NPC “.. the hearty cereal beverage with flavor and tang, Altemus-Hibble truck” 1920

“Finally, creditors are being made to pay for the consequences of their own folly.”

• Only Mass Default Will End The World’s Addiction To Debt (Telegraph)

In a valedictory speech at the weekend of characteristically Latin American duration – a mind-numbing three hours – the Argentine president, Cristina Fernandez de Kirchner, claimed that her country was the only one in the world to have reduced its national debt over recent years. I doubt she is right about being alone in this “achievement” – there must surely be others – but even if she is, I’m not sure that reduction in the national debt via the mechanism of default is anything to boast of. Only Kirchner could think this a matter of national pride. Nonetheless, where Argentina treads, others will surely soon be following. The world is sinking under a sea of debt, private as well as public, and it is increasingly hard to see how this might end, except in some form of mass default. Greece we already know about, but the coming much wider outbreak of debt repudiation will not be confined to sovereign nations.

Last week, there was another foretaste of what’s to come in developments at Austria’s failed Hypo Alpe-Adria-Bank International. Taxpayers have had enough of paying for the country’s increasingly crisis-ridden banking sector, and have determined to bail in private creditors to the remnants of this financial road crash instead – to the tune of $8.5bn in the specific case of Hypo Alpe-Adria. Finally, creditors are being made to pay for the consequences of their own folly. You might have thought that a financial crisis as serious as that of the past seven years would have ended the world economy’s addiction to debt once and for all. It has not. If anything, the position has grown even worse since the collapse of Lehman Brothers. According to recent analysis by McKinsey, global debt has increased to the tune of $57 trillion, or 17pc, since 2007, with little sign of a slowdown in sight.

Much of this growth has been in emerging markets, which were comparatively unaffected by the financial crisis. Yet even in the developed West, private sector deleveraging has been limited and, in any case, more than outweighed by growing public indebtedness. The combined public sector debt of the G7 economies has grown by 40pc to around 120pc of GDP since the crisis began. There has been no overall deleveraging to speak of. Where the West left off, Asia has taken up the pace, with a credit-induced real estate bubble that makes its pre-crisis Western counterpart look tame by comparison, much of it fuelled, as in Western economies, by growth in the shadow banking sector. China’s total indebtedness has quadrupled since 2007 to $28 trillion, according to estimates by McKinsey. At 282pc of GDP, the debt burden is now bigger, relative to output, that the US.

Attempts to rein in this growth have so far proved problematic. The Chinese property market has slowed markedly, which in turn has knocked the stuffing out of the all-important construction sector and its feeder industries. Starved of its regular fix of debt, the Chinese economy seems as incapable of generating decent levels of growth as the mature economies of the West. The addiction to credit has gone global.

“While Austria remains a rich and successful country, it is slithering towards the bottom of the reform league. France looks less sluggish by comparison, and Greece looks almost Thatcherite.”

• Eurozone Faces First Regional Bankruptcy In Austria’s Carinthia (AEP)

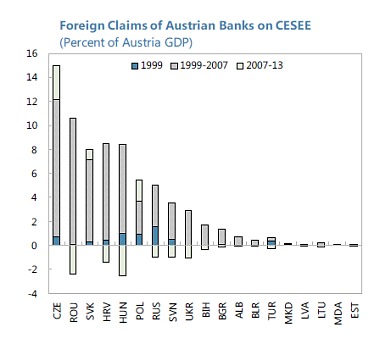

The Alpine region of Carinthia faces probable bankruptcy after Austria’s central government refused to vouch for debts left by a disastrous banking expansion in eastern Europe and the Balkans. It would be the first sub-sovereign default in Europe since the Lehman Brothers crisis, comparable in some respects to the bankruptcy of California’s Orange County in 1994 or the city of Detroit in 2013. Austria’s finance minister, Jörg Schelling, said Vienna would not cover €10.2bn (£7.4bn) in bond guarantees issued by the Carinthian authorities for the failed lender Hypo Alpe Adria, or for the “Heta” resolution fund that succeeded it. This leaves the 550,000-strong province on the Slovene border to fend for itself as losses spin out of control. “The government won’t waste another euro of taxpayer money on Heta,” he said, insisting that there must be an end to moral hazard.

The Hypo affair has alredy cost taxpayers €5.5bn. The Austrian state has said it will cover €1bn of its own guarantees “on the nail” but nothing more. Sources in Vienna suggested that even senior bondholders are likely to face a 50pc writedown, becoming the first victims of the eurozone’s tough new “bail-in” rules for creditors. These rules are already in force in Germany and Austria, and will be mandatory everywhere next year. “We are at a very delicate phase when Europe’s banking system switches from a bail-out regime into a much tougher bail-in regime, and Austria has just thrown this into sharp relief,” said sovereign bond strategist Nicholas Spiro. The biggest bondholders are Deutsche Bank’s DWS Investment, Pimco, Kepler-Fonds and BlackRock. The World Bank also owns €150bn of Hypo debt.

Austria’s banking regulators surprised markets by intervening over the weekend to wind down Heta and suspend debt payments until 2016 after discovering a further shortfall in capital of €7.6bn. The surge in the Swiss franc in January after the collapse of Switzerland’s currency floor against the euro appears to have been the last straw, setting off another wave of likely losses from eastern European mortgages denominated in francs. “This is getting bigger and bigger,” said Marc Ostwald from Monument. “They kept kicking the can down the road but it is finally catching up with them, and Heta won’t be the last. There is a whiff of the Irish situation in this story. Carinthia stood as guarantor for debts that it could not possibly cover,” he said. There are many regions that could slide into difficulties, including Belgium’s Wallonia, or the Italian region of Sicily.

Of course it should. Everyone should.

