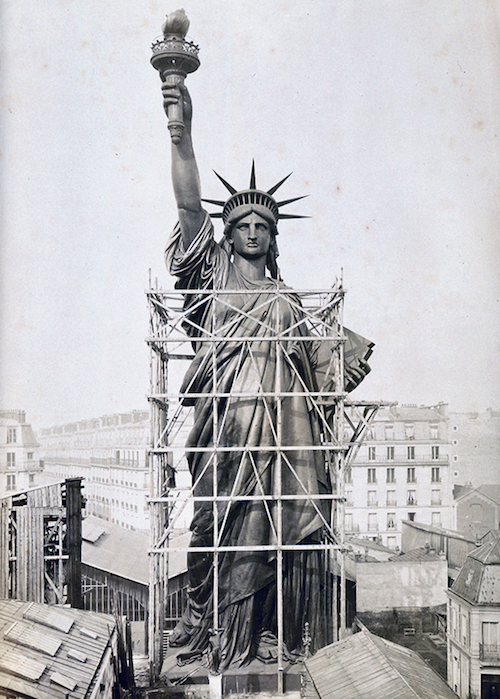

Seattle, WA during Spanish Influenza. No ride on street cars without wearing a mask 1918/19

There we go again:

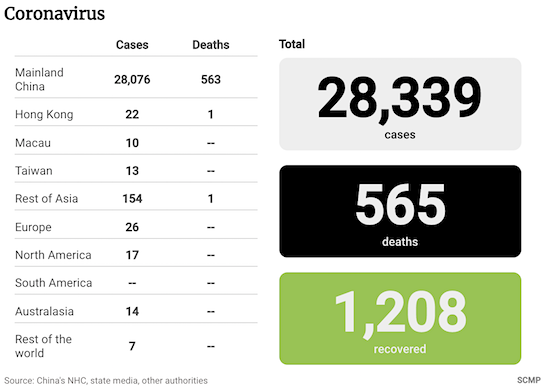

• 565 deaths (up 72 from yesterday, biggest increase in official numbers to date)

• 28,339 cases (up 3,797 from yesterday’s 24,542, and yeserday’s rise of 3872)

• There are suggestions from China that the increase in cases is slowing, but that’s after yesterday’s record increase. We’ll see.

• At the same time, the increase in severe cases appears to be accelerating.

• 10 more infections on cruise ship off Yokohama

• One thing that’s certainly increasing is the skepticism about the official numbers.

Some interesting things in this article:

1) Officials returning to Beijing from other provinces after Lunar New Year are in 14-day quarantine. First time I see mandatory quarantines for Beijing.

2) There’s talk of delaying the (10+ days) National People’s Congress, which only starts on March 5.

Events have been cancelled as far out as April 15. That syncs quite well with what I said in my article The Big Lockdown.

• China May Delay Annual Meeting Of Parliament Due To Virus Outbreak (R.)

China is considering delaying the annual meeting of its top legislative body, five people familiar with the matter said, as it grapples with a coronavirus epidemic that has forced drastic curtailment of travel and other activity to curb its spread. The National People’s Congress (NPC), made up of about 3,000 delegates, typically gathers for a session lasting at least 10 days in Beijing, beginning on March 5, to pass legislation and unveil key economic targets for the year. A postponement would be the first since China adopted the current March schedule in 1995 for the meeting of parliament. “The focus remains on taking steps forward towards meeting on schedule, but we are discussing a range of options as the (virus) situation doesn’t look likely to be contained by March,” a senior government official told Reuters, declining to be identified given the sensitivity of the matter.

“A delay is one of those options,” the official said. “It should come as no surprise given that we are in a very difficult time.” Many officials who would ordinarily be involved in preparation for the NPC are staying at home under 14-day mandatory quarantines after returning to Beijing from their home provinces following the Lunar New Year holidays. Central government officials in Beijing were told to resume work on Feb. 3. China has already postponed a high-level business event, the China Development Forum, which is usually held in late March, and the venue for the Canton Fair, a trade fair in the southern city of Guangzhou, has been suspended until further notice. The spring session of the trade fair was due to begin on April 15.

