G. G. Bain 100-mile Harkness Handicap, Sheepshead Bay Motor Speedway, Brooklyn 1918

Kept going down after this article was posted.

• China Shanghai Stocks Lose 6.15% Overnight On Yuan Fears (CNBC)

Chinese shares led losses in Asia on Tuesday, as nerves over China’s struggling economy and a deadly bomb explosion in Thailand sent investors scrambling for safety. A positive handover from Wall Street did little to help sentiment; the tech-heavy Nasdaq led gains with a 0.9% rise overnight, as investors scooped up battered biotech plays, while the Dow Jones Industrial Average and the S&P 500 notched up 0.4 and 0.5%, respectively, on the back of positive homebuilder data. China’s Shanghai Composite index widened losses to 5.2%, hitting a more than one-week low, as concerns over the yuan eclipsed data which showed monthly home prices up for a third straight month in July, indicating that country’s all-important property sector may be finally bottoming.

Prior to the market open, the People’s Bank of China (PBOC) set the midpoint rate at 6.3966 per dollar, firmer than the previous fix of 6.3969. However, the yuan fell against the greenback, slipping 0.2% to last change hands at 6.4086. Among the mainland’s other indexes, the blue-chip CSI300 and the smaller Shenzhen Composite plummeted 4.9 and 5.7%, respectively. Hong Kong’s Hang Seng index tracked the losses in its mainland peers to move down 0.9%. [..] utilities and industrial sectors were among the hardest-hit, with China Shipbuilding and China Shenhua Energy being two of the biggest drags on the index despite news that Beijing may be close to announcing broad plans to reform its state-owned enterprises (SOEs) this month.

From the same Ambrose who mere days ago was quite upbeat on world trade.

• World Shipping Slump Deepens As China Retreats (AEP)

World shipping has fallen into a deep slump over the late summer, dashing hopes of a quick recovery from the global trade recession earlier this year and heightening fears that the six-year economic expansion may be on its last legs. Freight rates for container shipping from Asia to Europe fell by over 20pc in the second week of August, even though trade volumes should be picking up at this time of the year. The Shanghai Containerized Freight Index (SCFI) for routes to north European ports crashed by 23pc in five trading days. The storm in the shipping industry comes as the New York state manufacturing index for July plummeted to a recessionary low of minus 14.9, the lowest since the Great Recession and one of the steepest one-month drops ever recorded.

The new shipments component fell to -13.8, and new orders to -15.7. A similar drop occurred in 2005 and proved to be a false alarm but the latest fall comes at a delicate moment for the world economy. There is now a full-blown August storm sweeping through global markets. The Bloomberg commodity index dropped to a fresh 13-year low on Monday and the MSCI index of emerging market equities touched depths not seen since August 2009. A closely-watched gauge of emerging market currencies has fallen for the eighth week – the longest run of unbroken declines since the beginning of the century – led by the Malaysian Ringgit, the Russian rouble and the Turkish lira. China’s surprise devaluation last week continues to send after-shocks through skittish global markets, already on edge over a likely rate rise by the US Fed in September – though this is now in doubt.

The currency move was widely taken as a warning that the Chinese economy is in deeper trouble than admitted so far, a menacing prospect for exporters of raw materials and for trade competitors in Asia. It threatens to transmit a fresh deflationary impulse through the global system. The great worry is that companies in emerging markets will struggle to service $4.5 trillion of US dollar debt taken out in the boom years when quantitative easing by the Fed flooded the world with cheap money, much of it at irresistible real rates of 1pc. This is up from $1 trillion in 2002. The monetary cycle has gone into reverse since the Fed ended QE in October 2014 and cut off the flow of fresh liquidity. While the first rate rise in eight years has been well-telegraphed, nobody knows for sure what will happen once tightening starts in earnest.

This stress-test could prove even more painful if China really has abandoned its (crawling) dollar peg and is seeking to protect export margins by driving down its currency. The yuan has risen by 60pc against the Japanese yen and 105pc against the rouble since mid-2012. Yet China nevertheless has a trade surplus of 6pc of GDP. Data from the Port of Hamburg released on Monday show much damage this currency surge may be doing to Chinese companies. Axel Mattern, the port’s chief executive, said a 10.9pc drop in trade with China was the chief reason why volumes of container cargoes passing through the port fell 6.8pc in the first six months.

Abenomics was always only a huge failure.

• Japan Exports Its Way to Irrelevance (Pesek)

There’s a difference between bad economic news and the devastating variety that Japan received Monday. Prime Minister Shinzo Abe might have been able to weather the second-quarter data showing a drop in Japanese consumption and a 1.6% decline in annualized growth. But it’s not clear his government can recover from the latest news about sputtering exports, which fell 4.4% from the previous quarter. An export boom, after all, was the main thing Abenomics, the prime minister’s much-heralded revival program, had going for it. The yen’s 35% drop since late 2012 made Japanese goods cheaper, companies more profitable and Nikkei stocks more attractive. But China is spoiling the broader strategy.

