Edvard Munch Spring in Johan Karl Street 1944

Goldilocks and Frankenstein.

• Steen Jakobsen Fears 30% Market Correction With Consumer ‘Maxed Out’ (CNBC)

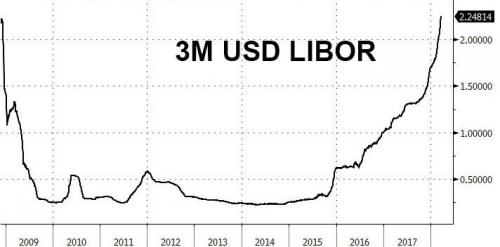

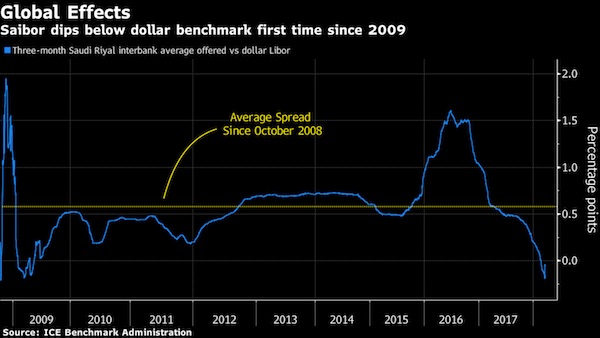

Stock markets could see a hefty fall in the coming months due to a slew of trends that point to a downturn in the global economy, one economist told CNBC. Steen Jakobsen, the often-bearish chief economist at Danish investment house Saxo Bank, cited several factors including growing credit loans, a widening fiscal deficit in the U.S., doubts over infrastructure spending plans and a potential trade war. “All the data we’ve seen over the last few weeks has basically been that the consumer is maxed out, we’ve seen that in credit card loans as well, so I think the consumer is done spending the money,” he told CNBC Tuesday. New data Tuesday showed that U.S. consumer confidence declined in March, falling below expectations and breaking a two month streak of gains.

“I think overall we have been pricing in for Goldilocks and we are closer to Frankenstein to be honest,” he said. He added that in a scenario of a potential sudden economic recession, he sees a possible market correction of between 25 and 30%. Jakobsen highlighted a “Goldilocks” scenario that he feels traders are mistakenly pricing in to markets, where fresh economic data are either not too hot or not too cold. Overall, the global economy is currently experiencing lower levels of unemployment and higher growth. Looking at 2018 in particular, many analysts hoped for strong global growth on the back of higher inflation and higher investment, but according to Jakobsen, these drivers “aren’t actually materializing.”

Instead, Jakobsen made a reference to the novel “Frankenstein,” arguing that the economy had been skewed by central bankers, who have injected trillions of dollars into the global economy to boost growth and investment. The first quarter of 2018 “started at more than 5% expected GDP; we are now significantly less than 2% for the (first quarter) expected, so I don’t really see things happening in the growth area,” Jacobsen added. “We’ve been at 2% exactly since the financial crisis, I don’t think we’re going to deviate from that,” he said.

Again, he says it’s what his father and grandfather wanted. Perfect way to save face.

• China Says Kim Jong Un Agrees To Denuclearize Korean Peninsula (R.)

China said on Wednesday it won a pledge from North Korean leader Kim Jong Un to denuclearize the Korean peninsula during a meeting with President Xi Jinping, who pledged in return that China would uphold its friendship with its isolated neighbor. After two days of speculation, China announced on Wednesday that Kim had visited Beijing and met Xi during what the official Xinhua news agency called an unofficial visit from Sunday to Wednesday. The trip was Kim’s first known journey abroad since he assumed power in 2011 and is believed by analysts to serve as preparation for upcoming summits with South Korea and the United States.