The NPC gathering is crucial this year, as it is set to ratify China’s first-ever civil code, a key milestone in President Xi Jinping’s legal reform effort. The NPC is also widely expected to discuss the months-long protests in Hong Kong, and to announce the annual economic growth target along with China’s defence budget. Under China’s constitution, a full plenary session of the NPC must be held every year. Chucheng Feng, a partner at Plenum, an independent research firm in Hong Kong, put the chance of a delay at just 10% because of the meeting’s political importance. “However, as the epidemic extends into February, the gathering of China’s entire political elite in a confined Great Hall of the People for over a week looks quite dangerous,” he said.

Tyler broke the story. This is a handy write-up. It’s the smaller numbers above the big ones that all but prove we’re looking at an automatically updating database.

• “Leaked” Infection Numbers Over 154,000; Deaths Approach 25,000 (NN)

Zero Hedge reported this morning, “As Taiwan [News] reports in a report first spotted by user @TheHKGroup, over the weekend, Tencent “seems to have inadvertently released what is potentially the actual number of infections and deaths, which were astronomically higher than official figures”, and were far closer to the catastrophic epidemic projections made by Jonathan Read.” According to official numbers from mainland China, which are updated daily, the current number of coronavirus infections is still under 25,000. Even then, it currently appears to be expanding at roughly 20% per 24-hour period, which represents a doubling of infections every 3.5 days (because the growth is compounded). (The left column is infections, and the right column is deaths.)

However, observers have noted that the official numbers reported by the communist Chinese government recently slipped into the “real numbers,” suddenly showing far higher confirmed infections and deaths: 154,024 infections and 24,589 deaths. Here’s a screen shot that was captured before the numbers reverted back to the lower, “official” numbers:The initial reaction from observers might be something along the lines of, “That was just a typo. So they corrected it.” However, there’s more to this story:

The higher numbers didn’t merely appear by themselves, out of context. Above each number is an “increase” factor that calculates how much larger today’s numbers are compared to yesterday’s numbers. For the 24,589 deaths, located at the lower right of this graphic, you’ll notice a number above it that states, “+1546.” The Chinese characters next to the numbers explain, “Compared to yesterday.” This means there is an underlying database that’s tracking daily numbers and being used to calculate the day-to-day differences. Similarly, there’s a number above the infection count of 154,023 that explains, “+20979.” This indicates the day-over-day increase from the previous day.

These numbers are clearly being automatically calculated, because if human error were to blame for typing the wrong numbers representing infections and deaths, it would be extremely unlikely that two more typos would coincidentally appear above those numbers, accidentally showing day-to-day increases that are consistent with a second set of numbers that are obviously being stored in parallel.

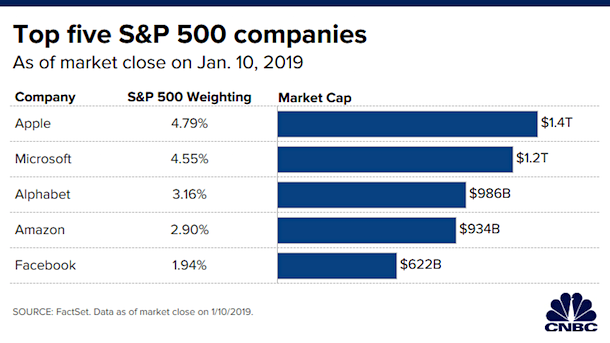

The highest paid.

