Alexander Gardner Ruins of Gallego Mills after Great Fire, Richmond, VA 1865

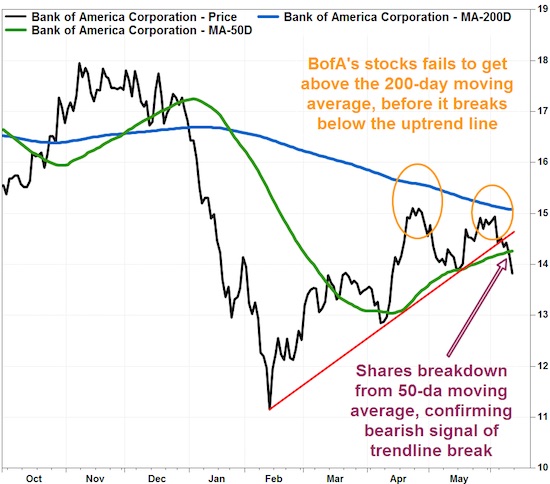

All gains are gone. And they were big.

• Asian Stocks Selloff Deepens To 2015 Lows On China Worry (Reuters)

An index of Asian shares outside Japan fell close to this year’s lows on Monday thanks to a deepening selloff in commodities and fresh concerns over slowing growth in China, while the dollar held its ground against a basket of currencies. In line with weaker Asian stocks, financial spreadbetters expected a slightly lower open for Britain’s FTSE, Germany’s DAX and France’s CAC. In a blow to risk sentiment, a private survey showed China’s factory activity shrank more than initially estimated in July, contracting by the most in two years as new orders fell. “We believe the stock market panic in early July chilled economic activity, which is what the manufacturing PMIs picked up,” ING economist Tim Condon said in a research note ahead of the Caixin PMI release.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell more than 1% before paring losses to be down 0.9%. The biggest losers were financials and cyclicals. The index’s low for this year was on July 8. Closely-watched Shanghai shares shed 1.9%. Japan’s Nikkei slid 0.3% and South Korea’s Kospi fell 1%. Australian stocks dropped 0.4%. “We believe the macro environment remains challenging for emerging market assets amid headwinds of low commodity prices, concerns over China and a looming Fed tightening cycle,” Barclays strategists wrote in a daily note in clients. Recent flows data confirmed that trend. Net foreign selling from emerging Asia has reached nearly $10 billion over the past two months with only India seeing some tiny inflows. Although outflows have pummeled stock markets from Korea to Taiwan, valuations suggest more downside is likely.

Read more …

No surprises here.

• Greek Stock Market Opens 23% Down After Five-Week Shutdown (Reuters, AFP)

Greece’s stock market fell sharply on Monday after being shut down for five weeks under capital controls imposed by the government in Athens to stop a flight of euros from the country. The main index was down nearly 23% in early trading. National Bank of Greece, the country’s largest commercial bank, was down 30%, the daily limit. The overall banking index was also down its limit. “Naturally, pressure is expected, markets will not fail to comment on such an extensive shutdown,” Constantine Botopoulos, head of the capital markets commission, told Skai radio. “But we must not get carried away. We must wait until the end of the week to see how the reopening will begin to be dealt with more coolly.” The bourse was last open for trading on June 26.

Read more …

The rest of the week is more interesting: will they recover?

• Banks Lead Greek Stock Slump In First Day Of Trading After Closure (Bloomberg)

Lenders led a record plunge in Greek equities as the Athens Stock Exchange reopened after a five-week shutdown, with restrictions in place due to capital controls. Piraeus Bank and National Bank of Greece sank 30%, the maximum allowed by the Athens bourse. The benchmark ASE Index slumped a record 22% to 622.6 at 11:09 a.m. in Athens. “The situation in Greek equity markets will have to get a lot worse before it gets better,” said Luca Paolini, Pictet Asset Management’s chief strategist in London. “There are still critical risks to be resolved.” The exchange suspension came as Greek stocks had begun enjoying some renewed optimism after losing 85% of their value since 2007. The ASE rebounded 17% from its almost three-year low in June through the suspension.

That trimmed its loss to 3.5% this year until June 26, the last day the exchange was open. The Greek market came to a halt in June as Prime Minister Alexis Tsipras ended bailout talks with creditors by asking voters to decide in a referendum whether to accept the terms offered in exchange for emergency loans. The nation was forced to shut banks and impose capital controls. The stock exchange remained closed, recording its longest halt since the 1970s, even after lenders reopened on July 20 with limited services, as Greek officials worked on rules to reopen the bourse with capital controls in place.

