Harris&Ewing Ford Motor Co. New medical center parking garage, Washington, DC 1938

In some places, this would be called a bubble.

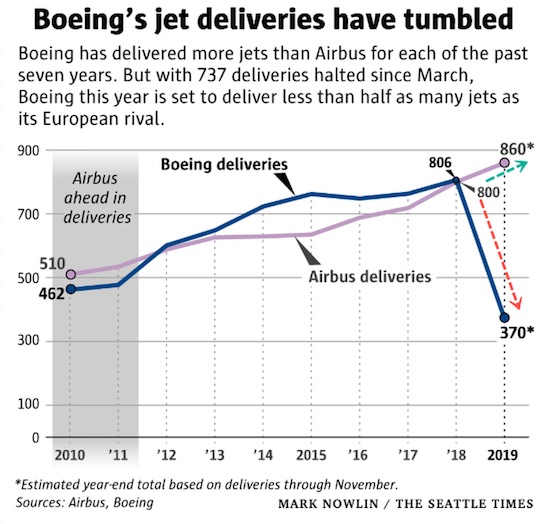

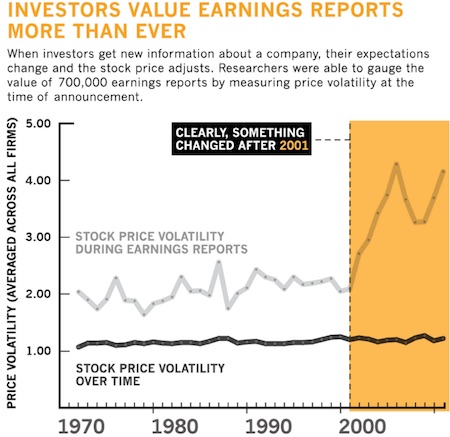

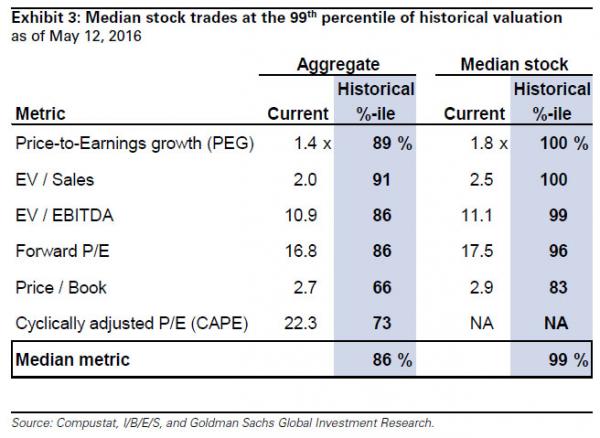

• Goldman: The Median Stock Has NEVER Been More Overvalued (ZH)

When Goldman warned on Friday that a “big drop” in the market is possible before the S&P hits the firm’s year end price target of 2,100, one of the bearish reasons brought up by the firm’s chief strategist David Kostin is that stocks are now massively overvalued. In fact, according to Goldman , while the aggregate market is more overvalued than 86% of all recorded instances, the median stocks has never been more overvalued, i.e., is in the 100% valuation percentile, according to some key metrics such as Price-to-Earnings growth and EV/sales.

This is what Goldman said: “Valuation is a necessary starting point of any drawdown risk analysis. At 16.7x the forward P/E multiple of the S&P 500 index ranks in the 86th percentile relative to the last 40 years. Most other metrics paint a similar picture of extended valuation. The median stock in the index trades at the 99th percentile of historical valuation on most metrics (see Exhibit 3).” Goldman’s conclusion: “The most likely future path of US equities involves a lower valuation.”

Read more …

America no longer makes much of anything anymore.

• The Business Of Corporate America Is No Longer Business – It Is Finance (FT)

One of the great ironies of business today is that the richest and most powerful companies in the world are more involved than ever before in the capital markets at a time when they do not actually need any capital. Take Apple, which has around $200bn sitting in the bank, yet has borrowed billions of dollars in recent years to buy back shares in order to bolster its stock price, which has lagged recently. Why borrow? Because it is cheaper than repatriating cash and paying US taxes, of course. The financial engineering helped boost the California company’s share price for a while. But it did not stop activist investor Carl Icahn — who had manically advocated borrowing and buybacks — from dumping the stock the minute revenue growth took a turn for the worse in late April. Apple is not alone in eschewing real engineering for the financial kind.

