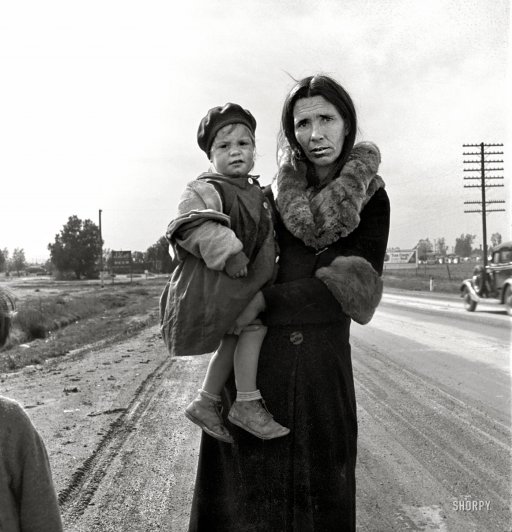

Lewis Wickes Hine Child Labor in Magnolia Cotton Mills spinning room, Mississippi Mar 1911

“It’s hard to imagine how anyone can survive at 50% of the poverty level. As of 2013, that corresponded to $9,384 a year for a family of three. [..] more than 7 million people were living below it.

• Being Poor Is Getting Scarier in the US (Bloomberg)

By any measure, the U.S. is among the wealthiest countries in the world. Judging from new research, though, it’s becoming an increasingly hazardous place to be poor. Every advanced nation has a mechanism to protect its most vulnerable members from economic shocks. In the U.S., government transfer programs such as unemployment insurance, food stamps and the earned income tax credit act to offset the impact of recessions, particularly for the poorest families. By putting much-needed money in the pockets of the people most likely to spend it, these “automatic stabilizers” also help the broader economy recover.

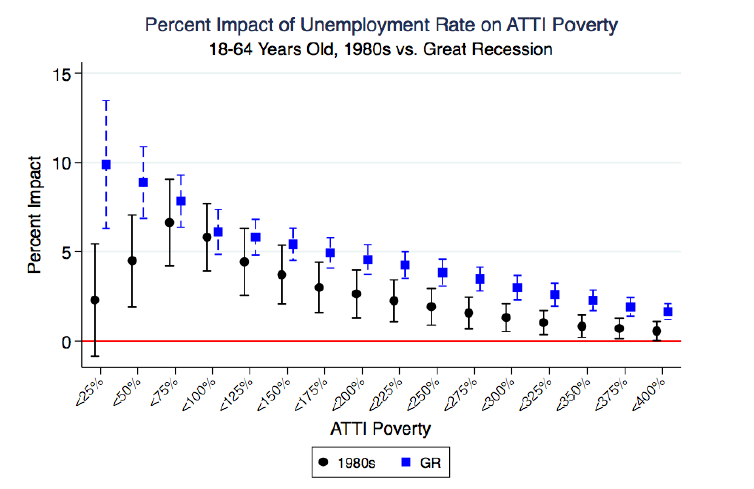

In a paper presented over the weekend at the annual meeting of the American Economic Association, economists Hilary Hoynes of the University of California at Berkeley and Marianne Bitler of UC Irvine explored how well automatic stabilizers in the U.S. are working. Using state-level data on unemployment rates and a measure of household income that accounts for taxes and transfers, they compared the effects of the most recent recession to those of the last deep recession in the 1980s. The result: The U.S. is doing a significantly worse job of protecting its most vulnerable households than it did a few decades ago.

Specifically, the economists estimate that during the 2008 recession, a one-percentage-point increase in the unemployment rate was associated with a nearly 10% increase in the share of 18- to 64-year-olds with household incomes of less than half the poverty level. That’s roughly double the effect of unemployment in the 1980s recession. It’s hard to imagine how anyone can survive at 50% of the poverty level. As of 2013, using the measure of income employed by Hoynes and Bitler, that corresponded to $9,384 a year for a family of three. Nonetheless, more than 7 million people were living below it. [..] Over the past three decades, economic output per person in the U.S. has increased more than 60%, to an estimated $54,678 in 2014. Surely such a rich country can afford to do better for the poor.

Nothing left to prop it up.

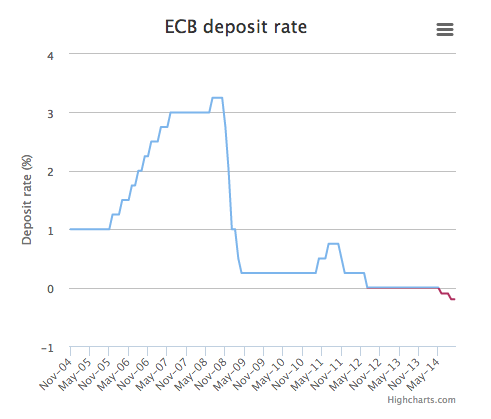

• The Euro In 2015: A Very Bad Start (CNBC)

The euro can’t seem to catch a break, starting 2015 with a drop to a nine-year low against the U.S. dollar as the timetable for central bank action appears to step up amid a storm of other negatives for the common currency. “The market was divided over when the ECB would undertake QE,” David Forrester, a foreign-exchange strategist at Macquarie, said. But comments from ECB President Mario Draghi changed that, he said, adding expectations are now for a policy adjustment possibly at the year’s first meeting on January 22. In an interview with German newspaper Handelsblatt, Draghi said he believes the risk that the central bank won’t be able to fulfill its mandate to preserve price stability had risen compared with six months ago. “It moves the timetable for QE potentially forward,” he said, but he noted that other factors are also weighing. “You also have U.S. dollar strength and the Fed potentially raising rates – that’s what’s feeding the euro weakness now.”

