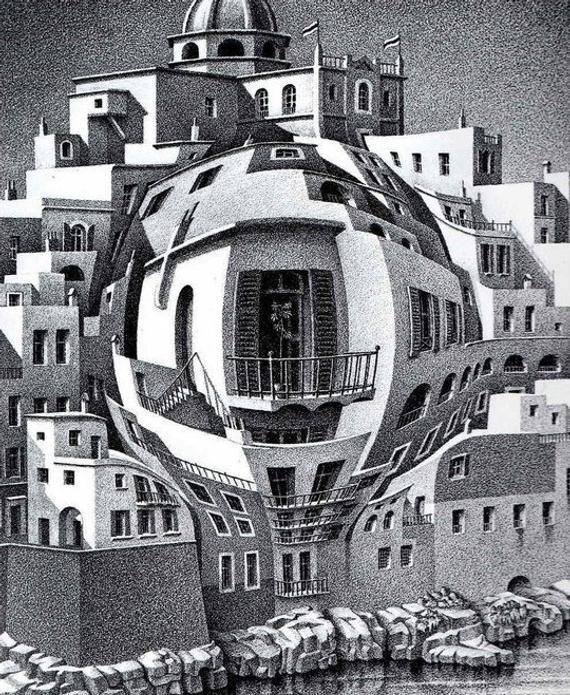

MC Escher Balcony 1945

The Working Class pay taxes.

The Middle Class pay accountants.

The Upper Class pay politicians.

There’s a new meme in town: #AlexandriaOcasioSmollett. No comment.

Psaki calls out RT and Sputnik in front of the MSM. It’s too much.

"It's important for the American people to know [RT and Sputnik] are outlets working on behalf of foreign governments that have an agenda. They’re not playing the role of 'free media' the way you all are…”

Jen Psaki claims RT definitely has an agenda, but CNN, Fox, BBC do not? pic.twitter.com/NlzQUOr7NL

— Rachel Blevins (@RachBlevins) February 3, 2021

“..several hundred times more effective than the current arsenal of antiviral treatments and is also effective against combined infections.”

• ‘Deadly Carrot’-Derived Antiviral Could Be Magic Bullet (RT)

Scientists are extolling the efficacy of a wonder drug in combating not only Covid-19 but influenza and other respiratory illnesses, in what may pave the way for a new generation of medicines to prevent future pandemics. Researchers led by a team at the University of Nottingham discovered that the broad spectrum antiviral thapsigargin has shown to be effective against SARS-CoV-2 (which causes Covid-19), a common cold coronavirus, the respiratory syncytial virus (RSV) as well as influenza A virus. Acute respiratory infections can be somewhat indistinguishable from one another on initial presentation to a doctor, which may result in lost time in terms of deploying the correct treatment. However, with an effective, broad-spectrum antiviral that can handle many of the main, more serious culprits with ease, it could yield far more positive outcomes for patients and medical practitioners.

Furthermore, it could also turn the tide against spontaneous community outbreaks of certain infections, including the dreaded clusters of Covid-19 which humanity can expect even after widespread vaccine rollout. The researchers, led by Professor Kin-Chow Chang, closely examined the plant-derived antiviral and put it through its paces against a number of pathogens. They found that it triggers a highly effective antiviral immune response against three major types of human respiratory viruses, and works before or during active infection, while preventing a virus from self-replicating for at least 48-hours, a critical component in stamping out community infections.

The drug remains stable in hostile, acidic environments, such as the human stomach, meaning it can be administered orally, without the need for injection or hospital admission, saving precious resources in the process. The researchers also claim the drug, derived from the ‘deadly carrot’ thapsia plant, is several hundred times more effective than the current arsenal of antiviral treatments and is also effective against combined infections. A derivative of the drug has been used in prostate cancer treatment, so concerns about safety in humans have already been allayed.

“The current pandemic highlights the need for effective antivirals to treat active infections, as well as vaccines, to prevent the infection,” Chang said, adding that future pandemics are likely to be zoonotic in nature, either animal-to-human or vice versa, so treating viral infections in humans and animals is crucial to prevent future catastrophe. The drug may mark the beginning of a new generation of powerful, host-centred antivirals, resulting in a holistic “One Health” approach to control both human and animal viruses and, hopefully at least, prevent further pandemics from inflicting such damage on the human race.

