Henri Rousseau The sleeping gypsy 1897

The folly of our times. The Fed has completely destroyed America’s market system, and thus its economy, and they are treated as wise men. There are no markets left, there are no pensions left, there’s only the Fed.

• A Fed Pivot, Born Of Volatility, Missteps, And New Economic Reality (R.)

The Federal Reserve’s promise in January to be “patient” about further interest rate hikes, putting a three-year-old process of policy tightening on hold, calmed markets after weeks of turmoil that wiped out trillions of dollars of household wealth. But interviews with more than half a dozen policymakers and others close to the process suggest it also marked a more fundamental shift that could define Chairman Jerome Powell’s tenure as the point where the Fed first fully embraced a world of stubbornly weak inflation, perennially slower growth and permanently lower interest rates. Along with Powell’s public comments, Fed minutes, and other documents, the picture emerges of a central bank edging towards a period of potentially difficult change as it reviews how to do business in light of that new reality.

[..] Concern that years of solid economic growth and falling unemployment would inevitably rekindle inflation or threaten financial stability have been a staple of Fed debates, but had largely disappeared by the Fed’s Dec. 18-19 meeting, according to a review of Fed meeting minutes and officials’ public statements. It was a conclusion hiding in plain sight. After a year when the Trump administration pumped around $1.5 trillion of tax cuts and public spending into a full employment economy, the Fed in 2018 would miss its 2 percent inflation target yet again.

“I hate to say we were right,” Dallas Federal Reserve president Robert Kaplan told reporters on Jan. 15 in Dallas. “But we have been warning for quite some time that…the structure of the economy has changed dramatically.” Technological innovation, globalization, and the Fed’s commitment to its inflation target all held down prices, and “those forces are powerful and they are accelerating,” he said.

Dave Stockman, too, keeps referring to markets. Stop it. A market has a definition, a function, based one-on-one on price discovery. And that simply ceased to exist.

• Get Out Of The Bond And Stock Market, Put Your Money In Cash – Stockman (MW)

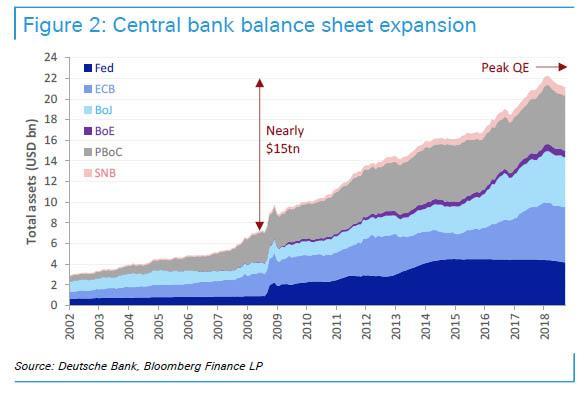

[..] thus far the market has bounded higher after shaking off a withering decline toward the end of 2018 that culminated in the worst Christmas Eve drop on record. The Dow Jones Industrial Average is up 19.4% since that time, breaking above a psychologically significant at 26,000 level on Friday, while the S&P 500 has advanced 19.5%, the Nasdaq Composite has risen 22.4% and the small-capitalization focused Russell 2000 index has returned more than 25%, according to FactSet data. Much of that gain has been underpinned by a Fed that has signaled that it is likely to slow a reduction of its $4 trillion balance sheet as soon as this year and a willingness to wait before increasing borrowing costs further. Both of those plans had been cited as a source of friction for markets.

However, Stockman has said a yawning deficit and an economic expansion in the U.S. that is making history for its length are signs that a reckoning my be at hand. He says easy-money days cannot last and has ramifications for all, arguing that the Fed must normalize its policy, at some point: “My point is, it’s finally catching up with us. We’ve gotten by with this for 30 years ‘cause the Fed has been monetizing the debt — buying bonds hand over fist. When Greenspan arrived, the balance sheet of the Fed was $200 billion; at the peak it was $4.5 trillion,” he told Cavuto, referring to former Fed boss Alan Greenspan. “We need to wake up and smell the roses here. We’re in year 10 of the longest business expansion in history.

