DPC Cuyahoga River, Lift Bridge and Superior Avenue viaduct, Cleveland, Ohio 1912

Maxed out.

• Emerging Market Debt Sales Are Down 98% (BBG)

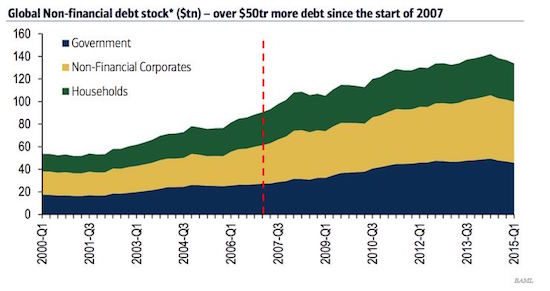

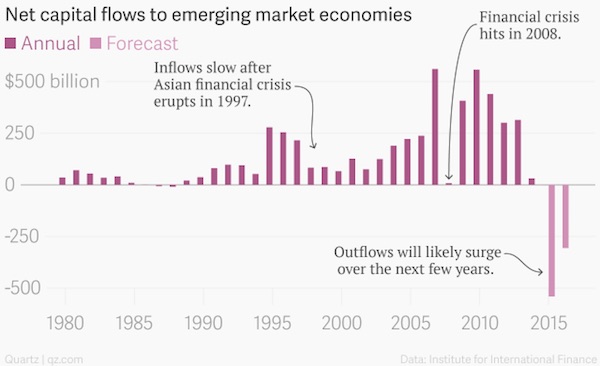

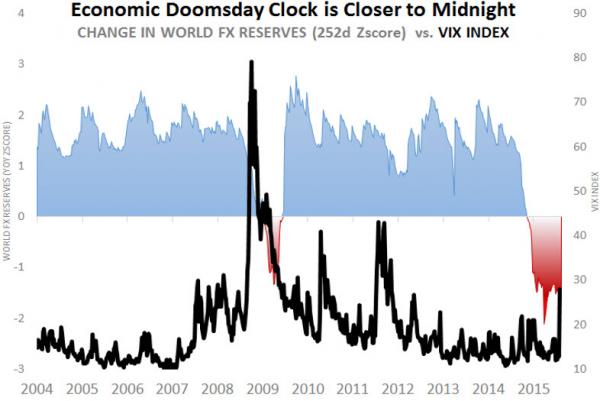

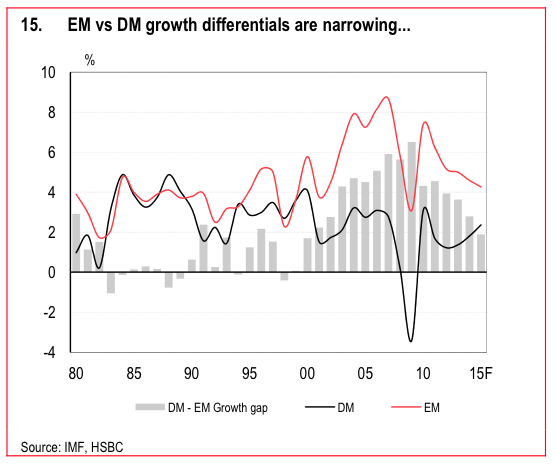

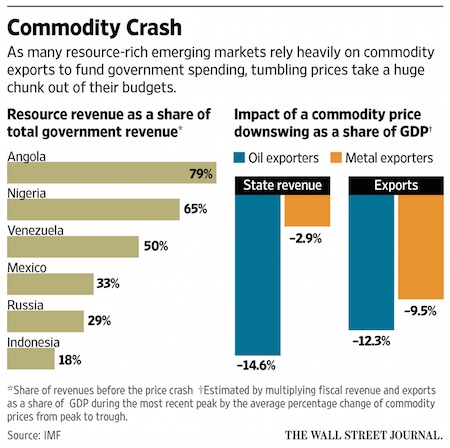

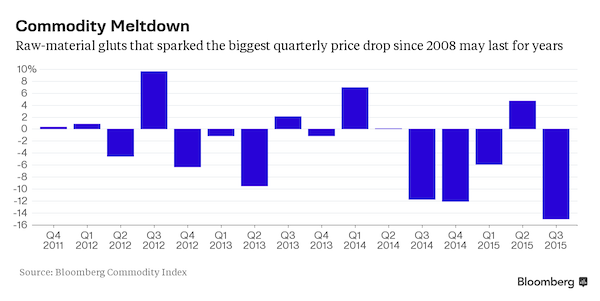

The commodity-price slump and the slowdown in China’s economy are crippling developing nations’ ability to borrow abroad, even as international debt sales from advanced nations remain at a five-year high. Issuance by emerging-market borrowers slumped to a net $1.5 billion in the third quarter, a drop of 98% from the second quarter, according to the Bank for International Settlements. That was the biggest downtrend since the 2008 financial crisis and helped to reduce global sales of securities by almost 80%, a BIS report said. Emerging-market assets tumbled in the third quarter, led by the biggest plunge in commodity prices since 2008 and China’s surprise devaluation of the yuan.

The average yield on developing-nation corporate bonds posted the biggest increase in four years, stocks lost a combined $4.2 trillion and a gauge of currencies slid 8.3% against the dollar. Sanctions on Russian entities and political turmoil in Brazil and Turkey also affected sales by companies in those countries. “Weak debt-securities issuance in the third quarter can only be partially explained by seasonality,” the latest quarterly review from the BIS said. “Growing concerns over emerging-market fundamentals, falling commodity prices and rising debt burdens probably played a role. Additionally, an increasing focus on local markets may also have been a factor.”

One side effect of the decline in international-debt sales was the emergence of the euro as a borrowing currency. The net issuance of securities in the shared currency by non-financial companies was $23 billion in the three months through Sept. 30, while dollar-denominated debt accounted for $22 billion. The main reason for that was a jump in euro-bond offerings from emerging markets, where the share of the currency went up to 62% from 18% in the second quarter. Borrowers from advanced economies issued a net $22 billion in debt, $100 billion less than in the preceding three months. Still, cumulative figures remained the highest since 2010 because of the increases in the first half of the year.

