Arthur Rothstein General store closed on account of the drought, Grassy Butte, ND July 1936

Everyone expects Mario Draghi’s ECB to announce stimulus measures on Thursday. If the forward guidance, if we can call it that, which was ‘leaked’ by Draghi and his minions is accurate, we’ll see the bank’s main refinancing rate lowered, and the deposit rate perhaps even turned negative, with a less obvious set of measures that may include asset purchases also in the offing. The main goal must be to drive down the euro, which is still way too expensive from the point of view of exports and which therefore holds back ‘recovery’ in the eyes of policy makers, pundits and economists. But it would have to be driving down the euro without driving down stock markets at the same time.

There are a lot of things in just that one simple paragraph that are accepted as gospel, no questions asked, without having been tested or even really thought about. Now, I think that making the deposit rate negative is fine. Why would anyone want banks to be paid to store money with a central bank? Just tell them they can’t park a single eurocent with the ECB without paying a reasonable price to do so. And while you’re at it, the long-term refinancing operation (LTRO) could do with a revision. The stated aim for LTRO is to provide liquidity for banks that hold illiquid assets, but isn’t that perhaps just counter productive? If assets are still illiquid 5-6 years into the crisis, maybe it’s better to simply get rid of them, write them down, not aid and abet banks in holding onto them. It just makes it harder for anyone to know what a bank is truly worth if you help them hide their liabilities, and who needs that? Well, yes, bankers, but if you can’t get your ship and your gambling debts in order in 6 years, who needs you, really?

So trim down LTRO. And then do nothing else at all. Send a message to the world that you’re not intending to play the same game the US, Japan and China have been engaging in. If only because, well, look at where these countries find themselves. What’s to be jealous about there? And if Draghi announces “nothing else at all”, wouldn’t that drive down the euro all by itself? And yes, although we’ve seen markets ‘counter intuitively’ rise a few times recently on bad news, stock markets and other asset markets will probably get hit, perhaps even hard. But isn’t that what this world needs, isn’t it quite simply a good thing if as much of the free and cheap and zombie and ultimately empty stimulus money as possible is driven out of the system?

Zombie money is the biggest scourge of our times and our economies, not its savior, but just about everyone seems to have that completely upside down. The stated idea behind QE and other stimuli is to bring recovery through achieving an escape velocity that could help manage the debt load through – very – rapid growth, but there are no signs, other than some handpicked ones, that it is working. As long as it isn’t, the not-so-stated fact is that things are deteriorating, and quite rapidly too, since huge layers of additional debt are poured onto the already existing debt. Obviously, financial institutions and their shareholders are doing just fine at the cost of those who will have to pay back the debts.

But how does that fit in with Mario Draghi’s job description? What we have is rising stock markets and home prices – in many regions – combined with rising poverty, unemployment and not-in-the-labor-force rates. In what book is that a good direction to go in? How is creating an ever bigger divide in our societies going to help us in a recovery, or in life in general for that matter? If Draghi starts buying up sovereign bonds or asset backed paper, that may help banks and investors for a while, but at what price for the poorest in Greece, Spain or even Germany? And despite that price, there are no guarantees whatsoever that the benefits such actions may have will last. How much road to nowhere do we need to travel before we actually get there?

Tyler Durden ran a piece from The Diplomat written by Yang Hengjun today, Why Do China’s Reforms All Fail? . The reasons Yang gives, which are solidly interlocked, are the exact same as why present day central bank stimulus doesn’t work.

- … all the reforms in Chinese history aimed to perpetuate the current system

- … almost all of China’s reforms were done purely for the benefit of the ruler

Central banks seek to perpetuate a system that is already in place, even if it has failed dramatically and is even beyond repair, because central banks are not independent at all, no matter how much they are supposed to be. They instead control the money and credit supply of entire nations or associations of nations for the benefit of the rulers of the existing paradigm, be they political, financial and/or social. Central banks exist to make sure that if existing powers are broke or in danger, they get to feed off the wealth of the people. Therefore, while we may have democratic systems, though that is by no means assured from a political viewpoint anymore, these systems are really moot, since central bankers decide who rules and who pays for that rule, and they always pick yesterday’s favorites to hang on for another day. So if you’re looking for recovery and progress and sanity, you’re out of luck as long as Yellen and Draghi have the powers they do.

But don’t let me get ahead of myself. Draghi may still choose the way of the wiser, and do nothing on Thursday but to cut off a bunch of broke banks’ long overdue lifelines. And cause the very crisis that is the only way to get our economies and societies back on the way to real health, not the zombified kind we’ve been “living” for 6 years now. Hey, I can still dream and hope for another two days …

That’s what I said: they spent it all! No pent-up demand anywhere in sight.

• Heloc Payment Jump to Take Bite Out of Consumer Spending (WSJ)

Another bill is coming due from America’s decade-old borrowing binge as payments jump on a number of home-equity credit lines taken out during the boom. Economists worry the new burden could reignite loan-payment troubles and dent consumer spending at an iffy moment in the economic recovery. At issue are home-equity lines of credit, known as Helocs, which allow homeowners to tap their equity to fund home improvement, college tuitions and other expenses. Those loans typically let borrowers make interest-only payments for the first 10 years before requiring principal payments as well. That reckoning will come this year for an estimated 817,000 borrowers owing more than $23 billion in Helocs, more than double last year’s level, according to estimates by Equifax, the credit-reporting firm, and the Office of the Comptroller of the Currency. An average of about $50 billion in loans will reset in each of the next three years.

“These resets are a very serious issue,” said Amy Crews Cutts, chief economist at Equifax. “It’s a nontrivial number of people who get smacked with a higher payment.” The added bite is another reminder of how the home-equity borrowing boom that juiced spending during the past decade still impedes the sluggish U.S. economic recovery. The problems could squeeze states such as California, Arizona, Nevada and Florida that saw the biggest surges in home prices—and borrowing—a decade ago. Equifax data show Heloc delinquency rates have doubled on loans that have already reached the end of their interest-only period. With home prices now rising, banks have begun to increase Heloc lending.

