W�y�l�a�n�d� �S�t�a�n�l�e�y R�E�O� �t�a�x�i�c�a�b�,� �S�a�n� �F�r�a�n�c�i�s�c�o 1924

“.. a stunning $1.6 trillion annual loss, at oil’s current $57 low ..” What about $50, $45, $40?

• Crashing Crude May Blow $1.6 Trillion Annual Hole In The Global Oil Sector (MW)

Santa Got Run Over By An Oil Tanker

Talk about an oil spill. The spectacular unhinging of crude oil prices over the past six months is weighing mightily on the U.S. stock market. And while it may be too early to abandon all hope that the market will stage a year-end Santa rally, it appears that if Father Christmas comes, there’s a good chance his sleigh will be driven by polar bears, instead of gift-laden reindeer. Indeed, the Dow Jones Industrial Average already endured a bludgeoning, registering its second-worst weekly loss in 2014, shedding 570 points, or 3.2%, on Friday. That’s just shy of the 579 points that the Dow lost during the week ending Jan. 24, earlier this year.

It’s also the second worst week for the S&P 500 this year, which was down about 58 points, over the past five trading days, or 2.83%, compared to a cumulative weekly loss of 61.7 points, or 3.14%, during the week concluding Oct. 10. But all that carnage is nothing compared to what may be in store for the oil sector as crude oil tumbles to new gut-wrenching lows on an almost daily basis. On the New York Mercantile exchange light, sweet crude oil for January delivery settled at $57.81 on Friday, its lowest settlement since May 15, 2009. Moreover, the largest energy exchange traded fund, the energy SPDR off by 14% over the past month and has lost a quarter of its value since mid-June.

The real damage, however, is yet to come. By some estimates the wreckage, particularly for the oil-services companies, may add up to a stunning $1.6 trillion annual loss, at oil’s current $57 low, predicts Eric Lascelles, RBC Global Asset Management chief economist. Since it’s a zero-sum game, that translates into a big windfall for everyone else outside of oil players. In his calculation, Lascelles includes the cumulative decline in oil prices since July and current supply estimates of 93 million barrels a day. It’s a fairly simplistic tally, but it gets the point across that the energy sector is facing a serious oil leak. Here’s a look at a graphic illustrating the zero-sum, wealth redistribution playing out as oil craters:

Read more …

Setting the new price level in one fell swoop.

• U.A.E. Sees OPEC Output Unchanged Even If Oil Falls to $40 (Bloomberg)

OPEC will stand by its decision not to cut crude output even if oil prices fall as low as $40 a barrel and will wait at least three months before considering an emergency meeting, the United Arab Emirates’ energy minister said. OPEC won’t immediately change its Nov. 27 decision to keep the group’s collective output target unchanged at 30 million barrels a day, Suhail Al-Mazrouei said. Venezuela supports an OPEC meeting given the price slide, though the country hasn’t officially requested one, an official at Venezuela’s foreign ministry said Dec. 12. The group is due to meet again on June 5. “We are not going to change our minds because the prices went to $60 or to $40,” Mazrouei told Bloomberg at a conference in Dubai. “We’re not targeting a price; the market will stabilize itself.” He said current conditions don’t justify an extraordinary OPEC meeting. “We need to wait for at least a quarter” to consider an urgent session, he said.

OPEC’s 12 members pumped 30.56 million barrels a day in November, exceeding their collective target for a sixth straight month, according to data compiled by Bloomberg. Saudi Arabia, Iraq and Kuwait this month deepened discounts on shipments to Asia, feeding speculation that they’re fighting for market share amid a glut fed by surging U.S. shale production. The Organization of Petroleum Exporting Countries supplies about 40% of the world’s oil. Brent crude, a pricing benchmark for more than half of the world’s oil, slumped 2.9% to $61.85 a barrel in London on Dec. 12, for the lowest close since July 2009. Brent has tumbled 20% since Nov. 26, the day before OPEC decided to maintain production. U.S. West Texas Intermediate crude dropped 3.6% to $57.81 in New York, the least since May 2009.

The U.A.E. hasn’t been informed of any plan for an emergency meeting, Al-Mazrouei said. OPEC Secretary-General Abdalla El-Badri said, “we don’t know,” when asked at the same conference about the possibility of such a meeting. An increase of about 6 million barrels a day in non-OPEC supply, together with speculation in oil markets, triggered the recent drop in prices, El-Badri said, without specifying dates for the higher output by producers outside the group such as the U.S. and Russia. Prices will rebound soon due to changes in the global economic cycle, he said, without giving details. “We will not have a real picture about oil prices until the end of the first half of 2015,” El-Badri said. Price will have settled by the second half of next year, and OPEC will have a clear idea by then about “the required measures,” he said.

Read more …

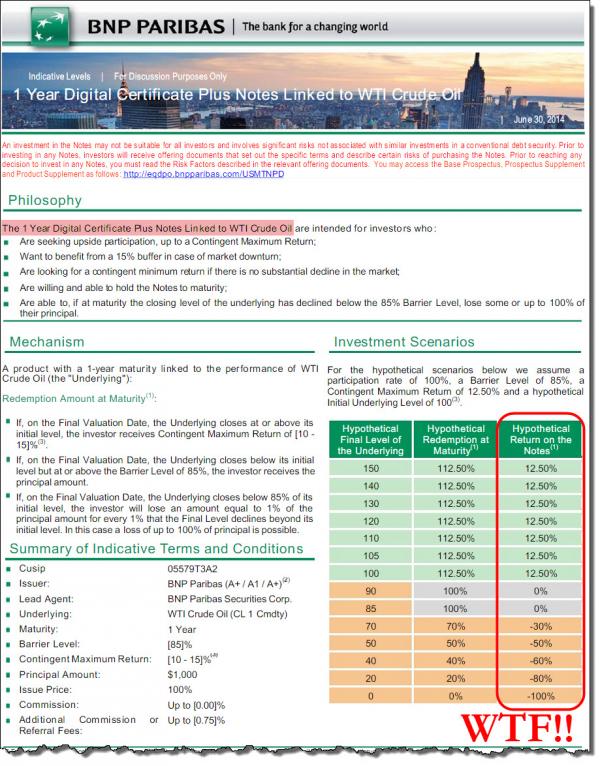

Bet you there’s tons of similar notes around.

