic Knights in the thirteenth century were international, pan-Western. The Napoleonic Invasion of 1812 was carried out by twelve Western nationalities. The Crimean War, i. e., the 1854 Invasion of Russia, was carried out by the French, the British, the Ottomans and the Sardinians. As for the Austro-Hungarian Army and the Kaiser’s Army in 1914, that too was an effort of the Combined West, and if it had not been for the Revolution, Russia would have taken Vienna and Berlin later in 1917. And Hitler’s invasion 27 years later was equally multinational.

And such is the case today, with the Kiev regime’s mercenary army, armed by multinational NATO. Today the US mentors of the Kiev regime are desperate for peace talks to begin. Peace could have been had at any time between February 2014 and April 2022. The US did not want it then and did not allow it then, so now they will have to pay the price. The US elite knows that they are about to lose big time. This is their last chance and the last chance for the former Ukraine – for that is what we are talking about now. Like so many, these Americans have big mouths, but when it comes to it, it is all just hot air. And although Russia is talking at the US request in order to keep channels open, it is ignoring ridiculous American demands.

Today Russia has no reason to talk. It is successfully fighting against and so demilitarising NATO in the Ukraine. Everybody knows it. However, we are also at a dangerous moment because the US is losing control of its puppets. Just as it promoted Hussein in Iraq or Bin Laden in Afghanistan, ISIS in Syria and any number of Latin American gangster-puppets and then lost control of them because they refused to behave as puppets, so they risk losing control now. The lickspittle Kiev regime and its allies in Poland, the Baltics and even in the UK (there they have been singing even pop songs with an American accent for over sixty years) are being more American than the Americans. The pupil is worse than the teacher.

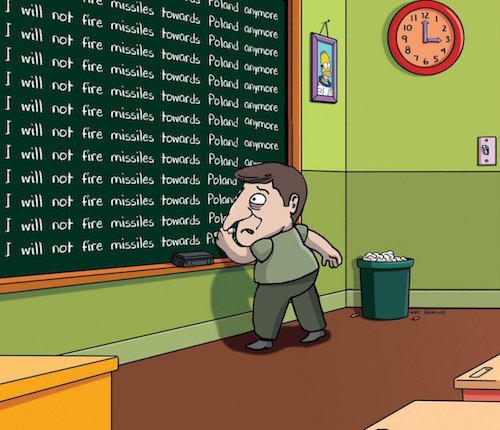

The recent provocation of a Ukrainian missile landing in Poland and the Poles and Latvians claiming it was Russian is an example, The Americans refused to fall for it. Before that the threat of a dirty bomb being prepared by the Kiev regime was another example. Alarmed, the Americans stopped that nonsense. The UK’s anti-German destruction of the Nordstream pipeline was yet another example. The culprit was covered up, just as the Americans covered up the culprits of MH-17. In Kiev, Warsaw, the Baltics and in London, they should remember what the Americans did to Hussein and Bin Laden. They are quite capable of doing the same again, pulling the plug on them all.

Warsaw and Kiev try to drag the US directly into war, but the US refuses.

• US Lectures Allies Over Poland Missile Incident – Politico (RT)

US officials have called on their European and Ukrainian counterparts to tread lightly when commenting on a deadly missile blast in Poland, Politico reported on Thursday. According to three Western officials interviewed by the outlet, over the last couple of days US officials have asked their European colleagues and the office of Ukrainian President Vladimir Zelensky to be careful when speaking about what caused the blast. They also reportedly made a series of urgent phone calls in which they requested that their NATO allies not make any definitive statements until an investigation is carried out. The outreach efforts come as Western and Ukrainian officials have been at loggerheads about who was responsible for the explosion in the Polish village of Przewodow close to the Ukrainian border that killed two people.

While Western officials have said that the blast was probably caused by a Ukrainian missile, Kiev insists that it was Russian in origin. According to Politico, these statements “illustrate one of the first major divergences in opinion between Washington and Kiev” since the start of Russia’s military campaign in the neighboring state in late February. US officials are trying to downplay this rift, but new fissures between Washington and Kiev may emerge as the conflict drags on, the report says. According to Heather Conley, a former State Department official, the “confusion” surrounding the Poland missile incident was a “really important test run” for the US, NATO, and Ukraine. “I think we all learned a pretty valuable lesson in [that] you cannot say something right off the bat until you understand what it is … because the stakes are so high right now,” she told Politico.

Following the Tuesday blast, Zelensky pinned the blame on Russia, calling the incident “a very serious escalation” and describing it as an attack on NATO and demanding a response. Later, however, he toned down his claims, admitting that “we do not know 100%” what caused the blast. The Russian Defense Ministry denied any involvement in the incident, saying its military experts had analyzed the photos from the scene and identified the debris as parts of an S-300 air defense system missile used by Ukraine.