• Shelby Says Fed Should Be Held Accountable for Its Actions (Bloomberg)

Richard Shelby, the Alabama Republican who heads the Senate Banking Committee, said lawmakers should consider ways to overhaul the Federal Reserve’s structure and tighten oversight by Congress. “We will further explore options to improve the oversight and structure of the Fed,” Shelby said Tuesday in prepared remarks at a hearing. Arguing the Fed has failed to explain the impact of its extraordinary monetary policies, he said it should “be held accountable for its actions.” Sherrod Brown of Ohio, the committee’s senior Democrat, said the group should focus on the Fed’s governance, not monetary policy. “Rather than attempting to interfere in, or even dictate, monetary policy, Congress should focus on whether the Federal Reserve is protecting consumers, ensuring safety and soundness, and strengthening the financial stability of our economy,” he said.

The Fed is under pressure from both parties in Congress to be more transparent and accountable. Republicans are unhappy with its aggressive monetary policy and some of the regulatory powers it has gained since the financial crisis. Democrats have criticized the New York Fed for being too close to the big Wall Street banks that it oversees. “Federal Reserve officials have stressed the importance of the Fed’s independence,” Shelby said in prepared remarks. “But, such independence does not mean that it is immune from congressional oversight.” Shelby said last week at Bloomberg TV that he’s looking “very strongly” at a proposal from Dallas Fed President Richard Fisher to strip the New York Fed of its permanent vote on the Federal Open Market Committee in favor of an equal vote rotation among all 12 regional reserve banks.

Sure.

• Yellen Says Fed Seeks to Avert ‘Capture’ by Banks It Oversees (Bloomberg)

Fed Chair Janet Yellen, countering criticism from members of Congress, said the central bank is trying to avoid being too cozy with the Wall Street firms it supervises and wants to ensure that regulators aren’t afraid to confront the financial industry. “The risk of regulatory capture is something the Federal Reserve takes very seriously and works very hard to prevent,” Yellen said in remarks prepared for a speech in New York on Tuesday night. “It is important that anyone serving the Fed feel safe speaking up when they have concerns about bias toward industry, and that those concerns be addressed.” The Fed has been criticized by Democratic lawmakers, including Senator Elizabeth Warren, who say it’s deferential to large banks. The issue was the subject of a Senate hearing in November following allegations by Carmen Segarra, a former examiner at the Fed of New York, who said her colleagues had been too soft on Goldman Sachs.

At the hearing, Warren told New York Fed President William C. Dudley that he needs to fix a “cultural problem” or “we need to get someone who will.” The Fed has also come under fire from Republicans, including Richard Shelby of Alabama, the Senate Banking Committee chairman, who called for more Fed transparency and greater congressional oversight at a hearing Tuesday. Yellen, in her speech to the Citizens Budget Commission, also took aim at ethical lapses at large banks supervised by the Fed. “We expect the firms we oversee to follow the law and to operate in an ethical manner,” she said. “Too often in recent years, bankers at large institutions have not done so, sometimes brazenly.” Such incidents “raise legitimate questions of whether there may be pervasive shortcomings in the values of large financial firms that might undermine their safety and soundness,” she said.

Pensions and low rates. A poisonous combination.

• Draghi’s Rescue Plan Has Created a $103 Billion Problem (Bloomberg)

There’s a corner of the pension world that needs to brace itself for Mario Draghi. His ECB’s €1.1 trillion bond-buying plan might have already blown a €92 billion hole in defined-benefit pension plans by depressing bond yields, Standard & Poor’s said Feb. 26. And if the actual start of QE pushes yields further, for longer, companies may have to take drastic measures to make ends meet, and could face a hit to their credit ratings. The ECB is expected to announce further details of its asset-purchase program after it meets in Cyprus Thursday. S&P estimates that the anticipation of quantitative easing in Europe squashed bond yields so much that the liabilities of defined-benefit pension plans rose by up to 18% last year.

Its analysis looked at the top 50 European companies it rates that have defined-benefit pension plans and are “materially underfunded,” meaning, the plans have deficits of more than 10% of adjusted debt, and that debt is more than 1 billion euros. In 2013, liabilities outstripped obligations for that group by more than 30% on average. “The challenge for companies in coming years will be how to rein in plan deficits in the new post-QE low interest-rate environment in Europe,” Paul Watters, credit analyst at S&P, said in a statement. “This will become a more material credit consideration where defined-benefit plan deficits are significant.”

Among the measures S&P says companies may have to take to adjust to this new low-yield world are freezes on pensionable salaries, raising the retirement age, and closing plans to new or even to existing members.vAnd that’s not the end of it. A potential cocktail of low bond yields, sluggish growth and faster inflation, which could result if QE fails to kickstart activity, could push those deficits out a further 10-15%. “The risk remains that QE achieves nothing more than promoting stagflation in the euro area,” Watters said. “A combination of weak growth, inducing the ECB to continue with its aggressive monetary-policy stance, and rising inflation would be a treacherous combination for DB-pension schemes already struggling to contain their plan deficits.”

” I realized I could afford to pay my children’s university expenses or my loan. I chose my kids and no one can blame me.”

• ECB Glimpse of Cyprus Debt Mountain Shows Limits of Bank Cleanup (Bloomberg)

There was a time when a Cypriot on a moderate income could take a gamble on foreign real-estate worth more than his life savings. One banking crash, three and a half years of recession and an international bailout later, 58-year-old Stelios Charalambous is among the Mediterranean island nation’s many debtors who realize that time has passed. “I took a €70,000 loan six years ago from a cooperative bank in the days when no one asked you many questions, and I bought six plots of land in Romania,” the Nicosia-based chiropractor said in an interview. “Now I’m earning half what I was and no one wants to buy my Romanian land. I realized I could afford to pay my children’s university expenses or my loan. I chose my kids and no one can blame me.”

