Paul Gauguin A seashore 1887

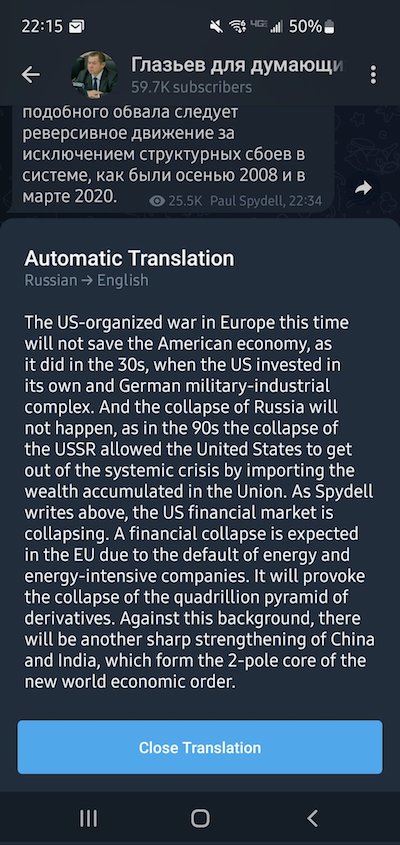

A Russian source whose name escapes me right now.

Quadruple

.@pfizer quadruples the price of the Covid shot after the CDC adds it to the list for child immunization shots. pic.twitter.com/8QqHvHSYXc

— The Dirty Truth (Josh) (@AKA_RealDirty) October 21, 2022

Gonzalo

Shoigu has allegedly also held multiple calls with US Defence Secretary Lloyd Austin. No details were revealed.

• Russia Says Kyiv Preparing False Flag “Dirty Bomb” Detonation In Ukraine (EWN)

UPDATE 4.44 pm (October 23) – Russian state-controlled media outlet TASS has reported that Russia’s Defence Minister Shoigu spoke to Britain’s Ben Wallace about Kyiv’s plans to detonate a “dirty bomb” in Ukraine as a false flag operation to “increase anti-Russian rhetoric.” The Russian Defence Ministry told reporters on Sunday, October 23 revealed that Shoigu spoke to Wallace via a phone call to discuss the situation in Ukraine and discuss “possible dirty bomb provocations by the Ukrainian armed forces”. The ministry said: “On 23 October 2022, Russian Defence Minister Army General S.K. Shoigu and British Defence Minister B. Wallace. The situation in Ukraine was discussed. “Sergey Shoigu conveyed to his British counterpart his concerns about the possibility of provocations by Kyiv using a dirty bomb.” Earlier, it was reported by the state-owned media outlet RIA that the UK was also involved in the process with regard to “the possible transfer of nuclear weapon components to the Kyiv authorities.”

ORIGINAL 8.33 am (October 23) – According to “credible sources in various countries – including Ukraine”, Kyiv is reportedly preparing a false flag attack on Ukraine involving the detonation of a so-called “dirty bomb” or a low-yield nuclear weapon, as reported by RIA on Sunday, October 23. The source reportedly told the Russian news outlet that the “purpose of the provocation is to accuse Russia of using weapons of mass destruction in the Ukrainian theatre of war and thereby launch a powerful anti-Russian campaign in the world aimed at undermining Moscow’s credibility.” RIA also said that according to its information, the management of the Eastern Mining and Processing Combine, located in the city of Zheltiye Vody, Dnipropetrovsk Region, as well as the Kyiv Institute for Nuclear Research, have been instructed by top Ukrainian officials to produce the “dirty bomb”, which is believed to be in its final stages.

The news outlet said that the UK is also involved in the process with regard to “the possible transfer of nuclear weapon components to the Kyiv authorities.” It added that if the provocation succeeds then “most countries will react extremely harshly to the ‘nuclear incident’ in Ukraine and as a result, Moscow will lose the support of many of its key partners, while the West will once again try to raise the issue of stripping Russia of its permanent UN Security Council membership status and increase anti-Russian rhetoric.”

Linking Russia to nukes is a popular pastime.

• Kiev Denies Moscow’s ‘Dirty Bomb’ Allegations (RT)

Ukrainian President Vladimir Zelensky has denied Moscow’s allegations that Kiev was preparing a false-flag attack with the use of a “dirty bomb,” and has pointed the finger at Russia instead. Zelensky was commenting on what he called “a phone carousel” by the Russian Defense Minister: on Sunday, Sergey Shoigu shared with his French, Turkish and British colleagues his concern over “possible provocations by Ukraine using a ‘dirty bomb.’” Russian state news agency RIA Novosti earlier reported that the goal of such a provocation would be to accuse Moscow of using weapons of mass destruction in a ploy to “launch a powerful anti-Russia campaign”. In a video address on social media, Zelensky claimed that “wherever Russia has brought death and degradation,” Ukraine is “returning a normal life.”

