Francisco Goya The dummy 1791

Ambrose calls the depletion of Ghawar a “first-order shock”. Common knowledge though. Still, Trump may not be aware of it either if Ambrose isn’t.

• Trump Has Just Taken The Biggest Economic Gamble Of His Presidency (AEP)

Donald Trump’s double strangulation of Iran and Venezuela is reducing spare capacity in the global oil markets to wafer-thin levels very fast. If anything goes wrong in the geopolitical cauldron of world energy over the next six months, we will discover whether Saudi Arabia really is capable of cranking up an extra 2 million barrels a day of crude. What we learnt from the rare glimpse of Saudi Aramco’s books this month is that the legendary Ghawar field is badly depleted. It cannot pump more that 3.8m barrels a day. This is a first-order shock. The company has always asserted with magisterial confidence that it can produce 5m barrels a day without difficulty.

Jean-Louis Le Mee, from Westbeck Capital, says the physical oil markets are on fire. They are heading for a supply deficit of 1.3m barrels a day by the third quarter even if OPEC matches every barrel of lost oil from Iran sanctions. “These numbers should have every investor worried,” he said. Global spare capacity is arguably as low today as it was during the great oil shocks of the last half century. We are skating on thin ice. The immediate wild card is renewed fighting in Libya but other supply problems are stacking up fast. Draconian new rules on shipping fuel to lower sulphur emissions imply a surge in demand for variants of diesel. Bank of America says this will add 1.1m barrels a day in short-term crude demand over coming months. “We see a risk of $US100 Brent by year-end,” it said.

The options markets are not priced for this so the theatrics could be spectacular. Libya is again on the cusp of full-blown civil war after the fateful march on Tripoli by general Khalifa Haftar, the mercurial Nasserist of Benghazi. The National Oil Corporation warns that a free-for-all by rival militias could cause a near total collapse in crude exports. The world could lose another 700,000 barrels a day. Brent crude has risen to a six-month high of $US74.50, up 25 per cent from its average levels over the winter. It has not yet reached the pain threshold for Europe or emerging markets but it is getting close. Oil has of course been much higher in the past – $US148 in 2008 – but the nominal price is not the macro-economic variable that matters. Trouble starts earlier if crude is rising because of a negative supply shock. That is what we face today.

No, I haven’t become a fan of Buchanan. But his view warrants attention.

“How does a nation so divided stand united in the world? And if it cannot stand united in the world, how long does it remain a great nation?”

• A Nation at War With Itself (Pat Buchanan)

President Donald Trump has decided to cease cooperating with what he sees, not incorrectly, as a Beltway conspiracy that is out to destroy him. “We’re fighting all the subpoenas,” Trump said Wednesday. “These aren’t, like, impartial people. The Democrats are out to win in 2020.” Thus the Treasury Department just breezed by a deadline from the House Ways and Means Committee to deliver Trump’s tax returns. Thus the White House will invoke executive privilege to deny the House Judiciary Committee access to ex-White House counsel Don McGahn, who spent 30 hours being interrogated by Robert Mueller’s team. Thus the Justice Department is withholding from the Oversight Committee subpoenaed documents dealing with the decision to include a question on the 2020 Census about citizenship status.

Across the capital, the barricades are going up figuratively as they did physically in the 1960s and ’70s. Once more, it’s us against them. Cognizant of the new reality, Trump seems to be saying: These House investigations constitute a massive political assault, in collusion with a hostile media, to destroy my presidency. We do not intend to cooperate in our own destruction. We are not going to play our assigned role in this scripted farce. We will resist their subpoenas all the way to November 2020. Let the people then decide the fate and future of the Trump presidency — and that of Nancy Pelosi’s House.

[..] Whatever may be said about the “deplorables,” they are not obtuse. They do not believe that people who call them racists, sexists, nativists and bigots are friends and merely colleagues of another party or persuasion. Trump’s defiance of subpoenas, however, will force the more moderate Democrats to join the militants in calling for hearings on impeachment in the House Judiciary Committee, which is where we are headed. The media are already salivating over the possible removal of a president they have come to loathe more than their great nemeses of the 20th century — Joe McCarthy and Richard Nixon. And the media will reward those who echo the call for impeachment. This week, two more Democrats running for president, including Sen. Kamala Harris, came aboard. Soon, the House will capitulate to the clamor and the stampede will be on.