Top-tier US businesses have never enjoyed greater financial resources. They have $2tn in cash on their balance sheets – enough money combined to make them the tenth largest economy in the world. Yet they are also taking on record amounts of debt to buy back their own stock, creating a corporate debt bubble that has already begun to burst (witness Exxon’s recent downgrade). The buyback bubble is only one part of a larger trend, which is that the business of corporate America is no longer business – it is finance. American firms today make more money than ever before by simply moving money around, getting about five times the revenue from purely financial activities, such as trading, hedging, tax optimisation and selling financial services, than they did in the immediate postwar period. No wonder share buybacks and corporate investment into research and development have moved inversely in recent years.

It is easier for chief executives with a shelf life of three years to try to please investors by jacking up short-term share prices than to invest in things that will grow a company over the long haul. It is telling that private firms invest twice as much in things like new technology, worker training, factory upgrades and R&D as public firms of similar size — they simply do not have to deal with market pressure not to. Indeed, the financialisation of business has grown in tandem with the rise of the capital markets and the financial industry itself, which has roughly doubled in size as a percentage of gross domestic product over the past 40 years (even the financial crisis did not keep finance down; the industry itself shrank only marginally and the largest institutions that remained became even bigger). As finance grew, so did its profits — the industry creates only 4% of US jobs yet takes around 25% of the corporate profit share.

Read more …

“..Why would you hang in a boiling pot where the upside is 2% and the downside is 40?”

• Stockman: Trump Will Scare The Hell Out Of The Markets, But That’s OK (CNBC)

Former Reagan administration aide David Stockman has a message for the next president: The markets are going down for the count and you can’t do anything about it! President Ronald Reagan’s director of the Office of Management and Budget said in a recent CNBC interview it doesn’t matter if Hillary Clinton or Donald Trump gets elected in November — neither will be able to stop the economic meltdown that’s looming. Wall Street seems to have its mind made up about which candidate it prefers. More than 70% of respondents to a recent Citigroup poll of institutional clients said the former secretary of state, first lady and New York senator would likely become the U.S.’s 45th president. Just over 10% gave Trump the nod, and small business owners appear to be divided between the GOP and Democratic standard bearers.

Stockman, however, doesn’t believe either one can prevent what may be on the horizon. “There’s no way the next president can stop a recession that’s already baked into the cake,” Stockman said Thursday in the “Futures Now” interview. Stockman has been calling for a major market downturn and global recession for some time, but he is more certain than ever that it could happen during this political cycle. He pointed to depleting earnings, peaked auto sales, inventory ratios and issues in the freight and rail space as some key indicators that the U.S. economy is more unstable than people would like to believe. “The idea that this economy is somehow going to get stronger in the second half, or that the next president can stall a recession I think is wrong,” he said.

According to Stockman, there is “plenty of evidence” that the U.S. will slip into a recession by year-end or shortly after. And as he sees it, that could send the S&P 500 spiraling to levels not seen since 2012. “The market can easily drop to 1,300,” Stockman warned. That represents a nearly 40% fall from where the large-cap S&P 500 Index is currently trading. “We have been trading in a range for the last 600 days plus or minus days 2,060 on the S&P 500. … Why would you hang in a boiling pot where the upside is 2% and the downside is 40?” Stockman noted that if given a choice between Trump and Clinton, he certainly would not want another Clinton in the White House. Instead, he said America needs a disruptor like Trump to “break the chains of the status quo” and manage the country in a different way than what has been done in the last decade.

Read more …

It’s time this becomes a serious discussion.

• Trump’s ‘Print the Money’ Proposal Echoes Franklin and Lincoln (E. Brown)

“Print the money” has been called crazy talk, but it may be the only sane solution to a $19 trillion federal debt that has doubled in the last 10 years. The solution of Abraham Lincoln and the American colonists can still work today.

“Reckless,” “alarming,” “disastrous,” “swashbuckling,” “playing with fire,” “crazy talk,” “lost in a forest of nonsense”: these are a few of the labels applied by media commentators to Donald Trump’s latest proposal for dealing with the federal debt. On Monday, May 9th, the presumptive Republican presidential candidate said on CNN, “You print the money.”

The remark was in response to a firestorm created the previous week, when Trump was asked if the US should pay its debt in full or possibly negotiate partial repayment. He replied, “I would borrow, knowing that if the economy crashed, you could make a deal.” Commentators took this to mean a default. On May 9, Trump countered that he was misquoted:

People said I want to go and buy debt and default on debt – these people are crazy. This is the United States government. First of all, you never have to default because you print the money, I hate to tell you, okay? So there’s never a default.

