DPC Times Square seen from Broadway 1908

Actually, a lot is wrong. Including Dimon talking his book and people thinking he’s doing something else, like trying to help anyone other than himself.

• JPMorgan CEO Jamie Dimon Warns ‘Something Is Wrong’ With the US (BBG)

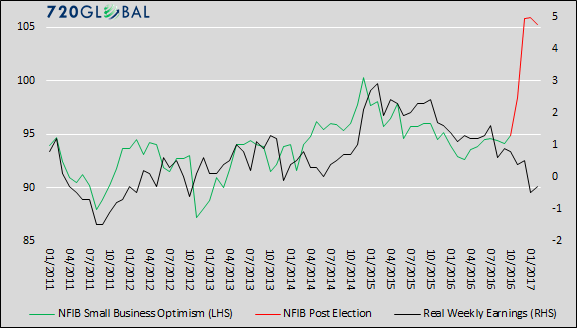

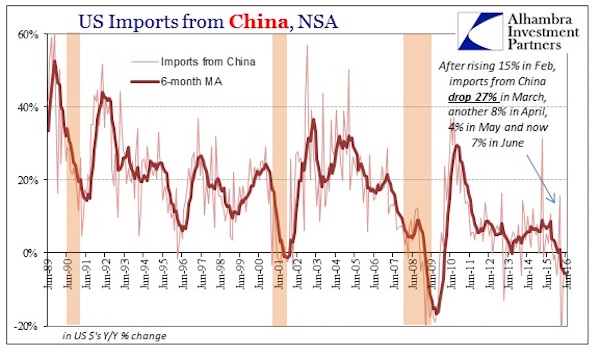

JPMorgan CEO Jamie Dimon has two big pronouncements as the Trump administration starts reshaping the government: “The United States of America is truly an exceptional country,” and “it is clear that something is wrong.” Dimon, leader of world’s most valuable bank and a counselor to the new president, used his 45-page annual letter to shareholders on Tuesday to list ways America is stronger than ever – before jumping into a much longer list of self-inflicted problems that he said was “upsetting” to write. Here’s the start: Since the turn of the century, the U.S. has dumped trillions of dollars into wars, piled huge debt onto students, forced legions of foreigners to leave after getting advanced degrees, driven millions of Americans out of the workplace with felonies for sometimes minor offenses and hobbled the housing market with hastily crafted layers of rules.

Dimon, who sits on Donald Trump’s business forum aimed at boosting job growth, is renowned for his optimism and has been voicing support this year for parts of the president’s business agenda. In February, Dimon predicted the U.S. would have a bright economic future if the new administration carries out plans to overhaul taxes, rein in rules and boost infrastructure investment. In an interview last month, he credited Trump with boosting consumer and business confidence in growth, and reawakening “animal spirits.” But on Tuesday, reasons for concern kept coming. Labor market participation is low, Dimon wrote. Inner-city schools are failing poor kids. High schools and vocational schools aren’t providing skills to get decent jobs. Infrastructure planning and spending is so anemic that the U.S. hasn’t built a major airport in more than 20 years.

Corporate taxes are so onerous it’s driving capital and brains overseas. Regulation is excessive. “It is understandable why so many are angry at the leaders of America’s institutions, including businesses, schools and governments,” Dimon, 61, summarized. “This can understandably lead to disenchantment with trade, globalization and even our free enterprise system, which for so many people seems not to have worked.”

I like Shilling. But this reeks of nonsense. It’s not about appeal, it’s about getting poorer.

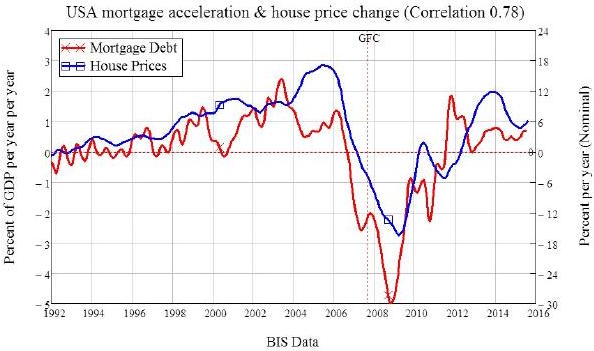

• US Housing Boom Is Anything But as Ownership Loses Appeal (A. Gary Shilling)

By many measures, the U.S. housing market seems in very good shape. The National Association of Realtors in Washington said last week that contracts to buy existing homes jumped 5.5% in February, the biggest increase since July 2010. Fannie Mae’s National Housing Survey showed that Americans expect home prices to rise a robust 3.2% over the next year as its sentiment index reached a record high. So, are boom times ahead for housing? Not quite. To understand why, it helps to revisit recent history. The housing bubble of the early 2000s was driven by subprime mortgages and other loose-lending practices. The subsequent collapse left many potential new homeowners with inadequate credit scores, not enough money for a down payment and insufficient job security to buy a house.