Sometimes I think the Democrats work for Trump. They hand him everything on a platter by getting lost in a fictional narrative.

• Trump Attacks Democrat ‘Coup’ In 1st Post-Mueller Interview (RT)

Trump unloaded on Democrats, accusing them of an “attempted coup” in his first interview since the release of the Mueller report. Rehashing his usual rhetoric, Trump called the ‘Russiagate’ flop “bigger than Watergate.” On a victory lap since his election campaign was cleared of collusion with Moscow, Trump relied on a few tried and trusted tropes as he bashed the “13 angry Democrats” and “dirty cops” from the FBI for sparking the Russia investigation in an interview with Fox News’ Sean Hannity. The long-awaited publication of the redacted version of the Mueller report appears to have given Trump a huge boost of confidence as he sounded more assertive than ever, taking aim at his political opponents and doubling down on his innocence.

“The greatest scandal in the history of our country. Bigger than Watergate, because it means so much. This wasn’t stealing information from an office in the Watergate apartments. This was an attempted coup. It’s inconceivable. Like a third world country.” Trump lashed out at former rival Hillary Clinton for “destroying the lives” of his staffers, and blasted the FBI for going light on her during her private server investigation. But now, he said, the “tables have turned” and “it’s time to look at the other side,” calling the Russia investigation an “attempted overthrow of the United States government” and “a disgraceful thing.”

Death penalty. For which UK cannot extradite. US is talking to Daniel Domscheit-Berg, who had a big fall-out with Assange. Letter sent to him is underneath the article.

• US Is Investigating Assange Under Espionage Act – WikiLeaks (NP)

Right after the London police carried Julian Assange from the Ecuadorian embassy, the United States demanded his extradition. A March 2018 indictment charges him with conspiracy to commit computer intrusion, carrying a maximum penalty of five years in prison. But that is not the entire truth. Only one day after writing the indictment, the US Attorney’s Office admitted it was also investigating Assange for the „unauthorized receipt and dissemination of secret information“. That is what the Department of Justice wrote in a letter to former WikiLeaks spokesperson Daniel Domscheit-Berg, which we are publishing in full.

This accusation can be charged under the Espionage Act of 1917, a World War I era federal law intended to protect military secrets which has also been used to charge Chelsea Manning and Edward Snowden. Convictions under the Espionage Act can be punished by death. The death penalty is not only inhumane and archaic, it has legal consequences: The United Kingdom is not allowed to extradite Assange if he faces the death penalty. Charging Assange for publishing classified information is an attack on press freedom, „obtaining and disseminating secret information“ is the very task of journalism. If WikiLeaks is charged, every journalist and media outlet publishing secret information will be on trial. While the Obama administration debated this dangerous precedent, the Trump government shows no restraints.

[..] In Virginia, a federal grand jury is secretly investigating Assange and WikiLeaks. In December 2017, an FBI agent filed an affidavit to support charging Assange with a computer hacking conspiracy. Based on that, the grand jury issued an indictment against Assange on March 6, 2018. This document was unsealed and published immediately after his arrest in London. It is the official justification for the extradition request. But that is not the whole story. Just one day after writing the indictment, on March 7, 2018, the same US Attorney, Tracy Doherty-McCormick, wrote a letter to the lawyers of Daniel Domscheit-Berg in Germany.

Sporting the Department of Justice seal, the chief federal prosecutor requests a „voluntary questioning“ of Domscheit-Berg, explicitly „about possible violations of US federal criminal law regarding the unauthorized receipt and dissemination of classified information“ – a drastic accusation under the Espionage Act. The US Attorney goes on to explain some conditions for Domscheit-Berg. He must answer all questions fully and truthfully, the US may use all statements and information for criminal investigations and cross-examination. In return, whatever Domscheit-Berg testifies will not be used for prosecutions against him.

Bit late perhaps?!

• UN Special Rapporteur On Privacy Meets Assange In Prison: “I Will Act” (Maurizi)

He is the first person who has been able to visit Julian Assange at the Belmarsh prison besides Assange’s lawyers. In fact, although two weeks have passed since the arrest of the WikiLeaks’ founder, no other visitors are allowed apart from his lawyers. The UN Special Rapporteur on Privacy, Professor Joe Cannataci, just visited Julian Assange at the Belmarsh prison, a high security prison marked by the strictest prison regime in the UK, and in fact even visitors have to undergo to intensive controls, including police interviews, and of course meetings are monitored. Repubblica just interviewed the UN Rapporteur Cannataci.