Weakness abounds, with the euro fetching $1.1936, after trading as low as $1.1860, its lowest since 2006. The ECB likely wants the euro to decline to help spur the economy and inflation, noted Jesper Bargmann, head of trading for Asia at Nordea. But he added, “I’m not sure they would like the euro to collapse in the short term.” Just how low could the euro fall? Willem Nabarro at Exane BNP Paribas, believes $1.1760 is the first target – the level where the common currency was first introduced, although he noted that consensus forecasts range from $1.10-$1.15. There are other ingredients likely spoiling the euro stew. For one, the euro’s attractiveness as a reserve currency appears to be slipping, with the IMF saying that the share of global central banks’ currency reserves held in the common currency was at 22.6% in the third quarter of last year, the lowest in a decade and off by more than a fullpercentage point from the previous quarter.

Another headwind: the price of oil has also started off the year with a run downward to fresh more than five year lows. U.S. crude futures extended declines to a third day on Monday, trading as low as $51.40 a barrel, while London Brent crude for February delivery fell as low as $55.36 a barrel, levels last seen in 2009. “In trying to anticipate the possible extent of further euro depreciation, it is worth remembering that inflation and inflation expectations lie at the crux of ECB policy initiatives,” Brian Martin, an economist at ANZ, said in a note Friday. “The trend in EUR/USD has been closely correlated with the trend in the oil price and is likely to remain so for the foreseeable future.”

Let’s see Draghi address this issue. Or Merkel.

• Tsipras Says ECB Cannot Shut Greece Out Of Stimulus (Reuters)

Greek leftwing opposition leader Alexis Tsipras said the European Central Bank (ECB) could not exclude Greece if it decides to move to a full «quantitative easing» programme to stimulate the euro zone’s faltering economy. Speaking at a party congress on Saturday, three weeks before a Jan. 25 general election, Tsipras also said his Syriza party would ensure much of Greece’s debt was written off as part of a renegotiation of its international bailout deal. The election takes place three days after a Jan. 22 policy meeting at which the ECB may decide to proceed with a quantitative easing (QE) programme to pump billions of euros into the euro zone economy by buying government bonds.

Tsipras said he hoped ECB President Mario Draghi would decide to go ahead with the programme and said Greece could not be shut out, as some economists and politicians from countries including Germany have suggested. “Quantitative easing by the ECB with direct purchases of government bonds must include Greece,» Tsipras said. The comments underline the pressures facing Draghi ahead of the decision, with many in Germany opposed to full-scale QE which they fear will create asset bubbles and remove incentives for reform-shy governments to act. Syriza, which holds a slim opinion poll lead over Prime Minister Antonis Samaras’ centre-right New Democracy party, has moderated its tone in recent months, pledging to keep Greece in the euro and not to unilaterally repudiate the bailout deal.

But the prospect of a Syriza-led government has set financial markets on edge and caused alarm in Germany, where a succession of politicians and economists have argued the euro zone could cope with Greece’s exit. In a speech laced with barbs against German Chancellor Angela Merkel and finance minister Wolfgang Schaeuble, Tsipras said his party would roll back many of the austerity policies imposed by the bailout «troika». “Austerity is both irrational and destructive. To pay back debt, a bold restructuring is needed,» he said. Repeating many policy pledges first laid out last year, he promised to do away with a real estate tax, freeze house foreclosures, raise the minimum wage and reinstate a €12,000 ($14,400) tax-free threshold to help low earners. He said he would abandon the goal of achieving primary budget surpluses, aimed at cutting Greece’s debt burden equivalent to more than 175% of gross domestic product. But he pledged to protect bank deposits and ensure public finances remain on a sound footing.

Greece needs to fight its corruption, and that won’t happen under Samaras.

• Samaras Warns of Euro Exit Risk as Greek Campaign Starts (Bloomberg)

Greece’s political parties embarked on a flash campaign for elections in less than three weeks that Prime Minister Antonis Samaras said it will determine the fate of the country’s membership in the euro currency area. Samaras used a Jan. 2 speech to warn that victory for the main opposition Syriza party would cause default and Greece’s exit from the 19-member euro region, while Syriza leader Alexis Tsipras said his party would end German-led austerity. Der Spiegel magazine reported Chancellor Angela Merkel is ready to accept a Greek exit, a development Berlin sees as inevitable and manageable if Syriza wins, as polls suggest. The high-stakes run-up to the Jan. 25 vote returns Greece to the center of European policy makers’ attention as they strive to fend off a return of the debt crisis that wracked the region from late 2009, forcing international financial support for five EU countries.

While Greek 10-year bond yields rose to about 9% last week from a post-crisis low of 5.57% in September, the relative improvement in yields from Italy to Ireland suggests that the contagion has been contained. “Many European officials believe a Greek exit would be manageable, and in contrast to 2010-2011, we wouldn’t see the same cascading effect on countries like Spain or Ireland,” Fredrik Erixon, director of the European Centre for International Political Economy in Brussels, said by telephone. Tsipras, in a speech on Jan. 3, vowed to restructure his nation’s debt and end what he called the “unreasonable and catastrophic” austerity policies. Greece will “write down on most of the nominal value of debt, so that it becomes sustainable,” Tsipras said, according to the e-mailed transcript of a speech in Athens. “That’s what was done for Germany in 1953, it should be done for Greece in 2015.”

