Arthur Rothstein Cow at Wabash Farms cooperative, Indiana May 1938

At this point, you may want to consider making it personal. Your government, wherever you are in the west, but especially in the US, takes you for a bunch of fools they can feed anything at all and fully expect you to believe all of it. As for the media who convey government messages, it’s up in the air whether they too take you for a flock of dimwits, or are just plain fools themselves. As for your families, friends and neighbors, you decide.

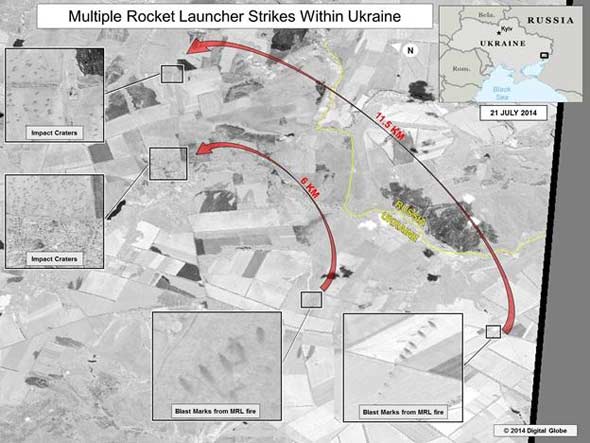

After failing to present a single shred of evidence in 10 days to substantiate their claims that either the rebels, Russia or all of the above were involved in the downing of MH17, they still haven’t. They did, however, come with something that is as devoid of shame as it is full of disgrace. And the media, surprise, present it as the real deal once again. Which goes to prove that nothing has to be real or true, Washington only has to claim it is.

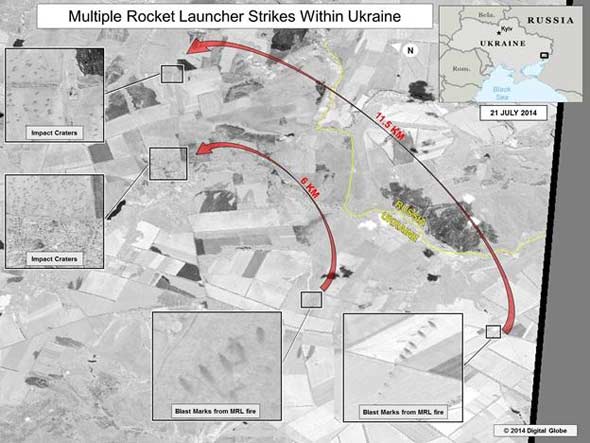

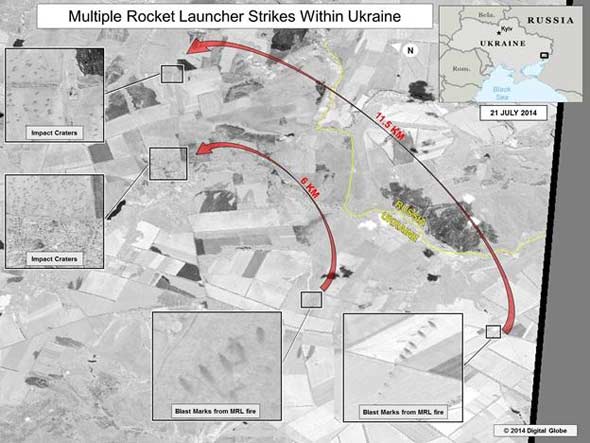

The latest ‘release’ allegedly proves that Russia is firing missiles into Ukraine across the border. But the country with by far the best satellites and other spy equipment (or should we from now on just say the most expensive?), with which it, on a daily basis, traces every move of millions of people worldwide, in particular its own citizens both home and abroad, hasn’t been able so far to locate one single incriminating piece of ‘evidence’ on its own multi-multi-billion dollar spy networks.

For its first ‘real’ proof it turns to a company called Digital Globe, which apparently has produced a number of satellite pics that the US now uses to show the world that the Russians indeed fire those missiles. Remember the precision bombing footage on CNN in the Gulf War? Think 50 years before that in technology. Think grainy pics you couldn’t make out anything on without the help of ‘useful’ US provided arrows and descriptions of what you see.

If you were a religious person, and one of those helpful arrows and partial blow-ups said “that’s Jesus walking on water there”, you’d probably believe it too. And if you’re of the anti-Putin conviction, you’ll be inclined to take these pics for gospel. But that still does not come anywhere near to constituting evidence.

Now if the US would really want to present these things as evidence to the whole world, in a serious way, they would do one of two things: either have Colin Powell take them to the UN and do a show and tell for the General Assembly (worked like a charm before), or at the least do a multi-hour State Dept. and/or Pentagon press-op, simulcast across all major networks, in which various experts can point long sticks at large blowups of the pics and tell us what we see (Thar walketh the Lord … ).

But that’s not what happened. Instead, the Digital Globe pics were released through, of all places, the Twitter account of Geoffrey Pyatt, the infamous US ambassador in Kiev who rose to fame when word got out that he and Assistant Secretary of State Victoria Nuland had handpicked the next Ukraine government even before the last – and elected – one had gone, after spending $5 billion to make sure the change happened.

Look, I don’t want to keep getting wound up about all this. What use is it? Suffice it to say that if Washington had solid proof of any of the accusations it has made against any of the parties it has made such accusations against, the ‘evidence’ wouldn’t be presented this way. That’s not the MO, and no, the government hasn’t all of a sudden gone all modern; things presented this way are simply much easier to dismiss when push comes to shove. That’s why they are.

Most accusations against Russia, Putin and the east Ukraine rebels since MH17 crashed 10 days ago have been made – and then easily refuted -through social media accounts located somewhere in Kiev, many through Kiev government accounts, and now Geoffrey Pyatt. This whole set-up stinks five ways into Tuesday.

One more thing: there is another implication of the release of the Digital Globe pics, namely that they make it even less probable that we’ll ever see any evidence that the rebels downed the plane. Unless Digital Globe has pictures of that too. The US government does not, or it would have already made it public. Then again, it has no need to: whatever it says is swallowed up whole by the faithful regardless of how likely its ‘reports’ are to be true.

