Wyland Stanley Bulletin press car: Mitchell auto at Yosemite National Park 1920

“..simple modifications like contract amendments will not overcome the system’s deficiencies.”

• A Fair Hearing For Sovereign Debt (Stiglitz/Guzman)

Last July, when United States federal judge Thomas Griesa ruled that Argentina had to repay in full the so-called vulture funds that had bought its sovereign debt at rockbottom prices, the country was forced into default, or “Griesafault”. The decision reverberated far and wide, affecting bonds issued in a variety of jurisdictions, suggesting that US courts held sway over contracts executed in other countries. Ever since, lawyers and economists have tried to untangle the befuddling implications of Griesa’s decision. Does the authority of US courts really extend beyond America’s borders? Now, a court in the UK has finally brought some clarity to the issue, ruling that Argentina’s interest payments on bonds issued under UK law are covered by UK law, not US judicial rulings.

The decision – a welcome break from a series of decisions by American judges who do not seem to understand the complexities of global financial markets – conveys some important messages. First and foremost, the fact that the Argentinian debt negotiations were pre-empted by an American court – which was then contradicted by a British court – is a stark reminder that market-based solutions to sovereign-debt crises have a high potential for chaos. Before the Griesafault, it was often mistakenly assumed that solutions to sovereign-debt repayment problems could be achieved through decentralised negotiations, without a strong legal framework. Even afterwards, the financial community and the IMF hoped to establish some order in sovereign-bond markets simply by tweaking debt contracts, particularly the terms of so-called collective-action clauses (which bind all creditors to a restructuring proposal approved by a supermajority).

But simple modifications like contract amendments will not overcome the system’s deficiencies. With multiple debts subject to a slew of sometimes-contradictory laws in different jurisdictions, a basic formula for adding the votes of creditors – which supporters of a market-based approach have promoted – would do little to resolve complicated bargaining problems. Nor would it establish the exchange rates to be used to value debt issued in different currencies. If these problems are left to markets to address, sheer bargaining power, not considerations of efficiency or equity, will determine the solutions. The consequences of these deficiencies are not mere inconveniences. Delays in concluding debt restructurings can make economic recessions deeper and more persistent, as the case of Greece illustrates.

Read more …

Finally some sense?

• Berlin Alarmed by Aggressive NATO Stance on Ukraine (Spiegel)

It was quiet in eastern Ukraine last Wednesday. Indeed, it was another quiet day in an extended stretch of relative calm. The battles between the Ukrainian army and the pro-Russian separatists had largely stopped and heavy weaponry was being withdrawn. The Minsk cease-fire wasn’t holding perfectly, but it was holding. On that same day, General Philip Breedlove, the top NATO commander in Europe, stepped before the press in Washington. Putin, the 59-year-old said, had once again “upped the ante” in eastern Ukraine – with “well over a thousand combat vehicles, Russian combat forces, some of their most sophisticated air defense, battalions of artillery” having been sent to the Donbass. “What is clear,” Breedlove said, “is that right now, it is not getting better. It is getting worse every day.”

German leaders in Berlin were stunned. They didn’t understand what Breedlove was talking about. And it wasn’t the first time. Once again, the German government, supported by intelligence gathered by the Bundesnachrichtendienst (BND), Germany’s foreign intelligence agency, did not share the view of NATO’s Supreme Allied Commander Europe (SACEUR). The pattern has become a familiar one. For months, Breedlove has been commenting on Russian activities in eastern Ukraine, speaking of troop advances on the border, the amassing of munitions and alleged columns of Russian tanks. Over and over again, Breedlove’s numbers have been significantly higher than those in the possession of America’s NATO allies in Europe. As such, he is playing directly into the hands of the hardliners in the US Congress and in NATO.

The German government is alarmed. Are the Americans trying to thwart European efforts at mediation led by Chancellor Angela Merkel? Sources in the Chancellery have referred to Breedlove’s comments as “dangerous propaganda.” Foreign Minister Frank-Walter Steinmeier even found it necessary recently to bring up Breedlove’s comments with NATO General Secretary Jens Stoltenberg. But Breedlove hasn’t been the only source of friction. Europeans have also begun to see others as hindrances in their search for a diplomatic solution to the Ukraine conflict. First and foremost among them is Victoria Nuland, head of European affairs at the US State Department. She and others would like to see Washington deliver arms to Ukraine and are supported by Congressional Republicans as well as many powerful Democrats.

Indeed, US President Barack Obama seems almost isolated. He has thrown his support behind Merkel’s diplomatic efforts for the time being, but he has also done little to quiet those who would seek to increase tensions with Russia and deliver weapons to Ukraine. Sources in Washington say that Breedlove’s bellicose comments are first cleared with the White House and the Pentagon. The general, they say, has the role of the “super hawk,” whose role is that of increasing the pressure on America’s more reserved trans-Atlantic partners.

Read more …

Not too much sense, though.