Beijing has traditionally been the closest ally of secretive North Korea, but ties have been frayed by North Korea’s pursuit of nuclear weapons and China’s backing of tough U.N. sanctions in response. Xinhua cited Kim as telling Xi that the situation on the Korean peninsula is starting to improve because North Korea has taken the initiative to ease tensions and put forward proposals for peace talks. “It is our consistent stand to be committed to denuclearisation on the peninsula, in accordance with the will of late President Kim Il Sung and late General Secretary Kim Jong Il,” Kim Jong Un said, according to Xinhua. North Korea is willing to talk with the United States and hold a summit between the two countries, he said.

Zero Hedge with the entire Twitter thread by Dylan Curran. Does that wake you up?

• All The Personal Data That Facebook/Google Collect (Curran)

The Cambridge Analytica scandal was never really about Cambridge Analytica. As we’ve pointed out, neither Facebook nor Cambridge Analytica have been accused of doing anything explicitly illegal (though one could be forgiven for believing they had, based on the number of lawsuits and official investigations that have been announced). Instead, the backlash to these revelations – which has been justifiably focused on Facebook – is so severe because the public has been forced to confront for the first time something that many had previously written off as an immutable certainty: That Facebook, Google and the rest of the tech behemoths store reams of personal data, essentially logging everything we do.

In response to demands for more transparency surrounding user data, Facebook and Google are offering users the option to view all of the metadata that Google and Facebook collect. And as Twitter user Dylan Curran pointed out in a comprehensive twitter thread examining his own data cache, the extent and bulk of the data collected and sorted by both companies is staggering. Google, Curran said, collected 5.5 gigabytes of data on him – equivalent to some 3 million Microsoft Word documents. Facebook, meanwhile, collected only 600 megabytes – equivalent to roughly 400,000 documents.

Another shocking revelation made by Curran: Even after deleting data like search history and revoking permissions for Google and Facebook applications, Curran still found a comprehensive log of his documents and other files stored on Google drive, his search history, chat logs and other sensitive data about his movements that he had expressly deleted. What’s worse, everything shown is the data cache of one individual. Just imagine how much data these companies hold in total.

By now, shareholders may be his prime concern. Congress won’t hurt the CIA’s interests.

• Mark Zuckerberg Agrees To Testify Before Congress Over Data Scandal (G.)

Facebook’s chief executive, Mark Zuckerberg, has agreed to testify before the United States Congress in the wake of a that has sent the company’s share price tumbling and prompted numerous investigations and lawsuits. Zuckerberg has accepted an invitation to testify before the House energy and commerce committee, according to an aide familiar with the discussions. A date has not yet been set, and the spokesperson for the House committee declined to confirm reports that the hearing was scheduled for 12 April. The Senate judiciary and commerce committees have also invited Zuckerberg to appear at hearings.

His decision to testify before the US Congress was first reported by CNN, and contrasts with his refusal to appear before members of parliament in the UK. The chair of a British committee of MPs on Tuesday said Zuckerberg’s decision to send other executives to the UK to answer questions on his behalf was “absolutely astonishing”. However, news of US congressional evidence paves the way for a major showdown for Zuckerberg, 33, who has come under increasing pressure from lawmakers and the general public to account for Facebook’s business practices since the company acknowledged last September that it had sold advertisements to Russian agents seeking to influence the US presidential election.

Facebook took 30% of the loot. They sold their data perhaps thousands of times.

• 37 State Attorneys General Demand Answers From Zuckerberg (ZH)

37 “profoundly concerned” U.S. state and territory attorneys general fired off a letter to Facebook CEO Mark Zuckerberg on Monday, demanding answers over reports that personal user information from Facebook profiles was provided to third parties without the users’ knowledge or consent. “Most recently, we have learned from news reports that the business practices within the social media world have evolved to give multiple software developers access to personal information of Facebook users. These reports raise serious questions regarding consumer privacy”

The letter notes the 50 million Facebook profiles which may have been “misused and misappropriated by third-party software developers,” noting that Facebook “took as much as 30%” of payments made through applications used by Facebook users. “According to these reports, Facebook’s previous policies allowed developers to access the personal data of “friends” of people who used applications on the platform, without the knowledge or express consent of those “friends.” It has also been reported that while providing other developers access to personal Facebook user data, Facebook took as much as 30% of payments made through the developers’ applications by Facebook users.”

