Edgar Degas Dancers in Blue 1895

Nomi Prins

Oxfam notes "The 25 richest billionaires have increased their wealth by staggering amounts.

Jeff Bezos could personally pay each of Amazon’s 876,000 employees a one-time $105,000 bonus today and still be as wealthy as he was at the beginning of the pandemic. "

Let that sink in

— Nomi Prins (@nomiprins) September 10, 2020

Are you ready for two more months of this? It’s the Atlantic, then Woodward, and it’s not going to stop. The Atlantic piece was found to be empty drivel, and Woodward was given full cooperation by Trump, whose biggest fault seems to be that he actually knew things, but as I said yesterday, who cares what is true. It’s getting the stuff out there and let it do its damage.

All the time they all say: he must listen to the science. And now apparently he shouldn’t have. He didn’t want to create a panic, but that apparently now is what a US president should do. It’s circular logic at its best.

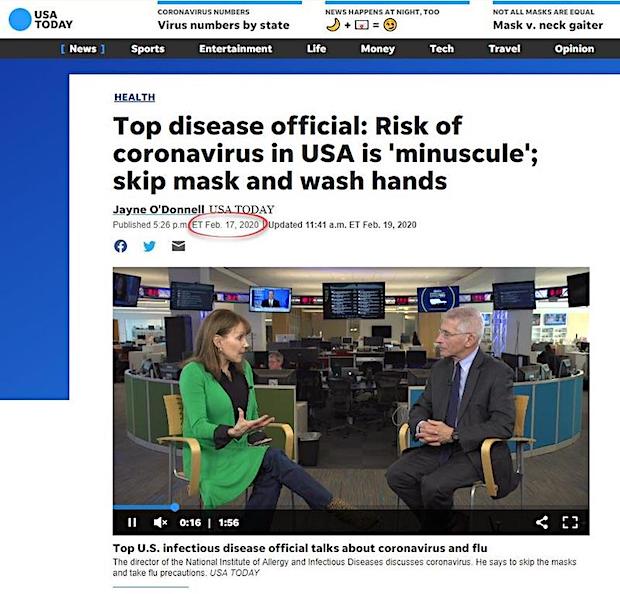

And why isn’t anyone talking about Fauci downplaying the threat, about Fauci’s “crimes against humanity”?

But Trump knew and he didn’t do anything! Yes, he did, he went and talked to the scientists. Guess what they told him. Trump told Woodward about what he had heard during a security briefing, not what Fauci had told him. And he’s supposed to listen to the scientists, remember?!

Tyler has it down:

Scott Adams Effective attack

This is an effective attack because only 2% of the public would know why it’s bullshit. https://t.co/mOKROmRjzO

— Scott Adams (@ScottAdamsSays) September 10, 2020

• Fauci Foils Latest ‘Bombshell’ – “Trump Didn’t Distort Anything” (ZH)

Well that didn’t take long. Woodward’s apparent ‘gotcha’ moment which is now spreading in an interestingly coordinated fashion across the MSM has been out-bombshell’d by none other than Dr.Fauci (he who speaks science truth and is above reproach). Fauci just went on Fox News and said that President Trump “did not distort anything and acted immediately when he was presented the data.” Birx and Redfield also testified the same thing under oath. Fauci also disputed alleged quotes from him in Bob Woodward’s story that President Trump is “unfocused in meetings” and that “his sole purpose is to get re-elected.” “I don’t recall that at all.”

On February 7, two days after President Trump was acquitted by the Senate of impeachment charges, he gave a lengthy interview to veteran journalist Bob Woodward which he allowed to be taped. Instead of talking about the impeachment, however, Woodward was ‘surprised’ that Trump was focused on COVID-19, the deadly virus gripping Wuhan, China while Dr. Anthony Fauci and the World Health Organization downplayed the risks. “This is deadly stuff,” Trump told Woodward, adding that the virus was possibly five times “more deadly” than the flu. Trump also told Woodward that the virus was airborne (while the World Health Organization explicitly said it was not, and maintained in January there was no human-to-human transmission).

Fauci Woodward

Dr. Fauci just came out and defended Trump. The Woodward stuff is nonsense. pic.twitter.com/ySPUM6pfP6

— Ian Miles Cheong (@stillgray) September 9, 2020

Fauci, on the other hand, told Newsmax TV on January 21 it was no big deal: “Obviously, you need to take it seriously and do the kind of things the (Centers for Disease Control and Prevention) and the Department of Homeland Security is doing. But this is not a major threat to the people of the United States and this is not something that the citizens of the United States right now should be worried about.” -Dr Anthony Fauci, January 21. On February 17, Fauci continued to downplay the virus – saying that the risk to the US is “minuscule,” and that people shouldn’t wear masks. In other words, Trump was doing what Biden claims he’ll do; listen to the scientists.