And here’s why the US refuses.

By Lidia Misnik, a Moscow-based reporter focused on the political process, sociology and international relations.

• ‘The US Won’t Sacrifice Chicago For Warsaw’ (Misnik)

“We approached the moment of truth in the confrontation between the collective West and Russia. When it happened, it became clear that an attack by Russia could be claimed. This situation tested the effectiveness of NATO’s strategy for ensuring the security of the collective West,” Senior Research Fellow at the Institute for US and Canadian Studies Vladimir Vasiliev told RT. He noted that the incident itself featured an element of happenstance, but that it helped shed light on a long-standing question: To what extent is the West prepared to invoke Article Five to defend NATO members? As Vasiliev noted, in this situation, the West “put the brakes on everything,” and the US quickly took cover behind the version that it was a Ukrainian rocket.

“There was always a question about the extent to which the US would be prepared to intervene on behalf of Riga, Vilnius, or Warsaw, and in doing so sacrifice Boston, Chicago, or California. And now it becomes clear that there is a problem and that the US is not willing to sacrifice its own security, its own territories,” Vasiliev said. In his words, this episode is extremely important for Russia, because it shows that the US is not prepared to invoke Article Five until there is a danger to the country itself or at least to some of the most important member states of the bloc, primarily Western Europe. “There is a certain understanding that conflicts such as this one should be resolved by others. The US will gladly put Poland, the Baltic States, Bulgaria, and Romania in the line of fire while itself staying out of the war zone.

That’s where the entire NATO architecture begins to crumble. Domestic politics will always take precedence,” Vasiliev added. From this situation, he believes, a far-reaching conclusion can be drawn: Ukraine in any shape or form is not wanted by NATO. Vasiliev says it is clear that the US is playing a geopolitical game against Russia by using Ukraine, which is expendable. This allows the vital interests of Washington to remain untouched. According to him, the countries of Eastern Europe are equally considered not to be vital interests, as are Finland and Sweden, and likely Türkiye.

The calm before the storm in Ukraine – MacGregor

“This complex fraud will smolder for a few weeks before it explodes into an extinction-grade event for the Democratic Party..”

• A Smoldering Fuse (Jim Kunstler)

Thirty-seven billion more dollars for Ukraine? (That’s thirty-seven thousand millions of dollars, by the way.) Bringing the total this year to a click-or-two over ninety billion (ninety-thousand millions), on top of whatever Sam Bankman-Fried’s FTX company funneled through that sad-sack international money laundromat — soon to be the darkest backwater of a European failed state since Field Marshal Melchior von Hatzfeldt of Westphalia left Bohemia a corpse-strewn wasteland after the Battle of Jankau (1645). It really doesn’t matter how much more money we pound down that rat-hole, you understand, because by the time various parties — the weapons-makers, Volodymyr Zelensky, sundry members of the US House of Representatives, the Biden family, the World Economic Forum — are finished creaming off their fair shares, poor Ukraine won’t have enough cash-on-hand to replace six fuse-boxes in Zaporizhzhia.

Against this backdrop, the USA enters a holiday season near-death spiral as unspooling scandals battle a collapsing economy for supremacy of the alt news sites. Case-in-point: the aforementioned FTX monkey business, a metastasizing tumor of the body politic. This complex fraud will smolder for a few weeks before it explodes into an extinction-grade event for the Democratic Party. The usual suspects among the mainstream media are trying strenuously to ignore it, but the shreds of this exploding money-borg are already sticking to guilty parties far and wide across the political landscape like so much rotting flesh.

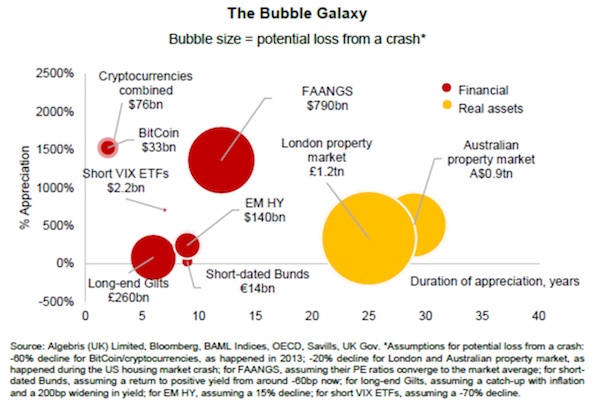

FTX commander-in-chief Sam Bankman-Fried remains at large after steering the crypto-currency trading platform into a bankruptcy so hideously tangled that the assigned liquidator in court proceedings, one John Ray III, who oversaw the Enron aftermath years ago, was boggled by what he’s found so far (and it’s early in the game): Namely, a company run by a handful of twenty-something drug freaks with no idea what they were doing, no record-keeping, and a slime trail of misappropriated investors’ funds leading to Kiev and Geneva through various crooked American political action committees, and the halls of Congress — with echos in ballot harvesting shenanigans which shaped the outcome of this month’s US elections.