The economy of Japan’s biggest customer is slowing precipitously, which has imperiled earnings outlooks for Toyota, Sony, and trading houses like Mitsui. But Abe needs to recognize, as China already has, that this is only the latest sign of a broader reality: Asia’s old export model of economic growth no longer works. China’s devaluation last week raised fears of a return of the currency wars that devastated Asia in the late 1990s. That’s a reach, considering that exports are playing less and less of a role in China. McKinsey, for example, found that as far back as 2010, net exports were contributing only between 10% and 20% of Chinese GDP. The services sector is growing in size and influence to rebalance the economy – not fast enough, perhaps, but change is nevertheless afoot.

If any major country has been relying too much on exports it’s Japan. As yet another recession beckons, the Bank of Japan will likely respond with yet more easing to extend the yen’s declines and save giant exporters. No matter how cheap the yen gets, though, China will still be slowing. All the stimulus BOJ Governor Haruhiko Kuroda can muster won’t change the worsening trajectory of the region’s most-populous nation. That’s why Abe needs to take a page from Beijing and focus more on creating new industries at home. Tokyo seldom acknowledges it can learn anything from Beijing. Japan wrote the book on exporting your way to prosperity, one followed to great effect from South Korea to Vietnam, and eventually even China. But recent years have seen the student (China) surpass the teacher in moving past that simplistic growth strategy.

Abenomics, meanwhile, has proven to be a time machine endeavoring to return Japan to the export boom times of 1985. But even with additional BOJ stimulus, says Diana Choyleva of Lombard Street Research, exports don’t offer Japan a path to sustainable growth. Europe is still limping, the U.S. consumer isn’t the reliable growth engine it was a decade ago, and China’s relatively modest devaluation (about 3.5% in total) still means the yen’s value will rise on a trade-weighted basis.

Better find an alternative to the term “emerging”.

• China’s Currency Move Rattles African Economies (WSJ)

The shock waves from China’s surprise yuan devaluation are ricocheting through African economies, sending currencies tumbling and stoking anxiety that the continent’s biggest trading partner might be losing its appetite for everything from oil to wine. In South Africa, the rand hit a 14-year low of 12.94 to the dollar on Monday, extending a 2% drop since Aug. 10 and a 12% slide this year. Currencies in other African countries with close ties to China, like Angola’s kwanza and Zambia’s kwacha, are also down sharply after Beijing unexpectedly cut the yuan’s value by 2% against the dollar last Tuesday. China’s demand for Angolan oil, Zambian copper and South African gold has fueled a steep increase in trade, helping fuel rapid growth but leaving economies exposed to policy shifts in Beijing.

In 2013, Africa’s trade with China was valued at $211 billion, the African Development Bank said in June, more than twice the continent’s trade with the U.S. By contrast, 15 years ago, the U.S. traded three times as much with Africa as China did. Now, a weaker yuan is stoking fears in some African treasury departments and boardrooms that China’s buying power will be eroded—and that the world’s second-biggest economy may be slowing even more than official statistics suggest. Razia Khan, chief Africa economist at Standard Chartered bank, said China’s move was happening at a difficult moment for many African economies, which have been buffeted by volatility that has sent many regional currencies lower this year as oil prices dropped and the dollar surged. “Countries…with narrow export bases will be substantially disadvantaged,” she said.

“..although countries can ride waves of growth and exploit commodity cycles despite having dysfunctional political institutions, the real test comes when times turn less favorable..”

• The Great Emerging-Market Bubble (BIll Emmott)

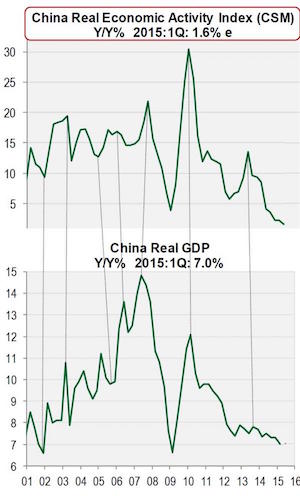

Officially, Chinese growth is rock-steady at 7% per year, which happens to be the government’s declared target, but private economists’ estimates mostly range between 4% and 6%. One mantra of recent years has been that, whatever the twists and turns of global economic growth, of commodities or of financial markets, “the emerging-economy story remains intact.” By this, corporate boards and investment strategists mean that they still believe that emerging economies are destined to grow a lot faster than the developed world, importing technology and management techniques while exporting goods and services, thereby exploiting a winning combination of low wages and rising productivity.

There is, however, a problem with this mantra, beyond the simple fact that it must by definition be too general to cover such a wide range of economies in Asia, Latin America, Africa, and Eastern Europe. It is that if convergence and outperformance were merely a matter of logic and destiny, as the idea of an “emerging-economy story” implies, then that logic ought also to have applied during the decades before developing-country growth started to catch the eye. But it didn’t. The reason why it didn’t is the same reason why so many emerging economies are having trouble now. It is that the main determinants of an emerging-economy’s ability actually to emerge, sustainably, are politics, policy and all that is meant by the institutions of governance. More precisely, although countries can ride waves of growth and exploit commodity cycles despite having dysfunctional political institutions, the real test comes when times turn less favorable and a country needs to change course.

“..if there is ever a dispute between what the bond market is saying and what the stock market is saying, the bond market is usually right..”

