Pablo Picasso Portrait of the artist’s mother 1896

Apparently, players never stood for the anthem until 2009. Then the Defense Department started paying teams to get them out of the dressing room and onto the field when the anthem was played. A recruiting tool.

But Kaepernick is a brave man no matter what. Trump should invite him to the White House and talk.

• Colin Kaepernick Has Won: He Wanted A Conversation And Trump Started It (G.)

All Colin Kaepernick ever asked was for his country to have a conversation about race. This, he warned, would not be easy. Such talks are awkward and often end in a flurry of spittle, pointed fingers and bruised feelings. But from the moment the former San Francisco 49ers quarterback first spoke about his decision to kneel or sit during the national anthem, he said was willing to give up his career to make the nation talk. In one speech on Friday night, Donald Trump gave Kaepernick exactly what he wanted. With a fiery blast at protesting NFL players that seemingly came from nowhere, the president bonded black and white football players with wealthy white owners in a way nobody could have imagined. By saying any player who didn’t stand for the anthem was a “son of a bitch” and should be fired by his team’s owner, Trump crossed a line from which no one could look away.

Come Sunday afternoon, players who wanted nothing of a racial dialogue stood before giant flags, linking arms in protest. Owners who once wished their kneeling players would just stop offending fans fired off statements in their support. Networks who have avoided showing the raised fists of dissent had no choice but show the rows of players standing strong against Trump’s rage. Whether anyone wanted it or not, Trump has forced the US to have the conversation Kaepernick has been requesting. [..] “I think this is something that can unify this country,” Kaepernick said in the summer of 2016, at his first press conference about his protest. “If we can have the real conversations that are uncomfortable for a lot of people – if we can have this conversation there’s a better understanding where both sides are coming from. (And) if we can reach common ground and can understand what everyone’s going through, we can really affect change.”

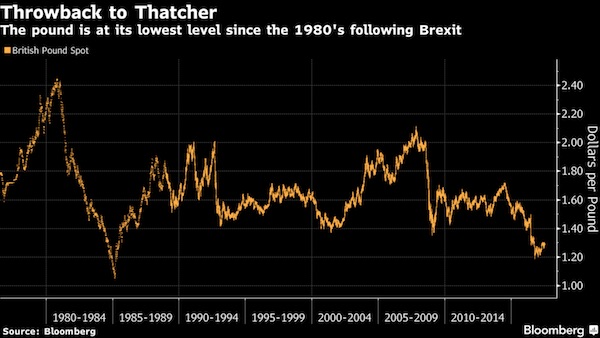

Why the dollar’s demise is greatly exaggerated.

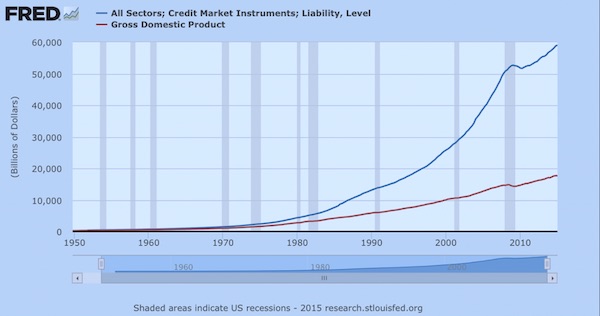

• The World Can’t Stop Borrowing Dollars (BBG)

