René Magritte The song of the storm 1937

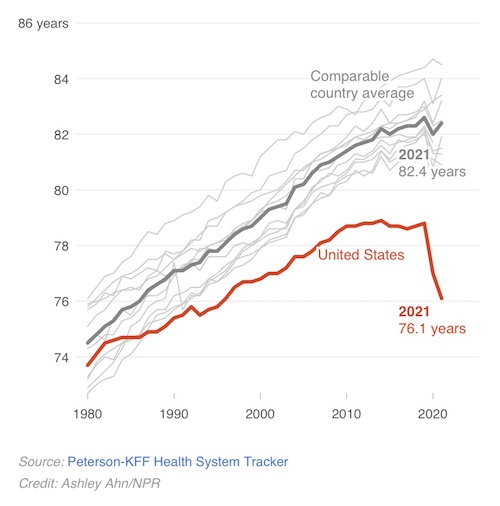

Life expectancy

Douglas Macgregor: Limited resources and the collapse of Ukraine

RESTRICT

Repression in the US is about to get turbo-charged with the RESTRICT bill S.686.pic.twitter.com/zM1vzuVgAj

— Gonzalo Lira (@GonzaloLira1968) March 28, 2023

Yeadon

https://twitter.com/i/status/1640172796797140992

https://twitter.com/i/status/1640045360369356804

Toxicity

When safety testing is skipped and a novel genetic technology is rush injected into two thirds of the worlds population, should we be surprised with a Biopharmaceutical disaster that unfolds over the ensuing years? #courageousdiscourse pic.twitter.com/dXmTK3d5WO

— Peter A. McCullough, MD, MPH™ (@P_McCulloughMD) March 27, 2023

Patrushev:

“Russia is patient and does not intimidate anyone with a military advantage. But it has a modern unique weapon capable of destroying any adversary, including the United States, in the event of a threat to its existence.”

• US Democracy ‘A Facade’ – Patrushev (RT)

The US is not really a democracy, nor does it seek to promote democracy in its relations with other nations, contrary to Washington’s claims, senior Russian security official Nikolay Patrushev has said. He made the remarks while commenting on the upcoming ‘Summit for Democracy’ hosted by the US government. Patrushev, who is the secretary of the Russian Security Council, described the US economy as “dependent on corruption and lobbying connections going to the White House and Capitol Hill.” Corporate interests have hijacked the levers of political power in the US and use the country’s international clout to pursue their own agenda, he said in an interview with Rossiyskaya Gazeta newspaper, to be published in full later today.

Their democracy is a pretty facade for the political system, which serves to hide the neglect of the rights of ordinary Americans. Washington pursues the same approach in the international arena, where it claims to be the champion of democracy but disregards other nations’ sovereignty, Patrushev said. He believes that this “hypocrisy” will be on display at the Summit for Democracy, which will kick off this week in Washington. The event will be “a gathering to support a world order in which Washington wants to play the central role forever. Dissenters will be labeled ‘undemocratic states,’”he predicted. The US, which “appointed itself the dictator of the world, will harass the nations whose sovereignties and democracies were undermined,”by Washington.

The reality is that “Washington has long been a leader in violating the sovereignty of other nations, in the number of wars and conflicts it has unleashed,” the security chief said. He called the nations that support this arrangement “vassals” that are constantly “humiliated” in their abusive relationships with the US. The international event, which is being held for the second time, is meant to promote democracy against what Washington increasingly sees as assertive “authoritarian” states. The US reportedly invited all participants of the first summit, which was held in 2021, including the administration of the self-governed Chinese island of Taiwan. NATO members Hungary and Türkiye were snubbed once again, according to Foreign Policy magazine.

Patrushev:

“The collapse of the European Union is just around the corner…The United States is ready to fight Russia…to the last European. Even during the Cold War, the Pentagon, at the slightest danger from the USSR, was ready to turn Europe into a radioactive desert.”

• Russian Security Chief Calls US World’s Biggest Dictator (TASS)

Washington actually violates the sovereignty of other countries while claiming to support free speech and is the world’s biggest dictator, Russian Security Council Secretary Nikolay Patrushev said in an interview with Rossiyskaya Gazeta. “While disingenuously talking about freedom of choice, the United States, which has proclaimed itself the world’s biggest dictator, will in fact simply abuse the countries whose sovereignty and democracy it violated,” he said, commenting on the upcoming Summit for Democracy. Patrushev emphasized that this event, which was organized by the White House, “certainly takes place within the framework of the US presidential race that has already begun.” He believes the summit will be “another meeting in favor of the world order, where Washington wants to play a central role indefinitely, and any dissidents can be expected to be labeled as ‘non-democratic states’.”

“Once again, the US will proclaim itself the defender of international law and declare that the rest of the world must follow its rules. The geopolitical opponents will be deliberately falsely accused of war crimes and corruption, but as usual they will turn a blind eye to real acts of genocide and financial fraud committed with the approval of the White House,” Patrushev added. He also believes that promises will be made to feed the hungry and release those wrongly imprisoned. “However, they will remain silent about the fact that about one-fifth of all prisoners in the world are held in US prisons, including those sentenced to multiple life terms. They will zealously support the rights of sexual minorities and impose a ‘green agenda’ on the entire globe, exacerbating the energy crisis in satellite countries,” Patrushev warned.