With bank withdrawals limited, Greek traders will only be able to buy stocks, bonds, derivatives and warrants with new money such as funds transferred from abroad, cash-only deposits, money earned from the future sale of shares or from existing investment account balances held at Greek brokerages, the Finance Ministry said in a decree on Friday. No such constraints will apply to foreign investors, provided they were already active in the market before the imposition of capital controls. During the shutdown, investors used a U.S.-listed exchange- traded fund as a proxy for Greek stocks. The Global X FTSE Greece 20 ETF fell 17% from June 26 through Friday. The fund plunged a record 19% the first day stocks in Athens were suspended. It advanced 2.6% on Friday.

Read more …

The BBC predicted it last night.

• Greek Shares ‘Set To Plunge 20%’ As Stock Exchange Reopens (BBC)

The Athens Stock Exchange is set to plunge by as much as 20% on Monday when trading finally resumes after a five-week closure, traders have predicted. The bourse was shut just before the Greek government imposed capital controls at the height of the debt crisis. Traders said they expect sharp losses as a result of pent-up trading and fears about Greece’s worsening economy. Takis Zamanis, chief trader at Beta Securities, is among the pessimists. “The possibility of seeing even a single share rise in tomorrow’s session is almost zero,” he said. “There is a lot of uncertainty about the government’s ability to sign the… bailout on time and for possible snap elections.” Shares in banks are likely to be particularly hard-hit because Greece’s financial sector needs to be recapitalised.

A report in Avgi newspaper, which is close to the government of Prime Minister Alexis Tsipras, suggested Athens was asking for about 10 billion euros (£7bn) this month for bank recapitalisation. Banks account for about a fifth of the main Athens index. National Bank of Greece’s US-listed stock has fallen about 20% while the Athens exchange has been closed. One asset manager at a Greek fund said: “The focus will be in the bank shares – they will suffer more because their investors have to face a dilution from the [expected] recapitalisation of the sector.” Greek banks will not be make a profit this year and are suffering from an increase in bad loans due to the crisis, the manager said. “It would be realistic to expect a decline of about 15-20% at the opening of the market on Monday,” he added.

Read more …

Part of suffocating an economy.

• Greek Manufacturing Slumps at Record Pace as Crisis Takes Toll (Bloomberg)

Greece’s manufacturing industry shrank at a record pace last month as demand collapsed amid capital controls introduced in an attempt to contain the nation’s crisis. Markit Economics said its factory Purchasing Managers’ Index fell to 30.2 from 46.9 in June. A reading below 50 indicates contraction. A gauge of new orders plunged to 17.9 from 43.2, also a record low. Markit said survey respondents blamed capital controls and a “generally uncertain operating environment” for the loss of business. The plunge in the index reflects heightened concerns last month about Greece’s future in the euro area after a temporary breakdown in negotiations on a bailout deal.

“Although manufacturing represents only a small proportion of Greece’s total productive output, the sheer magnitude of the downturn sends a worrying signal for the health of the economy as a whole,” said Phil Smith, an economist at Markit in London. “Bank closures and capital restrictions badly hampered normal business activity.” The weak factory reading highlights the challenge Prime Minister Alexis Tsipras faces in reviving the shattered Greek economy, which has shrunk by about a quarter in the past six years. The country has already fallen back into a recession and the economy is forecast to contract this year.

Read more …

France should grow a pair.

• French Finance Minister Takes Aim At Schäuble Over Grexit Idea (Reuters)

French finance minister Michel Sapin has criticized his German counterpart Wolfgang Schaeuble for suggesting that Greece could temporarily leave the euro zone, but said the Franco-German relationship is “not broken”. In an interview with German business daily Handelsblatt, Sapin said Schaeuble was wrong to suggest the euro zone “time-out” – an idea the German finance minister floated last month during talks to clinch a deal to keep Greece in the bloc. “I think that Wolfgang Schaeuble is wrong and is even getting into conflict with his deep European volition,” Sapin said in an interview to run in Handelsblatt’s Monday edition.