That remark wasn’t exactly crazy. It echoed one by former Federal Reserve Chairman Alan Greenspan, who said in 2011:

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

Paying the government’s debts by just issuing the money is as American as apple pie – if you go back far enough. Benjamin Franklin attributed the remarkable growth of the American colonies to this innovative funding solution. Abraham Lincoln revived the colonial system of government-issued money when he endorsed the printing of $450 million in US Notes or “greenbacks” during the Civil War. The greenbacks not only helped the Union win the war but triggered a period of robust national growth and saved the taxpayers about $14 billion in interest payments. But back to Trump. He went on to explain:

I said if we can buy back government debt at a discount – in other words, if interest rates go up and we can buy bonds back at a discount – if we are liquid enough as a country we should do that.

Apparently he was referring to the fact that when interest rates go up, long-term bonds at the lower rate become available on the secondary market at a discount. Anyone who holds the bonds to maturity still gets full value, but many investors want to cash out early and are willing to take less. As explained on MorningStar.com:

If a bond with a 5% coupon and a ten-year maturity is sold on the secondary market today while newly issued ten-year bonds have a 6% coupon, then the 5% bond will sell for $92.56 (par value $100).

Read more …

“..central banks “cannot claim to be out of ammunition because immediately that would create the wrong kind of expectations..”

• India’s Central Bank Governor Warns On Stimulus Overuse (FT)

Central banks and governments of rich countries are running out of ammunition for stimulating their economies, says Raghuram Rajan, the head of the Indian central bank — but they can never admit as much. Speaking to the Financial Times at the University of Chicago Booth School of Business in London, Mr Rajan criticised efforts to use fiscal and monetary policy and infrastructure programmes to boost growth rates in advanced economies. Long a critic of low interest rates in rich countries that can drive hot-money flows to poorer parts of the world, the governor of the Reserve Bank of India suggested that loose policies were also weakening the underlying performance of advanced economies.

Although Mr Rajan said there were limits on stimulus, he said central banks “cannot claim to be out of ammunition because immediately that would create the wrong kind of expectations, so there’s always something up their sleeves”. Mr Rajan said he was a supporter of stimulus policies to “balance things out” over short periods when households or companies were proving excessively cautious with their spending. But eight years after the financial crisis, we “have to ask ourselves is that the real problem?”. “I have this image of stimulus as a bridge,” he said. “As the economy goes down, there is an expectation it will come up. Stimulus is a bridge which smoothes over the growth rate of the economy and prevents damaging expectations from building up.”

If stimulus went on for a long time, if it did not work, he said, the adjustment would be sharp, indicating there was little room for further stimulus. Mr Rajan warned governments not to rely too much on fiscal stimulus through cutting taxes or increasing public spending. “If your debt to GDP is over 100%, [and you] do more fiscal stimulus, you’d better have a pretty high rate of return in mind, otherwise your younger and middle-aged generations are thinking ‘This thing is not going to return enough, but I’m going to have to pay for it’.”

Read more …

Want to know how to bankrupt a society?

• Average Asking Price For UK First-Time Buyer Home Jumps 6.2% In A Month (G.)

The average asking price of a typical first-time buyer home leapt by 6.2% in a month after buy-to-let investors rushed to buy properties before last month’s stamp duty increase, according to figures on Monday. The average for properties coming on to the market in England and Wales with two bedrooms or fewer was £11,298 higher in May than in April, at £194,224, according to data from the property website Rightmove. The figures, based on properties listed during the month, showed that across the UK the average price of a first-time buyer property had risen by 11.4% since May 2015. In hotspots such as Croydon, Dartford and Luton – all towns within easy commuting distance of central London – asking prices were up by more than 18% over the year.

The figures do not include inner-London homes. The website said strong demand from investors keen to buy before the introduction of the surcharge on second homes had caused a “property drought” at the lower end of the market, putting upwards pressure on prices for those homes that were being made available. However, Rightmove’s director, Miles Shipside, said: “It remains to be seen if these prices can be achieved and there may be some over pricing in the market. It is also a reflection of better quality property coming to market in this sector which is now targeting owner-occupiers rather than landlords.”

Read more …

Brilliantly hilarious must read.

• CERN Discovers New Particle Called The FERIR (Steve Keen)

CERN has just announced the discovery of a new particle, called the “FERIR”. This is not a fundamental particle of matter like the Higgs Boson, but an invention of economists. CERN in this instance stands not for the famous particle accelerator straddling the French and Swiss borders, but for an economic research lab at MIT—whose initials are coincidentally the same as those of its far more famous cousin. Despite its relative anonymity, MIT’s CERN is far more important than its physical namesake. The latter merely informs us about the fundamental nature of the universe. MIT’s CERN, on the other hand, shapes our lives today, because the discoveries it makes dramatically affect economic policy.