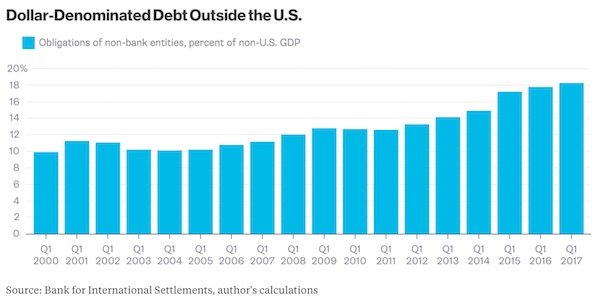

Companies and governments around the world can’t seem to stop borrowing U.S. dollars. This could be a problem, both for them and for the Federal Reserve. Not long ago, it seemed as though a global boom in dollar borrowing had to be reaching its limit. Encouraged by near-zero interest rates, non-U.S. borrowers had binged on trillions in new dollar-denominated debt. With the central bank aiming to increase rates and the U.S. currency rising, strains were beginning to show, as companies struggled to pay back the dollars with devalued local-currency earnings. Yet the party keeps going, perhaps thanks to the Fed’s extremely gradual pace of rate increases and a related decline in the dollar’s exchange rate. According to the Bank for International Settlements, total dollar borrowing outside the U.S. reached $10.7 trillion in the first quarter of 2017, up about 6% from a year earlier and up 83% from 2009. Here’s how that looks as a%age of non-U.S. GDP:

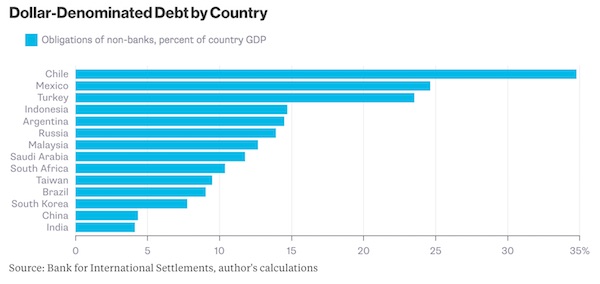

About a third of the debt is owed by companies and governments in emerging markets, where the relatively high volatility of earnings and exchange rates can make dollar borrowing particularly risky. Here’s the dollar-denominated debt of the countries that the BIS tracks, as a%age of their GDP:

To be sure, some of the debt might not be too burdensome if borrowers have a lot of dollar revenue from, say, oil exports (think Russia and Saudi Arabia). But to the extent that the obligations aren’t hedged, they will make the world more sensitive to the Fed’s interest-rate moves. And if future rate increases trigger belt-tightening and defaults abroad, the malaise could easily spread back to the U.S., complicating the Fed’s efforts to keep growth on track. So the world is becoming increasingly exposed to the Fed, which leaves the Fed increasingly exposed to the world.

What’s around the corner is more debt. Dollar-denominated debt.

• What’s Around The Corner For The Hottest Emerging Markets (BBG)

Nothing has been able to silence the roar of emerging markets this year, be it Kim Jong-Un’s missiles, President Donald Trump’s protectionist rhetoric or a host of domestic political ructions from Brazil to South Africa and Turkey. Instead, investors have focused on economies supported by slowing inflation, a recent recovery in commodity prices and the comfort of watching central banks conducting policy by more conventional methods than their developed-nation counterparts. The MSCI EM Currency Index and the Bloomberg Barclays index of emerging-market local-currency government bonds both reached three-year highs this month, while a gauge of developing-nation equities is close to its highest since 2011. And now that the Federal Reserve has laid out a tapering game plan likely to drive down longer-maturity U.S. Treasuries, the bulls are taking new heart, betting the rally’s just getting started.

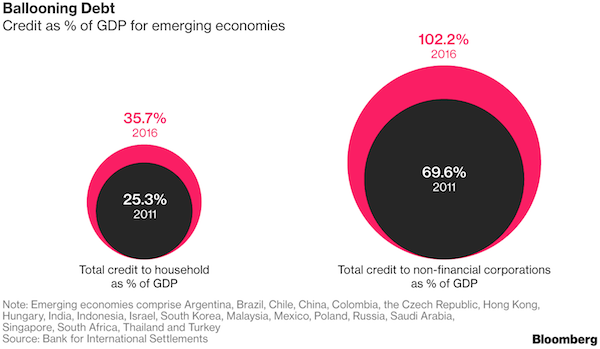

For others, it’s getting perilously near to closing time. “We all enjoyed the party, but this may be its last leg and there maybe more volatility in the year-end,” said Peter Schottmueller, the head of asset allocation at Deka Investment GmbH in Frankfurt, who helps manage the equivalent of $7.8 billion. “The market is very myopic and very short-term focused.’’ Corporate borrowing has outstripped economic growth over the five years through 2016, according to the Bank for International Settlements. That’s raised questions about how long it can continue as central banks in developed nations prepare to pare back quantitative easing, according to Toru Nishihama, at Tokyo-based Dai-ichi Life Research.