Yet, days before Trump’s February 7 interview with Woodward, he restricted travel from China on the advice of his National Security team – for which he was called a ‘xenophobe’ by Joe Biden and Nancy Pelosi. Three weeks later, Pelosi invited people to come to Chinatown, without masks, to “say everything is fine here.” Now, Pelosi is on MSNBC claiming that Trump’s “delay, distortion and denial is responsible for many of the deaths we have today.” Meanwhile, the WHO waited until March 11 to declare a pandemic. And so, CNN’s ‘gotcha’ is this: Trump also admitted to Woodward in a follow-up interview on March 19 that he purposefully downplayed the virus in order to avoid panic. “I wanted to always play it down,” he said, adding “I still like playing it down, because I don’t want to create a panic.”

CNN somehow overlooks Fauci, Pelosi and Biden downplaying the virus themselves – with the latter two calling Trump a xenophobe for his China travel restrictions. Three days later, Trump announced restrictions on travel from China, a move suggested by his national security team — despite Trump’s later claims that he alone backed the travel limitations. Nevertheless, Trump continued to publicly downplay the danger of the virus. February was a lost month. Woodward views this as a damning missed opportunity for Trump to reset “the leadership clock” after he was told this was a “once-in-a-lifetime health emergency.” -CNN. In other words – Trump took the virus seriously, restricted travel, was called a ‘xenophobe’ for it, and is now under attack for downplaying it in the same way his advisers, Pelosi, the WHO and others were in order to avoid public panic. Let’s see if the left’s latest ‘bombshell’ gains traction.

Biden fear-mongering

https://twitter.com/i/status/1303775675887820800

Well, so much for Bernie campaigner Sirota. A shame, just started to like him for his Biden comments.

It’s like: nothing Trump says is credible, unless and until you can use it against him.

Still, “crime against humanity”, it’s quite the take. So it’s Trump and Woodward, but not Fauci, whose ultimate responsibility it is to advise the president? Why, because Fauci won’t play the “crime against humanity” game?

• Bob Woodward Aided Trump’s Crime Against Humanity (Sirota/Perez)

Back in February, there were plenty of questions about just how deadly the coronavirus was, and how it could be transmitted. Was it really all that lethal? Could you catch it through the air? Some experts said it probably wasn’t airborne. Few seemed to have definitive answers. But the nation’s most famous celebrity journalist knew – and knew the president did too – but decided not to tell anyone, and nearly 200,000 people have died since. This is the story of Bob Woodward — the man who earned fame and fortune uncovering the Watergate scandal, and now the man who decades later was informed by the President of the United States that a pandemic was deadly and airborne, and decided to hold that information for seven months so he could juice book sales at a more opportune time closer to the election.

“It goes through air, Bob. That’s always tougher than the touch,” Trump told Woodward in early February, months before scientists publicly pressed the World Health Organization to acknowledge the airborne nature of the disease. “You know, the touch, you don’t have to touch things. Right? But the air, you just breathe the air and that’s how it’s passed. And so, that’s a very tricky one. That’s a very delicate one. It’s also more deadly than your — you know, your, even your strenuous flus.” Trump openly admitted to Woodward that he wanted to downplay the severity of the virus. “I wanted to always play it down,” Trump told him in March. “I still like playing it down, because I don’t want to create a panic.”

It is important to remember two things: 1) the first set of comments came in FEBRUARY, well before there was widespread public awareness of the lethality of the virus and 2) as much of a buffoon as he is, Trump is not some rando just speculating. He is quite literally the president, with access to the world’s top scientists. So he was divulging crucial, newsworthy and time-sensitive information. Clearly, he knew more about the lethality and transmission of the virus than he was publicly letting on, and yet he was still downplaying the severity of the disease and insinuating that it is like the common flu. That’s a horrific crime against humanity — but it was aided and abetted by the popular face of investigative journalism: Mr. All The President’s Men himself.

Now they’re blaming Trump

Now they’re blaming Trump. pic.twitter.com/fzve2mb7kU

— Ian Miles Cheong (@stillgray) September 10, 2020

What, wait? Woodward sat on this info too?