In other words – while a Facebook user may have agreed in the fine print to allowing the social media giant to hoover up their information – their “friends” did not. “These revelations raise many serious questions concerning Facebook’s policies and practices” reads the letter, which asks “were those terms of service clear and understandable, or buried in boilerplate where few users would even read them?”

He’s just not that into you. Why talk to “the UK parliamentary committee investigating fake news” when he’s already agreed to speak to Congress?

• Zuckerberg’s Refusal To Testify Before UK MPs ‘Absolutely Astonishing’ (G.)

Mark Zuckerberg has come under intense criticism from the UK parliamentary committee investigating fake news after the head of Facebook refused an invitation to testify in front of MPs for a third time. The chair, Damian Collins, said it had become more urgent the Facebook founder give evidence in person after oral evidence provided by the Cambridge Analytica whistleblower, Christopher Wylie. The MP said: “I think, given the extraordinary evidence we’ve heard so far today, it is absolutely astonishing that Mark Zuckerberg is not prepared to submit himself to questioning in front of a parliamentary or congressional hearing, given these are questions of fundamental importance and concern to his users, as well as to this inquiry.

“I would certainly urge him to think again if he has any care for people that use his company’s services.” Zuckerberg has been invited three times to speak to the committee, which is investigating the effects of fake news on UK democracy, but has always sent deputies to testify in his stead. MPs are likely to take a still dimmer view of his decision after he ultimately agreed to testify before Congress in the US. It was reported on Tuesday that the company is now considering strategy for his testimony. When the Commons committee travelled to Washington DC in February to obtain oral evidence from US companies, Facebook flew over its UK policy director rather than send a high-level executive to speak to the committee.

In response to the latest request, Facebook has suggested one of two executives could speak to parliament: Chris Cox, the company’ chief product officer, who is in charge of the Facebook news feed, or Mike Schroepfer, the chief technology officer, who heads up the developer platform. However, Theresa May declined to back Collins. Pressed by the committee chairman at the Commons liaison committee later in the day, the prime minister said “Mr Zuckerberg will decide for himself” whether to give evidence to parliament.

The US has one sane person left. And he’s 93. Not that he’s the only one denouncing Bolton. But none of the rest do that nearly loud enough.

• Jimmy Carter: Trump Hiring Bolton ‘A Disaster For Our Country’ (USAT)

Former president Jimmy Carter, one of the few U.S. officials who has traveled to North Korea and met with its leaders, expresses hope for the planned White House summit with Pyongyang but warns that President Trump may have made “one of the worst mistakes” of his tenure by naming John Bolton to the sensitive post of national security adviser. In an exclusive interview with USA TODAY, pegged to the publication of his new book titled Faith, Carter calls Bolton “a warlike figure” who backs policies the former president calls catastrophic. “Maybe one of the worst mistakes that President Trump has made since he’s been in office is his employment of John Bolton, who has been advocating a war with North Korea for a long time and even an attack on Iran, and who has been one of the leading figures on orchestrating the decision to invade Iraq,” Carter said. He called the appointment, announced last week, “a disaster for our country.”

Perfect for Tony Blair et al. Maybe too perfect. Who cares about this guy’s views? Stick to the facts, please.

• Brexit Referendum Won Through Fraud – Whistleblower (G.)

The EU referendum was won through fraud, the whistleblower Christopher Wylie has told MPs, accusing Vote Leave of improperly channelling money through a tech firm with links to Cambridge Analytica. Wylie told a select committee that the pro-Brexit campaign had a “common plan” to use the network of companies to get around election spending laws and said he thought there “could have been a different outcome had there not been, in my view, cheating”. “It makes me so angry, because a lot of people supported leave because they believe in the application of British law and British sovereignty. And to irrevocably alter the constitutional settlement of this country on fraud is a mutilation of the constitutional settlement of this country.”

