William Henry Jackson Saltair Pavilion, Great Salt Lake 1900

Timebomb: who’s going to want to buy anything EU anymore? “..the first test of the EU’s Bank Recovery and Resolution Directive, which takes full effect across the bloc next year..”

• Heta Senior Bonds Plunge as Austria Cuts Off Aid to Bad Bank (Bloomberg)

Senior bonds of Heta Asset Resolution tumbled to record lows after Austria said it won’t pump more money into the “bad bank,” the first test of European legislation designed to ensure investors pay for bank failures. Austria’s decision to cut funding to the vehicle that’s winding down assets of the failed Hypo Alpe-Adria-Bank International AG is the first test of the EU’s Bank Recovery and Resolution Directive, which takes full effect across the bloc next year. The rules, which Austria implemented earlier than most EU member states, give regulators the power to impose losses on both shareholders and creditors in the event of a bank collapse. The EU enacted the bank-resolution law last year in a bid to end taxpayer bailouts that prevailed in the financial crisis.

The bloc granted €661 billion for recapitalization and asset-relief measures from 2008 to 2013, according to European Commission data. Member states had to transpose the directive into national law by the end of 2014 and have until Jan. 1, 2016 to apply all rules. Heta’s €2 billion of 4.375% notes maturing in January 2017 plunged 19 cents on the euro to 46 cents, according to data compiled by Bloomberg. The company’s €450 million of floating-rate notes due March 6 slumped 37 cents to 46 cents on the euro, the data show. Austria cut support for Heta, which has already cost taxpayers about €5.5 billion in aid, after it notified the government it had a capital shortfall of as much as €7.6 billion, the Austrian Finance Ministry said in a statement on Sunday.

No more steam.

• The Great Global Monetary Easing of 2015 May Be Done by Midyear (Bloomberg)

The rush began in Tashkent, capital of Uzbekistan, on Jan. 1. The former Soviet state enacted the first interest-rate reduction of 2015. Since then, the cuts have come thick and fast, with the People’s Bank of China on Saturday becoming the 17th central bank of 57 monitored by Bloomberg News to pare its benchmark. By the end of this week, the list will probably include Poland. Some economists also forecast Australia and Canada will act for the second time this year. Norway, Hungary and Thailand will all join the party this month, followed by South Korea in April, according to JPMorgan economists led by Bruce Kasman.

Out of room on rates, the European Central Bank is set to begin its €1.1 trillion bond-buying program. And that may be that. For all the fireworks, the rate cutting may be over by the middle of the year as deflation worries ebb. Oil appears to be finding a bottom around $60 a barrel and global growth is firming. In the developed world, a measure of inflation expectations based on bond yields rose in January and February to 1.28% on Feb. 27, ending an eight-month slump, data compiled by Bank of America show. That backdrop has JPMorgan predicting the Federal Reserve will raise interest rates in June for the first time since 2006 and, in doing so, end the international easing cycle.

On the other hand, Goldman Sachs. and Morgan Stanley predict docile inflation will persuade the Fed to hold off. New-York based JPMorgan sees the average interest rate for the world bottoming at 2.46% this month before rising to 2.59% by the end of the year. The measure for developed economies will more than double to 0.58% from 0.22%, led by the Fed. “A deflationary wave is about to break,” Kasman wrote last week. So, what began in Uzbekistan may end in the U.S.

You’ve been warned.

• Fed Ushers In A New Era Of Uncertainty On Rates (Hilsenrath at FT)

Investors these days are obsessing over when the Federal Reserve will start raising short-term interest rates. Drawing less scrutiny is where rates will end up in the long run and how they’ll get there. But it’s time to start paying attention. Fed officials have made clear they expect to begin raising short-term interest rates from near-zero this year, though not before midyear. After that, there is great uncertainty at the central bank and in the markets about the future path of interest rates. The long-run outlook for rates has consequences for everyone. For households, it will determine payments on mortgages and car loans; for businesses, on corporate bonds; and for the government, on the $13 trillion in debt held by the public. A disconnect between the Fed and the market over the long-run rate outlook also could be a source of market turbulence in the months ahead.

Central-bank policy makers on average see rates going nearly twice as high as futures markets indicate in coming years, for a variety of reasons. If the Fed is wrong, it might make a mistake on interest rates that jars the economy. If the market is wrong, it might be setting itself up for a tumble if rates go higher than expected. The Fed’s latest forecasts show that nine of 17 policy makers see the central bank’s benchmark interest rate—the federal funds rate—at 1.13% or higher by year-end. The median estimates—meaning half are above and half below—reach 2.5% for the end of 2016 and 3.63% for the end of 2017. On the other hand, in fed funds futures markets, where traders buy and sell contracts based on expected rates, the expected fed funds rate is 0.50% on average in December 2015, 1.35% in December 2016 and 1.84% in December 2017.