The ECB, which holds a policy meeting in the euro area’s easternmost capital on Thursday, cares about such cases as they add up to almost €900 billion of soured credit in the region and hobble lenders’ ability to serve the economy. Yet Cyprus, where non-performing exposures account for more than half the country’s loan-book, also shows how politics can get in the way of a cleanup. The nation made euro-era history in March 2013 when it imposed capital controls for the first, and so far only, time in the single currency’s existence. The measures came alongside a €10 billion rescue led by the euro area, the merger of the country’s two largest lenders, and the seizure of almost half the savings of some 21,000 customers.

The crisis gave birth to a new class of individuals and small businesses that could not, or would not, service their debt, turning Cyprus into the country with the highest bad-debt ratio in the currency bloc. That meant banks had to tie up large chunks of their capital in loss provisions instead of making fresh loans to companies and households. To relieve the blockage, a new foreclosure law enabling banks to seize property from defaulters was introduced in 2014, only to be held up repeatedly by opposition politicians nervous of the impact on businesses and families. Implementation – and the disbursement of further bailout funding which is contingent on the law – is still pending. The economic slump and legal uncertainty created a “perfect storm” for the banks, Euan Hamilton at Bank of Cyprus said.

“Never before have speculators been gifted with such stupendous, easily harvested windfalls. And these adjectives are not excessive.”

• $2 Trillion Euro Government Bonds Trading At Negative Yield (David Stockman)

That investors anywhere in this age of fiscal profligacy would pay to own the notes and bonds of sovereign states is a testament to the financial deformations of modern central banking. But the fact that nearly $2 trillion of debt issued by European governments is currently trading at negative yields——now that’s a flat-out derangement. After all, the aging, sclerotic economies of the EU have been making a bee line toward fiscal insolvency for most of the last decade. So it goes without saying that this giant agglomeration of pay-to-own government debt is not reflective of an outbreak of fiscal rectitude or any other rational economic development.

It’s purely an artificial trading result stemming from central bank destruction of every semblance of honest price discovery. In this case, the impending ECB purchase of $70 billion of government debt and other securities per month for the next two years has transformed the financial casinos of Europe and elsewhere into a front runner’s paradise. As today’s Bloomberg piece tracking Europe’s $2 trillion of exuberant irrationality makes clear, sovereign bond prices are soaring because traders are accumulating, not selling, in anticipation of the ECB’s big fat bid hitting the market in the weeks ahead:

“It is something that many would not have pictured a year ago,” said Jan von Gerich at Nordea Bank in Helsinki. “It sounds very awkward in a sense, but if you look at it more, the central bank has a deposit rate in negative territory, and there’s a huge bond-buying program coming. People are holding on to these bonds and so you don’t have many willing sellers.”

Needless to say, this is the opposite of at-risk price discovery; it amounts to shooting fish in a barrel. Never before have speculators been gifted with such stupendous, easily harvested windfalls. And these adjectives are not excessive. The hedge fund buyers who came to the game early after Draghi’s “anything it takes”ukase have enjoyed massive price appreciation, but have needed to post only tiny slivers of their own capital, financing the balance at essentially zero cost in the repo and other wholesale funding venues. Indeed, the more risk, the bigger the windfall. German yields have now been driven below the zero bound on all maturities through seven years, emboldening speculators to move out on the risk curve. So doing, they have gorged on peripheral nation debt and have been generously rewarded. In the case of the 10-year bond of Ireland – a state which was on the edge of bankruptcy only a few years ago – leveraged speculator gains are now deep into three figures.

“March is sorted.”

• Greece Taps Public Sector Cash To Help Cover March Needs (Reuters)

Greece is tapping into the cash reserves of pension funds and public sector entities through repo transactions as it scrambles to cover its funding needs this month, debt officials told Reuters on Tuesday. Shut out of debt markets and with aid from lenders frozen, Athens is in danger of running out of cash in the coming weeks as it faces a €1.5 billion loan repayment to the IMF this month. The government has sought to calm fears and says it will be able to make the IMF payment and others, but not said how. At least part of the state’s cash needs for the month will be met by repo transactions in which pension funds and other state entities sitting on cash lend the money to the country’s debt agency through a short-term repurchase agreement for up to 15 days, debt agency officials told Reuters. However, one government official said they could not be used to repay the IMF unless Athens was able to repay the state entities the cash it borrowed from them.

Debt officials sought to play the repos as advantageous for both sides, arguing that the funds get a better return on their cash than what is available in the interbank market. “It is not something new, it’s a tactic that started more than a year ago and is a win-win solution. It’s a proposal, we are not twisting anyone’s arm,” one official said. In such repo transactions, a pension fund or government entity parks cash it does not immediately need at an account at the Bank of Greece, which becomes the counterparty in the deal with the debt agency. The money is lent to the debt agency for one to 15 days against collateral – mostly Greek treasury paper held in its portfolio – and is paid back with interest at expiry. The lender can always opt to roll over the repurchase agreement and continue to earn a higher return than what is available in the interbank market.

One source familiar with the matter has previously said Athens could raise up to €3 billion through such repos, but that it was not clear how much of that had already been used up by the government. “There is a sum that has already been raised this way,” the debt official said without disclosing specific numbers. Athens – which has monthly needs of about €4.5 billion including a wage and pension bill of €1.5 billion – is running out of options to fund itself despite striking a deal with the euro zone to extend its bailout by four months. Faced with a steep fall in revenues, it is expected to run out of cash by the end of March, possibly sooner, though the government is trying to assure creditors it will not default. “We are confident that the repayments will be made in full, particularly to the IMF, and there will be liquidity to get us through the end of the four-month period,” Finance Minister Yanis Varoufakis said on Greek TV on Monday. “March is sorted.”

Of course not. Only the north can, at the cost of the south.