We’re increasing the deficit at the very wrong time. They say it’s $900 billion this year it’ll be $1.2 trillion of borrowing at the same time that the Fed is beginning to shrink its balance sheet, which means they’ll be dumping bonds into the market,” he said.

All that new debt and still pension systems are being fully gutted.

• Global Sovereign Debt Will Top $50 Trillion This Year (ZH)

It has been one week since the US Treasury revealed that the national debt had topped $22 trillion (only 11 months after it had topped the $21 trillion threshold). And as the US budget deficit shows no signs of shrinking thanks to the Trump tax cuts and the death of the Obama-era budget sequester that has allowed for an expansion of federal spending (with more presumably on the way once the Trump infrastructure plan comes into focus), S&P warned on Thursday that worldwide sovereign debt could reach $50 trillion this year. According to Reuters, S&P predicted that governments will borrow some $7.78 trillion this year, up 3.2% since 2018 (the US will constitute more than $1 trillion of that all by itself). That’s a 6% increase in the total debt pile from the year before.

Most of this borrowing will be rolling over long-term debt. “Some 70 percent, or $5.5 trillion, of sovereigns’ gross borrowing will be to refinance maturing long-term debt, resulting in an estimated net borrowing requirement of about $2.3 trillion, or 2.6 percent of the GDP of rated sovereigns,” said S&P Global Ratings credit analyst Karen Vartapetov. Governments, like corporations and individuals, took advantage of low interest rates around the world to step up borrowing in the wake of the financial crisis. Now, with borrowing costs expected to rise, these long-term burdens will become more burdensome to service. And with central banks slowly beginning to allow their inflated balance sheets to run off…

No collusion.

• Mueller Won’t Deliver Report To DOJ Next Week (Hill)

Special counsel Robert Mueller will not deliver his report to the Justice Department on Friday or next week, a Justice Department official told The Hill. The news comes amid broad speculation that Mueller’s probe into Russia’s electoral interference is wrapping up, with several news outlets reporting Wednesday that newly confirmed Attorney General William Barr was preparing to receive Mueller’s final report as soon as next week. The highly anticipated report is expected to cap off a sprawling, nearly two-year investigation into Russia’s attempts to meddle in the 2016 presidential election, a probe that has ensnared multiple former Trump campaign officials and associates.

Next week is already slated to be a busy week in Washington, with former longtime Trump lawyer Michael Cohen appearing for testimony on Capitol Hill and several other major hearings and votes set to take place. President Trump is also slated to travel to Vietnam next week for his second summit with North Korean leader Kim Jong Un, which is scheduled for Wednesday and Thursday. It remains unclear when Mueller will ultimately wrap up and submit his final documentation, though Friday’s news indicates the end of the investigation is at least a week away.

Mueller has been investigating Russian interference and potential coordination between the Trump campaign and Moscow since May 2017, weathering constant attacks from Trump, who views the investigation as a “witch hunt” and has long denied allegations of collusion between his campaign and the Kremlin. In the course of his investigation, Mueller has unveiled charges against more than two dozen Russians for hacking Democratic emails and committing fraud in an elaborate plot to use social media to meddle in the election. The special counsel has also charged six Trump associates with making false statements, illegal foreign lobbying, financial violations and other crimes. However, none of the charges have alleged a conspiracy between the campaign and the Russians to interfere in the election.

“No acknowledgment that Mr. Schiff & Co. for years have pushed fake stories that accused innocent men and women of being Russian agents. No relieved hope that the country might finally put this behind us. Just a smooth transition—using Russia as a hook—into Mr. Trump’s finances. Mueller who?”