• The Oil-Price-Shock Contagion-Transmission Pathway (Zero Hedge)

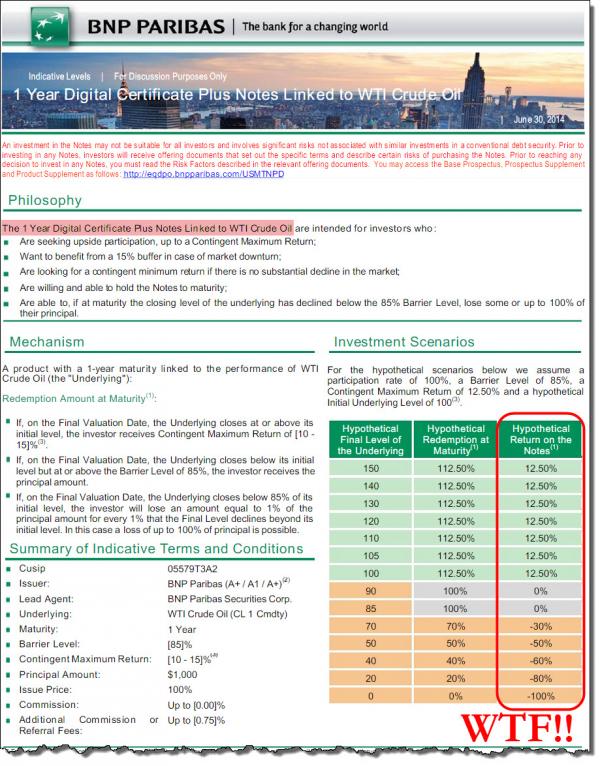

As we noted previously, counterparty risk concerns (and thus financial system fragility) are starting to rear their ugly heads. In the mid 2000s, it was massive one-way levered bets on “house prices will never go down again.” When the cracks started to appear, the mark-to-market losses in derivatives led to forced liquidations and snowballed systemically. In the mid 2010s, it is massively levered one-way asymmetric bets on “commodity prices [oil] will never go down again.” Meet WTI-structured-notes… the transmission mechanism for oil-price-shocks blowing up the financial system. Because nothing says exuberant ignorance like limited upside, unlimited downside OTC (illiquid) derivatives… Here’s BNP Paribas’ 1-Yr WTI-linked notes that collapse if oil drops below $70…

Read more …

It’ll be a bloodbath. Or, it already is, but you can’t see it yet.

• UK Energy Firms Go Under As Oil Price Tumbles (Guardian)

The tumbling oil price has led to a trebling of insolvencies among UK oil and gas services companies so far this year, while £55bn of further oil projects reportedly under threat. Brent crude closed below $62 a barrel on Friday, a five-and-a-half-year low, amid fears of falling demand and oversupply as the global economy slows down. [..] On Sunday, the United Arab Emirates energy minister, Suhail Al-Mazrouei, said Opec would not cut crude output even if the price dropped as low as $40 a barrel. He told Bloomberg at a conference in Dubai: “We are not going to change our minds because the prices went to $60 or to $40. We’re not targeting a price; the market will stabilise itself.” A report due on Monday from accountancy firm Moore Stephens said 18 businesses in the UK oil and gas services sector had become insolvent in 2014 compared with just six last year. It said that although the increase was from a low base, it was significant because insolvencies in the sector had been rare over the last five years.

Jeremey Willmont at Moore Stephens said: “The fall in the oil price has translated into insolvencies in the oil and gas services sector remarkably quickly. The oil and gas services sector has enjoyed very strong trading conditions for the last 15 years, so perhaps they have not been quite so well prepared for a sustained deterioration in trading conditions as other sectors would have been. “There was a sharp drop in the oil price during the financial crisis, but the sense that oil prices could be depressed for some time is much more widespread this time around. “It is clear that oil and gas majors are already cutting costs. Both Shell and BP have recently announced cuts to investment in a number of major projects. Smaller players are also reconsidering their capital deployment. If this retrenchment continues the result will be less work for oil and gas services companies.”

Read more …

A lot of these guys are in for a nasty surprise next time they go see their bankers.

• Oil Bust Veterans Brace While Shale-Boom Newbies Swagger (Bloomberg)

Autry Stephens knows the look and feel of an oil boom going bust, and he’s starting to get ready. The West Texas wildcatter, 76, has weathered four such cycles in his 52 years draining crude from the Permian basin, still the most prolific U.S. oilfield. Though the collapse in prices since June doesn’t yet have him in a panic, Stephens recognizes the signs of another downturn on the horizon. And like many bust-hardened veterans in this region – which has made and broken the fortunes of thousands – he’s talking about it like a gathering storm. The ups and downs of oil are a way of life in Midland and Odessa, Texas, dating all the way back to the Great Depression. It’s as much a part of the culture as Gulf Coast hurricanes, and residents often prepare accordingly.

“We’re going to hunker down and go into survival mode,” Stephens, founder of Endeavor Energy Resources LP, said in an interview from his Midland office, where visitors are first greeted by a statuette of a Texas Longhorn steer. “Stay alive is our mantra, until the price recovers.” Go about 1,300 miles (2,100 kilometers) due north and you get a very different take from the rookie oil barons in North Dakota, where crude output from the Bakken formation went from 200,000 barrels a day in 2008 to about 1.2 million today. They’re not seeing any need to take shelter, and it shows in their swagger. Rich Vestal, who’s seen his trucking business double, double again and then double one more time in the past five years, is sipping root beer out of a Styrofoam cup at the Courthouse Cafe in Williston, North Dakota.

“I would welcome a slowdown,” he says, while believing one’s not really in the works. Of all the booming U.S. oil regions set soaring by a drilling renaissance in shale rock, the Permian and Bakken basins are among the most vulnerable to oil prices that settled at $57.81 a barrel Dec. 12. With enough crude by some counts to exceed the reserves of Saudi Arabia, they’re also the most critical to the future of the U.S. shale boom. For the Texas veteran, the forecast is telling him to batten down the hatches. Up in North Dakota, oil’s new kids on the block figure there’s just a few clouds floating by. Early signs are pointing in favor of the worriers.

Read more …

“The Year of Living Dangerously.”

