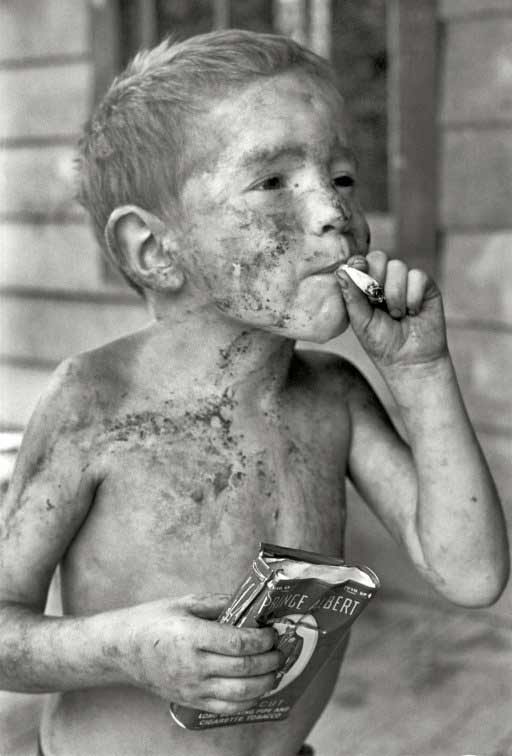

DPC Surf Avenue, Coney Island, NY 1903

Ambrose bets on a substantial fall-out.

• Panama Bombshell Spells Demise Of Shadow Finance, And Privacy (AEP)

The secret world of offshore banks and money-laundering has been under the microscope ever since the financial crisis. Now it is the turn of lawyers, registrars, and the hidden network of facilitators. The treasure trove of 11.5m documents leaked – or more precisely stolen – from the Panama law firm Mossack Fonseca lifts the lid on the extraordinary practices of the global elites, and on the alleged services of off-shore legal cabinets for terrorist organisations, drug cartels, sanctions busting, and front companies of all kinds. The files on 213,000 firms first slipped to the Suddeutsche Zeitung and then shared with the International Consortium of Investigative Journalists (ICIJ) is the biggest data leak in history. It will have long-lasting ramifications. The avalanche of allegations has barely begun.

The red-hot dossier on US citizens has not even been released. Yet the scandal has already triggered a string of criminal investigations around the world, kicking off in Australia and New Zealand within hours. Germany’s vice-chancellor Sigmar Gabriel said the files go far beyond issues of tax evasion, touching on vital national interests and the rule of law. “It is about organized crime, evasion of UN sanctions, and terrorist finance,” he said. “This shadow economy is a risk for global security. We must ban the anonymous letterbox companies. The international community must ostracize any country that allows these dirty dealings,” said Mr Gabriel. Mossack Fonseca’s clients include 23 people under sanctions for helping North Korea, Russia, Iran, Syria, and Zimbabwe. The Israeli newspaper Haaretz reports that 33 of those named are on the US black list for terrorism.

Panama has cornered the trade in anonymous shell companies that allow owners to disguise their identity and carry out global operations secretly. While this may be a legitimate for those in the limelight trying to protect their privacy or to safeguard sensitive corporate dealings, many use it to avoid detection for money-laundering, tax avoidance, or predatory behaviour. The country has pushed through reforms in a bid to clear its name and to get off the OECD’s ‘grey list’ of uncooperative tax havens, but has clearly not yet done enough. “Panama has an extremely aggressive and obstructive attitude. Dialogue has broken down,” said Pascal Saint-Amans, the OECD’s tax chief. “It is the last financial centre that has refused to implement global standards of fiscal transparency. There has been very strong pressure from the law firms on the Panamanian government.”

Mr Saint-Amans said offshore secrecy in on the wane in most of the world, but becoming more concentrated in Panama. “The majority of undeclared clients are coming clean in other locations, but those who don’t are going to Panama,” he said.

Thing is, that’s been obvious for ages.

• Tax Havens Don’t Need To Be Reformed. They Should Be Outlawed (Brooks)

The Panama Papers are not really about a central American state. They are a glimpse through a Panamanian keyhole of an orgy of tax evasion, money laundering and kleptocracy – amid the legitimate financial planning – hosted by the world’s tax havens. Seven years after world leaders came together at a post-financial crisis G20 summit in London and committed to end tax haven abuse, it is clear from these papers that no such end is in sight. The good intentions have translated into a blizzard of international agreements on sharing information, amnesties through which tax evaders can come clean, and prosecution drives of variable quality to nail the cheats. All are demonstrably inadequate. Information will not, and cannot, be exchanged to any meaningful extent by countries and territories whose “offer” is that they don’t ask for it or will turn a blind eye to being deceived.