EU referendum pushed forward.

• Worried About The UK In 2015? You’re Not Alone (CNBC)

The shadow of a general election and a possible exit from the European Union are already making investors nervous about the UK in 2015. On Monday, traditionally the first back-to-work day of the New Year, sterling fell slightly against the dollar and the FTSE was flat, as traders warily eyed the UK. The new year also saw all of the main parties launch their campaigns for May’s general election and for what many pundits predict will be the most unpredictable poll in living memory. “The traditional metrics in how the poll will turn out are being thrown out of the window,” Jeremy Stretch, head of currency strategy at CIBC, told CNBC. He argued that sterling is likely to come under continued pressure ahead of the elections. “All of a sudden, investors are saying they want to look back and see how the smoke clears before committing to the UK”

While the left-leaning Labour Party is leading most recent polls, it looks increasingly likely that either it or the Conservative Party may have to enter a coalition with one or more of the smaller parties to ensure a majority. Another option is that one of the parties governs in what is known as a “hung parliament”, where it doesn’t have a majority and is reliant on the support of other parties to pass laws. Either of these options may lead to the Liberal Democrats party, which got the third-biggest share of the vote in the last election, or minority parties like the Scottish National Party, the U.K. Independence Party (UKIP) or Northern Ireland’s Democratic Unionist Party (DUP) holding the key to running of the country.

The other cloud hanging over investors is whether the UK chooses to stay in the European Union or not. Back in 2013 Prime Minister David Cameron, under pressure from euro-skeptic members of his own party and the increasingly popular UKIP, promised to hold a referendum on the UK’s membership of the EU, which is seen as meddlesome, bureaucratic and expensive by a large number of voters. In an interview with the BBC, Cameron said Sunday that, if his party is in power after the next election, a referendum on the U.K.’s EU membership may come earlier than 2017, the year previously promised. Ministers who are against the U.K.’s continued membership of the trading bloc will have to step aside from their posts if they want to campaign for a “no” vote, he announced.

A divide between rich and poor, as well as one between old and young.

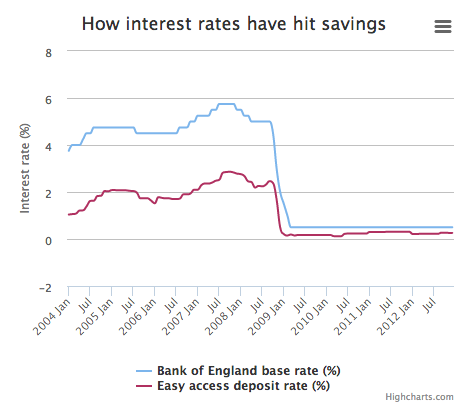

• The Credit Boom Is A Ticking Timebomb For UK Plc (Guardian)

There is a warning buried in the economic figures that appeared last week. While most of the focus was on the steady decline in house buying and numbers showing Britain’s national income grew more slowly last year than previously estimated; the latest borrowing figures set alarm bells ringing. Consumer credit figures from the Bank of England revealed Britons ended the year slapping their credit cards on shop counters as if the financial crisis was a distant memory. Borrowing on credit cards and unsecured loans grew in November at its strongest pace since 2008. We knew that retail sales had surged that month and now we knew why. Mortgage borrowing added to the credit boom, piling another £2.1bn on the debt mountain in November.

The increase was higher than expected and came despite a fall in the number of mortgage approvals. At the same time the central bank was publishing its credit figures, a survey of factory managers could only be described as depressing. Yet again, just as the sector appeared to be finally recovering from the great crash, the momentum has tailed off. The survey of manufacturers found expansion eased back in December after picking up in October and November. And that little period of early winter joy was shortlived, coming after a September that represented a 17-month low. Output and new orders growth moderated in December, and most importantly exports remained lacklustre.

Those economists who found reasons to be cheerful from the figures suggested that the UK’s strong domestic demand would keep the sector growing. The same economists look at the borrowing figures and discern a more benign outlook from the total UK household debt burden, which is continuing a trend since the crash and still coming down. What was once a household debt to income ratio of 175% is now nearer 130%. Yet the overall figure depends on the over-50s paying off their mortgages at an accelerated rate. By contrast, the under-40s take on bigger mortgages to buy a home with an inflated price and borrow on credit cards to fund a lifestyle ravaged by six years of below inflation pay rises.

No, it really is a race to the bottom.

• Oil’s Future Hangs Between The Emirates And The Shales Of Eagle Ford (Observer)

The decision by president Barack Obama to open the door to US oil exports seeped out of Washington in a low-key manner last week, but the impact could be as explosive as a New Year’s Eve firework display. The ban – imposed after the Middle East oil embargoes in the 1970s – has made it close to impossible to ship abroad the fruits of America’s shale bonanza. It also long looked wrong-headed in the home of free trade. The US department of commerce quietly overturned the four-decade-old policy by saying it had started to approve a backlog of requests to sell processed light oil to foreign buyers. The issue is tremendously sensitive, which is possibly why the announcement came out at a time of year when most policymakers were still at home enjoying the Christmas holidays with their families.