“And there’s only one subject who can use nuclear weapons in our part of Europe, and this subject is the one who ordered comrade Shoigu to call somewhere,” the Ukrainian leader said. So-called “dirty bombs” use conventional explosives along with radioactive material. While it could not rival a nuclear warhead in terms of power, such a device could disperse a radiation cloud around a radius of several kilometers from its explosion. Zelensky expressed confidence that “everyone understands” who is “the source of everything dirty that can be imagined in this war” and called on the world to react “in the toughest possible way” when it comes to “another escalating step” by Russia.

Earlier on Sunday, Ukrainian Foreign Minister Dmitry Kuleba also commented on Moscow’s allegations, saying that “Russian lies” about a “dirty bomb” “are as absurd as they are dangerous.” “Firstly, Ukraine is a committed NPT (non-proliferation treaty) member: we neither have any ‘dirty bombs’ nor plan to acquire any. Secondly, Russians often accuse others of what they plan themselves,” the minister said. According to the British Defense Ministry’s readout of the conversation between its head, Ben Wallace, and his Russian counterpart Shoigu, the Russian minister “alleged that Ukraine was planning actions facilitated by Western countries, including the UK, to escalate the conflict in Ukraine.” Wallace “refuted these claims” and warned Shoigu that “such allegations should not be used as a pretext for greater escalation,” the ministry said.

Earlier, in an interview with Deutsche Welle, NATO Secretary General Jens Stoltenberg said that any use of nuclear weapons by Russia in Ukraine will lead to “severe consequences” for Moscow, but refused to reveal details on these. At the same time, he said that the risk of such a Russian attack remains low. Numerous Russian officials have been insisting that the country wasn’t threatening anybody with nukes and have pointed to Russia’s military doctrine, which states that nuclear weapons may only be used if such arms or other weapons of mass destruction are being deployed against the state, or if it is faced with an existential threat from conventional arms.

Take a look at John McCain’s view of Blinken.

• US Rejects Russia’s Allegations Of Kyiv’s Preparations To Use Dirty Bomb (Az)

US Secretary of State Antony J. Blinken spoke with Ukrainian Foreign Minister Dmytro Kuleba to reaffirm the United States’ steadfast support for Ukraine’s sovereignty, independence, and territorial integrity, State Department Spokesman Ned Price said in a statement. “Secretary Blinken expressed to Foreign Minister Kuleba that the United States rejects Russian Defense Minister Shoygu’s transparently false allegations that Ukraine is preparing to use a dirty bomb on its own territory and that the world would see through any attempt by Russia to use this allegation as a pretext for escalation,” Price said.

McCain ..”Not only unqualified but one of the worst […] Mr Blinken has been a foreign policy advisor to VP Biden since his days in the Senate [but] Mr Biden has been wrong on nearly every major foreign policy issue”

https://twitter.com/i/status/1584250474131517440

Translation: Macron wants the war to continue indefinitely.

Second translation: The loser takes it all.

• Macron Calls For Peace On Ukraine’s Terms (RT)

French President Emmanuel Macron called on Sunday for a peace deal in Ukraine, but insisted that Kiev will dictate the terms of such an agreement. The Ukrainian government, however, has repeatedly ruled out any compromise with Moscow. Speaking at a peace conference organized by a Catholic charity in Rome, Macron said that while “calls for peace might seem…like a betrayal” of Ukraine, the “international community” will one day support a negotiated settlement between Kiev and Moscow, the Associated Press reported. However, peace cannot be “captured by Russian power,” Macron added. “We want the Ukrainian people to decide at a certain point…the moment and the terms of peace.” The French president has expressed this same sentiment already, declaring earlier this summer that “Ukraine will decide when the conditions are met to build peace.”

The leaders of the US, UK, and NATO have issued similarly-worded statements while continuing to bankroll and arm Ukraine’s military, and France, along with the other members of the G7, has pledged to maintain this support for “as long as it takes.” Ukraine’s terms, however, will likely preclude any settlement in the near future. President Vladimir Zelensky has pledged not to negotiate with Russia as long as Vladimr Putin remains in power, signing a decree earlier this month forbidding talks with the Russian president. Zelensky has also promised to seize the regions of Donetsk, Lugansk, Kherson and Zaporozhye, which acceded to membership of the Russian Federation following referendums last month. Additionally, the Ukrainian leader has vowed to capture Crimea, which joined Russia following a referendum in 2014.

