Harris&Ewing “Street scene with snow, F STreet Washington, DC” 1918

“What surprises me is that this all-or-nothing positioning takes anybody in. Debts are debts? Please.”

• Why Europe Will Cave to Greece (Bloomberg)

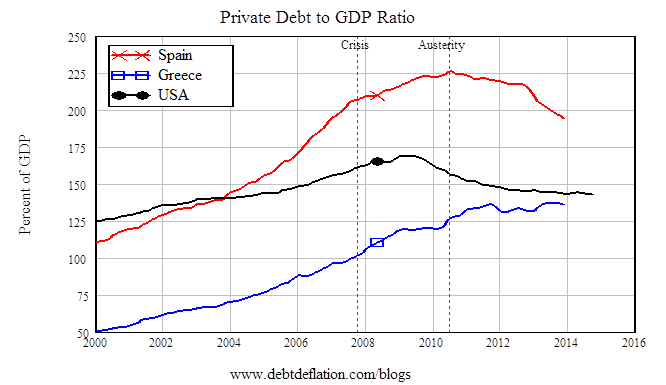

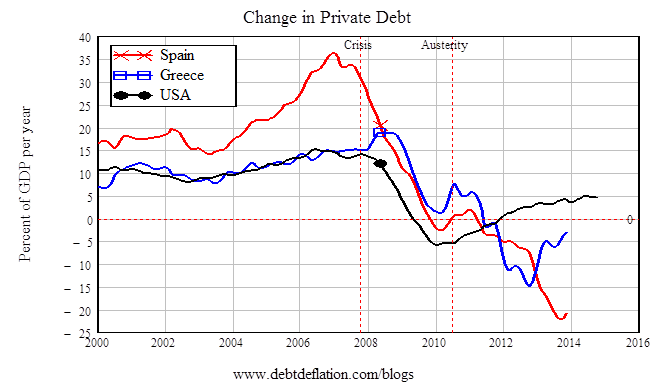

A prediction for you: Greece and the European Union will split the difference in their quarrel over debt relief. What’s uncertain is how their respective governments will justify the new deal, and how much damage they’ll inflict on each other before accepting the inevitable. EU governments, with Germany in the lead, are saying that debt writedowns are out of the question. Debts are debts. Greece’s newly elected leader, Alexis Tsipras, calls the current settlement “fiscal waterboarding” and says his country faces a humanitarian crisis. His government won’t pay and wants much of the debt written off. Neither side is willing to give way. What surprises me is that this all-or-nothing positioning takes anybody in. Debts are debts? Please. Europe’s governments have already provided debt relief to Greece. (In that process, private creditors saw their loans written down; most of what remains is owed to governments.)

However, the plan hasn’t worked. Greece’s fiscal position was so bad that the haircuts, reschedulings and interest-rate concessions weren’t sufficient to restore its creditworthiness. At the same time, thanks to slower-than-expected growth, the fiscal conditions tied to the settlement proved harsher than intended. Greek voters have just repudiated those terms. In other words, the existing settlement has failed. It therefore needs to be revised. No conceptual revolution is required. This conclusion follows from the same kind of analysis that EU governments have already relied on. For sure, granting additional debt relief has drawbacks – just as there were drawbacks to granting debt relief in the first place. It sends a bad message; it encourages bad behavior in future; it will inflame resentment among voters in other EU countries.

That’s why it’s a good idea, so far as possible, to make relief conditional on efforts to behave responsibly. But the likely consequences of any EU refusal to budge are much worse. There’s a serious risk that Greece will default unilaterally. This would not be in Greece’s interests, but it’s too close a call for comfort. The existing settlement will require the government to run primary budget surpluses (that is, excluding interest payments) in the neighborhood of 4% of GDP That means that if Greece defaulted, it could cut taxes or raise public spending substantially without needing to borrow. The downside of default would be huge – possible ejection from the euro system. That would be a calamity for Greece and, because of the risk of contagion, for the rest of the euro area as well. Nonetheless, if the EU offers Tsipras nothing, that’s how things could turn out.

“.. to bring its debts down to 60% of GDP – in order to meet the terms of the fiscal compact – Greece would require a primary surplus (where government income exceeds spending) of 9% (of GDP).”

• Can Europe Resist Greek Demands For A Debt Haircut? (CNBC)

As Greece’s new Prime Minister Alexis Tsipras settles into running government, euro zone leaders have rushed to dismiss talk of any haircut or forgiveness of Greek debt, but economists are already wondering how long Europe’s resistance can last. Tsipras became prime minister after his party won a snap general election on Sunday, dramatically ousting the New Democracy party and its leader Antonis Samaras from power. Samaras oversaw tough austerity measures that were imposed as part of a 240 billion euro ($271 billion) bailout terms agreed with the so-called troika, comprising the European Commission, International Monetary Fund and European Central Bank.

The left-wing party Syriza – which is joined in a coalition government by the right-wing Independent Greeks party – has said it will repeal unpopular austerity measures, rehire fired public sector workers and aim to get lenders to write off a third of Greece’s debt. Despite euro zone resistance to such a demand, the region’s leaders might not have much of a choice, according to economist Philippe Legrain. “Really, Greece needs a haircut,” Legrain, a former economic advisor to the President of the European Commission, told CNBC Tuesday. “Greece’s debts are unsustainably large.” On Monday, euro zone leaders did not delay in making their feelings on any possible debt haircut known to Syriza.