The Dutch, Australian and Malaysian forensic experts who have been sent in to work on the crash site to save what is left of the bodies and dignity of the victims whose remains haven’t yet been found, cannot enter the area, because the Ukraine army happened to have elected the past weekend to start a new offensive against the rebels. Ostensibly to clear the crash site for the experts, but they would have had full access already without the offensive.

Rebel leader Borodai says the army went in to ‘evade exposure’ (i.e. hide evidence) of its culpability in the crash, and I’m wondering how far off he could possibly be.

And that brings up yet another question: who commands the Ukraine army? The latest offensive began after former PM Yatsenyuk resigned, and just yesterday Ukraine president Poroshenko told journalists – again – that he had ordered to stop combat operations in a 40-kilometer zone around the crash site (the latest attacks take place much closer than that). If it’s not the government or the president ordering the latest attacks, the ones that make truth finding impossible, then who is it?

Does Poroshenko lie through his teeth or is something else going on? The country’s bankrupt. It has used large swaths of its IMF loans to fund its army, it has proposed conscription for all men under 50 years old, soldiers are fleeing to Russia because they don‘t want to shoot their own countrymen, but attacks with bombers and tanks on cities filled with civilians are intensified.

I still haven’t seen one single western leader call for an immediate cessation of all attacks on both sides, so the dead can be properly and respectfully buried. Not one. Not even the Dutch PM. And I think that should tell you all you need to know about what the true priorities are that ‘we’ have. Respect is a fleeting term.

Not that it’s only in matters related to Ukraine that Washington fully and arrogantly expects you to take for granted anything it says. Libya is going down the drain as we speak, and weren’t we just there recently? Israel is once again shooting fish in a barrel in the Gaza strip (and I know it’s not black and white), and “we” are not just outside observers there either. The blood-smeared ISIS campaign in Iraq can’t even make the headlines anymore, but “we” obviously have something to explain about our recent involvement there too.

“America” and “peace initiative” are two terms that are getting ever harder to fit into one sentence. And somehow, no matter how naive it may sound, that still feels like a giant betrayal of what the nation once stood for.

America doesn’t want peace, because peace doesn’t rhyme with power.

