Edwin Rosskam Service station, Connecticut Ave., Washington, DC 1940

The warnings come from all sides now.

• ‘Destruction Of Wealth’ Warning Looms Over Stocks (MarketWatch)

A new health indicator for the S&P 500 Index of the largest U.S. stocks shows a rising likelihood of a broad, long-term decline. The benchmark has fallen 6.8% this year, pulled down by an 11% correction from Aug. 17 through Aug. 25. Earlier this year, the S&P 500 SPX, +0.20% had been setting new highs. Investors are now bracing for more declines as there are plenty of indications of trouble ahead. For one thing, the S&P 500 trades for 16 times aggregate consensus 2015 earnings estimates, which is near a 10-year high. Another headwind is the coming rise in interest rates by the Federal Reserve. Fed Chairwoman Janet Yellen said last week that she anticipated an increase of short-term rates “later this year, followed by a gradual pace of tightening thereafter.”

The federal funds rate has been locked in a range of zero to 0.25% since late 2008. That, combined with the massive expansion of the central bank’s balance sheet, made stocks attractive to investors who might otherwise have been tempted by decent yields form other asset classes. Reality Shares, a San Diego-based firm founded in 2012, has a new market-health indicator called the Guardian Gauge, which uses volatility and price-momentum data to give a long-term outlook for the S&P 500. For the past 15 days, the Guardian Gauge has been in the red. Reality Shares CEO Eric Ervin explained it this way: “Guardian looks at the 10 sectors of the S&P 500. If three of the sectors go negative, it signals a very high probability of going into a bear market. Over the past 15 years, it would have predicted the tech wreck and the financial crisis.”

“Each and every day, we are witnessing the ongoing global selloff inflict more and more damage to the post-2009 cyclical bull market.”

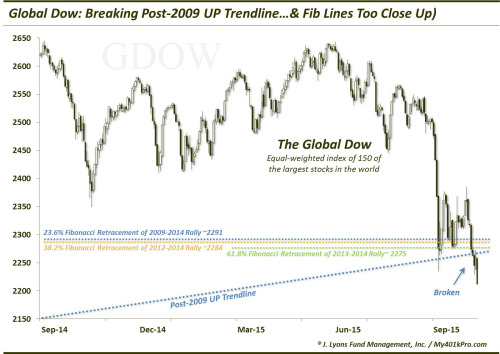

• Key Global Equity Index Has Fallen Off The Precipice (Dana Lyons)

On September 8, we posted a chart showing how a key worldwide equity index – the Global Dow – was “hanging on the precipice”. To refresh, the Global Dow is an equally-weighted index of the world’s 150 largest stocks. Therefore, while it may not directly be the target of a lot of money changing hands, it most certainly represents the stocks that see the most money trading hands. Thus, The Global Dow is a fairly important barometer of the state of the global large cap equity market. The “precipice” that we referenced in the September 8 post was the UP trendline from the bull market bottom in 2009. Not surprisingly, the index did attempt to climb up off of the precipice in the weeks following the post. However, as we suggested, “another test of the precipice here at 2280 would not be surprising”. The Global Dow did return to test that area and is now officially off of the precipice – having fallen down off of it in the last few days, as the following charts illustrate.

Additionally, as the charts indicate, the post-2009 UP trendline also coincided with a cluster of important Fibonacci Retracement levels shown below. Therefore, this breakdown wasn’t just about the trendline but a myriad of significant levels, making it even more consequential. [..] this is one more in a rapidly growing list of examples of indexes around the globe that are breaking long-term UP trendlines and other significant levels of various magnitude. Each and every day, we are witnessing the ongoing global selloff inflict more and more damage to the post-2009 cyclical bull market. And while that bull may not be declared dead for some time, it is now being wounded enough daily to warrant very seriously considering that possibility.

For 27 years, money has flown into emerging markets. That trend has now reversed.

• Is This The Mother Of All Warnings On Emerging Markets? (CNBC)