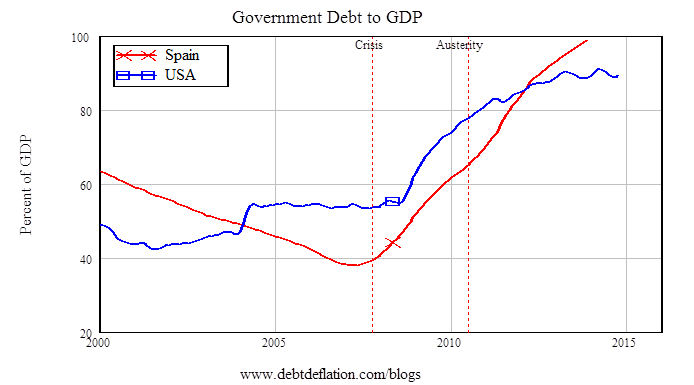

The head of the European Commission, Jean-Claude Juncker, reminded Tsipras of the need to “ensure fiscal responsibility” while German Finance Minister Wolfgang Schaeuble ruled out a debt haircut for Greece on Monday, telling ARD Television that Greece was not “overburdened by its debt servicing,” as Syriza argue. However, Legrain dismissed Scheuble’s comments as “propaganda” and criticized the Berlin government for “saying that this is somehow a bearable burden and that the interest costs are low. But to bring its debts down to 60% of GDP – in order to meet the terms of the fiscal compact – Greece would require a primary surplus (where government income exceeds spending) of 9% (of GDP).”

“Europe, like the United States, seems to be at the beck and call of its financial industry.”

• How Wall Street Squeezed Greece – And Germany (MarketWatch)

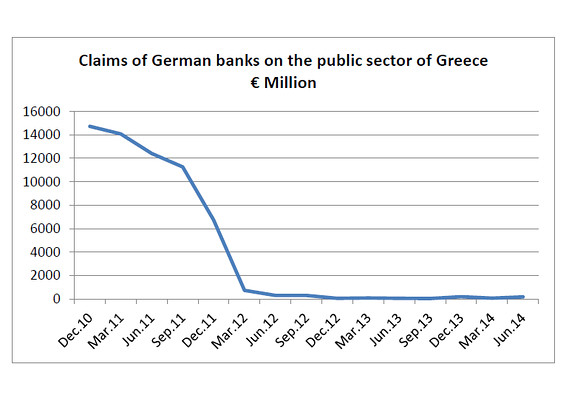

Europe’s political leaders and bankers would have you believe that the conflict between Greece and the European Union is a tug of war between a deadbeat nation and its richer ones who have come to the debtor’s aid time and time again. Instead, what most of these leaders miss is that it’s a bank bailout in plain view. What’s really happened is that since Greece ran into serious trouble repaying its debts four years ago, Germany, France and the EU have instituted what can only be described as a massive bailout of its own financial system — shifting the burden from its banks to taxpayers. Last week, asset manager Mike Shedlock republished research by Eric Dor, a French business school director, and it shows the magnitude of the shift. To put it simply, German taxpayers are on the hook for roughly $40 billion in Greek debt. German banks? Just $181 million, though they do hold $5.9 billion in exposure to Greek banks. Those numbers are a flip-flop from where things stood less than five years ago.

This massive shift from private gains to public losses was done through the European Financial Stability Facility. Created in 2010, this was the European Union’s answer to the U.S. Troubled Asset Relief Program, the Treasury Department’s 2008 bailout program. There are some differences. The EFSF issues bonds, for instance, but the principle is the same. Governments buy bad bank debt and hold it on the public’s books. The terms set by the EFSF are basically what’s at issue when we hear about Greece’s new government being opposed to austerity in their nation. The Syriza victory, which was a sharp rebuke to the massive cost-cutting in government spending, including pensions and social welfare costs, drew warnings from leaders across Europe. “Mr. Tsipras must pay, those are the rules of the game, there is no room for unilateral behavior in Europe, that doesn’t rule out a rescheduling of the debt,” ECB’s Benoît Coeuré said.

“If he doesn’t pay, it’s a default and it’s a violation of the European rules.” British Prime Minister David Cameron’s Twitter account said, the Greek election results “will increase economic uncertainty across Europe.” And Jens Weidmann, president of the German central bank, warned the new ruling party that it “should not make promises that the country cannot afford.” Those sound like very threatening words. And one wonders if these same officials made the same tough statements to Deutsche Bank, Commerzbank, Credit Agricole or SocGen when they were faced with potentially billions in losses when the banks were holding Greek debt. [..] Perhaps the move to shift Greek liabilities to state-owned banks (Germany’s export/import bank holds $17 billion in Greek debt) was necessary, but that doesn’t make it fair, or the right thing to do. Europe, like the United States, seems to be at the beck and call of its financial industry.

“Syriza wants Germany to repay a loan that the Nazis forced the Bank of Greece to pay during the occupation. That would work out at an estimated €11bn today.”

• Five Things Syriza Wants To Change (BBC)

Syriza, the left-wing party that stormed to power in Greece with 36% of the vote, has promised to ditch austerity and renegotiate the country’s €240bn bailout with the EU and IMF. But what exactly have Greeks signed up to, backing a party that was once a wide-ranging far-left coalition that included Maoists? Here are five of Syriza’s key aims.

Actions on jobs and wages Most eye-catching for Greeks is the promise of 300,000 new jobs in the private, public and social sectors, and a hefty increase in the minimum monthly wage – from €580 to €751. The new jobs would focus on the young unemployed – almost 50% of under-25s are out of work – and the long-term unemployed, especially those over 55. Salaries and pensions plummeted in 2012 as Greek ministers tried to curb spending. Now Syriza aims to reverse many of those “injustices”, bringing back the Christmas bonus pension, known as the 13th month, for pensioners receiving less than €700 a month. Syriza says it will rebuild Greece with what it describes as four pillars: • Confronting the humanitarian crisis • Restarting the economy and promoting tax justice • Regaining employment • Transforming the political system to deepen democracy

Power to the people For Syriza, 300,000 appears to be a magic number. They are promising 300,000 households under the poverty line up to 300 kWh of free electricity per month and food subsidies for the same number of families who have no income. Tax on heating fuel will be scrapped. Then there are plans for free medical care for those without jobs and medical insurance.