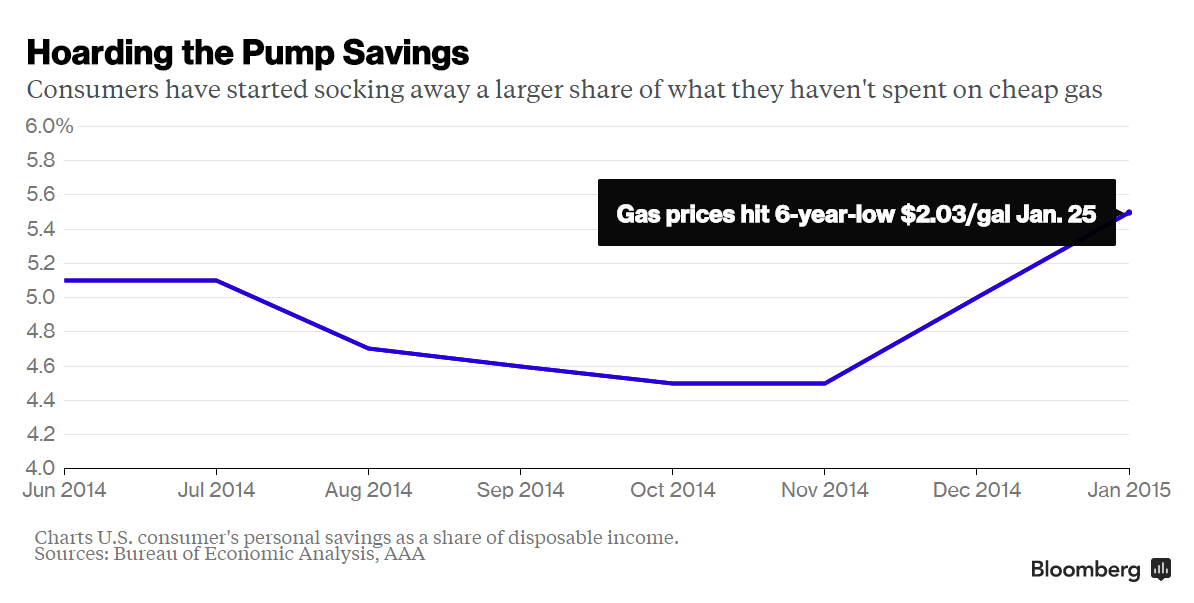

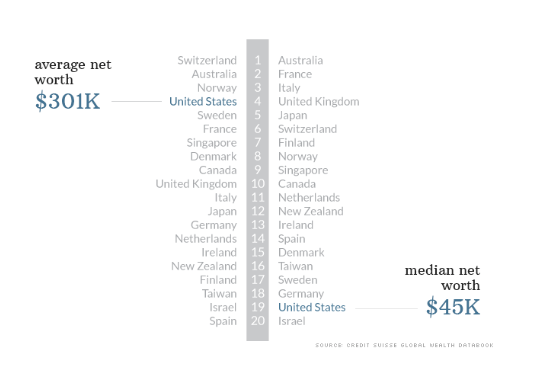

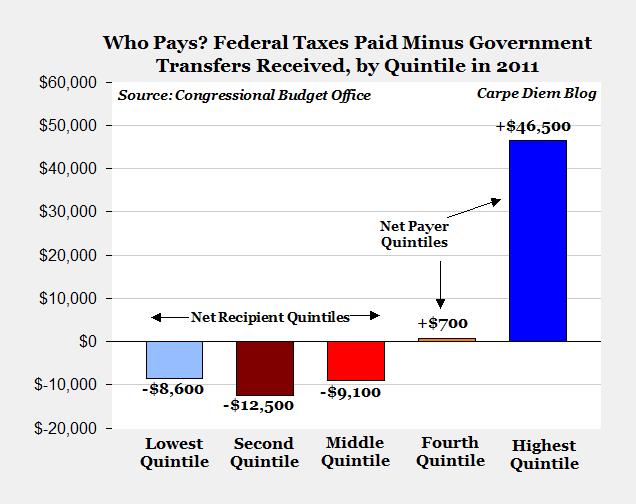

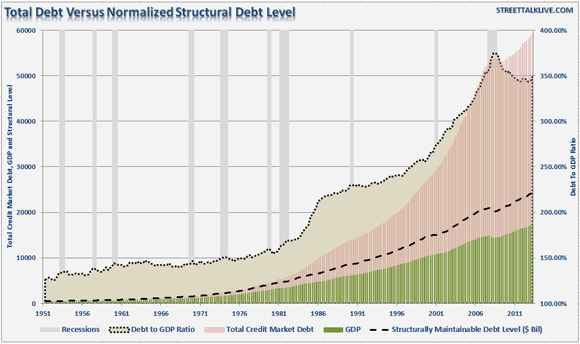

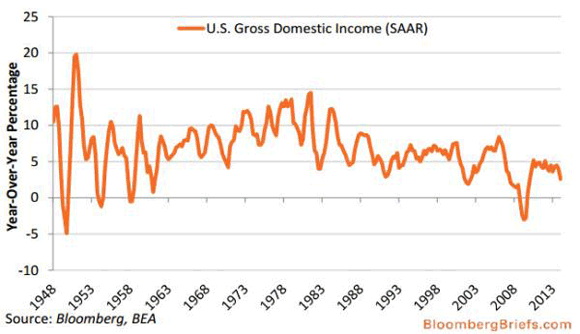

Meanwhile, at home, whenever you see someone anyone talk about ‘recovery’, you now know they’re full of it. The Russell Sage Foundation issued a 2-page report that makes clear ‘recovery’ is about the worst possible and least applicable term to use to describe what is happening in the US economy.

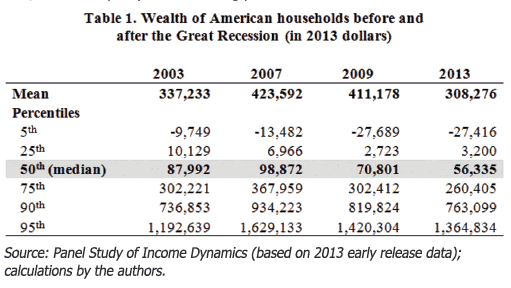

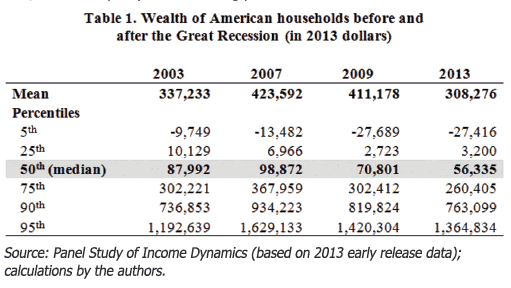

Households at the “median point in the wealth distribution – the level at which there are an equal number of households whose worth is higher and lower”, saw their wealth plummet -36% from 2003 to 2013. From the highest point, in 2007, to 2013 the number is -43%.

Five years after 2008 and Lehman, five years into the alleged recovery, which raised US federal, Federal Reserve, and hence taxpayer, obligations by $10-$15 trillion or more, US median household wealth was down -36% from 2003. And that’s by no means the worst of it:

If you look at the 5th and 25th percentile ‘wealth’ numbers (much of it negative), you see that they went down from 2003 to 2007, while the median was still rising. For both, wealth in the 2003-2013 timeframe deteriorated by some -200% (or two-thirds, if you will). -$9,479 to -$27,416 for the poorest 5%, $10.219 to $3,2000 for the lowest 25%.

This is how Washington defines recovery. Just in case you were wondering.

But they’re going to talk about it again, you just wait for it, just like they’re going to continue to blame Putin and the rebels for everything that goes wrong in Ukraine. They’re not going to stop until they have control over Russia’s resources, no matter what the body count, and they’re not going to stop until most Americans are de facto debt slaves.

And Uncle Sam counts on you! To swallow it all hook line and sinker. It works like a charm to date.

Hussman is solid.

• This Equity Bubble Has Already Surpassed 1929 And 2007 (Hussman)

Make no mistake – this is an equity bubble, and a highly advanced one. On the most historically reliable measures, it is easily beyond 1972 and 1987, beyond 1929 and 2007, and is now within about 15% of the 2000 extreme. The main difference between the current episode and that of 2000 is that the 2000 bubble was strikingly obvious in technology, whereas the present one is diffused across all sectors in a way that makes valuations for most stocks actually worse than in 2000. The median price/revenue ratio of S&P 500 components is already far above the 2000 level, and the average across S&P 500 components is nearly the same as in 2000. The extent of this bubble is also partially obscured by record high profit margins that make P/E ratios on single-year measures seem less extreme (though the forward operating P/E of the S&P 500 is already beyond its 2007 peak even without accounting for margins).

Recall also that the ratio of nonfinancial market capitalization to GDP is presently about 1.35, versus a pre-bubble historical norm of about 0.55 and an extreme at the 2000 peak of 1.54. This measure is better correlated with actual subsequent market returns than nearly any alternative, as Warren Buffett also observed in a 2001 Fortune interview. So if one wishes to use the 2000 bubble peak as an objective, we suggest that it would take another 15% market advance to match that highest valuation extreme in history – a point that was predictably followed by a decade of negative returns for the S&P 500, averaging a nominal total return, including dividends, of just 3.7% annually in the more than 14 years since that peak, and even then only because valuations have again approached those previous bubble extremes. The blue line on the chart below shows market cap/GDP on an inverted left (log) scale, the red line shows the actual subsequent 10-year annual nominal total return of the S&P 500.

Read more …

20% only?