• Can Greece Really Thrive Inside the Euro? (George Magnus)

After a lot of hubbub, in the end the Greek government submitted a list of policy proposals that elicited a positive response from Brussels, judging them to be “sufficiently comprehensive” to permit the four-month extension of the existing loan arrangements until June. The responses from the IMF and the ECB were rather more circumspect, indicating strongly that the next four months of negotiations to determine Greece’s relationship with the Eurosystem will be tough and most probably tense. The IMF noted that the Greek government’s “policy parameters” didn’t go far or weren’t detailed enough, especially about VAT and pension reforms, privatizations and policies to open up closed sectors, including the labor market. The ECB urged the Greek authorities to act swiftly to “stabilize the payments culture and refrain from any unilateral action to the contrary.”

This is believed to refer to matters such as Greek regulations on mortgage foreclosures and to tax and payments arrears in public policy. The “deal” between Greece and its Eurogroup partners has been widely welcomed, and spun according to what people thought would or should happen. I think that the current “deal” is just Act I in a play with an unpredictable, but very likely bad, ending — where “bad” equals Euro system fragmentation, or Grexit, if you prefer. (Or the even tonier “Grexident.”) I think it’s fair to say that however people judge the deal and what they think is good or positive about it from Greece’s point of view is really about one thing only: relief that the integrity of the Eurosystem has been preserved. That is some achievement, given that it looked as though it might not happen. Now, the hope (rather than conviction) prevails that the upcoming negotiations will see a realignment of interests and trust between Greece and its creditors.

Well, who wouldn’t wish for such an outcome? The problem though, as I see it, is that the economic and social policy agenda on which Syriza scored such a stunning electoral victory is entirely appropriate for Greece, but wholly incompatible with a Eurosystem that I call colloquially, Teutonia. While Teutonia normally refers to the geography of Germany or parts of Northern Europe, I use it to connote a German culture in economics and finance. In Teutonia, Germany doesn’t always win all the arguments, nor does it or can it impose a policy agenda by diktat. But in the absence of political and fiscal union – of which none of the major countries is in favor – the terms of the (narrow) monetary union will always reflect largely the interests of Germany and a relatively orthodox financial establishment viscerally opposed to the establishment of a genuine transfer, joint liability union.

“Given the overriding political resolve to keep Greece in the eurozone, above all because the precarious geopolitics of southeast Europe, some form of compromise is likely here, too.”

• ECB Will Need More Creative Accounting To Deal With Greece (MarketWatch)

The ECB faces pressure to carry out a new feat of creative accounting to meet Greek Finance Minister Yanis Varoufakis’s request for renegotiation of €6.7 billion in ECB bonds due to mature in July and August. In a round of interviews, Varoufakis has pledged that his country will make repaying its debts to the IMF its main priority. About €2 billion needs to be repaid to the Fund this month. But the Greek minister has drawn a strong distinction with the ECB, making it likely that the central bank may have to bring in further conditionality into its traditional insistence that it should always be treated as a preferred creditor on a par with the IMF.

Leading European politicians have long claimed that the ECB will have to show flexibility in rolling over some of the total of €30 billion in Greek bonds it still holds in its portfolio, resulting from its efforts started in 2010 to prop up weaker members of the euro. Further bruising tussles between Greece and its creditor look inevitable in view of the deliberate ambiguity the Greek government built into the provisional agreement with creditors clinched last month after several finance minister sessions in Brussels. Speaking in Berlin on Monday, German Chancellor Angela Merkel said Greece would have to make its reform proposals more specific and agree to the program with the “three institutions” (formerly called “the troika”) of the European Commission, the ECB and the IMF.

Similarly, Jeroen Dijsselbloem, the Dutch finance minister who heads the euro finance ministers’ group, says Greece must immediately start adopting the creditors’ list of reforms, as a condition for gaining access to emergency funds needed to meet March cash deadlines. There is little doubt that, provided Europe’s main capitals give political backing to the still-ambivalent Greek reform approach, the ECB will bend to the politicians’ will — even though it will face further charges of a watering down of its constitutional independence. The Greek government is calling for concessions such as the lifting of a €15 billion ceiling on the issue of short-term treasury bills. Given the overriding political resolve to keep Greece in the eurozone, above all because the precarious geopolitics of southeast Europe, some form of compromise is likely here, too.

“Greece’s economy minister vowed to cancel the Piraeus deal and pursue sweeping changes to the terms of already completed sales. Defending his government’s stance, Yanis Varoufakis claims there is enough “creative ambiguity” in the text submitted to Brussels to provide enough wiggle room for Syriza to re-open the question of the sale of Piraeus and Greece’s airports..”

• Greece vs Europe: Who Blinked First In The Bail-out Battle? (Telegraph)

The Greek parliament will not be voting on the country’s bail-out extension. Following internal turmoil among the ruling Syriza party over the terms of the reprieve, the Greek legislature will only be given the chance to “debate”, rather than officially ratify, the four-month extension. In an ironic twist of the EU’s democratic procedures, Greece’s 18 fellow eurozone parliaments will still need to rubber-stamp the deal. The move has prompted some to ask whether this represents Syriza’s “worst capitulation” in an already protracted and strained series of negotiations with its international creditors. Last week, Athens drew up a series of reforms in return for the remaining €7.2bn it needs to complete its bail-out programme.

At the time, finance minister Yanis Varoufakis insisted the country had become the “co-author of its own destiny” rather than the subject of EU diktats. But dissent among Syriza’s more Leftist elements started bubbling from the onset. Syriza MP and London-based academic Costas Lapavitsas has dismissed the deal as one agreed under “economic duress”. The nascent anti-austerity government now faces a four-week race to draft legislation and pass the laws that will see it come good on its promises. Only then will Greece’s creditors decide whether or not to disburse the vital cash the country needs to say afloat until June. But what exactly has Athens signed up for and could domestic political wranglings now put a brake on the country’s bid to avert bankruptcy?