And that’s before suspected COVID influence on -male- fertility.

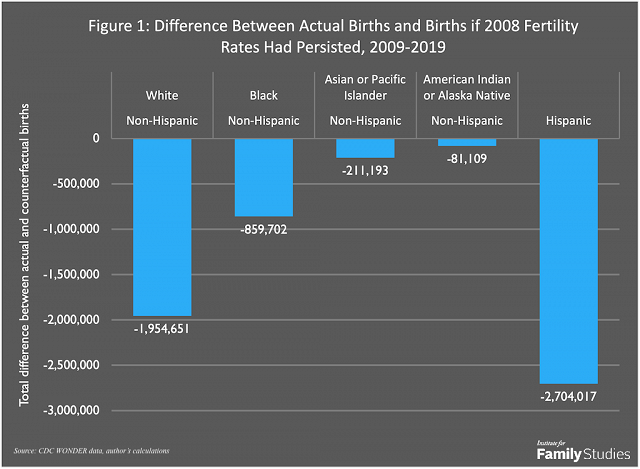

• 5.8 Million Fewer Babies: America’s Lost Decade in Fertility (IFS)

Fertility rates have fallen around the world over the last decade—even in countries with generous social welfare states, which experts had long expected to be holdouts in the face of fertility declines. But while demographers often talk about this change in terms of “fertility rates” or “births per woman,” another way to tally the total is in terms of missing births. That is, if the population of women who might have kids changed the way it did over the last decade, and if fertility rates had remained at their 2008 levels (the last time we had replacement-rate fertility in America), how many more babies would have been born?

The answer is 5.8 million babies. Since births in the U.S. actually tend to run around 4 million per year, that’s almost like saying nobody had a baby for a year and a half. Figure 1 below shows the difference between the number of babies actually born to moms of each major racial or ethnic group tracked by the CDC from 2009-2019, and the number that would have been born, had 2008 fertility rates remained stable but underlying population totals changed in the same way.

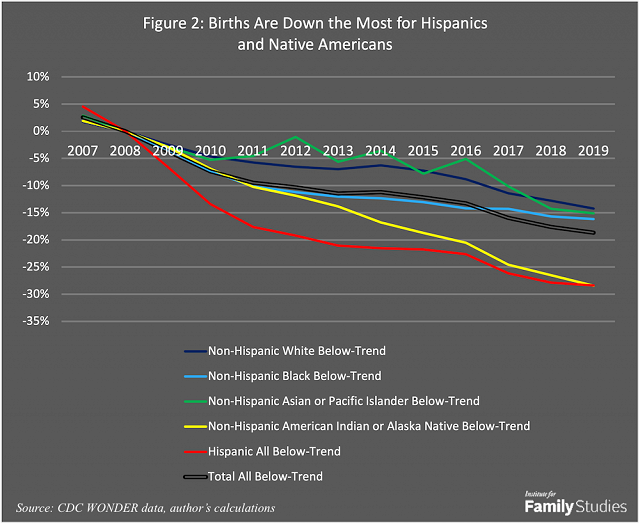

The lion’s share of “missing babies” would have been born to Hispanic moms. That’s because in 2008, Hispanic moms could expect to have about 2.8 kids on average; now, they can expect to have about 2. Fertility rates declining by almost a third is a huge change, resulting in a loss of 2.7 million Hispanic babies that would otherwise have been born. Non-Hispanic whites make up the second biggest category of missing babies, with almost 2 million missing births. But that’s a bit of an illusion: in fact, non-Hispanic white fertility rates experienced the least amount of decline of any group (from 1.9 children per woman to 1.6; Asian-Americans have always been lower, falling from 1.8 to 1.5). But the number of potential non-Hispanic white moms is very large. Figure 2 below shows the percentage difference between actual births each year, and the expected number of births for that group and year.

“Some of the current situation you are seeing – one of the factors – is there is a lot of liquidity, and some of that relates to Fed purchases..”