They also saw, for the first time since the 1930s, that not only house prices fall nationwide, but nosedive by a third. Homeownership plunged and those who did form households moved into rental apartments instead of single-family houses. That drove rental vacancy rates down and starts of multi-family housing – about two-thirds of which are rentals – up to 396,000 units, more than the earlier norm of 300,000 starts at annual rates. But single-family housing starts – even with the rebound to an 872,000 annual rate from the bottom of about 400,000 – are still far below the pre-housing bubble average of more than 1 million. Despite the recovery in house prices, rents have risen at a much faster pace. As a share of median income, rents have jumped while mortgage costs have fallen. The latest data from the National Association of Realtors show its Housing Affordability Index was up 52% in the fourth quarter of 2016 from the early 2007 low.

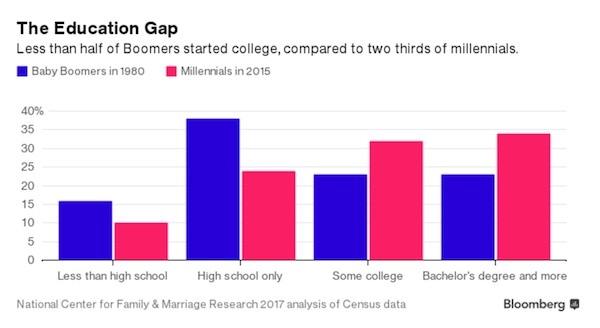

Yesterday we saw IMF head Lagarde saying the loss of productivity can be solved with education. But the younger have had a boatload more education than their parents.

• Young Americans Are Killing Marriage (BBG)

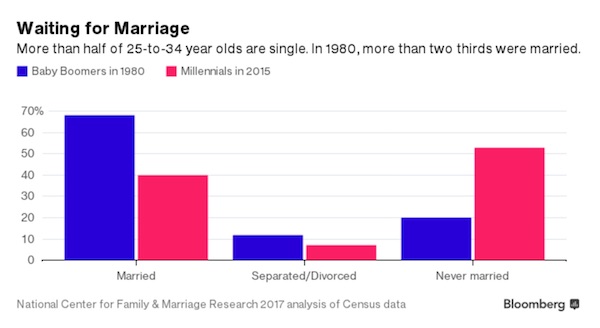

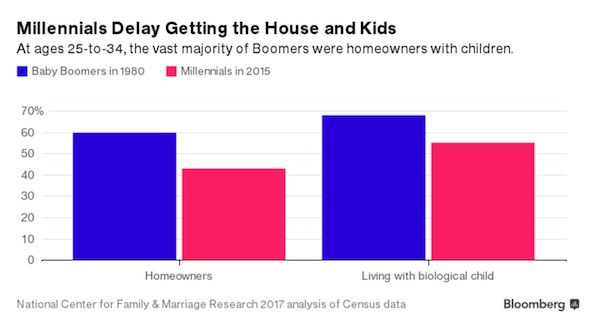

There’s no shortage of theories as to how and why today’s young people differ from their parents. As marketing consultants never cease to point out, baby boomers and millennials appear to have starkly different attitudes about pretty much everything, from money and sports to breakfast and lunch. New research tries to ground those observations in solid data. The National Center for Family and Marriage Research at Bowling Green State University set out to compare 25- to 34-year-olds in 1980—baby boomers—with the same age group today. Researcher Lydia Anderson compared U.S. Census data from 1980 with the most recent American Community Survey data in 2015. The results reveal some stark differences in how young Americans are living today, compared with three or four decades ago.

In 1980, two-thirds of 25- to 34-year-olds were already married. One in eight had already been married and divorced. In 2015, just two in five millennials were married, and only 7% had been divorced. Baby boomers’ eagerness to get married meant they were far more likely than today’s young people to live on their own. Anderson looked at the share of each generation living independently, either as heads of their own household or in married couples. The chance that Americans in their late twenties and early thirties live with parents or grandparents has more than doubled. In 1980, just 9% of 25- to 34-year-olds were doing so. In 2015, 22% lived with parents or grandparents. Millennials are also less likely than boomers to be living with kids—and to be homeowners.

It’s easy to look at these figures and say millennials are lagging behind their boomer parents. However, even as young Americans delay marriage, kids, and homeownership, they’re ahead of their parents by one measure: education.

Dazzling. “Historically, when the amount of paper exceeds the amount of underlying commodity that is available for delivery by more than 20-30%, the CFTC intervenes by investigating the possibility of market manipulation. But never with gold and silver.”

• The Comex Is The World’s Most Corrupted Market (IRD)

If you were to poll the public about comparing the investment returns between gold, silver and stocks during the first quarter of 2017, it’s highly probable that the majority of the populace would respond that the S&P 500 outperformed the precious metals. That’s a result of the mainstream media’s unwillingness to report on the precious metals market other than to disparage it as an investment. In reality, among silver, gold, the Nasdaq 100 and the S&P 500, the S&P 500 had the lowest ROR in Q1. Silver led the pack at 14%, followed by tech-heavy Nasdaq 100 at 11.1%, gold at 8.6% and the S&P 500 at 4.8%. Put that in your pipe and smoke it, Cramer. Imagine the performance gold and silver would have turned in if the Comex was prevented from creating paper gold and silver in amounts that exceeded the quantity of gold and silver sitting in the Comex vaults.