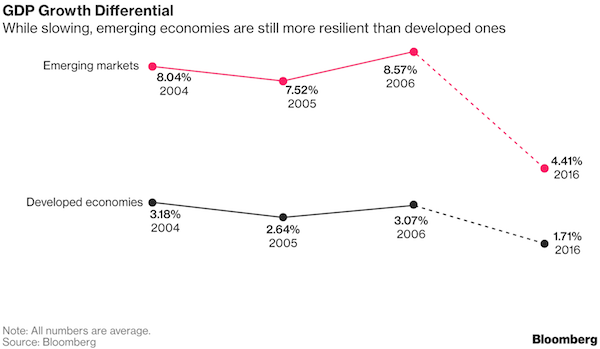

Emerging economies expanded 4.4% in 2016, almost half of the rate of a decade ago, when the Fed was in its last year of a cycle of interest-rate increases. “There remains a gap between the growth rate of emerging economies and developed countries as well as returns from investment, and investors will continue to pour funds into emerging markets,” Dai-ichi’s Nishihama said. “However, from here, not all emerging-market investments are rosy, and investors may become more selective in which country or countries to invest.”

“China will create a centralized financing company..” Yes, but to oversee assets, or to oversee debt, liabilities?

• China Plans Closer Oversight of $304 Billion in State Company Funds (BBG)

China will create a centralized financing company to oversee some $304 billion of funds held by the country’s state-owned enterprises’ finance units, people familiar with the matter said, allowing the government closer supervision of SOEs’ borrowing and investments. The plan, approved by the State Council or Cabinet, will increase the government’s ability to supervise the non-financial central SOE finance companies’ investments, giving the entity a fuller picture of how these companies are using funds, according to the people, who asked not to be named because the plans have not been made public. Non-financial, central SOEs have their own finance units that currently offer various products and services such as deposits and loans, and the new entity could facilitate those efforts.

The plan would assist regulators by directing some 2 trillion yuan of funds held by the non-financial SOEs through the new company, meaning they could monitor the flow through only one financing company rather than dozens. Many details about the new entity were not immediately clear, such as who would control it, how much regulatory and oversight authority it would have, and how it might conduct external financing on behalf of the SOEs. The aim is to boost efficiency in the $20 trillion state sector in line with a government campaign to reduce the companies’ debt, according to the people. While the centralized finance company would have a regulatory oversight role, the SOEs would retain control over the funds, the people said.

Not the plan.

• China’s Yuan Is Anything But Stable as Party Congress Approaches (BBG)

China’s currency has swung from hot to cold in a matter of weeks, thwarting expectations that policy makers would keep the yuan stable before a crucial Communist Party Congress next month. The yuan fell 0.3% to 6.6075 per greenback at 2:29 p.m. in Shanghai, taking its decline from a Sept. 8 peak to 2.6%. That’s a sharp reversal from earlier this month, when the currency surged 1.5% in just six days. The stunning shift has propelled a gauge of 50-day price swings on the yuan to a six-month high. With China’s financial markets closed for the whole of next week due to National Day holidays, there are effectively just over two weeks of trading to go before the congress begins Oct. 18.

The turning point for the currency came when the PBOC eased a forwards trading rule that made betting against the currency more expensive – a clear signal that the surge had gone far enough. A mild recovery in the greenback thanks to a more hawkish Federal Reserve – the Bloomberg Dollar Spot Index is up 1.2% since Sept. 8. – has hastened the yuan’s decline. “Investors were too optimistic earlier, and they are now pushing the yuan lower because they figured the policy makers believed the currency was too strong,” said Eddie Cheung at Standard Chartered in Hong Kong. “There’s still room for the dollar to rise in the short term if the market becomes more confident on U.S. rate hikes. That said, the yuan could weaken further this year, though the PBOC wouldn’t allow any sharp declines.”