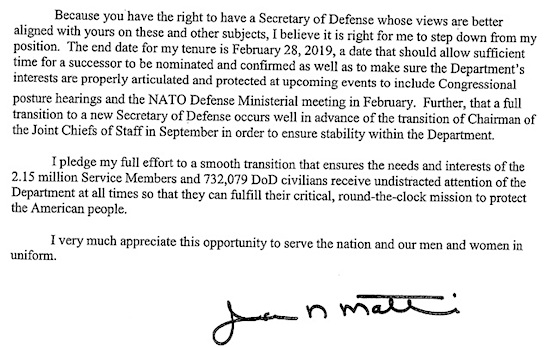

• Woodward: General James Mattis Plotted Overthrow of US Government (CT)

According to a pre-release excerpt from the Washington Post Bob Woodward writes about a discussion between General James Mattis and Director of National Intelligence Dan Coats about a plot to overthrow the elected government of the United States. […] “Mattis quietly went to Washington National Cathedral to pray about his concern for the nation’s fate under Trump’s command and, according to Woodward, told Coats, “There may come a time when we have to take collective action” since Trump is “dangerous. He’s unfit.” What do you call a conversation between the Defense Secretary and the head of the U.S. intelligence apparatus where they are talking about taking “collective action” to remove an elected President? That’s called sedition…. A seditious conspiracy.

As alarming as that sounds on its face, this actually aligns with our own previous research into key military leadership, the joint chiefs, and their corrupt intent to overthrow the elected government. Readers will remember when we noted this very issue after Lt. Col Alexander Vindman compromised his position yet was not removed by his command structure within the Pentagon.

NOVEMBER 2019 – […] For emphasis let me repeat a current fact that is being entirely overlooked. Despite his admitted usurpation of President Trump policy, Vindman was sent back to his post in the NSC with the full support of the United States Department of Defense. The onus of action to remove Vindman from the NSC does not just lay simply at the feet of the White House and National Security advisor Robert O’Brien; and upon whose action the removal of Vindman could be positioned as political; the necessary, albeit difficult or perhaps challenging, obligation to remove Lt. Col Vindman also resides purposefully with the Dept. of Defense. The Pentagon could easily withdraw Vindman from his position at the National Security Council; yet, it does not…. and it has not. WHY?

There is a code within the military whereby you never put your leadership into a position of compromise; ie. “never compromise your leadership”. In this example, President Trump cannot remove Vindman from the White House NSC advisory group due to political ramifications and appearances… The Joint Chiefs certainly recognize this issue; it is the very type of compromise they are trained to remove. Yet they do nothing to remove the compromise. They do nothing to assist. Lt. Col. Alexander Vindman was the majority (#1) source for the material CIA operative Eric Ciaramella used in a collaborative effort to remove President Trump from office. Let me make this implication crystal clear:

The United States Military is collaborating with the CIA to remove a U.S. President from office. Do you see the issue now? The Pentagon has done nothing, absolutely nothing, to countermand this implication/reality. The Joint Chiefs of Staff have done nothing, absolutely nothing, to diminish the appearance of, nor deconstruct the agenda toward, the removal of President Trump. Mr. President, do I have your attention?

You want to go after Trump? This is a much better and worthier topic.

• Julian Assange ‘Targeted As Political Opponent Of Trump Administration’ (ES)

Wikileaks founder Julian Assange has been targeted as a “political opponent” of President Trump’s administration and threatened with the death penalty, the Old Bailey heard today. Professor Paul Rogers, a lecturer in peace studies at Bradford University and specialist on the ‘War on Terror’, said Assange’s opinions put him “in the crosshairs” of Trump’s top team. Giving evidence to Assange’s extradition hearing this morning, he said he believes the prosecution case is part of a drive in the United States to target “dissenters”. “In my opinion Mr Assange’s expressed views, opinions and activities demonstrate very clearly ‘political opinions’”, he told the court.

“The clash of those opinions with those of successive US administrations, but in particular the present administration which has moved to prosecute him for publications made almost a decade ago, suggest that he is regarded primarily as a political opponent who must experience the full wrath of government, even with suggestions of punishment by death made by senior officials including the current President.” [..] Professor Rogers, in his witness statement, said Assange’s work involved exposing secrets that the US government wanted to keep hidden, he had been in conflict with the Obama administration, but there was “no question” that Assange had been targeted as a political opponent by Trump’s officials.

“The opinions and views of Mr Assange, demonstrated in his words and actions with the organisation WikiLeaks over many years, can be seen as very clearly placing him in the crosshairs of dispute with the philosophy of the Trump administration”, he said. Assange’s legal team argue that a decision was taken under President Obama not to prosecute the Wikileaks activist, but that move was overturned under Trump. During the Obama presidency there was a greater recognition of the problems and less pressure on those presenting conflicting evidence”, said Professor Rogers. “But since the election of President Trump there has been a vigorous denigration of the Obama era, a return to the outlook of the Bush administration and even more bitter opposition to those perceived as dissenters, especially those involved in communicating unwelcome information such as Mr Assange.”

Craig Murray Assange

Craig Murray (@CraigMurrayOrg) gives @SputnikInt his view that today's hearing went very well for #JulianAssange's defence team. pic.twitter.com/fyFLtogxxz

— Mohamed Elmaazi (@MElmaazi) September 9, 2020

From Julian’s mother, Christine:

“Its a stategic mistake as a #FreeAssange supporter to say:

“Even if you dont like #JulianAssange as a person defend him on free press principles”

1) Its giving credibility to the personal smear campaign!