• Stock Trader Who Called Three Crashes Sees 20% Collapse (MarketWatch)

Mark Cook, a veteran investor included in Jack Schwager’s best-selling book, “Stock Market Wizards,” and the winner of the 1992 U.S. Investing Championship with a 563% return, believes the U.S. market is in trouble. The primary indicator that Cook uses is the “Cook Cumulative Tick,” a proprietary measure he created in 1986 that uses the NYSE Tick in conjunction with stock prices. His indicator alerted him to the 1987, 2000, and 2007 crashes. The indicator also helped to identify the beginning of a bull market in the first quarter of April 2009, when the CCT unexpectedly went up, turning Cook into a bull. What does Cook see now? “There have been only two instances when the NYSE Tick and stock prices diverged radically, and that was in the first quarter of 2000 and the third quarter of 2007. The third time was April of 2014,” Cook says. In simple terms, as stock prices have gone higher, the NYSE Tick has moved lower.

This divergence is an extremely negative signal, which is why Cook believes the market is losing energy. In fact, the Tick is showing a bear market, which seems impossible considering how high the market is rising. “The Tick readings I am seeing (-1100 and -1200) is like an accelerator on the floor that is pressed for an indefinite amount of time,” Cook says. “Eventually the motor will run out of gas. Now, anything that comes out of left field will create a strain on the market.” Since the CCT is a leading indicator, prices have to catch up with the negative Tick readings. “Think of a dam that has small cracks that are imperceptible to the eye,” he says. “Finally, the dam gives way. Eventually, prices will go south, and the Tick numbers will be horrific.” Cook is also concerned that the market is acting abnormally. “It’s like being in the Twilight Zone, he says. “Imagine going outside when it’s raining and getting sunburned. That’s the environment we’re in right now.”

Read more …

Not sure I like the use of the word ‘intelligence’ in this context.

• US Releases Satellite Images ‘Proving’ Russia Is Firing Into Ukraine (RT)

The US State Department has released satellite images via email which it says act as “evidence” that Russia is firing rockets at Ukrainian troops across the border. The images were posted on Twitter by the US ambassador to Ukraine, Geoffrey Pyatt. The four-page emailed document, titled ‘Evidence of Russian Shelling into Ukraine,’ contains four satellite images, all dating between July 21 and July 25/26. Monochrome images taken by civilian satellites are said to be indicating fire from multiple rocket launchers “on the Russian side of the border” and “artillery strikes within Ukraine.” The slides were prepared by the US Office of the Director of National Intelligence (DNI), and came supplied with a short description. Thus, a slide dated July 25/26 shows what US officials claim to be “ground scarring at a multiple rocket launch site on the Russian side of the border oriented in the direction of Ukrainian military units within Ukraine.” [..]

Paul Craig Roberts, columnist and head of the Institute for Political Economy, told RT that he doubts the credibility of the photographs released by the State Department. “I can state with complete confidence that information this important would not be released in this way,” Roberts said. “If this was released by the State Department, which I doubt, it is so unprofessional; it would mean that the State Department is trying to spread propaganda about Russia on social media. Now the way this type of information would be released would be at a press conference with a high level of government officials addressing the bureau chiefs of the major news organizations.”

He added that experts would explain the meaning of the photographs and their validity. “The US government has been desperate to produce information to back up its claims. It would not release information in this way,” he said, adding that anyone can spread information on social media. Russia has been repeatedly criticizing the US for accusations made by the State Department without any sustainable evidence. Washington directly blamed Moscow for building up troops close to the border, as well as for the “firing of Russian heavy weapons from the Russian side of the border at Ukrainian military personnel.”

Read more …

Not what we want to hear.

• Intl. Inspectors Find ‘No Violations’ By Russia Along Ukraine Border (RT)

Inspectors who came to check the state of Russian troops along the Ukrainian borders have found no violations, Russia’s Ministry of Defense said. This came as a response to the US alleging 15,000 Russian troops have amassed in the area. “It has come to our attention that new allegations by top US officials as to the alleged amassing of Russian troops along the Ukrainian border have been voiced,” the statement by the Defense Ministry read, following allegations by the US Permanent Representative to NATO, Douglas Lute, and State Department spokeswoman, Marie Harf. The last four months have witnessed 18 separate inspections along the Ukrainian border with the Russian Federation, all in line with the Vienna Open Skies Treaty and the Vienna agreement of 2011.”

The statement goes on to list the international makeup of those inspections, which included representatives from the US, as well as NATO and Ukraine. The inspections also included flybys and visits to any military units that might have aroused suspicion. “No instances of violations by Russia along the Ukrainian border had been registered by the inspectors,” adding that in spite of the above, “frequent action by the Ukrainian military taking place on the Russian border has hindered our own ability to perform similar inspections and flybys along our border.” While no evidence of a Russian military buildup at Ukrainian border regions was registered, similar inspections in other regions, were they to be carried out, would undoubtedly find that the opposite is true for Ukrainian forces, who’ve had heavy equipment stationed there, firing regularly onto Russian settlements, the ministry states. “Their actions have already led to casualties on our side,” the statement concludes.

Read more …

How prepared is Putin? He must have seen this coming years ago.

• The West Risks Collateral Damage By Punishing Russia (FT)

The sanctions to be decided this week are known in EU jargon as “tier three”; the red-alert stage. As reported by Peter Spiegel, the Financial Times Brussels bureau chief, the European Commission wants a ban on purchases by EU citizens and companies of equity and debt issued by state-controlled Russian banks that has a maturity of more than 90 days. The ban would also include investment services. No EU bank would be allowed to help Russians banks raise funds on a regulated market. The rule would extend to development finance institutions. Last week, the EU and the US used their majority vote on the board of the European Bank for Reconstruction and Development to stop the bank’s investments in Russia, which accounts for almost 20% of its invested assets.

With the US sanctions, this is an impressive list. Even the tier one and tier two measures introduced after the annexation of Crimea appear to have had an impact. German industrial production started to fall soon after those sanctions took effect, by a combined 2% in April and May. It has also gone down elsewhere in the eurozone. The Committee on eastern European Economic Relations, a German business lobby with political power similar to that of the National Rifle Association in the US, says existing sanctions threaten 25,000 German jobs. An estimated 350,000 German jobs directly depend on German-Russian trade; many would be at risk if sanctions were stepped up. Total German trade with Russia was close to €80bn in 2013.