Amnesties teach rich tax evaders that, even if they are caught, they will get off far more lightly than somebody overclaiming a few pounds in social security benefits. Criminal pursuit of offenders, certainly in the UK, is little more than a joke. One prosecution from 1,000 tax evaders using HSBC’s Swiss accounts is the now infamously poor punchline. Here, the Panama Papers lay bare another national disgrace: Britain’s longstanding role at the centre of the offshore web. More than half of the 200,000 secret companies set up by the Panama lawyers Mossack Fonseca were registered in the British Virgin Islands, where details of company ownership don’t have to be filed with the authorities, never mind be made public. While this week’s leak is on an unprecedented scale, it exposes a historic as well as current failing.

As the British empire faded away after the second world war and territories such as the British Virgin Islands drifted into the constitutional limbo of semi-independence, they were encouraged to develop financial services as a way of sustaining precarious economies. If this meant a few of the world’s wealthier people paid a little less tax, thought successive British governments, it was a price worth paying for not having to support the territories. Late 20th-century financial liberalisation turned this already complacent calculation into something more lethal. With fortunes sloshing freely across borders, tax havens became voracious parasites on the world economy, most seriously sucking the life out of some of its poorer parts. All the great national robbers of recent decades, such as Nigeria’s Sani Abacha, have used tax haven companies, including British Virgin Islands ones, as the getaway cars.

Despite this long trail of evidence, leading economies refuse to address the problem at its source. The UK has great leverage over its 17 overseas territories and crown dependencies, all of which depend on the mother country for security and happily trade off its legal system. At a stroke our government could shut down the British Virgin Islands corporate system, for example. But under influence from a banking system that thrives on the legal benefits of offshore centres such as the British Virgin Islands and the Cayman Islands, it takes a more relaxed view. Asked recently about whether Britain’s overseas territories should publish registers of beneficial owners of their companies, foreign office minister James Duddridge replied that these were a “direction, rather than an ultimate destination”. The Panama Papers should expose this indifference for the great scandal that it is.

Gone tomorrow.

• Thousands Protest Demanding Icelandic PM’s Resignation (AFP)

Thousands of Icelanders took to the streets late Monday calling for their prime minister’s resignation after leaked tax documents dubbed the “Panama Papers” prompted allegations that he and his wife used an offshore firm to hide million-dollar investments. Protesters filled the square outside Iceland’s parliament in Reykjavik, footage on public television RUV showed, answering a call from opposition parties to demonstrate against Prime Minister Sigmundur David Gunnlaugsson. Police provided no estimate of the size of the crowd, but said the demonstrators outnumbered the thousands who in 2009 brought down the right-wing government over its responsibility in Iceland’s 2008 banking collapse.

“Take responsibility” and “Where is the new constitution?” read some of the signs carried by demonstrators on Monday, referring to the country’s new charter drawn up after the 2009 political crisis and which has since been held up in parliament. Financial records published by the International Consortium of Investigative Journalists showed that Gunnlaugsson, 41, and his wife Anna Sigurlaug Palsdottir bought the offshore company Wintris Inc. in the British Virgin Islands in December 2007. The company was intended to manage Palsdottir’s inheritance from her wealthy businessman father, the amount of which has not been disclosed. Gunnlaugsson transferred his 50% stake to his wife at the end of 2009, for the symbolic sum of one dollar.

But when he was elected a member of parliament for the first time in April 2009 as a member of the centre-right Progressive Party, he neglected to mention the stake in his declaration of shareholdings, as required by law. Gunnlaugsson has meanwhile denied any wrongdoing or tax evasion and insisted Monday he would not step down. He said he never hid any money abroad and that his wife paid all her taxes on the company in Iceland. A motion of no-confidence was presented to parliament by the opposition, and will be submitted to a vote at an as yet undetermined date. Almost 28,000 Icelanders, in a country of just 320,000 inhabitants, have also signed a petition demanding his resignation.

All global banks are involved.

• German Banks Enmeshed In Panama Papers Leak (DW)

The two German financial institutions specifically mentioned in media reports as having helped high-ranking politicians, celebrities and sports stars hide their money abroad were Deutsche Bank, Germany’s largest lender, and the Hamburg-based Berenberg bank. The allegations were part of the so-called Panama Papers, a massive trove of leaked emails, PDFs and other records that expose a world of letterbox companies and business arrangements that until recently had been largely hidden from public view. The Panama Papers were first obtained by reporters at the German daily “Süddeutsche Zeitung,” and on Sunday, the head of the paper’s investigative unit suggested to a German TV host that every bank in Germany was somehow implicated.

