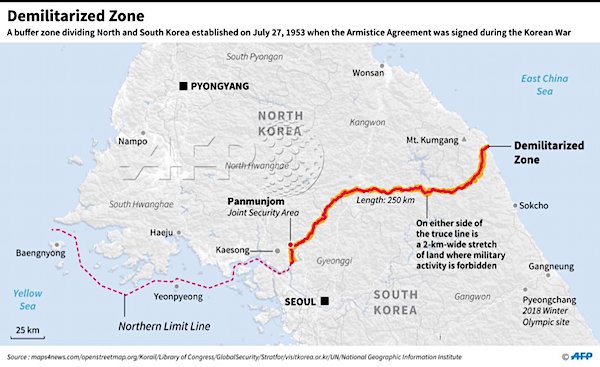

Big moment no matter what. The situation at the DMZ has changed a lot in the past year. It’s like the DMZ has been dimilitarized. Far fewer weapons, guards don’t even wear helmets anymore.

• Trump Invites Kim Jong-Un to the White House (BI)

Donald Trump has invited Kim Jong Un to the White House, after he became the first serving American President to step over the North Korean border and shake hands with a North Korean leader. Trump crossed over from the demilitarized zone to shake hands with Kim Jong Un, after earlier offering the meeting on Twitter. “When I put out the social media notification, if he didn’t show up he would have made me look very bad,” Trump told reporters. Kim Jong Un responded that “I was very surprised to hear about your offer on the tweet and only late in the afternoon I was able to confirm your invitation.”

The US president described his relationship with the North Korean leader as a “great friendship.” “This was a special moment, a historic moment,” Trump told reporters. “Stepping across that line was a great honour. A lot of progress has been made and a lot of friendships have been made and this in particular is a great friendship.” Following their handshake, the two men took part in a press conference during which the US president confirmed that he was extending an invite to Kim Jong Un to the White House. Trump thanked Kim Jong Un for meeting him. “I want to thank the chairman. You’ve got to hear that powerful voice.”

But at least talks are back on.

• China Warns Of Long Road Ahead For Deal With US After Ice-Breaking Talks (R.)

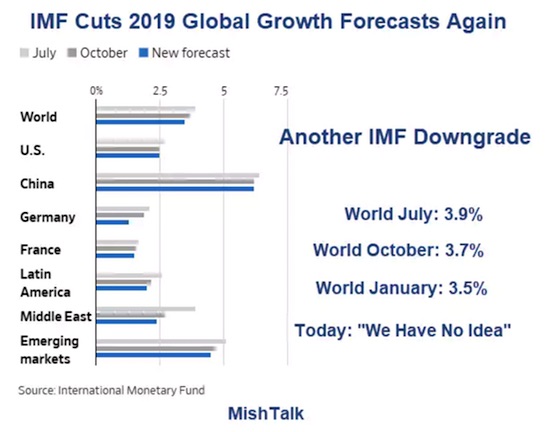

China and the United States will face a long road before they can reach a deal to end their bitter trade war, with more fights ahead likely, Chinese state media said after the two countries’ presidents held ice-breaking talks in Japan. The world’s two largest economies are in the midst of a bitter trade war, which has seen them level increasingly severe tariffs on each other’s imports. In a sign of significant progress in relations on Saturday, Chinese President Xi Jinping and U.S. President Donald Trump, on the sidelines of the G20 summit in Osaka, agreed to a ceasefire and a return to talks.

However, the official China Daily, an English-language daily often used by Beijing to put its message out to the rest of the world, warned while there was now a greater likelihood of reaching an agreement, there’s no guarantee there would be one. “Even though Washington agreed to postpone levying additional tariffs on Chinese goods to make way for negotiations, and Trump even hinted at putting off decisions on Huawei until the end of negotiations, things are still very much up in the air,” it said in an editorial late Saturday. “Agreement on 90 percent of the issues has proved not to be enough, and with the remaining 10 percent where their fundamental differences reside, it is not going to be easy to reach a 100-percent consensus, since at this point, they remain widely apart even on the conceptual level.”

What else could they do?