One reason for the disparity: Futures prices reflect investors’ calculations that there is some probability rates will return to near-zero after a few increases and stay there. This happened in Sweden after its central bank raised rates in 2010 and in Japan after 2006. In both cases, the central banks had to reverse course and cut rates after economic shocks and deflation pressures crippled their economies. A survey by the New York Fed of Wall Street bond dealers in January showed they attached a 20% probability to U.S. short-term rates returning to zero within two years after liftoff. A return to zero isn’t the Fed’s expected outcome, so it doesn’t show up in its rate forecasts.

From a Syriza MP. Good cop bad cop.

• To Beat Austerity Greece Must Break Free From The Euro (Costas Lapavitsas)

The agreement signed between Greece and the EU after three weeks of lively negotiations is a compromise reached under economic duress. Its only merit for Greece is that it has kept the Syriza government alive and able to fight another day. That day is not far off. Greece will have to negotiate a long-term financing agreement in June, and has substantial debt repayments to make in July and August. In the coming four months the government will have to get its act together to negotiate those hurdles and implement its radical programme. The European left has a stake in Greek success, if it is to beat back the forces of austerity that are currently strangling the continent. In February the Greek negotiating team fell into a trap of two parts.

The first was the reliance of Greek banks on the European Central Bank for liquidity, without which they would stop functioning. Mario Draghi, president of the European Central Bank, ratcheted up the pressure by tightening the terms of liquidity provision. Worried by developments, depositors withdrew funds; towards the end of negotiations Greek banks were losing a billion euros of liquidity a day. The second was the Greek state’s need for finance to service debts and pay wages. As negotiations proceeded, funds became tighter. The EU, led by Germany, cynically waited until the pressure on Greek banks had reached fever pitch. By the evening of Friday 20 February the Syriza government had to accept a deal or face chaotic financial conditions the following week, for which it was not prepared at all.

The resulting deal has extended the loan agreement, giving Greece four months of guaranteed finance, subject to regular review by the “institutions”, ie the European Commission, the ECB and the IMF. The country was forced to declare that it will meet all obligations to its creditors “fully and timely”. Furthermore, it will aim to achieve “appropriate” primary surpluses; desist from unilateral actions that would “negatively impact fiscal targets”; and undertake “reforms” that run counter to Syriza pledges to lower taxes, raise the minimum wage, reverse privatisations, and relieve the humanitarian crisis.

In short, the Syriza government has paid a high price to remain alive. Things will be made even harder by the parlous state of the Greek economy. Growth in 2014 was a measly 0.7%, while GDP actually contracted during the last quarter. Industrial output fell by a further 3.8% in December, and even retail sales declined by 3.7%, despite Christmas. The most worrying indication, however, is the fall in prices by 2.8% in January. This is an economy in a deflationary spiral with little or no drive left to it. Against this background, insisting on austerity and primary balances is vindictive madness.

Bluff and bluster.

• Greece Eyes Last Central Bank Funds To Avert IMF Default (AEP)

Greece is preparing to tap its final pension reserves at the country’s central bank if needed to avert a devastating default to the IMF and keep the government going over the next two weeks. The Greeks must pay the IMF €1.5bn in a series of deadlines this month, starting with €300m as soon as Friday. No developed country has ever defaulted to the IMF in the history of the Bretton Woods financial system. Such a move would shatter confidence and reduce Greece to a financial pariah in motley company with Zimbabwe. George Stathakis, the economy minister, said the government still has hidden reserves to keep operations going for a few more weeks, brushing aside warnings that the state could run out of cash within 10 days. “These stories are exaggerated. We have various buffers, including €3bn or €4bn at the Bank of Greece,” he told The Telegraph.

It is understood that the central bank deposits are mostly part of Greece’s social security and pension system. Analysts say it is far from clear whether the government can legitimately tap this money without breaching other fiduciary obligations. “We think the funds are already down to €1.8bn. If they draw on this, how are they going to meet their pension bills next month?” said one banker. A senior Greek official opened the door last week to a possible “delay” in repayments to the IMF, perhaps for a month or two, setting off alarm bells among investors and bank depositors. It was taken as an admission that the country is now desperate as capital flight runs at €800m a day. Yanis Varoufakis, the finance minister, sought to silence such talk over the weekend, telling AP that a default to the IMF was out of the question, even if a halt in payments to the EU institutions remains a serious threat.