• EU To Prepare Possible New Sanctions On Russia Over Ukraine (Reuters)

Britain’s foreign minister said on Friday the European Union would prepare possible new sanctions on Russia for its involvement in the Ukraine conflict that could be imposed quickly if the Minsk ceasefire agreement is broken. Both Kiev and pro-Russia separatists have accused each other of violence since last month’s peace deal that calls for heavy weapons to be withdrawn from the frontline in east Ukraine. “The European Union will remain united on the question of sanctions, sanctions must remain in place until there is full compliance (with the Minsk agreement),” Philip Hammond said. “We will prepare possible new sanctions, which could be imposed quickly if there is further Russian aggression or if the Minsk agreement is not complied with,” he said.

Hammond also said Britain does not have immediate plans to supply Kiev with weapons, but it is “not ruling anything out for the future” as the situation in east Ukraine remains “dynamic”. At a joint conference with his British counterpart in Warsaw, Polish Foreign Minister Grzegorz Schetyna said new sanctions could be imposed if, for example, separatists attack Ukraine’s port city of Mariupol, but a move such as excluding Russia from the SWIFT payments system was an extreme option. “(Exclusion) from SWIFT is the ‘nuclear’ option, this is an extreme option and there is a long list of sanctions that may be used before that,” he said. “Also, the truth is that it is a ‘double-edged sword’.”

Read more …

What comes up…

• Week of Milestones for US Stocks Spoiled by Fed Rate Anxiety (Bloomberg)

The specter of the Federal Reserve raising interest rates spoiled a week of milestones for U.S. equities. The Standard & Poor’s 500 Index capped a sixth year of the bull market, the Nasdaq Composite Index topped 5,000 for the first time in 15 years and Apple Inc., the world’s largest company by market value, gained admission to the Dow Jones Industrial Average. None of that stopped benchmarks from notching their worst week since January, as concern mounted that the monetary stimulus that helped equities triple from March 2009 will soon end, after a surge in hiring fueled speculation the Fed will raise borrowing costs this year.

The S&P 500 lost 1.6% in the five days, trimming its gain in 2015 to 0.6%, worst among 24 developed-nation markets. “It’s definitely been a week of milestones,” Russ Koesterich, the New York-based chief investment strategist at BlackRock, said in a phone interview. “People are obviously taking a pause as valuations aren’t cheap. This is all about rates. The ultra-dovish view that it won’t happen until next year is much less likely.” The S&P 500 tumbled 1.4% in the final session of the week after data showed employers added 295,000 workers to payrolls in February, more than forecast, and the unemployment rate dropped to 5.5%, the lowest in almost seven years.

The jobless rate has now reached the Fed’s range for what it considers full employment, keeping policy makers on course to raise interest rates this year as persistent job growth sets the stage for a pickup in wages. Three rounds of Fed bond-buying and near-zero interest rates have helped the S&P 500 rally more than 200% since its bear-market low on March 9, 2009. The current bull market, lasting almost 2,200 days, is about two months away from overtaking the 1974-1980 run as the third longest since 1929. The gauge hasn’t had a 10% drop since 2011.

Read more …

She doesn’t care. She wants the narrative, not reality.

• Dear Janet Yellen: We’re Nowhere Close To Full Employment (MarketWatch)