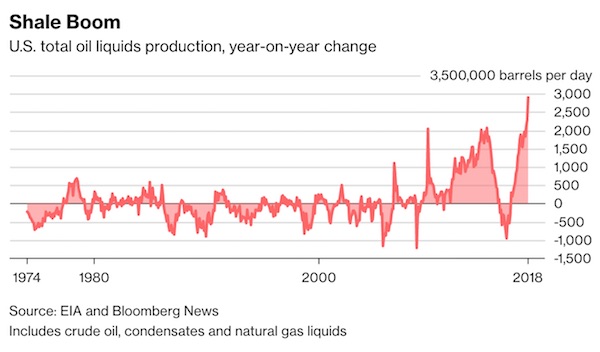

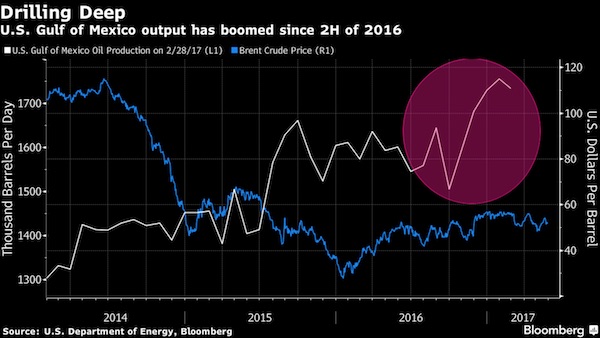

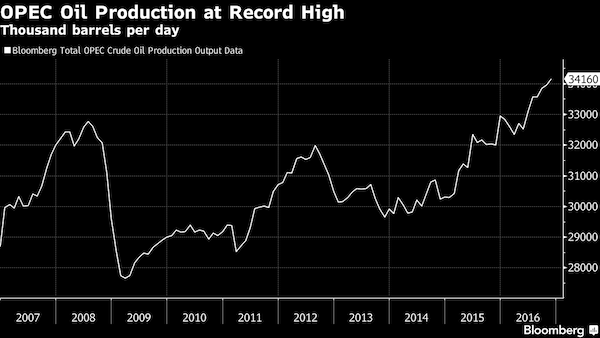

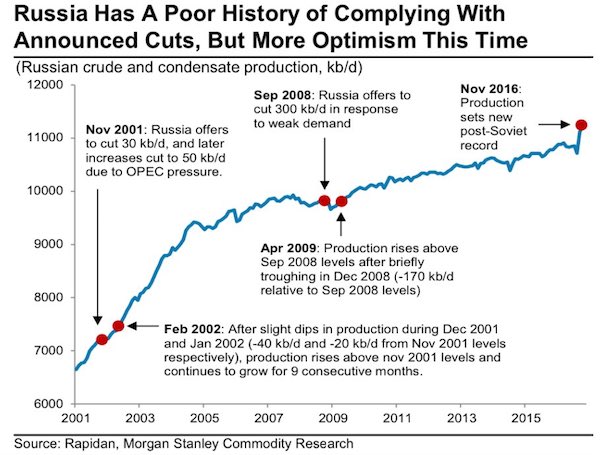

• Russia and Saudi Arabia Agree To Extend OPEC Oil Output Cuts Into 2020 (MW)

Russia and Saudi Arabia have agreed to extend the OPEC oil production cuts deal by another six to nine months, Russian President Vladimir Putin said at the G-20 leaders summit in Japan on Saturday. The OPEC+ group — the Organization of the Petroleum Exporting Countries, plus Russia and other producers — meet on July 1-2 to renegotiate the pact which expires June 30. In 2016, Saudi Arabia and Russia agreed to try to jointly manage global oil output to support prices in what became known as the OPEC+ coalition and the current deal called for production cuts of 1.2 million barrels a day. “We will support the extension, both Russia and Saudi Arabia,” Putin said at a news conference in Osaka, Reuters reported.