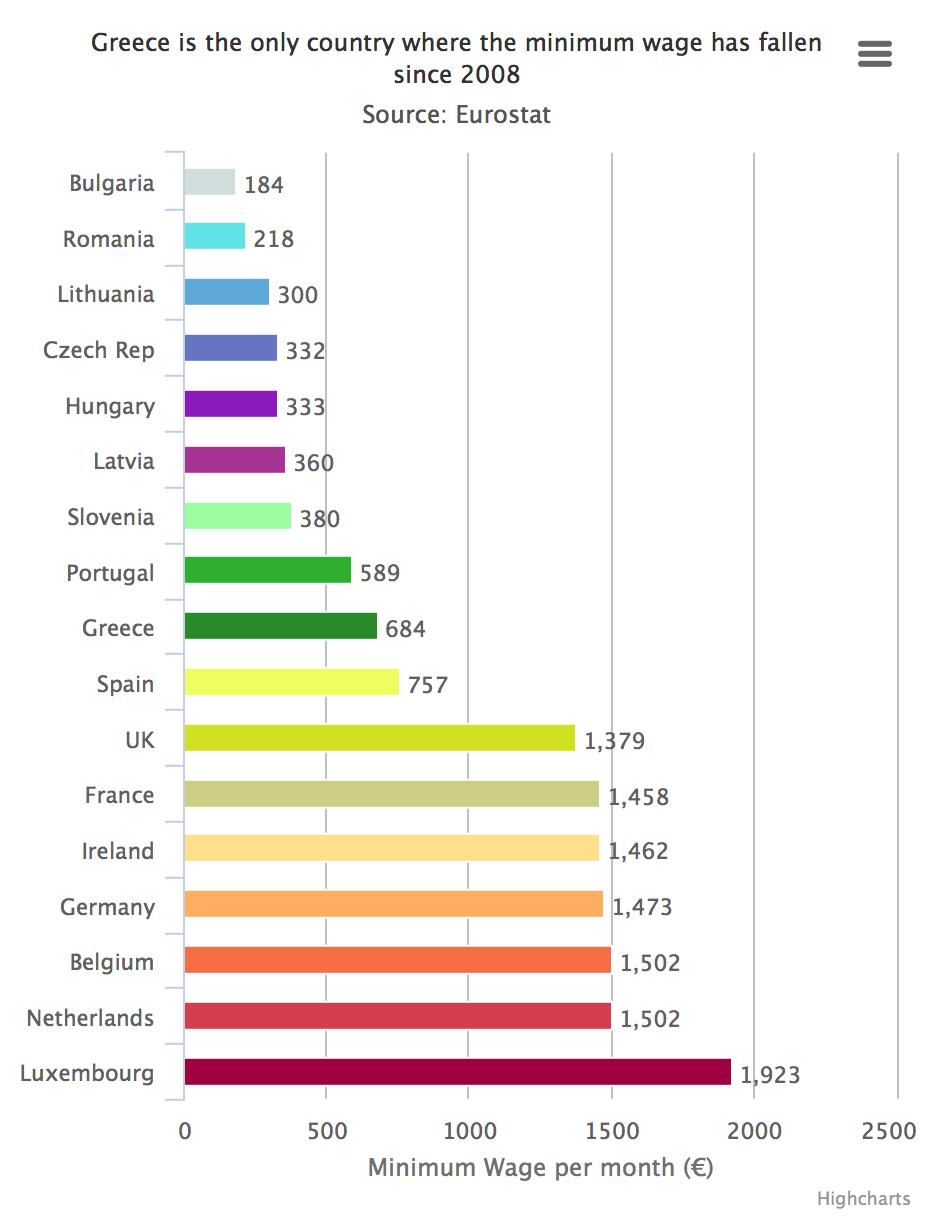

One of the cornerstones of Syriza’s plans to end Greece’s “ritual humiliation” has been an increase in the country’s minimum wage. In a vociferous speech to his parliament last month, Prime Minister Alexis Tsipras repeated his promise to raise the minimum wage by around 10pc to €750-a-month. Of the 22 EU member states with a national minimum wage, Greece is the only country that has seen its fall since the financial crisis. The country’s nominal gross wage is now 14pc lower compared to 2008, as Greece has undergone a progressive reduction in its labour costs in a bid to restore competitiveness in the stricken economy. The current €684-a-month puts Greece between its Iberian counterparts, both of whom have seen a steady rise in their mandated wage floors over the last seven years: Spain’s minimum wage has risen 8pc, while Portugal’s has gone up by 19pc.

If they refuse the proposals, Syriza may throw the towel.

• Athens Preparing Reform Proposals For Eurogroup (Kathimerini)

A collection of reform proposals are being put together by the government so Finance Minister Yanis Varoufakis can present them at Monday’s Eurogroup, with Athens hoping that this will help it secure part of the remaining €7.2 billion in bailout installments. Government sources said on Tuesday night that the six proposals Varoufakis is due to present will be measures to tackle the humanitarian crisis, administrative reform, a new scheme to settle overdue debts to the state, changes to tax collection, the creation of a fiscal council (a nonpartisan body to monitor and advise on fiscal policy) and the setting up of a new body for targeted tax inspections. The measures are due to be put forward at the Euro Working Group on Wednesday or Thursday but the Greek government is hoping that eurozone finance ministers will deem the proposals enough to pave the way for the release of some funding to Athens within March.

Varoufakis is also likely to be prepared to discuss with his counterparts what privatizations the government is willing to carry out. The finance minister said in an interview on Star TV on Monday night that he is in favor of further private investment at Piraeus port and in the Greek railway network. State Minister Alekos Flambouraris said on Tuesday that the coalition would not consider selling the country’s water or electricity firms. The preparation for Monday’s Eurogroup has led to the government making changes to some of the legislation it had planned. For instance, the provision for giving debtors a haircut on the principal they owe to the state has been removed from the legislation introducing a new payment plan for overdue taxes and social security contributions.