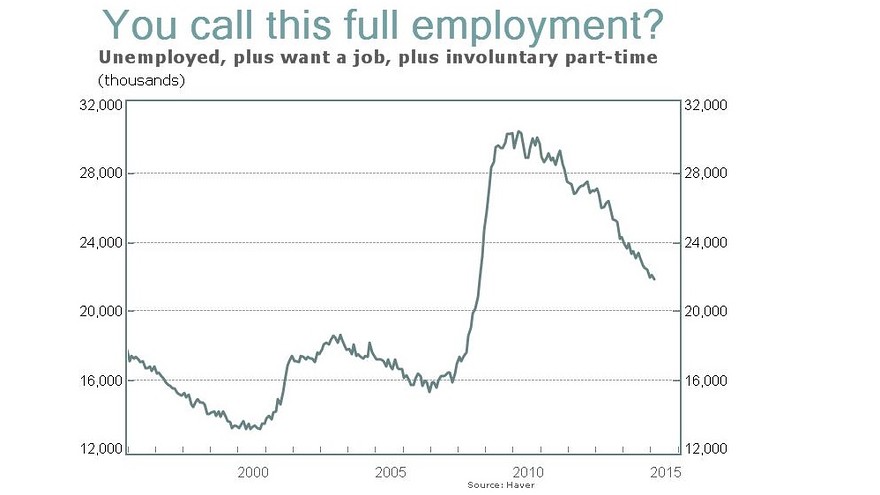

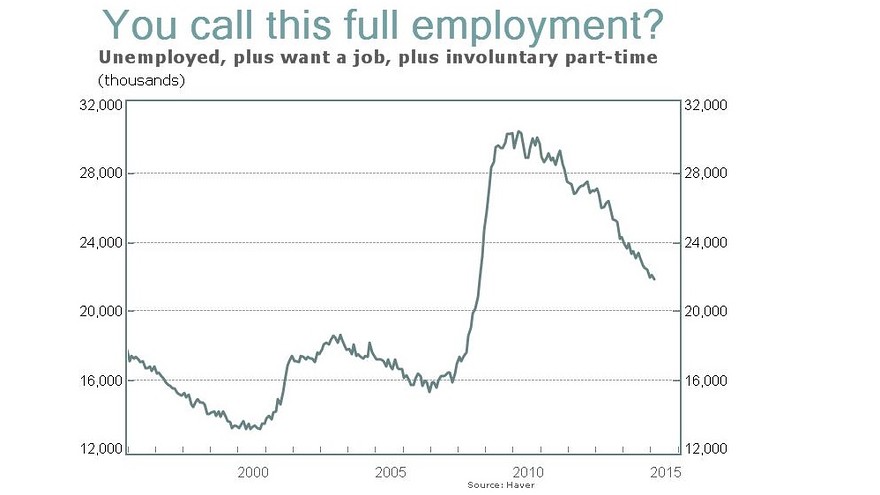

The unemployment rate fell to 5.5% in February, dropping to a level that some might call “full employment.” The Federal Reserve has said that, in the long run, the unemployment rate can’t go much below 5.2% to 5.5% without fostering a lot of unwanted inflation. With the February report, we’ve crossed that line. Already, the Fed is under a lot of pressure to raise interest rates this summer to make sure inflation doesn’t get too high. The February jobs report adds to that pressure. There’s just one problem: Inflation isn’t too high, and there’s no sign that inflation will suddenly accelerate. In fact, the main concern right now is that the inflation rate is too low. The Fed has long operated under a theory that there’s a limit to how low unemployment can safely go. This rate is known as the “non-accelerating inflation rate of unemployment,” or NAIRU.

The Fed has pegged this number at 5.2% to 5.5%. The argument goes like this: At low levels of unemployment, companies can’t find the workers they need without offering more pay. Once companies get into a bidding war for skilled workers, everyone’s pay goes up. And to pay those wages, companies need to raise their selling prices. Voilà! Inflation. It’s a tidy argument that might have made a lot of sense in 1979, but in today’s economy, there’s no sign that the labor market is so tight that wages are being bid up, even though lots of policy makers and private-sector economists are positive that inflationary wages are coming any day now, that they are right around the corner, just you wait. They’ve been saying that for months.

Here are the facts. According to the Bureau of Labor Statistics, average hourly earnings (wages) for all private-sector workers are up 2% in the past 12 months, about the same wage growth we saw last year and the year before that and the year before that. Average hourly wages for the 80% of workers who aren’t supervisors are up 1.6% in the past year, down from the 2.5% growth reported a year ago. The Employment Cost Index, which is a little more sophisticated than the average hourly wages report, tells a similar story: Wages and benefits are up 2.3% in the past year, up from 2% in the year before that. The ECI shows a little acceleration in compensation, but Fed Chair Janet Yellen has said that workers’ compensation can grow at about 3% to 4% without engendering any inflationary pressures. We’re still a long way from there.

Does anyone really think we’re close to full employment today? Officially, there are 8.7 million people who were actively searching for work last month, plus another 6.5 million people who didn’t look last month but who say they want a job. Plus another 6.6 million who want to work full-time but can only get a part-time job. That’s nearly 22 million people who are unemployed or underemployed. They deserve a shot at a job that pays a living wage. The Fed should think about them, rather than pay attention to a phantom inflation problem.

Read more …

Go Nafeez!

• ‘A Conspiracy Of Silence’: HSBC, Guardian And The Defrauded British Public (ML)

The corporate media have swiftly moved on from Peter Oborne’s resignation as chief political commentator at the Telegraph and his revelations that the paper had committed ‘a form of fraud’ on its readers over its coverage of HSBC tax evasion. But investigative journalist Nafeez Ahmed has delved deeper into the HSBC scandal, reporting the testimony of a whistleblower that reveals a ‘conspiracy of silence’ encompassing the media, regulators and law-enforcement agencies. Not least, Ahmed’s work exposes the vanity of the Guardian’s boast to be the world’s ‘leading liberal voice’.

Last month, the corporate media, with one notable exception, devoted extensive coverage to the news that the Swiss banking arm of HSBC had been engaged in massive fraudulent tax evasion. The exception was the Telegraph which, as Oborne revealed, was desperate to retain advertising income from HSBC. But now Ahmed reports another ‘far worse case of HSBC fraud totalling an estimated £1 billion, closer to home’. Moreover, it has gone virtually unnoticed by the corporate media, for all the usual reasons. According to whistleblower Nicholas Wilson, HSBC was ‘involved in a fraudulent scheme to illegally overcharge British shoppers in arrears for debt on store cards at leading British high-street retailers’ including B&Q, Dixons, Currys, PC World and John Lewis. Up to 600,000 Britons were defrauded.

Wilson uncovered the crimes while he was head of debt recovery for Weightmans, a firm of solicitors acting on behalf of John Lewis. But when he blew the whistle, his employer sacked him. He has spent 12 years trying to expose this HSBC fraud and to help obtain justice for the victims. The battle has ‘ruined his life’, he said during a brief appearance on the BBC’s The Big Questions, the only ‘mainstream’ coverage to date.

Read more …

Europe’s recovery symbol.

• Almost 100 Families Evicted Daily In Spain (RT)

At least 95 families were evicted every day in Spain in 2014, fresh statistics say as Spaniards struggle to meet mortgage payments. Home foreclosures have become a stark symbol of the 7-year economic crisis, with 2014 seeing a further rise in numbers. The number of foreclosures on all types of residences, including holiday homes, offices and farms, reached 119,442 last year, almost 10% higher than in 2013, according to data from the National Statistics Institute. Foreclosure procedures on main residences rose to 34,680 families in 2014, an increase of 7.4% over the previous year.

