John Collier Japanese restaurant, Monday after Pearl Harbor, San Francisco 1941

If you find this appealing, seek help. These people mean it, which makes them the biggest danger to your future, bar none. We’re not going to fix the world for profit. The sustainable delusion will kill us.

• World Could Enjoy Utopian Future With Sustainable Development (Ind.)

It is an unremittingly bleak vision of the future: over the next decade the world’s economy stagnates, fossil fuels ramp up global warming and the gap between rich and poor widens, fuelling nationalist tensions based on resentment of the ‘global elite’. But, while a major new report by the Business & Sustainable Development Commission (BSDC) warns this appears to be humanity’s current path, it also spells out how to create not quite “heaven on Earth” but a world that is wealthier, more peaceful and fair for all. And their call for the world to start living up to the United Nations’ 17 Sustainable Development Goals was backed by more than 80 major companies in a joint letter to Theresa May, which urged the UK Government to take this “essential” step to secure “our long-term prosperity and the well-being of generations to come”.

However, Ms May did not respond personally to the letter, with the Department for International Development instead issuing a response on behalf of the Government in an implicit snub to the letter’s call for all departments, “not only” DfID, to get involved. The UN’s ‘Global Goals’, as they are known, seem at first sight to be almost impossibly ambitious. There should be “no poverty” and “zero hunger” in the world, universal health coverage, a decent education for all, gender equality, access to affordable and clean energy, action on climate change, the list goes on. But the BSDC’s report, compiled after a year of research into their effects, says achieving them is actually key to delivering massive growth. The document, called Better Business, Better World, estimates the Global Goals could be worth up to $36,000bn a year in savings and extra revenue by 2030.

They based this on an analysis of four major economic sectors – food and agriculture; energy and materials; cities; and health and wellbeing – which would benefit to the tune of $12,000bn a year. They then estimated the total economic prize would be two to three times higher. Lifting people out of poverty could bring up to a billion people into the consumer economy. And achieving gender equality alone could add at least $12,000bn to the world’s total GDP by 2025, according to one estimate. “The overall prize is enormous,” the report says. “The results will not be heaven on Earth; there will be many practical challenges. “But the world would undoubtedly be on a better, more resilient path. We could be building an economy of abundance.

Mommy, tell me the story again about how smart we once were.

• The Global Chain That Produces Your Fish (AFP)

That smoked salmon you bought for the New Year’s festivities has a story to tell. The salmon may have been raised in Scotland – but it probably began life as roe in Norway. Harvested at a coastal farm, the fish may have been sent to Poland to be smoked. It may even have travelled halfway around the world to China to be sliced. It eventually arrived, wrapped in that tempting package, in your supermarket. Globalisation has changed the world in many ways, but fish farming is one of the starkest examples of its benefits and hidden costs. The nexus of the world fish-farming trade is China – the biggest exporter of fish products, the biggest producer of farmed fish and a major importer as well.

With battalions of lost-cost workers, linked to markets by a network of ocean-going refrigerated ships, China is the go-to place for labour-intensive fish processing. In just a few clicks on Alibaba, the Chinese online trading hub, you can buy three tonnes of Norwegian filleted mackerel shipped from the port city of Qingdao for delivery within 45 days. “There is a significant amount of bulk frozen fish sent to China just for filleting,” said a source from an association of importers in an EU country. “The temperature of the fish is brought up to enable the filleting but the fish are not completely defrosted.” The practice has helped transform the Chinese coastal provinces of Liaoning and Shandong into global centres for fish processing.

But globalised fish farming leaves a mighty carbon footprint and has other impacts, many of which are unseen for the consumer. Don Staniford, an activist and director of the Global Alliance Against Industrial Aquaculture, called the fish industry’s production and transportation chain “madness”. “The iconic image of Scottish salmon – a wild salmon leaping out of the river – has gone. The Scottish salmon farming industry is dominated, 60-70%, by Norwegian companies,” he said. The biggest such company, Marine Harvest, is the world’s largest producer of Atlantic salmon, some 420,000 tonnes in 2015. Scottish salmon farms import eggs from Norway, the fish food from Chile and then send the fish to Poland – “because it’s cheaper” – for smoking, said Staniford.