“We are not going to be the first country not to meet our obligations to the IMF. We shall squeeze blood out of stone if we need to do this on our own, and we shall do it,” he said. The IMF deadlines are not rock hard. The Fund usually allows some grace period. There is a procedure for arrears if a country genuinely wishes to pay. “The clock starts ticking. It is another matter if they start saying they won’t pay for six months,” said one expert. Syriza officials are aware that the IMF will be their last safeguard if Greece is ultimately blown out of the euro, although it is far from clear what would happen in such circumstances. Greece has already exhausted its IMF borrowing quota in earlier EU-IMF Troika bailouts, and patience is wearing thin among the Asian and Latin American representatives on the IMF board.

Futile.

• Mixed Messages On Third Greek Bailout Talks (Reuters)

Eurozone countries are discussing a third bailout for Greece worth €30 billion to €50 billion, Spain’s economy minister said on Monday, but EU officials said there were no such talks. Speaking at an event in Pamplona, northern Spain, Economy Minister Luis de Guindos said the new rescue plan would set more flexible conditions for Greece, which had no alternative other than European support. But the spokeswoman for Jeroen Dijsselbloem, who chairs the euro zone finance ministers’ group, said there was no discussion of a third bailout and senior euro zone officials concurred. “Euro zone finance ministers are not discussing a third bailout,” spokeswoman Simone Boitelle said. Greek leftist Prime Minister Alexis Tsipras used a televised address on Friday to deny his country would need another international program.

Greece has acute and immediate funding problems to overcome, despite the four-month extension to its existing bailout it negotiated with the euro zone last month. To win that, Tsipras had to give up on key pledges made during his election campaign. The extension averted a banking meltdown. But Greece still faces a steep decline in revenues and is expected to run out of cash by the end of March, possibly sooner. The new government in Athens sought to assure it can cover its funding needs this month, including repaying a €1.5 billion loan to the IMF. “The Greek government has been exploring solutions … to ensure there won’t be a single problem with repaying the IMF loan, or its funding obligations in March,” government spokesman Gabriel Sakellaridis told Greek radio.

Most of Greece’s options appear to have been shut off, for now at least. A request for €1.9 billion in profits the ECB made on buying Greek bonds will not be granted until Greece has completed promised reforms. Athens has also sought permission to issue more short-term treasury bills, having reached a cap of €15 billion set by its lenders. The euro zone has made clear it does not want to see that limit lifted. Dutch Finance Minister Dijsselbloem offered a potential escape route. He told the Financial Times that Greece’s international creditors could pay part of the €7.2 billion remaining in its bailout pot as early as this month if Athens started enacting necessary reforms. “There are elements that you can start doing today. If you do that, then somewhere in March, maybe there can be a first disbursement. But that would require progress and not just intentions..”

“Europe has transformed into a giant bank and its people are divided into lenders or borrowers..”

• Greeks in the Crisis: ‘We Need To Explain Ourselves’ (Spiegel)

With tensions between Greece and Berlin having been significant in recent weeks, SPIEGEL decided to invite six prominent Greeks to a roundtable discussion at Katzourbos tavern in Athens’ Pankrati neighborhood. The state minister is the first to arrive, 10 minutes early. Alekos Flambouraris, 72, wears a black suit, no tie and the kind of open-collared shirt made fashionable by the governing Syriza party in recent weeks. Flambouraris is a close confidant of Prime Minister Alexis Tsipras. “We need to keep up our contacts with the Germans. We want to explain ourselves,” he says. Athens’ politically independent mayor, Georgios Kaminis, 60, arrives shortly thereafter on foot — an inconspicuous man wearing a corduroy suitcoat.

The others are: Natassa Bofiliou, 31, a famous Greek pop star who has been threatened by supporters of Golden Dawn because of her vocal opposition to the party; Christos Ikonomou, 44, whose book “Just Wait, Something’s Happening,” is a compilation of short stories about everyday life in Greece during the crisis; entrepreneur Aggeliki Papageorgiou, 50, the owner of a small ice cream spoon factory that is on the verge of shutting down; and journalist Xenia Kounalaki, 44, who writes for the center-right newspaper Kathimerini and has been disappointed thus far by Syriza’s behavior in Europe. The guests conduct their discussion in Greek and the event is moderated by SPIEGEL editors Manfred Ertel and Katrin Kuntz as well as co-moderator Angelos Kovaios, a journalist with the weekly newspaper To Vima. They spent three hours discussing developments in the country over Greek wine and Cretan cuisine.

SPIEGEL: What are we drinking to here – Syriza’s election victory, the compromise reached in Brussels or German-Greek relations?

The Minister: I’m drinking to the welfare of all people in Europe. Our negotiations and the compromise in Brussels also shows that this isn’t just a problem for the Greeks. Democracy is also at stake, with the standard of living declining in many countries. I’m drinking to better days.SPIEGEL: That sounds rather florid. The debt crisis is about hard figures. It’s our impression that the governments and the finance ministers in the euro zone haven’t yet found a common language.