Not only would an assault on these territories present a formidable military challenge for Zelensky’s forces, a full-scale attack on Russian land would invite Moscow to retaliate with “all the means available” to it, Putin cautioned in a recent speech. Former Russian President Dmitry Medvedev was more blunt when he warned Kiev in July that an attack on Crimea would trigger “Judgement Day” for Kiev. Meanwhile, the Kremlin has warned the UK, France, and other Western powers that it believes Ukraine is preparing to detonate a so-called “dirty bomb” in a bid to frame Russia and escalate the conflict to the point of NATO intervention. While British Defense Minister Ben Wallace refuted these claims and intimated that London’s support for Ukraine would continue, he said after the call that the UK “stands ready” to “de-escalate this conflict.”

Sarkozy does a lot better than Macron.

• ‘Dancing On Edge Of Volcano’ With Ukraine – Sarkozy (RT)

It’s high time for the EU to abandon its emotionally driven policies on Ukraine and start talking about achieving peace, former French president Nicolas Sarkozy has suggested. In an interview with Le Journal du Dimanche on Saturday, Sarkozy criticized Brussels for its involvement in the conflict between Russia and Ukraine, which has included sweeping sanctions on Moscow, weapons deliveries to Kiev, and calls for a military solution to the crisis. “The European Commission is primarily an administrative body. Moreover, I still haven’t understood under which article of the European treaties [the body’s president Ursula] von der Leyen justifies her competence in the field of arms purchases and foreign policy,” he said.

“The only thing the Europeans are hearing now is more and more billions of euros being spent on the purchase of weapons. More weapons, more deaths, more war,” the 67-year-old politician added. The EU’s policy regarding the conflict in Ukraine is driven by “miscalculation, exaltation, anger, superficial reactions,” and because of this “we’re dancing at the edge of a volcano,” said Sarkozy, who was the president of France between 2007 and 2012. The bloc was right to condemn Russia and show solidarity with Ukraine, but it also needs to exercise “composure” and work to prevent the escalation of the conflict, he added. “It’s high time for serious initiatives to be taken to start talking about the future and peace.”

Sarkozy also criticized Ukrainian President Vladimir Zelensky for signing a decree earlier this month, which officially made it “impossible” for him to hold talks with his Russian counterpart Vladimir Putin. Such a stance amounted to “demanding a regime change in Moscow,” the veteran politician pointed out. “I consider this to be a dangerous leap into the unknown, although it’s understandable that it’s difficult for the Ukrainian president to talk to Putin,” he said. Moscow, which has repeatedly invited Kiev to come to the negotiating table in recent months, has blamed the Ukrainian side for undermining any potential for a peaceful settlement of the crisis.

It has also repeatedly condemned the deliveries of weapons to Zelensky’s government by the US, EU, UK and some other countries, arguing that they won’t change the outcome of the conflict, but will prolong the fighting and increase the risk of a direct confrontation between Russia and NATO. Zelensky previously set out the only conditions under which negotiations with Russia would be possible: “They can return our territory back to us if they want negotiations. They must withdraw from our territory and leave us our land within the internationally recognized borders of 1991. And then we will say in what format and with whom we are ready to talk.”

Google translate. I think this will be costed at $349 billion, the amount George Webb has been mentioning all along. He connects it to Kolomoisky, who is Zelensky’s puppeteer, and to an Israel pipeline.

• Scholz and Von der Leyen Want A Marshall Plan For Ukraine (NOS)

Ukraine’s reconstruction requires a strategy similar to the Marshall Plan after World War II. That write the German Chancellor Scholz and President von der Leyen of the European Commission in an opinion piece in the Frankfurter Allgemeine Zeitung. According to the two politicians, supporting Ukraine is also in the interest of the European Union. “Ukraine also defends the international rule-based order, the basis of our peaceful coexistence and well-being worldwide,” they write. “So if we support Ukraine, we are building our future and that of our common Europe.” Scholz and von der Leyen call rebuilding the Russian-invaded country a lengthy task that must begin now. “While one has to be careful with historical comparisons, this is nothing less than a Marshall Plan for the 21st century.”

With the Marshall Plan, European countries received money, goods, raw materials and foodstuffs from the United States between 1948 and 1952. This was done in the form of loans and gifts. It was an initiative of the then US Secretary of State Marshall of State. The timing of Scholz and Von der Leyen’s plea is not coincidental. A conference on the reconstruction of Ukraine begins today in Berlin, which includes representatives from German and Ukrainian business. The summit will be opened by Scholz and Ukrainian Prime Minister Shmyhal. On Friday, von der Leyen announced that the European Union wants to support Ukraine with 1.5 billion euros every month next year. EU finance ministers have yet to work out the details of that new aid.