2) People DONT support people they dont like!”

• How The US Makes You Focus On Assange’s Personality (Chomsky, Walker)

Assange is not on trial for skateboarding in the Ecuadorian embassy, for tweeting, for calling Hillary Clinton a war hawk, or for having an unkempt beard as he was dragged into detention by British police. Assange faces extradition to the United States because he published incontrovertible proof of war crimes and abuses in Iraq and Afghanistan, embarrassing the most powerful nation on Earth. Assange published hard evidence of “the ways in which the first world exploits the third”, according to whistleblower Chelsea Manning, the source of that evidence. Assange is on trial for his journalism, for his principles, not his personality. You’ve probably heard the refrain from well-meaning pundits: “You don’t have to like him, but you should oppose threats to silence him.”

But that refrain misses the point by reinforcing the manipulative tropes deployed against Assange. When setting a gravely dangerous precedent, governments don’t typically persecute the most beloved individuals in the world. They target those who can be portrayed as subversive, unpatriotic – or simply weird. Then they actively distort public debate by emphasizing those traits. These techniques are not new. After Daniel Ellsberg leaked the Pentagon Papers to journalists to expose the US government’s lies about Vietnam, the Nixon administration’s “White House Plumbers” broke into Ellsberg’s psychiatrist’s office in search of material that could be used to discredit him.

NSA whistleblower Edward Snowden was falsely portrayed as collaborating with the Chinese, then the Russians. Obsession with military intelligence analyst Manning’s mental health and gender identity was ubiquitous. By demonizing the messenger, governments seek to poison the message. The prosecution will be all too happy when coverage of Assange’s extradition hearing devolves into irrelevant tangents and smears. It matters little that Assange’s beard was the result of his shaving kit having been confiscated, or that reports of Paul Manafort visiting him in the embassy were proven to be fabricated. By the time these petty claims are refuted, the damage will be done. At best, public debate over the real issues will be derailed; at worst, public opinion will be manipulated in favour of the establishment.

“I’m now understanding that he did this because he was upset that the Director’s reopening of the investigation was going to negatively affect the election for Hillary Clinton.”

• Steele Acted Crazy, His FBI Handler Says: People’s Ears Were Bleeding (RCI)

“Crazy” was the term the FBI agent used to describe the behavior of Christopher Steele, author of the now-debunked Trump-Russia dossier. “I’ve seen crazy source-related stuff in 20 years in New York and this was one of the craziest,” the veteran agent testified to the Senate Select Committee on Intelligence. Nevertheless, the FBI continued to rely on Steele’s allegations – that Donald Trump and his team were conspiring with Russians who possessed compromising information – to justify its surveillance of the Trump campaign. Without evidence to verify Steele’s claims, the FBI fell back on its assertion that the former British intelligence agent was reliable. The previously unreported testimony of FBI agent Michael Gaeta is found on page 900 of the fifth and final volume of the Senate committee’s probe of Russian interference in the 2016 election.

It raises new questions about the basis of the FBI’s investigation of the Trump campaign, Crossfire Hurricane, and the declarations it made to the FISA court in four separate applications submitted to spy on American citizens. Gaeta had a long history with the London-based Steele, who had started his own firm, Orbis Business Intelligence, after leaving the British spy service MI6 in 2009. Between 2013 and 2016, the bureau had paid Steele $95,000 to pass along tidbits on Eurasian organized crime; Gaeta was his contact at the bureau. It was Gaeta whom Steele approached in July 2016 with wild and depraved stories of collusion and kompromat. Gaeta became the “handling agent” for Steele’s participation in Crossfire Hurricane. Among his tasks was to get Steele paid (a process that came along slowly) and to see to it that Steele didn’t violate the FBI’s rules on confidentiality.

This requirement for discretion created a conflict of interest for Steele, who was also being paid for the same information by the Washington-based firm Fusion GPS. Fusion, in turn was being paid by the Democratic National Committee and the Hillary Clinton campaign for opposition research on Trump. The Democrats wanted Steele’s information spread far and wide. They also wanted to be able to claim that the FBI was investigating the allegations. Paid FBI informants, however, are not allowed to tell anyone of their work for the FBI or of the bureau’s investigations. Gaeta was astonished, then, when shortly before the 2016 election an article appeared in Mother Jones titled “A Veteran Spy Has Given the FBI Information Alleging a Russian Operation to Cultivate Donald Trump.” The sub-headline asked, “Has the bureau investigated this material?” Gaeta was convinced Steele was the source for the article and confronted him about it. Steele readily admitted he was behind the Mother Jones story.