Many manufacturers and many domestic consumers are totally opposed to domestic oil or gas production being exported, on the grounds that it could bring an end to cheaper local energy supplies and competitive advantages. But prospectors from the shales in Eagle Ford, Texas and Marcellus, Pennsylvania have been campaigning in Washington for a change in the law for some time, their calls growing more urgent now that some face potential financial trouble as the price of oil plunges from $115 per barrel down to $56. Meanwhile American oil sometimes sells at $15 per barrel less on the local market as supply exceeds demand: not good for the frackers already burdened by their relatively high-cost operations.

But by opening the door to exports – of slightly refined products – Washington has struck a more serious blow to its export rivals in Saudi Arabia, Russia and elsewhere. Ed Morse, global head of commodities research at Citigroup bank, had no trouble predicting that the move would “open up the floodgates to substantial increases in [US] exports by end 2015”.

Bubble.

• Plunging Oil Prices Test Texas’ Economic Boom (WSJ)

Retired Southwest Airlines co-founder Herb Kelleher remembers a Texas bumper sticker from the late 1980s, when falling energy prices triggered an ugly regional downturn: “Dear Lord, give me another boom and I promise I won’t screw it up.” Texas got its wish with another energy-driven boom, and now plunging oil prices are testing whether the state has held up its end of the bargain. The Lone Star State’s economy has been a national growth engine since the recession ended, expanding at a rate of 4.4% annually between 2009 and 2013, twice the pace of the U.S. as a whole. The downturn in energy prices now has triggered a debate over whether Texas simply got lucky in recent years, thanks to a hydraulic-fracturing oil-and-gas boom, or whether it hit on an economic playbook that other states, and the country as a whole, could emulate.

One in seven jobs created nationally during the 50-month expansion has been created in Texas, where the unemployment rate, at 4.9%, is nearly a percentage point lower than the national average. But a big dose of the state’s good fortune comes from the oil-and-gas sector. Midland, which sits atop the oil-rich Permian Basin, had the fastest weekly wage growth in the country among large counties: 9% in the 12 months ending June 2014. Now that oil prices have plunged nearly 51% from their June peak to $52.69 a barrel, some Texans sobered by memories of past energy busts are bracing for a fall. The argument among economists and business leaders isn’t whether the state will be hurt, but how badly.

Mr. Kelleher is among the Texans predicting this won’t be a replay of the 1980s oil bust and banking crisis, which drove the state unemployment rate to 9.3%. As evidence, he and others cite a more cautious banking sector, a tax and regulatory environment favorable to business, and a state economy less dependent on energy and other resources. “Texas has become a well-rounded state,” Mr. Kelleher said. “People did remember not to overextend themselves.”

Michael Feroli, a New York-based economist at J.P. Morgan Chase & Co., is one of the skeptics of the “this-time-is-different” camp. Although the oil-and-gas industry today makes up a smaller share of Texas’ workforce than it did in the mid-1980s, it accounts for roughly the same share of its economic output, he said. So a decline in oil prices similar to the plunge of more than 50% seen in the mid-1980s, he said, could have a similar result: recession. “Texas is, if oil prices stay where they are, going to face a more difficult economic reality,” Mr. Feroli said.

Another bubble.

• From Boom To Bust In Australia’s Mining Towns (BBC)

After 23 years of growth, including one of the biggest mining booms in the nation’s history, tumbling iron ore and coal prices have put a brake on Australia’s economy – and mining towns are paying the price. Peter Windle is a casualty of the mining slowdown. The New South Wales mining employee has lost a well-paid job, a company car and an annual bonus that in some years was as high as A$60,000 ($48,800; £31,300). A termination package from the mining company he used to work for has helped soften the blow. But Mr Windle still had to sell his investment property to keep his head above water. Once part of a vast army of workers in what was Australia’s booming resources sector, Mr Windle now gets up at 5.30 am five days a week to clean and drive school buses in the small town of Muswellbrook.

For decades, the town had ridden the waves of Australia’s coal boom. “It’s the worst I’ve seen it in 28 years in the mining industry,” says Mr Windle. “Everyone is getting out. Three hundred houses are for sale in my town, three in my street, and rental prices have collapsed on older weatherboard houses from A$1,000 a week to A$200,” he says. Mr Windle was the purchase and compliance manager at Glennies Creek Coal Mine. Earlier this year, however, Brazilian company Vale – which owns the underground mine and an open-cut mine at nearby Camberwell – suddenly announced it was sacking 500 workers and mothballing the mines. Mr Windle’s story is not unusual. Across Australia, coal and iron ore mines are laying off staff, shutting down operations or putting new investments on hold.

Resource analysts say it is the end of a long and lucrative mining boom that was mostly fuelled by demand from China. The number of people employed in coal mining alone rose from 15,000 to 60,000 between 2001 and 2014, according to the Australian Bureau of Statistics. Mining companies offered high wages to entice workers from other industries, and to mines that were often in remote locations such as outback Western Australia. Preliminary estimates suggest that this year, Australia exported over A$40bn of coal, much of it to China. But as China’s economy has slowed, the price of coal used for power generation has fallen, from US$142 a tonne in January 2011 to US$67 a tonne in November 2014, according to the World Bank. In the case of iron ore, in mid-December it was trading at about US$70 a tonne, the lowest level since 2009.

And The Bubble to End All Bubbles.