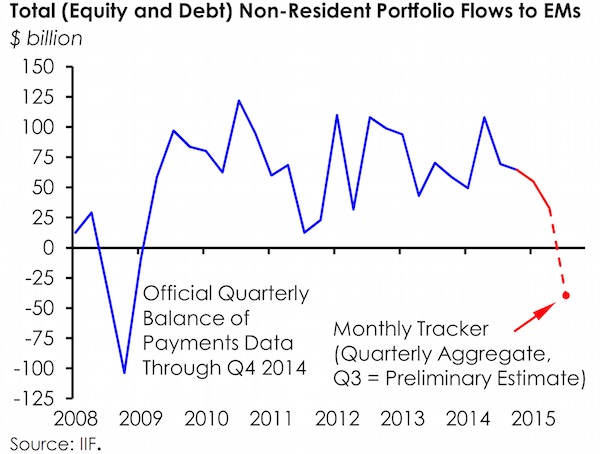

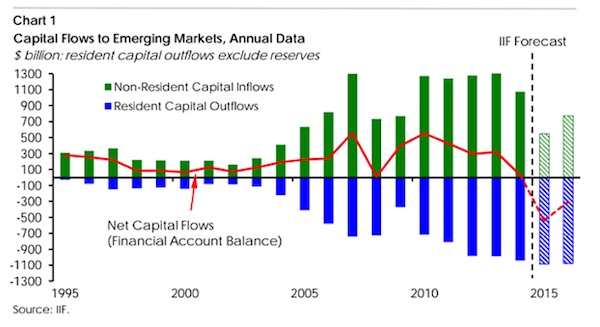

The last time emerging markets had it nearly this bad, Ronald Reagan was the U.S. President, KKR purchased RJR Nabisco, and a future popstar named Rihanna was born. Net capital flows for global emerging markets will be negative in 2015, the first time that has happened since 1988, the Institute of International Finance (IIF) said in its latest report. Net outflows for the year are projected at $541 billion, driven by a sustained slowdown in EM growth and uncertainty about China, it added. In other words, investors will pull out more money out of emerging markets than they will pump in. The data come on the heels of a separate IIF report this week that showed portfolio capital outflows in EMs amounted to $40 billion during the third quarter, the worst performance since 2008.

Indeed, relief from the Federal Reserve’s decision to delay its first interest rate hike in a decade has proved to be short-lived for EMs amid fresh evidence of a slowing Chinese economy, precipitous currency declines, a sustained slide in commodity prices, and political uncertainty in countries such as Brazil and Turkey. Covering a group of 30 economies, the IIF report estimates net non-resident inflows at $548 billion for 2015 from $1,074 billion last year—levels not seen since the global financial crisis. “As a share of GDP, non-resident inflows have fallen to about 2% from a record high of almost 8% in 2007.” The situation is exacerbated by the fact that investors residing in emerging market countries are buying more foreign assets.

Known as resident outward investment flows, 2015’s reading is expected to hit a historical high of $1,089 billion, which is likely to further pressurize reserves, exchange rates and asset prices of EMs, the IIF said. “On a net basis, lower inflows and rising outflows imply that private capital is leaving EMs for the first time since the early 1980s.” So, which region is the weakest? No surprises here. “It is noteworthy that a large part of the decline in overall flows this year is attributable to flows out of China, which intensified after the People’s Bank of China announced a mini-devaluation of the renminbi and a shift to a more market-oriented exchange rate fixing regime in August.”

“Global investors will suck capital out of emerging economies this year for the first time since 1988..”

• Global Investors Brace For China Crash (Guardian)

Global investors will suck capital out of emerging economies this year for the first time since 1988, as they brace themselves for a Chinese crash, according to the Institute of International Finance. Capital flooded into promising emerging economies in the years that followed the global financial crisis of 2008-09, as investors bet that rapid expansion in countries such as Turkey and Brazil could help to offset stodgy growth in the debt-burdened US, Europe and Japan. But with domestic investors in these and other emerging markets squirrelling their money overseas, at the same time as international investors calculate the costs of a sharp downturn in Chinese growth, the IIF, which represents the world’s financial industry, said: “We now expect that net capital flows to emerging markets in 2015 will be negative for the first time since 1988.”

Unlike in 2008-09, when capital flows to emerging markets plunged abruptly as a result of the US sub-prime mortgage crisis, the IIF’s analysts say the current reversal is the latest wave of a homegrown downturn. “This year’s slowdown represents a marked intensification of trends that have been underway since 2012, making the current episode feel more like a lengthening drought rather than a crisis event,” it says, in its latest monthly report on capital flows. The IIF expects “only a moderate rebound” in 2016, as expectations for growth in emerging economies remain weak. Mohamed El-Erian, economic advisor to Allianz, responding to the data, described emerging markets as “completely unhinged”, and warned that US growth may not be enough to rescue the global economy. “It’s not that powerful to pull everybody out,” he told CNBC.

Capital flight from China, where the prospects for growth have deteriorated sharply in recent months, and the authorities’ botched handling of the stock market crash in August undermined confidence in economic management, has been the main driver of the turnaround. “The slump in private capital inflows is most dramatic for China,” the institute says. “Slowing growth due to excess industrial capacity, correction in the property sector and export weakness, together with monetary easing and the stock market bust have discouraged inflows.” At the same time, domestic Chinese firms have been cutting back on their borrowing overseas, fearing that they may find themselves exposed if the yuan continues to depreciate, making it harder to repay foreign currency loans.