Vote Leave has repeatedly denied allegations of collusion or deliberate overspending. When they , Boris Johnson, who fronted the campaign, said: “Vote Leave won fair and square – and legally. We are leaving the EU in a year and going global.” Wylie, who used to work for Cambridge Analytica, gave evidence in a nearly four-hour session before the digital, culture, media and sport select committee. He made a string of remarkable claims about Brexit and Cambridge Analytica, including that his predecessor, Dan Mursean, died mysteriously in a Kenyan hotel room in 2012 after a contract in the company turned sour. Wylie said it was striking that Vote Leave and three other pro-Brexit groups – ; Veterans for Britain, and Northern Ireland’s Democratic Unionist party – all used the services of the little-known firm Aggregate IQ (AIQ) to help target voters online.

And Greece, Cyprus, Portugal, Bulgaria, Cyprus, Slovakia, Slovenia, Malta and Luxembourg. Belgium?!

• Austria Draws Scorn for Sitting Out Russian Diplomat Expulsions (BBG)

Austria is drawing criticism from parts of the European Union for saying it couldn’t expel Russian diplomats on account of its neutrality. Chancellor Sebastian Kurz’s government, which includes nationalists that cooperate with Vladimir Putin’s party, declined to join the tough international response to a nerve-agent attack on a former Russian spy in England. Austria is a “builder of bridges between East and West” and wants to “keep channels open” to Moscow, it said. That position is “hardly compatible with EU membership” and there’s “a big difference between being part of the West and being a bridge between the West and the East,” former Swedish Foreign Minister Carl Bildt said Tuesday on Twitter.

Artis Pabriks, a former Latvian foreign minister who’s a member of the European Parliament, called Austria’s decision a “bad joke.” He asked: “Which other EU policies/decisions Kurz does not apply to Austria?” Kurz, whose People’s Party is part of the same political family as the parties of Bildt and Pabriks, said Monday that Austria backs the EU’s decision to pull its ambassador to Russia. In declining to take further measures, his government cited Austria’s neutrality, which the country adopted as a condition for ending its post-World War II occupation by the U.S., the Soviet Union, the U.K. and France in 1955.

7 billion people do, too.

• 160 Countries Want To See Proof In Skripal Case – Russia’s UK Embassy (RT)

Scores of non-Western countries refuse to take the UK’s assertion that Russia was behind the incident in Salisbury at face value, demanding it present the evidence, Moscow’s embassy in London said. Some 160 states share that view. While many in the Western world, save several notable exceptions, united behind the UK as it accused Russia of poisoning the former spy with a military-grade toxic agent, many more countries have not been persuaded by the fiery rhetoric of British PM Theresa May, the spokesperson for Russia’s British embassy told Sputnik.

“Even if Mrs. May said that she was absolutely sure that Russia was responsible for the incident in Salisbury, she would have to present all evidence to Russia, the international community and the British public. This is the opinion of almost 160 countries which are not members of the Western bloc,” he said. “It is obvious that no one in the wider world would take British words for granted.” On Monday, following the lead of the UK, the US, 18 EU states and other European countries, Canada and Australia announced they would expel a number of Russian diplomats in solidarity with the UK. Washington alone ordered the expulsion of 60 diplomats, including 12 at the Russian mission to the UN, alleging they were covert intelligence operatives.

What became the largest collective expulsion of Russian diplomats in history was denounced by Moscow as an extremely unfriendly and unwarranted step. Still, there were voices in the West that refused to side with London until the evidence is laid out. Austria as well as Switzerland, both stressing their neutral country status, refused to follow suit. Cyprus, Portugal, Bulgaria, Cyprus, Slovakia, Slovenia, Malta and Luxembourg did not jump on the expulsion bandwagon either.