Hmm, really? With so many people living paycheck to paycheck?

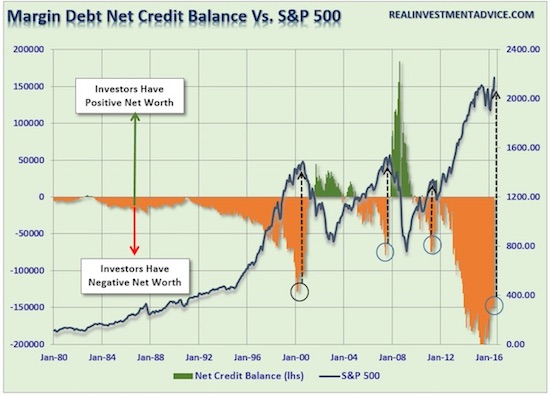

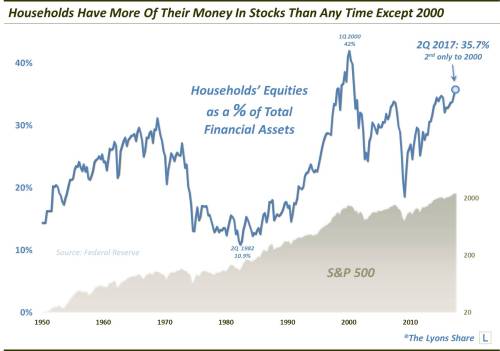

• US Households Are Loaded Up With Stocks (Lyons)

From the Federal Reserve’s latest Z.1 Release (formerly, Flow Of Funds), we learn that in the 2nd quarter, household and nonprofit’s stock holdings amounted to 35.7% of their total financial assets. This is the highest%age since 2000. In fact, the blow-off phase from 1998 to 2000 leading up to the dotcom bubble burst was the only time in the history of the data (since 1945) that saw higher stock investment than now. You might say that everyone is in the pool. We’ve talked about this data series many times. It is certainly not a timing tool. Rather, it is what we call a “background” indicator, representative of the longer-term backdrop — and potential — of the stock market.

It also serves as an instructional lens into investor psychology. For these reasons, it is one of our favorite metrics pertaining to the stock market, as we wrote in a September 2014 post: “This is one of our favorite data series because it reveals a lot about not only investment levels but investor psychology as well. When investors have had positive recent experiences in the stock market, i.e., a bull market, they have been happy to pour money into stocks. It is consistent with all of the evidence of performance-chasing pointed out by many. Note how stock investment peaked with major tops in 1966, 1968, 1972, 2000 and 2007. Of course, investment will rise merely with the appreciation of the market; however, we also observe disproportionate jumps in investment levels near tops as well.

Note the spikes at the 1968 and 1972 tops and, most egregiously, at the 2000 top. On the flip side, when investors have bad recent experiences with stocks, it negatively effects investment flows, and in a more profound way than the positive effect. This is consistent with the scientifically proven notion we’ve discussed before that feelings of fear or loss are much stronger than those of greed or gain. Stock investment during he 1966-82 secular bear market provides a good example of this. After stock investment peaked at 31% in 1968 (by the way, after many of the indexes had topped in 1966 – investors were still buying the dip), it embarked on steady decline over the next 14 years. This, despite the fact the stock market drifted sideways during that time. By the beginning of the secular bull market in 1982, the S&P 500 was right where it was in 1968. However, household stock investment was at an all-time low of 10.9%.

She won but lost. What happens here is the future of Europe is decided by German voters alone. That is the core of the European problem.