Lots of coverage of Trump’s weekend interviews in Europe. Too many details to cover them all in this format. Overall impression: he makes a lot of sense. Likes Brexit, doesn’t like NATO, sees EU as a project to benefit Germany, wants far less nukes, far less US regime change-focused interventionism.

• Trump Calls NATO Obsolete And Dismisses EU (BBG)

Donald Trump called NATO obsolete, predicted that other European Union members would follow the U.K. in leaving the bloc, and threatened BMW with import duties over a planned plant in Mexico, according to two European newspapers which conducted a joint interview with the president-elect. Trump, in an hourlong discussion with Germany’s Bild and the Times of London published on Sunday, signaled a major shift in trans-Atlantic relations, including an interest in lifting U.S. sanctions on Russia as part of a nuclear weapons reduction deal. Quoted in German by Bild from a conversation held in English, Trump predicted that Britain’s exit from the EU will be a success and portrayed the EU as an instrument of German domination designed with the purpose of beating the U.S. in international trade.

For that reason, Trump said, he’s fairly indifferent to whether the EU stays together, according to Bild. The Times quoted Trump as saying he was interested in making “good deals with Russia,” floating the idea of lifting sanctions that were imposed as the U.S. has sought to punish the Kremlin for its annexation of Crimea in 2014 and military support of the Syrian government. “They have sanctions on Russia – let’s see if we can make some good deals with Russia,’’ Trump said, according to the Times. “For one thing, I think nuclear weapons should be way down and reduced very substantially, that’s part of it.’’ Trump’s reported comments leave little doubt that he’ll stick to campaign positions and may in some cases upend decades of U.S. foreign policy, putting him fundamentally at odds with Angela Merkel on issues from free trade and refugees to security and the EU’s role in the world.

Repeating a criticism of NATO he made during his campaign, Trump said that while trans-Atlantic military alliance is important, it “has problems.” “It’s obsolete, first because it was designed many, many years ago,” Trump said in the Bild version of the interview. “Secondly, countries aren’t paying what they should” and NATO “didn’t deal with terrorism.” The Times quoted Trump saying that only five NATO members are paying their fair share. While those comments expanded on doubts Trump expressed about the North Atlantic Treaty Organization during his campaign, he reserved some of his most dismissive remarks for the EU and Merkel, whose open-border refugee policy he called a “catastrophic mistake.”

In contrast, Trump praised Britons for voting in 2016 to leave the EU. People and countries want their own identity and don’t want outsiders coming in to “destroy it,” he said. The U.K. is smart to leave the bloc because the EU “is basically a vehicle for Germany,” the Times quoted Trump as saying. “If you ask me, more countries will leave,” he said. Trump told the Times that he plans to quickly pursue a trade deal with the U.K. after taking office and will meet with British Prime Minister Theresa May soon. “We’re gonna work very hard to get it done quickly and done properly. Good for both sides,” he said. “We’ll have a meeting right after I get into the White House and it’ll be, I think we’re gonna get something done very quickly.”

ZH has a good summary of the interviews.

• Trump Slams NATO And EU, Prepared To “Cut Ties” With Merkel (ZH)

In two separate, and quite striking, interviews with Germany’s Bild (paywall) and London’s Sunday Times (paywall), Donald Trump did what he failed to do in his first US press conference, and covered an extensive amount of policy and strategy, much of which however will likely please neither the pundits, nor the markets. Among the numerous topics covered in the Bild interview, he called NATO obsolete, predicted that other European Union members would join the U.K. in leaving the bloc and threatened BMW with import duties over a planned plant in Mexico, according to a Sunday interview granted to Germany’s Bild newspaper that will raise concerns in Berlin over trans-Atlantic relations. Furthermore, in his first “exclusive” interview in the UK granted to the Sunday Times, Trump said he will offer Britain a quick and “fair” trade deal with America within weeks of taking office to help make Brexit a “great thing”.