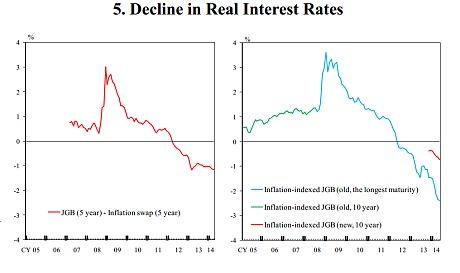

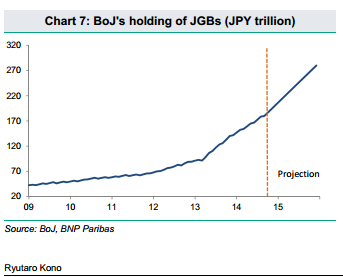

• Warning Over Horrible End To Japan’s QE Blitz (AEP)

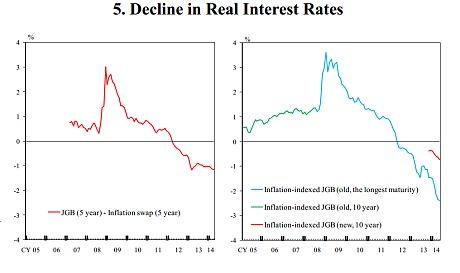

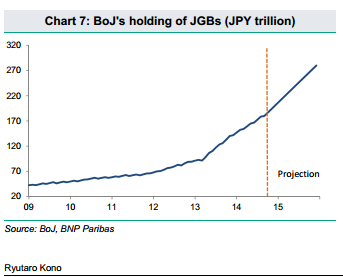

HSBC has warned that Japan’s barely-disguised attempt to drive down the yen is becoming dangerous and may spin out of control, leading to an exchange rate crisis next year and a worldwide currency storm. “It is entirely possible that the Yen decline becomes disorderly and swift,” said the bank, in one of the starkest criticisms so far of Japan’s radical stimulus policies. David Bloom and Paul Mackel, HSBC’s currency strategists, voiced growing concern that premier Shinzo Abe is backing away from fiscal retrenchment and may pressure the Bank of Japan (BoJ) to fund policies aimed at boosting household spending. “The temptation to drift towards increasingly generous fiscal programmes could grow. We do not expect a ‘helicopter drop’ of income into every household, but the yen would react very badly to any sign that the government is heading down a route of overt monetisation,” they wrote in a report entitled “The Year of Living Dangerously”.

The warning came as Mr Abe won a sweeping victory in Japan’s snap elections over the weekend, consolidating his power in the Diet and giving him a further mandate for deep reforms. “I promise to make Japan a country that can shine again at the centre of the world,” said Mr Abe. Japan’s recovery has faltered. Mr Abe’s Thatcherite shake-up, or Third Arrow, has yet to get off the ground, though he is now in a much stronger position to break monopolies and confront vested interests. The economy slumped back into recession in the middle of this year after a rise in the sales tax from 5pc to 8pc, a move that was clearly premature. The Abenomics experiment still depends largely on the BoJ’s asset purchases, running at 1.4pc of GDP each month, the most extreme monetary blitz ever attempted in a modern economy. Economists are deeply divided over whether this alone can overwhelm the fiscal shock, and lift the economy out a 20-year stagnation trap. HSBC said Mr Abe may succeed in driving up wages, setting off a “wage-inflation spiral”.

This may not necessarily lead to a bond rout since the Bank of Japan is effectively holding down bond yields. However, the exchange rate might take the strain instead. The worry is that this could set off a beggar-thy-neighbour devaluation process across Asia, eventually sucking in China. “The tentacle of the currency war would spread,” said the report. HSBC said China is determined to avoid joining this debasement game as it tries to wean its own economy off export-led growth, but there may be limits. The Chinese economy is slowing and is already in deep producer price deflation. Japanese exporters have been switching to a new strategy over the last six months, cutting export prices to gain market share as the yen falls, rather than pocketing the windfall as extra profit. “There are grounds to argue that China would join the currency war and devalue the yuan if currency moves elsewhere became disorderly,” it said. The warnings have raised eyebrows since HSBC has close policy ties with the Chinese authorities.

Read more …

Will Kuroda dare turn on Abe?

• Time to Take Away the Punchbowl in Japan (Bloomberg)

As the world watches to see what Prime Minister Shinzo Abe does with his renewed mandate in Japan, my eyes are on Haruhiko Kuroda instead. After all, the Bank of Japan governor probably deserves about 90% of the credit for whatever success Abe’s reflation efforts have had thus far – in particular, a more than 70% rise in the benchmark Topix index. Whether the prime minister now goes further and implements the real structural reforms Japan needs depends as much on Kuroda as anyone else. Abe’s victory was not as sweeping as might appear at first glance. Amid record-low turnout, his Liberal Democratic Party ended up with a couple fewer seats than previously – although still enough for the ruling coalition to maintain its two-thirds majority in the lower house of parliament.

Not surprisingly, officials in Tokyo are talking less about politically difficult reforms and more about putting money in the hands of Japanese to spend. Analysts are expecting a rush of new fiscal stimulus early in the new year. Kuroda, too, will face pressure to one-up himself when the BOJ meets on Friday. Like addicts looking for their next fix, markets want the central bank governor to outdo his “shock-and-awe” from April 2013 and recent Halloween surprise, when he boosted bond purchases to about $700 billion annually. It’s time for Kuroda to do exactly the opposite: hold his fire and prod Abe to begin doing his part to push through his “third arrow” structural reforms. To this point, Kuroda has been a dutiful and circumspect policymaker – perhaps to a fault. Other than a brief flash of impatience with Abe’s foot-dragging in a May Wall Street Journal interview – when he said “implementation is key, and implementation should be swift” – Kuroda has held his tongue.

Yet he bears a responsibility to play the honest broker role that monetary powers have over the years – from Paul Volcker at the Federal Reserve decades ago to Raghuram Rajan at the Reserve Bank of India today. On Friday, Kuroda should tell reporters, “Now that the election is over, it’s up to Prime Minister Abe to carry out the will of the people and deregulate the economy. For now, we at the BOJ have done all we can – and are willing to do – to make Abenomics a success.” Stock traders would abhor such candor from a central bank that’s spent the last 21 months refilling the punchbowl. But a smart economist and wise tactician like Kuroda has to know this Japanese experiment will end very badly if Abe fails to encourage innovation, loosen labor markets, lower trade tariffs and cut red tape. If bond traders drive government bond yields higher and credit-rating companies pounce, the blame will fall squarely on Kuroda.

Read more …

“Syriza leader Alexis Tsipras called Samaras “the prime minister of chaos” in a speech on Saturday.”