But new originations are a fraction of levels during the peak of the housing boom. And many borrowers with 10-year-old Helocs can’t readily refinance—which could extend their interest-only periods—because many home prices are below where they were when they signed the loans. A homeowner who owes $100,000 on a Heloc carrying a 3.5% interest rate would see payments rise to $715 from $292 when the interest-only loan converts to a 15-year amortizing mortgage. If interest rates were to rise by three%age points, payments would go up an additional $150. “The giant sucking sound is all of that money being taken out of consumer spending,” said Richard Redmond, a mortgage banker in Larkspur, Calif.

Read more …

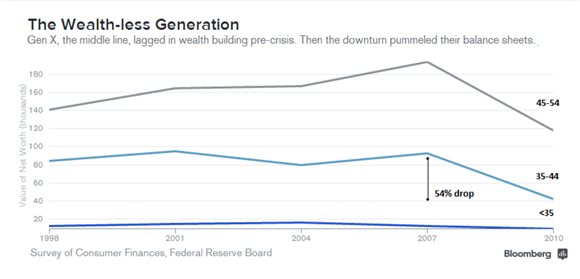

The generational divide steadily grows.

• Cash Deals for Homes Reach Record With Boomers Retiring (Bloomberg)

Mike Trafton bought a house in a suburb of Boise, Idaho, where he plans to retire. He made the deal without signing a stack of mortgage papers. Trafton, 55, and his wife Cindy, 54, paid $400,000 in cash for the 3,200-square-foot house in Eagle after selling their 4,400-square-foot home in a Portland, Oregon, suburb for $680,000. Like a growing number of baby boomers, born between 1946 and 1964, the Traftons had no desire to get a mortgage. “I feel better about owning my home outright,” said Trafton, who’s moving to a region with an average of 200 sunny days a year and skiing in the winter. “At this stage in our lives, we can afford it, and it’s better than having a monthly mortgage payment hanging over us.” U.S. home-price gains have restored $3.8 trillion of value to owners since the beginning of the real estate recovery in 2012, according to Federal Reserve data.

A record number of Americans are using that equity to pay cash for properties, avoiding a mortgage process that has become even more onerous in the wake of the 2007 housing collapse. In the first quarter, 29% of non-investment homebuyers used cash, the highest on record for the period, according to data compiled by Bloomberg. The majority of people making all-cash deals are baby boomers mostly because America’s largest-ever generation is beginning to retire, said Lawrence Yun, chief economist of the National Association of Realtors. In 2012, there were a record 61.8 million Americans over the age of 60, according to the Census. That compares with 46.6 million in 2000. “Cash purchases are on the rise because older homeowners who have decades of home-equity accumulation don’t want the hassle of a mortgage,” Yun said. “With the economy improving and the stock market at record highs, boomers are the ones who are driving the market.”

Read more …

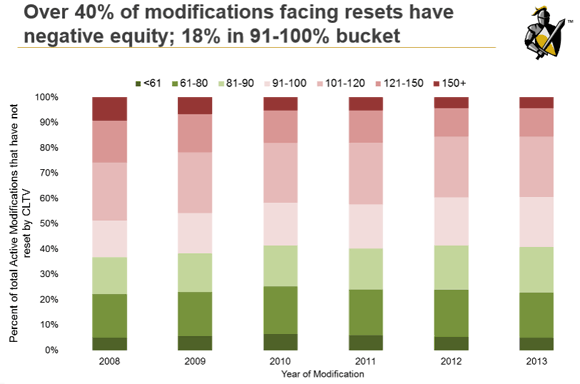

A lot of trouble’s brewing below the surface.

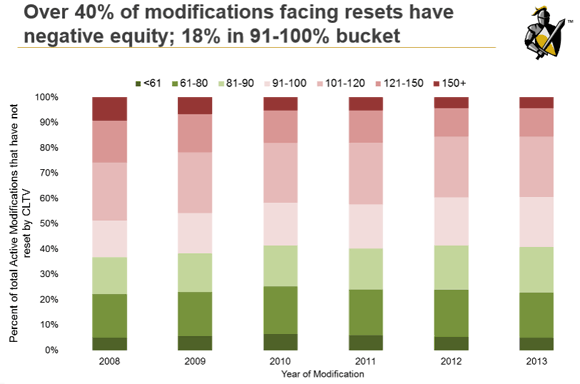

• Over 40% of 2 Million Modified Loans Facing Resets are Underwater (Mish)

Kostya Gradushy, Black Knight’s manager of Loan Data and Customer Analytics: “While the national negative equity rate as of April stands at 9.4% of active mortgages, the share of underwater modified loans facing interest rate resets is much higher — over 40%. In addition, another 18% of modified borrowers have 9% equity or less in their homes. Given that the data has shown quite clearly that equity — or the lack thereof — is one of the primary drivers of mortgage defaults, these resets may indeed pose an increased risk in the years ahead. “From a broader perspective, it’s also important to note that more than one of every 10 borrowers is in a ‘near negative equity’ position, meaning the borrower has less than 10% equity in his or her home.”

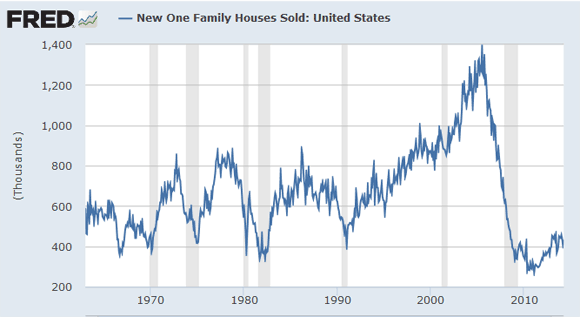

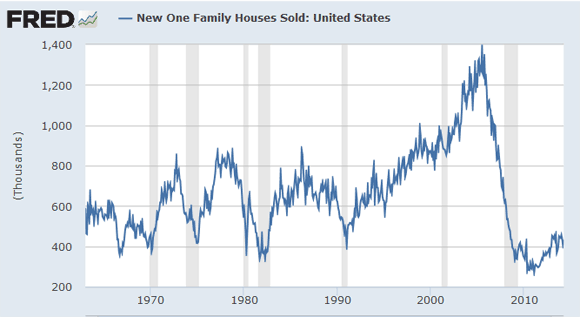

Underwater loans facing reset is one major problem. A second problem is the declining volume of new originations and home sales. A chart of new single-family homes sold will highlight the second problem.