In particular, there are 6,200 Russian companies benefiting from German capital. Robert Kahn from the Council on Foreign Relations in the US wrote in May that the impact of Russian sanctions on the global economy would depend on the financial channels that link Russia to the west. He notes that much of the public discussion has focused on critical trade ties. The implication is that, if you want to know how sanctions filter through to the global economy, it is probably best to follow the money not the flow of gas, oil or, indeed, helicopter carriers. Just as finance acted as a growth accelerator before the economic crisis, financial sanctions could act as decelerator.

Read more …

• Borodai: Kiev Intensifies Crash Zone Attacks To Evade Exposure (Itar-Tass)

Kiev is seeking to evade exposure of truth over a Malaysian MH17 crash near Donetsk in eastern Ukraine by intensifying combat operations around the crash site, the press centre of the self-proclaimed Donetsk People’s Republic (DNR) said on Sunday, citing DPR Prime Minister Alexander Borodai. Earlier, the mass media reported that the Ukrainian military planned to take control over the Malaysian jet crash area, for which ends they were shelling Gorlovka and other settlements controlled by the DPR forces. Intensified combat operations “are irrefutable evidence proving that Kiev is seeking to destroy all evidence of the crime committed by its military,” Borodai was quoted as saying.

“The junta is in panic, the only thing that matters for them today is to evade exposure. Kiev’s actions run counter to [President Pyotr] Poroshenko’s decision to declare a 40-kilometre zone around the crash site a ceasefire territory.” Earlier on Sunday after visiting the Malaysian embassy in Ukraine, President Poroshenko told journalists he had ordered to stop combat operations in a 40-kilometre zone around the Malaysian Boeing crash.

Read more …

Courts and politics. Lovely combination.

• Yukos Owners Win $50 Billion in 10-Year Fight With Russia (Bloomberg)

Former majority owners of Yukos Oil said they won a landmark $50 billion award against Russia for the confiscation of what was once the nation’s largest oil company. The Permanent Court of Arbitration in The Hague ruled that Russia is liable to pay almost half of the $103 billion plus interest sought by the company’s former owners, Tim Osborne, head of GML, former holding company of Yukos, told reporters in London today. The ruling found that the campaign against Yukos was “politically motivated,” Osborne said. The multi-billion-dollar award against Russia marks a fresh headache for President Vladimir Putin, who’s facing intensifying U.S. and European sanctions aimed at forcing him to resolve the deadly conflict in neighboring Ukraine. Mikhail Khodorkovsky, once Russia’s richest man with a fortune of $15 billion when he was CEO and the main owner of Yukos, was freed in December under an amnesty after serving a decade in Russian prison camps.

He says the charges against him were revenge for his financing of opposition parties, which the Kremlin denies. Collecting the damages is likely to involve years of legal wrangling, according to Yukos’ former chief legal counselor, Dmitry Gololobov. Russia will refuse to pay and seizing Russian state assets abroad will be a difficult task, he said. “Russia has the money to hire the best international lawyers, who won’t give up without a fight,” Gololobov said by e-mail before the ruling was announced. “So the Yukos affair could easily go on for another 10 years.” Putin’s government dismantled Yukos from 2004-2007 after imposing $27 billion in tax charges. Most of its former assets were acquired in a series of forced auctions by state-run OAO Rosneft, which is the world’s largest publicly traded oil company by output. Russia will have the opportunity to appeal the ruling, Foreign Minister Sergei Lavrov said. “Russia will use all available legal means to defend its position,” Lavrov said today at a televised news briefing in Moscow.

Read more …

Real numbers are much higher.

• Ukraine Civil War Death Toll At Least 1,100, Over 3,500 Wounded – UN (RT)

Some 1,129 people have been killed and nearly 3,500 wounded in eastern Ukraine since the start of the Kiev’s military operation in April, according to UN estimates. The report also states that these are the minimum casualty toll estimates by the UN monitoring mission and WHO. The report says that the cause of the rising death toll is intensified artillery shelling of the civilian residential areas and the so-called “collateral damage” of the armed actions in the heavily-populated areas. Also, 100,000 people were forcibly displaced in eastern Ukraine. The Kiev authorities are using heavy weaponry and artillery in strikes on residential areas, while the armed rebels are firing back, the report states. “Both sides must take great care to prevent more civilians from being killed or injured,” she added.

“Already increasing numbers of people are being killed, with serious damage to civilian infrastructure, which – depending on circumstances – could amount to violations of international humanitarian law. The fighting must stop,” the report stated. On Friday, Human Rights Watch alleged that Kiev is using indiscriminate Grad missiles to attack densely populated areas in Donetsk, which violates international humanitarian law, and also blames the militia for taking cover in the same areas. “Although Ukrainian government officials and the press service of the National Guard have denied using Grad rockets in Donetsk, a Human Rights Watch investigation on the ground strongly indicates that Ukrainian government forces were responsible for the attacks that occurred between July 12 and 21,” HRW stated.

Read more …

Oh, get real!

• New York Federal Reserve Steps Up Pressure On Bank Ethics (FT)

The Federal Reserve Bank of New York is stepping up pressure on the biggest banks to improve their ethics and culture, after investigations into the alleged rigging of benchmark rates led officials to conclude bankers had not learnt lessons from the financial crisis. The investigations into the alleged manipulation of Libor and foreign exchange rates produced emails and other evidence that NY Fed officials believe reflected risky and lawless behaviour, people familiar with the situation said. Fed officials were surprised that some of that reported behaviour occurred after the 2008 crisis, leading them to believe bankers had not curbed their poor conduct. To make sure the biggest banks are paying enough attention to ethics and culture, NY Fed bank evaluations have begun incorporating new questions emphasising such issues. Topics include whether the right performance structure is in place to punish bad behaviour, especially when it comes to compensation.