• Major Mainland Chinese Airlines Place All Foreign Pilots On Unpaid Leave (SCMP)

All foreign pilots working for China Southern Airlines, Hainan Airlines, and a host of smaller mainland Chinese carriers have been placed on indefinite unpaid leave, according to multiple sources and a memo seen by the Post. With the coronavirus crisis forcing airlines to slash flights, several hundred foreign pilots have seemingly become surplus overnight, with some telling the Post they were considering their options amid the uncertainty now facing the world’s fastest-growing air market. “All foreign pilots, including those who have applied for leave exemption and those who have not, shall start a non-fixed term leave without pay as soon as possible,” a Tuesday memo to a batch of foreign pilots for China Southern, the country’s largest carrier, said.

Their grounding was effective that day, with the pilots told they would “return to work when [the] situation gets better.” Xiamen Airlines along with Hainan Airlines, Tianjin Airlines and Beijing Capital Airlines (BCA) – a trio of carriers owned by debt-laden HNA Group – have also placed foreign aircrew on unpaid leave, according to multiple sources. A source at BCA said their pilots had been offered the option of taking a significant pay cut that would bring them in line with their Chinese counterparts. China Eastern Airlines, meanwhile, was understood to have offered unpaid leave to its foreign pilots but had not made it mandatory at this point.

The trade deal should be the least of Beijing’s worries by now.

Also, there are suggestions here that new cases rise less fast than before. But severe cases seem to rise.

• With Virus Deaths At 565 China Considers Trade Deal Disaster Clause (SCMP)

Daily deaths caused by the new coronavirus have reached another record in China, with 73 fatalities confirmed in figures released by health authorities on Thursday morning, taking the death toll in mainland China to 563. The number of new infections in mainland China and Hubei province both fell on Wednesday compared to the day before, with 3,694 additional cases in the country and 2,987 in Hubei, national and provincial health authorities announced Thursday morning. The last time new infection figures dropped was January 28, with the daily increase in confirmed cases in China and Hubei steadily rising to a record high on Tuesday – 3,887 and 3,156, respectively. The deadly new coronavirus, which first emerged at the end of December, has killed at least 565 people worldwide, and sickened more than 28,000.

Mainland media on Tuesday reported that China may consider using a disaster-related clause in the phase one trade deal with the US because of the coronavirus outbreak. The Global Times, a nationalist newspaper affiliated to People’s Daily, cited an unnamed Chinese trade expert close to the government as saying a decision on launching a consultation with the US on the disaster clause was unlikely until the end of the first quarter. In a commentary published on Wednesday, the newspaper said that even if China was unable to reach the goal of increasing purchases from the US, there was still a sensible path forward without jeopardising the agreement and the negotiation process.

“The phase one agreement clearly stated that the two parties would consult with each other, ‘in the event that a natural disaster or other unforeseeable event outside the control of the parties delays a party from timely complying with its obligations under this agreement’. Without doubt the epidemic fits this scenario,” it said.

Very popular man, I’m sure.

• Chinese Scholar Blames Xi Jinping, CCP For Not Controlling Outbreak (SCMP)

A prominent Chinese scholar has published an article criticising the country’s leadership for failing to control the coronavirus outbreak that has infected almost 25,000 people around the world. Xu Zhangrun, a law professor at Tsinghua University in Beijing, who has been under close surveillance by the authorities, blamed Communist Party leaders for putting politics ahead of the people in his strongly worded piece, which was published on several overseas Chinese-language websites this week. “The political system has collapsed under the tyranny, and a governance system [made up] of bureaucrats, which has taken [the party] more than 30 years to build has floundered,” he said in a reference to how reform-minded leaders sought to rebuild the country and modernise the government after the death of Mao Zedong in 1976 and moved away from one-man rule to collective leadership.

Xu was suspended from teaching at Tsinghua University in 2018, after the publication of an article in which he criticised the decision by party leaders to lift the two-term limit for presidents, allowing Xi Jinping to remain in office beyond his second term, which ends in 2023. His latest criticism came as China’s leaders and law enforcement officials warned that internet controls must be tightened to prevent the spread of rumours and misinformation. On Monday, Xi chaired a meeting of the Politburo Standing Committee at which it was agreed that officials must maintain a tight grip on online media and direct public opinion about “winning the war over the virus”.