“As far as the length of the extension is concerned, we have yet to decide whether it will be six or nine months. Maybe it will be nine months,” said Putin said, who met the crown prince on the sidelines of the G-20 summit in Osaka, Japan. “In any event we will support the continuation of agreements, both Russia and Saudi Arabia, in the volumes previously agreed.” The announcement marks the first time a leader from the OPEC+ group has indicated the curbs could be needed into 2020. That reflects a gloomy outlook for oil demand next year due to a combination of slowing global economic growth and rising U.S. shale oil output.

“For 34 years I lived behind the Iron Curtain so I know only too well what it means once borders vanish, once walls fall.”

• Johnson And Hunt Don’t Understand What It’s Like When A Wall Falls (G.)

Perhaps it is a problem of language. The dictionary lacks a necessary word: UKish. Northern Ireland is not in Britain but it is in the UK. The porous boundary that divides it from the rest of Ireland is not, strictly speaking, a British frontier. So it is called “the Irish border”, making it, for the Brexiters, someone else’s problem. The terrain where a post-Brexit UK meets the remaining 27-member EU bloc is, as the miserable Tory leadership debate shows yet again, somewhere over there. For Boris Johnson and Jeremy Hunt, its troubles are, as Neville Chamberlain might put it, “a quarrel in a faraway country between people of whom we know nothing”. They might have to know more about it if only we could call it what it is: the UKish border.

Hunt and Johnson both agree that a no-deal Brexit must be kept alive as a serious proposition. Both also agree that once in Downing Street they will reopen negotiations with the EU with the primary aim of ditching from the withdrawal agreement the so-called Irish backstop, which is also, of course, the UKish backstop. Hunt puts this in more emollient terms than Johnson, but makes up for this weakness by promising to include on his negotiating team representatives of the famously emollient Democratic Unionist party, which does not represent most voters in Northern Ireland. All of this is so drearily familiar (this hobbyhorse comes round and round on the non-stop Brexit carousel) that it is hard to remember how surreal it is.

It is weird not just because the backstop was designed around British demands; not just because Hunt and Johnson were in the cabinet when it was negotiated; not just because they both voted for it in parliament; and not just because the EU has repeated, over and over, that, in the words of the European council in January: “The backstop is part of the withdrawal agreement and the withdrawal agreement is not open for renegotiation.” That should be enough to be going on with, but there is an even deeper absurdity. On 4 April last, the German chancellor, Angela Merkel, flew to Dublin [..] she said: “For 34 years I lived behind the Iron Curtain so I know only too well what it means once borders vanish, once walls fall.”

Crazy enough that these two people are mentioned in the same sentence.

• The Extradition Cases of Pinochet & Assange (Vos)

In October 1998, Pinochet, whose regime became a byword for political killings, “disappearances” and torture, was arrested in London while there for medical treatment. A judge in Madrid, Baltasar Garzón, sought his extradition in connection with the deaths of Spanish citizens in Chile. Citing the aging Pinochet’s inability to stand trial, the United Kingdom in 2000 ultimately prevented him from being extradited to Spain where he would have faced prosecution for human rights abuses. At an early point in the proceedings, Pinochet’s lawyer, Clare Montgomery, made an argument in his defense that had nothing to do with age or poor health.

“States and the organs of state, including heads of state and former heads of state, are entitled to absolute immunity from criminal proceedings in the national courts of other countries,” the Guardian quoted Montgomery as saying. She argued that crimes against humanity should be narrowly defined within the context of international warfare, as the BBC reported. Montgomery’s immunity argument was overturned by the House of Lords. But the extradition court ruled that the poor health of Pinochet, a friend of former Prime Minister Margaret Thatcher, would prevent him from being sent to Spain. Though the cases of Pinochet and Assange are separated by more than two decades, two of the participants are the same, this time playing very different roles.

Montgomery reappeared in the Assange case to argue on behalf of a Swedish prosecutor’s right to seek a European arrest warrant for Assange. Her argument ultimately failed. A Swedish court recently denied the European arrest warrant. But as in the Pinochet case, Montgomery helped buy time, this time allowing Swedish sexual allegations to persist and muddy Assange’s reputation. Garzón, the Spanish judge, who had requested Pinochet’s extradition, also reappears in Assange’s case. He is a well-known defender of human rights, “viewed by many as Spain’s most courageous legal watchdog and the scourge of bent politicians and drug warlords the world over,” as the The Independent described him a few years ago. He now leads Assange’s legal team.