“If you were to ask me which German bank hadn’t helped its customers go to Mossack Fonseca, I would have to think long and hard to see if a single one came to mind,” said Georg Mascolo, referring to the Panama-based law firm that is at the center of the leaks because it’s where the documents originated. Mascolo proceeded to single out Deutsche Bank and Berenberg bank, the latter of which he said had “especially distinguished itself.” Both institutions promptly denied any wrongdoing. Speaking to the news agency DPA, a spokesman for Berenberg’s Swiss subsidiary insisted there was nothing inherently illegal about dealing with offshore companies. “This is, of course, done in line with legal regulations, but it does require greater due diligence on the part of the banks,” he said, noting that such accounts were “permanently monitored.”

Sort of funny. Note that this story had been playing out for a few years already.

• Data From Panama Law Firm Came From Employee, Not Hackers (Rijock)

Now it’s Panama Leaks: massive amounts of customer data stored on the computers of the country’s principal provider of corporations, Mossack Fonseca, have been stolen and delivered to foreign journalists, who reportedly are planning on releasing it as early as Monday. The data is believed to contain information on Panama companies, and bank accounts, held by foreign government officials, other politically exposed persons (PEPs) and organized crime syndicates. The public release of this information could result in widespread criminal charges against corrupt heads of state and other officials who have banked the proceeds of illegal bribes and kickbacks they have received.

There will be special attention paid to individuals who accepted money from American and British firms to allow them to participate in lucrative business arrangements, as the US and UK both strictly enforce their foreign corruption laws. Mossack Fonseca, already reeling being implicated in a major corruption case in Brazil, in which present or former government officials at the highest level are under criminal investigation, has also been in the news lately due to allegations that senior officials in Malta hold secret banks accounts in Panama, facilitated by the Mossack firm. Investigative reporters are allegedly already to publish the names, and sordid details, of a large number of corrupt PEPs. Some television media are reportedly planning on running stories early this week.

Panama insiders have said that the source of the information was not, as Mossack is reporting, an intrusion by hackers, but an inside job. A former female employee, with access to the data, was allegedly involved in an intimate relationship with a Mossack name partner. The relationship ended badly some time ago, and the employee exacted her revenge by going public with Mossack client lists and related data. The impact of this leak cannot be underestimated; it will seriously undermine global confidence in the ability of Panamanian financial service providers to assist corrupt government officials, and career criminals in hiding their ill-gotten gains, which is the major segment of the client base in such firms. It is too early to know whether dirty money will now seek a different opaque haven to be hidden.

To further illustrate the point I made yesterday.

• Panama Papers Cause Guardian to Collapse into Self-Parody (OG)

You’d be forgiven for thinking, given the above picture, that the Panama Papers had something to do with Vladimir Putin. Maybe he was a kingpin of the whole thing. Maybe he was, at least, among the 12 world leaders implicated in various shady financial practices – along with Petro Poroshenko, the saviour of Ukrainian democracy, and the King of Saudi Arabia (dad of the recent Légion d’Honneur winner). Luke Harding, a bastion of ethical journalism (and not at all a paranoid lunatic), has churned out 2 articles totaling over 5000 words, each using the word “Putin”, almost as often as they use the phrases “allegedly”, “speculation suggests”, “has been described as” and “may have been”.

Neither of his articles mentions by name any of the 12 world leaders, past and present, actually identified in the documents, nor do they mention David Cameron’s dad, who is also in there. No, they focus on a cellist friend of Putin’s, talk about his daughter’s marriage, and include an awful lot of diagrams with big arrows that point at pictures of…Vladimir Putin. This is, apparently, all evidence of…something …I’m not sure what, but it will probably be discussed at length in the “book” Luke Harding is probably planning to publish in a couple of weeks. That’s if the NSA don’t delete it all while he’s typing. The only important, or even true, phrase Harding uses appears at the very top of this article:

…the president’s name does not appear in any of the records…

That’s a minor detail of course, I mean, they have a video: “How to hide $1 billion”. The title screen is, you guessed it, a photo of Putin. Presumably because he is SO GOOD at hiding his billions that, unlike Petro Poroshenko and David Cameron’s dad:

…the president’s name does not appear in any of the records…

So there you go. The Guardian falls into self parody, pasting up a massive picture, a misleading headline and 5000 words (that Harding presumably copied from someone else), at the merest suggestion of a tenuous connection to the Russian president. It’s a bit odd, really.

While scrambling to delete any and all references. But still, they do have a point. It’s not as if something financed by Soros is even remotely neutral.