“Bankman-Fried has boasted of meeting policymakers in Washington “every two or three weeks for the last year.”

• ‘Aid To Ukraine,’ the US Democratic Party And The Collapse Of FTX (Livshitz)

Bankman-Fried is a very well-connected figure indeed in US politics. Over the course of the 2020 presidential election cycle, he contributed $5.2 million to two super PACs supporting Joe Biden’s campaign, and was the overall second-largest individual donor to Biden that year. Such extravagant spending appears trivial today. In 2021/22, he provided tens of millions to Democratic causes and candidates, becoming the party’s second-largest donor, behind only “spyless coup” specialist George Soros. Bankman-Fried has boasted of meeting policymakers in Washington “every two or three weeks for the last year.” Over 2022, this has included multiple audiences with senior government officials and top Biden advisers at the White House. These meetings escalated in volume around the time that the Ukraine conflict began.

On March 7, exactly one week before Aid for Ukraine was launched, his brother Gabe Bankman-Fried – who directs his political operations – visited the White House along with Jenna Narayanan, a Democratic strategist who once worked for the Democracy Alliance, which has been called the “most powerful liberal donor club” in the US. Bankman-Fried himself then visited the White House on numerous occasions in April and May, concurrent with him donating $865,000 to the Democratic National Committee. In early June, mere days after his last recorded White House meet-and-greet, Bankman-Fried announced he would invest up to $1 billion in further funds between then and 2024 to guarantee Biden – or whoever might take his place – won the next presidential election. These activities have been interpreted by many as an attempt by Bankman-Fried to ingratiate himself with politicians to further his commercial interests.

It is certainly true that, at the same time, he and FTX high-rankers were attempting to influence US lawmakers on crypto regulation, to make the market more favorable for his company. In this context, the promised $1 billion appears to be a dangled carrot, an implied promise of future financing if Bankman-Fried got his way. Accompanying him on some of these visits was Mark Wetjen, FTX head of policy and regulatory strategy, who previously served as commissioner on the Commodity Futures Trading Commission under President Barack Obama – but only some. Were the other meetings related to Ukraine? If so, the $1 billion pledge may have reflected what Bankman-Fried thought could be secretly skimmed from Aid for Ukraine for Democratic Party purposes. It’s conspicuous that in mid-October, he completely disowned that enormous commitment, saying, “That was a dumb quote. I think my messaging was sloppy and inconsistent in some cases.”

“BAHAMAS GOVT ORDERED BANKMAN-FRIED TO HACK FTX SYSTEM AND TRANSFER ASSETS TO THE BAHAMAS GOVT ACCOUNT: COURT FILING”

BAHAMAS SECURITIES REGULATOR SAYS IT ORDERED FTX CRYPTO WALLETS TO BE TRANSFERRED TO GOVERNMENT WALLETS

SAM BANKMAN STOLE $300 MILLION OF THE $420 MILLION FTX RAISED FROM INVESTORS LAST YEAR IN OCTOBER. (WSJ)

SBF’s lawyers at Paul Weiss have dropped him as a client: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, that conflicts have arisen that precluded us from representing him”

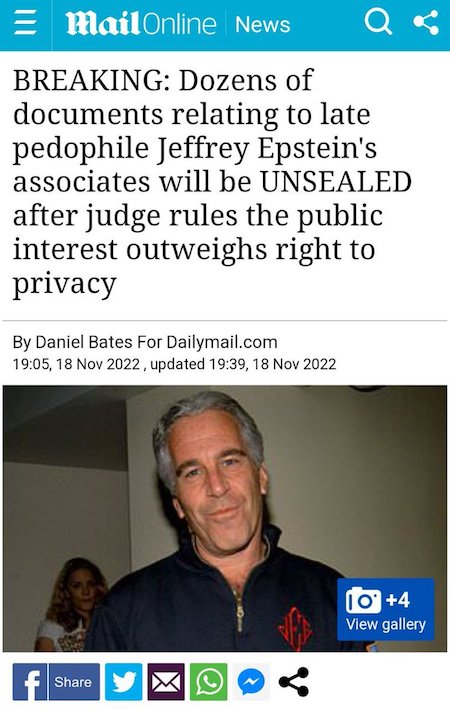

• FTX Boss Accused Of Using Offshore Funds After Bankruptcy (RT)