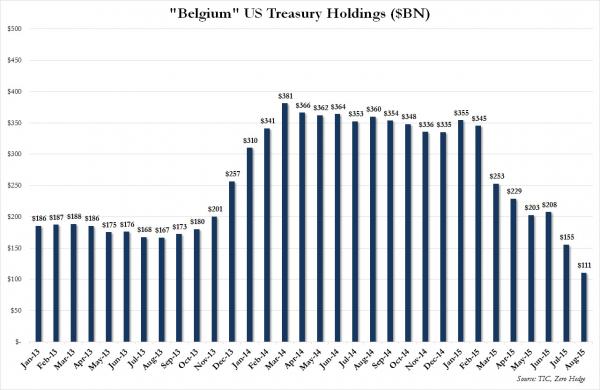

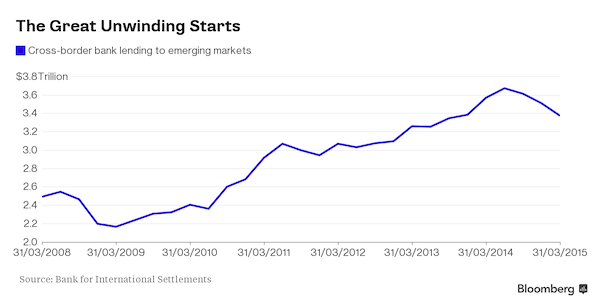

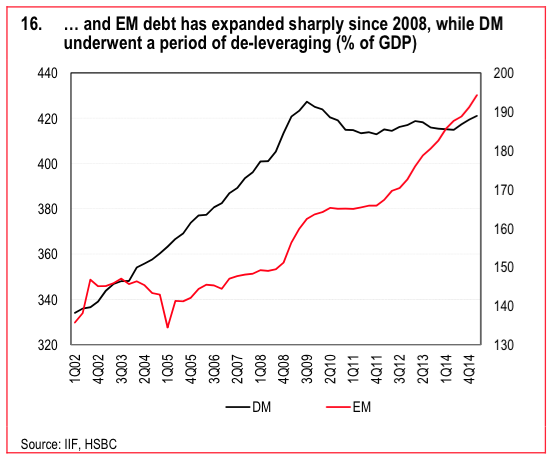

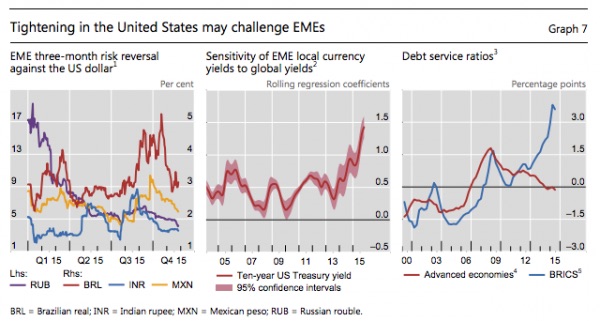

$3.3 trillion in non-bank EM debt. Hike into that.

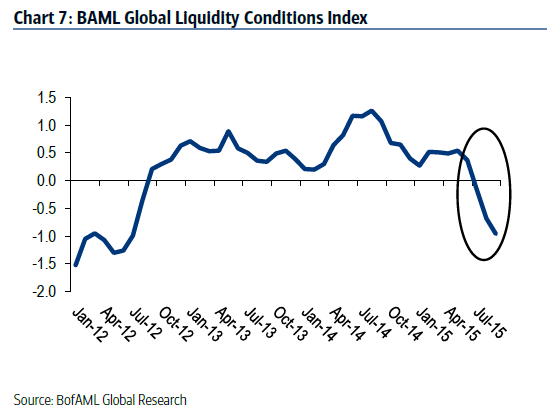

• BIS Warns “Uneasy Calm” In Global Markets May Be Shattered By Fed Hike (ZH)

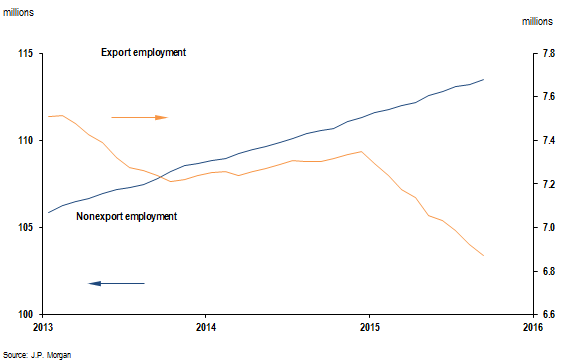

[..] the nightmare situation is that you accumulate an enormous amount of foreign currency liabilities only to see your currency crash just as market demand for EM assets dries up. Drilling down further, the bank notes that of the $9.8 trillion in non-bank, USD dollar debt outstanding, more than a third ($3.3 trillion) is concentrated in EM. “Since high overall dollar debt can leave borrowers vulnerable to rising dollar yields and dollar appreciation, dollar debt aggregates bear watching,” Robert Neil McCauley, Patrick McGuire and Vladyslav Sushko warn. The right pane here gives you an idea of how quickly borrowers’ ability to service that debt is deteriorating.

“Any further appreciation of the dollar would additionally test the debt servicing capacity of EME corporates, many of which have borrowed heavily in US dollars in recent years,” Borio reiterates, ahead of the December Fed meeting at which the FOMC is set to hike just to prove it’s actually still possible. All in all, central banks have managed to preserve an “uneasy calm,” Borio concludes, but “very much in evidence, once more, has been the perennial contrast between the hectic rhythm of markets and the slow motion of the deeper economic forces that really matter.” In other words: the market is increasingly disconnected from fundamentals and the rather violent reaction to a not-as-dovish-as-expected Mario Draghi proves that everyone still “hangs on the words and deeds” of central banks.

