Pierre-Auguste Renoir Riding in the Bois de Boulogne (Madame Henriette Darras or The Ride) 1873

First saw this a few days ago, and it slipped from my radar. Now, Steve Keen announced that he got a grant for his work with Tim Garrett and Matheus Grasselli on “developing models of production in which energy plays [a role] in production (and, necessarily, in climate degradation)”. Yes, you read that right: in 2019, economists need to begin the study the role of energy in an economic system, because it’s always been ignored. What a crazy field that is.

• Labour Without Energy Is A Corpse; Capital Without Energy Is A Sculpture (Keen)

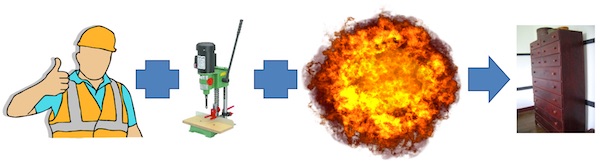

With the simple insight that “labour without energy is a corpse, and capital without energy is a sculpture”, I realised why economists have failed to properly incorporate the role of energy in production for so long. All previous attempts had treated energy as a third “factor of production”, on an equal footing with Labour and Capital. But that treatment is simply unrealistic. Adding energy on its own to a production process is like letting off a bomb in a factory: it will produce mayhem, not output. Equally, both Labour and Capital are “sterile”, to use the old Physiocratic term: without energy, they can’t produce anything.

Figure 1: The incorrect way to show energy as a factor of production

The correct way to incorporate energy into economic models of production, therefore, is to see energy as an input to both Labour and Capital (in vastly different forms, of course), which enable them to perform useful work. By the Second Law of Thermodynamics, this useful work necessarily results in disorder (waste energy, mainly in the form of waste matter, including CO2). Also by the Second Law, entropy increases globally, even though it can be reduced locally by the application of energy; so the increase in disorder in the waste from production necessarily exceeds the reduction in disorder manifest in output itself (raw materials turned into finished products).

Figure 2: The correct way: Energy as an input to labour and capital, output as necessarily generating waste

This useful work is what we call GDP, though we currently erroneously measure this as the inflation-adjusted sum of all monetary output—which means we add the cost of traffic accidents to GDP. Instead, the true measure of GDP is the sum of all the useful things we produce and consume: in transportation, that is moving a mass from one location to another in a given time, and traffic accidents (and congestion) subtract from it.

Palm oil or orangutans? For economists, an easy choice.

• Traditional Economics Has Absolutely Screwed Us (Tyee)

Capitalism is killing the planet. That is the gist of an exhaustive United Nations report on the bleak state of the world’s biodiversity. One million species face extinction in what has been aptly called a global murder-suicide, driven by a race to commodify ecosystems and externalize the costs of their destruction. If you were looking for a perky read to start your week, this report was not it. However, the collective efforts of 350 leading experts from 51 countries have resulted in the definitive wake-up call for those still doubting the dire consequences of business-as-usual on our one and only planet. A Noah’s ark of iconic species seems bound for oblivion due to our growing collective consumption and population.

Will your children be able to enjoy a world with wild elephants, orcas, or blue whales? Sixty per cent of primate species are threatened with extinction. The taste of a tuna sandwich may soon be consigned to lore. All of this has been happening in plain view but only recently has this become economically relevant by cutting into the bottom line. Up to $577 billion in global crop production is at risk due to collapsing populations of pollinating insects. One-third of commercial fish stocks are in steep decline with another 60 per cent being fully exploited, leaving only seven per cent of the world’s fisheries under safe management. This is exacerbated by regulatory failure where landings may be 50 per cent higher than reported, and illegal fishing accounts for up to one-third of the global catch.

Expanding agriculture is one of the main drivers of exploding extinction rates. Between 1980 and 2000, about 100 million hectares of tropical forests — roughly the area of France and Germany combined — were converted for grazing, monoculture plantations like palm oil, or short-term subsistence farming. Desperate humans and multinational companies both encroach on remaining rainforests, seeing only as far as the next growing season or financial quarter. Why does economics prioritize palm oil over orangutans? Because palm plantations are profitable, producing almost five times the oil yield per hectare of sunflowers, coconut or soybeans. Consumers too unintentionally contribute to this destruction, driving a market for a ubiquitous ingredient found in everything from lipstick to ice cream.

McGahn, Barr, Mueller, Mnuchin, are these all the same?

• House Dems To Bundle Numerous Contempt Citations For Trump Advisers (R.)