The NY Fed does not have the authority to write regulations, but it plays a crucial role in the regulatory landscape, overseeing banks in its jurisdiction that include Goldman Sachs, JPMorgan, Citigroup, Barclays and Deutsche Bank. It assesses banks through evaluations, which often do not contain specific criteria but which provide guidance for standards. NY Fed general counsel Thomas Baxter has also been meeting bank executives to emphasise that when it comes to ethics and culture the tone needs to be set at the top, people familiar with the efforts said. The agency will also hold a workshop on bank ethics and culture in the autumn Banks have already been working to overhaul their risk management and have hired thousands of additional compliance staff. But they are worried about how regulators will measure how well they are doing in terms of ethics and culture. “Banks are taking the Fed’s message very seriously,” a banking industry source said. “We just want to make sure we know what the rules are.”

Read more …

• Why We’re Still Waiting For A Banking ‘Culture Shock’ (CNBC)

Banks may have repaired their balance sheets following the global financial crash of 2008 but we’re still waiting for any notable shift in their culture, according to a market commentator. Alex Brummer, a journalist who concentrates on the U.K.’s financial hub for the Daily Mail, told CNBC Monday that “reckless banking” persists in the industry nearly six years after one of the greatest financial upheavals in the last two centuries. “The cultural change that we hoped for never actually happened,” he said. “(Regulators are) beginning to slam the door but it’s taking a hell of a long time to do so,” he said. Brummer added that any penalties that have been dished out to U.K. banks following a string of trading and market manipulation scandals are just being seen as a new cost of doing business.

“It’s really curious that the smallest countries involved in the crisis, Iceland and Ireland, where perhaps it had the most severe impact on ordinary people in some respects and on the future of their economies, are the only ones that bothered to try these people and put them in prison,” Brummer said. Brummer also rounded on bonus payments for bankers saying that the incentive schemes are all wrong, and added that any upheavals that policymakers or the public want to see would be a “really long term process.” Allegations of rate fixing and foreign exchange manipulation have provided setbacks for many banks across the globe as they try to reinforce capital buffers to provide better foundations in the event of another crisis. In the City of London, some bankers have been suspended from their roles, organizations have been fined and investigations have begun into the alleged wrongdoing. However, critics remain skeptical following the small number of prosecutions that have ended in a prison sentence.

Read more …

Who owns this country?

• Private Equity’s Free Pass (NY Times)

For thousands of hobbyists, the local Michaels Stores outlet is a must-stop shop for scrapbooks, dried flowers, crochet hooks, sewing notions and dozens of other do-it-yourself paraphernalia. In these essentials, Michaels, the nation’s largest arts-and-crafts retailer, has remained unchanged for years. But behind the scenes, the company has been refashioned by two financial giants — Bain Capital and the Blackstone Group — which have effectively controlled Michaels since 2006, when they took the chain private in a $6 billion leveraged buyout. Since then, Bain and Blackstone have profited from scrapbookers and needlepoint artists in part through an array of sophisticated financial techniques, most recently by selling shares in Michaels in an initial public offering in June.

In some ways, the practices used at Michaels by Bain and Blackstone — and by other private equity firms at other companies — closely resemble those employed by investment banks like Goldman Sachs and Morgan Stanley. For example, all of these financial firms advise corporations on mergers and acquisitions, on issuing debt and on how to rejigger their financial structures. And they are exceedingly well paid for these services. But there is a crucial difference. The investment bankers are generally designated as broker-dealers — entities that perform crucial functions in financial markets. This lucrative status comes at a cost: Broker-dealers are subject to Securities and Exchange Commission regulations aimed at reining in excesses and requiring that the advice they provide is appropriate. When this so-called suitability standard is violated, brokers face regulatory and legal penalties.

But while private equity firms often operate like Goldman and Morgan Stanley, they are not uniformly subject to the same broker-dealer regulatory regime. Blackstone, for example, registered as a broker-dealer in 2007, a year after it participated in the Michaels buyout. But to this day, Bain has not done so, and the S.E.C. has not required it or many other private equity firms to comply with broker-dealer requirements. Nor has the S.E.C. clamped down on buyout firms for marketing private equity funds to endowments, pension funds and wealthy investors. These activities, too, are usually the purview of broker-dealers. This inconsistent treatment reflects an internal debate in the S.E.C., several people close to the agency said. And it has caused consternation in the private equity industry.

Read more …

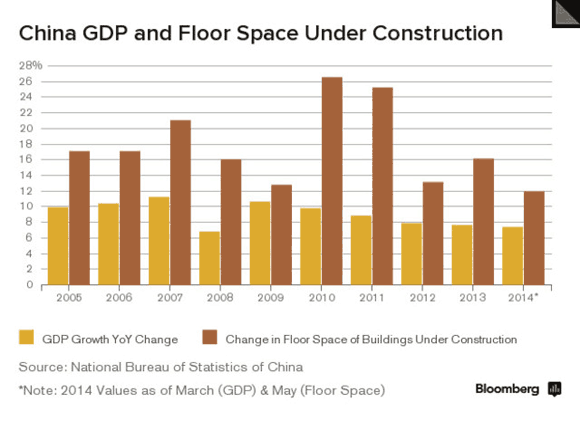

Empire building in the face of economic collapse. America does it, Europe does it, Japan. So why not China too?

• China’s Perilous Tangle Of Military And Economic Fortunes (FT)

Two debates are under way over China. The first, about Beijing’s aggression in the South and East China seas, is between naval strategists and diplomats who know little about economics. The second, about the fragility of the Chinese economy, is between economists who know little about naval strategy and diplomacy These debates should intersect but they rarely do. In one, China appears invincible; in the other, it seems to be on the brink of implosion. The background to the first debate is China’s seemingly inexorable military expansion, especially in sea, air, ballistic missiles and cyber warfare. As regards sea forces, this includes not only warships but also coastguard vessels, merchant shipping and strategic deployment of oil rigs. Beijing’s ability to co-ordinate all these attributes of power has resulted in a subtly shifting military balance in maritime Asia. [..]