CERN, which in this case stands for “Crazy Economic Rationalizations for aNomalies”, has discovered many important sub-economic particles in the past, with its most famous discovery to date being the NAIRU, or “Non-Accelerating Inflation Rate of Unemployment”. Today’s newly discovered particle, the FERIR, or “Full Employment Real Interest Rate”, is the anti-particle of the NAIRU. Its existence was first mooted some 30 months ago by Professor Larry Summers at the 2013 IMF Research Conference. The existence of the FERIR was confirmed just this week by CERN’s particle equilibrator, the DSGEin. Asked why the discovery had occurred now, Professor Krugman explained that ever since the GFC (“Global Financial Crisis”), economists had been attempting to understand not only how the GFC happened, but also why its aftermath has been what Professor Summers characterized as “Secular Stagnation”.

Their attempts to understand the GFC continued to fail, until Professor Summers suggested that perhaps the GFC had destroyed the NAIRU, leaving the ZLB (“Zero Lower Bound”) in its place. This could have happened only if there was a mysterious second particle, which was generated when a NAIRU equilibrated with a GFC. Rather than remaining in equilibrium, as sub-economic particles do in DSGEin, NAIRU apparently vanished instantly when the GFC appeared. Something else must have taken its place. DSGEin was unable to help here, since it rapidly returned to equilibrium—while the real world that it was supposed to simulate clearly had not. CERN’s attempts to model this phenomenon in DSGEin were frustrated by the fact that a GFC does not exist inside a DSGEin—in fact, the construction of the DSGEin was predicated on the non-existence of GFCs.

The ever-practical Professor Krugman recently suggested a way to overcome this problem. Why not turn to the real world, where GFCs exist in abundance, and feed one of those into the DSGEin? Unfortunately, the experiment destroyed the DSGEin, since the very existence of a GFC within it put it through an existential crisis. However, before it broke down (while mysteriously singing the first verse of “Daisy, Daisy, give me your answer do”), the value for the NAIRU in DSGEin suddenly turned negative. This led Professor Summers to the conjecture that perhaps there was a negative anti-particle to the NAIRU, which he dubbed the FERIR.

Read more …

It’s all in the eye of the beholder.

• Isn’t it Time to Stop Calling it “The National Debt”? (Steve Roth)

Fourteen. Trillion. Dollars. That’s how much the U.S. government “owes.” You hear that massive number all the time, right? And people are forever telling you that you and your family are on the hook to pay off that scary huge number. There are 125 million U.S. households. You do the arithmetic. The horror. What those scare-mongers don’t tell you, and generally don’t even understand: it actually makes almost no sense to call that figure “the national debt.” And no, you’re not on the hook to pay it back. Imagine this: you’re the queen or king of a sovereign country. You decide to mint and issue a bunch of tin coins that your people will find useful. You use those coins to buy stuff from people in the private sector, and pay them to do work. Voilà, the people have money.

Is your government now in “debt” as a result of that “deficit spending”? Does it have to “pay” something to somebody at some point in the future? Do you have to redeem those coins for wheat or pigs or anything else? Obviously not. There’s just a bunch of money out there that people can use. You’ve made no promise that your treasury will ever redeem those coins for anything. They just circulate. Those government-issued assets, held by the private sector, are only “liabilities” to the government in the most pettifogging accounting sense. If you “owed” some money that you would never, ever have to pay, would you put that on your balance sheet as a liability? Would it be anything beyond a pro forma entry designed to satisfy some obsessive impulse for accounting closure? A debt that will never be paid off is a very questionable “liability.”

That’s essentially the situation with the U.S. national “debt.” The U.S. issues money by deficit spending. It puts more money into private accounts than it takes out via taxes. The private sector has more balance-sheet assets (but no more liabilities, so it has more “net worth,” the balancing item on the righthand side of its balance sheet). The treasury has made no promises to redeem that new money for…anything (except maybe…different government-issued assets). It’s just out there. Now it’s true that the U.S. et al operate under an arguably archaic and purely self-imposed rule: their treasuries are required to issue bonds equal to that deficit spending. This is a straightforward asset swap: the private sector gives checking-account deposits (back) to the government, and the government gives bonds in return.