U.S. House Judiciary Committee Chairman Jerrold Nadler said lawmakers may bundle numerous contempt citations from different committees into a single resolution that the full House of Representatives could then vote on. “There obviously are going to have to be, perhaps from our committee and certainly from other committees, other contempt citations to enforce subpoenas,” Nadler told reporters. Asked about bundling citations together, the New York Democrat replied: “It’s a great idea. In fact, I suggested it … It just makes sense, to spend as little floor time as possible, to group them together.”

A consolidated contempt vote is among options Democrats are considering in response to Trump’s stonewalling of congressional investigations into his presidency and business investments. Another option is reviving Congress’s “inherent” contempt authority. Some Democrats say that would allow lawmakers to fine uncooperative officials up to $25,000 per day. Some Democrats are also calling for impeachment proceedings against recalcitrant Trump Cabinet members. Nadler said Congress faces “the unprecedented situation in which the administration is essentially stonewalling all subpoenas – we’ve never had this before in American history, so far as I know.”

They lost two years on the Russia collusion story. Doesn’t look so smart now, does it?

• House Democrat Subpoenas Six Years Of Trump Tax Returns (AP)

A top House Democrat on Friday issued subpoenas for six years of Donald Trump’s tax returns, giving the treasury secretary, Steven Mnuchin, and the IRS commissioner, Charles Rettig, a deadline of next Friday to deliver them. Richard Neal, the chairman of the House ways and means committee, issued the subpoenas days after Mnuchin refused to comply with demands to turn over Trump’s returns. Mnuchin told the panel he wouldn’t provide Trump’s tax records because the panel’s request “lacks a legitimate legislative purpose”, as supreme court precedent requires.

Neal reminded the two Trump appointees in a Friday letter that federal law states that the IRS “shall furnish” the tax returns of any individual upon the request of the chairmen of Congress’s tax-writing committees, and that ways and means “has never been denied” a request. The White House and the Democratic-controlled House are waging a multi-front battle over investigations into Trump, with the administration refusing to comply with subpoenas for the unredacted Mueller report and documents related to testimony by the former White House counsel Donald McGahn. If Mnuchin and Rettig refuse to comply with the subpoenas, Neal is likely to file a lawsuit in federal court.

He indicated earlier this week that he was leaning toward filing a court case immediately but changed course after meeting with lawyers for the House. Neal originally demanded access to Trump’s tax returns in early April. He maintains that the committee is looking into the effectiveness of mandatory IRS audits of tax returns of all sitting presidents, a way to justify his claim that the panel has a potential legislative purpose. Democrats are confident in their legal justification and say Trump is stalling in an attempt to punt the issue past the 2020 election. In rejecting Neal’s request earlier this week, Mnuchin said he relied on the advice of the justice department. He concluded that the treasury department was “not authorized to disclose the requested returns and return information”. Mnuchin has also said that Neal’s request would potentially weaponize private tax returns for political purposes.

I don’t think John Solomon is done yet.

As for the Papadopoulos $10,000 story, how is that an “explosive revelation”? Have known that for a long time.

• FISA Applications Were Illegally Obtained – DiGenova (PJ)

Washington attorney Joe diGenova claimed in an interview last night that the Department of Justice inspector general has determined that “the final three FISA extensions were illegally obtained,” and the first one is still being investigated. For the past year, DOJ IG Michael Horowitz has been investigating the FBI’s 2016 surveillance activities and his report is expected later this month or in early June. Washington power couple Joe diGenova and Victoria Toensing appeared on Lou Dobbs’ Fox Business Network show Thursday night to talk about the latest turns in the “SpyGate” saga. “The only question now is whether or not the first FISA was illegally obtained,” diGenova said.

He told Dobbs that the latest revelations in investigative reporter John Solomon’s piece at The Hill, have prompted further investigation from Horowitz’s team. On Thursday, Solomon reported that newly unearthed memos show that a high-ranking government official from the Obama State Department met with former British spy Christopher Steele in October of 2016, and figured out pretty quickly that his dossier was a political hit job intended to slime Donald Trump on behalf of Hillary Clinton’s campaign. [..] DiGenova said the inspector general was unaware of the memos, which were obtained last week through open-records litigation by the conservative group Citizens United. “The Bureau hid those memos from Horowitz. As a result of that, they are doing some additional work on the first FISA,” diGenova explained, adding: “It may be that all four FISAs will have been obtained illegally.”