“[Russia] saved the US at least twice – during the Revolutionary War and the Civil War. But I believe that this time, helping the US to maintain its integrity would be inappropriate..”

• US Politicians ‘Held Captive By Their Own Propaganda’ – Patrushev (RT)

US politicians are “held captive by their own propaganda” and still believe that Washington could deliver a fatal nuclear ‘first strike’ against Russia, the secretary of the Russian Security Council, Nikolay Patrushev, has said. That Cold War-era strategy, however, is nothing but a “dangerous” and “short-sighted” delusion nowadays, Patrushev said in an interview with the newspaper Rossiyskaya Gazeta published on Monday. “Held captive by their own propaganda, American politicians for some reason remain confident that in the event of a direct conflict with Russia, the US is capable of delivering a preventive missile strike, after which Russia will no longer be able to respond. This is a short-sighted delusion, and a very dangerous one,” Patrushev stated.

The ‘first strike’ strategy dates back to the early days of the Cold War between the Soviet Union and the US. Its proponents believe that achieving a certain advantage in nuclear warheads and means of delivery would allow a preemptive strike on an adversary without suffering an equally destructive retaliation. The concept was among the primary reasons behind the Cold War-era arms race, with both sides fearing a first strike at various points. Nowadays, however, Russia possesses state-of-the-art weapons that Patrushev warned are capable of defeating any opponent, should the country’s existence be threatened. “Forgetting the lessons of history, some in the West are already talking about revanche, which will lead to a military victory over Russia,” he stated.

“Russia is patient and does not threaten anyone with its military advantage. But it has modern unique weapons capable of destroying any enemy, including the US, in case of a threat to its existence.” Moreover, Moscow no longer believes it would be “appropriate” to help the US once again defend its sovereignty and territorial integrity should it be threatened, the security official stated. “[Russia] saved the US at least twice – during the Revolutionary War and the Civil War. But I believe that this time, helping the US to maintain its integrity would be inappropriate,” Patrushev said.

Lavrov

https://twitter.com/i/status/1640026645334487049

As “..NATO members appeared to be using the Ukraine crisis to dispose of “old equipment they no longer need.”, Russia issues new jets.

• Russia’s Newest Jets Provide Air Superiority – Ukrainian Official (RT)

Russia is increasingly dominating the skies over eastern Ukraine in its conflict with the former Soviet republic because the latest generation of its Su-35 fighter jet has capabilities that Kiev’s forces can’t neutralize, a senior Ukrainian government official has told ABC News. The newest Su-35s are equipped with “very effective radar and long-distance rockets,” enabling them to attack Ukrainian jets and provide air support for Russian ground troops, the unidentified official said in an article posted on Monday. Ukraine “does not have capabilities” to counter this threat, he told ABC. The Kiev regime sees Russian air superiority as a “real risk,” the official added, making its push for more air defense systems from the US “priority No. 1” for Ukraine.

“This is a problem,” another unidentified official said. “What we keep telling the Americans is that in the end, there is no other solution than to give us fighter jets.” He claimed that Russia has 12 times more military aircraft than Ukraine. The latest comments out of Kiev contradict recent claims by Western leaders. Russia’s air power in Ukraine is limited by Kiev’s air defenses, including surface-to-air missiles, one Western official told reporters in a briefing last week. “We’re not seeing a huge change in that situation.” However, the Ukrainian official noted that as Russia replaces older models of aircraft with the latest Su-35, it’s gaining a stronger advantage.

He conceded that with Washington refusing so far to provide fighter jets to Ukraine, there is increasing acceptance in Kiev that the government should focus on trying to get more air defense systems and artillery from the US. The governments of Slovakia and Poland pledged last week to give Soviet-era MiG-29 fighter jets to Ukraine. Kremlin spokesman Dmitry Peskov said the two NATO members appeared to be using the Ukraine crisis to dispose of “old equipment they no longer need.”

It’s what happens when you only blindly follow.

• The EU Is Losing Relevance In The Emerging New World (Fomenko)

Vladimir Putin and Xi Jinping met in Moscow last week, and Western circles predictably responded by accusing Russia of becoming “subservient” or even a “vassal state” to China. MEP Guy Verhofstadt, a Euro-fantasist and former prime minister of Belgium, jeered on Twitter, “Putin’s appalling legacy now includes turning Russia more and more into a Chinese vassal state,” oblivious to the irony of his own words. As the United States took the lead in denouncing China’s peace plan for the Ukraine conflict, publicly setting out the conditions on which it should end, the European Union was nowhere to be seen, or at least had nothing original to say. This makes Verhofstadt’s comments a damning display of lacking self-awareness. Russia and China are setting out their vision for a new multipolar world, while the US struggles against them in seeking to maintain its hegemonic position.

Meanwhile, the European Union has been reduced to the status of a mere bench player in it all, and has become effectively irrelevant. The failure of EU countries to stake out their own will and position amidst the larger powers, as well as their total subservience to the US, has made a mockery of the “strategic autonomy” concept once championed by Emmanuel Macron. “Strategic autonomy” is a principle of European integration where the EU should be an actor in a multipolar world, which advocates for its own interests and pursues its own agenda. Supporters of this principle insist that the EU should not blindly follow the will of the US when it comes to every foreign policy issue, but should be proactive and enhance its role on the world stage. Therefore, they should not, as is commonly demanded by Washington, take sides on matters such as a new Cold War with China.