“This volition, and it is also mine, involves strengthening the euro zone,” he said, adding that this ruled out the possibility of a temporary exit from the 19-member currency union. “If you allow a temporary departure, that means: every other country that finds itself in difficulties will want to get out of the affair via an adjustment of its currency,” Sapin added. The French minister said he nonetheless wanted to work with Schaeuble to foster closer euro zone integration by strengthening economic policy governance. However, treaty changes to introduce a European finance minister and a budget for the euro zone would not be possible before 2017, the paper reported Sapin as saying.

Read more …

How democratic is Europe? It just takes the first sentence of this article to know: “The battle for Europe will be won or lost in Germany.” A useless discussion from there on in.

• Germans Fret Over Europe’s Future But Still Believe (Reuters)

The battle for Europe will be won or lost in Germany. On some days recently, it has looked like it might be lost. But that is to underestimate the deep German commitment to the success of European integration based on the rule of law. If the EU falls apart, it will likely be due to a return of nationalism and a refusal by the French, British and Dutch to share more sovereignty, rather than to German insistence on fiscal discipline and respect for the rules. “If the euro fails, then Europe fails,” Chancellor Angela Merkel has repeatedly warned parliament. The aftermath of the euro zone’s ugly all-night summit on the Greek debt crisis that ended on July 13 with a deal on stringent, intrusive terms for negotiating a third bailout has sent shockwaves across Europe, especially in Germany.

It was the second time in weeks that EU leaders had clashed over fundamental problems they seem unable to solve, after an acrimonious June summit on how to cope with a wave of migrants – many of them refugees from conflict – desperate to enter Europe. And it has prompted intensive head-scratching in Berlin about how to strengthen European institutions and underpin the euro more durably – an intellectual ferment unmatched in most other EU capitals. “When you tour European countries, there aren’t many that are thinking as hard as Germany about how to make an integrated Europe work better,” says a senior German official. Perhaps due to its World War Two history, Berlin is more open than most EU nations to offering shelter to war victims and accepted the largest quota of asylum seekers.

Nor was Merkel as tough as creditors such as Finland, the Netherlands, Latvia, Lithuania and Slovakia in insisting on humiliating conditions for any further assistance to Greece. Yet like all leaders, Germany cops most of the blame. And due to its past, that is often laced with references to the Nazi tyranny that make present-day Germans cringe. That outcry was compounded when German Finance Minister Wolfgang Schaeuble breached a taboo by suggesting that Greece should leave the euro zone, at least temporarily, if it could not meet the conditions. After decades of trying to be an unobtrusive team player in Europe or co-steering integration through the Franco-German tandem, Berlin was catapulted into an unwelcome solo leadership role by the euro zone debt crisis that began in 2010.

That extra burden of responsibility, due more to French weakness and British indifference than Teutonic ambition, has weighed heavily on Germans who fear it means others trying to pick their pockets without doing their own fair share.

Read more …

Curious to say the least.

• Head Of Greek Statistics Office ELSTAT Steps Down (Reuters)

The head of the Greek statistics office stepped down on Sunday, adding new complexity to Greece’s bailout negotiations with its EU partners. A veteran IMF statistician, Andreas Georgiou was appointed head of ELSTAT in 2010 in an effort to restore the credibility of Greek statistics a few months after the country’s debt crisis erupted. “I have informed the finance minister of my decision not to accept the extension of my term … that ends today,” Georgiou told Reuters. Georgiou could have stayed on until a replacement was appointed, but he said he was not interested in having the finance minister renew his term and that it was a personal choice to leave.

He said he and his team had worked to make the statistics office independent, impartial, objective and transparent, sometimes against a series of “unsubstantiated and totally unfounded accusations”. In 2013, a prosecutor brought felony charges against Georgiou and two other agency employees, accusing them of falsifying 2009 fiscal data. A former ELSTAT employee had claimed that Georgiou had inflated the deficit numbers to justify austerity measures. He denied the accusation and the charge was dropped last month. In the run-up to joining the eurozone, which it did as a founder member in 2001, Greece under-reported its budget deficit for years.

Since then, unreliable statistics with frequent revisions were blamed in part for pushing the country to a financial crisis. Since Georgiou took over, however, the EU’s statistics office Eurostat has fully accepted the debt figures provided by Greece. The independence of ELSTAT remains a key concern as Greece seeks a new bailout from its EU partners. Prime Minister Alexis Tsipras agreed last Monday to the “safeguarding of the full legal independence of ELSTAT” as one of the conditions to achieve a third bailout.

Read more …

“Closing down the banks of a monetized economy is the worst form of monetary terrorism. It instills fear in people.”