Trump revealed that he was inviting Theresa May to visit him “right after” he gets into the White House and wants a trade agreement between the two countries secured “very quickly”. T�r�u�m�p� �t�o�l�d� �t�h�e� �T�i�m�e�s� �t�h�a�t� �o�t�h�e�r� �c�o�u�n�t�r�i�e�s� �w�o�u�l�d� �f�o�l�l�o�w� �B�r�i�t�a�i�n�’s� �l�e�a�d� �i�n� �l�e�a�v�i�n�g� �t�h�e� �E�u�r�o�p�e�a�n� �U�n�i�o�n�,� �c�l�a�i�m�i�n�g� �i�t� �h�a�d� �b�e�e�n� �d�e�e�p�l�y� ��d�a�m�a�g�e�d� �b�y� �t�h�e� �m�i�g�r�a�t�i�o�n� �c�r�i�s�i�s�.� I� �t�h�i�n�k� �i�t’s� �v�e�r�y� �t�o�u�g�h�,� �h�e� �s�a�i�d�.� P�e�o�p�l�e�,� �c�o�u�n�t�r�i�e�s� �w�a�n�t� �t�h�e�i�r� �o�w�n� �i�d�e�n�t�i�t�y� �a�n�d� �t�h�e� �U�K� �wa�n�t�e�d� �i�t�s� �o�w�n� �i�d�e�n�t�i�t�y�.� [..] Trump discussed his stance on Russia and suggested he might use economic sanctions imposed for Vladimir Putin’s encroachment on Ukraine as leverage in nuclear-arms reduction talks, while NATO, he said, “has problems.” “[NATO] is obsolete, first because it was designed many, many years ago,” Bild quoted Trump as saying about the trans-Atlantic military alliance. “Secondly, countries aren’t paying what they should” and NATO “didn’t deal with terrorism.”

While those comments expanded on doubts Trump raised about the North Atlantic Treaty Organization during his campaign, he reserved some of his most dismissive remarks for the EU and Merkel, whose open-border refugee policy he called a “catastrophic mistake.” He further elaborated on this stance in the Times interview, where he said he was willing to lift Russian sanctions in return for a reduction in nuclear weapons. When asked about the prospect of a nuclear arms reduction deal with Russia, Trump told the newspaper in an interview: “For one thing, I think nuclear weapons should be way down and reduced very substantially, that’s part of it.” Additionally, Trump said Brexit will turn out to be a “great thing.” Trump said he would work very hard to get a trade deal with the United Kingdom “done quickly and done properly”.

Trump praised Britons for voting last year to leave the EU. People and countries want their own identity and don’t want outsiders to come in and “destroy it.” The U.K. is smart to leave the bloc because the EU “is basically a means to an end for Germany,” Bild cited Trump as saying. “If you ask me, more countries will leave,” he was quoted as saying.

Goal-seeked ‘reporting’: “Five days before his inauguration as the 45th President of the United States, the billionaire populist let loose a torrent of controversial comments..” AFP didn’t stand out so far as having joined the anti-Trump ranks, but there you go.

• NATO, Russia, Merkel, Brexit: Trump Unleashes Broadsides On Europe (AFP)

NATO is “obsolete”, Germany’s Angela Merkel made a “catastrophic mistake” on refugees, Brexit will be “great” and the US could cut a deal with Russia: Donald Trump unleashed a volley of broadsides in interviews with European media. Five days before his inauguration as the 45th President of the United States, the billionaire populist let loose a torrent of controversial comments about European allies in interviews with British newspaper The Times and Germany’s Bild. He extended a hand to Russia, which has been hit by a string of sanctions under his predecessor Barack Obama over Moscow’s involvement in Ukraine, the Syrian war and for alleged cyber attacks to influence the US election. “Let’s see if we can make some good deals with Russia,” Trump said in remarks carried by The Times.