In the end, Borio is telling the same story he’s been telling for over a year now. Namely that the myth of central banker omnipotence is just that, a myth, and given the abysmal economic backdrop, the market risks a severe snapback if and when that myth is exposed. One of the pressure points is EM, where sovereigns may have avoided “original sin” (borrowing heavily in FX), but corporates have not. With $3.3 trillion in outstanding USD debt, a rate hike tantrum could spell disaster especially given the fact that the long-term, the fundamental outlook for EM continues to darken. Borio’s summary: “At some point, [this] will [all] have to be resolved. Markets can remain calm for much longer than we think. Until they no longer can.”

“Markets can remain calm for much longer than we think. Until they no longer can.”

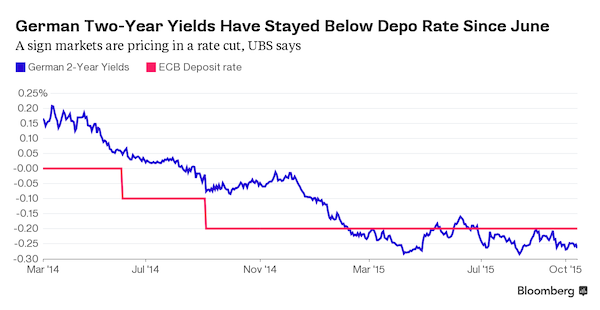

• BIS Argues For Tighter Monetary Policy In Spite Of ‘Uneasy Calm’ (FT)

Central banks must not let market volatility halt their plans to retreat from crisis-fighting monetary policies, the Bank for International Settlements has warned ahead of the expected first rate rise by the US Federal Reserve in nine years. While the current “uneasy calm” in financial markets threatened to blow up into bouts of financial turmoil, with clear tensions between markets’ behaviour and underlying economic conditions, such a threat should not dissuade monetary policymakers from taking the first steps towards tighter monetary policy, the BIS argued in its latest quarterly review. “At some point, [the tension] will have to be resolved,” said Claudio Borio, head of the BIS’s monetary and economic department. “Markets can remain calm for much longer than we think. Until they no longer can.”

The Federal Open Market Committee, the Fed’s rate-setting board, is set to vote on December 16. Recent strong jobs figures have raised the likelihood of an increase to the federal funds rate. An earlier shift towards the exit by the US central bank sparked a “taper tantrum” in financial markets — a reference to the Fed’s decision to announce that it was tapering, or slowing, the pace of its asset purchases made under its quantitative easing package. The Fed resisted raising rates this year in part because of market turmoil over the summer. Going into this month’s meeting, conditions have been milder — although the BIS noted this calm had been uneasy. “Very much in evidence, once more, has been the perennial contrast between the hectic rhythm of markets and the slow motion of the deeper economic forces that really matter,” Mr Borio said. The BIS has long believed that what it describes as “unthinkably” low interest rates are fuelling instability in global financial markets.

“People are going to be carried out on stretchers..”

• Corporate Bond Market Hit By Rates Fears (FT)

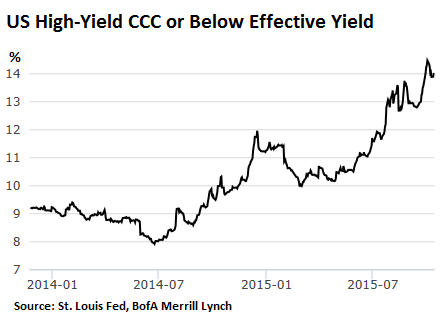

Investor alarm at the riskier end of the US corporate bond market is mounting, with borrowing costs for the lowest-rated companies climbing to their highest level since the financial crisis as the Federal Reserve prepares to raise interest rates for the first time in nearly a decade. While the US stock market has recovered after a bumpy autumn and is relaxed about the prospect of tighter monetary policy, the corporate bond market has become increasingly jittery. Typically, when bond and stock markets point in different directions, a drop in the former augurs a correction in the latter — as happened this summer.

Concerns over the possible impact of a US interest rate increase on more vulnerable borrowers has been exacerbated by rising indebtedness and shrinking revenues among companies. This has fuelled concerns that the profitable “credit cycle” that has reigned since the financial crisis receded is coming to an end. “People are going to be carried out on stretchers,” said Laird Landmann, a senior bond fund manager at TCW, a Californian asset manager. “When earnings are coming down, leverage is high and interest rates are going up. It’s not good.” Safer corporate bonds judged “investment grade” by Standard & Poor’s, Moody’s or Fitch have been reasonably steady, with average yields dipping slightly again after a faltering start to November.

But debt rated below that threshold has had a bad autumn, particularly debt issued by companies in the struggling energy industry. UBS estimated in a note last week that as much as $1tn of US corporate bonds and loans rated below investment grade could be in the danger zone as borrowing conditions become tougher just as many face repayments. Much of the pain is in the energy sector but the Swiss bank argues the problems are wider than this. “It is our humble belief that the consensus at the Fed does not fully understand the magnitude of the problems in corporate credit markets and the unintended consequences of their policy actions,” wrote Matthew Mish, a UBS strategist.

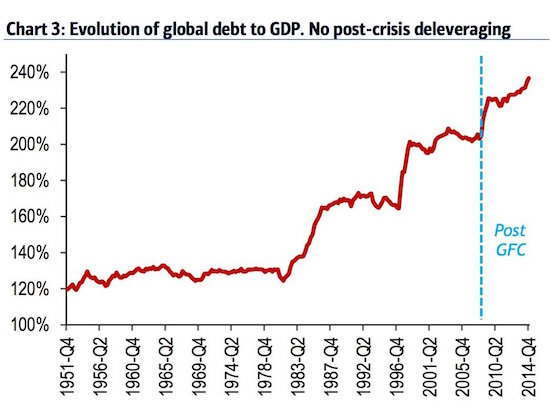

Debt debt debt wherever you look.