Read more …

Not spending.

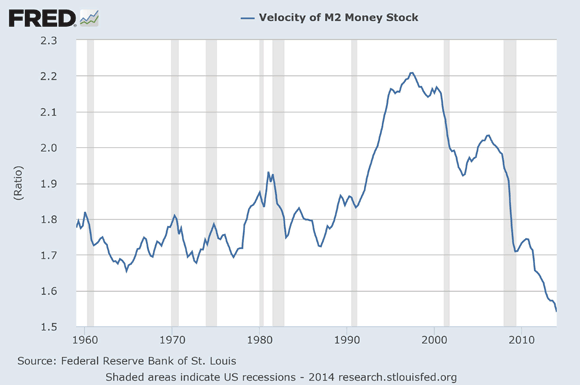

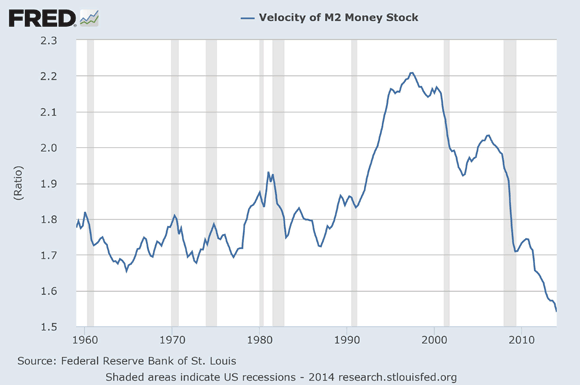

• US Velocity Of Money Falls To All-Time Record Low (M. Snyder)

Let’s take a look at M2. It includes more things in the money supply. The following is how Investopedia defines M2…

A measure of money supply that includes cash and checking deposits (M1) as well as near money. “Near money” in M2 includes savings deposits, money market mutual funds and other time deposits, which are less liquid and not as suitable as exchange mediums but can be quickly converted into cash or checking deposits.

This is a highly deflationary chart. It clearly indicates that economic activity in the U.S. has been steadily slowing down. And if we are honest, we have to admit that we are seeing signs of this all around us. Major retailers are closing down stores at the fastest pace since the collapse of Lehman Brothers, consumer confidence is down, trading revenues at the big Wall Street banks are way down, and the steady decline in home sales is more than just a little bit alarming. In addition, the employment situation in this country is much less promising than we have been led to believe. According to a report put out by the Republicans on the Senate Budget Committee, an all-time record one out of every eight men in their prime working years are not in the labor force…

“There are currently 61.1 million American men in their prime working years, age 25–54. A staggering 1 in 8 such men are not in the labor force at all, meaning they are neither working nor looking for work. This is an all-time high dating back to when records were first kept in 1955. An additional 2.9 million men are in the labor force but not employed (i.e., they would work if they could find a job). A total of 10.2 million individuals in this cohort, therefore, are not holding jobs in the U.S. economy today. There are also nearly 3 million more men in this age group not working today than there were before the recession began.”

Never before has such a high percentage of men in their prime years been so idle. But since they are not counted as part of “the labor force”, the government bureaucrats can keep the “unemployment rate” looking nice and pretty. Of course if we were actually using honest numbers, the unemployment rate would be in the double digits, our economy would be considered to have been in a recession since about 2005, and everyone would be crying out for an end to “the depression”. And now we are rapidly approaching another downturn. [..] And now Fed officials are slowly scaling back quantitative easing because they apparently believe that the economy is getting “back to normal”. We shall see. Many are not quite so optimistic. For example, the chief market analyst at the Lindsey Group, Peter Boockvar, believes that the S&P 500 could plummet 15 to 20% when quantitative easing finally ends. Others believe it will be much worse than that.

Since 2008, the size of the Fed balance sheet has grown from less than a trillion dollars to more than four trillion dollars. This unprecedented intervention was able to successfully delay the coming deflationary depression, but it has also made our long-term problems far worse. So when the inevitable crash does arrive, it will be much, much worse than it could have been. Sadly, most Americans do not understand these things.

Read more …

I’ve covered this many times.

• QE At Work: Pouring Cheap Debt Into The Shale Ponzi (Alhambra)

In Bernanke’s explanation, investors swap high quality MBS or Treasuries for high quality corporate bonds but reality has seen something a bit different. From 1996 to 2006, a bit over $1 trillion in junk bonds were issued. It took only 3 years to match that total in the QE era. What is more disturbing is that a large portion of that junk debt (and a lot more that isn’t reported via the bank lending channel) is being issued to fund oil and gas exploration companies for the fracking of oil and natural gas. Shale debt has at least doubled over the last four years. Why is that disturbing? Isn’t shale supposed to lead us to the nirvana of energy independence? Well, maybe not. I’ve been a critic of the industry since the boom first started and not because I’m concerned about the environmental impact (although that probably deserves more of my attention). My criticism has focused on the economics of shale.

There are two pieces of the economic puzzle when it comes to shale. First is that most shale oil deposits are not profitable to extract except at current high prices. This drilling/extraction method is not cheap. Breakeven prices vary by region but it is safe to say that no shale oil deposits are profitable below $50/barrel and most areas require much higher prices. An average might be in the range of $65 and there are plenty of areas where the price needs to be above $80 before anyone makes a nickel. I would just note that oil traded, albeit briefly, at $34 in the last recession. Second is the production profile of shale wells; production drops off rather precipitously after the first year (in contrast with traditional wells which deplete over much longer time frames). Combine high extraction costs with rapid depletion and the economics of shale become not only dubious but frankly insane.

Read more …

But there is none at the moment.