• China State Paper Sees ‘Powerful Force’ Behind Panama Leak (BBG)

A “powerful force is behind” the leak of more than 11 million documents detailing the offshore accounts of some of the world’s wealthiest people, and the U.S. government stands to gain the most from the revelations, a state-run Chinese newspaper said. An editorial published by the Global Times newspaper Tuesday provided China’s first official reaction to investigations by more than 100 news organizations, detailing overseas holdings of about 140 politicians, public officials and family members, including President Xi Jinping’s brother-in-law. The editorial, which focused on Russian President Vladimir Putin and didn’t mention any of the Chinese examples, assessed the “eye-catching” revelations as a salvo in an East-West ideological struggle, echoing the Kremlin’s response.

“The Western media has taken control of the interpretation each time there has been such a document dump, and Washington has demonstrated particular influence in it,” said the Global Times, which is published by the Communist Party’s flagship People’s Daily. “Information that is negative to the U.S. can always be minimized, while exposure of non-Western leaders, such as Putin, can get extra spin.” The release of the so-called Panama Papers come at an embarrassing time for Xi, who’s requiring party members to give authorities more information about their family wealth to institutionalize his more than three-year-old war on graft. Mentions of the documents were widely scrubbed from China’s heavily censored Internet and news outlets, which have come under increased pressure from Xi to toe the party line.

Links shared on Tencent Holdings’s WeChat messaging service said the “page could not be found.” Attempts to search “Panama Papers” on Baidu’s Google-like search engine returned only a one-line warning that “search results may not comply with relevant laws or regulations.” The Global Times editorial was published only in English.

Those forces are waiting for TTP and TTiP to be ratified.

• The Forces of Globalization Are Sputtering (WSJ)

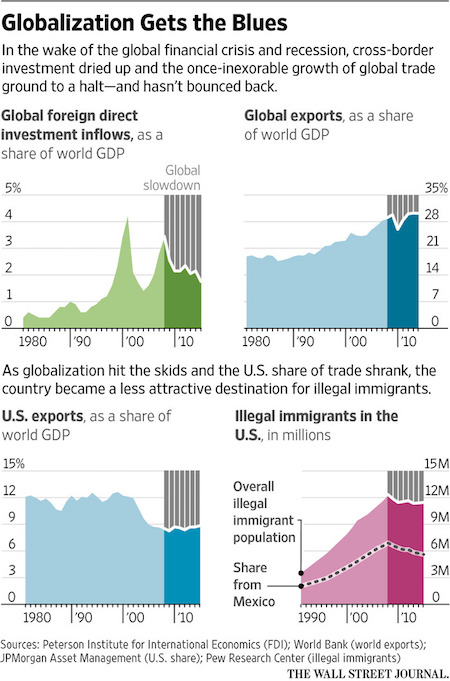

On the campaign trail, presidential candidates in both parties depict an America under siege from cheap imports, job-stealing globalization or waves of illegal immigration. The reality since the global recession is far more complicated. Across a range of measures, the forces that once pointed to an inexorable internationalization of the world’s economy have slowed, stuttered or swung into reverse. The slowdown points to deeper economic challenges far different from the political alarms. Much of the world is struggling with a sluggishness that is clouding the U.S. outlook, driven by aging demographics, slumping labor productivity and policy makers lacking the tools or the will to pump more life into the global economy. Whatever the causes, signs abound that the forces of globalization have slowed.

Manufacturing jobs in the U.S. declined every year from 1998 to 2009, regardless of whether the overall economy was expanding or in recession. But over the past six years, manufacturing employment has edged up. It’s hardly a renaissance—the U.S. has regained about 1 million manufacturing jobs after losing 8 million since the late 1970s—but it’s a halt to the decline. The U.S. share of global exports fell sharply, especially from 1998 to 2004, but has held steady over the past 12 years at roughly 8.5%. There’s even evidence the trend of illegal immigration in the 1990s and 2000s, when millions of Mexicans crossed the border for the U.S., has stalled or gone into reverse, despite frequent alarms raised by Republican front-runner Donald Trump. The Pew Research Center estimates that since 2007, the flow of illegal immigrants returning to Mexico has been larger than the number entering the U.S.

“The globalization process, which was firing on all cylinders during the 2000s, has stalled over the past six or seven years,” said Benjamin Mandel, global strategist at J.P. Morgan Asset Management and a former New York Fed economist. The trend isn’t specific to the U.S. Globalization has sputtered around the world. From 1992 to 2008, trade climbed to about 30% of total world economic output, from 20%. That climb has halted, and remains at about 30% of GDP in the latest World Bank estimates. If the historical trend between trade growth and GDP growth had continued, global trade would be $1.8 trillion larger, according to estimates from Eric Lascelles, chief U.S. economist of RBC Asset Management. That’s equivalent to an economy the size of Canada or Russia disappearing from global output.