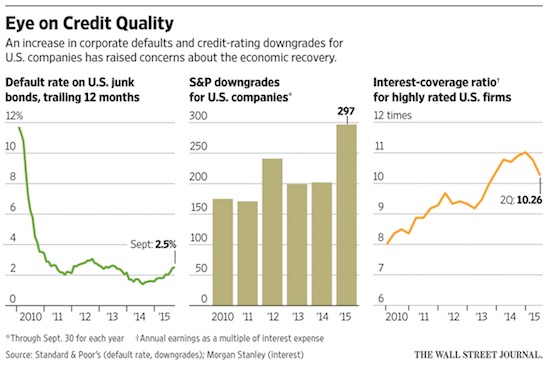

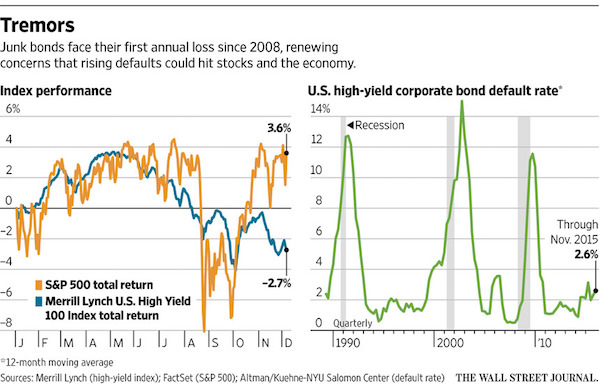

• Junk Bonds Set For First Annual Loss Since Credit Crisis (WSJ)

Junk bonds are headed for their first annual loss since the credit crisis, reflecting concerns among investors that a six-year U.S. economic expansion and accompanying stock-market boom are on borrowed time. U.S. corporate high-yield bonds are down 2% this year, including interest payments, according to Barclays data. Junk bonds have posted only four annual losses on a total-return basis since 1995. The declines are worrying Wall Street because junk-market declines have a reputation for foreshadowing economic downturns. Junk bonds are lagging behind U.S. stocks following a debt selloff in the past month. The S&P 500 has returned 3.6% on the year, including dividends.

Adding to the worries are signs that the selling has spread beyond firms hit by the energy bust to encompass much of the lowest-rated debt across the market, potentially snarling some takeovers and making it difficult for all kinds of companies to borrow new funds. In the fourth quarter of the year, there has been a “meaningful disconnect between equities and high yield,” said George Bory, head of credit strategy at Wells Fargo Securities. “It’s a warning sign about the potential challenges in the economy.” High-yield bonds pay high interest rates, typically above 7%, because the heavily indebted companies that issue them are more likely to default.

Investors flock to the debt in boom times when other securities pay minimal interest and often dump it just as quickly when they get nervous, making junk bonds a bellwether for risk appetite. Defaults are rising after several years near historically low levels, as new bond sales stall and companies with below-investment-grade credit ratings struggle to refinance their debts. The junk-bond default rate rose to 2.6% from 2.1% this year and will likely jump to 4.6% in 2016, breaching the 30-year average of 3.8% for the first time since 2009, said New York University Finance Professor Edward Altman, inventor of the most commonly used default-prediction formula.

Wow. Abe turns into Catweazle. All about magic.

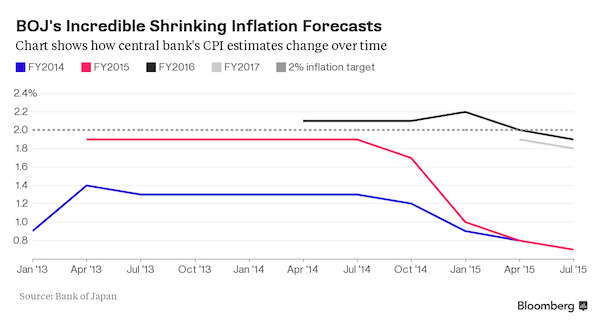

• Japan’s Current Recession To Prove An Illusion (FT)

Japan’s “recession” will soon be exposed as an illusion according to the country’s economy minister, Akira Amari, who on Sunday predicted data revisions this week will turn contraction into growth. Initial figures just three weeks ago showed the economy shrank at an annualised 0.8% in the third quarter, meeting the technical definition of a recession, and prompting gloom about the outlook. But Mr Amari said he expected a revision from 0.8% to zero this week. That would confirm Japan’s economy is not in a downward spiral, despite sluggish consumption and exports, but it would raise fresh questions about the unreliable early growth data. “I expect growth to turn positive from here,” said Mr Amari, an influential figure in the government of prime minister Shinzo Abe. “I think we’re on a path of steady recovery.”

Expectations for an upward revision have grown since the publication of finance ministry data last week showing a third-quarter rise in corporate investment. That was the opposite of the initial gross domestic product data, which showed investment falling. Analysts at Citi in Tokyo expect an upward revision to show growth was flat while Goldman Sachs expects a revision to plus 0.2% for the quarter. Mr Abe wants companies to invest more at home and is planning to encourage them by cutting corporation tax from 32.11% to 29.77% next year. He is also pushing them to raise wages. Mr Abe’s goal is to turn the surge in corporate profits caused by the weak yen into greater demand, in order to sustain economic growth and drive inflation towards the Bank of Japan’s goal of 2%.

One problem is the large number of Japanese companies that make accounting losses and therefore pay no corporation tax anyway. On Sunday, Mr Amari hinted at new measures to push them towards investment. “You have to pay fixed asset taxes regardless of losses,” he said. “I’d like to bring in fixed asset tax relief for companies making new investments, which is something we’ve never done before.”

“..in the U.S., the economy appears relatively healthier only because the rest of the world is so awful.”