• The Bubble to End All Bubbles (Phoenix)

If your job is to sit in front of a camera selling the notion of getting rich from investing, you’re not going to talk about bonds or currencies (maybe the latter is of interest but only with insane amounts of leverage which usually bankrupts a trader in his or her first trade). However, today stocks are in fact a very minor story. They are, in a sense, the investing equivalent of picking up pennies in front of a steamroller. That steamroller is the $100 trillion bond bubble. For 30+ years, Western countries have been papering over the decline in living standards by issuing debt. In its simplest rendering, sovereign nations spent more than they could collect in taxes, so they issued debt (borrowed money) to fund their various welfare schemes. This was usually sold as a “temporary” issue. But as politicians have shown us time and again, overspending is never a temporary issue. This is compounded by the fact that the political process largely consists of promising various social spending programs/ entitlements to incentivize voters.

This type of social spending is not temporary… this is endemic. The US is not alone… Most major Western nations are completely bankrupt due to excessive social spending. And ALL of this spending has been fueled by bonds. This is why Central Banks have done everything they can to stop any and all defaults from occurring in the sovereign bonds space. Indeed, when you consider the bond bubble everything Central Banks have done begins to make sense. 1) Central banks cut interest rates to make these gargantuan debts more serviceable. 2) Central banks want/target inflation because it makes the debts more serviceable and puts off the inevitable debt restructuring. 3) Central banks are terrified of debt deflation (Fed Chair Janet Yellen herself admitted that oil’s recent deflation was an economic positive) because it would burst the bond bubble and bankrupt sovereign nations.

The bond bubble, like all bubbles, will burst. When it does, everything about investing will change. Bonds have been in bull market since the early ‘80s. Thus, an entire generation of investors and money managers (anyone under the age of 55) has been investing in an era in which risk has generally gotten cheaper and cheaper. This, in turn, has driven the rise in leverage in the financial system. As the risk-free rate fell, so did all other rates of return. Thus investors turned to leverage or using borrowed money to try to gain greater rates of return on their capital. Today, that leverage has resulted in $100 trillion in bonds with over $555 trillion in derivatives based on bonds. This bubble, literally dwarfs all other bubbles. To put this into perspective, the Credit Default Swap (CDS) market that nearly took down the financial system in 2008 was only a tenth of this ($50-$60 trillion). When this bubble bursts, 2008 will look like a picnic.

Makes sense.

• Russia’s ‘Startling’ Proposal To Europe: Dump The US, Join Us (Zero Hedge)

Slowly but surely Europe is figuring out that as a result of the western economic and financial blockade of Russian, it is Europe itself that is suffering the most. And while Germany was first to acknowledge this late in 2014 when its economy swooned and is now on the verge of a recession, now others are catching on. Case in point: the former head of the European Commission, and Italy’s former Prime Minister, Romano Prodi who told Messaggero newspaper that the “weaker Russian economy is extremely unprofitable for Italy.” The other details from Prodi’s statement:

Lowered prices in the international energy markets have positive aspects for the Italian consumers, who pay less for the fuel, but the effect will be only short-term. In the long-term however the weaker economic situation in countries producing energy resources, caused by lower oil and gas prices, mostly in Russia, is extremely unprofitable for Italy, he said. “The lowering of the oil and gas prices in combination with the sanctions, pushed by the Ukrainian crisis, will drop the Russian GPD by five% per annum, and thus it will cause cutting of the Italian export by about 50%,” Prodi said. “Setting aside the uselessness or imminence of the sanctions, one should highlight a clear skew: regardless of the rouble rate against dollar, which is lower by almost a half, the American export to Russia is growing, while the export from Europe is shrinking.”

In other words, just as slowly, the world is starting to grasp the bottom line: it is not the financial exposure to Russia, or the threat of financial contagion should Russia suffer a major recession or worse: it is something far simpler that will lead to the biggest harm for Europe’s countries. The lack of trade. Because while central banks can monetize everything, leading to an unprecedented asset bubble which if only for the time being boosts investor and consumer confidence, they can’t print trade – that all important driver of growth in a globalized world long before central banks were set to monetize over $1 trillion in bonds each and every year to mask the fact that the world is deep in a global depression.

Which is why we read the following report written in yesterday’s Deutsche Wirtschafts Nachrichten with great interest because it goes right to the bottom line. In it Russia has a not so modest proposal to Europe: dump trade with the US, whose call for Russian “costs” has cost you another year of declining economic growth, and instead join the Eurasian Economic Union! From the source:

Russia has presented a startling proposal to overcome the tensions with the EU: The EU should renounce the free trade agreement with the United States TTIP and enter into a partnership with the newly established Eurasian Economic Union instead. A free trade zone with the neighbors would make more sense than a deal with the US.

It surely would, but then how will Europe feign outrage when the NSA is found to have spied yet again on its “closest trading partners?”

Funny. St. Cyr writes exactly what I did last November in Making Money While The World Burns and Hugh Hendry And The Deflationary Zeitgeist.

• Knowing It Will End Badly And Turning A Blind Eye (Mark St.Cyr)

As 2014 came to an end I like many of you probably felt a brief sigh of relief that maybe, just maybe, we could move into 2015 with a little more sanity shoved back into the financial markets. Now with QE as a know certain (at least for this moment) that indeed the spigot to the fire-hose has been shut off albeit there is still the “reinvestment” sprinkler system still at play. We might possibly get back to a little bit of sanity within the capital markets. I watched a great many pundits take to both the financial air-wave cameras, as well as radio and print with fervent breath to make more or less a blanket statement that all the so-called “doom crew” (this is what you are now branded if you dare make a cogent case against fairy-tales and pixie-dust) were proven to be, without a doubt – totally wrong.