As an example, as of Friday the Comex is reporting 949k ozs of gold in the registered accounts of the Comex vaults and 9 million ozs of total gold. Yet, the open interest in paper gold contracts as of Friday totaled 41.7 million ozs. This is 44x more paper gold than the amount of physical that has been designated – “registered” – as available for delivery. It’s 4.6x more than the total amount of gold sitting on Comex vaults. With silver the situation is even more extreme. The Comex is reporting 29.5 million ozs of silver as registered and 190.2 million total ozs. Yet, the open interest in paper silver is a staggering 1.08 billion ozs. 1.08 billion ozs of silver is more silver than the world mines in a year. The paper silver open interest is 5x greater than the total amount of silver held in Comex vaults; it’s an astonishing 37x more than the amount of silver that is available to be delivered.

This degree of imbalance between the open interest in CME futures contracts in relation to the amount of the underlying physical commodity represented by those contracts never occurs in any other CME commodity – ever. Historically, when the amount of paper exceeds the amount of underlying commodity that is available for delivery by more than 20-30%, the CFTC intervenes by investigating the possibility of market manipulation. But never with gold and silver. The Comex is perhaps the most corrupted securities market in history. It is emblematic of the fraud and corruption that has engulfed the entire U.S. financial and political system. The U.S. Government has now issued $20 trillion in Treasury debt for which it has no intention of every redeeming. It’s issued over $100 trillion in unfunded liabilities (entitlements, pensions, etc) for which default is not a matter of “if” but of “when.”

“..We are now in a position to see the real story behind “Russiagate.” It’s not about Russia, except incidentally…”

• The Real Russiagate (Paul Craig Roberts – Michael Hudson)

Wall Street Journal editorialist Kimberley A. Strassel poses the real question: Why hasn’t the Trump administration had the Secret Service arrest Comey, Brennan, Schiff, the DNC and Hillary for trying to overthrow the President of the United States? “Mr. Nunes has said he has seen proof that the Obama White House surveilled the incoming administration—on subjects that had nothing to do with Russia—and that it further unmasked (identified by name) transition officials. This goes far beyond a mere scandal. It’s a potential crime.” What we are watching is turning out to be traces of a plot against a government elected by the American people. Attempts by House national security committee Chairman Devin Nunes have been countered with demands by his potential victims to recuse himself so as to stop his exposé of how “Team Obama was spying broadly on the incoming administration.”

[..] We are now in a position to see the real story behind “Russiagate.” It’s not about Russia, except incidentally. The Obama regime abused the government’s surveillance powers and spied on Donald Trump and other Republicans in order to build a dossier for the DNC to leak to the press in an attempt to slander or compromise Trump and throw the election to Hillary. They’ve been caught, but we can now see that they took steps to protect themselves against this. They prepared a cover story. They pretend they were not spying on Trump, but on Russians – which only by fortuitous happenchance turned up incriminating smoke against Trump. This cover story was buttressed by the fake news story prepared by former MI6 freelancer Christopher Steele.

As Whitney reports, Steele “was hired as an opposition researcher last June to dig up derogatory information on Donald Trump.” Unvetted and unverified information paid for by so-called informants “somehow” found its way into U.S. intelligence agency reports. These reports were then leaked to Democrat-friendly media. This is where the crime lies. Obama regime and DNC were using these agencies for domestic political use, KGB style. The Obama/Clinton cover story is now falling to pieces. That explains the desperation in the attack by Adam Schiff, the ranking Democrat on the House Intelligence Committee, on Committee Chairman Devin Nunes to stop the exposure. Russiagate is not a Trump/Putin collusion but a domestic spy job carried out by Democrats. Law requires Trump to arrest those responsible and to put them on trial for treason and conspiracy to overthrow the government of the United States.

They end the investigation without answering the question that started it?!

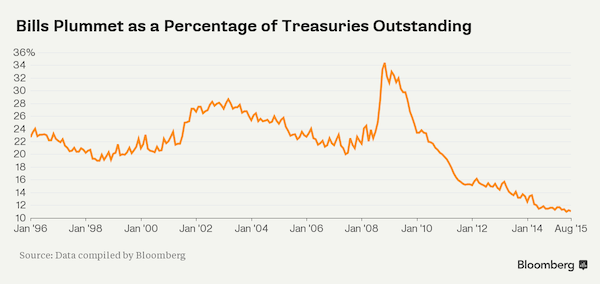

• Fed Leak Probe Dooms Lacker But Leaves Key Question: Who Leaked? (BBG)

The Federal Reserve’s inspector general says it will be ending its investigation into the 2012 release of confidential information. Even after the scandal cut short the career of one top Fed official, the answer to the most important question remains a mystery. Who did the initial leaking? Richmond Fed President Jeffrey Lacker resigned abruptly Tuesday as he announced his role in the unauthorized disclosure of information to Medley Global Advisors about policy options that the central bank was considering in 2012. His explanation suggested he was confirming facts the Medley analyst already knew. It was a sudden career stop for a Fed president who was frequently in opposition to the Fed board consensus on interest-rate policy, and the news will likely revive questions in Congress about the value of the central bank’s discretion and transparency.