On Tuesday, the Ministry of Public Security held a meeting to remind all police officers that political security was of utmost importance in handling the outbreak. The police would “strike harshly” on any and all disruption by “hostile forces”, according to a report by Xinhua. One of Xu’s close friends confirmed on Wednesday that the professor had written the article. “He has already been stripped of his teaching position but he is likely to face more punishment this time,” said the person, who asked not to be named. “We are concerned they [the police] will take him away now that he has published this article.”

There’s no such thing. Ridiculous headline.

• Who Owns The Coronavirus Cure? (SCMP)

China has applied to patent a drug candidate being developed by Gilead Sciences as the government rushes to find the cure for the deadly coronavirus, a move that could raise questions on intellectual property and marketing rights. The state-backed Institute of Virology in Wuhan filed the patent for using remdesivir to fight the novel coronavirus on January 21, according to a statement posted on its website two weeks later on February 4. If approved, the drug will be used to facilitate its potential global market entry, it added. Studies have been conducted outside the human bodies and found that Gilead’s remdesivir compound and the off-patent chloroquine malaria drug are both “highly effective” in the control of coronavirus infection, the Wuhan institute and the Beijing Institute of Pharmacology and Toxicology said in a research published in Cell Research Journal.

“Since these compounds have [separately] been used in human patients with a safety track record and shown to be effective against various ailments, we suggest that they should be assessed in human patients suffering from the novel coronavirus disease,” the researchers wrote. Remdesivir has not been approved anywhere globally and has not been showed to be safe or effective for any use, Gilead’s chief medical officer Merdad Parsey said in a statement on Friday. The firm is working with Chinese health authorities to conduct a clinical trial on patients with pneumonia symptoms to test its safety and efficacy, it said. Past clinical data on other coronaviruses give it “hope,” it added.

3 Turley articles today. One at the Hill, one at the BBC, one on his own site.

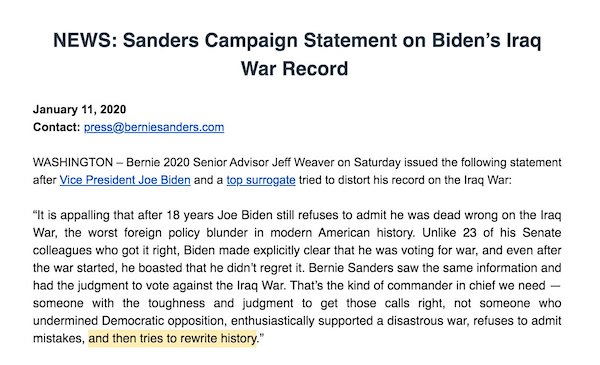

When The Dems lost to Trump in 2016, I said his role was to show how rotten the entire system is. And that they should take a good look at themselves, and try to figure out how that loss could ever come about. They never did, they only ever and exclusively looked at Trump, not themselves. This will not change as long as Hillary, Biden, Schiff et al lead the party.

• Pelosi Shreds Decades Of Tradition In Demonstrating Against Trump (Turley)

Forty-four years ago, I walked on to the floor of the House of Representatives as a new Democratic 15-year-old page from Chicago. I stood and marveled at the beehive of activity on the floor in the People’s House. I can still remember that moment because it forged a bond and reverence that has never weakened for me. As a Democratic leadership page during the speakership of Tip O’Neill, I watched some of the most passionate and important debates of the generation from the Neutron Bomb to civil rights legislation to sweeping national park bills. The country was deeply divided, but both parties maintained the tradition of civility and decorum. I was struck how members, even in the heat of furious debates, would not attack each other by name and followed rigid principles of decorum.