“The 101st has not deployed to Europe since the last world war. ”

• 101st Airborne Deployed to Ukraine’s Border ‘Ready To Fight Tonight’ (Antiwar)

The White House has deployed thousands of American soldiers just miles from Ukraine to prepare for war, according to CBS News. Officers speaking with the outlet revealed they were there for combat against Russia. Brigadier General John Lubas confirmed nearly 5,000 troops from the 101st Airborne recently joined the 100,000 American soldiers already deployed to Europe. Lubas described his troops as being on “full deployment,” and they are preparing to fight Russian soldiers in Ukraine. “This is not a training deployment, this is a combat deployment for us. We understand we need to be ready to fight tonight,” he said. CBS Reporter Charlie D’Agata was embedded with the American forces as they conducted military drills – at a forward operating base – within four miles of Ukraine’s border.

The 101st Airborne is engaged in joint exercises with Romanian forces, simulating Ukrainian soldiers’ combat against Russian troops. Colonel Edwin Matthaidess said his forces have been “closely watching” the Russian soldiers, “building objectives to practice against” and conducting war games that “replicate exactly what’s going on” in Ukraine. CBS News reported, “[Russia’s] goal is to cut off all Ukrainian access to the sea, leaving the country and its military forces landlocked.” CBS News did not provide a source for that assertion. The Kremlin has publicly said its war goal is limited to eastern Ukraine. Lubas declared the division was “ready to defend every inch of NATO soil.” However, Moscow has never threatened to invade a NATO country. Ukraine is not a NATO member.

When President Zelensky said Ukraine should be allowed into the North Atlantic alliance last month, National Security Adviser Jake Sullivan and NATO Secretary-General Jens Stoltenberg rejected Kiev’s proposal. The 101st Airborne is a light infantry division. It carries the nickname the “Screaming Eagles” as the Pentagon utilizes the 101st as a force that can deploy around the world within hours. Lubas described his division as bringing a “unique capability, from our air assault capability… We’re a light infantry force, but again, we bring that mobility with us, for our aircraft and air assaults.” Romanian Major General Lulian Berdila told CBS News that the presence of American troops was reminiscent of WWII, “The real meaning for me, to have the American troops here, is like if you were to have allies in Normandy before any enemy was there.” The 101st has not deployed to Europe since the last world war.

“Middle-class voters tend to choose to live in places where they can expect to get actual value out of their tax dollars..”

So you fail them on purpose.

• Weaponized Governmental Failure: A Primer (McKay)

Let’s call it Weaponized Governmental Failure. It’s the single most explicative factor in the breakdown of American political consensus in the 21st century, even though it’s been around since the latter part of the 20th century. The simple definition of Weaponized Governmental Failure is this: it’s the deliberate refusal to perform the basic tasks of urban governance for a specific political purpose. The crime and the graft and the potholes and the bad drainage, not to mention the spotty trash collection or nonexistent snow shoveling, aren’t incompetence. In fact, none of what you see in the American public sector is incompetence. The people responsible for it are quite highly educated and well-trained in their craft. You just need to understand what their craft is. It’s a choice to do a poor job with the more mundane tasks of running a city, and an educated and purposeful choice at that.

If you do those things effectively, after all, what you will get is middle-class voters moving in. Middle-class voters tend to choose to live in places where they can expect to get actual value out of their tax dollars — good roads, safe streets, functional drainage, decent schools, a friendly business climate, and a growing economy, among other things — and those things are hard to produce when you govern the way the Left does. Put a different way, middle-class voters are a pain in the ass. They want lots of things that make for unrewarding grunt work for a mayor, and a Democrat blowhard like a Mitch Landrieu or Ted Wheeler of Portland would rather spend his time on vacuous cultural aggressions like “social change” and offering wealth redistribution and excuses for the bad personal habits that cause so many people to be poor.

Not to mention tilting at bronze statues of better men long dead and nearly forgotten as a means of “making a difference.” For a Landrieu, or a Kwame Kilpatrick, Marion Barry, Bill de Blasio, or Lori Lightfoot, it is no great loss if those middle-class voters declare themselves fed up and decamp to the suburbs. Their exodus simply makes for an electorate that is a lot less demanding and easier to control. That “white flight” is a feature. It’s not a bug. And it isn’t all that white either. Those suburbs the folks are leaving for? Their minority population share usually increases as their population does. Why do you think that is? Simple: the black middle class has no more use for these woke urban Democrats than the white middle class does. And it’s quite a mutual sentiment, to be sure.