The collapsed cryptocurrency exchange FTX has provided court evidence suggesting that its former CEO, Sam Bankman-Fried, had transferred digital assets belonging to the company to regulators in the Bahamas just after filing for bankruptcy. In a bombshell emergency court filing on Thursday, FTX claimed that the government of the Bahamas directed Bankman-Fried to gain “unauthorized access” while in custody. While thousands of clients have been denied access to their funds, millions of dollars in crypto reportedly continued to be drained from FTX wallets over the weekend through a back door in the Bahamas. The filing cited an interview published by Vox on Wednesday, in which Bankman-Fried expressed disdain for regulators. “F**k regulators,” he said in the interview, adding: “They make everything worse. They don’t protect customers at all.” “You know what was maybe my biggest single f**k up?” he asked. “Chapter 11.”

The motion lodged by FTX in the US Bankruptcy Court in Delaware says the alleged conduct puts “in serious question” a request by regulators in the Bahamas for recognition as liquidators in the bankruptcy. “[I]n connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and [FTX co-founder Gary] Wang, stated in recorded and verified texts that ‘Bahamas regulators’ instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were ‘custodied on FireBlocks under control of Bahamian gov’t,’” the filing said. FTX, which is based in the Bahamas due to the relaxed tax laws, collapsed on November 11 in a scandal that has cost investors more than $11 billion. The debacle followed reports of mishandled customer funds and abandoned acquisition plans by rival exchange Binance. The scandal has triggered a crisis of confidence in the cryptocurrency market and caused the value of assets including Bitcoin to sink.

“The clobber list also includes this curious item: “The strike has resulted in the neutralisation of the production capacities for nuclear weaponry.”

• Ukraine – Switching The Lights Off (MoA)

The careful destruction of energy systems in Ukraine continues. From today’s clobber list as provided by the Defense Ministry of Russia: ” On 17 November, the Armed Forces of the Russian Federation launched a concentrated strike, using high-precision long-range air-, sea- and ground-based weapons, at the facilities of military control, defence industry, as well as related fuel and energy infrastructure of Ukraine. The goals of the strike have been reached. All the missiles have accurately stricken the assigned facilities.” I have no idea if the last line is true but it does not matter much. The targeting of 330 kilovolt transformers in various switching stations has cut some 50% of the distribution capability of Ukraine’s electricity network. These transformers weigh up to 200 tons.

There are no replacements. You do not buy them at the next corner but will have order them with years of lead time. As far as I can tell Russia is currently Russia the only producer of transformers of that type. Isn’t it a war crime to destroy the infrastructure that supplies civilians? It depends. If the infrastructure is used exclusively for civilian purpose the destruction is illegal. But the electricity and transport infrastructure in Ukraine is used for civilian AND military purposes. In a recent Politico piece Ukrainian officials are even confirming that: Ukraine tells allies it may not be able to recover from more Russian attacks on energy systems: ” An unreliable energy sector could have deadly consequences, Ukrainian officials say. In recent conversations, they’ve added that it could halt food production and transport operations — critical services needed to support military operations.”

The clobber list also includes this curious item: “The strike has resulted in the neutralisation of the production capacities for nuclear weaponry.” I wonder where and what that has been: “One depot of artillery armament, delivered by western countries and prepared for being sent to troops, has been destroyed. The redeployment of the reserve forces of the Armed Forces of Ukraine (AFU), and the delivery of foreign armament to operations areas have been frustrated.” The last sentence describes the real purpose of the attacks on the energy systems.

The lack of energy is degrading the railway network that brings weapons from the west to the eastern front. It makes redeployment of units from one front section to another very difficult and time consuming. It will give the Russian forces the advantage when they change the Schwerpunkt of their attacks from one corner of the frontline to another. Another effect of the strikes on the electricity systems and the blackouts in the big cities that follow them is a renewed stream of refugees that will want reach western Europe. It will over time change the public opinion and the political priorities of those countries. If they fail to end the war they will have to carry the burden.

“The New York Times notes the continued emergency that the country’s vital nuclear power plants are facing, given they themselves must rely on the national grid for aspects of their normal operations.”

• Ukraine Has Lost 40% Of Energy System As Kyiv Sees First Snow (ZH)

Ukraine’s largest city and capital of Kyiv, with about 3 million residents, saw half its home and businesses plunged into darkness following Tuesday’s largescale Russian airstrikes which once again targeted energy infrastructure nationwide. Much of the electricity was restored in the capital city Wednesday, while much of it remained off in many other parts of the country. In a rare occurrence, most of the western city of Lviv had also been plunged into darkness this week, after what authorities called the biggest wave of Russian strikes on power facilities since the invasion began. “Photos of Kyiv draped in darkness have become a shareable illustration of winter in Ukraine this year: dark, cold, dangerous,” observed The Hill.