• In Conversation With El Pais (Varoufakis)

Fiscal waterboarding: I am very proud of this term. It is a precise, an accurate description of what has been happening for years now. What is waterboarding? You take a subject, you push his head in the water until he suffocates but, at some point, before death comes you stop. You pull the head out just in time, before asphyxiation is complete, you allow the subject to take a few deep breaths, and then you push the head again in the water. You repeat until he… confesses. Fiscal waterboarding, on the other hand, is obviously not physical, it’s fiscal. But the idea is the same and it is exactly what happened to successive Greek governments since 2010. Instead of air, Greek governments nursing unsustainable debts were starved of liquidity.

Facing payments to their creditors, or meeting its obligations, they were denied liquidity till the very last moment just before formal bankruptcy, until they ‘confessed’’; until they signed on agreements they knew to add new impetus on the real economy’s crisis. At that moment, the troika would provide enough liquidity, like they did now with the 7 billion the Greek government received in order to repay the… ECB and the IMF. Just like waterboarding, this liquidity, or ‘oxygen’, is calculated to be barely enough to keep the ‘subject’ going, without defaulting formally, but never more than that. And so the torture continues with the effect that the government remains completely under the troika’s control. This is how fiscal waterboarding functions and I cannot imagine a better and more accurate term to describe what has been going on.

On my use of the word ‘terror’, take the case of the referendum. On the 25th of June we were presented with a comprehensive proposal by the troika. We studied it with an open mind and concluded that it was a non-viable proposal. If we signed it, we would have definitely failed within 4-5 months and then Dr. Schäuble would say “See, you accepted conditions you could not fulfill”. The Greek government cannot afford to do this anymore. We need to reclaim our credibility by only signing agreements we can fulfill. So I said to my colleagues in the Eurogroup, on the 27th, that our team convened and decided that we could not accept this proposal, because it wouldn’t work. But at the same time, we are Europeanists and we don’t have a mandate, nor the will or interest, to clash with Europe. So we decided to put their proposal to the Greek people to decide.

And what did the Eurogroup do? It refused us an extension of a few weeks in order to hold this referendum in peace and instead they closed down our banks. Closing down the banks of a monetized economy is the worst form of monetary terrorism. It instills fear in people. Imagine if in Spain tomorrow morning the banks didn’t open because of a Eurogroup decision with which to force your government to agree to something untenable. Spaniards would be caught up in a vortex of monetary terror. What is terrorism? Terrorism is to pursue a political agenda through the spread of generalized fear. That is what they did. Meanwhile the Greek systemic media were terrorizing people to think that, if they voted No in the referendum, Armageddon would come. This was also a fear-based campaign. And this is what I said. Maybe people in Brussels don’t like it to hear the truth. If they refrained from trying to scare the Greek, then I would have refrained from using this term.

Read more …

Just vote Podemos.

• Varoufakis Warns Spain Could ‘Become Greece’ (AFP)

Spain could become like Greece if the same austerity policies are imposed on the country, former Greek finance minister Yanis Varoufakis said in an interview published Sunday. “Spaniards need to look at their own economic and social situation and based on that evaluate what their country needs, independently of what happens in Greece or wherever,” he told center-left daily El Pais. “The danger of becoming Greece is always there and it will become reality if the same mistakes that were imposed on Greece are repeated,” he added. Varoufakis, an economist with unorthodox ideas about the euro and Greece’s debt restructuring, resigned the day after Greeks voted against creditor bailout terms in a July 5 referendum.

The Greek government later accepted even harsher terms in a deal at an all-night eurozone summit on July 12-13. With a general election looming later this year, Spanish Prime Minister Mariano Rajoy has used the economic turbulence in Greece as a chilling backdrop to promote his own government’s crisis management. Rajoy’s conservative Popular Party says that if new far-left party Podemos – a close ally of Greece’s ruling Syriza – forces a change of course on the economy after the election, Spain could plunge back into crisis. Asked about the Spanish government’s statements, Varoufakis said Greece “has become a sort of football for right-wing politicians, who insist on using Greece to frighten their population.”

Read more …

They have already.