The Minister: With the compromise, we have established a foundation we can build on – and also common language. Still, the media and government in German also has a duty to properly inform the German people about our country. [..]SPIEGEL: How bad do you think Greek-German relations really are?

The Entrepreneur: I have the feeling that the Germans view us with distrust, but there’s no reason for it. We work hard and we have a clear conscience.

The Author: We can’t view the Greek-German relationship isolation. I’m worried about developments in Europe. It appears to me that Europe has transformed into a giant bank and its people are divided into lenders or borrowers. The Irish, the Finns and the Belgians say: The Greeks owe us money and it can’t be allowed to disappear. This is a bad development. Germany is the leader of this policy and it has always viewed Europe as the garden behind its own house. I don’t think that is going to change in the future. The agreement in Brussels means that we Greeks can relax a little bit more, but we will be having the same discussion again come June. [..] I am dismayed that Europe is being equated with the euro today. It’s purely about money, debts, bonds and loans. We are viewed as an economic unit, not as people. That’s disappointing and it’s taking away my hope of a European future.

Low ballin’.

• Investor Survey Shows 38% Chance Of Eurozone Break-Up In 12 Months (Reuters)

Investor expectations of the euro zone breaking apart have risen to their highest level in two years, a survey showed on Tuesday, even after Greece agreed a financial lifeline with its euro zone partners. The sentix Euro Break-up Index (EBI) gave its highest reading since March 2013, with 38% of respondents expecting the bloc to break-up in the next 12 months, up from 24.3% in January. The current poll was conducted between Feb. 26-28, 2015, and surveyed 980 mainly German-based individual and institutional investors. Greece won approval for a four-month extension to its bailout on Feb. 24, after tense negotiations between Athens and its international creditors.

“The new aid program for the country does not seem to be convincing, rather a ‘grexit’ is now bound to be a constant topic among investors for the months to come,» said Sebastian Wanke, a senior analyst at sentix. Expectations of Greece leaving the euro in the next year rose to 37.1% from 22.5%, the survey said. A Reuters poll of economists in mid-February gave a one-in-four chance of Greece leaving the currency area in 2015. The EBI hit a high of 73% in July 2012, and touched its low at 7.6% in July 2014. The last time the reading was this high came after inconclusive elections in Italy and a banking crisis in Cyprus which saw the country become the fourth member state to be bailed out.

Next domino.

• French Factory Decline Even Worse Than Greece (Telegraph)

The economic divide between Europe’s largest economies widened in February, as a closely-watched survey showed manufacturing output in France contracted at a faster rate than Greece, despite the weakening euro. Output at French factories fell for a ninth consecutive month in February, as new orders dried up and overseas demand fell. This led to a further fall in employment, Markit said, as it described general demand in France as “lacklustre”. By contrast, a stronger rise in new business helped output at German manufacturers expand for the 22nd consecutive month in February. Markit described the latest rise as “broad-based”, but said growth was “weak by historical standards”. Despite an 8pc decline in the euro against the dollar since the start of the year, Markit’s French manufacturing PMI fell to 47.6 in February, from 49.2 in January. This was well below the 50 level that divides growth from contraction, and also worse than economists’ expectations of a decline to 47.7.

This also means output in France contracted at a faster rate than in Greece last month, where the decline steadied to 48.4. Germany’s PMI rose to 51.1 in February, up marginally from January’s reading of 50.9. Jack Kennedy, senior economist at Markit, said French manufacturing was in a “funk”. Chris Williamson, Markit’s chief economist, added: “France, Greece and Austria are the slow lane stragglers [in Europe], with all three seeing their manufacturing economies contract again in February. France is the most worrying, not just because it trails behind all other countries, but it is also the only country seeing a steepening downturn.” Ireland was the eurozone’s bright spot last month, as the country recorded the joint-fastest rate of job creation on record. Output rose to the highest level in 15 years, which helped to keep overall eurozone manufacturing output steady in February. The eurozone manufacturing PMI was unchanged, at 51.

“Catalonia would probably be comparable to Denmark. Denmark has more or less the same population, and Austria too.”

• Spain To Split? Snap Vote On Catalan Independence (CNBC)

The president of the Spanish region of Catalonia in Spain looks set to strain further relations with the country’s political establishment by calling a snap vote on independence as a general election approaches in September. Artur Mas, the president of Catalonia, told CNBC Monday that a referendum was needed to see if the majority of Catalonians still wanted independence. The region has long pushed for independence from the rest of Spain and, despite being dealt a blow when Scotland chose to remain a part of the U.K. last year, Mas is still confident an independent Catalonia would prosper. “Catalonia would probably be comparable to Denmark. Denmark has more or less the same population, and Austria too.