The urban socialist Left wants a manageably small core of rich residents and a teeming mass of poor ones, and nothing in between. That’s what Weaponized Governmental Failure produces, and it’s a wide-scale success. New Orleans votes 90 percent Democrat. Philadelphia is 80 percent Democrat. Chicago is 85 percent. Los Angeles? Seventy-one percent. None of those cities will have a Republican mayor or city council again, or at least not in the foreseeable future.Because there are very few middle-class voters left in the cities.

“What would happen in, say, New York City even if, improbably, it were not bombed? ”

• On Going Seriously Boom (Fred Reed)

A modern country is a system of systems of systems, interdependent and interconnected—water, electricity, manufacturing, energy, telecommunications, transportation, pipelines, and complex supply chains. These are interconnected, interdependent, and rely on large numbers of trained people showing up for work. Modern warheads are not the popgun squibs of Hiroshima. Talking of repair any time soon after the nuclear bombing of a conurbation is foolish because the city would have many hundreds of thousand of dead, housing destroyed, massive fires, horrendously burned people with no hope of medical care, and in general populations too focused on staying alive to worry about abstractions like supply chains.

The elimination of transportation might cause more death than the bombs. Cities, suburbs, and towns cannot feed themselves. They rely on a constant, heavy influx of food grown in remote regions. This food is shipped by rail or truck to distribution centers, as for example Chicago, whence it is transshipped to cities like New York. Heavy megatonnage on Chicago would disrupt rail lines and trucking firms. Trains and trucks need gasoline and diesel which come from somewhere, presumably in pipelines. These, broken by the blast, burning furiously, would take time to repair. Time is what cities would not have. What would happen in, say, New York City even if, improbably, it were not bombed?

Here we will ignore the likelihood of sheer, boiling panic and resultant chaos on learning that much of the country had been flattened. In the first few days there would be panic buying with shelves at supermarkets being emptied. Hunger would soon become serious. By day four, people would be hunting each other with knives to get their food. By the end of the second week, people would be eating each other. Literally. This happens in famines.Most things in America rely on electricity. This comes from generating plants which burn stuff, usually natural gas or coal. These arrive on trains, which would not be running, or in trucks, not likely to be running. They depend on oil fields, refineries, and pipelines unlikely to function.

All of the foregoing depend on employees continuing to go to work instead of trying to save their families. So—no electricity in New York, which goes dark. This means no telephones, no internet, no lighting, and no elevators. How would this work out in a city of high rises? Most people would be nearly incommunicado in a lightless city. Huge traffic jams would form as people with cars tried to leave—to go where?—as long as gasoline in the tank lasted.Where does water come from in New York? I don’t know, but it doesn’t flow spontaneously to the thirtieth floor. It needs to be pumped, which involves electricity, from wherever it comes from to wherever it has to go. No electricity, no pump. No pump, no water. And no flushing of toilets. River water could be drunk, of course. Think of the crowds.

“The Washington Post is solely owned by Amazon tycoon Jeff Bezos, who also owns Blue Origin, a private spaceflight firm in direct competition with SpaceX.”

• Musk Blasts ‘Hypocritical’ WaPo

Elon Musk called the staff of the Washington Post “such hypocrites,” after the newspaper – which proclaims that “democracy dies in darkness” – ran a series of highly critical articles on him. One referred to the SpaceX CEO as a “security risk.” While it was Bloomberg that first reported the possibility that the federal government may investigate Musk’s companies after the billionaire made them “uncomfortable” with his remarks on Ukraine, the Washington Post fired off a salvo of fiercely critical articles on the SpaceX CEO on Saturday. One piece described how lawmakers in Washington allegedly consider Musk “too powerful and increasingly reckless,” partly over his since-abandoned demand that the government reimburse him for providing Starlink internet access to Ukraine for free.

An op-ed suggested that Musk’s Twitter musings on resolving the Ukraine conflict peacefully should make him “a person of interest to security hawks,” and another opinion piece slammed the supposed lack of “discipline and respectability” in Musk’s personal life. One of Musk’s Twitter followers called the newspaper out for its editorial line. “‘Democracy dies in darkness,’ their slogan says, but instead, ‘democracy dies when influential people use journalism to protect powerful interests while deceptive[ly] claim they are protecting common people’s interests,’” the commenter wrote. “Exactly,” Musk replied on Sunday. “WaPo are such hypocrites.”