[..] DiGenova and Toensing shared another explosive revelation on Sebastian Gorka’s Salem Radio talk show “America First” on Thursday. According to Toensing, the FBI tried to frame former Trump campaign adviser George Papadopoulos by having an informant give him $10,000 in cash during a trip to Israel in the summer of 2017. An individual allegedly talked the then-29-year-old into traveling to Israel to make a deal, and invited him to his hotel room. “And there on the bed is $10,000 in cash in a suitcase,” she continued. Papadopoulos took the money and gave it to his lawyer, who has it still. Toensing said when Papadopoulos returned to the United States, he was greeted by FBI agents at Dulles Airport and they started searching through everything that he had “the second he landed.”

She added, “in fact, they already had his baggage from the plane. He couldn’t believe they had his baggage.” “It was a set up!” exclaimed Gorka. “It was a complete set up,” agreed Toensing. DiGenova explained that the Feds already knew that he hadn’t declared that he had $10,000 and were expecting to find the undeclared cash so they could arrest him and “put the thumbscrews on and make him squeal,” as Gorka put it. Worst of all, according to Toensing, “one of the FBI agents said to him, ‘this is what happens when you work for Donald Trump.’”

Good read. To a large extent, the Democrats made their own bed. Very far from a black and white story.

• William Barr vs. Eric Holder: A Tale of Two Attorneys General (McConnell)

Speaker of the House Nancy Pelosi has declared it a “constitutional crisis” that Attorney General William Barr refuses to divulge the small parts of the Mueller report that contain grand-jury material. By a straight party-line vote, the House Judiciary Committee voted to hold Barr in contempt of Congress. What did Pelosi think when Barr’s predecessor, Eric Holder, refused to divulge documents to a congressional committee and was held in contempt? “Ridiculous!” she said. What did Holder and Obama say? That the House subpoena was a violation of “separation of powers.” To partisans, the difference between the cases is obvious. Barr is defending Trump; Holder was Obama’s self-proclaimed “wing man.”

That is enough for many journalists and most politicians. The rest of us might want to know: What is the legal or constitutional difference between Holder’s refusal to provide documents and Barr’s? Here is the background of the Holder contempt. The Bureau of Alcohol, Tobacco, Firearms and Explosives (BATFE), a unit of Holder’s Department of Justice (DOJ), conducted an operation called “Fast & Furious,” intended to track illegal gun sales. In fact it put hundreds of weapons in the hands of Mexican criminal gangs, leading to the death of an American officer. On February 2, 2011, after news of the operation emerged, Holder’s assistant attorney general sent a letter to Congress declaring that the Obama administration had no knowledge of the operation. This letter was false, as Holder later admitted.

A congressional committee wanted to know why it had been misled. BATFE employees leaked to Congress that the department was still suppressing the truth about the operation and retaliating against whistleblowers. The committee wanted to dig into that. It demanded DOJ documents “relating to actions the Department took to silence or retaliate against Fast and Furious whistleblowers,” so that it could determine “what the Department knew about Fast and Furious, including when and how it discovered its February 4 letter was false, and the Department’s efforts to conceal that information from Congress and the public.”

“..funnelled [over $21 million] personally and through straw donors to President Obama’s 2012 re-election campaign, then lied about it to the Federal Elections Commission in 2015.”

• Fugees Founder, Banker Charged In 1MDB, Obama Campaign Scandal (RT)

A founding member of the Fugees is accused of conspiracy to funnel illegal campaign contributions to Barack Obama’s 2012 presidential campaign and lying about it, in a spinoff of the 1MDB corruption scandal. The indictment against Prakazrel “Pras” Michel, 46, was unsealed on Friday, the government says he received over $21 million from Malaysian businessman Low Taek Jho (also known as “Jho Low”) and funnelled it personally and through straw donors to President Obama’s 2012 re-election campaign, then lied about it to the Federal Elections Commission in 2015. Michel was charged with conspiracy to defraud US government, falsifying records, and making a false statement. He appeared before a federal judge in Washington, DC on Friday and pleaded not guilty.

Mr. Michel is extremely disappointed that so many years after the fact the government would bring charges related to 2012 campaign contributions,” said his attorney Barry Pollack. “Mr. Michel is innocent of these charges and looks forward to having the case heard by a jury.” Michel is best known as one of the founding members of the Fugees, an award-winning group that set music charts on fire with ‘Killing me softly’ in 1996 and launched the solo careers of Wyclef Jean and Lauryn Hill. Low, 37, was also charged in the case, adding to the existing indictments against the Malaysian businessman already wanted for conspiring to launder billions of dollars and violating the Foreign Corrupt Practices Act.

“..he rode on the back of that fraud for two years, as if touring a political landfill on a donkey, leaving the public to stew in anxious hallucinations.”