Both those countries are outstanding from the economic point of view and Catalonia could be at the same level,” Mas told CNBC. “It could have an open economy, a foreign-market oriented economy (and a) cutting edge research and innovation system”, he said, speaking to CNBC on the sidelines of the Mobile World Congress (MWC) in Barcelona, the “capital” of Catalonia. Mas and other separatist movement has tried to negotiate with the Spanish government to allow it to hold a referendum on the matter but has been refused. It has also been blocked by the Constitutional Court to hold “non-binding” consultations on the matter, Mas said, meaning that there was only one way forward: elections.

“So now we have only one way: elections. Snap elections. So that’s what I’m going to do. (I’m going ) to call snap elections in Catalonia in September this year to know the opinion of Catalan people about the independence process.” Holding a referendum in an election year is bound to go down badly with the Spanish government led by Prime Minister Mariano Rajoy, embattled as it already is by the rise of the popular anti-austerity party Podemos. There are concerns that the drive for independence is creating more political uncertainty in Spain ahead of the general election, which in turn could damage the economy , which is only just starting to recover from a housing market and banking collapse during the financial crisis.

Rinse and repeat.

• Portugal’s Successful Turnaround? A Fairy Tale (The Globalist)

Even a brief glance at the facts suffices. Portugal is no less bankrupt than Greece. The country’s government debt, at 124% of GDP, might be lower than in Greece. However, government debt is just one – even though important – part of the full debt picture. On an aggregate level, Portugal’s overall debt level – at 381% of GDP when also including private households and non-financial corporations — is well above Greece’s total debt level (286% of GDP). So while Greece’s problems mainly manifest themselves via government debt, Portugal suffers from too much debt in all three sectors of the economy. At the same time, debt continues to grow much faster than the Portuguese economy. Between 2008 and 2013, aggregate debt grew by 69 percentage points.

In order to stop the debt growing faster than the country’s economy, the government sector alone would have to improve its fiscal position by 3.6% of GDP. Given the overall status of the Portuguese economy and the debt problems of the private sector, that improvement is an impossible task. Trying to achieve it would push the economy into outright depression. Given all these facts, it is all the more astonishing that the German Bundestag voted unanimously in favor of Portugal’s proposal to pay back loans from the IMF earlier. Bundestag members did so with great pleasure. Why? Amidst the fraught negotiations in Brussels with the new Greek government about the extension of the Greek program, it was a welcome opportunity to claim that the European approach to the crisis with austerity and reform was indeed working.

For Portugal, it was a good deal, because it could replace relatively costly money from the IMF carrying interest around 4% with cheaper loans from the capital market. But Portugal’s refinancing itself in the markets is not really a sign of the success of the policy mix in Europe. Given that the country’s creditors are mainly foreigners, Portugal cannot inflate the debt away. It is also in no position to grow out of its debt problem. Assuming a current account surplus of 0.9% (as achieved in 2013), it would take 128 years just to pay back all foreign debt. Debt aside, Portugal faces other quite extraordinary challenges: It has the lowest birth rate in the Eurozone, has to contend with an exodus of the young people to other countries, the lowest overall level of qualifications of its population in Europe, as well as low productivity levels.

All dead in the water.

• Tough Talk On Greece Alone Won’t Boost Ireland, Spain At Home (Reuters)

Europe’s tough treatment of Greece’s new government has eased some immediate anti-austerity pressure in Ireland and Spain, but it may take a lot more than that to put Dublin and Madrid’s ruling parties’ re-election prospects back on track. Elected months apart in 2011 as financial crises enveloped their own countries, the two centre-right led governments’ hopes of winning a second term risk being upset by anti-austerity opponents aligned to Greece’s Syriza, among other challenges. They both toed the line with Germany in demanding that Greece stick to its bailout commitments – a blow to Athens, which had hoped for some support from countries that also suffered badly in the debt crisis. That was underlined on Saturday when Greek Prime Minister Alexis Tsipras accused Spain and Portugal of leading a conservative conspiracy to topple his government because they feared the rise of anti-austerity forces in their own countries. Madrid and Lisbon complained about the accusation to the European Commission.

Ireland avoided Alexis Tsipras’ ire, but it has taken one of the hardest lines with Greece. Unlike Portugal, it faces an anti-austerity challenge similar to Syriza in Greece and Spain’s anti-establishment Podemos party. It comes from left-wing Sinn Fein. After the new Greek government was unable to end the EU/IMF bailout it was elected to dismantle and was instead forced into a climbdown, Ireland, fresh from its own bailout, was among the first to exploit the retreat. “In 2016, the people will have a clear choice: between stable and coherent government; or chaos and instability,” Irish Prime Minister Enda Kenny told his Fine Gael party’s annual conference last month, a shot at its closest poll rivals Sinn Fein. Kenny awoke the next day to a Sunday Times editorial that proclaimed ‘Sinn Fein’s Greek tragedy is a win for Fine Gael’.