• “They Bury The Values Of Democracy”- Varoufakis (Stern)

We tried to implement an emergency food programme for the poor – but the troika disallowed it. We tried to take action against the wealthy, the oligarchs and the sharks – that was also disallowed. I’ve asked for help in these issues from my dialogue partners in Berlin, Brussels and Paris. But that wasn’t forthcoming. Instead, the Eurogroup told us unceremoniously that we shouldn’t do anything on our own initiative. If we did, they would punish us. We didn’t have a chance. They wanted to stonewall us. When we nevertheless took action against the oligarchs, the troika simply protected them. From the very beginning the aim was to cause our government to collapse or to overthrow it.

You’re talking about a country in 21st century Europe?

Yes. I had high expectations when I first entered politics. But then the big surprise for me was how little the concept of democracy means to the most important players. How indifferent they are to the tangible impact of their policies. When I wanted to address the issue in the Eurogroup, Dijsselbloem just snapped at me, saying: “We don’t talk about that. It’s too political!”

You sound bitter.

No. Throughout this euro-crisis, the question is never whether the structure of the eurozone is the reason why everything has become unstable. The fact that surplus countries have been forced into the straitjacket of a common currency with importing countries. All one hears is that the lazy Mediterraneans have lived beyond their means and that they should simply be as hardworking and frugal as the Germans. That is the mantra.

And what’s wrong with that?

It’s all about the balance of power. Who was responsible for awarding all those loans? The BMW Bank. The Mercedes-Benz Bank. Purchase! Enjoy! Here’s a loan, you don’t need your own money! But every reckless borrower is faced with a ruthless lender. The bankers were fully aware that they were taking an immense gamble – but they were driven by wanton greed.

For the past five years, hundreds of experts, economists and politicians have been busy tinkering with the Greek crisis, repeatedly promising that things were going uphill. But the situation is worse than ever.

The fundamental question remains: are the powers that be really interested in ending this crisis? I beg your pardon? This crisis of the century is too good to leave it unexploited. Right at the outset, Schäuble told me that we could no longer afford our welfare state. In this sense, they are unashamedly taking advantage of the humanitarian catastrophe. Thanks to this crisis, they can now implement all these painful things – wage cuts, pension cuts, privatisation – that would never win them any votes at an election.

Read more …

Beware the junk bond: “Spreads got insanely tight because of that reach for yield a lot of people were going for regardless of ratings..”

• Debt Traders Flee Junkyard’s Dogs as Oil Rout Extends Yield Gap (Bloomberg)

Debt investors are abandoning the bottom rungs of the speculative-grade market as commodity prices at their lowest level in more than a decade pummel borrowers in the energy and mining industries. The yield gap between higher- and lower-rated junk bonds expanded to the widest in more than three years, with the large number of energy and mining companies ranked CCC and lower – the riskiest bets – driving the dichotomy, said Martin Fridson at Lehmann Livian Fridson When removing those companies, the yield on CCC bonds barely changed in July, creating “an industry effect in disguise,” he said. “When you see the index, you think you’re buying all the CCCs cheaper,” New York-based Fridson said. “But outside of energy and metals, which look too scary to buy, the others are trading where they were.”

The yield gap between BB-rated bonds – the top of the junk pile – and those ranked CCC and lower expanded to 7.91 percentage points, the most since December 2011, according to Bank of America Merrill Lynch index data. The yield premium for energy companies rated junk versus all high-yielders expanded to 3.61 percentage points after touching the highest ever last week. The gaps have widened as the price of oil plunged by more than 50% in the past year. The plight of these high-yield energy companies may next be seen in default rates, which could reach 25% in the next year in the B and CCC categories, assuming current commodity prices, according to a UBS research report Thursday. “In a troublesome environment, there’s going to be a few companies that fall off the wagon,” said Jody Lurie, a corporate-credit analyst at Janney Montgomery Scott.

“Their ability to withstand such pressures in a longer period of time is low compared to the higher-rated peers.” The crude drop has caused losses for investors who just a few months ago bought bonds from petroleum companies such as Energy XXI and Comstock Resources that flooded the market. The yield gap reached its narrowest point this year March 3 as oil prices recovered in February. “Spreads got insanely tight because of that reach for yield a lot of people were going for regardless of ratings,” said Zach Jonson at Icon Advisers. Now, with oil prices mired by a global glut, investors are intent on moving toward the lower-risk level of higher-rated junk bonds.

Read more …

No need for him to defend himself.