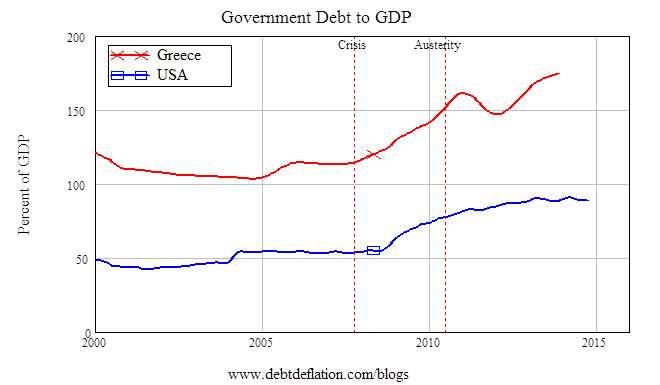

Debt write-off The headline-grabbing Syriza policy that has shaken the eurozone is a promise to write off most of Greece’s €319bn debt, which is a colossal 175% of its GDP. But the write-off is only part of it. Syriza also wants: • Repayment of the remaining debt tied to economic growth, not the Greek budget • A “significant moratorium” on debt payments • The purchase of Greek sovereign bonds under the European Central Bank’s €60bn monthly programme of quantitative easing.

Syriza wants a European Debt Conference modelled on the London Debt Conference of 1953, when half of Germany’s post-World War Two debt was written off, leading to a sharp increase in economic growth. If it happened for Germany, it can happen for Greece, the party argues. Syriza wants Germany to repay a loan that the Nazis forced the Bank of Greece to pay during the occupation. That would work out at an estimated €11bn today. The Independent Greeks also want Germany to pay war reparations.

Scrapping of property tax It is not just the poor who voted for Syriza but the middle classes as well. Property owners in Athens’s leafy, northern suburbs were enticed with the promised abolition of a hated annual levy on private property. Known as “Enfia”, the tax was introduced in 2011 as an emergency measure but made permanent under the previous government. Instead, there will be a tax on luxury homes and large second properties.

Closer relations with Russia It did not go unnoticed that the first foreign ambassador whom Syriza leader Alexis Tsipras met as prime minister was Russia’s envoy. Not a great surprise, perhaps, as he was once considered a pro-Moscow communist and visited Russia last May. Mr Tsipras has strongly criticised EU sanctions imposed on Russia for its annexation of Crimea and its involvement in eastern Ukraine, and there are signs that the election of a pro-Russian government in Athens could affect policy in Brussels.

“Sanctions require unanimity among the 28 governments.”

• Greece’s Coming Clash in Europe Starts With Russia Sanctions (Bloomberg)

Greece’s new government questioned moves to impose more sanctions on Russia, adding a foreign-policy angle to its challenge to the status quo in Europe. Prime Minister Alexis Tsipras’s Syriza-led coalition said it opposed a European Union statement issued in Brussels Tuesday paving the way to additional curbs on the Kremlin over the conflict in Ukraine, and complained it hadn’t been consulted. “Greece doesn’t consent,” the government said in a statement. It added that the announcement violated “proper procedure” by not first securing Greece’s agreement. Whether the government in Athens turns that rhetoric into reality will be tested when Greece’s new foreign minister, Nikos Kotzias, has the opportunity to block further sanctions at an EU meeting in Brussels on Thursday.

Sanctions require unanimity among the 28 governments. A Greek veto would shatter the fragile European consensus over dealing with Russia, potentially robbing Syriza of early goodwill as it lobbies for easier terms for Greece’s bailout. It would also deepen a looming stand-off with German Chancellor Angela Merkel, who has signaled her support to keep up the pressure on Russia amid an escalation in violence in eastern Ukraine. Kotzias, a politics professor and former communist, has advocated closer ties with Russia, spoken out against a German-dominated Europe and, in the 1980s, praised the Polish government’s crackdown on the Solidarity movement.

He said the new government objected to the “rules of operation” within the EU regarding the Russia statement. “Anyone who thinks that in the name of the debt, Greece will resign its sovereignty and its active counsel in European politics is mistaken,” Kotzias said at the ceremony to take over the Foreign Ministry. “We want to be Greeks, patriots, Europeanists, internationalists.” He’s part of a cabinet in Greece named on Tuesday by Tsipras after he formed a coalition with Independent Greeks, a more socially conservative party that also opposes austerity. After winning the election two seats short of a majority, Syriza decided against seeking a deal with To Potami, a new party whose leader has pledged to steer a “European course.”

“You know that I can’t really repay you the money I already borrowed and now you’re asking me to borrow more..”

• Greek Finance Minister Varoufakis: ‘End The Vicious Cycle’ (CNBC)

Greece’s newly elected government will look to “end the vicious cycle” of bailout and borrowing that has persisted through years of financial crisis, Finance Minister Yanis Varoufakis told CNBC on Tuesday. Varoufakis is a member of the Cabinet of Alexis Tsipras, who was elected prime minister on Sunday. Tsipras leads the leftist Syriza party, which has formed a coalition with the right-wing Independent Greeks party. The new government has made renegotiating Greek debt to the European Central Bank a priority. It wants European leaders, the European Central Bank and the International Monetary Fund to “table [its] comprehensive proposal for ending this never-ending Greek crisis,” Varoufakis said in an interview on CNBC.

Tsipras’ party has promised to repeal austerity policy and seek to shave off some of Greece’s debt. The country has imposed stiff austerity measures in the years following a €240 billion euro bailout package from the “troika” of the European Commission, ECB and IMF. Varoufakis stressed “finding common ground for Europeans.” He argued that Greece has been put in a tough situation where it is being asked to borrow money to pay back debts for which it already borrowed. “You know that I can’t really repay you the money I already borrowed and now you’re asking me to borrow more,” Varoufakis said.