After wielding painful austerity measures, the Spanish and Irish governments’ election hopes rely largely on voters feeling the benefits of recovering economies. Ireland’s is forecast to be the fastest growing in Europe again this year at almost 4% with Spain’s, six times as big, close by on 2.4%. For now, the Greek parallel has served to underscore early campaign messages by Spanish Prime Minister Mariano Rajoy, who took veiled swipes at Podemos, the anti-establishment movement that has painted itself as Syriza’s sister party. But the tough rhetoric could equally backfire for the two governments, some analysts say. Neither can afford to push Greece over the edge for fear of the economic impact. Setbacks for Syriza – while limiting the risk of emboldening Sinn Fein and Podemos – may also not necessarily translate into a boost for Fine Gael or Rajoy’s People’s Party (PP). Elections are due in Spain around November and, at most, five months later in Ireland.

Both the PP and Fine Gael still face big challenges at home. Nearly one in four Spaniards is out of work while frustration over Ireland’s uneven recovery last year spilled into the first major street protests in years. That has left many voters keen for political renewal, most acutely in Spain, as they blame local leaders for their woes, even if like Greece the two countries took international bailouts, in the case of Spain for its ailing banks. “The anger is more with the two big parties (in Spain) than with Germany,” said Jose Ignacio Torreblanca, senior fellow at the European Council on Foreign relations, referring to the PP and opposition Socialists being overtaken by Podemos in polls. Another new party, centre-right Ciudadanos, is also starting to gain traction, eating into the PP’s own turf.

Meanwhile, a wretched 2014 has left Kenny open to charges that little had changed in Irish politics since the crisis and has propelled independent candidates into first place in most opinion polls. But the status quo shake up may not be as deep in Ireland where the ruling coalition is making a tentative recovery. “There was a lot of anger in 2011 but we got the same old, same old. I don’t think we’ll see a massive change,” said David Farrell, professor of politics at University College Dublin “The conservative Irish voter is just a phenomenon that we have to recognise.”

Nice article, but that’s what I’m working on as I saw this. Well, better of course… 😉

• European Union Showing ‘Signs Of Strain’ (BBC)

In 1998 Austria held the rotating presidency of the European Union for the first time since becoming a member of the club and I was a fresh-faced reporter for Austrian radio’s English-language service. “Our aim is to bring Europe closer to its people,” announced Wolfgang Schuessel, then Foreign Minister of Austria. And he meant business, using that press conference to wave aloft a pair of limited edition running shoes. They had been commissioned in the national colours to demonstrate the government’s intent to get out and about, addressing all issues pertinent to European voters. The shoes didn’t get very muddy in the end, but they sprang to mind as I sat down to write my first blog post as Europe editor. Over the years, I’ve heard the same promise made over and over again in EU circles. But far from getting closer to people and appearing ever more relevant to them, the European project is showing signs of strain.

Back in 1998 the EU had 15 member states. Now there are 28. The European Parliament is one of the biggest in the world. It represents around half a billion people. But a record number of them chose to vote for populist, eurosceptic politicians in parliamentary elections last year. Many in Europe don’t want the EU to get any closer. They feel EU bureaucracy already invades their personal – and national sovereign – space too much. Those in favour of the EU argue just as vociferously that in our globalised world, acting as a bloc in terms of trade, commerce, security and more is imperative. The debate is a heated one and nowhere more so than in the UK which, depending on general election results this May, looks likely to organise an in/out referendum on EU membership.

Nobody can argue Europe is at a pivotal moment in its history. There are a number of front-page issues blazing concurrently across the continent. Political and economic problems are present in terms of the EU and the eurozone. But there is also a humanitarian crisis and an immigration debate, sparked by record numbers of people desperate enough to flee war and oppression at home, often in the Middle East, to attempt the perilous journey to European shores. Europe’s southern seas, traditionally associated with summer fun in the sun, are increasingly becoming horrific watery graves. The continent faces a stark security threat too, the greatest in more than a decade. As many as 5,000 Europeans have joined fighting in Syria, posing a risk to their homelands. The Charlie Hebdo attacks have left people across Europe wondering whether their city might be next.

Typical Bloomberg ‘reporting’, but the gist of it is, I think, very accurate.

• China Will End Up Like Japan, Says Observer Who Called It In 1990 (Bloomberg)

Forecasts for China to surpass the U.S. as the world’s main economic power are misplaced. So says an observer who foresaw Japan’s eventual demise a year before its land-price bubble began to burst. “The vulnerabilities in China today are very similar to the vulnerabilities in Japan,” said Roy Smith, 76, who was a Goldman Sachs partner when he wrote a column saying Japan’s rise as a financial hegemon was done. “Nobody agrees with me. But they didn’t agree with me in 1990, so at least I have one right.” Among the risks: bad loans, overpriced stocks and a frothy property market are flashing danger for China’s economy and putting pressure on a fragile financial system – similar to conditions that triggered Japan’s fall, said Smith, a finance professor at New York University’s Stern School of Business.