“Ukraine’s energy infrastructure is under attack from Russia, which has failed to defeat Ukrainian forces on the battlefield and is now once again targeting civilians.” An estimated 100 missiles had rained down on Ukrainian cities over the span of just a couple hours on Tuesday, chiefly targeting the energy grid. President Zelensky had already earlier in November warned that 40% of the country’s energy system has been destroyed. One Kyiv resident, Vladimir Yanachuk, was cited in NPR as saying, “We are not afraid about this. Ukrainians are not afraid about this,” while acknowledging: “Winter will be hard. But this winter will be hard not only for Ukrainians, but for Russian soldiers too.”

Temperatures in the capital and other parts of Ukraine have dipped below freezing this week, with the first snow fall of the season dusting Kyiv. The AFP reports, “The first snow of the winter falls on Maidan Square in Kyiv, blanketing its statues and anti-tank obstacles as the Ukrainian capital faces blackouts and power outages from a fresh series of Russian strikes targeting the country’s energy infrastructure.” Meanwhile The New York Times notes the continued emergency that the country’s vital nuclear power plants are facing, given they themselves must rely on the national grid for aspects of their normal operations.

“What we want is an end to this war. Someone is trying not to end the war. The US sees the prolongation of the war as its interest.”

• Ukraine Is ‘War Between West And Russia’ – Turkish Official (RT)

The West is using Ukraine to wage a war against Russia and has gone so far as to sabotage Turkish diplomacy that sought to negotiate an end to it, the deputy leader of Türkiye’s ruling AKP party, Numan Kurtulmus, told CNN Turk on Friday. “This war is not between Russia and Ukraine, it is a war between Russia and the West,” Kurtulmus told the outlet, adding that “the US and some countries in Europe” are prolonging the conflict by supporting Ukraine. Turkish President Recep Tayyip Erdogan is talking to both Moscow and Kiev, said Kurtulmus, and in March managed to organize negotiations in Istanbul that looked promising. Russian President Vladimir Putin and his Ukrainian counterpart, Vladimir Zelensky, “were going to sign” a deal, but “someone didn’t want” that to happen.

According to Ukrainian media, Kiev received a message in April that the West was not interested in peace with Russia, which encouraged Zelensky to break off the talks. The messenger was reportedly none other than the UK prime minister at the time, Boris Johnson. “There was progress on certain issues, and we were reaching the final point, and then suddenly we saw that the war accelerated,” Kurtulmus told CNN Turk on Friday. “What we want is an end to this war. Someone is trying not to end the war. The US sees the prolongation of the war as its interest.” In his opinion, the conflict has made much of Europe clamor for NATO to become more active against the perceived threat from Russia, which benefits Washington.

According to Kurtulmus, the “balance of the world system disappeared” with the demise of the Soviet Union, and a “fierce power struggle” is currently taking place. “It is essential to establish a global political system. It is necessary to establish new institutions that will ensure world peace,” he said. Kurtulmus is a former Turkish deputy prime minister, who has been Erdogan’s deputy at the head of AKP since 2018. His comments came as Russia agreed to extend the Turkish-negotiated deal for exporting grain through the Black Sea by 120 days, on the condition Kiev doesn’t use the sea corridor to carry out more attacks.

No coincidence. If you don’t want an end, you’re not going to define an end goal.

• Former Trump Advisor: Biden Admin Has No End Goal For Ukraine War (JTN)

Former Donald Trump advisor Victoria Coates said the Biden administration doesn’t have an end goal for its involvement in the war in Ukraine. “I think it’s a lot of confusion within the administration,” Victoria Coates said on Friday’s edition of the “Just the News, No Noise” TV show. “You’ll hear the Chairman of the Joint Chiefs, General Milley saying he wants to negotiate. Then we hear from the National Security Council that we don’t want to negotiate. So there’s friction within the administration. Unfortunately, I think that means we don’t have strong direction from the top.” Coates speculated that conflicting agendas within the administration were undermining Washington’s response to the conflict. “They’re all arguing about what kind of weapon weapon systems they may or may not give the Ukrainians,” Coates said. “They’re arguing about whether or not they should negotiate. It’s very confusing.”