• Merkel Lands Fourth Term, But at What Cost? (Spiegel)

Angela Merkel’s election result four years ago was, to be sure, extraordinary. It was clear from the surveys that her conservatives wouldn’t be able to repeat it. But a fall like this? Merkel’s Christian Democratic Union (CDU) and its Bavarian sister party Christian Social Union (CSU) saw their joint result fall by more than eight%age points – their worst showing since 1949. During her first appearance after the election at her party’s headquarters, the chancellor said she had, in fact, hoped for a somewhat better result. Those gathered at the headquarters dutifully chanted, “Angie, Angie.” Then things grew quiet again. Nobody waved the German flag. It was a far cry from 2013, when CDU politicians broke out into a spontaneous karaoke session after the results were announced. This time, the prominent members of Merkel’s party who had gathered behind her on the stage seemed sobered by the tepid showing.

Merkel can keep her job as chancellor, the “strategic goal” has been achieved, as Merkel refers to it. But it comes at a high price. Voters have severely punished the parties of the current governing coalition, with Merkel’s conservatives losing dozens of seats in parliament. The right-wing populist Alternative for Germany (AfD) will now enter parliament with a strong, double-digit result. And it will be extremely difficult for Merkel to build a government coalition that will be stable for the next four years. There won’t just be a sprinkling of renegades representing the AfD in parliament. The right-wing populists will be the third-largest party in the Bundestag and they have announced their intention to “chase down” the chancellor as one of the party’s two leading candidates expressed it on Sunday.

The election campaign already gave a taste of what might be coming, with AfD supporters loudly venting their hatred and anger at events held by Merkel’s CDU. Merkel, who isn’t known for being the world’s best public speaker, will now be confronted by them on a daily basis. And the conservatives will also have to ask themselves what share of the responsibility they carry for the AfD’s success. What can they do to win back disappointed voters? More than a million voters are believed to have flocked from the CDU and the CSU to the AfD. And most of them say that it was the chancellor’s refugee policies that led them to vote for the right-wing competition. It’s little wonder, then, that Merkel has identified the enduring regulation of refugee flows and domestic security as the key topics for the coming years.

I went for the headline. But good insights too.

• Angela’s Ashes: 5 Takeaways From The German Election (Pol.)

1. Merkel’s twilight has begun SPD leader Martin Schulz told Merkel on live television she was the election’s “biggest loser.” A bit harsh perhaps (especially coming from a candidate who just recorded his party’s worst-ever result), but there’s some truth to it. Instead of addressing tough questions such as migration head-on, Merkel ran a vague, feel-good campaign, promising a “Germany in which we live well and happily,” while offering few specifics about how she wanted to get there.

2. Germany’s consensus-driven political model is shattered The next parliament will include seven parties (eight, if you count the CSU, the Bavarian sister party to Merkel’s CDU), representing a much more diverse cross-section of the country’s body politic than its predecessor. Sparks will fly. The inclusion of the far right in parliament will make German politics louder and nastier. AfD leader Jörg Meuthen made it clear Sunday that confrontation and “provocation” were central to the party’s strategy. If other European countries where populists have a strong foothold are any indication, that no-holds-barred spirit will infect the political mainstream, creating a decidedly more raucous political climate.

3. Forget about meaningful eurozone reforms Merkel’s conservatives were skeptical of French President Emmanuel Macron’s reform proposals even before Sunday. A grand coalition represented the French president’s best chance for realizing his vision. With that option now off the table, a weakened Merkel is unlikely to be able win over the Free Democrats and skeptics in her own party, even if she wanted to. France and Germany may agree to establish some form of budget and an oversight position for the eurozone with the title of finance minister, but neither will have the scope the French, not to mention many economists, had been hoping for.

4. Berlin will play hardball with Europe on refugees German patience over Europe’s lack of solidarity on the refugee front was already wearing thin. After Sunday’s result, look for outright confrontation with countries like Poland and Hungary. In the view of many Christian Democrats, the AfD would have never gotten this far if other European countries had taken in their fair share of refugees instead of letting Germany bear the burden. It’s payback time.