• Bonds Signal Trouble Ahead As Equities Keep Calm (FT)

Confidence levels in corporate bond and equity markets have diverged to an extent not seen since the financial crisis as fixed income traders signal rougher times ahead to their stock market peers. Investment-grade bond yields and equity volatility, measures of investor sentiment in their respective markets, have moved further apart than at any time since March 2008, according to Bank of America Merrill Lynch analysts. US equities tumbled for the rest of that year as the financial crisis intensified. “Somebody has to be wrong here,” said Hans Mikkelsen, credit strategist at BofA. The contrast between equities and bonds comes as many economists expect the US Federal Reserve to increase overnight borrowing costs next month, the first rate rise in almost a decade.

“If I was an equity investor I would pay close attention to what’s going on in the corporate bond market, probably more than they are currently,” said Mr Mikkelsen. The broad S&P 500 has largely traded sideways this year, and briefly turned negative last week, while implied volatility, as measured by the CBOE Vix index, remains quiescent. The Vix has eased below 13, after a brief rise above 20 in July, a threshold that in the past has signalled an escalation of investor anxiety over equities. According to the BofA corporate bond index, the gap between yields on investment-grade corporate bonds and US government bonds has moved to 164 basis points.

This takes the difference between credit spreads per point of equity volatility to 10.26bp, BofA calculates, its highest level in more than seven years. “It’s a signal, but not necessarily a timing tool,” said Jack Ablin, chief investment officer at BMO Private Bank. He agreed that equity investors should be concerned by pessimism in the bond markets. “In my experience, if there is ever a dispute between what the bond market is saying and what the stock market is saying, the bond market is usually right,” he added.

“We call Dijsselbloem’s solution a bail-up: part bail-out, part bail-in and part cock-up.” But that’s not the whole story (see article below this one).

• Greek Senior Bank Bonds Fall on Dijsselbloem Bail-In Comment (Bloomberg)

Senior bonds of Greek banks tumbled after Euro-area finance ministers protected depositors from any losses in the nation’s €86 billion bailout. While Greece’s third bailout will spare depositors in any restructuring of the nation’s financial system, senior bank bondholders may not be so lucky, according to comments from Eurogroup President and Dutch Finance Minister Jeroen Dijsselbloem. The bondholders will be in line for losses if Greek lenders tap into any of the financial stability funds set aside in the new bailout. “Bondholders were overly optimistic because bail-in of senior bonds was not explicitly mentioned before,” said Robert Montague, a senior analyst at ECM Asset Management in London. “Today they were brought back down to earth with a bump.”

Under the bailout terms, as much as €25 billion will be made available in a fund to recapitalize the Greek banks, including €10 billion as a first installment. Greek stocks rose and government bond yields dropped on the deal, though senior unsecured bank bonds fell. “The bail-in instrument will apply for senior bondholders, whereas the bail-in of depositors is explicitly excluded,” Dijsselbloem said at a press conference in Brussels on Friday. Greece’s euro-area creditors made adoption of the EU’s Bank Resolution and Recovery Directive, or BRRD, a precondition of the bailout. The directive, which makes it easier to impose losses on senior creditors, should rank senior unsecured bondholders and depositors equally, said Olly Burrows at brokerage firm CRT Capital.

By protecting deposits, Greece is walking a different path to neighboring Cyprus, which imposed a levy on uninsured depositors as part of a rescue package in 2013. “It is not clear how they will make it possible to bail-in bonds while excluding deposits, but as we have seen in other problematic situations, where there is a will there will be a way,” Burrows said. “We call Dijsselbloem’s solution a bail-up: part bail-out, part bail-in and part cock-up.”

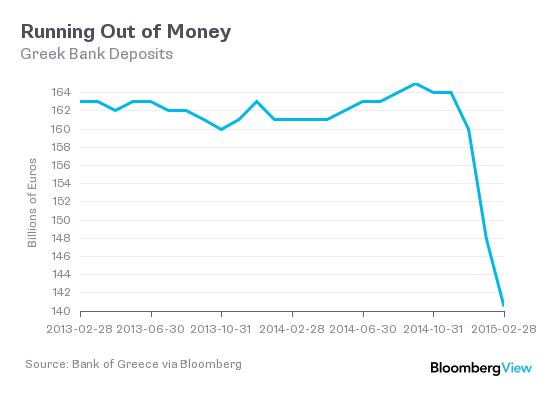

No bail-in for deposits?! Here’s the real story.

• Greek Deposits Become Eligible For Bail-In On January 1, 2016 (Zero Hedge)

Europe’s eagerness to promise depositor stability is transparent: the finmins will do everything in their power to halt the bank run from banks which will likely be grappling with capital controls for months if not years. Still, absent some assurance, there is no way that the depositors would be precluded from withdrawing all the money they had access to, which in turn would assure that the €86 billion bailout of which billions are set aside for bank recapitalization, would be insufficient long before the funds are even transfered. According to an Aug. 14 Eurogroup statement an asset quality review of Greek banks will take place before the end of the year,

“We expect a comprehensive assessment of the banks – so-called Asset Quality Review and Stress Tests – by the ECB/SSM to take place first,” EC spokeswoman Annika Breidthardt tells reporters in Brussels. “And this naturally takes a few weeks.” In other words Europe is stalling for time: time to get more Greeks to deposit their cash in the bank now, when deposits are “safe” and while everyone is shocked with confusion at the nonsensical financial acrobatics Europe is engaging in. But once Jan.1, 2016 rolls around, it will be a vastly different story. This was confirmed by the very next statement: “I must also stress that, depositors will not be hit” in this year’s review, she says. In this year’s, no. But the second the limitations from verbal promises of deposit immunity expire next year, everyone who is above the European deposit insurance limit becomes fair game for bail-in.