• Dallas Fed’s Kaplan: Reddit-Fueled Trading Frenzy Driven Partly By Fed (R.)

Dallas Federal Reserve Bank President Robert Kaplan said Tuesday that while the Fed’s massive bond-buying program is creating plenty of liquidity in financial markets, there are no signs of broad market instability at present. “I don’t see anything right now systemic,” Kaplan said in a CNBC interview, responding to a question about a possible link between the Reddit-fueled frenzy in GameStop Corp shares and monetary policy. Kaplan did not comment on GameStop directly, and instead addressed the broader question of how Fed policy affects financial markets.

“Some of the current situation you are seeing – one of the factors – is there is a lot of liquidity, and some of that relates to Fed purchases of $80 billion of Treasuries and $40 billion of mortgage-backed securities every month: I think it’s wise for us to acknowledge that.” The Fed has kept interest rates near zero since last March and has pledged to keep them there until the economy has returned to full employment and inflation has reached, and is on track to overshoot, the Fed’s 2% goal. It has also said it will keep buying at least $120 billion of bonds each month until there is “substantial further progress” toward the Fed’s full employment and 2% inflation goals, a benchmark that Fed Vice Chair Richard Clarida has said may not be reached until next year.

“Customers with direct market access are welcome, but raises questions about… new ways to manipulate markets..”

Let’s stick with the old ways.

• Beware Of Social Media-Fuelled Bubbles In Market – French Regulator (R.)

An increase in retail investors flocking to online brokers during the coronavirus pandemic risks creating “bubbles” engineered by social media, France’s top markets regulator said on Wednesday. Robert Ophele, chair of France’s AMF markets watchdog, said the trading frenzy fuelled by posts on the Reddit forum and surge in bitcoin prices have shown how technology and social media can bring “irrationality” to financial markets. “Customers with direct market access are welcome, but raises questions about… new ways to manipulate markets with a social media dimension,” Ophele told an Afore Consulting webinar.

Step 1: stop calling it a market.

• The Stock Market Is Broken, Now for All to See (WS)

It has finally blown into the open for all to see. The stock market has been broken for a while, for a long time, actually. The idea that the stock market is where price discovery takes place on a rational transparent basis, with ups and downs, and some amount of chaos, but free of rampant manipulations – that idea has now totally imploded. What has been visible for a long time but now blew into the open is just how manipulated the market is, by all sides, how overleveraged the big players are because the Fed encouraged them to, and how enormous the risks are, and how crazy the trading strategies are. And the stock market soared to record out-of-whack valuations, in a terrible economy where at least 10 million people have lost their jobs and are still out of work, and where entire industries have gotten crushed.

The whole thing is propped up by stimulus and bailout payments to consumers and companies alike. And then came a new force – or rather the force wasn’t new, but the magnitude was: regular folks ganging together in the social media, particularly on Reddit’s WallStreetBets, and they were deeply cynical about the fake markets and they saw an opportunity, and they conspired to make a ton of money and push some hedge funds over the cliff, by buying long the most shorted stocks, in other words, they conspired to engineer a historic short-squeeze. This coordinated buying by the crowd on WallStreetBets, of a handful of small most-shorted stocks, drove up their prices sometimes by 100% or more in a day, which pushed the hedge funds that were short these stocks to the brink. And it pushed online broker Robinhood to the brink. And it revealed for all to see just how broken the stock market has been.

“With the Town Square now digitized, centralized, and privatized in the hands of a cartel of Big Tech companies, the protections of the First Amendment no longer apply.”

Some of us warned of a slippery slope when Parler was taken down and a sitting president was systematically ghosted from every online speech platform. But we could not have foreseen how slippery the slope would be, or how fast we would slide down it. We were told that the curbs on speech of President Trump and his supporters were necessary to prevent further “insurrection” and protect the peaceful transition of power. However, much like the troops and barricades that still ring the Capitol, these speech restrictions remain in place well after the transition of power has occurred. The censorship power is always justified in response to a genuine outrage or crisis, but it is rarely relinquished once the threat passes. Rather it gets weaponized to protect powerful, connected insiders, as the GameStop fiasco illustrates.