• Crisis? What Crisis? (Jim Kunstler)

Information emerged over the weeks since the Mueller Report’s release that Mr. Mueller and his team knew unequivocally that the Special Counsel’s mission and the FBI operations that preceded it were based on concocted political bullshit supplied by Mrs. Clinton and her network of flunkies and fixers, ranging throughout the permanent DC bureacuracy (a.k.a. the Swamp), to outposts in foreign intel services and the political kitty-litter box known as Ukraine. Mr. Mueller must have suspected this from the outset, but knew for sure by the summer of 2017, and omitted to advise the American public that he had uncovered a fraud. Rather, he rode on the back of that fraud for two years, as if touring a political landfill on a donkey, leaving the public to stew in anxious hallucinations.

What else did Mr. Mueller do, or omit to do? He never engaged US government forensic computer analysts to examine the DNC servers at the heart of RussiaGate story. Rather, he allowed the conclusions to stand of a company called CrowdStrike, hired by the DNC itself to supposedly investigate the theft of emails, especially those of Clinton campaign chairman John Podesta. Mr. Mueller never bothered to interview the one person who might have known exactly who supplied the purloined emails to Wikileaks, namely Julian Assange. Mr. Mueller also did not bother to interview several dozen retired Intel Community computer experts, led by William Binney, former Technical Director of the NSA, who determined that the hack was accomplished by direct download by an insider onto a flash drive.

This is about what the US wants to add to the Assange charge once he’s been extradited.

• Manning Could Delay US Superseding Indictment Against Assange (Sp.)

According to Manning’s legal team, her release was triggered by the expiration of the term of the grand jury that had demanded her testimony. She will be back in court on May 16, trying to convince a new grand jury of what she failed to prove to the last one: that she cannot be forced to cooperate, as she fundamentally disagrees with the concept of a grand jury, which she says use activists’ testimonies against them. “This will go on until they get what they want or she continues to stay in jail,” Joe Lauria, editor-in-chief of Consortium News, told Radio Sputnik’s Loud and Clear Friday. “She’s in a position where she could delay or slow down what the Justice Department wants to do in terms of a superseding indictment against Assange.

Nobody believes that they are going to want to just put him in jail for five years… this initial indictment is a placeholder, and they have a deadline of June 12 to give to British court the charges; the decision has to be made in the UK,” Lauria said. However, there is a way around that, Lauria told hosts Brian Becker and John Kiriakou, called the Doctrine of Specialty, which, according to reference website USLegal.com, is “a principle of international law that is included in most extradition treaties, whereby a person who is extradited to a country to stand trial for certain criminal offenses may be tried only for those offenses and not for any other pre-extradition offenses.” “Once the asylum state extradites an individual to the requesting state under the terms of an extradition treaty, that person can be prosecuted only for crimes specified in the extradition request,” the website notes.

“This doctrine allows a nation to require the requesting nation to limit prosecution to declared offenses.” “In other words, Assange could come to the US based on this very silly charge that he tried to help Chelsea Manning hack into a computer — when she had top secret clearance and total access anyway — clearly he was trying to just help her hide her identity. But, he could come to the US and they could start adding charges there. I suspect that might happen if she doesn’t testify — which she will not do, obviously; she’s made that abundantly clear.” “They clearly need something from her, or they wouldn’t be throwing her back in jail, effectively, because she refuses to testify,” Lauria said. “But she’s not going to say a damn thing; she’s not going to cooperate, at incredible personal expense to herself, and that just goes to show what a person of principle she is.”

Curious but still..

• Dutch Court Blocks Extradition Of Man To ‘Inhumane’ UK Prisons (G.)

Judges in the Netherlands have refused to send a suspected drug smuggler back to the UK because of concerns that conditions in British jails are inhumane. An initial application to extradite the unnamed man, who had been on the run for two years, was refused this week due to the reported state of HMP Liverpool where he would probably be sent.The court of Amsterdam heard how inspectors had found “some of the most disturbing prison conditions we have ever seen” and “conditions which have no place in an advanced nation in the 21st century”, in reference to report on the state of prisons in the UK published last July.

A surprise inspection of HMP Liverpool in September 2017 found it was infested with rats and that inmates lived in squalid conditions, afraid of being attacked because of increasing violence. Similar conditions were found in HMP Birmingham and HMP Bedford. The Dutch judges said on Wednesday they were concerned the man, who was wanted in relation to cocaine and heroin smuggling on Merseyside, was at “real risk of inhuman or degrading treatment” if returned. The man had been made the subject of a European arrest warrant at Liverpool magistrates court in July 2017. His lawyer argued that the extradition should be refused based on the prison inspectors’ reports.