The background to the second debate is China’s overheated economy. For 30 years, double-digit growth has been the norm, but this could not go on for ever. The official growth rate of 7.5 per cent probably errs on the high side – and, even if not, growth on the more populous and developed Pacific coast is surely below that, since the poorer interior has tended to grow at a faster rate. Then there are the credit and housing bubbles; house prices fell by more than 10 per cent in the first five months of 2014. The economy has, especially since 2008, been on a nonstop stimulus. To think that such a situation can continue, with China eventually surpassing the US as the world’s biggest economy, constitutes linear thinking in the extreme.

This second debate pits those who believe China’s economy will muddle through against those who think it could collapse. The muddle-through scenario assumes that China’s very capable and collegial autocrats are not in denial about any of these problems, and can act nimbly – in ways democracies cannot – to make a successful course correction. The culture of discipline, and $4tn in foreign exchange reserves, will help. Others believe China is subject to the same economic laws as everyone else, and that the leadership, as capable as it may be, is still in over its head. It is China’s very authoritarianism that undermines economic reform, they say.

Read more …

• Eurozone Efforts To Boost Inflation Are Full Of Hot Air (Das)

Announcing the June initiatives, Draghi told reporters: “Are we finished? The answer is no.” It would be reasonable, based on established practice, to expect the ECB resident to repeat this formulation in the coming months, until circumstances dictate a new message. But the utterances are increasingly reminiscent of the Wizard of Oz: “Make no mistake, I have powers, powers beyond your understanding! Powers to make you quake!” It is unlikely that the policies in place will result in an immediate return to the required levels of growth. Inflation is likely to remain low. The ECB believes that inflation will rise from current rates (0.5%) to 1.4% in 2016, despite downward revisions of its inflation forecast for the next three years. The pace of structural reforms in individual nations will remain slow, particularly in the face of electoral disquiet and with low borrowing costs reducing pressures for change.

The ECB package of low-cost funding is unlikely to have the intended effect on the real economy, though it may assist in keeping bond yields low and stock markets buoyant. Draghi has acknowledged that almost all of policymakers’ conventional tools have been exhausted. Indeed, the ECB has only one more card left to play — a large-scale program of asset purchases. But it is not clear that monetary expansion will be effective in stimulating demand. The ECB’s own simulations show that the impact of full-scale quantitative easing on growth and inflation will be limited. The simulations indicated that a QE program of €1 trillion per year, roughly €80 billion per month, would increase inflation by only 0.2% to 0.8%.

European policymakers and investors have ignored real economy weaknesses, choosing to concentrate on the effect of massive central bank liquidity injections. The strategy has generated spectacular returns. But the balance of risk and return is shifting. Should growth and inflation not increase significantly and the present policies prove ineffective, Draghi’s bluff is likely to be called. And as Ambrose Bierce knew: “The hardest tumble a man can take is to fall over his own bluff.”

Read more …

Let’s hope they bring it down.

• Europe’s Banking Union Faces Legal Challenge In Germany (FT)

Europe’s banking union is set to face a challenge in Germany’s constitutional court, a development that threatens to generate renewed uncertainty over one of the main responses to the eurozone’s financial crisis. Five German academics have filed a case claiming that the EU’s banking union is illegal under German law because it was created without the necessary treaty changes. The constitutional court, which this year rejected a complaint against the European Stability Mechanism, the eurozone bailout fund, has a record of broadly supporting EU and eurozone integration. However, the new case, which could spend months winding its way through court hearings, will almost certainly force officials from the European Commission and the European Central Bank to defend the newly-created structure just as it begins to be implemented.

The suit highlights the determination of a group of eurosceptic German economics, finance and law experts to challenge the institutions underpinning the eurozone’s growing financial and economic integration. While the group has limited party political support, its position plays on deep-rooted German convictions that important political decisions should be legally ‘unassailable’ and fears that some EU decisions relating to the monetary union might not be. The banking union has no basis in law in the European treaties, said Markus Kerber, a finance professor at TUB, the Berlin Technical University, who also heads Europolis, a eurosceptic think-tank. Mr Kerber told the Financial Times that the banking union was illegal and contrary to the German constitution. He said the case specifically concerned the new single supervisory mechanism, granting the ECB the power to monitor the eurozone’s largest banks.

Read more …

China and Japan, too, will keep the taps open.

• Buyers Dream of Draghi as Fed-ECB Divide Bolsters Treasuries (Bloomberg)

As the Federal Reserve moves to end its debt purchases, U.S. bond-market bulls are discovering a new ally: European Central Bank President Mario Draghi. For the first time since 2007, Treasuries offer higher yields than government debt in Europe. That’s largely due to Draghi, who pushed the region’s borrowing costs to record lows after announcing an unprecedented set of stimulus measures last month including negative interest rates to prevent deflation.

With Fed Chair Janet Yellen trying to extricate the central bank from more than five years of its own extraordinary monetary policies to support the world’s largest economy, the relative advantage may help attract more overseas investors to Treasuries and prolong their biggest advance in four years. At 2.48%, 10-year notes yield more than twice as much as German bunds, the biggest premium since 1999. “It certainly does give the Fed some cover to pursue its agenda,” Tim Palmer, the Minneapolis-based head of global bonds at Nuveen Asset Management, which oversees $120 billion, said in a July 24 telephone interview. “It’s likely to be less disruptive to the extent that other countries are engaging in policies that add some liquidity.”

Read more …

But they’re too big to fail anyway. Empty threats.

• ECB Opaque-Asset Review Seen Targeting Deutsche Bank, BNP (Bloomberg)

Deutsche Bank and BNP Paribas, which hold almost half of the hard-to-value assets on the books of the euro area’s 10 biggest banks, are facing a reality check that could impose losses. As part of its review of 128 lenders, the European Central Bank is studying less-actively traded loans and securitized products that banks value with minimal external data. The unprecedented scope of the exercise gives the ECB, which is taking on a supervisory role this year, insight that has eluded investors: comparing how the biggest investment banks value complex assets. The findings, to be released in October, could require Deutsche Bank, BNP Paribas and other firms to restate the value of assets, driving down equity and slowing efforts to boost capital levels to meet demands set by regulators, according to Martin Hellmich, a professor of risk management and regulation at the Frankfurt School of Finance & Management.