[..] Here’s how Gaeta recounted that conversation to the Senate: “Listen, is it about the money?” Gaeta asked Steele. “Because we have the money now. Is it about the money?” The FBI had promised, but had yet to deliver to Steele, $15,000 for one meeting with Crossfire Hurricane agents. The bureau had further promised Steele he would be paid “significantly” for his Trump-Russia research. Gaeta assumed at first a delay in payment had made Steele go rogue. “Yes, I’m owed the money, but that’s secondary,” Steele told Gaeta. “I’m very upset about – we’re very upset – about the actions of your agency.” By the “we” in “we’re very upset” one can reasonably infer that Steele was speaking about himself and his client, Fusion GPS head Glenn Simpson (whose client, not counting cutouts, was Hillary Clinton’s campaign).

The handling agent was shocked: “I had no idea what he was talking about.” Before Gaeta could inquire further, Steele started railing about ”your Director” and his “reopening of the investigation.” This was an apparent reference to former FBI Director James Comey’s decision to reopen the probe into Hillary Clinton’s private email server after 340,000 copies of State Department emails between Clinton and her close personal aide, Huma Abedin, were discovered on a laptop used by Abedin and her husband, Anthony Weiner. He was a disgraced congressman under investigation by the bureau’s New York office for sending sexually explicit messages and photos to an underage girl. At which point it all became clear to the handling agent: “I’m now understanding that he did this because he was upset that the Director’s reopening of the investigation was going to negatively affect the election for Hillary Clinton.”

Oh, look, there’s Victoria Nuland again. Where’s the investigation into this?

• The Mysterious Destruction Of Evidence Related To Steele Dossier (Solomon)

Earlier this year, the infamous dossier author Christopher Steele revealed he had destroyed nearly all the records detailing his dirt-digging on Donald Trump and Russia. “They no longer exist,” Steele told a British court. Now comes word that Steele’s primary and longtime contact inside the Obama State Department, Jonathan Winer, also destroyed records of the former British MI6 agent’s contacts inside that federal agency, including many of the 100-plus unsolicited intelligence reports Steele provided the Obama administration. “I destroyed them, and I basically destroyed all the correspondence I had with him,” Winer is quoted as saying in a little noticed passage of the Senate Intelligence Committee’s final report on the Russia collusion scandal.

Winer apparently destroyed the records at Steele’s request, the report said. “After Steele’s memos were published in the press in January 2017, Steele asked Winer to make note of having them, then either destroy all the earlier reports Steele had sent the Department of State or return them to Steele, out of concern that someone would be able to reconstruct his source network,” the committee’s report released last month stated. The consequence of the document destruction appears to have been real. “Department of State was able to produce for the Committee, from their archives, many Steele memos from 2015 and some from 2016, but most of his reports from 2014 are missing,” the committee noted.

The missing documents create an evidentiary hole in the story of Steele’s extensive contact at the Obama State Department, where he delivered through Winer a total of 120 reports on Russia and Ukraine policy matters that reached as high as Assistant Secretary of State Victoria Nuland and Secretary of State John Kerry. “Starting in 2013, Steele offered Winer, who was then at Department of State, reports he had written for clients on Russian-Ukrainian political leadership, economic issues, and political security,” the Senate report reveals. “Winer showed them to Nuland, who asked Winer to share them with her Principal Deputy, Paul Jones.

“Winer recounted Nuland’s reaction: ‘She said, these are good reports; they’re valuable; keep them coming.’ Winer further said that State officials thought the reports were ‘shockingly real-time.’ Nuland, who said that she never met Steele, told the Committee, ‘I found his stuff to be 70, 75 percent accurate, credible … when he was off base, it generally looked to me, felt to me, like he had been paying human sources who were exaggerating or getting extra money by pumping up what they knew or extrapolating.'”

“It turns out ‘Hey Alexa’ is short for ‘Hey Keith Alexander.”

• Ex-NSA Chief Involved In Mass Spying Snowden Revealed Joins Amazon Board (RT)

General Keith Alexander, ex-director of the National Security Agency, who oversaw illegal mass spying on Americans, has been appointed to Amazon’s board of directors, drawing the ire of privacy advocates, including Edward Snowden. Amazon announced that Alexander, who served as NSA director from 2005 up to his retirement in March 2014, will join the company’s board on Wednesday. “We’re thrilled to elect a new member to our Board of Directors this month. Welcome, General Keith Alexander!” the tech giant said in a statement on Twitter. However, some, including the ex-CIA contractor Edward Snowden, were less than “thrilled” about the appointment.

Snowden – who in 2013 blew the whistle on a secret NSA surveillance program, leaking a massive trove of documents proving the bulk and warrantless collection of Americans’ telephone records by the government – was one of the first to call out Amazon for hiring Alexander. “It turns out ‘Hey Alexa’ is short for ‘Hey Keith Alexander.’ Yes, the Keith Alexander personally responsible for the unlawful mass surveillance programs that caused a global scandal,” tweeted the whistleblower, who remains in exile in Russia.