Dijsselbloem concluded on Friday that “Depositors have been excluded from the bail-in because in the first place it’s concerning SMEs and private persons. But it is only concerning depositors with more than 100,000 euros and those are mainly SMEs. That would again lead to a blow to the Greek economy. So the ministers said we will exclude them explicitly, it would bring damage the Greek economy.” Right, exclude them… until January 1, 2016. And only then impair them because Greece will never again be allowed to escape a state of permanent “damage” fo the economy. As for Greeks and local corporations whose funds are parked in a bank and who are wondering what all this means for their deposits, here is the answer: for the next 4.5 months, your deposits are safe, which under the current capital control regime doesn’t much matter: it’s not as if the money can be withdrawn in cash and moved offshore.

However, once January 1, 2016 hits and Greece becomes subject to a bank resolution process supervised and enforced by the BRRD, all bets are off. Which likely means that as the Greek bank balance sheet is finally “rationalized”, any outsized deposits will be promptly Cyprused. For our part, we tried to warn our Greek readers about the endgame of this farcical process since January of this year: we will warn them again – capital controls or not, pull whatever money you can in the next few months because once 2016 rolls around, all the rules change, and those unsecured bank liabilities yielding precisely nothing, and which some call “deposits” will be promptly restructured to make the Greek financial balance sheet at least somewhat remotely viable.

Sounds more dramatic than it is. In Greece, democracy works. In Germany, differences are much less pronounced.

• Greek Government On Its ‘Last Legs’, Merkel Faces Growing Rebellion (Telegraph)

Greek MPs are poised to hold a vote of confidence in the government of Alexis Tsipras after Leftist party rebels deserted the prime minister over the punishing terms of a third international bail-out agreement. Syriza’s energy minister Panos Skourletis said it was now “self evident” that parliamentarians would decide on whether or not to continue supporting the government after a “deep wound” had been inflicted on the ruling coalition. Lawmakers voted to ratify a 30-page “Memorandum of Understanding” to keep the country in the eurozone for the next three years on Friday. But the terms of the deal, which roll back a number of key pledges from the anti-austerity government, have split the ruling party. Mr Tsipras failed to get the backing of at least 120 of his own MPs, a constitutional threshold that could oblige him to trigger a vote in his leadership.

In a detailed evisceration of the austerity measures, former rebel finance minister Yanis Varoufakis denounced the agreement as encapsulating “the Greek government’s humiliating capitulation”. “Greek sovereignty is being forfeited wholesale” he said. “Not since the Soviet Union has wishful thinking, unsupported by anything tangible, posed as policymaking.” Support for the ruling coalition has becoming vanishingly thin. Greece’s two main opposition parties – which have so far voted to keep the country in the euro – vowed to pull the plug on the embattled premier should a vote be called in the coming weeks. Pasok, the much depleted socialist opposition, joined the conservative New Democracy in refusing to endorse Mr Tsipras and his junior coalition partner, led by defence minister Panos Kammenos.

[..] Chancellor Angela Merkel is facing the biggest domestic rebellion in her 10 years in office over the aid package. More than 60 of her Christian Democrat MPs rejected restarting talks over a new Greek rescue in an initial vote in July. This insurrection is set to mount when the package is put before a final parliamnetary vote on Wednesday, according to a key ally of the German premier. Michael Fuchs, deputy chairman of the CDU, said he had yet to decide whether or not he would back the bail-out as doubts over the involvement of the IMF continue to hang over Berlin. “There might be some changes by tomorrow, even,” said Mr Fuchs in an interview with Bloomberg.

A broad summit sounds like the by far best idea available.

• Leftist Veteran Glezos Appeals To Syriza Leadership To ‘Come To Senses’ (Kath.)

Leftist veteran Manolis Glezos, a former SYRIZA MEP, called on the party leadership to “come to your senses” and hold a broad summit, saying that the country’s third bailout “binds the Greek people hand and foot and enslaves them for entire decades.” “Let’s not allow the Left to become a seven-month parenthesis,” Glezos said in a statement. Describing the government’s strategy as “fickle and faltering,” he accused the party’s leadership of “erasing and destroying hopes and dreams.” “Finally come to your senses, fellow fighters and comrades of the leadership of the United Party,” Glezos wrote. “Before it is too late and before rushed initiatives are taken, listen to the voice of the people, of SYRIZA’s organizations and call a broad summit,” Glezos wrote, adding that “despite the intense dialogue that will take place, a solution will be found.”

“.. the Greek retreat is not the last word for the simple reason that the crisis will hit again..[..]..The task of the Syriza government is to get ready for that moment..”

• Thanks To The EU’s Villainy, Greece Is Now Under Financial Occupation (Zizek)

When my short essay on Greece after the referendum “The Courage of Hopelessness” was republished by In These Times, its title was changed into “How Alexis Tsipras and Syriza Outmaneuvered Angela Merkel and the Eurocrats”. Although I effectively think that accepting the EU terms was not a simple defeat, I am far from such an optimist view. The reversal of the NO of referendum to the YES to Brussels was a genuine devastating shock, a shattering painful catastrophe. More precisely, it was an apocalypse in both senses of the term, the usual one (catastrophe) and the original literal one (disclosure, revelation): the basic antagonism, deadlock, of the situation was clearly disclosed.