The US president-elect suggested a deal in which nuclear arsenals would be reduced and sanctions against Moscow would be eased, but gave no details. “Russia’s hurting very badly right now because of sanctions, but I think something can happen that a lot of people are gonna benefit,” said the president-elect, who has previously expressed admiration for Russian leader Vladimir Putin. Washington’s European allies imposed sanctions against Russia over Ukraine in 2014. Those measures were renewed on December 19.

Trump grants an interview to the WaPo? He has a big heart!

• Trump Vows ‘Insurance For Everybody’ In Replacing Obamacare (R.)

U.S. President-elect Donald Trump aims to replace Obamacare with a plan that would envisage “insurance for everybody,” he said in an interview with the Washington Post published on Sunday night. Trump did not give the newspaper specifics about his proposals to replace Democratic President Barack Obama’s signature health insurance law, but said the plan was nearly finished and he was ready to unveil it alongside the leaders of the Republican-controlled Congress. The Republican president-elect takes office on Friday. “It’s very much formulated down to the final strokes. We haven’t put it in quite yet but we’re going to be doing it soon,” Trump told the Post, adding he was waiting for his nominee for health and human services secretary, Tom Price, to be confirmed.

The plan, he said, would include “lower numbers, much lower deductibles,” without elaborating. “We’re going to have insurance for everybody,” Trump said. “There was a philosophy in some circles that if you can’t pay for it, you don’t get it. That’s not going to happen with us.” Trump was also quoted as saying in the interview that he would target pharmaceutical companies over drug pricing and insist they negotiate directly with the Medicare and Medicaid government health plans for the elderly and poor. U.S. House Republicans won passage on Friday of a measure starting the process of dismantling the Affordable Care Act, popularly known as Obamacare, despite concerns about not having a ready replacement and the potential financial cost of repealing the law.

All these people, CIA, media, who actively attempted to undermine Trump’s campaign and candidacy, are now shocked (I tell you, shocked!) that he doesn’t ignore what they did.

• CIA Director Warns Trump To Watch What He Says (R.)

CIA Director John Brennan on Sunday offered a stern parting message for Donald Trump days before the Republican U.S. president-elect takes office, cautioning him against loosening sanctions on Russia and warning him to watch what he says. Brennan rebuked Trump for comparing U.S. intelligence agencies to Nazi Germany in comments by the outgoing CIA chief that reflected the extraordinary friction between the incoming president and the 17 intelligence agencies he will begin to command once he takes office on Friday. In an interview with “Fox News Sunday,” Brennan questioned the message sent to the world if the president-elect broadcasts that he does not have confidence in the United States’ own intelligence agencies.

“What I do find outrageous is equating the intelligence community with Nazi Germany. I do take great umbrage at that, and there is no basis for Mr. Trump to point fingers at the intelligence community for leaking information that was already available publicly,” Brennan said. Brennan’s criticism followed a tumultuous week of finger-pointing between Trump and intelligence agency leaders over an unsubstantiated report that Russia had collected compromising information about Trump. The unverified dossier was summarized in a U.S. intelligence report presented to Trump and outgoing President Barack Obama this month that concluded Russia tried to sway the outcome of the Nov. 8 election in Trump’s favor by hacking and other means. The report did not make an assessment on whether Russia’s attempts affected the election’s outcome.

Trump has accused the intelligence community of leaking the dossier information, which its leaders denied. They said it was their responsibility to inform the president-elect that the allegations were being circulated. Later on Sunday, Trump took to Twitter to berate Brennan and wrote, “Was this the leaker of Fake News?” In a separate posting, Trump scolded “those intelligence chiefs” for presenting the dossier as part of their briefing. “When people make mistakes, they should APOLOGIZE,” he wrote.