Andalusia, Catalonia and Valencia were the worst-affected regions. Evictions have become a symbol of the economic crisis Spain has been struggling with since 2008. Most of them were connected to mortgages taken out during property booms in 2006 and 2007. The situation has provoked nationwide protest. Campaigners often rally outside homes in an attempt to prevent residents from having to spend the night in the street. They are calling on the country’s authorities to make more housing available, or allow vacant housing following developers’ bankruptcies to be used.

Read more …

“The problem with taxing the shipowners is that it would take only 24 hours for them to reflag their entire fleet..”

• It Might Be Time To Panic About Greek Government Bonds (John Dizard)

Judging by the prices of Greek government bonds, the investing community seems to have overcome its blind, unreasoning panic about the Syriza-led government that took office in January. In the past five weeks, the 10-year benchmark yield has dropped from a peak of about 11.2% to just over 9.5%. This is good. Blind, unreasoning panic is wrong. I think it might be time for open-eyed, reasoned panic about traded Greek Government bonds. They might look cheap compared to negative yield German bonds, or zero yield GDF Suez bonds, but they will get even cheaper later this year. If you own them, sell them. Bond investors have been lulled too quickly by the truce declared between Greece and its European creditors.

Not that Greece will necessarily default on the already-haircut issues held by the private sector. The principal payments will not be due for another eight years or so, and the interest payments are not very burdensome. Those bonds are now governed by English law, which makes them rather more enforceable than the old “local law” Greek debt. The Syriza cabinet recognises these facts. The problem is that the Greek government will run out of cash to pay its operating expenses in full by the summer, or even sooner, and neither the Europeans nor anyone else will give them enough new money to pay its bills. That means the Syriza cabinet will have to tell public sector employees and pensioners that part of their income will be paid in (transferable) IOUs, which will plunge to a steep discount.

The leaders can blame Germans, oligarchs, neoliberal economists or Martians, but a lot of their core supporters will be unhappy, and quite open about their feelings. The eurogroup political leadership and the eurocracy are prepared for this. Their recent civil exchange of letters represents a truce, not a peace. The eurogroupies know that there is no mutually acceptable deal to be had with the Syriza government. So their silent intention is to negotiate with the next government, whoever that might be, after the Greek government is forced to call for an early election. Things have to get pretty bad for that to happen; after all, Syriza just won fair and square less than two months ago, and their policies are supported by a majority of the Greek public. Bad enough for those 9.5% yields to look a bit thin on a risk-adjusted basis. And they will.

Read more …

Greece does good cop bad cop pretty well.

• Greek And German Bruisers Limber Up For ‘Rumble In The Eurozone’ (AFP)

They are both tough men of a certain age used to getting their way. In one corner stands Wolfgang Schaeuble, the dry 72-year-old German Finance Minister and self-appointed guardian of the European Union’s fiscal orthodoxy. And at the opposite end of Europe’s austerity divide glowers former Communist Panagiotis Lafazanis, Greece’s obdurate new energy and output minister. Schaeuble and Lafazanis, 63, have not yet sat down together around a negotiating table in Brussels, but a clash between them is unavoidable nonetheless as Athens and Berlin square up for another bail-out showdown. Lafazanis is responsible for some of Greece’s main state companies that were slated to be privatized under the rescue plan agreed with the EU and the International Monetary Fund.

These include dominant electricity provider PPC, state gas distributor DEPA and leading refiners HELPE. State stakes in all three were to be sold to private investors as part of the Greece’s bail-out deal until January, when the new hard-left Syriza government pulled the plug on the plan. “No privatisation will be held in the energy sector – neither at PPC, nor at DEPA nor at HELPE,” Lafazanis said at the time. When electricity workers were given a pay rise this week – to general consternation – the ministry did not object. Schaeuble, however, insists on the new Greek government honoring the country’s existing pledges, and he has castigated Syriza for making promises they cannot afford to keep.

Read more …

Juncker will need to act.

• Europe Holds ‘Noose Around Greek Necks’ Says PM Tsipras (Telegraph)

Greece’s prime minister has accused the ECB of holding a noose around the country’s neck as his government rushes to assure creditors it can avert bankruptcy this month. Speaking in an interview with Der Spiegel magazine, Alexis Tsipras appealed to the ECB to alleviate pressure on the cash-strapped country. The ECB “is still holding the rope which we have around our necks” said Mr Tsipras, referring to the central bank’s reluctance to resume ordinary lending to Greek banks at a meeting in Cyprus on Thursday. The central bank has also rebuffed Greek appeals to raise the limit on short-term debt issuance, as it faces €6.5bn in payments over the next three weeks. Should the ECB continue to resist Greek pleas for assistance, “the thriller we saw before February 20 will return” warned Mr Tsipras, referring to the market turmoil which gripped the country as it carried out protracted negotiations with its creditors.