The term gained growing traction during the years of the Trump administration, when Europe’s relations with the US hit a low due to his particular interpretation of the “America first” doctrine. However, the practical reality of “strategic autonomy” is that the EU is not a unitary state, but a loose intergovernmental organization of states which, while seeking to establish common positions on a principle of unity, do not truly have a unified foreign-policy-making mechanism. The intra-institutional politics of the EU are often a messy compromise and battle of wills between different levels of actors, including the states themselves, the European Commission, and the European Parliament. This combines with the reality that “European integration” has been a broken process since 2008. Challenges such as the Eurozone financial crisis, Brexit, Covid-19, and internal conflicts with various states such as Poland have all weakened and fractured the EU.

As a result, the EU has been ill-suited to deal with what is, despite media misdirection, the single most explicit source of foreign influence and interference against it, the US. Washington has multiple channels whereby it exerts control over the EU’s many foreign policy actors. Firstly, it uses a web of government-funded think tanks and associated journalists to control public opinion and steer EU countries towards supporting its objectives. Secondly, the US has an extraordinarily political hold over the former Soviet bloc states to the east of the EU (with the exception of Hungary), which it uses to foment increased antagonism against Russia and China, and therefore undermines the attempts of the bloc’s most “autonomous” and powerful states – Germany and France – to pursue more reconciliatory foreign policies.

1957 CIA doc

CIA document from 1957 shows US’s long-standing plans to use Ukraine to undermine USSR and Russia, and shows that U.S. has been aware that the Donbas and Crimea have loyalty to Soviet Union and Russia. pic.twitter.com/k3CgnJEOEl

— Dan Kovalik (@danielmkovalik) March 27, 2023

Wow: “..Ukrainian border guard service discouraged draft-dodgers from seeking asylum in the EU, noting in an interview on Monday that if the man had succeeded in his border crossing, “he would have been returned to Ukraine.”

• Conscription May Be Intensified In Ukraine (RT)

Ukraine may need to conscript even more people into military service to potentially fight against Belarus, a key ally of President Vladimir Zelensky has told British television. David Arakhamia, an MP who heads the faction of the president’s Servant of the People party in the Ukrainian parliament, spoke of a potential a clash with Belarus during an interview with SkyNews on Monday. He was commenting on Russia’s announcement last week that it would place tactical nuclear weapons at a facility currently being built on Belarusian soil. “I think we are facing a real challenge to have a second front opened,” the Ukrainian lawmaker said. “That would mean a real challenge to get even more people to conscript into the army, because we will need at least eight more brigades to control the frontline.”

However, Arakhamia downplayed his own concerns by saying that much of the border his country shares with Belarus is rough terrain dominated by swamps and forests, which makes it easier to defend. He also acknowledged that despite Kiev perceiving Belarus as “the same aggressor as Russia,” there actually was “no evidence during one year of war … of any Belarussian soldier crossing the Ukrainian border.” Belarus President Alexander Lukashenko has allowed the Russian military to use his nation’s territory in its military operation against Ukraine, but repeatedly stressed that Belarusian troops were not participating in it. Meanwhile, Russian President Vladimir Putin said that the decision to place nuclear weapons in Belarus was a step prompted by the UK’s announcement that it would send depleted uranium munitions to Ukraine.

Ukraine is believed to have suffered significant casualties in the conflict with Russia, in part because Kiev has reportedly been sending untrained soldiers to the frontline as it keeps its more experienced troops behind for an expected counter-offensive. Ukrainian military officials have already ramped up their mobilization efforts, according to various media sources. Reports have surfaced of conscription officers conducting raids at places where military-age men congregate, such as markets and even night clubs. Some Ukrainians appear willing to risk their lives to avoid joining the military. Last week, a 23-year-old man drowned while trying to sneak into Romania across the Tisza River. This was reportedly the 14th such fatality this year alone. A spokesman for the Ukrainian border guard service discouraged draft-dodgers from seeking asylum in the EU, noting in an interview on Monday that if the man had succeeded in his border crossing, “he would have been returned to Ukraine.”

DPR

The Kiev regime specifically sends mobilized people from the Russian-speaking regions of Ukraine to the most difficult areas in the DPR. The Russian military near Marinka told RIA Novosti about this and showed the passports and military tickets of the https://t.co/sSbKj1OsXr… pic.twitter.com/M2p7jRliUf

— Victor vicktop55 (@vicktop55) March 27, 2023

Lovely.

• Ukrainian Refugees Targeted For Sexual Exploitation (RT)

Analysis of search engine traffic has revealed a growing interest in Ukrainian pornography, The Guardian reported on Sunday, citing a Thomson Reuters study. The findings have sparked concern over the increasing sexual exploitation of refugees. According to the outlet, researchers found that views of pornographic videos claiming to show Ukrainian refugees have seen a significant rise in the past six months. The growing interest could be encouraging human traffickers to act more regularly and with greater impunity, Thomson Reuters warned. It called for urgent action to strengthen protection for Ukrainian women and children who are at risk from sexual exploitation. It was noted that evidence of the sex trafficking of Ukrainians appeared long before Moscow launched its military offensive last year.