• Schiffting to Phase 2 of Collusion (Strassel)

There’s been no more reliable regurgitator of fantastical Trump-Russia collusion theories than Democratic Rep. Adam Schiff. So when the House Intelligence Committee chairman sits down to describe a “new phase” of the Trump investigation, pay attention. These are the fever swamps into which we will descend after Robert Mueller’s probe. The collusionists need a “new phase” as signs grow that the special counsel won’t help realize their reveries of a Donald Trump takedown. They had said Mr. Mueller would provide all the answers. Now that it seems they won’t like his answers, Democrats and media insist that any report will likely prove “anticlimactic” and “inconclusive.” “This is merely the end of Chapter 1,” said Renato Mariotti, a CNN legal “analyst.”

Mr. Schiff turned this week to a dependable scribe—the Washington Post’s David Ignatius—to lay out the next chapter of the penny dreadful. Mr. Ignatius was the original conduit for the leak about former national security adviser Mike Flynn’s conversations with a Russian ambassador, and the far-fetched claims that Mr. Flynn had violated the Logan Act of 1799. Mr. Schiff has now dictated to Mr. Ignatius a whole new collusion theory. Forget Carter Page, Paul Manafort, George Papadopoulos—whoever. The real Trump-Russia canoodling rests in “Trump’s finances.” The future president was “doing business with Russia” and “seeking Kremlin help.”

So, no apologies. No acknowledgment that Mr. Schiff & Co. for years have pushed fake stories that accused innocent men and women of being Russian agents. No relieved hope that the country might finally put this behind us. Just a smooth transition—using Russia as a hook—into Mr. Trump’s finances. Mueller who? What’s mind-boggling is that reporters would continue to take Mr. Schiff seriously, given his extraordinary record of incorrect and misleading pronouncements. This is the man who, on March 22, 2017, helped launch full-blown hysteria when he said on “Meet the Press” that his committee already had the goods on Trump-Russia collusion. “I can’t go into the particulars, but there is more than circumstantial evidence now,” Mr. Schiff declared then. Almost two years later, he’s provided no such evidence and stopped making the claim..

Perhaps even more than politicians, it’s the media that will keep the collusion tale alive. They wouldn’t know how to make money anymore if they didn’t.

• ‘Even Nixon Wasn’t Like Him’: Trump’s Bid To Upend Russia Inquiry (G.)

It was yet another bombshell report for a president already ensnared in multiple investigations against his campaign, administration and family members. This time it had to do with hush money paid to women to silence them from speaking about alleged affairs they had with Donald Trump. According to a New York Times report published this week, Trump asked Matthew Whitaker, his controversial acting attorney general, if he could install a loyalist at the helm of the investigation into the hush money.

Although Whitaker declined Trump’s request, the story has raised fresh questions over whether the president was seeking to obstruct justice and how the reported move fits into a broad pattern of Trump attempting to interfere with an investigation concerning himself. Since taking office, Trump’s fixation on the federal inquiry into Russian interference in the 2016 election – and potential collusion between his campaign and Moscow – has spurred a series of actions that could now imperil his presidency and prospects of a second term.

From high-level firings to public misstatements, Trump’s repeated steps to undermine the investigations that have clouded his two years in office paint a picture of a president who is his own worst enemy, legal experts say. “It is quite clear from all the evidence that the president has had the intent to obstruct this investigation,” said Andy Wright, a former associate counsel to Barack Obama and the founding editor of the legal blog Just Security. “It’s been in plain sight.” “It’s a fundamental abuse of power for the president to be trying to shut down an investigation in which he has a personal stake – both as a potential target himself and his political allies and family members,” he added.

Jim stays on message. I changed the headline from Great Expectations to Great Investigations.

• Great Investigations (Kunstler)

Meanwhile, their antics may be eclipsed by the now inevitable inquiry around the misdeeds carried out by public officials in Act I of the show: the Russia Collusion Ruse. Based just on the current Andy McCabe book tour, there will be an awful lot to get to, and it is liable to be far more compelling than the nonsense conjured up by the Three Stooges. Mr. McCabe, in his quest to hand off the hot potato of culpability to his former colleagues, and to sell enough books to pay his lawyers’ retainers, has neatly laid out the case for his orchestrating a coup d’etat within the FBI. It’s an ugly story, and it’s all out there now, like so much spaghetti hurled against the wall, and it won’t be ignored.