Coates said that this inevitably will lead to scrutiny from the next Congress. “This is why you have a lot of concern out of the new Congress for these huge supplemental requests that are coming in,” Coates explained. “What’s the purpose here? Because if we have a strategy to win, and I think the Ukrainians have shown the will to win, how do we get them across that finish line sooner rather than later so the American people aren’t still feeling the pain of this conflict?” “We’re up against $100 billion of support to Ukraine over the course of the last 10 months,” Coates said. “Now, maybe I would spend more money if it means we’re going to defeat Putin, but I don’t hear that from the President. So I’m wondering why, in these difficult times, we’re spending all this taxpayer money.”

“..the market is going to set the price. So if you put sanctions on at higher prices, in a way you’re just making the situation worse.”

• Russian Oil Price Cap Idea ‘Ridiculous’ – Former US Treasury Secretary (RT)

Former US Treasury Secretary Steve Mnuchin has criticized the Group of Seven (G7) plan of capping the price of Russian oil in an interview to CNBC. The measure, which is due to be implemented early next month, is “not only not feasible, I think it’s the most ridiculous idea I’ve ever heard,” Mnuchin said. The former official said that “the market is going to set the price. So if you put sanctions on at higher prices, in a way you’re just making the situation worse.” The G7 countries, comprising the US, Canada, UK, Germany, France, Italy, and Japan, earlier agreed to set a fixed price limit on Russian oil. The measure takes effect on December 5.

While the price level is not yet known, reports indicate it will be set at around $60 per barrel. The current market price on Brent crude, the global oil benchmark, is around $86 per barrel. Under the plan, Western companies will be banned from providing certain services for shipments of Russian oil that is purchased at a price above the cap. The list of services includes insurance and facilitating payments. The mechanism, which had been pitched by Washington, is intended to limit Russia’s revenues from energy exports, which, the West claims Moscow uses to fund its military operation in Ukraine.

Moscow, meanwhile, has increased oil exports in recent months to countries outside of the West, particularly China and India, by offering discounts to secure buyers. Analysts say that in order for the price cap to have the desired effect, the G7 would have to make sure these countries join the scheme. However, Russian officials have repeatedly stated that the country will not sell oil to buyers that agree to the price cap, which may make many reluctant to participate in the mechanism. India, for instance, recently said it sees no “moral conflict” in importing Russian oil and will buy it “from wherever” to ensure the country’s energy stability.

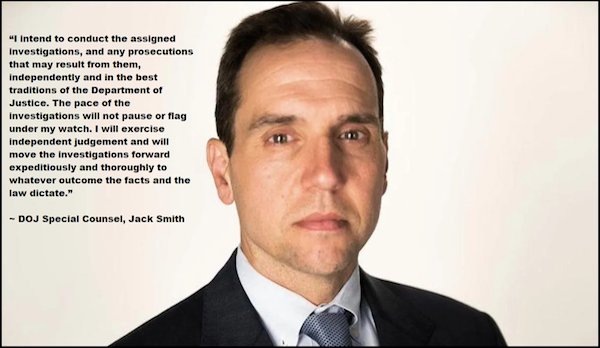

This puzzles me: Garland said:“Based on recent developments, including the former president’s announcement that he is a candidate for president in the next election and the sitting president’s stated intention to be a candidate as well, I have concluded that it is in the public interest to appoint a special counsel.”

See? They’re both candidates, but only one gets a special counsel. Where in his words is the logic? It’s not as if there is no reason to probe Hunter. And FTX should be probed too, but yes, that too is linked to Biden.

• DOJ Appoints Special Counsel For Trump Probes, But What About Hunter? (JTN)

Powell’s words follow Garland’s appointment of Jack Smith, a former career Justice Department prosecutor and former chief prosecutor at The Hague, to serve as special counsel to oversee two ongoing criminal investigations. The first is the investigation into whether any individual, Trump included, attempted to interfere unlawfully in the transfer of presidential power or the electoral certification process in connection with the Jan. 6 Capitol riot. The second is the investigation into the documents the FBI seized from Trump’s Mar-a-Lago estate in August and any obstruction of justice charges that could stem from it. Garland’s announcement came three days after Trump launched his 2024 presidential campaign.

“The Department of Justice has long recognized that in certain extraordinary cases it is in the public interest to appoint a special prosecutor to independently manage an investigation and prosecution,” said Garland. “Based on recent developments, including the former president’s announcement that he is a candidate for president in the next election and the sitting president’s stated intention to be a candidate as well, I have concluded that it is in the public interest to appoint a special counsel.” Trump blasted the appointment as the “politicization of justice” and said he “won’t partake in it” in comments to Fox News Digital. Observers were quick to similarly criticize Garland’s decision, noting a potential double standard as the Justice Department hasn’t named a special counsel to oversee its ongoing investigation into Hunter Biden.