• Galbraith Denies Being Part Of Plan B For Greece ‘Criminal Gang’ (Telegraph)

A world-renowned US economist who was part of a secret “Plan B” team devised by Greece’s former finance minister, has denied being involved in a “criminal gang” intent on bringing the drachma back to the country. James K. Galbraith, a professor of government at the University of Texas and long-time friend of Yanis Varoufakis, co-ordinated a five-man effort which advised Athens on the emergency measures it could take if Greece was forced out of the eurozone. The clandestine plans were made public last week following the airing of a private coversation between Mr Varoufakis and international investors in London. Greece’s supreme court has since lodged two private lawsuits against the former minister with the to the country’s parliament. They are said to be related to charges of treason and the formation of a “criminal gang”.

But speaking to The Telegraph, Mr Galbraith said he has received no official communication from Greek authorities about his own involvement and does not expect an extradition order to face trial in the country. “If questions come my way I’ll be happy to answer them” said Mr Galbraith. “We will see what happens, but I would be surprised if there is anything more than a fact finding mission [from Greek authorities] at this stage.” The US economist spent five months working on the plans until May and was not paid for his efforts. The identity of the other three members has not been revealed, but Mr Varoufakis currently enjoys parliamentary immunity from criminal prosecution. “We were content to stay completely out of view” said Mr Galbraith, who described his work as “precautionary troubleshooting” as Greece was threatened with a collapse of its banking system by Europe’s creditors.

“It was a situation where any leaks would have done harm, and so we proceeded carefully with that very much in mind. No leaks occurred, we were not involved in any policy discussions and we had no role in the negotiating strategy.” Mr Galbraith also distanced himself from a separate finance ministry operation to devise a system of “parallel liquidity” allowing the government to continue paying its suppliers in the face of the cash squeeze. Mr Varoufakis courted controversy after telling investors he asked a childhood friend and professor at Columbia University to “hack” into the computer system of the equivalent of Greece’s inland revenue body, to set up the payments network. Varoufakis said the system could be denominated in drachma at the “flick of a button”.

The revelation that he sought access to private taxpayer information has sparked fury among opposition parties in Greece, who have called for an inquiry into the operation. Mr Varoufakis said the system, which was denominated in euros, could be switched to drachmas at the “flick of a button”. But Mr Galbraith, who has never met the Columbia professor, downplayed the implications of the plan as an “administrative” matter for the finance ministry. “It could have been implemented within the eurozone, and had no implications for the exit strategy”, he said. “It would have facilitated payments between the state and its counterparties and possibly could have been extended to private sector liquidity”.

Read more …

Something tells me the Economist doesn’t quite get it yet.: “The big question is whether this weakness tells us anything about the global economy.”

• Emerging Markets’ Material Difficulties (Economist)

Five years ago, two views were fairly common. The future belonged not to the sluggish, ageing advanced economies but to the emerging markets. Furthermore, those economies had such demand for raw materials that a “commodity supercycle” was well under way and would last for years. Commodity prices peaked in 2011, and have been heading remorselessly downwards ever since. Their decline of more than 40% so far is a huge bear market; had it happened in equities, the talk would be of calamity and collapse. News coverage in the Western media tends to view the decline in commodity prices as a benign phenomenon, as indeed it is for countries that are net importers. But it is not good for commodity exporters, many of which are emerging markets.

That helps explain why emerging-market equities have had only one positive year since 2011, and have underperformed their rich-country counterparts by a significant margin in recent years (see chart). The latest sign of trouble came in China, where the Shanghai Composite fell by 8.5% on July 27th. The growth rate of emerging economies is likely to slow in 2015 for the fifth consecutive year, according to the IMF. Of the BRICs, Brazil and Russia will see their output decline this year, while China is slowing. Only the Indian economy is set to accelerate. Developing economies were boosted in the first decade of the 21st century by the rapid expansion of Chinese demand, as the world’s most populous country underwent an investment boom. This was good news for commodity exporters; China comprises almost half of global demand for industrial metals.

But the fall in commodity prices indicates that Chinese demand has slowed in recent years. It also shows that high prices did their job, by bringing forth new sources of supply, such as shale oil and gas. At the same time, China has shifted its manufacturing industry from the assembly of components made abroad to the creation of finished products from scratch. This has hit other Asian economies. Emerging-market exports are down 14% over the past year in dollar terms. In terms of volume, they continued to grow, but only by 1.1%, according to Capital Economics. Such anaemic growth is becoming a trend. World trade, which was expanding faster than global GDP before the financial crisis, is no longer even keeping pace: last year, it grew by 3.2% while GDP advanced 3.4%.