“The story is not over today,” said Andrew Levin, a professor at Dartmouth College who was previously a special adviser at the Fed board and helped then-Vice Chair Janet Yellen develop the Fed’s policy on external communication. “There are a number of distinct details that suggest that Lacker wasn’t the main source of information.” Aaron Klein, a fellow at the Brookings Institution and the former chief economist on the Senate Banking Committee, said the Lacker statement “is not a full and complete accounting of what happened.” “The Fed, internally and its inspector general, would be wise to fully explore every aspect of what happened here because today’s actions and statements by Lacker raise more questions than they answer,” he said.

[..] Lacker’s carefully worded statement, distributed by his attorney, said he “crossed the line to confirming information that should have remained confidential.” The investigation into Lacker has concluded and no charges will be brought against him, the attorney said. He also said the Medley analyst “introduced into the conversation an important non-public detail” about one of the policy options under consideration. Lacker says he didn’t decline to comment “and the interview continued.” His statement doesn’t suggest that he tipped the Medley analyst initially. Indeed, the Fed board’s own investigation said “a few Federal Reserve personnel” had contact with the Medley analyst.

Lacker the only leaker? Doesn’t quite look that way.

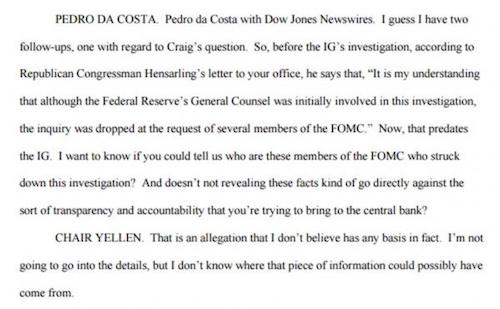

• I Tried To Ask Yellen About The Fed Leak (Da Costa)

I once asked Janet Yellen a rather straightforward question that would echo for much longer than I expected. It was March 2015, and the Federal Reserve was under pressure from Congress to reveal details about an internal investigation into how key details of its interest rate policy deliberations had made their way into a report by a private sector firm. I was a reporter at the Wall Street Journal, and I asked the following at a press conference:

Let’s make something clear: Like any journalist, I love a good leak. But this was not your typical leak of important information to a journalist who then reported it to the public. This was the sharing of private, market-sensitive details with a private party – Medley Global Advisors – which then shared that information with its clients. The leak, it should be noted, happened all the way back in 2012 but it was still being discussed in 2015 because – despite the Fed’s internal investigation – nobody seemed to have gotten to the bottom of what had happened. And back in 2012, any read on what the Federal Reserve might do to suppress interest rates as the US economy continued to crawl out of the Great Recession, could lead to huge profits for the traders who bet on such things. These days, traders are thinking about the next rate hike.

Back then, interest rates were already at zero and the real insight gleaned from Medley’s report was how aggressively the Fed would work to keep them there by using its balance sheet. My question to Yellen had to do with basic public trust in the Fed. Why should the American people believe the central bank is working in its best interests if policymakers chat privately with movers and shakers on Wall Street? This was an alarming trend I had been reporting on since 2010, when I co-authored a report for Reuters entitled “Cozying up to big investors at Club Fed.” In it, my colleagues and I detailed other instances of market-moving information inappropriately being shared with investors, a trend we first observed when Fed officials speaking to bankers and hedge fund managers at conferences would suddenly go silent when a reporter walked by.

After the Yellen press conference, I took two weeks of paid leave for the birth of my daughter. When I returned, my editor at the paper told me I would no longer be attending Fed press conferences. No reason was given, and I left the job a few months later. Market bloggers speculated the Fed had “banned” me from the press conference. I have no reason to think that was the case because the central bank let me back in as soon as I changed news organizations. Fast-forward to April 4, 2017: Richmond Fed President Jeffrey Lacker resigns abruptly after admitting he was a source of the leak. As soon as I saw the news, the whole press conference incident flashed before my eyes. But Lacker’s admission that the Medley leak originated with him doesn’t entirely settle the matter. We know Yellen also met with Medley herself. Why? What did she say to them? Former Fed economist and Treasury official Seth Carpenter was also under scrutiny on the issue. What were the results of the Fed’s own investigation? And of Congress’?

Meanwhile in the gutter….