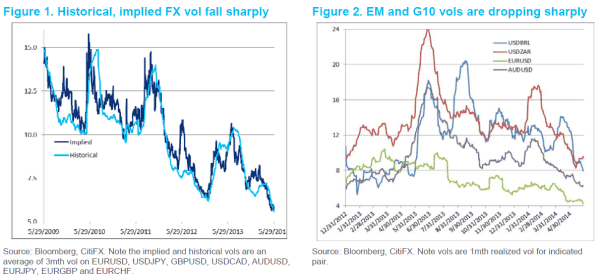

• Why Central Banks Need More Volatility (Zero Hedge)

Will volatility become a policy tool? The PBOC decided that enough was enough with the ever-strengthening Yuan and are trying to gently break the back of the world’s largest carry trade by increasing uncertainty about the currency. As Citi’s Stephen Englander notes, this somewhat odd dilemma (of increasing uncertainty to maintain stability) is exactly what the rest of the world’s planners need to do – Central banks will need more FX and asset market volatility in order to provide low rates for an extended period… here’s why. Via Citi’s Stephen Englander:

Will central banks need volatility to restrain asset prices?

• Cyclical and trend growth pessimism is leading central banks to guide expectations of rates downward

• The more credible the guidance, the more risk will be bought

• To prevent asset market overheating while keeping rates low, central bankers may have to introduce more volatility into asset markets…

• …emphasizing risk and vigilance and central bank readiness to raise rates if needed

Central banks will need more FX and asset market volatility in order to provide low rates for an extended period. The argument goes like this:

1) Low realized and implied volatility have come as a surprise to investors

2) Investors are underinvested out of skepticism that the low rates, low volatility environment will persist

3) If the central bank mantra of “low rates, low vol forever” persists in asset markets, investors will buy high beta assets and add leverage

4) Asset prices will respond much more to rates incentives than (so-called) rates sensitive sectors of the economy

5) Central banks want to keep the low rates without creating an asset bubble and will purposely induce volatility to calm speculation

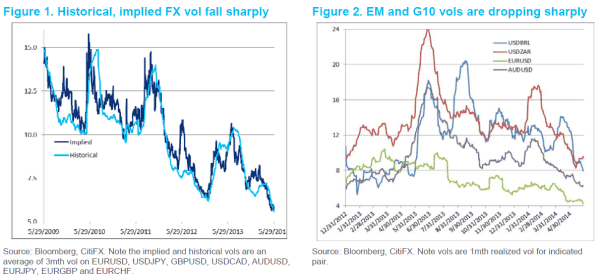

The big surprise this year is the reduction in FX and asset market volatility (Figures 1, 2) Realized USDBRL volatility over the last month is where EURUSD vol was in Q1 2013. Since it was unexpected, investors were underinvested and even wrongly positioned as volatility declined.

Read more …

People are not spending.

• Eurozone Inflation Dives To 0.5% As ECB Poised To Act (Reuters)

Euro zone price inflation fell unexpectedly in May, increasing the risks of deflation in the currency area and sealing the case for the European Central Bank to act this week. Annual consumer inflation in the 18 countries sharing the euro fell to 0.5% in May from 0.7% in April, the EU’s statistics office Eurostat said on Tuesday. A clutch of senior sources told Reuters earlier this month that the ECB was preparing a package of policy options for its meeting on Thursday, including cuts in all its interest rates and targeted measures aimed at boosting lending to small– and mid-sized firms (SMEs). The weak rate of May price rises would seem to cement expectations that the ECB will now deliver a series of measures to make it even cheaper to borrow and help the economy.

May’s reading is back at levels last seen in March – the lowest level since November 2009 and reflecting low inflation in Germany. Inflation in the 9.5 trillion euro economy is stuck in the ECB’s ‘danger zone’ of below 1%, a sign of the fragile recovery. The ECB says it stands ready to use all tools available to fend off deflation risks and aid the economy. Core inflation, excluding energy, food, alcohol and tobacco, fell to 0.7% in May from 1.0% in April. Energy prices were flat on the year, showing no decline for the first time in five months. Global financial markets have been buoyed by the odds of cheaper money in the bloc and could react sharply if the ECB does not deliver on Thursday.

Read more …

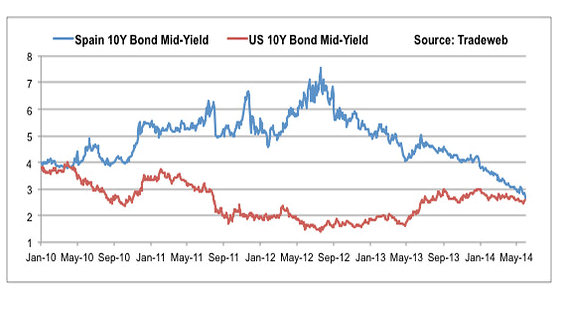

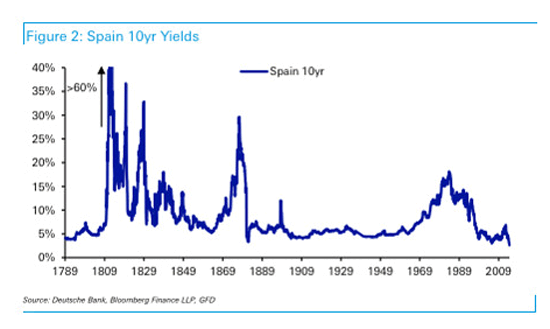

The lowest yields in 200 years. How does that rhyme with the state our economies are in?

• Napoleonic Yields No Comfort to Draghi Fighting Deflation (Bloomberg)

Europe’s lowest government bond yields since the Napoleonic Wars are signaling investors want more action from Mario Draghi. Instead of a vote of confidence, the most pronounced rally in 200 years suggests the European Central Bank president needs to stave off the risks of stagnation and deflation. Austria, Belgium, France (GFRN10) and Germany can borrow at lower rates than the U.S. as inflation less than half the ECB’s target stokes concern the euro zone will take many years to recover from its longest-ever recession. While bond, currency and derivative markets show an abatement in the contagion that began in Greece in 2009 before engulfing Spain and Italy, a closer look reveals high debt and deficits that have yet to be addressed, unemployment near record levels and a banking system still to be fixed.