Snowden noted that while Amazon Web Services (AWS) hosts nearly 6 percent of all websites, the figure looks even more damning “if you measure it by traffic instead of number of sites.” Journalist Glenn Greenwald, a Snowden ally who was awarded a Pulitzer Prize for his reporting on the US intelligence machine’s global mass surveillance program, tweeted that Alexander’s appointment only revealed Amazon’s true colors. “Gen. Keith Alexander was head of NSA when it secretly built a massive domestic surveillance system aimed at Americans – the one an appellate court just ruled likely illegal. Amazon just appointed him to its Board of Directors, again showing who they are,” Greenwald said.

Last week, a federal appeals court ruled that the “bulk collection” of data used by the NSA was illegal, with Snowden hailing the decision as a milestone in the fight against government-sanctioned snooping. Even without an ex-spy chief with a less-than-stellar reputation in terms of privacy protection on its board, Amazon has faced growing pushback over its intrusive high-tech devices. Its virtual assistant Alexa was caught red-handed passively recording intimate conversations of unsuspecting family members, while its new fitness tracker ‘Halo’ promises to scan users’ bodies and track emotions in their voice.

Now we know why nobody is investigating the Wuhan lab, and why the WHO team was not allowed anywhere near it.

• NIH Funded Human Coronavirus Experiments In 2019 In China (JTN)

The National Institutes of Health (NIH) was funding experiments in China in 2019 that sought to assess the risk of dangerous coronaviruses jumping from bat populations into human beings — research conducted in a laboratory near the site of — and possibly around the time of — the initial outbreak of the SARS-Cov-2 pandemic in that country, records show. The State Department, meanwhile, noted in 2018 that NIH has been a “major funder” of coronavirus research at that laboratory, one which —according to a recently released State memo — possessed a “shortage of trained staff EcoHealth Alliance, a New York-based organization dedicated to infectious disease research, received $3.4 million over 6 years from NIH, according to an NIH spokeswoman. Among the sub-awardees of that grant was the Wuhan Institute of Virology, the infectious disease institute that sits within a few miles of where the Chinese government claimed the COVID-19 outbreak began.

[..] Due to the proximity of the outbreak to the Wuhan Institute of Virology, concerns have arisen in recent months that the lab was carrying out what is known as “gain-of-function” research that may have led to the pandemic. Gain-of-function experiments, as defined by the Center for Infectious Disease Research and Policy at the University of Arizona, involve “studies that enhance the pathogenicity, transmissibility, or host range of a pathogen” in order to assess the possible threat it poses to human beings, including its potential to become a pandemic virus. Citing biosafety concerns, the U.S. government in 2014 imposed a moratorium on gain-of-function studies into several types of viruses, including severe acute respiratory syndrome (or SARS) coronaviruses.

A spokeswoman for the NIH denied that the EcoHealth Alliance projects constituted gain-of-function experiments. “The research supported under grant characterized the function of newly discovered bat spike proteins and naturally occurring pathogens and did not involve the enhancement of the pathogenicity or transmissibility of the viruses studied,” she said. [..] A recently declassified State Department memo from 2018 indicates that the U.S. believed the WIV — the first P4-level lab in China — may have posed an outbreak risk due to what it said was the lab’s “shortage of trained staff” in that year at least. The P4 lab “became fully operational and began working with live viruses” only within the first four months of 2018, the memo said. The memo notes that the NIH had been a “major funder … of SARS research” at the Wuhan Institute of Virology, including helping to determine the origin of the SARS virus.

“Trump would have to be quite a feckless fascist to allow himself to be constantly maligned in the country’s major media, plotted against by his own administration underlings, and impeached.”

• Stop Crying Foul Over Fascism (Tracey)

It might not seem immediately apparent that Joe Biden would have anything in common with insurrectionary anarchists. After all, Biden has been deeply entrenched in the uppermost echelons of American political power for nearly five decades straight — whereas insurrectionary anarchists generally seek to overthrow those systems, by violent force if necessary. The former Vice-President is not exactly the type you would imagine clad in all-black combat-style street apparel, hurling commercial-grade fireworks at police officers. Rather, he drafted the infamous 1994 omnibus crime bill in concert with the National Association of Police Organizations. He is even known to venerate the arcane institutionalist ethos of the US Senate — whereas to insurrectionary anarchists, such institutions could only be tools of oppression.