Greece made its first €300m payment to the International Monetary Fund on Friday. It faces another €1.2m in loan redemptions to the Fund before the end of the month. But the government is scrambling to find the funds it needs to meet its obligations to creditors in March. Athens is not due to receive €7.2bn of bail-out money before April. ECB president Mario Draghi said a collateral waiver on Greek bonds would only be reinstated once “a successful completion of the bail-out review be put in place”. Greek banks are having to rely on an a form of expensive emergency funding to stay afloat as capital has rushed out of the country. Ahead of a meeting of European ministers on Monday, Greece’s Yanis Varoufakis submitted an 11-page list of reforms his government intends to carry out to unlock the vital cash it needs from its creditors.

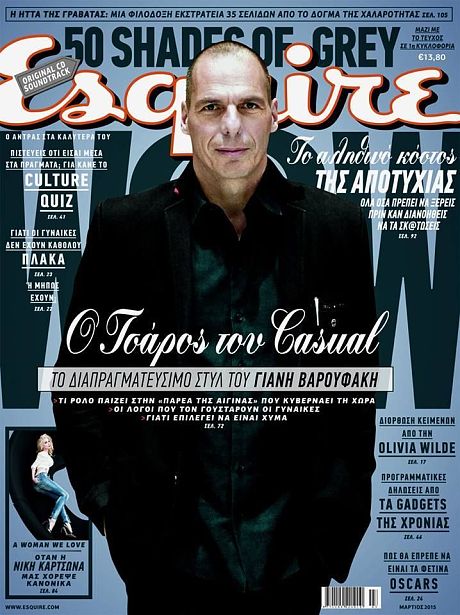

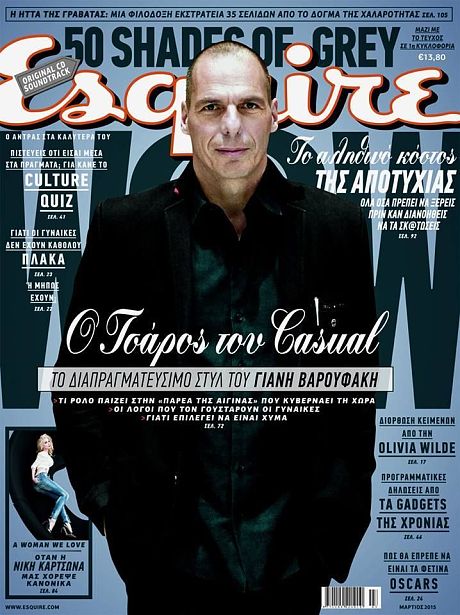

The proposals include measures to fight tax evasion using students, tourists and housekeepers as undercover tax inspectors. The “rock-star” finance minister also made an appearance on the cover of the Greece’s Esquire magazine for March. Following the ECB’s hostility to Greece’s woes, Mr Tsipras asked to meet with the European Commission’s Jean-Claude Juncker but was turned down, according to a Greek government source. A meeting between the two could now take place next week to “discuss how Greece will utilise European funds to address the humanitarian crisis and unemployment”, said a Syriza spokesman. Amid fears that the country will not come good on its election promises, Mr Varoufakis has promised his Leftist government has “alternative plans” to plug its financing gap over the next 21 days. “We go into the negotiations with optimism, with especially good preparation”, said the finance minister.

Read more …

Be sure the plan is there. They just can’t talk about it.

• Time For Greece To Plan Its Exodus From The Euro (MarketWatch)

Greece must now plan on a way to exit the euro if it is to have any chance of staying. This is not a conundrum; it is the way negotiation works. The new government of Prime Minister Alexis Tsipras was forced to backtrack last month on its election pledges to get its foreign debt reduced and reverse austerity because it had no plausible alternative to European Union intransigence on extending the bailout. The only viable alternative would be to exit the euro, default on the debt and suffer the consequences, and Athens was not ready to do that. This “Plan B” cannot be a bluff and at this point it is better than even odds it will be the plan Greece will have to follow.

Tsipras and his finance minister, Yannis Varoufakis, have so far argued in their “Plan A” that Greece can stay in the euro, but pinned that belief on Germany and other EU members being reasonable. Germany — as well as the European Commission, the European Central Bank, and the International Monetary Fund — made it amply clear in the initial round of negotiations that they have no intention of being reasonable in the way Tsipras and Varoufakis believe they should. It was always a fairly delusional assumption that German leaders would suddenly see the light and embrace an enlightened Keynesian solution to the economic and social crisis in Greece. Berlin and Brussels remain pitiless and more convinced than ever of the rightness of their destructive neoliberal policies.

The only way Greece can regain its sovereignty — which is essentially what Tsipras’s Syriza party pledged to voters in its rise to power — is to reclaim its sovereign rights, and especially control of its currency and banking system. The consequences of defaulting on the country’s debt would be dramatic, but relatively short-lived compared to the guaranteed long-term misery of the EU austerity program.

Read more …

Finance ministers are out of their league, they need third-party advisers.