However, the latest data shows a significant increase in such reports in the past 12 months, while internet searches for terms such as “Ukrainian porn” are at a higher level than ever before, according to the researchers. The Guardian reports that Thomson Reuters is now working with the Organization for Security and Cooperation in Europe (OSCE) to raise awareness of the issue. The pair have launched a campaign to encourage the global community to provide Ukrainians with safety information, and to help spot the warning signs of trafficking. The OSCE’s special representative and coordinator for combating human trafficking, Valiant Richey, told The Guardian that “the high demand from men for sexual access to Ukrainian women and girls creates an enormous incentive for traffickers to recruit vulnerable people in order to meet the demand and profit from it.”

“We already found direct evidence of recruitment attempts on chats used by Ukrainians and an increase in the advertisement of Ukrainians online,” he added. According to the UN Refugee Agency, it is estimated that around 8.1 million Ukrainians have fled to Europe since Russia launched its military operation in February 2022. It is believed that around 90% of all Ukrainian refugees are women and children, as Ukrainian men between the ages of 18 and 60 are banned from leaving the country.

The UN Security Council did not accept Russia/China resolution on the establishment of a commission to investigate the sabotage at Nord Stream. The resolution was supported by 3 countries (Russia, China and Brazil), no one voted against, 12 abstained.

• Moscow Mulls Demanding Damages For Nord Stream Blasts (RT)

Moscow may insist on compensation for the blasts that ruptured the Nord Stream 1 and 2 gas pipelines last autumn, Dmitry Birichevsky, head of the Russian Foreign Ministry’s department for economic cooperation, said on Monday. Speaking to RIA Novosti, the diplomat said that Russia did not rule out “the possibility of later raising the issue of compensatory damages over the explosion of the Nord Stream gas pipelines,” which directly connected Russia and Germany under the Baltic Sea. Birichevsky did not say from whom Russia would be demanding payment, nor did he specify in what form or amount it should be.

He noted that after veteran investigative journalist Seymour Hersh released his bombshell report last month pinning the blame on the US for the sabotage – a claim dismissed in Washington – Russia prepared a resolution urging the UN Security Council to launch an independent international investigation into the matter. However, Birichevsky claimed that “Western countries are actively sabotaging the work on the draft resolution, claiming that the international investigation lacks ‘added value’.” Despite this opposition, Russia would continue to push for a “comprehensive and open international investigation,” he said, stressing that Moscow’s representatives should absolutely take part in the process.

Speaking to reporters on Monday, Kremlin Press Secretary Dmitry Peskov supported a possible push for compensation. He described the claim as “justified,” arguing that the available data “indicate that… such a terrorist attack against critical infrastructure could not have been staged without the involvement of the state and intelligence services.” In an interview on Saturday, Russian President Vladimir Putin said that he “fully agrees” with Hersh’s conclusions on who orchestrated the blasts. The American journalist alleged that US President Joe Biden ordered the attack because he did not like the German government’s reluctance to send more military support to Ukraine.

Western media, however, has presented another version of events. Earlier this month, the New York Times claimed, citing sources, that a “pro-Ukrainian group” may have been behind the attack on the pipelines while German media reported that a yacht allegedly used in the sabotage belonged to a Polish-based company owned by two Ukrainians. Kremlin Press Secretary Peskov has dismissed those reports as “a coordinated hoax” meant to divert attention from the real culprits behind the blasts.

China and Russia will be fine.

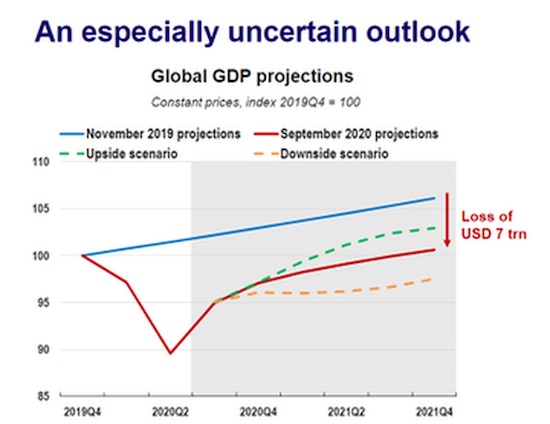

• World Bank: World Economy May Face “Lost Decade” (Az.)

The global economy’s potential growth through the end of the decade has slowed to the weakest in 30 years, the World Bank said, citing fallout from the coronavirus pandemic and the conflict in Ukraine, Report informs referring to Bloomberg. Having started the millennium on a faster trajectory, the global economy’s “speed limit” – or the highest long-term rate at which it can grow without triggering inflation – is set to slow between 2022 and 2030 to 2.2% a year, the organization said in a report released on March 27. “A lost decade could be in the making for the global economy,” Indermit Gill, the World Bank’s chief economist and senior vice president for development economics, said in a release accompanying the report.