But the Trump Era has an odd way of bringing about unexpected ideological convergences. In the announcement video that formally kicked off his 2020 presidential campaign, Biden paid homage to what he called the “courageous group of Americans” who descended upon Charlottesville, VA in August 2017 to confront an assembly of Right-wing rally-goers. Among that “courageous group” were Left-wing activist factions broadly classified under the banner of “antifa”. For Biden, what transpired in Charlottesville was a “defining moment,” and formed the basis for his decision to launch a third campaign for the presidency at age 76. While Biden did herald generic American idealism in that announcement video — which would be anathema to most insurrectionary anarchists — in the gravity he assigned to the Charlottesville episode, he also affirmed a core tenet of the “antifa” worldview: the notion that a uniquely pressing fascistic threat has gripped the country, and crushing this threat is a matter of unparalleled world-historic urgency.

Certainly, if you picked any “antifa” member at random, there’d be an almost 0% chance that they would express any kind of personal enthusiasm for Joe Biden. But there’d be a virtually 100% chance that they’d express a great deal of enthusiasm for the theory that “fascism” is an accurate characterisation of America’s current state of governance. Biden would be similarly enthused to present a variation of this analysis, albeit from a slightly different ideological angle. He typically intones things like, “This is not who we are”, rather than “All Cops Are Bastards”. Still, where Biden is united with “antifa” is in assigning such outsized importance to the role of small-time “fascist” agitators like the ones who gathered that weekend three years ago in Charlottesville (despite ultimately being outnumbered by Left-wing activists) on account of the validation they are purported to have received from Donald Trump. For both Biden and “antifa,” this dynamic constitutes the chief prism through which contemporary American political affairs must be viewed.

And for both Biden and “antifa,” this mode of analysis has been hugely successful. “Antifa” has succeeded in stoking nationwide insurrectionary fervour on a scale unseen in decades. Given their opposition to Trump as the alleged fascist-in-chief, as well as their appropriation of the “Black Lives Matter” protest mantle, they’ve received an extraordinary amount of mainstream liberal legitimation. Democratic Party operatives have even gone so far as to exalt “antifa” activists as the modern-day equivalents of US soldiers fighting in World War II — while apparently exhibiting no embarrassment for invoking this comparison.

[..] if your main sources of information tell you for years on end that the reins of state have been seized by an out-and-out fascist, who is fuelling a siege of “Nazi” street agitators, whatever deficiencies the Democratic Party might have at the moment are of little or no concern. Now even Sanders himself has called for a “united front” against Trump ahead of the election, seeming to suggest that the precedent of Francisco Franco is historically apt. Wasn’t the whole problem with Franco that he couldn’t be voted out? Never mind that Trump would have to be quite a feckless fascist to allow himself to be constantly maligned in the country’s major media, plotted against by his own administration underlings, and impeached.

The story that never ends, until it does.

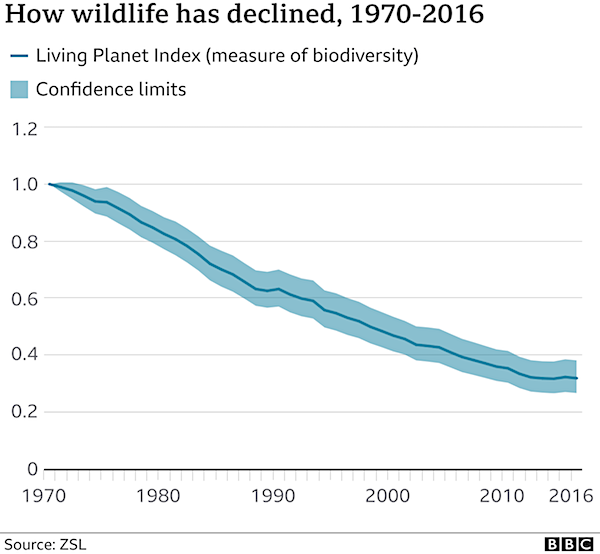

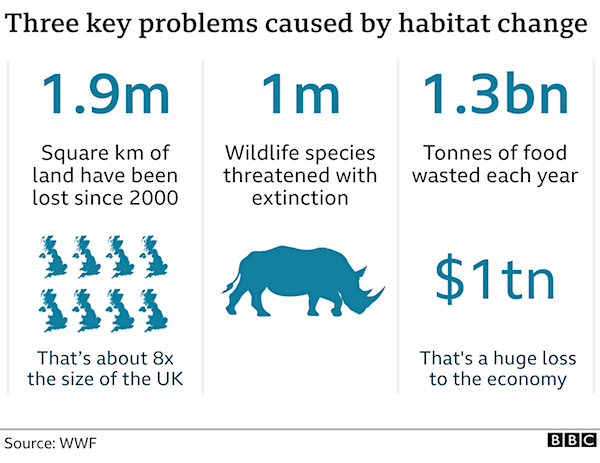

• Wildlife In ‘Catastrophic Decline’ That Shows No Sign Of Slowing (BBC)

Wildlife populations have fallen by more than two-thirds in less than 50 years, according to a major report by the conservation group WWF. The report says this “catastrophic decline” shows no sign of slowing. And it warns that nature is being destroyed by humans at a rate never seen before. Wildlife is “in freefall” as we burn forests, over-fish our seas and destroy wild areas, says Tanya Steele, chief executive at WWF. “We are wrecking our world – the one place we call home – risking our health, security and survival here on Earth. Now nature is sending us a desperate SOS and time is running out.” The report looked at thousands of different wildlife species monitored by conservation scientists in habitats across the world.