ECB policy makers will share their outlook in two days, when they probably will lower the 18-nation currency bloc’s official rate toward zero and take the deposit rate negative for the first time. “The outright level of yields is suggesting an incredibly weak outlook for growth,” Russell Silberston, a London-based money manager at Investec Asset Management, which oversees $110 billion, said in a May 30 phone interview. “It’s a powerful signal telling you policy is too tight and that there’s complacency toward the risks. Not a great deal has been solved. We’ve still got bank stress tests to come, too low growth and too low inflation.”

Read more …

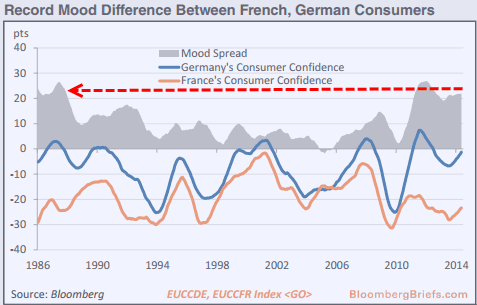

In times of pleanty, differences can be papered over. When they turn lean, not so much.

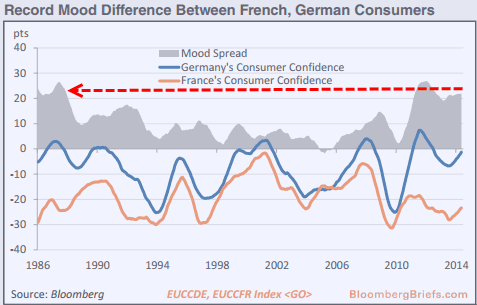

• The Most Worrying Chart For Europe’s Stability (Zero Hedge)

While we have historically noted the explosion of youth unemployment as a key factor for instability in Europe, there appears to be an ever more concerning indicator of the potential fragility of the European Union. As Bloomberg’s Maxime Sbahi notes, the difference in economic performance (and mood) between France and Germany, often referred to as the European “engine,” is at a record high. This disparity is likely to weaken France and isolate Germany further, heightening political tensions and indecision in the euro area. And the “mood” of the people – perhaps even more contentiously – is near 30 year highs…

Via Bloomberg Brief: “The political consequences of these economic gaps are growing clearer, though the differences in underlying policy choices have been visible for some time. Last week’s European Parliament elections provided a first glimpse of the political shakeout, with the victory of the National Front in France. The country will send a record 24 euroskeptic members to the European Parliament in a total delegation of 74, compared with seven out of 96 from Germany. Disagreements between the two EU founding members are likely to intensify as past common interests are now strained by increasing economic divergence. Recently, France has repeatedly argued for a relaxation of fiscal targets and called on the European Central Bank to be more proactive to weaken the euro. Germany has retorted by insisting on the ECB’s independence and respect for fiscal discipline, directly warning France against non-compliance with budget commitments.

If the French economy continues its slide from the euro area’s core to the profile of a periphery member, new standoffs are likely to materialize, weakening the Franco-German relationship that has provided leadership in the past. This might slow down the functioning of the euro area, where decisions are mostly made between heads of government in summits. Over the long term, one of the most disturbing consequences is a potential lack of a common strategic view for the euro area’s future at a time when direction is needed more than ever. If its historic partner is downgraded to a junior status, Germany may grow even more powerful on the European stage. The country may find itself in a more isolated and uncomfortable position.”

Read more …

Profit from central banks giving away your children’s futures. What a great concept.

• Buy With Central Banks Is U.S.-Japan Lesson for ECB QE Scenario (Bloomberg)

[..] … how should investors react if the ECB finally starts buying assets? Societe Generale analysts looked to the U.S. and Japan for clues. They found three patterns in both the Japanese purchase of asset-backed securities from August 2003 to September 2006 and the three rounds of quantitative easing deployed by the Federal Reserve from November 2008 to now. First, QE triggered a reallocation from bonds to equities, In Japan, that proved enough to push up the MSCI Index Japan by 76% over the three period during which the bank spent 3.8 trillion yen ($37 billion). In the U.S., the Standard & Poor’s Index 500 rose 36% in the first wave of buying until March 2010, 24% in the second round from August 2010 to the following June and 29% in QE3 since September 2012, Societe Generale strategists Alain Bokobza and Gaelle Blanchard said in a report last month.

Second, 10-year bond yields were pushed higher, to the tune of 71 basis points in Japan and a cumulative 212 basis points in the U.S. over their respective quantitative-easing periods. While that may sound counterintuitive if the central banks are buying bonds, the resulting spur to economic growth and inflation boosted long-term yields, according to Bokobza. Third, QE supported the banking sector. Japanese bank stocks improved strongly once the BOJ started quantitative easing, reducing the sector’s credit risk after bad loans had hurt their balance sheets. In the U.S., the buying helped stabilize the share performance of banks.

Such a blueprint has Societe Generale making some early recommendations if Draghi’s ECB follows the BOJ and the Fed. Investors should bet on euro-region equities to outperform rivals elsewhere. In the U.S., industrials and consumer discretionary stocks did better than the market in every QE episode, while consumer staples, utilities and telecommunications systematically underperformed. The stocks and bonds of crisis countries such as Greece and Spain and maybe even less-infected France should do well as asset purchases supports their equity markets by aiding economic activity. It’s also worth preparing for the banking outlook to turn more positive, with Societe Generale favoring Credit Agricole SA, BNP Paribas and Unicredit SpA. All that’s needed now is for Draghi to start writing checks.

Read more …

• Why Do China’s Reforms All Fail? (The Diplomat)

To simplify, there are three common factors.

First, as opposed to other reforms recorded in world history, almost all of China’s reforms were done purely for the benefit of the ruler (the emperor). The reforms adjusted the ruler’s policies on how to control the people, how to manage the four classes (scholars, peasants, artisans and merchants), how to exploit the peasants’ land, and how to fill the treasury with taxes. None of the reforms touched on philosophies of holding power, or the methods of governance, much less centered around public interests.