Excellent. The elite press do not deserve their status.

• Trump Team May Move West Wing Briefings to Expand Capacity (BBG)

The incoming Trump administration is considering moving White House press briefings out of the West Wing to accommodate more than the “Washington media elite,” President-elect Donald Trump’s press secretary said. “This is about greater accessibility, more people in the process,” Sean Spicer said Sunday on Fox News Channel’s “Media Buzz.” Involving more people, including bloggers and others who aren’t from the mainstream media, “should be seen as a welcome change,” he said. Their comments followed a report Saturday by Esquire, citing unidentified officials from the transition team, that the new administration may move the press corps out of the main White House building altogether because of antagonism between Trump and the media.

Any change would be made for logistical reasons, in response to heavy demand from media organizations, Vice President-elect Mike Pence said Sunday. “The briefing room is open now to all reporters who request access,” White House Correspondents’ Association President Jeff Mason said in a statement Sunday. “We object strenuously to any move that would shield the president and his advisers from the scrutiny of an on-site White House press corps.” Mason said he was meeting with Spicer “to try to get more clarity on exactly what” the proposal is. “There’s such a tremendous amount of interest in this incoming administration that they’re giving some consideration to finding a larger venue on the 18 acres in the White House complex, to accommodate that extraordinary interest,” Pence said on CBS News’ “Face the Nation.”

“The interest of the team is to make sure that we accommodate the broadest number of people who are interested and media from around the country and around the world,” Pence said. On ABC’s “This Week,” incoming White House chief of staff Reince Priebus said demand for press-conference credentials far exceeds the “49 people” who can fit into the current briefing room. “The one thing that we discussed was whether or not we want to move the initial press conferences into the Executive Office Building,” Priebus said, adding, “you can fit four times the amount of people.”

Oh well, with Trump praising Brexit and promising a swift deal, this may reverse.

• Pound Sterling Hits New 31-Year-Low Ahead Of May’s Brexit Speech (Ind.)

Fears of the consequences of a hard Brexit have sent the pound to a fresh 31-year-low against the dollar, excluding last October’s flash crash. The pound hit new lows after reports said that Prime Minister Theresa May will on Tuesday signal plans to quit the EU’s single market to regain control of Britain’s borders, in a speech which is expected to give the most detailed insight yet into her approach to the forthcoming negotiations with Brussels. Sterling fell against all of its major peers, dropping below $1.1985 against the dollar in early Asian trade on Monday, before recovering slightly to just above $1.20. This is a more than three-decade low for the currency, excluding the flash crash on 7 October that sent the pound plunging more than six per cent to $1.18.

Fears among currency traders and investors that the UK is heading for a hard Brexit – in which access to the EU’s single market would be sacrificed in favour of tighter control over immigration – have tended to weaken the pound while suggestions that the UK could retain access to the EU single market have helped it recover. Sterling is down against the dollar by about 19 per cent since the Brexit vote, with declines since mainly sparked by concerns that Mrs May would pursue a so-called hard Brexit. City analysts are anticipating Mrs May’s speech on Tuesday with a sense of gloom.

I know, I know, we should ignore this drivel. But there’s a few good take downs, this being one. I still wonder how the peeing hookers tale -apparently- ended up in Steele’s report. Because it came from the US, not Russia. Then again, of course, Steele hasn’t been to Russia in decades. If this report says anything, it’s that they can’t find dirt on Trump.

• The Scandal of the 35-Page Anti-Trump ‘Intelligence Dossier’ (GR)

Some critics have been ungrateful enough to suggest that claims published without the least scintilla of supporting evidence by intelligence agencies which have a rich history of lying to the American people as well as everyone else, and which are in addition led by James Clapper, the Director of National Intelligence, may not be above suspicion. But the latest revelation, a 35-page sequence of linked texts published on January 10 by BuzzFeedNews, gives what simpletons are expected to interpret as unimpeachable evidence of soundness and credibility. The document is authored “by a person who has claimed to be a former British intelligence official,” and its sources, identified by letters of the alphabet, include a “senior Russian Foreign Ministry figure,” “a former top level Russian intelligence officer still active inside the Kremlin,” as well as another “senior Kremlin official.”