“What wasn’t known were the specifics of just how severe this bubble deterioration was for the most critical for China, in the current deflationary bust, commodity sector. We now know, and the answer is truly terrifying.”

• Over Half Of China Commodity Companies Can’t Pay The Interest On Their Debt (ZH)

Earlier today, Macquarie released a must-read report titled “Further deterioration in China’s corporate debt coverage”, in which the Australian bank looks at the Chinese corporate debt bubble (a topic familiar to our readers since 2012) however not in terms of net leverage, or debt/free cash flow, but bottom-up, in terms of corporate interest coverage, or rather the inverse: the ratio of interest expense to operating profit. With good reason, Macquarie focuses on the number of companies with “uncovered debt”, or those which can’t even cover a full year of interest expense with profit. The report’s centerprice chart is impressive. It looks at the bond prospectuses of 780 companies and finds that there is about CNY5 trillion in total debt, mostly spread among Mining, Smelting & Material and Infrastructure companies, which belongs to companies that have a Interest/EBIT ratio >100%, or as western credit analysts would write it, have an EBIT/Interest <1.0x. As Macquarie notes, looking at the entire universe of CNY22 trillion in corporate debt, the "percentage of EBIT-uncovered debt went up from 19.9% in 2013 to 23.6% last year, and the percentage of EBITDA-uncovered debt up from 5.3% to 7%. Therefore, there has been a further deterioration in financial soundness among our sample." To be sure, both the size (the gargantuan CNY22 trillion) and the deteriorating quality (the surge in "uncovered debt" companies) of cash flows, was generally known. What wasn't known were the specifics of just how severe this bubble deterioration was for the most critical for China, in the current deflationary bust, commodity sector. We now know, and the answer is truly terrifying.

“..September picked up many of the unresolved issues that we left behind in August..”

• Here’s How Ugly The Third Quarter Was For Stocks And Commodities (MarketWatch)

Needless to say, September and the third quarter overall were tough for many investors. “The third quarter of 2015 proved to be the weakest quarter for risk assets for some years and most market participants are probably glad to see the back of it,” wrote Jim Reid, global strategist at Deutsche Bank, in a Thursday note. “Indeed Q3 saw the poorest quarterly performance for the S&P 500 and the Stoxx 600 since Q3 2011. It was also the worst quarter for the Nikkei since 2010 whereas in [emerging markets] the Shanghai Composite and Bovespa posted their worst quarterly scorecard since 2008. Reid breaks down the quarterly performance in a series of charts…

September on its own was pretty brutal, with 27 of Deutsche Bank’s 42 selected global asset classes ending the month with losses. “In many ways, September picked up many of the unresolved issues that we left behind in August,” Reid wrote. The selloff in commodities and emerging markets gained more momentum on deepening recession fears that, in turn, raised more questions about the sustainability of global growth, he said.

More Jim Reid: “Although we don’t think QE and zero interest rates does much apart from prop up an inefficient financial system it’s all we’ve got until we have a huge policy sea change..“

• This Is The Endgame, According To Deutsche Bank (Jim Reid)

From Jim Reid, Deutsche Bank’s chief credit strategist: “Our thesis over the last few years has basically been that the global financial system/economic fundamentals are so bad that its good for financial assets given it forces central banks into extraordinary stimulus and for them to continue to buy assets in never before seen volumes. The system failed in 2008/09 and rather than allow a proper creative destruction cleansing, policy makers have been aggressively propping it up ever since. This has surely led to a large level of inefficiency in the system which helps explain weak post crisis growth and thus forces them to do even more thus supporting asset prices if not the global economy. However since the summer this theory has been severely tested by China’s equity bubble bursting, China’s small ‘shock’ devaluation and the start of a rundown in reserves for the first time in over a decade.

We’ve also seen associated commodities and EM woes, endless unsettling speculation about the Fed’s next move and more recently the idiosyncratic corporate scandal around VW and funding concerns around Glencore. The hits keep on coming. Is it now so bad it’s actually bad again? The most recent leg of the sell-off begun after the Fed held rates steady two weeks ago as the narrative focused on either this reflecting worrying economic concerns or a Fed that is a slave to financial markets and losing credibility. So do we think we’re now entering a period where central banks are increasingly impotent? The answer is that they have been for a while on growth so not much has changed. However they can still buy more assets and continue to keep policy loose.