From the IMF research department.

• China Hard Landing Could Trigger Global Market Bloodbath: IMF (Tel.)

Jitters over the health of the Chinese economy could trigger a bloodbath on financial markets if a hard landing materialises, the IMF has warned. The IMF said policy choices in the world’s second largest economy would also have “increasing implications for global financial stability” in the coming years as the country opens up its bond and equity markets. The fund said emerging market economies such as China, India, Brazil and Russia had driven more than half of global growth over the past 15 years. Stronger trade ties and financial linkages meant spillovers from these countries had become “the norm, not the exception”, increasing the risk that future shocks could send powerful reverberations around the globe. The IMF calculated that emerging market spillovers now accounted for a third of the fluctuations seen in equity and currency markets in advanced nations.

Highlighting last summer’s massive stock market sell-off after China devalued its currency, the IMF noted that Chinese growth had an “increasing” and “significant” impact on global equity prices. “The impact of shocks to China’s fundamentals on global financial markets is expected to grow stronger and wider over time,” the Fund said in a pre-released chapter of its Financial Stability report. “Clear and timely communication of its policy decisions, transparency about its policy goals, and strategies consistent with achieving them will, therefore, be essential to ensure against volatile market reactions, which may have broader repercussions.” The IMF also urged policymakers to do more to rein in corporate debt, which it has previously said could see a wave of defaults as the US hikes interest rates.

“Fire sales” of assets by money managers could also amplify emerging market spillovers in a downturn, if mutual funds rushed to sell illiquid assets, the IMF warned. Financial “spillbacks” triggered by policy actions in advanced economies such as tighter monetary policy in the US underscored “the importance of enhanced international macroeconomic and macroprudential policy co-operation”, the IMF said. The Fund issued a separate warning on the $24 trillion life insurance sector. It said herding behaviour created systemic risks that could make firms “too many to fail”. The IMF said the low interest rate environment had encouraged many firms to increase risk taking in order to “resurrect their fortunes”, particularly among smaller and less capitalised firms. “Jointly firms can propagate shocks, if they act similarly,” the IMF said. “They may be ‘too many to fail’,” it warned.

From the other IMF orifice. She has absolutely nothing. Zilch. Not a word she utters has any meaning.

• Lagarde Says Risks to Weak Global Recovery Are Increasing (BBG)

The global recovery is facing growing risks, and frustration with inequality is increasing the lure of protectionism, IMF Managing Director Christine Lagarde said. The world economy’s outlook has dimmed over the last six months, exacerbated by China’s slowdown, lower commodity prices and the risk of financial tightening in many countries, Lagarde said Tuesday in the prepared text of a speech in Frankfurt. The expected passing of the “growth baton” from emerging markets to advanced economies hasn’t occurred, she added. Lagarde, fresh from winning a new five-year term at the fund’s helm, used the opportunity to caution against being drawn to the kinds of forces that have fueled the populism-driven candidacies of Bernie Sanders and Donald Trump in the U.S. presidential election.

While inequality has been declining on a global scale, the perception remains that “the cards are stacked against the common man – and woman – in favor of elites,” said Lagarde, 60. “To some, the answer is to look inward, to somehow unwind these linkages, to close borders and retreat into protectionism,” she said, without naming any politicians. “As history has told us – time and again – this would be a tragic course.” Lagarde’s comments on the global economy add to signs that the IMF will downgrade its growth forecast when it releases its updated World Economic Outlook on April 12. Finance ministers and central bankers from the fund’s 188 member nations will gather later that week in Washington for the IMF’s spring meetings. “The good news is that the recovery continues; we have growth; we are not in a crisis,” Lagarde said. “The not-so-good news is that the recovery remains too slow, too fragile, and risks to its durability are increasing.”

Lagarde said U.S. growth is flat due partly to the strong dollar, while low investment and high unemployment are weighing on growth in the euro zone. Growth and inflation in Japan have been weaker than expected, she added. China’s transition to a more sustainable economic model involves slower growth, Lagarde said, adding that downturns in Brazil and Russia have been worse than expected and Middle Eastern nations have been hit hard by the decline in oil prices. “Certainly, we have made much progress since the great financial crisis,” Lagarde said. “But because growth has been too low for too long, too many people are simply not feeling it.” The persistent low growth can be “self-reinforcing,” because of negative effects on potential output that can be hard to reverse, she said.