Many Leftist commentators (Habermas included) got it wrong when they read the conflict between the EU and Greece as the conflict between technocracy and politics: the EU treatment of Greece is not technocracy but politics at its purest, a politics which even runs against economic interests (as it was clearly stated by IMF, a true representative of cold economic rationality, which declared the bailout plan unworkable). If anything, it was Greece which stood for economic rationality and EU which stood for politico-ideological passion. After the Greek banks and stock exchange reopened, there was a tremendous flight of capital and fall of stocks which were not primarily a sign of the distrust of the Syriza government but of the distrust of the imposed EU measures a clear brutal message that (as we are used to put it in today s animistic terms) capital itself does not believe in the EU bailout plan.

(And, incidentally, most of the money given to Greece goes to the Western private banks, which means that Germany and other EU superpowers are spending taxpayers money to save their own banks which made the mistake of giving bad loans. Not to mention the fact that Germany profited tremendously from the escape of the Greek capital from Greece to Germany.) When Varoufakis justified his vote against the measures imposed by Bruxelles, he compared the deal to the Versailles treaty which was unjust and harboured a new war. Although his parallel is correct, I would prefer another one, with the Brest-Litovsk treaty between Soviet Russia and Germany at the beginning of 1918, in which, to the consternation of many of its partisans, the Bolshevik government ceded to Germany’s outrageous demands.

True, they retreated, but this gave them a breathing space to fortify their power and wait. And the same goes for Greece today: we are not at the end, the Greek retreat is not the last word for the simple reason that the crisis will hit again, in a couple of years if not earlier, and not only in Greece. The task of the Syriza government is to get ready for that moment, to patiently occupy positions and plan options. Keeping political power in these impossible conditions nonetheless provides a minimal space for preparing the ground for future action and for political education.

“The ECB will service (as opposed to purchase) a portion of every maturing government bond corresponding to the percentage of the member state’s public debt that is allowed by the Maastricht rules.”

• A New Approach to Eurozone Sovereign Debt (Yanis Varoufakis)

Greece’s public debt has been put back on Europe’s agenda. Indeed, this was perhaps the Greek government’s main achievement during its agonizing five-month standoff with its creditors. After years of “extend and pretend,” today almost everyone agrees that debt restructuring is essential. Most important, this is true not just for Greece. In February, I presented to the Eurogroup (which convenes the finance ministers of eurozone member states) a menu of options, including GDP-indexed bonds, which Charles Goodhart recently endorsed in the Financial Times, perpetual bonds to settle the legacy debt on the ECB’s books, and so forth. One hopes that the ground is now better prepared for such proposals to take root, before Greece sinks further into the quicksand of insolvency.

But the more interesting question is what all of this means for the eurozone as a whole. The prescient calls from Joseph Stigltiz, Jeffrey Sachs, and many others for a different approach to sovereign debt in general need to be modified to fit the particular characteristics of the eurozone’s crisis. The eurozone is unique among currency areas: Its central bank lacks a state to support its decisions, while its member states lack a central bank to support them in difficult times. Europe’s leaders have tried to fill this institutional lacuna with complex, non-credible rules that often fail to bind, and that, despite this failure, end up suffocating member states in need.

One such rule is the Maastricht Treaty’s cap on member states’ public debt at 60% of GDP. Another is the treaty’s “no bailout” clause. Most member states, including Germany, have violated the first rule, surreptitiously or not, while for several the second rule has been overwhelmed by expensive financing packages. The problem with debt restructuring in the eurozone is that it is essential and, at the same time, inconsistent with the implicit constitution underpinning the monetary union. When economics clashes with an institution’s rules, policymakers must either find creative ways to amend the rules or watch their creation collapse.

Here, then, is an idea (part of A Modest Proposal for Resolving the Euro Crisis, co-authored by Stuart Holland, and James K. Galbraith) aimed at re-calibrating the rules, enhancing their spirit, and addressing the underlying economic problem. In brief, the ECB could announce tomorrow morning that, henceforth, it will undertake a debt-conversion program for any member state that wishes to participate. The ECB will service (as opposed to purchase) a portion of every maturing government bond corresponding to the percentage of the member state’s public debt that is allowed by the Maastricht rules. Thus, in the case of member states with debt-to-GDP ratios of, say, 120% and 90%, the ECB would service, respectively, 50% and 66.7% of every maturing government bond.

He’s not done yet by any means.

• Yanis Varoufakis: Bailout Deal Allows Greek Oligarchs To Maintain Grip (Guardian)

Greece’s former finance minister Yanis Varoufakis has accused European leaders of allowing oligarchs to maintain their stranglehold on Greek society while punishing ordinary people in a line-by-line critique of the country’s €86bn bailout deal. Varoufakis said the Greek parliament had pushed through an agreement with international creditors that would allow oligarchs, who dominate sections of the economy, to generate huge profits and continue to avoid paying taxes. The outspoken economist published an annotated version of the deal memorandum on his website on Monday, arguing throughout the 62-page document that most of the measures imposed on Greece would make the country’s dire economic situation worse.