There are many other spaghetti wads already plastered on that wall ranging from Hillary Clinton’s Fusion GPS hijinks, to Loretta Lynch’s written assurances to the Clinton campaign that the email server matter would be dropped, to the rather complete failure of the FISA process, and much much more that needs to be ventilated in a court of law. I suspect that Barack Obama and his White House confidents will enter the picture, too, sooner later, and to the great dismay of his partisans who do not want to see his legacy tarnished. Whatever your view of all these dark events, it would be pretty awful for the country to have to see him in a witness chair, but it may be unavoidable. Ditto Hillary, who is liable to go all Captain Queeg-y when she finally has to answer for her campaign’s turpitudes.

Can both major parties in Britain dissolve in just 4 weeks time?

• Theresa May Must Go In Three Months, Cabinet Ministers Say (G.)

Cabinet ministers will make it clear they believe Theresa May should step down after the local elections in May and allow a new leader to deliver the next phase of the Brexit negotiations, the Guardian understands.Senior figures in government have suggested they want the prime minister to leave shortly after the first phase of the Brexit negotiations finishes – or risk being defeated in a vote of no confidence at the end of the year. May wants to stay in place for long enough after Brexit to secure a political legacy beyond the fraught negotiations. But some ministers believe she should announce the timeline for her departure “on a high” after the local election results, paving the way for a Conservative leadership contest over the summer.

Brexiters in the cabinet are keen to see a new leader take over for the next stage of the negotiations with the EU, which May has already pledged will involve more active involvement for politicians rather than advisers. The hardening mood among cabinet ministers on the timeline for her departure will place further pressure on May before a critical week of Brexit talks and votes amid a febrile climate in Westminster. On Thursday the Guardian revealed that remainer ministers emboldened by the departure of three MPs to the Independent Group (TIG) were threatening to rebel against her leadership to prevent a no-deal outcome – daring her to sack them.

And in a fresh blow to May, three cabinet ministers publicly say they would back moves to delay Brexit if she fails to get her deal through parliament. In a joint newspaper article, Amber Rudd, the work and pensions secretary, David Gauke, the justice minister, and the business secretary, Greg Clark, say they want to ensure the UK does not crash out of the EU without a deal on 29 March. And they insist they are prepared to defy the prime minister and join those MPs pushing for an extension to article 50 if there is no significant progress next week.

Writing for the Daily Mail on Saturday, they argue that a no-deal Brexit would wreck the country’s economy and put its security at risk. “If there is no breakthrough in the coming week, the balance of opinion in parliament is clear – that it would be better to seek to extend article 50 and delay our date of departure rather than crash out of the European Union on 29 March,” they write. “It is time that many of our Conservative parliamentary colleagues in the ERG recognised that parliament will stop a disastrous no-deal Brexit on 29 March. If that happens, they will have no one to blame but themselves for delaying Brexit.”

Both May and Brussels appear to think they stand to gain from a no-deal Brexit. Maybe that makes it more likely than we think.

• UK Food Imports From EU Face ‘£9bn Tariff Bill’ Under No-Deal Brexit (G.)

The government is expected next week to spell out its plan to mitigate a potential £9bn food-price shock from a no-deal Brexit, as analysts predict the cost of staples such as beef, cheddar cheese and tomatoes could soar. With just over a month until the Brexit deadline, the Department for International Trade is expected on Monday to publish a list of new import taxes, or tariffs, that will apply to 5200 products, including food and clothing, should the UK crash out of the EU without a deal. The relationship with the EU is key to the price of food because nearly one third of the food eaten in the UK comes from the bloc. At this time of year the situation is more acute because, with UK produce out of season, 90% of lettuces, 80% of tomatoes and 70% of soft fruit is sourced from, or via, the EU.