Already under fire from the liberal media for his planned buyout of Twitter, Musk angered lawmakers in Washington and Kiev when he proposed a peaceful settlement to the Ukrainian conflict that would involve Ukraine abandoning its claim to Crimea. With one Ukrainian diplomat telling Musk to “f**k off” and US Senator Lindsey Graham proposing that the government pull subsidies to Tesla in response, the Washington Post declared that the tycoon’s “ego” put Ukraine’s “war efforts” in jeopardy. The Washington Post is solely owned by Amazon tycoon Jeff Bezos, who also owns Blue Origin, a private spaceflight firm in direct competition with SpaceX. The two firms have competed for federal contracts, with Bezos’ company having a lawsuit against NASA dismissed last year, after the agency awarded a lunar lander contract to SpaceX.

” The European Union has lost the moral right to speak about war crimes because, for eight years, it has turned a blind eye to the killing of civilians, women and children during the shelling of the Donbass by the regime in Kiev.”

• EU Displays ‘Height Of Hypocrisy’ – Russia (RT)

The European Union doesn’t have the right to accuse Moscow of committing war crimes in Ukraine because the bloc has spent years ignoring the suffering of civilians in Donbass, the Russian Foreign Ministry has said. Russia’s statement came after EU’s main decision-making body, the European Council, condemned Moscow on Friday for “indiscriminate” missile and drone attacks on civilian targets in Kiev and elsewhere in Ukraine, adding that there was “growing evidence” of war crimes against Ukrainians. In a response released on Saturday, Russian Foreign Ministry spokeswoman Maria Zakharova rebuffed the accusations as “the height of hypocrisy.”

The European Union has lost the moral right to speak about war crimes because, for eight years, it has turned a blind eye to the killing of civilians, women and children during the shelling of the Donbass by the regime in Kiev. Zakharova further accused the European bloc of “covering up Kiev’s criminal actions.” She argued that, instead of seeking a peaceful solution, the EU has been “senselessly investing significant sums into prolonging the fighting.” The spokeswoman also claimed that Ukrainian soldiers who receive Western training and weapons are targeting civilians.

Russia stepped up strikes on Ukraine this month, hitting many thermal power plants and power lines across the country, among other targets. President Vladimir Putin said the intensification was a retaliation against “terrorist attacks” on Russian soil, including a truck bombing that had recently damaged a strategic bridge connecting the Crimean Peninsula with Russia proper. Kiev has not confirmed its involvement in the bridge attack, but several top officials and government agencies openly celebrated the bombing. President Vladimir Zelensky later accused Russia of killing civilians on purpose during its renewed strikes on Ukrainian territory.

And soon. Start peace talks to save your economy.

• Germany Should Go Back To Buying Gas From Russia – Saxony PM (RT)

Germany needs to get back to purchasing gas from Russia as soon as the conflict in Ukraine ends, the prime minister of the German eastern state of Saxony, Michael Kretschmer, said on Saturday. His nation would still need “pipeline gas” from Russia, the official believes. “When the war is over, we should use gas from Russia again,” Kretschmer told the German tabloid Bild’s weekend edition when asked what he would say to people demanding the Russian Nord Stream 2 gas pipeline be commissioned. Nord Stream 2 was one of the two pipelines designed to deliver natural gas from Russia to Germany via a route along the bed of the Baltic Sea. The project was shelved in late February as Germany halted its certification process when Russia recognized the two Donbass republics as independent.

Kretschmer believes Germany would need the Russian gas pipeline infrastructure to be fully restored if it seeks to ensure sufficient energy supply. He was asked if he believes the two Nord Stream pipelines damaged in an alleged act of sabotage in late September would be repaired. “We will need pipeline gas and that is only possible with functioning pipelines,” he told Bild. Russia should not be the only energy supplier for Germany in the future, the prime minister said, adding that Berlin should also secure long-term gas contracts with the US, Qatar and other Arab nations, as well as “develop our own gas [fields] in the North Sea.” His words came amid an acute energy crunch in Germany as the EU has been striving to wean itself off Russian energy supplies. Brussels’ sanctions policy against Moscow has so far brought more ill than good to Germany, Kretschmer believes.

An economic “tsunami is building up now,” the state leader warned. According to him, entrepreneurs in Saxony face a “dramatic” struggle “for survival” and many of them “are about to give up” in a matter of “weeks, not months.” Kretschmer also said that the federal government relief measures had not yet been properly implemented, while Berlin’s energy saving tips only “get people annoyed.” The prime minister also called for a speedy diplomatic solution to the ongoing conflict, adding that the EU should team up with the US, China, India and Japan to stop the war. At the same time, he said there was “not a single reason why Ukraine should give up even one square meter of its territory.”