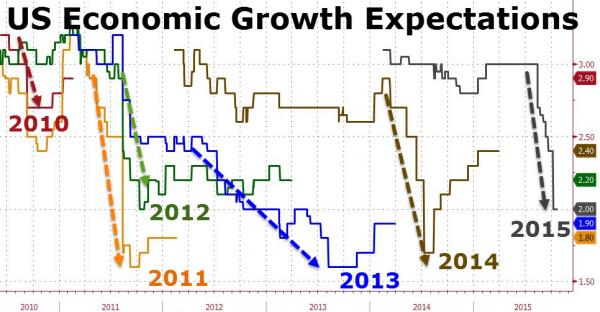

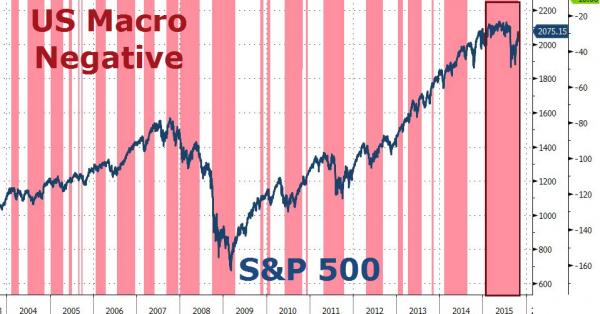

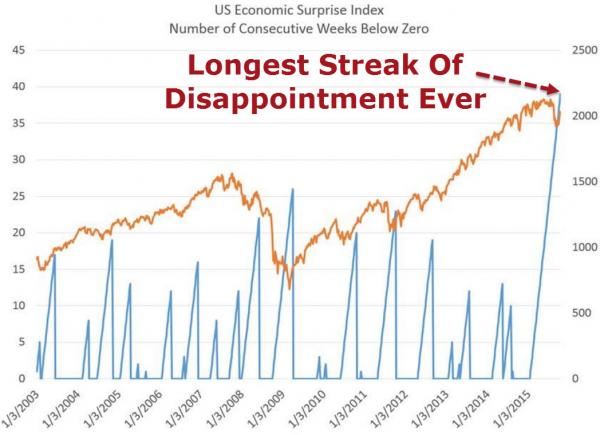

• Last Gasps of a Dying Bull Market – And Economy (Hickey)

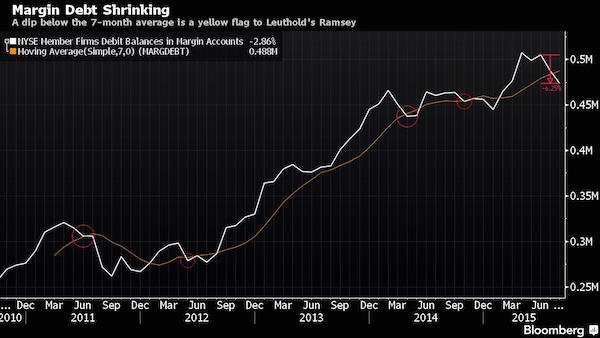

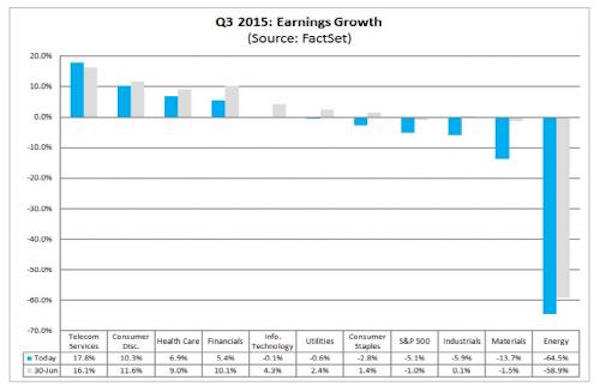

Deteriorating market breadth and herding into an ever-narrower number of stocks is classic market top behavior. Currently, there are many other warning signs that are also being ignored. The merger mania (prior tops occurred in 2000 and 2007), the stock buyback frenzy (after the record amount of buybacks in 2007 buybacks were less than one-sixth of that level at the bottom in 2009), the year-over-year declines in corporate sales (-4% in Q3 and down every quarter this year) and falling earnings for the entire S&P 500 index, the plunges this year in the high-yield (junk bond) and leveraged loan markets, the topping and rolling over (the unwind) of the massive (record) level of stock margin debt… and I could go on.

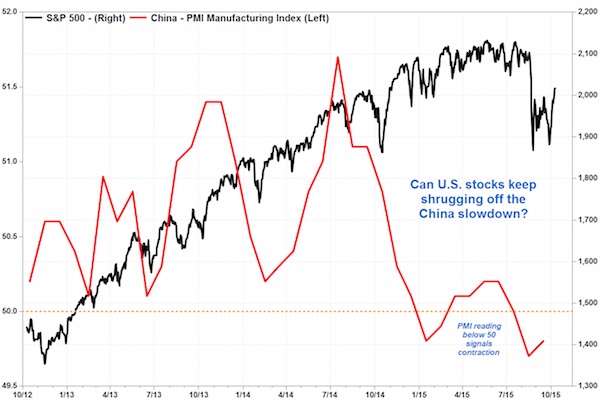

It was very lonely as a bear at the tops in 2000 and 2007. I was just a teenager in 1972 so I was not an active investor, but just a few days prior to the early 1973 January top, Barron ‘s featured a story titled: “Not a Bear Among Them.” By “them” Barron ‘s meant institutional investors. I do vividly remember my Dad listening to the stock market wrap-ups on the kitchen radio nearly every night in 1973-74. It seemed to me back then that the stock market only went in one direction — and that was DOWN. The global economy is in disarray. It’s the legacy of the central planners at the central banks. China’s economy has been rapidly slowing despite all sorts of attempts by the government to prop it up (including extreme actions to hold up stocks). China’s economic slowdown has cratered commodity prices to multi-year lows and helped drive oil down to around $40 a barrel.

All the “commodity country” economies (and others) that relied on exports to China are suffering. Brazil is now in a deep recession. Last month Taiwan officially entered recession driven by double-digit declines (for five consecutive months) in exports. Also last month Japan officially reentered recession. Canada and South Korea’s governments recently cut forecasts for economic growth. Despite the lift from an extremely weak euro, Germany’s Federal Statistical Office reported last month that the economy slowed in Q3 due to weak exports and slack corporate investment. The German slowdown led a slide in the overall eurozone economy in Q3 per data from the European Union’s statistics agency. The recent immigration and terrorist problems make matters worse. Tourism will suffer.