Private sector assets and net worth are unaffected by that accounting swap; it just changes the private-sector portfolio mix — more bonds, less “cash.” (Treasury “forces” the private sector to make that collective portfolio-adjusting swap through the simple expedient of selling bonds at an attractive price — a point or two below similar deals in the private sector.) The same kind of asset swap happens when the Fed “prints money” for quantitative easing. The private sector gives bonds (back) to the government, and the Fed gives “reserves” in return — deposits in banks’ Fed accounts. Sure, the Fed creates those reserves ab nihilo, but they’re not a money injection into the private sector, like deficit spending. They’re just swapped for bonds. That accounting event doesn’t increase private-sector assets or net worth. It just changes the private-sector portfolio mix (more reserves, less bonds).

In any case, the private sector is holding government-issued assets. Whether they consist of bonds, “cash,” or reserves, is it realistic to call that money originally spent into private accounts a “debt” for the government? Is it in any real sense a government “liability” if it will never be redeemed for anything?

Read more …

Big Oil’s decades of criminal activity come home to roost.

• Forget the Saudis, Nigeria’s the Big Oil Worry (BBG)

Drag your attention away from the Middle East for a moment. While policymakers have been focused on Saudi Arabia’s oil market machinations, what really matters right now is happening 3,000 miles away in the Niger River delta. The country that was, until recently, Africa’s biggest crude producer is slipping back into chaos. A wave of attacks and accidents have hit infrastructure, taking Nigeria’s output down to 20-year lows. Oil prices are responding, rising to their highest in more than six months. Part of this is explained by the IEA lifting demand estimates this week. But taking both things together, it’s easy to doubt whether current oil surpluses are sustainable. With no solution in sight to the problems that beset the delta’s creeks and mangrove swamps, production from onshore and shallow-water oil fields looks vulnerable.

If the latest group of freedom fighters seeks to outdo its predecessors, then deepwater facilities may be at risk too.The Niger Delta Avengers have certainly been busy, forcing Shell’s Forcados terminal to shut in about 250,000 barrels of daily exports; and breaching an offshore Chevron facility in the 160,000 barrels per day Escravos system. In April, ENI had to declare force majeure – letting it stop shipments without breaching contracts – on exports of its Brass River grade after a pipeline fire. It’s hard to see any long-term let-up given Nigeria’s record on fixing this problem. The previous wave of discontent, which hit a peak in 2009, only came to an end when President Yar’Adua offered amnesty, training programs and monthly cash payments to nearly 30,000 militants, at a yearly cost of about $500 million.

Some leaders of the Movement for the Emancipation of the Niger Delta (MEND), the militant group, got lucrative security contracts. But the failure to properly address local grievances means it was only a matter of time before another wave of angry young men took up the fight for a better deal for southern Nigeria. The crisis has been hastened by new president Muhammadu Buhari’s termination of the ex-militants’ security contracts and his seeking the arrest of former MEND leaders. The Avengers now say they want independence for the Niger River delta. And it’s not as if Nigeria’s oil woes are limited to the militants. Exxon had to declare force majeure on Qua Iboe exports after a drilling platform ran aground and ruptured a pipeline, while Shell did similar with Bonny Light exports after a leak from a pipeline feeding the terminal.

Read more …

Beijing will flood in enough money to ‘reach its targets’ while talking about clamping down.

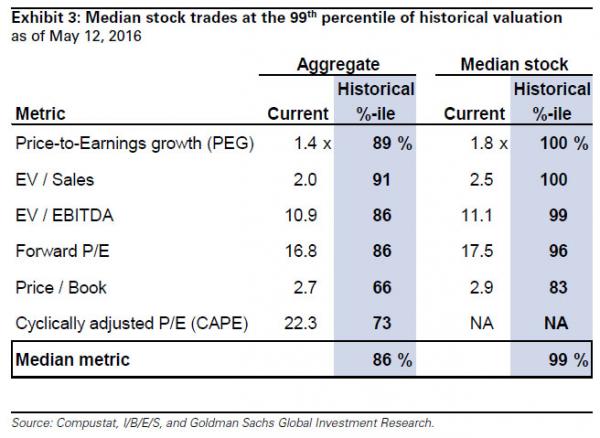

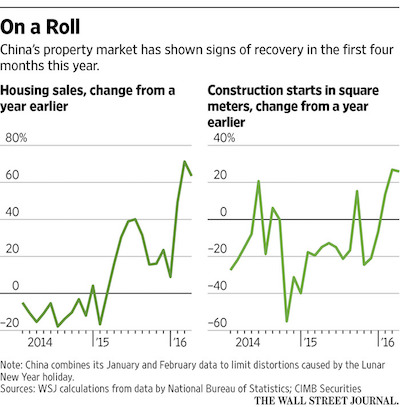

• China Housing Revival Props Up Economy (WSJ)