Russia must also compensate for all the damage the conflict dealt to Ukraine, he added. Four former Ukrainian regions – the People’s Republics of Donetsk and Lugansk, as well as Kherson and Zaporozhye regions – were officially declared part of Russia in early October, after voters in those territories overwhelmingly supported the move in referendums. Kiev and Western nations, including Germany, declared the votes a “sham” and continue to view the territories as part of Ukraine.

Homeschooling?!

• Energy Costs Will Bankrupt 90% Of English Schools (RT)

Schools in England are struggling to pay their electricity and heating bills, and 90% will run out of money next year, the Observer reported on Saturday. With the cost of living crisis forcing some schoolchildren to go hungry, the government plans to cut spending across all departments. The National Association of Head Teachers told the newspaper that 50% of their schools will be in deficit this year, with the figure rising to 90% by next September. Power and heating bills at some schools have risen from £26,000 a year to £89,000 ($100,609), the report stated. On top of this increase, schools are having to fund a 5% teachers’ pay rise announced this summer. Chancellor Jeremy Hunt is expected to announce spending cuts to all departments, including education, at the end of the month.

Several school trusts told the newspaper that they are eating into their cash reserves to keep their buildings heated and their teachers paid. However, “there comes a point where we simply run out of money,” said Garry Ratcliffe, whose trust runs three primary schools in Kent. Furthermore, Ratcliffe said he’s seen an increase in the number of families unable to pay their own bills or feed their children. “Families who have never required support before are coming to us,” he said. “There is a great sense of shame for the dad who works every hour he can but still has to walk into school and ask for help.” A survey released last week by Chefs in Schools found that 83% of teachers reported children coming to school hungry because their parents were unable to afford food. Nearly a quarter said that children at their schools skipped lunch “due to poverty.”

Energy costs and inflation – which had been creeping upwards since the end of the Covid-19 pandemic – have skyrocketed since the UK decided to cut itself off from Russian fossil fuels. Outgoing Prime Minister Liz Truss exacerbated the economic crisis with a disastrous ‘mini-budget’ last month that crashed the British pound, and attempted to blame Britain’s economic woes on Russian President Vladimir Putin. Responding to The Observer’s latest report, a Department of Education spokesperson took a similar tack, blaming the “cost pressures” on schools on “international events,” and promising to offset the costs via an energy relief scheme.

“No vote of Congress — just hundreds of billions of dollars written off by Biden, as if he is an American tsar.”

• Blocking Judicial Review Of A Half-trillion Tuition Giveaway (Turley)

In a speech at Delaware State University on Friday, President Biden was positively exuberant as he announced that he had prevailed in asserting unilateral authority to forgive hundreds of billions of dollars in tuition loans. He declared that “just yesterday, a state court and the Supreme Court said, ‘No, we’re on Biden’s side.’” Some of us immediately noted that these were actually federal judges and they did not rule that he has this authority but that the other parties in two cases did not have legal standing to challenge his authority. Indeed, one of those Biden “supporters” was Supreme Court Justice Amy Coney Barrett, who simply denied an emergency application to the court. If it seems unlikely that Barrett is now “on Biden’s side,” it is because the claim is perfectly delusional.

No one could possibly read these decisions as even remotely supporting Biden’s claim to have virtually absolute authority to give away roughly $500 billion owed to the American people shortly before a critical midterm election. Within a few hours of Biden’s boast, the U.S. Court of Appeals for the Eighth Circuit enjoined the lower court. However, even the Eighth Circuit will not decide whether to be “on Biden’s side” but only whether six states have the constitutional right to bring any challenge as a matter of legal standing. Even the trial judge said the merits of the challenge raised “important and significant” concerns about Biden exceeding his authority.

Overwhelming constitutional concerns are raised by this massive election-year giveaway. Biden simply announced that he would forgive up to $10,000 in student loan debt for borrowers earning less than $125,000 annually; those who received Pell grants could receive up to $20,000 in relief; couples can qualify despite a joint annual income of $250,000. No vote of Congress — just hundreds of billions of dollars written off by Biden, as if he is an American tsar.

“..the initial WHO estimates were off by 99% for 94% of the world’s population..”