Beijing is deliberately creating an ever bigger housing bubble. Scary.

• Subprime Housing Risks Raise Red Flags In China (WSJ)

China’s efforts to tackle a glut of vacant housing by spurring home lending have triggered a bigger problem: A surge in risky subprime-style loans that is generating alarm among regulators. Home buyers in China normally put down a third of the cost of a new property upfront. But a rapid rise in buyers borrowing for their down payments – an echo of the easy credit that cratered the U.S. housing market and sparked the financial crisis – has prompted authorities to clamp down. Peer-to-peer lenders, who raise money from investors and then lend it out at higher interest rates, made 924 million yuan ($143 million) in down-payment loans in January, more than three times the amount made in July, according to Shanghai-based consultancy Yingcan.

A senior banking executive at one of China’s top four state-owned banks said down-payment loans directly contributed to a recent run-up in housing prices in big cities. “It’s a risky practice that should be contained,” he said. Officials at various levels of government are now stepping on the brakes. The central bank and the housing ministry last month started to crack down on loans enticing home-buyers with “zero-down-payment” slogans. [..] Beijing began easing credit in late 2014 to help cities fill empty apartments — a legacy of a housing-construction boom fueled by a decade of urban population growth and cheap credit. As companies and local governments sag under crippling debt, authorities have seen room for more borrowing among households and have tried to widen the pool of home buyers.

But despite a rise in down-payment loans and lower mortgage barriers for groups such as rural migrant workers, it has proven hard to unleash buying in the right places. Instead, the easing measures and new incentives fed a property frenzy in China’s megacities, with buyers driven by fear of being left behind in a market increasingly out of reach. Shenzhen, where housing prices have soared 57% since last year, according to official data, has tightened down-payment requirements. So has Shanghai, where housing loans more than tripled in January compared with a year earlier. Data on loans used to finance down payments is sketchy, as such financing is a relatively new business. In addition, developers sometimes offer such loans, and banks offer mortgage applicants loans for renovations, taxes or travel that can be channeled toward the down payment, according to property agents. Depending on the housing market, agents say, these loans can attract annual interest rates of up to 24%.

Until there’s nothing left.

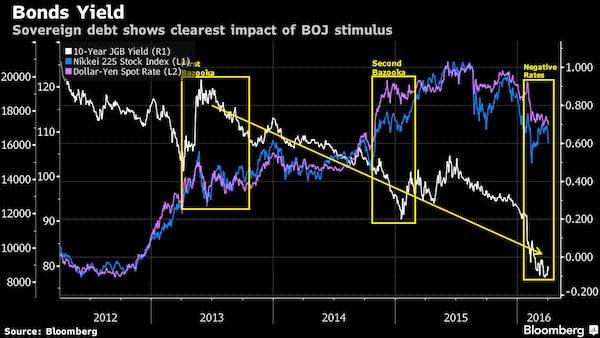

• Bond Market ‘Exhausted’ as Kuroda Stimulus Enters Fourth Year (BBG)

Three years since Bank of Japan Governor Haruhiko Kuroda embarked on an unprecedented monetary experiment, yields continue to test new lows even as concern grows that his policies will cripple the world’s second-biggest bond market. Yields have tumbled below zero on maturities up to a decade following the central bank’s surprise decision this year to implement negative interest rates, after unleashing two rounds of quantitative easing since April 4, 2013. As the BOJ’s bond holdings have swelled to one-third of total debt outstanding, the market has begun to seize up amid a dearth of liquidity, causing volatility to soar. Even so, inflation – and inflationary expectations – remain far from Kuroda’s 2% target.

That’s why an overwhelming majority of analysts predict the BOJ will expand stimulus again by July, even while some warn that the technical limits to the asset-purchase program are rapidly approaching. In the BOJ’s latest survey of bond market participants, 41% rated market functioning as “low.” Kuroda said Tuesday the central bank can lower the deposit rate from the current minus 0.1% if needed, and he doesn’t think negative rates will make asset purchases difficult. “The bond market is becoming increasingly exhausted, and increasingly volatile,” said Shuichi Ohsaki at Bank of America Merrill Lynch in Tokyo. “It’s not a properly functioning market anymore. This stimulus can’t go on indefinitely.”

The achievements of the ‘intelligent’ human species.