China’s reformers saw the interests of the common people as objects of reform, rather than reforming the regime in order to benefit the people. As a result, these reforms never touched the ruling dynasty, but only caused power struggles between the interest groups involved. Compared to revolutions (which are either loved or feared), the people were generally indifferent to “reform.” And reforms without public support fail utterly once they encounter counterattacks from interest groups and opposition parties. For the common people, the failure of the reforms was nothing to mourn.

Second, many vigorous reforms in Chinese history had one thing in common: The reformers were not the highest ruler (the emperor). Many had been (provisionally) selected by the emperor to act as pioneers for the reforms — and as scapegoats when reforms failed. Reformers like Shang Yang, Wang Anshi and the late Qing Westernization school all suffered this fate. The people who held supreme power were usually governing from behind the scenes. They maintained a certain distance from the reform, which left plenty of room to maneuver. If the reforms succeed, those in charge will take the credit; if the reforms fail, they will sacrifice the reformers. Under these circumstances, the reforms would be half-hearted from the beginning — so much for “top-down” reforms. By contrast, the series of reforms conducted directly by Emperor Wu in the Han dynasty and by Tang dynasty emperors were more effective.

Third, all the reforms in Chinese history aimed to perpetuate the current system, rather than changing the existing regime. Some reforms failed, and the reformers were dismembered (like Shang Yang) or died in disgrace (Wang Anshi). But even then, leaders kept the parts of the reform policies that could help maintain the existing system, turning the reforms into cogs in the authoritarian machine.

Read more …

Oh yes it is.

• China’s Debt Reckoning Is Coming (Bloomberg)

It took China to prove Friedrich Nietzsche wrong. What didn’t kill the Communist Party hasn’t made it stronger. It’s only making the inevitable crash bigger, more spectacular and needlessly dangerous. China’s debt reckoning is coming. Maybe not this quarter or this year, but Chinese President Xi Jinping’s unbridled effort to keep growth from falling below the official 7.5% target is cementing China’s fate. China is investing just as much as it did in 2008 and 2009, when authorities were desperately trying to avert a slowdown. Just as debt troubles in Japan, Europe and the U.S. ended badly, so will China’s. Why, then, with so many clear examples of financial excess leading to ruin, is Xi continuing down this road? Blame it on the ghosts of Tiananmen Square.

In the aftermath of the crackdown on student protesters on June 4, 1989, China’s leaders made a bargain with their people: We will make you richer, as long as you no longer dissent. After the crash of Lehman Brothers, the regime had to go to extraordinary lengths to keep up its end of the bargain, pumping up what was already the world’s highest investment rate. In doing so, China itself became a Lehman economy – powered by shadowy funding sources, off-balance-sheet investing and unconvincing claims that all remained well. For a while this rampant investment growth seemed to make China stronger; now that strategy is its main vulnerability. Yet Xi and Premier Li Keqiang apparently can’t bring themselves to roll back those policies and rebalance the economy away from exports and toward more consumption.

They know that if they do so, growth will slow a lot, challenging the post-Tiananmen compact — and in the Internet age, no less. As anger grows over any slowdown, Chinese censors won’t be able to delete text messages and microblog entries fast enough. It’s often said that when the U.S. sneezes, the entire world catches a cold. But the eventual popping of China’s $23 trillion credit bubble could send many nations to the emergency room. Any crash would make deflation China’s biggest export. China’s brawn is widely misunderstood. Take Donald Trump’s recent musings to Fox News about China’s rising economic dominance and the tragedy of the U.S. borrowing from Beijing to service a debt “no one ever dreamt possible.” You would think a man with Trump’s track record of bankruptcies would understand that losses from debt don’t disappear. When a company, or nation, rolls over unpaid debts without resolving them, profits – or GDP – are overstated, as China’s is today.

Read more …

“Wall Street’s biggest firms can’t get a break in the bond business.” So?

• Bond Bankers Have 144 Reasons to Fret Over Underwriting Frenzy (Bloomberg)

Wall Street’s biggest firms can’t get a break in the bond business. With trading profits dwindling, more dealers than ever are fighting for assignments managing U.S. corporate-bond sales, one of the few bright spots in fixed income. Companies from the most-creditworthy to the most-indebted have been selling trillions of dollars of debt, locking in record-low borrowing costs ahead of the anticipated rise in interest rates. The increased competition is bad for JPMorgan Chase, Bank of America, Citigroup Goldman Sachs and Barclays because the top five banks won the smallest share of the assignments this year for any comparable timeframe, according to data compiled by Bloomberg. A record 144 underwriters for the period have split an estimated $4.2 billion of fees on U.S. sales, the data show.

“One business is challenged, so people have become aggressive in other businesses,” said Alison Williams, a senior financials analyst with Bloomberg Industries. While the biggest firms are still dominant, they’re losing their hold on a reliable profit center in an increasingly bleak fixed-income world. The five most-active corporate-debt underwriters this year landed 47% of the business, the smallest share on record. That’s down from 59% of the assignments for all of 2009. Smaller firms see an opportunity to break into the business as Wall Street’s behemoths unload inventories of riskier securities in the face of higher capital requirements and limits imposed by the U.S. Dodd-Frank Act’s Volcker Rule on the amount of their own money they can use to trade.

Read more …

Hey, PIMCO makes a killing on zombie money.

• Pimco: Blithering About Minsky Moments And Free Money Forever (Stockman)

The single most dangerous meme now extant among the Cool-Aid drinkers is that we already had something called the Minsky Moment in 2008—so six years on its still too early for another. Fittingly, CNBC trotted out one of Pimco’s retired bond peddlers, Paul McCulley, to explain this, and why it is therefore safe to load up on bonds. That is, bonds which Bill Gross has already bought and which McCulley now invites the mullets to bid higher. After all, in a world of monetary central planning appearing on bubblevision to egg on the mullets is what bond fund economists do for a living: ‘We don’t have to be worried about the Big One. We had the Big One, and you don’t have another Big One after you have had the Minsky moment,’ he said.” Now lets see. Either the last Big One came crashing into Wall Street on the tail of a comet from deep space—in which case we need to consult the astronomical charts about the timing of the next one— or it was enabled, fueled and cheered on by the denizens of the Eccles Building.