Although we don’t think QE and zero interest rates does much apart from prop up an inefficient financial system it’s all we’ve got until we have a huge policy sea change which probably only happens in the next recession (more later). So for now we think central banks are trapped into continuing on the same high liquidity path. The BoJ and the ECB are likely to do more QE in my opinion and the Fed is going to have a real struggle raising rates this year which has been our long-term view. Indeed we have sympathy with DB’s Dominic Konstam that they may also struggle in 2016. At the moment central banks are fortunate that they have the conditions to do more as virtually all are failing on their mandate to keep inflation close to or at 2%. The real problem would be if inflation was consistently looking like breaching 2%.

Then central banks would generally be going beyond their mandate by printing money and keeping rates close to zero. So in short the ‘plate spinning’ era continues for a number of quarters yet and certainly while inflation is so low. We think the end game is that when the next global recession hits, then QE/zero rate world will be re-appraised. Perhaps the G20 will get together and decide to try a different approach. In our 2013 long-term study we speculated how we thought the end game was ‘helicopter money’ – ie money printing to finance economic objectives (tax cuts, infrastructure etc). While it has obvious flaws and huge risks (eg political manipulation and inflation), one can argue it will always have more economic impact than QE in its current form. However that’s perhaps a couple of years away still.”

The only thing left to prop up the US economy is companies buying their own stock. Let that sink in.

• Goldman: Buyback Burst Could Be Enough to Save the S&P 500’s Year (Bloomberg)

Stock repurchases may accelerate enough toward the end of the year to salvage an annual gain for the Standard & Poor’s 500 Index, according to David Kostin, Goldman’s chief U.S. equity strategist. November is the busiest month of the year for buybacks among S&P 500 companies. 13% of annual spending occurs during the month, according to figures that Kostin presented in a report two days ago. The data is based on averages for 2007 and 2009-2014. The fourth quarter is the year’s busiest three-month period for S&P 500 repurchases, accounting for 30% of outlays, according to Kostin’s data. The total compares with 18% during the first quarter, 25% in the second and 26% in the third. These figures don’t add up to 100% because of rounding.

“Buybacks represent the single largest source of demand for U.S. equities,” he wrote, adding that he expects companies in the index to spend more than $600 billion this year on their own shares. “The typical year-end surge in buyback activity could help boost the market above our year-end target.” Kostin reduced his projection for the S&P 500 to 2,000 from 2,100. Assuming the latest estimate from the strategist is accurate, the index would post a loss of 2.9% for the year. A return to optimism among investors may also help the index exceed 2,000, according to Kostin. He cited a Goldman sentiment indicator, based on S&P 500 futures trading, that has been at the lowest possible reading for seven of the past eight weeks. That’s the longest stretch in the gauge’s eight-year history, the report said.

TAE’s long lasting adage in action: “Multiple claims to underlying real wealth”.

• There Are Five Times More Claims On Dollars As Dollars In Existence (Brodsky)

According to the Fed, there is about $60 trillion of US Dollar credit (claims for US dollars):

Also according to the Fed, there are about $12 trillion US dollars:

So, the data show plainly there are five times as many claims for US dollars as US dollars in existence. Does this matter to investors? Well, yes, it matters a lot. Not only is there not enough money to repay outstanding debt; the widening gap between credit and money is making it more difficult to service the debt and more difficult for nominal US GDP to grow through further credit extension and debt assumption. Remember, only a dollar can service and repay dollar-denominated debt. Principal and interest payments cannot be made with widgets or labor, only dollars. This means that future demand and output growth generated through more credit issuance and debt assumption is self-defeating. In fact, it adds to the problem.

Credit-generated growth is not growth in real (inflation-adjusted) terms because rising GDP, which engenders an increase in money, is also accompanied by a larger increase in claims on that money. Why larger? Because debt comes with interest. By definition then, debt compounds while real growth does not. In fact, economies naturally economize because innovation and competition tend to drive prices lower. This natural deflation works against debt service and repayment that needs perpetual inflation. As we know, for thirty years beginning in the early 1980s the Fed helped the US and global economies grow consistently more or less by reducing interest rates, which gave consumers of goods, services and assets incentive to take on more debt. Following the inevitable debt crisis in 2008, the Fed had to reduce the overnight interest rate it targets to 0%.

As we also know, to keep the economy growing from there, the Fed then had to begin creating money, which it did through quantitative easing (QE). It bought assets directly from the money center banks it deals with (primary dealers), and paid for them with the newly created money. At the same time, the Fed paid these banks – and continues to pay them – interest on the money they created for them (Interest on Excess Reserves). This provides a disincentive for banks to lend to the public, which is how the Fed is trying to control US growth and inflation today.

Leverage.