Here in the U.S., the economy appears relatively healthier only because the rest of the world is so awful. That has driven the U.S. dollar skyward (DXY index over 100), hurting tourism and multinational companies exporting goods and services overseas. Last month the U.S. Agriculture Department forecast that U.S. farm incomes will plummet 38% this year to $56 billion – the lowest level since 2002.

But someone will have to take the losses… And they will be spectacular.

• As Oil Keeps Falling, Nobody Is Blinking (WSJ)

The standoff between major global energy producers that has created an oil glut is set to continue next year in full force, as much because of the U.S. as of OPEC. American shale drillers have only trimmed their pumping a little, and rising oil flows from the Gulf of Mexico are propping up U.S. production. The overall output of U.S. crude fell just 0.2% in September, the most recent monthly federal data available, and is down less than 3%, to 9.3 million barrels a day, from the peak in April. Some analysts see the potential for U.S. oil output to rise next year, even after Saudi Arabia and OPEC on Friday again declined to reduce their near-record production of crude. With no end in sight for the glut, U.S. oil closed on Friday below $40 a barrel for the second time this month.

The situation has surprised even seasoned oil traders. “It was anticipated that U.S. shale producers, the source of the explosive growth in supply in recent years, would be the first to fold,” Andrew Hall, CEO of commodities hedge fund Astenbeck Capital wrote in a Dec. 1 letter to investors reviewed by The Wall Street Journal. “But this hasn’t happened, at least not at the rate initially expected.” For the past year, U.S. oil companies have been kept afloat by hedges—financial contracts that locked in higher prices for their crude—as well as an infusion of capital from Wall Street in the first half of the year that helped them keep pumping even as oil prices continued to fall. The companies also slashed costs and developed better techniques to produce more crude and natural gas per well.

The opportunity for further productivity gains is waning, experts say, capital markets are closing and hedging contracts for most producers expire this year. These factors have led some analysts to predict that 2016 production could decline as much as 10%. But others predict rising oil output, in part because crude production is growing in the Gulf, where companies spent billions of dollars developing megaprojects that are now starting to produce oil. Just five years after the worst offshore spill in U.S. history shut down drilling there, companies are on track to pump about 10% more crude than they did in 2014. In September, they produced almost 1.7 million barrels a day, according to the latest federal data.

What it always should have been, at the most.

• Gradual Erosion Of The EU Will Leave A Glorified Free-Trade Zone (Münchau)

The main characteristic of today’s EU is an accumulation of crises. This is no accident. It happens because policies are not working. Political leaders such as David Cameron and Viktor Orban, the prime ministers of the UK and Hungary, are even questioning some of the fundamental values on which the EU is built – such as the freedom of movement of people. The EU is in an unstable equilibrium: small disturbances can produce large changes. We have reached this point because the various projects of the union now have a negative economic effect on large parts of the European population. I would no longer hesitate to say, for example, that your average Italian is worse off because of the euro.

The country has had no real growth since it joined the euro, while it had grown at fairly average rates before and I have heard no rational explanation that does not attribute this to the flaws in European monetary arrangements. This is not just a problem for the eurozone. As Simon Tilford of the Centre for European Reform has argued, the worst-paid Britons have been made worse off, too. Their real incomes have fallen, and an inadequate supply of housing has pushed up accommodation costs. Both trends have been exacerbated by a net inflow of workers from abroad, even though net immigration into the UK has not been extreme by European standards.

No individual is in a position to make an objective assessment of the effect of immigration on their own income and wealth, but it is clearly not irrational to suspect that an influx of net immigration and one’s own falling real wages to be somehow related. The Danes, who last week voted against ending the country’s opt-out from EU home and justice affairs, also acted rationally. Why opt into a common justice system that still cannot produce adequate levels of co-ordination between police forces in the fight against terrorism? Home and justice affairs are public goods. Why should a rational voter prefer a dysfunctional public goods provider? The same holds for Finland. The country has been locked in a four-year long recession.

There is now a parliamentary motion in the works that may end up in a referendum on whether to quit the eurozone. I do not think that Finland will take that step, for political reasons. But, at the same time, I have not the slightest doubt that Finnish growth and employment would recover if it did. A currency devaluation would be a much more powerful tool than the policy that the Finnish government is trying to implement right now: improving competitiveness through wage cuts.

Overextended miners and producers face a lot of hurt.

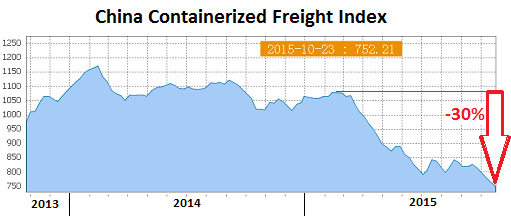

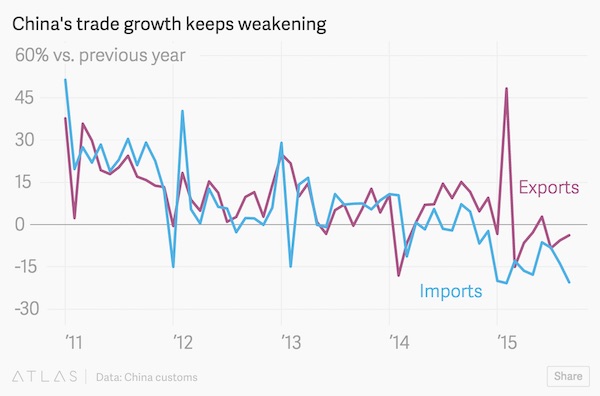

• China’s Iron Ore, Steel Demand To Fall Further In 2016 (AFR)

China’s steel production will not recover next year, according to its official government forecaster, which believes demand for iron ore will decline by 4.2%. The report released on Monday by the China Metallurgical Industry Planning and Research Institute predicts steel production will fall 3.1% to 781 million tonnes in 2016, as economic growth continues to moderate. The forecast provides another round of bad news for Australian iron ore miners, which are already battling record low prices of around $US40 a tonne. China’s steel industry reached a long predicted turning point in 2015, as the economy slowed and over-supply in the property sector crimped demand for everything from machinery, to home appliances and cars.