Professor Cannataci, how did Assange seem to be doing? «My visit went well, Mr Assange was ready to answer my questions. We have already started gathering facts and asked questions of Assange’s legal team and of the Ecuadorian ambassador in London»

How is Julian Assange? We were all shocked by his appearance the day of his arrest… «I am not a physician, and so I am unable to make a medical assessment of him and of course I met him in prison, which is never a pleasant place to meet, however, it seemed to me he was in fairly good condition».

Were you able to talk to him with some privacy, or were you under surveillance? «No, my impression was that the UK authorities assured us a level of privacy intended for meetings with legal counsel. Usually in the UK prisons you have the following rules: for social meetings, like meetings with relatives, you don’t expect privacy, whereas meetings with legal counsels are usually not subjected to monitoring. These kinds of meetings are held in special places, usually 10-15 small rooms where detainees can meet their lawyers confidentially. I had asked for a confidential meeting and I am happy that the UK government agreed to provide us such a private meeting».

What are you investigating exactly, in relation to this meeting with Julian Assange? «At the end of March Mr Assange submitted an official complaint, which said that his right to privacy had been infringed during his time in the embassy of Ecuador. Together with my team, I made a preliminary assessment to see if his privacy has been infringed, therefore I am gathering the facts, these facts lead to a number of questions about behaviour which took place in the embassy. Today we are still in the preliminary stage. After my meeting with Mr Assange, I had a meeting with his legal team and then a meeting with the ambassador of Ecuador».

I tell you: Macron simply doesn’t know he’s lost it all. He’s blind: “Did we take a wrong turn?’ I believe quite the opposite.” And that in the face of 25 weekends of protests against him.

• Macron Responds To Gilets Jaunes Protests With €5 Billion Tax Cuts (G.)

Emmanuel Macron has vowed to make his style of politics more “humane”, but insisted he would press on with his project to liberalise the French economy and overhaul its welfare state despite five months of demonstrations by gilets jaunes (yellow vest) anti-government protesters. In his first press conference in two years as president, Macron promised €5bn worth of cuts to income tax for lower and average earners as well as pension rises for the poorest and vowed no more schools or hospitals would be closed during his presidency, as he responded to protests.

The centrist politician conceded that he needed to inject more “humanity” into his style of governance but insisted he would not make changes to his pro-business programme, despite the ongoing anti-government Saturday protests by gilets jaunes, which resulted in sporadic rioting and arson in Paris and other cities. Macron said he recognised the protesters’ “just demands” and “anger and impatience for change” and their feeling of not being taken into account by the “elites”, including the presidency, but public order must now be restored. He said although he respected the demonstrators who gathered at the start of the movement in November, he said it had “transformed progressively” and been marred by episodes of antisemitic violence, homophobia and rioting.

He said he stood by his project to liberalise the French economy, defending his controversial cuts to its wealth tax, which protestors sought to overturn. He said France was unique in Europe in not having dealt with its structural problem of mass unemployment so he would not go back on his planned “transformation” of the country. He said: “I asked myself: ‘Should we stop everything that was done over the past two years? Did we take a wrong turn?’ I believe quite the opposite.” [..] He promised to scrap the École nationale d’administration elite graduate training school for French civil servants and public officials. Saying the French style of governance needed to shift, Macron said he planned to make it easier for citizens to propose national referendums, and also would introduce 20% proportional representation into the lower house of parliament.

Schengen, Dublin, they don’t serve Macron’s career, so out with them.

• Macron: Smaller Schengen Zone Because EU Migration Policies ‘Do Not Work’ (RT)

The Schengen agreement and the current migrant-sharing mechanism are deeply flawed and need urgent fixing, French President Emmanuel Macron has said. Europe must “have borders” even if it means a smaller Schengen zone, he said. In the first major press conference since the Yellow Vest movement took off in November, Macron unveiled a range of policy measures to placate the protesters, including a proposed overhaul of the European-wide migration policy and the Schengen agreement. The embattled French leader argued that the agreement that guarantees free movement across the Schengen area, while “wonderful,” does not work anymore. The same, he said, applies to the Dublin Regulation that determines which EU member-state is responsible for accepting asylum seekers.