• Sperm Whales Found Full of Car Parts and Plastics (NatGeo)

Fishing gear and an engine cover are just some of the startling contents found inside the stomachs of sperm whales that recently beached themselves on Germany’s North Sea coast. The 13 sperm whales washed up near the German state of Schleswig-Holstein earlier this year, the latest in a series of whale strandings around the North Sea. So far, more than 30 sperm whales have been found beached since the start of the year in the U.K., the Netherlands, France, Denmark, and Germany. After a necropsy of the whales in Germany, researchers found that four of the giant marine animals had large amounts of plastic waste in their stomachs. The garbage included a nearly 43-foot-long shrimp fishing net, a plastic car engine cover, and the remains of a plastic bucket, according to a press release from Wadden Sea National Park in Schleswig-Holstein.

However, “the marine litter did not directly cause the stranding,” says Ursula Siebert at the University of Veterinary Medicine Hannover, whose team examined the sperm whales. Instead, the researchers suspect that the whales died because the animals accidentally ventured into shallow seas. Male sperm whales normally migrate from their tropical or subtropical breeding grounds to colder waters at higher latitudes. The species is one of the deepest diving animals in the cetacean family, known to plummet as far as 3,280 feet (1,000 meters) in search of squid, its favorite food. The beached whales were all young males between the ages of 10 and 15, and the necropsies revealed that they died of heart failure. The team believes this particular group mistakenly swam into the North Sea, a shallower zone in between the U.K. and Norway. There the whales could not support their own body weights, and their internal organs collapsed.

“It is thought that the sperm whales may have got lost and entered the North Sea (possibly chasing squid), where the sea floor is not deep enough, causing the whales to become disorientated and die,” Danny Groves, a spokesperson for the nonprofit Whale and Dolphin Conservation (WDC), wrote in an email. According to the WDC, whales and dolphins may strand for many reasons, such as excessive noise pollution from ships and drilling surveys or even subtle shifts in Earth’s magnetic field. In addition, pilot whales that beached off the coast of Scotland three years ago showed high levels of toxins from ocean pollution, which scientists linked to stress on their brains that may have caused disorientation.

The EU-Turket deal is a disgrace on more levels than we can count.

• Turkey: The Business Of Refugee Smuggling & Sex Trafficking (ZH)

A detailed report on Syrian women refugees, asylum seekers, and immigrants in Turkey, issued as far back as 2014 by the Association for Human Rights and Solidarity with the Oppressed (known in Turkish as Mazlumder), tells of early and forced marriages, polygamy, sexual harassment, human trafficking, prostitution, and rape that criminals inflicted upon Syrians in Turkey. According to the Mazlumder report, Syrians are sexually exploited by those who take advantage of their destitution. Children, especially girls, suffer most. Evidence, both witnessed and forensic, indicates that in every city where Syrian refugees have settled, prostitution has drastically increased. Young women between the ages of 15 and 20 are most commonly prostituted, but girls as young as thirteen are also exploited.

Secil Erpolat, a lawyer with the Women’s Rights Commission of the Bar Association in the Turkish province of Batman, said that many young Syrian girls are offered between 20 and 50 Turkish liras ($7-$18). Sometimes their clients pay them with food or other goods for which they are desperate. Women who have crossed the border illegally and arrive with no passport are at high risk of being kidnapped and sold as prostitutes or sex slaves. Criminal gangs bring refugees to towns along the border or into the local bus terminals where “refugee smuggling” has become a major source of income. Professional criminals convince parents that their daughters are going to a better life in Turkey. The parents are given 2000-5000 Turkish liras ($700-$1700) as a “bride price” – an enormous sum for a poor Syrian family – to smuggle their daughters across the border.

“Many men in Turkey practice polygamy with Syrian girls or women, even though polygamy is illegal in Turkey,” the lawyer Abdulhalim Yilmaz, head of Mazlumder’s Refugee Commission, told Gatestone Institute. “Some men in Turkey take second or third Syrian wives without even officially registering them. These girls therefore have no legal status in Turkey. Economic deprivation is a major factor in this suffering, but it is also a religious and cultural phenomenon, as early marriage is allowed in the religion.” Syrian women and children in Turkey also experience sexual harassment at work. Those who are able to get jobs earn little – perhaps enough to eat, but they work long and hard for that little. They are also subjected to whatever others choose to do to them as they work those long hours.

[..] The organization End Child Prostitution, Child Pornography and Trafficking of Children for Sexual Purposes (ECPAT) has produced a detailed report on the “Status of action against commercial sexual exploitation of children: Turkey.” ECPAT’s report cites, from the 2014 Global Slavery Index, estimates that the incidence of slavery in Turkey is the highest in Europe, due in no small measure to the prevalence of trafficking for sexual exploitation and early marriage.

The problem merely shifts.