There is even a possibility that the dreaded ENFIA property tax will remain for another year, albeit reduced by 15 to 20%. The government wants to replace it with a levy on large property but will need to ensure it can raise revenues of €2.6 billion to do so. A new formula has not been found yet. The coalition has, however, finalized the legislation aimed at tackling the social impact of the crisis. The bill foresees households in “extreme poverty” receiving free electricity for a year. This is estimated to affect 150,000 families. The draft law also provides a rent subsidy of between €70 and €220 per month for up to 30,000 households. Furthermore, food coupons will be provided to up to 170,000 families. The total cost of these interventions is estimated at €200 million.

This is going to hurt. A lot.

• Oil at $95 a Barrel Discovered in SEC Rules on Reserves (Bloomberg)

There’s one place in the world where oil is still $95 a barrel. On paper. The US Securities and Exchange Commission requires drillers to calculate the value of their oil reserves every year using average prices from the first trading days in each of the previous 12 months. Because oil didn’t start its freefall to about $45 till after the OPEC meeting in late November, companies in their latest regulatory filings used $95 a barrel to figure out how much oil they could profitably produce and what it’s worth. Of the 12 days that went into the fourth-quarter average, crude was above $90 a barrel on 10 of them. So Continental Resources reported last month that the present value of its oil and gas operations increased 13% last year to $22.8 billion. For Devon, a pioneer of hydraulic fracturing, it jumped 31% to $27.9 billion.

This year tells a different story. The average price on the first trading days of January, February and March was $51.28 a barrel. That means a lot of pain – and writedowns – are in store when drillers’ first-quarter numbers are announced in April and May. “It has postponed the reckoning,” said Julie Hilt Hannink at New York-based CFRA, an accounting adviser. Companies use the first-trading-day-of-every-month calculation to estimate future cash flow and to tally how much crude can be profitably pumped out of the ground. The SEC introduced the formula in 2009 as part of wider changes in how the regulator required drillers to report reserves. Prior to the shift, the value of the reserves was measured based on the oil price on the last day of the year, which also caused distortions. There are no current plans to revisit or modify SEC reporting rules, Erin Stattel, an SEC spokeswoman, said.

Most shale drillers are reporting increases in what’s known as proved reserves. The SEC requires oil producers to submit an annual tally, along with an estimate of the present value of the future cash flow from those properties. The estimates are limited to what the firm is reasonably certain it can extract from existing wells and prospects scheduled to be drilled within five years. The reports are based on factors such as geology, engineering, historical production – and price. To count as proved, the resources must be economic to develop given existing market conditions. “What the SEC requires isn’t thorough enough to get to the numbers investors really want,” said Mike Kelly with Global Hunter Securities. “What is the true cost of producing a barrel of oil? And what is the real value of the assets?” A similar pricing formula helps determine whether some companies need to write off their oil and gas properties.

Keep going.

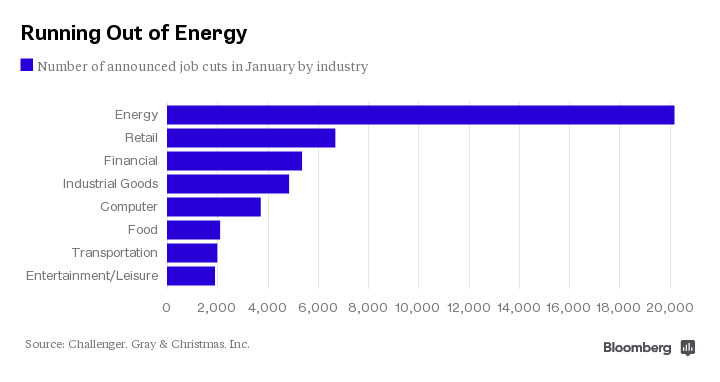

• The Latest Sign the Oil-Price Plunge Is Hitting the Job Market (Bloomberg)

As investors prepare for the release of the February U.S. employment data on Friday, we’re getting more inklings of how the shakeout in the oil industry will impact the jobs market, and it doesn’t look great: Demand for workers in energy-related occupations is plunging. Online help-wanted ads for jobs involved in the extraction of oil and gas – derrick operators, wellhead pumpers, roustabouts and the like – declined 42% in the two months through January as oil prices cratered, according to data compiled by the Conference Board and Wanted Technologies.

Occupations in the industry that have higher education requirements, such as petroleum engineers, geoscientists and technicians, also saw demand for their services collapse, with ads dropping 38%, Gad Levanon and his fellow researchers at the Conference Board wrote on their blog this week. The downbeat message from the online ad postings echoes that of a report last month by global outplacement firm Challenger, Gray & Christmas, which showed that 38% of announced job cuts in January were in the energy industry. As we noted last month, employment in oil and gas extraction and related supply industries doubled over the last decade, reaching some 523,500 workers. If the Conference Board and Challenger data are anything to go by, that trend is likely to reverse big-time this year.

Nice graphics.

• Wall Street Has Its Eyes on Millennials’ $30 Trillion Inheritance (Bloomberg)

There have been any number of pieces written about how the millennial generation is consciously refusing to do things that preceding generations thought were perfectly reasonable, such as playing golf or investing in the stock market or even doing a SINGLE NICE THING for someone else! This seems to have caused some consternation on Wall Street, where the powers-that-be would obviously like to see millennials do at least one nice thing for them: hand over all their money. But have no fear, because Wall Street is ON IT! Financial firms are working hard to solve the Rubik’s Cube (err, sorry the 2048) that is the Gen Y zeitgeist, if recent reports from Federated Investors and Goldman Sachs are any indication. Based on the research, here are the highlights of what you need to know about this enigmatic generation: They like skinny ties and skinny jeans and, based on the way these firms are presenting these findings, they seem to only be reachable through cartoon-like graphics and animation.

“If Japan can’t get its finances under control, people are going to start questioning what exactly the difference between Japan and Greece is.”