This will see China’s steel consumption post its first annual decline since 1995, falling 4.8% this year, according to the government forecaster. The declines are set to continue next year with consumption falling by 3% to 648 million tonnes. “With a slowdown in steel for construction, machinery and vehicles we saw consumption decline for the first time in 20 years,” said the institute in its annual outlook report. The declines this year have been faster than the institute predicted. Monday’s downgrade to 2015 production was the third this year. It believes iron ore demand, which fell 0.4% in 2015, will decline by 4.2% in 2016 to around 1.07 billion tonnes.

Everyday occurence.

• China’s Biggest Broker CITIC Can’t Locate Two Of Its Top Execs (Reuters)

CITIC Securities is not able to contact two of its top executives, China’s biggest brokerage said on Sunday, following media reports that they had been asked by authorities to assist in an investigation. CITIC said in a Hong Kong exchange filing it could not reach two of its most senior investment bankers, Jun Chen and Jianlin Yan. Chinese business publication Caixin said on Friday the pair had been detained, although it was not clear whether they were subjects of an investigation or merely being asked to assist with it. CITIC Securities is among Chinese brokerages facing investigation by the country’s securities regulator for suspected rule breaches. Some employees of CITIC Securities have returned to work after assisting with unspecified government investigations, the company said in the filing.

Chen is head of CITIC’s investment banking division, according to the company website, while Yan runs investment banking at the company’s overseas unit CITIC Securities International. Several high-profile brokerage executives have been investigated in mainland China as authorities looked for answers to explain a slump of more than 40% in stocks between June and August that they blamed in part on “malicious short-selling”. Executives at CITIC Securities have been investigated for insider trading and leaking information. Last month, CITIC said it was choosing a new chairman and incumbent Wang Dongming could not take part because of his age. However, the Financial Times reported that Wang had been forced out because of the scandal, citing people familiar with the matter.

Yet another way to spell debt deflation.

• Falling Cattle Prices Put The Hurt On Kansas Ranchers, Feedlots (WE)

Tumbling cattle prices have left the mood of the state’s ranchers a lot more somber this year. The Kansas Livestock Association held its annual meeting at the Hyatt Regency Wichita this week and, on Friday, heard from Randy Blach, president of market analyst CattleFax. Blach’s message is that he knows 2015 has been a rough ride for ranchers as prices have plunged from their record highs a year ago. The reasons have been long in coming. Ranchers and feeders enjoyed a terrific year in 2013 and 2014 as beef and cattle prices skyrocketed. Herds had shrunk because of the drought, and prices hit record highs. High prices and the return of the rains caused ranchers to hold back large numbers of heifers to rebuild herds. Well, now the herds are largely rebuilt. And more steers are being sent to slaughter.

The effect has been dramatic in the second half of the year, Blach said, citing the slaughter price for cattle. “Last year at this time it was $174 a hundred (pounds),” he said. “Now, it’s $125. That’s a $50-a-hundred loss in a very short period of time.” In addition, the export market for beef has dropped significantly as the global economy, particularly in China, has slowed, and the dollar has risen 15 to 20% against foreign currencies. This year has already punished some of the middlemen in the chain. Kansas feedlots have seen steep losses in the second half. For the consumer, high prices will start to fall in grocery stores by mid-2016, Blach said. Shoppers will start seeing more quantity, variety and price specials. “It will start being pretty visible,” he said. And prices will remain down through the end of the decade, he said, rebuilding demand for beef.

“..a prison where modern day Black men labor in the sun while guards patrol from horseback just as they did a century and a half ago.”

• Prison Labor In USA Borders On Slavery (AHT)

When slavery was abolished in the United States in 1865, the focus on free labor shifted from human ownership, to forced prison labor. This practice has been exploited for a very long time and the companies that prosper from it, the list of which includes American corporate giants like Wal Mart, McDonald’s, Victoria’s Secret and a long list of others, are generating huge revenues by people who are reportedly paid 2 cents to $1.15 per hour. According to the USUncut.com article, “These 7 Household Names Make a Killing Off of the Prison-Industrial Complex”, the list of companies benefiting from this questionable type of workforce is a real eye opener. The article reveals how prisoners work an average of 8 hours a day, yet they are paid roughly six times less than the federal minimum wage. Prison labor is an even cheaper alternative to outsourcing.

“Instead of sending labor over to China or Bangladesh, manufacturers have chosen to forcibly employ up to 2.4 million incarcerated people in the United States. Chances are high that if a product you’re holding says it is ‘American Made,’ it was made in an American prison.” It is also noteworthy that items that say “Made in China” are sometimes manufactured in Chinese prisons. According to the NPR article, “Made In China – But Was It Made In A Prison?”, there are few limits to the use of prison labor in Communist China, “Prisoners in China’s re-education-through-labor camps make everything from electronics to shoes, which find their way into U.S. homes.” This is an issue that potentially affects every American family, but squarely impacts the African-American community, where on any given day, more Black males are serving prison time than attending college.

The practice hearkens back to the brutal days of slavery in America’s deep South, in countless ways. An article published by The Atlantic this year, “American Slavery, Reinvented,” examines the Louisiana State Penitentiary called Angola, which was converted from a southern plantation into a prison, where modern day Black men labor in the sun while guards patrol from horseback just as they did a century and a half ago. The article explains that the prisoners who do not perform the labor as expected, will be severely punished, “…once cleared by the prison doctor, (the prisoners) can be forced to work under threat of punishment as severe as solitary confinement. Legally, this labor may be totally uncompensated; more typically inmates are paid meagerly—as little as two cents per hour—for their full-time work in the fields, manufacturing warehouses, or kitchens. How is this legal? Didn’t the Thirteenth Amendment abolish all forms of slavery and involuntary servitude in this country?”