His first insertion makes clear his dismay at the dramatic events of last month, when the Greek prime minister, Alexis Tsipras, was forced to accept stringent terms for a new bailout amid calls from Germany for Greece’s temporary exit from the eurozone. Varoufakis, who resigned from his post in June, said: “This MoU [memorandum of understanding] was prepared to reflect the Greek government’s humiliating capitulation of 12 July, under threat of Grexit put to Tsipras by the Euro summit.” Folllowing the July summit, Athens agreed a three-year memorandum of understanding last week that will release €86bn of funds, much of it to repay debts related to two previous rescue deals. In exchange, Athens will implement wide-ranging reforms including changes to the state pension system and selling off government assets.

But Varoufakis said a reform programme overseen by the troika of lenders would only enslave ordinary workers and families by imposing tough welfare cuts while letting foreign companies grab domestic assets cheaply through privatisations. He said billionaire business owners in Greece would also escape scrutiny. In the memorandum it says: “Fiscal constraints have imposed hard choices, and it is therefore important that the burden of adjustment is borne by all parts of society and taking into account the ability to pay. Priority has been placed on actions to tackle tax evasion.” In answer, Varoufakis said: “As long as it is not committed by the oligarchs in full support of the troika through their multifarious activities.”

Reforming the EU is a dead end street.

• The Future of Europe (James Galbraith)

On June 8th, I had the honor of accompanying then-Greek finance minister, Yanis Varoufakis, to a private meeting in Berlin with the German finance minister, Wolfgang Schäuble. The meeting began with good-humored gesture, as Herr Schäuble presented to his colleague a handful of chocolate Euros, “for your nerves.” Yanis shared these around, and two weeks later I had a second honor, which was to give my coin to a third (ex-)finance minister, Professor Giuseppe Guarino, dean of constitutional scholars and the author of a striking small book (called The Truth about Europe and the Euro: An Essay, available here) on the European treaties and the Euro. Professor Guarino’s thesis is the following:

“On 1st January 1999 a coup d’état was carried out against the EU member states, their citizens, and the European Union itself. The ‘coup’ was not exercised by force but by cunning fraud… by means of Regulation 1466/97… The role assigned to the growth objective by the Treaty (Articles 102A, 103 and 104c), to be obtained by the political activity of the member states… is eliminated and replaced by an outcome, namely budgetary balance in the medium term.” As a direct consequence: “The democratic institutions envisaged by the constitutional order of each country no longer serve any purpose. Political parties can exert no influence whatever. Strikes and lockouts have no effect. Violent demonstrations cause additional damage but leave the predetermined policy directives unscathed.”

These words were written in 2013. Can there be any doubt, today, of their accuracy and of their exact application to the Greek case? It is true that Greek governments in power before 2010 governed badly, entered into the euro under false premises and then misrepresented the country’s deficit and debt. No one disputes this. But consider that when austerity came, the IMF and the European creditors imposed on Greece a program dictated by the doctrines of budget balance and debt reduction, including (a) deep cuts in public sector jobs and wages; (b) a large reduction in pensions; (c) a reduction in the minimum wage and the elimination of basic labor rights; (d) large regressive tax increases and (e) fire-sale privatization of state assets.

Pretty brutal assessment.

• Brutish, Nasty And Not Even Short: The Ominous Future Of The Eurozone (Streeck)

Now the dust has temporarily settled over the ruins of Greece’s economy, it is worth asking if there wasn’t a brief moment when the actors had found a way to cut the eurozone crisis’s Gordian knot. At some point in July German finance minister, Wolfgang Schäuble, appeared to have realised that his dream of a “core Europe” with a Franco-German avant-garde would vanish into thin air if Greece was allowed to remain in the economic and monetary union. Rewriting the rules of the union to accommodate the Greeks, Schäuble realised, would pull the euro southwards, and France, Italy and Spain with it – forever breaking up the European core.

His Greek equivalent Yanis Varoufakis, for his part, may have learned from his encounters of the third kind with the Eurogroup that the only role there was for Greece in the Europe of monetary union was that of an underfed and overregulated welfare recipient. Not only was this incompatible with Greek national pride; more importantly, what the governors of Europe would be willing to offer the Greeks by way of “European solidarity” would, at best, be too little to live on. The deal Schäuble offered in the last hour of July’s battle of the euro might have been worth exploring: a voluntary exit (an involuntary one not being possible under the current treaties) that gave Greece the freedom to devalue its currency and return to an independent monetary and fiscal policy, plus emergency assistance and some restructuring of the national debt, outside of the monetary union to avoid softening its rules by creating a precedent.

A generous golden handshake might have also been an idea, protecting Germany from being blamed for having plunged the Greeks into misery or driven them into the arms of Vladimir Putin. Politics can make strange bedfellows, but sometimes just for a one-night stand. In the end Varoufakis was overruled by Alexis Tsipras and Schäuble was overruled by Angela Merkel. The latter, displaying truly breathtaking political skills, managed within a day or two to redefine the resounding no of the Greek people to their creditors’ demands into a yes to “the European idea”, defined as a common currency – allowing him to sign on to even harsher conditions than had been rejected in the referendum (called, it seems, at the suggestion of Varoufakis, who was sacked on the very evening the results were in).