• Japan Public Debt Keeps BNP Chief Credit Analyst Awake at Night (Bloomberg)

For most of her career, Mana Nakazora has taken a pre-dawn train to work regardless of whether she arrived home just hours earlier. Her colleagues describe BNP Paribas’s Tokyo head of investment research as a powerhouse, and she was Japan’s No. 1 bond picker from 2010 to 2012 and No. 2 for the last two years in Nikkei Veritas newspaper polls. Making it to the top in an industry whose corporate bond sales exceeded $70 billion last year can be tough. “I usually get home on average at about midnight, sometimes it can be 2 a.m.,” Nakazora said in an interview at BNP’s Tokyo offices on the 42nd floor overlooking the nation’s parliament and Imperial Palace. “I get up at 5 a.m., so I don’t sleep much. It has been like that forever.”

One thing keeping her up – analysis of Japan’s public debt, which is expected to climb to 1.06 quadrillion yen ($8.85 trillion) at the end of March. With a population that’s been shrinking for the past six years and annual debt servicing costs that are bigger than New Zealand’s gross domestic product, the world’s third-largest economy is quite simply running out of people who can pick up the tab. “Maybe there’s no point in throwing stones at this huge rock, but if you keep hurling just maybe you can open up a crack,” said Nakazora, who also sits on two government panels including the finance ministry’s fiscal system council that advises on budgetary rectitude. “If Japan can’t get its finances under control, people are going to start questioning what exactly the difference between Japan and Greece is.”

With unprecedented central bank stimulus compressing debt yields, Nakazora said she likes SoftBank’s bonds, which offer investors more than five times the average spread Japanese notes pay. She also recommends the debt of TEPCO, operator of the tsunami-hit Fukushima power plant, but is no longer a fan of Sony debentures because the jury’s still out on whether the electronics maker can revive its fortunes. Nakazora also doesn’t favor the delay in Japan’s sales tax increase. Prime Minister Shinzo Abe in November postponed raising the levy to 10% by 18 months after an increase to 8% from 5% in April plunged the economy into a recession. Japan’s debt will rise to the equivalent of 246% of GDP this year, one of the highest ratios in the world, the IMF forecasts.

That’s what the US is waiting for.

• Ukraine Looks Ready To Default (MarketWatch)

The conflict in the Ukraine is relevant to global investors as it directly affects security in Europe, which is the home of an economy the size of the U.S. The trade bans due to conflict-driven sanctions involve many countries and add to the European deflation at present. Those trade bans might get wider should the conflict intensify based on the realization that a political solution would not give the rebels and their Russian backers what they want — enough autonomy to keep Ukraine out of the EU and NATO. I do not follow this conflict to determine who is right or wrong but to gauge how it affects financial markets.

Most of my conclusions may seem relevant only to institutional investors that deal in currencies, sovereign bonds, credit-default swaps (CDSs), and the energy markets, but I do believe those geopolitical developments affect quite a few individual investors, even those in the U.S. Last week the Ukrainian truce barely took hold when fighting over the strategic Ukrainian town of Debaltseve, which controls rail lines linking Luhansk and Donetsk, threatened to unravel the ceasefire agreement. The rebels decided to take the town “no matter what,” as a prolonged truce made it necessary for them to control logistics in their territory. It has been clear for a long time that Ukraine is a divided country where half the population supports the rebels and the other half supports the government in Kiev — as demonstrated by this map of the 2010 election, which brought Yanukovych to power.

This map also suggests this conflict can quickly carry all the way to Odessa, which Russian ruler Catherine the Great (1729-1796) turned into a key trading hub for the Russian Empire. There is also an unhappy minority of Russians in a strip of Moldova adjacent to Ukraine, where Russian peacekeepers have been stationed for years. It is entirely possible they see this conflict as the opportunity to resolve their situation once and for all. Perhaps because of all of the above considerations, Ukrainian government bonds are at all-time lows. When such a bear market in credit gets to prices like 44 cents on the dollar, this is the bond market saying that Ukraine will likely default.

Done deal.

• Ukraine Raises Interest Rates To 30% (BBC)

Ukraine’s central bank has sharply raised interest rates from 19.5% to 30% in an effort to curb inflation and prop up its beleaguered currency. The new benchmark refinancing rate takes effect on Wednesday. It comes as the government in Kiev is seeking a $17.5bn assistance programme from the IMF. Inflation is expected to hit at least 26% this year and the hryvnia has tumbled against the dollar. The currency has lost 80% of its value since last April, when pro-Russian separatists took up arms in the country’s eastern Donetsk and Luhansk regions, a month after Russia annexed Ukraine’s southern Crimea peninsula. Last week, the hryvnia hit a record low of 33.75 to the dollar before recovering some ground.

The conflict has taken its toll on Ukraine’s economy, which is forecast to shrink by 5.5% in 2015. The interest rate increase is the second in two months, after the central bank raised the rate from 14% in February. On Monday night, Ukraine’s parliament approved a package of reforms that could determine whether it will avoid economic meltdown in the coming weeks. They include changes to the tax and energy laws and the government’s budget. The passing of the reform package was a condition for the IMF rescue package. The IMF’s executive board will meet on 11 March, when it will make its decision. If it says yes, the first tranche of some $5bn will become available within days.

Not a single doubt.

• Financial Collapse Leads To War (Dmitry Orlov)

Scanning the headlines in the western mainstream press, and then peering behind the one-way mirror to compare that to the actual goings-on, one can’t but get the impression that America’s propagandists, and all those who follow in their wake, are struggling with all their might to concoct rationales for military action of one sort or another, be it supplying weapons to the largely defunct Ukrainian military, or staging parades of US military hardware and troops in the almost completely Russian town of Narva, in Estonia, a few hundred meters away from the Russian border, or putting US “advisers” in harm’s way in parts of Iraq mostly controlled by Islamic militants. The strenuous efforts to whip up Cold War-like hysteria in the face of an otherwise preoccupied and essentially passive Russia seems out of all proportion to the actual military threat Russia poses. (Yes, volunteers and ammo do filter into Ukraine across the Russian border, but that’s about it.)