China’s housing market is showing nascent signs of recovery after a two-year downturn, helping to counter a slowdown in the broader economy but prompting fresh warnings about a buildup of debt. Property prices and sales have risen in recent months, driven by looser lending policies, accompanied by a sustained advance in new construction. That occurred even though China is weighed down by unsold homes with enough square footage to fill seven Manhattan islands. “Property developers’ appetite has returned,” said Xia Qiang, a senior partner at Yi He Capital, which provides loans to property firms. “Just two weeks ago four developers from Fujian and Zhejiang asked if there were any projects they could invest in in Shanghai.”

From January to April, housing sales rose 61.4% to 2.41 trillion yuan ($369 billion) from a year ago, the National Bureau of Statistics said on Saturday. Property investment in the first four months of this year rose 7.2% to 2.54 trillion yuan. Construction starts gained 21.4% to 434.3 million square meters. But the rosy statistics present a quandary for Chinese officials. After engineering a credit-fueled property upturn, Beijing has started tapping the brakes amid concern that it has overshot, economists say. Among the fixes Beijing has imposed are a decrease in bank lending and more purchase restrictions on some of the hottest property markets, including Shanghai and Shenzhen. A column in the official People’s Daily recently criticized debt-fueled growth policies, warning that China faces a “property bubble.”

The zigzag policy reflects China’s tough balancing act in a nation where empty apartment towers ring many smaller cities. It wants to boost the property sector enough to hit its 6.5%-plus growth target for 2016 without making its overcapacity and debt problems too much worse, economists said. “New loans are pouring into the real-estate sector,” said Alicia Garcia-Herrero, economist with investment bank Natixis, part of France’s Groupe BPCE. “But the elephant in the room is credit risk.”

Read more …

This is about money that doesn’t at all want to move back home, no matter how lucrative that may seem.

• China’s Record $26 Billion Buyout Deals at Risk of Unraveling (BBG)

The great retreat of Chinese companies from the U.S. stock market is hitting a snag. Concern last week that Chinese regulators may restrict overseas-traded companies from returning home helped erase more than $5 billion in the market value of firms seeking to do so. Shares of companies from Momo to 21Vianet have plunged at least 20% since May 6 amid speculation that the management-led investor groups may back away from the buyout deals or lower their purchase prices. The selloff marks another twist in the saga of U.S.-listed Chinese companies seeking to go private, lured by the prospect of relisting at higher valuations in Shanghai or Shenzhen. More than 40 have received buyout offers worth at least $35 billion since the beginning of 2015.

About three quarters of the deals are still pending, including Qihoo 360, whose $9.3 billion offer is the largest. The unraveling started on May 6 when the China Securities Regulatory Commission said that it’s studying the impact of companies seeking to relist domestically after withdrawing from overseas. The regulators are concerned the valuations estimated for some domestic backdoor listings are too high and could affect the stability of the stock market, according to the people familiar with matter. Policy makers also want to avoid encouraging more buyouts that could prompt capital outflows, the people said.

Read more …

The one sector Beijing cannot control is the biggest there is. “Pushing on a string” comes to mind. “Interest rates are low, but investment is declining, which shows that the overall market – domestic and overseas market – is not good,” he said.”

• China Private Sector Investment Is Declining (R.)

Xia Xiaokang and Bruno Chen, who both run private-sector companies, are the sort of businessmen that Chinese leaders are increasingly concerned about as economic growth slows. Beijing is counting on the private sector to invest more in the economy and take up the slack as the government tries to engineer a shift away from largely state-run heavy industry to more entrepreneurial and services-led growth. Unfortunately, just when China needs the private sector to step up, they look to be stepping back. “We plan to downsize our business rather than expand,” said Chen, who runs Ningbo Tengsheng Garments Co in the coastal export hub of Zhejiang province in eastern China. “We cannot feel any improvement in the economy,” he said.