They understood that they were the custodians of this institution and bore a duty to strengthen and pass along those traditions to the next generation. That is why I was (and remain) so offended by this display. I believe that President Trump himself is worthy of criticism for not shaking the hand of Pelosi. I also did not approve of aspects of his speech, including bestowing the Medal of Freedom on Rush Limbaugh in the gallery like a reality show surprise scene. There was much to object to in the address, but presidents often make comments that enrage or irritate speakers. However, none of that excuses Pelosi. At that moment, she represents the House as an institution — both Republicans and Democrats. Instead, she decided to become little more than a partisan troll from an elevated position.

The protests of the Democratic members also reached a new low for the House. Pelosi did not gavel out the protest. She seemed to join it. It was the tradition of the House that a speaker must remain in stone-faced neutrality no matter what comes off that podium. The tradition ended last night with one of the more shameful and inglorious moments of the House in its history. Rather than wait until she left the floor, she decided to demonstrate against the President as part of the State of the Union and from the Speaker’s chair. That made it a statement not of Pelosi but of the House. For those of us who truly love the House as an institution, it was one of the lowest moments to unfold on the floor. That is why I argue in the Hill that, if Pelosi does not apologize and agree to honor the principle of neutrality and civility at the State of the Union, she should resign as speaker.

Tweet: “Buttigieg campaign manager’s wife owns the app company that ruined the Iowa caucuses, and his campaign DONATED $42,500.00 to that same company, Shadow Inc.”

The video is educative.

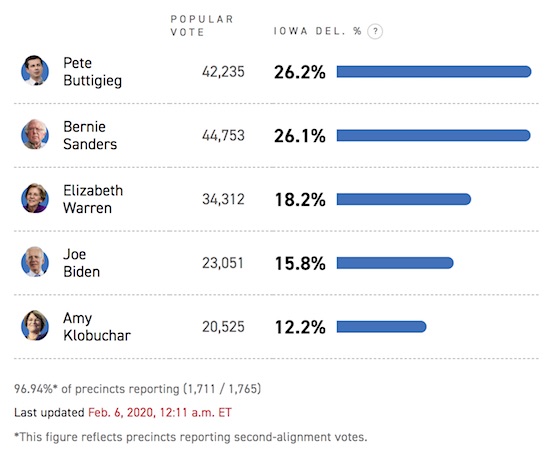

• Buttigieg and Sanders Separated By Razor-Thin Margin In Iowa (Pol.)

Pete Buttigieg and Bernie Sanders are running neck and neck in the Iowa caucuses with almost all of the votes counted. Buttigieg has 26.23 percent of the state delegate count to 26.06 percent for Sanders with 97 percent of precincts reporting, making the race too close to call, according to The Associated Press. Elizabeth Warren is in third at 18 percent of the state delegate count, followed by Joe Biden at nearly 16 percent and Amy Klobuchar at 12 percent. After a technical meltdown created significant delays in the reporting of results in Monday’s caucuses, the Iowa Democratic Party released almost all of the remaining data Wednesday night. The latest results came as CNN wrapped up a series of town halls with candidates in New Hampshire.

Earlier results came Wednesday afternoon as Sanders, Warren and Klobuchar were in the Senate voting in President Donald Trump’s impeachment trial. The Republican-led chamber ultimately voted to acquit Trump on charges of abuse of power and obstruction of Congress as the numbers from Iowa were released. The latest results don’t change the order of the top five candidates, but they do show a razor-thin race at the top, where both the Buttigieg and Sanders campaigns have already declared themselves winners. Buttigieg insisted as early as Monday night that he was the clear victor, and he reportedly reassured supporters of that in a phone call on Wednesday. Sanders, meanwhile, told supporters in New Hampshire that he was leading in popular-vote totals and would come out of Iowa with the same number of national convention delegates as Buttigieg.

In terms of raw votes, Sanders leads in by more than 2,500 votes in the final alignment of Iowa caucus-goers, after supporters of non-viable candidates had the chance to realign at their precincts on Monday night.