Afraid of the unimaginable economic disaster publicly imagined by fear-mongering euro supporters, and perhaps encouraged by informal promises by Brussels functionaries of future injections of other peoples’ money, Tsipras was ready to split his party and govern with those who had for decades let Greece rot in clientelism and corruption, offering the parties of Samaras and Papandreou an opportunity to regain legitimacy as pro-European supporters of “reform”.

Little people from little countries get to have their say in the press. And they get off on that.

• Greece To Trouble Eurozone For Decades, Says Finland’s Soini (Reuters)

Greece will be a headache for the eurozone for decades, Finland’s eurosceptic foreign minister said, and called for the IMF to participate in the Greece’s new bailout package. “Unfortunately, this problem will be in front of us for decades, I would say, if the eurozone stays together,” foreign minister Timo Soini said in an interview with public broadcaster YLE on Monday. IMF’s participation in the new bailout is uncertain because the fund demands debt reliefs to ease the burden on Greece. “An absolute debt cut, I think, is out of question, Germany too is against it … On other issues (maturities, interest rates) we must negotiate,” Soini said.“IMF’s participation would also strengthen the expertise in the package, so that the programs will actually be carried out by Greece.” The Finnish parliament’s grand coalition last week approved the bailout deal. Soini’s nationalist the Finns party is known for opposing eurozone bailouts but had to support the new Greek deal to be able to keep a seat in the coalition government which it joined in May for the first time. “I still think bailout policy is bad policy … But in politics, one must make unpleasant decisions,” he said.

If governments and regulatirs won’t do it…

• Banks Braced For Billions In Civil Claims Over Forex Rate Rigging (FT)

Global banks are facing billions of pounds-worth of civil claims in London and Asia over the rigging of currency markets, following a landmark legal settlement in New York. Barclays, Goldman Sachs, HSBC and Royal Bank of Scotland were among nine banks revealed last Friday to have agreed a $2bn settlement with thousands of investors affected by rate-rigging in a New York court case. Lawyers warned the victory opens the floodgates for an even greater number of claims in London, the largest foreign exchange trading hub in the world, in a sign that the currency manipulation scandal is far from over. Banks could be hit as early as the autumn with claims in London’s High Court from corporates, fund managers and local authorities, according to lawyers working on the cases.

In addition, investors are expected to bring cases in Hong Kong and Singapore, which are also home to large foreign exchange markets. The US settlement comes just months after a record $5.6bn fine was slapped on six banks by regulators for manipulating the $5.3tn-a-day foreign exchange markets. “There will be more claims in London than in New York because it’s a bigger forex market,” said David McIlroy, a barrister at Forum Chambers. A settlement in London could amount to “tens of billions of pounds”, he said. Analysts said it would be extremely difficult to assess the financial impact on banks at this stage. “We’ve put in some element of civil fines for all the banks we cover, but it’s difficult to be specific because there aren’t that many clear precedents,” said one analyst.

“We looked at this one last week with interest, but the range of outcomes [from civil suits] is still quite wide.” Lawyers at US firm Hausfeld who worked on the class action said the recent settlement was “just the beginning”. Anthony Maton, a managing partner at Hausfeld, said: “There is no doubt that anyone who traded FX in or through the London or Asian markets — which transact trillions of dollars of business every day — will have suffered significant loss as a result of the actions of the banks. “Compensation for these losses will require concerted action in London.”

Make that more.

• US Graft Probes May Cost Petrobras Record $1.6 Billion Or More (Reuters)

Brazil’s Petrobras may need to pay record penalties of $1.6 billion or more to settle U.S. criminal and civil probes into its role in a corruption scandal, a person recently briefed by the company’s legal advisors told Reuters. State-run Petroleo Brasileiro, as the company is formally known, expects to face the largest penalties ever levied by U.S. authorities in a corporate corruption investigation, according to the person, who has direct knowledge of the company’s thinking. The settlement process could take two-to-three years, this person said. To date, the largest settlement of corporate corruption charges with the U.S. Department of Justice and the U.S. Securities and Exchange Commission was a 2008 agreement with Siemens, the German industrial giant.

It agreed to pay the U.S. $800 million to settle charges related to its role in a bribery scheme, and paid about the same amount to German authorities. The person told Reuters the legal advisors said they believed Petrobras faced fines that could be as large as, or more than, the $1.6 billion in combined U.S. and German penalties that Siemens faced. Two other sources with direct knowledge of Petrobras’ plans also said that any settlement, while several years away, would likely be “large,” but declined to give a specific estimate. All three sources requested anonymity, and cautioned that any estimates for the size of possible fines are very preliminary. Petrobras has not yet begun settlement talks with U.S. authorities, whose investigations are believed to be in an early phase, they said.

In November, the SEC sent a subpoena to Petrobras requesting information about the widening corruption investigations that have ensnared top company executives, major private contractors and senior politicians in Brazil. According to people familiar with the matter, the DOJ, which can bring criminal charges, is also investigating the company.

“They’re terrified of 1937..” Hmm. Don’t forget that certain people made a killing post-1937.