Added to this near foamed mouthed expression of glee was the added generalized diatribe, “when will these people just admit they were wrong and go away?!” Every time I heard or read a statement reminiscent of this I burst out into laughter. Until I read Hugh Hendry’s Eclectica Fund’s “Letter to Investors.” Here is where I went from laughter – to outright stupefaction. Before I go any further let me make this point clear: I am, and have been a fan of Mr. Hendry’s investing prowess, his willingness to point out in public whether an Emperor is clothed or not, and more. However, I have also made my opinion clear about my uneasiness when he originally turned his investing thesis onto its head and became by his own words “a Bull.”

Although I understood the thesis I believed (and still do) that there is an inherent danger when this view is accepted and codified based on this market. So strongly do I feel about this I suggest we turn the danger scale up more towards perilous. Or, in simple terms – the danger knob has just been turned to 11 in my view after reading his latest letter. The opening paragraph was nearly all one had to read as to know both the direction and the stance that seems now fully embraced by more than just Mr, Hendry – but everyone currently on this Keynesian fueled bandwagon. To wit:

“There are times when an investor has no choice but to behave as though he believes in things that don’t necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully. The good news is that mankind clearly has the ability to suspend rational judgment long and often.”

“The Czech President said something is “wrong” not only with Ukraine, but also with the European Union, which did not protest or condemn this action.”

• Czech President Condemns Kiev ‘Nazi Torchlight Parade’, EU’s Silence (RT)

The chilling slogans and a flagrant demonstration of nationalist symbols during the neo-Nazi march in Kiev reminded the Czech President Milos Zeman of Hitler’s Germany. He said something was “wrong” both with Ukraine and the EU which didn’t condemn it. Zeman was commenting on the appalling scenes, which showed thousands of Ukrainian nationalists holding a torchlight procession across the Ukrainian capital on Thursday to commemorate the 106th birthday of Stepan Bandera, a Nazi collaborator and the Ukraine nationalist movement’s leader during World War II. “There is something wrong with Ukraine,” the Czech Republic’s leadertold radio F1 on Sunday. “Yesterday evening I was browsing the Internet and discovered a video showing the demonstration on Kiev’s Maidan on January 1.”

“These demonstrators carried portraits of Stepan Bandera, which reminded me of Reinhard Heydrich,” Zeman said referring to one of the main architects of the Holocaust and at the time a Reich-Protector of Czech Republic’s territories. The parade itself was organized similar to Nazi torchlight parades, where participants shouted the slogan: ‘Death to the Poles, Jews and communists without mercy,”Zeman explained. Bandera was the head of the Organization of Ukrainian Nationalists (OUN), which collaborated with Nazi Germany, and was involved in the ethnic cleansing of Poles, Jews and Russians. “Glory to the nation! Death to enemies!”, “Ukraine belongs to Ukrainians” and “Bandera will return and restore order”, were the repeated slogans during the neo-Nazi march. Some of the participants wore World War II Bandera’s insurgent army uniforms while others paraded with red and black nationalist flags.

The Czech President said something is “wrong” not only with Ukraine, but also with the European Union, which did not protest or condemn this action. “Don’t forget that Bandera is considered a national hero in Ukraine, his image is hanging in the Maidan, his statue is in Lvov. In reality, he was a mass murderer,” Zeman said last summer on Czech Television. Russia too has on numerous occasions condemned the resurgence of neo-Nazi traditions in Ukraine and considers such displays of militant nationalism as means to fabricate history. “Torch-lit marches in Ukraine demonstrate that it is continuing to move along the path of the Nazis!” Konstantin Dolgov, the foreign ministry’s human rights envoy, said last week. “And this is in the center of civilized Europe!”

They need to throw out Yats and the other US agents.

• France Seeks End To Russia Sanctions Over Ukraine (BBC)

French President Francois Hollande says he wants Western sanctions on Russia to be lifted if progress is made in talks on the Ukraine conflict this month. He did not specify which sanctions – imposed by the EU, US and Canada – could be lifted. The sanctions began after Russia annexed Crimea in March. Mr Hollande said Russian President Vladimir Putin “doesn’t want to annex eastern Ukraine – he told me that”. Germany’s vice-chancellor has warned against further sanctions on Russia. Sigmar Gabriel – a centre-left politician like Mr Hollande – said the sanctions were aimed at making Russia negotiate to resolve the Ukraine conflict. But some “forces” in Europe and the US wanted sanctions to cripple Russia, which would “risk a conflagration”. “We want to help get the Ukraine conflict resolved, but not to push Russia onto its knees,” he told Bild am Sonntag newspaper.

The OSCE security organisation has reported sporadic shelling between Ukrainian forces and pro-Russian separatists in eastern Ukraine despite a ceasefire agreement. In late December several hundred prisoners were exchanged. There have been calls elsewhere in the EU for an easing or lifting of the sanctions on Russia, which have hit Russia’s banks, energy industry and arms manufacturers, as well as targeting powerful figures close to Mr Putin. Politicians in Italy, Hungary and Slovakia are among those who want the sanctions eased. “The sanctions must be lifted if there is progress. If there is no progress the sanctions will stay in place,” Mr Hollande told France Inter radio. He confirmed that a France-Germany-Russia-Ukraine summit would be held in Astana, Kazakhstan, on 15 January, focusing on the Ukraine conflict.