A further parallel is the burden of an aging population, with mounting pension and health-care costs, he says. While China probably will avoid prolonged Japan-style stagnation, a major crisis could expose weaknesses that aren’t apparent now, according to Smith. “Most people today are talking about China displacing the United States as the great power of the 21st century,” he said in a telephone interview last week. “My view is that it is more likely to end up like Japan — that is, the status of a former would-be superpower that isn’t.” China surpassed Japan as the world’s No. 2 economy by gross domestic product in 2010 after three decades of rapid growth, fueled by the largest urbanization in history. It is tipped by many forecasters eventually to overtake the U.S. in output. By other measures, such as GDP per person, China is further behind the U.S.

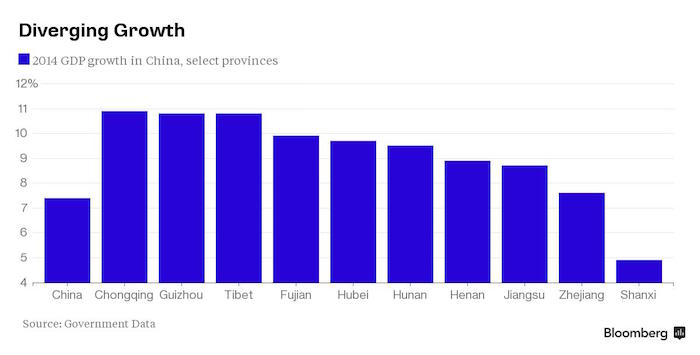

On a per-capita basis, China’s GDP in 2013 was still just half of where Japan was in 1960, according to World Bank data. That leaves plenty of scope to catch up to rich-world peers, more optimistic observers say. “The key difference I see between China now and Japan in 1990 is that China is at a much lower stage of development,” said Louis Kuijs at RBS in Hong Kong. Even so, China’s progress has confronted mounting challenges in recent years. In 2014, the economy expanded at the slowest full-year pace in almost a quarter century. The slowdown has thrown a spotlight on a mounting debt pile that includes souring loans to local government financing vehicles, or LGFVs, which funded a boom in construction. Doubts about the creditworthiness of LGFV debt deepened last year. China’s total debt pile, including borrowing by households, banks, governments and companies, ballooned to 282% of national output in mid-2014 from 121% in 2000, according to an estimate by McKinsey.

Better take him serious.

• Gaddafi’s Cousin Warns Of A ‘9/11 In Europe Within Two Years’ (Independent)

Colonel Gaddafi’s cousin has warned of a “9/11 in Europe within two years”, as fighters from the Islamic State join the tens of thousands of migrants crossing the Mediterranean to European shores. Ahmed Gaddafi al-Dam, one of the late dictator’s most trusted security officers, predicted at least half a million migrants would set sail from Libya to Europe this year as Isis gained a stronger foothold in the country. “There are many terrorists among them, between 10 and 50 in every thousand,” he told MailOnline. “They are going all throughout Europe. Within one year, two years, you will have another September 11.”

While alarmist, his warning will chime inside the chambers of some Western governments. After January’s murder of 21 Coptic Christians by Isis militants in Sirte, there is growing recognition of the threat an unstable Libya is posing the West in the fight against Isis. Militants loyal to the extremist group have made gains in Libya in recent weeks, and are thought to be in control of three towns including Sirte. Mr Gaddaf al-Dam also claims that militias loyal to ISIS in Libya are likely to be in possession of more than 6,000 barrels of uranium that were previously under the guard of the government’s army in the desert outside the south-western town of Sabha.

“The uranium I think they already have it, ISIS, because they control this territory,” he said. “They are not stupid anymore. They know how to make money. They will try and sell it.” The Gaddafi family has kept a low profile since the 2011 uprising in which the leader was killed, ending 42 years of one-man rule. Rival armed groups have since battled for power, pushing the internationally-recognised government from the capital and raising fears of a full-scale civil war.= The former security official was speaking from Cairo where he has since fled.

War party parties on.

• US to Deploy Six National Guard Companies to Ukraine This Week (Sputnik)

The United States will deploy personnel by the end of this week to train the Ukrainian national guard, US 173rd Airborne Brigade Commander Colonel Michael Foster said at the Center for Strategic and International Studies in Washington, DC on Monday. “Before this week is up, we’ll be deploying a battalion minus… to the Ukraine to train Ukrainian forces for the fight that’s taking place,” Foster stated. “What we’ve got laid out is six United States companies that will be training six Ukrainian companies throughout the summer.” The training will take place at the level of US and Ukrainian national guard companies, Foster explained, adding that “we have nothing above battalion staff level” engaged in the military training. The Ukrainian nationalist Aidar battalion was officially disbanded and reorganized as the 24th Separate Assault Battalion of the Ukrainian Ground Forces.