• Samaras Grexit Talk Summons Bond Vigilantes to Greece (Bloomberg)

As he enters a critical week for his premiership, Prime Minister Antonis Samaras has awoken the bond market to the dangers of a political rupture in Greece. Samaras will put forward his candidate for the presidency in the first of three votes on Dec. 17 in a process that risks toppling his government. He spent the weekend trading barbs with the Syriza party that leads in the polls, setting out the consequences of letting the anti-austerity group into power, as Syriza accused him of “begging” markets to attack Greece. A bond selloff pushed the yield on the three-year notes Greece sold earlier this year up more than 60 basis points in an hour on Dec. 11 after Samaras accused the opposition of reviving concerns that Greece could be forced out of the euro. The debt, which symbolized Greece’s financial rehabilitation when it was issued earlier this year, closed the week yielding more than 10-year bonds, a signal of the growing default risk.

“The leading party could be portraying the movement as a way to scare voters,” said Yannick Naud, a money manager at Pentalpha Capital in London. “They are blaming Syriza for the move, and rightly so, and it’s probably to tell the electorate it’s our way or chaos.” Samaras triggered the worst stock market selloff in 27 years last week when he decided to bring forward the vote in parliament on a new head of state. The prime minister will be forced to call a snap election unless he can find another 25 lawmakers for the supermajority required to confirm his nominee by Dec. 29. Samaras wrote in an article in Real News that anxiety about Greece is justified and caused by Syriza. Syriza leader Alexis Tsipras called Samaras “the prime minister of chaos” in a speech on Saturday.

Read more …

“The pressure from the European commission on the electoral process of a sovereign country is unbearable, and raises serious questions about the future of democracy in Europe ..“

• EU Finance Chief Flies Into Athens As Grexit Fears Mount (Guardian)

The EU’s finance commissioner, Pierre Moscovici, flies into Athens on Monday amid mounting political uncertainty following the Greek government’s abrupt decision to bring forward the presidential elections. The Frenchman’s visit comes as the country’s radical-left opposition leader, Alexis Tsipras, steps up claims that Greece is being subjected to a campaign of “frenetic fear-mongering” not only by its Prime Minister Antonis Samaras but senior European officials ahead of this week’s ballot, the first of three polls. “An operation of terror, of lies, is underway,” the leader of Syriza told supporters on Sunday. “An operation whose only aim is to sow terror among the Greek people and MPs, and to thrust the country ever deeper into the poverty and uncertainty of the memorandum,” he said referring to the EU-IMF-sponsored rescue programme to keep the debt-stricken economy afloat.

Tsipras was speaking after government leaders reiterated fears that Greece could be forced to exit the eurozone if parliament failed to elect a new head of state by 29 December. Should the ruling alliance lose the three-round race, the Greek constitution demands that general elections are called, a vote Tsipras’s party is tipped to win. “Everything is hanging by a thread … and if it is cut, it could lead the country to absolute catastrophe,” said the deputy premier, Evangelos Venizelos, whose centre-left Pasok party is junior partner in Athens’ two-party coalition. In a re-run of the drama that haunted Greece at the height of the eurozone crisis in 2012, markets have tumbled with the country’s borrowing costs soaring on the back of revived fears of a Greek exit – called Grexit – if a Syriza-led government assumes power.

Moscovici, whose two-day visit is expected to focus on discussing stalled negotiations with the nation’s troika of creditors – the European commission, the IMF and the European Central Bank – will not be meeting Tsipras. Aides described the snub as “unbelievable”. Last week, the finance commissioner said he thought Samaras “knows what he is doing” and would win his gamble of expediting the vote for a new head of state. In an interview with Kathimerini on Sunday, he described the former EU environment commissioner Stavros Dimas, who is the government candidate for president, as “a good man.” But the newly installed president of the European commission Jean-Claude Juncker, who is a close friend of Samaras, has gone further, warning of the perils of the “wrong election result”. “I wouldn’t like extreme forces to come to power,” he said of the poll’s potential to trigger early general elections. “I would prefer if known faces show up.”

Although it is not the first time that the politics of fear have been invoked to ensure that the twice bailed-out Greece toes the line, the flagrant intervention of figures so directly linked to Athens’ €240bn financial rescue programme has been quick to stir angry reaction abroad. Rushing to the support of Syriza on Saturday, the Party of the European Left, the continent’s alliance of leftist groups, deplored what it said was evidence of declining levels of democracy in the EU. “The pressure from the European commission on the electoral process of a sovereign country is unbearable, and raises serious questions about the future of democracy in Europe,” Pierre Laurent, the organisation’s president said in a statement posted on the party’s website.

Read more …

There’s one solution, and one only: Grexit. Not sure what Steve feels about that, though.

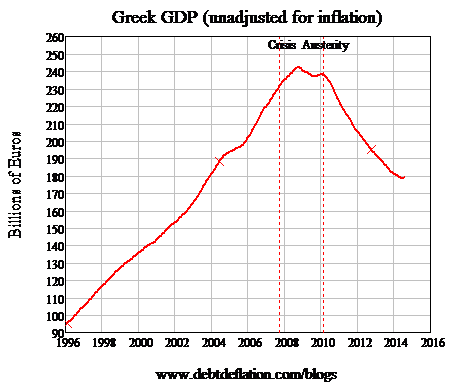

• The EU Must Face Up To Austerity’s Failures (Steve Keen)

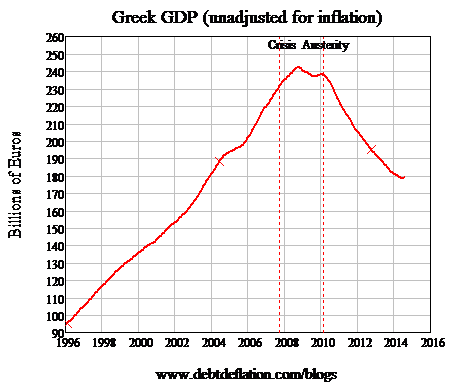

The Greek stockmarket slumped further overnight as investors continue to digest Prime Minister Antonis Samaras’ decision to call a snap presidential election. Greek stocks fell a further 7%, bringing the market’s loss for the year to 29%. Oliver Marc Hartwich commented in Business Spectator earlier this week that the election might “allow the radical anti-austerity forces to gain power. This would not only dash any hopes of a Greek recovery, it would also force the eurozone to make a choice between the lesser of two evils: to expel Greece from the monetary union and let it default on its debt, or to continue supporting it financially, despite an end to fiscal consolidation”. If, as appears likely, the leftist Syriza Party takes over in Greece, Hartwich lamented that “then, whatever may have been achieved on budget consolidation and reform in the meantime will not be worth much anymore.” This assumes that “whatever may have been achieved on budget consolidation and reform” was worth something in the first place.