They recorded an average 68% fall in more than 20,000 populations of mammals, birds, amphibians, reptiles and fish since 1970. The decline was clear evidence of the damage human activity is doing to the natural world, said Dr Andrew Terry, director of conservation at the Zoological Society of London (ZSL), which provides the data. “If nothing changes, populations will undoubtedly continue to fall, driving wildlife to extinction and threatening the integrity of the ecosystems on which we depend,” he added. The report says the Covid-19 pandemic is a stark reminder of how nature and humans are intertwined. Factors believed to lead to the emergence of pandemics – including habitat loss and the use and trade of wildlife – are also some of the drivers behind the decline in wildlife.

New modelling evidence suggests we can halt and even reverse habitat loss and deforestation if we take urgent conservation action and change the way we produce and consume food. The British TV presenter and naturalist Sir David Attenborough said the Anthropocene, the geological age during which human activity has come to the fore, could be the moment we achieve a balance with the natural world and become stewards of our planet. “Doing so will require systemic shifts in how we produce food, create energy, manage our oceans and use materials,” he said. “But above all it will require a change in perspective. A change from viewing nature as something that’s optional or ‘nice to have’ to the single greatest ally we have in restoring balance to our world.”

Nordhaus claimed that nothing that happened indoors would be affected by climate change. And both the IPPC and the Nobel committee bought that. Oh boy!

• Nobel Prize Economics Of Climate Change Is Misleading, Dangerous (Steve Keen)

While climate scientists warn that climate change could be catastrophic, economists such as 2018 Nobel prize winner William Nordhaus assert that it will be nowhere near as damaging. In a 2018 paper published after he was awarded the prize, Nordhaus claimed that 3°C of warming would reduce global GDP by just 2.1%, compared to what it would be in the total absence of climate change. Even a 6°C increase in global temperature, he claimed, would reduce GDP by just 8.5%. If you find reassurance in those mild estimates of damage, be warned. In a newly published paper, I have demonstrated that the data on which these estimates are based relies upon seriously flawed assumptions.

Nordhaus’s celebrated work, which, according to the Nobel committee, has “brought us considerably closer to answering the question of how we can achieve sustained and sustainable global economic growth”, gives governments a reason to give climate change a low priority. His estimates imply that the costs of addressing climate change exceed the benefits until global warming reaches 4°C, and that a mild carbon tax will be sufficient to stabilise temperatures at this level at an overall cost of less than 4% of GDP in 120 year’s time. Unfortunately, these numbers are based on empirical estimates that are not merely wrong, but irrelevant.

Nordhaus (and about 20 like-minded economists) used two main methods to derive sanguine estimates of the economic consequences of climate change: the “enumerative method” and the “statistical method”. But my research shows neither stand up to scrutiny. In the enumerative method, to quote neoclassical climate change economist Richard Tol, “estimates of the ‘physical effects’ of climate change are obtained one by one from natural science papers … and added up”. This sounds reasonable, until you realise that the way this method has been deployed ignores industries that account for 87% of GDP, on the assumption that they “are undertaken in carefully controlled environments that will not be directly affected by climate change”.

Nordhaus’s list of industries that he assumed would be unaffected includes all manufacturing, underground mining, transportation, communication, finance, insurance and non-coastal real estate, retail and wholesale trade, and government services. It is everything that is not directly exposed to the elements: effectively, everything that happens indoors or underground. Two decades after Nordhaus first made this assumption in 1991, the economics section of the IPCC Report repeated it: “Economic activities such as agriculture, forestry, fisheries, and mining are exposed to the weather and thus vulnerable to climate change. Other economic activities, such as manufacturing and services, largely take place in controlled environments and are not really exposed to climate change.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Biden blooper roll

Biden: “I will beat Trump in the debates.”

Also Biden:

— Benny (@bennyjohnson) September 9, 2020

Trump Biden teleprompter

— Donald J. Trump (@realDonaldTrump) September 10, 2020

Tucker Bring the troops home

LET'S BRING THEM HOME! @TuckerCarlson pic.twitter.com/CKvEZGiDIY

— Donald J. Trump (@realDonaldTrump) September 10, 2020

Support the Automatic Earth in virustime.