“Food and drink tariff rates will be higher than those in any other supply chain,” says Richard Lim, chief executive of consultancy firm Retail Economics. “All stages within the food supply chain will experience increased costs, with retailers hit disproportionately as processed goods attract higher duties than raw materials and semi-processed goods.” In 2017 the UK bought about £34bn of groceries from the EU, which arrived on supermarket shelves and at factory gates without being hit by customs duties or other trade costs. But if the UK leaves the EU without a deal, both will fall back on the World Trade Organisation’s “most favoured nation” tariffs, which means they must pay import duties on each other’s trade. On that basis the UK’s 2017 EU food imports would come with a hefty £9.3bn tariff bill on top, according to Retail Economics’s analysis.

Having been there for 30 years is not exactly a positive thing, given how much things have deteriorated in that time. Hand it over to the kids, they couldn’t possibly do worse.

• Dianne Feinstein Snaps At Group Of Environmental Activist Children (ZH)

Armed with an impassioned letter and memorized talking points, the children belonging to three Bay Area environmentalist groups (Sunrise Bay Area, Youth Versus the Apocalypse, and Earth Guardians San Francisco) implored Feinstein to support the Green New Deal. The Senator responded: “Ok, I’ll tell you what. We have our own Green New Deal.” The video skips forward to the children warning Feinstein that “some scientists have said that we have 12 years to turn this around” – referring to a conclusion by a recent UN-backed report that man-made climate change will become irreversible if carbon emissions are not significantly reduced over the next 12 years (which Ocasio-Cortez turned into “the world is gonna end in 12 years if we don’t address climate change”).

“It’s not gonna get turned around in 10 years,” responded Feinstein – drawing a harsh rebuke from an angry chaperone. “Senator if this doesn’t get turned around in 10 years you’re looking at the faces of the people who are going to be living with these consequences,” said the adult – as one of the children chimed in “the government is supposed to be for the people and by the people and for all the people!” Feinstein was not amused. I’ve been doing this for 30 years. I know what I’m doing. You come in here and you say “it has to be my way or the highway.” “I don’t respond to that,” shot back Feinstein. “I’ve gotten elected. I just ran. I was elected by almost a million vote plurality. And, I know what I’m doing. So, you know, maybe people should listen a little bit. -Dianne Feinstein

One kid shot back “I hear what you’re saying but we’re the people who voted you. You’re supposed to listen to us, that’s your job.” “How old are you?” challenged Feinstein. “I’m 16. I can’t vote,” said the girl. “Well you didn’t vote for me,” replied the Senator.

https://twitter.com/sunrisemvmt/status/1099075460649107458

The new fight for control of the world. Orwell International Inc.

• The Cold War in Tech (Barron’s)

Cisco Systems, an early Silicon Valley success story, has become one of the nation’s top tech exporters. Today, roughly half of the networking giant’s sales come from outside the U.S. As foreign countries sought to catch up with U.S. connectivity, Cisco helped plug them in. But a wave of nationalist thinking has put Cisco—and most of its peers—in an uncomfortable position. Earlier this month, Cisco CEO Chuck Robbins described the current climate as “one of the more complex macro, geopolitical environments that I think we’ve seen in quite a while with all the different moving parts.” It’s likely to get worse.

While investors are cheering indications of progress being made toward a resolution of trade issues between China and the U.S., the battle for tech supremacy between the two global superpowers shows few signs of abating. Even as the White House was negotiating on trade with Beijing, it was also contemplating a U.S. ban of telecommunications equipment from Chinese companies like Huawei Technologies, essentially China’s version of Cisco. As President Donald Trump was tweeting about the importance of 5G on Thursday, Secretary of State Mike Pompeo was pushing U.S. allies to ditch Huawei. This is a fight that is not going to end anytime soon. For years, U.S. officials have worried about Chinese equipment being used to infiltrate U.S. networks and businesses for possible espionage and theft of intellectual property.