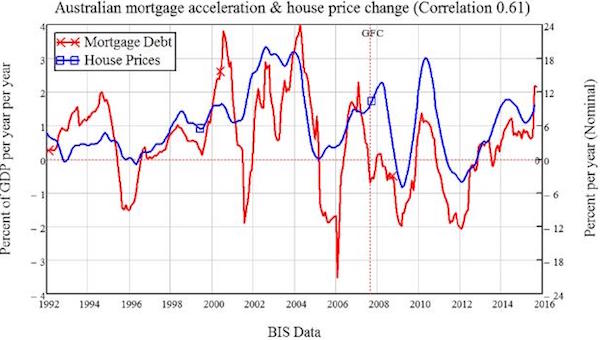

• Australia’s Household Debt Crisis Is Worse Than Ever (Abc.au)

Mr Russell told me there had been a big increase in debt-distressed Australians calling the [National Debt] helpline in recent months unable to pay their utilities bills. Naturally, he explained, rent and mortgage repayments take priority over the utilities bills because, in the order of survival priorities, you first need a roof over your head. Generally speaking, though, the National Debt helpline told me the rising cost of living is becoming crippling. Utilities bills, mortgage repayments and credit card debt, are all contributing to household financial stress. Last year over 150,000 calls were made to the National Debt Helpline. This year, monthly call volumes for the helpline are already 20% higher, compared to 2016. Based on current call volumes, the NDH predicts that there will be over 182,000 calls this year.

Martin North is the principal of financial research firm Digital Finance Analytics. He crunched the numbers and calculated that, in March, of the 3.1 million mortgaged households, around 22% were in “mild mortgage stress”. That’s up 1.5% on February, and is directly related to the even the smallest of interest rate increases by some of the big four banks. That means those households are managing to make their mortgage repayments, but only by cutting back on other expenditure, or putting more on credit cards, and generally hunkering down. Then there are those Australians under extreme levels of financial stress. Data from Digital Finance Analytics show 1% of households are in severe stress. That means they’re behind with their repayments, and are trying to dig their way out by refinancing, selling their property, or seeking help from services like the National Debt Helpline.

Ha ha: “Our banks are resilient and they are soundly capitalised,” he said.”

• Australian Economy At Risk As Debt Bomb Grows (Aus.)

The rampant debt-fuelled surge in the Sydney and Melbourne property markets will threaten the health of the national economy if it continues, Reserve Bank governor Philip Lowe has warned. However, Treasurer Scott Morrison has talked down drastic action on house prices after a “strong intervention” from Dr Lowe. The RBA is worried that housing debts are rising more than twice as fast as household incomes and that banks are lending to people who cannot afford to repay their debts. The concern has been that the longer the recent trends continued, the greater the risk to the future health of the Australian economy, Dr Lowe told a business dinner in Melbourne last night. “Stretched balance sheets make for more volatility when things turn down.” “For many people, the high debt levels and low wage growth are a sobering combination.”

The chairman of the government’s Financial System Inquiry, former Future Fund chairman David Murray, yesterday sounded a further alarm on the housing boom, saying a crisis on the scale of the 1890s great property collapse could not be ruled out. “What people should do is look at the 1890s, which was caused by a housing land boom,” he told The Australian. “To say it won’t happen and simply ignore it is wrong.” Half of the nation’s banks closed their doors following the 1890s crash. “Many people say a crisis has a low probability of occurrence, but the problem with that view is that whatever the probability, the severity can be very high if it occurs”, Mr Murray, who is also a former Commonwealth Bank chief executive, said. “It shouldn t be allowed to grow & it’s too big a risk to take.”

[..] House prices in Australia’s capital cities have risen 12.9% compared with this time last year, with a surge of 18.9% in Sydney and 15.9% in Melbourne, according to data released on Monday by property analytics firm CoreLogic. [..] Dr Lowe dismissed fears that the banks would be undermined by a housing downturn, saying the Council of Financial Regulators did not believe the boom was a threat to financial stability. “Our banks are resilient and they are soundly capitalised,” he said.