“Panos Kammenos, who has declared that Europe is governed by “German neo-Nazis”, assumes the helm of the defence ministry.”

• Greek PM Alexis Tsipras Unveils Cabinet Of Mavericks And Visionaries (Guardian)

Greece’s prime minister, Alexis Tsipras, has lined up a formidable coterie of academics, human rights advocates, mavericks and visionaries to participate in Europe’s first anti-austerity government. Displaying few signs of backing down from pledges to dismantle punitive belt-tightening measures at the heart of the debt-choked country’s international rescue programme, the leftwing radical put together a 40-strong cabinet clearly aimed at challenging Athens’s creditors. In a taste of what lies ahead, Yanis Varoufakis, the flamboyant new finance minister, said on his way to the government’s swearing-in ceremony that negotiations would not continue with the hated troika of officials representing foreign lenders. “They have already begun but not with the troika,” said Varoufakis, an economist who has disseminated his anti-orthodox views through blogs and tweets almost daily since the debt crisis exploded in Athens in late 2009 – something he promised on Tuesday to continue to do.

“The time to put up or shut up has, I have been told, arrived,” he wrote on his blog. “My plan is to defy such advice.” Tsipras’s Syriza party, which emerged as the winner of snap polls on Sunday, has been adamant that it will deal only with governments, and not the technocrats that represent the EU, ECB and IMF. Varoufakis is to represent Greece at eurozone meetings. Setting its stamp on the new era, the cabinet took the oath of office in two separate ceremonies, with some sworn in during a religious service but most breaking with tradition to conduct their investiture before the president, Karolos Papoulias. Tsipras, an avowed atheist, was sworn in by Papoulias on Monday. At 40 he is Athens’s youngest postwar prime minister. After falling two seats short of attaining a 151-seat majority in Greece’s 300-seat parliament, Syriza was forced into a coalition with the populist rightwing Independent Greeks party.

The junior partner is openly Eurosceptic and withering of the way international creditors have turned Greece into an “occupied zone, a debt colony”. Its leader, Panos Kammenos, who has declared that Europe is governed by “German neo-Nazis”, assumes the helm of the defence ministry. Tsipras acted on pledges to pare back government with the establishment of 10 ministries and four super-ministries amalgamating different portfolios, starkly illuminating the failure of previous Greek governments to act on promises to reform ministry structures. Giorgos Stathakis, a political economics professor, took over the development portfolio, a super-ministry that includes oversight of tourism, transport and shipping, the country’s biggest industries. Panaghiotis Kouroublis, who is blind, was made health minister, becoming the first Greek politician with a disability to hold public office. Euclid Tsakalotos, a British-trained economist who rose out of the anti-globalisation movement, became deputy minister in charge of international economic relations.

“Greece made a few mistakes … but Europe made even bigger mistakes..”

• Stiglitz: Germany’s The Problem, Not Greece (CNBC)

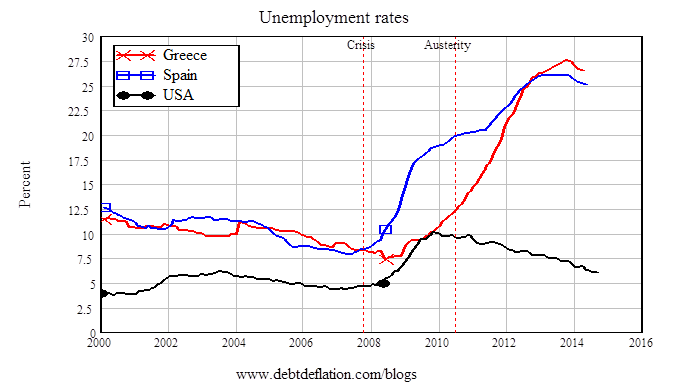

Nobel Prize-winning economist Joseph Stiglitz told CNBC on Monday that the euro zone should stay together but if it breaks apart, it would be better for Germany to leave than for Greece. “While it was an experiment to bring them together, nothing has divided Europe as much as the euro,” Stiglitz said in a “Squawk Box” interview. The risk of a sovereign default in Greece has increased after the anti-austerity party Syriza won Sunday’s snap elections, raising concerns over the possibility of a Greek exit from the euro zone. Greece is not the only economy struggling under the euro, and that’s why a new approach is needed, Stiglitz said. “The policies that Europe has foisted on Greece just have not worked and that’s true of Spain and other countries.”

The Columbia University professor is one of 18 prominent economists who co-authored a letter saying that Europe would benefit from giving Greece a fresh start through debt reduction and a further conditional extension in the grace period. But in the letter in the Financial Times last week, they stressed that Greece would also have to carry out reforms. “Greece made a few mistakes … but Europe made even bigger mistakes,” Stiglitz told CNBC. “The medicine they gave was poisonous. It led the debt to grow up and the economy to go down.” “If Greece leaves, I think Greece will actually do better. … There will be a period of adjustment. But Greece will start to grow,” he said. “If that happens, you going to see Spain and Portugal, they’ve been giving us this toxic medicine and there’s an alternative course.”

Insisting that it’s best for Europe and the world to keep the euro intact, he argued that keeping the single currency together requires more integration. “There’s a whole set of an unfinished economic agenda which most economists agree on, except Germany doesn’t.” He said the real problem is Germany, which has benefited greatly under the euro. “Most economists are saying the best solution for Europe, if it’s going to break up, is for Germany to leave. The mark would rise, the German economy would be dampened.” Under that scenario, Germany would find out just how much it needs the euro to stay together, he added, and possibly be more willing to help out the countries that are struggling. “The hope was, by having a shared currency, they would grow together.” But he said that should work both ways.

Ambrose has a more aggressive take.