Read more …

“The reason is simple: they don’t have it. Investors were warned in the documents that were issued with the bonds, so their claim may be a weak one.”

• Puerto Rico Set For Debt Default (FT)

Puerto Rico defaulted on some of its debts this weekend after years of battling to stay current on its obligations, signalling the start of a long and contentious restructuring process for the US commonwealth’s $72bn debt pile. The territory, which successfully scrambled to make a $169m payment on debts owed by the Government Development Bank on Friday, did not make a $58m payment on Public Finance Corporation bonds, according to Victor Suarez, chief of staff for Puerto Rico’s governor. “We don’t have the money,” he said on Friday, according to newswire reports. “The PFC payment will not be made this weekend.” The missed payment will push Puerto Rico formally into default after the close of business on Monday said credit rating agency analysts.

The PFC bonds are the first to fall into arrears, and a government “working group” is racing to come up with a plan to restructure the territory’s debts and overhaul its economy. Puerto Rico governor Alejandro Garcia Padilla startled investors earlier this year when he said the commonwealth would not be able to pay off all of its debts and required a restructuring, a move many bondholders – especially creditors to the government itself –are loath to accept. The PFC bonds hold fewer protections than “general obligation” bonds issued by the Puerto Rican government. The US commonwealth is likely to prioritise which bond payments it makes over the remainder of the year, said traders and portfolio managers. Peter Hayes at BlackRock said the missed payment would be an “awakening” for investors who were holding Puerto Rican debt to generate income.

“It gives you an indication of how [Puerto Rico] is going to proceed going forward,” he said. “They will have some interruption to debt payments, potentially a moratorium of debt service. It is indicative of their solvency situation.”Mr Hayes added that economic activity would have to grow “substantially” in a very short time to avoid a haircut of $30bn to $40bn, which is necessary to get Puerto Rico “out from underneath this debt”. Nonetheless, litigation may start as early as next week, predicted David Kotok, CIO of Cumberland Advisors. “A moral obligation requires an appropriation, and the Puerto Rican legislature failed to appropriate the money,” he said. “The reason is simple: they don’t have it. Investors were warned in the documents that were issued with the bonds, so their claim may be a weak one.”

Read more …

Harper’s still the only game in town after 9 years. Canada’s a country in a coma.

• Harper Calls October 19 Election With Canada’s Economy On The Ropes (Bloomberg)

Prime Minister Stephen Harper fired the starting gun early on Canada’s election campaign amid polls showing his Conservative government’s nine-year reign is threatened by a leftist party that’s never held power nationally. Harper, 56, met with Governor General David Johnston, Queen Elizabeth II’s representative in Canada, on Sunday morning. He requested the dissolution of parliament and formally began campaigning for an Oct. 19 vote, making it the longest electoral contest since 1872. “Now is most certainly not the time for higher taxes, reckless spending and permanent deficits,” Harper told reporters at Ottawa’s Rideau Hall. “Now is the time to stay on track, now is the time to stick to our plan.”

The incumbent prime minister faces the toughest fight of his political life after almost a decade in power, as an oil shock ransacks the economy and voters grow increasingly weary of his government. Polls show Harper’s Conservatives in a tight three-way race with the left-leaning New Democratic Party and the centrist Liberals. The narrow contest suggests Canada is poised return to a minority government, in which no party can unilaterally push through its agenda and elections are more frequent. It would be the country’s fourth minority government in the past five elections. However by starting the campaign early, Harper – whose Conservatives have continued to easily outpace their opponents in fundraising – may tilt the scale in his favor.

“The government is trying at this stage to line up clearly as many advantage touch points as possible,” said John Wright, managing director of polling firm Ipsos Reid. Polling suggests Harper’s biggest challenge will come from the New Democrats, Canada’s official opposition party with the second highest number of seats in the House of Commons. The NDP was averaging 32.6% of popular support, ahead of the Conservatives at 31.6% and the Liberals at 25.6%, according to national averages compiled July 28 by polling aggregator ThreeHundredEight.com for the Canadian Broadcasting Corp.

Read more …

Psychos rule.