“The ongoing decline in potential growth has serious implications for the world’s ability to tackle the expanding array of challenges unique to our times – stubborn poverty, diverging incomes, and climate change.”The silver lining of the multilateral development bank’s 550-page report: Potential growth could reach as high as 2.9%, marking an acceleration should policymakers deploy the right plans to boost productivity and labor supply and shore up investment. The World Bank’s latest research is set against the backdrop of a fragile global economy that’s still reeling from Russia’s war in Ukraine and efforts to reopen after the darkest days of the Covid pandemic. Many economies, including China, are facing ongoing demographic crises that have meant a mad scramble for policies to promote more childbearing – or to push back the retirement age, as France has most recently demonstrated.

“What do you want?” Bragg asks. “Your law license, asshole.”

• An Eastertime Carol (Kunstler)

After wolfing down a heartburn-inducing Popeye’s Shrimp Tacklebox Combo for supper, Manhattan District attorney Alvin Bragg retires to his four-poster Sleep Number bed beset with anxiety about the grand jury he has convened for fulfilling his campaign promise to stuff Donald Trump into a state prison cell. From the wall-mounted flat-screen across from his bed, the specter of a of giant rabbit emerges, gaunt and grizzled, draped in chains and weighty padlocks. “Who are you, spirit?” Bragg asks.“I am the ghost of prosecutions past,” it moans. “This night you will be visited by three other spirits: The ghost of what you wish to be, the ghost of what should be, and the ghost of actually what-it-is.” Oh, Gawd,” Bragg groans, his esophagus on fire with acidified hot-sauce residue.

The DA falls back into a febrile sleep, but wakens minutes later. The bedroom of his condo has transformed itself into a sunny street scene. He is riding an open limousine down Broadway through a blizzard of tickertape, the sidewalks filled with cheering citizens. Beside him sits a nubile person of the birthing persuasion, with supernaturally large infant-feeding glands, not unlike a certain star of adult films at the center of his brilliant case against the former president. “I am the ghost of what you wish to be,” she says, her breath warm in his ear. “You’re a bigger star now than ever I was in life, and without all the mess.” “Yeah? What’s that up ahead?” he asks. “The steps of City Hall where you will receive your Nobel Peace Prize and be handed the nomination for governor, your stepping stone to the White House.” “We gonna have to change the name of that place,” Bragg grumbles.

Suddenly a box appears on Bragg’s lap. It contains two McDonald’s Sausage, Egg, and Cheese McGriddles® plus an apple fritter and a caramel macchiato. No sooner do his teeth close on that first delicious bite, when the confetti in the air turns to pixels, which dissolve along with the street scene, and then Bragg is back in his bed. Laughter rings across the big room, but with a demonic dissonance. A large white man with a silvery mane of hair and a nose like an Appalachian dulcimer, draped in black judicial robes, sits up behind a lofty bench, wearing a scowl of privilege. “What do you want?” Bragg asks. “Your law license, asshole.”

Durham’s still around?!

• Durham Unveils Smoking Gun FBI Text Message, ‘Joint Venture’ Trump Smear (JTN)

Special Counsel John Durham is revealing new smoking gun evidence, a text message that shows a Clinton campaign lawyer lied to the FBI, while putting the courts on notice he is prepared to show the effort to smear Donald Trump with now-disproven Russia collusion allegations was a “conspiracy.” In a bombshell court filing late Monday night, Durham for the first time suggested Hillary Clinton’s campaign, her researchers and others formed a “joint venture or conspiracy” for the purpose of weaving the collusion story to harm Trump’s election chances and then the start of his presidency.”These parties acted as ‘joint venturer[s]’ and therefore should be ‘considered as co-conspirator[s],'” he wrote.

Durham also revealed he has unearthed a text message showing Hillary Clinton campaign lawyer Michael Sussmann falsely told the FBI he was not working on behalf of any client when he delivered now-discredited anti-Trump research in the lead-up to the 2016 election. In fact, he was working for the Clinton campaign and another client, prosecutors say. The existence of the text message between Sussmann and then-FBI General Counsel James Baker was revealed in a court filing late Monday night by Durham’s team. Prosecutors said they intend to show Sussmann gave a false story to the FBI but then told the truth about working on behalf of the Clinton campaign when he later testified to Congress.

“Jim – it’s Michael Sussmann. I have something time-sensitive (and sensitive) I need to discuss,” Sussmann texted Baker on Sept. 18, 2016, according to the new court filing. “Do you have availability for a short meeting tomorrow? I’m coming on my own – not on behalf of a client or company – want to help the Bureau. Thanks.” Prosecutors said the text message will become essential evidence at trial to show Sussmann lied to the FBI. “The defendant lied in that meeting, falsely stating to the General Counsel that he was not providing the allegations to the FBI on behalf of any client,” Durham’s motion said. “In fact, the defendant had assembled and conveyed the allegations to the FBI on behalf of at least two specific clients, including (i) a technology executive (“Tech Executive-1”) at a U.S.-based Internet company (“Internet Company-1″), and (ii) the Clinton Campaign.”

Some stories are crazier than others.

• Jim Jordan Demands Docs After IRS “Attempt To Intimidate” Matt Taibbi (ZH)

It has been eleven years since Lois Lerner presided over (and then apologized for) the IRS targeting of conservatives during the 2012 election. But her “inappropriate… error of judgment” may just have been turned up to ’11’ as during the day when independent journalist Matt Taibbi was in Washington DC delivering testimony to the Select Subcommittee on the Weaponization of the Federal Government on March 9, an IRS agent visited his home in New Jersey, leaving a note demanding he contact the agency within four days.