• Germany’s Top Institutes Push ‘Grexit’ Plans As Showdown Escalates (AEP)

A top German body has called for a clear mechanism to force Greece out of the euro if the left-wing Syriza government repudiates the terms of the country’s €245bn rescue. “Financial support must be cut off if Greece does not comply with its reform commitments,” said the Institute of German Economic Research (IW). “If Greece is going to take a tough line, then Europe will take a tough line as well.” IW is the second German institute in two days to issue a blunt warning to the new Greek premier, Alexis Tsipras, who has vowed to halt debt payments and reverse austerity measures imposed by the EU-IMF Troika. The ZEW research group said on Tuesday that the EU authorities should order an immediate stress test of banks linked to Greece, and drive home the threat that they are willing to let a Greek default run its course rather than cave to pressure.

“Europe should clearly signal that it is not susceptible to blackmail,” it said. Germany’s finance minister, Wolfgang Schäuble, said in Brussels that debt forgiveness for Greece is out of the question. “Anybody discussing a haircut just shows they don’t know what they are talking about.” Mr Schäuble said he was sick of having to justify his rescue strategy. “We have given exceptional help to Greece. I must say emphatically that German taxpayers have handed over a great deal,” he said. In a clear warning, he said the eurozone is now strong enough to withstand a major shock. “In contrast to 2010, the financial markets have faith in the eurozone. We face no risk of contagion, so nobody should think we can be put under pressure easily. We are relaxed,” he said. Officials in Berlin are irritated that Mr Tsipras has gone into coalition with the Independent Greeks, a viscerally anti-German party that seems to be spoiling for a cathartic showdown over Greece’s debt.

“This increases the risk of a head-on collision with the international creditors,” said Holger Schmieding, from Berenberg Bank. Mr Schmieding said the likelihood of “Grexit” has risen to 35pc. He warned that Mr Tsipras could be in for a reality shock after making “three impossible promises to his country in one campaign”. The risk is that he will end up “ruining his country” like Argentina’s Peronist leader Cristina Kirchner. “Vicious circles can start fast,” he said. Sources close to Mr Tsipras say he is convinced that German leaders are bluffing and will ultimately yield rather than admit to their own people that the whole EMU crisis strategy has been a failure. Markets do not agree. Credit default swaps measuring bankruptcy risk in Greece rocketed on Tuesday by 248 points to 1,654, but those for Portugal, Italy and Spain barely moved.

“Greece’s debt problem is worse today than it was when it was rescued.”

• Why Aren’t Markets Panicking About Greece? (BBC)

The Greek people don’t seem desperately grateful for the 240bn euros in bailouts they’ve had from the eurozone and IMF – and here is one way of seeing why. The country’s economic crisis was caused in large part because its government had taken on excessive debts. So at the time the crisis began in earnest, at the end of 2009, its debts as a share of GDP were 127% of GDP or national income – and rose the following year to 146% of GDP. As a condition of the official rescues, significant public spending cuts and austerity were imposed on Greece. And that had quite an impact on economic activity. The country was already in recession following the 2008 financial crisis. But since 2010, and thanks in large part to austerity imposed by Brussels, GDP has shrunk a further 19%.

GDP per head, perhaps a better measure of the hardship imposed on Greeks, has fallen 22% since the onset of the 2008 debacle. So austerity has certainly hurt. But has it worked to get Greece’s debts down? To the contrary, Greek debt as a share of GDP has soared to 176% of GDP, as of the end of September 2014. Now it has fallen a bit in absolute terms. Greek public sector debt was €265bn in 2008, €330bn in 2010 and was €316bn in September of last year. But it is debt as a share of GDP or national income which determines affordability. And on that important measure, Greece’s debt problem is worse today than it was when it was rescued. To state the obvious, it is the collapse in the economy which has done the damage.

And although Greece started to grow again last year, at the current annual growth rate of 1.6% (which may not be sustained) it would take longer than a generation to reduce national debt to a manageable level. Little wonder therefore that a party – Syriza – campaigning to end austerity and write off debts, has enjoyed an overwhelming victory in the general election. That it appears to be two seats short of a clear majority in the Athens parliament should not disguise the clear message sent by Greek people to Brussels. Or perhaps it would be more apt to talk of the message being sent to Berlin – since it is Germany which has been the big eurozone country most wedded to the economic orthodoxy that there’s no gain without austerity pain.

Samaras is one sore loser.

• New Greek PM Finds Official Residence Strippped Bare By Predecessor (Guardian)

To the victor the spoils? Not in Athens, where the new prime minister arrived at his official residence on Monday night to discover that computers, paperwork and even the toiletries had been removed by the outgoing administration. Shortly after he was sworn in, Syriza leader Alexis Tsipras found himself inside the Maximos Mansion without some basic necessities. “They took everything,” he said. “I was looking for an hour to find soap.” Traditionally, a defeated Greek prime minister will wait until their successor has been anointed to wish them well. But Antonis Samaras was in such a rush to go that he even failed to leave the Wi-Fi password.

“We sit in the dark. We have no internet, no email, no way to communicate with each other,” one staffer told Germany’s Der Spiegel. It took until Tuesday evening for Tsipras to get his hands on the official prime ministerial Twitter account. In his first tweet, he repeated the oath he took 24 hours earlier, pledging to uphold the constitution and always serve the interests of the Greek people. But on Tuesday night, the new administration was struggling to put its mark on the system; 48 hours after the polls closed, an official Greek government website still showed Samaras as prime minister.

3.4% is no pittance.