• Italy Pleads For Greek-Style Push To Return Its Migrants (FT)

Italy is pleading for EU help to ramp up the deportation of migrants arriving on its southern shores, warning that the bloc’s immigration system is at risk of collapse without a more aggressive policy on so-called returns. In an interview with the FT, Angelino Alfano, Italy’s interior minister, says the EU should move to secure deals with African nations, which are the source of the vast majority of migrants arriving in Italy, offering economic aid in exchange for taking back their citizens and preventing new flows. His comments come as the EU enacts a scheme with Turkey in which thousands of Middle Eastern refugees will be sent back across the Aegean Sea from Greece in exchange for up to €6bn in EU aid for Ankara. A first group of 135 were returned to Turkey on Monday.

“Europe was able to find the resources when it was urgent – I am referring to Turkey. It’s a matter of political leadership,” Mr Alfano said. “If returns don’t work, the whole Juncker migration agenda will fail,” he said. Mr Alfano’s request reflects renewed nervousness in Rome about the migration crisis following an 80 per cent spike in the number of arrivals to Italy across the central Mediterranean Sea in the first quarter of this year compared to 2015. If that increase holds through the warmer spring and summer months, it would smash the record 170,000 migrants who arrived in Italy in 2014, straining resources and creating a political problem for the centre-left government led by Matteo Renzi. As the Greece plan goes into action, there are worries in Rome that it may compound problems by encouraging Middle Eastern migrants to switch routes and attempt to enter the EU through Italy, boosting the numbers even further.

“If Syrians don’t want to stay in Turkey but want to try the trip to Europe, they will go around and try to get here from Libya,” Mr Alfano said. “We still don’t have any evidence that this is happening, but we are monitoring.” Italy has held talks with Albania about containing a possible surge in flows through the Balkan nation. Mr Alfano also expressed hope that the recent, if wobbly, establishment of a national unity government in Libya could lead to a crackdown against migrant smugglers there. For those who do arrive, Italian officials are hoping that an EU plan to relocate thousands of refugees across its 28 member states will relieve some pressure. So far, only about 500 migrants have been moved from Italy under the plan – “apartment building numbers” – says Mr Alfano, derisively.

Italy last year deported 15,000 people, or about 10 per cent of all arrivals. Officials believe higher figures are essential to alleviate the country’s burden, even if mass returns could trigger concerns about possible violations of human rights and international law. “Irregular [migrants] have to be kept in closed camps from where they cannot escape. So how many tens of thousands of people can you keep, year after year? Without returns, either you organise real prisons, or it’s obvious that the system will collapse,” Mr Alfano said. “It doesn’t take a prophet to glimpse the future”.

Yesterday’s deportations will prove to be mainly symbolic. From here on in the problems start.

• So The Greece Deportations Are Going ‘Smoothly’? Take A Closer Look (G.)

Today had been declared the first day that migrants and refugees would be deported from Greece within the framework of the EU-Turkey deal, and European authorities seemed determined not to miss the date. So as of Sunday, Greek police, along with the EU border agency Frontex, organised a large-scale operation to ensure the smooth handling of today’s returns from the islands of Chios and Lesbos. The operation was initially deemed a success, with reports being limited to the boats and their occupants, which offered some digestible photo ops. There is plenty of evidence, though, that suggests that it has been no more than a media-savvy gesture on behalf of the European commission.

Officials from Frontex clarified that the boats carried mostly Pakistanis, Bangladeshis, Afghans and Moroccans who were going to be deported to Turkey prior to the deal or didn’t request asylum. There were only two Syrians among them who appear not to have requested international protection. Indeed authorities appear to have rushed to identify such people so they could be available for today’s return. Termed “easy cases” by Frontex spokeswoman Eva Moncure, they are perfect material for today’s photo op. As it turns out, more than 90% of people arriving in Greek islands since 20 March – when the EU-Turkey deal was enacted – have opted for asylum, thus complicating their return under the arrangement. It is no surprise then that no further dates have been announced for future deportations.

The first day of deportations has been met with affirmative statements by credible international organisations, including the UN High Commissioner for Refugees (UNHCR), who confirmed that all procedures were regular and rights of deportees were observed. Everything is smooth and tidy, it seems. But this is one version of the story only. There is a second where things have gone less smoothly. Activist lawyers’ accounts and journalist reports from the islands raise the question of whether refugees have been given sufficient time and access to asylum procedures. It appears that many of them do not yet understand the content of the deal or why they have been restricted, and there has been a last-minute rush for asylum claims among the people who are possible deportees. It is also unclear how Turkey plans to handle returnees, how they will be received, and whether they will be able to receive the protection that was previously offered to them there.