So let’s stop assuming and check the data. Figure 1 shows Greek GDP since 1996, and it has clearly collapsed since the policy of austerity was imposed. If the Greeks feel inclined to kick out the incumbent government after a more than 25% fall in nominal GDP over the last six years, could you really blame them? Supporters of austerity, such as Hartwich, point to the tiny uptick in GDP in the last six months as a sign that austerity is working. But the original proponents of austerity actually argued that it would cause the economy to grow, not shrink. Some growth. Austerity began in February 2010 in Greece (as marked on Figure 1), and since then the economy has shrunk by almost 25%. Unemployment rose from 10% when the policy began to a peak of 27.5% — worse than the US experienced during the Great Depression. Rather than seeing the slight recovery in the last six months as signs of success, supporters of austerity should be asking why their policies failed so abjectly.

Read more …

“If by the time of the third vote at the end of the December, the centre right’s candidate Stavros Dimas, a former EU commissioner, has not secured 180 votes out of 300 – unlikely as things stand – there will be an election that Syriza could win.”

• The Eurozone Crisis History Is Repeating Itself … Again (Guardian)

It’s funny how history repeats itself. The inconclusive general election in 2010 took place when the economy appeared to be on the mend and against the backdrop of a crisis in the eurozone prompted by Greece. As things stand, we could be in for a repeat performance in May 2015. Be in no doubt, what’s happening in Europe matters to Britain. The eurozone is perhaps one crisis and one deep recession away from splintering. The more TV pictures of rioting on the streets of Athens or general strikes in Italy between now and the election, the better support for Nigel Farage’s UK Independence party will hold up. Stronger support for Ukip will encourage the Conservatives to adopt a more Eurosceptic approach, hardening their stance on the concessions required for them to continue supporting Britain’s membership of the EU.

Meanwhile, a permanently weak eurozone economy will push Britain’s trade balance into the red. The economic debate in the current parliament has been about sorting out the budget deficit; the debate in the next parliament will also be about sorting out the current account deficit. Let’s start with Greece, which was where the eurozone crisis began all those years ago. The French statesman Talleyrand once said of the Bourbons that they had learned nothing and forgotten nothing. The same applies to the bunch of incompetents in Brussels, Berlin and Frankfurt responsible for pushing Greece towards economic and political meltdown. Greece’s recent economic performance has been pretty good. The economy is growing, unemployment is on the decline and the debt to GDP ratio has come down a bit. Time, you might think, to cut Athens a bit of slack.

Not if you are the German government, the European commission or the European Central Bank. No, they are insisting on even more austerity and continued surveillance by the IMF. But the Greeks have had a bellyful of austerity. They have had enough of being pushed around. Predictably, support for the anti-austerity Syriza party is strong and the mood is angry. In an attempt to regain the initiative, the government in Athens brought forward the dates for the votes in parliament to elect a new president. If by the time of the third vote at the end of the December, the centre right’s candidate Stavros Dimas, a former EU commissioner, has not secured 180 votes out of 300 – unlikely as things stand – there will be an election that Syriza could win.

Read more …

” .. the sorry state of the French-German couple – the stalled engine of European integration..”

• Time For Bottom Fishing In The Eurozone? (CNBC)

By taking the euro area stocks down 2.9% in the course of last Friday’s trading, markets may be signaling that recessionary and stagnant economies have set the stage for unsettling political developments throughout the monetary union. There is no safe harbor left in that troubled region. Even Germany is moving toward the eye of the storm. When you see the German Chancellor Merkel’s blistering attack on its coalition partners – the Social Democrats – for having formed the government in the federal state of Thuringia with the far Left Party (Die Linke) and the Greens, you know that German political stability is gone. In fact, she sounded like she was actively searching for a new partner when, in the same speech last Tuesday (December 9), she invited the Greens (polling at 11%) to cooperate with her center-right party CDU/CSU (polling at 41%). Germany’s current governing coalition is at odds about euro area economic policies and the economic fallout from sanctions against Russia.

More generally, it seems, Chancellor Merkel’s hostile policies toward Russia have opened ominous differences on issues of European security. It looks like a perfect deal breaker may be in the offing. And then there is Germany’s deteriorating relationship with France. Invectives and name calling are flying across the Rhine, and things are seriously amiss at the highest political level. For example, in response to Chancellor Merkel’s repeated criticisms of France’s failure to meet budget deficit targets and to implement structural reforms, the French Prime Minister Valls is saying that France is doing its reforms for its own needs rather than to please foreign governments. In other words, what France is doing, or not doing, is none of Germany’s business. That is the sorry state of the French-German couple – the stalled engine of European integration.

Read more …

But asking prices are up!

• London House Prices Fall By More Than £30,000 In A Month (Guardian)

The average asking price of a home in London has tumbled by more than £30,000 over the past month, figures from property website Rightmove showed on Monday, with new sellers in all of the capital’s boroughs seemingly becoming less optimistic about the price they can achieve. Across the country, Rightmove reported the largest ever monthly fall in the price of properties coming to market, a 3.3% or nearly £9,000 decline to £258,424. Asking prices in Greater London have been falling since the summer, and the drop to an average of £570,796 from £601,180 in November, represents a 5.1% decline in sellers’ expectations over the month, the second biggest after August. Prices were down in all 32 London boroughs, with the biggest drops in Hammersmith & Fulham and Hackney, where new asking prices dropped by 7% and 6% respectively.

However despite the drop, average asking prices of homes coming onto the market across London are up by £57,000, or 11.1%, on December 2013. In Hackney, sellers are asking 22.5% more than in December last year, while in Haringey prices are 21% higher. Rightmove reported month-on-month drops everywhere except Wales, where new sellers put homes up for sale for 0.2% more than in November, at an average of £167,271. However asking prices are set to end the year up 7%, and the website said it expected further increases in the range of 4% to 5% in 2015. The falls come despite the changes to stamp duty announced in this month’s autumn statement. Estate agents have predicted the changes could lead to higher prices being paid for homes, particularly around the old “cliff edge” thresholds at which higher tax rates kicked in.

Read more …

“.. we are two bad decisions away from not being an independent central bank ..”

• Fed Vice-Chairman Fisher: ‘Boy, Was I Wrong’ About Banks’ Political Power (WSJ)

Did the political influence of big Wall Street banks wane after the financial crisis? Not according to the vice chairman of the Federal Reserve. Stanley Fischer gave some unscheduled remarks Friday morning at the Peterson Institute for International Economics, waxing philosophic about the global process for setting financial-system rules. Mr. Fischer suggested rules set directly by legislatures can be imperfect, lamenting the role of Wall Street banks in shaping the 2010 Dodd-Frank financial overhaul law.