Magic Muskroom.

• Tesla Just Months From A Total Collapse – Hedge Fund (MW)

Unless Elon Musk “pulls a rabbit out of his hat,” Tesla will be bankrupt within four months, says John Thompson of Vilas Capital Management. “Companies eventually have to make a profit, and I don’t ever see that happening here,” he told MarketWatch. “This is one of the worst income statements I’ve ever seen and between the story and the financials, the financials will win out in this case.” Thompson manages $25 million and his Tesla short is the fund’s biggest position. To be fair, he’s been betting big against Tesla for years, which, of course, means he’s endured some brutal stretches. Last April, for instance, the stock hit a record high around the $300 mark, and Musk was right there to troll the Tesla bears.

From that point, the stock continued to break new ground, eventually topping out at $389.61. But despite Tesla’s strong performance in 2017, Thompson’s fund still managed to churn out a 65% gain for the year. Now, Tesla’s back to where it was when Musk fired off his “Shortville” tweet, and Thompson is confident his bet is about to pay off nicely. In fact, Thompson says if his prediction comes true, his fund could surge by another 50%. With that in mind, he says he’s investing $500,000 of his own money. “Tesla, without any doubt, is on the verge of bankruptcy,” he told clients in an email over the weekend.

He explained that funding will be hard to come by in the face of problems in delivering the Model 3, declining demand for the Model S and X, extreme valuation and a likely downgrade of its credit rating by Moody’s from B- to CCC. “As a reality check, Tesla is worth twice as much as Ford [estimate of the enterprise value of both companies], yet Ford made 6 million cars last year at a $7.6 billion profit while Tesla made 100,000 cars at a $2 billion loss,” Thompson said. “Further, Ford has $12 billion in cash held for ‘a rainy day’ while Tesla will likely run out of money in the next 3 months. I’ve never seen anything so absurd in my career.”

Flows vs stocks. GDP is attractive if you want to make money with destruction.

• The Missing Economic Measure: Wealth, not GDP (OWiD)

So, what is GDP? GDP is a measure of economic activity – in terms of market-based gross output – in a given period (often a year). This is of course useful in many ways. GDP growth, when captured accurately, has the potential to tell us about the pace of change and rising levels of consumption. Equally, a cessation of GDP growth can serve as an important red flag: stalling enterprises and increases in unemployed workers tend to imply hardship and losses in welfare. However, there are important changes that GDP does not shed light on, and indeed might give us incorrect signals about. Think about climate change, a critical issue that has been increasingly under the international spotlight. An economy can increase its CO2 emissions and drive up local pollutants – both clearly harmful to the long-term wellbeing of the population – while being rewarded with rising GDP figures.

Similarly, a natural disaster might harm people, destroy infrastructure, and require expensive emergency measures – yet thanks to a rise in spending, this too would temporarily register as an increase in GDP. On the flip side, beneficial endeavors such as attempting to stall the alarming rate of biodiversity loss or deforestation not only fail to register in our headline statistic; they might slow its growth. This is where wealth accounting comes in. Rather than measuring flows, as GDP does, wealth is an indicator of an economy’s underlying capital stocks. Wealth, if measured in detail, accounts for the assets such as natural capital, produced capital, and human capital that underpin growth and consumption possibilities, and in this way shows us viable development pathways.

In the event of a natural disaster or rising pollution, for example, while GDP might grow, wealth measures would alert us to the depletion of underlying physical and natural capital stocks and the need for targeted investment. A detailed enough balance sheet would thus theoretically allow for the sustainable management of an economy’s productive capital. Therefore, while GDP has little to say about whether a nation’s assets can sustain current consumption levels into the future, wealth measures can tell us exactly this. The relationship between wealth and GDP is analogous to company accounts: the balance sheet of a company describes the stock of useful assets owned by a company (akin to wealth), while the profit and loss statement describes the flows of revenue, costs, and net income that the company has been able to generate using those assets (akin to GDP).