“.. If you start with a monetary union, you make sure there will not be a democratic political union.”

• Varoufakis On Eurozone: ‘We Created A Monster’ (Exp.)

Former Greek financial minister Yanis Varoufakis branded the eurozone “a monster” for allegedly taking away financial oversight from European Union member states. Mr Varoufakis, an outspoken opponent of the European monetary union, claimed the creation of the common currency led to an “undemocratic political union”. Recounting his first meeting with other eurozone Finance Ministers in 2015, Mr Varoufakis said: “When I was in the Eurogroup, Wolfgang Schauble was very clear. The first time he spoke, in my presence, he said –spectacularly and very honestly – ’democracy cannot be allowed to change economic policies.’

Mr Varoufakis continued: “We’ve created a monster. We’ve created a monetary union that has a central bank without a state behind it because the European Central Bank (ECB) doesn’t have a corresponding state. Before the euro, you had the Treasury, the ministry of finance and you had the central banks – correspondence. “The ECB is a gigantic central bank with no state behind it and you’ve got 19 states without a central bank. This is not the way to create a monetary union which is consistent with the political union.” He added: “The fallacy in 1992 with Helmut Kohl and Francois Mitterrand, is that they believed you start with a monetary union and then you move towards a democratic political union. “No. If you start with a monetary union, you make sure there will not be a democratic political union.”

Not sure the biggest EU monster is a finance one.

• 70 Migrants Dead After Boat Capsizes Trying To Reach Europe From Libya (G.)

As many as 70 people trying to reach Europe from Libya have drowned after their vessel capsized in the deadliest such incident in the Mediterranean since January. According to survivors, at least 16 of whom were rescued, the boat left Zuwara in Libya, where renewed warfare between rival factions has gripped the capital, Tripoli, in the past five weeks. The vessel capsized 40 miles off the coast of Sfax, south of Tunis, as it headed towards Italy. The survivors reported that a Tunisian fishing boat came to their rescue and transferred them to a Tunisian coastguard vessel.

The incident came as overall number of people reaching Europe has decreased, whilethe journey has become increasingly dangerous. So far this year, 17,000 migrants and refugees have entered Europe via the sea, about 30% fewer than in the same period last year, according to the International Organization for Migration. The IOM said 443 people have reportedly died on Mediterranean crossings since 1 January, compared with 620 in the same period in 2018. The Institute for International Political Studies (ISPI) thinktank said that one person died for every eight people who left Libya from January to April, based on analysis of figures from the Italian interior ministry.

There’ll always be a dictator somewhere who invites a few million dollars. There’s only one solution: stop producing the stuff. 2 trillion drinks containers were sold in 2018. Cut it out.

• Nearly All Countries Agree To Stem Flow Of Plastic Waste Into Poor Nations (G.)

Almost all the world’s countries have agreed on a deal aimed at restricting shipments of hard-to-recycle plastic waste to poorer countries, the United Nations announced on Friday. Exporting countries – including the US – now will have to obtain consent from countries receiving contaminated, mixed or unrecyclable plastic waste. Currently, the US and other countries can send lower-quality plastic waste to private entities in developing countries without getting approval from their governments. Since China stopped accepting recycling from the US, activists say they have observed plastic waste piling up in developing countries. The Global Alliance for Incinerator Alternatives (Gaia), a backer of the deal, says it found villages in Indonesia, Thailand and Malaysia that had “turned into dumpsites over the course of a year”.

“We were finding that there was waste from the US that was just piled up in villages throughout these countries that had once been primarily agricultural communities,” said Claire Arkin, a spokeswoman for Gaia. The legally binding framework emerged at the end of a two-week meeting of UN-backed conventions on plastic waste and toxic, hazardous chemicals that threaten the planet’s seas and creatures. The pact comes in an amendment to the Basel convention. The US is not a party to that convention so it did not have a vote, but attendees at the meeting said the country argued against the change, saying officials didn’t understand the repercussions it would have on the plastic waste trade.

They lied to us about: #Vietnam#Cambodia#Laos#Grenada#Nicaragua#Panama#Yugoslavia#Afghanistan#Pakistan#Somalia#Iraq#Libya#Syria#Yemen#Venezuela

And now they’re salivating over yet another illegal war based on lies with #Iran. pic.twitter.com/Icpvv0xFZY

— Sarah Abdallah (@sahouraxo) May 10, 2019