If the latter, then it is obvious that they have done nothing differently in the last six years and, in fact, have actually doubled down and then some on Greenspan’s housing bubble maneuver. Indeed, the Fed has pegged interest rates in the money markets at essentially zero for the past 66 months—a condition that has never before happened during the history of modern financial markets. That makes Greenspan’s 24 month experiment with 1% money during 2003-2005 pale by comparison. Yet free or nearly free funding to the carry trades always and everywhere has the same effect: it incites massive leveraged speculation in the financial markets as gamblers seek to capture easy profit spreads between zero cost liabilities and “risk assets” which generate a positive yield or appreciation.

Now deep into year six of a monetary policy that is the mother’s milk of financial bubbles, there are warning signs everywhere. Margin debt reached historic peaks a few months ago; momentum driving hysteria of dotcom era intensity afflicted the bio-tech, cloud and social media stocks until they rolled-over recently; the Russell 2000 is trading at 85X reported income; junk bond issuance is at record levels and cov lite loans and booming CLO issuance–the hallmarks of the 2007-2008 blow-off top—have made an even more virulent reappearance; the LBO kings are busy strip-mining cash from portfolio companies already groaning under the weight of unrepayable debt via the device of “leveraged recaps” –another proven sign of a speculative top; and now the LBO houses are furiously buying and selling among themselves what have become permanent debt-mule companies by scalping cash from buyers who then reload more of the same debt on the sellers.

Read more …

Turn it upside down and see what it looks like.

• On The False Idea That Money Is A Resource (Lisa Wade)

Watts makes a truly profound argument about what money really is. I’ll summarize it here and you can watch the full three-and-a-half minute video below if you like. Watts notes that we like to talk about “laws of nature,” or “observed regularities” in the world. In order to observe these regularities, he points out, we have to invent something regular against which to compare nature. Clocks and rulers are these kinds of things. All this is fine but, all too often, the clocks and the rulers come to seem more real than the nature that is being measured. For example, he says, we might think that the sun is rising because it’s 6AM when, of course, the sun will rise independently of our measures. It’s as if our clocks rule the universe instead of vice versa.

He uses these observations to make a comment about wealth and poverty. Money, he reminds us, isn’t real. It’s an invented measure. A dollar is no different than a minute or an inch. It is used to measure prosperity, but it doesn’t create prosperity any more than 6AM makes the sun rise or a ruler gives things inches. When there is a crisis — an economic depression or a natural disaster, for example — we may want to fix it, but end up asking ourselves “Where’s the money going to come from?” This is exactly the same mistake that we make, Watts argues, when we think that the sun rises because it’s 6AM. He says:

They think money makes prosperity. It’s the other way around, it’s physical prosperity which has money as a way of measuring it. But people think money has to come from somewhere… and it doesn’t. Money is something we have to invent, like inches. So, you remember the Great Depression when there was a slump? And what did we have a slump of? Money. There was no less wealth, no less energy, no less raw materials than there were before. But it’s like you came to work on building a house one day and they said, “Sorry, you can’t build this house today, no inches.” “What do you mean no inches?” “Just inches! We don’t mean that… we’ve got inches of lumber, yes, we’ve got inches of metal, we’ve even got tape measures, but there’s a slump in inches as such.” And people are that crazy!

Read more …

• Coasting Toward Zero (Jim Kunstler)

In just about any realm of activity this nation does not know how to act. We don’t know what to do about our mounting crises of economy. We don’t know what to do about our relations with other nations in a strained global economy. We don’t know what to do about our own culture and its traditions, the useful and the outworn. We surely don’t know what to do about relations between men and women. And we’re baffled to the point of paralysis about our relations with the planetary ecosystem. To allay these vexations, we just coast along on the momentum generated by the engines in place — the turbo-industrial flow of products to customers without the means to buy things; the gigantic infrastructures of transport subject to remorseless decay; the dishonest operations of central banks undermining all the world’s pricing and cost structures; the political ideologies based on fallacies such as growth without limits; the cultural transgressions of thought-policing and institutional ass-covering.

This is a society in deep danger that doesn’t want to know it. The nostrum of an expanding GDP is just statistical legerdemain performed to satisfy stupid news editors, gull loose money into reckless positions, and bamboozle the voters. If we knew how to act we would bend every effort to prepare for the end of mass motoring, but instead we indulge in fairy tales about the “shale oil miracle” because it offers the comforting false promise that we can drive to WalMart forever (in self-driving cars!). Has it occurred to anyone that we no longer have the capital to repair the vast network of roads, streets, highways, and bridges that all these cars are supposed to run on? Or that the capital will not be there for the installment loans Americans are accustomed to buy their cars with? The global economy is withering quickly because it was just a manifestation of late-stage cheap oil. Now we’re in early-stage of expensive oil and a lot of things that seemed to work wonderfully well before, don’t work so well now.

Read more …

Good, simple, clear video.

• The Federal Reserve Explained In 7 Minutes (Zero Hedge)

As members of the world’s central banks (most importantly Draghi and the ECB this week) are held up as Idols on mainstream business TV, despite their disastrous historical performances and inaccuracies, we thought it time to dust off the dark ‘reality’ behind the Federal Reserve – the uber-central bank … perhaps summed up nowhere better than in the words of former Fed Chair Alan Greenspan himself … “There is no other agency of government which can over-rule actions that we take.”

Read more …

The growth monster now lives everywhere.