• A Closer Look at the Covid Mortality Rate (Miller)

The median infection fatality rate for those aged 0-59 was 0.035%. This represents 86% of the global population and the survival rate for those who were infected with COVID pre-vaccination was 99.965%. For those aged 0-69, which covers 94% of the global population, the fatality rate was 0.095%, meaning the survival rate for nearly 7.3 billion people was 99.905%. Those survival rates are obviously staggeringly high, which already creates frustration that restrictions were imposed on all age groups, when focused protection for those over 70 or at significantly elevated risk would have been a much more preferable course of action. But it gets worse. The researchers broke down the demographics into smaller buckets, showing the increase in risk amongst older populations, and conversely, how infinitesimal the risk was amongst younger age groups.

They added that “Including data from another 9 countries with imputed age distribution of COVID-19 deaths yielded median IFR of 0.025-0.032% for 0-59 years and 0.063-0.082% for 0-69 years.” These numbers are astounding and reassuringly low, across the board. But they’re almost nonexistent for children. Yet as late as fall 2021, Fauci was still fear-mongering about the risks of COVID to children in order to increase vaccination uptake, saying in an interview that it was not a “benign situation:” “We certainly want to get as many children vaccinated within this age group as we possibly can because as you heard and reported, that this is not, you know, a benign situation.” It’s nearly impossible for any illness to be less of a risk, or more “benign” than a 0.0003% risk of death.

Even in October 2021, during that same interview with NPR, Fauci said that masks should continue on children as an “extra step” to protect them, even after vaccination:And when you have that type of viral dynamic, even when you have kids vaccinated, you certainly – when you are in an indoor setting, you want to make sure you go the extra step to protect them. So I can’t give you an exact number of what that would be in the dynamics of virus in the community, but hopefully we will get there within a reasonable period of time. You know, masks often now – as we say, they’re not forever. And hopefully we’ll get to a point where we can remove the masks in schools and in other places. But I don’t believe that that time is right now.

Nothing better highlights the incompetence and misinformation from Dr. Fauci than ignoring that pre-vaccination, children were at vanishingly small risks from COVID, that vaccination uptake amongst kids was entirely irrelevant since they do not prevent infection or transmission, and that mask usage is completely ineffective at protecting anyone. Especially for those who didn’t need protection in the first place. The CDC, “expert” community, World Health Organization, media figures — all endlessly spread terror that the virus was a mass killer while conflating detected case fatality rates with infection fatality rates. Yet now we have another piece of evidence suggesting that the initial WHO estimates were off by 99% for 94% of the world’s population.

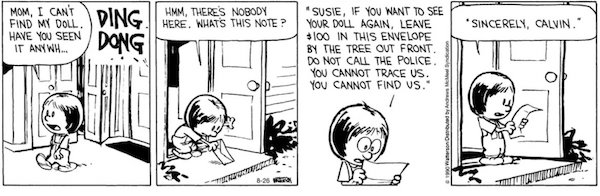

Things that don’t rhyme:

“..37 per cent said they had not taken any vaccine..”

“..Only 35 per cent out of more than 45,000 people said they were vaccinated..”

“..more than 20 million Australians have received at least one dose of a Covid vaccine, or more than 95 per cent of the over-16 population..”

• A Pulse Check Of Australia As We Exit The Pandemic (news.com.au)

Today Covid has become an afterthought for many. We no longer have to isolate after a positive test, masks are rarely seen – even on flights. And the tense — and at times explosive — conversations between friends and family members over issues like vaccines are largely behind us. But we want to know how you feel as Australia emerges from the pandemic. Take our poll and see how the rest of the country views what we’ve been through and where we sit today.

After a day of voting, each question has received more than 42,000 responses, ranging up to more than 50,000. The results are striking. More than half of respondents either said they regret getting vaccinated, or were unvaccinated and happy with their decision. Only 35 per cent out of more than 45,000 people said they were vaccinated and would make the same decision again. Not a single person said they were unvaccinated and regret the decision. One fifth of respondents said they had received two doses of a vaccine, 26 per cent had three and 16 per cent had four shots, while 37 per cent said they had not taken any vaccine.

According to Health Department data, more than 20 million Australians have received at least one dose of a Covid vaccine, or more than 95 per cent of the over-16 population. An overwhelming majority of respondents said they were no longer concerned about Covid and no longer wore masks in public settings. Half of respondents said they caught Covid, with 6 per cent of those catching it more than once, while 40 per cent said they never did. Meanwhile, more than two thirds of respondents said Australia‘s leaders had been too heavy-handed in the pandemic response, 25 per cent said they did they best they could, and 8 per cent said as well as any other country.

Yottabyte

https://twitter.com/i/status/1584197056406892544

Battery

— Electrician consultants (@electriciancons) October 23, 2022

Changing of the guards, Parliament building, Syntagma square, Athens

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.