Even a resolution of the trade war won’t quell those fears. “The perception is that too much of the information- and communication-technology supply chain is centered on China,” says Paul Triolo, who focuses on global technology policy issues for risk consulting firm Eurasia Group. “If we are in a conflict and using infrastructure built by China, they could theoretically hit a button and shut off everything.” “After 30 years of saying companies should optimize supply chains and move some abroad, now we are saying it’s a security concern,” he says. “Adjusting to that is jarring.”

The sort of thing you know someone will always try, no matter what laws are invented. And it’s not about Silicon Valley, it’s about the CIA through big Tech.

• Silicon Valley Wants In On It Pair Of Gene-Edited Chinese Twins (ZH)

A pair of Chinese twins who were gene-edited for resistance to HIV may also have ‘supercharged’ brains, along with possible resistance to age-related cognitive diseases such as Alzheimer’s. In a controversial experiment led by Chinese scientist He Jiankui, the embroys of seven couples had their genes “edited” using a tool known as CRISPR. By removing a gene called CCR5, Jiankui sought to create a natural immunity to HIV – which requires CCR5 to enter blood cells. Based on new research, however, Jiankui may have also left the twins, Lulu and Nana, with improved memory and enhanced cognition, according to MIT Technology Review. They may also enjoy some degree of protection from Alzheimer’s Disease and other maladies which are rapidly being linked to chronic inflammation, as some groups of mice without CCR5 – or who have been given CCR5 inhibitors, experience less severe dementia or Alzheimer’s symptoms.

“The answer is likely yes, it did affect their brains,” says UCLA neurobiologist Alcino J. Silva, whose lap discovered a link between CCR5 and the brain’s ability to form new connections. “The simplest interpretation is that those mutations will probably have an impact on cognitive function in the twins,” says Silva, adding that the exact effect on the girls’ cognition cannot be predicted, which is “why it should not be done.” Jiankui’s human experiments drew harsh rebuke after news of Lulu and Nana’s birth in late October or early November, and has reportedly been fired from his position at the Southern University of Science and Technology (SUSTech) in Shenzhen, China. Jiankui says there are more gene-edited babies on the way.

Silva tells the MIT Technology Review that “because of his research, he sometimes interacts with figures in Silicon Valley and elsewhere who have, in his opinion, an unhealthy interest in designer babies with better brains.” When word of Jiankui’s experiment went public, Silva says he immediately questioned whether enhanced cognition was the real goal of the experiment. “I suddenly realized—Oh, holy shit, they are really serious about this bullshit,” said Silva. “My reaction was visceral repulsion and sadness.” He Jiankui acknowledged that he knew about the potential cognitive benefits of removing the CCR5 gene discovered by the UCLA team during a Q&A session, though he said “I am against using genome editing for enhancement.”

Brave new world: gene-edited superhumans controlled through embedded technology. That Orwell guy appears smarter by the day.

• China Blocks 17.5 Million Plane Tickets Due to Lack of ‘Social Credit’ (Ind.)

The Chinese government blocked 17.5 million would-be plane passengers from buying tickets last year as a punishment for offences including the failure to pay fines, it emerged. Some 5.5 million people were also barred from travelling by train under a controversial “social credit” system which the ruling Communist Party claims will improve public behaviour. The penalties are part of efforts by president Xi Jinping‘s government to use data-processing and other technology to tighten control on society. Human rights activists warn the system is too rigid and may lead to people being unfairly blacklisted without their knowledge, while US vice-president Mike Pence last year denounced it as “an Orwellian system premised on controlling virtually every facet of human life”.

Authorities have experimented with social credit in parts of China since 2014. Points are deducted for breaking the law, but also, in some areas, for offences as minor as walking a dog without a lead. Offences punished last year also included false advertising and violating drug safety rules, said China’s National Public Credit Information Centre. It gave no details of how many people live in areas with social credit systems. [..] The ruling party is spending heavily to roll out facial recognition systems, and human rights activists say people in Muslim and other areas with high ethnic minority populations have been compelled to give blood samples for a genetic database. Those systems rely heavily on foreign technology, which has prompted criticism of US and European suppliers for enabling human rights abuses.