• Few Understand Why Glencore Lost 1/3 Of Its Value. That’s Worrying (BBG)

From London to New York to Hong Kong, the frantic question kept coming: could this be another Lehman? But nowhere did it cause more alarm than inside Glencore – the Swiss commodities giant that had suddenly found itself at the epicenter of a global panic on Monday. What began that morning in London, with a sudden plunge in Glencore’s share price, cascaded across oceans and time zones and left the company’s billionaire chief executive, Ivan Glasenberg, scrambling to calm anxious shareholders, creditors and trading partners. Days later, even as Glencore regained most of the $6 billion of shareholder wealth erased in a few hours, many investors wondered if Glasenberg can hold the markets at bay.

Few market players, including people close to Glencore, are able to pinpoint why a blue-chip member of the FTSE-100 Index – even one that had been under pressure from sliding commodities prices – lost almost a third of its value in a blink. And that, investors worry, suggests this could all happen again. “There’s more pain to be had,” said Serge Berger at Zurich-based Blue Oak Advisors. “I don’t think the story is over.”

Monday started out as just another workday in Baar, the tiny town where Glencore is based. The village could easily pass for a Swiss backwater, except for the billions of dollars worth of commodities that quietly course through Glencore’s headquarters on Baarermattstrasse, between the lake and the Alpine hills. Glasenberg, a former coal trader, has honed his skills over more than 30 years in the commodity-trading business since he joined a predecessor firm, Marc Rich & Co., in 1984. He was part of a $1.2 billion management buyout from Rich in 1994, when the company was renamed Glencore. A 2011 initial public offering – at the peak of a 10-year commodity boom – made him a billionaire on paper, with a stake worth about $9 billion. At the worst of Monday’s panic, that holding was worth $1.2 billion. What unfolded when the London markets opened at 8 a.m. stunned mining-industry veterans.

“Monday was certainly very scary,” said Benno Galliker, a trader at Luzerner Kantonalbank. “It had a similar feeling to that before Lehman collapsed.” There’d been no news of consequence over the weekend; the last major headline – a Bloomberg story about Glencore’s hiring of banks to sell a stake in its agriculture unit – had sent its shares up. In China, whose coal plants and steel mills are the largest consumers of Glencore’s products, there’d been some discouraging economic data. But this year’s drumbeat of negative news about the world’s second-largest economy was hardly a new phenomenon. Meanwhile, South African bank Investec had published a provocative note in which analyst Marc Elliott suggested the company could see its equity all but vanish if commodity prices stayed weak. While that was an alarming prediction, Elliott could hardly have expected his views to have much of an effect on an operation with almost $200 billion in annual turnover.

“..the data highlight just how difficult it will be for policymakers to steer China’s economy out of the biggest slowdown in decades..”

• Global Economy Loses Steam As Chinese, European Factories Falter (Reuters)

The world economy lost momentum in September, with China’s vast factory sector shrinking again and euro zone manufacturing growth weakening slightly, both casualties of waning global demand. The latest business surveys across Asia and Europe paint a darkening picture and are likely to prompt more calls for central banks around the world to loosen monetary policy even further. “The data probably increases the case for more stimulus in certain parts of the world, especially from the People’s Bank of China and the ECB,” said Philip Shaw, economist at Investec in London. “Those economies that are at less advanced paths of the recovery cycle – the key example is the euro zone, where we’re looking at more disinflation – may well find more stimulus is in order.”

Surveys of China’s factory and services sectors showed the world’s second largest economy may be cooling more rapidly than earlier thought, with deeper job cuts. Taken together with a stock market crash in Shanghai during the summer and a surprise devaluation of the Chinese yuan, the data highlight just how difficult it will be for policymakers to steer China’s economy out of the biggest slowdown in decades.

“..a global bond rout in the second quarter erased more than a half a trillion dollars in the value of sovereign debt..”

• BOE Says Market May Be Underpricing Risks of Falling Liquidity (Bloomberg)

Financial markets may not be alert to the potential damage caused by drops in liquidity, according to stability officials at the Bank of England. “Market prices might not yet sufficiently be factoring in the potential for a deterioration in liquidity conditions given changes in market functioning and elevated tail risks” related to emerging markets, the officials said, according to the record of the Financial Policy Committee meeting held on Sept. 23 in London. Concern about liquidity is intensifying since a global bond rout in the second quarter erased more than a half a trillion dollars in the value of sovereign debt. Exacerbating matters, the world’s biggest banks are scaling back their bond-trading activities to comply with higher capital requirements imposed in the wake of the financial crisis.

Stability officials at the BOE have already asked for more work to be done on the topic, including dealers’ ability to act as intermediaries in markets, contagion and investment funds. The record of the September meeting published Thursday also noted the increased importance of emerging markets and said “there was the potential for a material impact on U.K. financial stability.” Officials also discussed the appropriate settings for the countercyclical capital buffer, currently at zero, given that credit conditions were normalizing. When officials reconsider the setting in light of the 2015 stress-test results, they will assess the appropriate level for all stages of the credit cycle. There was a “possible benefit of moving the CCB in smaller increments, especially when credit growth was not unusually strong,” the record said.