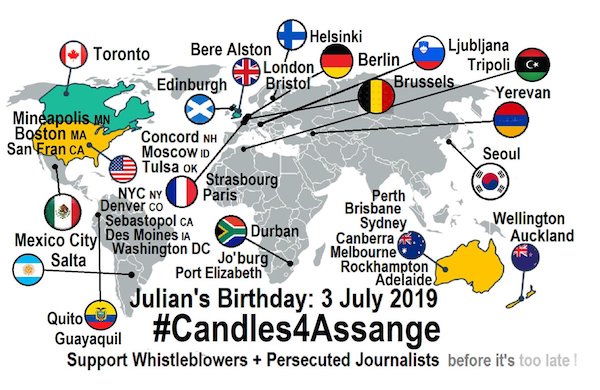

Melzer is not planning to let go. Now where’s his support?

“When you start exposing an isolated individual who can’t defend himself to a sustained campaign of humiliation, of shame, of ridicule, even death threats, then it can cause severe psychological trauma.”

• UN Torture Rapporteur About Op-Ed On Assange Rejected By MSM (RT)

The UN rapporteur on torture told RT about the fanciful excuses Western media used to avoid publishing his damning op-ed on the extreme pressure Julian Assange was exposed to – despite covering every wild allegation against him. A host of reputed Western media outlets turned a deaf ear to Nils Melzer and his op-ed in which he said Julian Assange was exposed to enormous psychological trauma and isolation while in the Ecuadorian Embassy, and afterwards in the UK high-security prison. “Some of them said it wasn’t high enough on their news agenda, some of them said it wasn’t within their core area of interest.”

“The explanations seem awkward given that the same newspapers – the Guardian, the Times, the Washington Post, the Telegraph, and others – have been running news stories about Assange “when it was about his cat and his skateboard and… allegations that he smeared excrement on the walls.” “But when you have a serious piece that actually tries to de-mask this public narrative and to actually show the facts below it, then they’re not interested.”

In his piece, which was eventually published on blogging website Medium, Melzer admitted he “had been blinded by propaganda” and didn’t believe Assange was being dehumanized through isolation, ridicule, and shame. He even asked himself how could “life in an Embassy with a cat and a skateboard ever amount to torture.” “I didn’t know Assange, so I took with me experienced medical experts, a psychiatrist and a forensic expert that have worked for decades in examining torture victims,” he told RT. These experts, he said, found that Assange showed “all the symptoms that are typical for a person who has been exposed to prolonged psychological torture.”

He has been exposed to public mobbing. Now, that’s the slippery slope… When you start exposing an isolated individual who can’t defend himself to a sustained campaign of humiliation, of shame, of ridicule, even death threats, then it can cause severe psychological trauma.

Criminal investigation next.

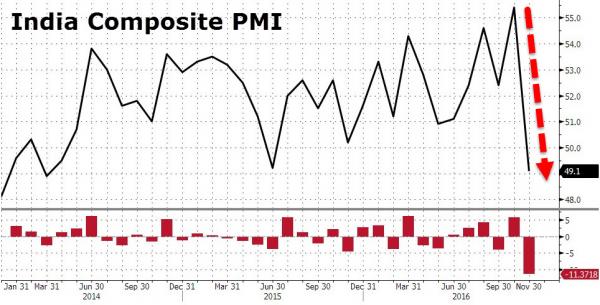

• Boeing Outsourced Its 737 MAX Software To $9-Per-Hour Engineers (ZH)

The software at the heart of the Boeing 737 MAX crisis was developed at a time when the company was laying off experienced engineers and replacing them with temporary workers making as little as $9 per hour, according to Bloomberg. In an effort to cut costs, Boeing was relying on subcontractors making paltry wages to develop and test its software. Often times, these subcontractors would be from countries lacking a deep background in aerospace, like India. Boeing had recent college graduates working for Indian software developer HCL Technologies Ltd. in a building across from Seattle’s Boeing Field, in flight test groups supporting the MAX. The coders from HCL designed to specifications set by Boeing but, according to Mark Rabin, a former Boeing software engineer, “it was controversial because it was far less efficient than Boeing engineers just writing the code.”