5. This isn’t Weimar For all the breathless historical comparisons, it’s worth taking a deep breath and remembering Germany is a stable democracy. The vast majority of Germans didn’t vote for the AfD and most of those who did, did so in protest. The coming years won’t be pretty, but Germany’s democratic foundations are robust enough to withstand the populist onslaught.

Not could, will. Already has.

• German Vote Could Doom Merkel-Macron Deal On Europe (R.)

Weakened by the worst result for her party since 1949 and facing a more fractious political landscape at home, Germany’s Angela Merkel could be forced to rein in plans to re-shape Europe together with France’s Emmanuel Macron. Merkel’s conservatives garnered more support than any other party in the German election on Sunday, projections showed, ensuring that she will return for a fourth term as chancellor. But her party appeared on track for its poorest performance since the first German election after World War Two and its only path to power may be through an unwieldy, untested three-way coalition with the ecologist Greens and liberal Free Democrats (FDP), fierce critics of Macron’s ideas for Europe.

Over the next four years, Merkel will also have to cope with a more confrontational opposition force in the Alternative for Germany (AfD), a eurosceptic, anti-immigration party that rode a wave of public anger after her decision to open Germany’s borders to hundreds of thousands of migrants in 2015.[..] This will be a new world for Merkel, who has grown accustomed to cozy coalitions and toothless Bundestag opposition during her 12 years in power. “In my mind, reform of the euro zone is the single most important foreign policy issue that the new government has in front of it,” said Thomas Kleine-Brockhoff, who runs the Berlin office of the German Marshall Fund. But he predicted a so-called “Jamaica” coalition between Merkel’s conservatives, the FDP and the Greens – whose combined party colors of black, yellow and green are like those the Jamaican national flag – would struggle to deliver.

Party in the streets of Athens.

• German FinMin Wolfgang Schaeuble May Soon Be Losing His Job (CNBC)

In the aftermath of the German election, there could be one important casualty for markets. Wolfgang Schaeuble, the German Finance minister, could soon lose his influence on Germany and the euro zone if coalition talks remove him from his key ministry. Schaeuble became the face of austerity and had a determinant role in bailout programs across the euro zone, namely Greece, and is often described as Chancellor Angela Merkel’s co-chancellor, given his importance to the German government. However, given the tough political horse-trading that lies ahead, Merkel might not manage to keep her close ally. “Coalition building will be extremely difficult,” Carsten Brzeski, chief economist at ING, told CNBC Monday via email.

“If Schauble would really no longer be Finance minister it would be a watershed for the entire euro zone. An exit of one of the main characters of the entire euro zone crisis clearly marks the end of a historical chapter,” he said. Merkel’s center-right CDU and its Bavarian sister-party the CSU won 33% of the vote, provisional votes showed, down from 41.5% in the previous election. The pro-business FDP party, which placed fourth with 10.7% of the votes, has said it is open for coalition talks with Merkel’s CDU. The Greens are set to join coalition talks too, which could ultimately form Germany’s first four-party government in decades. In German politics, it’s usually the case that the largest party chooses the chancellor, and the second largest group picks the next post.

As such, the FDP could opt for the Finance Ministry and put an end to Schaeuble’s eight-year reign. The future for Schaeuble is “the question” from a market perspective, Carsten Nickel, managing director at Teneo Intelligence, told CNBC Monday. “In the end, I think there is probably very little alternative to Schaeuble, right now, at least in terms of individual politicians. There’s nobody who really comes to mind as the key person who would challenge him for that role. I wouldn’t be surprised if he stays on in the end,” he said. f Germany were to lose Schaeuble as Finance minister, the current momentum for further euro zone integration could also be damaged.

The firesale continues unabated. Prices were cut in half over the last decade, even in the high end. Greeks won’t own anything in their own country anymore.

• Luxury Properties On Greek Islands Attract Ever More Foreign Buyers (K.)