In a wide-ranging record that follows last week’s statement, the FPC highlighted its need for new powers to intervene in the buy-to-let housing market. “The rapid growth of the market underscored the importance of FPC powers of direction for use in future,” the FPC said in its record. “Housing tools were important for the FPC,” given the potential for systemic risks.

They’re all involved in scheming yet another system. But jail? Hell, no! Slap on the wrist fines to be paid not by the bankers, but by their corporations, that’s all.

• JPMorgan Said to Pay Most in $1.86 Billion CDS Rigging Settlement (Bloomberg)

JPMorgan Chase is set to pay almost a third of a $1.86 billion settlement to resolve accusations that a dozen big banks conspired to limit competition in the credit-default swaps market, according to people briefed on terms of the deal. JPMorgan is paying $595 million, with the lender’s portion of the accord largely based on the plaintiffs’ measure of market share, said the people, who asked not to be identified because the firms haven’t disclosed how they’re splitting costs. The settlement also enacts reforms making it easier for electronic-trading platforms to enter the CDS market, according to a statement Thursday from attorneys for the plaintiffs, which include the Los Angeles County Employees Retirement Association. Morgan Stanley, Barclays and Goldman Sachs are paying about $230 million, $175 million and $164 million, respectively, the people said.

Plaintiffs’ lawyers disclosed the approximate size of the settlement in Manhattan federal court last month, saying they were still ironing out details. They updated the total Thursday. The accord averts a trial following years of litigation by hedge funds, pension funds, university endowments, small banks and other investors, who sued as a group. They alleged that global banks – along with Markit Group, a market-information provider in which the banks owned stakes – conspired to control the information about the multitrillion-dollar credit-default-swap market in violation of U.S. antitrust laws. Credit Suisse, Deutsche Bank and Bank of America will pay about $160 million, $120 million and $90 million, respectively, the people said. BNP Paribas, UBS, Citigroup, RBS and HSBC also would pay less than $100 million apiece, the people said.

The IMF needs an independent chief. Or its credibility will continue to erode until it is irrelevant.

• IMF’s Botched Involvement In Greece Attacked By Former Watchdog Chief (Telegraph)

The IMF has come under fire for failing in its duty of care towards Greece by pushing self-defeating austerity measures on the battered economy. The fund was told it should have eased up on the spending cuts and tax hikes, pushed for an earlier debt restructuring and paid more “attention” to the political costs of its punishing policies during its five-year involvement in Greece. The recommendations came from a former deputy director of IMF’s Independent Evaluation Office (IEO) David Goldsbrough.The IEO is an independent watchdog tasked with scrutinising the fund’s activities. Mr Goldsbrough worked at the body until 2006. His suggestions are set to embolden critics of the IMF’s handling of the Greek crisis. They follow previous admissions from the fund that it has over-stated the benefits of imposing excessive austerity on successive Greek governments.

The suggestions from the former watchdog chief come as reports suggest the IMF is still poised to pull out of Greece’s third international rescue in five years over the sensitive issue of debt relief. The fund is pushing for a restructuring of at least €100bn of Greece’s debt pile, according to a report in Germany’s Rheinische Post. Such bold measures to extend maturities and reduce interest payments are set to be rejected by its European partners, who are unwilling to impose massive lossess on their taxpayers. The head of Greece’s largest creditor – Klaus Regling of the European Stability Mechanism – told the Financial Times that such radical restructuring was “unnecessary”. This intransigence could now see the IMF withdraw its involvement when its programme ends in March 2016.

In addition to his findings on Greece, Mr Goldsbrough urged the IMF to question its involvement in many bail-out countries for the sake of the institution’s credibility. “Few reports probe more fundamental questions – either about alternative policy strategies or the broader rationale for IMF engagement,” said the report. Accounts from 2010 show the IMF was railroaded into a Greek rescue programme on the insistence of European authorities, vetoing the objections of its own board members from the developing world. The IMF is prevented from lending to bankrupt nations by its own rules. But it deployed an “exceptional circumstances” justification to provide part of a €110bn loan package to Athens five years ago. Greece has since become the first ever developed nation to default on the IMF in its 70-year history.