• Ron Paul: Fed May Not Hike Because ‘Everything Is Vulnerable’ (CNBC)

China’s move to devalue its currency roiled the markets last week, and stoked new fears about the health of the world’s third largest economy. However, according to former Rep. Ron Paul, the move may have given Federal Reserve Chair Janet Yellen the cover she needs to not raise rates later this year, as many market participants expect. “She’s going to be more hesitant to raise rates because she sees how fragile the global economy is,” Paul told CNBC’s “Futures Now” on Thursday. “She’s under the gun,” he added. “I could be wrong, but I don’t think they are going to raise interest rates.” According to the former Republican presidential candidate, a rapidly slowing Chinese economy adds just another headwind for an already struggling U.S. economy.

“I think there’s going to be enough problems existing, whether it’s the Chinese precipitating some crisis, or whether it’s our economy breaking down,” he said. Currently, markets expect the Fed will begin tightening monetary policy at its meeting in September. Gauges like closely watched fed fund futures contracts are pricing in a 45% chance of a September rate hike, while other analysts see the odds as higher. Yet institutions like the IMF have warned that a rate hike might imperil a fragile global recovery. In June, the IMF’s deputy director warned about potential risks of a Fed tightening. By Paul’s reasoning, the Fed is too scared to raise interest rates in the middle of an already weak recovery and risk sending the U.S. economy back into recession, or worse.

“They’re terrified of 1937,” said Paul, who has long called for a “day of reckoning” that will lead to the collapse of both the fixed income and equity markets. The Fed chief “does not want to be responsible for the depression that I think we’ve been in the midst of all along,” Paul added.

The entire oil industry will try to keep smiling all the way to bankruptcy.

• Junk-Rated Offshore Drillers Headed into Bankruptcy (WolfStreet)

After fracking, offshore drilling. At the leading edge is rig-contractor Hercules Offshore. In March 2014, before the oil price collapsed, it had the temerity to sell for 100 cents on the dollar $300 million in junk bonds. Since then, its shares have collapsed to near zero. Its bonds have collapsed too. And on Thursday last week, it and a whole gaggle of related companies filed for Chapter 11 bankruptcy. It won’t be the only junk-rated offshore driller with that fate, according to Fitch Ratings. Investors are going to get their pockets cleaned. “This is the lowest level of demand we have seen since the early days of the offshore industry,” Hercules CEO John Rynd had told investors in a quarterly conference call on April 29.

Hercules had already cut its global workforce – about 1,800 employees at the end of 2014 – by nearly 40%, he said. Offshore drillers have been buffeted from two directions: the collapse of drilling activity and the collapse in the daily rates they can charge for their offshore drilling rigs. So fewer rigs, and less money for each of the fewer rigs: Hercules’ revenues in the second quarter plunged 67% from a year ago! And junk-rated companies like Hercules that need new money to stay afloat and service their debts are finding out that their burned investors have shut off the spigot. “A leading indicator of further bankruptcies among other challenged high yield (HY) offshore drillers,” is what Fitch Ratings calls Hercules.

In the prepackaged bankruptcy, Hercules swaps four senior bond issues totaling $1.2 billion for 96.9% of the company’s equity. So how do these bondholders fare? The recovery rate for senior noteholders would be 41%, the company said in its disclosure statement. According to S&P Capital IQ LCD’s highyieldbond.com, “the range of reorganized equity value implies a recovery rate of 32-47.8%.” Meanwhile, the notes are quoted in the “low” 30-cents-on-the-dollar range. So for now, nearly a 70% haircut. Stockholders get the remaining 3.1% of the equity, plus warrants. Mere crumbs. To finish construction of the Hercules Highlander rig and to stay afloat a while longer, the company will also get $450 million in new money for 4.5 years, at LIBOR +9.5% per year, with a 1% floor. No more cheap money, even after bankruptcy, though it dramatically deleveraged the balance sheet at the expense of investors.

The poor are expendable here too.

• How Money, Race and Religion Determine the Fate of Europe-Bound Migrants (WSJ)

As Europe grapples with the biggest wave of migration since World War II, the fates of those crossing the Mediterranean are increasingly being determined by class systems based on money, ethnicity and religion. On these transnational trails, migrants tell of a fast-developing market for human cargo, where cash or creed can ensure a safer trip, more resources and better treatment. The discrimination starts at the beginning of migrants’ journeys at the hands of smugglers looking to maximize profits, and it ends with European authorities scrambling to handle the overwhelming numbers of people arriving and prioritizing them by nationality. In Greece this weekend, authorities deployed a 3,000-capacity passenger ferry to the island of Kos to host Syrian refugees arriving in record numbers.

Thousands of other asylum seekers on the island from Iraq and Afghanistan have been left without shelter, and with only sporadic access to food and a much longer wait to get their documents processed. Syrians are prioritized because the United Nations High Commissioner for Refugees has advised governments that they are so-called prima facie refugees, meaning they should be granted instant humanitarian protection because they are fleeing a war zone. EU countries recently agreed to resettle some 32,000 refugees from Greece and Italy, but said they would only do that for Syrian and Eritrean nationals, both designated as prima facie refugees by the U.N.

First reception procedures should be the same for everyone, said Barbara Molinario, a spokeswoman for the U.N. agency. Syrians are considered prima facie refugees, but “people from other countries might also have valid refugee claims, and generalizations should be avoided,” she said. On Kos, many locals view Syrians—who are almost neighbors across the Aegean Sea—as culturally similar to them. “Syrians are more civilized and they show more respect,” said Lefteris Kefalianos, a Kos resident who sells construction materials.