• Greece Sends Proposals, But No Decision Due At Monday’s Eurogroup (Kathimerini)

Greece submitted to Eurogroup chief Jeroen Dijsselbloem Friday an outline of seven reform proposals to form the basis for discussion at Monday’s meeting of eurozone finance ministers, but the signs from Brussels are that Athens is no closer to securing the release of its next tranche of bailout funding. The 11-page document sent by Finance Minister Yanis Varoufakis sets out several proposals that have already been made public as well as some that were only made known Friday. The suggestion that caused the most surprise was to fight tax evasion by enlisting non-professional inspectors, including tourists, on a two-month basis during which they would collect audiovisual data that could be used to target evaders. Varoufakis also outlined plans to activate a fiscal council to generate budget savings and update licensing of gaming and lotteries to boost state revenues by an estimated €500 million.

He also gave details of the government’s plan to ease the social impact of the crisis, which will cost some €200 million, and to introduce a new payment plan for tax debtors, which the coalition estimates could raise €3 billion in revenues. In his letter to Dijsselbloem, Varoufakis calls for technical discussions regarding the proposals to begin as soon as possible. “We envisage that… the majority of the items on our first list can be further specified as soon as possible so that the resulting agreement can be ratified by the Eurogroup, and Greece’s Parliament, and become the basis for the review,” wrote the Greek finance minister, who added that the government proposes all technical discussions and fact-finding or fact-exchange sessions should take place in Brussels.

Read more …

It’s about what comes after.

• Cash-Strapped Greece Repays First Part Of IMF Loan Due In March (Reuters)

Greece repaid on Friday the first €310 million instalment of a loan from the International Monetary Fund that falls due this month, as it scrambles to cover its funding needs. Prime Minister Alexis Tsipras’s newly elected government must pay a total of €1.5 billion to the IMF this month, but it is rapidly depleting its cash. The payments fall due over two weeks starting on Friday. The next three instalments are due on March 13, 16 and 20. “The payment of €310 million has been made, with a Friday value date,” a government official told Reuters, requesting anonymity. The Tsipras government has said it will make the payments, but uncertainty has been growing over Greece’s cash position. It faces a decline in tax revenues, while aid from EU/IMF lenders remains on hold until Athens completes promised reforms.

Athens sent an updated list of reforms to Brussels on Friday, before a meeting of euro zone finance ministers on Monday, a Greek government official said. The list expanded on an earlier set of proposals, he said. The reforms include measures to fight tax evasion and red tape and facilitate repayment of tax and pension fund arrears owed by millions of Greeks, the official said. It also proposes a “fiscal council” to generate savings for the state. In the letter to the Eurogroup, Greek Finance Minister Yanis Varoufakis says Athens aims to save €200 million by cuts in public-sector spending, offseting an estimated €200 million cost to tackle what it calls the country’s “humanitarian crisis.” It also aims to collect €500 million in extra revenues annually from new gaming licences and taxing online gaming operators.

Read more …

Keep up the pressure, see if they make mistakes.

• Greece Wants Immediate Talks With Troika On Bailout, Eyes Follow-up Deal (Reuters)

Greece asked euro zone countries on Friday for an immediate start of technical talks with international creditors on the first batch of reforms that would help conclude its current bailout programme and allow the disbursement of more loans. The request marks a softening of Greece’s stance. Until now, it has rejected talks with the three institutions that have supervised it so far on implementing reforms. But Greece, which faces loan repayments over the coming weeks and months, is running out of cash and needs more euro zone credit to avoid bankruptcy. If it concludes the bailout, which means implementing reforms the previous government had agreed to, but which the current government rejects, it could get €1.8 billion of loans remaining from the existing 240 billion-euro bailout.

It would also be eligible to get €1.9 billion that the ECB made in profits on buying Greek bonds. And Greek banks would again become eligible to finance themselves at the ECB’s open market operations. “I am now writing to you … to convey the Greek government’s view that it is necessary to commence immediately the discussions between our technical team and that of the institutions,” Greek Finance Minister Yanis Varoufakis said in a letter to the chairman of euro zone finance ministers, Jeroen Dijsselbloem. Varoufakis proposed that discussions with the institutions take place in Brussels – avoiding the connotation of a loss of sovereignty that visits to Athens by Troika representatives over the past five years have had for the Greek public.

Read more …

Bye bye Rousseff.

• The Noise From Brazil? An Economy On The Brink (Guardian)

The more you look at Brazil’s fundamentals, the more shaky the country looks. And we are not talking about the defensive prowess of David Luiz here. It is the country’s economic backline that risks tumbling down like a set of dominoes. When a Latin American economy is in trouble a good place to start is its inflation rate. Brazil’s is today running at 7.5%. While this is nowhere near the 2,000-3,000% of the early 1990s, when the price of everything went up several times a week, it is far higher than the central bank’s mid-point target of 4.5%. On Wednesday, in an effort to bring inflation down, Brazil’s central bank raised interest rates to 12.75%, a six-year high.

The problem is that the country is hiking interest rates – and trying to curb high prices – at a time in which its economy is on the brink of recession. Between 2002 and 2008, Brazil’s economy expanded at 4% a year. It has since averaged less than 2%. GDP is expected to contract 0.5% this year. High inflation makes matters worse in at least two ways. First, high prices hinder shoppers’ purchasing power. The Economist calculates that about half of the country’s growth over the past decade was driven by consumption. A drop in purchases will not only dampen economic prospects but would lead to a recession that would freeze the pay of millions because the minimum wage is linked to GDP and inflation.