(How could one fail to doff one’s cap in acknowledgment of the spy-craft of those Brits, who are able so deftly to penetrate the inner counsels of the wicked Mr. Putin and induce his close associates to sing like canaries?) The texts which make up this document propose that Mr. Trump and his entourage had routine treasonous contacts with Russian state authorities over a long period leading up to the election, and that Mr. Putin was interfering in that election in every way possible—including by exploiting “TRUMP’s personal obsessions and sexual perversion in order to obtain suitable ‘kompromat’ (compromising material) on him.” The document’s most lurid claim—certified by Sources B, D, E and F—is made on its second page. It’s not clear what form of perverse pleasure Mr. Trump was supposed to have obtained by having “a number of prostitutes” urinate on his bed in the Moscow Ritz Carlton’s presidential suite.

The explanation given for the motivation behind this command performance – that the same bed had previously been slept in, on one of their official visits to Russia, by Barack and Michelle Obama (“whom he hated”) – seems bizarre. After all, on the night in question, whose soggy bed was it now? [..] The most immediate concern raised by this literally filthy story may be humanitarian. It seems well attested that Mr. Trump is not merely fastidious, but germaphobic: where is he supposed to have slept out the rest of the night? On the perhaps undefiled sofa, or on the carpet? And what are we to make of the claim by trolling posters at 4Chan that this “golden showers” story was a hoax they had foisted onto a Republican operative known to despise Trump, who then shopped it around to news media, other politicians, and intelligence agencies? If this story is a fiction, then are the document’s Sources B, D, E and F, who confirmed it, also fictional? And if some of the document’s sources are made up, what kind of fool would want to believe that any of the rest are authentic?

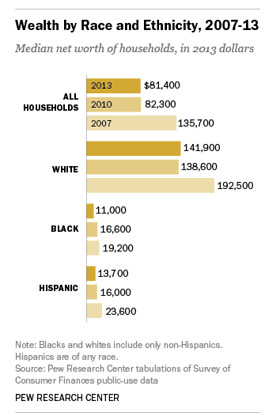

We call these people success stories. We need to redefine ‘success’.

• Eight Billionaire Men ‘As Rich As World’s Poorest 3.5 Billion People’ (BBC)

The world’s eight richest individuals have as much wealth as the 3.6bn people who make up the poorest half of the world, according to Oxfam. The charity said its figures, which critics have queried, came from improved data, and the gap between rich and poor was “far greater than feared”. Oxfam’s report coincides with the start of the World Economic Forum in Davos. Mark Littlewood, of the Institute of Economic Affairs, said Oxfam should focus instead on ways to boost growth. “As an ‘anti-poverty’ charity, Oxfam seems to be strangely preoccupied with the rich,” said the director-general of the free market think tank. For those concerned with “eradicating absolute poverty completely”, the focus should be on measures that encourage economic growth, he added.

Ben Southwood, head of research at the Adam Smith Institute, said it was not the wealth of the world’s rich that mattered, but the welfare of the world’s poor, which was improving every year. “Each year we are misled by Oxfam’s wealth statistics. The data is fine – it comes from Credit Suisse – but the interpretation is not.” The annual event in Davos, a Swiss ski resort, attracts many of the world’s top political and business leaders. Katy Wright, Oxfam’s head of global external affairs, said the report helped the charity to “challenge the political and economic elites”. “We’re under no illusions that Davos is anything other than a talking shop for the world’s elite, but we try and use that focus,” she added.

But that would sink it. A band of 25%?!

• “China Should Stop Intervening In FX Market And Let Yuan Float” (R.)