Xia, general manager of Wenzhou Kingsdom Sanitary Ware, some 400 km from Shanghai, similarly lacks confidence in the economy. “We have hardly made any fixed-asset investment since last year and we now plan to rent out part of our factory building because it’s too big,” he said. After March data suggested that economic activity was finally picking up after a long slowdown, April figures released at the weekend suggested otherwise. Overall investment, factory output and retail sales all grew more slowly than expected. Private-sector investment for January to April grew just 5.2%, its weakest pace since the National Bureau of Statistics (NBS) started recording the data in 2012. More worrying, private-sector investment is decelerating sharply from rates near 25% in 2013, to just 10% last year and now just over 5%.

Read more …

Damn the torpedoes!

• China’s Record Daily Steel Output Bodes Ill for Global Industry (BBG)

China’s record daily steel output in April bodes ill for an embattled global steel industry already reeling from a deluge of exports from the world’s top producer. Crude steel output over the month rose 0.5% to 69.42 million metric tons from a year earlier, the National Bureau of Statistics said on Saturday. The gains came after mills ramped up production to take advantage of a spurt higher in prices that has given them the best profits this decade. While below March’s record monthly figure of 70.65 million tons, the daily rate of 2.314 million tons was higher due to fewer producing days and surpassed the previous best set in June 2014. “Given how high margins went, we’ve been expecting to see a supply response like this,” Ian Roper at Macquarie said in a WeChat message. “Chinese mills will likely look back to the export market as domestic oversupply reappears.”

China’s overseas sales in the first four months were already running 7.6% higher than a year earlier, piling on the pressure after the nation shipped a record 112 million tons in 2015. Output remaining at such elevated levels “definitely adds to oversupply risks and exports may continue to rise,” said Helen Lau, Hong Kong-based analyst at Argonaut Securities. In a sign that China is recommitting to the reform of its bloated state sector, its top producer, Hebei Iron & Steel, said Friday it’ll cut 5.02 million tons of capacity. That still leaves a way to go. Japan’s biggest mill, Nippon Steel & Sumitomo Metal, also said Friday that it would take control of a smaller domestic steelmaker in a bid to weather a “rapid deterioration of the business environment” caused in part by overcapacity in China of some 400 million tons.

Read more …

It’s all so sad it’s funny.

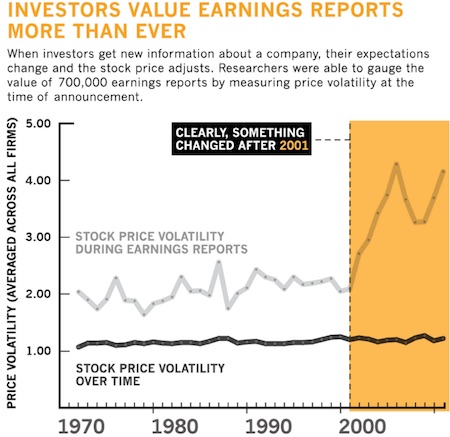

• How Investors Are Duped Each Earnings Season (MW)

A year ago, we explained the many ways companies make reading their quarterly earnings reports a miserable task. We weren’t just whining. We wanted to remind companies that our readers regularly tell us they struggle to understand earnings announcements, and our job is to decode them for investors. Making that difficult isn’t helping anyone. We noted that some of their tactics – inventing or manipulating numbers, using meaningless jargon, distributing lame executive quotes, and more — can be outright damaging, eroding investor trust and creating skepticism. We hoped they’d change their ways. We’re sorry to say that today, as another earnings season draws to a close, things are even worse.

“Companies are definitely less transparent than they used to be,” said Leigh Drogen, founder and chief executive of Estimize, which crowdsources earnings estimates. They are “using accounting schemes that are more specific to … how they want investors to perceive their results.” Earnings are a crucial quarterly update for investors, as they provide the “best unbiased” view of what’s going on with companies, sectors and the economy, said Karyn Cavanaugh, senior market strategist at Voya Investment Management. “Earnings discount all the noise,” she said. But today, according to FactSet, more than 90% of S&P 500 companies use their own metrics in an attempt to make their numbers look better. Some conceal revenue and other key numbers in hard-to-access tables.

And a recent NYSE rule change has led some companies to report very early in the morning and pushed others to join the posse reporting after the closing bell, creating bottlenecks. While all this has meant more stress for reporters and analysts, it’s also made things harder for everyday investors trying to do due diligence on the companies they own. Experts say more companies seem to be breaking the most fundamental pact they have with their co-owners: to keep them informed of the true state of their business. “It’s a holographic presentation bubble distorting underlying operational reality,” said analyst Nicholas Heymann at William Blair. “Companies are working all the angles.”

Read more …

What you get when decision makers don’t understand their fields.