“Odd” indeed, Mr. Musk. As The Wall Street Journal reports, Mr. Taibbi was told in a call with the agent that both his 2018 and 2021 tax returns had been rejected owing to concerns over identity theft. The journalist has provided House Judiciary Committee Chairman Jim Jordan’s committee with documentation showing his 2018 return had been electronically accepted, and he says the IRS never notified him or his accountants of a problem after he filed that 2018 return more than four-and-a-half years ago. He says the IRS initially rejected his 2021 return, which he later refiled, and it was rejected again – even though Mr. Taibbi says his accountants refiled it with an IRS-provided pin number. Mr. Taibbi notes that in neither case was the issue “monetary,” and that the IRS owes him a “considerable” sum.

The bigger question on everyone’s minds (most of all Rep. Jordan) is simple – since when did the IRS dispatch agents for surprise house calls? Is this the new $80 billion budget being well spent to ‘send a message’ to a reporter telling the truth? The coincidental timing of this unannounced IRS agent visit prompted Rep. Jordan to write to IRS Commissioner Daniel Werfel and Treasury Secretary Janet Yellen, demanding answers: “In light of the hostile reaction to Mr. Taibbi’s reporting among left-wing activists, and the IRS’s history as a tool of government abuse, the IRS’s action could be interpreted as an attempt to intimidate a witness before Congress. We expect your full cooperation with our inquiry.”

Jordan added that “the circumstances… are incredible,” and “demand a careful examination by the Committee to determine whether the visit was a thinly-veiled attempt to influence or intimidate a witness before Congress.” And the committee Chair demanded that the IRS and Treasury provide the following documents and information: 1. All documents and communications referring or relating to the IRS’s field visit to the residence of Matthew Taibbi on March 9, 2023; 2. All documents and communications between or among the IRS, Treasury Department, and any other Executive Branch entity referring or relating to Matthew Taibbi; and 3. All documents and communications sent or received by Revenue Officer [James Nelson] referring or relating to Matthew Taibbi. Yellen and Werfel were given until April 10th to comply with the request.

Complex systems.

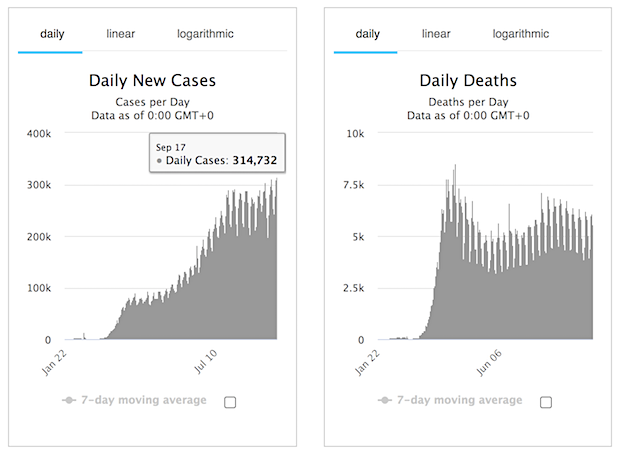

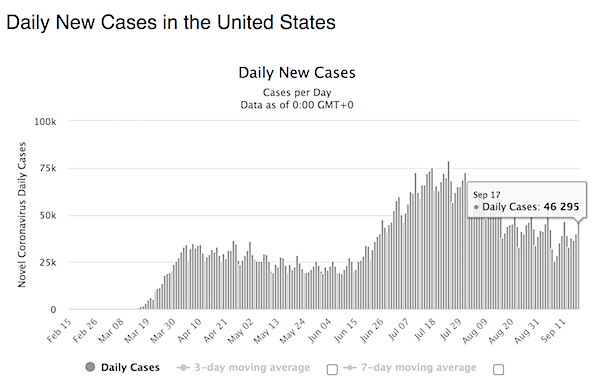

• The Worst Model in History: How the Curve was not Flattened (Ugo Bardi)

Multiparameter models of complex systems are mainly tools to interpret the data: they are meant to tell you what’s causing what and how. In the case of climate change, the models tell us that the correlation between temperature and the concentration of greenhouse gases is consistent with a causal relationship according to what we know of atmospheric physics. In other words, they provide evidence that greenhouse gases are “forcing” the climate system to heat up. But you could arrive at this conclusion even without models: just on the basis of known physics and observations. After all, Svante Arrhenius had already arrived at a reasonably correct estimation of the parameters of the system in 1896, without using sophisticated models. Then, suppose the concentration of greenhouse gases continues increasing. In that case, we can expect that temperatures will keep increasing, too, and over a certain level, that’s surely not a good thing for us.

Climate models, incidentally, tend to be optimistic in the sense that they are normally unable to describe the kind of abrupt climate changes that occur in the form of “Seneca Cliffs” which were observed in the remote past. In climate science, they are often called “climate tipping points,” going through one would surely be extremely bad for us. This said, there remains the typical problem of multiparameter models: that of separating the roles of parameters that have similar effects on the system. Climate models might overestimate the role of greenhouse gases and underestimate the cooling effects of the ecosystem’s metabolic processes, as argued, for instance, in this paper by Makarieva et al. In that case, we risk neglecting the role of an important factor in what we are seeing.