How do we suppose Discord chose that moment to enforce its “Community Guidelines” against WallStreetBets? Almost certainly, one of the hedge funds whose ox was being gored combed through their message boards looking for anything that might violate the terms of service. And surely they found it, as these boards contain the same raunchy language you would hear if you visited any trading floor or boiler room on Wall Street. They presumably reported the content to Discord, which took the group down. Did Discord warn WallStreetBets of content violations before last Wednesday? I’m sure they did. Amazon sent such a warning letter to Parler as well. Frankly, such a letter could be, and likely is, sent to every large message board on the web.

The founder of a user-generated content site described it to me as “the One Percent Problem.” Every user-generated content site will have a small percentage of offensive material that gets through, no matter how many content moderators are hired. For example, Facebook, Twitter, and YouTube allowed far more content advocating for and planning the Capitol riot than Parler. But instead of acknowledging this, they were eager to blame the upstart, which had recently taken over the top spot in the social networking category in the app store. Scapegoating Parler served the dual purpose of deflecting blame and squashing a competitor. Critics of social networks insist that these sites simply need to double down on censorship in order to finally rid us of problematic speech. But that ignores how social media moderation actually works.

Algorithms set to recognize keywords capture only a small fraction of problematic posts, leaving millions of posts for humans to review. The work is so voluminous that it’s outsourced to far-flung locales where English may not even be the first language. Low-level employees must decipher complicated guidelines while navigating our increasingly Byzantine world of political and cultural hot-buttons. Mistakes are inevitable, and the harder a company tightens the standards to get the One Percent Problem down to 0.1 or 0.01 percent, the more undeserving accounts—from Ron Paul to the Socialist Equality Party—will be swept up in the dragnet. With the Town Square now digitized, centralized, and privatized in the hands of a cartel of Big Tech companies, the protections of the First Amendment no longer apply.

The battle against Bitcoin will be fierce.

• SWIFT Sets Up Digital Currency Joint Venture With China’s Central Bank (R.)

SWIFT, the global system for financial messaging and cross-border payments, has set up a joint venture with the Chinese central bank’s digital currency research institute and clearing centre, in a sign that China is exploring global use of its planned digital yuan. Other shareholders of the Beijing-based venture include China’s Cross-border Interbank Payment System (CIPS) and the Payment & Clearing Association of China, both supervised by the People’s Bank of China (PBOC), according to public information.

The new entity, called Finance Gateway Information Services Co, was established in Beijing on Jan. 16, and its business scope includes information system integration, data processing and technological consultancy, according to the website of the National Enterprise Credit Information Public System. China is a front-runner in the global race to launch central bank digital currencies, having launched domestic trials in several major cities including Shenzhen, Chengdu and Hangzhou. Its digital currency will help increase oversight of money flows, while also raising the efficiency of cross-border payments and facilitate yuan internationalization, HSBC said in a recent report. China’s cross-border payment system CIPS both partners and competes with SWIFT amid growing Sino-U.S. tensions.

Rickards recognizes the role of money velocity in inflation, but doesn’t explain why he sees it change.

• “It Can’t Happen Here” (Rickards)

The Federal Reserve printed $4 trillion in the years following the 2008 crash, expanding its pre-crisis balance sheet of about $900 billion to roughly $4.5 trillion. Many people thought, if hyperinflation were ever going to happen in the U.S., it would have already. Well, it never happened. Today, in response to the pandemic and the economic lockdowns that followed, the Fed has cranked up the printing press to even higher levels. It’s printed almost as much money in one year as it printed in the several years after the financial crisis. On February 26, 2020, the balance sheet was $4.16 trillion. Less than one year later, it’s roughly $7.3 trillion. Meanwhile, America’s M1 money supply spiked 70% last year.

But this blizzard of money-printing has not caused the level of alarm that the post-financial crisis money creation caused. If we didn’t get the hyperinflation then, they say, why should we get it now? Most people are complacent. They have a point. We still have no hyperinflation or even moderate inflation (except maybe in asset prices). But I’ve even argued that we won’t see inflation right away. Inflation is not only a product of money creation but also of money velocity. You can print as much money as you want, but if it’s not exchanging hands and there isn’t much turnover, it won’t lead to inflation. Inflation is at least as much a psychological phenomenon as a monetary phenomenon. And expectations right now are for disinflation.