This is very genuinely funny. (Please don’t watch if you’re not American or you’ll know we’re a failed state) pic.twitter.com/HAiyP9bKSz

— rob delaney (@robdelaney) February 5, 2020

The entire impeachment trial was based on Trump wanting dirt on his “main political rival”. But Biden was never that. At the time of the Trump/Zelensky call, enough was known about Hunter/Burisma to realize Joe had no chance. And there was very little to suggest that Hunter/Burisma did not warrant an investigation. But Dems keep on saying it was “debunked”, without being able to suggest who did the debunking.

• Biden Vows To Press On Despite Iowa ‘Gut Punch’ (BBC)

White House hopeful Joe Biden has called his poor performance in the Democrats’ first 2020 leadership vote, in Iowa’s caucuses, a “gut punch”. Mr Biden has come fourth, according to incomplete results from the election to pick a Democratic presidential nominee. “I’m not going to sugarcoat it,” Mr Biden said. “This isn’t the first time in my life I’ve been knocked down.” With most results declared in Monday’s glitch-plagued caucuses, Pete Buttigieg and Bernie Sanders are neck and neck. But Mr Biden told an audience in New Hampshire: “I’m not going anywhere.”

According to partial results from Iowa, the former US vice-president under Barack Obama has failed to pick up a single one of the delegates needed to clinch the Democratic White House nomination under America’s quirky political system. New Hampshire will be the next state to vote on 11 February in a string of nationwide votes culminating with the crowning of the party’s presidential candidate in July. Eleven contenders remain in the race to challenge President Donald Trump, a Republican, in November’s election.

[..] On Wednesday, Mr Biden sharpened his attacks, targeting the two Democratic front-runners by name. “We need a nominee who can help Democrats up and down the ticket,” Mr Biden said. He suggested that self-described democratic socialist Mr Sanders would be unelectable in a general election. Mr Biden also said it would be a “risk” to nominate 38-year-old Mr Buttigieg, “someone who’s never held an office higher than mayor of a town of 100,000 people”. Mr Buttigieg responded by saying “the bulk of the credit for the achievements of the Obama administration belong with President Obama”.

As go strictly partisan battles.

• In This Impeachment, People Only Heard What They Wanted To (Turley)

Recently, MSNBC host Lawrence O’Donnell declared that his show will not allow Trump supporters on as guests because all Trump supporters are “liars”. Likewise, Trump recently denounced Fox for even interviewing Democratic senators. When that is the state of our news, why should trials be any different? In our hardened political silos, even Framers are bit players in a crushingly formulaic play. Witnesses are as immaterial as facts when the public demands the same predictability from politicians that they do from cable hosts. We are all to blame. Politicians achieve their offices by saying what voters want to hear and today voters have little tolerance for hearing anything that contradicts their preset views of Trump.

As a result, the trial was pre-packed by popular demand. Speaker Nancy Pelosi even declared that Trump would “not be acquitted” even if he was acquitted. When the actual vote doesn’t matter, why should the actual testimony? Just as voters get the government that they deserve, they also get the impeachment trials that they demand. Watching on their favourite biased cable networks, voters raged at the bias of the opposing side in the impeachment as refusing to see the truth. Viewers thrilled as their side denounced their opponents and hissed when those opponents returned the criticism. The question and answer period even took on a crossfire format as senators followed up one side’s answer with a request for the other side to respond.

It was precisely the “fight, fight” tempo that has made cable news a goldmine. As the trial ends, perhaps justice has been done. The largely partisan vote showed that the trial could have had the sound turned off for the purposes of most viewers. We are left with our rage undiluted by reason. It really did not matter what anyone had to say because we were only hearing half of the trial anyway. It provided the perfect verdict on our times.

Nancy should go home and be a grandma. She acted like a 5-year old during and after the SOTU. You don’t express your “hatred” of someone by imitating their behavior. Grace.