• Orders for US Durable Goods Fell in December for Fourth Month (Bloomberg)

Orders for business equipment unexpectedly fell in December for a fourth month, signaling a global growth slowdown is weighing on American companies. Bookings for non-military capital goods excluding aircraft dropped 0.6% for a second month, data from the Commerce Department showed today in Washington. Demand for all durable goods – items meant to last at least three years – declined 3.4%, the worst performance since August. Slackening demand from Europe and some emerging markets is probably weighing on orders, making companies less willing to invest in new equipment. At the same time, brightening American consumer attitudes are leading to gains in purchases of big-ticket items such as automobiles and appliances that can ripple through the economy and underpin manufacturing.

No need for any Yellen announcements this week.

• ECB Bond Buying Makes Fed Rate Increase More Likely (Bloomberg)

Dollar bulls say Europe’s €1.1 trillion euro bond-buying plan will bring the Federal Reserve a step closer to raising interest rates before the year’s out. By pumping cash into global markets, the European Central Bank may clear the way for the U.S. to tighten its own money supply without stoking volatility, according to Citigroup and Bank of America. As Fed officials start a two-day policy meeting, the greenback is extending a rally that’s taken it to a more than decade-high versus a basket of its peers even as bond investors express less conviction about the timing of an U.S. central bank’s first rate increase since 2006. “We’ve been expecting dollar strength, and it’s coming quicker than we thought,” Steven Englander at Citigroup said.

Fed officials “may feel they actually have to advance the first tightening rather than put it off.” Money has flooded into dollar assets in recent months as the world’s largest economy outperforms its developed peers and the Fed prepares to raise its main interest rate from the zero-to-0.25% range it’s been in since 2008. That makes the dollar more valuable to investors, particularly as central banks from Japan and Canada to Europe debase their currencies by easing their monetary policies. The anticipated timing of that first Fed increase inched forward as the ECB unveiled its government-bond purchase program. Investors now expect the U.S. central bank to boost borrowing costs from near zero in October, after betting on a December increase just a month ago, according to futures prices compiled by Bloomberg.

Sure, we don’t have enough of the stuff yet.

• Obama Proposes Offshore Oil Drilling From Virginia to Georgia (Bloomberg)

The Obama administration proposed opening to offshore drilling an area from Virginia to Georgia in a policy shift long sought by energy companies but opposed by environmentalists concerned about popular resorts such as the Outer Banks and Myrtle Beach. The proposed offshore plan for 2017 to 2022, marks the second time President Barack Obama has recommended unlocking areas in the U.S. Atlantic for oil drilling, and faced criticism from allies who say the risks of a spill along the populated coast don’t justify the payoff. “At this early stage in considering a lease sale in the Atlantic, we are looking to build up our understanding of resource potential, as well as risks to the environment and other uses,” Interior Secretary Sally Jewell said in a statement.

The agency said it would do one auction in the Atlantic and keep a 50-mile buffer from the shore. Managing the U.S. oil and gas boom has become a fraught issue for Obama, who has continued to trumpet the benefits of the jump in production and falling prices, while also seeking to balance it with a desire to combat climate change. Environmentalists say the administration hasn’t done enough to counter the risks of pollution, spills and greenhouse-gas emissions from the domestic production. “The world is in a very big hole with climate change and when you’re in a hole the first order of business should be to stop digging,” Steve Kretzmann, executive director of Oil Change International, said in an e-mail. “Unfortunately, the administration’s five-year plan amounts to climate denial.”

“Our research suggests that the consensus view that oil markets will recover by the second half of 2015 may well be optimistic.”

• Crude at $49: The New Reality for Big Oil Companies (Bloomberg)

Financial results from a fourth quarter that saw the collapse of the crude market will provide a window into how the world’s biggest oil companies are adjusting to a new reality of slowing growth and low prices. Oil that topped $115 a barrel as recently as June has been trading below $50 a barrel since the first week of the year, portending a bleak 2015 for the world’s five so-called supermajors – Exxon Mobil, Shell, Chevron, Total and BP. The companies, whose businesses combine oil and natural gas exploration with refining and chemical manufacturing, have historically been among the most resilient players during down cycles. This could be the oil bust that breaks that pattern. “The issue for this group of companies is they don’t have bulletproof business models,” said Brian Hennessey at Alpine Woods. A 57% plunge in the price of oil since June “really tests your convictions.”

The industry’s stark change in fortune set off panic from corporate board rooms to drill-rig floors as companies that pump almost one-tenth of the world’s crude scramble to tighten budgets and preserve cash for dividends, buybacks and capital projects too far along to abandon. BP froze wages, Chevron delayed its 2015 drilling budget and Shell canceled a $6.5 billion Persian Gulf investment; layoffs industrywide have topped 30,000, enough to fill almost every seat in Madison Square Garden twice. Investors will be sifting the data from the fourth quarter for clues to how long the current slump will last. Momentum from $109 a barrel oil during the first half of the year helped carry producers through the last three months, when the price of Brent, the benchmark used by most of the world, averaged $77.07 — well above the current price of $49.

The effects of lower prices will still take their toll as all except Shell are forecast to report earnings declines compared with the fourth quarter of 2013. Shell profits are expected to rise compared with unusually ugly results the year before. Worldwide crude supplies appear likely to exceed demand for the rest of the year and beyond, even as the lowest oil prices since 2009 discourage new developments in high-cost regions such as Canada’s oil sands, said Paul Sankey at Wolfe Research. That would postpone any rebound in share prices of the five biggest oil majors, which have tumbled by an average of 8.1% since crude prices began to slide in June. That compares with a 28% decline in a Standard & Poors index of 18 smaller U.S. oil and gas producers. “Buying oil equities here would be dangerous,” Sankey said. “Our research suggests that the consensus view that oil markets will recover by the second half of 2015 may well be optimistic.”

“’Never’ is a long time.” Then he paused. “It’s going to be a long time.”