• Training Officers to Shoot First, and He Will Answer Questions Later (NY Times)

The shooting looked bad. But that is when the professor is at his best. A black motorist, pulled to the side of the road for a turn-signal violation, had stuffed his hand into his pocket. The white officer yelled for him to take it out. When the driver started to comply, the officer shot him dead. The driver was unarmed. Taking the stand at a public inquest, William J. Lewinski, the psychology professor, explained that the officer had no choice but to act. “In simple terms,” the district attorney in Portland, Ore., asked, “if I see the gun, I’m dead?” “In simple terms, that’s it,” Dr. Lewinski replied.

When police officers shoot people under questionable circumstances, Dr. Lewinski is often there to defend their actions. Among the most influential voices on the subject, he has testified in or consulted in nearly 200 cases over the last decade or so and has helped justify countless shootings around the country. His conclusions are consistent: The officer acted appropriately, even when shooting an unarmed person. Even when shooting someone in the back. Even when witness testimony, forensic evidence or video footage contradicts the officer’s story. He has appeared as an expert witness in criminal trials, civil cases and disciplinary hearings, and before grand juries, where such testimony is given in secret and goes unchallenged.

In addition, his company, the Force Science Institute, has trained tens of thousands of police officers on how to think differently about police shootings that might appear excessive. A string of deadly police encounters in Ferguson, Mo.; North Charleston, S.C.; and most recently in Cincinnati, have prompted a national reconsideration of how officers use force and provoked calls for them to slow down and defuse conflicts. But the debate has also left many police officers feeling unfairly maligned and suspicious of new policies that they say could put them at risk. Dr. Lewinski says his research clearly shows that officers often cannot wait to act. “We’re telling officers, ‘Look for cover and then read the threat,’ ” he told a class of Los Angeles County deputy sheriffs recently. “Sorry, too damn late.”

Read more …

“There was a building in Calais where asylum seeker claims could be processed. Health was checked, children were fed, women were protected from rape [..] In 2002, we told the French to close it.”

• They Are Not Migrant Hordes, But People, And Probably Nicer Than Us (Mirror)

They do not have names. They do not have needs, or rights, or jobs, or a tax code, or a passport. They are your choice of collective noun: a swarm, a flood, a tide, a horde. They are not Bob, or Sue, or David or Kate or Charlotte or Adrian. They are not like us. They are Them. They are stateless and helpless, foodless and friendless. Why should we share? The migrant crisis sounds so much more threatening than the humanitarian crisis . The need for usterity sounds more important than the need for common sense . Let’s put to one side for a moment any arguments about space and what we ll do if the entire population of the world wants to move to these few cold, wet, paedophile-producing square miles of rock. Let’s look at the facts.

1) There are about 5,000 stateless people in Calais. And 64.1 million people in the UK. That means if we let in every single person who’d currently like us to, the population would explode by 0.000078%. That’s not a flood. It’s barely a drip.

2) They would not cost very much . Total UK welfare spending is expected to be £217 billion this year, 29% of our overall budget. It includes benefits, tax credits, and pensions. That works out to £3,385 per head of current population, or £7,406 per taxpayer. If we let in those 5,000 extra people, and we assume they get benefits and pay taxes at the same rates as everyone else, we’d turn a profit. They’d cost us about £17m, but make us at the current rate of GDP £100m extra. Divide that, carry the one… Even if they didn’t work, that £17m divided by all the taxpayers is an extra 57p each. That’s not a drain on resources. And when you consider that over their lifetimes those immigrants are more likely than those born here to work harder for longer while taking less out of the system, it might even turn into a plus.

3) Most people don’t want to come here The argument that letting these people in would mean everyone else would do the same is common, but unreasonable. Yes, each immigrant may have family members who would join them but if you multiplied their numbers by five, 10, or 20, they still have virtually no impact on our population or finances. Most of those trying to come to Britain are from Syria, Libya, Somalia and Eritrea, which have a combined population of 45m. Those 5,000 immigrants represent 0.01% of them. That s not a horde. [..]

5) It’s our fault. There was a building in Calais where asylum seeker claims could be processed. Health was checked, children were fed, women were protected from rape. No-one had to die under trains or drown in the world s busiest shipping lane. Unworthy claims were thrown out before they set foot on British soil, and the ones who genuinely needed help got it. In 2002, we told the French to close it. And we put up a fence. Then we bombed Libya, were unable to pick a side in Syria, complained about Somalia, did nothing at all about Eritrea while mining it of resources and watched the Arab Spring install schismatic warlords all over the Middle East. It’s hardly a surprise some of them want to come here, if only to lodge a formal complaint.

Read more …