Elsewhere, salaries in both the public and private sector have grown above GDP for the past decade and are now unlikely to keep pace with inflation. Tax hikes and fare rises will not help either. It is therefore not surprising that consumer confidence is at its lowest since records began in 2005. Second, next to rising prices, the real is sinking. Despite the rate increase, Brazil’s currency hit R$3 to the US dollar on Wednesday for the first time in more than a decade. This puts further pressure on prices: the cost of imported goods goes up – more bad news for shoppers.

Read more …

Cats in a sack.

• Brazil Supreme Court Clears Probe of Top Lawmakers Amid Petrobras Scandal (WSJ)

A corruption dragnet that has jailed dozens of executives and erased billions from Brazil’s state-controlled oil giant has now snared some of the nation’s top lawmakers, deepening a crisis that is weighing on South America’s largest economy. Brazil’s Supreme Court on Friday gave the go-ahead to federal prosecutors to investigate close to 50 politicians, including Senate President Renan Calheiros and Eduardo Cunha, head of the Chamber of Deputies, as part of a widening corruption probe of Petróleo Brasileiro S.A., known as Petrobras. Both men are members of the PMDB party, Brazil’s largest and a key partner in President Dilma Rousseff ’s effort to pass austerity measures to narrow a yawning budget gap. With the economy skidding and Brazil in danger of losing its investment-grade sovereign rating, the investigation could push top legislators away from strict measures and toward populism.

“What’s going to prevail is the survival instinct,” said Ricardo Ismael at Rio’s Pontifical Catholic University. “The big problem I think is with the economy because the government was really counting on fast votes from Congress, so they could share the cost of the fiscal adjustment.” Fear that fallout from the scandal would threaten budget cuts has weighed on Brazil’s stocks and currency. The IBOVESPA stock index declined by 3.1% this week, while the real plunged about 7%. On Tuesday, hours after rumors emerged that his name was on “Janot’s list,” Mr. Calheiros torpedoed an executive order from Ms. Rousseff that would have raised payroll taxes to fill government coffers. Local press characterized the move as retaliatory, though it followed a period of heightened tension between the two politicians. The attorney general is independent of the government.

“What happened this week is that the risks, which were already there, became more visible,” says Carlos Melo, a professor at São Paulo business school Insper. “After Renan´s move, it is clear the government will not be able to push any kind of fiscal adjustment through Congress without negotiating first.” In practice, analysts say, that stretches the odds of the government meeting its 1.2% target for the primary budget surplus, seen by many as a make-or-break goal in the effort to avoid a sovereign downgrade. Prosecutors say the PMDB, Ms. Rousseff’s Workers’ Party, and other government-aligned parties suggested executives to run major divisions at Petrobras.

Read more …

“The devourers of capitalism had become the devourers of Petrobras.”

• Petrobras Has a $13.7 Billion Yard Sale (Bloomberg)

Staggered by $135 billion in debt and scandal, Brazilian state-run oil giant Petroleo Brasileiro SA has announced plans to offload some $13.7 billion in assets. Officials claim this is not a plan to raffle the jewel of the government crown. Instead think fire sale, a maneuver to raise cash and keep creditors at bay. The move plays like a scene in a script coming full circle. Luiz Inacio Lula da Silva once joked that back in the 1990s, when he was still the country’s ranking lefty and not its president, “people trembled” whenever he passed by the door of the Sao Paulo stock exchange. “There goes that devourer of capitalism,” they’d say.

Yet scarcely more than a decade later, Lula, a self-described “walking metamorphosis,” was at Bovespa as president of Brazil, hosting the feast as the state-run oil giant went on the bloc in one of the world’s biggest public stock offerings. “Capitalization,” he beamed in 2010, “is one of the safeguards the government has to assure that this wealth doesn’t get lost to the labyrinths of waste and dubious interests.” Tell that to prosecutor general Rodrigo Janot, who just handed the Supreme Court a list of 54 lawmakers and government officials suspected of looting the country’s flagship multinational for political gain. So labyrinthine is waste and corruption that the new management – the old one resigned in disgrace – has yet to file the 2014 balance sheet, which is one reason why Moody’s Investor Services recently downgraded Petrobras paper to junk.

The fire sale Petrobras is planning may prove difficult. With crude prices slumping, it’s a buyer’s market for rigs and refineries. Meanwhile, the ruling Working Party and union rank and file, who see a plot to privatize Petrobras by stealth, have called for a mass protest March 13 to defend the company and roll back austerity measures announced by Lula’s successor, President Dilma Rousseff. Leading the charge, strangely enough, is Lula himself, who exhorted companheiros to stand up to bottom-feeding “neoliberals.” This was wagging the dog. It’s not the market-friendly opposition that threatens Brazil’s biggest brand, but repeated government attempts – first by Lula, then Rousseff — to suspend the basic rules of economic gravity. The devourers of capitalism had become the devourers of Petrobras.

Read more …

New normal.