“I thought that when Dodd-Frank started, that the banks would not succeed in influencing it, having lost all the prestige they lost,” he told a crowd of several dozen at the Washington, D.C., think tank. “Boy, was I wrong.”

His remarks came less than a day after the House passed a spending bill that included a provision, long sought by banks, to scale back a Dodd-Frank requirement. Mr. Fischer also recalled how during his time leading the Bank of Israel, he felt keenly aware of political considerations. When his central bank colleagues asserted that the institution acted independently of the elected government, his reply was, “Yes. And we are two bad decisions away from not being an independent central bank.”

Read more …

When did Krugman last get anything right? I still think he lost it in the Swedish schnapps he drank when picking up his Fauxbel.

• Krugman Says Fed Is Unlikely to Raise Interest Rates in 2015 (Bloomberg)

Nobel laureate Paul Krugman said the U.S. Federal Reserve is unlikely to raise interest rates next year as it struggles to meet its inflation target and global economic growth remains weak. “When push comes to shove they’re going to look and say: ‘It’s a pretty weak world economy out there, we don’t see any inflation, and the risk if we raise rates and turns out we were mistaken is just so huge’,” Krugman said in Dubai today. “It’s certainly a real possibility that they’ll go ahead and do it, but probably not.” Top Fed officials, including Vice Chairman Stanley Fischer and New York Fed President William C. Dudley, said this month they expect the drop in oil prices to spur domestic consumption, playing down the risk that it could push inflation further below the central bank’s 2% goal. Krugman, however, said he agrees with signals from financial markets suggesting that policy makers will delay raising borrowing costs.

U.S. Treasuries rallied, with 10-year yields falling the most since June 2012 on Dec. 12 while bond yields showed five-year inflation expectations fell to the lowest since 2010. The policy-setting Federal Open Market Committee, which next meets Dec. 16-17, will take energy prices into account in its assessment of inflation and the economy. While most major central banks view inflation of about 2% as the yardstick for price stability, more than a fourth of 90 economies monitored by researcher Capital Economics Ltd. are below 1%, the most since 2009. The outlook for world economic growth may deteriorate in 2015 with risks of crises in China and the euro-area, Krugman said, as the European Central Bank fails to dodge deflation and the world’s second-biggest economy struggles to bolster domestic demand. “The two scary spots are the euro-area and China,” Krugman said in a presentation about the state of the world economy at the Arab Strategy Forum in Dubai.

Read more …

It’ll take a crash for people to really understand what the swaps rule demise entails. And by then it’ll be too late by a wide margin.

• Congress Deals A Blow To Financial Reform (Bloomberg ed.)

Passing a last-minute spending bill to avoid shutting down the U.S. government might be better than another self-inflicted budget crisis, but the deal on the table is nothing to be proud of. The measure approved by the House of Representatives last night and now before the Senate carries with it a set of so-called riders, which change policy in ways that haven’t been examined or discussed. One of them is especially troublesome. It weakens the Dodd-Frank financial reforms. The rider in question removes the so-called swaps push-out rule, which was intended to reduce the risks posed by the largest U.S. banks’ trading in derivatives. Without it, regulators will have to work harder in other areas to promote stability. The rule addressed a dangerous incentive created by the pre-crash regulatory system. Various government backstops, such as deposit insurance and access to emergency loans from the Federal Reserve, have given the largest banks a great advantage in the derivatives market.

Counterparties assume that the government will help them make good on their obligations. This implicit subsidy encouraged them to build huge, interconnected trading operations. Trouble at any one of them could trigger a broader panic and necessitate a rescue. The size of the business is staggering. As of June, the top four banks – JPMorgan Chase, Citigroup, Goldman Sachs and Bank of America – had written derivative contracts on the equivalent of more than $200 trillion in stocks, bonds and other assets. The rule told banks to move some of their derivatives out of federally insured, deposit-taking subsidiaries and to put them in other units instead. This was never going to make the financial system safe on its own. In the case of the biggest banks, all units, not just deposit-takers, enjoy government support, as the bailouts of 2008 and 2009 plainly demonstrated. In addition, pleading practical difficulties, banks had already succeeded in narrowing the scope of the requirement. Still, the swaps rule would have been helpful. Its demise gives regulators more work to do.

They’ll probably need to take further steps to reduce the value of the government subsidy, by making banks less likely to need it. How? First, by making sure that banks have ample capital, and plenty of cash on hand, to cope with sudden setbacks. Here, the regulators have made a start but need to do more. Second, by requiring derivatives trades to be routed transparently through new central counterparties and by setting up trading hubs that let investors transact directly with one another. This strengthening of the financial infrastructure is in train. Third, by monitoring the market for dangerous concentrations of risk, such as the credit-derivative positions that almost brought down insurance giant AIG and a number of large banks in 2008. Here, progress has been sluggish at best. The killing of the swaps rule needn’t be a disaster. That’s what it would be, though, if it proved to be the first step in a broader rollback of financial reform, and if regulators failed to use their other powers to better effect.

Read more …

A ‘little risky’, clueless Robert? Check this for ‘deep thinking’: “Maybe neighborhoods are not as important. Or maybe there’s an urbanization trend going on.”

• Shiller Sees Risk In New Push For First-Time Homebuyers (CNBC)

Lax lending standards were widely faulted for triggering the 2008 financial crisis. If recent developments are any indication, those conditions may be making a comeback. In an effort to accelerate lending to lower- and middle-income borrowers, mortgage giants Fannie Mae and Freddie Mac are launching programs that will guarantee loans with down payments of as little as 3%. But could an ultralow down payment create a housing market boom, or could it lead to another mortgage bubble? A prominent housing market expert who made his name predicting the 2008 bust has at least some doubts. “It sounds a little risky,” Nobel Prize-winning economist Robert Shiller told CNBC. “Risky for the lender, and for the mortgage insurer who is going to insure” the mortgage obligations, he added.

Borrowing criteria tightened after the housing market crashed, but in recent days some of those strictures have been loosened. Lack of a big cash down payment has been cited by some as keeping many possible buyers from becoming homeowners. According to Fannie Mae and Freddie Mac, to get a mortgage with just 3% down, borrowers must have a credit score of at least 620. They must also be able to able to prove income, assets and job status, and purchase private mortgage insurance. However, Shiller still cast doubt on whether that would be the best course of action. “Because it’s only a 3% margin, if somebody defaults and they have to sell the house, they might not get all the money back.”