• India Growth Below 5% Adds Pressure on Modi to Spur Investment (Bloomberg)

India’s economy grew less than 5% for a second quarter, adding pressure on Prime Minister Narendra Modi to spur investment after winning the strongest electoral mandate in 30 years. Gross domestic product rose 4.6% in the three months ended March from a year earlier, unchanged from the previous quarter, the Central Statistical Office said in a statement in New Delhi yesterday. The median of 42 estimates in a Bloomberg News survey had been for a 4.7% gain. GDP expanded 4.7% in the fiscal year that ended March 31, compared with the previous period’s decade-low 4.5%.

Reviving growth is the new government’s immediate challenge while the central bank works to lower inflation, Reserve Bank of India Governor Raghuram Rajan said in Tokyo yesterday. The first single-party parliamentary majority in India since 1984 puts Modi in a position to take politically sensitive decisions such as cutting subsidies and hastening project approvals. “There is euphoria over the new government and some consumption uptick can happen,” said Indranil Pan, an economist at Kotak Mahindra Bank Ltd. in Mumbai. “You can’t expect a sudden turnaround. There could be some limitations in clearing projects faster as some were stuck over court jurisdictions.” India’s GDP has been below 5% in seven of the last eight quarters. Over the last decade, growth has averaged about 8%.

Read more …

• Top US CEOs Make 330 Times More Than Average Employees (RT)

The average employee in the US will have to work 331 years to earn the annual salary of an average Fortune 500 CEO, according to the AFL-CIO’s 2013 Executive Paywatch. The ratio of CEO pay to worker pay has increased by more than 500 percent in the last thirty years. In 1983, the average CEO made 46 times the average worker’s pay packet. The ratio quadrupled through the decade to 195 times in 1993. Highly paid CEOs of companies employing low wage earners are fueling economic inequality, which continues to grow.

The CEO salary data was sourced from the US Securities and Exchange Commission (SEC) and the US Bureau of Labor Statistics (BLS) data for the latest fiscal years, covering around 3,000 corporations, most listed in the Russell 3000 Index. America is considered to be the land of opportunity, however in recent decades, corporate CEOs have been taking a greater share of the economic pie. The wage of chief executives is constantly growing, while the salary of the average worker has stagnated and unemployment remains high.

Read more …

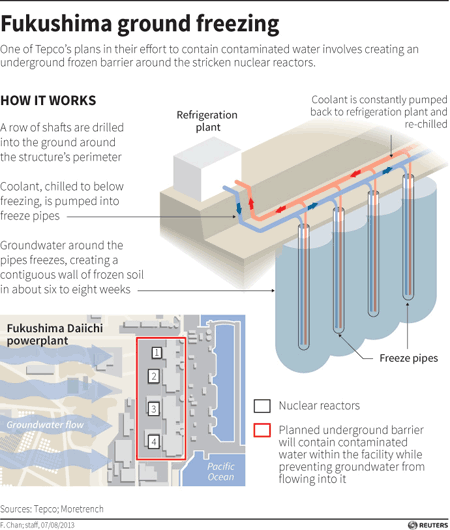

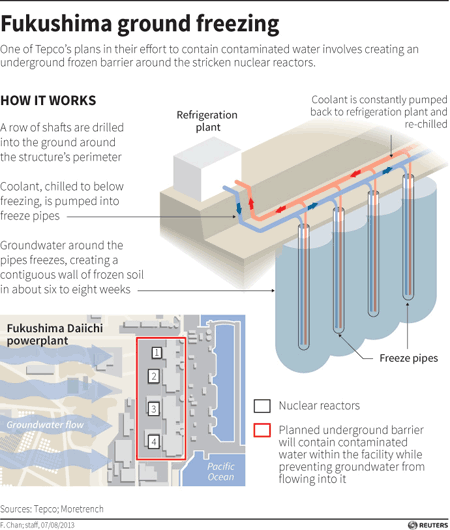

How much energy does it take to keep an ice wall going for decades or even hundreds of years?

• TEPCO Starts Work On Fukushima Underground Ice Wall (RT)

Aiming to isolate radioactive water build-up, Fukushima nuclear plant’s operator, TEPCO, has started constructing a huge underground ice wall around the facility. The ambitious project will have to be maintained for well over a century to reach its goal. Tokyo Electric Power Company has launched work on the 1.5 kilometer underground ice wall, which is to be built around four reactors at the crippled Fukushima Daiichi No. 1 nuclear power plant, Kyodo news agency reports. According to Kyodo, 1,550 pipes will now be inserted into the ground to circulate coolant around the reactors, keeping the surrounding soil constantly frozen. The government funded project, which will cost an estimated 32 billion yen (US$314 million), is scheduled for completion by the end March 2015. It will then take a few more months to fully freeze the soil after the coolant starts circulating, according to TEPCO.

The work started days after Japan’s Nuclear Regulation Authority (NRA) granted the go-ahead for the project, despite earlier reservations. TEPCO reportedly managed to convince the watchdog that the ice wall – which might cause some ground to sink – will not have any significant effect on the stability of the reactor buildings. However, some experts remained skeptical of TEPCO’s plan, which is the latest move in the company’s struggle to contain the fallout of the March 2011 nuclear disaster triggered by a strong earthquake. TEPCO’s efforts have been overshadowed by revelations that the company repeatedly concealed the true radiation levels at the plant and “misreported” the radiation risks to US servicemen helping to contain the disaster. New evidence also allegedly shows that some 90% of workers were not present at the plant when the meltdown started.

While the frozen wall may indeed help to at least reduce the escape of contaminated liquid into the groundwater, it will still take decades – if not hundreds of years – for record-high radiation levels to clear away in the area, including in the ocean. Michio Aoyama, a professor at Fukushima University’s Institute of Environmental Radioactivity, told Kyodo that the Fukushima plant contains radiation equivalent to “14,000 times” the amount released in the atomic bomb attack on Hiroshima 68 years ago, and has seriously affected the ocean and the coastal area. The problem is thus left for the coming generations to tackle, stretching the impact of the accident into the future. Japan, meanwhile, is eyeing the resumption of work on some of its 20 nuclear power plants suspended or shut down after the 2011 earthquake, despite public protests. As of June, two units at Oi nuclear power plant are the only operating Japanese nuclear facilities.

Read more …