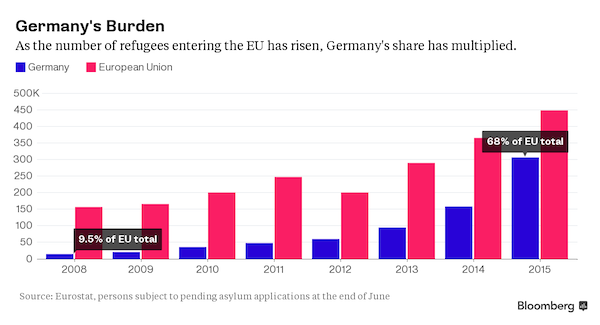

“..964,574 refugees had arrived in Germany by the end of November..”

• German States Slam New Refugee Boss For ‘Slow Work’ (DPA)

Ministers rushed to defend the new head of the national refugee authority from attacks by leaders of Germany’s federal states, saying he had only been in position a few weeks and needed time to make a difference. Rhineland-Palatinate minister-president Malu Dreyer said on the weekend that the Federal Office for Migration and Refugees (BAMF) was working too slowly and shouldn’t be taking weekends off during the crisis. On Monday, the Passauer Neue Presse (PNP) reported that 964,574 refugees had arrived in Germany by the end of November, based on figures the Interior Ministry gave in response to a parliamentary question. That’s more than four times as many as arrived in 2014, when the total for the whole year was 238,676. The BAMF still faces a backlog of 355,914 cases, the PNP reported.

But Chancellor Angela Merkel’s chief of staff Peter Altmaier – who has overall responsibility for refugees – leapt to the defence of BAMF boss Frank-Jürgen Weise on Sunday. Altmaier told broadcaster ARD on Sunday evening that Weise “has only been in office for a few weeks, and an unbelievable amount has been done in this time”. Altmaier said that in spite of massively increased numbers of asylum applications, the BAMF had managed to cut down the time it takes to make decisions. “That’s why I don’t think it’s productive when whoever it is thinks they can make political declarations off the backs of the workers” at the BAMF, he said. Labour Minister Andrea Nahles told broadcaster ZDF that things would really pick up at the BAMF after the new year, when 4,000 new officials would join the office. “Then there will be a big step forward,” she said.

“Allies” fighting one another.

• US Alliance-Supported Groups In Syria Turn Guns On Each Other (Reuters)

Groups that have received support from the United States or its allies have turned their guns on each other in a northern corner of Syria, highlighting the difficulties of mobilizing forces on the ground against Islamic State. As they fought among themselves before reaching a tenuous ceasefire on Thursday, Islamic State meanwhile edged closer to the town of Azaz that was the focal point of the clashes near the border with Turkey. Combatants on one side are part of a new U.S.-backed alliance that includes a powerful Kurdish militia, and to which Washington recently sent military aid to fight Islamic State. Their opponents in the flare-up include rebels who are widely seen as backed by Turkey and who have also received support in a U.S.-backed aid program.

Despite the ceasefire, reached after at least a week of fighting in which neither side appeared to have made big gains, trust remains low: each side blamed the other for the start of fighting and said it expected to be attacked again. A monitoring group reported there had still been some firing. The fighting is likely to increase concern in Turkey about growing Kurdish sway near its border. It also poses a new challenge for the U.S.-led coalition which, after more than a year of bombing Islamic State in Syria, is trying to draw on Syrian groups to fight on the ground but finding many have little more in common than a mutual enemy. Azaz controls access to the city of Aleppo from the nearby border with Turkey. It also lies in an area coveted by Islamic State, which advanced to within 10 km of the town on Tuesday and took another nearby village later in the week.

The fighting pitched factions of the Free Syrian Army, supported by Turkey and known collectively as the Levant Front, against the YPG and Jaysh al-Thuwwar – both part of the Democratic Forces of Syria alliance backed by Washington. The Syrian Observatory for Human Rights, a Britain-based group that monitors the conflict in Syria, said Levant Front was supported in the fighting by the Ahrar al-Sham Islamist group and the al Qaeda-linked Nusra Front. Observatory director Rami Abdulrahman said the rebels had received “new support, which is coming in continuously” from Turkey, a U.S. ally in the fight against Islamic State. “Turkish groups against U.S. groups – it’s odd,” he said.

Russia will act in careful ways. They’re not going to send troops into battle with Turkey.

• Iraq Could Ask Russia for Help After ‘Invasion’ by Turkish Forces (Sputnik)

The head of Iraq’s parliamentary committee on security and defense, Hakim al-Zamili, in an interview with Al-Araby Al-Jadeed, said that Baghdad could turn to Moscow for help after Turkey had allegedly breached Iraq’s sovereignty. Numerous reports suggest that on Friday Turkey sent approximately 130 soldiers to norther Iraq. Turkish forces, deployed near the city of Mosul, are allegedly tasked with training Peshmerga, which has been involved in the fight against Daesh, also known as ISIL. On Saturday, Baghdad described the move as “a serious violation of Iraqi sovereignty,” since it had not been authorized by Iraqi authorities.

“We may soon ask Russia for direct military intervention in Iraq in response to the Turkish invasion and the violation of Iraqi sovereignty,” Iraqi lawmaker al-Zamili said. Earlier, Hakim al-Zamili threatened Turkey with a military operation if the Turkish soldiers do not leave Iraq immediately The parliamentarian reiterated that Turkey sent troops into Iraqi territory without notifying the government. Iraqi Prime Minister Haider Abadi urged Ankara to immediately pull out its forces, including tanks and artillery, from the Nineveh province. Iraqi President Fuad Masum referred to the incident as a violation of international law and urged Ankara to refrain from similar activities in the future, al-Sumaria TV Channel reported.