Although banks have implemented tighter lending standards, a spate of new borrowing programs have been aimed at first-time and lower-income homebuyers, most of whom have stayed on the sidelines of the housing market. According to recent data from the National Association of Realtors, first-time homebuyers account for just 33% of all home purchases. That’s the lowest level in 27 years. “Maybe there’s a cultural change. Our millennials spend more time on Facebook than standing over the backyard fence and talking to the neighbor,” Shiller said, attempting to explain the drop in new homebuyers. “Maybe neighborhoods are not as important. Or maybe there’s an urbanization trend going on.”

Read more …

Didn’t have the guts to go below 7%, did you?

• China Economic Growth May Slow To 7.1% In 2015 – PBOC (Reuters)

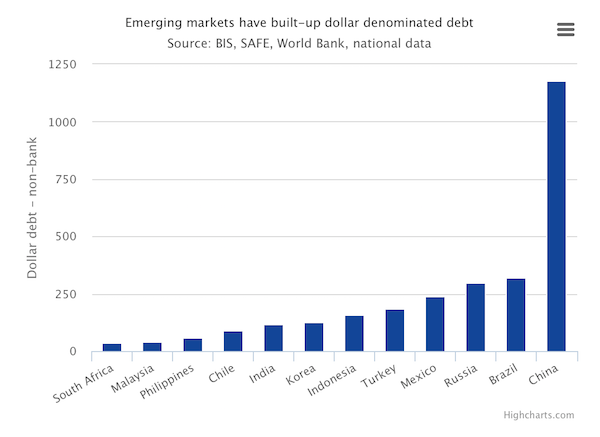

China’s economic growth could slow to 7.1% in 2015 from an expected 7.4% this year, held back by a sagging property sector, the central bank said in research report seen by Reuters on Sunday. Stronger global demand could boost exports, but not by enough to counteract the impact from weakening property investment, according to the report published on the central bank’s website. China’s exports are likely to grow 6.9% in 2015, quickening from this year’s 6.1% rise, while import growth is seen accelerating to 5.1% in 2015 from this year’s 1.9%, it said. The report warned that the Federal Reserve’s expected move to raise interest rates sometime next year could hit emerging-market economies.

Fixed-asset investment growth may slow to 12.8% in 2015 from this year’s 15.5%, while retail sales growth may quicken to 12.2% from 12%, it said. Consumer inflation may hold largely steady in 2015, at 2.2%, it said. China’s economic growth weakened to 7.3% in the third quarter, and November’s soft factory and investment figures suggest full-year growth will miss Beijing’s 7.5% target and mark the weakest expansion in 24 years. Economists who advise the government have recommended that China lower its growth target to around 7% in 2015. China’s employment situation is likely to hold up well next year due to faster expansion of the services sector, despite slower economic growth, said the report.

Read more …

Oz has different worries today.

• Australia’s Budget Deficit Blows Out Amid Commodity Slide (Reuters)

Australia’s government forecast its budget deficit would balloon to A$40.4 billion ($33.2 billion) in the year to June as falling prices for key resource exports and sluggish wage growth blew a gaping hole in tax revenues. Releasing his midyear budget outlook on Monday, Treasurer Joe Hockey predicted the economy would grow by 2.5% in 2014/15 before picking up to 3.5% over the next few years, while unemployment was likely to peak at 6.5%. “While there are positive signs of the Australian economy strengthening and transitioning towards broader-based drivers of growth, there is still much work to be done and budget repair will take time,” said Hockey. Just a year into office, Prime Minister Tony Abbott’s government has suffered record low approval ratings, with the economy running into strong external headwinds.

The deficit for 2014/15 had been forecasted at A$29.8 billion in the May budget, while the 2015/16 shortfall was now put at A$31.2 billion, instead of A$17.1 billion. The release was delayed for over an hour as the government reacted to a hostage siege in the heart of Sydney’s financial district, which has diverted media coverage away from the budget update and the government’s political troubles. Hockey predicted tax receipts would be A$31 billion less than first hoped in the four years to 2017/18, due largely to a slide in the price of iron ore, Australia’s biggest export earner. The government has had to cut its forecast from A$92 a ton in May, to A$60 a ton for the foreseeable future. The government has also faced problems getting unpopular cost cutting and revenue raising measures through the Senate, which Hockey said cost another A$10.6 billion.

Read more …

“The Cold War was the dialectic conditioning of the whole world ..”

• The Implosion Of American Culture (PhoM)

It was widely expressed by the mainstream media of the time that the collapse of the Soviet Union and the fall of the Berlin Wall could not have been predicted. In hindsight, the stagnation and drop in oil prices should have been the obvious signs that a dramatic change was coming. And when the USSR began to borrow from western banks, the fix was in. Western banks is something of a misnomer, as no bank, or conglomerate of banking interests, can exist separate and independent of the larger international banking structure which has been built throughout the the 20th Century. Stagnating growth and the deflationary oil prices which began in 1986 acted as fine toothed methods of transferring wealth from the social trust within the Soviet Union, forcing banks within the USSR to borrow from western banks, which was in fact an exchange of assets amongst financial institutions.

The inevitable policy shifts towards “perestroika” were obvious and planned well in advance. The agricultural crisis within the country was designed to parallel the mass movement towards “glasnost”, or openness. When we consider the larger mandates of the CSI, Cultural and Socioeconomic Interception, the same machinations as “perestroika” and ‘glasnost” can be observed in the social fragmentation and devolution of the American middle class. Where the Soviet Union enacted policies which instigated the CSI changes within the country, it will be Americas lack of enacting policy change which will precipitate the implosion of its culture.

To understand what this means we must consider the expansion of American culture around the globe since 1944, which was the year the USD became the primary reserve currency used in global trade. As use of the dollar increased, so did the acceptance of western culture. Everything from McDonald’s burgers to Hollywood creations were exported around the world. America has followed the Soviet Union down the path of re-engineering its ideological culture. Russia has no more moved towards democracy than America has moved towards Communism. Both have shifted towards a new socialist middle ground where centralization has woven the macro economic system tighter around a supra-sovereign statehood. The Cold War was the dialectic conditioning of the whole world.