ECB President Mario Draghi, seeking to show the assessment will be credible, has said some lenders need to fail its stress test. “Banks with a lot of level-three assets that still have a viable business model and funds to spare make for good candidates for the ECB to discipline,” Hellmich said. “That’s a political approach, but it makes sense.” Banks split assets into three categories: one for those with transparent prices, such as stocks; a second for assets where some external data is available, including many over-the-counter derivatives, such as interest-rate swaps; and a third for those they assign their own values to because there isn’t an active market. The last group, known as level three, contains the most illiquid asset-backed securities, collateralized debt obligations, repurchase agreements and derivatives. Banks value these assets using their own models based on historical data and risk assumptions. The models aren’t made available to investors.

Read more …

It doesn’t matter who’s guilty. What matters is who pays: the poor.

• Argentina Braces For Sovereign Debt Default (FT)

Santiago Medina frowns as he recalls Argentina’s economic crisis at the time of its 2001 sovereign debt default, when he lost his job and took part in street protests. “Those were tough times,” says Mr Medina, who sells newspapers at a small kiosk beside a traffic-clogged avenue in Buenos Aires. “I don’t understand why the government wants to risk default again. It’s irresponsible: people are going to suffer.” Despite such painful memories, Argentines are poised for a default on Wednesday – their third in just over three decades. The trigger would be a missed $539m interest payment after mediated talks between the government and a group of “holdout” creditors made no apparent progress last week.

The growing prospect of default has begun to focus minds on what would come next. Economists broadly expect a recession in the country would deepen, inflation to rise and capital flight – possibly triggering a second devaluation of the peso this year. Still, few believe the consequences of a default would be as dire as 13 years ago, when unemployment reached nearly 25% and forced tens of thousands of Argentines on to the streets to scavenge for cardboard to sell to recycling plants. The economy is not in as deep a crisis as in 2001, when Argentina had suffered from a four-year recession before defaulting. The size of the forgone debt would also be smaller – a maximum of $30bn compared with $80bn.

Read more …

” … homeowners owing their creditors 370% of disposable incomes”. What else do you need to know?

• Swedes Engage in Household Debt Binge (Bloomberg)

Three weeks after Sweden’s central bank delivered a surprise half-point rate cut, a fresh set of credit data showed that households are borrowing at the fastest pace in almost three years. The Swedish Financial Supervisory Authority and the government “have concluded that the higher credit growth and the high household indebtedness is problematic,” Mats Hyden, an economist at Nordea Bank, said by phone. Last week’s credit report “increases the pressure on them to act.” While the Riksbank fights back criticism from Nobel laureates and former members of its own board that it was too slow to tackle disinflation with rate cuts, households are piling on more debt. Consumer borrowing is at a record high with homeowners owing their creditors 370% of disposable incomes, the central bank estimates.

“Credit growth has changed course and is now on an upwards trend,” Hyden said. “And the fact that it increased already in June, before the Riksbank’s rate cut, indicates that there is more momentum in credit growth than previously thought.” Credit grew at an annual rate of 5.4% in June, the quickest pace since November 2011, Statistics Sweden said on Friday. The news sent the krona 0.4% higher against the euro to its strongest since July 3, the day the Riksbank said it was cutting its repo rate to 0.25% from 0.75% to try to drive inflation closer to its 2% target. Prices rose at one tenth that pace in June. Total private debt in Sweden, including households with no loans, stood at about 173% of disposable incomes in the second quarter of this year, according to the Riksbank, which forecasts that that ratio will rise to 185% in 2017.

Read more …

Wait till it reaches America.

• Two Americans Infected With Ebola In Liberia (UPI)

Two U.S. aid workers in Liberia have tested positive for the Ebola virus in what health officials in west Africa are calling the deadliest outbreak of the disease ever. Both Nancy Writebol and Dr. Kent Brantly were working in Liberia with Samaritan’s Purse to treat Ebola victims when they were diagnosed with the virus last week, the organization said in a statement. Writebol is an aid worker with the Serving in Mission group, which was partnered with Samaritan’s Purse. Brantly worked directly with Samaritan’s Purse Ebola Consolidated Case Management Center in Monrovia.

Writebol and her husband, David Writebol, had been living in Liberia since August 2013 and are originally from Charlotte, N.C. Brantly, 33, of Fort Worth, Texas, began feeling ill last week and quarantined himself when he recognized the symptoms. He had been living in Liberia since October. As of June 30, the World Health Organization says some 1,093 people in Guinea, Sierra Leone and Liberia are believed to have been infected with Ebola with 660 deaths. Testing has confirmed 786 cases with 442 deaths.

Read more …

Baseload issues. We’ve talked about those 1000 times. They force Germany to pay as much as 400 times wholesale electricity prices to coal plants just to keep the grid going. No surprise for Automatic Earth readers.

• German Utilities Bail Out Electric Grid at Wind’s Mercy (Bloomberg)

Germany’s push toward renewable energy is causing so many drops and surges from wind and solar power that the government is paying more utilities than ever to help stabilize the country’s electricity grid. Twenty power companies including Germany’s biggest utilities, EON SE and RWE AG, now get fees for pledging to add or cut electricity within seconds to keep the power system stable, double the number in September, according to data from the nation’s four grid operators. Utilities that sign up to the €800 million ($1.1 billion) balancing market can be paid as much as 400 times wholesale electricity prices, the data show.

Germany’s drive to almost double power output from renewables by 2035 has seen one operator reporting five times as many potential disruptions as four years ago, raising the risk of blackouts in Europe’s biggest electricity market while pushing wholesale prices to a nine-year low. More utilities are joining the balancing market as weak prices have cut operating margins to 5% on average from 15% in 2004, with RWE reporting its first annual loss since 1949. “At the beginning, this market counted for only a small portion of our earnings,” said Hartmuth Fenn, the head of intraday, market access and dispatch at Vattenfall AB, Sweden’s biggest utility. “Today, we earn 10% of our plant profits in the balancing market” in Germany, he said by phone from Hamburg July 22.

Read more …