Despite privately urging haircuts for private sector creditors in 2010, the IMF was ignored for fear of triggering a “Lehman” moment in Europe, by then ECB chief Jean-Claude Trichet. Greece later underwent the biggest debt restructuring in history in 2012. The findings of the fund’s research division have largely discredited the notion that harsh austerity will bring debtor nations back to health. However, this stance has been at odds with its negotiators during Greece’s new bail-out talks where officials have continued to demand deep pension reforms and spending cuts for Greece. Diplomatic cables between Greece’s ambassador to Washington have since revealed the White House pressed the fund to make vocals calls for mass debt relief to keep Greece in the eurozone during fraught negotiations in the summer. However, the issue of debt relief is not due to be discussed when eurozone finance ministers gather to meet for talks on Monday, said EU officials.

“Cars accounted for almost 20% of Germany’s near $1.5 trillion in exports last year, or to put it in blunt political terms: one in seven jobs.”

• Volkswagen Too Big to Fail For Germany’s Political Classes (Bloomberg)

At Volkswagen AG, political connections come already fitted. In part, it’s due to Volkswagen’s iconic role as a symbol of West Germany’s economic revival after Nazi rule and the destruction of World War II. Angela Merkel, who grew up under communism in East Germany, has said her first car after the fall of the Berlin Wall in 1989 was a VW Golf compact. Mostly it’s about jobs: around a third of Volkswagen’s almost 600,000 positions are in Germany, and that’s not to mention the company’s supply chain. For Volkswagen, however, proximity to political power is enshrined in statute. When Germany privatized the automaker in 1960, its home state of Lower Saxony kept a blocking minority and a supervisory board seat for the region’s premier. Future presidents, chancellors and cabinet ministers have cut their political teeth in the state with VW at their side.

That nexus of political affinity and economic awareness ensures the scandal engulfing VW is too big a threat to national prosperity for the government to be a neutral observer. “It’ll be important for the German government to look at scenarios for the worst possible outcome,” Stefan Bratzel at the University of Applied Sciences in Bergisch Gladbach said. Merkel’s options could include helping the state of Lower Saxony increase its stake in VW or tax incentives to promote electric cars, he said. Merkel is thus far trying to keep VW’s scandal over cheating on diesel-car emissions at arm’s length, simply demanding that the automaker come clean quickly. Her restraint signals a reluctance by chancellery officials to exercise direct influence on private companies, according to a person familiar with government policy making. In any case, the full scope of the scandal is still not clear, the person said.

“Of course German governments take business interests into account,” Marcel Fratzscher, head of the Berlin-based DIW economic institute, said by phone. Still, “if you look at France, the ties between business and politics are much closer there than in Germany,” he said. With almost 35% wiped off VW’s share value since the affair came to light, that’s a luxury that might not be granted for long if the company’s position deteriorates further. [..] Merkel has experience of intervening when it comes to autos. In 2013, she watered down European pollution-control legislation aimed at reducing CO2 emissions from cars, an action for which she was lauded by German auto-industry lobby VDA. Justifying her decision to defend jobs, Merkel said at the time there was a need “to take care that, notwithstanding the need to make progress on environmental protection, we don’t weaken our own industrial base.” Cars accounted for almost 20% of Germany’s near $1.5 trillion in exports last year, or to put it in blunt political terms: one in seven jobs.

Stalling as a last defense.

• VW Says Emissions Probe Will Take Months as It Faces Fines (Bloomberg)

Volkswagen said its investigation into rigged diesel engines will probably take months to complete, highlighting the complexity of the scandal that upended the carmaker two weeks ago. The company set up a five-person committee led by Berthold Huber, interim chairman of the supervisory board. The group will work closely with U.S. law firm Jones Day to unravel how software to cheat diesel-emissions tests was developed and installed for years in millions of vehicles, the company said Thursday. Volkswagen stuck to a pre-crisis plan that CFO Hans Dieter Poetsch will become the permanent chairman. Frank Witter, 56, head of the financial-services division, will succeed Poetsch as CFO.

The automaker is facing a significant financial impact, including at least €6.5 billion it already set aside for repairs and recalls and a U.S. fine that may reach $7.4 billion, according to analysts from Sanford C. Bernstein. A sales stop in September already put a dent in its U.S. deliveries. The board’s leadership panel met for seven hours on Wednesday night with CEO Matthias Mueller, who was appointed after his predecessor Martin Winterkorn stepped down under pressure last week. “We’re at the beginning of a long process,” said Olaf Lies, who is economy minister of the German state of Lower Saxony, which owns one-fifth of Volkswagen’s voting shares, and a member of Volkswagen’s investigation committee. “In the end, a series of people will be held accountable, and that doesn’t mean the software developers but those responsible at the senior level.”