Under the current version of the agreement, which came into force in 2013 and applies to all EU member-states except Denmark, the main criteria for determining responsibility is the first point of entry. “The common borders, Schengen, Dublin agreements do not work anymore,” Macron said, adding that it is essential for Europe to make “profound” changes in its way of handling migrant arrivals. Macron called for reinforced border security, which might entail having a Schengen “with fewer states.” The Schengen area comprises 26 states, including 22 EU member-states and four non-EU countries: Norway, Iceland, Switzerland and Liechtenstein. It is named after the 1985 agreement that abolished internal borders allowing people within the zone to travel freely from one country to another.

Trojan horse.

• Irish Backstop Could Undermine EU Standards – Report (G.)

It is a dastardly trap, designed to lock freedom-loving Britain into the European Union’s protectionist customs union: that is the argument against the so-called backstop, cited by hardline Brexit advocates as the main reason why they have thrice voted down Theresa May’s deal with the European Union. But as the dust settles after months of chaos in Westminster, suspicions are growing on the other side of the Channel that the backstop could in fact be the very opposite: a brilliant deception device constructed by crack UK negotiators, which would allow a more reckless British prime minister to undermine the EU’s green and social standards while still keeping access to the European single market.

A new report, commissioned by the German Green party and seen by the Guardian, will exacerbate concerns in Berlin over the small print of the withdrawal agreement in its current form. The deal, agreed between the EU and the UK in November 2018 but voted down three times in the House of Commons, states that the whole of the UK would remain in a de facto customs union with the EU until a trade and security agreement has been reached that prevents the setting up of a hard border between the Republic of Ireland and Northern Ireland. nTo prevent Britain from diverting from EU standards on environmental or social protection after the backstop has come into effect, the customs territory would “include the corresponding level playing field commitments and appropriate enforcement mechanisms to ensure fair competition between the EU27 and the UK”.

The new German report, however, warns that the wording of the deal means the EU side will find it impossible to stop a more aggressive Britain led by a Boris Johnson or a Jacob Rees-Mogg from flouting such standards while still being able to export British products into the single market. “If the EU wants to have a level playing field, it must not just set up the goals but also assign a referee,” said the author of the report, EU law expert Dr René Repasi. “At the moment it has even given the UK licence to assign its own players with officiating the match.”

On 5G, individual countries make the decisions.

• Juncker Refuses To Reject Huawei ‘Just Because It’s Chinese’ (RT)

European Commission President Jean-Claude Juncker says he won’t bar Chinese firms like Huawei from doing business with Europe, as long as they respect market rules, despite continued US pressure to ban the company. “We are not rejecting someone because he is coming from faraway, because he is Chinese, the rules have to be respected,” Juncker said at a press conference with Japanese PM Shinzo Abe on Thursday. Asked about his response to the US call to “eliminate” Chinese telecoms equipment from Europe’s 5G buildout, Juncker was defiant. “The European Union and our internal market are open markets and all those respecting our rules governing this internal market are welcome,” he said.

Last month, Europe’s Parliament passed a resolution “expressing their deep concern” about alleged Chinese cybersecurity threats, but a subsequent statement from the European Commission regarding 5G cybersecurity did not include such language, instead merely urging member states to develop a “toolbox of mitigating measures” to combat cybersecurity risks to their growing 5G infrastructure. The US has leaned heavily on allies to keep Huawei and other Chinese telecoms out of their countries, claiming the company could act as a spy for the Chinese government. Washington has even threatened to withhold intelligence from Germany over their refusal to ban the Chinese firm, pressure China’s foreign minister has called “abnormal” and “immoral.”

May invites Huawei. Will she stand up to Trump in other areas too?

• Huawei Leak Highlights Collapse Of Discipline In May’s Cabinet (G.)

Leaks from deep within Theresa May’s bitterly divided administration have become widespread and common: as one despairing official remarked recently, “this government is a sieve”. But the revelation of the highly sensitive news that ministers have decided to set aside cybersecurity concerns and involve the Chinese firm Huawei in the creation of Britain’s 5G network is regarded by many as a leak too far. The decision was taken at the national security council, on which ministers sit alongside officials and members of the security services. The secrecy of its discussions has never before been breached. A full-scale inquiry is now expected to be launched, but a slew of other briefings and counter-briefings from private meetings in recent weeks and months has not just gone unpunished but become almost unremarkable.