• Nancy Pelosi Should Resign (Turley)

The House has its share of infamies, great and small, real and symbolic, and has been the scene of personal infamies from brawls to canings. But the conduct of Speaker Nancy Pelosi (D-Calif.) at the State of the Union address this week will go down as a day of infamy for the chamber as an institution. It has long been a tradition for House Speakers to remain stoic and neutral in listening to the address. However, Pelosi seemed to be intent on mocking President Trump from behind his back with sophomoric facial grimaces and head shaking, culminating in her ripping up a copy of his address.

Her drop the mic moment will have a lasting impact on the House. While many will celebrate her trolling of the president, she tore up something far more important than a speech. Pelosi has shredded decades of tradition, decorum and civility that the nation could use now more than ever. The House Speaker is more than a political partisan, particularly when carrying out functions such as the State of the Union address. A president appears in the House as a guest of both chambers of Congress. The House Speaker represents not her party or herself but the entirety of the chamber. At that moment, she must transcend her own political ambitions and loyalties.

Tensions for this address were high. The House impeachment managers sat as a group in front of the president as a reminder of the ongoing trial. That can be excused as a silent but pointed message from the Democrats. Trump hardly covered himself with glory by not shaking hands with Pelosi. I also strongly disliked elements of his address which bordered on “check under your seat” moments, and the awarding of conservative radio host Rush Limbaugh with the Presidential Medal of Freedom inside the House gallery like a Mardi Gras bead toss. However, if Trump made the State of the Union look like Oprah, then Pelosi made it look like Jerry Springer.

Yeah. Buttigieg’s campaign manager is married to a woman who owns Shadow Inc. , which produced an app developed by among others Hillary’s campaign manager Robby Mook. And Bloomberg has his people inside the DNC. As does Biden, obviously. It smells like incest.

• Bloomberg Surrogates Have Seats on DNC Rules Committees (Sludge)

As the Democratic National Committee establishes procedures for the Democratic presidential nominating process, two members of DNC rules committees simultaneously work on the campaign of former New York Mayor Michael Bloomberg. Having surrogates on the Democratic National Convention’s Rules Committee and the Standing Rules and Bylaws Committee could be a boon for Bloomberg if nominating rules are re-opened for amendment ahead of the July convention. Some DNC members who are concerned about the polling support of Sen. Bernie Sanders (D-Vt.) have discussed reversing rule changes limiting the power of superdelegates that were put in place after the 2016 election, according to a report from Politico. Those discussions have been sharply rebuked by DNC leadership.

The DNC passed intensely-negotiated rule changes in August 2018 that sought to reduce the influence of superdelegates—appointed at-large delegates whose ranks include influential party consultants—primarily by preventing them from casting votes on the first nomination ballot, as they did in 2016. If no candidate receives a majority on the first ballot at the upcoming convention, which will be voted on by 3,979 pledged delegates, then the 771 superdelegates—including some lobbyists for corporate clients—can vote on the second ballot, under the new rules. If the superdelegates were to vote as a block, they could add over 16% to a candidate, potentially pushing their favorite over the top.

Michael Nutter, the former Mayor of Philadelphia who is a member of the Standing Rules and Bylaws Committee, was selected by Bloomberg in December 2019 to serve as his campaign’s national political chair. “Nutter will advise the campaign on policy development and strategy, and serve as a national surrogate on behalf of the campaign, recruiting key voices to join the campaign and traveling to field offices and events, speaking to constituents and press about why Mike Bloomberg is uniquely qualified to unite and rebuild the country at a time when it is more divided than ever,” the Bloomberg campaign said in a December statement.

Nutter was nominated by former DNC Chair Rep. Debbie Wasserman Schultz (D-Fla.) in 2013 and he has served on the rules committee since 2017. Nutter co-hosted a kick-off fundraiser for former vice president Joe Biden in April 2019 after Bloomberg announced a month earlier that he would not run for president, but he quickly switched to Bloomberg’s camp after the former New York mayor reversed course and entered the race.

Who needs drug labs?

Please donate what you can.