The current plan is for US forces to stay six months, he said, and noted there have been discussions about how to increase the duration and the scope of the training mission. The current channels for military training set up between Ukraine and the United States would not be used for transferring defensive lethal aid if the United States decided to provide arms to Ukraine, Foster told Sputnik on Monday. “It would go through something separate… We would not funnel the lethal aid or arms through that [training] event, we would use a secondary method for that,” Foster said, adding that a completely separate process is preferable. The United States and NATO have been engaged in military training exercises with Ukraine since the fall of 2014, according to NATO press releases. UK Prime Minister David Cameron announced last week that the UK will also be sending military advisors to Ukraine.

Snowden and Putin. And a bunch of empty suits.

• Heroes and Villains (Jim Kunstler)

The more interesting hero to me is Snowden. The purity of his name alone kind of says it all. The documentary movie about his brush with history, Citizen Four (by Laura Poitras, also a hero), is now showing on cable TV. It follows Snowden during the days of spring 2013 when he went rogue on the National Security Agency and revealed to the public the extent to which the American government was prying and worming its way into everybody’s electronic life — ignoring the pain-in-the-ass constitutional limits on such mischief, and setting the USA up to be a police state beyond the frontiers of anything George Orwell dreamed about in his darkest nights of the soul. It is more than ironic that Snowden was also Mr. Ed, because if you take his comportment on film at face value, never was there such an exemplary and seemingly normal American young man.

His heroism resided largely in his amazing composure under the strain of events. He spoke English clearly and calmly, and reacted to the weighty events he set in motion with startling equanimity. He appeared to know exactly what he was doing, and with quiet, unshakable moral commitment. And then he disappeared down the gullet of America’s modern times nemesis, Russia, where he continues to taunt with his very existence, the NSA gameboys, lizard-lawyers and puppet-masters who cordially invite him back home to face, ho-ho, our vaunted justice system. Of course any six-year-old understands that they would love to jam Snowden down some federal supermax memory hole as an example to any other waffling NSA code-jockey having second thoughts about reading your grandpa’s phone records.

And then, strangest of all to relate, there is Putin. Our guys are moving heaven and earth to jam him into a red-hot Satan suit but it’s not working. The pitchfork they want him to brandish looks strangely like a sword of justice. Even Americans of modest intelligence, when not locked into the Kardashian trance, can detect something false in all our official handwringing over Ukraine — the made-in-the-USA failed state now eating itself alive on Russia’s border.

Before February 2014, Ukraine was just a struggling, marginal demi-nation still economically dependent on Russia, of which it had effectively been a province for centuries. Mr. Obama and his haircut-in-search-of-a-brain Secretary of State, Mr. Kerry, thought it would be a good idea to make Ukraine our client state instead. They couldn’t have botched the operation more completely. I have to say, Vlad Putin’s composure in the face of this perfidious idiocy is really something to behold, regardless of the roughness of the polity he rules. Our guys, in contrast, look like something less than sheer clueless rogues. They look like empty suits.

We have a winner!

• Syrian Conflict Is The World’s First ‘Climate Change War’ (Independent)

Climate change was a key driver of the Syrian uprising, according to research which warns that global warming is likely to unleash more wars in the coming decades, with Eastern Mediterranean countries such as Jordan and Lebanon particularly at risk. Experts have long predicted that climate change will be a major source of conflict as drought and rising temperatures hurt agriculture, putting a further strain on resources in already unstable regimes. But the Syria conflict is the first war that scientists have explicitly linked to climate change. Researchers say that global warming intensified the region’s worst-ever drought, pushing the country into civil war by destroying agriculture and forcing an exodus to cities already straining from poverty, an influx of refugees from war-torn Iraq next door and poor government, the report finds.

“Added to all the other stressors, climate change helped kick things over the threshold into open conflict,” said report co-author Richard Seager, of Columbia University in New York. “I think this is scary and it’s only just beginning. It’s going to continue through the current century as part of the general drying of the Eastern Mediterranean – I don’t see how things are going to survive there,” Professor Seager added. Turkey, Lebananon, Israel, Jordan, Iraq and Afghanistan are among those most at risk from drought because of the intensity of the drying and the history of conflict in the region, he says. Israel is much better equipped to withstand climate change than its neighbours because it is wealthy, politically stable and imports much of its food. Drought-ravaged East African countries such as Somalia and Sudan are also vulnerable along with parts of Central America – especially Mexico, which is afflicted by crime, is politically unstable, short of water and reliant on agriculture, Prof Seager said.