Further south, the efforts to topple the government of Syria by aiding and arming Islamist radicals seem to be backfiring nicely. But that’s the pattern, isn’t it? What US military involvement in recent memory hasn’t resulted in a fiasco? Maybe failure is not just an option, but more of a requirement? Let’s review. Afghanistan, after the longest military campaign in US history, is being handed back to the Taliban. Iraq no longer exists as a sovereign nation, but has fractured into three pieces, one of them controlled by radical Islamists. Egypt has been democratically reformed into a military dictatorship. Libya is a defunct state in the middle of a civil war. The Ukraine will soon be in a similar state; it has been reduced to pauper status in record time—less than a year. A recent government overthrow has caused Yemen to stop being US-friendly.

Closer to home, things are going so well in the US-dominated Central American countries of Guatemala, Honduras and El Salvador that they have produced a flood of refugees, all trying to get into the US in the hopes of finding any sort of sanctuary. Looking at this broad landscape of failure, there are two ways to interpret it. One is that the US officialdom is the most incompetent one imaginable, and can’t ever get anything right. But another is that they do not succeed for a distinctly different reason: they don’t succeed because results don’t matter. You see, if failure were a problem, then there would be some sort of pressure coming from somewhere or other within the establishment, and that pressure to succeed might sporadically give rise to improved performance, leading to at least a few instances of success.

But if in fact failure is no problem at all, and if instead there was some sort of pressure to fail, then we would see exactly what we do see. In fact, a point can be made that it is the limited scope of failure that is the problem. This would explain the recent saber-rattling in the direction of Russia, accusing it of imperial ambitions (Russia is not interested in territorial gains), demonizing Vladimir Putin (who is effective and popular) and behaving provocatively along Russia’s various borders (leaving Russia vaguely insulted but generally unconcerned).

The level of absurdity is stunning.

• NATO Rolls Out ‘Russian Threat’ In Budget Battle (RT)

NATO member-states unwilling or unable to help boost the military spending are being accused of ignoring the “Russian threat,” that has re-emerged as the core of the alliance’s agenda to boost arms sales. A report saying one of major NATO funding contributors, the UK, could fail to fulfil the commitment to spend 2% of its GDP on the alliance in 2015 came as a bombshell for some of the West’s military elite. The head of the US army, General Raymond Odierno, told the Telegraph he was “very concerned” about Britain’s possible defense cuts. “[Odierno] warned that, while the US was willing to provide leadership in tackling future threats, such as Russia and ISIL [the Islamic State, aka IS or ISIS], it was essential that allies such as Britain played their part,” the British daily wrote.

Former MI6 chief, Sir John Sawers, called for a rise in defense spending, also mentioning the “threat” coming out of Russia “not necessarily directly to the UK, but to countries around its periphery.” “The level of threat posed by Moscow has increased and we have to be prepared to take the defensive measures necessary to defend ourselves, defend our allies – which now extend as far as the Baltic States and Central Europe,” Sawers said, according to the Guardian. In turn, Moscow said it will take all “necessary measures” including military, technical and political to neutralize a possible threat from NATO presence in Eastern Europe, Russia’s ambassador to NATO, Aleksandr Grushko, told the Rossiya 24 TV channel on Monday. He added NATO’s actions “significantly impair regional and European security, and pose risks to our security.”

Grushko said NATO has intensified its military drills in Eastern Europe, with about 200 exercises in its eastern member states, mostly in the Baltic and Black seas, Poland and Baltic states. Russia’s Defense Ministry has consistently denied all reports of its personnel or hardware being involved in the conflict in eastern Ukraine, calling NATO’s allegations “groundless.” Among “proof” of the “Russian aggression” there have been fake photos of the Russian tanks, which eventually turned out to have been taken in a different place at a different time, a supposed Russian airplane in British airspace, that turned out to be Latvian, and mysterious “Russian submarines” in Swedish waters – which never were found. “Demonizing” Russia plays well into the hands of the military, believes former NATO intelligence analyst, Lt Cdr Martin Packard.

On their way to your dinner plate.

• Massive Swarms of Jellyfish Wreak Havoc on Fish Farms, Power Plants (Bloomberg)

As the oceans get warmer, jellyfish are causing pain beyond their sting. The marine animals have shut power plants from Sweden to the U.S. while killing thousands of farmed fish in pens held off the U.K. coast. GPS devices normally used to track the behavior of house cats were attached to 18 barrel-jellyfish off the coast of northern France. The study upended previous assumptions about their movement. Climate change may be one reason more jellyfish are congregating in large numbers known as blooms, which can encompass millions of the creatures over tens of kilometers.

Researchers are seeking to develop a system, akin to weather forecasting, to help predict their movement and prevent fish deaths, such as the loss of 300,000 salmon off Scotland last year, or power outages that shut a Swedish nuclear plant in 2013. “Jellyfish blooms may be increasing as a result of climate change and overfishing,” Graeme Hays, the leader of the group from Deakin University in Australia and Swansea University in the U.K. that did the research, said by phone Jan. 28. “They have a lot of negative impacts – clogging power station intakes, stinging people and killing fish in farms.” The study was conducted in 2011 with results published online in January by the journal Current Biology.

Hays plans to replicate the work in Tasmania, Australia, where salmon farming is an industry valued at about A$550 million ($430 million) a year. Combined land and ocean surface temperatures have warmed 0.85 of a degree Celsius since 1880, according to the IPCC. Global warming is “unequivocal” and many observed changes since the 1950s are “unprecedented over decades to millennia,” it said in a 2014 report. “Warmer water is a dream come true for jellyfish,” Lisa-ann Gershwin, a marine scientist who has studied the creatures for about 25 years and author of Stung!: On Jellyfish Blooms and the Future of the Ocean, said by phone Feb. 4. “It amps up their metabolism so they grow faster, eat more, breed more and live longer.”