Read more …

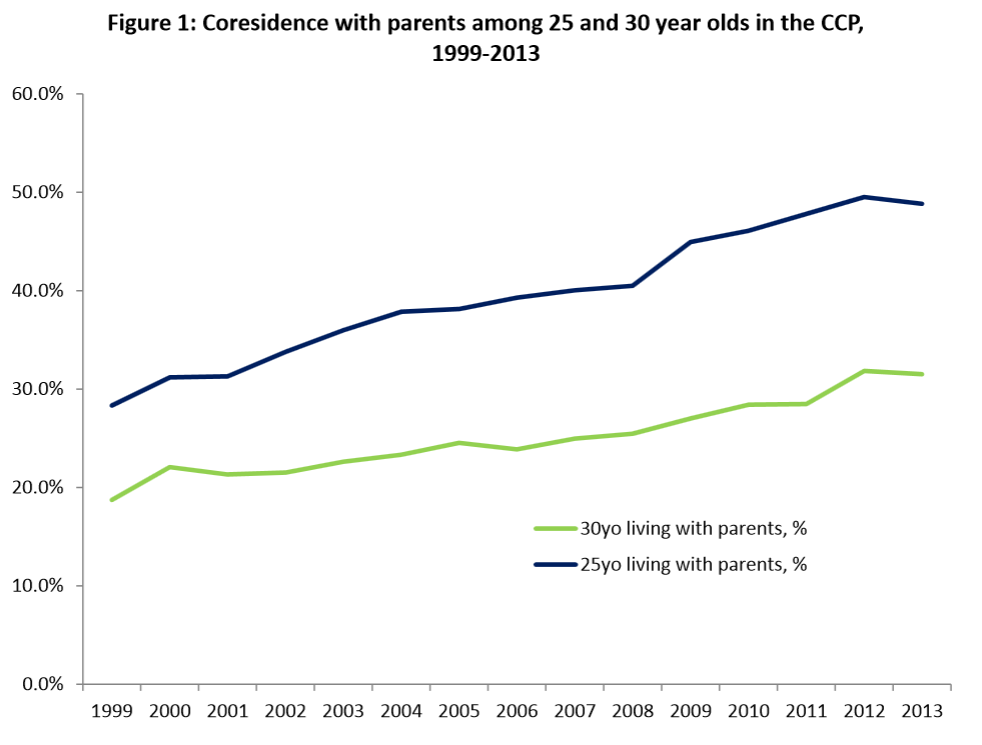

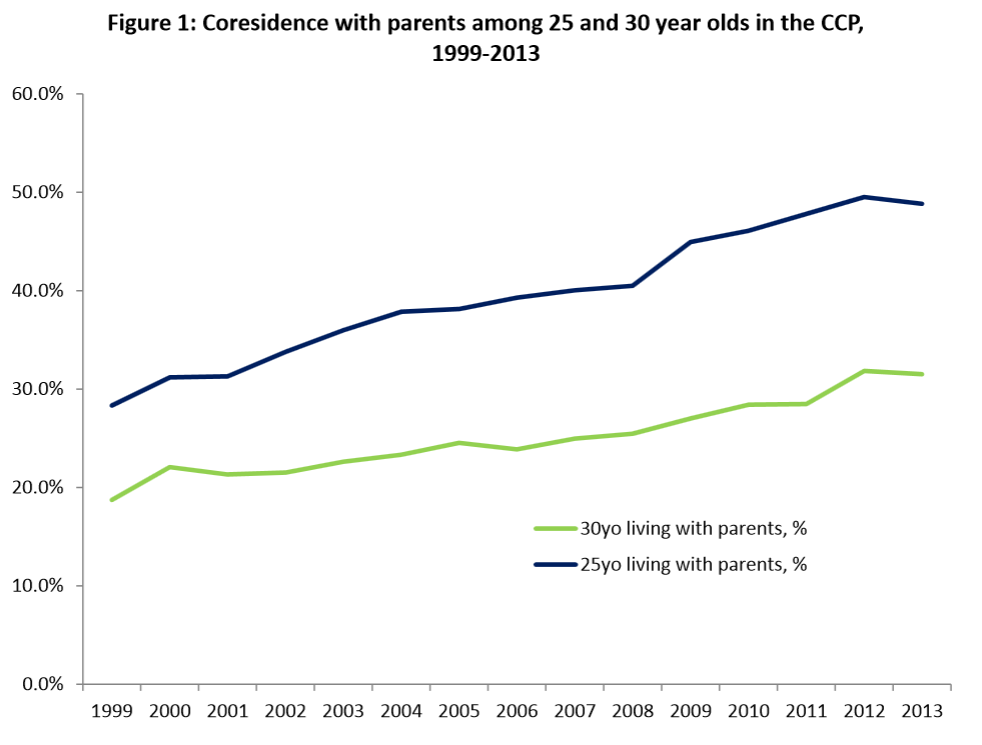

“Nearly half of those 25 years of age are living at home with parents. The rate is up to 30% for those 30 years of age.”

• Why Milennials Are Stuck Living At Home With Parents (Dr. Housing Bubble)

The Federal Reserve conducted a study on Millennials and tried to ascertain why so many of them are living at home. Is it too much student debt? Lower incomes? Or is it that home prices are simply unaffordable? The study finds that all of these factors have a big impact on why many Millennials are living at home and why the first time home buyer market is performing so badly. It also gives us insight into the shifting building demand of new construction. Many builders are focusing their energies on multi-unit structures to cater to an audience that will look for rentals or lower priced condos. There is a heavy renting trend undertaking this country. We are seeing a record numbers of young people living at home with mom and dad heading directly back into their childhood rooms to rock out the NES and attempting to pass Super Mario Brothers once again. There are major implications for housing because of this new structural change. First time home buying is down dramatically. Construction is catering to a lower income cohort. Let us look at what the Fed found in their report.

One of the interesting findings is that the trend of young adults living at home has continued on an upward slope going all the way back to 1999. Even the toxic mortgage days of Housing Bubble 1.0 didn’t really shift this figure by much. But the homeownership rate increased which means that the push came from older cohorts or young buyers that had the misfortune of buying near the top (and of course many were burned in epic fashion).

So let us look at the findings: Nearly half of those 25 years of age are living at home with parents. The rate is up to 30% for those 30 years of age. These are dramatic increases from 1999. There has been paltry data on the makeup of housing composition because some were saying that many were shacking up with roommates. That does not appear to be the case. If you were placing a bet, you would be in a good position putting your money on those 25 years of age living at home with parents. The first time home buyer market continues to perform pathetically. Of course, with investors pulling back we now have the FHFA trying to push for 3% down payment loans to get the juices flowing again. We are already at 5% down payments so this move to 3% will likely offer minimal help for younger Americans.

Read more …