There are several, allied reasons for this pervasive culture of briefing and counter-briefing, which means multiple competing accounts of cabinet meetings are available shortly after ministers walk out of Downing Street. One is simply the ready availability of instant electronic communication – a string of WhatsApp messages is a lot quicker and more straightforward than the old-fashioned gossip over lunch or in a Westminster bar (though that still happens too, of course). Another is the historic significance of the issues at stake and the lack of trust on both sides of the Brexit debate, which means all the key players want to ensure their point is heard even if they lost the argument in the room.

The Fed will make up the difference. Can’t have stocks going down.

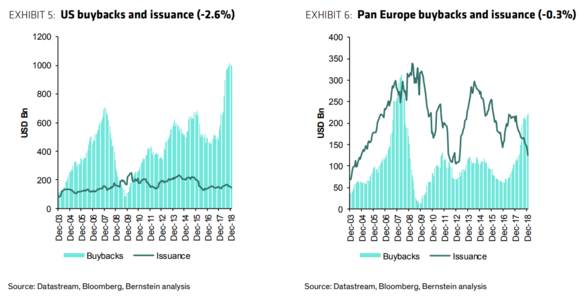

• European Equities May Benefit As $1 Trillion In US Buybacks Vanish (ZH)

European equities may start to finally see some love, as they are now positioned to take advantage of one significant coming tailwind from the U.S., according to Bloomberg. Over the next 12 months, US stocks are going to lose a significant amount of support that they have received from buybacks, as the nearly $1 trillion buyback bonanza that has fueled stock purchases in the United States starts to come to an end, according to Sanford C. Bernstein strategists. This could be an area where European stocks, due to their low dependence on buybacks, could see help as a result. Bernstein strategists led by Inigo Fraser-Jenkins said: “This would remove one advantage of U.S. equities over Europe. As the buyback support is reduced it will make a stronger relative case for Europe.”

And the decision of the U.S. central bank to hold off on rate increases may have temporarily reduced concerns about debt hurting equities, but the topic is still on the table and credit spreads are expected to keep widening over the next year. Furthermore, the significance of share repurchases to the US rally has been pronounced, with $1 trillion in buybacks in just 2018 alone, far overshadowing the $100 billion in net inflows from active and passive funds. And even though European equities have rallied to the tune of more than $1.5 trillion since December’s lows, shorting these stocks remains a popular trade globally, according to Bank of America Corp.’s latest fund manager survey. And many traders are still on the sidelines, as Europe’s ugly politics and mixed economic data continues to weigh on sentiment.

To find this out, we must travel back in time.

• Universe Expands Faster Than Expected – NASA

The universe is expanding considerably faster than it should be, Nasa has confirmed. The space agency’s Hubble Space Telescope shows that it is growing about 9 per cent faster than had been expected, based on the trajectory it started with shortly after the Big Bang, according to astronomers. While such a discrepancy had already been suggested, the new measurements reduce the chance this is a mistake to just one in 100,000. Such a confirmation could require astronomers to find new physics theories to explain the universe‘s strange behaviour. “This mismatch has been growing and has now reached a point that is really impossible to dismiss as a fluke.

This is not what we expected,” says Adam Riess, Bloomberg Distinguished Professor of physics and astronomy at Johns Hopkins University, Nobel laureate and the project’s leader. The speed of the universe’s expansion, known as the Hubble constant, is a central part of physics and our understanding of the universe. But it has repeatedly been observed to behave unexpectedly – the more astronomers find out about it, the more wrong it appears – in ways that have forced scientists to wonder whether our assumptions about it had been wrong. The new study confirms that speculation, and requires further work to explain how exactly the universe is growing.

The research saw Professor Riess and his team analyse light from 70 stars in a galaxy near ours, known as the Large Magellanic Cloud, using a new method that allowed them to capture the stars quickly. The stars they observed are called Cepheid variables, and change brightness predictably, allowing them to be used to measure intergalactic distances. The new method allowed the researchers to measure many more of those stars far more quickly. Normally, Hubble can only look at one star each time it takes one of its 90-minute orbits around Earth, but the new method allowed it to see dozens in that same time.