Volkswagen postponed an extraordinary shareholders’ meeting that had been planned for Nov. 9, saying “it would not be realistic to provide well-founded answers which would fulfill the shareholders’ justified expectations” by that time. Some investors have criticized the appointment of Poetsch. Though Volkswagen hasn’t assigned blame for the diesel scandal to the CFO or to ousted CEO Winterkorn, the two were close associates. “Making Poetsch the chairman at this point while the investigation into the diesel scandal is ongoing isn’t the right way to go about rebuilding trust in the company,” said Ingo Speich, a fund manager at Volkswagen shareholder Union Investment. “Volkswagen needs a strong chairman right now, and he’ll be in a weak position.”

The company is facing an “enormous recall” in the U.S., though it’s still not clear what hardware and software corrections it will use to fix the problem, U.S. Energy Secretary Ernest Moniz said Thursday in an interview in Istanbul. “Obviously there’s a discussion of fines, of very, very major fines” from the Environmental Protection Agency, Moniz said. The amount of the penalties VW faces is “going to depend upon what corrective actions” the company takes, he said. Volkswagen’s 600,000-person workforce is starting to feel the impact of the scandal as the carmaker cuts spending in anticipation of fines, recalls and a drop in U.S. sales.

Taking your pensions into the casino is an obvious last desperate step.

• World’s Biggest Pension Fund Is Moving Into Junk and Emerging Bonds (Bloomberg)

Japan’s $1.2 trillion Government Pension Investment Fund, the world’s largest, unveiled sweeping changes to its foreign bond investments, hiring more than a dozen new asset managers and creating mandates for junk and emerging-market securities. The fund picked managers for eight categories of active investments in overseas debt, it said Thursday. GPIF chose Nomura Asset Management to oversee U.S high-yield bonds and UBS Global Asset Management for European speculative-grade debt. Janus Capital Management will handle part of the pension giant’s U.S. bond investments as a subcontractor for Diam Co., according to GPIF’s statement, which didn’t specify whether the money would go to Bill Gross’s fund.

Ashmore Japan, a specialist in developing-country investment, won the only local-currency emerging-market contract. GPIF faces mounting pressure to boost returns and diversify assets as pension payouts for the world’s oldest population swell. The fund has pared domestic bonds in the past year in favor of equities, inflation-linked debt and alternative assets. Its foray into high-yield bonds comes as the securities hand investors the biggest losses in four years. “I’m worried,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management in Tokyo. “The timing isn’t good. We’re talking about the Fed raising rates, and the assets that are likely to be affected the most by this are junk bonds. Investing in emerging-market currencies is worrying, too.”

A gauge of global speculative-grade debt compiled by Bank of America Merrill Lynch dropped for a fourth month in September, the longest stretch since the data began in 1998. This year is shaping up as one to forget for investors in risky assets, with stocks, commodities and currency funds all in the red amid concern about the outlook for the global economy and as the Federal Reserve prepares to raise interest rates. Investors pulled $40 billion out of emerging markets in the third quarter, fleeing at the fastest pace since the height of the global financial crisis.

Joris should get into today’s events, things move too fast to linger on the past.

• How The Banks Ignored The Lessons Of The Crash (Joris Luyendijk)

I spent two years, from 2011 to 2013, interviewing about 200 bankers and financial workers as part of an investigation into banking culture in the City of London after the crash. Not everyone I spoke to had been so terrified in the days and weeks after Lehman collapsed. But the ones who had phoned their families in panic explained to me that what they were afraid of was the domino effect. The collapse of a global megabank such as Lehman could cause the financial system to come to a halt, seize up and then implode. Not only would this mean that we could no longer withdraw our money from banks, it would also mean that lines of credit would stop.

As the fund manager George Cooper put it in his book The Origin of Financial Crises: “This financial crisis came perilously close to causing a systemic failure of the global financial system. Had this occurred, global trade would have ceased to function within a very short period of time.” Remember that this is the age of just-in-time inventory management, Cooper added – meaning supermarkets have very small stocks. With impeccable understatement, he said: “It is sobering to contemplate the consequences of interrupting food supplies to the world’s major cities for even a few days.” These were the dominos threatening to fall in 2008. The next tile would be hundreds of millions of people worldwide all learning at the same time that they had lost access to their bank accounts and that supplies to their supermarkets, pharmacies and petrol stations had frozen.

The TV images that have come to define this whole episode – defeated-looking Lehman employees carrying boxes of their belongings through Wall Street – have become objects of satire. As if it were only a matter of a few hundred overpaid people losing their jobs: Look at the Masters of the Universe now, brought down to our level! In reality, those cardboard box-carrying bankers were the beginning of what could very well have been a genuine breakdown of society. Although we did not quite fall off the edge after the crash in the way some bankers were anticipating, the painful effects are still being felt in almost every sector. At this distance, however, seven years on, it’s hard to see what has changed. And if nothing has changed, it could all happen again.