Because of the lockdowns and their economic fallout, we will likely suffer a recession in the first quarter of 2021. Money velocity is low, so disinflation is the problem in the short term. But that doesn’t mean inflation isn’t coming back or even that hyperinflation isn’t possible once it does. Inflation will return, and when it does, it could be massive and potentially lead to hyperinflation. All this can happen faster than most people think.

A useful scapegoat is past his best before date.

• Andrew Cuomo Was a Villain All Along (NR)

For much of the past year, the mainstream media and Democrats have largely blamed former president Donald Trump and his administration for most of America’s COVID-19 deaths. Trump did indeed fail in certain aspects of coordination, messaging, and inserting politics into the parts of the process where it didn’t belong. He deserves credit, however, for Operation Warp Speed, the initiative that (ultimately successfully) fostered the development of coronavirus vaccines, one of the most successful public-private ventures in modern history. But Trump’s overbearing personality tended to absorb all the attention, leaving little room for real debate on the successes and failures of other politicians, except when the media found time to criticize Republican governors. But serious criticism of Democrats in this period was rare. Until now.

Last week, New York attorney general Letitia James, a Democrat, released a long-awaited report on the state of New York’s response to the coronavirus outbreak as led by Governor Andrew Cuomo. Her findings were stunning in their demonstration of both gross incompetence and outright malfeasance, and were recently reinforced by a New York Times report this week on Cuomo’s leadership failures and staffing troubles during the coronavirus period. The Times now reports that nine leading health-care experts for the state of New York resigned during the last summer and through the fall, all of whom complained that Cuomo had politicized health-care decisions and was ignoring the experts on long-standing plans for the pandemic, including regarding vaccinations.

Why the discrepancy? First, the state refused to count those patients who were transferred to, and later died at, hospitals. Why this loophole? Nobody has ever provided a good answer. Every other state in the country counts these deaths in the nursing-home numbers, because that is the practical and commonsense way to count it. New York specifically chose to be an outlier. The real failure, however, was New York’s unwillingness to be transparent with the data after the fact. For many who analyzed the data in April and May, it quickly became apparent that the state was not being fully transparent on nursing-home deaths. Many individuals were reporting that their family members died at the hospital, but only after getting severely ill at their extended-care facilities first. But somehow the numbers did not appear to bear that out.

An objective observer might be willing to give anyone in charge during such horrific events the benefit of the doubt. New York was at the time the worldwide center of COVID deaths, and it continued in this manner all through the spring. The vast majority of the more than 40,000 deaths in the state occurred during a horrific twelve-week period, when hospitals and health professionals faced war-like situations as patients died left and right.

Please don’t send anyone to jail!

• Media Runs Defense as Amazon Caught Stealing Millions From Workers (MPN)

It has been a turbulent 24 hours for retail giant Amazon. First, the company’s founder (and world’s richest individual) Jeff Bezos announced that he would step down as CEO. Then, the Federal Trade Commission (FTC) ruled that the company had illegally stolen more than $61 million worth of customer tips meant for its delivery drivers. Under their contracts, Amazon drivers were supposed to make between $18 and $25 per hour and keep all their tips. However, since at least 2016, the company had been secretly confiscating tips customers sent through an app, using their contributions to reduce their own wage payouts, meaning they were swindling both customers and employees. “In total, Amazon stole nearly one-third of drivers’ tips to pad its own bottom line,” said FTC Commissioner Rohit Chopra.

Unlike corporate crime cases in other nations, Amazon will merely be required to pay back the money it took from employees. Thus, it will face no negative consequences, except a possible public relations backlash due to bad press. Yet, instead of grilling Amazon, the media appear to be working hard to run defense for it, downplaying the nature of the crime in their headlines. The word “steal” was noticeably absent from much of the reporting, despite the fact that the original Reuters report used the word in its title — a direct reflection of the FTC’s ruling. Many newspapers instead decided to go with “withhold” instead. Even worse, many more framed the news as a mere allegation, despite the fact that the FTC had made a formal ruling.