“By appointing a special counsel to investigate his boss’s political enemy, Attorney General Merrick Garland continues to politicize and weaponize the Biden Justice Department — all while Garland ignores smoking-gun evidence of Biden’s foreign corruption,” tweeted Mike Davis, former chief counsel for nominations for the Senate Judiciary Committee. Other legal experts thought Garland’s appointment itself was fine but took issue with not doing the same for Biden. s”Appointment of a special counsel is a significant step, but Garland is well within his rights to do so,” said Geoff Shepard, a lawyer and author who served in the Nixon administration. “The disturbing thing is that he has not already done so with regard to the Hunter Biden investigation. It reeks of a double standard and gives critics plenty of reason to object.”

“The more he spoke of his honor, the faster we counted the spoons…”

@JulieZebrak: “Fun fact: Jack Smith and Jim Trusty both worked in the Criminal Division when I was there. Jack was the head of Public Integrity Section aka PIN. Jim was the head of the Organized Crime and Gang Section. Jim now represents Trump.”

• MTG Says Kevin McCarthy, House GOP Will Defund Trump Special Counsel (JTN)

Georgia Republican Rep. Marjorie Taylor Green on Friday said that current House Minority Leader and likely next House Speaker Kevin McCarthy would deny funding to the Department of Justice special counsel investigating former President Donald Trump. In a Tweet detailing the plan, Greene insisted McCarthy would invoke the Holman rule, a procedural measure by which the House may adjust appropriations legislation to reduce the salary of or fire specific government employees. They may also use it to cut specific programs. “Holman Rule. Look it up! [McCarthy] is going to put it in place,” Greene wrote. “That means no money for Garland’s politically weaponized Special Counsel. Don’t promise too many jobs! Whoops defunded.”

It was not immediately clear whether Greene was predicting such action or announcing that McCarthy had made the decision. Just the News has sought comment from Greene’s office. McCarthy’s office could not immediately be reached. Attorney General Merrick Garland announced Friday that he was appointing Jack Smith as special counsel to oversee the DOJ investigations relating the former president. “The Department of Justice has long recognized that in certain extraordinary cases it is in the public interest to appoint a special prosecutor to independently manage an investigation and prosecution,” Garland said.

“Based on recent developments, including the former president’s announcement that he is a candidate for president in the next election and the sitting president’s stated intention to be a candidate as well, I have concluded that it is in the public interest to appoint a special counsel.” McCarthy has thus far not announced any plans akin to what Greene has indicated. The California Republican this week won his party’s nomination for speaker while the party. Republicans won control of the House during the 2022 midterm elections, meaning McCarthy will likely be the one driving the lower chamber’s operations in the next congressional session.

Trump

https://twitter.com/i/status/1593785088055029761

Game over, guys, don’t even try.

• G20 Pushes Vaccine Passports For All Future International Travel (ZH)

The G20 has issued a formal decree promoting vaccine passports as preparation for any future pandemic response in its final communique. Indonesian Health Minister Budi Gunadi Sadikin, speaking on the matter on behalf of the G20 host country, had earlier in the summit called for a “digital health certificate” using WHO standards. Sadikin advocated for that he dubbed a “digital health certificate” which shows whether a person has been “vaccinated or tested properly” so that only then “you can move around”. Watch his comments during a G20 Bali panel discussion earlier in the week… A somewhat more vaguely-worded version of these recommendations was included in the official G20 leaders’ declaration, which calls for digital COVID-19 certificates, or often simply called vaccine passports.

The section of the final communique, which is republished and available on the White House website, which deals with vaccines and the Covid-19 pandemic begins, “We recognize that the extensive COVID-19 immunization is a global public good and we will advance our effort to ensure timely, equitable and universal access to safe, affordable, quality and effective vaccines, therapeutics and diagnostics (VTDs).” While describing the need for greater collaboration among nations during any future pandemic response, it continues in this section, “We remain committed to embedding a multisectoral One Health approach and enhancing global surveillance, including genomic surveillance, in order to detect pathogens and antimicrobial resistance (AMR) that may threaten human health.”

[..] Article 24 of the final G20 declaration begins, “The COVID-19 pandemic has accelerated the transformation of the digital ecosystem and digital economy.” And then leads into to the following statement later in the section: “We acknowledge the importance to counter disinformation campaigns, cyber threats, online abuse, and ensuring security in connectivity infrastructure.” So as predicted by many early on in the pandemic (who were all dismissed and condemned as “conspiracy theorists”), a future proposed standardized vaccine passport will be accompanied by efforts for greater standardization and policing against ‘disinformation’ – likely to include any speech critical of the type of regimen that G20 leaders wish to enact.