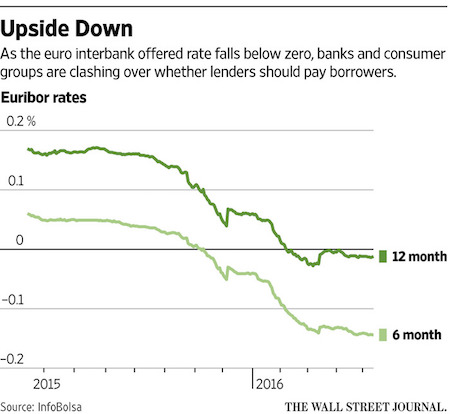

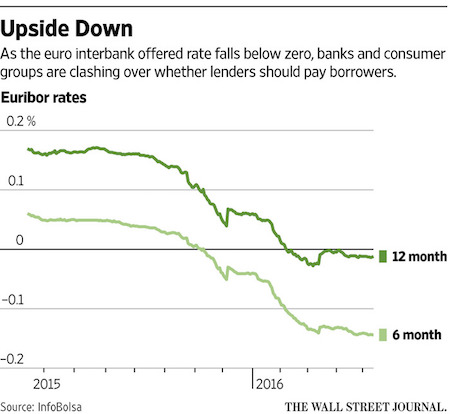

• Battle Brews in Spain, Portugal Over Negative Mortgage Rates (WSJ)

As interest rates in Europe fall near or below zero, lawmakers and consumer advocates in Spain and Portugal are attacking an ancient tenet of finance by insisting that lenders can owe money to borrowers. Banks in the two countries, struggling to recover from recessions that shook their financial systems, are fighting back, with billions of dollars in mortgage interest payments potentially at stake. Portugal’s central-bank governor, in a reversal, has rushed to defend the banks against a proposed law that would require them to pay borrowers when interest rates turn negative. Banks in both countries are rewriting new mortgage contracts to warn homeowners that they could never profit from subzero rates.

In Spain and Portugal, banks typically tie interest rates on mortgages to the euro interbank offered rate, or Euribor, a fluctuating rate banks pay to borrow from each other. In addition, interest rates in both countries include a fixed percentage of the loan, called the spread. In much of Europe, by contrast, fixed mortgage rates are common. Euribor began turning negative last year after the ECB cut interest rates below zero—charging lenders to hold deposits—to stimulate the Continent’s economies. That has pulled mortgage rates into negative territory in a few isolated cases in Portugal.

The vast majority of Spanish and Portuguese mortgage holders still pay interest, because Euribor hasn’t dropped enough to wipe out the spreads. But while lenders consider further steep drops unlikely, they are taking steps to protect themselves just in case. Europe already has a precedent: Banks in Denmark are paying thousands of borrowers interest on their home loans, nearly four years after the central bank introduced negative interest rates. Danish banks have increased some fees to compensate but never mounted serious legal objections. In Spain and Portugal, bank executives said they would pay borrowers when pigs fly.

Read more …

Europeans have established the ultimate NIMBY.

Another EU plan that goes predictably off track. “Brussels wants to see group returns but Greece is looking at applications for asylum on a case-by-case basis.”

• Refugee Numbers Returned To Turkey Fall Short Of EU Expectations (FT)

The number of migrants being sent back to Turkey from Greece has fallen well short of EU expectations, prompting fears that a fresh wave of arrivals could overwhelm the Aegean Islands during this summer. Fewer than 400 of the 8,500 people who have arrived on the Greek islands since the March 20 EU deal with Ankara — aimed at reducing migrant flows — have been returned to Turkey, according to figures from the Greek government’s migration co-ordination unit. Instead, Athens has approved more than 30% of the 600 asylum applications from Syrians that have been assessed since March 20, a significantly higher percentage than anticipated, according to European officials and aid workers. While the slow pace of returns will irk many in Brussels, Greek officials say it reflects their own policy on asylum requests.

They dismiss fears that the deal between the EU and Turkey could collapse if the trend continues – leading to a fresh influx – and stress that Greece’s migration laws do not recognise Turkey as a safe third country for refugees. Maria Stavropoulou, a former UN official who heads the Greek asylum service, said: “We fully understand the [EU] concerns but if you look at it from the perspective of the rule of law, it is going exactly as it should. “We have many vulnerable people on the islands … a lot of very sick people. By law they are exempt from the return process.” Epaminondas Farmakis of Solidarity Now, a refugee charity funded by the billionaire investor George Soros, said: “Brussels wants to see group returns but Greece is looking at applications for asylum on a case-by-case basis.”

Read more …