Forbes, for instance, led with the headline “Amazon Will Pay $61.7 Million Settlement After Allegedly Withholding Tips From Delivery Drivers.” Others (Daily Caller, Daily Mail) did the same. Meanwhile, in a tweet on the news, Vox claimed that (emphasis added) “Amazon will pay $61.7 million in a settlement over allegations that the company used customer tips to subsidize the hourly wages of some delivery drivers.” Thus, the fact that Amazon had been caught stealing was watered down into a claim that it was merely “subsidizing” “some” of its employees’ wages.

Perhaps the worst offender was business and tech news site ZDNet, whose headline was “Amazon will pay $61.7 million to settle Flex driver tip dispute with FTC,” which obscured the matter into a foggy and very technical sounding financial dispute. Only a very small number of outlets, including Slate and The Huffington Post, echoed the FTC’s decision by using the word “stole” in their headlines.

The most extreme things in the US military take place in far-away lands.

• Defense Sec. Orders 60-Day Stand-down To Confront Extremism In Military (MT)

Defense Secretary Lloyd Austin has called on the services to conduct a 60-day stand-down on the issue of extremism in the military, prompted by the Jan. 6 attack on the the Capitol and subsequent reports of both active-duty and former service members attending a rally calling to overturn the 2020 election and the riot that ensued. Austin held a meeting Wednesday of the service secretaries and Joint Chiefs, Pentagon spokesman John Kirby told reporters, to ask them about their concerns and ideas for improving the situation. “Even though the numbers might be small, they may not be as small as we would like them to be, or we believe them to be,“ Kirby said of the prevalence of troops with extremists views, ties or activities. “And that no matter what it is, it is not an insignificant problem.”

Guidance is forthcoming on what Austin expects to see after the 60 days. “It wasn’t a blithe, ‘Hey, just go talk to your people,’” Kirby said of Austin’s direction to the service secretaries and Joint Chiefs. “He was very clear that he wants commands to take the necessary time. And I didn’t hear him be overly proscriptive about that … to speak with troops about the scope of this problem, and certainly to get a sense from them about what they’re seeing at their level.” The Defense Department does not centrally track troops who have been investigated for domestic terrorism or extremist sentiment, and neither do the services, making it difficult to get a read on how prevalent the problem is. Kirby told reporters on Jan. 28 that the FBI opened 143 investigations into troops and veterans in 2020, 68 of those for domestic extremism.

The MIC needs orders.

• US Admiral Warns Nuclear War With Russia, China a ‘Real Possibility’ (Antiwar)

The head of US Strategic Command (STRATCOM) warned that a nuclear war with Russia or China is a “real possibility” and is calling for a change in US policy that reflects this threat. “There is a real possibility that a regional crisis with Russia or China could escalate quickly to a conflict involving nuclear weapons, if they perceived a conventional loss would threaten the regime or state,” Vice Adm. Charles Richard wrote in the February edition of the US Naval Institute’s monthly magazine. Richard said the US military must “shift its principal assumption from ‘nuclear employment is not possible’ to ‘nuclear employment is a very real possibility,’ and act to meet and deter that reality.”

The STRATCOM chief said Russia and China “have begun to aggressively challenge international norms and global peace using instruments of power and threats of force in ways not seen since the height of the Cold War.” Richard hyped up Russia and China’s nuclear modernization, calling for the US to compete with the two nations. When it comes to China’s nuclear weapons, the US and Russia have vastly larger arsenals. Current estimates put Beijing’s nuclear arsenal at about 320 warheads, while Washington and Moscow have about 6,000 warheads each.

Was it Trump’s policies that made them stronger, or was it the way America handled Trump?

• Xi, Putin Make The Case For Win-Win, Not Zero-Sum (Escobar)

The best in-depth analysis of Putin’s extraordinary speech , hands down, was provided by Rostislav Ishchenko, whom I had the pleasure to meet in Moscow in 2018. Ishchenko stresses how, “in terms of scale and impact on historical processes, this is steeper than the Battles of Stalingrad and Kursk combined.” The speech, he adds, was totally unexpected, as much as Putin’s stunning intervention at the Munich Security Conference in 2007, “the crushing defeat” imposed on Georgia in 2008, and the return of Crimea in 2014. Ishchenko also reveals something that will never be acknowledged in the West: “80 people from among the most influential on the planet did not laugh in Putin’s face, as it was in 2007 in Munich, and without noise immediately after his open speech signed up for a closed conference with him.”