• RBS Top Bankers Received Millions Despite £3.5 Billion Loss (Guardian)

Royal Bank of Scotland paid 128 of its top bankers more than €1m (£720,000) in 2014, a year when it reported its seventh consecutive year of losses since being bailed out by the taxpayer and was punished by regulators for rigging foreign exchange markets. Three bankers, whose identities are protected because only the pay deals of boardroom directors have to be published, received up to €6m. The disclosures are likely to reignite the controversy over the pay handed out by the bank, which has incurred losses on a par with the £45bn ploughed in by taxpayers to prevent it going bust. None of the 79% stake has yet to been sold off although George Osborne has promised to sell it as “quickly as we can” if he remains chancellor after the 7 May election.

Chief executive Ross McEwan was paid £1.8m in salary, pension and benefits in 2014 and was handed £1.5m in shares to buy him out of his previous employer in Australia when he was recruited to run the retail bank. He was awarded £1.5m of shares under a long-term plan that will pay out in the future. The pay of the New Zealander, though, was eclipsed by a number of colleagues. The newly recruited finance director Ewen Stevenson received £3.1m after being bought out of his previous employer, Credit Suisse, and Rory Cullinan, who runs the non-core division of the bank, received £2.2m from bonuses handed out in previous years. Cullinan, who has been promoted to help wind down the investment banking arm, cashed in £1.2m of shares and was awarded £2m in a new pay deal.

The bank published share payouts and awarded to the members of the executive management team who do not sit on the board. When share awards to McEwan and Stevenson are included, eight senior managers were awarded shares worth £11m which will payout in the future. In total more than £5m of shares were cashed in from previous years. The bank said the 128 paid more than €1m compares with 149 a year ago when the staff who have relocated to the US through its Citizens Financial arm, in the process of being floated in the US stock market, are included.

Read more …

Too little too late.

• EU To Hold Immigrants At Bay With Third-Country Asylum Centers (RT)

Opening processing centers in transit countries in the hope that it will curb the number of illegal immigrants is Brussels’ answer to the inflow of refugees, who risk their lives to cross the Mediterranean in search of a better life. The measure is part of the new European Agenda on Migration, which will be published later in mid-May. At a media conference this week, Dimitris Avramopoulos, the European Commissioner for Migration and Home Affairs, said amending the way the EU deals with illegal immigration is an urgent issue that requires complex solutions. “When presenting a comprehensive European Agenda on Migration we have to think about all dimensions of migration – this is not about quick fixes; this is about creating a more secure, prosperous and attractive European Union,” he said.

Last year, over 276,000 people entered the EU illegally, which is 155% more than in 2013, according the EU borders agency Frontex. Some 220,000 arrived via the Mediterranean, with at least 3,500 and possibly more than 4,000 people dying en route. The passage is considered the most dangerous in the world. “We need to be effective, as Europeans, on the immediate response and at the same time to address the root causes, starting from the crises spreading at our borders, most of all in Libya,” said EU foreign policy chief Federica Mogherini. “That’s why we are increasing our work with origin and transit countries to provide protection in conflict regions, facilitate resettlement and tackle trafficking routes.”

Establishing processing centers in countries like Niger, Egypt, Turkey or Lebanon represents a U-turn in EU policies as the idea is gaining traction among the more affected members. Southern European countries including Italy and Malta are among those members of the union that pay the greatest price dealing with the inflow. France and Germany also favor the idea. Strong opposition to the idea remains among national governments less eager to welcome refugees from countries like Libya and Syria on their soil, such as Denmark and the UK. Part of the reluctance is because some EU members don’t want to relinquish authority over immigration policies to Brussels.

Read more …

How’s the CIA supposed to make a living now?

• ISIS Generates Up To $1 Billion Annually From Trafficking Afghan Heroin (RT)

Drug money is a massive source of profit for ISIS, who makes up to $1 billion annually from sales throughout its conquered lands, according to the Russian Federal Drug Control Service (FSKN). “The area of poppy plantations is growing. This year, I think, we’ll hear news about a record-high poppy harvest, therefore a high yield of opium and heroin. So this issue should be raised not only in Moscow, but also in the UN in general, because this is a threat not only to our country, but also European security. Over the past five years the Balkan route has been split – heroin traffic now also goes through Iraqi territory,” TASS quotes FSKN head Viktor Ivanov as saying. What makes profits especially huge is that, despite not operating in Afghanistan, large quantities of poppy are being transported through those parts of Iraq the Islamic State (IS, formerly ISIS) controls.

To Ivanov, this makes possible a “huge financial sponsorship.” “According to our estimates, IS makes up to $1 billion annually on Afghan heroin trafficked through its territory,” he added. The FSKN in November said that the sale of Afghan heroin in Europe could generate upwards of $50 billion for the militants. What’s more, over half of Europe’s heroin now comes from the IS, according to Ivanov. Indeed, drug money has been high on the IS’s list of profit generators, together with oil and conquest. A recent report by the Financial Action Task Force talked of how the IS has been branching out into all manner of finance-generating activities, though it is the reliance on oil that makes them a truly unique terrorist group, unlike others before it.

It remains unclear whether IS can hold its drugs though, let alone run a smuggling business. One British ex-soldier who joined the Peshmerga Kurdish fighters in November 2014 to fight the IS describes the majority of Islamist militants as a disorganized bunch of “office workers and villagers” on drugs. “They do not have a choice, and they don’t have any information, or even any clear leadership. Many of them are heavily involved in taking drugs they are so terrified,” Jamie Read said.

Read more …