Rabin said: “…it took many rounds going back and forth because the code was not done correctly.” In addition to cutting costs, the hiring of Indian companies may have landed Boeing orders for the Indian military and commercial aircraft, like a $22 billion order received in January 2017. That order included 100 737 MAX 8 jets and was Boeing’s largest order ever from an Indian airline. India traditionally orders from Airbus. HCL engineers helped develop and test the 737 MAX’s flight display software while employees from another Indian company, Cyient Ltd, handled the software for flight test equipment. In 2011, Boeing named Cyient, then known as Infotech, to a list of its “suppliers of the year”. One HCL employee posted online: “Provided quick workaround to resolve production issue which resulted in not delaying flight test of 737-Max (delay in each flight test will cost very big amount for Boeing).”

Does Merkel really want to risk things getting worse?

• Deutsche Bank’s Medieval Medicine (Coppola)

If there is one thing that Deutsche Bank executives agree on, it is the efficacy of medieval medicine. Bloodletting, to be precise. Successive Chief Executives have bled the patient, but it hasn’t recovered: profits remain disappointing, and the share price has continued to decline. So the latest incumbent is going to bleed it again – on a much larger scale. On Friday, June 28, the Wall Street Journal revealed plans to slash up to 20,000 jobs worldwide. This would reduce full-time headcount to just over 70,000, the lowest since the financial crisis. The WSJ says the staff cuts will fall “across all divisions and business lines.” But the largest cuts are expected to fall on the investment bank and the troubled U.S. arm. Deutsche Bank has been trying – and largely failing – to reduce its staff costs for years.

It may surprise people to learn that despite repeated cuts, Deutsche Bank’s headcount is significantly higher than it was in 2008. This is mainly due to the acquisition of PostBank in 2010, which added 18,000 employees. Back in 2016, Deutsche Bank announced plans to cut its headcount to 77,000, largely through disposing of PostBank. But when the PostBank disposal evaporated, so too did the headcount reductions. The bank now intends to integrate PostBank with its own retail bank, and says this will achieve “synergies” (i.e. cost savings). Presumably that will mean headcount reductions, though it is not clear whether these are included in the plans leaked to the WSJ.

But there has also been a gradual increase in headcount in other divisions, notably the investment bank. Frankly, given the bank’s awful performance in recent years, it is hard to see what benefit this has brought. It looks suspiciously like empire-building to me. Or perhaps gambling. “Recruit some star performers, they’ll soon turn this business round….” [..] Deutsche Bank’s high cost-income ratio isn’t caused by clerks in retail branches. No, it is due to the insanely high salaries and bonuses Deutsche Bank pays to traders and analysts in its investment bank. And above all, it is due to executive management’s head-in-the-sand attitude to business lines in terminal decline. In 2016, despite glaringly poor performance in its equities division, Deutsche Bank recruited more equities analysts. Now, it appears to be intending to sack them all.

Larry Sanger is a co-founder of Wikipedia. This is a very detailed declaration.

• Declaration of Digital Independence (Sanger)

Humanity has been contemptuously used by vast digital empires. Thus it is now necessary to replace these empires with decentralized networks of independent individuals, as in the first decades of the Internet. As our participation has been voluntary, no one doubts our right to take this step. But if we are to persuade as many people as possible to join together and make reformed networks possible, we should declare our reasons for wanting to replace the old. We declare that we have unalienable digital rights, rights that define how information that we individually own may or may not be treated by others, and that among these rights are free speech, privacy, and security.

Since the proprietary, centralized architecture of the Internet at present has induced most of us to abandon these rights, however reluctantly or cynically, we ought to demand a new system that respects them properly. The difficulty and divisiveness of wholesale reform means that this task is not to be undertaken lightly. For years we have approved of and even celebrated enterprise as it has profited from our communication and labor without compensation to us. But it has become abundantly clear more recently that a callous, secretive, controlling, and exploitative animus guides the centralized networks of the Internet and the corporations behind them. The long train of abuses we have suffered makes it our right, even our duty, to replace the old networks. To show what train of abuses we have suffered at the hands of these giant corporations, let these facts be submitted to a candid world.