China should stop intervening in the foreign exchange market, devalue the yuan and let it float freely to restore stability, a senior researcher at a government-backed think tank said. Xiao Lisheng, a finance expert with the Chinese Academy of Social Sciences, made the remarks in an article on Monday in the official China Securities Journal amid a growing debate among the country’s economists on whether authorities should let the closely-managed currency trade more freely. The yuan lost 6.6% against the dollar last year, the biggest annual loss since 1994. “The more the government delays the release of depreciation pressure, the greater the impact and destructive power of the release of depreciation pressure will be,” Xiao wrote.

The authorities should “let the yuan exchange rate have a one-off adjustment to realize a free float” of the currency, he said. The yuan is allowed to trade in a band of 2% on either side of a daily reference rate managed by the central bank. Authorities have said repeatedly there was no basis for continued depreciation of the unit, but many currency strategists predict a further weakening this year if the U.S. dollar remains strong, spurring further capital outflows from China. Xiao said the current mid-point formation mechanism, adopted in 2015, is still immature and in transition, although it has eased depreciation pressure and curbed sharp declines in the country’s foreign exchange reserves. “But any foreign exchange rate mechanism without a free float cannot fundamentally reach a market clearing (price),” he wrote.

Much more of that to come, even if -or especially if- their economy tanks.

• China’s Booming Middle Class Drives Asia’s Toxic E-Waste Mountains (G.)

Asia’s mountains of hazardous electronic trash, or e-waste, are growing rapidly, new research reveals, with China leading the way. A record 16m tonnes of electronic trash, containing both toxic and valuable materials, were generated in a single year – up 63% in five years, new analysis looking at 12 countries in east and south-east Asia shows. In China the mountain of discarded TVs, phones, computers, monitors, e-toys and small appliances grew by 6.7m tonnes in 2015 alone. That’s an 107% increase in just five years. To get a sense of scale, if every woman, man and child in China had an old LCD monitor and dumped it the pile would not equal the 2015 tonnage. The region’s fast-increasing middle class is the main driver of e-waste increases, not population growth, the report by the United Nations University found.

However, Asia’s 3.7kg per person of waste is still tiny compared to Europe’s 15.6 kg per person, it said. “Growing incomes, the creation of more and more gadgets and ever-shorter lifespans of things like mobile phones are the reasons for this tremendous increase in Asia,” said co-author Ruediger Kuehr of UN University. Electronics and electrical devices have a big eco footprint, meaning their manufacture consumes a lot of energy and water, along with valuable and sometimes scarce resources, making recycling and recovery very important. The increasing volumes of e-waste combined with a lack of environmentally sound management is a cause for concern, says Kuehr. “We risk future production of these devices and very high costs without recycling the materials,” he said.

The numbers start to be confusing. It’s good to realize that Kathimerini is not a fan of Tsipras. What we know is the EU prefers to donate millions to NGOs rather than Greece.

But the point stands: where is the money going, what is it being spend on, and why is there no public accounting of this? Why are refugees freezing to death?

• Greece Strives To Absorb EU’s Migration Funds (Kath.)

Greece is struggling to make use of EU money for migrants and refugees after having absorbed just a fraction of the 509 million euros in funding for up to 2020. So far, Athens has used about 2% of 294.6 million euros from the EU’s Asylum, Migration and Integration Fund, and around 25% of 214.8 million euros from the Internal Security Fund. Greek authorities blame the slow absorption rate on emergency conditions caused by the migrant influx, whereas Brussels has pointed to technical faults on the other end.

Athens, however, appears more flexible absorbing separate EU emergency funding: From about 350 million euros for 2015-16, some 175 million has gone to state agencies and an equal sum to the UN refugee agency, the International Organization for Migration (IOM) and the European Asylum Service. “Were it not for the emergency funds, we would be able to do nothing. Or we would have to spend money from the state budget. Regular funding requires a lot of bureaucracy,” a Labor Ministry official told Kathimerini on condition of anonymity.