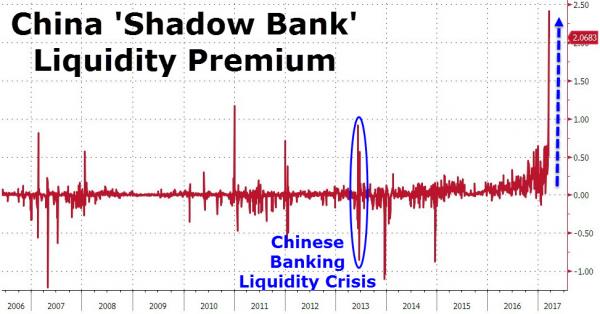

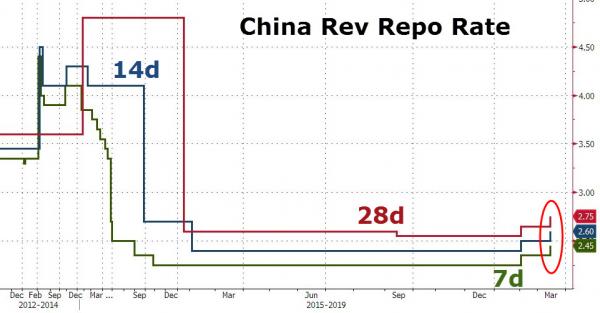

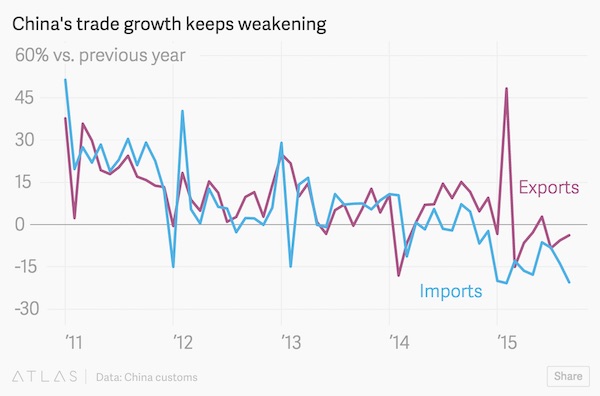

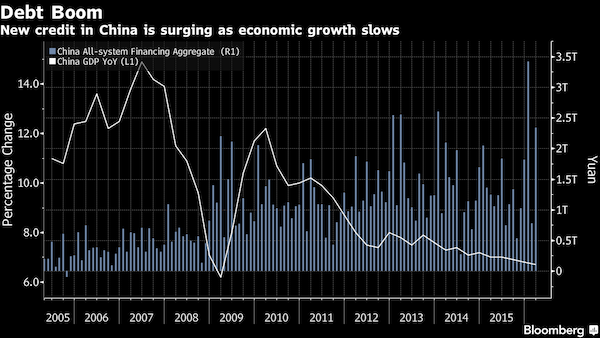

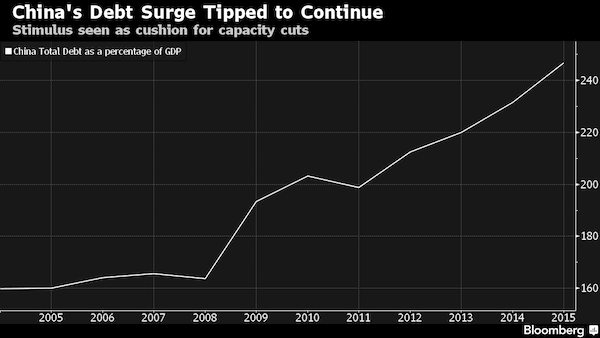

In China, the shadow banks are taking over…

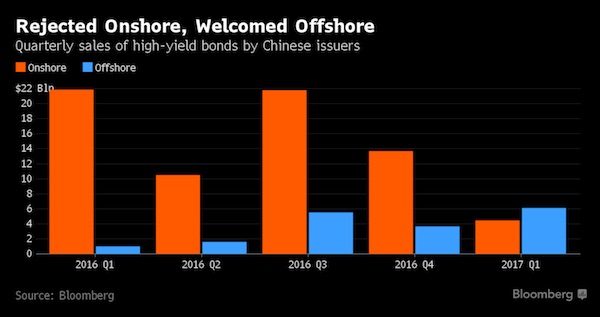

• Chinese Brokers Are Muscling in on Asia’s Junk Bond Underwriters

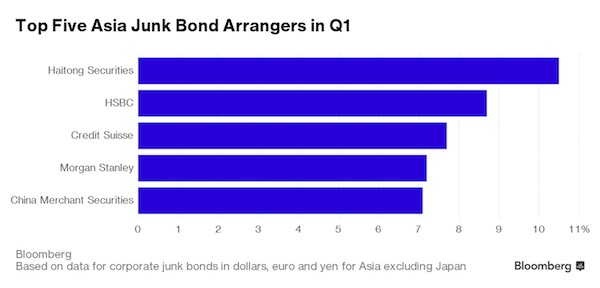

China’s brokerages are out-muscling global investment banks to win more underwriting business in Asia’s junk bond market amid record offerings, as they increasingly help borrowers from the nation raise foreign currency debt. Haitong Securities topped the league table for high-yield notes denominated in dollars, euro and yen from companies in Asia excluding Japan in the first quarter, according to data compiled by Bloomberg. China Merchants Securities moved up four places to fifth. While HSBC rose three places to second, Standard Chartered and UBS slid to eighth and 11th from first and second in the first quarter of 2016. Junk bonds offer more lucrative fees than high-grade bonds, giving an extra boost to financial institutions that can expand in the business.

As Chinese firms have flocked to the offshore high-yield market, mainland banks and brokerage firms have grabbed market share away from international peers. Issuance of junk notes in dollars, euro and yen from Asia excluding Japan swelled to a record $14.6 billion in the first quarter, with nearly 70% from Chinese companies. “It’s increasingly competitive and Chinese banks are effectively buying market share with their balance sheet,” said Veronique Lafon-Vinais at the Hong Kong University of Science and Technology. Alexi Chan, global co-head of debt capital markets at HSBC, said that the significant rise in Asia high-yield bond sales reflected the “constructive market sentiment” and “positive outlook for China’s economy.”