“.. additional sanctions may exclude Moscow from partnership in the resolution of conflicts which “will have very dangerous consequences for the entire world.”

• ‘More Russia Sanctions To Provoke ‘Dangerous Situation’ In Europe’ (RT)

Tougher sanctions against Russia could destabilize the country and provoke an “even more dangerous” situation in Europe and have negative consequences for the entire world, German Vice-Chancellor Economic Affairs and Energy Minister has warned. “Those who want it, provoke an even more dangerous situation for all of us in Europe,” Sigmar Gabriel said in an interview with the Bild am Sonntag newspaper on Sunday. “Those who are seeking to even more destabilize Russia from the economic and political point of view are pursuing quite different goals.” The goal of sanctions against Russia was to return Moscow to the negotiating table to find ways for a peaceful resolution to the crisis in Ukraine, he said. He elaborated that additional sanctions may exclude Moscow from partnership in the resolution of conflicts which “will have very dangerous consequences for the entire world.”

Though there are some in the US and EU that “would like to floor their superpower rival,” but it is not in the interest of Germany or Europe, he stated. “We want to help solve the conflict in Ukraine, not to force Russia to its knees,” he stressed. The US and EU slapped Russia with several rounds of sanctions, starting in March after Crimea joined Russia. Western nations have accused Russia of annexing Crimea, though Moscow has denied the claims stressing that residents of the peninsula voted in favor of the notion in a referendum that was in line with the international law and the UN Charter. The first round of Western sanctions targeted Russian officials and companies and included visa bans and asset freezes. The second round of sanctions that put pressure on financial, energy, and defense sectors was announced in July with the US and EU blaming Moscow for involvement in the unrest in eastern Ukraine.

Amen.

• North Korea/Sony Shows US Media Still Regurgitate Government Claims (Greenwald)

This government-subservient reporting was not universal; there were some noble exceptions. On the day of Obama’s press conference, MSNBC’s Rachel Maddow hosted Xeni Jardin in a segment which repeatedly questioned the evidence of North Korea’s involvement. The network’s Chris Hayes early on did the same. The Guardian published a video interview with a cyber expert casting doubt on the government’s case. The Daily Beast published an article by Rogers expressly arguing that “all the evidence leads me to believe that the great Sony Pictures hack of 2014 is far more likely to be the work of one disgruntled employee facing a pink slip.” He concluded: “I am no fan of the North Korean regime. However I believe that calling out a foreign nation over a cybercrime of this magnitude should never have been undertaken on such weak evidence.”

Earlier this week, the NYT‘s Public Editor, Margaret Sullivan, chided the paper’s original article on the Sony hack, noting – with understatement – that “there’s little skepticism in this article.” Sullivan added that the paper’s granting of anonymity to administration officials to make the accusation yet again violated the paper’s own supposed policy on anonymity, a policy touted by the paper as a redress for the debacle over its laundering of false claims about Iraqi WMDs from anonymous officials. But – especially after that first NYT article, and even more so after Obama’s press conference – the overwhelming narrative disseminated by the U.S. media was clear: North Korea was responsible for the hack, because the government said it was.That kind of reflexive embrace of government claims is journalistically inexcusable in all cases, for reasons that should be self-evident. But in this case, it’s truly dangerous.

It was predictable in the extreme that – even beyond the familiar neocon war-lovers – the accusation against North Korea would be exploited to justify yet more acts of U.S. aggression. In one typical example, the Boston Globe quoted George Mason University School of Law assistant dean Richard Kelsey calling the cyber-attack an “act of war,” one “requiring an aggressive response from the United States.” He added: “This is a new battlefield, and the North Koreans have just fired the first flare.” The paper’s own writer, Hiawatha Bray, explained that “hackers allegedly backed by the impoverished, backward nation of North Korea have terrorized one of the world’s richest corporation” and approvingly cited Newt Gingrich as saying: “With the Sony collapse America has lost its first cyberwar.”

“.. the hospital was unable to obtain ZMapp, the drug used to treat fellow British volunteer nurse William Pooley, because “there is none in the world at the moment ..”

• UK Ebola Patient Zero In Critical Condition (FT)

The condition of Pauline Cafferkey, a Scottish nurse who this week became the first person to be diagnosed with Ebola on UK soil, has deteriorated and is now critical, the Royal Free Hospital said on Saturday, as it emerged that another patient had tested negative for the deadly virus at a hospital in Swindon The 39-year-old’s sudden change in condition comes after her doctor described her as sitting up, eating, drinking and communicating with her family on New Year’s Day. Michael Jacobs, one of the medics treating her, warned that she faced a “critical” few days while she was treated with the blood from a survivor and an experimental antiviral drug which is “not proven to work.” Great Western Hospitals NHS Foundation Trust said on Sunday that an individual with a history of travel to west Africa had tested negative for Ebola but remained under observation at the hospital.

“The test results have come back negative. The patient is continuing to stay within the hospital for treatment,” the trust said. Ms Cafferkey was initially admitted to a hospital in Glasgow, the city in which she works as part of a public health team, after she returned from west Africa having flown via Morocco to London’s Heathrow airport. As her condition worsened she was transferred to an isolation unit at the Royal Free Hospital in Hampstead, north London. However, the hospital was unable to obtain ZMapp, the drug used to treat fellow British volunteer nurse William Pooley, because “there is none in the world at the moment,” Dr Jacobs said. Mr Pooley, who was also treated at the Royal Free, made a full recovery and has since returned to Sierra Leone to continue treating those affected by the virus.