So, do we run the risk of making the same mistakes with climate change mitigation that were made with the attempt to flatten the curve during the Covid-19 epidemic? That is, do we risk disrupting the fabric of society for an overestimated risk or for the misattribution of the causes of the problem? I’d say it is unlikely, but we need to keep an open attitude and accept that, with new data, models must change (which is exactly what was not done with the Covid epidemic). The only certain thing is that disasters are unavoidable if complex systems are left to politicians to manage. There are several other areas of modeling that developed features that could be described as “flattening the curve” — perhaps the main one is the series of scenarios presented in the 1972 study, “The Limits to Growth.” One of the proposals, for instance, was to place a cap on industrial production to reduce the exploitation of natural resources.

It is likely that it was never intended as a realistic proposal but rather as an illustration of the features of the model. In any case, there were no global political structures that could have imposed such a rule, and its consequences on the real world would have been unknown and possibly negative or even disastrous. Indeed, if you look at the most recent incarnation of the concepts at the basis of “The Limits to Growth” idea, the 2022 study “Earth4All,” you’ll see that there are no proposals aiming at “flattening” any curve. The proposed interventions are all based on resource allocation, changes in the financial and political structure of society, and more aiming at steering, but not forcing, the system to move in a certain direction. It is an approach pioneered, among others, by one of the authors of the 1972 “The Limits to Growth,” Donella Meadows, with her concept of “leverage points.” We are still learning how to manage complex systems, but we are starting to understand that brutal, top-down actions do not usually work.

“..if a sponsor doesn’t like what the committee has to say—the conclusions of the committee—… the sponsor can’t prevent the report from being made public,” Stratton said. “This is a very powerful tool that we have.”

• US Expert Panel to Meet on Adverse Events Caused By COVID-19 Vaccines (ET)

A group of U.S. experts is set to meet soon as part of a project to determine which adverse events the COVID-19 vaccines cause. The National Academies of Sciences, Engineering, and Medicine (NASEM) has appointed a committee to review evidence on the relationship between the vaccines and specific adverse events that have occurred after vaccination, including infertility and sudden death. The committee’s process includes establishing methods, reviewing literature, drawing conclusions, and preparing a report. “The committee will make conclusions about the causal association between vaccines and specific adverse events,” the NASEM website states.

While their work is funded by the U.S. Centers for Disease Control (CDC) and the U.S. Department of Health and Human Services (HHS), the sponsors will not be able to examine the report before it is published to the public, Kathleen Stratton, a NASEM official, said during a recent meeting. “What that means is that if a sponsor doesn’t like what the committee has to say—the conclusions of the committee—… the sponsor can’t prevent the report from being made public,” Stratton said. “This is a very powerful tool that we have.” Dr. Tom Shimabukuro, a CDC official, told panel members recently that the CDC would help members locate studies and data from the agency. “We very much value your expertise and your independence. We look forward to working with you, look forward to seeing the results of your findings,” he said.

The upcoming meeting will be held on March 27 and March 31, the latter of which will include time for public comments. The rest of the two-day meeting will be held behind closed doors. The panel already met on Jan. 25 and Feb. 1. “Your conclusions will help inform injury compensation recommendations and decisions when assessing whether specific adverse events are causally associated with vaccines,” Dr. George Reed Grimes, the official in charge of the HHS Division of Injury Compensation Programs, told panel members during the meeting. The report is slated to be published in March 2024.

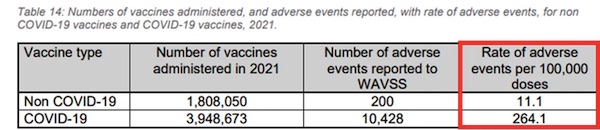

“Australia is experiencing worse excess mortality than at any point in 80 years, while neighboring New Zealand is experiencing the worst mortality since the Spanish flu.”

• Australia Bears Witness To Vaccine Deaths (Horowitz)

Despite everything we know about the deadly and ineffective nature of the COVID shots, our government recommends four booster doses for people as young as 6 months old. The shots have even been added to the child immunization schedule. Yet there is no protest whatsoever from the GOP establishment, including the biggest voice among them – Donald J. Trump. Just how radical is this? Even Australia – the poster child for COVID fascism – now only recommends the shots for the elderly and those with health risks. Perhaps it’s because the excess deaths down under have become too big to ignore. Australia is experiencing worse excess mortality than at any point in 80 years, while neighboring New Zealand is experiencing the worst mortality since the Spanish flu.

Officials won’t openly acknowledge the likely cause, but their policy changes regarding boosters clearly demonstrate a quiet walk-back of the needle idol. The latest booster advice from the Australian Technical Advisory Group on Immunisation (ATAGI) only recommends new doses for those over 65 and those “at risk,” while recommending against the shots for children. Moreover, as our government continues to completely deny any risk in the shots, the government of Western Australia’s Department of Health recently revealed that its own safety monitoring showed that there is a 24 times greater risk of adverse events following the COVID shots than other vaccines. This was in 2021 before the boosters, when the excess deaths really accelerated in Australia. It would be nice to see the total numbers, but those 2021 numbers were hidden for over a year as officials pushed the boosters.