• He Called $50 Oil, Now He Says It’s Going Lower (MarketWatch)

Last November, when I was trying to figure out where oil prices were going, I spoke with Shawn Driscoll, manager of the T. Rowe Price New Era Fund, a mutual fund that focuses on natural resource stocks. Brent crude was trading at $80 a barrel, and there was speculation that OPEC would halt its slide by cutting production at its upcoming meeting, scheduled for Thanksgiving Day. Driscoll was having none of it. Oil, gold, and other commodities, he told me, were in a secular bear market that could last another decade. He said oil would bottom out around $50 over the next 10 years. Actually it took less than 10 weeks, as Brent traded under $48 a barrel on Monday. I usually don’t revisit columns or sources that quickly, but events have moved so fast I decided to catch up with Driscoll again. Right off the bat, he acknowledged being surprised by the suddenness of oil’s price drop.

“We expected Saudi Arabia to cut, frankly,” he told me in a phone interview. “Once Saudi Arabia didn’t cut production, it became clear to us there was a problem.” Both supply and demand were heading in opposite directions more drastically than he expected. “Underlying demand got a lot weaker, Libya came back, Iraqi volumes have been pretty good,” he explained. We spoke last Friday, the day after the pro-U.S. Yemeni government had fallen and King Abdullah of Saudi Arabia died and was succeeded by his 79-year-old half-brother Salman. Yet despite these new uncertainties in the world’s most volatile, energy-rich region, Driscoll’s view remains unchanged: look out below. He explained that $40 a barrel is the top of the industry’s operating cost curve – the price at which individual wells break even after they’ve been drilled and are producing and below which operators shut in existing wells.

So, does he think Brent will fall below that $40 magic number? “I do,” he told me. Why? Whatever political or competitive motives may be behind Saudi Arabia’s refusal to cut production, the world is awash in oil. “There’s still an overwhelming glut of supply in global markets,” Stephen Schork, president of Schork Group, said. No wonder Wall Street firms have been falling all over each other to predict ever-lower crude prices: Goldman Sachs is looking for $40 Brent and Bank of America Merrill Lynch says crude futures could fall to $31 a barrel in the first quarter, lower than they were during the financial crisis. “The job of correcting markets when they’re oversupplied is to find a price that destroys the oversupply,” Driscoll told me. That destruction is just getting started. Asked about billionaire Saudi investor Prince Alwaleed bin Talal’s comments that “I’m sure we’re never going to see $100 anymore,” Driscoll replied: “’Never’ is a long time.” Then he paused. “It’s going to be a long time.”

Not for the banks.

• France ‘Proves’ Q€ Is Entirely Useless (Zero Hedge)

According to the doctrine of central planners, the idea of Q€ is to lower rates to encourage borrowing (and credit creation) to spark growth and kickstart a virtuous recovery. As the following chart shows, that is total and utter crap… French jobseekers just hit a fresh record high and French rates just hit a record low – and that has been the story for 6 years. So – just as The Fed was finally forced to admit, Q€ is nothing more than wealth redistribution from all taxpayers to the ultra-rich asset owners who – it is hoped- will bless the plebeians with some trickle-down-ness… with every asset under the moon already at record highs, once again we ask – just what do you think this will achieve Draghi.

And finally, we have no words for this idiot…: “Bank Of Italy’s PANETTA: ECB QE TO BOOST GROWTH ‘SIGNIFICANTLY’ OVER NEXT 2 YEARS”. Yep – they really believe that.

Syriza is sure to wake up sentiments across Europe.

• Syriza’s ‘Bella Ciao’ Casts Shadow Over Italy President Vote (Bloomberg)

As Greeks welcome Syriza’s historical victory with the Italian partisan anthem “Bella Ciao,” Italian Premier Matteo Renzi is nervously eyeing resistance within his own party before a key presidential vote this week. “By gaining a clear lead and moving to form a new government in a short time, Syriza leader Alexis Tsipras is also galvanizing his Italian supporters, including a significant number of Renzi’s opponents within his party,” Francesco Galietti, founder of research firm Policy Sonar in Rome, said in a phone interview. Renzi’s grip on the Democratic Party, or PD, will be closely-watched Jan. 29, when 1,009 national lawmakers and regional delegates meet in Rome to start voting for the new head of state, a post left vacant by 89-year-old Giorgio Napolitano earlier this month.

Some lawmakers within the left-wing PD minority, including Giuseppe Civati and Stefano Fassina, were part of a pro-Syriza delegation who visited Athens before the vote. Supporters of Nichi Vendola, leader of the Left, Ecology and Freedom party, one of the strongest supporters of Syriza in Italy, sang the World War II “Bella Ciao” anthem at a three-day event in Milan last week. Now, Vendola is trying to open a dialogue with the anti-Renzi line of the PD to see if they can join forces. “Numerous defections in the first three rounds of voting and an election that drags on past the fifth round will spell trouble” for the premier, Wolfango Piccoli, managing director at Teneo Intelligence in London, wrote in a Jan. 13 note to clients. Such an outcome would probably mark the beginning of the end for “his flagship reforms and the current legislature.”

Paying off the IMF through record low borrowing. Sounds nice, but what justifies the low rates for places like Portugal?

• Portugal Repays IMF Early; Greece Prepares Fight (Bloomberg)

As Greece gets ready to fight the IMF, Portugal wants to pay it off early. While Greece catapulted Alexis Tsipras into power and set up a confrontation with its creditors, Portugal has raised almost half of its planned gross bond issuance for this year. With falling borrowing costs, Portugal now plans to make an early repayment of its IMF bailout loans. “Portugal has already covered about 40% of the maximum size of its own target, and it extended its curve by eight years,” said David Schnautz at Commerzbank. “After this start, Portugal should be able to wrap up its ‘must do’ bond supply activities soon, maybe before the slow supply summer season.” Portugal’s message to investors is this: the country is more like Ireland than Greece. The Irish government has already taken advantage of record low borrowing costs and relative political stability to refinance about €9 billion of its IMF loans.