The international Law of the Sea makes it obligatory to rescue people in peril. Salvini is breaking that law.

• Italian Police Arrest Migrant-Rescue Ship Captain After Docking (R.)

Italian police arrested on Saturday the German captain of a migrant-rescue ship at the center of a standoff with the Italian government, after she docked at the island port of Lampedusa. The Dutch-flagged Sea-Watch 3, operated by German charity Sea-Watch, has been at sea for more than two weeks with rescued Africans on board. After waiting in international waters for an invitation from Italy or an EU state to accept the ship, German captain Carola Rackete decided this week to sail for the southern Italian island of Lampedusa but was blocked by Italian government vessels. The ship eventually entered the port in the early hours of Saturday morning amid a heavy police presence.

Live television video showed the 31-year-old Rackete being taken off Sea-Watch 3 by tax police and driven away amid applause and barracking from bystanders gathered at the port. She has been arrested for “resisting a war ship”, a charge which, according to media reports, carries a penalty of up to 10 years in prison. After Rackete was taken away, 40 Africans on board the ship were allowed to disembark and were taken to a reception center on the island. Italy’s right-wing interior minister, Matteo Salvini, who is taking a tough line against migrant rescue ships, previously said he would only allow Rackete to dock when other European Union states agree to immediately take the migrants. “Outlaw arrested. Pirate ship seized. Big fine on foreign NGO. Migrants all redistributed in other European countries. Mission completed,” Salvini said in a tweet on Saturday.

Suicide. Or murder, since it’s about babies.

• Spike In Autism Linked To Preservative In Processed Foods (F.)

Researchers from the University of Central Florida (UCF) just announced intriguing findings which describe cellular changes that develop when neuronal stem cells are exposed to elevated levels of a chemical typically found in processed foods. The study serves as an example of the importance of the food pregnant women eat, and how it may potentially affect development of the fetal brain. The study describes how elevated levels of the preservative, propionic acid (PPA)–used to extend shelf life and reduce mold in packaged foods, breads and cheeses—can adversely affect the development and differentiation of neurons in fetal brains in children with autism spectrum disorder (ASD).

From clinical experience, healthcare providers have observed for many decades how children with ASD are often afflicted with gastrointestinal ailments, including chronic constipation and irritable bowel syndrome (IBS). The mechanism behind this association is unclear, but ongoing research suggests that the gut microbiome plays an important role in brain development. One of the key questions is how the gut microbiome–the bacteria that live in our intestines–may be unique in those with ASD compared to those without the condition. Previous studies have demonstrated increased levels of PPA, a short chain fatty acid (SCFA), in the feces of children with ASD; we also know that the gut microbiome in these children is also quite distinct in terms of the type of bacteria that inhabit their intestines.

Clostridia, Bacteriodetes, and Desulfovibrio bacteria are unique to patients with ASD. What’s interesting is that these bacteria are also known to be fermenters of carbohydrates that produce PPA, and other SCFAs as well. Ironically, while PPA is the most common compound produced by bacteria in ASD patients, it is also widely used in the food industry as a preservative due to its ability to inhibit growth of fungi (mold). In the current study, Saleh Naser, PhD and her team at UCF found that when neural stem cells were exposed to high levels of PPA, the neurons incurred multiple changes resulting in cellular damage and inflammation.

One of the major effects of PPA they noted was the overproduction of glial cells , the protective outer cells making up the sheath covering neurons, with a corresponding reduction in the number of neurons themselves. An excess of glial cells may disrupt the connectivity between the neurons and induce inflammation, a common finding in the brains of children with ASD. While prior studies have suggested the role of genetic factors and environmental influence in ASD, this study, according to the authors, is the first to note a molecular link from elevated levels of PPA, overproduction of glial cells, disruption of neural connections and autism.

Wednesday is Julian’s birthday.