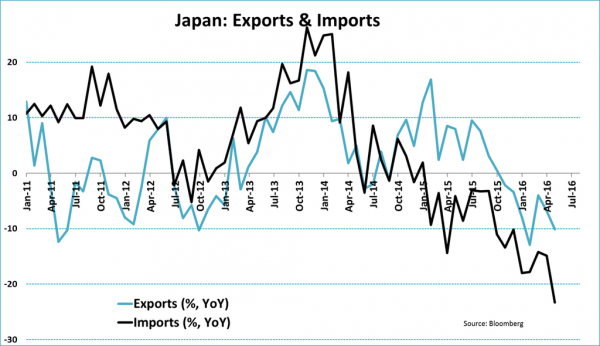

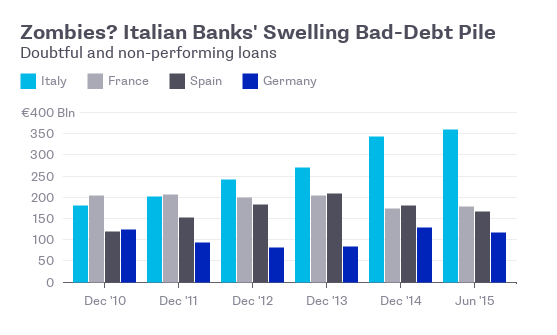

… and in Japan, the zombies take over.

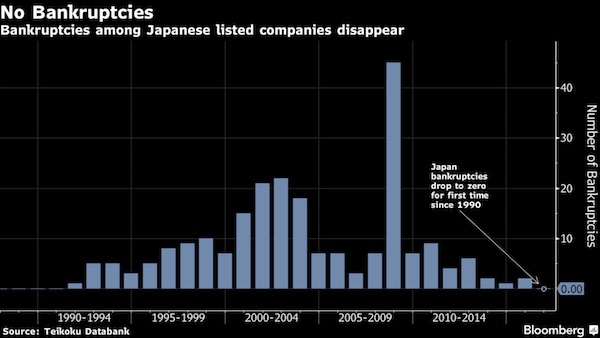

• Zombie Nation: In Japan, Zero Public Companies Went Bust in 2016 (BBG)

Corporate Japan achieved a rare feat in the fiscal year that ended last week. Not one of its almost 4,000 publicly-traded firms filed for bankruptcy protection. Yet that’s no reason to celebrate, according to analysts who see Japan’s easy credit conditions standing in the way of a much-needed, corporate restructuring to flush out failing companies and make room for new businesses. “It’s totally unhealthy,” says Martin Schulz, an economist at Fujitsu Research Institute in Tokyo. “Japan’s business cycle isn’t working. When no old companies go out of business, no new ones can come in because there isn’t room. The old companies will always compete on price, simply because they can.”

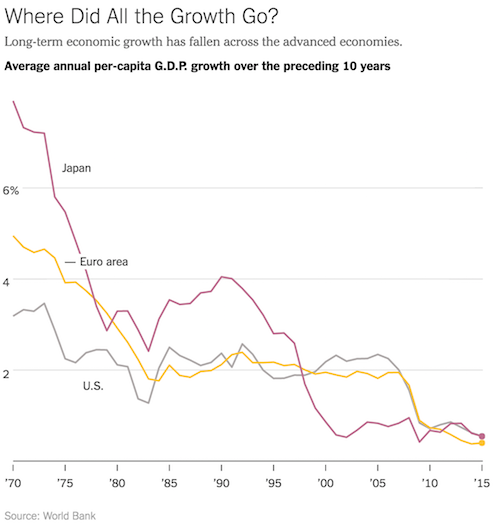

The last time not a single Japanese corporate titan went belly up was a four-year stretch 26 years ago, according to a report published this week by research firm Teikoku Databank. Back then, though, an overheated Japanese economy averaged 5.5% growth per year and then hit a wall when stock and real estate asset bubbles burst. This time, ultra-low interest rates and government loan guarantees left over from the global financial crisis are keeping companies afloat. Prime Minister Shinzo Abe touts fewer business failures as an economic success, but critics say too-easy credit is keeping “zombie” firms alive, worsening labor shortages, and excess competition is putting downward pressure on prices.