The rise of tourism and the popularity of certain destinations such as Myconos and Santorini have sent demand for and purchases of luxury holidays homes soaring. The first half of the year saw a 63.5% annual increase in the inflow of capital for property buys in Greece, following a 45.3% rise in the entire 2016 year-on-year to reach 270 million euros. Another factor boosting investments in holiday homes grow is the considerable decline in prices – averaging at 50% – compared to the period before the financial crisis, around 2008. The drop mainly took place from 2009 to 2013, as this section of the property market has become stable since then with some growth signs mainly regarding properties that have unique features and are regarded as emblematic.

Several foreigner buyers are scrambling to complete their acquisitions within the year, sensing that the window of opportunity may shut in the coming months, as there already are cases of owners who are raising their asking prices in view of the spike in demand. Franceska Kalamara, the head of the Franceska Properties estate agency that is active in the Myconos market, tells Kathimerini that “the buyers from abroad are interested in sizable and luxurious properties, from 400 square meters upward, and at very favorable locations, as close to the sea as possible. These are mostly individuals from Egypt, Lebanon and Israel, but also from the US, while there has recently been particular activity by Cypriot buyers.”

Among the recent well-known buyers of luxurious homes on Greek islands are Israeli entrepreneur Teddy Sagi (owner of Camden Market in London) who bought a series of properties on Myconos, according to estate agency sources, and Egyptian businessman Naguib Sawiris, buyer of two villas on the same island costing a total of some 11 million euros. It should be noted that the actual volume of the funds invested in the Greek holiday home market is far greater than reported by the Bank of Greece, as the majority of sellers ask buyers to deposit the money in bank accounts abroad. This trend has grown considerably since the imposition of capital controls two years ago.

But we like the story! Don’t take our modern mythology away.

• There Never Was a Real Tulip Fever (Smithsonian)

According to popular legend, the tulip craze took hold of all levels of Dutch society in the 1630s. “The rage among the Dutch to possess them was so great that the ordinary industry of the country was neglected, and the population, even to its lowest dregs, embarked in the tulip trade,” wrote Scottish journalist Charles Mackay in his popular 1841 work Extraordinary Popular Delusions and the Madness of Crowds. According to this narrative, everyone from the wealthiest merchants to the poorest chimney sweeps jumped into the tulip fray, buying bulbs at high prices and selling them for even more. Companies formed just to deal with the tulip trade, which reached a fever pitch in late 1636. But by February 1637, the bottom fell out of the market.

More and more people defaulted on their agreement to buy the tulips at the prices they’d promised, and the traders who had already made their payments were left in debt or bankrupted. At least that’s what has always been claimed. In fact, “There weren’t that many people involved and the economic repercussions were pretty minor,” Goldgar says. “I couldn’t find anybody that went bankrupt. If there had been really a wholesale destruction of the economy as the myth suggests, that would’ve been a much harder thing to face.” That’s not to say that everything about the story is wrong; merchants really did engage in a frantic tulip trade, and they paid incredibly high prices for some bulbs. And when a number of buyers announced they couldn’t pay the high price previously agreed upon, the market did fall apart and cause a small crisis—but only because it undermined social expectations.

“In this case it was very difficult to deal with the fact that almost all of your relationships are based on trust, and people said, ‘I don’t care that I said I’m going to buy this thing, I don’t want it anymore and I’m not going to pay for it.’ There was really no mechanism to make people pay because the courts were unwilling to get involved,” Goldgar says. But the trade didn’t affect all levels of society, and it didn’t cause the collapse of industry in Amsterdam and elsewhere. As Garber, the economist, writes, “While the lack of data precludes a solid conclusion, the results of the study indicate that the bulb speculation was not obvious madness.” [..] All the outlandish stories of economic ruin, of an innocent sailor thrown in prison for eating a tulip bulb, of chimney sweeps wading into the market in hopes of striking it rich—those come from propaganda pamphlets published by Dutch Calvinists worried that the tulip-propelled consumerism boom would lead to societal decay.