Meanwhile, in the U.S., we still have a total blackout from Republicans, including from Donald Trump, who not only falsely said the vaccines saved millions, but completely denied the existence of any risk. “I have had absolutely no side effects,” he coldly noted in an interview. Even the Australian Department of Health conceded, “Adolescents and younger adults have a lower age-related risk of severe COVID-19, and a comparatively higher risk of myocarditis following vaccination.” Who would have thought the top GOP leaders would be to the left of Australia? Obviously, the media is trying to cover up the pandemic of deaths in Australia by suggesting it has nothing to do with the shots. Of course, the Associated Press’ fact-check team, in their infinite wisdom, have concluded that the surge in deaths must be because of COVID itself.

But that is a self-indictment of the vaccine. How could Australians experience almost all of their COVID deaths AFTER the vaccine and boosters? We were all told that the vaccine itself was supposedly 95% effective against hospitalizations and deaths, if not against transmission. Yet a new preprint study estimates that Aussie excess deaths in 2021 were seven times higher than during the pre-vaccine pandemic year of 2020 and an unfathomable 19 times higher in 2022. That was the year of mild Omicron, and everyone was boosted. Checkmate.

“Net Zero is becoming the dividing line in the age-old battle between Right and Left, Free markets and Socialism, Cavaliers and Roundheads..”

• Climate Hysteria and Woke Gobbledegook Are Becoming Inseparable (DS)

One of Britain’s leading climate ‘experts’, Professor Kevin Anderson, has provided a valuable insight into the increasingly bizarre demands that surround the promotion of the collectivist Net Zero political project. Writing in the Conversation, he argues for Net Zero within 12 years, complete with a refit of U.K. housing stock, a withdrawal of all combustion engine cars in favour of expanded public transport, electrification of industry, the roll out of ‘zero-carbon’ energy, and the banning of all fossil fuel production. To achieve his aims, Anderson suggests mobilisation on the scale of the post-war European reconstruction Marshall Plan. Others might suggest his crackpot schemes will leave the country facing a similar scale of destruction, ruin and poverty to that caused by the Luftwaffe.

Anderson is currently a Professor of Energy and Climate Change at the University of Manchester and he has plenty of form when it comes to extremist claims and calls for widespread rationing. As early as 2010, he was calling on politicians to consider a rationing system “similar to the one introduced during the last time of crisis in the 1930s and 40s”. He also suggested a limit on electricity “so people are forced to turn the heating down”, and a limit on goods that require a lot of energy to manufacture. On a practical level, Anderson’s latest calls for radical societal restructuring under the guise of a ‘climate emergency’ are plainly ridiculous. Retrofitting Britain’s well-ventilated housing and industrial stock along with installing heat pumps would cost around £3 trillion, according to a paper published last year by the technology professor Michael Kelly – equivalent, it should be noted, to Britain’s annual GDP.

That, of course, is before we’ve factored in the cost of Anderson’s other plans such as retrofitting the entire industrial and transport infrastructure, all within the next 12 years. In its more sane moments, even Extinction Rebellion might be proud of such an ambitious plan. Collectivist economic solutions alongside the ubiquitous woke dogma are increasingly dominating debate around climate change. This blatantly political agenda is said to be dictated by ‘the Science’ which its advocates then refuse to discuss, a ruse used to disguise the paucity of evidence that humans control the climate thermostat. Net Zero is becoming the dividing line in the age-old battle between Right and Left, Free markets and Socialism, Cavaliers and Roundheads. In the U.S. the issue is rapidly becoming yet another fight between the Republicans and the Democrats. Similar trends are likely in the U.K. and Europe as Net Zero starts wreaking economic and social havoc.

JFK Secret Society

JFK's Secret Society speech….and Mystery Babylon today. pic.twitter.com/SQ437WrZOV

— DailyNoah.com (@DailyNoahNews) March 25, 2023

Frequency+Bowie

https://twitter.com/i/status/1640042545416925185

Sinatra

One of the most extraordinary tribute speeches you’ll ever hear – delivered with typical power & profundity by RICHARD BURTON to his friend FRANK SINATRA in 1983.

Phenomenal stuff.

— Michael Warburton (@MichaelWarbur17) March 27, 2023

The Mandelbulb is a 3-dimensional fractal that can be constructed as a Mandelbrot set in 4 dimensions using quaternions and bicomplex numbers. This is one spotted in the wild

The Mandelbulb is a 3-dimensional fractal that can be constructed as a Mandelbrot set in 4 dimensions using quaternions and bicomplex numbers. This is one spotted in the wild

[source + tutorial by Machina Infinitum: https://t.co/N0gI4D2Iyn]pic.twitter.com/lDqMQnOKCm

— Massimo (@Rainmaker1973) March 27, 2023

The marvelous spatuletail gets its name from the male’s two longest tail feathers, which can be controlled independently and play a major role in the hummingbird’s courtship displays

Shark feeding frenzy

Nature: Shark feeding frenzy.

That’s crazy. pic.twitter.com/RbfNNy4VPV

— Ben Proj (@ben_proj) March 27, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.