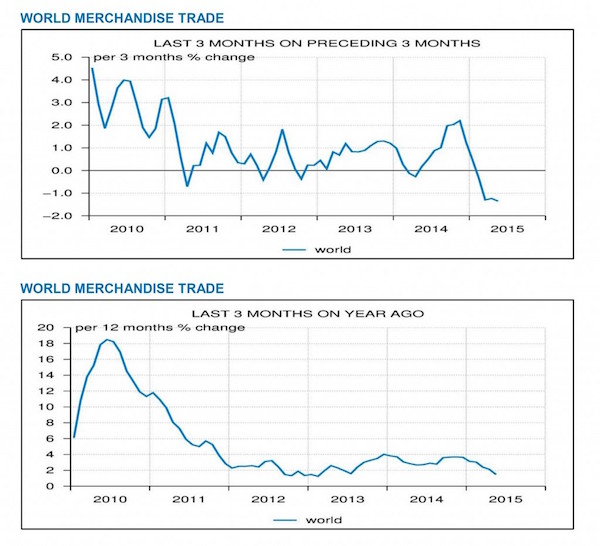

The Austrian economist Joseph Schumpeter in 1942 coined the term “creative destruction” to describe the messy way that capitalism reinvents itself. Japan may be stuck in a rut because it refuses to take the economic pain needed for a revival. Yet it’s hardly the only country keeping companies on life support. A January study by the OECD blamed zombies – defined as firms with persistent difficulties paying interest on debt – for slowing productivity, and thus causing sluggish growth, in the developed world. In South Korea, where the shipping industry has been hit by slumping global trade, state-run banks last month agreed to lend Daewoo Shipbuilding $2.6 billion and swap debt for equity to prevent a default. It was the second time in less than two years that the troubled shipbuilder was bailed out.

In China, roughly 10% of the country’s publicly-traded companies are “among the walking dead,” being kept alive by continuous support from government and banks, according to research by He Fan, an economist at Beijing’s Renmin University. Banks keep lending, often because they don’t want to own up to their bad debts. Meanwhile, the government fears the unemployment that would result if so many troubled firms were left to wither away.

“..the owners of property along the subway line experience a rise in property values. They owe their increased wealth and their increased incomes from the rental values of their properties to the expenditure of taxpayer dollars. If these gains were taxed away, the subway line could have been financed without taxpayers’ money.”

• The World’s Best Economist (PCR)

If you want to learn real economics instead of neoliberal junk economics, read Michael Hudson’s books. What you will learn is that neoliberal economics is an apology for the rentier class and the large banks that have succeeded in financializing the economy, shifting consumer spending power from the purchase of goods and services that drive the real economy to the payment of interest and fees to banks. His latest book is J is for Junk Economics. It is written in the form of a dictionary, but the definitions give you the precise meaning of economic terms, the history of economic concepts, and describe the transformation of economics from classical economics, where the emphasis was on taxing incomes that are not the product of the production of goods and services, to neoliberal economics, which rests on the taxation of labor and production.

This is an important difference that is not easy to understand. Classical economists defined “unearned income” as “economic rent.” This is not the rent that you pay for your apartment. Economic rent is an income stream that has no counterpart in cost incurred by the receipient of the income stream. For example, when a public authority, say the city of Alexandria, Virginia, decides to connect Alexandria with Washington, D.C., and with itself, with a subway paid for with public money, the owners of property along the subway line experience a rise in property values. They owe their increased wealth and their increased incomes from the rental values of their properties to the expenditure of taxpayer dollars. If these gains were taxed away, the subway line could have been financed without taxpayers’ money.

It is these gains in value produced by the subway, or by a taxpayer-financed road across property, or by having beachfront property instead of property off the beach, or by having property on the sunny side of the street in a business area that are “economic rents.” Monopoly profits due to a unique positioning are also economic rents. Hudson adds to these rents the interest that governments pay to bondholders when governments can avoid the issuance of bonds by printing money instead of bonds. When governments allow private banks to create the money with which to purchase the government’s bonds, the governments create liabilities for taxpayers than are easily avoidable if, instead, government created the money themselves to finance their projects. The buildup of public debt is entirely unnecessary.

No less money is created by the banks that buy government bonds than would be created if the government printed money instead of bonds. The inability of neoliberal economics to differentiate income streams that are economic rents with no cost of production from produced output makes the National Income and Product Accounts, the main source of data on economic activity in the US, extremely misleading. The economy can be said to be growing because public debt-financed investment projects raise the rents along subway lines. “Free market” economists today are different from the classical free market economists. Classical economists, such as Adam Smith, understood a free market to be one in which taxation freed the economy from untaxed economic rents. In neoliberal economics, Hudson explains, “free market” means freedom for rent extraction free of government taxation and regulation. This is a huge difference.

I got nothing. We’re doomed.

• New Zealand Post To Deliver KFC (AFP)

New Zealand Post has announced its couriers will home-deliver KFC fast food, in a trial that could provide a recipe for success as letter volumes continue to dwindle. Under a pilot scheme that started this week in the North Island town of Tauranga, KFC customers can order online and have their food delivered by NZ Post drivers. KFC operator Restaurant Brands NZ said that while it knew how to produce food, it had no experience in logistics, making the postal service a natural fit. “NZ Post has an extensive delivery distribution network around New Zealand, and KFC is available in most towns nationwide,” chief executive Ian Letele said.

“With the support of NZ Post, we hope to service the home delivery needs of many more KFC customers throughout New Zealand.” New Zealand Post has struggled in the digital age as email and texts have replaced traditional “snail mail”. The state-owned service slashed 2,000 jobs, or 20% of its workforce in 2013, and two years later moved to three-day-a-week deliveries, down from six. It said in its last financial statement that the fall in letter deliveries meant it was losing up to NZ$30 million ($21 million) a year in revenue. However, it said parcel volumes were up due to rising online orders and NZ Post was concentrating on capturing more e-commerce business.