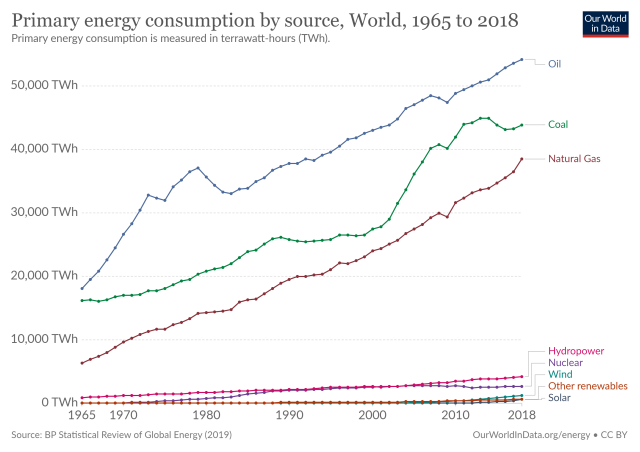

“..many people misunderstood the meaning of “peak oil” and saw it as equivalent to “running out” of oil…”

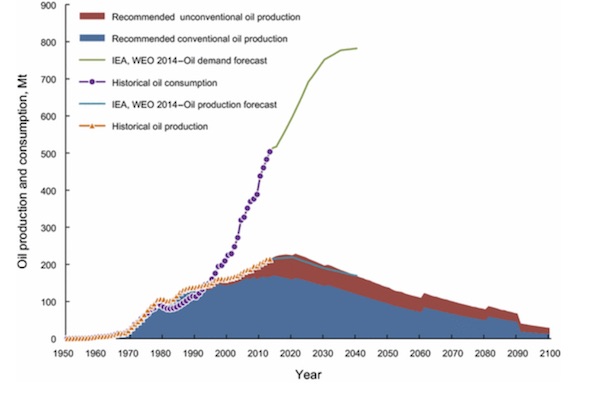

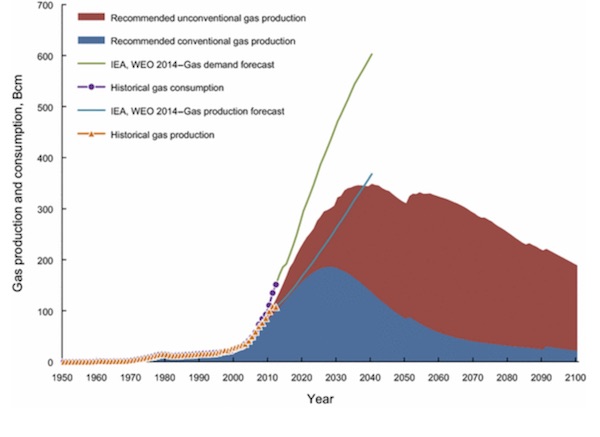

• Colin Campbell: A Tribute To The Father Of The Concept Of “Peak Oil” (Ugo Bardi)

Rethinking today about Colin’s legacy, we can see that he was not always right in his assessments. One of the limits of his approach was that it was focused only on oil and gas. His models were sometimes oversimplified, and, at times, he would be too quick in disparaging new technologies that could change the picture. Perhaps his main limit was to have overemphasized the importance of the peak date as a turning point for humankind and to have believed that it could be determined by models. I know that he understood that the peak was just one point in a smooth curve, and he said that several times in public statements. But many people misunderstood the meaning of “peak oil” and saw it as equivalent to “running out” of oil. For some, it was the equivalent of the religious concept of apocalypse, and that led to accusations against ASPO of being a millenarian cult of some kind.

It should go without saying that Colin’s ideas were as far from millenarism as they could possibly have been. His approach was good, data-based science, and he was fond of quoting Keynes saying, “when I have new data, I change my mind, what do you do, sir?” (actually, Samuelson said that). Colin’s capability of dispassionately analyzing data led him to avoid the mistakes that other members of ASPO made, such as putting all their hopes on nuclear energy or refusing to accept climate science as a valid scientific field. So, even though right now the concept of “peak oil” seems to be out of fashion, good ideas are like souls. They move from one generation to another, being reborn as new incarnations if they are good.

Campbell’s ideas have that power, right now they are nearly forgotten, but waiting to reappear in a suitable body, like the spirit of the Dalai Lama. We, humans, forget things so easily, especially important things. But one day we’ll understand Campbell’s main message that what we get from the Earth may seem to be free, but it must be repaid, sooner or later. And the debt recovery agency employed by Gaia is ruthless and cannot be bribed using money.

Cooling

A few decades ago they tried to scare everybody with global cooling. pic.twitter.com/hQFH2zvOEt

— Wittgenstein (@backtolife_2023) November 18, 2022

Baby chimp

https://twitter.com/i/status/1593402415985971200

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.