While anti-austerity parties Podemos in Spain and Tsipras’s Syriza in Greece tap into voter discontent, in Portugal the ruling Social Democrats and the Socialists, the main opposition party, still dominate opinion polls ahead of elections scheduled for September or October. “The political system has proven its maturity,” Economy Minister Antonio Pires de Lima said. “The radical parties exist, but you cannot imagine in Portugal that those parties get more than 10% or 15%, never more than 20% in polls.” Portugal this month sold 5.5 billion euros of 10- and 30-year government securities via banks. Debt agency IGCP plans gross issuance of €12 billion to €14 billion in 2015. The government is paying an estimated 3.7% on 26.5 billion euros of IMF loans. They formed part of the country’s 2011 bailout program, which Portugal exited in May last year after Ireland wrapped up its rescue package in December 2013.

One more down in the currency race to the bottom.

• Singapore Surprises With Easing, Clubbing Currency (CNBC)

Singapore’s central bank surprised markets with a between-meeting easing amid nearly non-existent inflation, sending the city-state’s currency sharply lower. “With material downward revision to the inflation outlook, MAS (Monetary Authority of Singapore) saw cause for preemptive action,” Mizuho Bank said in a note Wednesday. “On the growth front, MAS also sounded more cautious, pointing to a mixed outlook for the global economy, which is likely to weigh on the export-oriented sectors.” Without waiting for its scheduled April review – or today’s U.S. Federal Reserve’s meeting – the MAS Wednesday announced that it was reducing the slope of the Singapore dollar’s appreciation against an undisclosed, trade-weighted basket of currencies.

Rather than using interest rates, Singapore sets its monetary policy by adjusting the currency’s trading range. The slope was last flattened in 2011 and this was the MAS’ first unscheduled policy statement since 2001. Inflation in the trade-dependent city-state has been on the wane despite rising labor shortages as the government limited the number of foreign workers. In December, the consumer price index fell 0.2% on-year after declining 0.3% in November as declining oil prices globally eased fuel costs and as housing costs were lower. The MAS cut its headline inflation forecast for 2015 to a band of negative 0.5% to 0.5% from 0.5-1.5% previously.

Just great.

• Subprime Bonds Are Back With Different Name 7 Years After US Crisis (Bloomberg)

The business of bundling riskier U.S. mortgages into bonds without government backing is gearing up for a comeback. Just don’t call it subprime. Hedge fund Seer Capital Management, money manager Angel Oak Capital and Sydney-based bank Macquarie are among firms buying up loans to borrowers who can’t qualify for conventional mortgages because of issues such as low credit scores, foreclosures or hard-to-document income. They each plan to pool the mortgages into securities of varying risk and sell some to investors this year. JPMorgan analysts predict as much as $5 billion of deals could get done, while Nomura Holdings Inc. forecasts $1 billion to $2 billion. Investment firms are looking to revive the market without repeating the mistakes that fueled the U.S. housing crisis last decade, which blew up the global economy.

This time, they will retain the riskiest stakes in the deals, unlike how Wall Street banks and other issuers shifted most of the dangers before the crisis. Seer Capital and Angel Oak prefer the term “nonprime” for lending that flirts with practices that used to be employed for debt known as subprime or Alt-A. While “subprime is a dirty word” these days, “what everyone is seeing is the credit box has shrunk so much that there’s a lot of good potential borrowers out there not being served,” said John Hsu, the head of capital markets at Angel Oak. The Atlanta-based firm expects to have enough loans for a deal next quarter in which it retains about 20% to 33%, he said. Reopening this corner of the bond market may lower consumer costs and expand riskier lending, aiding the housing recovery.

“..the slowdown/recession finds a secondary downturn thanks to the immediate closing down of any discretionary capital expenditure..”

• Looming Recession Will Be “Remembered For 100 Years”: Crispin Odey (Zero Hedge)

“I think equity markets will get devastated,” warns famed $12bn AUM hedge fund manager Crispin Odey in his latest letter to investors. Having been one of the biggest bulls of this particular central bank artificial-bull cycle, his dramatic bearish tilt (as we discussed what he thinks are the biggest risks underpriced by the market previously), is notable. Finally, Odey fears major economies are entering a recession that will be “remembered in a hundred years,” adding that the “bearish opportunity” to short stocks looks as great as it was in 2007-2009.

Odey Asset Management (report for Dec 2014)

• The themes I have been outlining since the second quarter of 2014 are now establishing themselves:

• A faltering Chinese economy with growth ultimately slowing down to 3%.

• A hard landing for those countries plugged into China’s growth – especially Australia, South Africa and Brazil.A fall in commodity prices bringing with it pain to those heavily exposed. For oil this is the Middle East, Venezuela, Argentina, mid-west USA, Canada, Norway and Scotland. No one forecast how fast and how far those commodity markets would fall. However, the same people who singly failed to see this coming are the first to say that the benefits of falling prices will outweigh the costs. My problem with such a hopeful outcome is that, in my experience, those that lose out from a fall in their income are quicker to adjust than those that benefit. In that intertemporal space lurks a recession. For me, the slowdown/recession finds a secondary downturn thanks to the immediate closing down of any discretionary capital expenditure in the affected industries and countries, something we are only just seeing.

This obviously has knockon effects for incomes and employment. At that time the exchange rate is likely to be falling to give some support. In my world this slowdown in the commodity producer’s economy is felt via falling exports back in the beneficiary’s economy, which finds external markets weaken. Again, if I am right on timing, the effect can be great because it is not yet affected by a pickup in spending in the beneficiary’s economy. As always, that is the theory and markets will show whether it works in practice. In my world, this hit to the world economy is the first experience of a business cycle since 2008. Most investors do not believe we can experi-ence such a downturn. They rely upon Central bankers who they think have solved the problem.