Putin’s very important reference to the ominous 1930s – “the inability and unwillingness to find substantive solutions to problems like this in the 20th century led to World War 2 catastrophe” – was juxtaposed with a common sense warning: the necessity of preventing the takeover of global policy by Big Tech , which “are de facto competing with states”. Xi and Putin’s speeches were de facto complementary – emphasizing sustainable, win-win economic development for all actors, especially across the Global South, coupled with the necessity of a new socio-political contract in international relations. This drive should be based on two pillars: sovereignty – that is, the good old Westphalian model (and not Great Reset, hyper-concentrated, one world “governance”) and sustainable development propelled by techno-scientific progress (and not techno-feudalism).

So what Putin-Xi proposed, in fact, was a concerted effort to expand the basic foundations of the Russia-China strategic partnership to the whole Global South: the crucial choice ahead is between win-win and the Exceptionalist zero-sum game.

Amen.

• If BlacK Lives Matter Wins Nobel, Rename It ‘Mostly Peaceful’ Prize (RT)

While 2020 may be remembered as the year Orwell turned over in his grave – and also the year deemed the perfect “match” for Satan – 2021 might well be remembered for the year Alfred Nobel did back flips in his. The Nobel Peace Prize has often generated controversy over many of its dubious nominees and recipients. Secretary of State Henry Kissinger shared the prize with his counterpart, Le Duc Tho, “for jointly having negotiated a cease fire in Vietnam in 1973.” Kissinger won despite his role in the bombings in Cambodia and in the killings in ‘Operation Candor’. President Barack Obama was awarded the Nobel Peace Prize in 2009, inspiring him to bomb seven countries as he managed to out-Bush G.W. Bush. The former Nobel secretary told the AP news agency in 2015 that in awarding the prize to Obama, “the committee didn’t achieve what it had hoped for.” You don’t say?

Yet, one of the biggest jaw-droppers may be a current contender, the corporate-funded Marxist front group, Black Lives Matter. The nomination must make BLM’s sponsors proud. And how much do corporate socialists like Black Lives Matter? As of June 2020, corporate America had pledged BLM over $1.678 billion, led by Bank of America and cheap-labor lover Nike. BLM was nominated for the Nobel Peace Prize by a Norwegian lawmaker. NBC News reported: “In his nomination letter, Petter Eide, a Socialist Left member of the Storting, Norway’s parliament, wrote that he had nominated Black Lives Matter ‘for their struggle against racism and racially motivated violence.’”

By now, much has been said about BLM’s violent roots. I discovered attempts by BLM (and its enablers) to disguise its history and ideology. But BLM’s scrubbing of its shady past has been to no avail, since its goals and tactics were on full display in the BLM-inspired riots. Protests and riots, including looting and arson, rampaged through the US from May to December 2020. The violence that resulted in the aftermath of the killing of George Floyd in Minneapolis was the first “multi-state catastrophe event” ever declared for civil disorder by claim-tracking company Property Claim Services, Triple-I has said. BLM demonstrations have included calling for the murder of police officers: “What do we want? Dead cops. When do we want it? Now!” On August 29, 2015, during a Black Lives Matter march outside the Minnesota State Fair in St. Paul, a chant rang out: “Pigs in a blanket, fry ‘em like bacon.” Inspired by BLM, at least two police officers were murdered, one at point-blank range.

On September 16, 2020, Axios headlined: “$1 billion-plus riot damage is most expensive in insurance history.” But noted in the report was the obligatory leftist cover for those who looted and set many cities ablaze. “The protests that took place in 140 U.S. cities this spring were mostly peaceful, but the arson, vandalism and looting that did occur will result in at least $1 billion to $2 billion of paid insurance claims.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Not quite dead yet meme:

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.