Too good to be true?

• Scientists Target ‘Universal’ Protein To Treat Brain Cancer And Ebola (RT)

US researchers have identified a protein, which they believe is a universal therapeutic target for treating a number of deadly human diseases. They used a drug combination which included Viagra to effectively target the protein. Researchers at Virginia Commonwealth University (VCU) have figured out a protein – GRP78 – that may be a possible target to rid humans of such viral and bacterial infections as Ebola, Influenza and Hepatitis, as well as be a way to cure brain cancer. The pre-clinical study which was led by the US University, and published in the Journal of Cellular Physiology, used a drug combination – with Viagra being one of its elements – to target GRP78 and related proteins. As a result, researchers managed to prevent replication of a variety of major viruses in infected cells, and made some antibiotic-resistant bacteria vulnerable to common antibiotics. Evidence that brain cancer stem cells were killed was also found.

“Basically, we’ve got a concept that by attacking GRP78 and related proteins: (a) we hurt cancer cells; (b) we inhibit the ability of viruses to infect and to reproduce; and (c) we are able to kill superbug antibiotic-resistant bacteria,” said the study’s lead investigator, Paul Dent. After studying the effect in cancer cells, the researchers applied the same drug combination to target the protein for infectious diseases. Viral receptor expression on the surface of target cells was reduced, which decreased infectivity, and replication of a virus in infected cells was also prevented. By proving GRP78 to be a “drugable” target, researchers say the findings open new possibilities in treating various viral infections – “that certainly most people would say we’ll never be able to treat.” According to Dent, scientists already know that in mice the same Viagra treatment can kill tumor cells without harming other tissues, and the next steps in further discovering the possibilities of the method have already been taken.

How to make me sad on a Monday morning.

• 13 Species We Might Have To Say Goodbye To In 2015 (GlobalPost)

British broadcaster and naturalist Sir David Attenborough once asked: “Are we happy to suppose that our grandchildren may never be able to see an elephant except in a picture book?” This year marked the 100th anniversary of the death of the last passenger pigeon, Martha, who managed to survive only 14 years in captivity after her species became extinct in the wild. More recently, Angalifu, a 44-year-old northern white rhinoceros, died at the San Diego Zoo, leaving just five other white rhinos worldwide, all in captivity. Chances are our grandchildren will never get to see this remarkable creature. In fact, the world is losing dozens of species every day in what experts are calling the sixth mass extinction in Earth’s history.

As many as 30 to 50% of all species are moving toward extinction by mid-century – and the blame sits squarely on our shoulders. “Habitat destruction, pollution or overfishing either kills off wild creatures and plants or leaves them badly weakened,” said Derek Tittensor, a marine ecologist at the World Conservation Monitoring Centre in Cambridge. “The trouble is that in coming decades, the additional threat of worsening climate change will become more and more pronounced and could then kill off these survivors.” About 190 nations met last month at the United Nations climate talks in Lima, Peru to discuss action needed to curb rising greenhouse gas emissions. It ended with a watered-down agreement that seems unlikely to help much in the battle against global warming.

Corruption and illegal online trafficking also threaten conservation efforts. The illegal wildlife trade is an estimated $10-billion-a-year industry. It’s the fifth largest contraband trade after narcotics, fueled by the rising demand for animals as pets, trophies, and ingredients in medicine, food and other products. There’s no doubt that we’re facing an uphill battle against mankind’s unsustainable greed and consumption, but it’s a battle we can’t afford to lose. “The thought of having to explain to my children that there were once tigers — real, wild tigers, out there, in the great forests of the world – but that we let them die out, because we were busy – well, it was bad enough explaining about the Tooth Fairy, and that wasn’t even my fault,” said English comedian Simon Evans.

Yikes!

• Earth’s Magnetic Field Now Flips More Often Than Ever (BBC)

The Earth’s magnetic field, which protects us from potentially dangerous solar radiation, is gradually losing its stability. No need to move underground or build space colonies just yet, though: the changes are taking place over millions of years. You might assume that compasses will always point north, but in fact the magnetic poles have swapped places many times in the Earth’s history. Earth scientists have long suspected that these flips are becoming more frequent, and that the magnetic field was less prone to pole reversals in the distant past. Now the most detailed analysis of the geological evidence to date suggests that the field really is slowly destabilising. Whereas in the distant past it reversed direction every 5 million years, it now does so every 200,000 years.

Earth’s magnetic field is powered by the heart of the planet. At its centre is a solid inner core surrounded by a fluid outer core, which is hotter at the bottom. Hot iron rises within the outer core, then cools and sinks. These convection currents, combined with the rotation of the Earth, are thought to generate a “geodynamo” that powers the magnetic field. Because of changing temperatures and fluid flows, the strength of the magnetic field varies, and the positions of the north and south magnetic poles shift. These shifts leave traces in rocks. When lava cools, metal oxide particles within the rock become frozen in the direction of the prevailing magnetic field. So scientists can work out the historic positions of the magnetic poles by examining and dating lava samples. As a result we know there have been about 170 magnetic pole reversals during the last 100 million years, and that the last major reversal was 781,000 years ago.